Boeing's Global Business Management Strategy in China's Economy

VerifiedAdded on 2023/06/04

|16

|4134

|74

Case Study

AI Summary

This case study examines Boeing's global business management strategy in the context of China's emerging economy. It identifies the opportunities and challenges Boeing faces in the Chinese market, particularly concerning competition from existing players like Gulfstream and regulatory hurdles. The analysis explores Boeing's resources and capabilities, highlighting its technological advancements and strategic fit. The study further delves into the market opportunities presented by China's growing aviation sector, including general and commercial aviation. Boeing's market entry strategies, including adapting the 737 for business jet use and considering exportation and joint ventures, are discussed, along with the importance of corporate social responsibility. Finally, the case study assesses potential market risks and threats to Boeing's strategy in China. Desklib provides access to similar case studies and solved assignments for students.

Running head: GLOBAL BUSINESS MANAGEMENT

Global Business Management

Name of the Student

Name of the University

Author Note

Global Business Management

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1GLOBAL BUSINESS MANAGEMENT

Table of Content

1. Background of Boeing...........................................................................................................2

2. Problem Identification............................................................................................................2

3. Problem analysis....................................................................................................................3

3.1 Exploring resource and capabilities of Boeing....................................................................3

4. Market opportunity derived from emerging Chinese economy.............................................4

Some basic and specified opportunities:................................................................................6

5. Strategy adopted by Boeing to pursue the emerging economy in China...............................7

Market Entry Strategy............................................................................................................8

Corporate Social Responsibility...........................................................................................10

6. Estimated market risk from the adoption of the strategy.....................................................11

Market threats.......................................................................................................................12

References................................................................................................................................13

Table of Content

1. Background of Boeing...........................................................................................................2

2. Problem Identification............................................................................................................2

3. Problem analysis....................................................................................................................3

3.1 Exploring resource and capabilities of Boeing....................................................................3

4. Market opportunity derived from emerging Chinese economy.............................................4

Some basic and specified opportunities:................................................................................6

5. Strategy adopted by Boeing to pursue the emerging economy in China...............................7

Market Entry Strategy............................................................................................................8

Corporate Social Responsibility...........................................................................................10

6. Estimated market risk from the adoption of the strategy.....................................................11

Market threats.......................................................................................................................12

References................................................................................................................................13

2GLOBAL BUSINESS MANAGEMENT

1. Background of Boeing

It is widely known that Boeing presently has become largest aerospace company as

well as leading manufacturer of aerospace and security system. As US’s biggest

manufacturing exporter, Boeing provides airline services to US and allied government

customers in more than 150 nations. On the other side, Boeing Global Services provides a

complete, cost competitive services for commercial defense as well as space customers

(Boeing.com 2018). With the help of engineering, digital analytics, training support spanning

and supply chain across both government and commercial service deals, Boeing is

exclusively positioned to deliver world class services to customers. Furthermore, the service

offering of Boeing is not limited here, as in the field of Boeing Defense, Space and Security,

Boeing remains as the only aerospace manufacturer that provides products, which enabling

its customers to achieve mission requirements with the inclusion of sea bed and outer space.

There is no doubt that organization serves a diverse customer base but the portfolio is

particularly focused in major six market areas such as commercial Derivatives, Military

Rotocraft, Human Space Exploration and Autonomous System and Services (Boeing.com

2018). Thus, it is worth stating that when it comes to expanding the services and markets,

Boeing is never standing behind. So, China’s emerging economy is a significant market

opportunity for Boeing as the part of global expansion.

2. Problem Identification

It has been identified that the world market is widely influenced by emerging

economy of China which is particularly luring the aerospace airplane manufacturers, as

Chinese government who looks after the business jet management, had imposed stiff

provisions for business jets with respect to allowance, is now welcoming business air jets

both domestic and international (Fu et al. 2015). As the economy is flourishing, many global

1. Background of Boeing

It is widely known that Boeing presently has become largest aerospace company as

well as leading manufacturer of aerospace and security system. As US’s biggest

manufacturing exporter, Boeing provides airline services to US and allied government

customers in more than 150 nations. On the other side, Boeing Global Services provides a

complete, cost competitive services for commercial defense as well as space customers

(Boeing.com 2018). With the help of engineering, digital analytics, training support spanning

and supply chain across both government and commercial service deals, Boeing is

exclusively positioned to deliver world class services to customers. Furthermore, the service

offering of Boeing is not limited here, as in the field of Boeing Defense, Space and Security,

Boeing remains as the only aerospace manufacturer that provides products, which enabling

its customers to achieve mission requirements with the inclusion of sea bed and outer space.

There is no doubt that organization serves a diverse customer base but the portfolio is

particularly focused in major six market areas such as commercial Derivatives, Military

Rotocraft, Human Space Exploration and Autonomous System and Services (Boeing.com

2018). Thus, it is worth stating that when it comes to expanding the services and markets,

Boeing is never standing behind. So, China’s emerging economy is a significant market

opportunity for Boeing as the part of global expansion.

2. Problem Identification

It has been identified that the world market is widely influenced by emerging

economy of China which is particularly luring the aerospace airplane manufacturers, as

Chinese government who looks after the business jet management, had imposed stiff

provisions for business jets with respect to allowance, is now welcoming business air jets

both domestic and international (Fu et al. 2015). As the economy is flourishing, many global

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3GLOBAL BUSINESS MANAGEMENT

and existing aerospace manufacturers are gearing themselves up for the growing demands of

business jet services. Presently, Beech Hawker, Cessna and Gulfstream of United States are

the major and traditional competitions who are trying to deal with this growing demands

business air jets. Nonetheless, the demand is rapidly growing demands.

