Governance, Risk, and Ethics Analysis: Burberry Case Study Report

VerifiedAdded on 2020/07/22

|20

|6776

|110

Report

AI Summary

This report provides a comprehensive analysis of the corporate governance, risk, and ethical challenges faced by Burberry. The study begins with an introduction outlining the purpose and importance of the analysis, followed by a background section detailing Burberry's organizational structure, including its board of directors and committees. The report then describes key events and corporate governance issues, such as board ineffectiveness, lack of risk management, and insufficient internal control. It applies agency and stakeholder theories to understand the impact of these issues on shareholders and stakeholders. The report also examines Burberry's responses to these challenges, including discussions of CSR and environmental concerns. The conclusion summarizes key findings and offers recommendations for improved governance, risk management, and ethical practices within the company.

Governance, Risk and Ethics

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

1. INTRODUCTION.......................................................................................................................3

Purpose of the study....................................................................................................................3

Importance of the study..............................................................................................................3

Structure of the study..................................................................................................................3

2. CONTEXT: BACKGROUND....................................................................................................3

Organisational chart....................................................................................................................3

Board of directors.......................................................................................................................4

Committee...................................................................................................................................4

3. DESCRIPTION OF KEY EVENTS...........................................................................................5

The reason behind choosing Burberry for this case study: ........................................................5

Case Summary and Corporate Governance Issues ....................................................................5

Main Theories Applicable to Burberry Corporation ..................................................................7

4 Main Corporate Governance issues..............................................................................................8

5. Corporate Governance theories.................................................................................................11

6. Response of Burberry to the Issues...........................................................................................13

7 Grenfell Tower was in fire months ago......................................................................................15

General lesson learnt.....................................................................................................................15

CONCLUSION ............................................................................................................................17

REFERENCES .............................................................................................................................19

What is agency theory? 2012[Online]. Available

through:<http://kfknowledgebank.kaplan.co.uk/KFKB/Wiki%20Pages/Agency

%20theory.aspx> .....................................................................................................................20

1. INTRODUCTION.......................................................................................................................3

Purpose of the study....................................................................................................................3

Importance of the study..............................................................................................................3

Structure of the study..................................................................................................................3

2. CONTEXT: BACKGROUND....................................................................................................3

Organisational chart....................................................................................................................3

Board of directors.......................................................................................................................4

Committee...................................................................................................................................4

3. DESCRIPTION OF KEY EVENTS...........................................................................................5

The reason behind choosing Burberry for this case study: ........................................................5

Case Summary and Corporate Governance Issues ....................................................................5

Main Theories Applicable to Burberry Corporation ..................................................................7

4 Main Corporate Governance issues..............................................................................................8

5. Corporate Governance theories.................................................................................................11

6. Response of Burberry to the Issues...........................................................................................13

7 Grenfell Tower was in fire months ago......................................................................................15

General lesson learnt.....................................................................................................................15

CONCLUSION ............................................................................................................................17

REFERENCES .............................................................................................................................19

What is agency theory? 2012[Online]. Available

through:<http://kfknowledgebank.kaplan.co.uk/KFKB/Wiki%20Pages/Agency

%20theory.aspx> .....................................................................................................................20

1. INTRODUCTION

Purpose of the study

The purpose of this study is to study the corporate governance related issues faced by the

organizations operating at a global level. For which, a well-known fashion company named

Burberry has been chosen. Corporate governance is considered as the comer-stone to any

effective, ethical and accountable company and can be defined as the system which is considered

as the unit of balance and check, these are the internal and external forces of the company.

Importance of the study

This is important because in the international market, there are many organizations who face

various kinds of issues regarding several business disasters and dilemmas. It is therefore

important to study the issues related to corporate governance and resolve in the best possible

way.

Structure of the study

This report is thus based upon the Governance, risk and ethics related issues that are usually

being faced by the chosen fashion company named Burberry. Burberry is the Luxury fashion

house situated in London, it is very high end store who deals in very exclusive products for both

men and women. It provides trench coats, ready to wear dresses, stylish accessories, sunglasses,

cosmetics and many other products. The current study has firstly reviewed the background of the

selected establishment by studying its organizational chart consisting of its board of members as

well as committee members. After which, it has described some key events that took place in

Burberry with a special consideration of addressing its corporate governance related issues.

Lastly, it has applied the theories with recommendation to deal with the identified problems

related to ethical concerns and corporate governance, etc.

