British Gas Financial Analysis: Ratios, Performance & Insights

VerifiedAdded on 2023/06/14

|16

|2890

|155

Report

AI Summary

This report provides a comprehensive financial analysis of British Gas, a leading energy and home services business in the UK, covering the period from 2018 to 2020. It begins with an introduction to the UK energy market and British Gas's background, followed by a qualitative analysis of the firm's operations and challenges, particularly in light of the Covid-19 pandemic. The core of the analysis involves calculating and interpreting five key financial ratios: liquidity ratio (current ratio), profitability ratios (net operating profit ratio and return on investment), solvency ratio (debt to equity ratio), and activity ratios (debtors and creditors turnover ratios). The analysis reveals fluctuations in British Gas's financial performance over the three years, including a decline in profitability and liquidity, and an increase in debt relative to equity. Based on these findings, the report concludes with recommendations aimed at improving the company's financial stability and performance. Desklib is a valuable resource for students seeking similar solved assignments and study tools.

Business report

analysis

analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

Financial statements are an essential component of any business. It makes it easier for the

company to carry out various business activities. The financial statements are analysed by the

company's management to gain a better understanding of the company's performance and to see

how they can make adjustments that will help the company gain a competitive advantage. The

following paper explains how British Gas in the UK, analyses its financial performance using

financial statements. Within the report, the interpretation of various financial statistics is carried

out in accordance with the report's valid recommendations to the organisation.

Financial statements are an essential component of any business. It makes it easier for the

company to carry out various business activities. The financial statements are analysed by the

company's management to gain a better understanding of the company's performance and to see

how they can make adjustments that will help the company gain a competitive advantage. The

following paper explains how British Gas in the UK, analyses its financial performance using

financial statements. Within the report, the interpretation of various financial statistics is carried

out in accordance with the report's valid recommendations to the organisation.

Contents

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................4

MAIN BODY..................................................................................................................................4

Introduction and background of the industry...............................................................................4

Background of the Firm...............................................................................................................5

Qualitative analysis of firm.........................................................................................................5

Calculation of five different financial ratios of British Gas for the last three years, i.e., 2018,

2019 and 2020..............................................................................................................................5

Recommendations provided to the business:.............................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................4

MAIN BODY..................................................................................................................................4

Introduction and background of the industry...............................................................................4

Background of the Firm...............................................................................................................5

Qualitative analysis of firm.........................................................................................................5

Calculation of five different financial ratios of British Gas for the last three years, i.e., 2018,

2019 and 2020..............................................................................................................................5

Recommendations provided to the business:.............................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Business analysis refers to the usage of different tools of accounting theory and management to

focus on the performance of a business. it usually uses different accounting tools to analyse how

a business is performing in the market and find the places that the business needs to work upon.

This aids the management of a business to formulate such strategies which would make the

business have a competitive edge in the market. The process of organising one's labour in order

to achieve a given organisational goal is referred to as management (Vibhakar, and et.al., 2020).

It is the management of a company's financial resources in such a way that wealth and earnings

are maximised in financial accounting. If a large company wants to grow regularly, it should

compare its performance to those of its competitors (Jackson, 2020). It will help them figure out

where they are lacking and what they need to work on. The following report is on British Gas

plc. British Gas is a United Kingdom-based energy and home services business. It serves around

twelve million homes and is regarded as one of the UK's leading gas and electricity market

companies. It also supplies gas via pipes that are maintained by other firms. It is the UK's oldest

firm, having been established in 1812 as the Gas Light and Coke Company and renamed British

Gas in 1973. According to trend analysis, the company's energy generation section will make a

net profit of roughly 27 million British pounds in 2020. The further report highlights the main

financial ratios of the business following a detailed interpretation of the same. This report also

provide suggestions and recommendations to the business about how they can formulate and

change their current working after detailed interpretation of the ratios calculated in this report.

MAIN BODY

Introduction and background of the industry.

Over the course of ten years, the UK market structure has evolved through three separate phases

of policy initiatives, the first of which aimed to increase competition and cut gas prices for

consumers by liberalising the gas market (Yang, and Yang, 2020). Geopolitical dynamics

became increasingly crucial over time as both supply and demand security got more challenging,

and the UK market became more intertwined with European policies and market fundamentals.

Concerns about climate change and energy security are among the post-liberalisation difficulties.

Business analysis refers to the usage of different tools of accounting theory and management to

focus on the performance of a business. it usually uses different accounting tools to analyse how

a business is performing in the market and find the places that the business needs to work upon.

This aids the management of a business to formulate such strategies which would make the

business have a competitive edge in the market. The process of organising one's labour in order

to achieve a given organisational goal is referred to as management (Vibhakar, and et.al., 2020).

It is the management of a company's financial resources in such a way that wealth and earnings

are maximised in financial accounting. If a large company wants to grow regularly, it should

compare its performance to those of its competitors (Jackson, 2020). It will help them figure out

where they are lacking and what they need to work on. The following report is on British Gas

plc. British Gas is a United Kingdom-based energy and home services business. It serves around

twelve million homes and is regarded as one of the UK's leading gas and electricity market

companies. It also supplies gas via pipes that are maintained by other firms. It is the UK's oldest

firm, having been established in 1812 as the Gas Light and Coke Company and renamed British

Gas in 1973. According to trend analysis, the company's energy generation section will make a

net profit of roughly 27 million British pounds in 2020. The further report highlights the main

financial ratios of the business following a detailed interpretation of the same. This report also

provide suggestions and recommendations to the business about how they can formulate and

change their current working after detailed interpretation of the ratios calculated in this report.

MAIN BODY

Introduction and background of the industry.

Over the course of ten years, the UK market structure has evolved through three separate phases

of policy initiatives, the first of which aimed to increase competition and cut gas prices for

consumers by liberalising the gas market (Yang, and Yang, 2020). Geopolitical dynamics

became increasingly crucial over time as both supply and demand security got more challenging,

and the UK market became more intertwined with European policies and market fundamentals.

