University: BUS103 Accounting for Managers - Metcash Company Report

VerifiedAdded on 2023/04/25

|8

|1267

|350

Report

AI Summary

This report analyzes Metcash, a leading Australian wholesale distribution and marketing company, focusing on its financial performance and accounting practices. The report is divided into two parts: Part A provides an overview of the company, covering its business segments, revenue recognition methods, property, plant, and equipment valuation, the role of external auditors (Ernst & Young), and corporate social responsibility initiatives. Part B delves into the analysis of Metcash's financial information, including calculations and interpretations of key financial ratios such as accounts receivable turnover, inventory turnover, gross profit ratio, and debt ratios, comparing 2017 and 2018. The analysis reveals insights into the company's efficiency, profitability, and financial leverage, highlighting trends and potential areas of concern. The report references the 2018 Annual Report of Metcash to support its findings.

Running head: ACCOUNTING FOR MANAGERS

Accounting for Managers

Name of the Student

Name of the University

Author’s Note

Accounting for Managers

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING FOR MANAGERS

Table of Contents

PART A – THE COMPANY..........................................................................................................2

Answer to Question 1..................................................................................................................2

Answer to Question 2..................................................................................................................2

Answer to Question 3..................................................................................................................2

Answer to Question 4..................................................................................................................3

Answer to Question 5..................................................................................................................3

PART B – ANALYSIS OF COMPANY’S FINANCIAL INFORMATION.................................4

Answer to Question 1..................................................................................................................4

Requirement A.........................................................................................................................4

Requirement B.........................................................................................................................4

Requirement C.........................................................................................................................5

Requirement D.........................................................................................................................5

Requirement E.........................................................................................................................5

Requirement F.........................................................................................................................6

References........................................................................................................................................7

Table of Contents

PART A – THE COMPANY..........................................................................................................2

Answer to Question 1..................................................................................................................2

Answer to Question 2..................................................................................................................2

Answer to Question 3..................................................................................................................2

Answer to Question 4..................................................................................................................3

Answer to Question 5..................................................................................................................3

PART B – ANALYSIS OF COMPANY’S FINANCIAL INFORMATION.................................4

Answer to Question 1..................................................................................................................4

Requirement A.........................................................................................................................4

Requirement B.........................................................................................................................4

Requirement C.........................................................................................................................5

Requirement D.........................................................................................................................5

Requirement E.........................................................................................................................5

Requirement F.........................................................................................................................6

References........................................................................................................................................7

2ACCOUNTING FOR MANAGERS

PART A – THE COMPANY

Answer to Question 1

Metcash is regarded as the leading wholesale distribution and marketing company of

Australia. The principal business operations of the company can be seen in three segments of the

retail industry; they are Food, Liquor and Hardware. Metcash provides merchandising,

operational as well as marketing support to these three pillars of business (metcash.com 2019).

Answer to Question 2

Metcash recognizes their revenue to the degree when it is likely that the company will get

the economic benefits and they can measure the revenue on reliable basis. In case of Sale of

Goods, Metcash recognizes the revenue when the buyer receives the risk and rewards. For Rental

Income, the recognition is done on straight-line basis over the term of lease. Revenue from

Supplier Income is recognized based on purchase volume, promotional and marketing activities.

This information can be obtained from Page no. 92, Note 17 of 2018 Annual Report of Metcash

(mars-metcdn-com.global.ssl.fastly.net 2019).

Answer to Question 3

Metcash measures their all classes of property, plant and equipment at cost value after

deducting accumulated depreciation and accumulated impairment losses. The company charges

depreciation on these assets on straight-line basis except freehold land and assets. major

depreciation period for freehold buildings are 25 to 50 years where the same for plant and

equipment are 2 to 20 years. De-recognition of these assets is done at the time of disposal and

when there is no possibility of economic benefits from these assets. This information can be

PART A – THE COMPANY

Answer to Question 1

Metcash is regarded as the leading wholesale distribution and marketing company of

Australia. The principal business operations of the company can be seen in three segments of the

retail industry; they are Food, Liquor and Hardware. Metcash provides merchandising,

operational as well as marketing support to these three pillars of business (metcash.com 2019).

Answer to Question 2

Metcash recognizes their revenue to the degree when it is likely that the company will get

the economic benefits and they can measure the revenue on reliable basis. In case of Sale of

Goods, Metcash recognizes the revenue when the buyer receives the risk and rewards. For Rental

Income, the recognition is done on straight-line basis over the term of lease. Revenue from

Supplier Income is recognized based on purchase volume, promotional and marketing activities.

