BTEC Accounting Principles: Financial Statements and Budgetary Control

VerifiedAdded on 2023/06/07

|17

|5508

|203

Report

AI Summary

This report delves into core accounting principles essential for business success, emphasizing recording, classifying, summarizing, and interpreting financial data for internal and external stakeholders. It highlights the scope and purpose of accounting, including transaction recording, income statement preparation, balance sheet analysis, and cash flow statement construction. The report also examines ethical considerations in accounting, emphasizing independence, objectivity, integrity, confidentiality, professional competence, and behavior. Furthermore, it explores the preparation of financial statements, ratio analysis, and the creation of a 12-month cash budget, discussing the importance and limitations of budgeting and offering solutions for budgetary control. The analysis provides a comprehensive overview of accounting functions and their impact on decision-making and business performance. Desklib provides students with access to past papers and solved assignments to aid in their studies.

ACCOUNTING

PRINCIPLES

PRINCIPLES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

PART-1 ...........................................................................................................................................3

Scope and purpose of accounting-based.....................................................................................3

Ethical accounting function.........................................................................................................6

PART-2............................................................................................................................................8

Preparation of income statement, balance sheet and ratio analyses ...........................................8

PART-3..........................................................................................................................................10

Prepare the cash budget of 12 months ......................................................................................10

Importance and limitations of budget in a company................................................................11

Solutions used in budgetary control .........................................................................................14

CONCLUSION.........................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

PART-1 ...........................................................................................................................................3

Scope and purpose of accounting-based.....................................................................................3

Ethical accounting function.........................................................................................................6

PART-2............................................................................................................................................8

Preparation of income statement, balance sheet and ratio analyses ...........................................8

PART-3..........................................................................................................................................10

Prepare the cash budget of 12 months ......................................................................................10

Importance and limitations of budget in a company................................................................11

Solutions used in budgetary control .........................................................................................14

CONCLUSION.........................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

This report talk about the accounting concept that is most important for every business

for accomplishing the targets in an optimised manner. Accounting is the process of recording,

assorting, summarising and interpreting the financial data to the internal and external users. It

helps to appraise the execution of the company. This accounting information is utilized by the

investors for investment purpose. This data is used by the government, creditors, banks and

financial institutions. The prime purpose of the accounting is to identify and record the

transactions, gather the financial information and to check the findings of the business. Further

this report analyses the budget that how budgetary tool is essential for the organisation. This

reports includes all the financial instruments like financial statements, types of budget and ratio

analysis. Company has done deep research on the benefits or limitations of the budget. Company

has learned the budgetary solution techniques for resolving the problem. It helps to take

economically feasible conclusions (Aggarwal, K., 2022).

MAIN BODY

PART-1

Scope and purpose of accounting-based

Accounting consists the recording, summarizing, recording, and analysing process that

helps in financial transaction in the organization. The accounting core function is to evaluate,

report and compile the accounting data or information of organization performance, financial

position of the organization as well as cash flow of the company. This data of financial assists to

decision making regarding various management activities of business such as investment,

budgeting, lending the money and so on.

Record transactions: Holding an exact, effective and organized and complete record of

all the accounting transactions in the organisation, it is known as the first and core role of the

book keeping because all over accounting system is based on the records. It is the recoding about

all the financial information of the business. This stage is known as bookkeeping. The

transactions are recorded on the day-to-day basis. It is the low level work in the organisation and

is clerical in nature (Alanzi, and Alfraih, 2018).

Income statements: The main motive of this accounting is to furnish efficient, certain

and prompt accounting data or information. This statement assists to provide the information that

This report talk about the accounting concept that is most important for every business

for accomplishing the targets in an optimised manner. Accounting is the process of recording,

assorting, summarising and interpreting the financial data to the internal and external users. It

helps to appraise the execution of the company. This accounting information is utilized by the

investors for investment purpose. This data is used by the government, creditors, banks and

financial institutions. The prime purpose of the accounting is to identify and record the

transactions, gather the financial information and to check the findings of the business. Further

this report analyses the budget that how budgetary tool is essential for the organisation. This

reports includes all the financial instruments like financial statements, types of budget and ratio

analysis. Company has done deep research on the benefits or limitations of the budget. Company

has learned the budgetary solution techniques for resolving the problem. It helps to take

economically feasible conclusions (Aggarwal, K., 2022).

MAIN BODY

PART-1

Scope and purpose of accounting-based

Accounting consists the recording, summarizing, recording, and analysing process that

helps in financial transaction in the organization. The accounting core function is to evaluate,

report and compile the accounting data or information of organization performance, financial

position of the organization as well as cash flow of the company. This data of financial assists to

decision making regarding various management activities of business such as investment,

budgeting, lending the money and so on.

Record transactions: Holding an exact, effective and organized and complete record of

all the accounting transactions in the organisation, it is known as the first and core role of the

book keeping because all over accounting system is based on the records. It is the recoding about

all the financial information of the business. This stage is known as bookkeeping. The

transactions are recorded on the day-to-day basis. It is the low level work in the organisation and

is clerical in nature (Alanzi, and Alfraih, 2018).

Income statements: The main motive of this accounting is to furnish efficient, certain

and prompt accounting data or information. This statement assists to provide the information that

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

is related to the outcome or performance of the business. In case of the net loss and income, it

analyse the net situation or position. The statement of income helps to matches the expenditure

and revenue. It has been made for a certain period for the purpose of gather the information

regarding performance of the business. In this company compute the gross profit or net profit to

know the profitability of the business.

Balance sheet: It helps to evaluate the financial position of the business. It has been

divided into two parts or section that are assets and liabilities. Assets are shown at the right side

of the statements and liabilities has been shown at the other side of the statement that is left side.