2. CONTEXT: BACKGROUND

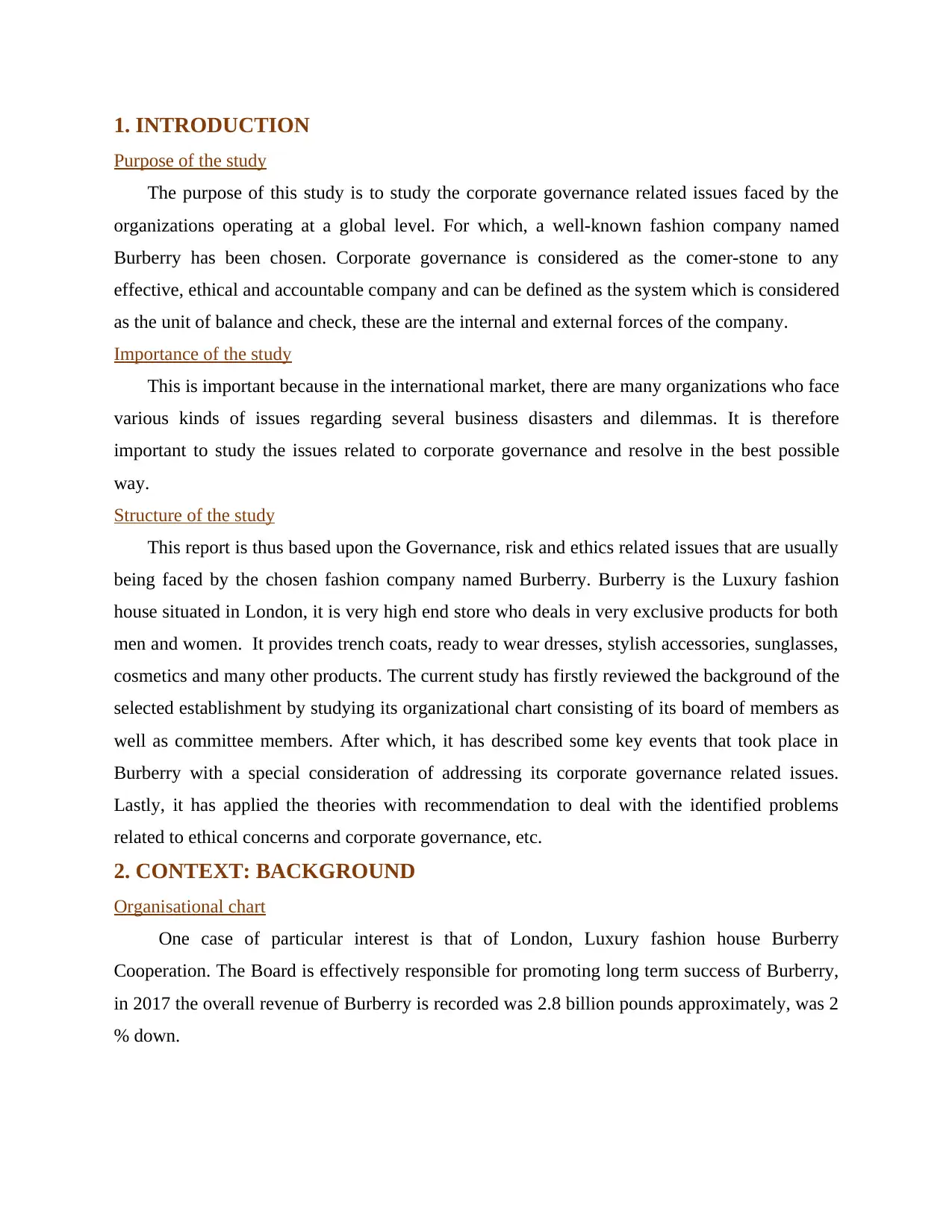

Organisational chart

One case of particular interest is that of London, Luxury fashion house Burberry

Cooperation. The Board is effectively responsible for promoting long term success of Burberry,

in 2017 the overall revenue of Burberry is recorded was 2.8 billion pounds approximately, was 2

% down.

Purpose of the study

The purpose of this study is to study the corporate governance related issues faced by the

organizations operating at a global level. For which, a well-known fashion company named

Burberry has been chosen. Corporate governance is considered as the comer-stone to any

effective, ethical and accountable company and can be defined as the system which is considered

as the unit of balance and check, these are the internal and external forces of the company.

Importance of the study

This is important because in the international market, there are many organizations who face

various kinds of issues regarding several business disasters and dilemmas. It is therefore

important to study the issues related to corporate governance and resolve in the best possible

way.

Structure of the study

This report is thus based upon the Governance, risk and ethics related issues that are usually

being faced by the chosen fashion company named Burberry. Burberry is the Luxury fashion

house situated in London, it is very high end store who deals in very exclusive products for both

men and women. It provides trench coats, ready to wear dresses, stylish accessories, sunglasses,

cosmetics and many other products. The current study has firstly reviewed the background of the

selected establishment by studying its organizational chart consisting of its board of members as

well as committee members. After which, it has described some key events that took place in

Burberry with a special consideration of addressing its corporate governance related issues.

Lastly, it has applied the theories with recommendation to deal with the identified problems

related to ethical concerns and corporate governance, etc.

2. CONTEXT: BACKGROUND

Organisational chart

One case of particular interest is that of London, Luxury fashion house Burberry

Cooperation. The Board is effectively responsible for promoting long term success of Burberry,

in 2017 the overall revenue of Burberry is recorded was 2.8 billion pounds approximately, was 2

% down.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Board of directors

The above organizational chart has depicted the board of directors in Burberry that

involves a chairman, a chief executive officer and a chief financial officer and operating officer

at similar level. After which, there exists 2 non-executive directors and a senior independent

director at another level. At the third level, there exists total 5 non-executive directors

responsible for handling its operations at distinct regions.

Committee

Burberry’s committee is divided into 3 distinct sections with an audit committee handled

by Jeremy Darroch, as the chairperson of this committee. It is with a responsibility of monitoring

the reliability of all sort of fiscal data. This is basically to ensure the Board about a regulated and

continually reviewed system of risk management as well as internal control measures.

Next is their remuneration committee handled by Orna Nichionna with a role of ensuring a

suitable remuneration to the executive directors as well as other executives at senior level. This

is basically to keep them driven towards submitting productive work and performing well

towards the achievement of company’s objectives on a set time period.

Last is the nomination committee which is administered by Sir John Peace who is

accountable for balancing the alignment of both board and committee members along with their

work. For this, it is important to supervise the necessities of sequential planning by framing

effective group strategies for positioning the group at a diversified level.

