BFA507 The Accounting Framework Assignment: Borderline Ltd Analysis

VerifiedAdded on 2023/03/23

|16

|2528

|21

Homework Assignment

AI Summary

This assignment solution for Borderline Ltd encompasses a comprehensive manual accounting task, including detailed journal entries, T-accounts, and a closing trial balance for June 2018. It presents a revenue account, balance sheet, and bank reconciliation statement, alongside computations of inventory. The solution addresses environmental concerns, suggesting mitigation strategies and potential financial impacts. Specifically, the assignment details journal entries for various transactions, including sales, purchases, payments, and adjustments for depreciation, wages, and income tax. T-accounts for purchase, sales, sundry debtors and creditors are provided. Furthermore, the solution includes a profit and loss statement and balance sheet to present a complete financial picture of Borderline Ltd. The assignment also delves into environmental issues such as climate change and water pollution, proposing solutions and financial implications for the company. This analysis ensures a thorough understanding of accounting principles and their practical application.

Assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

PArt A..............................................................................................................................................3

Journal entries..............................................................................................................................3

T-Accounts..................................................................................................................................6

Closing Trial Balance................................................................................................................10

Revenue Account.......................................................................................................................11

Balance sheet.............................................................................................................................12

Bank Reconcilation statement...................................................................................................13

Part C.............................................................................................................................................14

What environmental concerns may need to be addressed?.......................................................14

How these concerns might be addressed?.................................................................................14

What might be the financial impact of these decisions?............................................................14

Why you believe it is important to address these concerns?.....................................................15

Reference.......................................................................................................................................16

PArt A..............................................................................................................................................3

Journal entries..............................................................................................................................3

T-Accounts..................................................................................................................................6

Closing Trial Balance................................................................................................................10

Revenue Account.......................................................................................................................11

Balance sheet.............................................................................................................................12

Bank Reconcilation statement...................................................................................................13

Part C.............................................................................................................................................14

What environmental concerns may need to be addressed?.......................................................14

How these concerns might be addressed?.................................................................................14

What might be the financial impact of these decisions?............................................................14

Why you believe it is important to address these concerns?.....................................................15

Reference.......................................................................................................................................16

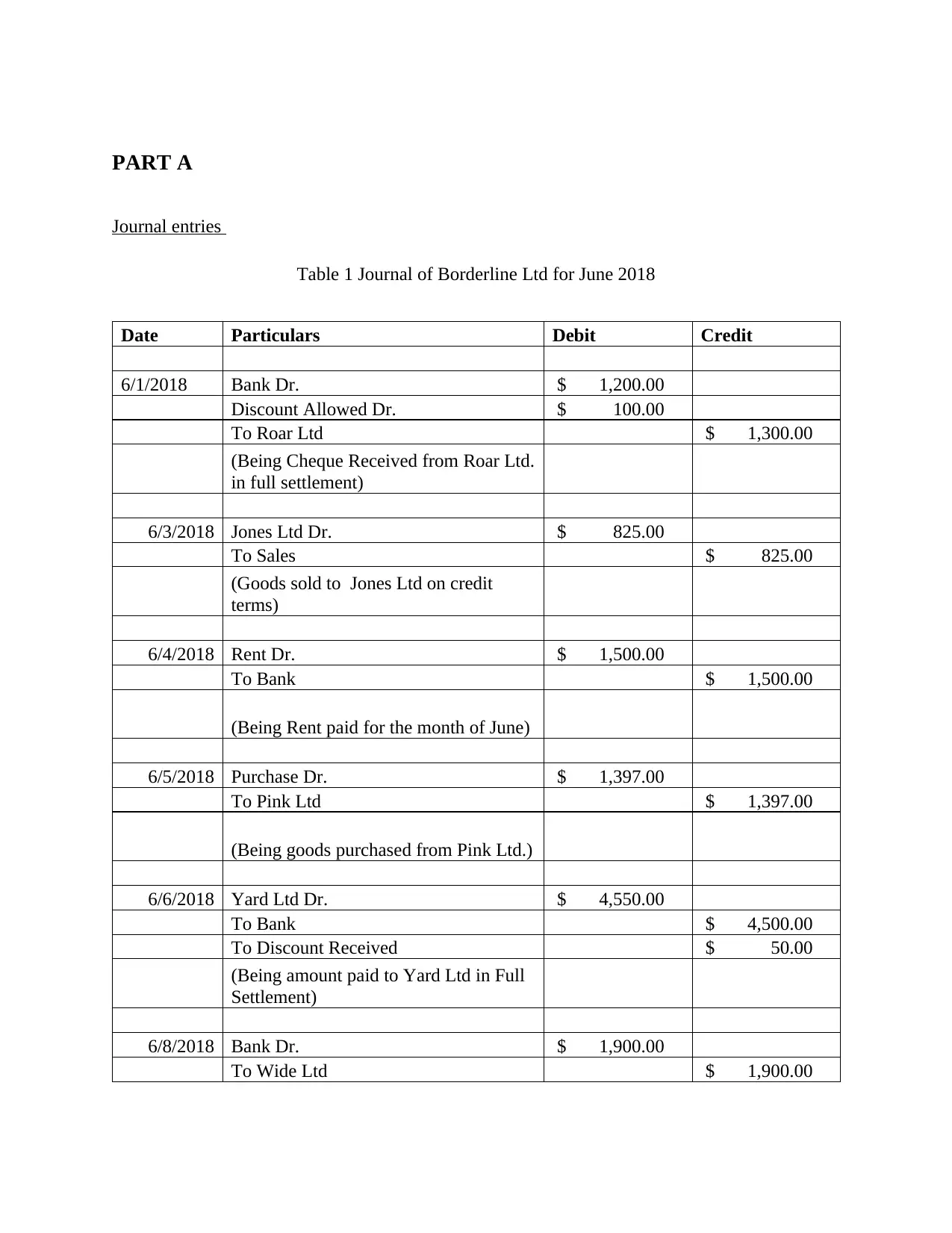

PART A

Journal entries

Table 1 Journal of Borderline Ltd for June 2018

Date Particulars Debit Credit

6/1/2018 Bank Dr. $ 1,200.00

Discount Allowed Dr. $ 100.00

To Roar Ltd $ 1,300.00

(Being Cheque Received from Roar Ltd.

in full settlement)

6/3/2018 Jones Ltd Dr. $ 825.00

To Sales $ 825.00

(Goods sold to Jones Ltd on credit

terms)

6/4/2018 Rent Dr. $ 1,500.00

To Bank $ 1,500.00

(Being Rent paid for the month of June)

6/5/2018 Purchase Dr. $ 1,397.00

To Pink Ltd $ 1,397.00

(Being goods purchased from Pink Ltd.)

6/6/2018 Yard Ltd Dr. $ 4,550.00

To Bank $ 4,500.00

To Discount Received $ 50.00

(Being amount paid to Yard Ltd in Full

Settlement)

6/8/2018 Bank Dr. $ 1,900.00

To Wide Ltd $ 1,900.00

Journal entries

Table 1 Journal of Borderline Ltd for June 2018

Date Particulars Debit Credit

6/1/2018 Bank Dr. $ 1,200.00

Discount Allowed Dr. $ 100.00

To Roar Ltd $ 1,300.00

(Being Cheque Received from Roar Ltd.

in full settlement)

6/3/2018 Jones Ltd Dr. $ 825.00

To Sales $ 825.00

(Goods sold to Jones Ltd on credit

terms)

6/4/2018 Rent Dr. $ 1,500.00

To Bank $ 1,500.00

(Being Rent paid for the month of June)

6/5/2018 Purchase Dr. $ 1,397.00

To Pink Ltd $ 1,397.00

(Being goods purchased from Pink Ltd.)