It is helpful to forecast the borrowings, lending money for the future and analyse that how the

cash flow and the future revenue divided or distributed into the business with interest rate. It

presents the performance of the structure that are going and success to arise finance in future. It

is the statements which depicts the position of the owners equity and debt. It is prepared by every

form of organisation whether it is company, partnership, sole proprietorship or cooperative

society (Bruno, and Lapsley, 2018.) .

Cash flow statements: It aids to summarize and evaluate the cash amount and cash

equivalents. It helps to measure how effectively the business maintain the cash position. It mean

how they generate the cash for do payments of the funds for the activities of operational and

debt. This statements consist three elements that are operating, financing and investing activities.

Operating activities includes the transaction from the core business and the principal revenue

producing activities. Financing activities is the capital structure of the company such as issue of

shares and debenture and redemption of preference shares, dividend received, interest paid on

loan and debentures. Investment activity is related to the purchase or disposal of long term

financial assets of the company.

Decision making: The book keeping system helps to the company in decision making

regarding the operational activities of the business. It is helpful for the managers to develop and

evaluate the business plan and policies to enhance the operational activity of the business. This

accounting information helps to evaluate the several option and choose the best profitable option

for the decision making. It helps to disseminate all the financial information to the users of the

financial statements.

Liquidity: Accounting aids the company to determine the business liquidity that are

crucial part at the time of the payment of the financial commitments. The information reduces

analyse the net situation or position. The statement of income helps to matches the expenditure

and revenue. It has been made for a certain period for the purpose of gather the information

regarding performance of the business. In this company compute the gross profit or net profit to

know the profitability of the business.

Balance sheet: It helps to evaluate the financial position of the business. It has been

divided into two parts or section that are assets and liabilities. Assets are shown at the right side

of the statements and liabilities has been shown at the other side of the statement that is left side.

It is helpful to forecast the borrowings, lending money for the future and analyse that how the

cash flow and the future revenue divided or distributed into the business with interest rate. It

presents the performance of the structure that are going and success to arise finance in future. It

is the statements which depicts the position of the owners equity and debt. It is prepared by every

form of organisation whether it is company, partnership, sole proprietorship or cooperative

society (Bruno, and Lapsley, 2018.) .

Cash flow statements: It aids to summarize and evaluate the cash amount and cash

equivalents. It helps to measure how effectively the business maintain the cash position. It mean

how they generate the cash for do payments of the funds for the activities of operational and

debt. This statements consist three elements that are operating, financing and investing activities.

Operating activities includes the transaction from the core business and the principal revenue

producing activities. Financing activities is the capital structure of the company such as issue of

shares and debenture and redemption of preference shares, dividend received, interest paid on

loan and debentures. Investment activity is related to the purchase or disposal of long term

financial assets of the company.

Decision making: The book keeping system helps to the company in decision making

regarding the operational activities of the business. It is helpful for the managers to develop and

evaluate the business plan and policies to enhance the operational activity of the business. This

accounting information helps to evaluate the several option and choose the best profitable option

for the decision making. It helps to disseminate all the financial information to the users of the

financial statements.

Liquidity: Accounting aids the company to determine the business liquidity that are

crucial part at the time of the payment of the financial commitments. The information reduces

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the risk that are related to the bankruptcy through the detection of bottleneck (Bukvareva, and

Sviridova, 2020).

Business performance: The bookkeeping helps the owner of the company to decide the

business performance. financial statements are the core sources of evaluating and measuring the

key indicators of the performance of company.

It determines the past data of the finance to evaluate the reason of bad condition or

situation of the concern and take the appropriate measure of the organization to improve the

performance of the company.

All statements that are discussed above, those are useful for preparation and interrelated

with each other because they presents several aspects of similar transactions. The main function

of the accounting is to analyse the data from each and every statement that helps to give the

information which are separate from each others.

Scope of the company: It refers to changes in the demand of societal and the economy scope of

accounting.

In Business: Accounting is applicable widely in this sector. The main target of each and

every organization is to earn the revenue and achieve the goal of the company in efficient way.

All the financial transactions that are related to the business are reported in the books of the

account that aids to determine the operational activity and financial situation of the company.

Government organization: The business utilize the accounting system for the various

purposes such as evaluating the income and expenditure of the organization. It also helps to

interpret the accounting data that are essential for performing the financial budgets as well as

planning. Accounting is used in the government businesses to monitor the expenses spend on

different departments, to run the several programmes and to record the transactions spend on the

social welfare activities. This also records the revenue received to the government from different

type of direct or indirect taxes (Chahed, 2021).

Individual: The transaction that are related to the finance are also performing with the

help of the human beings. They use many form of accounting to gain their livelihood or financial

information. It includes the every single transaction done by the single person for execute its

business.

Professionals: Each and every profession needs book keeping data or information for the

financing in organisation. All the professions such as doctor, CA, businessman, sports person

Sviridova, 2020).

Business performance: The bookkeeping helps the owner of the company to decide the

business performance. financial statements are the core sources of evaluating and measuring the

key indicators of the performance of company.

It determines the past data of the finance to evaluate the reason of bad condition or

situation of the concern and take the appropriate measure of the organization to improve the

performance of the company.

All statements that are discussed above, those are useful for preparation and interrelated

with each other because they presents several aspects of similar transactions. The main function

of the accounting is to analyse the data from each and every statement that helps to give the

information which are separate from each others.

Scope of the company: It refers to changes in the demand of societal and the economy scope of

accounting.

In Business: Accounting is applicable widely in this sector. The main target of each and

every organization is to earn the revenue and achieve the goal of the company in efficient way.

All the financial transactions that are related to the business are reported in the books of the

account that aids to determine the operational activity and financial situation of the company.

Government organization: The business utilize the accounting system for the various

purposes such as evaluating the income and expenditure of the organization. It also helps to

interpret the accounting data that are essential for performing the financial budgets as well as

planning. Accounting is used in the government businesses to monitor the expenses spend on

different departments, to run the several programmes and to record the transactions spend on the

social welfare activities. This also records the revenue received to the government from different

type of direct or indirect taxes (Chahed, 2021).

