Budgeting, Control, and Evaluation of Financial Management

VerifiedAdded on 2023/06/08

|20

|3312

|126

Report

AI Summary

This report provides a comprehensive analysis of financial management, focusing on budgeting, implementation, monitoring, and evaluation. It includes tasks related to planning financial management approaches, implementing these approaches, monitoring and controlling finances, and reviewing and evaluating financial management processes. The report covers aspects such as expense allocation policies, training requirements, contingency planning, budget variance analysis, and key financial ratios like average debtor days, creditor days, and stock turnover. Recommendations are provided for improving financial performance, along with calculations for required units and variable costs. Additionally, the report addresses GST liability and includes an action plan for financial improvements, touching upon accounting principles, cash flow management, ledger maintenance, and financial statement preparation, including profit and loss statements. The Big Red Bicycle company serves as a case study throughout the assignment.

MANAGE BUDGETS AND FINANCIAL PLAN

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Assignment 1: Plan financial management approaches...................................................................4

Task A..............................................................................................................................................4

Expenses Allocation.....................................................................................................................5

A policy of expense reimbursement.............................................................................................5

The policy of Petty Cash..............................................................................................................5

Task B..............................................................................................................................................5

Requirement of training...............................................................................................................5

Assignment 2 Implement financial management approaches.........................................................6

Task A..............................................................................................................................................6

Task B..............................................................................................................................................7

Assignment 3: Monitor and control finance....................................................................................9

Task A..............................................................................................................................................9

Task B............................................................................................................................................11

Contingency Plan.......................................................................................................................11

Variance of Budget....................................................................................................................13

Assignment 4: Review and evaluate financial management processes.........................................14

Task A............................................................................................................................................14

1. The Average Debtor days......................................................................................................14

2. The Average Creditor days....................................................................................................14

3. The Average Stock Turnover.................................................................................................14

Recommendation.......................................................................................................................14

Task B............................................................................................................................................15

1. Calculation for required units................................................................................................15

2. Calculation of variable costs..................................................................................................15

Recommendation.......................................................................................................................16

Task C............................................................................................................................................16

2

Assignment 1: Plan financial management approaches...................................................................4

Task A..............................................................................................................................................4

Expenses Allocation.....................................................................................................................5

A policy of expense reimbursement.............................................................................................5

The policy of Petty Cash..............................................................................................................5

Task B..............................................................................................................................................5

Requirement of training...............................................................................................................5

Assignment 2 Implement financial management approaches.........................................................6

Task A..............................................................................................................................................6

Task B..............................................................................................................................................7

Assignment 3: Monitor and control finance....................................................................................9

Task A..............................................................................................................................................9

Task B............................................................................................................................................11

Contingency Plan.......................................................................................................................11

Variance of Budget....................................................................................................................13

Assignment 4: Review and evaluate financial management processes.........................................14

Task A............................................................................................................................................14

1. The Average Debtor days......................................................................................................14

2. The Average Creditor days....................................................................................................14

3. The Average Stock Turnover.................................................................................................14

Recommendation.......................................................................................................................14

Task B............................................................................................................................................15

1. Calculation for required units................................................................................................15

2. Calculation of variable costs..................................................................................................15

Recommendation.......................................................................................................................16

Task C............................................................................................................................................16

2

GST Liability.............................................................................................................................16

Task D............................................................................................................................................17

Action Plan.................................................................................................................................17

Task E............................................................................................................................................17

Accounting Principle..................................................................................................................17

Cash Flow..................................................................................................................................17

Ledger and financial statement..................................................................................................18

Profit and loss statement............................................................................................................18

References......................................................................................................................................19

Appendix 1: Budgeted Value.........................................................................................................20

3

Task D............................................................................................................................................17

Action Plan.................................................................................................................................17

Task E............................................................................................................................................17

Accounting Principle..................................................................................................................17

Cash Flow..................................................................................................................................17

Ledger and financial statement..................................................................................................18

Profit and loss statement............................................................................................................18

References......................................................................................................................................19

Appendix 1: Budgeted Value.........................................................................................................20

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Assignment 1: Plan financial management approaches

Task A

Budgeting is a long-term planning procedure that helps in estimating the value of income and

expenditure that could be incurred in a business project in the future. Most of the companies

generally formulate various types of the monetary plan according to the policy that makes the

income and expenses on project accordingly to facilitate the budgeted project. The budget helps

in forecasting the sales and demand for a project in a market. An importance of budget is stated

below

1. It helps the company management in performing, controlling and reviewing the

expenditure and income

2. By making comparison of the result of actual expenditure with budgeted results would

help in ensuring the performance of a plan

3. It helps in taking an action regarding the disparity that occurs from the action plan and

expenses of budget

When the above-mentioned importance are followed for achieving the target of a company, then,

the estimated prepared master budget of Big Red Bicycle could be said to be accurate,

understandable, achievable and fair (Newberry, 2015).

As per the master budget of Big Red Bicycle, the sales in a budget of each quarter are shown as

fixed to $ 750000. However, in new project, the budgeted sales at quarter 2 has been mentioned

as $ 1000000. Another quarter is mentioned to be 30 percent less than compared to quarter 2

which indicates the Quarter 1, 3 and 4 to be sales forecasting of $ 70000 each. As mentioned in a

scenario that sales of a new project decrease due to the economic downturn. Therefore sales of a

budget could be poor.

The direct wages are deducted from the sales in each quarter that results to $ 50000 as a fixed

amount. After deducting the cost of goods sold from sales in each quarter remains $ 1000000 as

mentioned to be fixed. However, commission on a percentage of sales is the shown to increase

by 2 or 2.5 percent of sales. According to the changes in commission on sales forecast the

changes in sales quarter 1, 3 and 4 is $ 75000, whereas quarter 2 incur the changes in the

commission of $ 25000.

