BSBFIM501 Manage Budgets and Financial Plans: Student Assessment Tasks

VerifiedAdded on 2023/01/19

|35

|6932

|1

Homework Assignment

AI Summary

This document contains a student's comprehensive response to the assessment tasks for the BSBFIM501 unit, focusing on managing budgets and financial plans. The assessment includes various tasks such as answering written questions on accounting principles, GST, taxation, and superannuation obligations. Additionally, the student undertakes a budget planning project, a project to monitor and control finances, a profit and loss analysis project, and a debtor management project, demonstrating their understanding of financial management processes. The assessment covers a wide range of topics, including double-entry bookkeeping, cash and accrual accounting, and GST reporting, with detailed explanations and practical application of financial concepts. The document provides a complete solution for the assessment, showcasing a strong grasp of the unit's learning objectives.

Student Assessment Tasks

BSBFIM501 Manage budgets and financial plans

1

BSBFIM501 Manage budgets and financial plans

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. Table of Contents

1.Table of Contents...................................................................................................................... 2

2.Assessment Information............................................................................................................ 3

3.Assessment Instructions............................................................................................................ 5

4.Assessment Task 1: Written Questions ....................................................................................7

5.Assessment Task 1 Instructions................................................................................................8

6.Assessment Task 1 Checklist.................................................................................................. 11

7.Assessment Task 2: Budget planning project..........................................................................13

8.Assessment Task 2 Instructions ............................................................................................. 15

9.Assessment Task 2 Checklist.................................................................................................. 18

10.Assessment Task 3: Monitor and control finances project.....................................................19

11.Assessment Task 3 Instructions ........................................................................................... 21

12.Assessment Task 3 Checklist................................................................................................ 22

13.Assessment Task 4: Profit and loss review project................................................................24

14.Assessment Task 4 Instructions ........................................................................................... 25

15.Assessment Task 4 Checklist................................................................................................ 26

16.Assessment Task 5: Debtor management project.................................................................28

17.Assessment Task 5 Instructions ........................................................................................... 30

18.Assessment Task 5 Checklist................................................................................................ 32

2

1.Table of Contents...................................................................................................................... 2

2.Assessment Information............................................................................................................ 3

3.Assessment Instructions............................................................................................................ 5

4.Assessment Task 1: Written Questions ....................................................................................7

5.Assessment Task 1 Instructions................................................................................................8

6.Assessment Task 1 Checklist.................................................................................................. 11

7.Assessment Task 2: Budget planning project..........................................................................13

8.Assessment Task 2 Instructions ............................................................................................. 15

9.Assessment Task 2 Checklist.................................................................................................. 18

10.Assessment Task 3: Monitor and control finances project.....................................................19

11.Assessment Task 3 Instructions ........................................................................................... 21

12.Assessment Task 3 Checklist................................................................................................ 22

13.Assessment Task 4: Profit and loss review project................................................................24

14.Assessment Task 4 Instructions ........................................................................................... 25

15.Assessment Task 4 Checklist................................................................................................ 26

16.Assessment Task 5: Debtor management project.................................................................28

17.Assessment Task 5 Instructions ........................................................................................... 30

18.Assessment Task 5 Checklist................................................................................................ 32

2

2. Assessment Information

The assessment tasks for BSBFIM501 Manage budgets and financial plans are included in this Student

Assessment Tasks booklet and outlined in the assessment plan below.

To be assessed as competent for this unit, the student must complete all of the assessment tasks

satisfactorily.

Assessment Plan

Assessment Task Overview

1. Written questions Students must correctly answer all questions.

2. Budget planning project Students must complete a budget template and participate in

a meeting to discuss the budget. They must then present the

budget to their team.

3. Monitor and control finances project Students must review budget figures as part of a monitoring

process and report on these.

4. Profit and loss analysis project Students must review financial performance from a profit and

loss account

5. Debtor Management project Students must review and evaluate financial management

processes

Assessment Preparation

Please read through this assessment thoroughly before beginning any tasks. Ask your assessor for

clarification if you have any questions at all.