Individual: The transaction that are related to the finance are also performing with the

help of the human beings. They use many form of accounting to gain their livelihood or financial

information. It includes the every single transaction done by the single person for execute its

business.

Professionals: Each and every profession needs book keeping data or information for the

financing in organisation. All the professions such as doctor, CA, businessman, sports person

and so on, all have to do manage and holds their bookkeeping information for the purpose of

smoothly function of the business.

Non profit organization: It is set up for society welfare and do not work for the profit

maximisation. Accounting used in everywhere in every sector so the scope of the accounting also

utilized in non profit organization. They report their transactions in subscription form that

provided by the individual or member of the non profit organisation (Edwards, 2019).

Ethical accounting function

Accounting plays a huge role in steering controlling and maintaining the organisation in

right way. Information should be proper and effective. Insufficient accounting information can

occur difficulties, errors in the company to reach the targets. All the decisions that are related to

the business activities such as investing, expanding, pricing are needs good and proper financial

information. All the level of the management needs effective information of accounting in the

business to act in appropriate manner. A business person acts better if they takes appropriate

decisions which are depend on facts and actual figures. Bookkeeping information furnish an

overview of the money flow in the company. These data or information assists in the era of the

budgeting, interpretation uses for both the decision making internally as well as externally.

Assists in investing decision making: These information are recorded on the company's

financial statements such as cash flow, income statements and balance sheet. This data assist to

the investors to evaluate the organization valuation. It also helps in setting up the target of cost

and check that the stock price is reasonable or not.

Effective operational decision: Business can make the appropriate decision with the

help of these information for their operational activities. By evaluating the accounting

information the organization can take decision regarding effectively cost for their day to day

company activities and secure whole organization from the financial organization.

Stakeholders: It comprises the stock that is owned by the owner of the private held

company or publicly traded company evaluate the accounting information to take decision.

These data aids the owner to evaluate the acts or performance of the company. On the other side,

publicly traded organization utilize the accounting data to evaluate the strategic issues such as

leadership, compensation arrangements. The main role of the bookkeeping data in the decision

making is to communicate them regarding the profit and expenses (Evans, 2020).

smoothly function of the business.

Non profit organization: It is set up for society welfare and do not work for the profit

maximisation. Accounting used in everywhere in every sector so the scope of the accounting also

utilized in non profit organization. They report their transactions in subscription form that

provided by the individual or member of the non profit organisation (Edwards, 2019).

Ethical accounting function

Accounting plays a huge role in steering controlling and maintaining the organisation in

right way. Information should be proper and effective. Insufficient accounting information can

occur difficulties, errors in the company to reach the targets. All the decisions that are related to

the business activities such as investing, expanding, pricing are needs good and proper financial

information. All the level of the management needs effective information of accounting in the

business to act in appropriate manner. A business person acts better if they takes appropriate

decisions which are depend on facts and actual figures. Bookkeeping information furnish an

overview of the money flow in the company. These data or information assists in the era of the

budgeting, interpretation uses for both the decision making internally as well as externally.

Assists in investing decision making: These information are recorded on the company's

financial statements such as cash flow, income statements and balance sheet. This data assist to

the investors to evaluate the organization valuation. It also helps in setting up the target of cost

and check that the stock price is reasonable or not.

Effective operational decision: Business can make the appropriate decision with the

help of these information for their operational activities. By evaluating the accounting

information the organization can take decision regarding effectively cost for their day to day

company activities and secure whole organization from the financial organization.

Stakeholders: It comprises the stock that is owned by the owner of the private held

company or publicly traded company evaluate the accounting information to take decision.

These data aids the owner to evaluate the acts or performance of the company. On the other side,

publicly traded organization utilize the accounting data to evaluate the strategic issues such as

leadership, compensation arrangements. The main role of the bookkeeping data in the decision

making is to communicate them regarding the profit and expenses (Evans, 2020).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Independence and objectivity: In the accounting profession, the ethics and

independence plays a important role. An essential element of belief is caused of taking unbiased

decisions and suggestion which are beneficial for the clients. The rest objective and independent,

it is also important to assure that suggestions should not subject to other outside influence. The

professional accountant judgment is adjusted if they give their judgement to other person.

Integrity: It refers to the being straightforward in all organisation and professional

human relationship. Presenting integrity needs accountant who do not subordinate themselves

with the data. It refers to the honesty between the employees and the staffs in the organisation.

Confidentiality: It consists open up the information related to the financial position of

the business and reveal the disposition with the help of the professional accountant without

taking any other permission (Hughes, and Williams, 2018).

Professional competence: The area of accounting is regularly deranged by the several

evolving elements. It needs to developing new accountant skills, competencies in role of

professionals. The accountant professional must keep themselves updated in manner of

technology, legislation, security consideration and so on. It can enhance the skills of accountant

by practice it mean it helps to identify the skill level and not recommending that they have

expertise in the field where they do not. Taking help with the another professionals is a standard

activity that aids to create a network of human beings and generate the respects.

Professional behaviour: Ethics needs bookkeeping professional to obey with laws, rules

and regulations that govern their legal power and their bodies of work. Ignoring actions that

impact negatively on the reputation of the profession is a commitment which an organization

partners and another professions should expect. This professional bodies must play a huge role in

the rules and regulation of their area to assure the quality of the services given by their member.

These bodies are close to the market scenario where the member operate and evaluate that how

the regulation or law might influence the behaviour. They have responsibilities to inform and

work with the help of government in order to public interest to utilize their skills and knowledge

of their field (Khlif, Ahmed, and Alam, 2020).

independence plays a important role. An essential element of belief is caused of taking unbiased

decisions and suggestion which are beneficial for the clients. The rest objective and independent,

it is also important to assure that suggestions should not subject to other outside influence. The

professional accountant judgment is adjusted if they give their judgement to other person.

