BMP3005 - Applied Business Finance: Financial Management & Improvement

VerifiedAdded on 2023/06/12

|14

|3244

|52

Report

AI Summary

This report provides a comprehensive analysis of financial management, emphasizing its importance in business operations. It defines financial management, discusses key financial statements (Income Statement, Balance Sheet, Cash Flow Statement, and Statement of Changes in Equity), and explains the use of financial ratios for performance evaluation. The report includes a practical application through a case study, where financial data is analyzed to assess profitability, liquidity, and efficiency. Furthermore, it suggests processes and strategies that businesses can implement to improve their financial performance, such as enhancing asset utilization and optimizing accounts receivable collection periods. The analysis is supported by calculations and ratio interpretations, providing a clear understanding of the financial health and potential improvements for the case study organization. This student contributed the assignment to Desklib.

BSc (Hons) Business Management with Foundation

BMP3005

Applied Business Finance

The concept and importance of financial

management and the processes businesses

might use to improve their financial

performance

Submitted by:

Name:

ID:

0

BMP3005

Applied Business Finance

The concept and importance of financial

management and the processes businesses

might use to improve their financial

performance

Submitted by:

Name:

ID:

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction p

Section 1: Definition and discussion of the concept and

importance of financial management p

Section 2: Description and discussion of the main financial

statements and explain the use of ratios in financial management

p

Section 3: Using the template provided p-p

Completing the Information on the ‘Business Review Template (Ensure

that you display your calculations for this detail)

p

Using Excel producing an Income Statement for the Sample Organisation

(see Case Study). This should be included within your appendices

p

Using Excel completing the Balance Sheet p

1

Introduction p

Section 1: Definition and discussion of the concept and

importance of financial management p

Section 2: Description and discussion of the main financial

statements and explain the use of ratios in financial management

p

Section 3: Using the template provided p-p

Completing the Information on the ‘Business Review Template (Ensure

that you display your calculations for this detail)

p

Using Excel producing an Income Statement for the Sample Organisation

(see Case Study). This should be included within your appendices

p

Using Excel completing the Balance Sheet p

1

Using the Case study information describing the profitability, liquidity and

efficiency of the company based on the results of ratio analysis

p

Section 4: Using examples from the case study describing and

discussing the processes this business might use to improve their

financial performance p

Conclusion p

References

Appendix p

2

efficiency of the company based on the results of ratio analysis

p

Section 4: Using examples from the case study describing and

discussing the processes this business might use to improve their

financial performance p

Conclusion p

References

Appendix p

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

Financial management refers to the planning, organizing and directing the financial resources

of the business in attempt to establish effective control over the financial activities of an

enterprise which involves acquisition and utilization of funds. Within the present report,

discussion pertaining to the concept and importance of financial management will be done

along with the discussion of main financial statement that the business prepares at the end of

every reporting period. Also, the uses of ratios that are calculated on the basis of information

obtained through these financial statements will be stated in this section of the report. Further,

the financial analysis of case study organization will be done and accordingly, processes that

could be adopted in order to improvise its financial performance will be discussed.

Section 1: Definition and discussion of the concept and

importance of financial management

Definition of financial management: As per the views of Solomon and Phillippatus,

financial management refers to the efficient utilization of economic resources of the business.

It involves decision making with reference to acquisition and utilization of long and short

term financial needs of the business. In this financial assets and risks can be managed in

better way (Al Breiki and Nobanee, 2019).

Concept of financial management

The concept of financial management revolves around making of decisions with regard to the

following three areas:

Investment decision: It involves decision regarding which project should be chosen for

better returns on investment along with ensuring generation of required level of cash inflows.

Financing decision: Here, it is being determined that from where to obtain funds for

financing business affairs, so that there could be lower financial risks and costs for the

business.

Dividend decision: It involves deciding on how much should be distributed among

shareholders in the form of dividend and how much earnings should be retained with the

business in order to finance future needs of the business for growth.

Importance of financial management

It helps in making sufficient funds available with the business at every point of time.

3

Financial management refers to the planning, organizing and directing the financial resources

of the business in attempt to establish effective control over the financial activities of an

enterprise which involves acquisition and utilization of funds. Within the present report,

discussion pertaining to the concept and importance of financial management will be done

along with the discussion of main financial statement that the business prepares at the end of

every reporting period. Also, the uses of ratios that are calculated on the basis of information

obtained through these financial statements will be stated in this section of the report. Further,

the financial analysis of case study organization will be done and accordingly, processes that

could be adopted in order to improvise its financial performance will be discussed.

Section 1: Definition and discussion of the concept and

importance of financial management

Definition of financial management: As per the views of Solomon and Phillippatus,

financial management refers to the efficient utilization of economic resources of the business.

It involves decision making with reference to acquisition and utilization of long and short

term financial needs of the business. In this financial assets and risks can be managed in

better way (Al Breiki and Nobanee, 2019).

Concept of financial management

The concept of financial management revolves around making of decisions with regard to the

following three areas:

Investment decision: It involves decision regarding which project should be chosen for

better returns on investment along with ensuring generation of required level of cash inflows.

Financing decision: Here, it is being determined that from where to obtain funds for

financing business affairs, so that there could be lower financial risks and costs for the

business.

Dividend decision: It involves deciding on how much should be distributed among

shareholders in the form of dividend and how much earnings should be retained with the

business in order to finance future needs of the business for growth.

Importance of financial management

It helps in making sufficient funds available with the business at every point of time.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

With the help of appropriate financial management techniques in place, shareholders

of the business can get better returns over their investment (Prihartono and

Asandimitra, 2018).

It helps in financial planning through which; amount of capital required, capital

structure of the business, financial policies and regulations can be determined in

effective manner.

Section 2: Description and discussion of the main financial

statements and explain the use of ratios in financial management

There are basically four main component of financial statement which the company

need to prepare in order to reflect its financial position. The four components are as follows:

Income Statement: This is statement which state the profit earned and loss incurred

by the company. This cover the list of income and expenses on the basis of accrual

not cash. As per this statement, if the revenue is higher than the expenses than the

company has earned income but in case if revenue is lower than expenses than the

company has incur loss.

