EMBA Finance Assignment: Boulton & Paul Bid

VerifiedAdded on 2019/09/22

|7

|2403

|234

Report

AI Summary

This finance assignment analyzes a bid for Boulton & Paul Limited, a company considering an ESA contract. The report uses Net Present Value (NPV) as the primary investment appraisal technique to evaluate the long-term viability and profitability of the project. The analysis includes detailed calculations of cash flows, considering factors like initial investment (including opportunity costs), variable costs (with inflation), depreciation, taxes, and working capital. The report finds a positive NPV, suggesting the project is financially viable. However, it also recommends further analysis using sensitivity analysis and risk-adjusted NPV to account for uncertainties and potential variations in cash flows.

1

University of Edinburgh Business School

EMBA 2015-2016

Finance Assignment

University of Edinburgh Business School

EMBA 2015-2016

Finance Assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

About Boulton & Paul Limited

The assignment is about an acceptance of a bid which is available to Boulton & Paul Limited,

a company which was established in 1797 and which is an iron foundry also a wire netting

manufacturer. Moreover, it is also a constructer of pre-fabricated wooden homes. It also

constructs huts for Robert Falcon Scott’s Antarctic expeditions. The firm has also become

famous for manufacturing of aircrafts. The firm is responsible for manufacturing some iconic

planes involved in WWII which also includes Defiant NF MKII. The firm has also become a

medium sized niche high-tech aerospace equipment manufacturer.

Investment Appraisal Techniques

Acceptance of a bid or start of a new project by any firm requires many critical things to be

analysed first. The technique used commonly by every firm to analyse new projects are

investment appraisal techniques. Investment appraisal techniques are the techniques to

evaluate the project to be undertaken, its viability and profitability with respect to the

investment to be made in the project. The project can be a long term or a short term project.

Before starting or investing in a project, a detailed analysis of the project is necessary in order

to gain from the project. While analysing the project many critical parts are required to be

given importance to. The technique is advantageous as it allows the firms to estimate the long

term viability of the project. The important factors that are considered here are the investment

in new plant and machinery, cash flows that will be generated over years from the project,

property related decisions, projects on research and development and advertising campaigns.

There are many techniques used for the purpose of Capital Investment Appraisal. Some of the

techniques used are as follows:

Net Present Value

Accounting Rate of Return

Internal Rate of Return

Modified Internal Rate of Return

Adjusted Present Value

Profitability Index

Equivalent Annuity

Payback Period

Discounted Payback Period

Real Option Analysis

The most commonly used technique to evaluate the project is the Net Present Value. NPV is

the technique where the cash flows of the projects are estimated and they are compared with

the initial investment to be made in the project at the start of the year. Proper discounting rate

is used for the purpose of evaluating the project and assumptions are also made while

evaluating the project. The project or an investment plan is given assent when the NPV of the

project is positive. The project with positive NPV is accepted as the cash flows or the

revenues which will be generated in long term recovers the initial cost of the project and the

firm ends up making profit with positive NPV. The technique of NPV is the most reliable

About Boulton & Paul Limited

The assignment is about an acceptance of a bid which is available to Boulton & Paul Limited,

a company which was established in 1797 and which is an iron foundry also a wire netting

manufacturer. Moreover, it is also a constructer of pre-fabricated wooden homes. It also

constructs huts for Robert Falcon Scott’s Antarctic expeditions. The firm has also become

famous for manufacturing of aircrafts. The firm is responsible for manufacturing some iconic

planes involved in WWII which also includes Defiant NF MKII. The firm has also become a

medium sized niche high-tech aerospace equipment manufacturer.

Investment Appraisal Techniques

Acceptance of a bid or start of a new project by any firm requires many critical things to be

analysed first. The technique used commonly by every firm to analyse new projects are

investment appraisal techniques. Investment appraisal techniques are the techniques to

evaluate the project to be undertaken, its viability and profitability with respect to the

investment to be made in the project. The project can be a long term or a short term project.