Integrity: It refers to the being straightforward in all organisation and professional

human relationship. Presenting integrity needs accountant who do not subordinate themselves

with the data. It refers to the honesty between the employees and the staffs in the organisation.

Confidentiality: It consists open up the information related to the financial position of

the business and reveal the disposition with the help of the professional accountant without

taking any other permission (Hughes, and Williams, 2018).

Professional competence: The area of accounting is regularly deranged by the several

evolving elements. It needs to developing new accountant skills, competencies in role of

professionals. The accountant professional must keep themselves updated in manner of

technology, legislation, security consideration and so on. It can enhance the skills of accountant

by practice it mean it helps to identify the skill level and not recommending that they have

expertise in the field where they do not. Taking help with the another professionals is a standard

activity that aids to create a network of human beings and generate the respects.

Professional behaviour: Ethics needs bookkeeping professional to obey with laws, rules

and regulations that govern their legal power and their bodies of work. Ignoring actions that

impact negatively on the reputation of the profession is a commitment which an organization

partners and another professions should expect. This professional bodies must play a huge role in

the rules and regulation of their area to assure the quality of the services given by their member.

These bodies are close to the market scenario where the member operate and evaluate that how

the regulation or law might influence the behaviour. They have responsibilities to inform and

work with the help of government in order to public interest to utilize their skills and knowledge

of their field (Khlif, Ahmed, and Alam, 2020).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