Balance Sheet: The statement of financial position is also one of the significant

component of financial statement which state the list of assets, liabilities and equity.

This is prepared by the company to state the liquidity and financial health of the

business so that stakeholders can make decision regarding their investment

(Nasirzadeh and Herez, 2020). For each transaction cover in balance sheet, has to be

recorded as per fundamental accounting equation. The fundamental accounting

equation involve assets + liabilities = owner equity.

Cash flow statement: The cash flow statement need to be prepare by every business

in order to reflect its cash inflows and cash outflow. It is prepared by the company on

the cash basis not in accrual basis. This basically reflects the new cash flow from the

three main activities of business such as investing, financing and operating. This is

best for bridges the gap between the cash come in and goes out. Not only that, it also

helps the stakeholder to understand the sources of cash and utilization of cash within

the business.

Statement of change in equity: This is last component of financial statement such as

statement of change in equity. This statement basically reports the amount as well as

source of changes in equity (Meihana, Halim and Maria, 2021). The change in

retained earnings because of the payment of dividend, net profit for the year etc. has

4

of the business can get better returns over their investment (Prihartono and

Asandimitra, 2018).

It helps in financial planning through which; amount of capital required, capital

structure of the business, financial policies and regulations can be determined in

effective manner.

Section 2: Description and discussion of the main financial

statements and explain the use of ratios in financial management

There are basically four main component of financial statement which the company

need to prepare in order to reflect its financial position. The four components are as follows:

Income Statement: This is statement which state the profit earned and loss incurred

by the company. This cover the list of income and expenses on the basis of accrual

not cash. As per this statement, if the revenue is higher than the expenses than the

company has earned income but in case if revenue is lower than expenses than the

company has incur loss.

Balance Sheet: The statement of financial position is also one of the significant

component of financial statement which state the list of assets, liabilities and equity.

This is prepared by the company to state the liquidity and financial health of the

business so that stakeholders can make decision regarding their investment

(Nasirzadeh and Herez, 2020). For each transaction cover in balance sheet, has to be

recorded as per fundamental accounting equation. The fundamental accounting

equation involve assets + liabilities = owner equity.

Cash flow statement: The cash flow statement need to be prepare by every business

in order to reflect its cash inflows and cash outflow. It is prepared by the company on

the cash basis not in accrual basis. This basically reflects the new cash flow from the

three main activities of business such as investing, financing and operating. This is

best for bridges the gap between the cash come in and goes out. Not only that, it also

helps the stakeholder to understand the sources of cash and utilization of cash within

the business.

Statement of change in equity: This is last component of financial statement such as

statement of change in equity. This statement basically reports the amount as well as

source of changes in equity (Meihana, Halim and Maria, 2021). The change in

retained earnings because of the payment of dividend, net profit for the year etc. has

4

also cover in this report only. This is preparing by the organization to identify and

determine the ending balance of equity because of the various increase and decrease.

Use of ratio in financial management:

Ratio is a measure with the help of which the users of financial statement can identify

and analyses the relationship between the two or more component of financial statement. The

four main type of financial ratio includes profitability, liquidity, solvency, efficiency and

investment ratio. With the use of this measure, the company can identify its profitability,

liquidity and efficiency performance and position in the market (Sassikala, 2018). It is also

useful for comparing the current performance of company with that of the previous years as

well as the competitor’s performance. In simple term, the financial ratio analysis helps the

organization to determine whether they are effectively operating and working in the market

or not. In case if they are not performing well than they need to adopt proper strategy in order

to enhance the overall performance of the company. The investors of the company can use

this information to analyses that investing in such company is profitable or not.

Section 3: Using the template provided:

I. Completing the Information on the ‘Business Review Template

(Ensure that you display your calculations for this detail)

