BTEC Higher National Unit 5 Management Accounting Report: Analysis

VerifiedAdded on 2020/06/05

|17

|4962

|28

Report

AI Summary

This report delves into the realm of management accounting, providing a comprehensive overview of its significance and application within a manufacturing context. It begins by enumerating the core principles of management accounting, including various types such as inventory management, cost accounting, job costing, and price optimization, emphasizing their role in internal decision-making and organizational improvement. The report then explores diverse management accounting reporting methods, including segmental, performance, inventory management, accounts receivables aging, job cost, and operational budget reports, highlighting their utility in assessing performance, controlling costs, and optimizing resource allocation. Furthermore, the report presents detailed computations of costs using both marginal and absorption costing methods, illustrated with example financial data. The report concludes by discussing the merits and demerits of different planning tools and how organizations adapt management accounting systems to solve financial problems. This comprehensive analysis offers valuable insights into the practical application of management accounting principles within a business environment.

UNIT 5 MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

P1 Enumerate management accounting and various types of it.............................................1

P2 Methods used for management accounting reporting.......................................................2

P3 Computation of costs using marginal and absorption costing...........................................3

P4 Merits and demerits of different types of planning tools..................................................3

P5 Organisation adapting management accounting systems to solve financial problems.....3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................4

INTRODUCTION...........................................................................................................................1

P1 Enumerate management accounting and various types of it.............................................1

P2 Methods used for management accounting reporting.......................................................2

P3 Computation of costs using marginal and absorption costing...........................................3

P4 Merits and demerits of different types of planning tools..................................................3

P5 Organisation adapting management accounting systems to solve financial problems.....3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................4

INTRODUCTION

Management accounting is quite useful for organisation as it provides crucial information

to the management to take better and enhanced decisions with much ease. The present report

deals with importance of management accounting information in the manufacturing company.

Various planning tools and techniques are discussed in this report. Moreover, types of

management accounting are also discussed along with importance and essential requirements of

all of them. Absorption and marginal costing is discussed which is helpful in the manufacture

sector. Apart from this, various management accounting reports are also discussed which aids in

making effective decisions by the top management quite effectively.

P1 Enumerate management accounting and various types of management accounting

Management accounting is the branch of accounting which is used for making internal

decisions by the top management so that organisation can become internally strong and perform

well. It is helpful to managers to take viable decisions so that organisation may be benefited in

the best possible way. Various reports are being provided by it which helps management to

initiate control over various business costs and as such, aids in making viable decisions.

Management accounting information is not provided various stakeholders' of the company as it is

restricted only to management for analysing business conditions and then accordingly take

decisions for the betterment of the firm (Otley, 2016). As such, it is much helpful for

management to make business perform better in the market. Various types of management

accounting are listed below-

1. Inventory management system-

Inventory is an integral part of the company engaged in the manufacturing sector so that

production may be carried out with much ease. As such, managing inventory is important to be

done by management so that it does not result into unnecessary spoilage of the scarce resources.

In the same way, overstocking also leads to wastage of stock quite badly. Thus, in order to solve

this issue, inventory management system is prepared and given to management (Tucker and

Lowe, 2014). Afterwards, managers who takes responsibility to ensure optimum utilisation of

inventory makes sure that only required amount of inventory is purchased. This helps to reduce

overall wastage of resources and production is carried out effectively.

1

Management accounting is quite useful for organisation as it provides crucial information

to the management to take better and enhanced decisions with much ease. The present report

deals with importance of management accounting information in the manufacturing company.

Various planning tools and techniques are discussed in this report. Moreover, types of

management accounting are also discussed along with importance and essential requirements of

all of them. Absorption and marginal costing is discussed which is helpful in the manufacture

sector. Apart from this, various management accounting reports are also discussed which aids in

making effective decisions by the top management quite effectively.

P1 Enumerate management accounting and various types of management accounting

Management accounting is the branch of accounting which is used for making internal

decisions by the top management so that organisation can become internally strong and perform

well. It is helpful to managers to take viable decisions so that organisation may be benefited in

the best possible way. Various reports are being provided by it which helps management to

initiate control over various business costs and as such, aids in making viable decisions.

Management accounting information is not provided various stakeholders' of the company as it is

restricted only to management for analysing business conditions and then accordingly take

decisions for the betterment of the firm (Otley, 2016). As such, it is much helpful for

management to make business perform better in the market. Various types of management

accounting are listed below-

1. Inventory management system-

Inventory is an integral part of the company engaged in the manufacturing sector so that

production may be carried out with much ease. As such, managing inventory is important to be

done by management so that it does not result into unnecessary spoilage of the scarce resources.

In the same way, overstocking also leads to wastage of stock quite badly. Thus, in order to solve

this issue, inventory management system is prepared and given to management (Tucker and

Lowe, 2014). Afterwards, managers who takes responsibility to ensure optimum utilisation of

inventory makes sure that only required amount of inventory is purchased. This helps to reduce

overall wastage of resources and production is carried out effectively.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2. Cost accounting-

Cost accounting is another useful part of company as it analyses various costs such as

direct, indirect, variable, fixed and other expenses necessary to carry out production with much

ease. It analyses such costs and as such, records them so that overall control can be ensured quite

effectively. In simple words, it allocates expenditures in that way so that overall profitability is

maximised and costs are reduced. Thus, management takes such decisions by allocating expenses

in effective way so that it may not exceed profits of the firm. As such, cost accounting helps to

take better and effective decisions by the management so that company may flourish and

manufacture products with much ease (Renz and Herman, 2016).

3. Job costing-

Various jobs are performed to carry out the production of commodities in effective way.

As such, costs of each of the jobs are required to be maintained so that costs may not exceed

revenue of the manufacturing firm. To resolve this issue, job costing is being used. It records

expenditures incurred on each of the jobs so that management may be able to keep track on each

of them. It aids to management that which factors are producing more output and on which

company should reduce expenditures so that only efficient jobs can be performed and production

may be achieved with much ease. Generally, manufacturing costs are allocated to batches of

products quite effectively to track them.

4. Price optimisation-

Price optimisation technique is another useful tool for management to take viable

decisions with much ease. It is a mathematical analysis which is used to assess how change in

prices of items and services will impact customers' behaviour. As such, this information is quite

useful for management to analyse and determine how customers' respond to the change in the

prices of commodities of the firm (Fullerton, Kennedy and Widener, 2014). This helps firm to

take effective and relevant decisions so that it can set price of a particular product according to

the customer behaviour. If it does not analyse such aspect, customers' may be driven away by the

rivals. As such, it is important technique of management accounting used by the managers to

take enhanced decisions.

