Brisbane Magnus Mall Project: Scenario & Sensitivity Analysis Report

VerifiedAdded on 2023/06/11

|25

|5510

|144

Report

AI Summary

This report presents a comprehensive scenario and sensitivity analysis for the Brisbane Magnus Mall project, a Build, Operate, and Transfer (BOT) agreement between Well Built Infrastructure Company (WBIC) and Queensland Investment Corporation (QIC). It examines two scenarios: outsourcing repairs and construction to Ae7 Private Limited (Scenario A) and not outsourcing, seeking an extension instead (Scenario B). The analysis considers cash inflows from REIT establishment, QIC funding, lease revenues, and parking lot fees, as well as cash outflows related to loan payments, operating costs, and taxes. Sensitivity analysis identifies key variables and investigates the impact of adverse changes on project profitability, evaluating break-even points under best, neutral, and worst economic conditions. The report concludes with an assessment of each scenario's financial viability, providing insights for decision-making and project evaluation. Desklib offers similar documents and study tools for students.

Contents

Introduction................................................................................................................................................................................................................................... 3

Scenario Analysis.......................................................................................................................................................................................................................... 3

Scenario A: Outsourcing the Repairs and Construction of the Mall..............................................................................................................................................3

Scenario B: Not Out Sourcing................................................................................................................................................................................................... 5

Cash Inflows................................................................................................................................................................................................................................... 7

Funding...................................................................................................................................................................................................................................... 7

Setting Up an REIT.................................................................................................................................................................................................................. 7

Revenues................................................................................................................................................................................................................................... 7

Cash Outflows................................................................................................................................................................................................................................ 9

Operation Phase.......................................................................................................................................................................................................................... 10

Cash Outflows During Operation Phase................................................................................................................................................................................... 10

Loan Payments.................................................................................................................................................................................................................... 10

Operating Costs................................................................................................................................................................................................................... 11

Taxes:.................................................................................................................................................................................................................................. 12

Depreciation........................................................................................................................................................................................................................ 12

SENSITIVITY ANALYSIS –............................................................................................................................................................................................................... 12

IDENTIFIED THE KEY VARIABLES –................................................................................................................................................................................................ 12

INVESTIGATION OF RESULT OF PROBABLE ADVERSE CHANGES –...............................................................................................................................................13

FOR DECISION MAKING AND EVALUATION OF PROJECT –..........................................................................................................................................................13

SENSITIVITY ANALYSIS OF THE COMPANY –................................................................................................................................................................................ 14

ORIGINAL COST AND BENEFIT OF THE PROJECT -........................................................................................................................................................................ 14

Introduction................................................................................................................................................................................................................................... 3

Scenario Analysis.......................................................................................................................................................................................................................... 3

Scenario A: Outsourcing the Repairs and Construction of the Mall..............................................................................................................................................3

Scenario B: Not Out Sourcing................................................................................................................................................................................................... 5

Cash Inflows................................................................................................................................................................................................................................... 7

Funding...................................................................................................................................................................................................................................... 7

Setting Up an REIT.................................................................................................................................................................................................................. 7

Revenues................................................................................................................................................................................................................................... 7

Cash Outflows................................................................................................................................................................................................................................ 9

Operation Phase.......................................................................................................................................................................................................................... 10

Cash Outflows During Operation Phase................................................................................................................................................................................... 10

Loan Payments.................................................................................................................................................................................................................... 10

Operating Costs................................................................................................................................................................................................................... 11

Taxes:.................................................................................................................................................................................................................................. 12

Depreciation........................................................................................................................................................................................................................ 12

SENSITIVITY ANALYSIS –............................................................................................................................................................................................................... 12

IDENTIFIED THE KEY VARIABLES –................................................................................................................................................................................................ 12

INVESTIGATION OF RESULT OF PROBABLE ADVERSE CHANGES –...............................................................................................................................................13

FOR DECISION MAKING AND EVALUATION OF PROJECT –..........................................................................................................................................................13

SENSITIVITY ANALYSIS OF THE COMPANY –................................................................................................................................................................................ 14

ORIGINAL COST AND BENEFIT OF THE PROJECT -........................................................................................................................................................................ 14

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMIC CONDITION WISE ANALYSIS:..................................................................................................................................................................................... 16

BEST ECONOMIC CONDITION VALUATIONS -.............................................................................................................................................................................. 16

BREAK EVEN ANALYSIS -.............................................................................................................................................................................................................. 17

NEUTRAL ECONOMIC CONDITION:.............................................................................................................................................................................................. 18

BREAK EVEN ANALYSIS -.............................................................................................................................................................................................................. 19

Worst Economic Condition -........................................................................................................................................................................................................ 21

BREAK EVEN ANALYSIS -.............................................................................................................................................................................................................. 21

ANALYSIS –................................................................................................................................................................................................................................... 22

ANALYSIS OF BEST ECONOMIC CONDITIONS –............................................................................................................................................................................ 23

ANALYSIS OF NEUTRAL ECONOMIC CONDITIONS –..................................................................................................................................................................... 23

ANALYSIS OF WORST ECONOMIC CONDITIONS –........................................................................................................................................................................ 23

CONCLUSION –............................................................................................................................................................................................................................ 24

Bibliography................................................................................................................................................................................................................................. 24

BEST ECONOMIC CONDITION VALUATIONS -.............................................................................................................................................................................. 16

BREAK EVEN ANALYSIS -.............................................................................................................................................................................................................. 17

NEUTRAL ECONOMIC CONDITION:.............................................................................................................................................................................................. 18

BREAK EVEN ANALYSIS -.............................................................................................................................................................................................................. 19

Worst Economic Condition -........................................................................................................................................................................................................ 21

BREAK EVEN ANALYSIS -.............................................................................................................................................................................................................. 21

ANALYSIS –................................................................................................................................................................................................................................... 22

ANALYSIS OF BEST ECONOMIC CONDITIONS –............................................................................................................................................................................ 23

ANALYSIS OF NEUTRAL ECONOMIC CONDITIONS –..................................................................................................................................................................... 23

ANALYSIS OF WORST ECONOMIC CONDITIONS –........................................................................................................................................................................ 23

CONCLUSION –............................................................................................................................................................................................................................ 24

Bibliography................................................................................................................................................................................................................................. 24

Introduction

Well Built Infrastructure Company (WBIC) is building the Brisbane Magnus Mall under the build , Operate and Transfer (BOT) agreement with

the Queensland Investment Corporation (QIC). has agreed to pay Smart c Company AUD100 million for the mall and will allow WBIC to

operate the mall for period of 10 years. During the period of 10 years, WBIC incur all the operational costs. WBIC will also operate the parking

lots within the mall and shall be permitted to collect a parking fee from every vehicle that makes use of the parking premises. WBIC shall have

the right to make all decisions regarding the operation of the mall, subject to limitations set by the Queensland Government. The revenues

accrued from

the mall will be shared by the QIC and WBIC. The mall, under construction has an estimated construction cost of AUD 320,000,000 and

approximately 60 per cent of the constructed structure work was completed. Cyclone Debbie caused damage worth AUD 120,000 and delayed

the completion of the project by four months. WBIC now must re-assess all of its initial assumptions. The given report takes a scenario analysis

and a sensitivity analysis which will help point towards the profitability of the project.

Scenario Analysis

The company now has two alternatives further:

Scenario A: WBIC may outsource a part of the project to another construction firm and ensure that the project would be completed on time. In

this case, there will be an increase in costs but WBIC shall be able to start earning revenues in time which will help decrease the payback period.

Scenario B: WBIC could seek an extension of time for the project and complete the construction. The damages of AUD 120,000 would still be

incurred by WBIC. However, all the other cost projections shall remain the same. This will be the least expensive option but may jeopardise the

project due to the delay in construction.