Before starting or investing in a project, a detailed analysis of the project is necessary in order

to gain from the project. While analysing the project many critical parts are required to be

given importance to. The technique is advantageous as it allows the firms to estimate the long

term viability of the project. The important factors that are considered here are the investment

in new plant and machinery, cash flows that will be generated over years from the project,

property related decisions, projects on research and development and advertising campaigns.

There are many techniques used for the purpose of Capital Investment Appraisal. Some of the

techniques used are as follows:

Net Present Value

Accounting Rate of Return

Internal Rate of Return

Modified Internal Rate of Return

Adjusted Present Value

Profitability Index

Equivalent Annuity

Payback Period

Discounted Payback Period

Real Option Analysis

The most commonly used technique to evaluate the project is the Net Present Value. NPV is

the technique where the cash flows of the projects are estimated and they are compared with

the initial investment to be made in the project at the start of the year. Proper discounting rate

is used for the purpose of evaluating the project and assumptions are also made while

evaluating the project. The project or an investment plan is given assent when the NPV of the

project is positive. The project with positive NPV is accepted as the cash flows or the

revenues which will be generated in long term recovers the initial cost of the project and the

firm ends up making profit with positive NPV. The technique of NPV is the most reliable

3

technique among all other techniques of investment appraisal. Every technique has its own

advantages as well as disadvantages. It may also happen that one technique of investment

appraisal may suggest different project and other technique also suggest different project. The

key determinants for the NPV technique are the duration of the project, discounting rate of

the project and the estimates of costs and benefits.

The major assumptions made while using the NPV techniques are as follows.

1. All the cash flows that are generated every year occur at the end of the period.

2. Another assumption is that the cash flows occurred at the end of the year are re-

invested at the project’s discounting rate of return.

Net present value is used with assumptions and available information like cash flows,

discounting rate and investment to be made. NPV allows the firm to estimate the cash flow

which is not 100% accurate. It does not fully take into account the opportunity cost of

choosing the project. For example, it may happen that after starting with the project based on

NPV technique, it may happen that there comes a more advantageous opportunity for the firm

which can’t be taken used now. So, this technique doesn’t take into account the future

investment opportunities. Another disadvantage of the project is that it doesn’t provide the

investor with the true and correct picture of the gain or loss. There is always a kind of

uncertainty involved in the project being analysed.

The bid in the given assignment is analysed using the NPV technique being the most reliable

technique of investment appraisal.

Analysis of the Bid

The firm is in the running of a new ESA contract which would earn the firm at least revenue

of 1.5$ million if the bid is accepted. The contract is a long term fixed contract of 5 years. It

involves supply of high-tech optical component for a continuous period of 5 years. 10 units of

component would be supplied to the agency every year for 5 years and the selling price of the

component would be 300000$. According to the estimates made by the team, the selling price

set is a very competitive price and it is less likely to make any better offer.

If the bid of B & P Limited is accepted by ESA, it would commit the firm a long term fixed

price contract. The initial investment required to be made in the project would be 1.5$ million

for the purpose of purchasing the machinery and for refurbishment of the plant which is not

used now by the firm situated in Great Yarmouth.

The information useful for the purpose of evaluating the project is given as follows:

1. The plant in Great Yarmouth was depreciated fully in the books of the firm except for

the value of the land which is 10,000$.

2. The land on which the plant stands was purchased for 10,000$ but it has now the

value of 600,000$ due to its proximity to a reasonably high end shorefront

development area.

technique among all other techniques of investment appraisal. Every technique has its own

advantages as well as disadvantages. It may also happen that one technique of investment

appraisal may suggest different project and other technique also suggest different project. The

key determinants for the NPV technique are the duration of the project, discounting rate of

the project and the estimates of costs and benefits.

The major assumptions made while using the NPV techniques are as follows.

1. All the cash flows that are generated every year occur at the end of the period.

2. Another assumption is that the cash flows occurred at the end of the year are re-

invested at the project’s discounting rate of return.

Net present value is used with assumptions and available information like cash flows,

discounting rate and investment to be made. NPV allows the firm to estimate the cash flow

which is not 100% accurate. It does not fully take into account the opportunity cost of

choosing the project. For example, it may happen that after starting with the project based on

NPV technique, it may happen that there comes a more advantageous opportunity for the firm

which can’t be taken used now. So, this technique doesn’t take into account the future

investment opportunities. Another disadvantage of the project is that it doesn’t provide the

investor with the true and correct picture of the gain or loss. There is always a kind of

uncertainty involved in the project being analysed.

