Business Strategy Report: BP Oil's Strategic Planning and Analysis

VerifiedAdded on 2020/11/23

|16

|5652

|381

Report

AI Summary

This report provides a comprehensive analysis of BP Oil's business strategy. It begins with an introduction to business strategy and its role in achieving organizational objectives. The report then delves into the macro environment of BP Oil using SWOT and PESTLE analyses, examining political, economic, social, technological, legal, and environmental factors. The internal environment is assessed using the McKinsey 7S model and VRIO framework to evaluate the company's capabilities. Industry competition is analyzed using Porter’s Five Forces, and strategic recommendations are made using the Ansoff Matrix. Finally, the report applies Porter’s Generic Model and concludes with a strategic management plan for BP Oil. The report covers various aspects of BP Oil's operations, including its strengths, weaknesses, opportunities, and threats, as well as its competitive position within the oil and gas sector.

UNIT 32:

BUSINESS STRATEGY

BUSINESS STRATEGY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1. (a) Meaning of Strategy....................................................................................................1

(b) Role of strategy to achieve business objectives................................................................1

(c) Strategic Planning Techniques..........................................................................................2

M1. (a) Macro Environment of BP Oil..................................................................................2

(b) Critical Analysis of Macro Environment using SWOT Analysis.....................................2

D1. (a) PESTLE......................................................................................................................4

LO 2.................................................................................................................................................5

P2. (a) Meaning of internal environment and capabilities.....................................................5

(b) McKinsey 7S Model applied to BP Oil............................................................................5

M2. (a) Critical analysis of McKinsey 7S Model...................................................................6

(b) VRIO Framework.............................................................................................................6

LO 3.................................................................................................................................................8

P3. (a) Analysis of industry competition using Porter’s Five Force Model...........................8

M3. (a) Recommending strategy using Ansoff Matrix..........................................................9

LO 4...............................................................................................................................................10

P4. (a) Porter’s Generic Model applied to BP Oil................................................................10

M4. (a) Meaning of Strategic Management Plan.................................................................11

(b) Strategic Management Plan for BP Oil...........................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1. (a) Meaning of Strategy....................................................................................................1

(b) Role of strategy to achieve business objectives................................................................1

(c) Strategic Planning Techniques..........................................................................................2

M1. (a) Macro Environment of BP Oil..................................................................................2

(b) Critical Analysis of Macro Environment using SWOT Analysis.....................................2

D1. (a) PESTLE......................................................................................................................4

LO 2.................................................................................................................................................5

P2. (a) Meaning of internal environment and capabilities.....................................................5

(b) McKinsey 7S Model applied to BP Oil............................................................................5

M2. (a) Critical analysis of McKinsey 7S Model...................................................................6

(b) VRIO Framework.............................................................................................................6

LO 3.................................................................................................................................................8

P3. (a) Analysis of industry competition using Porter’s Five Force Model...........................8

M3. (a) Recommending strategy using Ansoff Matrix..........................................................9

LO 4...............................................................................................................................................10

P4. (a) Porter’s Generic Model applied to BP Oil................................................................10

M4. (a) Meaning of Strategic Management Plan.................................................................11

(b) Strategic Management Plan for BP Oil...........................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION

Business strategy is defined as the set of actions taken by a company with a view to attain

a competitive advantage in marketplace (Bell, Bryman and Harley, 2018). The primary motive of

enforcing an effective business strategy is that it provides assistance in accomplishing the

organisational goals and objectives in the stipulated course of time. The emphasis of devising

such a strategy is to enhance the sales and profitability of business by undertaking measures

which are aimed at gaining the attention of population.

The present report is based on the business strategy and the strategic planning of British

Petroleum Oil Company. BP Oil is a multinational corporation functioning within oil and gas

sector and has its headquarters within London, UK. This assignment provides knowledge about

the influence of macro environment on business and its strategies. Also, it includes an analysis of

the internal environment of organisation and its capabilities by making use of McKinsey 7S

Model and VRIO framework. Additionally, the assignment gains an insight into the application

of Porter’s Five Force Model to evaluate industry rivalry along with the selection of appropriate

strategy by using Ansoff Matrix. Lastly, a strategic plan is devised by analysing Porter’s Generic

Strategies.

LO 1

P1. (a) Meaning of Strategy

Strategy can be defined as “the set of actions that are taken with a view to attain the long

term objectives of a company” (Brewster, 2017).

In other words, it can be said that “Strategy refers to the alignment of people and their

behaviour towards accomplishment of a desired state in future.

Both the definitions state that strategy is future-oriented and provides assistance in

accomplishment of long term business objectives.

While the former definition states that strategy is a course of action, the latter depicts that

it is directing the behaviour of people towards the long term objective.

(b) Role of strategy to achieve business objectives

Strategy is the course of action by which companies aim to achieve a competitive

advantage in marketplace so that they can override rivals operating within the same industry and

enhance the overall sales and profitability. Thus, strategy provides assistance to an organisation

1

Business strategy is defined as the set of actions taken by a company with a view to attain

a competitive advantage in marketplace (Bell, Bryman and Harley, 2018). The primary motive of

enforcing an effective business strategy is that it provides assistance in accomplishing the

organisational goals and objectives in the stipulated course of time. The emphasis of devising

such a strategy is to enhance the sales and profitability of business by undertaking measures

which are aimed at gaining the attention of population.