The above organizational chart has depicted the board of directors in Burberry that

involves a chairman, a chief executive officer and a chief financial officer and operating officer

at similar level. After which, there exists 2 non-executive directors and a senior independent

director at another level. At the third level, there exists total 5 non-executive directors

responsible for handling its operations at distinct regions.

Committee

Burberry’s committee is divided into 3 distinct sections with an audit committee handled

by Jeremy Darroch, as the chairperson of this committee. It is with a responsibility of monitoring

the reliability of all sort of fiscal data. This is basically to ensure the Board about a regulated and

continually reviewed system of risk management as well as internal control measures.

Next is their remuneration committee handled by Orna Nichionna with a role of ensuring a

suitable remuneration to the executive directors as well as other executives at senior level. This

is basically to keep them driven towards submitting productive work and performing well

towards the achievement of company’s objectives on a set time period.

Last is the nomination committee which is administered by Sir John Peace who is

accountable for balancing the alignment of both board and committee members along with their

work. For this, it is important to supervise the necessities of sequential planning by framing

effective group strategies for positioning the group at a diversified level.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3. DESCRIPTION OF KEY EVENTS

The reason behind choosing Burberry for this case study:

Often Multinational companies are failed to address the appropriate corporate-

governance, and one of the clearest example of this is Burberry, there are number of

issues which organization have to face every year, and it creates economic effect upon

the London.

Burberry symbolize the importance of risk management and internal controls as it

practicing its business since last so many decades.

The most famous slogan of Burberry is “Fragrance of women and men” is very popular

among people.

The economic culture and background of Burberry as a British company is interesting

because of corporate and high fashion culture within London.

Case Summary and Corporate Governance Issues

The board has constructed several improvements since the rebellion of last shareholder,

the confused behavior regarding the several salary problems, the problem that arises this year has

highlighted the concerns and problems regarding the poor corporate governance with Burberry.

The main issue with the organization is imposition of high taxes in other countries for operating

business, because those countries wants to promote domestic production rather than the foreign.

There are many cases where it has been seen that, functioning operations for Burberry is difficult

in other countries (Asarpota, 2014).

Board Ineffectiveness: grievances ignored oversight :

Burberry believes that to be a great brand, we must be a great company. Burberry's culture

underpins the brand and business internally and externally and creates a vibrant global

community connected through shared values and purpose. The Human Rights Policy details the

procedures the Company has put in place to protect and uphold human rights in this context,

including the mechanisms to address potential infringement that may arise in connection with the

Company’s operations and activities. Burberry is committed to upholding the International Bill

of Human Rights through a policy aligned to the core Conventions of the International Labour

Organization and steered by the UN Guiding Principles on Business and Human Rights.

Burberry is also a signatory of the UN Global Compact and a member of the Ethical Trading

Initiative.

The reason behind choosing Burberry for this case study:

Often Multinational companies are failed to address the appropriate corporate-

governance, and one of the clearest example of this is Burberry, there are number of

issues which organization have to face every year, and it creates economic effect upon

the London.

Burberry symbolize the importance of risk management and internal controls as it

practicing its business since last so many decades.

The most famous slogan of Burberry is “Fragrance of women and men” is very popular

among people.

The economic culture and background of Burberry as a British company is interesting

because of corporate and high fashion culture within London.

Case Summary and Corporate Governance Issues

The board has constructed several improvements since the rebellion of last shareholder,

the confused behavior regarding the several salary problems, the problem that arises this year has

highlighted the concerns and problems regarding the poor corporate governance with Burberry.

The main issue with the organization is imposition of high taxes in other countries for operating

business, because those countries wants to promote domestic production rather than the foreign.

There are many cases where it has been seen that, functioning operations for Burberry is difficult

in other countries (Asarpota, 2014).

Board Ineffectiveness: grievances ignored oversight :

Burberry believes that to be a great brand, we must be a great company. Burberry's culture

underpins the brand and business internally and externally and creates a vibrant global

community connected through shared values and purpose. The Human Rights Policy details the

procedures the Company has put in place to protect and uphold human rights in this context,

including the mechanisms to address potential infringement that may arise in connection with the

Company’s operations and activities. Burberry is committed to upholding the International Bill

of Human Rights through a policy aligned to the core Conventions of the International Labour

Organization and steered by the UN Guiding Principles on Business and Human Rights.

Burberry is also a signatory of the UN Global Compact and a member of the Ethical Trading

Initiative.

CSR: Green issue environment:

Burberry has warned of a “challenging demand environment” after a tough year in which the

luxury British retailer has struggled to recover from a sales collapse in Hong Kong and Macau.

The high-end fashion brand said full year profits before tax are likely to be at the bottom of

analysts’ expectations this financial year, after comparable revenues fell 5 per cent in the fourth

quarter – far short of consensus expectations of a 1.4 per cent decline. Burberry is more reliant

than other luxury goods groups on Chinese buyers, who for a time, flocked to Hong Kong in

search of status design brands.

The corporate governance issues within Burberry that will be discussed in this:

Lack of Risk Management: Within Burberry there is no as such management unit

which controls the possible risk factors of the organization, in order to avoid such

situations that can affect the business of the Burberry adversely, it is essential for the

company to maintain their risk evaluation structure.

Insufficient Internal Control: The internal audit department of Burberry is not very

effective, it is insufficient in acting as a supervisory mechanism within each individual

operation under the group of Burberry, while on the other hand the fashion and luxury

industries are always been manipulated by the social ethics.

