Comprehensive Business Finance Solutions: Bond Pricing and Valuation

VerifiedAdded on 2023/06/15

|8

|1032

|239

Homework Assignment

AI Summary

This document provides solutions to a business finance assignment, covering various aspects of bond valuation and share price analysis. It includes calculations for bond prices at par, premium, and discount, considering factors like coupon rates, market rates, and years to maturity. Furthermore, it analyzes shareholder returns, expected dividends, and the impact of growth rates on share prices. Specific scenarios, such as the sale of bonds and revisions in growth rates, are also addressed with detailed numerical examples and explanations. Desklib offers more solved assignments and study tools for students.

Running head: BUSINESS FINANCE

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS FINANCE

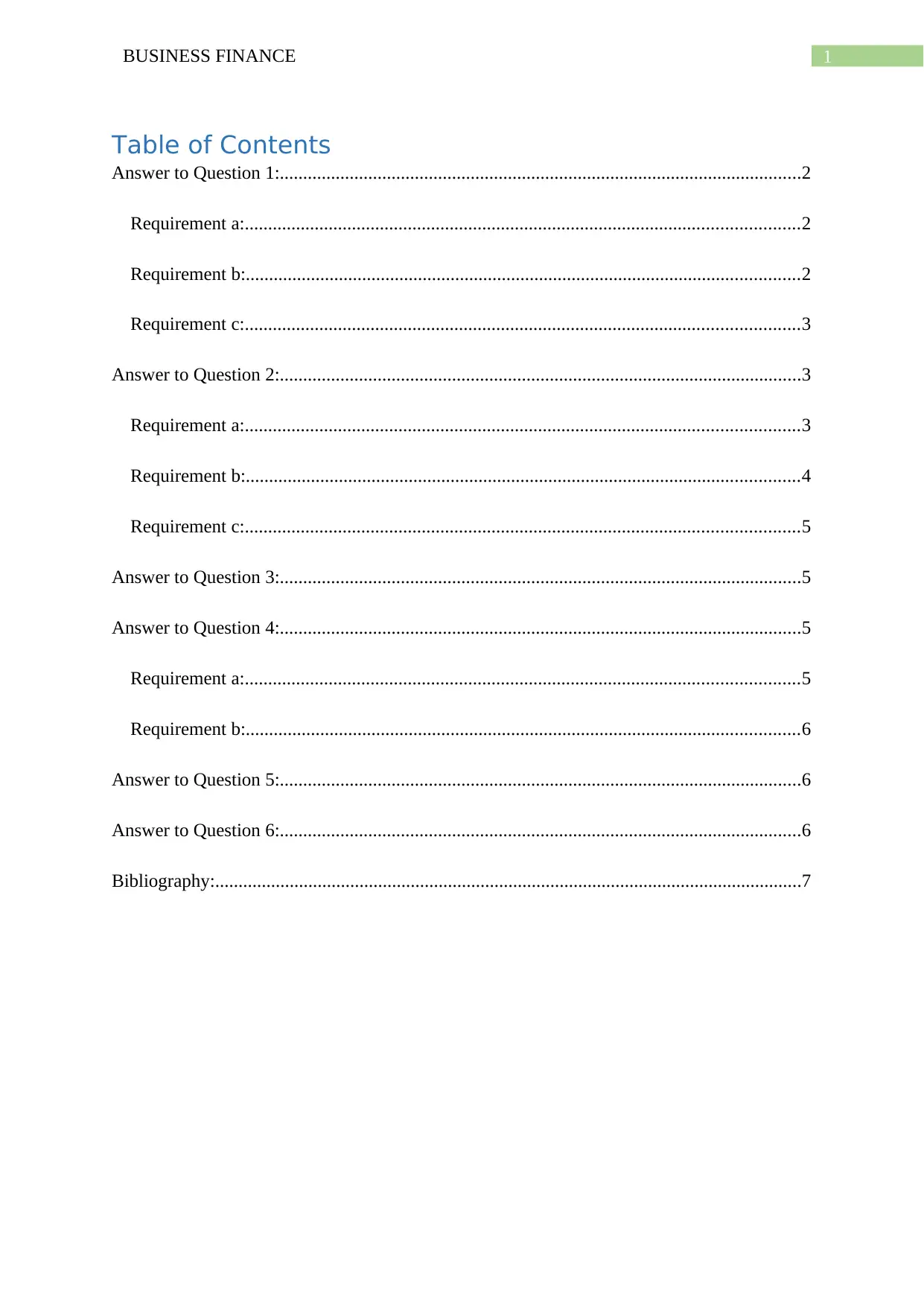

Table of Contents

Answer to Question 1:................................................................................................................2