The present report is based on the business strategy and the strategic planning of British

Petroleum Oil Company. BP Oil is a multinational corporation functioning within oil and gas

sector and has its headquarters within London, UK. This assignment provides knowledge about

the influence of macro environment on business and its strategies. Also, it includes an analysis of

the internal environment of organisation and its capabilities by making use of McKinsey 7S

Model and VRIO framework. Additionally, the assignment gains an insight into the application

of Porter’s Five Force Model to evaluate industry rivalry along with the selection of appropriate

strategy by using Ansoff Matrix. Lastly, a strategic plan is devised by analysing Porter’s Generic

Strategies.

LO 1

P1. (a) Meaning of Strategy

Strategy can be defined as “the set of actions that are taken with a view to attain the long

term objectives of a company” (Brewster, 2017).

In other words, it can be said that “Strategy refers to the alignment of people and their

behaviour towards accomplishment of a desired state in future.

Both the definitions state that strategy is future-oriented and provides assistance in

accomplishment of long term business objectives.

While the former definition states that strategy is a course of action, the latter depicts that

it is directing the behaviour of people towards the long term objective.

(b) Role of strategy to achieve business objectives

Strategy is the course of action by which companies aim to achieve a competitive

advantage in marketplace so that they can override rivals operating within the same industry and

enhance the overall sales and profitability. Thus, strategy provides assistance to an organisation

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

in accomplishing the organisational goals and objectives, thereby attaining the strategic intent by

directing the behavioural characteristics of individuals towards the vision of company. Also,

business strategy aids an organisation to undertake such activities and processes which provide

strategic directions to various units and departments of an entity so that long term goals can be

timely attained.

(c) Strategic Planning Techniques

There are a number of strategic planning techniques that are available to a business in

order to take tactical decisions aimed at improving the position of company at marketplace and

enhancing its overall sales as well as profitability. Some of the techniques that are widely used

by the business organisations are BCG Matrix, SWOT analysis, PESTLE analysis, Stakeholder

analysis etc. (Chang, 2016). These techniques provide assistance to an organisation to take

decisions for the entity based upon the analysis and evaluation of macro and micro environment.

M1. (a) Macro Environment of BP Oil

BP Oil is a well renowned multinational company which is following vertical integration

and successfully functioning within all the areas of oil and gas industry, inclusive of refining,

marketing and distribution, exploration and manufacturing, petrochemicals, trading and power

generation. By the end of 2017, this organisation was operating within 70 nations producing

approximately 3.6 million barrels per day of oil equivalents and had overall proved reserve of

18.441 billions of barrels of equivalent (Cavusgil and et. al., 2014). Thus, it becomes necessary

to examine and assess the macro environmental factors of this company such as stakeholders,

PESTLE factors, strengths, weaknesses, opportunities and threats in order to improve the overall

market position.