Well Built Infrastructure Company (WBIC) is building the Brisbane Magnus Mall under the build , Operate and Transfer (BOT) agreement with

the Queensland Investment Corporation (QIC). has agreed to pay Smart c Company AUD100 million for the mall and will allow WBIC to

operate the mall for period of 10 years. During the period of 10 years, WBIC incur all the operational costs. WBIC will also operate the parking

lots within the mall and shall be permitted to collect a parking fee from every vehicle that makes use of the parking premises. WBIC shall have

the right to make all decisions regarding the operation of the mall, subject to limitations set by the Queensland Government. The revenues

accrued from

the mall will be shared by the QIC and WBIC. The mall, under construction has an estimated construction cost of AUD 320,000,000 and

approximately 60 per cent of the constructed structure work was completed. Cyclone Debbie caused damage worth AUD 120,000 and delayed

the completion of the project by four months. WBIC now must re-assess all of its initial assumptions. The given report takes a scenario analysis

and a sensitivity analysis which will help point towards the profitability of the project.

Scenario Analysis

The company now has two alternatives further:

Scenario A: WBIC may outsource a part of the project to another construction firm and ensure that the project would be completed on time. In

this case, there will be an increase in costs but WBIC shall be able to start earning revenues in time which will help decrease the payback period.

Scenario B: WBIC could seek an extension of time for the project and complete the construction. The damages of AUD 120,000 would still be

incurred by WBIC. However, all the other cost projections shall remain the same. This will be the least expensive option but may jeopardise the

project due to the delay in construction.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

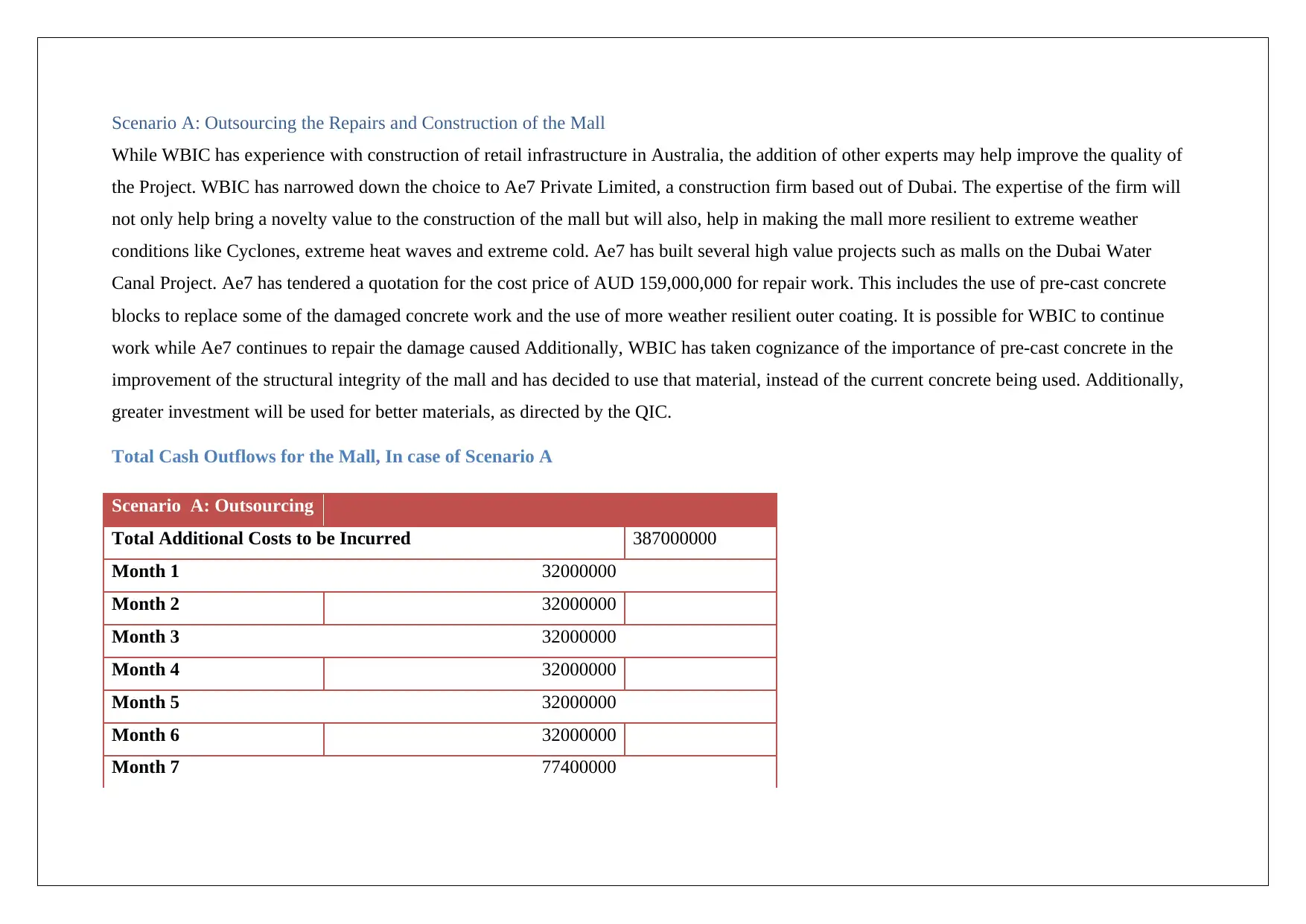

Scenario A: Outsourcing the Repairs and Construction of the Mall

While WBIC has experience with construction of retail infrastructure in Australia, the addition of other experts may help improve the quality of

the Project. WBIC has narrowed down the choice to Ae7 Private Limited, a construction firm based out of Dubai. The expertise of the firm will

not only help bring a novelty value to the construction of the mall but will also, help in making the mall more resilient to extreme weather

conditions like Cyclones, extreme heat waves and extreme cold. Ae7 has built several high value projects such as malls on the Dubai Water

Canal Project. Ae7 has tendered a quotation for the cost price of AUD 159,000,000 for repair work. This includes the use of pre-cast concrete

blocks to replace some of the damaged concrete work and the use of more weather resilient outer coating. It is possible for WBIC to continue

work while Ae7 continues to repair the damage caused Additionally, WBIC has taken cognizance of the importance of pre-cast concrete in the

improvement of the structural integrity of the mall and has decided to use that material, instead of the current concrete being used. Additionally,

greater investment will be used for better materials, as directed by the QIC.

Total Cash Outflows for the Mall, In case of Scenario A

Scenario A: Outsourcing

Total Additional Costs to be Incurred 387000000

Month 1 32000000

Month 2 32000000

Month 3 32000000

Month 4 32000000

Month 5 32000000

Month 6 32000000

Month 7 77400000

While WBIC has experience with construction of retail infrastructure in Australia, the addition of other experts may help improve the quality of

the Project. WBIC has narrowed down the choice to Ae7 Private Limited, a construction firm based out of Dubai. The expertise of the firm will

not only help bring a novelty value to the construction of the mall but will also, help in making the mall more resilient to extreme weather

conditions like Cyclones, extreme heat waves and extreme cold. Ae7 has built several high value projects such as malls on the Dubai Water

Canal Project. Ae7 has tendered a quotation for the cost price of AUD 159,000,000 for repair work. This includes the use of pre-cast concrete

blocks to replace some of the damaged concrete work and the use of more weather resilient outer coating. It is possible for WBIC to continue

work while Ae7 continues to repair the damage caused Additionally, WBIC has taken cognizance of the importance of pre-cast concrete in the

improvement of the structural integrity of the mall and has decided to use that material, instead of the current concrete being used. Additionally,

greater investment will be used for better materials, as directed by the QIC.