2

Cost accounting is another useful part of company as it analyses various costs such as

direct, indirect, variable, fixed and other expenses necessary to carry out production with much

ease. It analyses such costs and as such, records them so that overall control can be ensured quite

effectively. In simple words, it allocates expenditures in that way so that overall profitability is

maximised and costs are reduced. Thus, management takes such decisions by allocating expenses

in effective way so that it may not exceed profits of the firm. As such, cost accounting helps to

take better and effective decisions by the management so that company may flourish and

manufacture products with much ease (Renz and Herman, 2016).

3. Job costing-

Various jobs are performed to carry out the production of commodities in effective way.

As such, costs of each of the jobs are required to be maintained so that costs may not exceed

revenue of the manufacturing firm. To resolve this issue, job costing is being used. It records

expenditures incurred on each of the jobs so that management may be able to keep track on each

of them. It aids to management that which factors are producing more output and on which

company should reduce expenditures so that only efficient jobs can be performed and production

may be achieved with much ease. Generally, manufacturing costs are allocated to batches of

products quite effectively to track them.

4. Price optimisation-

Price optimisation technique is another useful tool for management to take viable

decisions with much ease. It is a mathematical analysis which is used to assess how change in

prices of items and services will impact customers' behaviour. As such, this information is quite

useful for management to analyse and determine how customers' respond to the change in the

prices of commodities of the firm (Fullerton, Kennedy and Widener, 2014). This helps firm to

take effective and relevant decisions so that it can set price of a particular product according to

the customer behaviour. If it does not analyse such aspect, customers' may be driven away by the

rivals. As such, it is important technique of management accounting used by the managers to

take enhanced decisions.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

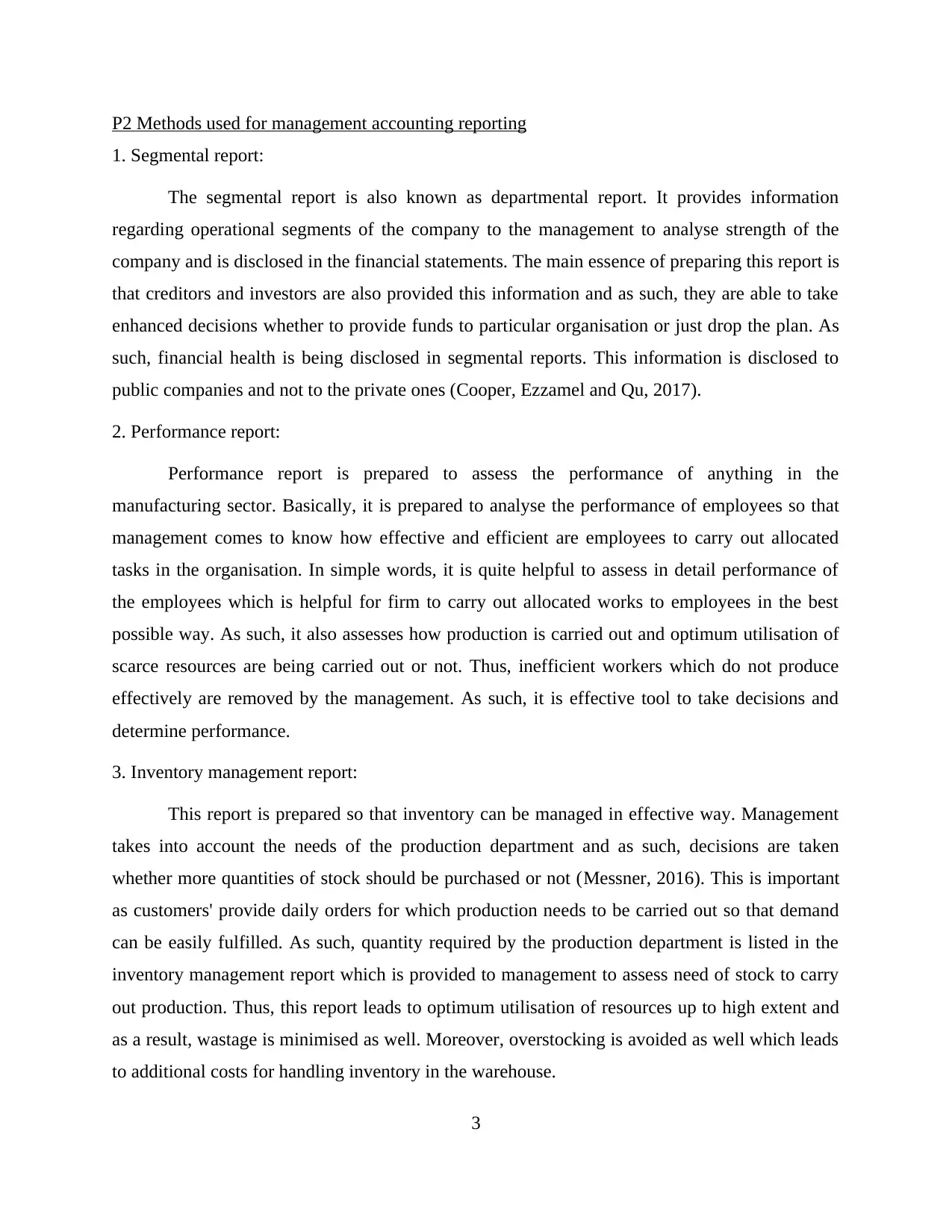

P2 Methods used for management accounting reporting

1. Segmental report:

The segmental report is also known as departmental report. It provides information

regarding operational segments of the company to the management to analyse strength of the

company and is disclosed in the financial statements. The main essence of preparing this report is

that creditors and investors are also provided this information and as such, they are able to take

enhanced decisions whether to provide funds to particular organisation or just drop the plan. As

such, financial health is being disclosed in segmental reports. This information is disclosed to

public companies and not to the private ones (Cooper, Ezzamel and Qu, 2017).

2. Performance report:

Performance report is prepared to assess the performance of anything in the

manufacturing sector. Basically, it is prepared to analyse the performance of employees so that

management comes to know how effective and efficient are employees to carry out allocated

tasks in the organisation. In simple words, it is quite helpful to assess in detail performance of

the employees which is helpful for firm to carry out allocated works to employees in the best

possible way. As such, it also assesses how production is carried out and optimum utilisation of

scarce resources are being carried out or not. Thus, inefficient workers which do not produce

effectively are removed by the management. As such, it is effective tool to take decisions and

determine performance.