Even though the demands are high, acquiring China’s aerospace and business jet

market will not be an easy task, the existing competitor Gulfstream has a strong position in

the market. According to the case study, Gulfstream has tremendous record of acquiring

every order and it tends to apply market-oriented approach. Although acquiring Chinese

market seems to be difficult, observing the demand the local Chinese aerospace take the

advantages of leniency Chinese government with respect to the allowance of business air jet

(Fu, Zhang and Lei 2012). Nevertheless, it is worth stating that the demands business airline

in the Chinese market will further grow and on the basis of the scenario, Boeing should enter

the market by avoiding the possible the challenges and threats from the existing competitors.

Hence, the major market barriers for Boeing is that entering China market which is already

acquired by large global competitors and dealing with excessive tax and provisions from

Chinese government on global businesses.

3. Problem analysis

3.1 Exploring resource and capabilities of Boeing

According to the study conducted by Zhang, YangWang and Zhang (2014), it is

certain that for quantifying resources and capability as strategic, the business has to be

organized to utilize or exploit those resources and capabilities. It is observed that starting and

running an effective airline is effective as it needs extensive resources, capabilities and core

competencies. When it comes to Boeing strategic capability, it is identified that Boeing

commercial airplane segment is strategically fit as well as developed division in terms of

and existing aerospace manufacturers are gearing themselves up for the growing demands of

business jet services. Presently, Beech Hawker, Cessna and Gulfstream of United States are

the major and traditional competitions who are trying to deal with this growing demands

business air jets. Nonetheless, the demand is rapidly growing demands.

Even though the demands are high, acquiring China’s aerospace and business jet

market will not be an easy task, the existing competitor Gulfstream has a strong position in

the market. According to the case study, Gulfstream has tremendous record of acquiring

every order and it tends to apply market-oriented approach. Although acquiring Chinese

market seems to be difficult, observing the demand the local Chinese aerospace take the

advantages of leniency Chinese government with respect to the allowance of business air jet

(Fu, Zhang and Lei 2012). Nevertheless, it is worth stating that the demands business airline

in the Chinese market will further grow and on the basis of the scenario, Boeing should enter

the market by avoiding the possible the challenges and threats from the existing competitors.

Hence, the major market barriers for Boeing is that entering China market which is already

acquired by large global competitors and dealing with excessive tax and provisions from

Chinese government on global businesses.

3. Problem analysis

3.1 Exploring resource and capabilities of Boeing

According to the study conducted by Zhang, YangWang and Zhang (2014), it is

certain that for quantifying resources and capability as strategic, the business has to be

organized to utilize or exploit those resources and capabilities. It is observed that starting and

running an effective airline is effective as it needs extensive resources, capabilities and core

competencies. When it comes to Boeing strategic capability, it is identified that Boeing

commercial airplane segment is strategically fit as well as developed division in terms of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4GLOBAL BUSINESS MANAGEMENT

enhancing and managing existing resources that guide the business to design distinctive

capabilities and core competencies. The concept of boundary of business makes complete

sense with respect to last dimension as it deals with the questions of whether the business is

supposed to design and manufacture resource itself or it commend it to a partner (Lin and Wu

2014).

Particularly, it has been identified that with a series of consideration to the newly

developed architecture for the electronic system which could affect the flight control. Till

date, aircraft delivered by Boeing has been designed by instilling federated architecture,

where computers have been allocated to a single function (Lawrence and Thornton 2017).

The recently developed architecture by Boeing called “Modular” and “Distributed” leads to

the distribution of computer technologies throughout the entire aircraft as well as support the

involvement of many functions in single computer technology (Al-Najjar et al. 2017). When

it comes to capability, the influence of architectural changes made by Boeing can call for a

strong and comprehensive implications of architect-integrators in their design. Therefore,

existing capabilities and resources indicate that Boeing has enhanced technology background.

4. Market opportunity derived from emerging Chinese economy

It is certain that economy fluctuation is a permanent scenario in each market but

globalization plays a great role in changing the market scenario. It has been particularly

identified that China’s socialist economy remains as world’s second largest economy by the

nominal growth and GDP as well as world largest economy with respect to purchasing power

parity. Tuschke, Sanders and Hernandez, (2014) has mentioned that China is a global hub for

manufacturing as well as is the largest manufacturing economy in the world. Specifically,

China has become the second biggest domestic aviation market in the globe, apart from being

the fastest developing market with 9.5% passenger traffic growth rate in the consecutive year

enhancing and managing existing resources that guide the business to design distinctive

capabilities and core competencies. The concept of boundary of business makes complete

sense with respect to last dimension as it deals with the questions of whether the business is

supposed to design and manufacture resource itself or it commend it to a partner (Lin and Wu

2014).

Particularly, it has been identified that with a series of consideration to the newly

developed architecture for the electronic system which could affect the flight control. Till

date, aircraft delivered by Boeing has been designed by instilling federated architecture,

where computers have been allocated to a single function (Lawrence and Thornton 2017).

The recently developed architecture by Boeing called “Modular” and “Distributed” leads to

the distribution of computer technologies throughout the entire aircraft as well as support the

involvement of many functions in single computer technology (Al-Najjar et al. 2017). When

it comes to capability, the influence of architectural changes made by Boeing can call for a

strong and comprehensive implications of architect-integrators in their design. Therefore,

existing capabilities and resources indicate that Boeing has enhanced technology background.