When you have read and understood this unit’s assessment tasks, print out the Student Assessment

Agreement. Fill it out, sign it, and hand it to your assessor, who will countersign it and then keep it on file.

Keep a copy of all of your work, as the work submitted to your assessor will not be returned to you.

Assessment appeals

If you do not agree with an assessment decision, you can make an assessment appeal as per your Alpha

Institute (Australia’s) assessment appeals process.

Students have the right to appeal the outcome of assessment decisions if they feel they have been dealt

with unfairly or have other appropriate grounds for an appeal.

Naming electronic documents

Students are directed to name documents logically.

Each should include:

Course identification code

Assessment Task number

3

The assessment tasks for BSBFIM501 Manage budgets and financial plans are included in this Student

Assessment Tasks booklet and outlined in the assessment plan below.

To be assessed as competent for this unit, the student must complete all of the assessment tasks

satisfactorily.

Assessment Plan

Assessment Task Overview

1. Written questions Students must correctly answer all questions.

2. Budget planning project Students must complete a budget template and participate in

a meeting to discuss the budget. They must then present the

budget to their team.

3. Monitor and control finances project Students must review budget figures as part of a monitoring

process and report on these.

4. Profit and loss analysis project Students must review financial performance from a profit and

loss account

5. Debtor Management project Students must review and evaluate financial management

processes

Assessment Preparation

Please read through this assessment thoroughly before beginning any tasks. Ask your assessor for

clarification if you have any questions at all.

When you have read and understood this unit’s assessment tasks, print out the Student Assessment

Agreement. Fill it out, sign it, and hand it to your assessor, who will countersign it and then keep it on file.

Keep a copy of all of your work, as the work submitted to your assessor will not be returned to you.

Assessment appeals

If you do not agree with an assessment decision, you can make an assessment appeal as per your Alpha

Institute (Australia’s) assessment appeals process.

Students have the right to appeal the outcome of assessment decisions if they feel they have been dealt

with unfairly or have other appropriate grounds for an appeal.

Naming electronic documents

Students are directed to name documents logically.

Each should include:

Course identification code

Assessment Task number

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Document title (if appropriate)

Student name

Date it was created

For example, BSBFIM501 AT2 Revised Marketing Budget Joan Smith 20/04/18

Additional Resources

The following resources have been added to appendix.

Assessment Task 2

Marketing Budget Template

Finance Policy and Procedures

Assessment Task 3

Marketing Expenditure

Assessment Task 4

Profit and Loss Account

Assessment Task 5

Aged Debtors Report

4

Student name

Date it was created

For example, BSBFIM501 AT2 Revised Marketing Budget Joan Smith 20/04/18

Additional Resources

The following resources have been added to appendix.

Assessment Task 2

Marketing Budget Template

Finance Policy and Procedures

Assessment Task 3

Marketing Expenditure

Assessment Task 4

Profit and Loss Account

Assessment Task 5

Aged Debtors Report

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3. Assessment Instructions

Each assessment task in this booklet consists of the following:

Assessment Task Cover Sheet

This must be filled out, signed and submitted together with your assessment responses.

If you are submitting hardcopy, the Cover Sheet should be the first page of each Assessment’s submission.

If you are submitting electronically, print out the cover sheet, fill it out and sign it, then scan this and submit

the file.

The Assessment Cover Sheet will be returned to you with the outcome of the assessment, which will be

satisfactory (S) or unsatisfactory (U). If your work has been assessed as being not satisfactory, your

assessor will include written feedback in the Assessment Task Cover Sheet giving reasons why. Your

assessor will also discuss this verbally with you and provide advice on re-assessment opportunities as per

your Alpha Institute (Australia’s) re-assessment policy.