Total Cash Outflows for the Mall, In case of Scenario A

Scenario A: Outsourcing

Total Additional Costs to be Incurred 387000000

Month 1 32000000

Month 2 32000000

Month 3 32000000

Month 4 32000000

Month 5 32000000

Month 6 32000000

Month 7 77400000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

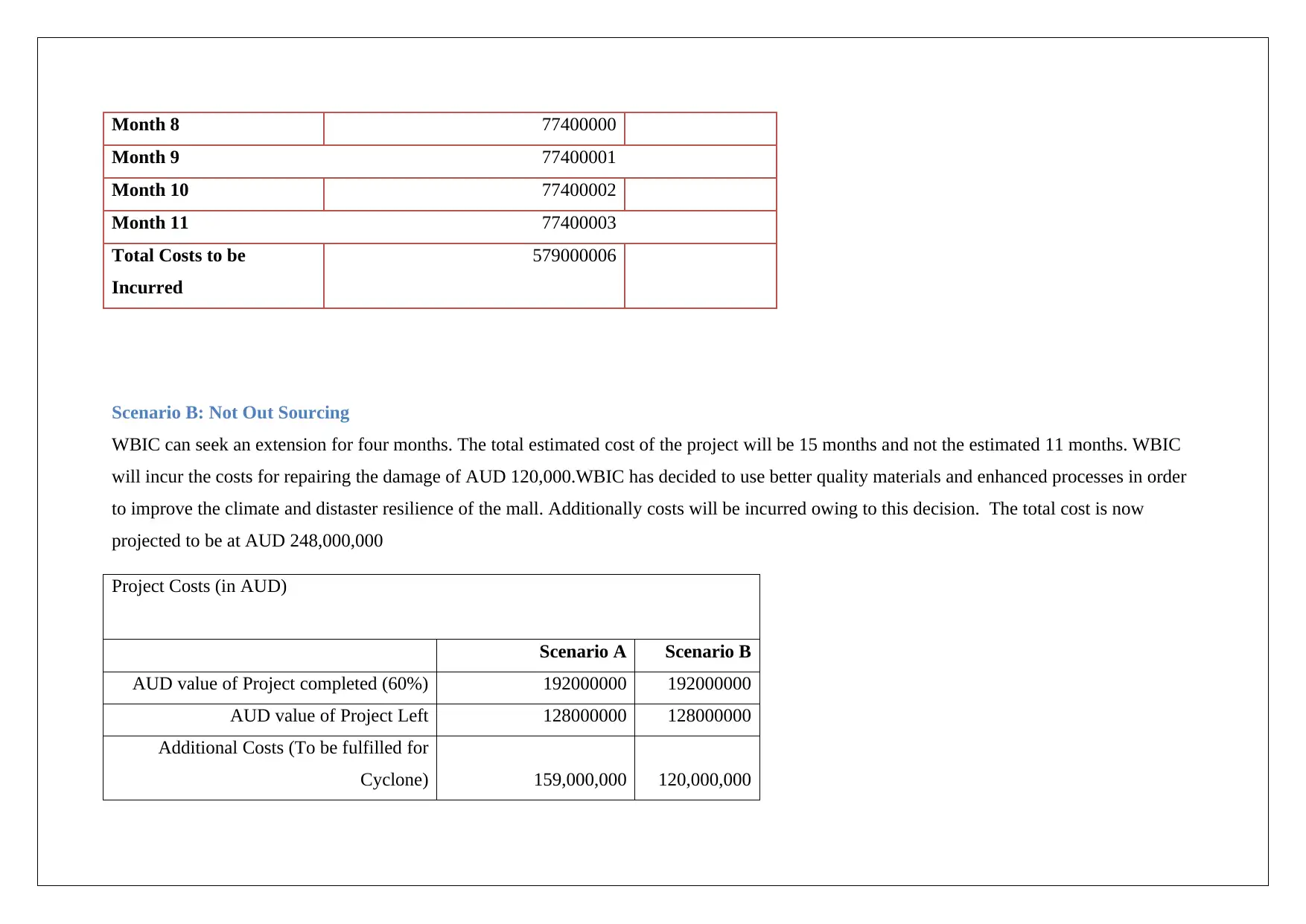

Month 8 77400000

Month 9 77400001

Month 10 77400002

Month 11 77400003

Total Costs to be

Incurred

579000006

Scenario B: Not Out Sourcing

WBIC can seek an extension for four months. The total estimated cost of the project will be 15 months and not the estimated 11 months. WBIC

will incur the costs for repairing the damage of AUD 120,000.WBIC has decided to use better quality materials and enhanced processes in order

to improve the climate and distaster resilience of the mall. Additionally costs will be incurred owing to this decision. The total cost is now

projected to be at AUD 248,000,000

Project Costs (in AUD)

Scenario A Scenario B

AUD value of Project completed (60%) 192000000 192000000

AUD value of Project Left 128000000 128000000

Additional Costs (To be fulfilled for

Cyclone) 159,000,000 120,000,000

Month 9 77400001

Month 10 77400002

Month 11 77400003

Total Costs to be

Incurred

579000006

Scenario B: Not Out Sourcing

WBIC can seek an extension for four months. The total estimated cost of the project will be 15 months and not the estimated 11 months. WBIC

will incur the costs for repairing the damage of AUD 120,000.WBIC has decided to use better quality materials and enhanced processes in order

to improve the climate and distaster resilience of the mall. Additionally costs will be incurred owing to this decision. The total cost is now

projected to be at AUD 248,000,000

Project Costs (in AUD)