4

Task A

Budgeting is a long-term planning procedure that helps in estimating the value of income and

expenditure that could be incurred in a business project in the future. Most of the companies

generally formulate various types of the monetary plan according to the policy that makes the

income and expenses on project accordingly to facilitate the budgeted project. The budget helps

in forecasting the sales and demand for a project in a market. An importance of budget is stated

below

1. It helps the company management in performing, controlling and reviewing the

expenditure and income

2. By making comparison of the result of actual expenditure with budgeted results would

help in ensuring the performance of a plan

3. It helps in taking an action regarding the disparity that occurs from the action plan and

expenses of budget

When the above-mentioned importance are followed for achieving the target of a company, then,

the estimated prepared master budget of Big Red Bicycle could be said to be accurate,

understandable, achievable and fair (Newberry, 2015).

As per the master budget of Big Red Bicycle, the sales in a budget of each quarter are shown as

fixed to $ 750000. However, in new project, the budgeted sales at quarter 2 has been mentioned

as $ 1000000. Another quarter is mentioned to be 30 percent less than compared to quarter 2

which indicates the Quarter 1, 3 and 4 to be sales forecasting of $ 70000 each. As mentioned in a

scenario that sales of a new project decrease due to the economic downturn. Therefore sales of a

budget could be poor.

The direct wages are deducted from the sales in each quarter that results to $ 50000 as a fixed

amount. After deducting the cost of goods sold from sales in each quarter remains $ 1000000 as

mentioned to be fixed. However, commission on a percentage of sales is the shown to increase

by 2 or 2.5 percent of sales. According to the changes in commission on sales forecast the

changes in sales quarter 1, 3 and 4 is $ 75000, whereas quarter 2 incur the changes in the

commission of $ 25000.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Hence, the gross profit incurred by Big Red Bicycle manufacturer ltd in a financial year

= $ (532500 + 852000 + 532500 + 532500)

= $ 2422500

According to the scenario all other expenses are remained constant, therefore a net profit earned

by Big Red Bicycle = $ (2422500 - 1401500)

= $ 1021000.

It could be assumed from the above calculation, that new projection of budget is drawn, accurate

and correct for achieving the target by Big Red Bicycle of $ 1000000. The new budgeted project

is achievable and fair because the incurred net profit is $ 1021000 that is higher than the target

net profit.

Expenses Allocation

A policy of expense reimbursement

The reimbursement policy is reasonable for the operation of the business by Big Red Bicycle.

The expenses which would not be reimbursed by staff are mentioned specifically. A form of

expense reimbursement should be submitted with an attachment of relevant documents.

The policy of Petty Cash

This policy tracks the expenses incurred under the petty cash category that could be used for

funding the requirement of small business.

Task B

Requirement of training

A team member, Bill Goodale needed to track the expenses of petty cash over a financial year.

Bill requires learning about the procedure of petty cash maintenance that would help in preparing

and developing a spreadsheet.

5

= $ (532500 + 852000 + 532500 + 532500)

= $ 2422500

According to the scenario all other expenses are remained constant, therefore a net profit earned

by Big Red Bicycle = $ (2422500 - 1401500)

= $ 1021000.

It could be assumed from the above calculation, that new projection of budget is drawn, accurate

and correct for achieving the target by Big Red Bicycle of $ 1000000. The new budgeted project

is achievable and fair because the incurred net profit is $ 1021000 that is higher than the target

net profit.

Expenses Allocation

A policy of expense reimbursement

The reimbursement policy is reasonable for the operation of the business by Big Red Bicycle.

The expenses which would not be reimbursed by staff are mentioned specifically. A form of

expense reimbursement should be submitted with an attachment of relevant documents.

The policy of Petty Cash

This policy tracks the expenses incurred under the petty cash category that could be used for

funding the requirement of small business.

Task B

Requirement of training

A team member, Bill Goodale needed to track the expenses of petty cash over a financial year.

Bill requires learning about the procedure of petty cash maintenance that would help in preparing

and developing a spreadsheet.