6/6/2018 Yard Ltd Dr. $ 4,550.00

To Bank $ 4,500.00

To Discount Received $ 50.00

(Being amount paid to Yard Ltd in Full

Settlement)

6/8/2018 Bank Dr. $ 1,900.00

To Wide Ltd $ 1,900.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

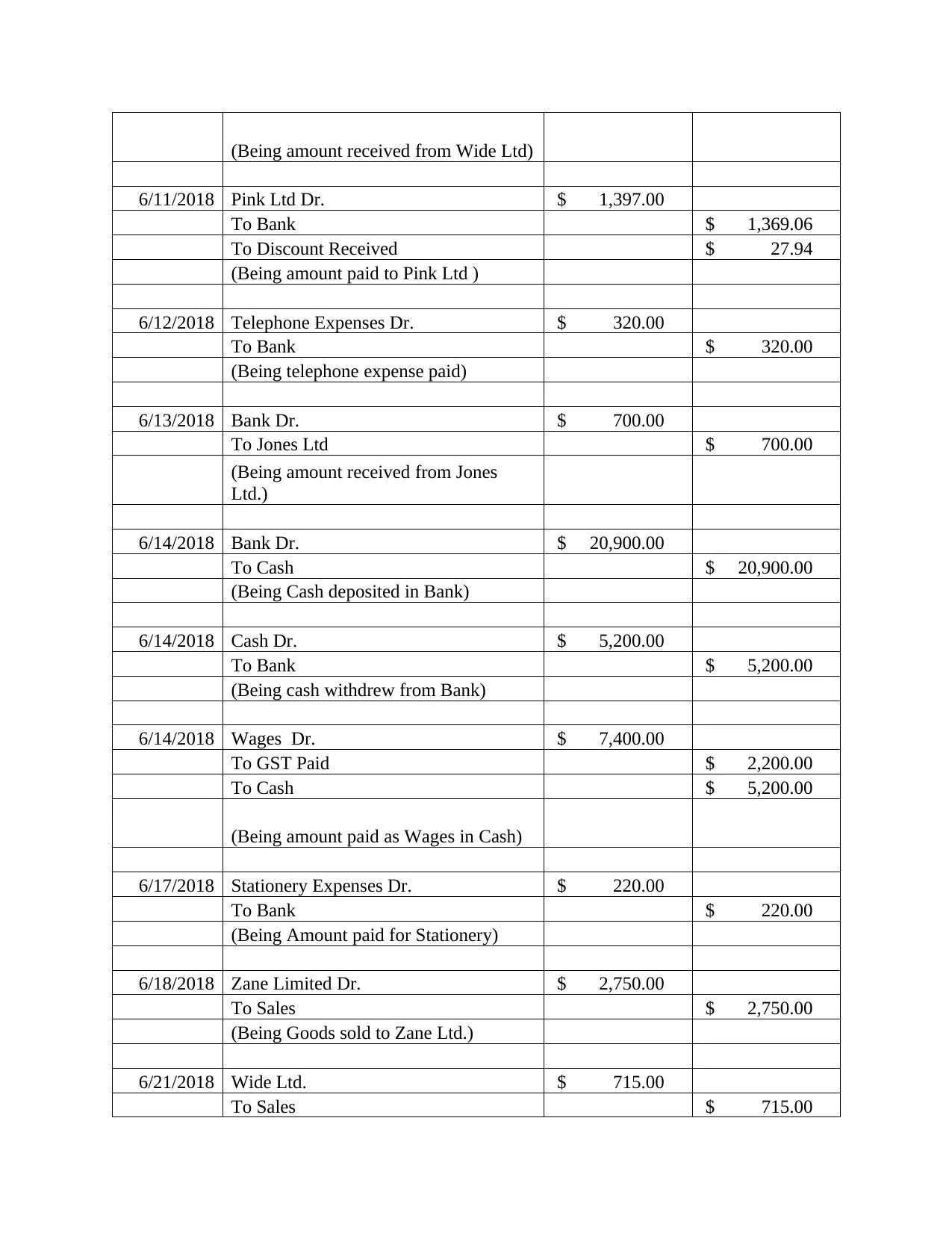

(Being amount received from Wide Ltd)

6/11/2018 Pink Ltd Dr. $ 1,397.00

To Bank $ 1,369.06

To Discount Received $ 27.94

(Being amount paid to Pink Ltd )

6/12/2018 Telephone Expenses Dr. $ 320.00

To Bank $ 320.00

(Being telephone expense paid)

6/13/2018 Bank Dr. $ 700.00

To Jones Ltd $ 700.00

(Being amount received from Jones

Ltd.)

6/14/2018 Bank Dr. $ 20,900.00

To Cash $ 20,900.00

(Being Cash deposited in Bank)

6/14/2018 Cash Dr. $ 5,200.00

To Bank $ 5,200.00

(Being cash withdrew from Bank)

6/14/2018 Wages Dr. $ 7,400.00

To GST Paid $ 2,200.00

To Cash $ 5,200.00

(Being amount paid as Wages in Cash)

6/17/2018 Stationery Expenses Dr. $ 220.00

To Bank $ 220.00

(Being Amount paid for Stationery)

6/18/2018 Zane Limited Dr. $ 2,750.00

To Sales $ 2,750.00

(Being Goods sold to Zane Ltd.)

6/21/2018 Wide Ltd. $ 715.00

To Sales $ 715.00

6/11/2018 Pink Ltd Dr. $ 1,397.00

To Bank $ 1,369.06

To Discount Received $ 27.94

(Being amount paid to Pink Ltd )

6/12/2018 Telephone Expenses Dr. $ 320.00

To Bank $ 320.00

(Being telephone expense paid)

6/13/2018 Bank Dr. $ 700.00

To Jones Ltd $ 700.00

(Being amount received from Jones

Ltd.)

6/14/2018 Bank Dr. $ 20,900.00

To Cash $ 20,900.00

(Being Cash deposited in Bank)

6/14/2018 Cash Dr. $ 5,200.00

To Bank $ 5,200.00

(Being cash withdrew from Bank)

6/14/2018 Wages Dr. $ 7,400.00

To GST Paid $ 2,200.00

To Cash $ 5,200.00

(Being amount paid as Wages in Cash)

6/17/2018 Stationery Expenses Dr. $ 220.00

To Bank $ 220.00

(Being Amount paid for Stationery)

6/18/2018 Zane Limited Dr. $ 2,750.00

To Sales $ 2,750.00

(Being Goods sold to Zane Ltd.)