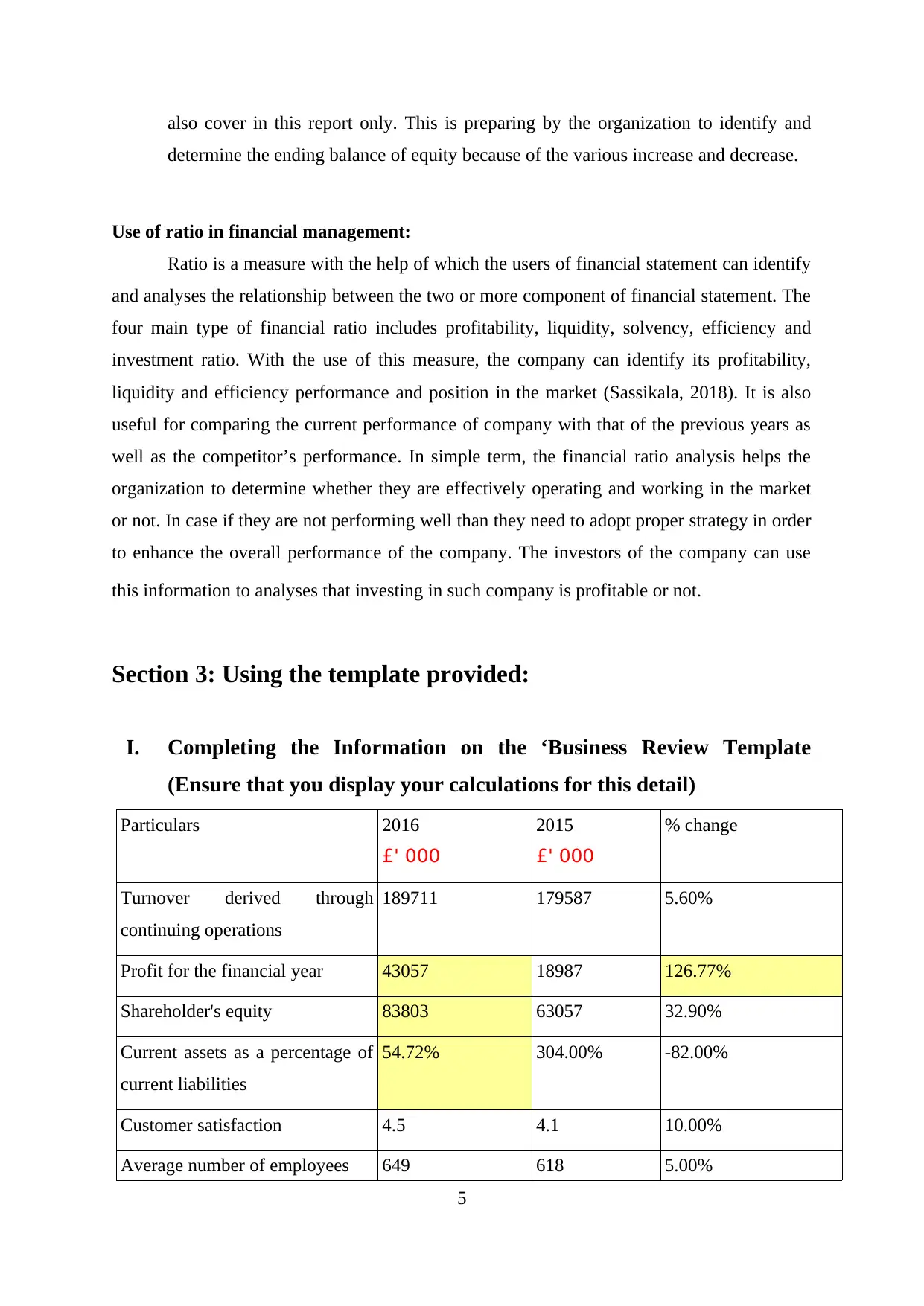

Particulars 2016

£' 000

2015

£' 000

% change

Turnover derived through

continuing operations

189711 179587 5.60%

Profit for the financial year 43057 18987 126.77%

Shareholder's equity 83803 63057 32.90%

Current assets as a percentage of

current liabilities

54.72% 304.00% -82.00%

Customer satisfaction 4.5 4.1 10.00%

Average number of employees 649 618 5.00%

5

determine the ending balance of equity because of the various increase and decrease.

Use of ratio in financial management:

Ratio is a measure with the help of which the users of financial statement can identify

and analyses the relationship between the two or more component of financial statement. The

four main type of financial ratio includes profitability, liquidity, solvency, efficiency and

investment ratio. With the use of this measure, the company can identify its profitability,

liquidity and efficiency performance and position in the market (Sassikala, 2018). It is also

useful for comparing the current performance of company with that of the previous years as

well as the competitor’s performance. In simple term, the financial ratio analysis helps the

organization to determine whether they are effectively operating and working in the market

or not. In case if they are not performing well than they need to adopt proper strategy in order

to enhance the overall performance of the company. The investors of the company can use

this information to analyses that investing in such company is profitable or not.

Section 3: Using the template provided:

I. Completing the Information on the ‘Business Review Template

(Ensure that you display your calculations for this detail)