5

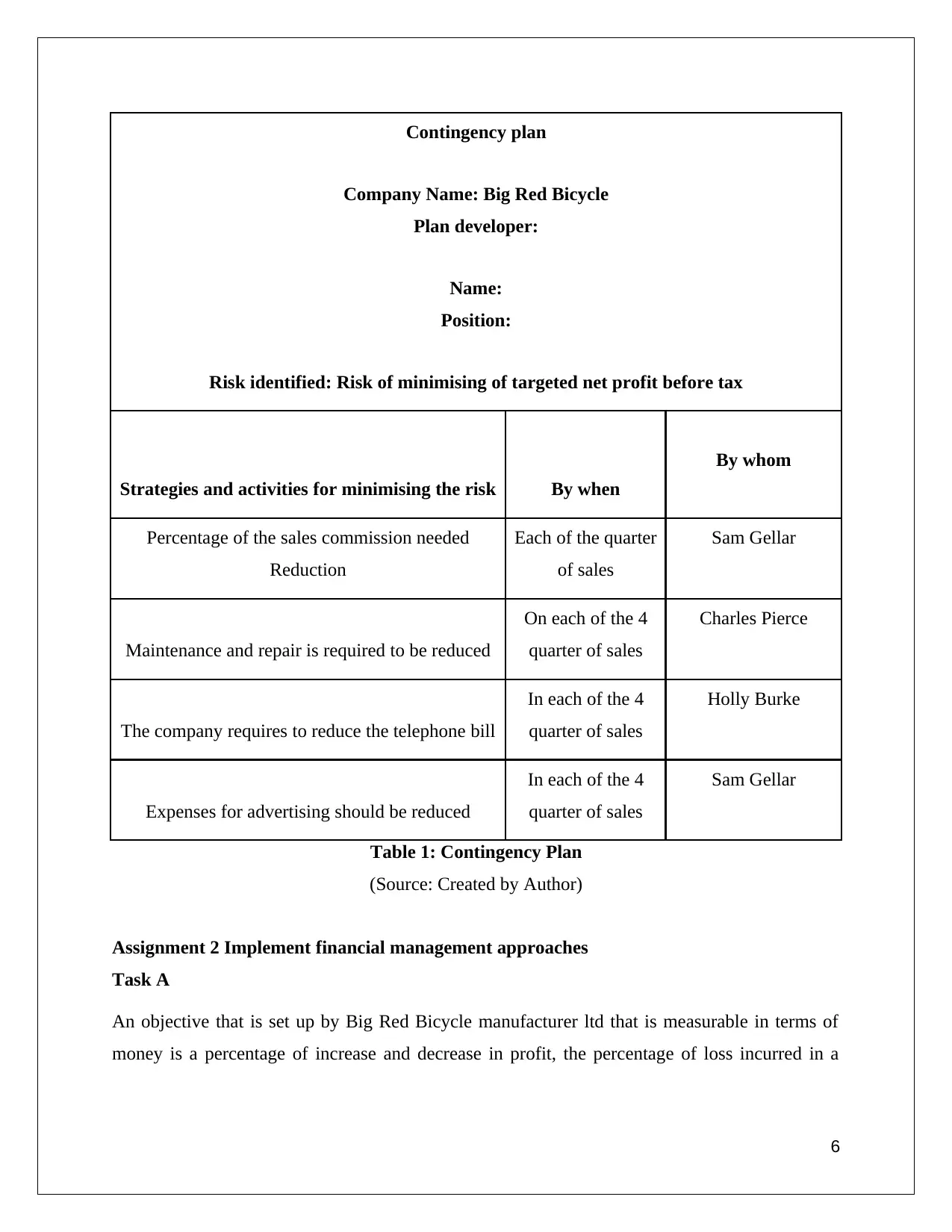

Contingency plan

Company Name: Big Red Bicycle

Plan developer:

Name:

Position:

Risk identified: Risk of minimising of targeted net profit before tax

Strategies and activities for minimising the risk By when

By whom

Percentage of the sales commission needed

Reduction

Each of the quarter

of sales

Sam Gellar

Maintenance and repair is required to be reduced

On each of the 4

quarter of sales

Charles Pierce

The company requires to reduce the telephone bill

In each of the 4

quarter of sales

Holly Burke

Expenses for advertising should be reduced

In each of the 4

quarter of sales

Sam Gellar

Table 1: Contingency Plan

(Source: Created by Author)

Assignment 2 Implement financial management approaches

Task A

An objective that is set up by Big Red Bicycle manufacturer ltd that is measurable in terms of

money is a percentage of increase and decrease in profit, the percentage of loss incurred in a

6

Company Name: Big Red Bicycle

Plan developer:

Name:

Position:

Risk identified: Risk of minimising of targeted net profit before tax

Strategies and activities for minimising the risk By when

By whom

Percentage of the sales commission needed

Reduction

Each of the quarter

of sales

Sam Gellar

Maintenance and repair is required to be reduced

On each of the 4

quarter of sales

Charles Pierce

The company requires to reduce the telephone bill

In each of the 4

quarter of sales

Holly Burke

Expenses for advertising should be reduced

In each of the 4

quarter of sales

Sam Gellar

Table 1: Contingency Plan

(Source: Created by Author)

Assignment 2 Implement financial management approaches

Task A

An objective that is set up by Big Red Bicycle manufacturer ltd that is measurable in terms of

money is a percentage of increase and decrease in profit, the percentage of loss incurred in a

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

specified period and the amount of profit and loss. Every organisation is required to set a

financial objective for the following reason

1. It helps a company in collecting funds in maximum quantity

2. It operates in fixation of appropriate structure of capital

3. Helps in determining the project that should be invested on by company

4. It helps in activities of the business operation

5. It acts as a base for controlling the issues of finance

6. It boosts the utilisation of finance accurately

7. It helps in eliminating the issues that could be incurred in future from project investment

8. It acts as a link between financial decision making and its concerned investment

The financial objectives of Big Red Bicycle are as follows

1. To reduce expenses

2. To achieve the targeted net profit of $ 1000000 before tax

3. To compensate the reduction in sales which has occurred due to the economic downfall

A master budget of Big Red Bicycle Ltd identifies the conclusion that the total expenses and a

gross profit of a company in each of the four quarters are similar. However, a percentage of

commission is required to reduce in comparison to the amount of sales budget in each quarter. In

the projected budget of a company the sales amount if decreased due to a downfall in economic.

The master budget highlights a direct wage to be fixed for each year. The amount of expenses on

salaries and wages according to master budget is highlighted as $ 125000 per quarter. However,

in the budget of projection, there is an increase in the salary and wages expenditure due to an

inflation and time value. It is assumed that if there would be an increase in wages expenditure

then, a company could not achieve targeted Net profit before tax of $ 1000000. Big Red Bicycle

ltd would then require reducing the value of other expenses such as repair and maintenance, legal

fees and offices supplies by reducing late payment and wastage of resource.