The bid in the given assignment is analysed using the NPV technique being the most reliable

technique of investment appraisal.

Analysis of the Bid

The firm is in the running of a new ESA contract which would earn the firm at least revenue

of 1.5$ million if the bid is accepted. The contract is a long term fixed contract of 5 years. It

involves supply of high-tech optical component for a continuous period of 5 years. 10 units of

component would be supplied to the agency every year for 5 years and the selling price of the

component would be 300000$. According to the estimates made by the team, the selling price

set is a very competitive price and it is less likely to make any better offer.

If the bid of B & P Limited is accepted by ESA, it would commit the firm a long term fixed

price contract. The initial investment required to be made in the project would be 1.5$ million

for the purpose of purchasing the machinery and for refurbishment of the plant which is not

used now by the firm situated in Great Yarmouth.

The information useful for the purpose of evaluating the project is given as follows:

1. The plant in Great Yarmouth was depreciated fully in the books of the firm except for

the value of the land which is 10,000$.

2. The land on which the plant stands was purchased for 10,000$ but it has now the

value of 600,000$ due to its proximity to a reasonably high end shorefront

development area.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

3. Refurbishment of the plant would require an initial investment of 500,000$ which

would be depreciated on a straight line method and the tax rate applicable to the firm

is 35%.

4. The new machinery to support the refurbished plant would cost the company

10,00,000$, which would be depreciated on a straight line basis for a period of 5

years.

5. The studies of the market revealed that the refurbished plant and machinery being

highly customised for the project would not earn the firm a second hand value after

the project is completed. Hence, the salvage value estimated at the end of 5 years for

the plant and machinery to be used in the project would be zero.

6. It is forecasted by the firm that the cost of goods sold would include fixed cost of

300,000$ every year. Moreover, variable cost of 180,000$ per unit is also forecasted

which would have an inflation rate of 4% every year.

7. Working capital of the project would be 10% of sales at the start of production. The

working capital of the project will be recovered at the end of the projct duration.

Analysis of the above information

Initial investment in the project would be 15,00,000$ which would be depreciated over a

period of 5 years on a straight line basis. Working capital would also be considered while

computing initial investment.

The cost of the land purchased is not useful while evaluating the project as it is sunk cost

which has already been incurred. However, if the project is not undertaken the firm could

have sold the land on which the plant stands for the amount of 600,000$. Therefore, this

would be considered as an opportunity cost and it will be included in cost of first year.

If the firm had salvage value it could have been included in revenue of the last year, but as

the firm had no salvage value, it will be ignored while estimating the cash flows of the

project.

Fixed cost is the cost which is going to be incurred irrespective of the acceptance of the

project. Hence, it is ignored while estimating the cash flows. Only those expenditures which

will be incurred if the project is accepted are considered while estimating cash flows. Fixed

cost would be incurred even if the project is not accepted.

Working capital is the basic requirement of the project to start with. Business can’t be

conducted without working capital. Working capital is the capital used for day to day

expenditure of the business. Hence, every year 10% of sales would be required for working

capital and the working capital invested in the project would be recovered at the end of 5th

year.

The discounting rate of the project is 12%. Tax rate applicable to the firm is 35% and the

depreciation method used by the firm is straight line method.

3. Refurbishment of the plant would require an initial investment of 500,000$ which

would be depreciated on a straight line method and the tax rate applicable to the firm

is 35%.

4. The new machinery to support the refurbished plant would cost the company

10,00,000$, which would be depreciated on a straight line basis for a period of 5

years.

5. The studies of the market revealed that the refurbished plant and machinery being

highly customised for the project would not earn the firm a second hand value after

the project is completed. Hence, the salvage value estimated at the end of 5 years for

the plant and machinery to be used in the project would be zero.

6. It is forecasted by the firm that the cost of goods sold would include fixed cost of

300,000$ every year. Moreover, variable cost of 180,000$ per unit is also forecasted

which would have an inflation rate of 4% every year.