Particulars 2016

£' 000

2015

£' 000

% change

Turnover derived through

continuing operations

189711 179587 5.60%

Profit for the financial year 43057 18987 126.77%

Shareholder's equity 83803 63057 32.90%

Current assets as a percentage of

current liabilities

54.72% 304.00% -82.00%

Customer satisfaction 4.5 4.1 10.00%

Average number of employees 649 618 5.00%

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

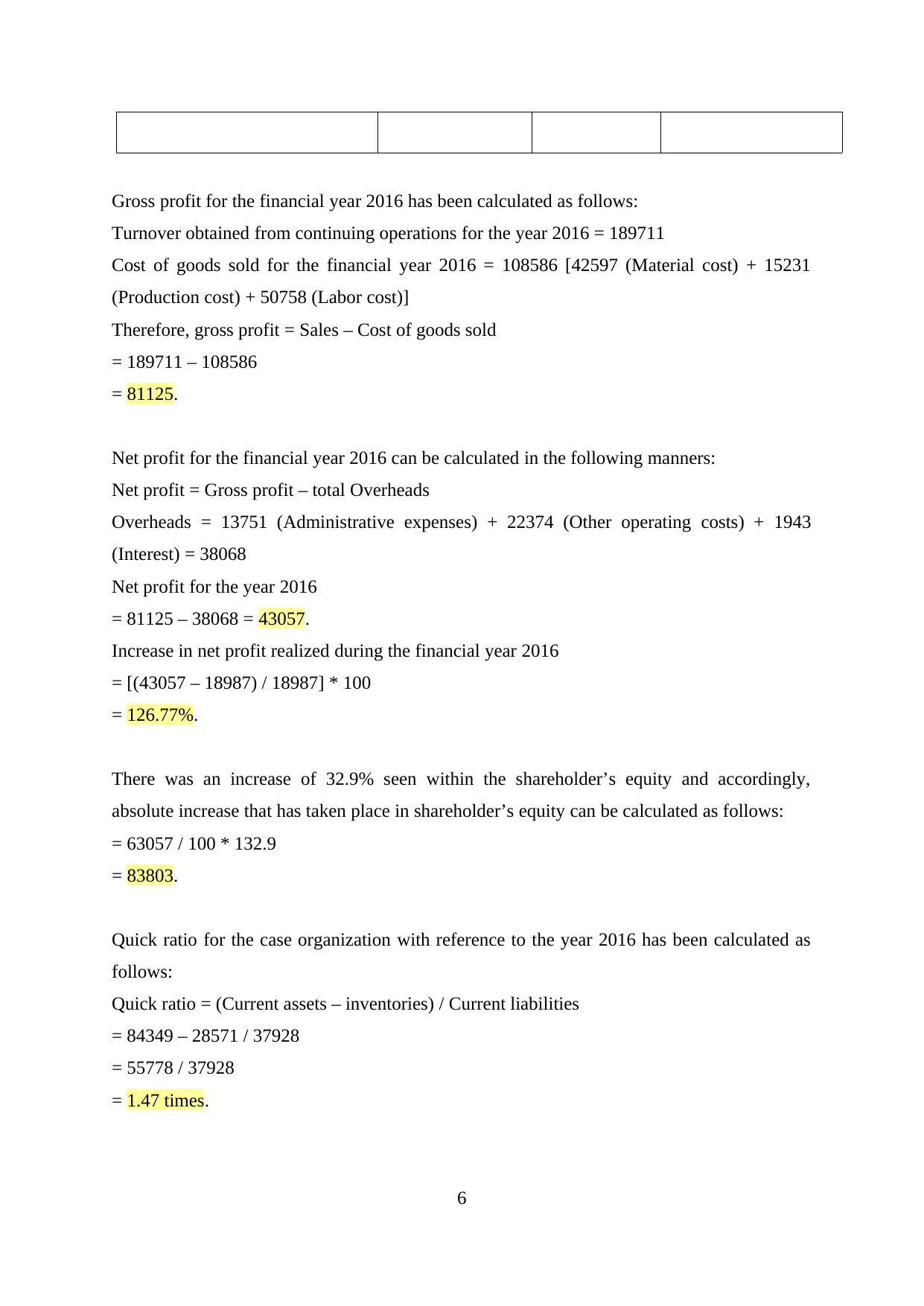

Gross profit for the financial year 2016 has been calculated as follows:

Turnover obtained from continuing operations for the year 2016 = 189711

Cost of goods sold for the financial year 2016 = 108586 [42597 (Material cost) + 15231

(Production cost) + 50758 (Labor cost)]

Therefore, gross profit = Sales – Cost of goods sold

= 189711 – 108586

= 81125.

Net profit for the financial year 2016 can be calculated in the following manners:

Net profit = Gross profit – total Overheads

Overheads = 13751 (Administrative expenses) + 22374 (Other operating costs) + 1943

(Interest) = 38068

Net profit for the year 2016

= 81125 – 38068 = 43057.

Increase in net profit realized during the financial year 2016

= [(43057 – 18987) / 18987] * 100

= 126.77%.

There was an increase of 32.9% seen within the shareholder’s equity and accordingly,

absolute increase that has taken place in shareholder’s equity can be calculated as follows:

= 63057 / 100 * 132.9

= 83803.

Quick ratio for the case organization with reference to the year 2016 has been calculated as

follows:

Quick ratio = (Current assets – inventories) / Current liabilities

= 84349 – 28571 / 37928

= 55778 / 37928

= 1.47 times.

6

Turnover obtained from continuing operations for the year 2016 = 189711

Cost of goods sold for the financial year 2016 = 108586 [42597 (Material cost) + 15231

(Production cost) + 50758 (Labor cost)]

Therefore, gross profit = Sales – Cost of goods sold

= 189711 – 108586

= 81125.

Net profit for the financial year 2016 can be calculated in the following manners:

Net profit = Gross profit – total Overheads

Overheads = 13751 (Administrative expenses) + 22374 (Other operating costs) + 1943

(Interest) = 38068

Net profit for the year 2016

= 81125 – 38068 = 43057.

Increase in net profit realized during the financial year 2016

= [(43057 – 18987) / 18987] * 100

= 126.77%.

There was an increase of 32.9% seen within the shareholder’s equity and accordingly,

absolute increase that has taken place in shareholder’s equity can be calculated as follows:

= 63057 / 100 * 132.9

= 83803.

Quick ratio for the case organization with reference to the year 2016 has been calculated as

follows:

Quick ratio = (Current assets – inventories) / Current liabilities

= 84349 – 28571 / 37928

= 55778 / 37928

= 1.47 times.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Current ratio of the case organization with reference to the year 2016 can be calculated in the

following manner:

Current ratio = (Current assets / Current liabilities)

= 84349 / 37928

= 2.22 times.

II. Using Excel producing an Income Statement for the Sample

Organization (see Case Study)