Scenario A Scenario B

AUD value of Project completed (60%) 192000000 192000000

AUD value of Project Left 128000000 128000000

Additional Costs (To be fulfilled for

Cyclone) 159,000,000 120,000,000

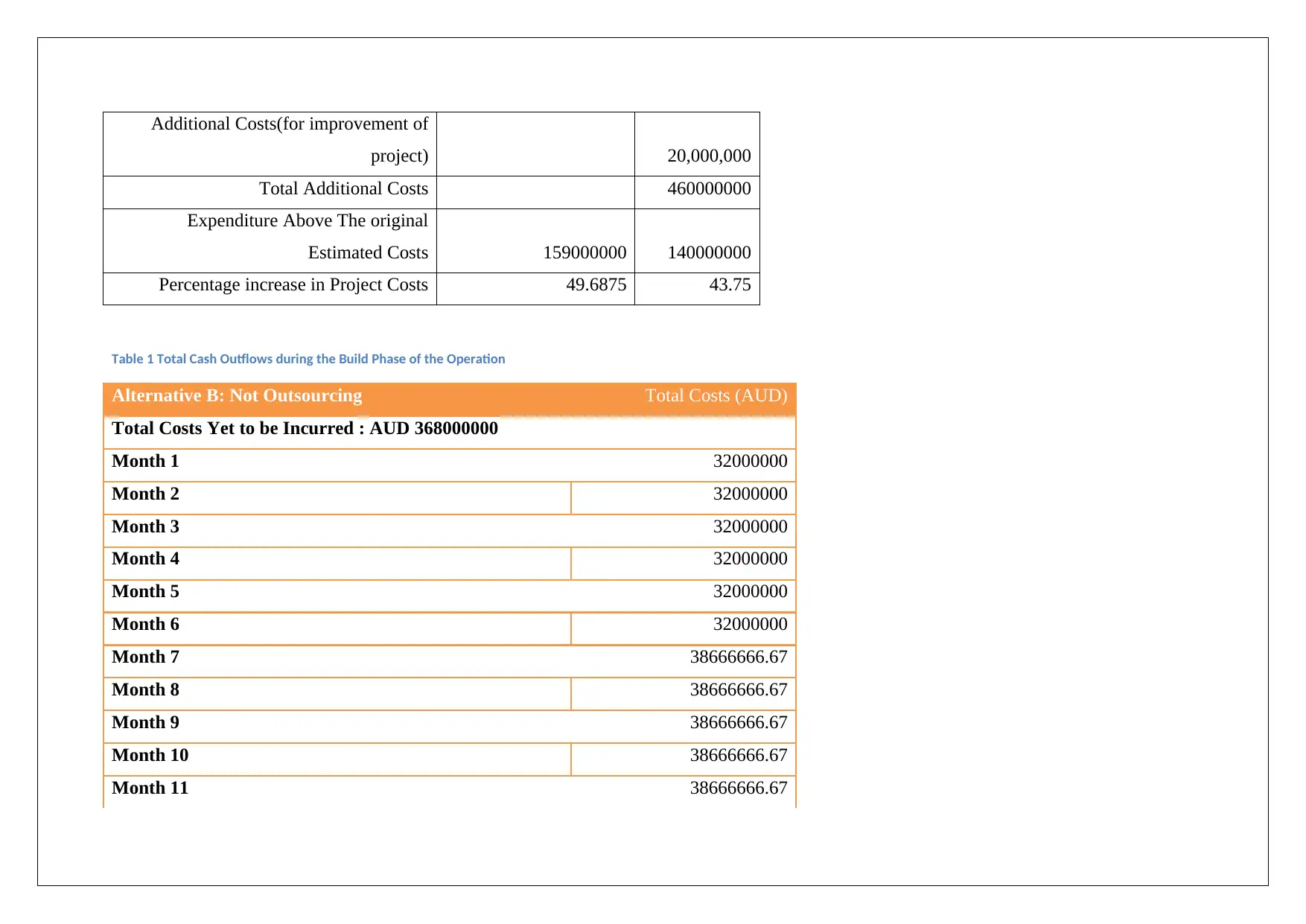

Additional Costs(for improvement of

project) 20,000,000

Total Additional Costs 460000000

Expenditure Above The original

Estimated Costs 159000000 140000000

Percentage increase in Project Costs 49.6875 43.75

Table 1 Total Cash Outflows during the Build Phase of the Operation

Alternative B: Not Outsourcing Total Costs (AUD)

Total Costs Yet to be Incurred : AUD 368000000

Month 1 32000000

Month 2 32000000

Month 3 32000000

Month 4 32000000

Month 5 32000000

Month 6 32000000

Month 7 38666666.67

Month 8 38666666.67

Month 9 38666666.67

Month 10 38666666.67

Month 11 38666666.67

project) 20,000,000

Total Additional Costs 460000000

Expenditure Above The original

Estimated Costs 159000000 140000000

Percentage increase in Project Costs 49.6875 43.75

Table 1 Total Cash Outflows during the Build Phase of the Operation

Alternative B: Not Outsourcing Total Costs (AUD)

Total Costs Yet to be Incurred : AUD 368000000

Month 1 32000000

Month 2 32000000

Month 3 32000000

Month 4 32000000

Month 5 32000000

Month 6 32000000

Month 7 38666666.67

Month 8 38666666.67

Month 9 38666666.67

Month 10 38666666.67

Month 11 38666666.67

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

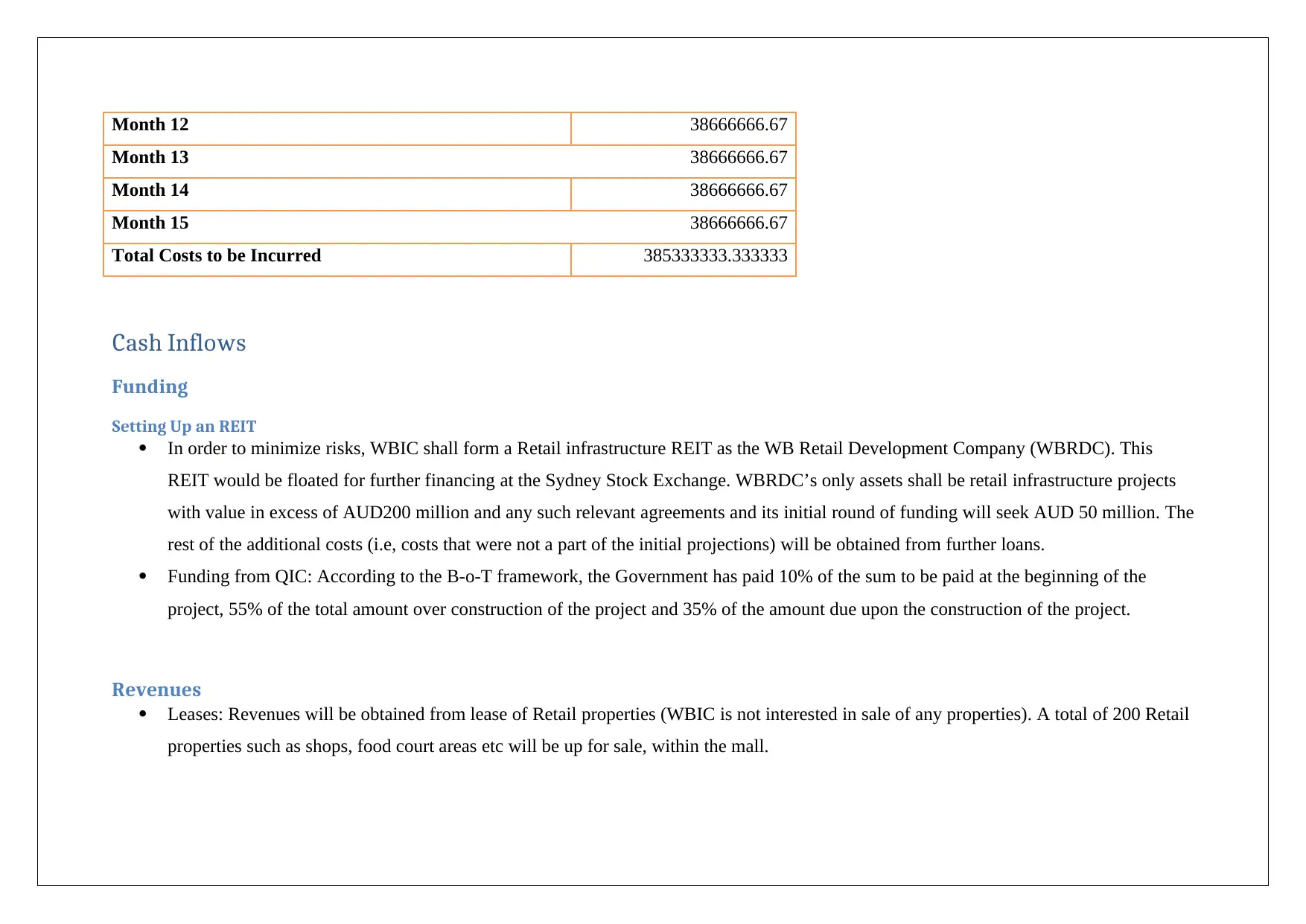

Month 12 38666666.67

Month 13 38666666.67

Month 14 38666666.67

Month 15 38666666.67

Total Costs to be Incurred 385333333.333333

Cash Inflows

Funding

Setting Up an REIT

In order to minimize risks, WBIC shall form a Retail infrastructure REIT as the WB Retail Development Company (WBRDC). This

REIT would be floated for further financing at the Sydney Stock Exchange. WBRDC’s only assets shall be retail infrastructure projects

with value in excess of AUD200 million and any such relevant agreements and its initial round of funding will seek AUD 50 million. The

rest of the additional costs (i.e, costs that were not a part of the initial projections) will be obtained from further loans.

Funding from QIC: According to the B-o-T framework, the Government has paid 10% of the sum to be paid at the beginning of the

project, 55% of the total amount over construction of the project and 35% of the amount due upon the construction of the project.

Revenues

Leases: Revenues will be obtained from lease of Retail properties (WBIC is not interested in sale of any properties). A total of 200 Retail

properties such as shops, food court areas etc will be up for sale, within the mall.

Month 13 38666666.67

Month 14 38666666.67

Month 15 38666666.67

Total Costs to be Incurred 385333333.333333

Cash Inflows

Funding

Setting Up an REIT

In order to minimize risks, WBIC shall form a Retail infrastructure REIT as the WB Retail Development Company (WBRDC). This

REIT would be floated for further financing at the Sydney Stock Exchange. WBRDC’s only assets shall be retail infrastructure projects

with value in excess of AUD200 million and any such relevant agreements and its initial round of funding will seek AUD 50 million. The

rest of the additional costs (i.e, costs that were not a part of the initial projections) will be obtained from further loans.