7. Working capital of the project would be 10% of sales at the start of production. The

working capital of the project will be recovered at the end of the projct duration.

Analysis of the above information

Initial investment in the project would be 15,00,000$ which would be depreciated over a

period of 5 years on a straight line basis. Working capital would also be considered while

computing initial investment.

The cost of the land purchased is not useful while evaluating the project as it is sunk cost

which has already been incurred. However, if the project is not undertaken the firm could

have sold the land on which the plant stands for the amount of 600,000$. Therefore, this

would be considered as an opportunity cost and it will be included in cost of first year.

If the firm had salvage value it could have been included in revenue of the last year, but as

the firm had no salvage value, it will be ignored while estimating the cash flows of the

project.

Fixed cost is the cost which is going to be incurred irrespective of the acceptance of the

project. Hence, it is ignored while estimating the cash flows. Only those expenditures which

will be incurred if the project is accepted are considered while estimating cash flows. Fixed

cost would be incurred even if the project is not accepted.

Working capital is the basic requirement of the project to start with. Business can’t be

conducted without working capital. Working capital is the capital used for day to day

expenditure of the business. Hence, every year 10% of sales would be required for working

capital and the working capital invested in the project would be recovered at the end of 5th

year.

The discounting rate of the project is 12%. Tax rate applicable to the firm is 35% and the

depreciation method used by the firm is straight line method.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