3. Inventory management report:

This report is prepared so that inventory can be managed in effective way. Management

takes into account the needs of the production department and as such, decisions are taken

whether more quantities of stock should be purchased or not (Messner, 2016). This is important

as customers' provide daily orders for which production needs to be carried out so that demand

can be easily fulfilled. As such, quantity required by the production department is listed in the

inventory management report which is provided to management to assess need of stock to carry

out production. Thus, this report leads to optimum utilisation of resources up to high extent and

as a result, wastage is minimised as well. Moreover, overstocking is avoided as well which leads

to additional costs for handling inventory in the warehouse.

3

1. Segmental report:

The segmental report is also known as departmental report. It provides information

regarding operational segments of the company to the management to analyse strength of the

company and is disclosed in the financial statements. The main essence of preparing this report is

that creditors and investors are also provided this information and as such, they are able to take

enhanced decisions whether to provide funds to particular organisation or just drop the plan. As

such, financial health is being disclosed in segmental reports. This information is disclosed to

public companies and not to the private ones (Cooper, Ezzamel and Qu, 2017).

2. Performance report:

Performance report is prepared to assess the performance of anything in the

manufacturing sector. Basically, it is prepared to analyse the performance of employees so that

management comes to know how effective and efficient are employees to carry out allocated

tasks in the organisation. In simple words, it is quite helpful to assess in detail performance of

the employees which is helpful for firm to carry out allocated works to employees in the best

possible way. As such, it also assesses how production is carried out and optimum utilisation of

scarce resources are being carried out or not. Thus, inefficient workers which do not produce

effectively are removed by the management. As such, it is effective tool to take decisions and

determine performance.

3. Inventory management report:

This report is prepared so that inventory can be managed in effective way. Management

takes into account the needs of the production department and as such, decisions are taken

whether more quantities of stock should be purchased or not (Messner, 2016). This is important

as customers' provide daily orders for which production needs to be carried out so that demand

can be easily fulfilled. As such, quantity required by the production department is listed in the

inventory management report which is provided to management to assess need of stock to carry

out production. Thus, this report leads to optimum utilisation of resources up to high extent and

as a result, wastage is minimised as well. Moreover, overstocking is avoided as well which leads

to additional costs for handling inventory in the warehouse.

3

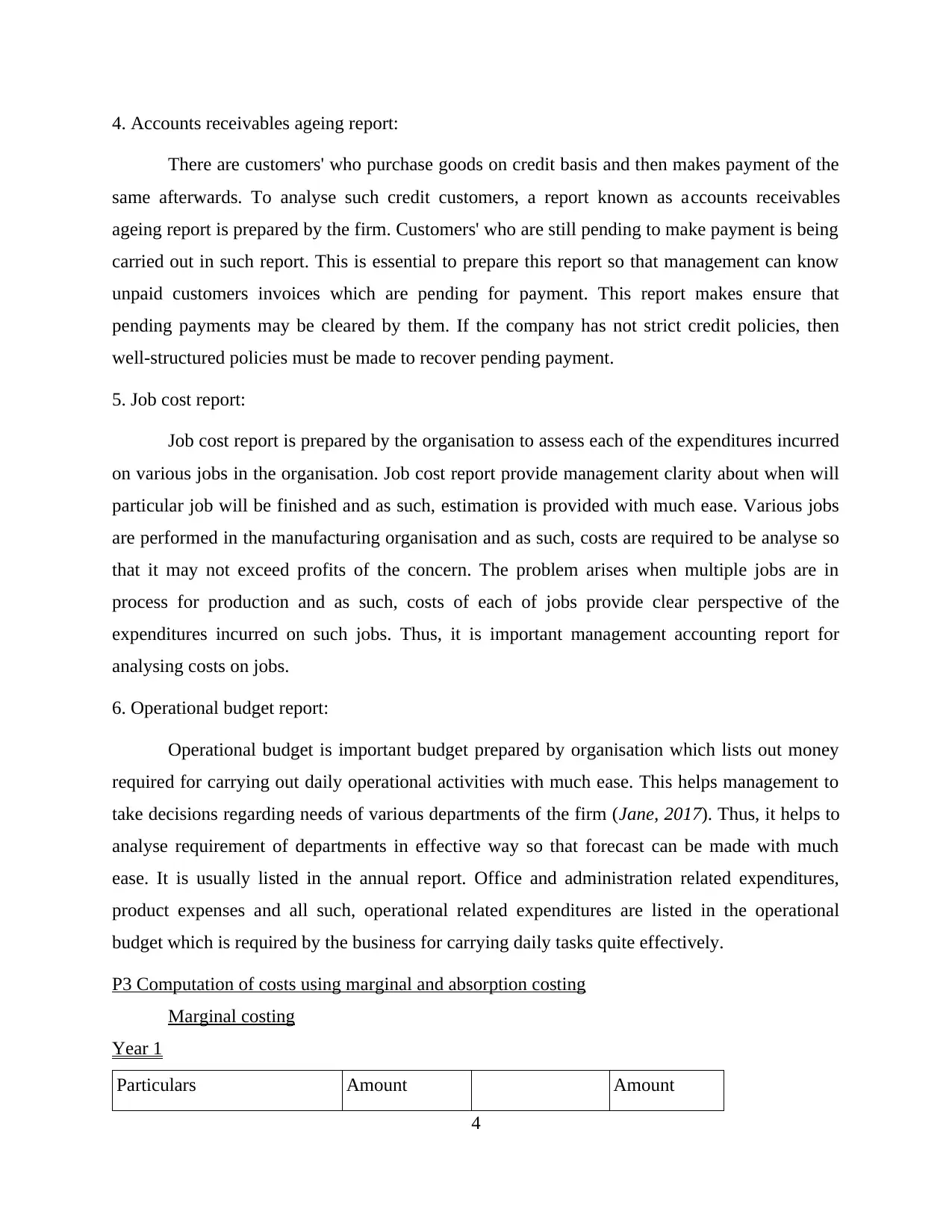

4. Accounts receivables ageing report:

There are customers' who purchase goods on credit basis and then makes payment of the

same afterwards. To analyse such credit customers, a report known as accounts receivables

ageing report is prepared by the firm. Customers' who are still pending to make payment is being

carried out in such report. This is essential to prepare this report so that management can know

unpaid customers invoices which are pending for payment. This report makes ensure that

pending payments may be cleared by them. If the company has not strict credit policies, then

well-structured policies must be made to recover pending payment.

5. Job cost report:

Job cost report is prepared by the organisation to assess each of the expenditures incurred

on various jobs in the organisation. Job cost report provide management clarity about when will

particular job will be finished and as such, estimation is provided with much ease. Various jobs

are performed in the manufacturing organisation and as such, costs are required to be analyse so

that it may not exceed profits of the concern. The problem arises when multiple jobs are in

process for production and as such, costs of each of jobs provide clear perspective of the

expenditures incurred on such jobs. Thus, it is important management accounting report for

analysing costs on jobs.