4. Market opportunity derived from emerging Chinese economy

It is certain that economy fluctuation is a permanent scenario in each market but

globalization plays a great role in changing the market scenario. It has been particularly

identified that China’s socialist economy remains as world’s second largest economy by the

nominal growth and GDP as well as world largest economy with respect to purchasing power

parity. Tuschke, Sanders and Hernandez, (2014) has mentioned that China is a global hub for

manufacturing as well as is the largest manufacturing economy in the world. Specifically,

China has become the second biggest domestic aviation market in the globe, apart from being

the fastest developing market with 9.5% passenger traffic growth rate in the consecutive year

5GLOBAL BUSINESS MANAGEMENT

(Ang, Benischke and Doh 2015). Moreover, as per Lawrence and Thornton (2017), Boeing

market analysis has forecasted that China presently should add an additional 6800 aircraft to

business commercial fleet to deal with the growing demands.

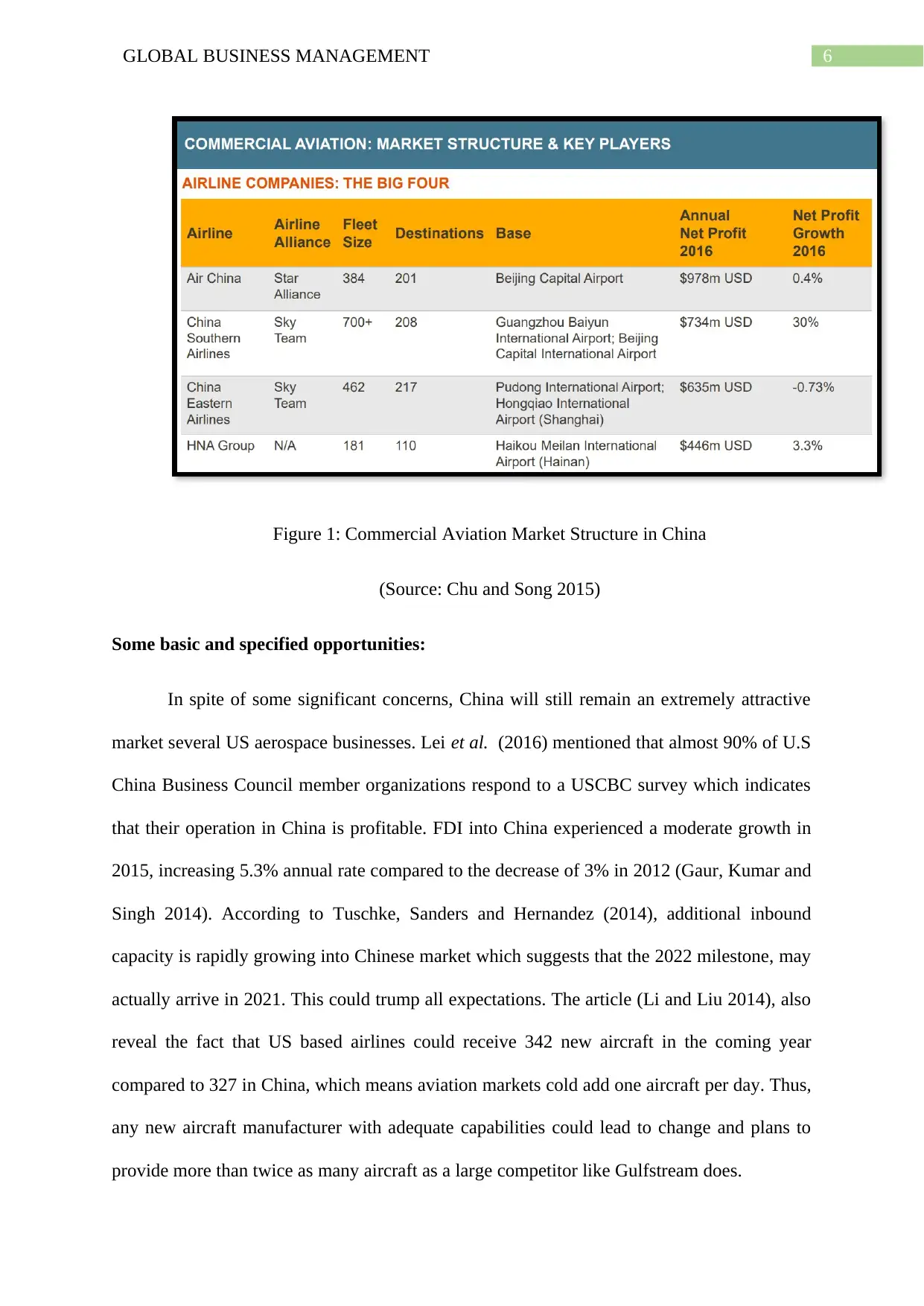

Among the vast categories of options for entering and developing business in China,

there are four significant market opportunities in the aviation sector such as General aviation,

commercial aviation, joint programs and technology providers. Particularly, in general

aviation, presently 364 GA firms in China are running their operation and almost 2185

registered GA aircrafts are there in the market along with projected 77000 GA flying hours in

2017 (De Beule, Elia and Piscitello 2014). In addition to this, there is limited barriers to

General Aviation for market entrance. It is also identified that by 2020, China plans to have

more than 500 GA aircraft as well as 500 GA airports, which is certainly a significant

opportunity for Boeing. Albu, Albu and Alexander (2014), commented that air resources

might face challenges and there is an extensive use of airspace by the military. The author of

this article has also mentioned that about 50% of registered GA pilots find business in

domestic environment, while less than 100 new GA pilots demanded annually (Jiang and

Zhang 2016). However, there is a still demand for high-skilled pilots in some particular