Depending on the task, this may include

resubmitting incorrect answers to questions (such as short answer questions and case studies)

resubmitting part or all of a project, depending on how the error impacts on the total outcome of the task

redoing a role play after being provided with appropriate feedback about your performance

being observed a second (or third time) undertaking any tasks/activities that were not satisfactorily

completed the first time, after being provided with appropriate feedback.

Assessment Task Information

This gives you:

a summary of the assessment task

information on the resources to be used

submission requirements

re-submission opportunities if required

Assessment Task Instructions

These give questions to answer or tasks which are to be completed.

Your answers need to be typed up using software as indicated in the Assessment Task Instructions.

Copy and paste each task’s instructions into a new document and use this as the basis for your assessment

task submission. Include this document’s header and footer.

If you are submitting electronically, give the document a file name that includes the unit identification

number, the task number, your name and the date.

Checklist

This will be used by your assessor to mark your assessment. Read through this as part of your preparation

before beginning the assessment task. It will give you a good idea of what your assessor will be looking for

when marking your responses.

5

Each assessment task in this booklet consists of the following:

Assessment Task Cover Sheet

This must be filled out, signed and submitted together with your assessment responses.

If you are submitting hardcopy, the Cover Sheet should be the first page of each Assessment’s submission.

If you are submitting electronically, print out the cover sheet, fill it out and sign it, then scan this and submit

the file.

The Assessment Cover Sheet will be returned to you with the outcome of the assessment, which will be

satisfactory (S) or unsatisfactory (U). If your work has been assessed as being not satisfactory, your

assessor will include written feedback in the Assessment Task Cover Sheet giving reasons why. Your

assessor will also discuss this verbally with you and provide advice on re-assessment opportunities as per

your Alpha Institute (Australia’s) re-assessment policy.

Depending on the task, this may include

resubmitting incorrect answers to questions (such as short answer questions and case studies)

resubmitting part or all of a project, depending on how the error impacts on the total outcome of the task

redoing a role play after being provided with appropriate feedback about your performance

being observed a second (or third time) undertaking any tasks/activities that were not satisfactorily

completed the first time, after being provided with appropriate feedback.

Assessment Task Information

This gives you:

a summary of the assessment task

information on the resources to be used

submission requirements

re-submission opportunities if required

Assessment Task Instructions

These give questions to answer or tasks which are to be completed.

Your answers need to be typed up using software as indicated in the Assessment Task Instructions.

Copy and paste each task’s instructions into a new document and use this as the basis for your assessment

task submission. Include this document’s header and footer.

If you are submitting electronically, give the document a file name that includes the unit identification

number, the task number, your name and the date.

Checklist

This will be used by your assessor to mark your assessment. Read through this as part of your preparation

before beginning the assessment task. It will give you a good idea of what your assessor will be looking for

when marking your responses.

5

4. Assessment Task 1: Written Questions

Task summary

You need to answer all of the written questions correctly.

Your answers must be word processed.

Required

Access to learning materials

Computer and Microsoft Office

Access to the internet

Timing

Your assessor will advise you of the due date of this assessment.

Submit

Answers to all questions

Assessment criteria

All questions must be answered correctly in order for a student to be assessed as having completed the

task satisfactorily.

Re-submission opportunities

Students will be provided feedback on their performance by their Assessor. The feedback will indicate if you

have satisfactorily addressed the requirements of each part of this task.

If any parts of the task are not satisfactorily completed your assessor will explain why and provide you

written feedback along with guidance on what you must undertake to demonstrate satisfactory performance.

Re-assessment attempt(s) will be arranged at a later time and date.

Students have the right to appeal the outcome of assessment decisions if they feel they have been dealt

with unfairly or have other appropriate grounds for an appeal.

Students are encouraged to consult with their assessor prior to attempting this task if they do not understand

any part of this task or if they have any learning issues or needs that may hinder them when attempting any

part of the assessment.

6

Task summary

You need to answer all of the written questions correctly.

Your answers must be word processed.

Required

Access to learning materials

Computer and Microsoft Office

Access to the internet

Timing

Your assessor will advise you of the due date of this assessment.