6. Operational budget report:

Operational budget is important budget prepared by organisation which lists out money

required for carrying out daily operational activities with much ease. This helps management to

take decisions regarding needs of various departments of the firm (Jane, 2017). Thus, it helps to

analyse requirement of departments in effective way so that forecast can be made with much

ease. It is usually listed in the annual report. Office and administration related expenditures,

product expenses and all such, operational related expenditures are listed in the operational

budget which is required by the business for carrying daily tasks quite effectively.

P3 Computation of costs using marginal and absorption costing

Marginal costing

Year 1

Particulars Amount Amount

4

There are customers' who purchase goods on credit basis and then makes payment of the

same afterwards. To analyse such credit customers, a report known as accounts receivables

ageing report is prepared by the firm. Customers' who are still pending to make payment is being

carried out in such report. This is essential to prepare this report so that management can know

unpaid customers invoices which are pending for payment. This report makes ensure that

pending payments may be cleared by them. If the company has not strict credit policies, then

well-structured policies must be made to recover pending payment.

5. Job cost report:

Job cost report is prepared by the organisation to assess each of the expenditures incurred

on various jobs in the organisation. Job cost report provide management clarity about when will

particular job will be finished and as such, estimation is provided with much ease. Various jobs

are performed in the manufacturing organisation and as such, costs are required to be analyse so

that it may not exceed profits of the concern. The problem arises when multiple jobs are in

process for production and as such, costs of each of jobs provide clear perspective of the

expenditures incurred on such jobs. Thus, it is important management accounting report for

analysing costs on jobs.

6. Operational budget report:

Operational budget is important budget prepared by organisation which lists out money

required for carrying out daily operational activities with much ease. This helps management to

take decisions regarding needs of various departments of the firm (Jane, 2017). Thus, it helps to

analyse requirement of departments in effective way so that forecast can be made with much

ease. It is usually listed in the annual report. Office and administration related expenditures,

product expenses and all such, operational related expenditures are listed in the operational

budget which is required by the business for carrying daily tasks quite effectively.