Attached in appendix section

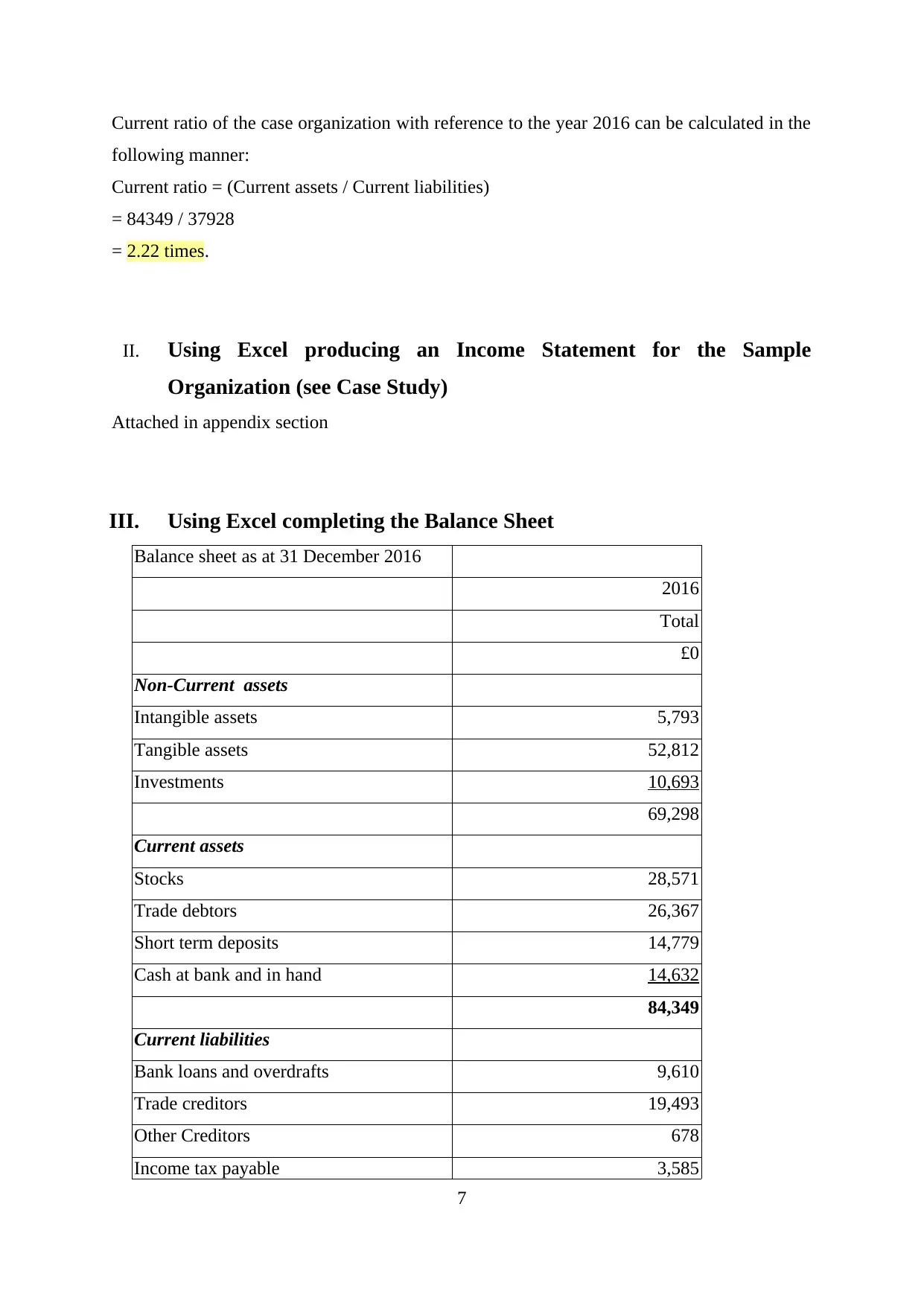

III. Using Excel completing the Balance Sheet

Balance sheet as at 31 December 2016

2016

Total

£0

Non-Current assets

Intangible assets 5,793

Tangible assets 52,812

Investments 10,693

69,298

Current assets

Stocks 28,571

Trade debtors 26,367

Short term deposits 14,779

Cash at bank and in hand 14,632

84,349

Current liabilities

Bank loans and overdrafts 9,610

Trade creditors 19,493

Other Creditors 678

Income tax payable 3,585

7

following manner:

Current ratio = (Current assets / Current liabilities)

= 84349 / 37928

= 2.22 times.

II. Using Excel producing an Income Statement for the Sample

Organization (see Case Study)