The Boardroom is not very effective: The internal heads of the Burberry are quite

insufficient in conducting their duties effectively, company ace kind of problems while

practising its business in other countries. But there is no as such discussion happened in

the organization regarding the problem faced by them in operating in other countries. The

company provides high end fashion clothing and accessories for both men and women

and it is highly manipulated by the social environmental ethics.

Company level association and Corporate culture: Due to the pressures from the

principal company management, alongside the British cultural expectation of employees

yielding to the objectives of superiors due to the contrary being deemed intolerable, this

resulted in accounting treatments being carried out that were not compliant with global

standards. This lack of compliance has been evident in the corporate culture surrounding

this case but has been proactively addressed in the reverberations of Burberry

(Macchion,2017).

Burberry has warned of a “challenging demand environment” after a tough year in which the

luxury British retailer has struggled to recover from a sales collapse in Hong Kong and Macau.

The high-end fashion brand said full year profits before tax are likely to be at the bottom of

analysts’ expectations this financial year, after comparable revenues fell 5 per cent in the fourth

quarter – far short of consensus expectations of a 1.4 per cent decline. Burberry is more reliant

than other luxury goods groups on Chinese buyers, who for a time, flocked to Hong Kong in

search of status design brands.

The corporate governance issues within Burberry that will be discussed in this:

Lack of Risk Management: Within Burberry there is no as such management unit

which controls the possible risk factors of the organization, in order to avoid such

situations that can affect the business of the Burberry adversely, it is essential for the

company to maintain their risk evaluation structure.

Insufficient Internal Control: The internal audit department of Burberry is not very

effective, it is insufficient in acting as a supervisory mechanism within each individual

operation under the group of Burberry, while on the other hand the fashion and luxury

industries are always been manipulated by the social ethics.

The Boardroom is not very effective: The internal heads of the Burberry are quite

insufficient in conducting their duties effectively, company ace kind of problems while

practising its business in other countries. But there is no as such discussion happened in

the organization regarding the problem faced by them in operating in other countries. The

company provides high end fashion clothing and accessories for both men and women

and it is highly manipulated by the social environmental ethics.

Company level association and Corporate culture: Due to the pressures from the

principal company management, alongside the British cultural expectation of employees

yielding to the objectives of superiors due to the contrary being deemed intolerable, this

resulted in accounting treatments being carried out that were not compliant with global

standards. This lack of compliance has been evident in the corporate culture surrounding

this case but has been proactively addressed in the reverberations of Burberry

(Macchion,2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Main Theories Applicable to Burberry Corporation

Within this case study and subsequent analysis, we will discuss the impact Burberry

actions had upon its shareholders and stakeholders, referring to the relevant theories of

relationships within business of both Agency Theory and Stakeholder Theory. Initially, we will

discuss the agency theory with reference to the operation issue cases; as it can be viewed as

analogous to the circumstances in Burberry where the company has faced various issues

regarding the operating functions in other country, because the government of the country does

not want Burberry to manipulate their domestic market. It is assumed that directors will ensure

the growth of shareholder capital in every choice they make.

However, this was not the case in Burberry within this case study and subsequent analysis

we will discuss the impact Burberry actions had upon its shareholders and stakeholders, referring

to the relevant theories of relationships within business of both Agency Theory and Stakeholder

Theory. Initially, we will discuss the agency theory with reference to the operation issue cases;

as it can be viewed as analogous to the circumstances in Burberry where the company has faced

various issues regarding the operating functions in other country, because the government of the

country does not want Burberry to manipulate their domestic market. It is assumed that directors

will ensure the growth of shareholder capital in every choice they make.

However, this was not the case in Burberry where executive discretion and opportunism

engaged in the expansion of the directors’ benefits irrespective of the shareholders in order to

achieve unrealistic targets or ‘Challenges’ as they were referred to. These ‘Challenges’ were

frequently agreed approaching the quarterly end at the CEO meetings, causing them to be

impossible to achieve regardless of sales growth, in such a brief time frame and ultimately

occasioned the exaggeration of profits as the only alternative. Secondly, we will analyse the

impact of Burberry manipulation of profits with reference to stakeholder theory, particularly

their corporate social responsibility (CSR) that is evident in Burberry slogan and statements

made throughout their annual reports.

Everywhere, executive discretion and opportunism engaged in the expansion of the

directors’ benefits irrespective of the shareholders in order to achieve unrealistic targets or

‘Challenges’ as they were referred to (Vadicherla, 2015). These ‘Challenges’ were frequently

agreed approaching the quarterly end at the CEO meetings, causing them to be impossible to

achieve regardless of sales growth, in such a brief time frame and ultimately occasioned the

Within this case study and subsequent analysis, we will discuss the impact Burberry

actions had upon its shareholders and stakeholders, referring to the relevant theories of

relationships within business of both Agency Theory and Stakeholder Theory. Initially, we will

discuss the agency theory with reference to the operation issue cases; as it can be viewed as

analogous to the circumstances in Burberry where the company has faced various issues

regarding the operating functions in other country, because the government of the country does

not want Burberry to manipulate their domestic market. It is assumed that directors will ensure

the growth of shareholder capital in every choice they make.

However, this was not the case in Burberry within this case study and subsequent analysis

we will discuss the impact Burberry actions had upon its shareholders and stakeholders, referring

to the relevant theories of relationships within business of both Agency Theory and Stakeholder

Theory. Initially, we will discuss the agency theory with reference to the operation issue cases;

as it can be viewed as analogous to the circumstances in Burberry where the company has faced

various issues regarding the operating functions in other country, because the government of the

country does not want Burberry to manipulate their domestic market. It is assumed that directors

will ensure the growth of shareholder capital in every choice they make.