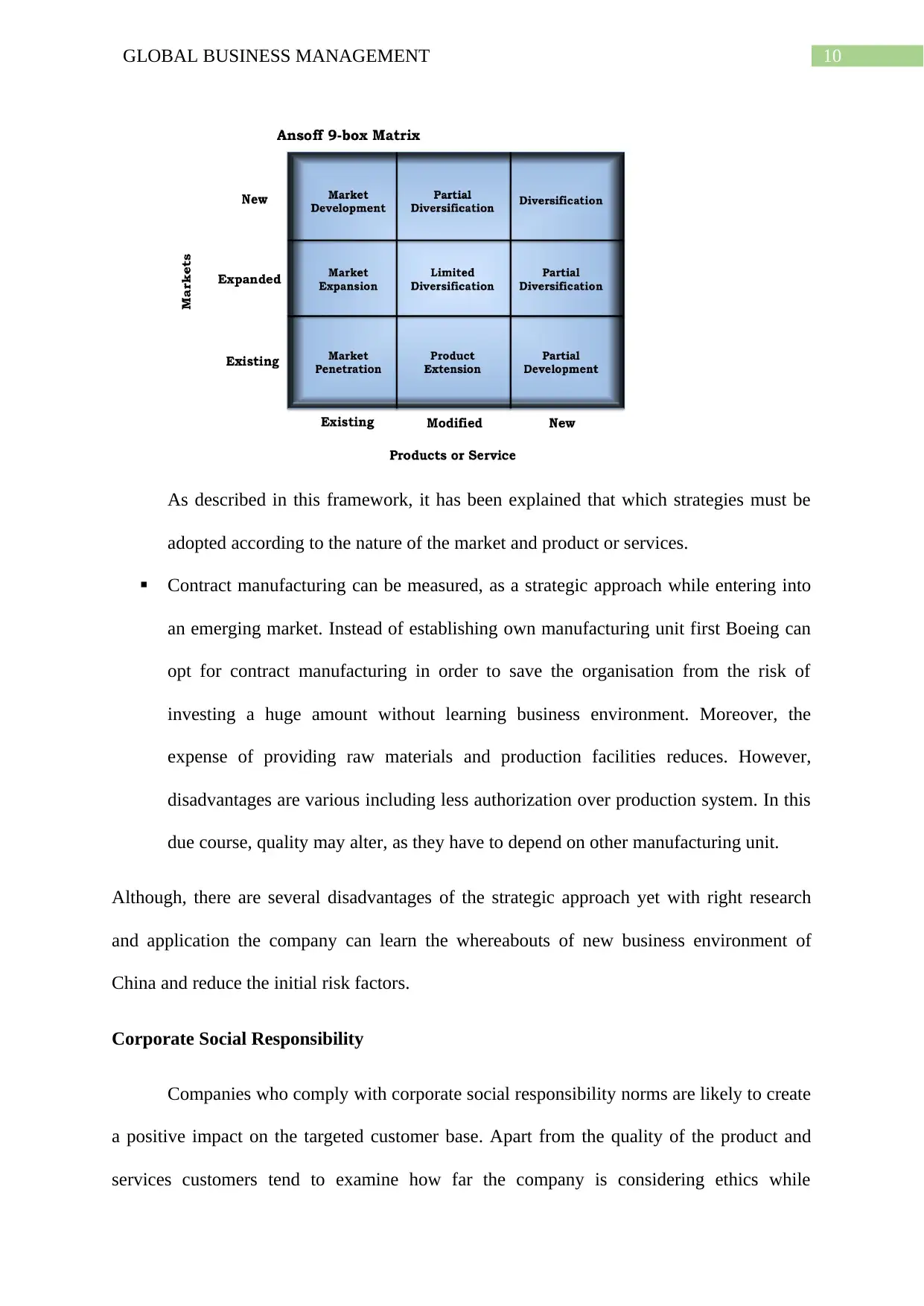

sector. The following figure shows the market structure and key players of commercial

business aviation in China.

(Ang, Benischke and Doh 2015). Moreover, as per Lawrence and Thornton (2017), Boeing

market analysis has forecasted that China presently should add an additional 6800 aircraft to

business commercial fleet to deal with the growing demands.

Among the vast categories of options for entering and developing business in China,

there are four significant market opportunities in the aviation sector such as General aviation,

commercial aviation, joint programs and technology providers. Particularly, in general

aviation, presently 364 GA firms in China are running their operation and almost 2185

registered GA aircrafts are there in the market along with projected 77000 GA flying hours in

2017 (De Beule, Elia and Piscitello 2014). In addition to this, there is limited barriers to

General Aviation for market entrance. It is also identified that by 2020, China plans to have

more than 500 GA aircraft as well as 500 GA airports, which is certainly a significant

opportunity for Boeing. Albu, Albu and Alexander (2014), commented that air resources

might face challenges and there is an extensive use of airspace by the military. The author of

this article has also mentioned that about 50% of registered GA pilots find business in

domestic environment, while less than 100 new GA pilots demanded annually (Jiang and

Zhang 2016). However, there is a still demand for high-skilled pilots in some particular

sector. The following figure shows the market structure and key players of commercial

business aviation in China.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6GLOBAL BUSINESS MANAGEMENT

Figure 1: Commercial Aviation Market Structure in China

(Source: Chu and Song 2015)

Some basic and specified opportunities:

In spite of some significant concerns, China will still remain an extremely attractive

market several US aerospace businesses. Lei et al. (2016) mentioned that almost 90% of U.S

China Business Council member organizations respond to a USCBC survey which indicates

that their operation in China is profitable. FDI into China experienced a moderate growth in

2015, increasing 5.3% annual rate compared to the decrease of 3% in 2012 (Gaur, Kumar and

Singh 2014). According to Tuschke, Sanders and Hernandez (2014), additional inbound

capacity is rapidly growing into Chinese market which suggests that the 2022 milestone, may

actually arrive in 2021. This could trump all expectations. The article (Li and Liu 2014), also

reveal the fact that US based airlines could receive 342 new aircraft in the coming year

compared to 327 in China, which means aviation markets cold add one aircraft per day. Thus,

any new aircraft manufacturer with adequate capabilities could lead to change and plans to

provide more than twice as many aircraft as a large competitor like Gulfstream does.