6/21/2018 Wide Ltd. $ 715.00

To Sales $ 715.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

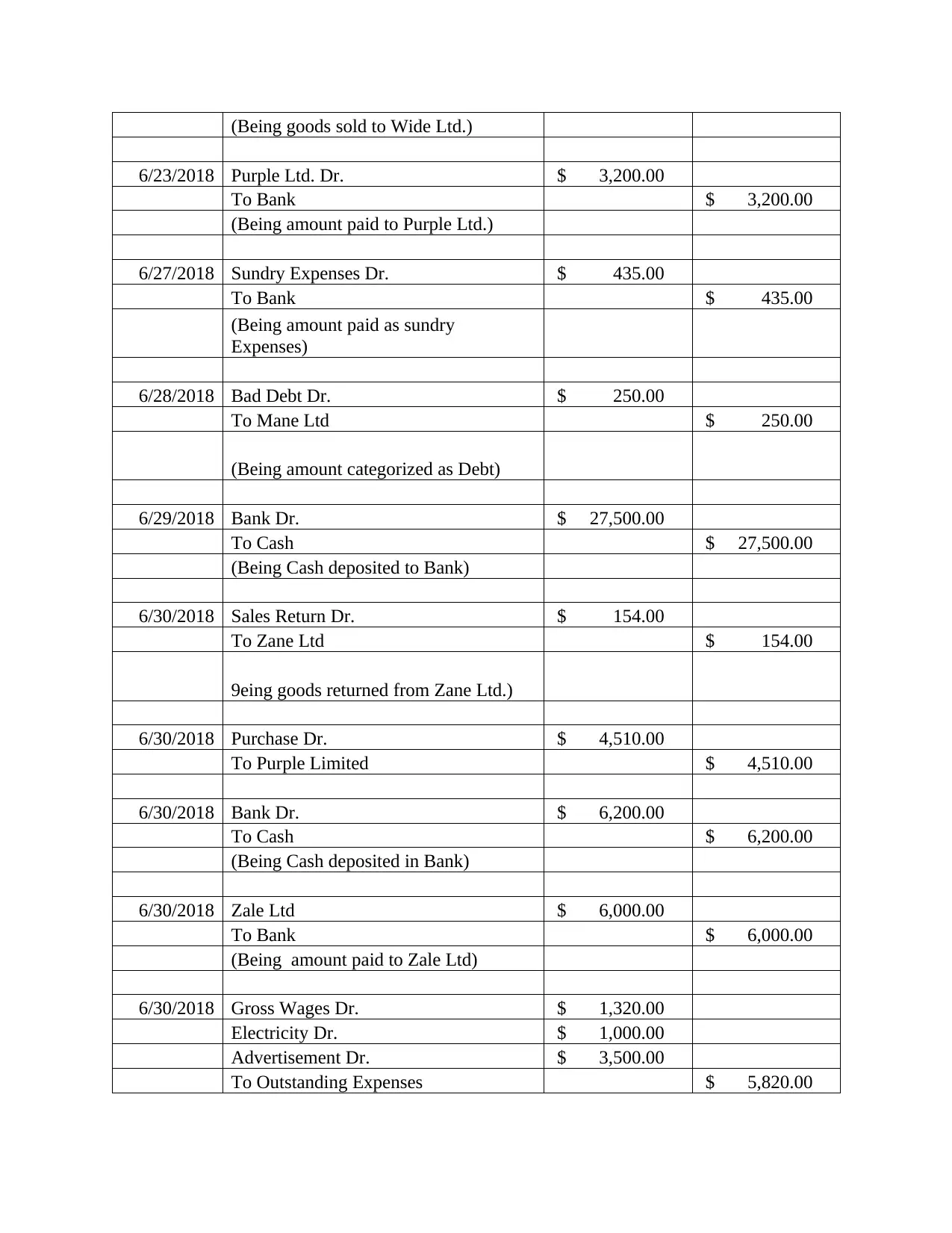

(Being goods sold to Wide Ltd.)

6/23/2018 Purple Ltd. Dr. $ 3,200.00

To Bank $ 3,200.00

(Being amount paid to Purple Ltd.)

6/27/2018 Sundry Expenses Dr. $ 435.00

To Bank $ 435.00

(Being amount paid as sundry

Expenses)

6/28/2018 Bad Debt Dr. $ 250.00

To Mane Ltd $ 250.00

(Being amount categorized as Debt)

6/29/2018 Bank Dr. $ 27,500.00

To Cash $ 27,500.00

(Being Cash deposited to Bank)

6/30/2018 Sales Return Dr. $ 154.00

To Zane Ltd $ 154.00

9eing goods returned from Zane Ltd.)

6/30/2018 Purchase Dr. $ 4,510.00

To Purple Limited $ 4,510.00

6/30/2018 Bank Dr. $ 6,200.00

To Cash $ 6,200.00

(Being Cash deposited in Bank)

6/30/2018 Zale Ltd $ 6,000.00

To Bank $ 6,000.00

(Being amount paid to Zale Ltd)

6/30/2018 Gross Wages Dr. $ 1,320.00

Electricity Dr. $ 1,000.00

Advertisement Dr. $ 3,500.00

To Outstanding Expenses $ 5,820.00

6/23/2018 Purple Ltd. Dr. $ 3,200.00

To Bank $ 3,200.00

(Being amount paid to Purple Ltd.)

6/27/2018 Sundry Expenses Dr. $ 435.00

To Bank $ 435.00

(Being amount paid as sundry

Expenses)

6/28/2018 Bad Debt Dr. $ 250.00

To Mane Ltd $ 250.00

(Being amount categorized as Debt)

6/29/2018 Bank Dr. $ 27,500.00

To Cash $ 27,500.00

(Being Cash deposited to Bank)

6/30/2018 Sales Return Dr. $ 154.00

To Zane Ltd $ 154.00

9eing goods returned from Zane Ltd.)

6/30/2018 Purchase Dr. $ 4,510.00

To Purple Limited $ 4,510.00

6/30/2018 Bank Dr. $ 6,200.00

To Cash $ 6,200.00

(Being Cash deposited in Bank)

6/30/2018 Zale Ltd $ 6,000.00

To Bank $ 6,000.00

(Being amount paid to Zale Ltd)

6/30/2018 Gross Wages Dr. $ 1,320.00

Electricity Dr. $ 1,000.00

Advertisement Dr. $ 3,500.00

To Outstanding Expenses $ 5,820.00

(Being outstanding expenses made due)

6/30/2018 Income Tax Dr. $ 12,430.00

To Provision for Income Taxes $ 12,430.00

(Being Income Tax for the month of

June)

6/30/2018 Depreciation Dr. $ 955.00

To Accumulated Depreciation on

Fittings $ 455.00

To Accumulated Depreciation on Motor

Vehicles $ 500.00

(Being Depreciation for the June

Month)

6/30/2018 Interest on Loan Dr. $ 240.00

To Outstanding Interest $ 240.00

(Being Interest on Loan for the month

of June

6/30/2018 Wages Dr. $ 7,600.00

To GST Paid $ 2,000.00

To Cash $ 5,600.00

(Being amount paid as Wages in Cash)

6/30/2018 Provision For Bad & Doubtful Debt Dr. $ 250.00

To Bad Debt $ 250.00

(Being Bad Debt Charged to its

Provision)

$ 126,618.00 $ 126,618.00

T-Accounts

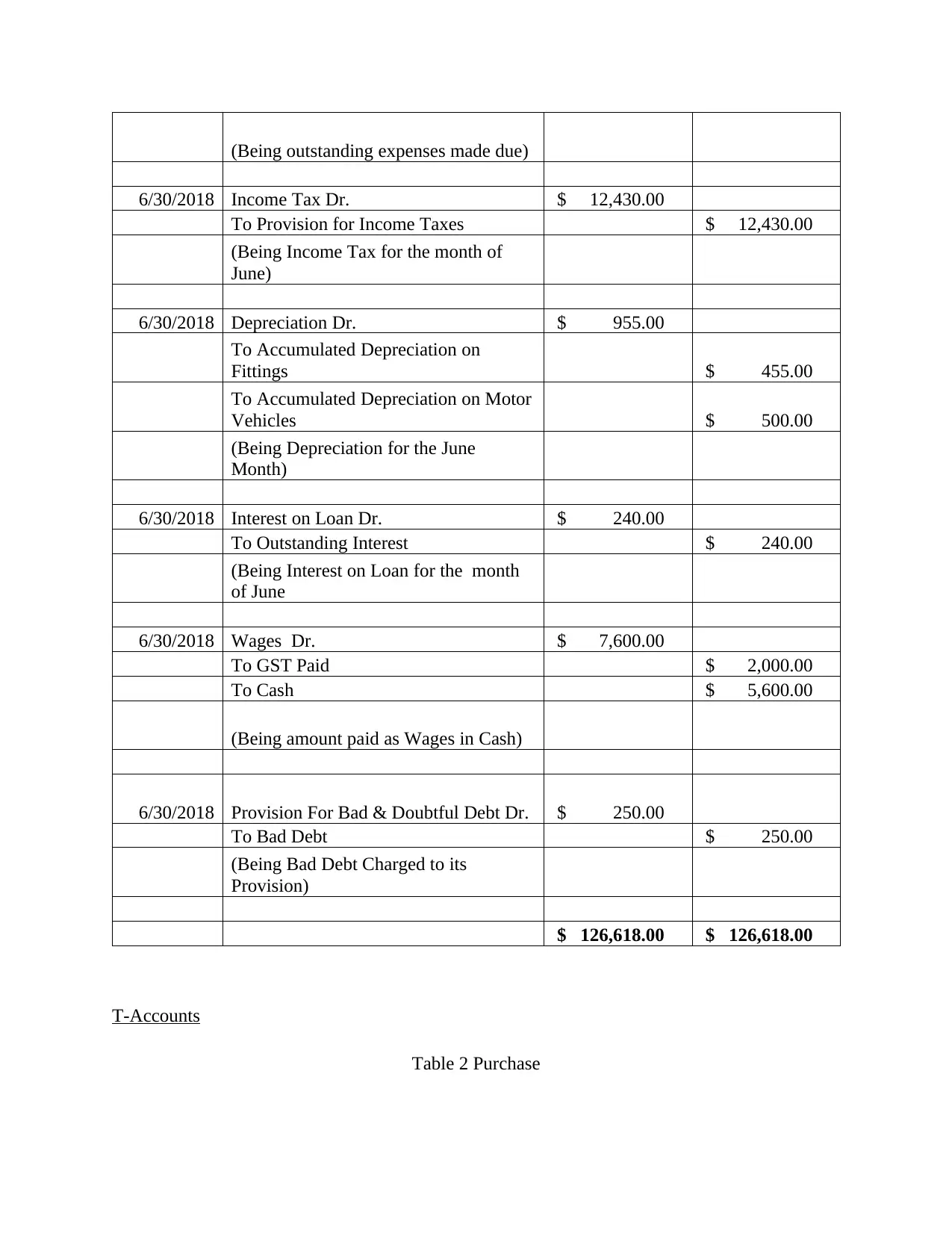

Table 2 Purchase

6/30/2018 Income Tax Dr. $ 12,430.00

To Provision for Income Taxes $ 12,430.00

(Being Income Tax for the month of

June)