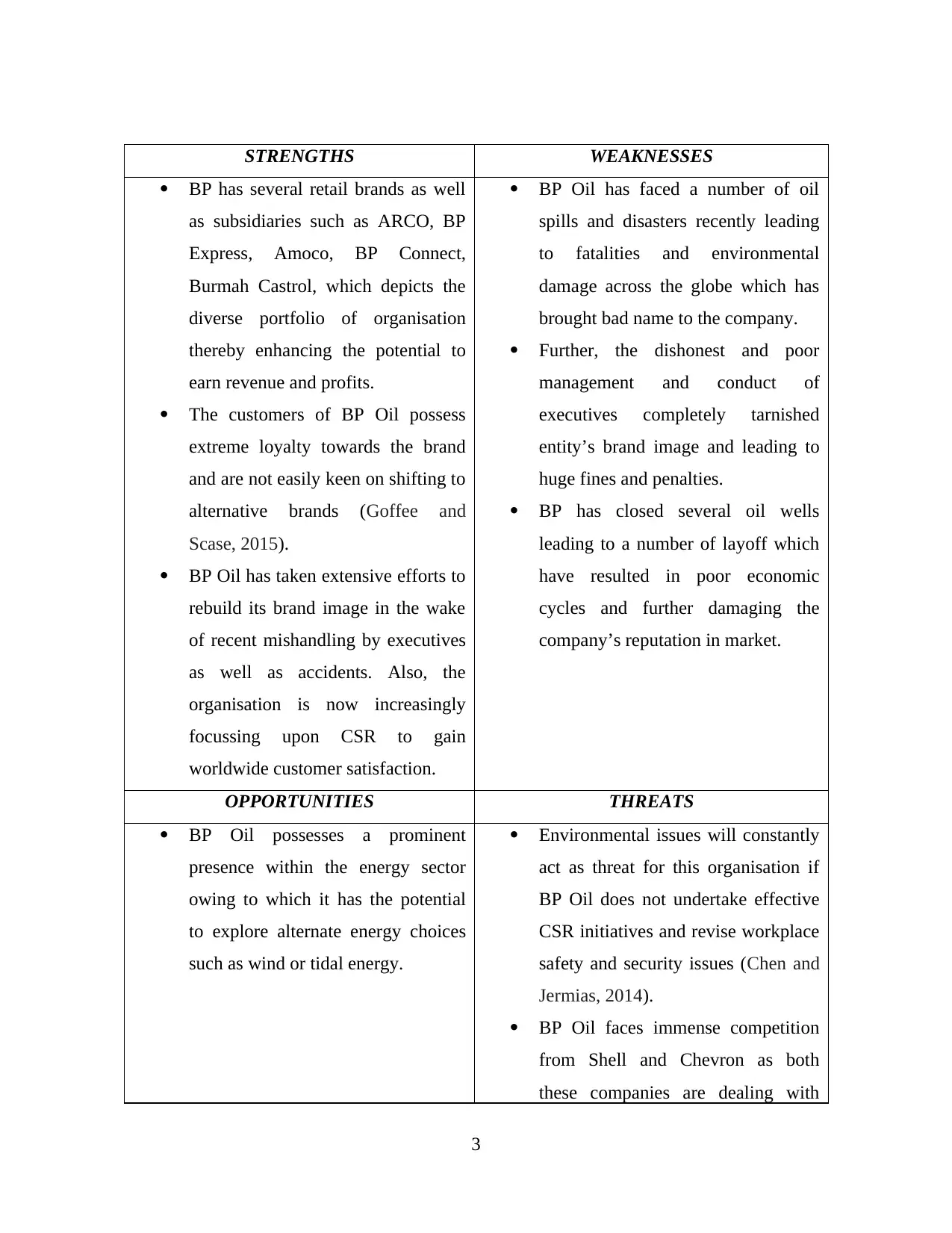

(b) Critical Analysis of Macro Environment using SWOT Analysis

It is essential to evaluate the macro environment of an organisation as it assists an entity

to take adequate and relevant decision which will aid in gaining a strategic edge over rivals and

enhancing the overall profitability. BP Oil has experienced major challenges in last some years,

inclusive of costly as well as brand shattering accidents along with the pressure to take into

account targets of global climate change and emphasize upon CSR. In this regard, being one of

the world’s largest energy companies of the world, BP Oil has examined the macro environment

by making use of SWOT analysis as follows:-

2

directing the behavioural characteristics of individuals towards the vision of company. Also,

business strategy aids an organisation to undertake such activities and processes which provide

strategic directions to various units and departments of an entity so that long term goals can be

timely attained.

(c) Strategic Planning Techniques

There are a number of strategic planning techniques that are available to a business in

order to take tactical decisions aimed at improving the position of company at marketplace and

enhancing its overall sales as well as profitability. Some of the techniques that are widely used

by the business organisations are BCG Matrix, SWOT analysis, PESTLE analysis, Stakeholder

analysis etc. (Chang, 2016). These techniques provide assistance to an organisation to take

decisions for the entity based upon the analysis and evaluation of macro and micro environment.

M1. (a) Macro Environment of BP Oil

BP Oil is a well renowned multinational company which is following vertical integration

and successfully functioning within all the areas of oil and gas industry, inclusive of refining,

marketing and distribution, exploration and manufacturing, petrochemicals, trading and power

generation. By the end of 2017, this organisation was operating within 70 nations producing

approximately 3.6 million barrels per day of oil equivalents and had overall proved reserve of

18.441 billions of barrels of equivalent (Cavusgil and et. al., 2014). Thus, it becomes necessary

to examine and assess the macro environmental factors of this company such as stakeholders,

PESTLE factors, strengths, weaknesses, opportunities and threats in order to improve the overall

market position.

(b) Critical Analysis of Macro Environment using SWOT Analysis

It is essential to evaluate the macro environment of an organisation as it assists an entity

to take adequate and relevant decision which will aid in gaining a strategic edge over rivals and

enhancing the overall profitability. BP Oil has experienced major challenges in last some years,

inclusive of costly as well as brand shattering accidents along with the pressure to take into

account targets of global climate change and emphasize upon CSR. In this regard, being one of

the world’s largest energy companies of the world, BP Oil has examined the macro environment

by making use of SWOT analysis as follows:-

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

STRENGTHS WEAKNESSES

BP has several retail brands as well

as subsidiaries such as ARCO, BP

Express, Amoco, BP Connect,

Burmah Castrol, which depicts the

diverse portfolio of organisation

thereby enhancing the potential to

earn revenue and profits.

The customers of BP Oil possess

extreme loyalty towards the brand

and are not easily keen on shifting to

alternative brands (Goffee and

Scase, 2015).

BP Oil has taken extensive efforts to

rebuild its brand image in the wake

of recent mishandling by executives

as well as accidents. Also, the

organisation is now increasingly

focussing upon CSR to gain

worldwide customer satisfaction.

BP Oil has faced a number of oil

spills and disasters recently leading

to fatalities and environmental

damage across the globe which has

brought bad name to the company.

Further, the dishonest and poor

management and conduct of

executives completely tarnished

entity’s brand image and leading to

huge fines and penalties.

BP has closed several oil wells

leading to a number of layoff which

have resulted in poor economic

cycles and further damaging the

company’s reputation in market.

OPPORTUNITIES THREATS

BP Oil possesses a prominent

presence within the energy sector

owing to which it has the potential

to explore alternate energy choices

such as wind or tidal energy.

Environmental issues will constantly

act as threat for this organisation if

BP Oil does not undertake effective

CSR initiatives and revise workplace

safety and security issues (Chen and

Jermias, 2014).

BP Oil faces immense competition

from Shell and Chevron as both

these companies are dealing with

3

BP has several retail brands as well

as subsidiaries such as ARCO, BP

Express, Amoco, BP Connect,

Burmah Castrol, which depicts the

diverse portfolio of organisation

thereby enhancing the potential to

earn revenue and profits.

The customers of BP Oil possess

extreme loyalty towards the brand

and are not easily keen on shifting to

alternative brands (Goffee and

Scase, 2015).