Attached in appendix section

III. Using Excel completing the Balance Sheet

Balance sheet as at 31 December 2016

2016

Total

£0

Non-Current assets

Intangible assets 5,793

Tangible assets 52,812

Investments 10,693

69,298

Current assets

Stocks 28,571

Trade debtors 26,367

Short term deposits 14,779

Cash at bank and in hand 14,632

84,349

Current liabilities

Bank loans and overdrafts 9,610

Trade creditors 19,493

Other Creditors 678

Income tax payable 3,585

7

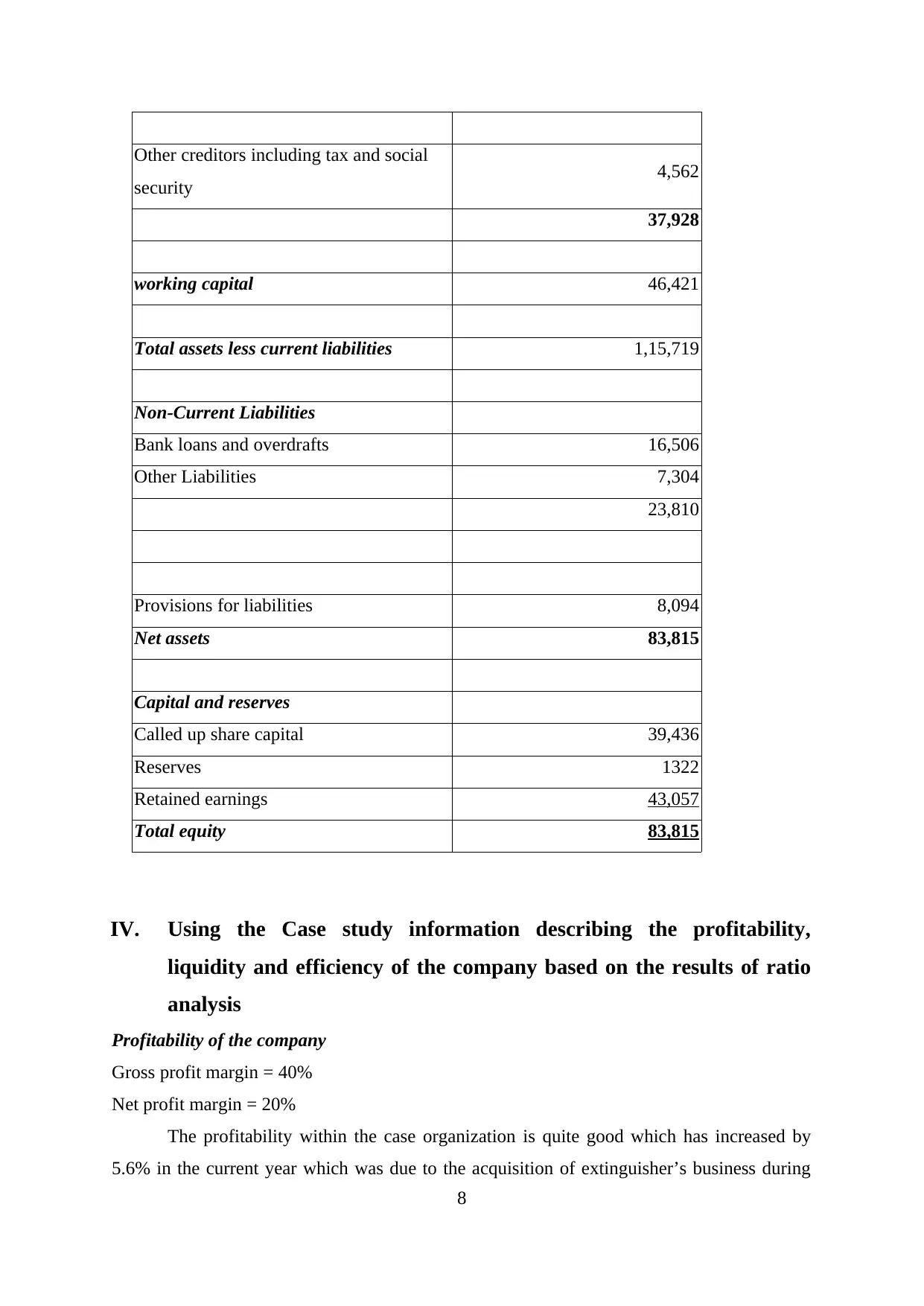

Other creditors including tax and social

security 4,562

37,928

working capital 46,421

Total assets less current liabilities 1,15,719

Non-Current Liabilities

Bank loans and overdrafts 16,506

Other Liabilities 7,304

23,810

Provisions for liabilities 8,094

Net assets 83,815

Capital and reserves

Called up share capital 39,436

Reserves 1322

Retained earnings 43,057

Total equity 83,815

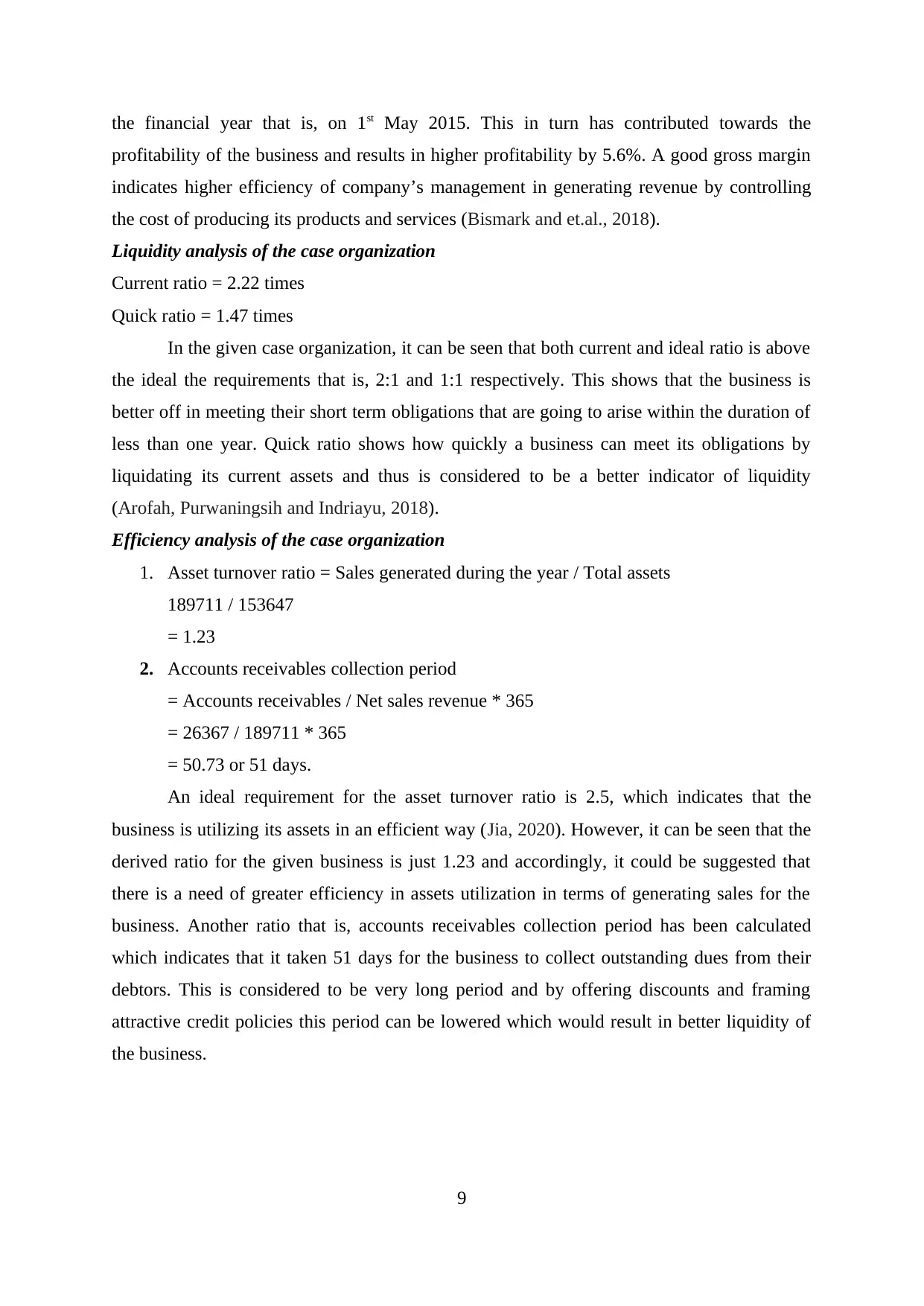

IV. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the results of ratio

analysis

Profitability of the company

Gross profit margin = 40%

Net profit margin = 20%

The profitability within the case organization is quite good which has increased by

5.6% in the current year which was due to the acquisition of extinguisher’s business during

8

security 4,562

37,928

working capital 46,421

Total assets less current liabilities 1,15,719

Non-Current Liabilities

Bank loans and overdrafts 16,506

Other Liabilities 7,304

23,810

Provisions for liabilities 8,094

Net assets 83,815

Capital and reserves

Called up share capital 39,436

Reserves 1322

Retained earnings 43,057

Total equity 83,815

IV. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the results of ratio

analysis

Profitability of the company

Gross profit margin = 40%

Net profit margin = 20%

The profitability within the case organization is quite good which has increased by

5.6% in the current year which was due to the acquisition of extinguisher’s business during

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the financial year that is, on 1st May 2015. This in turn has contributed towards the

profitability of the business and results in higher profitability by 5.6%. A good gross margin

indicates higher efficiency of company’s management in generating revenue by controlling

the cost of producing its products and services (Bismark and et.al., 2018).