Funding from QIC: According to the B-o-T framework, the Government has paid 10% of the sum to be paid at the beginning of the

project, 55% of the total amount over construction of the project and 35% of the amount due upon the construction of the project.

Revenues

Leases: Revenues will be obtained from lease of Retail properties (WBIC is not interested in sale of any properties). A total of 200 Retail

properties such as shops, food court areas etc will be up for sale, within the mall.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

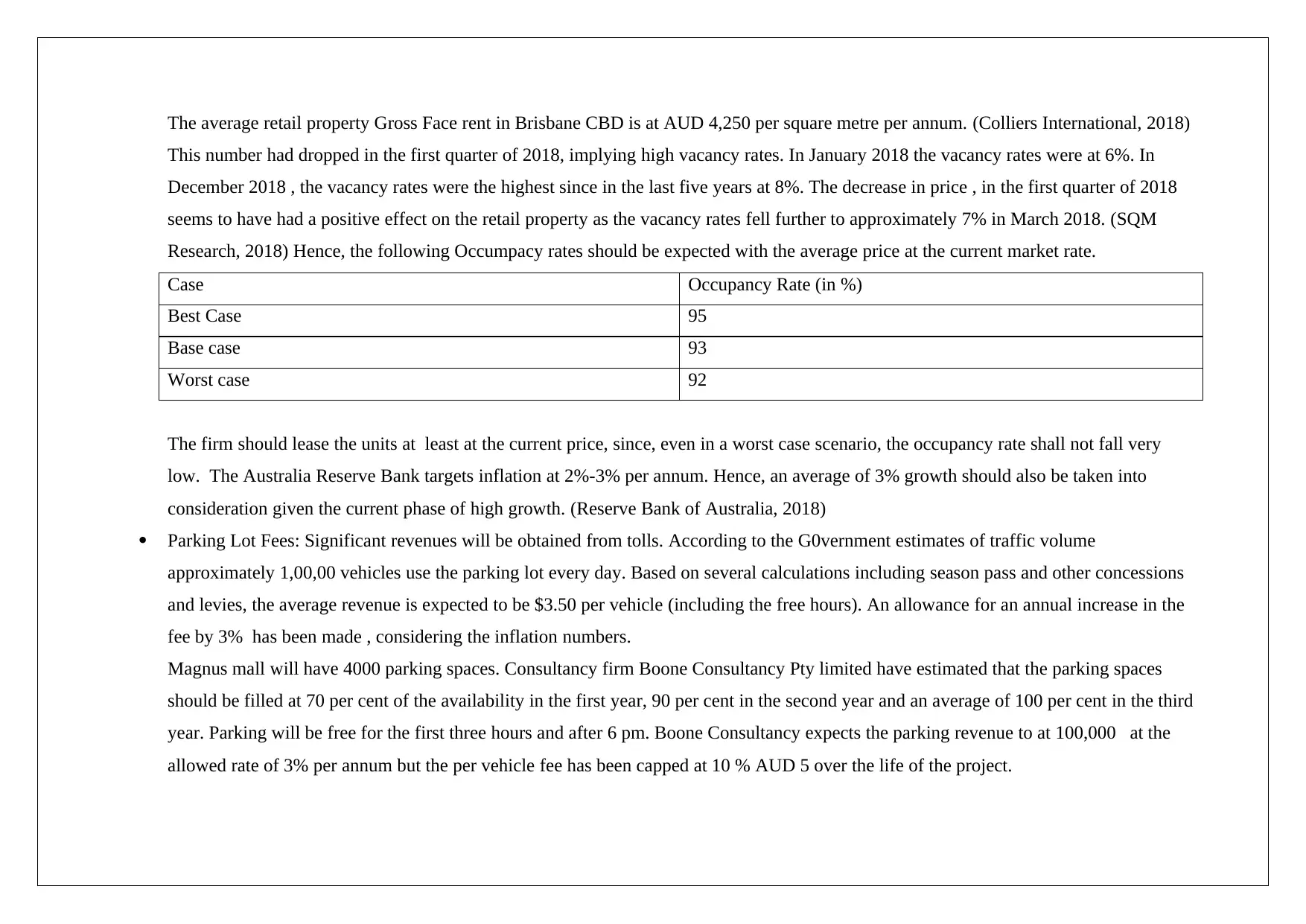

The average retail property Gross Face rent in Brisbane CBD is at AUD 4,250 per square metre per annum. (Colliers International, 2018)

This number had dropped in the first quarter of 2018, implying high vacancy rates. In January 2018 the vacancy rates were at 6%. In

December 2018 , the vacancy rates were the highest since in the last five years at 8%. The decrease in price , in the first quarter of 2018

seems to have had a positive effect on the retail property as the vacancy rates fell further to approximately 7% in March 2018. (SQM

Research, 2018) Hence, the following Occumpacy rates should be expected with the average price at the current market rate.

Case Occupancy Rate (in %)

Best Case 95

Base case 93

Worst case 92

The firm should lease the units at least at the current price, since, even in a worst case scenario, the occupancy rate shall not fall very

low. The Australia Reserve Bank targets inflation at 2%-3% per annum. Hence, an average of 3% growth should also be taken into

consideration given the current phase of high growth. (Reserve Bank of Australia, 2018)

Parking Lot Fees: Significant revenues will be obtained from tolls. According to the G0vernment estimates of traffic volume

approximately 1,00,00 vehicles use the parking lot every day. Based on several calculations including season pass and other concessions

and levies, the average revenue is expected to be $3.50 per vehicle (including the free hours). An allowance for an annual increase in the

fee by 3% has been made , considering the inflation numbers.

Magnus mall will have 4000 parking spaces. Consultancy firm Boone Consultancy Pty limited have estimated that the parking spaces

should be filled at 70 per cent of the availability in the first year, 90 per cent in the second year and an average of 100 per cent in the third

year. Parking will be free for the first three hours and after 6 pm. Boone Consultancy expects the parking revenue to at 100,000 at the

allowed rate of 3% per annum but the per vehicle fee has been capped at 10 % AUD 5 over the life of the project.

This number had dropped in the first quarter of 2018, implying high vacancy rates. In January 2018 the vacancy rates were at 6%. In

December 2018 , the vacancy rates were the highest since in the last five years at 8%. The decrease in price , in the first quarter of 2018

seems to have had a positive effect on the retail property as the vacancy rates fell further to approximately 7% in March 2018. (SQM

Research, 2018) Hence, the following Occumpacy rates should be expected with the average price at the current market rate.

Case Occupancy Rate (in %)

Best Case 95

Base case 93

Worst case 92

The firm should lease the units at least at the current price, since, even in a worst case scenario, the occupancy rate shall not fall very

low. The Australia Reserve Bank targets inflation at 2%-3% per annum. Hence, an average of 3% growth should also be taken into

consideration given the current phase of high growth. (Reserve Bank of Australia, 2018)

Parking Lot Fees: Significant revenues will be obtained from tolls. According to the G0vernment estimates of traffic volume

approximately 1,00,00 vehicles use the parking lot every day. Based on several calculations including season pass and other concessions

and levies, the average revenue is expected to be $3.50 per vehicle (including the free hours). An allowance for an annual increase in the

fee by 3% has been made , considering the inflation numbers.

Magnus mall will have 4000 parking spaces. Consultancy firm Boone Consultancy Pty limited have estimated that the parking spaces

should be filled at 70 per cent of the availability in the first year, 90 per cent in the second year and an average of 100 per cent in the third

year. Parking will be free for the first three hours and after 6 pm. Boone Consultancy expects the parking revenue to at 100,000 at the

allowed rate of 3% per annum but the per vehicle fee has been capped at 10 % AUD 5 over the life of the project.