Requirement a:.......................................................................................................................2

Requirement b:.......................................................................................................................2

Requirement c:.......................................................................................................................3

Answer to Question 2:................................................................................................................3

Requirement a:.......................................................................................................................3

Requirement b:.......................................................................................................................4

Requirement c:.......................................................................................................................5

Answer to Question 3:................................................................................................................5

Answer to Question 4:................................................................................................................5

Requirement a:.......................................................................................................................5

Requirement b:.......................................................................................................................6

Answer to Question 5:................................................................................................................6

Answer to Question 6:................................................................................................................6

Bibliography:..............................................................................................................................7

Table of Contents

Answer to Question 1:................................................................................................................2

Requirement a:.......................................................................................................................2

Requirement b:.......................................................................................................................2

Requirement c:.......................................................................................................................3

Answer to Question 2:................................................................................................................3

Requirement a:.......................................................................................................................3

Requirement b:.......................................................................................................................4

Requirement c:.......................................................................................................................5

Answer to Question 3:................................................................................................................5

Answer to Question 4:................................................................................................................5

Requirement a:.......................................................................................................................5

Requirement b:.......................................................................................................................6

Answer to Question 5:................................................................................................................6

Answer to Question 6:................................................................................................................6

Bibliography:..............................................................................................................................7

2BUSINESS FINANCE

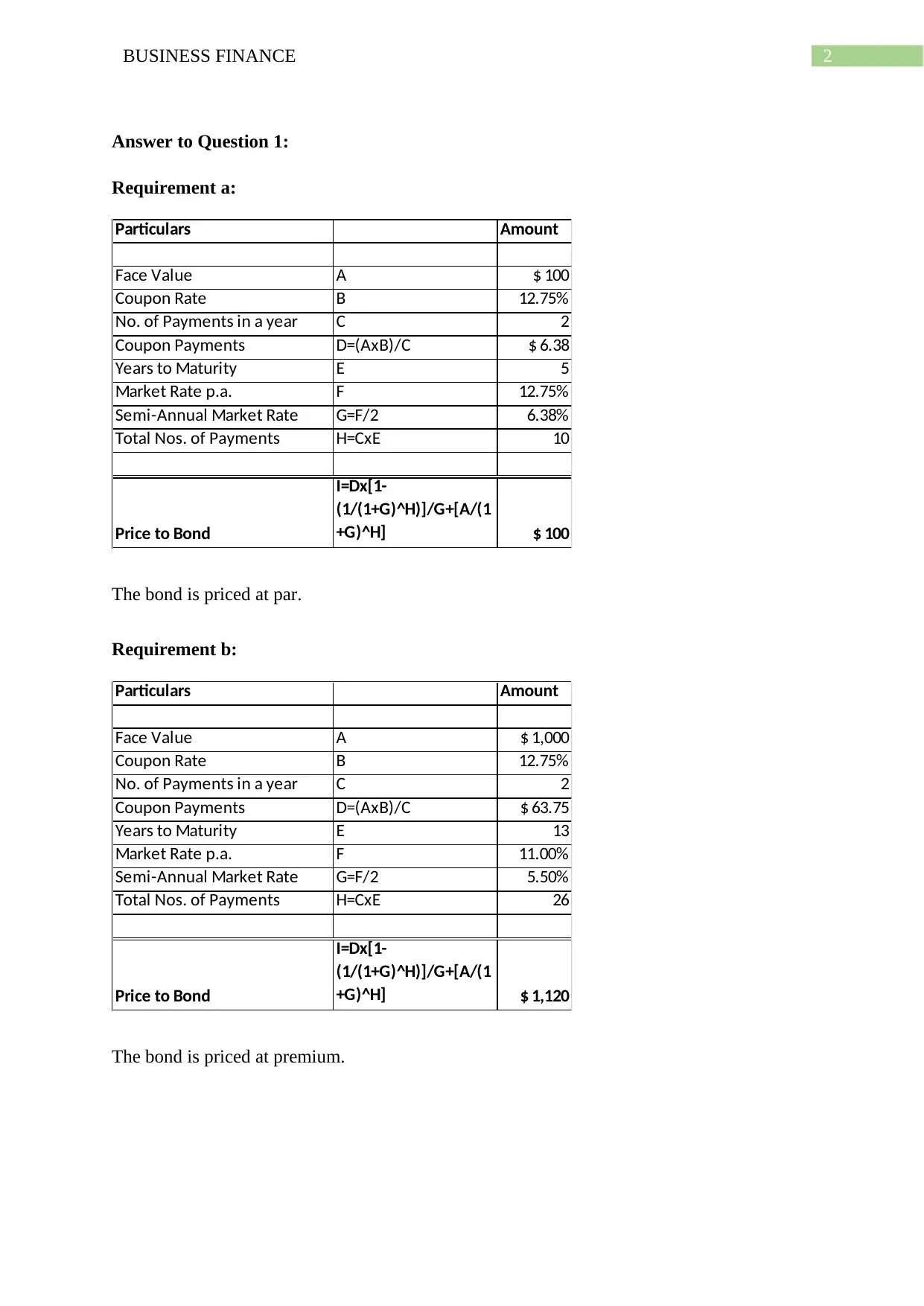

Answer to Question 1:

Requirement a:

Particulars Amount

Face Value A $ 100

Coupon Rate B 12.75%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 6.38

Years to Maturity E 5

Market Rate p.a. F 12.75%

Semi-Annual Market Rate G=F/2 6.38%

Total Nos. of Payments H=CxE 10

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[A/(1

+G)^H] $ 100

The bond is priced at par.

Requirement b:

Particulars Amount

Face Value A $ 1,000

Coupon Rate B 12.75%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 63.75

Years to Maturity E 13

Market Rate p.a. F 11.00%

Semi-Annual Market Rate G=F/2 5.50%

Total Nos. of Payments H=CxE 26

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[A/(1

+G)^H] $ 1,120

The bond is priced at premium.

Answer to Question 1:

Requirement a:

Particulars Amount

Face Value A $ 100

Coupon Rate B 12.75%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 6.38

Years to Maturity E 5

Market Rate p.a. F 12.75%

Semi-Annual Market Rate G=F/2 6.38%

Total Nos. of Payments H=CxE 10

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[A/(1

+G)^H] $ 100

The bond is priced at par.

Requirement b:

Particulars Amount

Face Value A $ 1,000

Coupon Rate B 12.75%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 63.75

Years to Maturity E 13

Market Rate p.a. F 11.00%

Semi-Annual Market Rate G=F/2 5.50%

Total Nos. of Payments H=CxE 26

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[A/(1

+G)^H] $ 1,120

The bond is priced at premium.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS FINANCE