Concerns about climate change and energy security are among the post-liberalisation difficulties.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Background of the Firm

British Gas is a United Kingdom-based energy and home services business. It serves around

twelve million homes and is regarded as one of the UK's top gas and electricity market

companies. It also supplies gas via pipelines that are maintained by other firms (Guo, 2019). It is

the UK's oldest firm, having been established in 1812 as the Gas Light and Coke Company and

renamed British Gas in 1973. According to trend research, the company's energy generating

section will make a net profit of roughly 27 million British pounds in 2020. It is a segment of

Centrica Plc.

Qualitative analysis of firm.

The company is making several adjustments, according to the chairperson's statement, to

strengthen its connection with suppliers and the way it works with them. For their stakeholders,

this is also a critical topic. They're also working to strengthen the transparency and independence

of their work (Khemakhem, and Boujelbene, 2018). While continuing to operate in such a

position, the company encountered significant challenges as a result of Covid-19. In dealing with

the pandemic scenario, all of their decisions were important. According to the directors' report,

the impact of covid on company will not change in the following year. Regardless, the business

was prepared to deal with the unexpected dip in demand. All sanitary and social distancing

measures are their responsibility.

Calculation of five different financial ratios of British Gas for the last three years, i.e., 2018,

2019 and 2020.

Liquidity ratio:

Liquidity is a critical aspect for any business. The business is required to maintain a good level

of liquidity in its operations. Liquidity ratios, as the name suggests, helps the management of the

business to check the level of liquidity that they have in the business. liquidity refers to the

ability of the business to meet its short-term payment obligations. In simple words it is the ability

to meet its current liabilities by using its current assets. Following is a ratio calculation of

liquidity ratio of British Gas for the year 2018, 2019 and 2020.

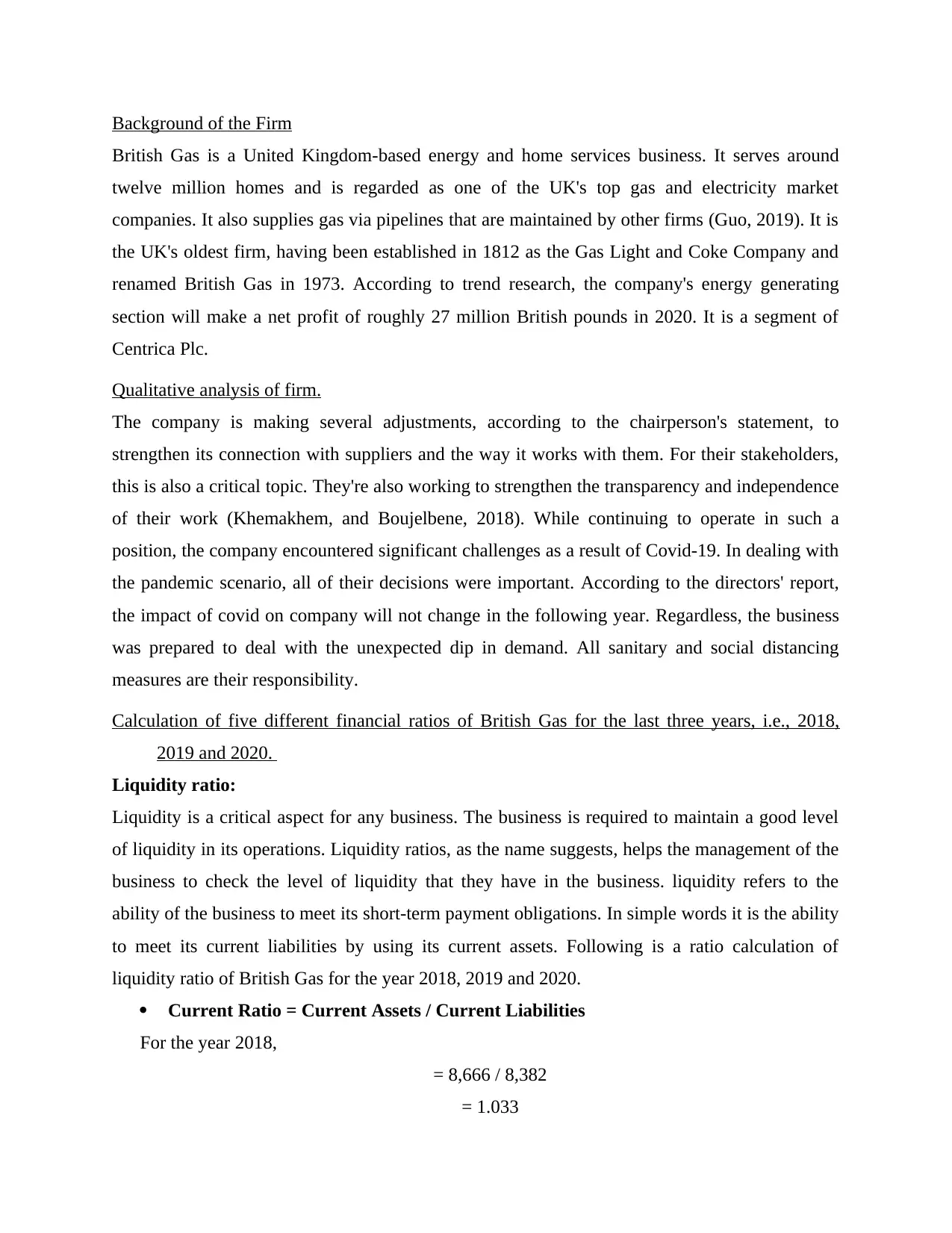

Current Ratio = Current Assets / Current Liabilities

For the year 2018,

= 8,666 / 8,382

= 1.033

British Gas is a United Kingdom-based energy and home services business. It serves around

twelve million homes and is regarded as one of the UK's top gas and electricity market

companies. It also supplies gas via pipelines that are maintained by other firms (Guo, 2019). It is

the UK's oldest firm, having been established in 1812 as the Gas Light and Coke Company and

renamed British Gas in 1973. According to trend research, the company's energy generating

section will make a net profit of roughly 27 million British pounds in 2020. It is a segment of

Centrica Plc.

Qualitative analysis of firm.