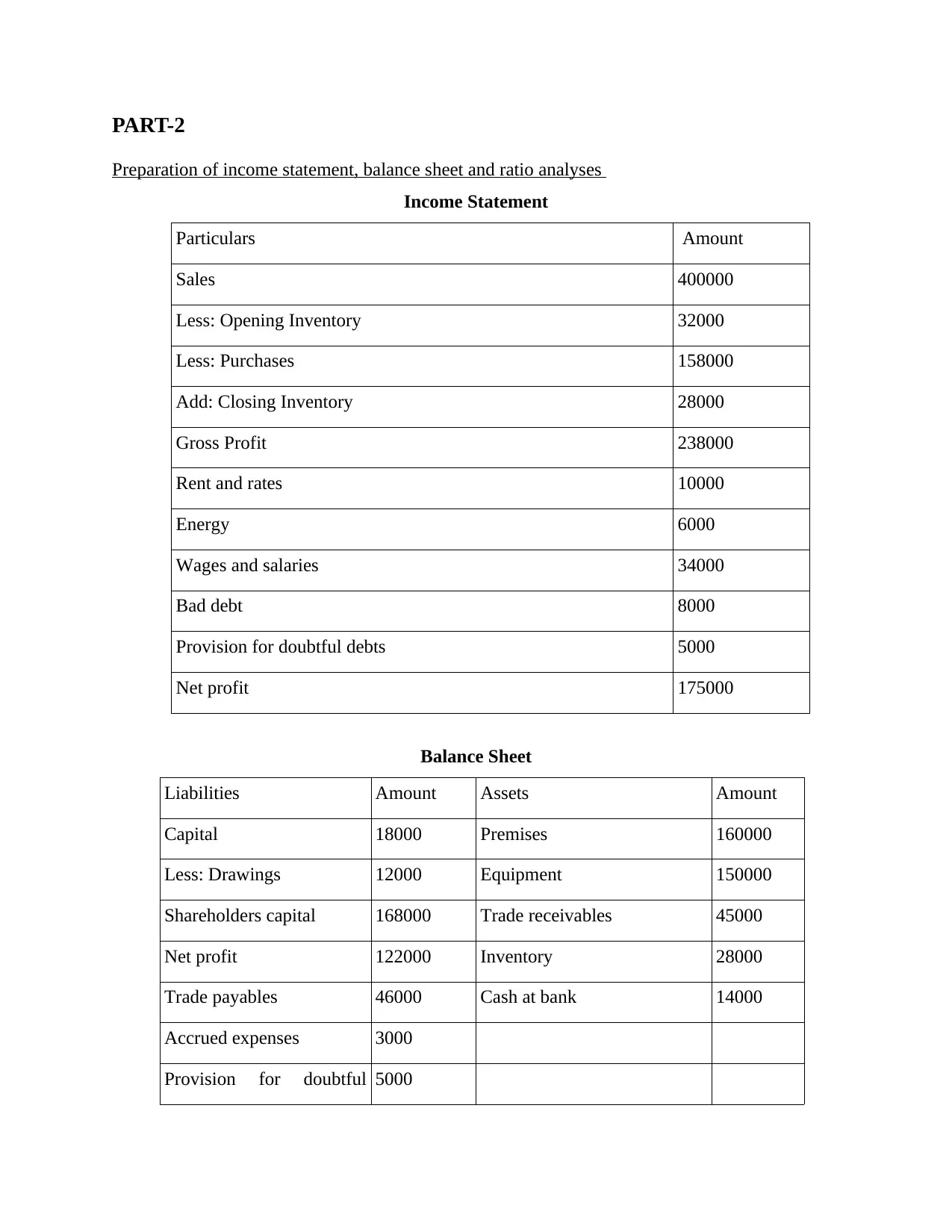

PART-2

Preparation of income statement, balance sheet and ratio analyses

Income Statement

Particulars Amount

Sales 400000

Less: Opening Inventory 32000

Less: Purchases 158000

Add: Closing Inventory 28000

Gross Profit 238000

Rent and rates 10000

Energy 6000

Wages and salaries 34000

Bad debt 8000

Provision for doubtful debts 5000

Net profit 175000

Balance Sheet

Liabilities Amount Assets Amount

Capital 18000 Premises 160000

Less: Drawings 12000 Equipment 150000

Shareholders capital 168000 Trade receivables 45000

Net profit 122000 Inventory 28000

Trade payables 46000 Cash at bank 14000

Accrued expenses 3000

Provision for doubtful 5000

Preparation of income statement, balance sheet and ratio analyses

Income Statement

Particulars Amount

Sales 400000

Less: Opening Inventory 32000

Less: Purchases 158000

Add: Closing Inventory 28000

Gross Profit 238000

Rent and rates 10000

Energy 6000

Wages and salaries 34000

Bad debt 8000

Provision for doubtful debts 5000

Net profit 175000

Balance Sheet

Liabilities Amount Assets Amount

Capital 18000 Premises 160000

Less: Drawings 12000 Equipment 150000

Shareholders capital 168000 Trade receivables 45000

Net profit 122000 Inventory 28000

Trade payables 46000 Cash at bank 14000

Accrued expenses 3000

Provision for doubtful 5000

debts

397000 397000

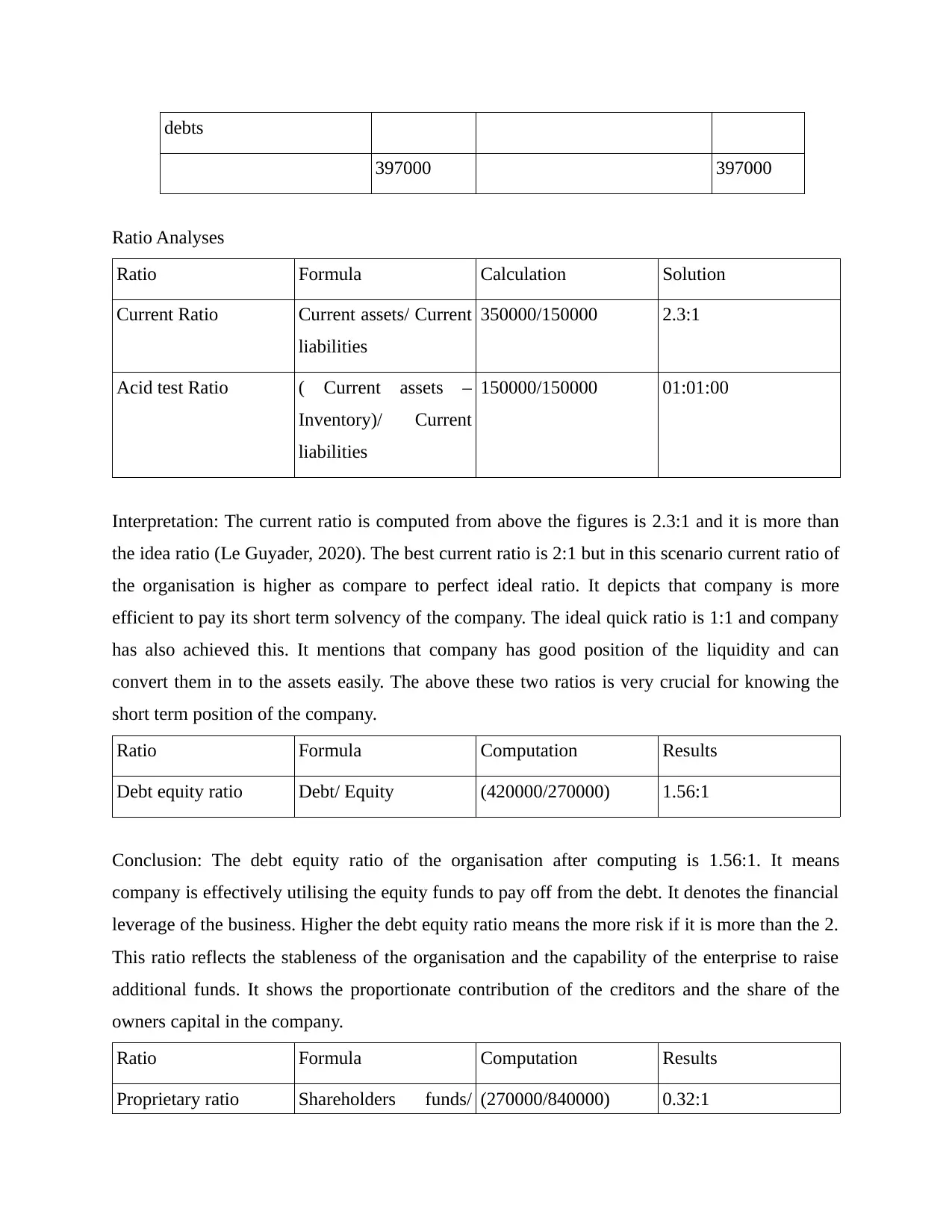

Ratio Analyses

Ratio Formula Calculation Solution

Current Ratio Current assets/ Current

liabilities

350000/150000 2.3:1

Acid test Ratio ( Current assets –

Inventory)/ Current

liabilities

150000/150000 01:01:00

Interpretation: The current ratio is computed from above the figures is 2.3:1 and it is more than

the idea ratio (Le Guyader, 2020). The best current ratio is 2:1 but in this scenario current ratio of

the organisation is higher as compare to perfect ideal ratio. It depicts that company is more

efficient to pay its short term solvency of the company. The ideal quick ratio is 1:1 and company

has also achieved this. It mentions that company has good position of the liquidity and can

convert them in to the assets easily. The above these two ratios is very crucial for knowing the

short term position of the company.

Ratio Formula Computation Results

Debt equity ratio Debt/ Equity (420000/270000) 1.56:1

Conclusion: The debt equity ratio of the organisation after computing is 1.56:1. It means

company is effectively utilising the equity funds to pay off from the debt. It denotes the financial

leverage of the business. Higher the debt equity ratio means the more risk if it is more than the 2.

This ratio reflects the stableness of the organisation and the capability of the enterprise to raise

additional funds. It shows the proportionate contribution of the creditors and the share of the

owners capital in the company.