6/30/2018 Depreciation Dr. $ 955.00

To Accumulated Depreciation on

Fittings $ 455.00

To Accumulated Depreciation on Motor

Vehicles $ 500.00

(Being Depreciation for the June

Month)

6/30/2018 Interest on Loan Dr. $ 240.00

To Outstanding Interest $ 240.00

(Being Interest on Loan for the month

of June

6/30/2018 Wages Dr. $ 7,600.00

To GST Paid $ 2,000.00

To Cash $ 5,600.00

(Being amount paid as Wages in Cash)

6/30/2018 Provision For Bad & Doubtful Debt Dr. $ 250.00

To Bad Debt $ 250.00

(Being Bad Debt Charged to its

Provision)

$ 126,618.00 $ 126,618.00

T-Accounts

Table 2 Purchase

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Date Particulars Amount Date Particulars Amount

6/5/2018 To Pink Ltd $ 1,397.00 6/30/2018

By Revenue

Account $ 7,597.00

6/30/2018 To Purple Ltd $ 6,200.00

$ 7,597.00 $ 7,597.00

Table 3 Sales

Date Particulars Amount Date Particulars Amount

6/30/2018

To Revenue

Account $ 58,970.00 6/3/2018 By Jones Ltd $ 905.00

6/14/2018 By Cash $ 20,900.00

6/18/2018 By Zane Ltd $ 2,750.00

6/21/2018 By Wide Ltd $ 715.00

6/28/2018 By Cash $ 27,500.00

6/30/2018 By Cash $ 6,200.00

$ 58,970.00 $ 58,970.00

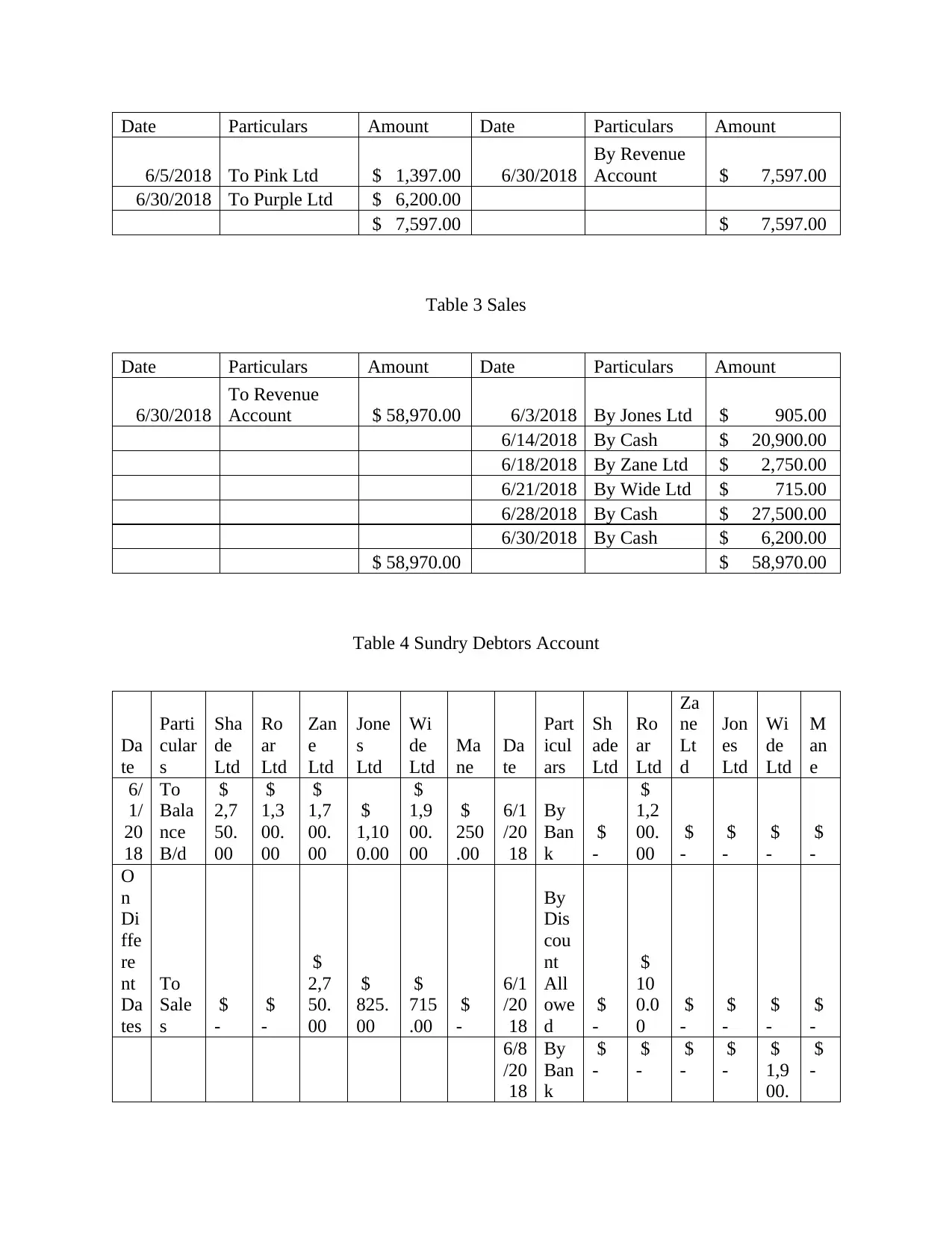

Table 4 Sundry Debtors Account

Da

te

Parti

cular

s

Sha

de

Ltd

Ro

ar

Ltd

Zan

e

Ltd

Jone

s

Ltd

Wi

de

Ltd

Ma

ne

Da

te

Part

icul

ars

Sh

ade

Ltd

Ro

ar

Ltd

Za

ne

Lt

d

Jon

es

Ltd

Wi

de

Ltd

M

an

e

6/

1/

20

18

To

Bala

nce

B/d

$

2,7

50.

00

$

1,3

00.

00

$

1,7

00.

00

$

1,10

0.00

$

1,9

00.

00

$

250

.00

6/1

/20

18

By

Ban

k

$

-

$

1,2

00.

00

$

-

$

-

$

-

$

-

O

n

Di

ffe

re

nt

Da

tes

To

Sale

s

$

-

$

-

$

2,7

50.

00

$

825.

00

$

715

.00

$

-

6/1

/20

18

By

Dis

cou

nt

All

owe

d

$

-

$

10

0.0

0

$

-

$

-

$

-

$

-

6/8

/20

18

By

Ban

k

$

-

$

-

$

-

$

-

$

1,9

00.

$

-

6/5/2018 To Pink Ltd $ 1,397.00 6/30/2018

By Revenue

Account $ 7,597.00

6/30/2018 To Purple Ltd $ 6,200.00

$ 7,597.00 $ 7,597.00

Table 3 Sales

Date Particulars Amount Date Particulars Amount

6/30/2018

To Revenue

Account $ 58,970.00 6/3/2018 By Jones Ltd $ 905.00

6/14/2018 By Cash $ 20,900.00

6/18/2018 By Zane Ltd $ 2,750.00

6/21/2018 By Wide Ltd $ 715.00

6/28/2018 By Cash $ 27,500.00

6/30/2018 By Cash $ 6,200.00

$ 58,970.00 $ 58,970.00

Table 4 Sundry Debtors Account

Da

te

Parti

cular

s

Sha

de

Ltd

Ro

ar

Ltd

Zan

e

Ltd

Jone

s

Ltd

Wi

de

Ltd

Ma

ne

Da

te

Part

icul

ars

Sh

ade

Ltd

Ro

ar

Ltd

Za

ne

Lt

d

Jon

es

Ltd

Wi

de

Ltd

M

an

e

6/

1/

20

18

To

Bala

nce

B/d

$

2,7

50.

00

$

1,3

00.

00

$

1,7

00.

00

$

1,10

0.00

$

1,9

00.

00

$

250

.00

6/1

/20

18

By

Ban

k

$

-

$

1,2

00.

00

$

-

$

-

$

-

$

-

O

n

Di

ffe

re

nt

Da

tes

To

Sale

s

$

-

$

-

$

2,7

50.