BP Oil has taken extensive efforts to

rebuild its brand image in the wake

of recent mishandling by executives

as well as accidents. Also, the

organisation is now increasingly

focussing upon CSR to gain

worldwide customer satisfaction.

BP Oil has faced a number of oil

spills and disasters recently leading

to fatalities and environmental

damage across the globe which has

brought bad name to the company.

Further, the dishonest and poor

management and conduct of

executives completely tarnished

entity’s brand image and leading to

huge fines and penalties.

BP has closed several oil wells

leading to a number of layoff which

have resulted in poor economic

cycles and further damaging the

company’s reputation in market.

OPPORTUNITIES THREATS

BP Oil possesses a prominent

presence within the energy sector

owing to which it has the potential

to explore alternate energy choices

such as wind or tidal energy.

Environmental issues will constantly

act as threat for this organisation if

BP Oil does not undertake effective

CSR initiatives and revise workplace

safety and security issues (Chen and

Jermias, 2014).

BP Oil faces immense competition

from Shell and Chevron as both

these companies are dealing with

3

safety concerns in an appropriate

manner to reduce oil spills and

leakages, refinery explosions and

pipeline corrosion.

D1. (a) PESTLE

It is essential for an organisation to analyse the external factors of business environment

so as to set its strategies accordingly. In this regard, BP Oil is making use of a strategic tool for

analysing the macro environment prevailing within the organization. PESTLE analysis has been

used to identify the impact of external factors upon the functioning of company, as follows:-

Political factors: This factor comprises of trading policies, lobbying, inter-countries

relations and many other. Energy market within the world is becoming unstable due to

alterations in changing needs of oil and variability of Chinese economy, unpredictability arises

among different countries. As BP Oil and Gas is operating in different countries, they have to

acknowledge various types of political environment and political system risks involved in this.

BP Oil needs to take into consideration factors like risk of military invasion, level of corruption,

political stability, interference and bureaucracy in Oil and Gas sector in which they are carrying

out their services (Laudon and Traver, 2016).

Economic factors: The economy of different countries is dependent on British

Petroleum which is assisted by energy supply. There are different sources of energy that are

enhancing and growth is predictable within less time, this will create threat to BP. These factors

include savings rate, foreign exchange rate, interest rates as well as economic cycle which

combine demand and investment within economy. Economic factors which BP Oil must consider

while conducting their services are economic system in the country in which they are rendering

their services and their stability, government intervention related with oil and gas, stability of

host country currency, exchange rates and many other (Klettner, Clarke and Boersma, 2014).

Social factors: The view of world is altering in front of people which are responsible for

spreading uncertainties associated with sustainability. Shared attitudes as well as beliefs play an

important role to analyse customers of market of BP Oil and the ways in which marketing

designs are formulated. They need to identify demographics and level of skills of population,

4

manner to reduce oil spills and

leakages, refinery explosions and

pipeline corrosion.

D1. (a) PESTLE

It is essential for an organisation to analyse the external factors of business environment

so as to set its strategies accordingly. In this regard, BP Oil is making use of a strategic tool for

analysing the macro environment prevailing within the organization. PESTLE analysis has been

used to identify the impact of external factors upon the functioning of company, as follows:-

Political factors: This factor comprises of trading policies, lobbying, inter-countries

relations and many other. Energy market within the world is becoming unstable due to

alterations in changing needs of oil and variability of Chinese economy, unpredictability arises

among different countries. As BP Oil and Gas is operating in different countries, they have to

acknowledge various types of political environment and political system risks involved in this.

BP Oil needs to take into consideration factors like risk of military invasion, level of corruption,

political stability, interference and bureaucracy in Oil and Gas sector in which they are carrying

out their services (Laudon and Traver, 2016).

Economic factors: The economy of different countries is dependent on British

Petroleum which is assisted by energy supply. There are different sources of energy that are

enhancing and growth is predictable within less time, this will create threat to BP. These factors

include savings rate, foreign exchange rate, interest rates as well as economic cycle which

combine demand and investment within economy. Economic factors which BP Oil must consider

while conducting their services are economic system in the country in which they are rendering

their services and their stability, government intervention related with oil and gas, stability of

host country currency, exchange rates and many other (Klettner, Clarke and Boersma, 2014).

Social factors: The view of world is altering in front of people which are responsible for

spreading uncertainties associated with sustainability. Shared attitudes as well as beliefs play an

important role to analyse customers of market of BP Oil and the ways in which marketing

designs are formulated. They need to identify demographics and level of skills of population,

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

hierarchy, power structure and class structure, entrepreneurial spirit, broader nature of society

and many other factors must be considered by BP Oil to furnish services.

Technological factors: It is one of the most important factors which impact the

procedures of company. By making use of technology they have refined, distributed and

explored the market of oil and gas. BP Oil must conduct technological analysis and identify the

speed at which technology is evolving. BP Oil needs to analyse different factors they includes

product offerings, rate of technological diffusion, impact of value chain, cost structure and many

other factors.

Legal factors: The government controls health and safety policies which are related with

oil and gas organizations which will create an impact on health of employees who are part of BP

Oil. They might be working in disposal, distribution, exploration and oil drilling (Davies, 2016).

A firm needs to identify market and legal framework of countries to ensure intellectual property

rights. BP Oil needs to adhere to discrimination law, copyrights, patents, anti-trust laws,

employment laws must be considered by them.