Submit

Answers to all questions

Assessment criteria

All questions must be answered correctly in order for a student to be assessed as having completed the

task satisfactorily.

Re-submission opportunities

Students will be provided feedback on their performance by their Assessor. The feedback will indicate if you

have satisfactorily addressed the requirements of each part of this task.

If any parts of the task are not satisfactorily completed your assessor will explain why and provide you

written feedback along with guidance on what you must undertake to demonstrate satisfactory performance.

Re-assessment attempt(s) will be arranged at a later time and date.

Students have the right to appeal the outcome of assessment decisions if they feel they have been dealt

with unfairly or have other appropriate grounds for an appeal.

Students are encouraged to consult with their assessor prior to attempting this task if they do not understand

any part of this task or if they have any learning issues or needs that may hinder them when attempting any

part of the assessment.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Written answer question guidance

The following written questions use a range of “instructional words” such as “identify” or “explain”, which tell

you how you should answer the question. Use the definitions below to assist you to provide the type of

response expected.

Note that the following guidance is the minimum level of response required.

Analyse – when a question asks you to analyse something, you should do so in in detail, and identify

important points and key features. Generally, you are expected to write a response one or two paragraphs

long.

Compare – when a question asks you to compare something, you will need to show how two or more things

are similar, ensuring that you also indicate the relevance of the consequences. Generally, you are expected

to write a response one or two paragraphs long.

Contrast – when a question asks you to contrast something, you will need to show how two or more things

are different, ensuring you indicate the relevance or the consequences. Generally, you are expected to write

a response one or two paragraphs long.

Discuss – when a question asks you to discuss something, you are required to point out important issues or

features, and express some form of critical judgement. Generally, you are expected to write a response one

or two paragraphs long.

Describe – when a question asks you to describe something, you should state the most noticeable qualities

or features. Generally, you are expected to write a response two or three sentences long.

Evaluate – when a question asks you to evaluate something, you should do so putting forward arguments

for and against something. Generally, you are expected to write a response one or two paragraphs long.

Examine – when a question asks you to examine something, this is similar to “analyse”, where you should

provide a detailed response with key points and features and provide critical analysis. Generally, you are

expected to write a response one or two paragraphs long.

Explain – when a question asks you to explain something, you should make clear how or why something

happened or the way it is. Generally, you are expected to write a response two or three sentences long.

Identify – when a question asks you to identify something, this means that you are asked to briefly describe

the required information. Generally, you are expected to write a response two or three sentences long.

List – when a question asks you to list something, this means that you are asked to briefly state information

in a list format.

Outline – when a question asks you to outline something, this means giving only the main points, Generally,

you are expected to write a response a few sentences long.

Summarise – when a question asks you to summarise something, this means (like “outline”) only giving the

main points. Generally, you are expected to write a response a few sentences long.

5. Assessment Task 1 Instructions

Provide answers to all of the questions below:

7

The following written questions use a range of “instructional words” such as “identify” or “explain”, which tell

you how you should answer the question. Use the definitions below to assist you to provide the type of

response expected.

Note that the following guidance is the minimum level of response required.

Analyse – when a question asks you to analyse something, you should do so in in detail, and identify

important points and key features. Generally, you are expected to write a response one or two paragraphs

long.

Compare – when a question asks you to compare something, you will need to show how two or more things

are similar, ensuring that you also indicate the relevance of the consequences. Generally, you are expected

to write a response one or two paragraphs long.

Contrast – when a question asks you to contrast something, you will need to show how two or more things

are different, ensuring you indicate the relevance or the consequences. Generally, you are expected to write

a response one or two paragraphs long.

Discuss – when a question asks you to discuss something, you are required to point out important issues or

features, and express some form of critical judgement. Generally, you are expected to write a response one

or two paragraphs long.

Describe – when a question asks you to describe something, you should state the most noticeable qualities

or features. Generally, you are expected to write a response two or three sentences long.