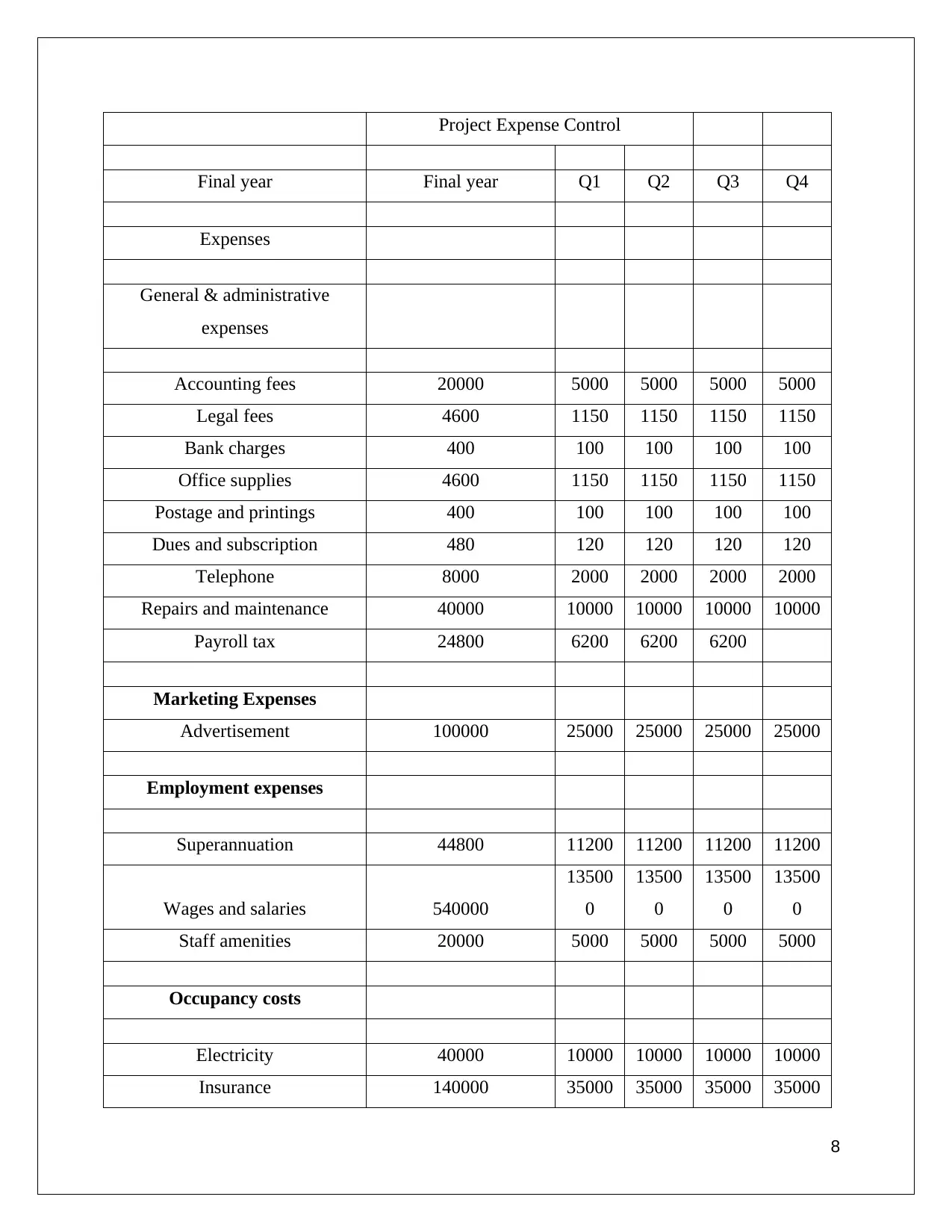

Task B

To control the expenses and track the actual expenditure, Bills Goodale require to prepare the

following spreadsheet

Big Red Bicycle Pty

Ltd

7

financial objective for the following reason

1. It helps a company in collecting funds in maximum quantity

2. It operates in fixation of appropriate structure of capital

3. Helps in determining the project that should be invested on by company

4. It helps in activities of the business operation

5. It acts as a base for controlling the issues of finance

6. It boosts the utilisation of finance accurately

7. It helps in eliminating the issues that could be incurred in future from project investment

8. It acts as a link between financial decision making and its concerned investment

The financial objectives of Big Red Bicycle are as follows

1. To reduce expenses

2. To achieve the targeted net profit of $ 1000000 before tax

3. To compensate the reduction in sales which has occurred due to the economic downfall

A master budget of Big Red Bicycle Ltd identifies the conclusion that the total expenses and a

gross profit of a company in each of the four quarters are similar. However, a percentage of

commission is required to reduce in comparison to the amount of sales budget in each quarter. In

the projected budget of a company the sales amount if decreased due to a downfall in economic.

The master budget highlights a direct wage to be fixed for each year. The amount of expenses on

salaries and wages according to master budget is highlighted as $ 125000 per quarter. However,

in the budget of projection, there is an increase in the salary and wages expenditure due to an

inflation and time value. It is assumed that if there would be an increase in wages expenditure

then, a company could not achieve targeted Net profit before tax of $ 1000000. Big Red Bicycle

ltd would then require reducing the value of other expenses such as repair and maintenance, legal

fees and offices supplies by reducing late payment and wastage of resource.

Task B

To control the expenses and track the actual expenditure, Bills Goodale require to prepare the