However, this was not the case in Burberry where executive discretion and opportunism

engaged in the expansion of the directors’ benefits irrespective of the shareholders in order to

achieve unrealistic targets or ‘Challenges’ as they were referred to. These ‘Challenges’ were

frequently agreed approaching the quarterly end at the CEO meetings, causing them to be

impossible to achieve regardless of sales growth, in such a brief time frame and ultimately

occasioned the exaggeration of profits as the only alternative. Secondly, we will analyse the

impact of Burberry manipulation of profits with reference to stakeholder theory, particularly

their corporate social responsibility (CSR) that is evident in Burberry slogan and statements

made throughout their annual reports.

Everywhere, executive discretion and opportunism engaged in the expansion of the

directors’ benefits irrespective of the shareholders in order to achieve unrealistic targets or

‘Challenges’ as they were referred to (Vadicherla, 2015). These ‘Challenges’ were frequently

agreed approaching the quarterly end at the CEO meetings, causing them to be impossible to

achieve regardless of sales growth, in such a brief time frame and ultimately occasioned the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

exaggeration of profits as the only alternative. Secondly, we will analyse the impact of Burberry

manipulation of profits with reference to stakeholder theory, particularly their corporate social

responsibility (CSR) that is evident in Burberry slogan and statements made throughout their

annual reports (Perry, 2014).

Associated profit records and current Annual Reports of Burberry Corporation that will

offer opportunities for independent examination of the operations impact of this case on business

functions, company revenue and on wider society. Literature concerning British corporate

culture, the importance of internal controls and the impact both Toshiba and similar cases have

had. Principles of Corporate Governance for Listed Companies which predated the majority of

the Burberry Operating issues. London's Corporate Governance Code following the Burberry

operating functions problem; UK Corporate Governance Code for comparison purposes

(Shrives, 2014).

4 Main Corporate Governance issues

In order to sustain in the competitive environment and to prevent any uncertainties and

risks, it is essential for the management of Burberry to follow all the policies, rules and

regulations thoroughly and adequately. Whilst doing business activities, organisations might face

one or several corporate governance issues that could negatively impact on the reputation of the

organisation (McCahery, Sautner and Starks, 2016). In this context, the major corporate

governance issues that Burberry could face is described below:

Risk Management

Risk management refers to the anticipation and evaluation of the financial, business,

strategic and any other form of risks together with the identification of procedures to avoid or

minimise its impact. Business organisation who wants to thrive in the competitive environment

needs to identify, analyse and evaluate the nature of risk and devise strategy in order to

overcome it efficiently (Tricker and Tricker, 2015). Risk management is considered as major

issue in corporate governance. Every business irrespective of its size, nature or types of

customers faces one or many risks. It is the duty and responsibility of the board of directors to

formulate effective risk management plans in order to boost up the motivation of shareholders,

customers, employees and society. As per UK Corporate Governance Code Main Principle C.2

Risk Management and Internal Control states that it is the duty of board of directors for

determining the nature and extent of principle risk which influences the organisation while

manipulation of profits with reference to stakeholder theory, particularly their corporate social

responsibility (CSR) that is evident in Burberry slogan and statements made throughout their

annual reports (Perry, 2014).

Associated profit records and current Annual Reports of Burberry Corporation that will

offer opportunities for independent examination of the operations impact of this case on business

functions, company revenue and on wider society. Literature concerning British corporate

culture, the importance of internal controls and the impact both Toshiba and similar cases have

had. Principles of Corporate Governance for Listed Companies which predated the majority of

the Burberry Operating issues. London's Corporate Governance Code following the Burberry

operating functions problem; UK Corporate Governance Code for comparison purposes

(Shrives, 2014).

4 Main Corporate Governance issues

In order to sustain in the competitive environment and to prevent any uncertainties and

risks, it is essential for the management of Burberry to follow all the policies, rules and

regulations thoroughly and adequately. Whilst doing business activities, organisations might face

one or several corporate governance issues that could negatively impact on the reputation of the

organisation (McCahery, Sautner and Starks, 2016). In this context, the major corporate

governance issues that Burberry could face is described below:

Risk Management

Risk management refers to the anticipation and evaluation of the financial, business,

strategic and any other form of risks together with the identification of procedures to avoid or

minimise its impact. Business organisation who wants to thrive in the competitive environment

needs to identify, analyse and evaluate the nature of risk and devise strategy in order to

overcome it efficiently (Tricker and Tricker, 2015). Risk management is considered as major

issue in corporate governance. Every business irrespective of its size, nature or types of

customers faces one or many risks. It is the duty and responsibility of the board of directors to

formulate effective risk management plans in order to boost up the motivation of shareholders,

customers, employees and society. As per UK Corporate Governance Code Main Principle C.2

Risk Management and Internal Control states that it is the duty of board of directors for

determining the nature and extent of principle risk which influences the organisation while

accomplishing its strategic objectives. A sound risk management and internal control systems

must be maintained by the board (The UK Corporate Governance Code. 2016).

C 2.1 states that in annual report of the organisation, the directors should detailed that a robust

assessment of principle risks the organisation faced has been carried out by them.

C2.2 states that directors in the annual report of the company should explain that the way they

have assessed the prospectus of company over a particular period and rationale for considering

that particular period most suitable.

C2.3 states that it is the duty and responsibility of the board to monitor the company's risk

management and internal control system.