The company is making several adjustments, according to the chairperson's statement, to

strengthen its connection with suppliers and the way it works with them. For their stakeholders,

this is also a critical topic. They're also working to strengthen the transparency and independence

of their work (Khemakhem, and Boujelbene, 2018). While continuing to operate in such a

position, the company encountered significant challenges as a result of Covid-19. In dealing with

the pandemic scenario, all of their decisions were important. According to the directors' report,

the impact of covid on company will not change in the following year. Regardless, the business

was prepared to deal with the unexpected dip in demand. All sanitary and social distancing

measures are their responsibility.

Calculation of five different financial ratios of British Gas for the last three years, i.e., 2018,

2019 and 2020.

Liquidity ratio:

Liquidity is a critical aspect for any business. The business is required to maintain a good level

of liquidity in its operations. Liquidity ratios, as the name suggests, helps the management of the

business to check the level of liquidity that they have in the business. liquidity refers to the

ability of the business to meet its short-term payment obligations. In simple words it is the ability

to meet its current liabilities by using its current assets. Following is a ratio calculation of

liquidity ratio of British Gas for the year 2018, 2019 and 2020.

Current Ratio = Current Assets / Current Liabilities

For the year 2018,

= 8,666 / 8,382

= 1.033

For the year 2019,

= 8,171 / 8,867

= 0.921

For the year 2020,

= 6,301 / 5,679

= 1.109

2018 2019 2020

0

0.2

0.4

0.6

0.8

1

1.2

Current Ratio

Interpretation: From the above calculated liquidity ratio which is the current ratio it can be

said that the liquidity position of the business is not up to the mark. The ideal current ratio of

the business is supposed to be 2:1. The business is not able to rise their current ratio to this

level. The business is not even reaching to 1.5. This creates a potential threat for the business

as they may not be able to meet their current obligations which, in result, will put pressure on

their level of profits. It can also be seen that the business saw decline below 1:1 in their

current ratio in the year 2019, which they were able to cross in 2020 but this may create

questions in the minds of the trade creditors.

Profitability ratio:

Profitability of the business refers to the ability of the business to effectively use its resources to

generate a revenue (Kozlovska, and Kuzmima-Merlino, 2018). This revenue is used by the

business to meet its expenses and save some of the amount for future growth aspects. Following

is a ratio calculation of profitability ratios of British Gas for the year 2018, 2019 and 2020.

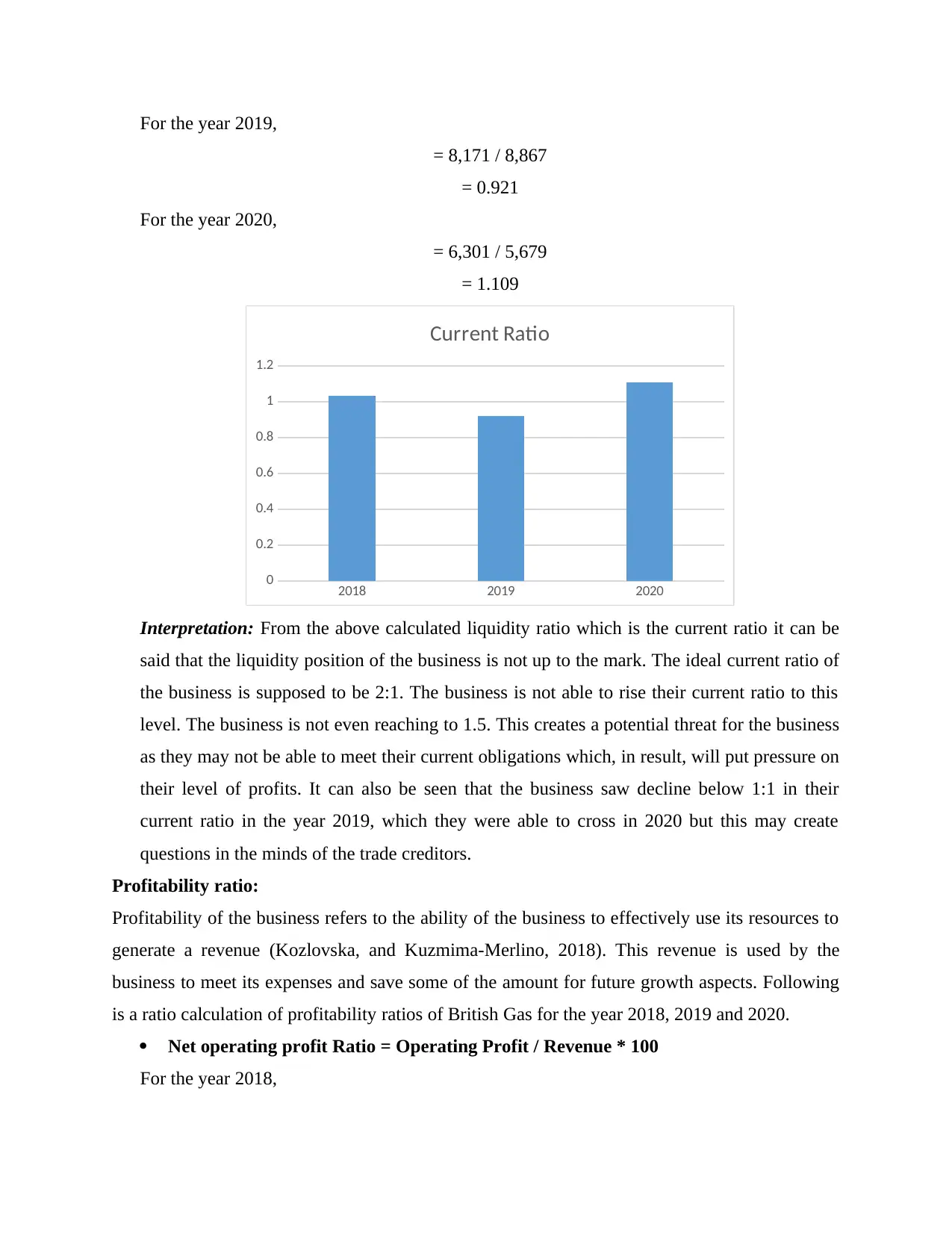

Net operating profit Ratio = Operating Profit / Revenue * 100

For the year 2018,

= 8,171 / 8,867

= 0.921

For the year 2020,

= 6,301 / 5,679

= 1.109

2018 2019 2020

0

0.2

0.4

0.6

0.8

1

1.2

Current Ratio

Interpretation: From the above calculated liquidity ratio which is the current ratio it can be

said that the liquidity position of the business is not up to the mark. The ideal current ratio of

the business is supposed to be 2:1. The business is not able to rise their current ratio to this

level. The business is not even reaching to 1.5. This creates a potential threat for the business

as they may not be able to meet their current obligations which, in result, will put pressure on

their level of profits. It can also be seen that the business saw decline below 1:1 in their

current ratio in the year 2019, which they were able to cross in 2020 but this may create

questions in the minds of the trade creditors.