Ratio Formula Computation Results

Proprietary ratio Shareholders funds/ (270000/840000) 0.32:1

397000 397000

Ratio Analyses

Ratio Formula Calculation Solution

Current Ratio Current assets/ Current

liabilities

350000/150000 2.3:1

Acid test Ratio ( Current assets –

Inventory)/ Current

liabilities

150000/150000 01:01:00

Interpretation: The current ratio is computed from above the figures is 2.3:1 and it is more than

the idea ratio (Le Guyader, 2020). The best current ratio is 2:1 but in this scenario current ratio of

the organisation is higher as compare to perfect ideal ratio. It depicts that company is more

efficient to pay its short term solvency of the company. The ideal quick ratio is 1:1 and company

has also achieved this. It mentions that company has good position of the liquidity and can

convert them in to the assets easily. The above these two ratios is very crucial for knowing the

short term position of the company.

Ratio Formula Computation Results

Debt equity ratio Debt/ Equity (420000/270000) 1.56:1

Conclusion: The debt equity ratio of the organisation after computing is 1.56:1. It means

company is effectively utilising the equity funds to pay off from the debt. It denotes the financial

leverage of the business. Higher the debt equity ratio means the more risk if it is more than the 2.

This ratio reflects the stableness of the organisation and the capability of the enterprise to raise

additional funds. It shows the proportionate contribution of the creditors and the share of the

owners capital in the company.

Ratio Formula Computation Results

Proprietary ratio Shareholders funds/ (270000/840000) 0.32:1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total assets

Interpretation: The proprietary ratio which is calculated from the above shows that the long term

stability of the business is not well and company has to improve its position by increasing the

share capital and to reduce the rely on the non current liabilities. Higher equity ratio indicates

that company has powerful position and provides benefits to the creditors while low equity ratio

shows that creditors is not interested to give finance to this company. In this analysis it denotes

that organisation is mostly depends on the debts for its workings of the business(Oulasvirta,

2019).

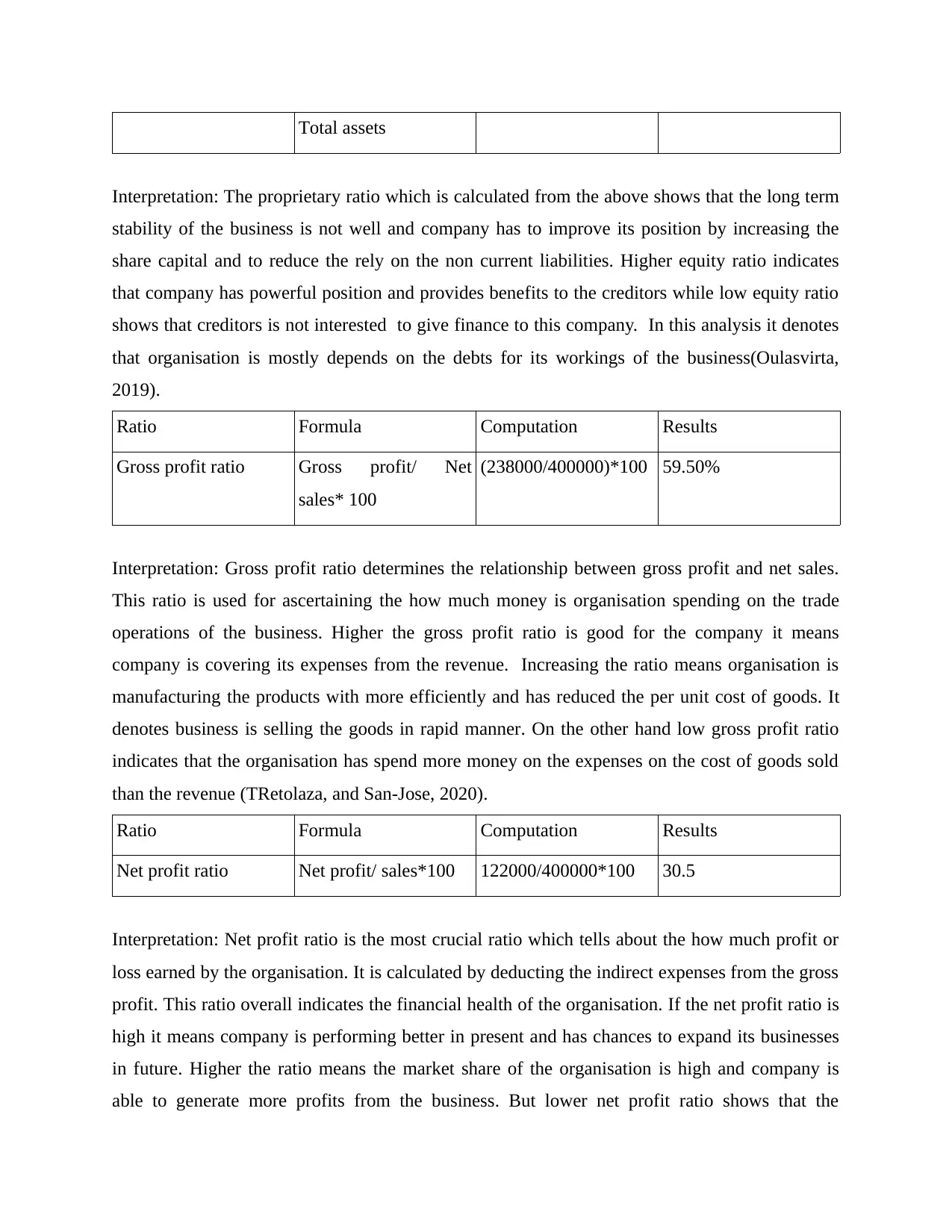

Ratio Formula Computation Results

Gross profit ratio Gross profit/ Net

sales* 100

(238000/400000)*100 59.50%

Interpretation: Gross profit ratio determines the relationship between gross profit and net sales.