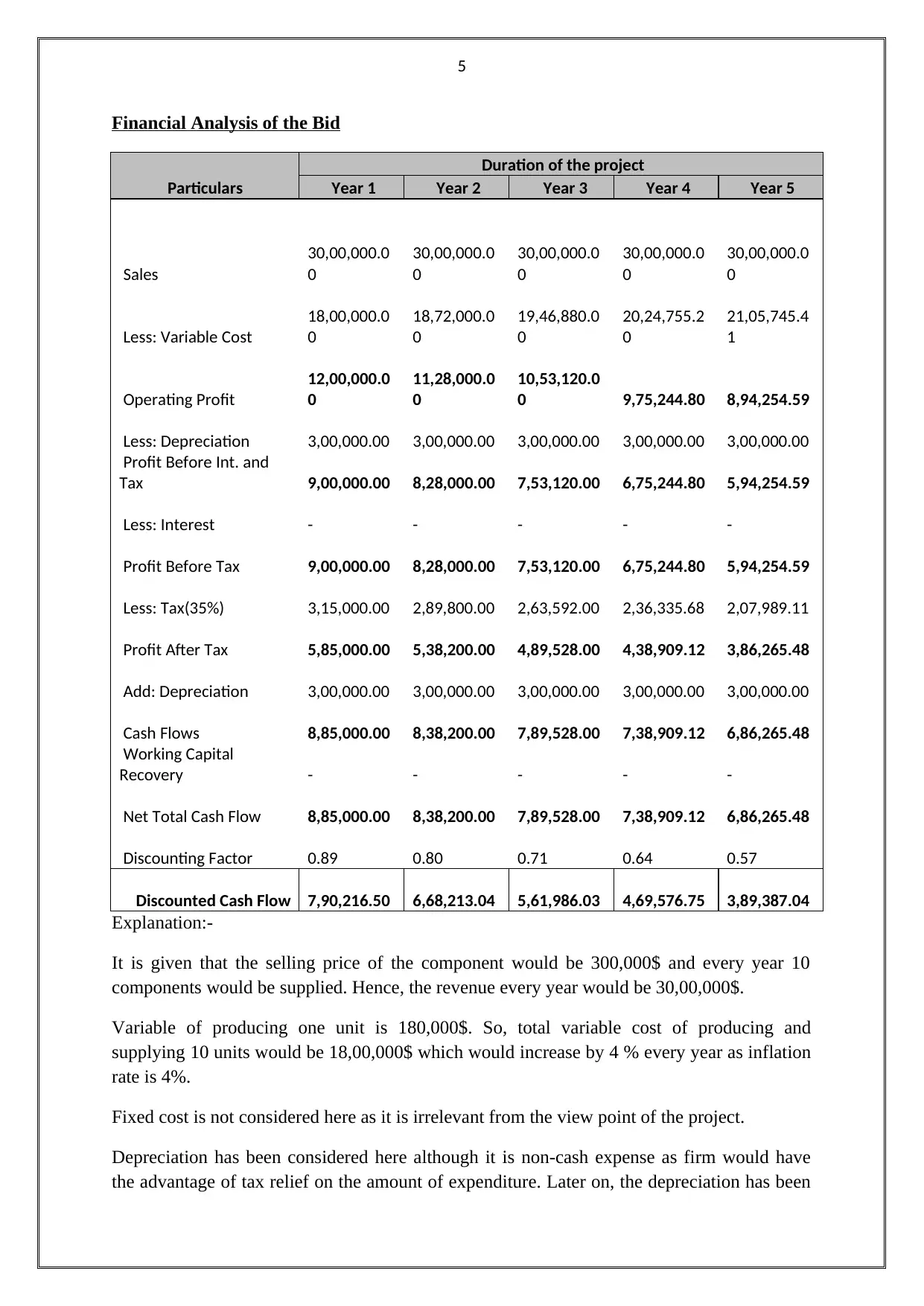

Financial Analysis of the Bid

Particulars

Duration of the project

Year 1 Year 2 Year 3 Year 4 Year 5

Sales

30,00,000.0

0

30,00,000.0

0

30,00,000.0

0

30,00,000.0

0

30,00,000.0

0

Less: Variable Cost

18,00,000.0

0

18,72,000.0

0

19,46,880.0

0

20,24,755.2

0

21,05,745.4

1

Operating Profit

12,00,000.0

0

11,28,000.0

0

10,53,120.0

0 9,75,244.80 8,94,254.59

Less: Depreciation 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00

Profit Before Int. and

Tax 9,00,000.00 8,28,000.00 7,53,120.00 6,75,244.80 5,94,254.59

Less: Interest - - - - -

Profit Before Tax 9,00,000.00 8,28,000.00 7,53,120.00 6,75,244.80 5,94,254.59

Less: Tax(35%) 3,15,000.00 2,89,800.00 2,63,592.00 2,36,335.68 2,07,989.11

Profit After Tax 5,85,000.00 5,38,200.00 4,89,528.00 4,38,909.12 3,86,265.48

Add: Depreciation 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00

Cash Flows 8,85,000.00 8,38,200.00 7,89,528.00 7,38,909.12 6,86,265.48

Working Capital

Recovery - - - - -

Net Total Cash Flow 8,85,000.00 8,38,200.00 7,89,528.00 7,38,909.12 6,86,265.48

Discounting Factor 0.89 0.80 0.71 0.64 0.57

Discounted Cash Flow 7,90,216.50 6,68,213.04 5,61,986.03 4,69,576.75 3,89,387.04

Explanation:-

It is given that the selling price of the component would be 300,000$ and every year 10

components would be supplied. Hence, the revenue every year would be 30,00,000$.

Variable of producing one unit is 180,000$. So, total variable cost of producing and

supplying 10 units would be 18,00,000$ which would increase by 4 % every year as inflation

rate is 4%.

Fixed cost is not considered here as it is irrelevant from the view point of the project.

Depreciation has been considered here although it is non-cash expense as firm would have

the advantage of tax relief on the amount of expenditure. Later on, the depreciation has been

Financial Analysis of the Bid

Particulars

Duration of the project

Year 1 Year 2 Year 3 Year 4 Year 5

Sales

30,00,000.0

0

30,00,000.0

0

30,00,000.0

0

30,00,000.0

0

30,00,000.0

0

Less: Variable Cost

18,00,000.0

0

18,72,000.0

0

19,46,880.0

0

20,24,755.2

0

21,05,745.4

1

Operating Profit

12,00,000.0

0

11,28,000.0

0

10,53,120.0

0 9,75,244.80 8,94,254.59

Less: Depreciation 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00

Profit Before Int. and

Tax 9,00,000.00 8,28,000.00 7,53,120.00 6,75,244.80 5,94,254.59

Less: Interest - - - - -

Profit Before Tax 9,00,000.00 8,28,000.00 7,53,120.00 6,75,244.80 5,94,254.59

Less: Tax(35%) 3,15,000.00 2,89,800.00 2,63,592.00 2,36,335.68 2,07,989.11

Profit After Tax 5,85,000.00 5,38,200.00 4,89,528.00 4,38,909.12 3,86,265.48

Add: Depreciation 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00 3,00,000.00