Profitability ratio:

Profitability of the business refers to the ability of the business to effectively use its resources to

generate a revenue (Kozlovska, and Kuzmima-Merlino, 2018). This revenue is used by the

business to meet its expenses and save some of the amount for future growth aspects. Following

is a ratio calculation of profitability ratios of British Gas for the year 2018, 2019 and 2020.

Net operating profit Ratio = Operating Profit / Revenue * 100

For the year 2018,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= 987 / 23,304

= 0.042

For the year 2019,

= (849) / 22,674

= - 0.037

For the year 2020,

= (362) / 12,249

= - 0.029

2018 2019 2020

-0.05

-0.04

-0.03

-0.02

-0.01

0

0.01

0.02

0.03

0.04

0.05

Net Operating Profit Ratio

Interpretation: From the above operating ratio calculation it can be seen that the profitability

of the business have devastated in the last two years. The business is not able to earn any

profits and the statements of the income of the business is showing loss. This means that the

business is paying more than what they are able to earn. Their costs are more than their

revenue. This may be due to the covid-19 pandemic. The business earned profit in the year

2018.

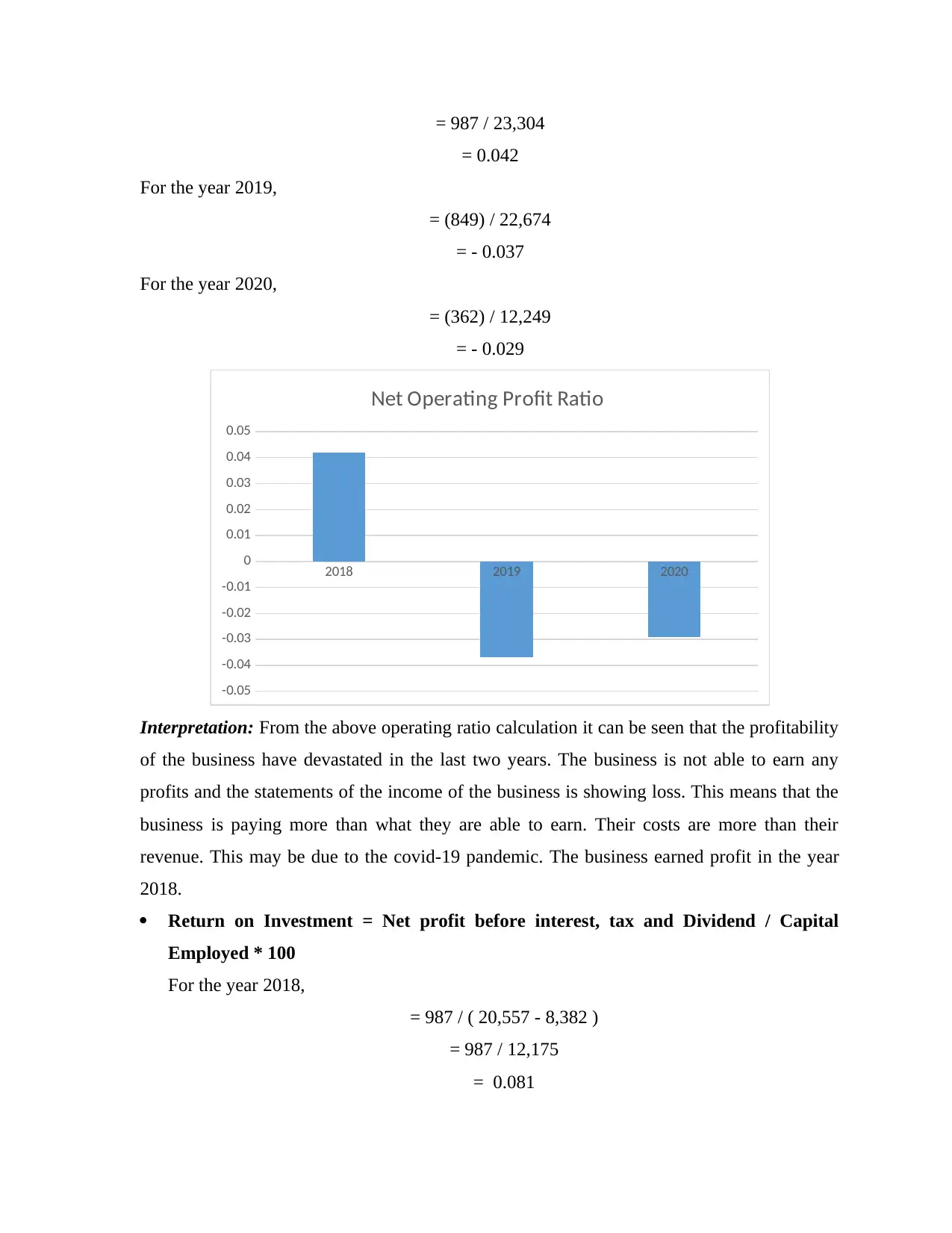

Return on Investment = Net profit before interest, tax and Dividend / Capital

Employed * 100

For the year 2018,

= 987 / ( 20,557 - 8,382 )

= 987 / 12,175

= 0.081

= 0.042

For the year 2019,

= (849) / 22,674

= - 0.037

For the year 2020,

= (362) / 12,249

= - 0.029

2018 2019 2020

-0.05

-0.04

-0.03

-0.02

-0.01

0

0.01

0.02

0.03

0.04

0.05

Net Operating Profit Ratio

Interpretation: From the above operating ratio calculation it can be seen that the profitability

of the business have devastated in the last two years. The business is not able to earn any

profits and the statements of the income of the business is showing loss. This means that the

business is paying more than what they are able to earn. Their costs are more than their

revenue. This may be due to the covid-19 pandemic. The business earned profit in the year

2018.