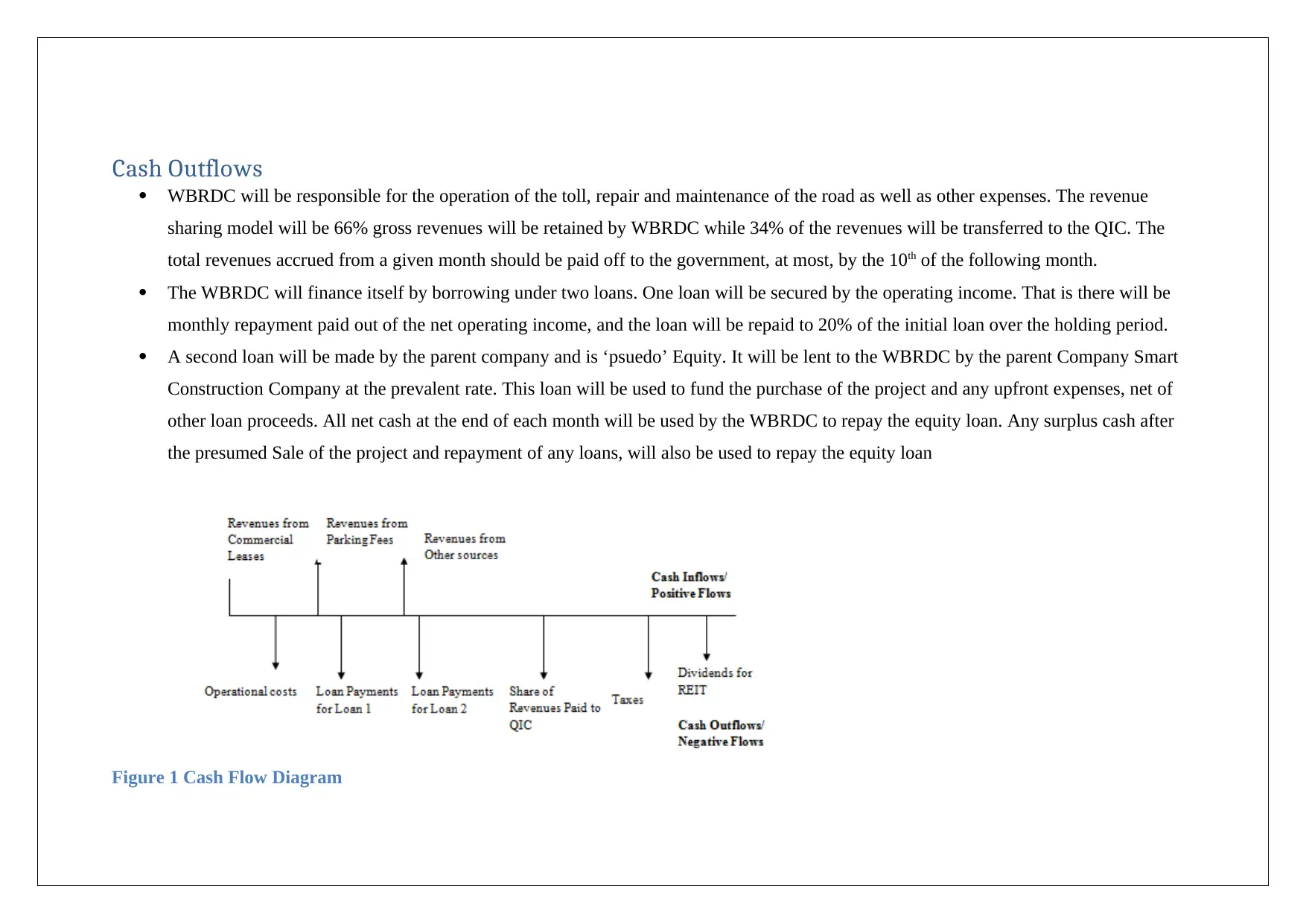

Cash Outflows

WBRDC will be responsible for the operation of the toll, repair and maintenance of the road as well as other expenses. The revenue

sharing model will be 66% gross revenues will be retained by WBRDC while 34% of the revenues will be transferred to the QIC. The

total revenues accrued from a given month should be paid off to the government, at most, by the 10th of the following month.

The WBRDC will finance itself by borrowing under two loans. One loan will be secured by the operating income. That is there will be

monthly repayment paid out of the net operating income, and the loan will be repaid to 20% of the initial loan over the holding period.

A second loan will be made by the parent company and is ‘psuedo’ Equity. It will be lent to the WBRDC by the parent Company Smart

Construction Company at the prevalent rate. This loan will be used to fund the purchase of the project and any upfront expenses, net of

other loan proceeds. All net cash at the end of each month will be used by the WBRDC to repay the equity loan. Any surplus cash after

the presumed Sale of the project and repayment of any loans, will also be used to repay the equity loan

Figure 1 Cash Flow Diagram

WBRDC will be responsible for the operation of the toll, repair and maintenance of the road as well as other expenses. The revenue

sharing model will be 66% gross revenues will be retained by WBRDC while 34% of the revenues will be transferred to the QIC. The

total revenues accrued from a given month should be paid off to the government, at most, by the 10th of the following month.

The WBRDC will finance itself by borrowing under two loans. One loan will be secured by the operating income. That is there will be

monthly repayment paid out of the net operating income, and the loan will be repaid to 20% of the initial loan over the holding period.

A second loan will be made by the parent company and is ‘psuedo’ Equity. It will be lent to the WBRDC by the parent Company Smart

Construction Company at the prevalent rate. This loan will be used to fund the purchase of the project and any upfront expenses, net of

other loan proceeds. All net cash at the end of each month will be used by the WBRDC to repay the equity loan. Any surplus cash after

the presumed Sale of the project and repayment of any loans, will also be used to repay the equity loan