Evaluate – when a question asks you to evaluate something, you should do so putting forward arguments

for and against something. Generally, you are expected to write a response one or two paragraphs long.

Examine – when a question asks you to examine something, this is similar to “analyse”, where you should

provide a detailed response with key points and features and provide critical analysis. Generally, you are

expected to write a response one or two paragraphs long.

Explain – when a question asks you to explain something, you should make clear how or why something

happened or the way it is. Generally, you are expected to write a response two or three sentences long.

Identify – when a question asks you to identify something, this means that you are asked to briefly describe

the required information. Generally, you are expected to write a response two or three sentences long.

List – when a question asks you to list something, this means that you are asked to briefly state information

in a list format.

Outline – when a question asks you to outline something, this means giving only the main points, Generally,

you are expected to write a response a few sentences long.

Summarise – when a question asks you to summarise something, this means (like “outline”) only giving the

main points. Generally, you are expected to write a response a few sentences long.

5. Assessment Task 1 Instructions

Provide answers to all of the questions below:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. Explain the basic principle of double entry bookkeeping.

The basic principle reflects that transactions are recorded with both aspects that is debit and credit. In other

words for every entry there is a debit and credit effect.

2. Describe the principle of cash accounting and one advantage and one disadvantage of this method

of accounting.

It is the method in which the payment and the receipts are been recorded when they are actually been paid

and received.

Advantage: Cash accounting method is counted as simplest method where only cash transactions

is been recorded.

Disadvantage: Chances of discrepancies are more as only cash related transactions are entered

so business can get it involved in some unfair practices.

3. Describe the principle of accrual accounting and one advantage and one disadvantage of cash

accounting

It is the concept that is to be recorded in period within which it actually occurs instead of the period within

which the cash flows regarding it occurs.

Advantages: This method takes into consideration both cash as well as credit transaction which in

turn gives a clear picture of the company's records.

Disadvantage: It requires more and more estimation and judgement as compared to cash basis.

4. Explain the two accounting principles on which the calculation and reporting of deprecation is

based.

Cost principle- It refers to the principle where amount of depreciation expense that is reported on

P&L and an asset amount on balance sheet must be on the basis of historical cost that is original

cost.

Matching principle- This principle states that cost of asset allocated in terms of depreciation

expense over useful life of asset. This means that asset's cost must match with revenues earned.

5. Identify and explain three key features of A New Tax System (GST) Act 1999.

Dual GST

computing GST based on the method of invoice credit

Uniform process for collecting GST

6. Identify and then explain the four main taxation and superannuation obligations for a business.

Briefly discuss each obligation.

Withholding tax from the report and the wages

Paying super, at least on quarterly basis for the eligible employees

Reporting and paying the fringe benefits taxes

FBT obligation

7. According to GST legislation, list four items that do not attract GST.

Dairy products

vegetables

coffee

Tea

8

The basic principle reflects that transactions are recorded with both aspects that is debit and credit. In other

words for every entry there is a debit and credit effect.

2. Describe the principle of cash accounting and one advantage and one disadvantage of this method

of accounting.

It is the method in which the payment and the receipts are been recorded when they are actually been paid

and received.

Advantage: Cash accounting method is counted as simplest method where only cash transactions

is been recorded.

Disadvantage: Chances of discrepancies are more as only cash related transactions are entered

so business can get it involved in some unfair practices.

3. Describe the principle of accrual accounting and one advantage and one disadvantage of cash

accounting

It is the concept that is to be recorded in period within which it actually occurs instead of the period within

which the cash flows regarding it occurs.

Advantages: This method takes into consideration both cash as well as credit transaction which in

turn gives a clear picture of the company's records.

Disadvantage: It requires more and more estimation and judgement as compared to cash basis.

4. Explain the two accounting principles on which the calculation and reporting of deprecation is

based.

Cost principle- It refers to the principle where amount of depreciation expense that is reported on

P&L and an asset amount on balance sheet must be on the basis of historical cost that is original

cost.