The role of board of Burberry is to adequately follow the corporate governance code and provide

information regarding assessment of risk in their annual report in order to increase the

knowledge of its stakeholder and shareholders.

Ethics

Ethics in simple term refers to the moral principles of an individual that governs a person

behaviour. To enhance the reputation of the organisation and increase the goodwill of the

company, it is important for the management to follow specific ethical code of conduct and

practices. Business ethics also refers to the way the employees and management behave in the

organisation. In order to sustain in the competitive environment, it is essential for the

management of to consider the importance to ethical codes and conducts. In recent years, it was

identified that many companies incorporating in United Kingdom have been facing ethical issues

which includes Burberry, Tesco, etc (Kraakman and Hansmann, 2017). Ethical issues are

another major corporate governance issue that affects the organisational growth and

development. Ethical issues includes fundamental issues such as dealing with clients or

customers. Any organisation who unfairly deal with their customers comes under this category.

Diversity issues are another form of ethical issues. An organisation with diverse workforce face

this issue where diversified employees faced discrimination within the organisation. Decision

making issues, compliance and governance issues are also form of ethical issue that a

corporation faced while operating in the country (Bovens, Goodin and Schillemans, 2014). The

role of Board of Burberry's is to establish precise code of ethics within the organisation so the

brand reputation and goodwill can be enhanced effectively.

Corporate Social Responsibility (CSR)

must be maintained by the board (The UK Corporate Governance Code. 2016).

C 2.1 states that in annual report of the organisation, the directors should detailed that a robust

assessment of principle risks the organisation faced has been carried out by them.

C2.2 states that directors in the annual report of the company should explain that the way they

have assessed the prospectus of company over a particular period and rationale for considering

that particular period most suitable.

C2.3 states that it is the duty and responsibility of the board to monitor the company's risk

management and internal control system.

The role of board of Burberry is to adequately follow the corporate governance code and provide

information regarding assessment of risk in their annual report in order to increase the

knowledge of its stakeholder and shareholders.

Ethics

Ethics in simple term refers to the moral principles of an individual that governs a person

behaviour. To enhance the reputation of the organisation and increase the goodwill of the

company, it is important for the management to follow specific ethical code of conduct and

practices. Business ethics also refers to the way the employees and management behave in the

organisation. In order to sustain in the competitive environment, it is essential for the

management of to consider the importance to ethical codes and conducts. In recent years, it was

identified that many companies incorporating in United Kingdom have been facing ethical issues

which includes Burberry, Tesco, etc (Kraakman and Hansmann, 2017). Ethical issues are

another major corporate governance issue that affects the organisational growth and

development. Ethical issues includes fundamental issues such as dealing with clients or

customers. Any organisation who unfairly deal with their customers comes under this category.

Diversity issues are another form of ethical issues. An organisation with diverse workforce face

this issue where diversified employees faced discrimination within the organisation. Decision

making issues, compliance and governance issues are also form of ethical issue that a

corporation faced while operating in the country (Bovens, Goodin and Schillemans, 2014). The

role of Board of Burberry's is to establish precise code of ethics within the organisation so the

brand reputation and goodwill can be enhanced effectively.

Corporate Social Responsibility (CSR)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate social responsibility or CSR is contribution of organisations towards the

society, community and environment. It is a managerial concept whereby companies integrate

social and environmental concerns in their business operations and interactions with their

stakeholders. It is an efficient through which organisations able to achieve balance of economic,

environmental and social imperatives. Good corporate governance is the key part of organisation

and CSR initiatives led by the organisations influences the corporate governance greatly.

According to Companies Act 2006, it is important for the management of organisations to

perform CSR activities in order to provide valuable services to the society and environment of

Untied Kingdom (Shrives and Brennan, 2015). Corporate social responsibility is important for

the management as it helps in enhancing the productivity of the organisation. Through CSR the

organisation able to promote the products and services to the customers. According to UK

corporate governance code, the board is responsible for formulating and implementing specific

codes for conducting corporate social responsibility. Albeit, many organisations have faced key

corporate social responsibility issues such as environmental management, eco-efficiency,

responsible sourcing, labour standards, working conditions, employee and community relations.

In order to avoid these issues, the management needs to implement CSR activities effectively

and efficiently (Soltani and Maupetit, 2015). The role of board of Burberry is to formulate

precise policies and conducts so that the organisation could initiate efficient CSR activities.

Ineffective board

Board of the organisation is the apex body which is responsible for formulating polices, norms,

regulations, code of conducts, code of ethics and practices which are meant to be followed

within the organisation. Board represents companies main parties which includes directors,

chairman, chief executive officer, chief operating officers, etc. In order to create a robust

organisational structure, it is essential for the board to be effective (Kraakman and Hansmann,

2017). An effective board leads the organisation on the path of growth and development whereas

an ineffective board degrades the organisational performance and productivity. The role of

Board of Burberry's is to focus on the policies and regulations and aligned it appropriately with

national policies and regulations so that organisation can thrive effectively.

Poor Internal Control

Poor internal control is yet another corporate governance issue that disturbs the

performance of the company greatly (Tricker and Tricker, 2015). If the internal control and

society, community and environment. It is a managerial concept whereby companies integrate

social and environmental concerns in their business operations and interactions with their

stakeholders. It is an efficient through which organisations able to achieve balance of economic,

environmental and social imperatives. Good corporate governance is the key part of organisation

and CSR initiatives led by the organisations influences the corporate governance greatly.