Figure 1 Cash Flow Diagram

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

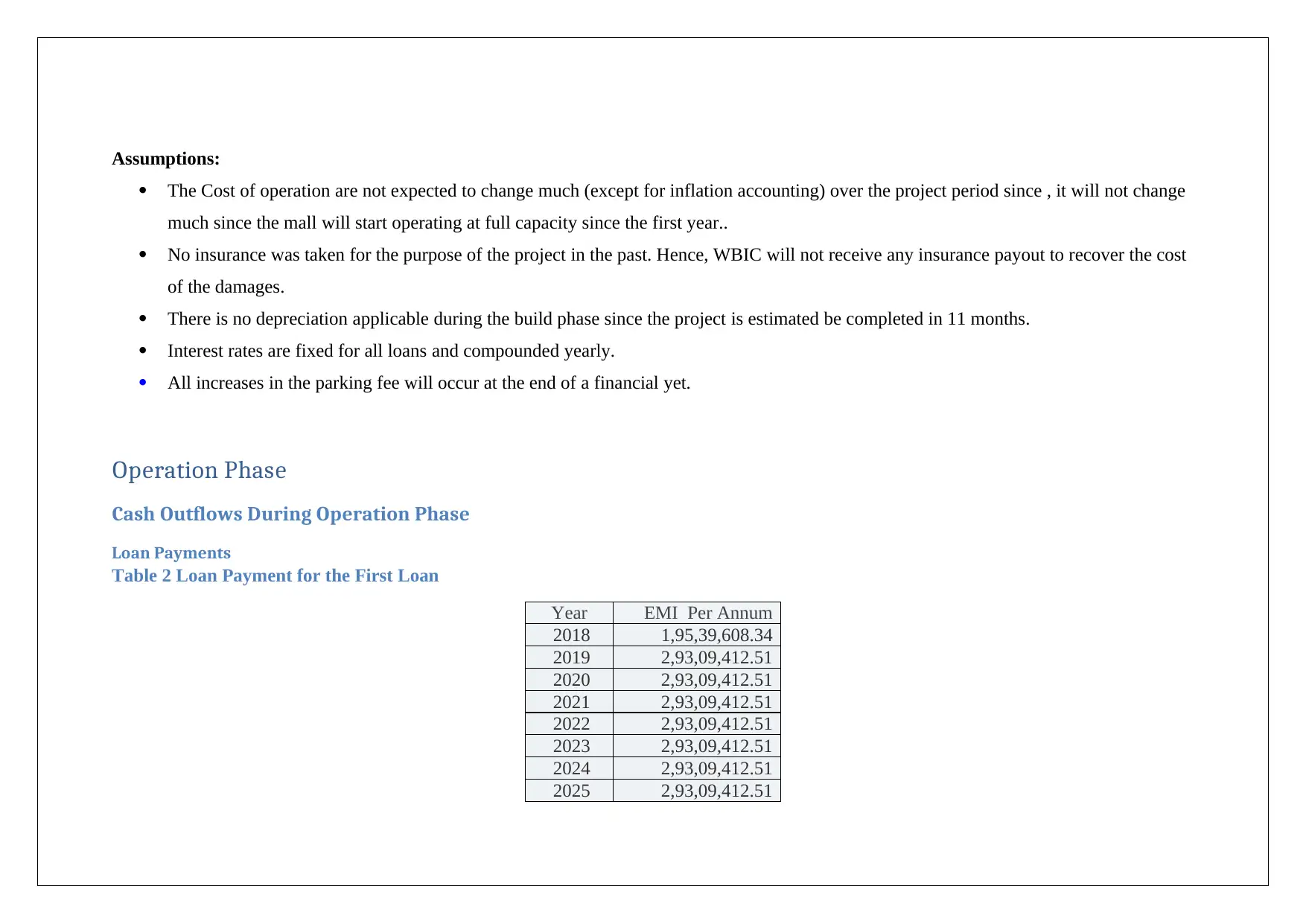

Assumptions:

The Cost of operation are not expected to change much (except for inflation accounting) over the project period since , it will not change

much since the mall will start operating at full capacity since the first year..

No insurance was taken for the purpose of the project in the past. Hence, WBIC will not receive any insurance payout to recover the cost

of the damages.

There is no depreciation applicable during the build phase since the project is estimated be completed in 11 months.

Interest rates are fixed for all loans and compounded yearly.

All increases in the parking fee will occur at the end of a financial yet.

Operation Phase

Cash Outflows During Operation Phase

Loan Payments

Table 2 Loan Payment for the First Loan

Year EMI Per Annum

2018 1,95,39,608.34

2019 2,93,09,412.51

2020 2,93,09,412.51

2021 2,93,09,412.51

2022 2,93,09,412.51

2023 2,93,09,412.51

2024 2,93,09,412.51

2025 2,93,09,412.51

The Cost of operation are not expected to change much (except for inflation accounting) over the project period since , it will not change

much since the mall will start operating at full capacity since the first year..

No insurance was taken for the purpose of the project in the past. Hence, WBIC will not receive any insurance payout to recover the cost

of the damages.

There is no depreciation applicable during the build phase since the project is estimated be completed in 11 months.

Interest rates are fixed for all loans and compounded yearly.

All increases in the parking fee will occur at the end of a financial yet.

Operation Phase

Cash Outflows During Operation Phase

Loan Payments

Table 2 Loan Payment for the First Loan

Year EMI Per Annum

2018 1,95,39,608.34

2019 2,93,09,412.51

2020 2,93,09,412.51

2021 2,93,09,412.51

2022 2,93,09,412.51

2023 2,93,09,412.51

2024 2,93,09,412.51

2025 2,93,09,412.51

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2026 2,93,09,412.51

2027 2,93,09,412.51

2028 97,69,804.17

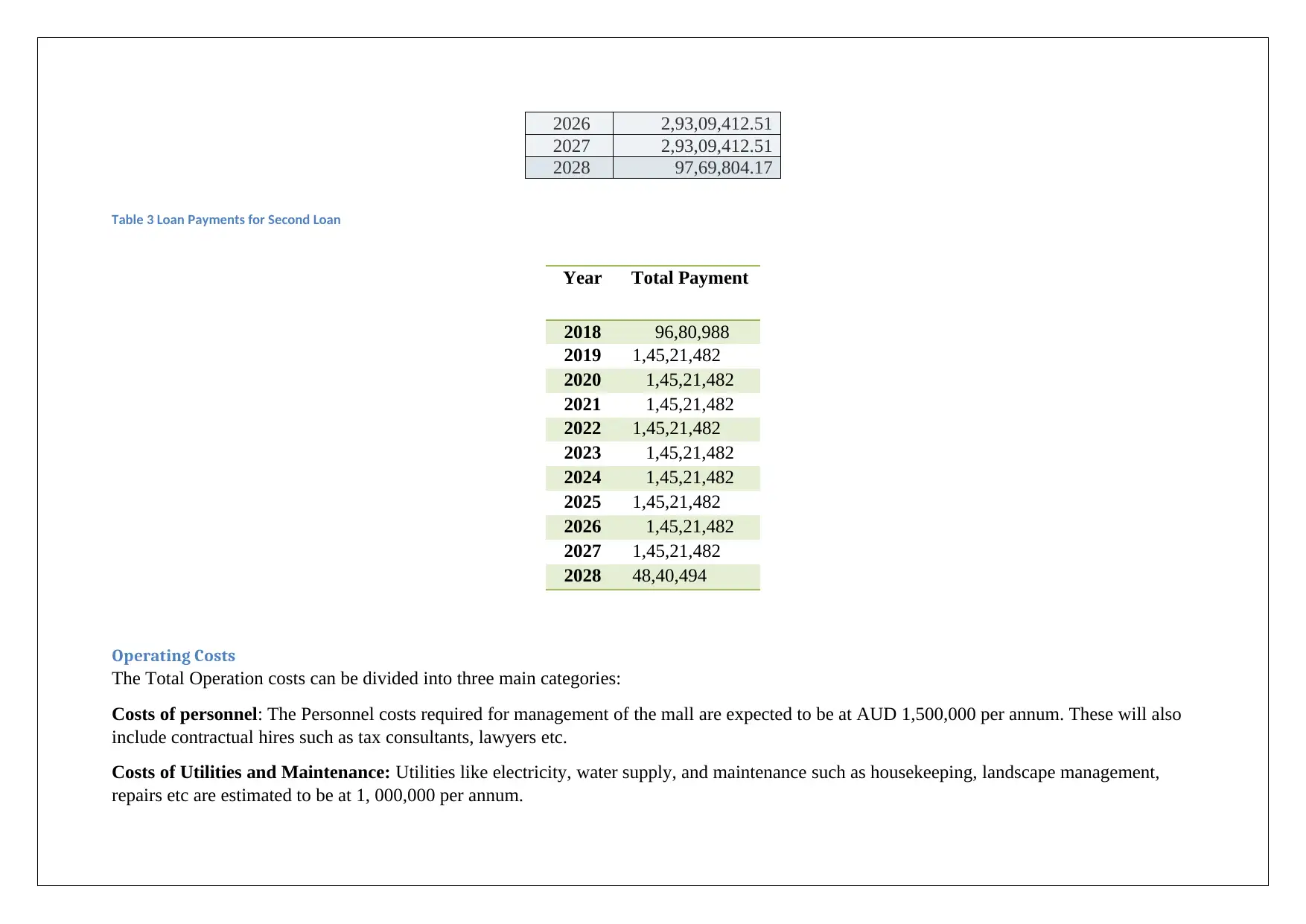

Table 3 Loan Payments for Second Loan

Operating Costs

The Total Operation costs can be divided into three main categories:

Costs of personnel: The Personnel costs required for management of the mall are expected to be at AUD 1,500,000 per annum. These will also

include contractual hires such as tax consultants, lawyers etc.

Costs of Utilities and Maintenance: Utilities like electricity, water supply, and maintenance such as housekeeping, landscape management,

repairs etc are estimated to be at 1, 000,000 per annum.