This information can be obtained from Page no. 92, Note 17 of 2018 Annual Report of Metcash

(mars-metcdn-com.global.ssl.fastly.net 2019).

Answer to Question 3

Metcash measures their all classes of property, plant and equipment at cost value after

deducting accumulated depreciation and accumulated impairment losses. The company charges

depreciation on these assets on straight-line basis except freehold land and assets. major

depreciation period for freehold buildings are 25 to 50 years where the same for plant and

equipment are 2 to 20 years. De-recognition of these assets is done at the time of disposal and

when there is no possibility of economic benefits from these assets. This information can be

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING FOR MANAGERS

obtained from Page no. 90, Note 9 of 2018 Annual Report of Metcash (mars-metcdn-

com.global.ssl.fastly.net 2019).

Answer to Question 4

It can be seen from the 2018 Annual Report of Metcash that Ernst & Young (EY) was

responsible for the audit of the financial statements of the company (mars-metcdn-

com.global.ssl.fastly.net 2019).

The primary purpose of an audit is to provide the shareholders with an independent and

expert opinion on the fact that whether the financial statements are true and fair. Hence, the

declaration of auditor’s indolence ensures the fact that the expressed audit opinion is not

influenced by any relationship between the auditor and the client (Tepalagul and Lin 2015).

The financial statements of the companies must be audited by external party as the

external auditors are independent third party professionals and responsible for performing neutral

review of the financial statements and records of the company (Tepalagul and Lin 2015).

Answer to Question 5

As per the 2018 Annual Report of Metcash, the company has taken certain major

Corporate Social Responsibility (CSR) initiatives for their community like ensuring healthier

food, healthier people and communities. The CSR initiatives of the company for people are

diversity, healthy wellbeing, safety and human rights; the initiatives for environment are

responsible sourcing, energy reduction and waste control (mars-metcdn-com.global.ssl.fastly.net

2019).

Sustainability activities ensure the long-term wealth of the companies. These

sustainability activities assist the companies in maximization of business opportunities while

obtained from Page no. 90, Note 9 of 2018 Annual Report of Metcash (mars-metcdn-

com.global.ssl.fastly.net 2019).

Answer to Question 4

It can be seen from the 2018 Annual Report of Metcash that Ernst & Young (EY) was

responsible for the audit of the financial statements of the company (mars-metcdn-

com.global.ssl.fastly.net 2019).

The primary purpose of an audit is to provide the shareholders with an independent and

expert opinion on the fact that whether the financial statements are true and fair. Hence, the

declaration of auditor’s indolence ensures the fact that the expressed audit opinion is not

influenced by any relationship between the auditor and the client (Tepalagul and Lin 2015).

The financial statements of the companies must be audited by external party as the

external auditors are independent third party professionals and responsible for performing neutral

review of the financial statements and records of the company (Tepalagul and Lin 2015).

Answer to Question 5

As per the 2018 Annual Report of Metcash, the company has taken certain major

Corporate Social Responsibility (CSR) initiatives for their community like ensuring healthier

food, healthier people and communities. The CSR initiatives of the company for people are

diversity, healthy wellbeing, safety and human rights; the initiatives for environment are

responsible sourcing, energy reduction and waste control (mars-metcdn-com.global.ssl.fastly.net

2019).

Sustainability activities ensure the long-term wealth of the companies. These

sustainability activities assist the companies in maximization of business opportunities while

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING FOR MANAGERS

minimizing the negative impact of their business operations on the environment, community and

economies in places where they operate (Cheng, Ioannou and Serafeim 2014).