Figure 1: Commercial Aviation Market Structure in China

(Source: Chu and Song 2015)

Some basic and specified opportunities:

In spite of some significant concerns, China will still remain an extremely attractive

market several US aerospace businesses. Lei et al. (2016) mentioned that almost 90% of U.S

China Business Council member organizations respond to a USCBC survey which indicates

that their operation in China is profitable. FDI into China experienced a moderate growth in

2015, increasing 5.3% annual rate compared to the decrease of 3% in 2012 (Gaur, Kumar and

Singh 2014). According to Tuschke, Sanders and Hernandez (2014), additional inbound

capacity is rapidly growing into Chinese market which suggests that the 2022 milestone, may

actually arrive in 2021. This could trump all expectations. The article (Li and Liu 2014), also

reveal the fact that US based airlines could receive 342 new aircraft in the coming year

compared to 327 in China, which means aviation markets cold add one aircraft per day. Thus,

any new aircraft manufacturer with adequate capabilities could lead to change and plans to

provide more than twice as many aircraft as a large competitor like Gulfstream does.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7GLOBAL BUSINESS MANAGEMENT

Beside Chinese market, a market trend can be observed in other Asian countries like

India. At present, India has no less than 250 jets owned by business tycoons of first rows. As

per the market prediction, India will be the owner of 1000+ private jets and aircrafts in total

in coming decades. Comparing with the developed countries India has a low growth rate as

far as this industry is concerned. The difference with the Chinese market is that in spite of the

economical imbalance China has a demand of private jets within industry. On the other hand,

being a developing country, India has overshadowed both China and Japan as far as number

of owned Private jets are concerned. However, as a market threat Boeing can face Indians

changing attitude towards buying private jets as they feel post purchase maintenance charges

of infrastructure is not convenient for them. Currently, as of now the market trend is in favour

of aircraft manufacturing companies like Boeing.

5. Strategy adopted by Boeing to pursue the emerging economy in China

Being one of the biggest aircraft manufacturing company of American origin; it has

mastered the operations of defence and aerospace. The company has a positive global image

as well. Acknowledging the favourable business environment in China Boeing has decided to

expand its territory to china’s private or business jet market. China is known as the land of

second largest billionaire after US (Fu et al. 2015). Therefore, buying power of the market in

terms of selling business jets or private jets is powerful enough. As compared to the buying

power, the number of business jets are 400, which are currently flying across virgin sky of

China. In order to explore this opportunity Boeing has decided to enter into the China’s virgin

skies. Boeing has considered a strategic approach while planning to enter into the Chinese

market as well as they have decided to handle corporate social responsibility with highest

priority as it will assist them to sustain in the market and enhance competitive edge.

Beside Chinese market, a market trend can be observed in other Asian countries like

India. At present, India has no less than 250 jets owned by business tycoons of first rows. As

per the market prediction, India will be the owner of 1000+ private jets and aircrafts in total

in coming decades. Comparing with the developed countries India has a low growth rate as

far as this industry is concerned. The difference with the Chinese market is that in spite of the

economical imbalance China has a demand of private jets within industry. On the other hand,

being a developing country, India has overshadowed both China and Japan as far as number

of owned Private jets are concerned. However, as a market threat Boeing can face Indians

changing attitude towards buying private jets as they feel post purchase maintenance charges

of infrastructure is not convenient for them. Currently, as of now the market trend is in favour

of aircraft manufacturing companies like Boeing.

5. Strategy adopted by Boeing to pursue the emerging economy in China

Being one of the biggest aircraft manufacturing company of American origin; it has

mastered the operations of defence and aerospace. The company has a positive global image

as well. Acknowledging the favourable business environment in China Boeing has decided to

expand its territory to china’s private or business jet market. China is known as the land of

second largest billionaire after US (Fu et al. 2015). Therefore, buying power of the market in

terms of selling business jets or private jets is powerful enough. As compared to the buying

power, the number of business jets are 400, which are currently flying across virgin sky of

China. In order to explore this opportunity Boeing has decided to enter into the China’s virgin

skies. Boeing has considered a strategic approach while planning to enter into the Chinese

market as well as they have decided to handle corporate social responsibility with highest

priority as it will assist them to sustain in the market and enhance competitive edge.

8GLOBAL BUSINESS MANAGEMENT

Market Entry Strategy

There are three major consideration, which must be taken while going global. Boeing

has its positive global reputation of delivering quality service. As per the description of De

Beule, Elia and Piscitello (2014), while entering into Chinese market the company will

consider Chinese political, economic, social, technological and legal orientation. According

to the current market condition, Chinese market has immense potential for jet makers

especially who deals with manufacturing of business or private jets. Before entering

into market, it is essential to look into the country’s resources. According to the provided

case study. In order to enter into the market, as described in Ang, Benischke and Doh, (2015),

Boeing has adapted 737 to offer ‘Boeing Business Jet’, which can carry up to 60 passengers.

Moreover, before establishing its individual unit the firm can consider exporting and joint

venture to avoid the extreme initial competition. Exportation of parts and collaborating with

other existing aircraft manufacturers Boeing can think of preparing a strong customer base

first to receive a warm welcome after its individual establishment. Besides, several strategies

regarding outsourcing, by performing acquisitions will be helpful too. Strategies are as

follows.