Liquidity analysis of the case organization

Current ratio = 2.22 times

Quick ratio = 1.47 times

In the given case organization, it can be seen that both current and ideal ratio is above

the ideal the requirements that is, 2:1 and 1:1 respectively. This shows that the business is

better off in meeting their short term obligations that are going to arise within the duration of

less than one year. Quick ratio shows how quickly a business can meet its obligations by

liquidating its current assets and thus is considered to be a better indicator of liquidity

(Arofah, Purwaningsih and Indriayu, 2018).

Efficiency analysis of the case organization

1. Asset turnover ratio = Sales generated during the year / Total assets

189711 / 153647

= 1.23

2. Accounts receivables collection period

= Accounts receivables / Net sales revenue * 365

= 26367 / 189711 * 365

= 50.73 or 51 days.

An ideal requirement for the asset turnover ratio is 2.5, which indicates that the

business is utilizing its assets in an efficient way (Jia, 2020). However, it can be seen that the

derived ratio for the given business is just 1.23 and accordingly, it could be suggested that

there is a need of greater efficiency in assets utilization in terms of generating sales for the

business. Another ratio that is, accounts receivables collection period has been calculated

which indicates that it taken 51 days for the business to collect outstanding dues from their

debtors. This is considered to be very long period and by offering discounts and framing

attractive credit policies this period can be lowered which would result in better liquidity of

the business.

9

profitability of the business and results in higher profitability by 5.6%. A good gross margin

indicates higher efficiency of company’s management in generating revenue by controlling

the cost of producing its products and services (Bismark and et.al., 2018).

Liquidity analysis of the case organization

Current ratio = 2.22 times

Quick ratio = 1.47 times

In the given case organization, it can be seen that both current and ideal ratio is above

the ideal the requirements that is, 2:1 and 1:1 respectively. This shows that the business is

better off in meeting their short term obligations that are going to arise within the duration of

less than one year. Quick ratio shows how quickly a business can meet its obligations by

liquidating its current assets and thus is considered to be a better indicator of liquidity

(Arofah, Purwaningsih and Indriayu, 2018).

Efficiency analysis of the case organization

1. Asset turnover ratio = Sales generated during the year / Total assets

189711 / 153647

= 1.23

2. Accounts receivables collection period

= Accounts receivables / Net sales revenue * 365

= 26367 / 189711 * 365

= 50.73 or 51 days.

An ideal requirement for the asset turnover ratio is 2.5, which indicates that the

business is utilizing its assets in an efficient way (Jia, 2020). However, it can be seen that the

derived ratio for the given business is just 1.23 and accordingly, it could be suggested that

there is a need of greater efficiency in assets utilization in terms of generating sales for the

business. Another ratio that is, accounts receivables collection period has been calculated

which indicates that it taken 51 days for the business to collect outstanding dues from their

debtors. This is considered to be very long period and by offering discounts and framing

attractive credit policies this period can be lowered which would result in better liquidity of

the business.