PART B – ANALYSIS OF COMPANY’S FINANCIAL INFORMATION

Answer to Question 1

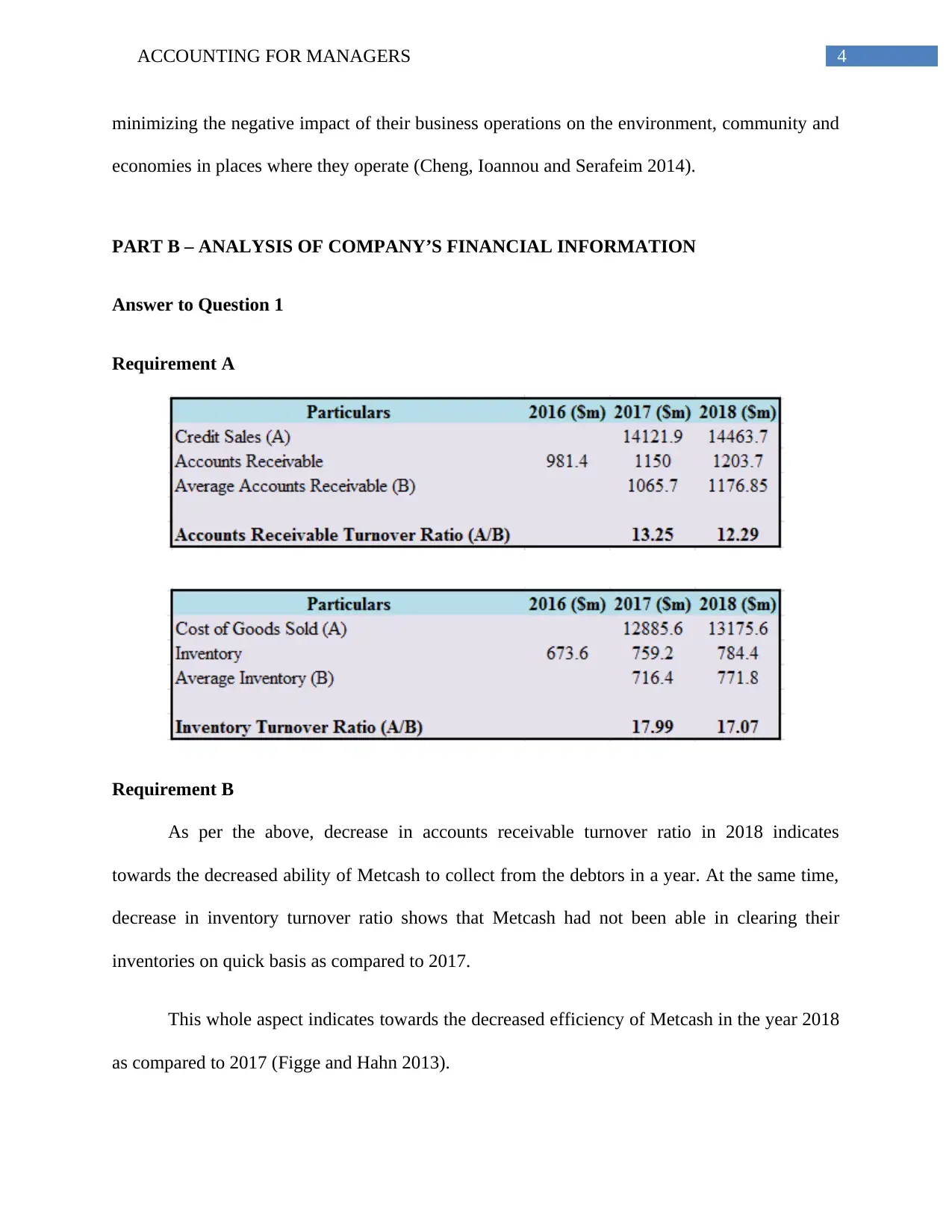

Requirement A

Requirement B

As per the above, decrease in accounts receivable turnover ratio in 2018 indicates

towards the decreased ability of Metcash to collect from the debtors in a year. At the same time,

decrease in inventory turnover ratio shows that Metcash had not been able in clearing their

inventories on quick basis as compared to 2017.

This whole aspect indicates towards the decreased efficiency of Metcash in the year 2018

as compared to 2017 (Figge and Hahn 2013).

minimizing the negative impact of their business operations on the environment, community and

economies in places where they operate (Cheng, Ioannou and Serafeim 2014).

PART B – ANALYSIS OF COMPANY’S FINANCIAL INFORMATION

Answer to Question 1

Requirement A

Requirement B

As per the above, decrease in accounts receivable turnover ratio in 2018 indicates

towards the decreased ability of Metcash to collect from the debtors in a year. At the same time,

decrease in inventory turnover ratio shows that Metcash had not been able in clearing their

inventories on quick basis as compared to 2017.

This whole aspect indicates towards the decreased efficiency of Metcash in the year 2018

as compared to 2017 (Figge and Hahn 2013).

5ACCOUNTING FOR MANAGERS

Requirement C

Requirement D

As per the above tables, increase in gross profit ratio in 2018 implies that increased

efficiency of Metcash in using their material and labors for the generation of sales. However, net

loss in the year 2018 indicates the inability of the company in managing the operating expenses

as compared to sales. Increase in revenue is another main reason for this.