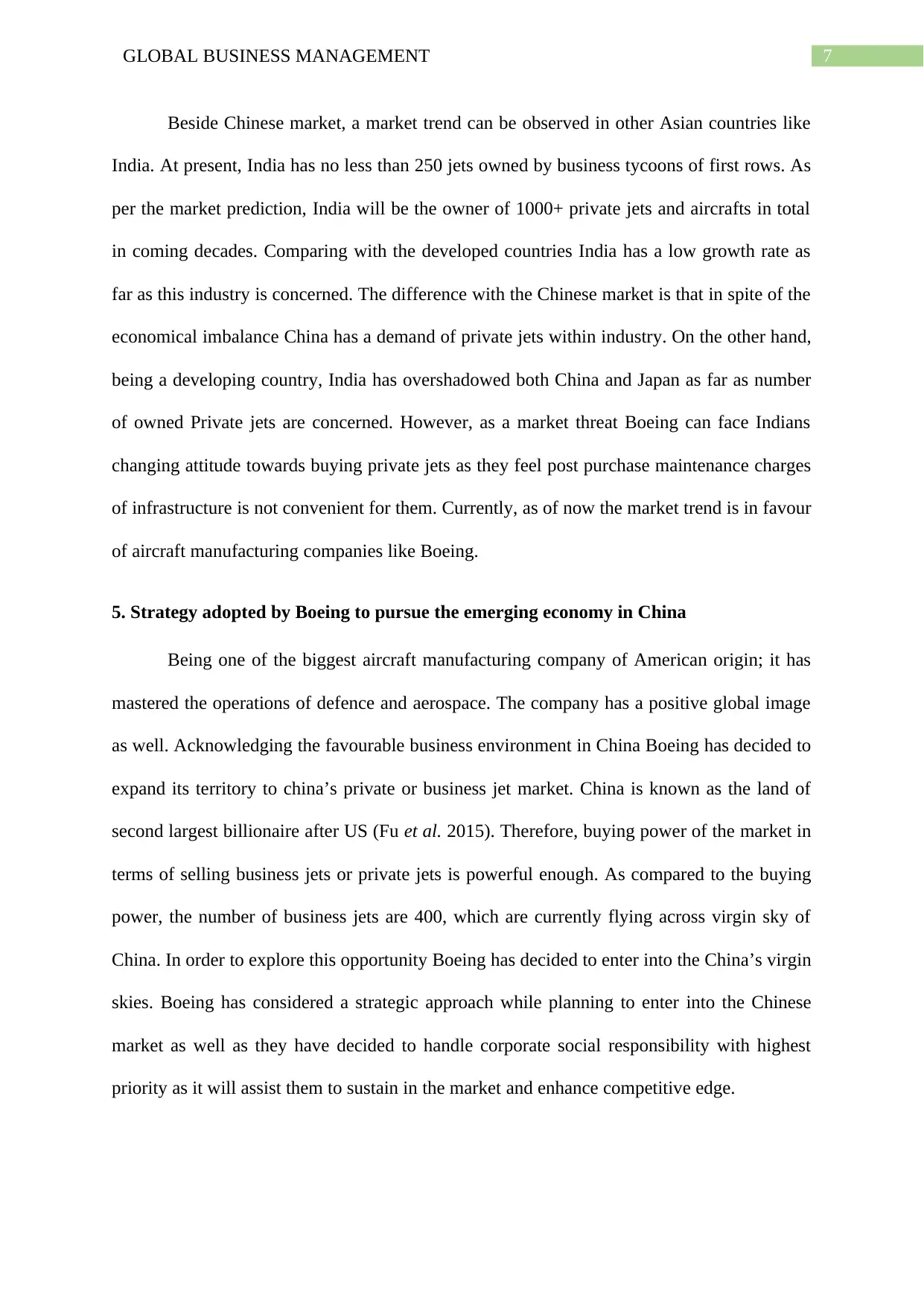

In order to deal with a very promising foreign market, exporting the aircraft manufacturing

parts will be a wise idea to enter the market and understand the response first.

Response will come only them the product is well marketed and customers will

develop a distinct idea about it. Therefore, along with exporting parts of aircraft

manufacturing, company needs to invest on promotional activities as well following

the multinational strategy structure. As per Gao et al. (2016), exporting will help to

gain an insight of the foreign market, allows learning the risk factors associated with

the proposed plan of business extension. There are four strategic choices, which

Boeing can opt for. Replicating the products in the targeted emerging market will

Market Entry Strategy

There are three major consideration, which must be taken while going global. Boeing

has its positive global reputation of delivering quality service. As per the description of De

Beule, Elia and Piscitello (2014), while entering into Chinese market the company will

consider Chinese political, economic, social, technological and legal orientation. According

to the current market condition, Chinese market has immense potential for jet makers

especially who deals with manufacturing of business or private jets. Before entering

into market, it is essential to look into the country’s resources. According to the provided

case study. In order to enter into the market, as described in Ang, Benischke and Doh, (2015),

Boeing has adapted 737 to offer ‘Boeing Business Jet’, which can carry up to 60 passengers.

Moreover, before establishing its individual unit the firm can consider exporting and joint

venture to avoid the extreme initial competition. Exportation of parts and collaborating with

other existing aircraft manufacturers Boeing can think of preparing a strong customer base

first to receive a warm welcome after its individual establishment. Besides, several strategies

regarding outsourcing, by performing acquisitions will be helpful too. Strategies are as

follows.

In order to deal with a very promising foreign market, exporting the aircraft manufacturing

parts will be a wise idea to enter the market and understand the response first.