Cash Flows 8,85,000.00 8,38,200.00 7,89,528.00 7,38,909.12 6,86,265.48

Working Capital

Recovery - - - - -

Net Total Cash Flow 8,85,000.00 8,38,200.00 7,89,528.00 7,38,909.12 6,86,265.48

Discounting Factor 0.89 0.80 0.71 0.64 0.57

Discounted Cash Flow 7,90,216.50 6,68,213.04 5,61,986.03 4,69,576.75 3,89,387.04

Explanation:-

It is given that the selling price of the component would be 300,000$ and every year 10

components would be supplied. Hence, the revenue every year would be 30,00,000$.

Variable of producing one unit is 180,000$. So, total variable cost of producing and

supplying 10 units would be 18,00,000$ which would increase by 4 % every year as inflation

rate is 4%.

Fixed cost is not considered here as it is irrelevant from the view point of the project.

Depreciation has been considered here although it is non-cash expense as firm would have

the advantage of tax relief on the amount of expenditure. Later on, the depreciation has been

6

added up to calculate cash flows as it is non-cash expense and company will not actually

incur the expenditure.

To find out total cash flows, working capital which will be recovered at the end of the project

life is added up. The cash flows are discounted using the discounting rate to calculate the

discounted cash flows.

Total discounted cash flow for 5 years is 28,79,379.35$.