P3 Computation of costs using marginal and absorption costing

Marginal costing

Year 1

Particulars Amount Amount

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

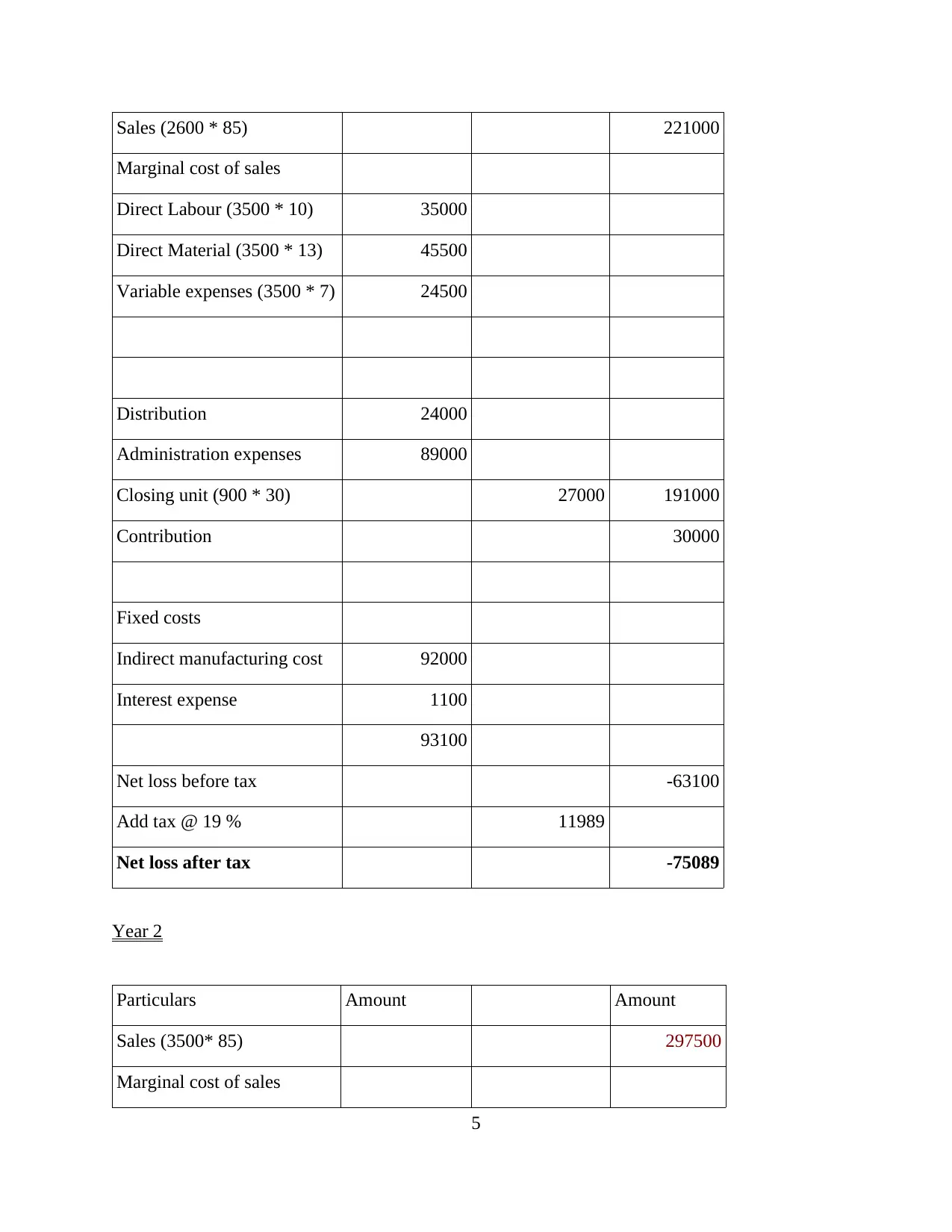

Sales (2600 * 85) 221000

Marginal cost of sales

Direct Labour (3500 * 10) 35000

Direct Material (3500 * 13) 45500

Variable expenses (3500 * 7) 24500

Distribution 24000

Administration expenses 89000

Closing unit (900 * 30) 27000 191000

Contribution 30000

Fixed costs

Indirect manufacturing cost 92000

Interest expense 1100

93100

Net loss before tax -63100

Add tax @ 19 % 11989

Net loss after tax -75089

Year 2

Particulars Amount Amount

Sales (3500* 85) 297500

Marginal cost of sales

5

Marginal cost of sales

Direct Labour (3500 * 10) 35000

Direct Material (3500 * 13) 45500

Variable expenses (3500 * 7) 24500

Distribution 24000

Administration expenses 89000

Closing unit (900 * 30) 27000 191000

Contribution 30000

Fixed costs

Indirect manufacturing cost 92000

Interest expense 1100

93100

Net loss before tax -63100

Add tax @ 19 % 11989

Net loss after tax -75089

Year 2

Particulars Amount Amount

Sales (3500* 85) 297500

Marginal cost of sales

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

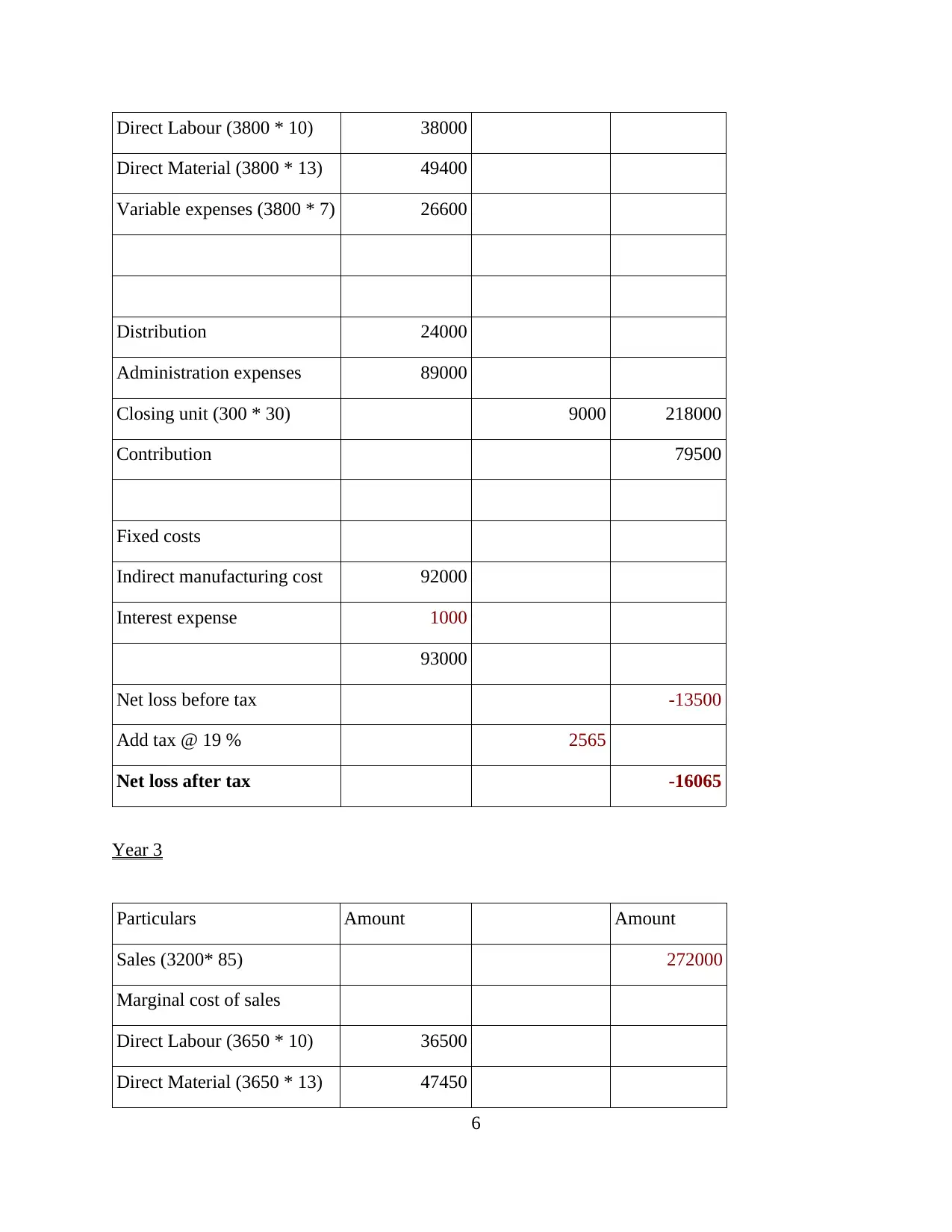

Direct Labour (3800 * 10) 38000

Direct Material (3800 * 13) 49400

Variable expenses (3800 * 7) 26600

Distribution 24000

Administration expenses 89000

Closing unit (300 * 30) 9000 218000

Contribution 79500

Fixed costs

Indirect manufacturing cost 92000

Interest expense 1000

93000

Net loss before tax -13500

Add tax @ 19 % 2565

Net loss after tax -16065

Year 3

Particulars Amount Amount

Sales (3200* 85) 272000

Marginal cost of sales

Direct Labour (3650 * 10) 36500

Direct Material (3650 * 13) 47450

6

Direct Material (3800 * 13) 49400

Variable expenses (3800 * 7) 26600

Distribution 24000

Administration expenses 89000

Closing unit (300 * 30) 9000 218000

Contribution 79500

Fixed costs

Indirect manufacturing cost 92000