Matching principle- This principle states that cost of asset allocated in terms of depreciation

expense over useful life of asset. This means that asset's cost must match with revenues earned.

5. Identify and explain three key features of A New Tax System (GST) Act 1999.

Dual GST

computing GST based on the method of invoice credit

Uniform process for collecting GST

6. Identify and then explain the four main taxation and superannuation obligations for a business.

Briefly discuss each obligation.

Withholding tax from the report and the wages

Paying super, at least on quarterly basis for the eligible employees

Reporting and paying the fringe benefits taxes

FBT obligation

7. According to GST legislation, list four items that do not attract GST.

Dairy products

vegetables

coffee

Tea

8

8. Explain the process by which a business reports GST to the Australian tax office.

Using the default simpler BAS

using full reporting technique

By making use of GST instalment method

9. What is the penalty rate to be applied if a supplier does not provide an ABN?

In this case he has to pay for the highest tax rate as the penalty payment.

10. A non-profit organisation needs to register for GST after it has a turnover of more than how much?

Until and unless their projected annual turnover exceeds AUD 150000 or greater than this amount excluding

the GST.

11. List the key information that must be included on a tax invoice for sales of $1,000 or more.

Tax invoice needs to include at least 7 pieces of an information that is to be valid. For tax invoice in respect

of sales amounting to $ 1000 or more, it is important to shows the identity of buyer with its ABN.

12. Identify and explain three types of financial statements and their purpose.

Profit and loss statement – It is the report that stores information relating to all kinds of income

and the expenditures of an enterprise. The main purpose of framing this statement is evaluate

financial performance of the firm.

Balance sheet- It refers to the statement that is considered as the final output for all final reports

and records for assets and liabilities of the company. The major purpose of this report is analysing

financial position of the company.

Cash flow statement- Under this statement all the cash transactions are shown in business. In

order to ascertain cash position, this statement is counted as most suitable.

13. Describe the type of entity that is required to have financial reports audited.

All the companies other than the small proprietary firms, registered scheme, disclosing enterprise must have

to audit its final reports.

14. Explain the purpose of a financial audit and auditor’s report.

The aim of auditors report is documenting reasonable assurance that the financial statement of the company

remains error free. Along with the balance sheet, P&L, Directors report and an auditors report make up as

the part for the statutory accounts of the company.

15. Describe why companies may choose to develop budgets.

By creating budget, manager can hold an organisation accountable relating to its expenses, cost etc. It is

been served as the measurement tool which helps in visualising enough cash in operating the growth.

16. Explain the main steps in the budgeting process.

Setting goals

Identifying the income and the expenses

separating the needs and the wants

Designing the budget

Putting the plan into an action

Seasonal expenses

Looking ahead

9

Using the default simpler BAS

using full reporting technique

By making use of GST instalment method

9. What is the penalty rate to be applied if a supplier does not provide an ABN?

In this case he has to pay for the highest tax rate as the penalty payment.

10. A non-profit organisation needs to register for GST after it has a turnover of more than how much?

Until and unless their projected annual turnover exceeds AUD 150000 or greater than this amount excluding

the GST.

11. List the key information that must be included on a tax invoice for sales of $1,000 or more.

Tax invoice needs to include at least 7 pieces of an information that is to be valid. For tax invoice in respect

of sales amounting to $ 1000 or more, it is important to shows the identity of buyer with its ABN.

12. Identify and explain three types of financial statements and their purpose.

Profit and loss statement – It is the report that stores information relating to all kinds of income

and the expenditures of an enterprise. The main purpose of framing this statement is evaluate

financial performance of the firm.

Balance sheet- It refers to the statement that is considered as the final output for all final reports

and records for assets and liabilities of the company. The major purpose of this report is analysing

financial position of the company.

Cash flow statement- Under this statement all the cash transactions are shown in business. In

order to ascertain cash position, this statement is counted as most suitable.