00

$

825.

00

$

715

.00

$

-

6/1

/20

18

By

Dis

cou

nt

All

owe

d

$

-

$

10

0.0

0

$

-

$

-

$

-

$

-

6/8

/20

18

By

Ban

k

$

-

$

-

$

-

$

-

$

1,9

00.

$

-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

00

6/1

3/2

01

8

By

Ban

k

$

-

$

-

$

-

$

70

0.0

0

$

-

$

-

6/2

8/2

01

8

By

Bad

Deb

t

$

-

$

-

$

-

$

-

$

-

$

25

0.

00

6/3

0/2

01

8

By

Sal

es

Ret

urn

$

-

$

-

$

15

4.0

0

$

-

$

-

$

-

6/3

0/2

01

8

By

Bal

anc

e

C/d

$

2,7

50.

00

$

-

$4,

29

6.0

0

$

1,2

25.

00

$

71

5.0

0

$

-

$

2,7

50.

00

$

1,3

00.

00

$

4,4

50.

00

$

1,92

5.00

$

2,6

15.

00

$

250

.00

$

2,7

50.

00

$

1,3

00.

00

$4,

45

0.0

0

$

1,9

25.

00

$

2,6

15.

00

$

25

0.

00

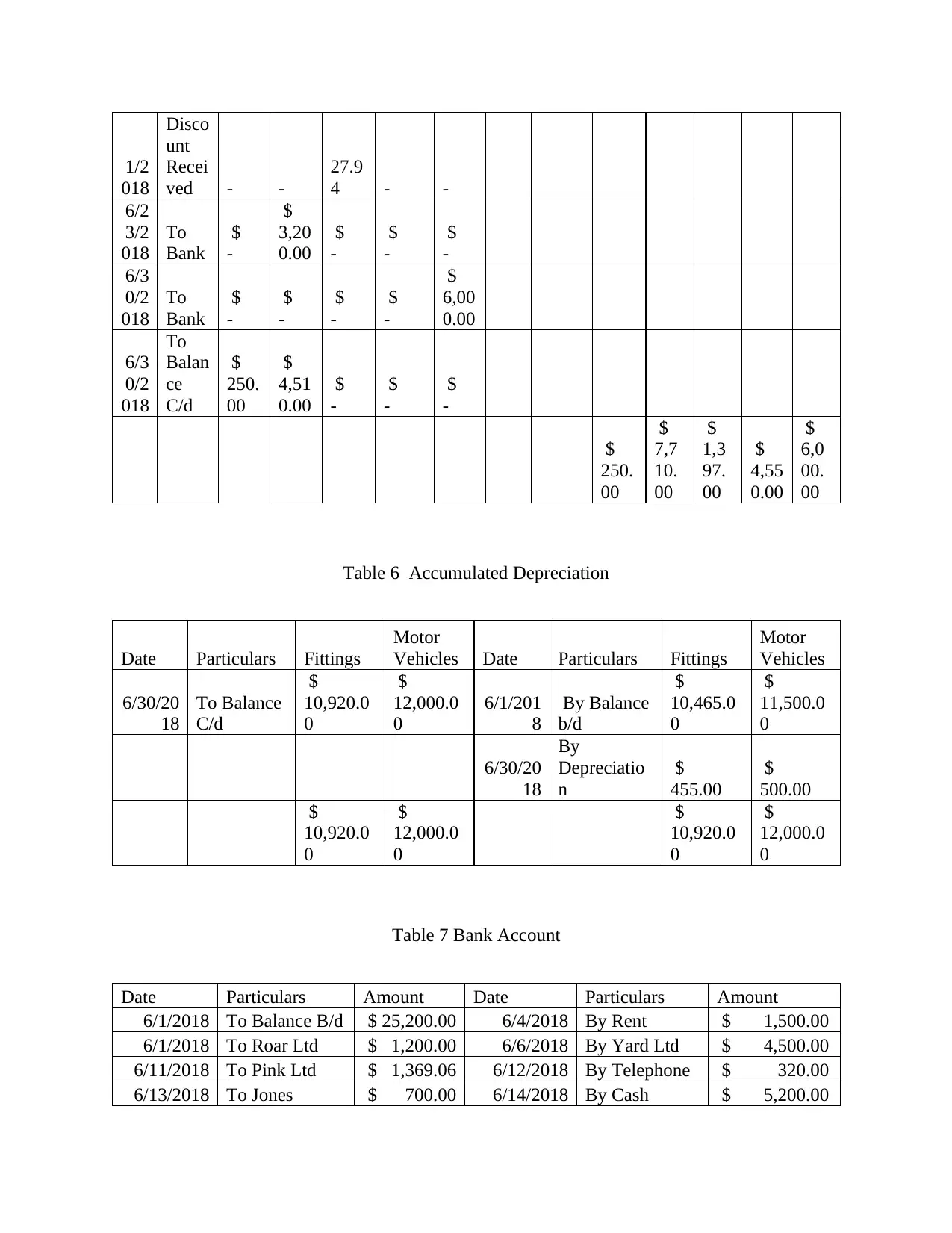

Table 5 Sundry Creditors Account

Dat

e

Partic

ulars

Man

e

Ltd

Pur

ple

Ltd

Pink

Ltd

Yard

Ltd

Zale

Ltd

Dat

e

Partic

ulars

Man

e

Ltd

Pur

ple

Ltd

Pin

k

Ltd

Yar

d

Ltd

Zal

e

Ltd

6/6

/20

18

To

Bank

$

-

$

-

$

-

$

4,500

.00

$

-

6/1

/20

18

By

Balan

ce

B/d

$

250.

00

$

3,2

00.

00

$

-

$

4,55

0.00

$

6,0

00.

00

6/6

/20

18

To

Disco

unt

Recei

ved

$

-

$

-

$

-

$

50.00

$

-

6/5

/20

18

By

Purch

ase

$

-

$

-

$

1,3

97.

00

$

-

$

-

6/1

1/2

018

To

Bank

$

-

$

-

$

1,36

9.06

$

-

$

-

6/3

0/2

018

By

Purch

ase

$

-

$

4,5

10.

00

$

-

$

-

$

-

6/1 To $ $ $ $ $

6/1

3/2

01

8

By

Ban

k

$

-

$

-

$

-

$

70

0.0

0

$

-

$

-

6/2

8/2

01

8

By

Bad

Deb

t

$

-

$

-

$

-

$

-

$

-

$

25

0.

00

6/3

0/2

01

8

By

Sal

es

Ret

urn

$

-

$

-

$

15

4.0

0

$

-

$

-

$

-

6/3

0/2

01

8

By

Bal

anc

e

C/d

$

2,7

50.

00

$

-

$4,

29

6.0

0

$

1,2

25.

00

$

71

5.0

0

$

-

$

2,7

50.

00

$

1,3

00.

00

$

4,4

50.

00

$

1,92

5.00

$

2,6

15.

00

$

250

.00

$

2,7

50.

00

$

1,3

00.

00

$4,

45

0.0

0

$

1,9

25.

00

$

2,6

15.

00

$

25

0.

00

Table 5 Sundry Creditors Account

Dat

e

Partic

ulars

Man

e

Ltd

Pur

ple

Ltd

Pink

Ltd

Yard

Ltd

Zale

Ltd

Dat

e

Partic

ulars

Man

e

Ltd

Pur

ple

Ltd

Pin

k

Ltd

Yar

d

Ltd

Zal

e

Ltd

6/6

/20

18

To

Bank

$

-

$

-

$

-

$

4,500

.00

$

-

6/1

/20

18

By

Balan

ce

B/d

$

250.

00

$

3,2

00.

00

$

-

$

4,55

0.00

$

6,0

00.

00

6/6

/20

18

To

Disco

unt

Recei

ved

$

-

$

-

$

-

$

50.00

$

-

6/5

/20

18

By

Purch

ase

$

-

$

-

$

1,3

97.

00

$

-

$

-

6/1

1/2

018

To

Bank

$

-

$

-

$

1,36

9.06

$

-

$

-

6/3

0/2

018

By

Purch

ase

$

-

$

4,5

10.

00

$

-

$

-

$

-

6/1 To $ $ $ $ $

1/2

018

Disco

unt

Recei

ved - -

27.9

4 - -

6/2

3/2

018

To

Bank

$

-

$

3,20

0.00

$

-

$

-

$

-

6/3

0/2

018

To

Bank

$

-

$

-

$

-

$

-

$

6,00

0.00

6/3

0/2

018

To

Balan

ce

C/d

$

250.