Interest expense 1000

93000

Net loss before tax -13500

Add tax @ 19 % 2565

Net loss after tax -16065

Year 3

Particulars Amount Amount

Sales (3200* 85) 272000

Marginal cost of sales

Direct Labour (3650 * 10) 36500

Direct Material (3650 * 13) 47450

6

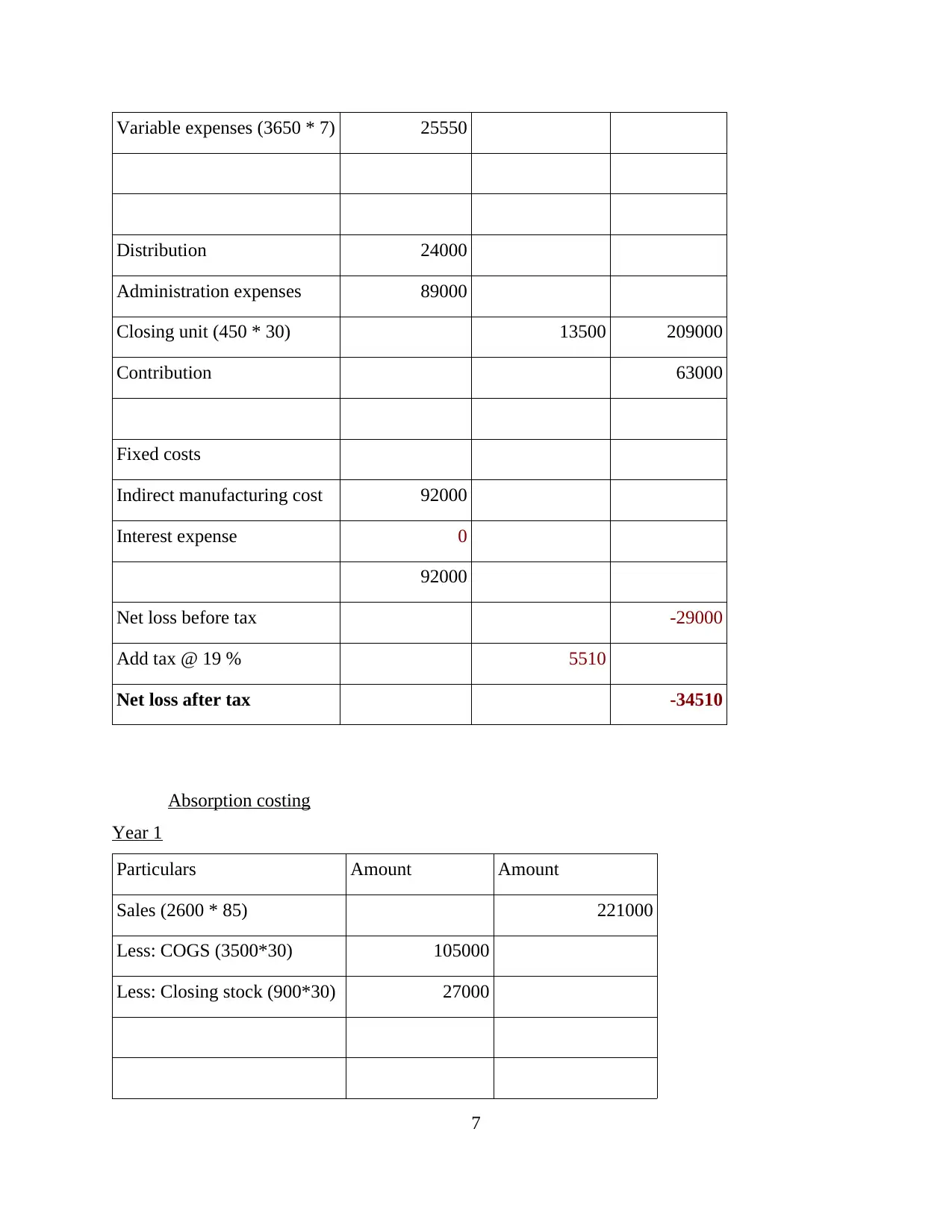

Variable expenses (3650 * 7) 25550

Distribution 24000

Administration expenses 89000

Closing unit (450 * 30) 13500 209000

Contribution 63000

Fixed costs

Indirect manufacturing cost 92000

Interest expense 0

92000

Net loss before tax -29000

Add tax @ 19 % 5510

Net loss after tax -34510

Absorption costing

Year 1

Particulars Amount Amount

Sales (2600 * 85) 221000

Less: COGS (3500*30) 105000

Less: Closing stock (900*30) 27000

7

Distribution 24000

Administration expenses 89000

Closing unit (450 * 30) 13500 209000

Contribution 63000

Fixed costs

Indirect manufacturing cost 92000

Interest expense 0

92000

Net loss before tax -29000

Add tax @ 19 % 5510

Net loss after tax -34510

Absorption costing

Year 1

Particulars Amount Amount

Sales (2600 * 85) 221000

Less: COGS (3500*30) 105000

Less: Closing stock (900*30) 27000

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

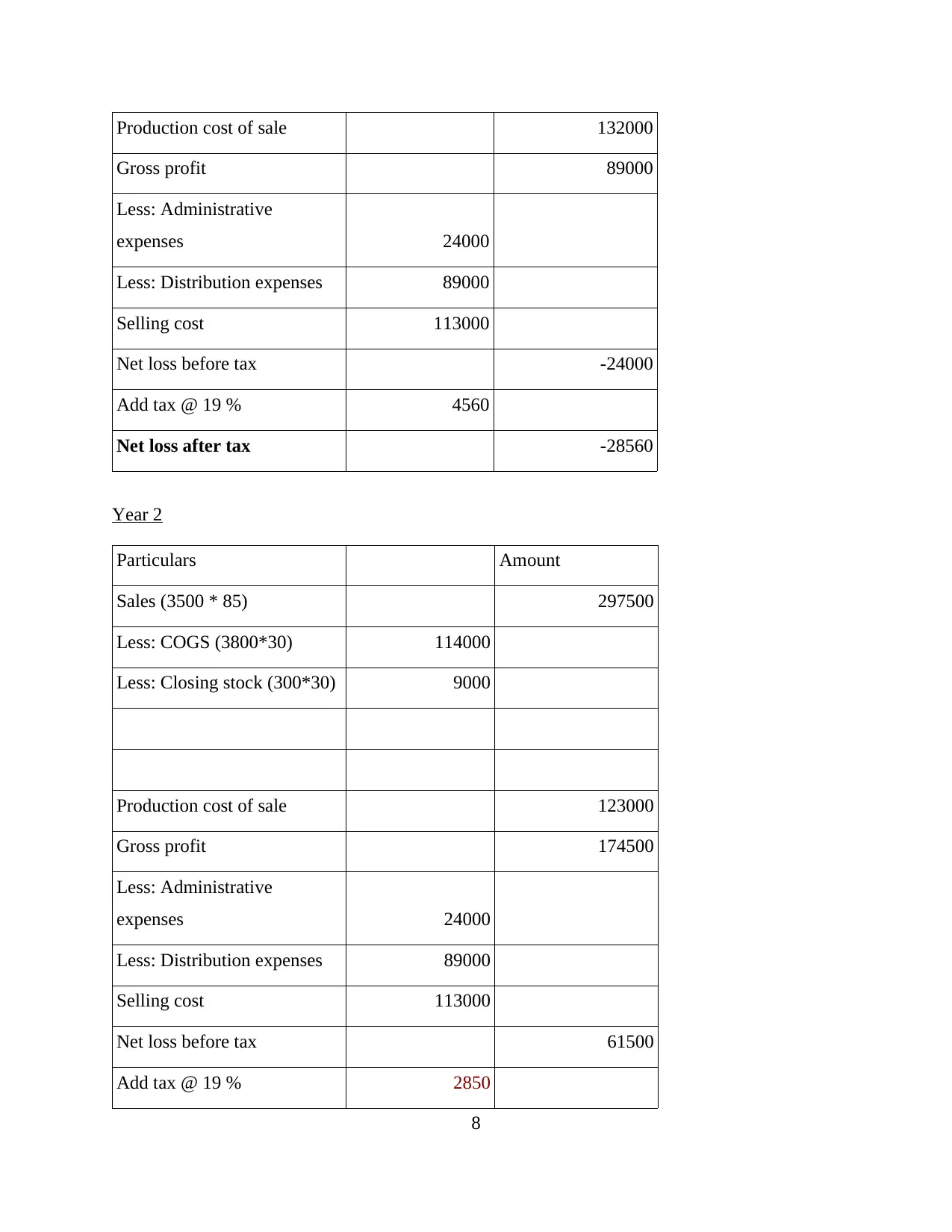

Production cost of sale 132000

Gross profit 89000

Less: Administrative

expenses 24000

Less: Distribution expenses 89000

Selling cost 113000

Net loss before tax -24000

Add tax @ 19 % 4560

Net loss after tax -28560

Year 2

Particulars Amount

Sales (3500 * 85) 297500

Less: COGS (3800*30) 114000

Less: Closing stock (300*30) 9000

Production cost of sale 123000

Gross profit 174500

Less: Administrative

expenses 24000

Less: Distribution expenses 89000

Selling cost 113000

Net loss before tax 61500

Add tax @ 19 % 2850

8

Gross profit 89000

Less: Administrative

expenses 24000

Less: Distribution expenses 89000

Selling cost 113000

Net loss before tax -24000

Add tax @ 19 % 4560

Net loss after tax -28560

Year 2

Particulars Amount

Sales (3500 * 85) 297500