13. Describe the type of entity that is required to have financial reports audited.

All the companies other than the small proprietary firms, registered scheme, disclosing enterprise must have

to audit its final reports.

14. Explain the purpose of a financial audit and auditor’s report.

The aim of auditors report is documenting reasonable assurance that the financial statement of the company

remains error free. Along with the balance sheet, P&L, Directors report and an auditors report make up as

the part for the statutory accounts of the company.

15. Describe why companies may choose to develop budgets.

By creating budget, manager can hold an organisation accountable relating to its expenses, cost etc. It is

been served as the measurement tool which helps in visualising enough cash in operating the growth.

16. Explain the main steps in the budgeting process.

Setting goals

Identifying the income and the expenses

separating the needs and the wants

Designing the budget

Putting the plan into an action

Seasonal expenses

Looking ahead

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

17. List 5 ways to improve cash inflow and give examples.

The main five ways that could be adopted for improving the cash flow are as follows-

Reevaluating pricing of the product

Replacing inventory and an old equipment

Re-negotiating the long term contracts

Developing incentives for the early payments and the penalties for the delayed payment

Improving marketing

18. Explain the use of electronic spreadsheets in developing budgets and give two of their key features.

Use of an electronic spreadsheets means that contains automatic formulas with graphs and the charts so

that it becomes easy in producing duplicates with the electronic spreadsheets. It helps in enhancing

accuracy, speed and an efficiency in the budget.

19. Explain three key principles relating to the management of a chart of accounts.

The 3 main principles for charting the account are as follows-

Debiting the receiver, crediting the giver

Debit what comes inside and credit what goes outside

Debiting all the expenses and the losses and crediting all the income and the gains

20. Explain the purpose of a profit and loss statement and give two of its key features.

The purpose of P&L account is to facilitate the financial earnings performance of an enterprise over the

particular time period.

The features are as follows-

It accounts for recording income and the expenses occurred from the business activities.

It provides for computation of the profits earned by the firm.

10

The main five ways that could be adopted for improving the cash flow are as follows-

Reevaluating pricing of the product

Replacing inventory and an old equipment

Re-negotiating the long term contracts

Developing incentives for the early payments and the penalties for the delayed payment

Improving marketing

18. Explain the use of electronic spreadsheets in developing budgets and give two of their key features.

Use of an electronic spreadsheets means that contains automatic formulas with graphs and the charts so

that it becomes easy in producing duplicates with the electronic spreadsheets. It helps in enhancing

accuracy, speed and an efficiency in the budget.

19. Explain three key principles relating to the management of a chart of accounts.

The 3 main principles for charting the account are as follows-

Debiting the receiver, crediting the giver

Debit what comes inside and credit what goes outside

Debiting all the expenses and the losses and crediting all the income and the gains

20. Explain the purpose of a profit and loss statement and give two of its key features.

The purpose of P&L account is to facilitate the financial earnings performance of an enterprise over the

particular time period.

The features are as follows-

It accounts for recording income and the expenses occurred from the business activities.

It provides for computation of the profits earned by the firm.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6. Assessment Task 1 Checklist