00

$

4,51

0.00

$

-

$

-

$

-

$

250.

00

$

7,7

10.

00

$

1,3

97.

00

$

4,55

0.00

$

6,0

00.

00

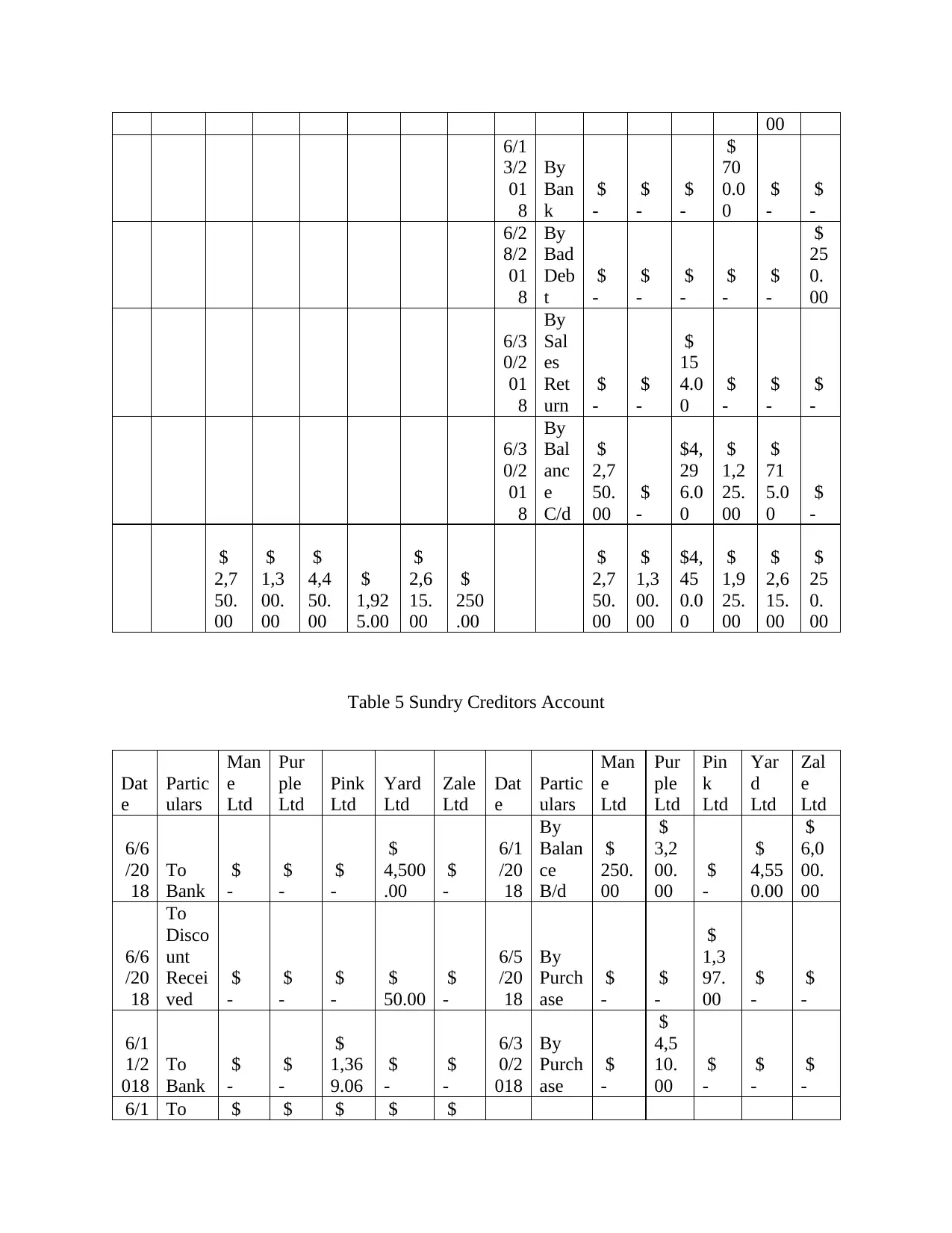

Table 6 Accumulated Depreciation

Date Particulars Fittings

Motor

Vehicles Date Particulars Fittings

Motor

Vehicles

6/30/20

18

To Balance

C/d

$

10,920.0

0

$

12,000.0

0

6/1/201

8

By Balance

b/d

$

10,465.0

0

$

11,500.0

0

6/30/20

18

By

Depreciatio

n

$

455.00

$

500.00

$

10,920.0

0

$

12,000.0

0

$

10,920.0

0

$

12,000.0

0

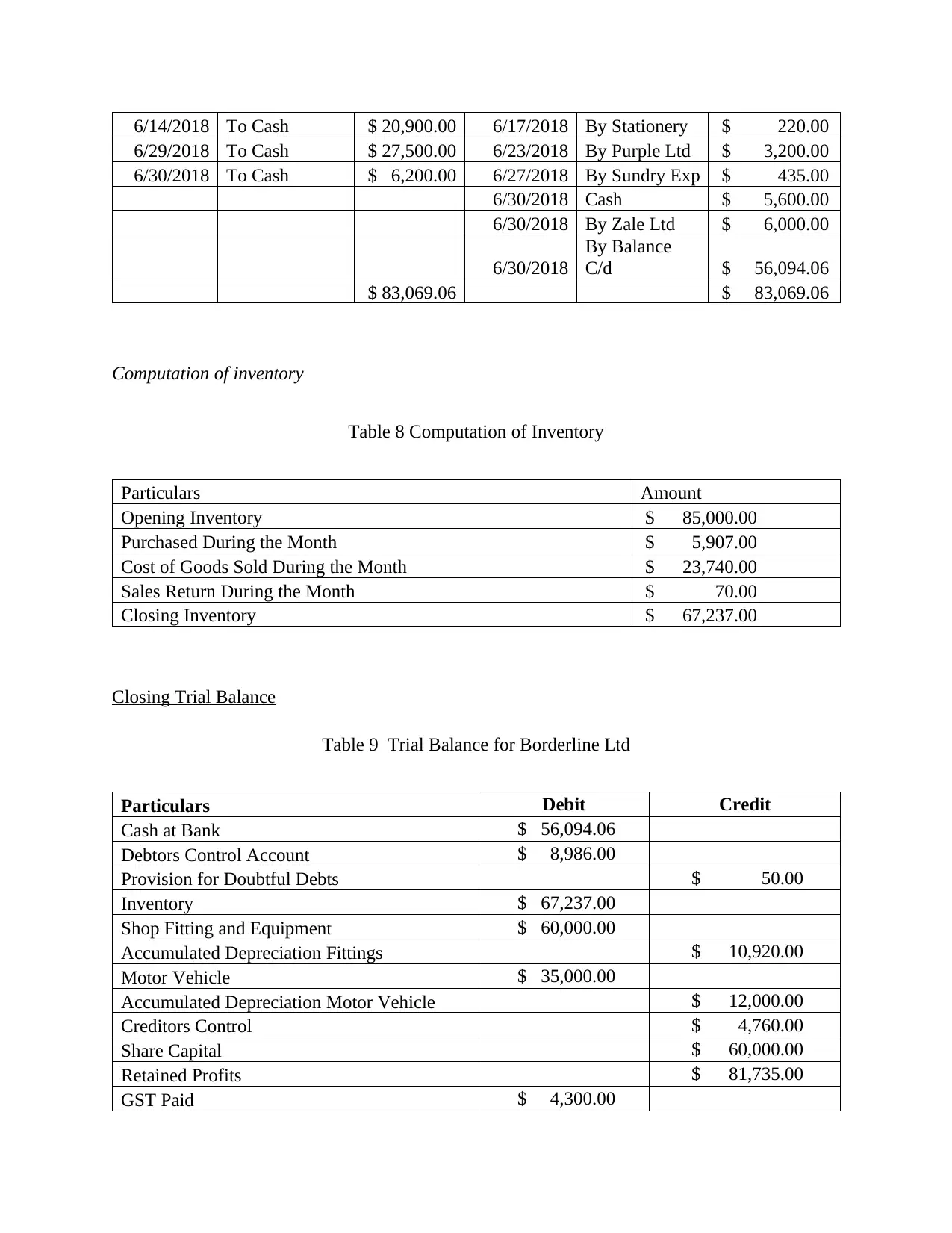

Table 7 Bank Account

Date Particulars Amount Date Particulars Amount

6/1/2018 To Balance B/d $ 25,200.00 6/4/2018 By Rent $ 1,500.00

6/1/2018 To Roar Ltd $ 1,200.00 6/6/2018 By Yard Ltd $ 4,500.00

6/11/2018 To Pink Ltd $ 1,369.06 6/12/2018 By Telephone $ 320.00

6/13/2018 To Jones $ 700.00 6/14/2018 By Cash $ 5,200.00

018

Disco

unt

Recei

ved - -

27.9

4 - -

6/2

3/2

018

To

Bank

$

-

$

3,20

0.00

$

-

$

-

$

-

6/3

0/2

018

To

Bank

$

-

$

-

$

-

$

-

$

6,00

0.00

6/3

0/2

018

To

Balan

ce

C/d

$

250.