On the overall basis, it can be said that the profitability position of Metcash has

deteriorated in the year 2018 as compared to 2017 (Healy et al. 2014).

Requirement E

Requirement C

Requirement D

As per the above tables, increase in gross profit ratio in 2018 implies that increased

efficiency of Metcash in using their material and labors for the generation of sales. However, net

loss in the year 2018 indicates the inability of the company in managing the operating expenses

as compared to sales. Increase in revenue is another main reason for this.

On the overall basis, it can be said that the profitability position of Metcash has

deteriorated in the year 2018 as compared to 2017 (Healy et al. 2014).

Requirement E

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING FOR MANAGERS

Requirement F

As per the debt ratio, the total burden of debt of Metcash increases in 2018 due to the

increase in total liabilities and decrease in total assets. As per the debt to equity ratio, Metcash

increases the portion of term debts for their capital requirement while decreases the portion of

equity. It makes the company highly leveraged as well as risky due to the massive increase in

interest expense.

On the overall basis, it indicates towards the deteriorated debt position of Metcash in

2018 as compared to 2017 (Garcia-Appendini and Montoriol-Garriga 2013).

Requirement F

As per the debt ratio, the total burden of debt of Metcash increases in 2018 due to the

increase in total liabilities and decrease in total assets. As per the debt to equity ratio, Metcash

increases the portion of term debts for their capital requirement while decreases the portion of

equity. It makes the company highly leveraged as well as risky due to the massive increase in

interest expense.

On the overall basis, it indicates towards the deteriorated debt position of Metcash in

2018 as compared to 2017 (Garcia-Appendini and Montoriol-Garriga 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING FOR MANAGERS

References

Cheng, B., Ioannou, I. and Serafeim, G., 2014. Corporate social responsibility and access to

finance. Strategic management journal, 35(1), pp.1-23.

Figge, F. and Hahn, T., 2013. Value drivers of corporate eco-efficiency: Management accounting

information for the efficient use of environmental resources. Management Accounting

Research, 24(4), pp.387-400.

Garcia-Appendini, E. and Montoriol-Garriga, J., 2013. Firms as liquidity providers: Evidence

from the 2007–2008 financial crisis. Journal of financial economics, 109(1), pp.272-291.

Healy, P., Serafeim, G., Srinivasan, S. and Yu, G., 2014. Market competition, earnings

management, and persistence in accounting profitability around the world. Review of Accounting

Studies, 19(4), pp.1281-1308.

Metcash | Australia’s leading wholesale distribution and marketing company. 2019. About Us -

Metcash | Australia’s leading wholesale distribution and marketing company. [online] Available

at: https://www.metcash.com/about-us/ [Accessed 28 Jan. 2019].

Metcash. 2019. 2018 Annual Report. [online] Available at: https://mars-metcdn-

com.global.ssl.fastly.net/content/uploads/sites/101/2018/07/24145704/Metcash-Annual-Report-

2018.pdf [Accessed 28 Jan. 2019].

Tepalagul, N. and Lin, L., 2015. Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

References

Cheng, B., Ioannou, I. and Serafeim, G., 2014. Corporate social responsibility and access to

finance. Strategic management journal, 35(1), pp.1-23.

Figge, F. and Hahn, T., 2013. Value drivers of corporate eco-efficiency: Management accounting

information for the efficient use of environmental resources. Management Accounting

Research, 24(4), pp.387-400.

Garcia-Appendini, E. and Montoriol-Garriga, J., 2013. Firms as liquidity providers: Evidence

from the 2007–2008 financial crisis. Journal of financial economics, 109(1), pp.272-291.

Healy, P., Serafeim, G., Srinivasan, S. and Yu, G., 2014. Market competition, earnings

management, and persistence in accounting profitability around the world. Review of Accounting

Studies, 19(4), pp.1281-1308.

Metcash | Australia’s leading wholesale distribution and marketing company. 2019. About Us -

Metcash | Australia’s leading wholesale distribution and marketing company. [online] Available

at: https://www.metcash.com/about-us/ [Accessed 28 Jan. 2019].

Metcash. 2019. 2018 Annual Report. [online] Available at: https://mars-metcdn-

com.global.ssl.fastly.net/content/uploads/sites/101/2018/07/24145704/Metcash-Annual-Report-

2018.pdf [Accessed 28 Jan. 2019].

Tepalagul, N. and Lin, L., 2015. Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.