following spreadsheet

Big Red Bicycle Pty

Ltd

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Project Expense Control

Final year Final year Q1 Q2 Q3 Q4

Expenses

General & administrative

expenses

Accounting fees 20000 5000 5000 5000 5000

Legal fees 4600 1150 1150 1150 1150

Bank charges 400 100 100 100 100

Office supplies 4600 1150 1150 1150 1150

Postage and printings 400 100 100 100 100

Dues and subscription 480 120 120 120 120

Telephone 8000 2000 2000 2000 2000

Repairs and maintenance 40000 10000 10000 10000 10000

Payroll tax 24800 6200 6200 6200

Marketing Expenses

Advertisement 100000 25000 25000 25000 25000

Employment expenses

Superannuation 44800 11200 11200 11200 11200

Wages and salaries 540000

13500

0

13500

0

13500

0

13500

0

Staff amenities 20000 5000 5000 5000 5000

Occupancy costs

Electricity 40000 10000 10000 10000 10000

Insurance 140000 35000 35000 35000 35000

8

Final year Final year Q1 Q2 Q3 Q4

Expenses

General & administrative

expenses

Accounting fees 20000 5000 5000 5000 5000

Legal fees 4600 1150 1150 1150 1150

Bank charges 400 100 100 100 100

Office supplies 4600 1150 1150 1150 1150

Postage and printings 400 100 100 100 100

Dues and subscription 480 120 120 120 120

Telephone 8000 2000 2000 2000 2000

Repairs and maintenance 40000 10000 10000 10000 10000

Payroll tax 24800 6200 6200 6200

Marketing Expenses

Advertisement 100000 25000 25000 25000 25000

Employment expenses

Superannuation 44800 11200 11200 11200 11200

Wages and salaries 540000

13500

0

13500

0

13500

0

13500

0

Staff amenities 20000 5000 5000 5000 5000

Occupancy costs

Electricity 40000 10000 10000 10000 10000

Insurance 140000 35000 35000 35000 35000

8

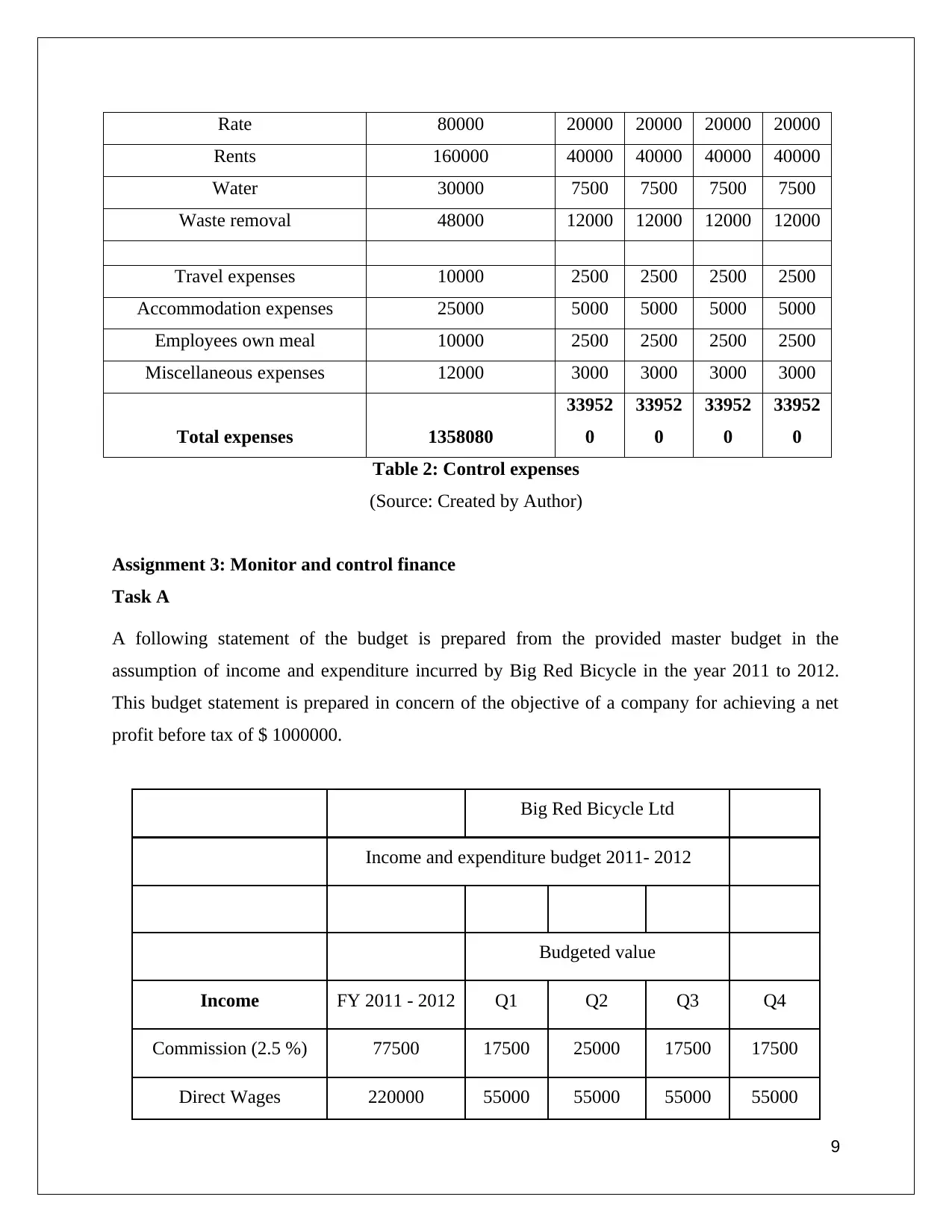

Rate 80000 20000 20000 20000 20000

Rents 160000 40000 40000 40000 40000

Water 30000 7500 7500 7500 7500

Waste removal 48000 12000 12000 12000 12000

Travel expenses 10000 2500 2500 2500 2500

Accommodation expenses 25000 5000 5000 5000 5000

Employees own meal 10000 2500 2500 2500 2500

Miscellaneous expenses 12000 3000 3000 3000 3000

Total expenses 1358080

33952

0

33952

0

33952

0

33952

0

Table 2: Control expenses

(Source: Created by Author)