00

$

4,51

0.00

$

-

$

-

$

-

$

250.

00

$

7,7

10.

00

$

1,3

97.

00

$

4,55

0.00

$

6,0

00.

00

Table 6 Accumulated Depreciation

Date Particulars Fittings

Motor

Vehicles Date Particulars Fittings

Motor

Vehicles

6/30/20

18

To Balance

C/d

$

10,920.0

0

$

12,000.0

0

6/1/201

8

By Balance

b/d

$

10,465.0

0

$

11,500.0

0

6/30/20

18

By

Depreciatio

n

$

455.00

$

500.00

$

10,920.0

0

$

12,000.0

0

$

10,920.0

0

$

12,000.0

0

Table 7 Bank Account

Date Particulars Amount Date Particulars Amount

6/1/2018 To Balance B/d $ 25,200.00 6/4/2018 By Rent $ 1,500.00

6/1/2018 To Roar Ltd $ 1,200.00 6/6/2018 By Yard Ltd $ 4,500.00

6/11/2018 To Pink Ltd $ 1,369.06 6/12/2018 By Telephone $ 320.00

6/13/2018 To Jones $ 700.00 6/14/2018 By Cash $ 5,200.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6/14/2018 To Cash $ 20,900.00 6/17/2018 By Stationery $ 220.00