Less: COGS (3800*30) 114000

Less: Closing stock (300*30) 9000

Production cost of sale 123000

Gross profit 174500

Less: Administrative

expenses 24000

Less: Distribution expenses 89000

Selling cost 113000

Net loss before tax 61500

Add tax @ 19 % 2850

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

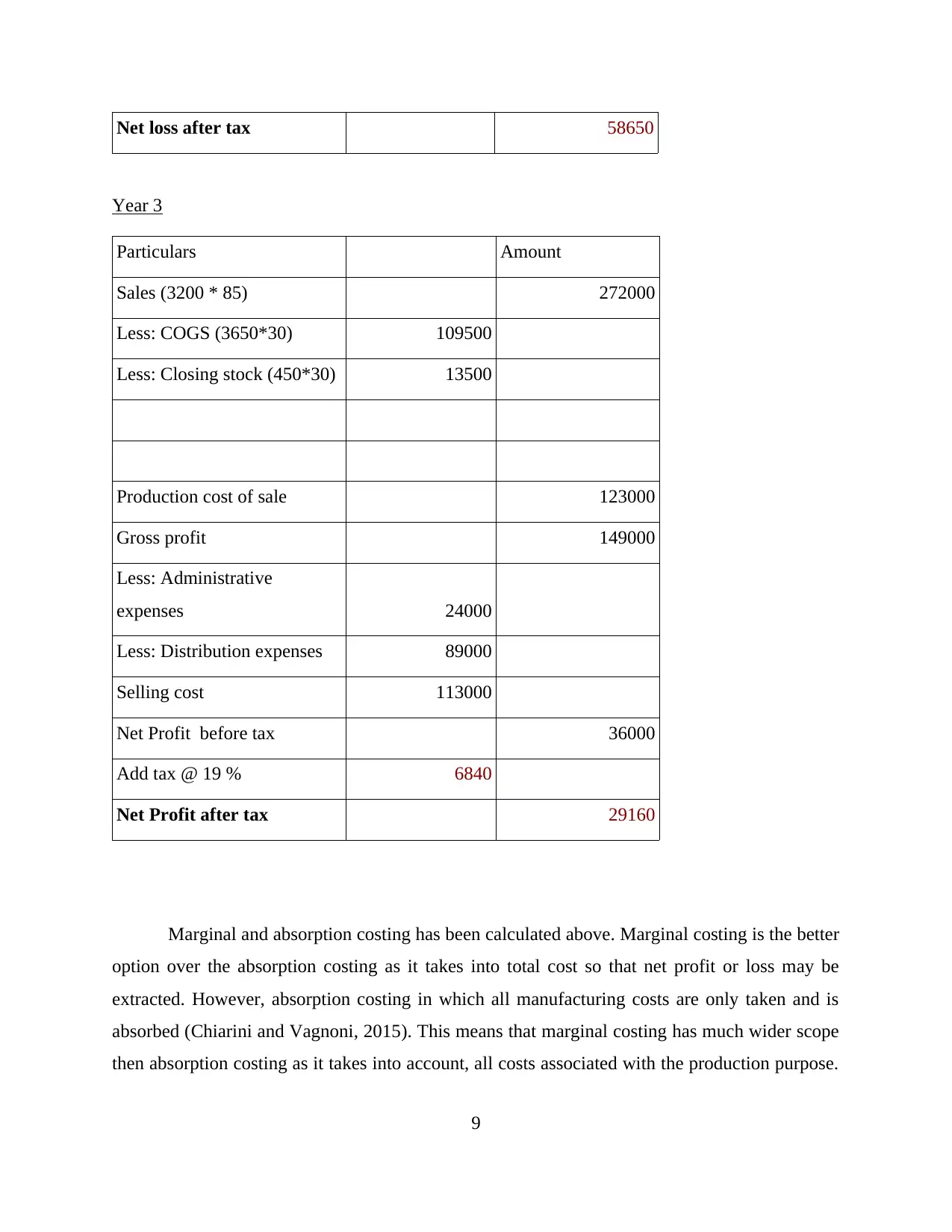

Net loss after tax 58650

Year 3

Particulars Amount

Sales (3200 * 85) 272000

Less: COGS (3650*30) 109500

Less: Closing stock (450*30) 13500

Production cost of sale 123000

Gross profit 149000

Less: Administrative

expenses 24000

Less: Distribution expenses 89000

Selling cost 113000

Net Profit before tax 36000

Add tax @ 19 % 6840

Net Profit after tax 29160

Marginal and absorption costing has been calculated above. Marginal costing is the better

option over the absorption costing as it takes into total cost so that net profit or loss may be

extracted. However, absorption costing in which all manufacturing costs are only taken and is

absorbed (Chiarini and Vagnoni, 2015). This means that marginal costing has much wider scope

then absorption costing as it takes into account, all costs associated with the production purpose.

9

Year 3

Particulars Amount

Sales (3200 * 85) 272000

Less: COGS (3650*30) 109500

Less: Closing stock (450*30) 13500

Production cost of sale 123000

Gross profit 149000

Less: Administrative

expenses 24000

Less: Distribution expenses 89000

Selling cost 113000

Net Profit before tax 36000

Add tax @ 19 % 6840

Net Profit after tax 29160

Marginal and absorption costing has been calculated above. Marginal costing is the better

option over the absorption costing as it takes into total cost so that net profit or loss may be

extracted. However, absorption costing in which all manufacturing costs are only taken and is

absorbed (Chiarini and Vagnoni, 2015). This means that marginal costing has much wider scope

then absorption costing as it takes into account, all costs associated with the production purpose.