Environment factors: When it comes to business, environment is one of the most

critical factors which must be considered by an organisation. This is so because harmful gases

which are emitted while producing, extracting and refining petroleum creates a great negative

impact on environment. It is necessary for BP Oil to identify the environmental factors in which

they are rendering their services. This includes climate change, laws regulating environment

pollution, recycling, waste management and their attitude towards ecological or green products.

LO 2

P2. (a) Meaning of internal environment and capabilities

Internal environment of an organisation is made up of components such as management,

employees, corporate culture, strategies, tactics and employees’ behaviour. This internal

environment of a company keeps on changing depending upon the situations arising within the

business environment and market place (Mittal and Dhar, 2015). Further, organisational

capabilities refer to the potential of entity to manage and allocate its resources in an effective and

efficient manner with a view to gain a competitive advantage in market.

5

and many other factors must be considered by BP Oil to furnish services.

Technological factors: It is one of the most important factors which impact the

procedures of company. By making use of technology they have refined, distributed and

explored the market of oil and gas. BP Oil must conduct technological analysis and identify the

speed at which technology is evolving. BP Oil needs to analyse different factors they includes

product offerings, rate of technological diffusion, impact of value chain, cost structure and many

other factors.

Legal factors: The government controls health and safety policies which are related with

oil and gas organizations which will create an impact on health of employees who are part of BP

Oil. They might be working in disposal, distribution, exploration and oil drilling (Davies, 2016).

A firm needs to identify market and legal framework of countries to ensure intellectual property

rights. BP Oil needs to adhere to discrimination law, copyrights, patents, anti-trust laws,

employment laws must be considered by them.

Environment factors: When it comes to business, environment is one of the most

critical factors which must be considered by an organisation. This is so because harmful gases

which are emitted while producing, extracting and refining petroleum creates a great negative

impact on environment. It is necessary for BP Oil to identify the environmental factors in which

they are rendering their services. This includes climate change, laws regulating environment

pollution, recycling, waste management and their attitude towards ecological or green products.

LO 2

P2. (a) Meaning of internal environment and capabilities

Internal environment of an organisation is made up of components such as management,

employees, corporate culture, strategies, tactics and employees’ behaviour. This internal

environment of a company keeps on changing depending upon the situations arising within the

business environment and market place (Mittal and Dhar, 2015). Further, organisational

capabilities refer to the potential of entity to manage and allocate its resources in an effective and

efficient manner with a view to gain a competitive advantage in market.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(b) McKinsey 7S Model applied to BP Oil

Mckinsey model is considered as the strategic framework which is used by businesses

when they are not working well in the company. With reference to BP oils, it can be said that the

company can use this model in order to improve its internal factors which are not going well in

the company and also influencing their work in negative manner. It includes total seven

independent factors that are categorised into two types that is Hard elements and soft elements.

All the factors belonging to this are specified as below:

Hard elements

Strategy: In this element, management team of BP Oils develops effective strategy by

which they can easily gain competitive advantage and enhance their profitability.

Structure: The top management team of BP oils are using flat organisational structure

for enhancing their size of team effectively (McCahery, Sautner and Starks, 2016).

Systems: The company is specifically using latest updated systems and also uses best

communication processes in order to make sure that work is going to be done in effective manner

without facing any barrier.

Soft elements

Shared value: The core value of this company is to deliver best services to the customers

for the purpose of developing their brand name at market place.

Skills: Management team of BP oils is conducting regular based training sessions for its

employees in order to enhance their skills. This development is helpful for them in maximising

their productivity.

Style: Management team of BP oils is using democratic leadership style for improve their

value of decision making. It can be said that with the help of this style they will easily be able to

improve their business performance with better support of customers

Staff: BP oils owns around 74000 employees who are capable of performing their work

effectively in the company (Lawton, 2017).

M2. (a) Critical analysis of McKinsey 7S Model

Although BP Oil put a lot of efforts in effectively managing the 7 elements of this model,

it can be seen that this organisation has been suffering from mishandling and mismanagement

issues of executives. This has largely damaged the organisational goodwill of BP Oil within the

6

Mckinsey model is considered as the strategic framework which is used by businesses

when they are not working well in the company. With reference to BP oils, it can be said that the

company can use this model in order to improve its internal factors which are not going well in

the company and also influencing their work in negative manner. It includes total seven

independent factors that are categorised into two types that is Hard elements and soft elements.

All the factors belonging to this are specified as below:

Hard elements

Strategy: In this element, management team of BP Oils develops effective strategy by

which they can easily gain competitive advantage and enhance their profitability.

Structure: The top management team of BP oils are using flat organisational structure

for enhancing their size of team effectively (McCahery, Sautner and Starks, 2016).

Systems: The company is specifically using latest updated systems and also uses best

communication processes in order to make sure that work is going to be done in effective manner

without facing any barrier.

Soft elements

Shared value: The core value of this company is to deliver best services to the customers

for the purpose of developing their brand name at market place.

Skills: Management team of BP oils is conducting regular based training sessions for its

employees in order to enhance their skills. This development is helpful for them in maximising

their productivity.

Style: Management team of BP oils is using democratic leadership style for improve their

value of decision making. It can be said that with the help of this style they will easily be able to

improve their business performance with better support of customers

Staff: BP oils owns around 74000 employees who are capable of performing their work

effectively in the company (Lawton, 2017).

M2. (a) Critical analysis of McKinsey 7S Model

Although BP Oil put a lot of efforts in effectively managing the 7 elements of this model,

it can be seen that this organisation has been suffering from mishandling and mismanagement

issues of executives. This has largely damaged the organisational goodwill of BP Oil within the

6

global market and thus, it is essential that the management of this entity pays more attention to

all these 7 aspects so that work takes place in an orderly manner.