According to Companies Act 2006, it is important for the management of organisations to

perform CSR activities in order to provide valuable services to the society and environment of

Untied Kingdom (Shrives and Brennan, 2015). Corporate social responsibility is important for

the management as it helps in enhancing the productivity of the organisation. Through CSR the

organisation able to promote the products and services to the customers. According to UK

corporate governance code, the board is responsible for formulating and implementing specific

codes for conducting corporate social responsibility. Albeit, many organisations have faced key

corporate social responsibility issues such as environmental management, eco-efficiency,

responsible sourcing, labour standards, working conditions, employee and community relations.

In order to avoid these issues, the management needs to implement CSR activities effectively

and efficiently (Soltani and Maupetit, 2015). The role of board of Burberry is to formulate

precise policies and conducts so that the organisation could initiate efficient CSR activities.

Ineffective board

Board of the organisation is the apex body which is responsible for formulating polices, norms,

regulations, code of conducts, code of ethics and practices which are meant to be followed

within the organisation. Board represents companies main parties which includes directors,

chairman, chief executive officer, chief operating officers, etc. In order to create a robust

organisational structure, it is essential for the board to be effective (Kraakman and Hansmann,

2017). An effective board leads the organisation on the path of growth and development whereas

an ineffective board degrades the organisational performance and productivity. The role of

Board of Burberry's is to focus on the policies and regulations and aligned it appropriately with

national policies and regulations so that organisation can thrive effectively.

Poor Internal Control

Poor internal control is yet another corporate governance issue that disturbs the

performance of the company greatly (Tricker and Tricker, 2015). If the internal control and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

monitoring of the organisation is not efficient, it can negatively impact on the shareholders of the

organisation. It is the duty and responsibility of the board to focus on the internal control and

monitoring so that the management and employees can work collaboratively. It is the role of

board of Burberry's to focus on the internal control thoroughly so that motivation of both

stakeholders and shareholders can be enhanced.

5. Corporate Governance theories

Agency theory

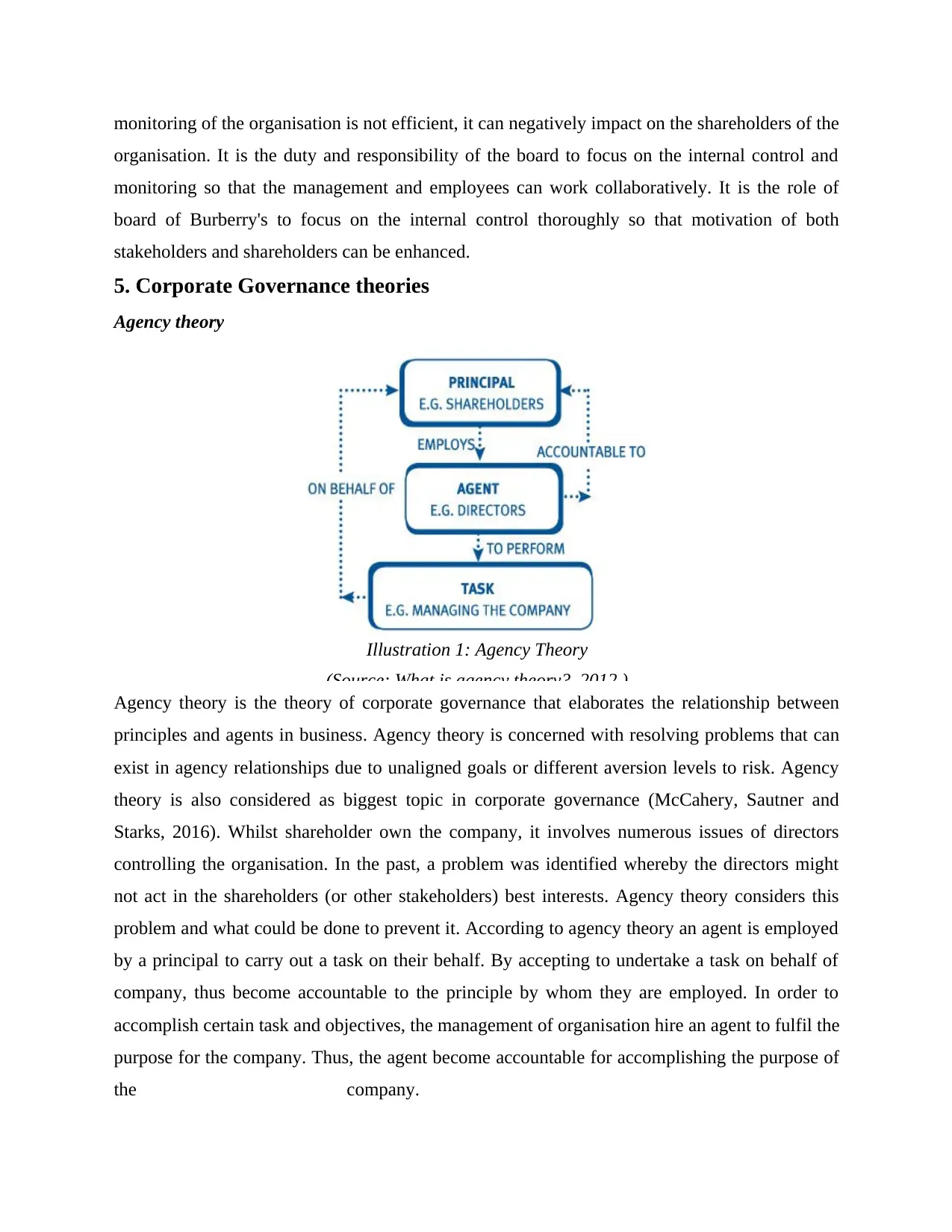

Agency theory is the theory of corporate governance that elaborates the relationship between

principles and agents in business. Agency theory is concerned with resolving problems that can

exist in agency relationships due to unaligned goals or different aversion levels to risk. Agency

theory is also considered as biggest topic in corporate governance (McCahery, Sautner and