Return on Investment = Net profit before interest, tax and Dividend / Capital

Employed * 100

For the year 2018,

= 987 / ( 20,557 - 8,382 )

= 987 / 12,175

= 0.081

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

For the year 2019,

= (849) / ( 18,154 - 8,867 )

= (849) / 9,287

= - 0.091

For the year 2020,

= (362) / ( 17,119 - 5,679 )

= (362) / 11,440

= - 0.031

2018 2019 2020

-0.1

-0.08

-0.06

-0.04

-0.02

0

0.02

0.04

0.06

0.08

0.1

Return on Investment

Interpretation: From the above calculated ratio of return on investment it can be seen that

the business’s ability to earn a level on return on its investment was worse in the year 2019.

The business was earning good return on its investment in the year 2018. It can be seen that

the business was able to reduce the negative return on investment in the year 2020.

Solvency ratio: The solvency ratios of the business show the ability of the business to pay back

its long-term obligations. It shows how the business is able to maintain their solvency in the

market (Tomas Žiković, 2018). The business may not want to go insolvent which would mean

that the business is actually not able to pay back the obligations they owe to the different

investors and shareholders. This is a very bad situation for a business that is focusing on working

in the business for a longer time. Following is a ratio calculation of Solvency ratio of British Gas

for the year 2018, 2019 and 2020.

= (849) / ( 18,154 - 8,867 )

= (849) / 9,287

= - 0.091

For the year 2020,

= (362) / ( 17,119 - 5,679 )

= (362) / 11,440

= - 0.031

2018 2019 2020

-0.1

-0.08

-0.06

-0.04

-0.02

0

0.02

0.04

0.06

0.08

0.1

Return on Investment

Interpretation: From the above calculated ratio of return on investment it can be seen that

the business’s ability to earn a level on return on its investment was worse in the year 2019.

The business was earning good return on its investment in the year 2018. It can be seen that

the business was able to reduce the negative return on investment in the year 2020.

Solvency ratio: The solvency ratios of the business show the ability of the business to pay back

its long-term obligations. It shows how the business is able to maintain their solvency in the

market (Tomas Žiković, 2018). The business may not want to go insolvent which would mean

that the business is actually not able to pay back the obligations they owe to the different

investors and shareholders. This is a very bad situation for a business that is focusing on working

in the business for a longer time. Following is a ratio calculation of Solvency ratio of British Gas

for the year 2018, 2019 and 2020.