6/29/2018 To Cash $ 27,500.00 6/23/2018 By Purple Ltd $ 3,200.00

6/30/2018 To Cash $ 6,200.00 6/27/2018 By Sundry Exp $ 435.00

6/30/2018 Cash $ 5,600.00

6/30/2018 By Zale Ltd $ 6,000.00

6/30/2018

By Balance

C/d $ 56,094.06

$ 83,069.06 $ 83,069.06

Computation of inventory

Table 8 Computation of Inventory

Particulars Amount

Opening Inventory $ 85,000.00

Purchased During the Month $ 5,907.00

Cost of Goods Sold During the Month $ 23,740.00

Sales Return During the Month $ 70.00

Closing Inventory $ 67,237.00

Closing Trial Balance

Table 9 Trial Balance for Borderline Ltd

Particulars Debit Credit

Cash at Bank $ 56,094.06

Debtors Control Account $ 8,986.00

Provision for Doubtful Debts $ 50.00

Inventory $ 67,237.00

Shop Fitting and Equipment $ 60,000.00

Accumulated Depreciation Fittings $ 10,920.00

Motor Vehicle $ 35,000.00

Accumulated Depreciation Motor Vehicle $ 12,000.00

Creditors Control $ 4,760.00

Share Capital $ 60,000.00

Retained Profits $ 81,735.00

GST Paid $ 4,300.00

6/29/2018 To Cash $ 27,500.00 6/23/2018 By Purple Ltd $ 3,200.00

6/30/2018 To Cash $ 6,200.00 6/27/2018 By Sundry Exp $ 435.00

6/30/2018 Cash $ 5,600.00

6/30/2018 By Zale Ltd $ 6,000.00

6/30/2018

By Balance

C/d $ 56,094.06

$ 83,069.06 $ 83,069.06

Computation of inventory

Table 8 Computation of Inventory

Particulars Amount

Opening Inventory $ 85,000.00

Purchased During the Month $ 5,907.00

Cost of Goods Sold During the Month $ 23,740.00

Sales Return During the Month $ 70.00

Closing Inventory $ 67,237.00

Closing Trial Balance

Table 9 Trial Balance for Borderline Ltd

Particulars Debit Credit

Cash at Bank $ 56,094.06

Debtors Control Account $ 8,986.00

Provision for Doubtful Debts $ 50.00

Inventory $ 67,237.00

Shop Fitting and Equipment $ 60,000.00

Accumulated Depreciation Fittings $ 10,920.00

Motor Vehicle $ 35,000.00

Accumulated Depreciation Motor Vehicle $ 12,000.00

Creditors Control $ 4,760.00

Share Capital $ 60,000.00

Retained Profits $ 81,735.00

GST Paid $ 4,300.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

GST Payable $ 4,200.00

GST Collected $ 8,500.00

Loan $ 32,000.00

Discount Allowed $ 100.00

Discount Received $ 77.94

Rent $ 1,500.00

Telephone $ 320.00

Wages $ 16,320.00

Electricity $ 1,100.00

Stationery Expenses $ 220.00

Sundry Expenses $ 435.00

Sales Return $ 154.00

Advertisement $ 3,500.00

Outstanding Expense $ 2,420.00

Income Tax $ 12,430.00

Provision for Income Tax $ 12,430.00

Outstanding Advertisement Expenses $ 3,500.00

Interest on Loan $ 240.00

Outstanding Interest on Loan $ 240.00

Sales $ 58,970.00

Purchase $ 7,597.00

Accounting Fees $ 250.00

Depreciation $ 955.00

Outstanding Accounting Fees $ 250.00

Suspense Account $ 15,314.88

$ 292,052.94 $ 292,052.94

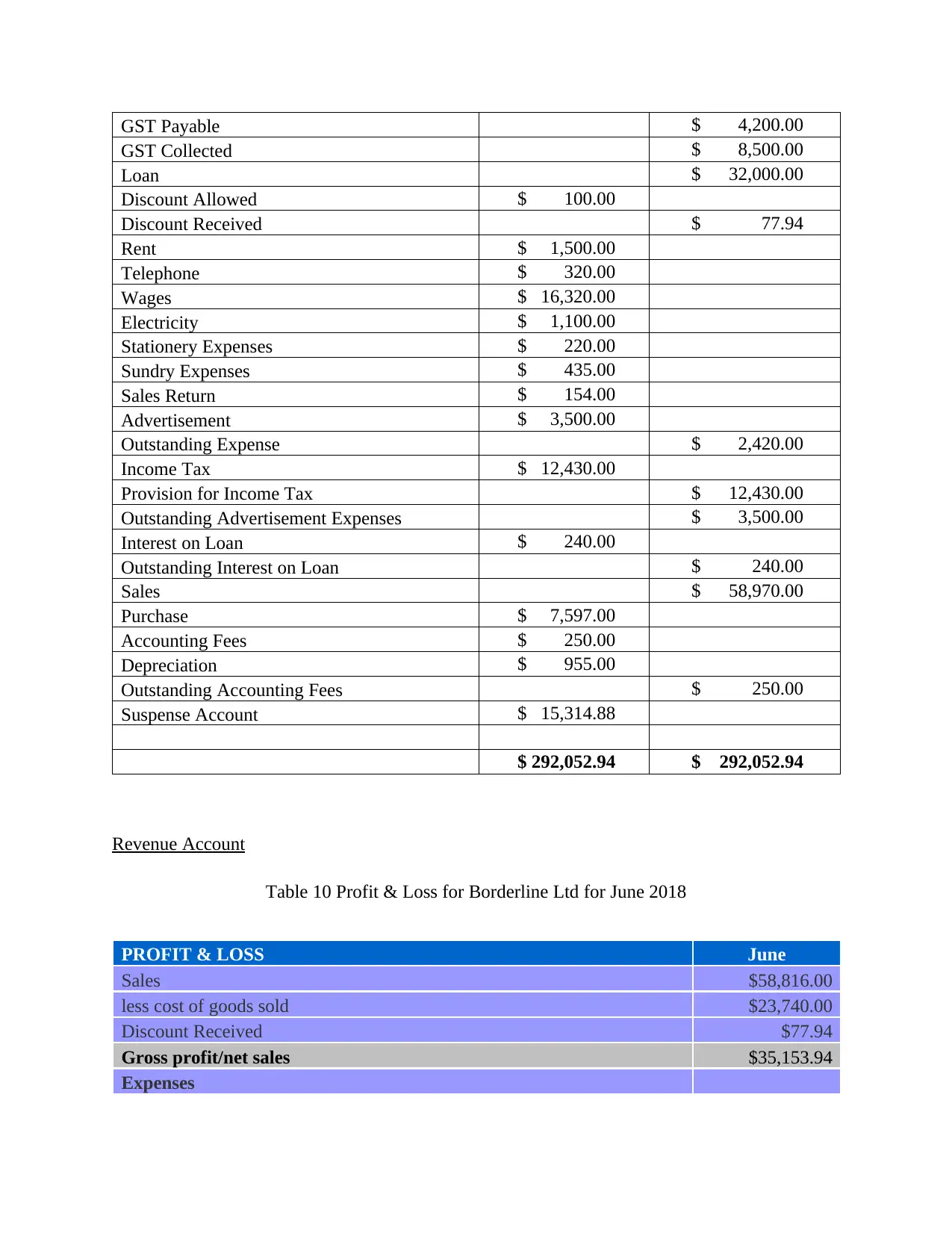

Revenue Account

Table 10 Profit & Loss for Borderline Ltd for June 2018

PROFIT & LOSS June

Sales $58,816.00

less cost of goods sold $23,740.00

Discount Received $77.94

Gross profit/net sales $35,153.94

Expenses

GST Collected $ 8,500.00

Loan $ 32,000.00

Discount Allowed $ 100.00

Discount Received $ 77.94

Rent $ 1,500.00

Telephone $ 320.00

Wages $ 16,320.00

Electricity $ 1,100.00

Stationery Expenses $ 220.00

Sundry Expenses $ 435.00

Sales Return $ 154.00

Advertisement $ 3,500.00

Outstanding Expense $ 2,420.00

Income Tax $ 12,430.00

Provision for Income Tax $ 12,430.00

Outstanding Advertisement Expenses $ 3,500.00

Interest on Loan $ 240.00

Outstanding Interest on Loan $ 240.00

Sales $ 58,970.00

Purchase $ 7,597.00

Accounting Fees $ 250.00

Depreciation $ 955.00

Outstanding Accounting Fees $ 250.00

Suspense Account $ 15,314.88

$ 292,052.94 $ 292,052.94

Revenue Account

Table 10 Profit & Loss for Borderline Ltd for June 2018

PROFIT & LOSS June

Sales $58,816.00

less cost of goods sold $23,740.00

Discount Received $77.94

Gross profit/net sales $35,153.94

Expenses

Accountant fees $250.00

Discount Allowed $100.00

Advertising & marketing $3,500.00

Sundry Expenses $435.00

Bank interest $240.00

Credit card fees $0.00

Utilities (electricity, gas, water) $1,100.00

Telephone $320.00

Lease/loan payments $0.00

Rent & rates $1,500.00

Depreciation $955.00

Repairs & maintenance $0.00

Stationery & printing $220.00

Insurance $0.00

Superannuation $0.00

Income tax $12,430.00

Wages (including PAYG) $16,320.00

Total expenses $37,370.00

NET PROFIT (Net Income) -$2,216.06

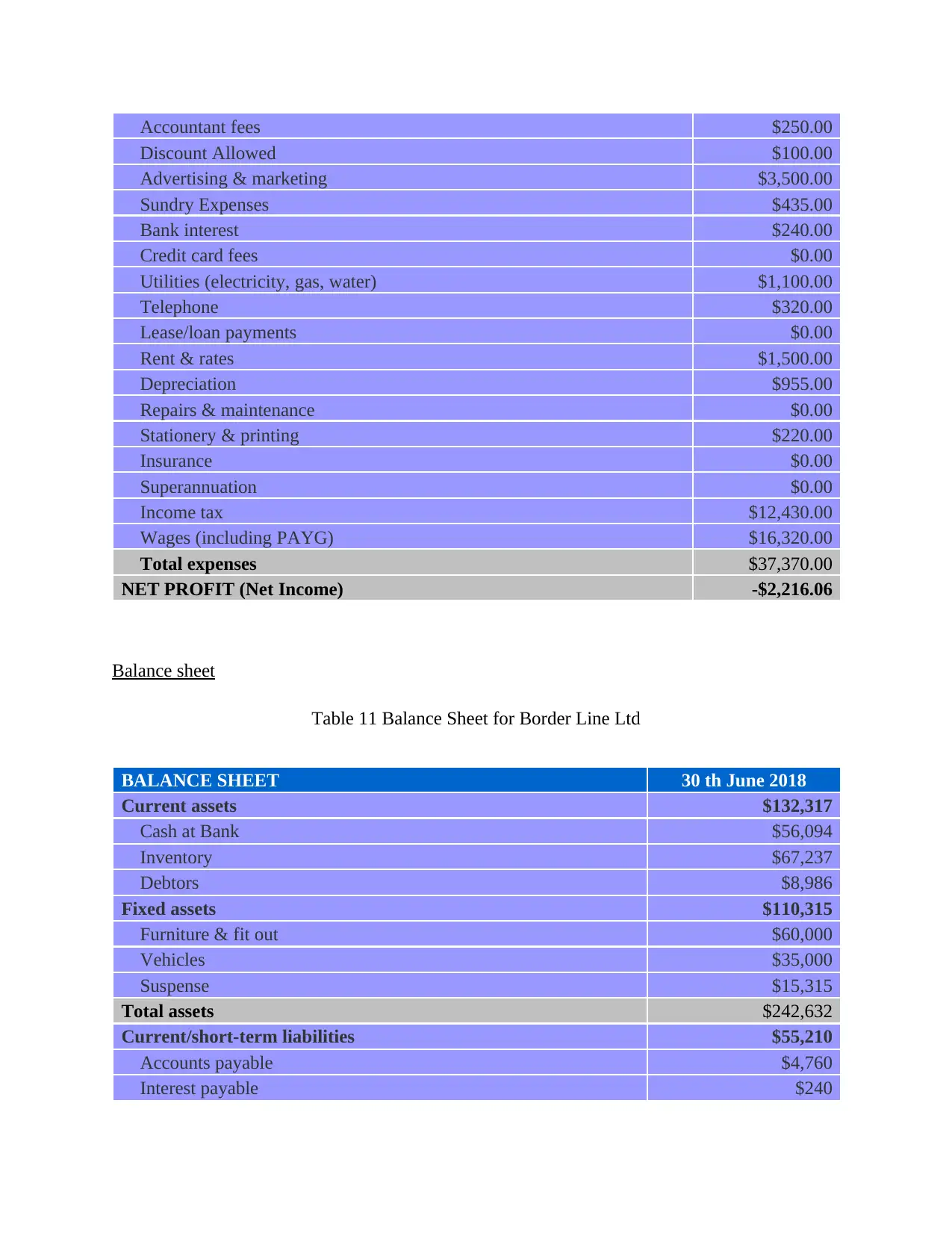

Balance sheet

Table 11 Balance Sheet for Border Line Ltd

BALANCE SHEET 30 th June 2018

Current assets $132,317

Cash at Bank $56,094

Inventory $67,237

Debtors $8,986

Fixed assets $110,315

Furniture & fit out $60,000

Vehicles $35,000

Suspense $15,315

Total assets $242,632

Current/short-term liabilities $55,210

Accounts payable $4,760

Interest payable $240

Discount Allowed $100.00

Advertising & marketing $3,500.00

Sundry Expenses $435.00

Bank interest $240.00

Credit card fees $0.00

Utilities (electricity, gas, water) $1,100.00

Telephone $320.00

Lease/loan payments $0.00

Rent & rates $1,500.00

Depreciation $955.00

Repairs & maintenance $0.00

Stationery & printing $220.00

Insurance $0.00

Superannuation $0.00

Income tax $12,430.00

Wages (including PAYG) $16,320.00

Total expenses $37,370.00

NET PROFIT (Net Income) -$2,216.06

Balance sheet

Table 11 Balance Sheet for Border Line Ltd

BALANCE SHEET 30 th June 2018

Current assets $132,317

Cash at Bank $56,094

Inventory $67,237

Debtors $8,986

Fixed assets $110,315

Furniture & fit out $60,000

Vehicles $35,000

Suspense $15,315

Total assets $242,632

Current/short-term liabilities $55,210

Accounts payable $4,760

Interest payable $240

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.