This ratio is used for ascertaining the how much money is organisation spending on the trade

operations of the business. Higher the gross profit ratio is good for the company it means

company is covering its expenses from the revenue. Increasing the ratio means organisation is

manufacturing the products with more efficiently and has reduced the per unit cost of goods. It

denotes business is selling the goods in rapid manner. On the other hand low gross profit ratio

indicates that the organisation has spend more money on the expenses on the cost of goods sold

than the revenue (TRetolaza, and San-Jose, 2020).

Ratio Formula Computation Results

Net profit ratio Net profit/ sales*100 122000/400000*100 30.5

Interpretation: Net profit ratio is the most crucial ratio which tells about the how much profit or

loss earned by the organisation. It is calculated by deducting the indirect expenses from the gross

profit. This ratio overall indicates the financial health of the organisation. If the net profit ratio is

high it means company is performing better in present and has chances to expand its businesses

in future. Higher the ratio means the market share of the organisation is high and company is

able to generate more profits from the business. But lower net profit ratio shows that the

Interpretation: The proprietary ratio which is calculated from the above shows that the long term

stability of the business is not well and company has to improve its position by increasing the

share capital and to reduce the rely on the non current liabilities. Higher equity ratio indicates

that company has powerful position and provides benefits to the creditors while low equity ratio

shows that creditors is not interested to give finance to this company. In this analysis it denotes

that organisation is mostly depends on the debts for its workings of the business(Oulasvirta,

2019).

Ratio Formula Computation Results

Gross profit ratio Gross profit/ Net

sales* 100

(238000/400000)*100 59.50%

Interpretation: Gross profit ratio determines the relationship between gross profit and net sales.

This ratio is used for ascertaining the how much money is organisation spending on the trade

operations of the business. Higher the gross profit ratio is good for the company it means

company is covering its expenses from the revenue. Increasing the ratio means organisation is

manufacturing the products with more efficiently and has reduced the per unit cost of goods. It

denotes business is selling the goods in rapid manner. On the other hand low gross profit ratio

indicates that the organisation has spend more money on the expenses on the cost of goods sold

than the revenue (TRetolaza, and San-Jose, 2020).

Ratio Formula Computation Results

Net profit ratio Net profit/ sales*100 122000/400000*100 30.5

Interpretation: Net profit ratio is the most crucial ratio which tells about the how much profit or

loss earned by the organisation. It is calculated by deducting the indirect expenses from the gross

profit. This ratio overall indicates the financial health of the organisation. If the net profit ratio is

high it means company is performing better in present and has chances to expand its businesses

in future. Higher the ratio means the market share of the organisation is high and company is

able to generate more profits from the business. But lower net profit ratio shows that the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company is earning the net loss and which can not be good for the long term survival of the

organisation. It indicates the poor management of the organisation and is using ineffective or

poor price strategies for the product.

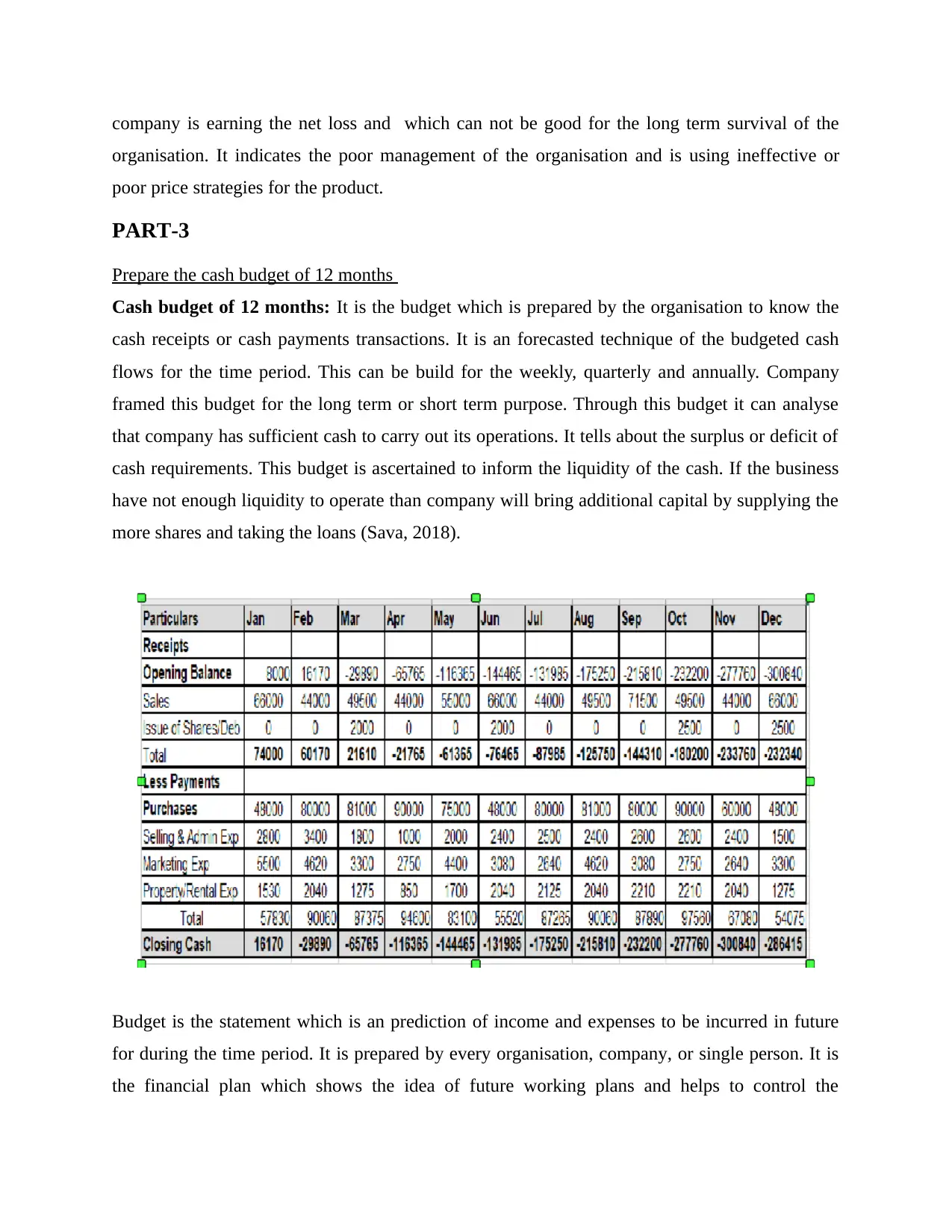

PART-3

Prepare the cash budget of 12 months

Cash budget of 12 months: It is the budget which is prepared by the organisation to know the