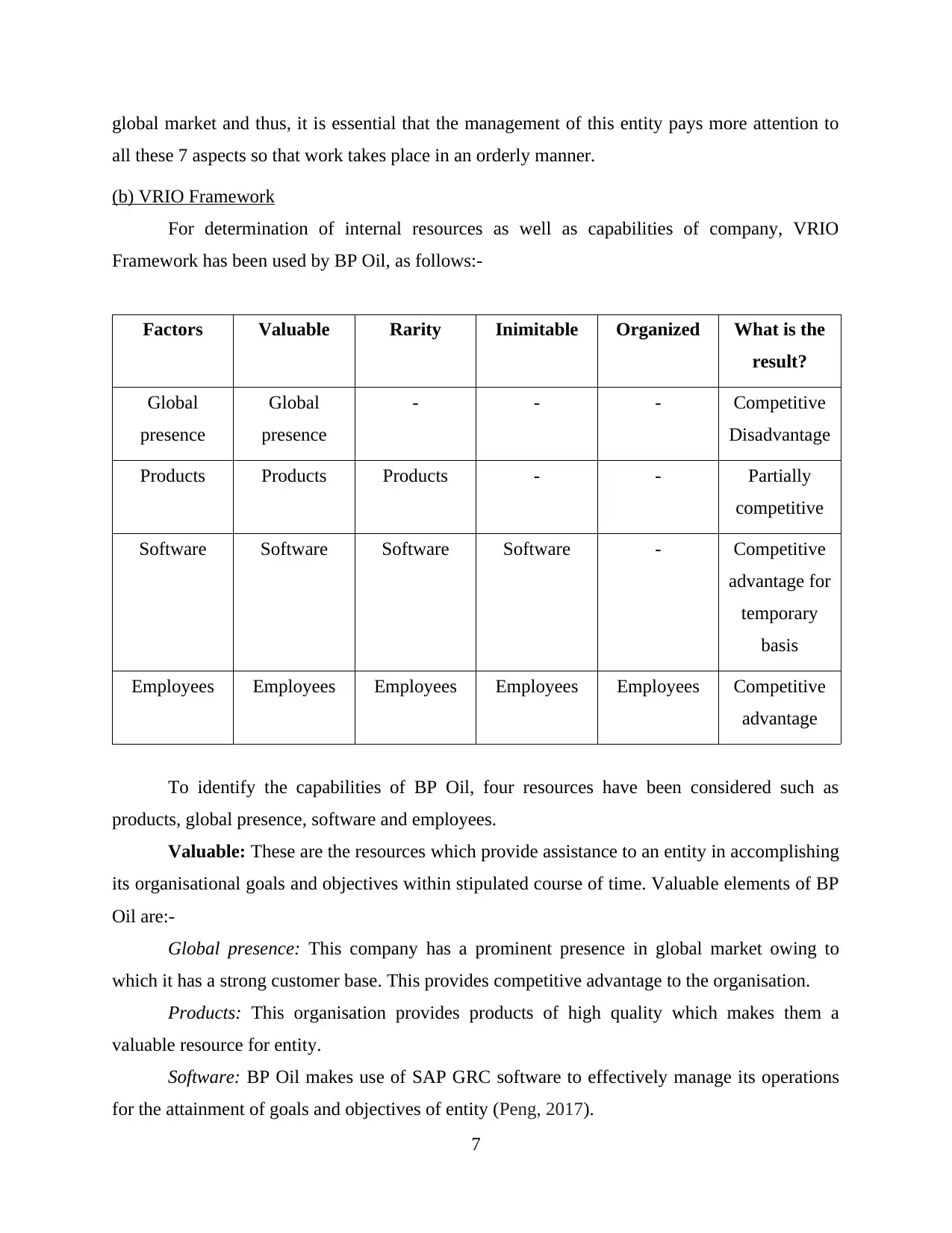

(b) VRIO Framework

For determination of internal resources as well as capabilities of company, VRIO

Framework has been used by BP Oil, as follows:-

Factors Valuable Rarity Inimitable Organized What is the

result?

Global

presence

Global

presence

- - - Competitive

Disadvantage

Products Products Products - - Partially

competitive

Software Software Software Software - Competitive

advantage for

temporary

basis

Employees Employees Employees Employees Employees Competitive

advantage

To identify the capabilities of BP Oil, four resources have been considered such as

products, global presence, software and employees.

Valuable: These are the resources which provide assistance to an entity in accomplishing

its organisational goals and objectives within stipulated course of time. Valuable elements of BP

Oil are:-

Global presence: This company has a prominent presence in global market owing to

which it has a strong customer base. This provides competitive advantage to the organisation.

Products: This organisation provides products of high quality which makes them a

valuable resource for entity.

Software: BP Oil makes use of SAP GRC software to effectively manage its operations

for the attainment of goals and objectives of entity (Peng, 2017).

7

all these 7 aspects so that work takes place in an orderly manner.

(b) VRIO Framework

For determination of internal resources as well as capabilities of company, VRIO

Framework has been used by BP Oil, as follows:-

Factors Valuable Rarity Inimitable Organized What is the

result?

Global

presence

Global

presence

- - - Competitive

Disadvantage

Products Products Products - - Partially

competitive

Software Software Software Software - Competitive

advantage for

temporary

basis

Employees Employees Employees Employees Employees Competitive

advantage

To identify the capabilities of BP Oil, four resources have been considered such as

products, global presence, software and employees.