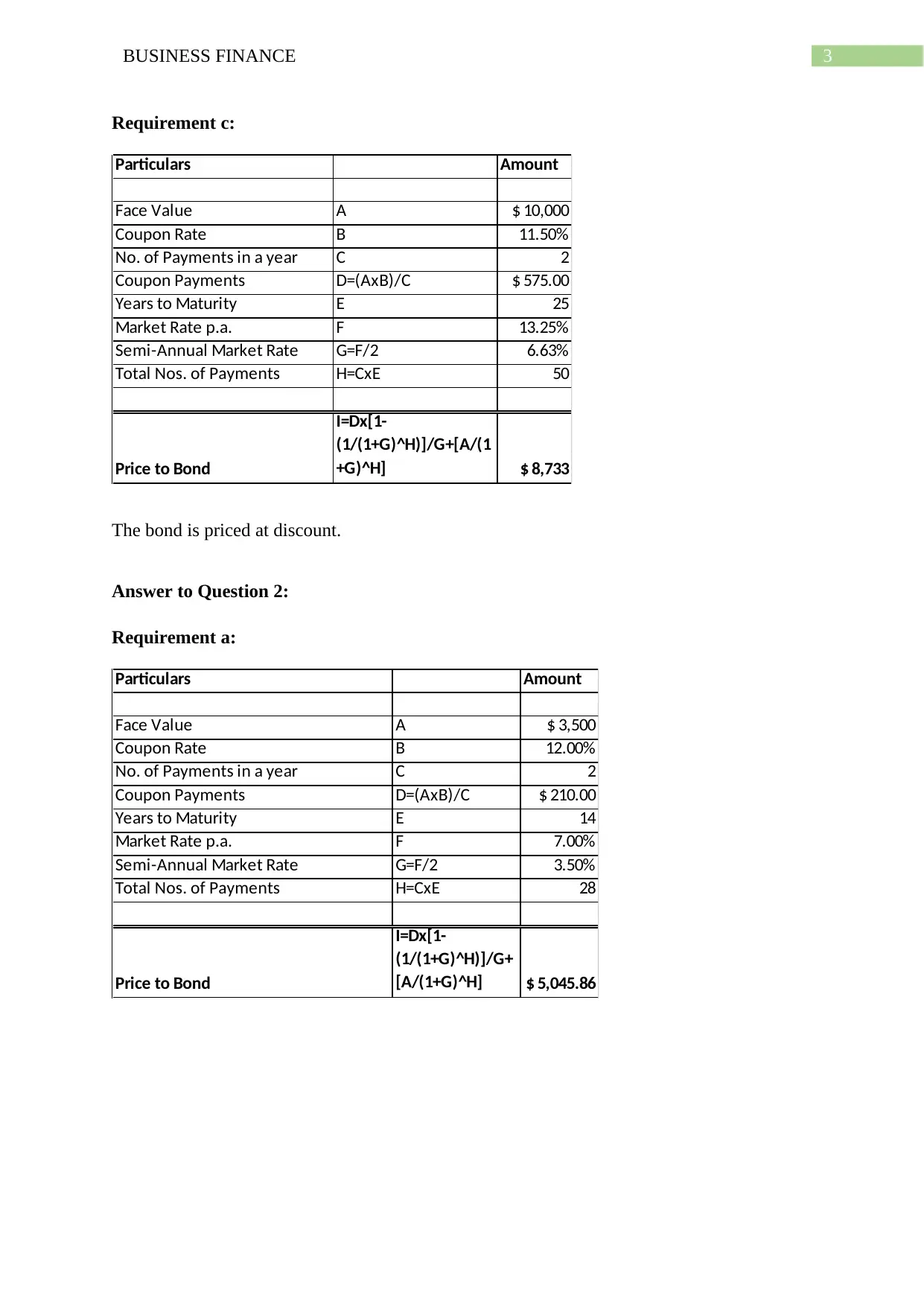

Requirement c:

Particulars Amount

Face Value A $ 10,000

Coupon Rate B 11.50%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 575.00

Years to Maturity E 25

Market Rate p.a. F 13.25%

Semi-Annual Market Rate G=F/2 6.63%

Total Nos. of Payments H=CxE 50

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[A/(1

+G)^H] $ 8,733

The bond is priced at discount.

Answer to Question 2:

Requirement a:

Particulars Amount

Face Value A $ 3,500

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 210.00

Years to Maturity E 14

Market Rate p.a. F 7.00%

Semi-Annual Market Rate G=F/2 3.50%

Total Nos. of Payments H=CxE 28

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+

[A/(1+G)^H] $ 5,045.86

Requirement c:

Particulars Amount

Face Value A $ 10,000

Coupon Rate B 11.50%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 575.00

Years to Maturity E 25

Market Rate p.a. F 13.25%

Semi-Annual Market Rate G=F/2 6.63%

Total Nos. of Payments H=CxE 50

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[A/(1

+G)^H] $ 8,733

The bond is priced at discount.

Answer to Question 2:

Requirement a:

Particulars Amount

Face Value A $ 3,500

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 210.00

Years to Maturity E 14

Market Rate p.a. F 7.00%

Semi-Annual Market Rate G=F/2 3.50%

Total Nos. of Payments H=CxE 28

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+

[A/(1+G)^H] $ 5,045.86

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS FINANCE

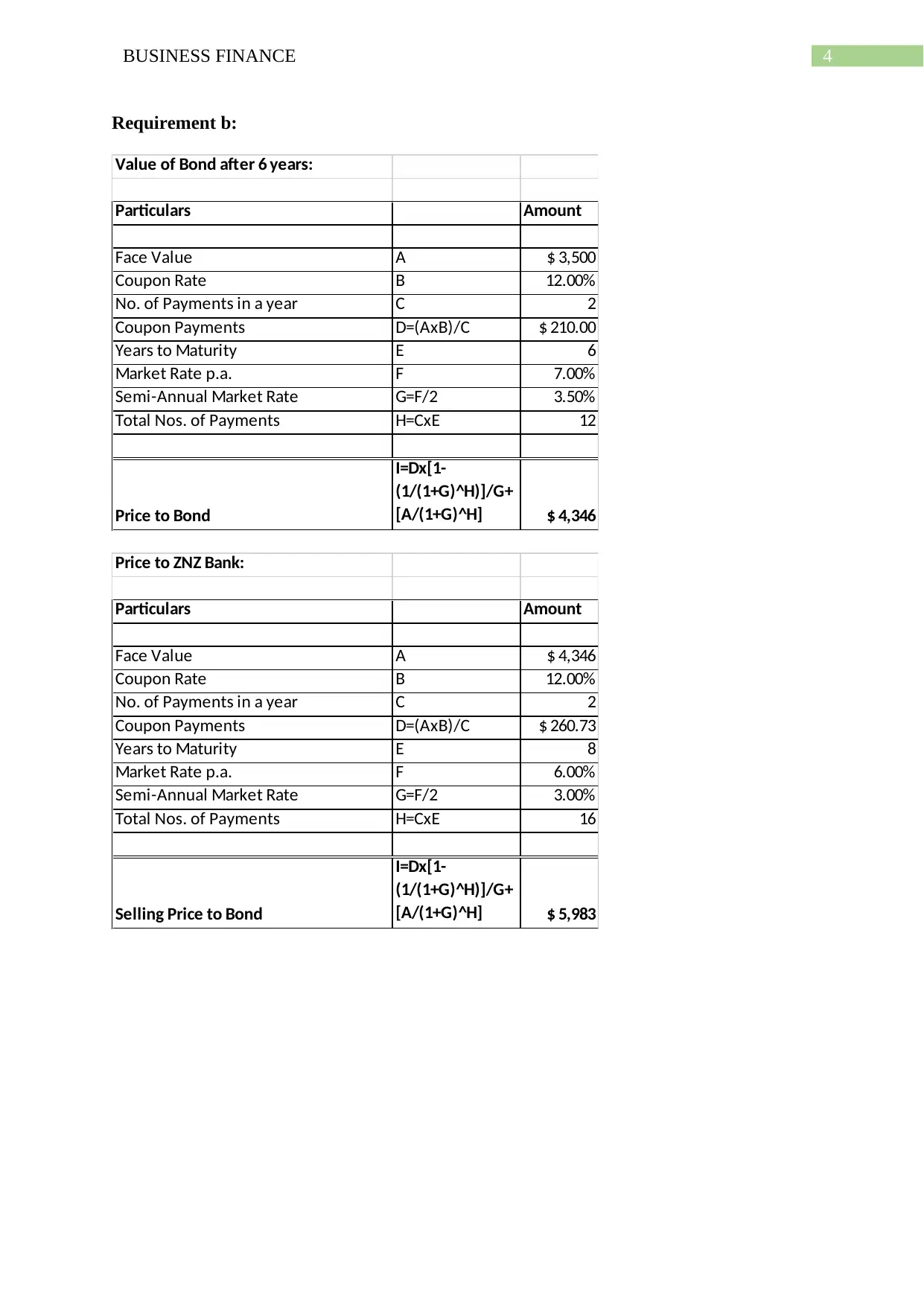

Requirement b:

Value of Bond after 6 years:

Particulars Amount

Face Value A $ 3,500

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 210.00

Years to Maturity E 6

Market Rate p.a. F 7.00%

Semi-Annual Market Rate G=F/2 3.50%

Total Nos. of Payments H=CxE 12

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+

[A/(1+G)^H] $ 4,346

Price to ZNZ Bank:

Particulars Amount

Face Value A $ 4,346

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 260.73

Years to Maturity E 8

Market Rate p.a. F 6.00%

Semi-Annual Market Rate G=F/2 3.00%

Total Nos. of Payments H=CxE 16

Selling Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+

[A/(1+G)^H] $ 5,983

Requirement b:

Value of Bond after 6 years:

Particulars Amount

Face Value A $ 3,500

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 210.00

Years to Maturity E 6

Market Rate p.a. F 7.00%

Semi-Annual Market Rate G=F/2 3.50%

Total Nos. of Payments H=CxE 12

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+

[A/(1+G)^H] $ 4,346

Price to ZNZ Bank:

Particulars Amount

Face Value A $ 4,346

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 260.73

Years to Maturity E 8

Market Rate p.a. F 6.00%

Semi-Annual Market Rate G=F/2 3.00%

Total Nos. of Payments H=CxE 16

Selling Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+

[A/(1+G)^H] $ 5,983

5BUSINESS FINANCE

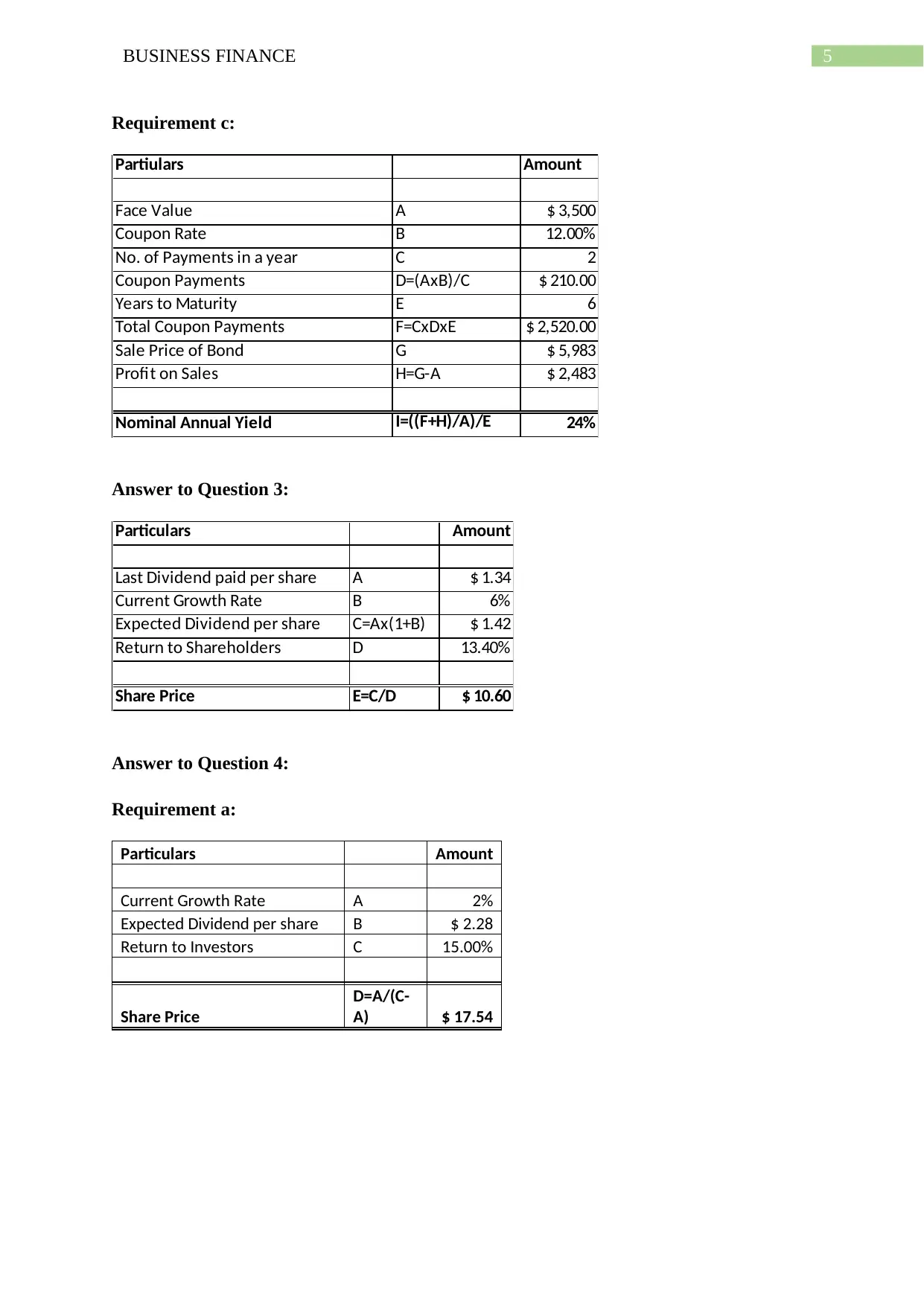

Requirement c:

Partiulars Amount

Face Value A $ 3,500

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 210.00

Years to Maturity E 6

Total Coupon Payments F=CxDxE $ 2,520.00

Sale Price of Bond G $ 5,983

Profit on Sales H=G-A $ 2,483

Nominal Annual Yield I=((F+H)/A)/E 24%

Answer to Question 3:

Particulars Amount

Last Dividend paid per share A $ 1.34

Current Growth Rate B 6%

Expected Dividend per share C=Ax(1+B) $ 1.42

Return to Shareholders D 13.40%

Share Price E=C/D $ 10.60

Answer to Question 4:

Requirement a:

Particulars Amount

Current Growth Rate A 2%

Expected Dividend per share B $ 2.28

Return to Investors C 15.00%

Share Price

D=A/(C-

A) $ 17.54

Requirement c:

Partiulars Amount

Face Value A $ 3,500

Coupon Rate B 12.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 210.00

Years to Maturity E 6

Total Coupon Payments F=CxDxE $ 2,520.00

Sale Price of Bond G $ 5,983

Profit on Sales H=G-A $ 2,483

Nominal Annual Yield I=((F+H)/A)/E 24%

Answer to Question 3:

Particulars Amount

Last Dividend paid per share A $ 1.34

Current Growth Rate B 6%

Expected Dividend per share C=Ax(1+B) $ 1.42

Return to Shareholders D 13.40%

Share Price E=C/D $ 10.60

Answer to Question 4:

Requirement a:

Particulars Amount

Current Growth Rate A 2%

Expected Dividend per share B $ 2.28

Return to Investors C 15.00%

Share Price

D=A/(C-

A) $ 17.54

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS FINANCE

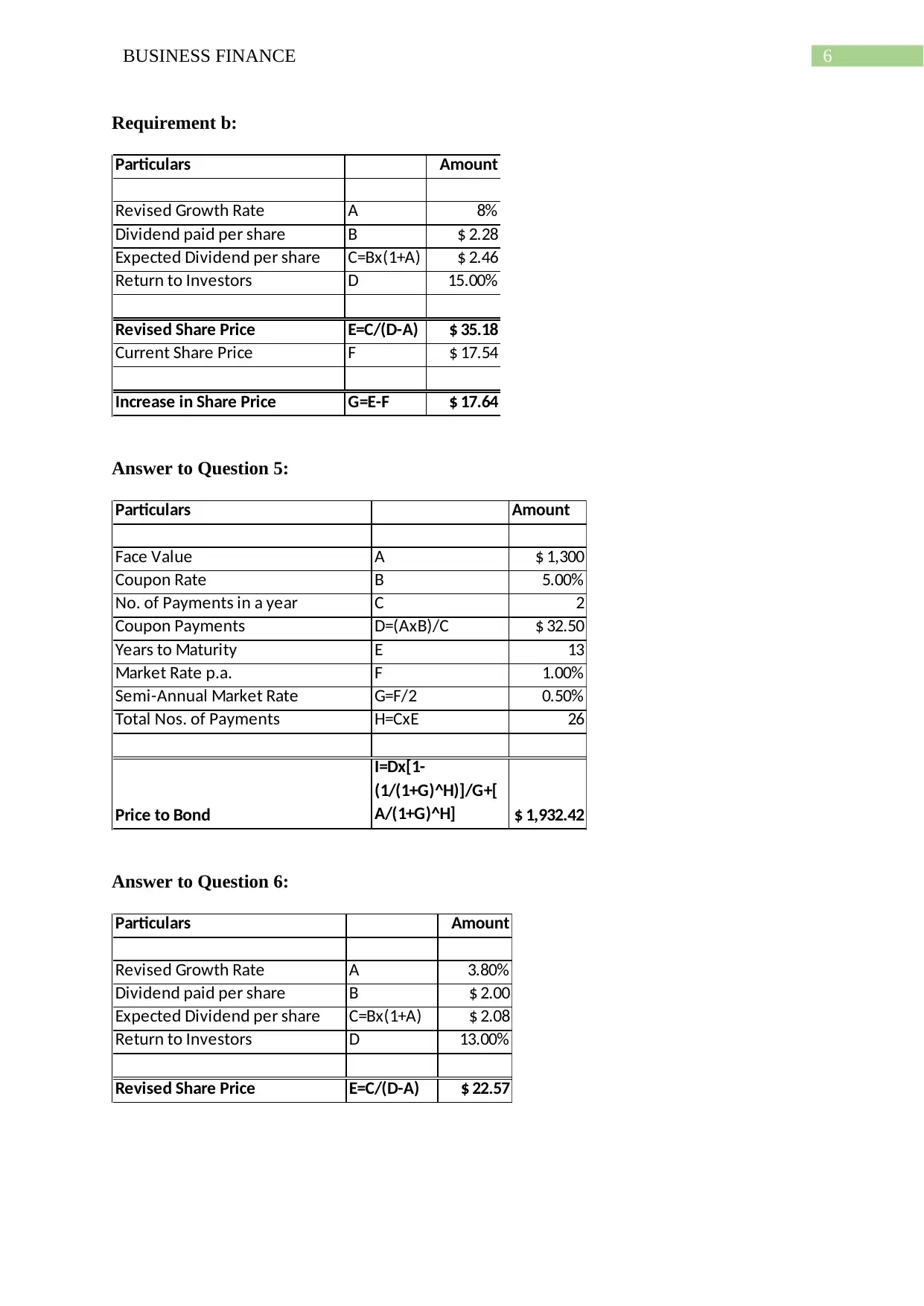

Requirement b:

Particulars Amount

Revised Growth Rate A 8%

Dividend paid per share B $ 2.28

Expected Dividend per share C=Bx(1+A) $ 2.46

Return to Investors D 15.00%

Revised Share Price E=C/(D-A) $ 35.18

Current Share Price F $ 17.54

Increase in Share Price G=E-F $ 17.64

Answer to Question 5:

Particulars Amount

Face Value A $ 1,300

Coupon Rate B 5.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 32.50

Years to Maturity E 13

Market Rate p.a. F 1.00%

Semi-Annual Market Rate G=F/2 0.50%

Total Nos. of Payments H=CxE 26

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[

A/(1+G)^H] $ 1,932.42

Answer to Question 6:

Particulars Amount

Revised Growth Rate A 3.80%

Dividend paid per share B $ 2.00

Expected Dividend per share C=Bx(1+A) $ 2.08

Return to Investors D 13.00%

Revised Share Price E=C/(D-A) $ 22.57

Requirement b:

Particulars Amount

Revised Growth Rate A 8%

Dividend paid per share B $ 2.28

Expected Dividend per share C=Bx(1+A) $ 2.46

Return to Investors D 15.00%

Revised Share Price E=C/(D-A) $ 35.18

Current Share Price F $ 17.54

Increase in Share Price G=E-F $ 17.64

Answer to Question 5:

Particulars Amount

Face Value A $ 1,300

Coupon Rate B 5.00%

No. of Payments in a year C 2

Coupon Payments D=(AxB)/C $ 32.50

Years to Maturity E 13

Market Rate p.a. F 1.00%

Semi-Annual Market Rate G=F/2 0.50%

Total Nos. of Payments H=CxE 26

Price to Bond

I=Dx[1-

(1/(1+G)^H)]/G+[

A/(1+G)^H] $ 1,932.42

Answer to Question 6:

Particulars Amount

Revised Growth Rate A 3.80%

Dividend paid per share B $ 2.00

Expected Dividend per share C=Bx(1+A) $ 2.08

Return to Investors D 13.00%

Revised Share Price E=C/(D-A) $ 22.57

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS FINANCE

Bibliography:

Jordan, B., 2014. Fundamentals of investments. McGraw-Hill Higher Education

Titman, S. and Martin, J.D., 2014. Valuation. Pearson Higher Ed

Bibliography:

Jordan, B., 2014. Fundamentals of investments. McGraw-Hill Higher Education

Titman, S. and Martin, J.D., 2014. Valuation. Pearson Higher Ed

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.