Response will come only them the product is well marketed and customers will

develop a distinct idea about it. Therefore, along with exporting parts of aircraft

manufacturing, company needs to invest on promotional activities as well following

the multinational strategy structure. As per Gao et al. (2016), exporting will help to

gain an insight of the foreign market, allows learning the risk factors associated with

the proposed plan of business extension. There are four strategic choices, which

Boeing can opt for. Replicating the products in the targeted emerging market will

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9GLOBAL BUSINESS MANAGEMENT

reduce cost yet there is chances of receiving less response. Using local materials to

produce products will maximize responsiveness yet the cost will be higher as effort is

being delivered in several countries. Global presence reduces local responsiveness

and increases centralised control. However, cost advantage is higher in this case.

Transactional strategy is both locally responsive and cost efficient. Innovative

strategies can be implemented towards organisational benefit yet it is difficult to

execute and critical in terms of structure.

Joint ventures common when a company seeks for enhancement of its customer base

across the nation. Joint ventures are important in order to avoid the excessive

competition in a promising market. Gulfstream holds the biggest market share in

Chinese jet market. There are 100 jets supplied which works on board. As argued in

the words of Shi et al. (2014), collaborating with such a reputed company will create

learning atmosphere in terms of risks. Additionally, potential field of future

development will be expanded. However, joint ventures can be difficult if the

business partners’ opinion differs on point of benefits and the core company has the

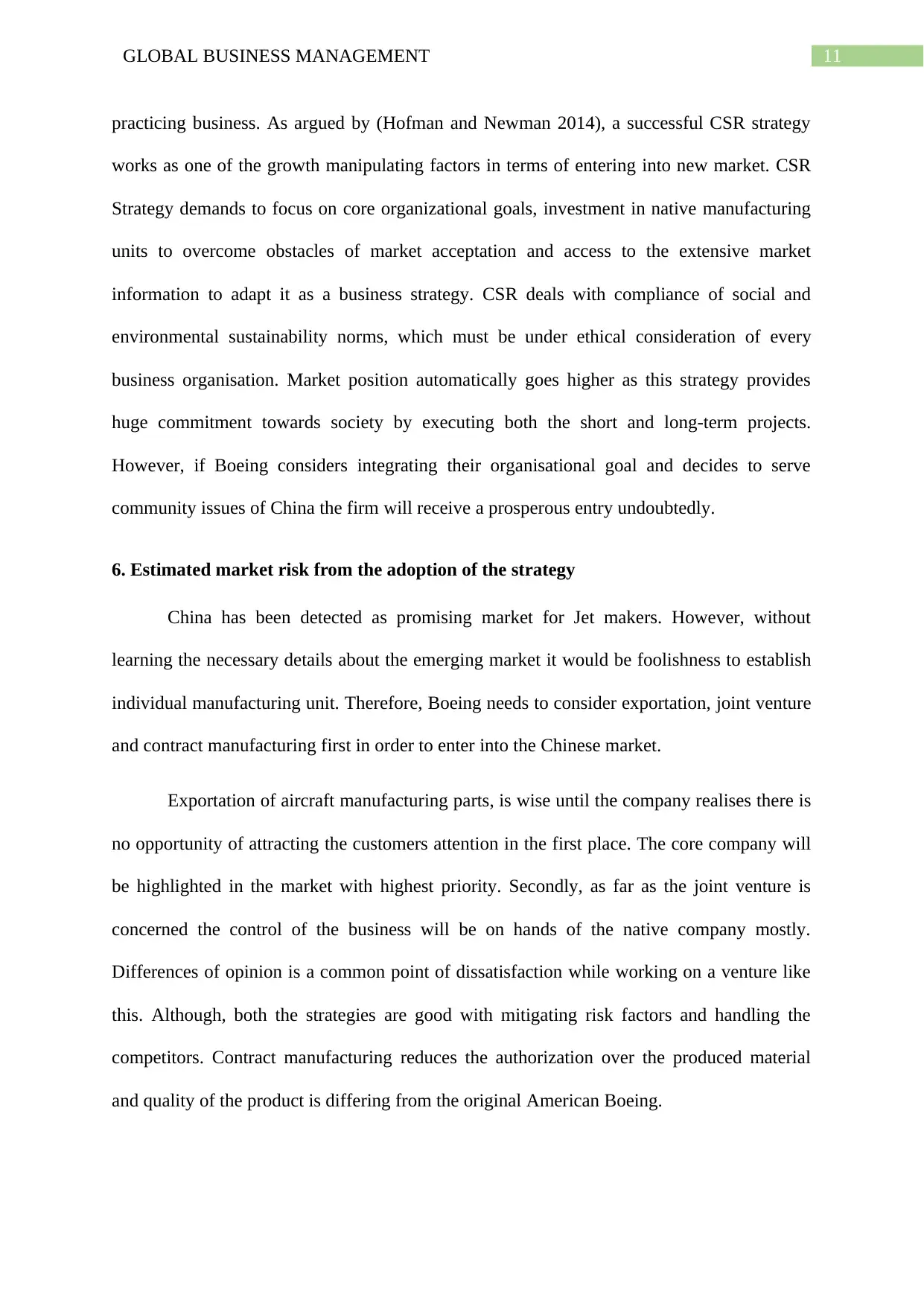

central power of management. Such diversification strategies, apart from joint

ventures acquisition and merging companies within industry will be helpful to initiate

the business in a foreign land. In order to do that Ansoff Matrix framework can be

considered to plan the future business considering the Chinese market.

reduce cost yet there is chances of receiving less response. Using local materials to

produce products will maximize responsiveness yet the cost will be higher as effort is

being delivered in several countries. Global presence reduces local responsiveness

and increases centralised control. However, cost advantage is higher in this case.