Valuable: These are the resources which provide assistance to an entity in accomplishing

its organisational goals and objectives within stipulated course of time. Valuable elements of BP

Oil are:-

Global presence: This company has a prominent presence in global market owing to

which it has a strong customer base. This provides competitive advantage to the organisation.

Products: This organisation provides products of high quality which makes them a

valuable resource for entity.

Software: BP Oil makes use of SAP GRC software to effectively manage its operations

for the attainment of goals and objectives of entity (Peng, 2017).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Employees: The personnel of BP Oil are given training sessions so as to ensure that there

is no mismanagement or mishandling within the organisational premises.

Rarity: These refer to the aspects which are unique to an enterprise and provides a

competitive edge to the enterprise in marketplace (Jeston, 2014). In context of BP Oil, global

presence is not rare as several large scale organisations have global presence. The rare resources

of this organisation are:-

Products: The offerings of company are of high quality and in accordance with the needs

and requirements of consumers or oil consuming countries, thus, it is difficult to copy them.

Software: The software taken in use by BP Oil is rare as it is developed as per the

requirements of the organisation.

Employees: The staff of BP Oil is rare as they have their own skill set owing to which

they are able to handle and manage the operations within refineries and thus, they can not be

imitated by any entity.

Inimitable: These refer to the resources which can not be copied by competitors. For BP

Oil, products do not hold this characteristic as these can be produced by rival entities by making

use of technologies and software.

Software: The software taken in use by company is designed as well as developed as per

the needs and requirements of enterprise, thus, it can not be copied.

Employees: The skill set as well as knowledge of employees are unique to individuals

and the organisation owing to the training sessions given to them and thus, can not be easily

imitated by rival firms (Jocovic and et. al., 2014).

Organized: These are the elements which need to be organised in an orderly manner to

achieve goals and objectives of organisation. The software of BP Oil has to be updated at

frequent time intervals so as to meet the requirements of entity and thus does not fit into this

criterion.

Employees: The personnel of this organisation mostly have to be organised only when a

change occurs within organisational premises.

8

is no mismanagement or mishandling within the organisational premises.

Rarity: These refer to the aspects which are unique to an enterprise and provides a

competitive edge to the enterprise in marketplace (Jeston, 2014). In context of BP Oil, global

presence is not rare as several large scale organisations have global presence. The rare resources

of this organisation are:-

Products: The offerings of company are of high quality and in accordance with the needs

and requirements of consumers or oil consuming countries, thus, it is difficult to copy them.

Software: The software taken in use by BP Oil is rare as it is developed as per the

requirements of the organisation.

Employees: The staff of BP Oil is rare as they have their own skill set owing to which

they are able to handle and manage the operations within refineries and thus, they can not be

imitated by any entity.

Inimitable: These refer to the resources which can not be copied by competitors. For BP

Oil, products do not hold this characteristic as these can be produced by rival entities by making

use of technologies and software.

Software: The software taken in use by company is designed as well as developed as per

the needs and requirements of enterprise, thus, it can not be copied.

Employees: The skill set as well as knowledge of employees are unique to individuals

and the organisation owing to the training sessions given to them and thus, can not be easily

imitated by rival firms (Jocovic and et. al., 2014).

Organized: These are the elements which need to be organised in an orderly manner to

achieve goals and objectives of organisation. The software of BP Oil has to be updated at

frequent time intervals so as to meet the requirements of entity and thus does not fit into this

criterion.

Employees: The personnel of this organisation mostly have to be organised only when a

change occurs within organisational premises.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LO 3

P3. (a) Analysis of industry competition using Porter’s Five Force Model

In today’s modern and hyper competitive era, organisations face immense competition

from rival firms operating within the same business sector. Thus, it becomes essential for

companies to constantly analyse and evaluate the industrial environment so as to devise and

develop strategies accordingly. In this regard, the manager of BP Oil has used Porter Five Force

analysis to evaluate industry rivalry and its impact over the operations of entity, as follows:-

Industry Rivalry: High

The competitive rivalry in oil and gas sector is high. BP Oil faces threat in this regard

from the presence of companies such as Shell, Texaco, Gulf Coast, Total, Chevron, OMP etc.

(Scholes, 2015). The players in this industry compete on the basis of factors such as economies

of scale, product differentiation and fixed and variable cost. With a view to capture large share in

market, BP Oil can move towards merger with small companies.

Threat of New Entrants: Low

The threat of new entrants within oil and gas sector is low owing to the high barriers to

entry that are noticed within this sector due to high fixed cost being involved. Further, it is not

easy for new companies to enter this sector and sustain due to the large market share that is held

by companies such as BP Oil, Shell and Chevron etc.

Threat of Substitutes: Moderate

The threat of substitution within this sector is found to be moderate because there is no

such large organisation available that is dealing in substitute energy resources such as biofuels.

Further, there are many governmental regulations against the use of fossil fuel which pose threat

to the companies which come up with alternative solutions to oil.

Bargaining Power of Buyers: High

Within oil and gas industry, bargaining power of purchasers is found to be high as the

price of oil varies in accordance with global demand. Countries which are developed and have

high power such as US, China or Japan can use their power to negotiate with BP (Spender,

2014). Everyday consumers also have high bargaining power as they can easily switch to other

brands.