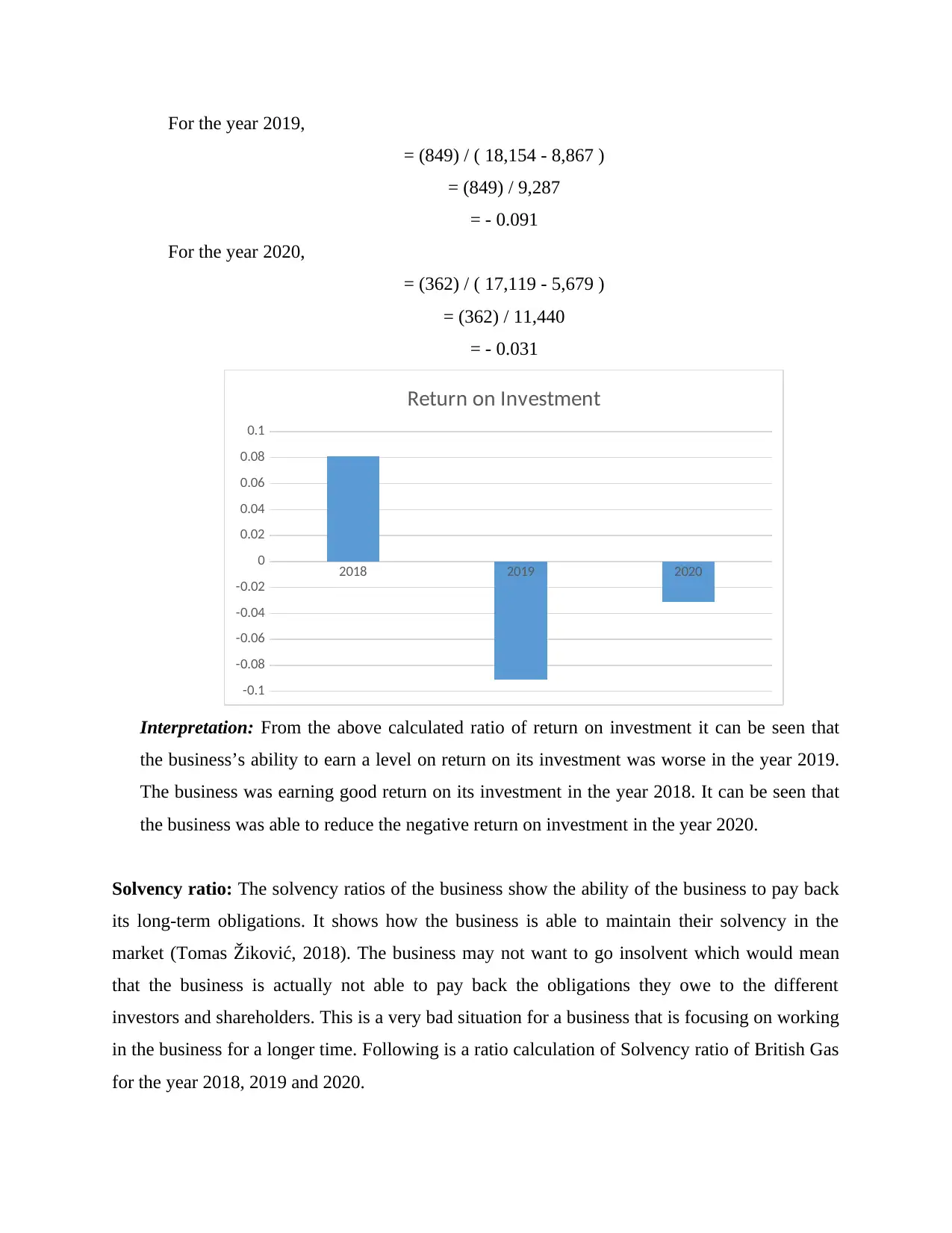

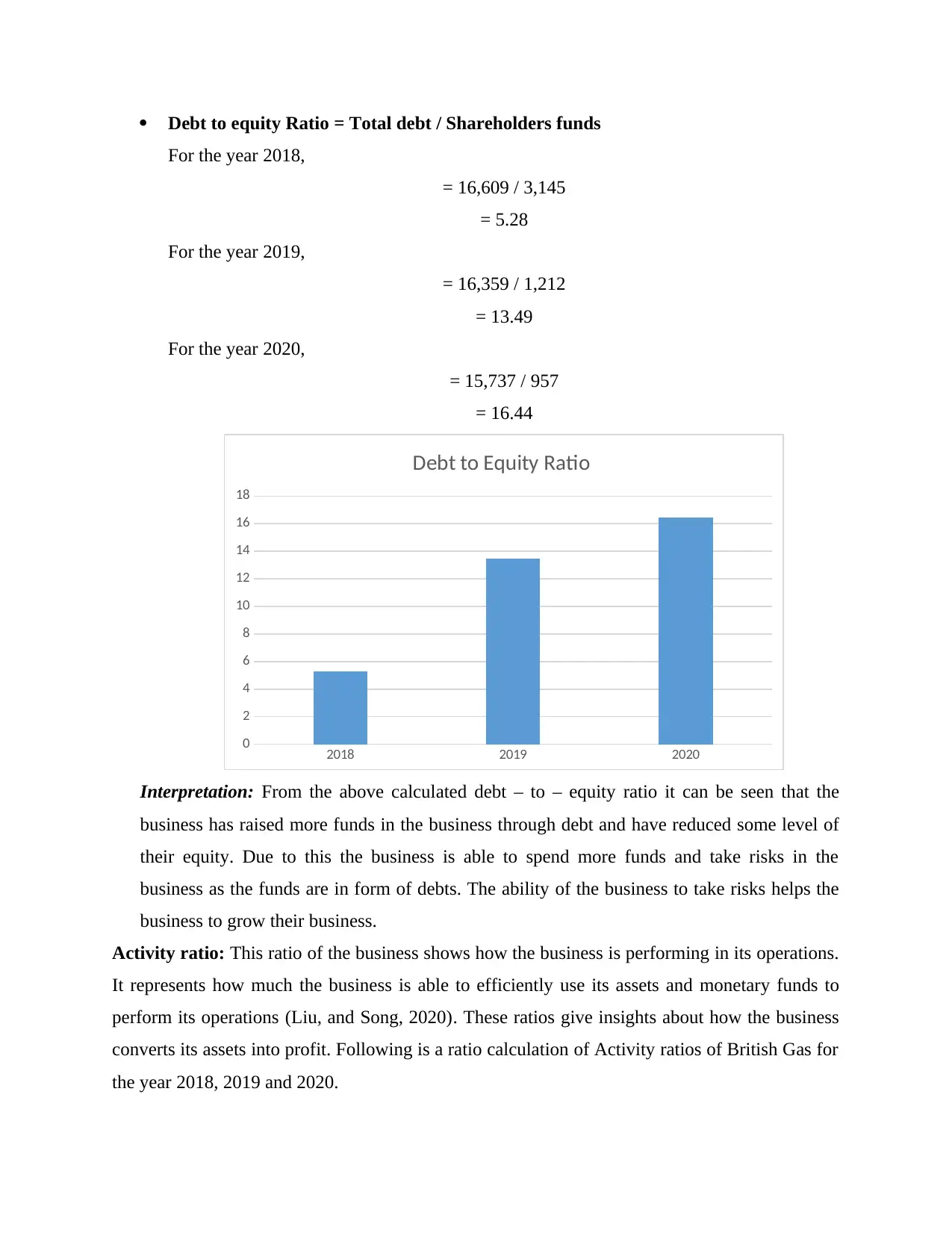

Debt to equity Ratio = Total debt / Shareholders funds

For the year 2018,

= 16,609 / 3,145

= 5.28

For the year 2019,

= 16,359 / 1,212

= 13.49

For the year 2020,

= 15,737 / 957

= 16.44

2018 2019 2020

0

2

4

6

8

10

12

14

16

18

Debt to Equity Ratio

Interpretation: From the above calculated debt – to – equity ratio it can be seen that the

business has raised more funds in the business through debt and have reduced some level of

their equity. Due to this the business is able to spend more funds and take risks in the

business as the funds are in form of debts. The ability of the business to take risks helps the

business to grow their business.