9

It can be said that company should choose marginal costing as it has enough clarity as compared

to absorption costing.

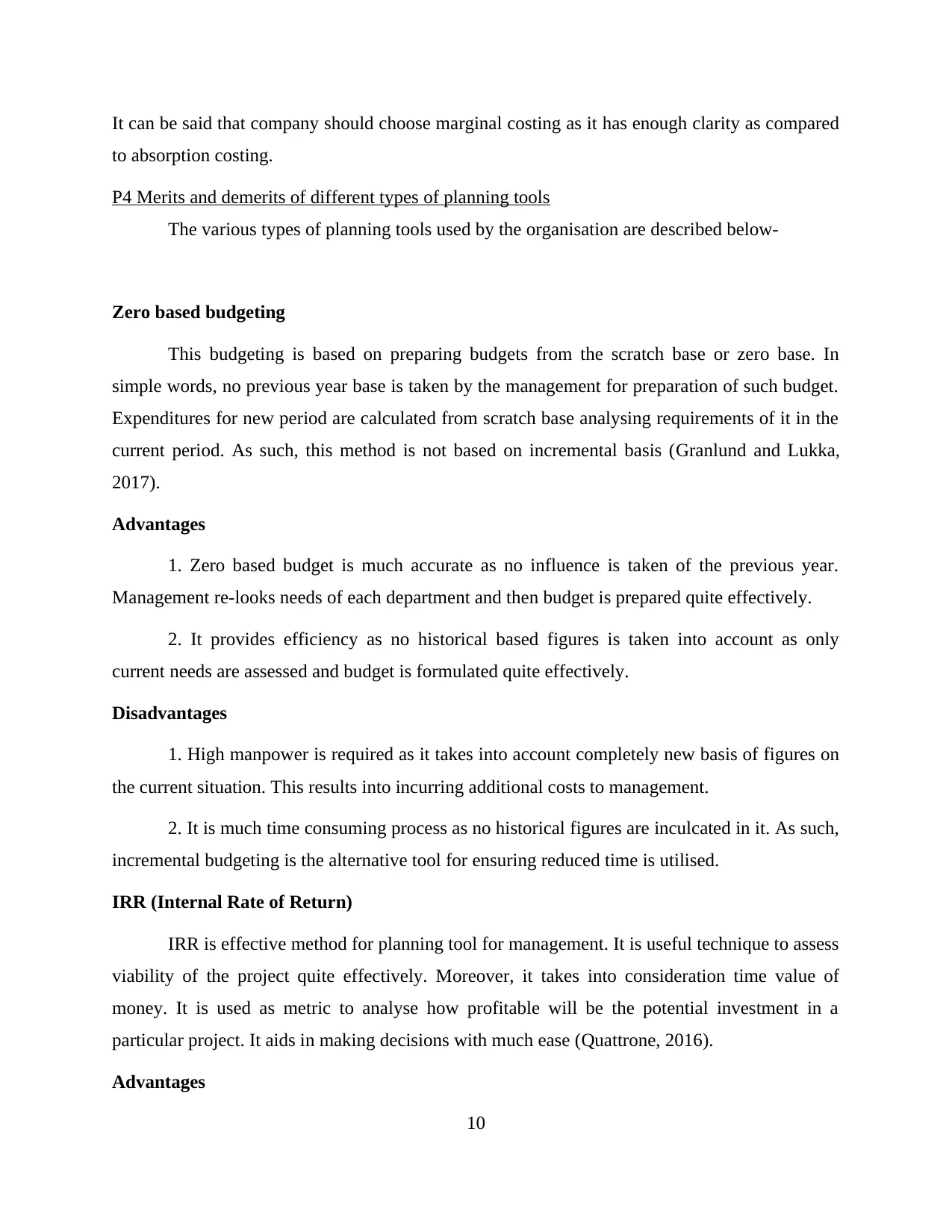

P4 Merits and demerits of different types of planning tools

The various types of planning tools used by the organisation are described below-

Zero based budgeting

This budgeting is based on preparing budgets from the scratch base or zero base. In

simple words, no previous year base is taken by the management for preparation of such budget.

Expenditures for new period are calculated from scratch base analysing requirements of it in the

current period. As such, this method is not based on incremental basis (Granlund and Lukka,

2017).

Advantages

1. Zero based budget is much accurate as no influence is taken of the previous year.

Management re-looks needs of each department and then budget is prepared quite effectively.

2. It provides efficiency as no historical based figures is taken into account as only

current needs are assessed and budget is formulated quite effectively.

Disadvantages

1. High manpower is required as it takes into account completely new basis of figures on

the current situation. This results into incurring additional costs to management.

2. It is much time consuming process as no historical figures are inculcated in it. As such,

incremental budgeting is the alternative tool for ensuring reduced time is utilised.

IRR (Internal Rate of Return)

IRR is effective method for planning tool for management. It is useful technique to assess

viability of the project quite effectively. Moreover, it takes into consideration time value of

money. It is used as metric to analyse how profitable will be the potential investment in a

particular project. It aids in making decisions with much ease (Quattrone, 2016).

Advantages

10

to absorption costing.

P4 Merits and demerits of different types of planning tools

The various types of planning tools used by the organisation are described below-

Zero based budgeting

This budgeting is based on preparing budgets from the scratch base or zero base. In

simple words, no previous year base is taken by the management for preparation of such budget.

Expenditures for new period are calculated from scratch base analysing requirements of it in the

current period. As such, this method is not based on incremental basis (Granlund and Lukka,

2017).

Advantages

1. Zero based budget is much accurate as no influence is taken of the previous year.

Management re-looks needs of each department and then budget is prepared quite effectively.

2. It provides efficiency as no historical based figures is taken into account as only

current needs are assessed and budget is formulated quite effectively.

Disadvantages

1. High manpower is required as it takes into account completely new basis of figures on

the current situation. This results into incurring additional costs to management.

2. It is much time consuming process as no historical figures are inculcated in it. As such,

incremental budgeting is the alternative tool for ensuring reduced time is utilised.

IRR (Internal Rate of Return)

IRR is effective method for planning tool for management. It is useful technique to assess

viability of the project quite effectively. Moreover, it takes into consideration time value of

money. It is used as metric to analyse how profitable will be the potential investment in a

particular project. It aids in making decisions with much ease (Quattrone, 2016).

Advantages

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.