Bargaining Power of Suppliers: Low

9

P3. (a) Analysis of industry competition using Porter’s Five Force Model

In today’s modern and hyper competitive era, organisations face immense competition

from rival firms operating within the same business sector. Thus, it becomes essential for

companies to constantly analyse and evaluate the industrial environment so as to devise and

develop strategies accordingly. In this regard, the manager of BP Oil has used Porter Five Force

analysis to evaluate industry rivalry and its impact over the operations of entity, as follows:-

Industry Rivalry: High

The competitive rivalry in oil and gas sector is high. BP Oil faces threat in this regard

from the presence of companies such as Shell, Texaco, Gulf Coast, Total, Chevron, OMP etc.

(Scholes, 2015). The players in this industry compete on the basis of factors such as economies

of scale, product differentiation and fixed and variable cost. With a view to capture large share in

market, BP Oil can move towards merger with small companies.

Threat of New Entrants: Low

The threat of new entrants within oil and gas sector is low owing to the high barriers to

entry that are noticed within this sector due to high fixed cost being involved. Further, it is not

easy for new companies to enter this sector and sustain due to the large market share that is held

by companies such as BP Oil, Shell and Chevron etc.

Threat of Substitutes: Moderate

The threat of substitution within this sector is found to be moderate because there is no

such large organisation available that is dealing in substitute energy resources such as biofuels.

Further, there are many governmental regulations against the use of fossil fuel which pose threat

to the companies which come up with alternative solutions to oil.

Bargaining Power of Buyers: High

Within oil and gas industry, bargaining power of purchasers is found to be high as the

price of oil varies in accordance with global demand. Countries which are developed and have

high power such as US, China or Japan can use their power to negotiate with BP (Spender,

2014). Everyday consumers also have high bargaining power as they can easily switch to other

brands.

Bargaining Power of Suppliers: Low

9

The bargaining power of suppliers in oil and gas sector is found to be low. This is

because large scale companies such as British Petroleum can easily negotiate prices with vendors

as suppliers who transact with such entities on a regular basis are not willing to lose such

business opportunities.

M3. (a) Recommending strategy using Ansoff Matrix

Owing to the recent oil spills and other disasters taking place due to the mishandling and

carelessness of executives, BP Oil is now looking for an adequate strategy through which it can

regain its lost brand image as well as enhance its existing market position. For this, the manager

of this organisation is making use of Ansoff Matrix, as follows:-

Market Penetration: This growth strategy focuses upon delivering existing products into

existing markets. In relation to BP Oil, company has been constantly making use of this strategy

over years and offering diversified products like motor oil and lubricants (Veit and et. al., 2014).

This strategy will further assist the entity to enhance its sales and profitability in dominant

revenue generating countries.

Market expansion: Here, a company offers its current products in new markets. BP Oil

has already been operating in 80 countries. However, this organisation has the potential as well

as scope to expand more in locations such as Europe, Africa and Russia.

Product expansion: This strategy of organisation is keen on providing its new offerings

in existing locations. Owing to the global fuel crisis, it has become essential for companies to

now look for alternate energy options such as bio fuels in order to ensure sustainability within

marketplace. BP Oil can look forward to this opportunity to gain a competitive edge and enhance

its overall market share.

Diversification: Although this strategy is risky, it is one of the most effective strategies if

it works out in the favour of an organisation. In this regard, BP has invested $8 million in

development of economical ways to produce alternate and renewable energies owing to the

global environmental pressure.

As per the analysis and evaluation done of the above mentioned growth strategies of

Ansoff Matrix, it can be recommended that diversification will serve as the best marketing

strategy for BP Oil. This will assist the company to regain its lost brand image due to oil spills,

leakages and refinery explosions by gaining expertise in renewable energy sources and becoming

10

because large scale companies such as British Petroleum can easily negotiate prices with vendors

as suppliers who transact with such entities on a regular basis are not willing to lose such

business opportunities.

M3. (a) Recommending strategy using Ansoff Matrix

Owing to the recent oil spills and other disasters taking place due to the mishandling and

carelessness of executives, BP Oil is now looking for an adequate strategy through which it can

regain its lost brand image as well as enhance its existing market position. For this, the manager

of this organisation is making use of Ansoff Matrix, as follows:-

Market Penetration: This growth strategy focuses upon delivering existing products into

existing markets. In relation to BP Oil, company has been constantly making use of this strategy

over years and offering diversified products like motor oil and lubricants (Veit and et. al., 2014).

This strategy will further assist the entity to enhance its sales and profitability in dominant

revenue generating countries.

Market expansion: Here, a company offers its current products in new markets. BP Oil

has already been operating in 80 countries. However, this organisation has the potential as well

as scope to expand more in locations such as Europe, Africa and Russia.

Product expansion: This strategy of organisation is keen on providing its new offerings

in existing locations. Owing to the global fuel crisis, it has become essential for companies to

now look for alternate energy options such as bio fuels in order to ensure sustainability within

marketplace. BP Oil can look forward to this opportunity to gain a competitive edge and enhance

its overall market share.

Diversification: Although this strategy is risky, it is one of the most effective strategies if

it works out in the favour of an organisation. In this regard, BP has invested $8 million in

development of economical ways to produce alternate and renewable energies owing to the

global environmental pressure.

As per the analysis and evaluation done of the above mentioned growth strategies of

Ansoff Matrix, it can be recommended that diversification will serve as the best marketing

strategy for BP Oil. This will assist the company to regain its lost brand image due to oil spills,

leakages and refinery explosions by gaining expertise in renewable energy sources and becoming

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.