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

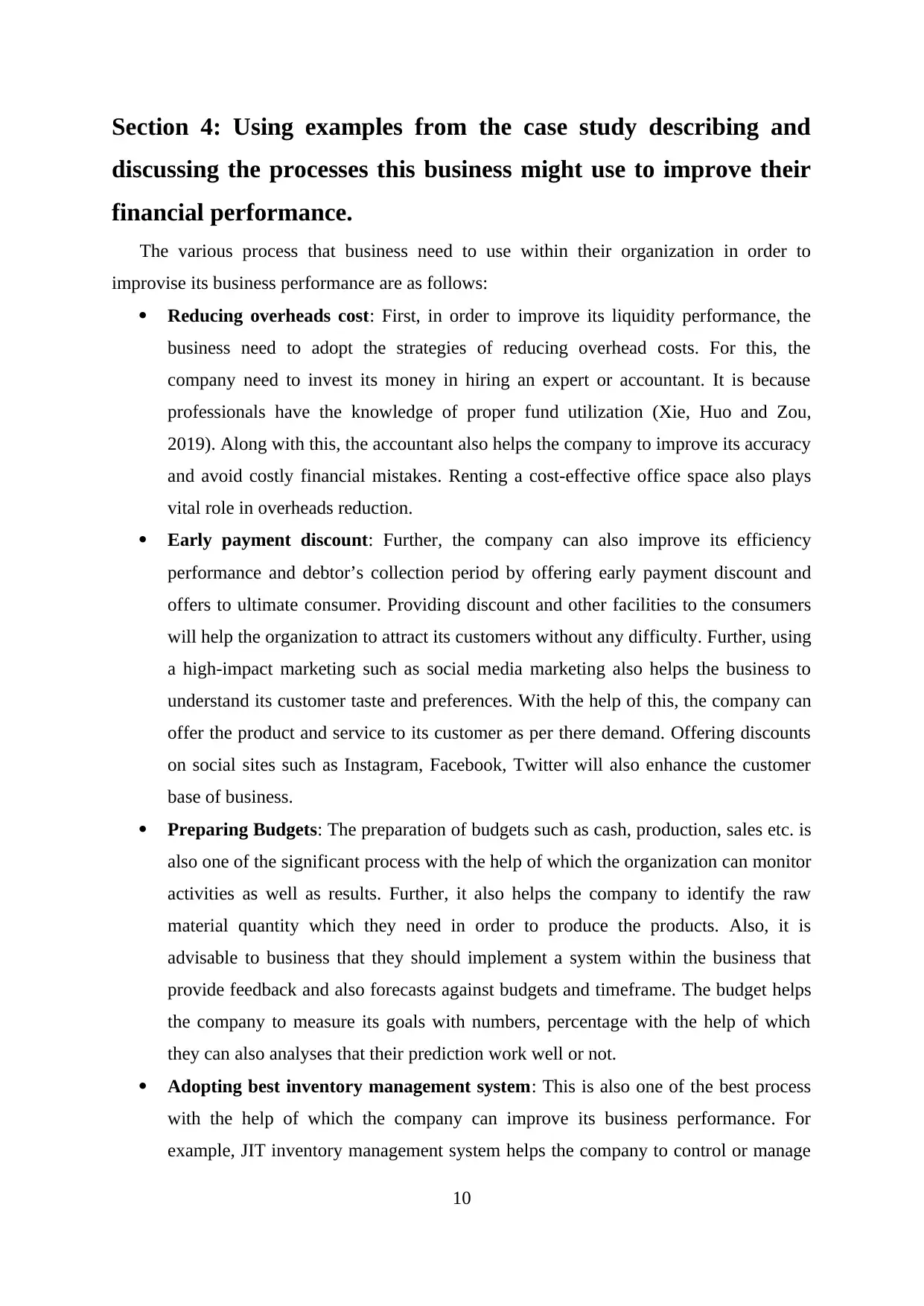

Section 4: Using examples from the case study describing and

discussing the processes this business might use to improve their

financial performance.

The various process that business need to use within their organization in order to

improvise its business performance are as follows:

Reducing overheads cost: First, in order to improve its liquidity performance, the

business need to adopt the strategies of reducing overhead costs. For this, the

company need to invest its money in hiring an expert or accountant. It is because

professionals have the knowledge of proper fund utilization (Xie, Huo and Zou,

2019). Along with this, the accountant also helps the company to improve its accuracy

and avoid costly financial mistakes. Renting a cost-effective office space also plays

vital role in overheads reduction.

Early payment discount: Further, the company can also improve its efficiency

performance and debtor’s collection period by offering early payment discount and

offers to ultimate consumer. Providing discount and other facilities to the consumers

will help the organization to attract its customers without any difficulty. Further, using

a high-impact marketing such as social media marketing also helps the business to

understand its customer taste and preferences. With the help of this, the company can

offer the product and service to its customer as per there demand. Offering discounts

on social sites such as Instagram, Facebook, Twitter will also enhance the customer

base of business.

Preparing Budgets: The preparation of budgets such as cash, production, sales etc. is

also one of the significant process with the help of which the organization can monitor

activities as well as results. Further, it also helps the company to identify the raw

material quantity which they need in order to produce the products. Also, it is

advisable to business that they should implement a system within the business that

provide feedback and also forecasts against budgets and timeframe. The budget helps

the company to measure its goals with numbers, percentage with the help of which

they can also analyses that their prediction work well or not.

Adopting best inventory management system: This is also one of the best process

with the help of which the company can improve its business performance. For

example, JIT inventory management system helps the company to control or manage

10

discussing the processes this business might use to improve their

financial performance.

The various process that business need to use within their organization in order to

improvise its business performance are as follows:

Reducing overheads cost: First, in order to improve its liquidity performance, the

business need to adopt the strategies of reducing overhead costs. For this, the

company need to invest its money in hiring an expert or accountant. It is because

professionals have the knowledge of proper fund utilization (Xie, Huo and Zou,

2019). Along with this, the accountant also helps the company to improve its accuracy

and avoid costly financial mistakes. Renting a cost-effective office space also plays

vital role in overheads reduction.

Early payment discount: Further, the company can also improve its efficiency

performance and debtor’s collection period by offering early payment discount and

offers to ultimate consumer. Providing discount and other facilities to the consumers

will help the organization to attract its customers without any difficulty. Further, using

a high-impact marketing such as social media marketing also helps the business to

understand its customer taste and preferences. With the help of this, the company can

offer the product and service to its customer as per there demand. Offering discounts

on social sites such as Instagram, Facebook, Twitter will also enhance the customer

base of business.

Preparing Budgets: The preparation of budgets such as cash, production, sales etc. is

also one of the significant process with the help of which the organization can monitor

activities as well as results. Further, it also helps the company to identify the raw

material quantity which they need in order to produce the products. Also, it is

advisable to business that they should implement a system within the business that

provide feedback and also forecasts against budgets and timeframe. The budget helps

the company to measure its goals with numbers, percentage with the help of which

they can also analyses that their prediction work well or not.

Adopting best inventory management system: This is also one of the best process

with the help of which the company can improve its business performance. For

example, JIT inventory management system helps the company to control or manage

10

its inventory within the organization (Ngoc, Tien and Thu, 2021). This helps the

company to reduce its inventory holding cost, the impact of which the overall

performance of the business gets improved along with the profitability margin. The

proper communication process within the organization is also need to be implement

by organization in order to improve the performance of business.

Conclusion

After summing up the above information, it is analyzed that the performance of

organization has improved in the term of profitability. However, on the other hand, it is also

concluded that the liquidity performance of the company has decrease which they need to

improve. Further, the report has also concluded the concept and important of financial

management. Also, the report has concluded the components of financial statement including

uses of ratio in financial management. On the basis of ratio calculation, the report has also

identified that the company has shifted from debt financing to equity financing the impact of

which their interest expenses has reduced.

11

company to reduce its inventory holding cost, the impact of which the overall

performance of the business gets improved along with the profitability margin. The

proper communication process within the organization is also need to be implement

by organization in order to improve the performance of business.

Conclusion

After summing up the above information, it is analyzed that the performance of

organization has improved in the term of profitability. However, on the other hand, it is also

concluded that the liquidity performance of the company has decrease which they need to

improve. Further, the report has also concluded the concept and important of financial

management. Also, the report has concluded the components of financial statement including

uses of ratio in financial management. On the basis of ratio calculation, the report has also

identified that the company has shifted from debt financing to equity financing the impact of

which their interest expenses has reduced.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.