cash receipts or cash payments transactions. It is an forecasted technique of the budgeted cash

flows for the time period. This can be build for the weekly, quarterly and annually. Company

framed this budget for the long term or short term purpose. Through this budget it can analyse

that company has sufficient cash to carry out its operations. It tells about the surplus or deficit of

cash requirements. This budget is ascertained to inform the liquidity of the cash. If the business

have not enough liquidity to operate than company will bring additional capital by supplying the

more shares and taking the loans (Sava, 2018).

Budget is the statement which is an prediction of income and expenses to be incurred in future

for during the time period. It is prepared by every organisation, company, or single person. It is

the financial plan which shows the idea of future working plans and helps to control the

organisation. It indicates the poor management of the organisation and is using ineffective or

poor price strategies for the product.

PART-3

Prepare the cash budget of 12 months

Cash budget of 12 months: It is the budget which is prepared by the organisation to know the

cash receipts or cash payments transactions. It is an forecasted technique of the budgeted cash

flows for the time period. This can be build for the weekly, quarterly and annually. Company

framed this budget for the long term or short term purpose. Through this budget it can analyse

that company has sufficient cash to carry out its operations. It tells about the surplus or deficit of

cash requirements. This budget is ascertained to inform the liquidity of the cash. If the business

have not enough liquidity to operate than company will bring additional capital by supplying the

more shares and taking the loans (Sava, 2018).

Budget is the statement which is an prediction of income and expenses to be incurred in future

for during the time period. It is prepared by every organisation, company, or single person. It is

the financial plan which shows the idea of future working plans and helps to control the

expenses. It aids to improve the success of business organisation. Big organisation used the

corporate budget to improve the efficiency of the enterprise. Beside all this budget helps to work

with the systematic plan. It also furnishes the people and the organisation to arrange the funds for

any emergency. Individual makes the personal budget is used for managing the personal finances

for short or long term period (Tohirovich, 2021).

Importance and limitations of budget in a company

It is the estimated financial report of any enterprise. It is prepared for monthly, quarterly, and

annually. It has vital benefit in the planning strategy. It clearly depicts the picture of the

organisation that how much time and resources will be used in the enterprise. Company can

monitor the expenditure by preparing various type of budget like master budget, cost budget,

production budget and sales budget. Master budget is the most important functional budget in the

enterprise. It is the summary of all the types of the budget.

1. It ensures the availability of the resources: The main motive of the any company is to

make sure the resource availability. It ensures the optimum utilisation of all the available

resources. By making plan in beforehand it gives the full fledged idea to analyse which

department needs more resources and where company can mitigate the resources.

Resources are scarce in the country so company has to use these resources by keeping en

eye on the future requirements (Vedpuriswar, 2021).

2. It manages the internal affairs of the company: Budgeting is not the technique which

shows the allocation of expenditure it also tells about how much the revenue can

company generate. Company is able to achieve its target or not. Company utilize the

budgeting method to see the wider view of the organisation and to align the financial

objectives. This can be measured by the ABC analysis. Budgeting tools furnishes to

update the progress of the employees and allocate them the roles and responsibilities.

Monitoring the progress and any differences will permit the company to adjust with the

team and correct the any deficiencies.

3. It aids to prioritize the projects: It helps the businesses organisation to evaluate the viable

projects and ideas. Company consider the viable project by calculating the return on

investment ratio for each project. It gives an overview of the values of the organisation

and how they can impact on the financial goals. It helps the senior management to choose

corporate budget to improve the efficiency of the enterprise. Beside all this budget helps to work

with the systematic plan. It also furnishes the people and the organisation to arrange the funds for

any emergency. Individual makes the personal budget is used for managing the personal finances

for short or long term period (Tohirovich, 2021).

Importance and limitations of budget in a company

It is the estimated financial report of any enterprise. It is prepared for monthly, quarterly, and

annually. It has vital benefit in the planning strategy. It clearly depicts the picture of the

organisation that how much time and resources will be used in the enterprise. Company can

monitor the expenditure by preparing various type of budget like master budget, cost budget,

production budget and sales budget. Master budget is the most important functional budget in the

enterprise. It is the summary of all the types of the budget.

1. It ensures the availability of the resources: The main motive of the any company is to

make sure the resource availability. It ensures the optimum utilisation of all the available

resources. By making plan in beforehand it gives the full fledged idea to analyse which

department needs more resources and where company can mitigate the resources.

Resources are scarce in the country so company has to use these resources by keeping en

eye on the future requirements (Vedpuriswar, 2021).

2. It manages the internal affairs of the company: Budgeting is not the technique which

shows the allocation of expenditure it also tells about how much the revenue can

company generate. Company is able to achieve its target or not. Company utilize the

budgeting method to see the wider view of the organisation and to align the financial

objectives. This can be measured by the ABC analysis. Budgeting tools furnishes to

update the progress of the employees and allocate them the roles and responsibilities.

Monitoring the progress and any differences will permit the company to adjust with the

team and correct the any deficiencies.

3. It aids to prioritize the projects: It helps the businesses organisation to evaluate the viable

projects and ideas. Company consider the viable project by calculating the return on

investment ratio for each project. It gives an overview of the values of the organisation

and how they can impact on the financial goals. It helps the senior management to choose

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.