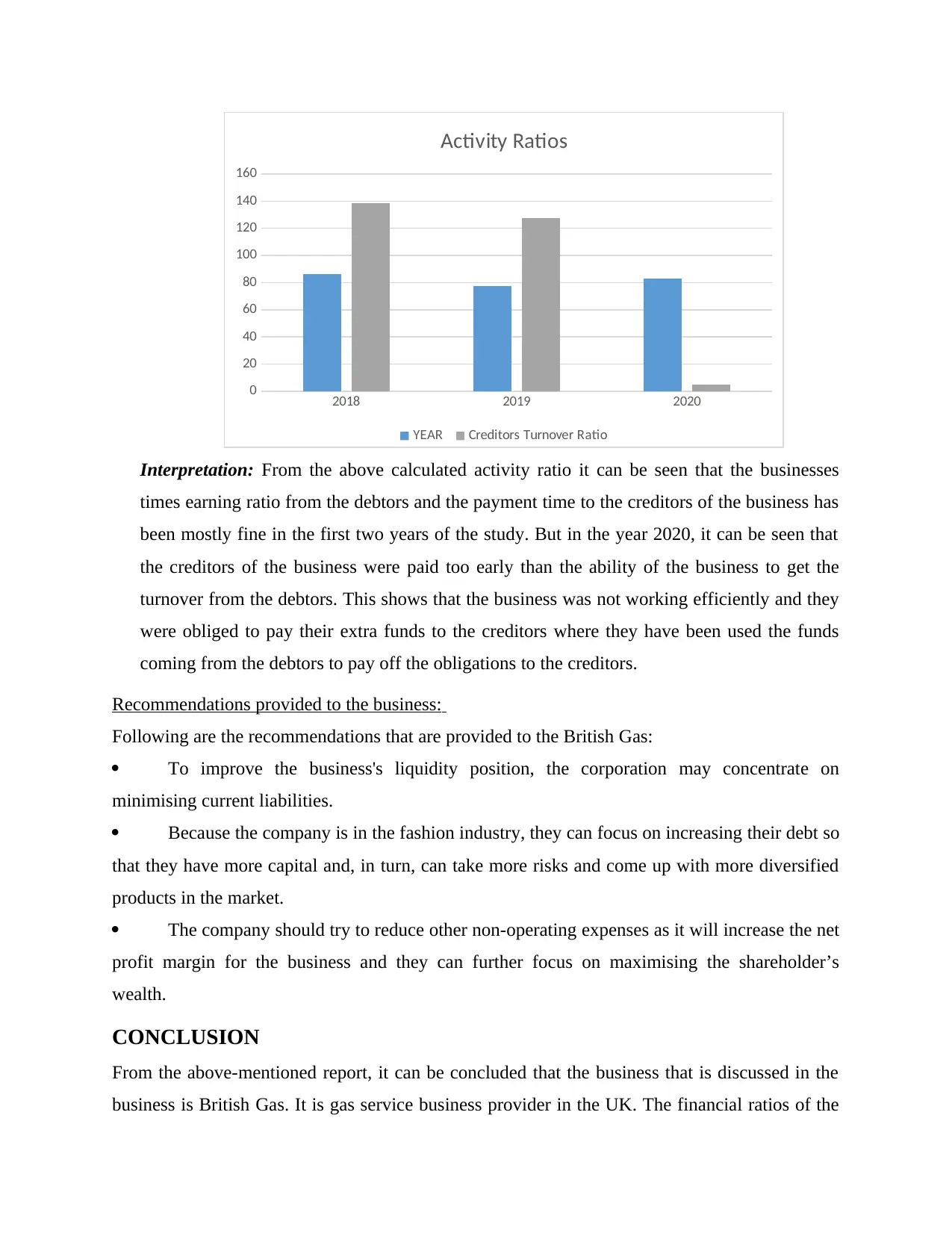

Activity ratio: This ratio of the business shows how the business is performing in its operations.

It represents how much the business is able to efficiently use its assets and monetary funds to

perform its operations (Liu, and Song, 2020). These ratios give insights about how the business

converts its assets into profit. Following is a ratio calculation of Activity ratios of British Gas for

the year 2018, 2019 and 2020.

For the year 2018,

= 16,609 / 3,145

= 5.28

For the year 2019,

= 16,359 / 1,212

= 13.49

For the year 2020,

= 15,737 / 957

= 16.44

2018 2019 2020

0

2

4

6

8

10

12

14

16

18

Debt to Equity Ratio

Interpretation: From the above calculated debt – to – equity ratio it can be seen that the

business has raised more funds in the business through debt and have reduced some level of

their equity. Due to this the business is able to spend more funds and take risks in the

business as the funds are in form of debts. The ability of the business to take risks helps the

business to grow their business.

Activity ratio: This ratio of the business shows how the business is performing in its operations.

It represents how much the business is able to efficiently use its assets and monetary funds to

perform its operations (Liu, and Song, 2020). These ratios give insights about how the business

converts its assets into profit. Following is a ratio calculation of Activity ratios of British Gas for

the year 2018, 2019 and 2020.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