Starks, 2016). Whilst shareholder own the company, it involves numerous issues of directors

controlling the organisation. In the past, a problem was identified whereby the directors might

not act in the shareholders (or other stakeholders) best interests. Agency theory considers this

problem and what could be done to prevent it. According to agency theory an agent is employed

by a principal to carry out a task on their behalf. By accepting to undertake a task on behalf of

company, thus become accountable to the principle by whom they are employed. In order to

accomplish certain task and objectives, the management of organisation hire an agent to fulfil the

purpose for the company. Thus, the agent become accountable for accomplishing the purpose of

the company.

Illustration 1: Agency Theory

(Source: What is agency theory?, 2012 )

organisation. It is the duty and responsibility of the board to focus on the internal control and

monitoring so that the management and employees can work collaboratively. It is the role of

board of Burberry's to focus on the internal control thoroughly so that motivation of both

stakeholders and shareholders can be enhanced.

5. Corporate Governance theories

Agency theory

Agency theory is the theory of corporate governance that elaborates the relationship between

principles and agents in business. Agency theory is concerned with resolving problems that can

exist in agency relationships due to unaligned goals or different aversion levels to risk. Agency

theory is also considered as biggest topic in corporate governance (McCahery, Sautner and

Starks, 2016). Whilst shareholder own the company, it involves numerous issues of directors

controlling the organisation. In the past, a problem was identified whereby the directors might

not act in the shareholders (or other stakeholders) best interests. Agency theory considers this

problem and what could be done to prevent it. According to agency theory an agent is employed

by a principal to carry out a task on their behalf. By accepting to undertake a task on behalf of

company, thus become accountable to the principle by whom they are employed. In order to

accomplish certain task and objectives, the management of organisation hire an agent to fulfil the

purpose for the company. Thus, the agent become accountable for accomplishing the purpose of

the company.

Illustration 1: Agency Theory

(Source: What is agency theory?, 2012 )

This will help to manage and control various activities of Burberry which

drive the business performance and profitability. This will also help to

manage risk in order to reduce the negative impact of relationship and

financial activities effectively.

Stewardship Theory of Corporate Governance

There are several corporate governance theories included in as a model. The business is

able to select best one according to the operational activities and management in order to become

success in the market and towards customers effectively. Stewardship theory is a theory that

managers, left on their own, will act as responsible stewards of the assets they control. This

theory is an alternative view of agency theory, in which manager is assumed to act in their own

self interest at the expense of shareholder. The executive and manager of Burberry are stewards

towards a common goals or objective. Therefore, the board should not be too effective towards

controlling as the agency theory suggests. The main role of board of is to empower executives

and enhance potential performances which helps to achieve common goals and objectives

effectively.

One Voice of the Organisation: The theory has a clear objective of shareholder satisfaction. A

single leader is effective towards business communication process to shareholders in order to

meet their requirements and need effectively. It also include situation where business needs

charge in storm situations. The steward governance requires some potential trustworthy CEO

that they put their personal gains aside from the business in order to provide strengthen for

company.

Contrasting theory: It is necessary to understand stewardship theory that with the help of

contrast on two popular governance styles, rest two theories can be determined effectively. The

CEO and chairmen of business are two distinct entities of Burberry. Board of directors are

comprised with shareholder needs.

Finding the right fit: It can be said that every business requires effective and quality products

and services in order to survive in this competitive world. Corporate governance is one of them

which is the first step towards a successful company. Management is responsible for managing

and controlling various operational activities of Burberry in order to identify suitable theories.

This will help to increase sales and profitability which lead towards production and achieving

goals and targets effectively.

drive the business performance and profitability. This will also help to

manage risk in order to reduce the negative impact of relationship and

financial activities effectively.

Stewardship Theory of Corporate Governance

There are several corporate governance theories included in as a model. The business is

able to select best one according to the operational activities and management in order to become

success in the market and towards customers effectively. Stewardship theory is a theory that

managers, left on their own, will act as responsible stewards of the assets they control. This

theory is an alternative view of agency theory, in which manager is assumed to act in their own

self interest at the expense of shareholder. The executive and manager of Burberry are stewards

towards a common goals or objective. Therefore, the board should not be too effective towards

controlling as the agency theory suggests. The main role of board of is to empower executives

and enhance potential performances which helps to achieve common goals and objectives

effectively.

One Voice of the Organisation: The theory has a clear objective of shareholder satisfaction. A

single leader is effective towards business communication process to shareholders in order to

meet their requirements and need effectively. It also include situation where business needs

charge in storm situations. The steward governance requires some potential trustworthy CEO

that they put their personal gains aside from the business in order to provide strengthen for

company.

Contrasting theory: It is necessary to understand stewardship theory that with the help of

contrast on two popular governance styles, rest two theories can be determined effectively. The

CEO and chairmen of business are two distinct entities of Burberry. Board of directors are

comprised with shareholder needs.

Finding the right fit: It can be said that every business requires effective and quality products

and services in order to survive in this competitive world. Corporate governance is one of them

which is the first step towards a successful company. Management is responsible for managing

and controlling various operational activities of Burberry in order to identify suitable theories.

This will help to increase sales and profitability which lead towards production and achieving

goals and targets effectively.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.