Assignment 3: Monitor and control finance

Task A

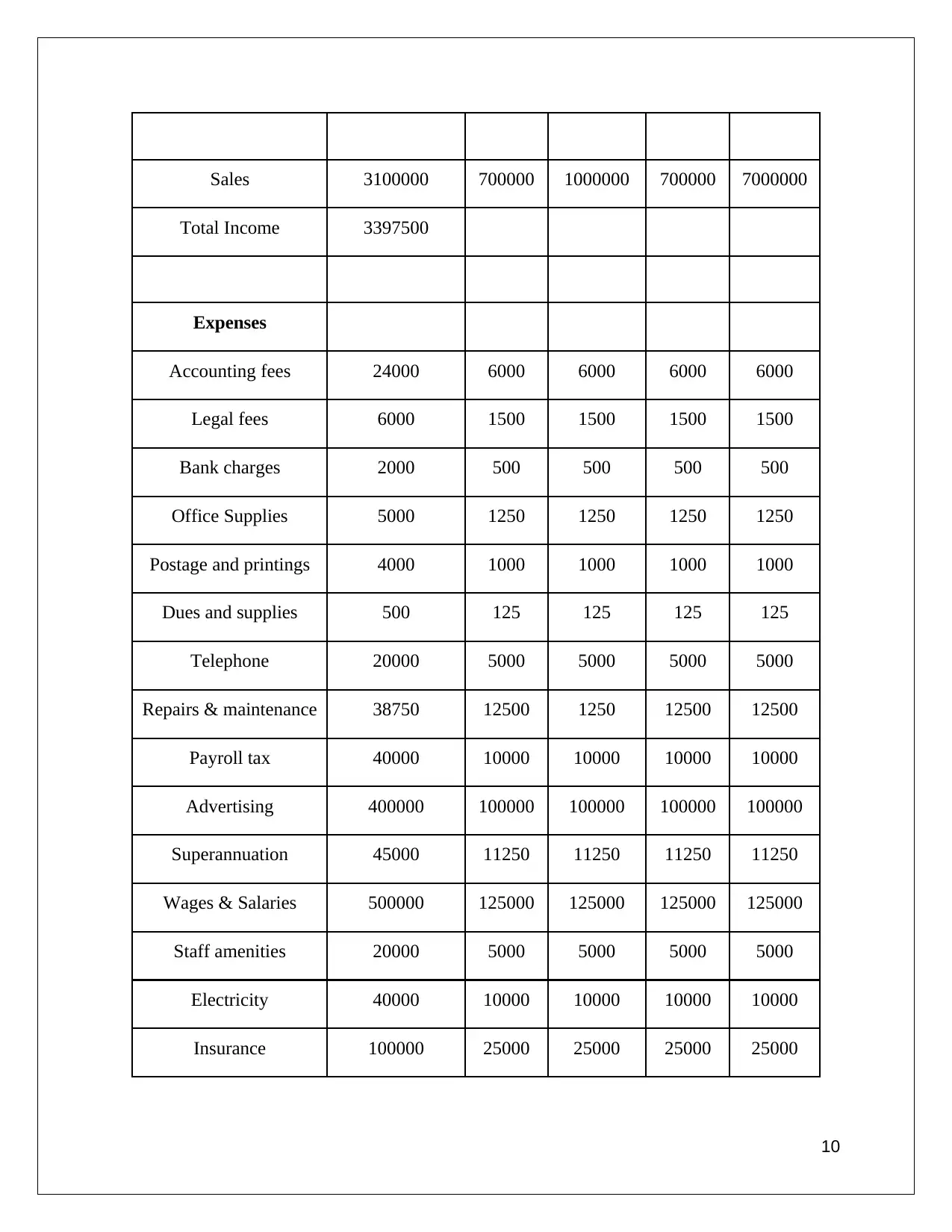

A following statement of the budget is prepared from the provided master budget in the

assumption of income and expenditure incurred by Big Red Bicycle in the year 2011 to 2012.

This budget statement is prepared in concern of the objective of a company for achieving a net

profit before tax of $ 1000000.

Big Red Bicycle Ltd

Income and expenditure budget 2011- 2012

Budgeted value

Income FY 2011 - 2012 Q1 Q2 Q3 Q4

Commission (2.5 %) 77500 17500 25000 17500 17500

Direct Wages 220000 55000 55000 55000 55000

9

Rents 160000 40000 40000 40000 40000

Water 30000 7500 7500 7500 7500

Waste removal 48000 12000 12000 12000 12000

Travel expenses 10000 2500 2500 2500 2500

Accommodation expenses 25000 5000 5000 5000 5000

Employees own meal 10000 2500 2500 2500 2500

Miscellaneous expenses 12000 3000 3000 3000 3000

Total expenses 1358080

33952

0

33952

0

33952

0

33952

0

Table 2: Control expenses

(Source: Created by Author)

Assignment 3: Monitor and control finance

Task A

A following statement of the budget is prepared from the provided master budget in the

assumption of income and expenditure incurred by Big Red Bicycle in the year 2011 to 2012.

This budget statement is prepared in concern of the objective of a company for achieving a net

profit before tax of $ 1000000.

Big Red Bicycle Ltd

Income and expenditure budget 2011- 2012

Budgeted value

Income FY 2011 - 2012 Q1 Q2 Q3 Q4

Commission (2.5 %) 77500 17500 25000 17500 17500

Direct Wages 220000 55000 55000 55000 55000

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sales 3100000 700000 1000000 700000 7000000