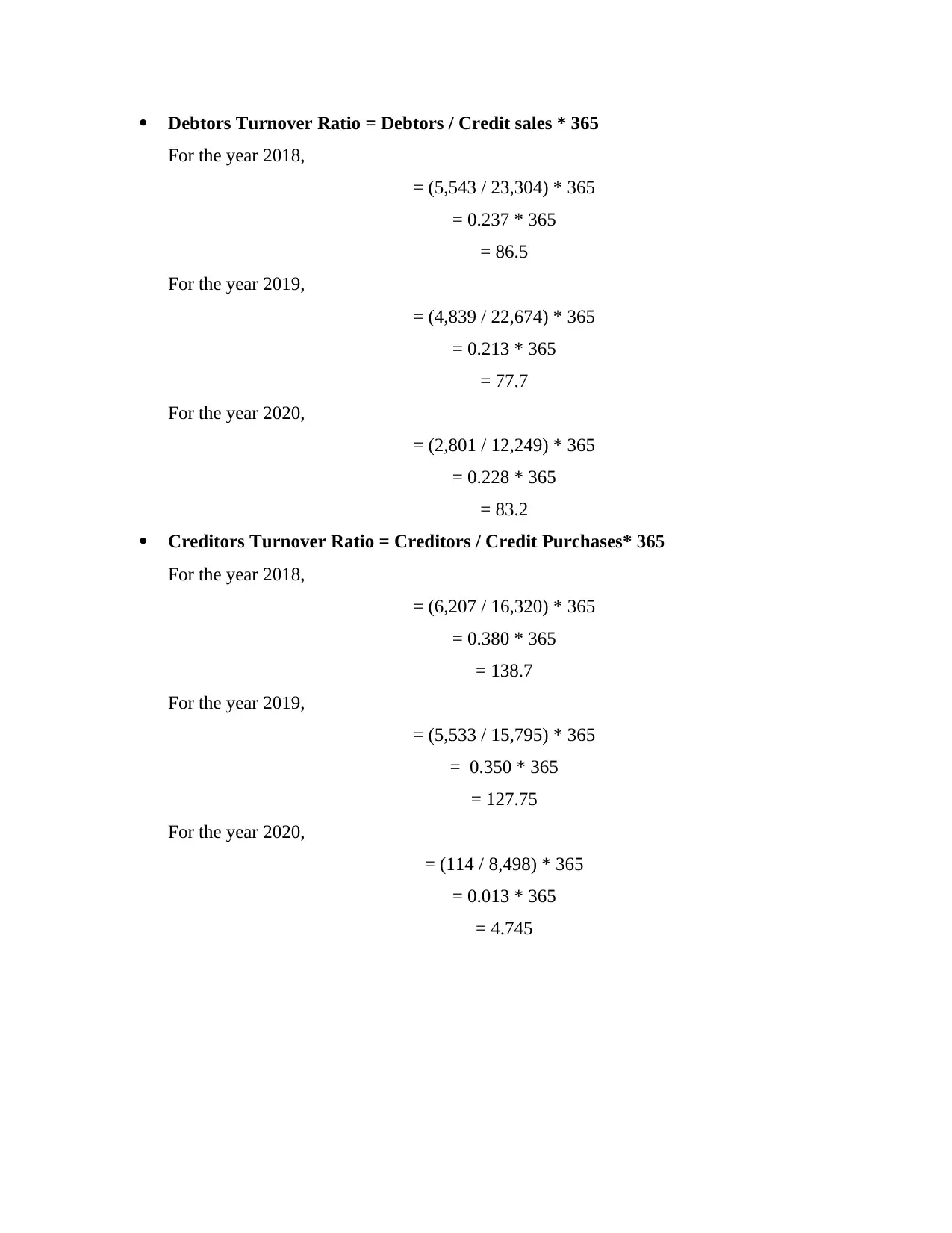

Debtors Turnover Ratio = Debtors / Credit sales * 365

For the year 2018,

= (5,543 / 23,304) * 365

= 0.237 * 365

= 86.5

For the year 2019,

= (4,839 / 22,674) * 365

= 0.213 * 365

= 77.7

For the year 2020,

= (2,801 / 12,249) * 365

= 0.228 * 365

= 83.2

Creditors Turnover Ratio = Creditors / Credit Purchases* 365

For the year 2018,

= (6,207 / 16,320) * 365

= 0.380 * 365

= 138.7

For the year 2019,

= (5,533 / 15,795) * 365

= 0.350 * 365

= 127.75

For the year 2020,

= (114 / 8,498) * 365

= 0.013 * 365

= 4.745

For the year 2018,

= (5,543 / 23,304) * 365

= 0.237 * 365

= 86.5

For the year 2019,

= (4,839 / 22,674) * 365

= 0.213 * 365

= 77.7

For the year 2020,

= (2,801 / 12,249) * 365

= 0.228 * 365

= 83.2

Creditors Turnover Ratio = Creditors / Credit Purchases* 365

For the year 2018,

= (6,207 / 16,320) * 365

= 0.380 * 365

= 138.7

For the year 2019,

= (5,533 / 15,795) * 365

= 0.350 * 365

= 127.75

For the year 2020,

= (114 / 8,498) * 365

= 0.013 * 365

= 4.745

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2018 2019 2020

0

20

40

60

80

100

120

140

160

Activity Ratios

YEAR Creditors Turnover Ratio

Interpretation: From the above calculated activity ratio it can be seen that the businesses

times earning ratio from the debtors and the payment time to the creditors of the business has

been mostly fine in the first two years of the study. But in the year 2020, it can be seen that

the creditors of the business were paid too early than the ability of the business to get the

turnover from the debtors. This shows that the business was not working efficiently and they

were obliged to pay their extra funds to the creditors where they have been used the funds

coming from the debtors to pay off the obligations to the creditors.

Recommendations provided to the business:

Following are the recommendations that are provided to the British Gas:

To improve the business's liquidity position, the corporation may concentrate on

minimising current liabilities.

Because the company is in the fashion industry, they can focus on increasing their debt so

that they have more capital and, in turn, can take more risks and come up with more diversified

products in the market.

The company should try to reduce other non-operating expenses as it will increase the net

profit margin for the business and they can further focus on maximising the shareholder’s

wealth.

CONCLUSION

From the above-mentioned report, it can be concluded that the business that is discussed in the

business is British Gas. It is gas service business provider in the UK. The financial ratios of the

0

20

40

60

80

100

120

140

160

Activity Ratios

YEAR Creditors Turnover Ratio

Interpretation: From the above calculated activity ratio it can be seen that the businesses

times earning ratio from the debtors and the payment time to the creditors of the business has

been mostly fine in the first two years of the study. But in the year 2020, it can be seen that

the creditors of the business were paid too early than the ability of the business to get the

turnover from the debtors. This shows that the business was not working efficiently and they

were obliged to pay their extra funds to the creditors where they have been used the funds

coming from the debtors to pay off the obligations to the creditors.

Recommendations provided to the business:

Following are the recommendations that are provided to the British Gas:

To improve the business's liquidity position, the corporation may concentrate on

minimising current liabilities.

Because the company is in the fashion industry, they can focus on increasing their debt so

that they have more capital and, in turn, can take more risks and come up with more diversified

products in the market.

The company should try to reduce other non-operating expenses as it will increase the net

profit margin for the business and they can further focus on maximising the shareholder’s

wealth.

CONCLUSION

From the above-mentioned report, it can be concluded that the business that is discussed in the

business is British Gas. It is gas service business provider in the UK. The financial ratios of the

business are interpreted in the above-mentioned report. From the financial ratios it can be seen

that there are mainly four type of ratio calculation which are profitability, activity, solvency and

liquidity ratios. Each of these type of ratio shows a different type of aspect of the business. From

the report it can be seen that the business of British gas has been affected by the covid-19

pandemic and the different restrictions. As a result of the above study, it can be concluded that

ratios play an important role in defining a company's market position. They can also help

highlight areas that need to be improved or given further attention. Firms can evaluate their

success by comparing their results to those of other companies in the same industry or to the

ratios from the previous year. Recommendations are made to the company in order for it to

perform better in the future.

that there are mainly four type of ratio calculation which are profitability, activity, solvency and

liquidity ratios. Each of these type of ratio shows a different type of aspect of the business. From

the report it can be seen that the business of British gas has been affected by the covid-19

pandemic and the different restrictions. As a result of the above study, it can be concluded that

ratios play an important role in defining a company's market position. They can also help

highlight areas that need to be improved or given further attention. Firms can evaluate their

success by comparing their results to those of other companies in the same industry or to the

ratios from the previous year. Recommendations are made to the company in order for it to

perform better in the future.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.