Transactional strategy is both locally responsive and cost efficient. Innovative

strategies can be implemented towards organisational benefit yet it is difficult to

execute and critical in terms of structure.

Joint ventures common when a company seeks for enhancement of its customer base

across the nation. Joint ventures are important in order to avoid the excessive

competition in a promising market. Gulfstream holds the biggest market share in

Chinese jet market. There are 100 jets supplied which works on board. As argued in

the words of Shi et al. (2014), collaborating with such a reputed company will create

learning atmosphere in terms of risks. Additionally, potential field of future

development will be expanded. However, joint ventures can be difficult if the

business partners’ opinion differs on point of benefits and the core company has the

central power of management. Such diversification strategies, apart from joint

ventures acquisition and merging companies within industry will be helpful to initiate

the business in a foreign land. In order to do that Ansoff Matrix framework can be

considered to plan the future business considering the Chinese market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10GLOBAL BUSINESS MANAGEMENT

As described in this framework, it has been explained that which strategies must be

adopted according to the nature of the market and product or services.

Contract manufacturing can be measured, as a strategic approach while entering into

an emerging market. Instead of establishing own manufacturing unit first Boeing can

opt for contract manufacturing in order to save the organisation from the risk of

investing a huge amount without learning business environment. Moreover, the

expense of providing raw materials and production facilities reduces. However,

disadvantages are various including less authorization over production system. In this

due course, quality may alter, as they have to depend on other manufacturing unit.

Although, there are several disadvantages of the strategic approach yet with right research

and application the company can learn the whereabouts of new business environment of

China and reduce the initial risk factors.

Corporate Social Responsibility

Companies who comply with corporate social responsibility norms are likely to create

a positive impact on the targeted customer base. Apart from the quality of the product and

services customers tend to examine how far the company is considering ethics while

As described in this framework, it has been explained that which strategies must be

adopted according to the nature of the market and product or services.

Contract manufacturing can be measured, as a strategic approach while entering into

an emerging market. Instead of establishing own manufacturing unit first Boeing can

opt for contract manufacturing in order to save the organisation from the risk of

investing a huge amount without learning business environment. Moreover, the

expense of providing raw materials and production facilities reduces. However,

disadvantages are various including less authorization over production system. In this

due course, quality may alter, as they have to depend on other manufacturing unit.

Although, there are several disadvantages of the strategic approach yet with right research

and application the company can learn the whereabouts of new business environment of

China and reduce the initial risk factors.

Corporate Social Responsibility

Companies who comply with corporate social responsibility norms are likely to create

a positive impact on the targeted customer base. Apart from the quality of the product and

services customers tend to examine how far the company is considering ethics while

11GLOBAL BUSINESS MANAGEMENT

practicing business. As argued by (Hofman and Newman 2014), a successful CSR strategy

works as one of the growth manipulating factors in terms of entering into new market. CSR

Strategy demands to focus on core organizational goals, investment in native manufacturing

units to overcome obstacles of market acceptation and access to the extensive market

information to adapt it as a business strategy. CSR deals with compliance of social and

environmental sustainability norms, which must be under ethical consideration of every

business organisation. Market position automatically goes higher as this strategy provides

huge commitment towards society by executing both the short and long-term projects.

However, if Boeing considers integrating their organisational goal and decides to serve

community issues of China the firm will receive a prosperous entry undoubtedly.

6. Estimated market risk from the adoption of the strategy

China has been detected as promising market for Jet makers. However, without

learning the necessary details about the emerging market it would be foolishness to establish

individual manufacturing unit. Therefore, Boeing needs to consider exportation, joint venture

and contract manufacturing first in order to enter into the Chinese market.

Exportation of aircraft manufacturing parts, is wise until the company realises there is

no opportunity of attracting the customers attention in the first place. The core company will

be highlighted in the market with highest priority. Secondly, as far as the joint venture is

concerned the control of the business will be on hands of the native company mostly.

Differences of opinion is a common point of dissatisfaction while working on a venture like

this. Although, both the strategies are good with mitigating risk factors and handling the

competitors. Contract manufacturing reduces the authorization over the produced material

and quality of the product is differing from the original American Boeing.

practicing business. As argued by (Hofman and Newman 2014), a successful CSR strategy

works as one of the growth manipulating factors in terms of entering into new market. CSR

Strategy demands to focus on core organizational goals, investment in native manufacturing

units to overcome obstacles of market acceptation and access to the extensive market

information to adapt it as a business strategy. CSR deals with compliance of social and

environmental sustainability norms, which must be under ethical consideration of every

business organisation. Market position automatically goes higher as this strategy provides

huge commitment towards society by executing both the short and long-term projects.

However, if Boeing considers integrating their organisational goal and decides to serve

community issues of China the firm will receive a prosperous entry undoubtedly.

6. Estimated market risk from the adoption of the strategy

China has been detected as promising market for Jet makers. However, without

learning the necessary details about the emerging market it would be foolishness to establish

individual manufacturing unit. Therefore, Boeing needs to consider exportation, joint venture

and contract manufacturing first in order to enter into the Chinese market.

Exportation of aircraft manufacturing parts, is wise until the company realises there is

no opportunity of attracting the customers attention in the first place. The core company will

be highlighted in the market with highest priority. Secondly, as far as the joint venture is

concerned the control of the business will be on hands of the native company mostly.

Differences of opinion is a common point of dissatisfaction while working on a venture like

this. Although, both the strategies are good with mitigating risk factors and handling the

competitors. Contract manufacturing reduces the authorization over the produced material

and quality of the product is differing from the original American Boeing.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.