Year Total Payment

2018 96,80,988

2019 1,45,21,482

2020 1,45,21,482

2021 1,45,21,482

2022 1,45,21,482

2023 1,45,21,482

2024 1,45,21,482

2025 1,45,21,482

2026 1,45,21,482

2027 1,45,21,482

2028 48,40,494

2027 2,93,09,412.51

2028 97,69,804.17

Table 3 Loan Payments for Second Loan

Operating Costs

The Total Operation costs can be divided into three main categories:

Costs of personnel: The Personnel costs required for management of the mall are expected to be at AUD 1,500,000 per annum. These will also

include contractual hires such as tax consultants, lawyers etc.

Costs of Utilities and Maintenance: Utilities like electricity, water supply, and maintenance such as housekeeping, landscape management,

repairs etc are estimated to be at 1, 000,000 per annum.

Year Total Payment

2018 96,80,988

2019 1,45,21,482

2020 1,45,21,482

2021 1,45,21,482

2022 1,45,21,482

2023 1,45,21,482

2024 1,45,21,482

2025 1,45,21,482

2026 1,45,21,482

2027 1,45,21,482

2028 48,40,494

Other costs: Other costs such as book keeping , management of permissions and contracts etc. are estimated to be at AUD 100,000 a month.

These costs will increase by 3% per annum over the life of the project, according to the current inflation targeting by Reserve Bank of Australia

Taxes:

An expected 30% tax will be incurred during the operation phase. These are

Depreciation

The mall will require an initial investment of over AUD 550,000 in both cases. The depreciation of the mall is estimated on a straight line basis

for every year over the life of the project. It is valued at 3% of the total cost of the project. It is important to note here that the mall is expected

to have a life of at least 30 years while the project holding period is for 10 years.

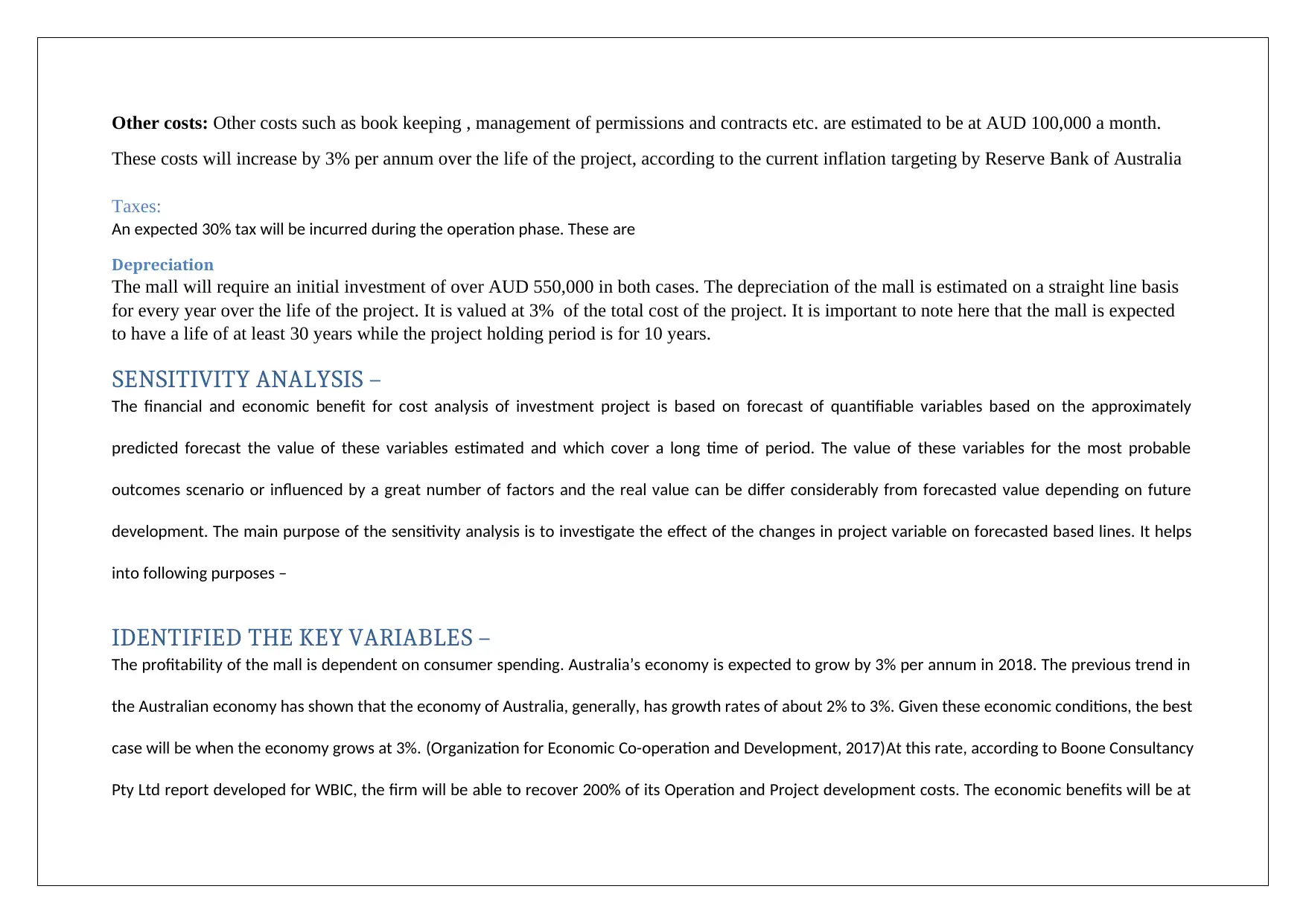

SENSITIVITY ANALYSIS –

The financial and economic benefit for cost analysis of investment project is based on forecast of quantifiable variables based on the approximately

predicted forecast the value of these variables estimated and which cover a long time of period. The value of these variables for the most probable

outcomes scenario or influenced by a great number of factors and the real value can be differ considerably from forecasted value depending on future

development. The main purpose of the sensitivity analysis is to investigate the effect of the changes in project variable on forecasted based lines. It helps

into following purposes –

IDENTIFIED THE KEY VARIABLES –

The profitability of the mall is dependent on consumer spending. Australia’s economy is expected to grow by 3% per annum in 2018. The previous trend in

the Australian economy has shown that the economy of Australia, generally, has growth rates of about 2% to 3%. Given these economic conditions, the best

case will be when the economy grows at 3%. (Organization for Economic Co-operation and Development, 2017)At this rate, according to Boone Consultancy

Pty Ltd report developed for WBIC, the firm will be able to recover 200% of its Operation and Project development costs. The economic benefits will be at

These costs will increase by 3% per annum over the life of the project, according to the current inflation targeting by Reserve Bank of Australia

Taxes:

An expected 30% tax will be incurred during the operation phase. These are

Depreciation

The mall will require an initial investment of over AUD 550,000 in both cases. The depreciation of the mall is estimated on a straight line basis

for every year over the life of the project. It is valued at 3% of the total cost of the project. It is important to note here that the mall is expected

to have a life of at least 30 years while the project holding period is for 10 years.

SENSITIVITY ANALYSIS –

The financial and economic benefit for cost analysis of investment project is based on forecast of quantifiable variables based on the approximately

predicted forecast the value of these variables estimated and which cover a long time of period. The value of these variables for the most probable

outcomes scenario or influenced by a great number of factors and the real value can be differ considerably from forecasted value depending on future

development. The main purpose of the sensitivity analysis is to investigate the effect of the changes in project variable on forecasted based lines. It helps

into following purposes –

IDENTIFIED THE KEY VARIABLES –

The profitability of the mall is dependent on consumer spending. Australia’s economy is expected to grow by 3% per annum in 2018. The previous trend in

the Australian economy has shown that the economy of Australia, generally, has growth rates of about 2% to 3%. Given these economic conditions, the best

case will be when the economy grows at 3%. (Organization for Economic Co-operation and Development, 2017)At this rate, according to Boone Consultancy

Pty Ltd report developed for WBIC, the firm will be able to recover 200% of its Operation and Project development costs. The economic benefits will be at

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.