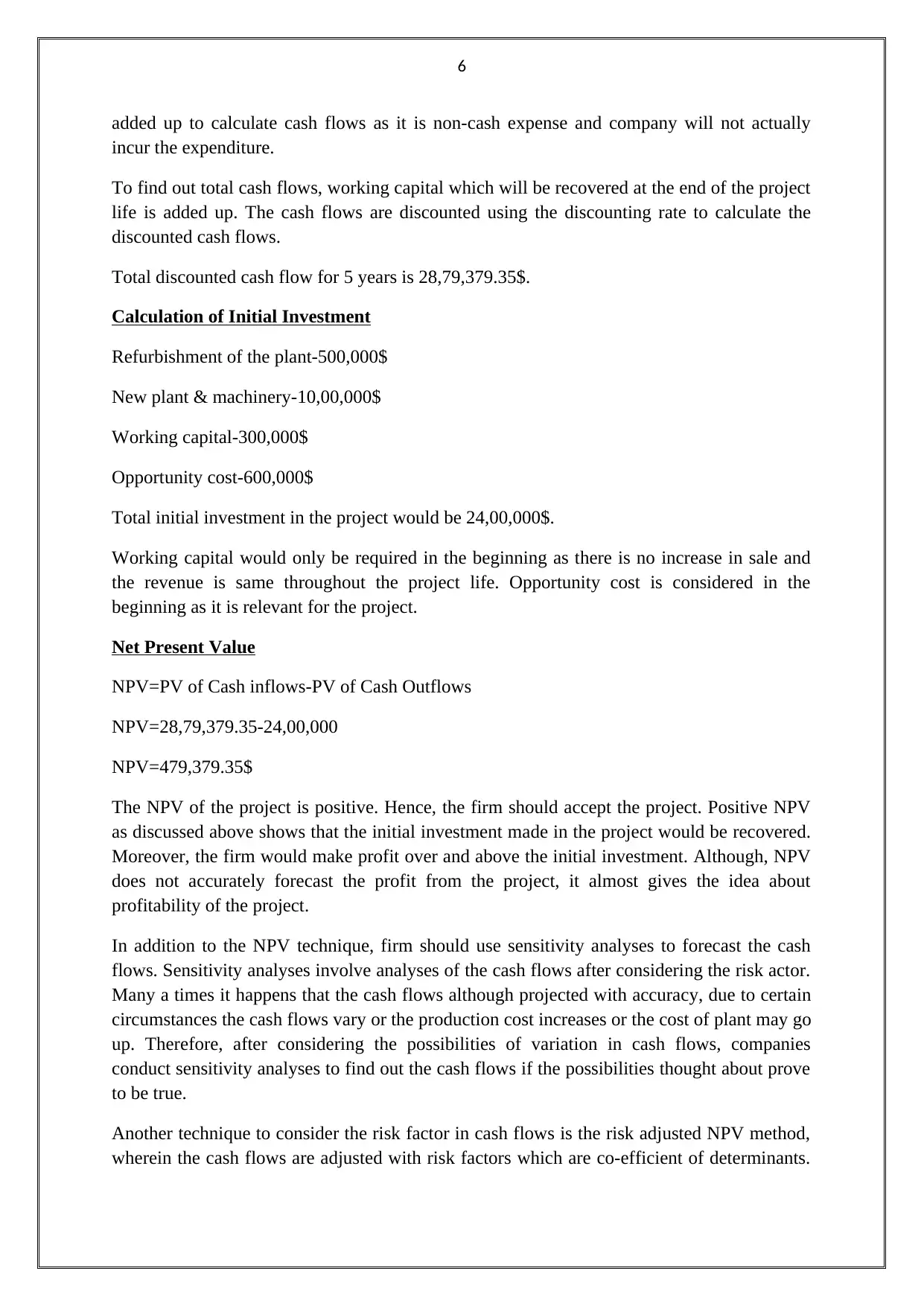

Calculation of Initial Investment

Refurbishment of the plant-500,000$

New plant & machinery-10,00,000$

Working capital-300,000$

Opportunity cost-600,000$

Total initial investment in the project would be 24,00,000$.

Working capital would only be required in the beginning as there is no increase in sale and

the revenue is same throughout the project life. Opportunity cost is considered in the

beginning as it is relevant for the project.

Net Present Value

NPV=PV of Cash inflows-PV of Cash Outflows

NPV=28,79,379.35-24,00,000

NPV=479,379.35$

The NPV of the project is positive. Hence, the firm should accept the project. Positive NPV

as discussed above shows that the initial investment made in the project would be recovered.

Moreover, the firm would make profit over and above the initial investment. Although, NPV

does not accurately forecast the profit from the project, it almost gives the idea about

profitability of the project.

In addition to the NPV technique, firm should use sensitivity analyses to forecast the cash

flows. Sensitivity analyses involve analyses of the cash flows after considering the risk actor.

Many a times it happens that the cash flows although projected with accuracy, due to certain

circumstances the cash flows vary or the production cost increases or the cost of plant may go

up. Therefore, after considering the possibilities of variation in cash flows, companies

conduct sensitivity analyses to find out the cash flows if the possibilities thought about prove

to be true.

Another technique to consider the risk factor in cash flows is the risk adjusted NPV method,

wherein the cash flows are adjusted with risk factors which are co-efficient of determinants.

added up to calculate cash flows as it is non-cash expense and company will not actually

incur the expenditure.

To find out total cash flows, working capital which will be recovered at the end of the project

life is added up. The cash flows are discounted using the discounting rate to calculate the

discounted cash flows.

Total discounted cash flow for 5 years is 28,79,379.35$.

Calculation of Initial Investment

Refurbishment of the plant-500,000$

New plant & machinery-10,00,000$

Working capital-300,000$

Opportunity cost-600,000$

Total initial investment in the project would be 24,00,000$.

Working capital would only be required in the beginning as there is no increase in sale and

the revenue is same throughout the project life. Opportunity cost is considered in the

beginning as it is relevant for the project.

Net Present Value

NPV=PV of Cash inflows-PV of Cash Outflows

NPV=28,79,379.35-24,00,000

NPV=479,379.35$

The NPV of the project is positive. Hence, the firm should accept the project. Positive NPV

as discussed above shows that the initial investment made in the project would be recovered.

Moreover, the firm would make profit over and above the initial investment. Although, NPV

does not accurately forecast the profit from the project, it almost gives the idea about

profitability of the project.