Total Income 3397500

Expenses

Accounting fees 24000 6000 6000 6000 6000

Legal fees 6000 1500 1500 1500 1500

Bank charges 2000 500 500 500 500

Office Supplies 5000 1250 1250 1250 1250

Postage and printings 4000 1000 1000 1000 1000

Dues and supplies 500 125 125 125 125

Telephone 20000 5000 5000 5000 5000

Repairs & maintenance 38750 12500 1250 12500 12500

Payroll tax 40000 10000 10000 10000 10000

Advertising 400000 100000 100000 100000 100000

Superannuation 45000 11250 11250 11250 11250

Wages & Salaries 500000 125000 125000 125000 125000

Staff amenities 20000 5000 5000 5000 5000

Electricity 40000 10000 10000 10000 10000

Insurance 100000 25000 25000 25000 25000

10

Total Income 3397500

Expenses

Accounting fees 24000 6000 6000 6000 6000

Legal fees 6000 1500 1500 1500 1500

Bank charges 2000 500 500 500 500

Office Supplies 5000 1250 1250 1250 1250

Postage and printings 4000 1000 1000 1000 1000

Dues and supplies 500 125 125 125 125

Telephone 20000 5000 5000 5000 5000

Repairs & maintenance 38750 12500 1250 12500 12500

Payroll tax 40000 10000 10000 10000 10000

Advertising 400000 100000 100000 100000 100000

Superannuation 45000 11250 11250 11250 11250

Wages & Salaries 500000 125000 125000 125000 125000

Staff amenities 20000 5000 5000 5000 5000

Electricity 40000 10000 10000 10000 10000

Insurance 100000 25000 25000 25000 25000

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

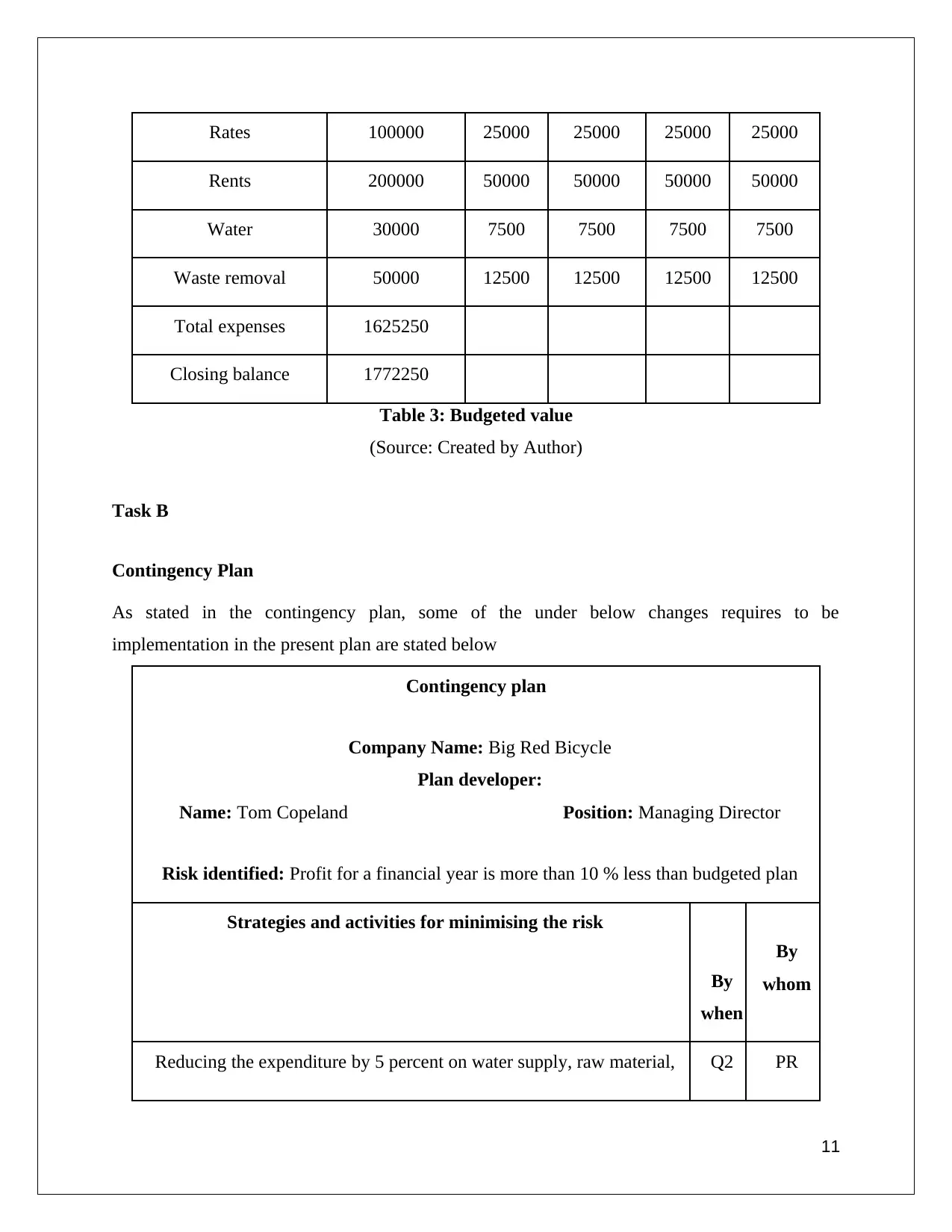

Rates 100000 25000 25000 25000 25000

Rents 200000 50000 50000 50000 50000

Water 30000 7500 7500 7500 7500

Waste removal 50000 12500 12500 12500 12500

Total expenses 1625250

Closing balance 1772250

Table 3: Budgeted value

(Source: Created by Author)

Task B

Contingency Plan

As stated in the contingency plan, some of the under below changes requires to be

implementation in the present plan are stated below

Contingency plan

Company Name: Big Red Bicycle

Plan developer:

Name: Tom Copeland Position: Managing Director

Risk identified: Profit for a financial year is more than 10 % less than budgeted plan

Strategies and activities for minimising the risk

By

when

By

whom

Reducing the expenditure by 5 percent on water supply, raw material, Q2 PR

11

Rents 200000 50000 50000 50000 50000

Water 30000 7500 7500 7500 7500

Waste removal 50000 12500 12500 12500 12500

Total expenses 1625250

Closing balance 1772250

Table 3: Budgeted value

(Source: Created by Author)

Task B

Contingency Plan

As stated in the contingency plan, some of the under below changes requires to be

implementation in the present plan are stated below

Contingency plan

Company Name: Big Red Bicycle

Plan developer:

Name: Tom Copeland Position: Managing Director

Risk identified: Profit for a financial year is more than 10 % less than budgeted plan

Strategies and activities for minimising the risk

By

when

By

whom

Reducing the expenditure by 5 percent on water supply, raw material, Q2 PR

11

electricity, and paper

Increasing the training period by including 4 more days every month Q2 PR

Monitoring properly the impact of training on employees Q3 PR

Expenses for advertising should be reduced Q3 PR

Increasing the relationship between employee and employer Q4 PR

Stopping the system of email which provides warning and monitors the

employee's performance. Stopping the announcement of a commission

to the team of sales

Q4 PR

Reducing direct wages by 50 percent due to the expiry of the contract

with the contractual employees

Q4 PR

Table 4: Contingency Plan

(Source: Created by Author)

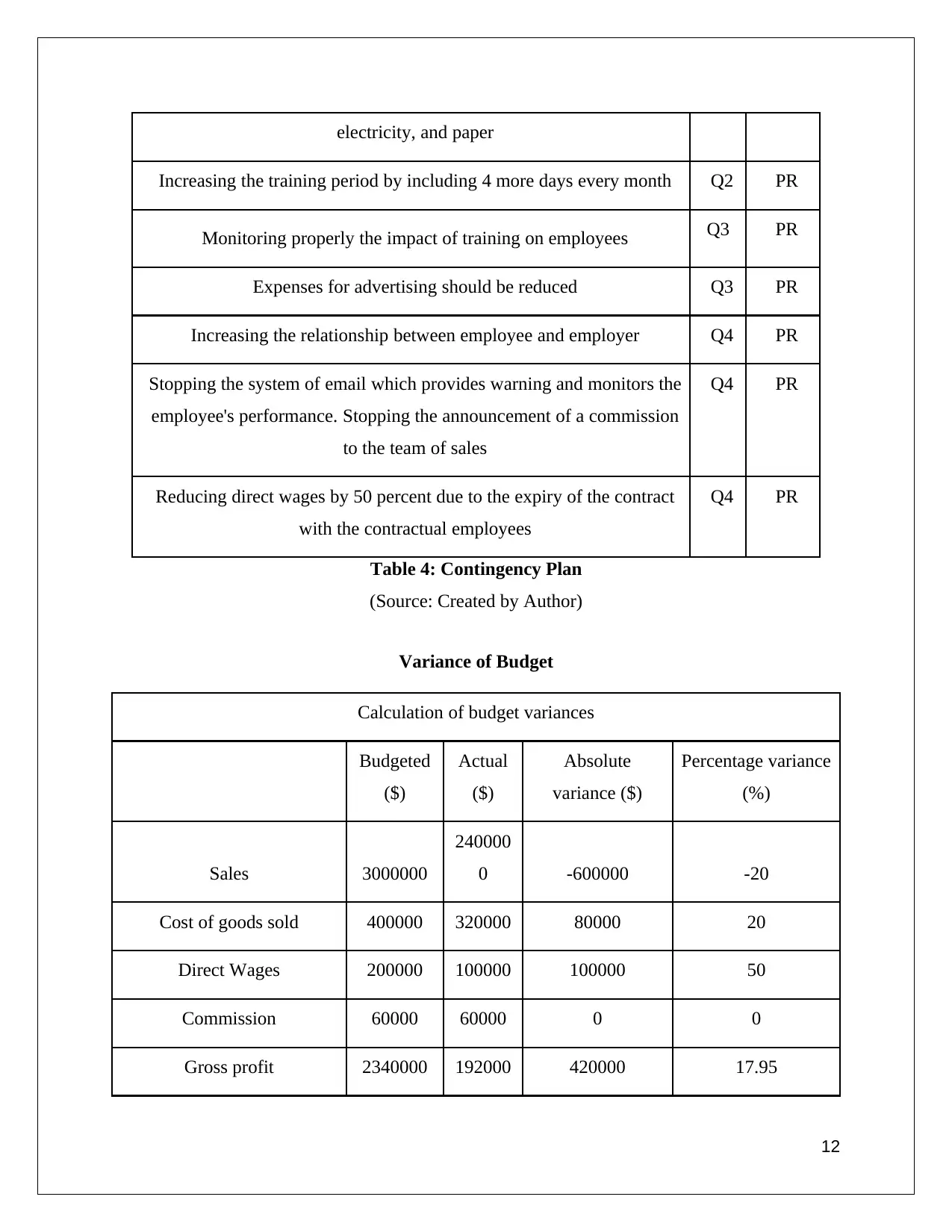

Variance of Budget

Calculation of budget variances

Budgeted

($)

Actual

($)

Absolute

variance ($)

Percentage variance

(%)

Sales 3000000

240000

0 -600000 -20

Cost of goods sold 400000 320000 80000 20

Direct Wages 200000 100000 100000 50

Commission 60000 60000 0 0

Gross profit 2340000 192000 420000 17.95

12

Increasing the training period by including 4 more days every month Q2 PR

Monitoring properly the impact of training on employees Q3 PR

Expenses for advertising should be reduced Q3 PR

Increasing the relationship between employee and employer Q4 PR

Stopping the system of email which provides warning and monitors the

employee's performance. Stopping the announcement of a commission

to the team of sales

Q4 PR

Reducing direct wages by 50 percent due to the expiry of the contract

with the contractual employees

Q4 PR

Table 4: Contingency Plan

(Source: Created by Author)

Variance of Budget

Calculation of budget variances

Budgeted

($)

Actual

($)

Absolute

variance ($)

Percentage variance

(%)

Sales 3000000

240000

0 -600000 -20

Cost of goods sold 400000 320000 80000 20

Direct Wages 200000 100000 100000 50

Commission 60000 60000 0 0

Gross profit 2340000 192000 420000 17.95

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.