11

11

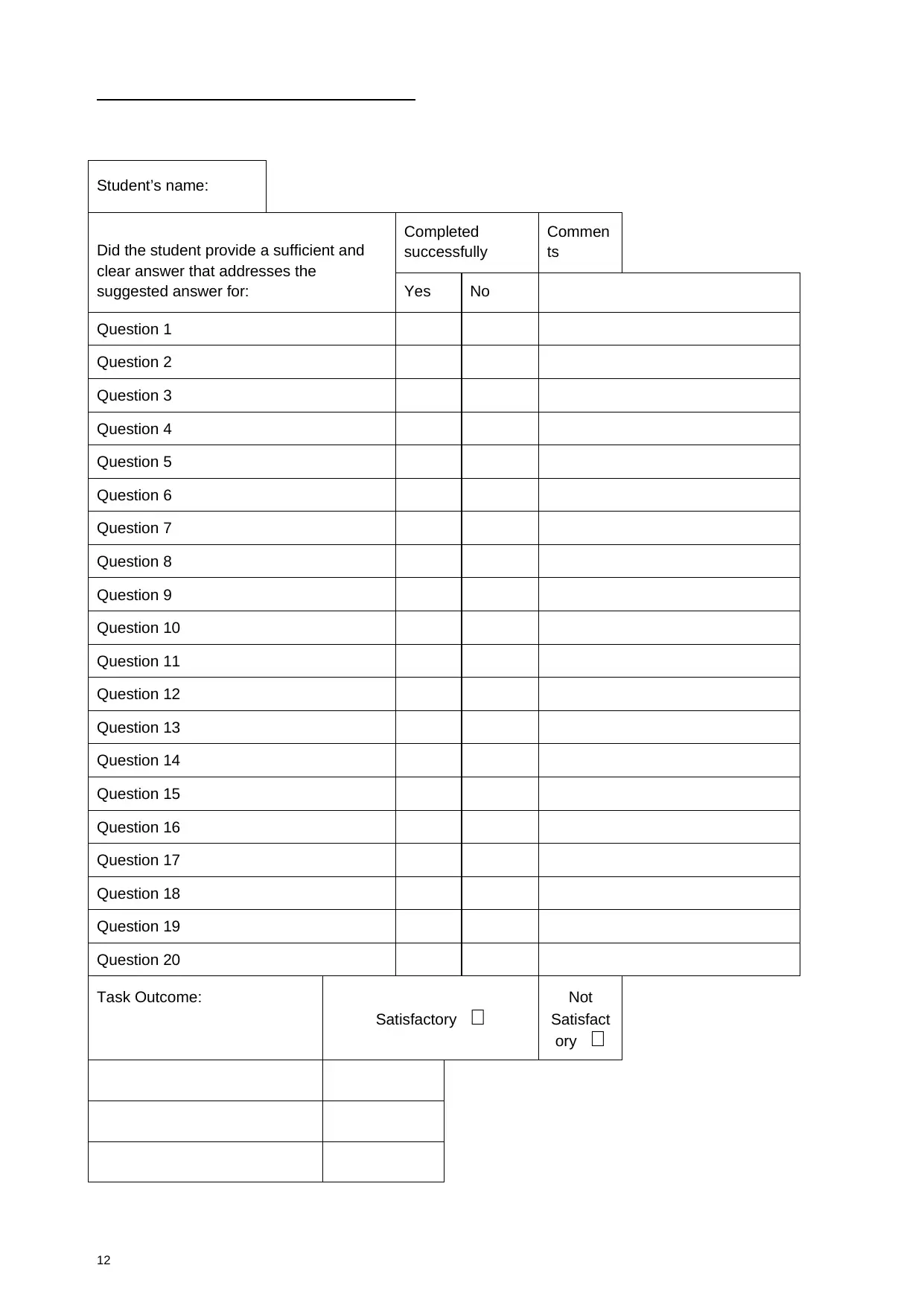

Student’s name:

Did the student provide a sufficient and

clear answer that addresses the

suggested answer for:

Completed

successfully

Commen

ts

Yes No

Question 1

Question 2

Question 3

Question 4

Question 5

Question 6

Question 7

Question 8

Question 9

Question 10

Question 11

Question 12

Question 13

Question 14

Question 15

Question 16

Question 17

Question 18

Question 19

Question 20

Task Outcome:

Satisfactory Not

Satisfact

ory

12

Did the student provide a sufficient and

clear answer that addresses the

suggested answer for:

Completed

successfully

Commen

ts

Yes No

Question 1

Question 2

Question 3

Question 4

Question 5

Question 6

Question 7

Question 8

Question 9

Question 10

Question 11

Question 12

Question 13

Question 14

Question 15

Question 16

Question 17

Question 18

Question 19

Question 20

Task Outcome:

Satisfactory Not

Satisfact

ory

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 35

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.