In addition to the NPV technique, firm should use sensitivity analyses to forecast the cash

flows. Sensitivity analyses involve analyses of the cash flows after considering the risk actor.

Many a times it happens that the cash flows although projected with accuracy, due to certain

circumstances the cash flows vary or the production cost increases or the cost of plant may go

up. Therefore, after considering the possibilities of variation in cash flows, companies

conduct sensitivity analyses to find out the cash flows if the possibilities thought about prove

to be true.

Another technique to consider the risk factor in cash flows is the risk adjusted NPV method,

wherein the cash flows are adjusted with risk factors which are co-efficient of determinants.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Higher the risk, higher are the co-efficient of determinants and lower would be the

discounting rate.

References

ANON, N.D., “Capital Investment Appraisal”, Accessed on 1st December 2015,

<http://www.capital-investment.co.uk/capital-investment-appraisal.php>

ANON, N.D., “Capital Investment Appraisal”, Accessed on 1st December 2015,

<http://publicspendingcode.per.gov.ie/overview-of-appraisal-methods-and-techniques/>

ANON, N.D., “Disadvantages of NPV”, Accessed on 1st December 2015,

<https://www.boundless.com/finance/textbooks/boundless-finance-textbook/capital-

budgeting-11/net-present-value-94/disadvantages-of-the-npv-method-411-7040/>

ANON, N.D., “Net Present Value Method”, Accessed on 1st December 2015,

<http://accountingexplained.com/managerial/capital-budgeting/npv>

ANON, N.D., “Assumptions of NPV Method”, Accessed on 1st December 2015,

<http://www.another71.com/cpa-exam-forum/topic/net-present-value-versus-internal-rate-of-

return-assumptions>

ANON, N.D., “Advantages And Disadvantages of NPV Method”, Accessed on 1st December

2015, <http://www.fool.com/knowledge-center/2015/11/14/advantages-and-disadvantages-

of-net-present-value.aspx>

ANON, N.D., “Capital Investment Appraisal Techniques”, Accessed on 1st December 2015,

<http://www.bookkeepers.org.uk/out/?dlid=54341>

ANON, N.D., “Capital Investment Appraisal Techniques”, Accessed on 1st December 2015,

<http://www.cimaglobal.com/Documents/Student%20docs/2010%20syllabus%20docs/P1/

P1%20investment%20appraisal%20methods.pdf>

Higher the risk, higher are the co-efficient of determinants and lower would be the

discounting rate.

References

ANON, N.D., “Capital Investment Appraisal”, Accessed on 1st December 2015,

<http://www.capital-investment.co.uk/capital-investment-appraisal.php>

ANON, N.D., “Capital Investment Appraisal”, Accessed on 1st December 2015,

<http://publicspendingcode.per.gov.ie/overview-of-appraisal-methods-and-techniques/>

ANON, N.D., “Disadvantages of NPV”, Accessed on 1st December 2015,

<https://www.boundless.com/finance/textbooks/boundless-finance-textbook/capital-

budgeting-11/net-present-value-94/disadvantages-of-the-npv-method-411-7040/>

ANON, N.D., “Net Present Value Method”, Accessed on 1st December 2015,

<http://accountingexplained.com/managerial/capital-budgeting/npv>

ANON, N.D., “Assumptions of NPV Method”, Accessed on 1st December 2015,

<http://www.another71.com/cpa-exam-forum/topic/net-present-value-versus-internal-rate-of-

return-assumptions>

ANON, N.D., “Advantages And Disadvantages of NPV Method”, Accessed on 1st December

2015, <http://www.fool.com/knowledge-center/2015/11/14/advantages-and-disadvantages-

of-net-present-value.aspx>

ANON, N.D., “Capital Investment Appraisal Techniques”, Accessed on 1st December 2015,

<http://www.bookkeepers.org.uk/out/?dlid=54341>

ANON, N.D., “Capital Investment Appraisal Techniques”, Accessed on 1st December 2015,

<http://www.cimaglobal.com/Documents/Student%20docs/2010%20syllabus%20docs/P1/

P1%20investment%20appraisal%20methods.pdf>

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.