BUS 700 Economics - Australia's Economic Growth: A 25-Year Analysis

VerifiedAdded on 2024/06/03

|15

|3451

|219

Report

AI Summary

This report provides an executive summary and detailed analysis of the Australian economy over the past 25 years, with a comparative study to the United States. It examines key macroeconomic factors such as real GDP growth rate, inflation rate, unemployment rate, net exports, real exchange rate, and cash rate, comparing them with the Federal Reserve Fund Rate of the U.S. The report discusses the relationships between these factors and presents predictions for the future of Australia's economy, concluding with recommendations based on the analysis. It uses historical data to explain Australia's economic success and provides insights into the dynamics of its mixed economy.

BUS 700 ECONOMICS

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

Studying the data of Australian Economy and analysing it with a comparison to the United States

should be the core of this project. While analysing the data one should understand the system of

economy prevailing in Australia and the extent to which it varies from that of United States

should be clear. The data on the key economic factors for Australia would provide a clear

analysis of the last 25 years and how Australia has grown out to be among the top five developed

countries would emerge up. The report has presented the detailed analysis of the future

prediction related to GDP so that economic performance could be identified more easily

2

Studying the data of Australian Economy and analysing it with a comparison to the United States

should be the core of this project. While analysing the data one should understand the system of

economy prevailing in Australia and the extent to which it varies from that of United States

should be clear. The data on the key economic factors for Australia would provide a clear

analysis of the last 25 years and how Australia has grown out to be among the top five developed

countries would emerge up. The report has presented the detailed analysis of the future

prediction related to GDP so that economic performance could be identified more easily

2

Table of Contents

1.0: Introduction..............................................................................................................................4

2.0: Finding and Analysis................................................................................................................5

2.1: Obtaining Data on Key Macroeconomic Factors Concerning Australia..................................5

2.2: Discussion on the Relationship of Australia’s Real GDP growth Rate and Inflation Rate

along with the relationship of unemployment rate and real GDP growth rate................................6

2.3: Discussing the relationship between the Net Exports and Real Exchange Rate of Australia

and U.S.A.........................................................................................................................................8

2.4: Discussing and presenting the relationship between the cash Rate of Australia and Federal

Reserve Fund Rate of U.S.A..........................................................................................................10

2.5: Presentation of the detailed discussing on the prediction for Future of Australia’s Economy

.......................................................................................................................................................11

3.0: Recommendation....................................................................................................................12

4.0 Conclusion...............................................................................................................................13

References:....................................................................................................................................14

3

1.0: Introduction..............................................................................................................................4

2.0: Finding and Analysis................................................................................................................5

2.1: Obtaining Data on Key Macroeconomic Factors Concerning Australia..................................5

2.2: Discussion on the Relationship of Australia’s Real GDP growth Rate and Inflation Rate

along with the relationship of unemployment rate and real GDP growth rate................................6

2.3: Discussing the relationship between the Net Exports and Real Exchange Rate of Australia

and U.S.A.........................................................................................................................................8

2.4: Discussing and presenting the relationship between the cash Rate of Australia and Federal

Reserve Fund Rate of U.S.A..........................................................................................................10

2.5: Presentation of the detailed discussing on the prediction for Future of Australia’s Economy

.......................................................................................................................................................11

3.0: Recommendation....................................................................................................................12

4.0 Conclusion...............................................................................................................................13

References:....................................................................................................................................14

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.0: Introduction

Australia is a mixed economy with higher GDP growth rate and lower poverty line, has

prospered in the recent years. Being rich and wealthy in natural resources, Australia has used its

strength to its fullest and has reached in the list of the top five developed countries in the world.

Obtaining its historical data and analysing the same would help in knowing the exact reason for

its success. This would help in getting a clear view and concept of the economics as a whole.

4

Australia is a mixed economy with higher GDP growth rate and lower poverty line, has

prospered in the recent years. Being rich and wealthy in natural resources, Australia has used its

strength to its fullest and has reached in the list of the top five developed countries in the world.

Obtaining its historical data and analysing the same would help in knowing the exact reason for

its success. This would help in getting a clear view and concept of the economics as a whole.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

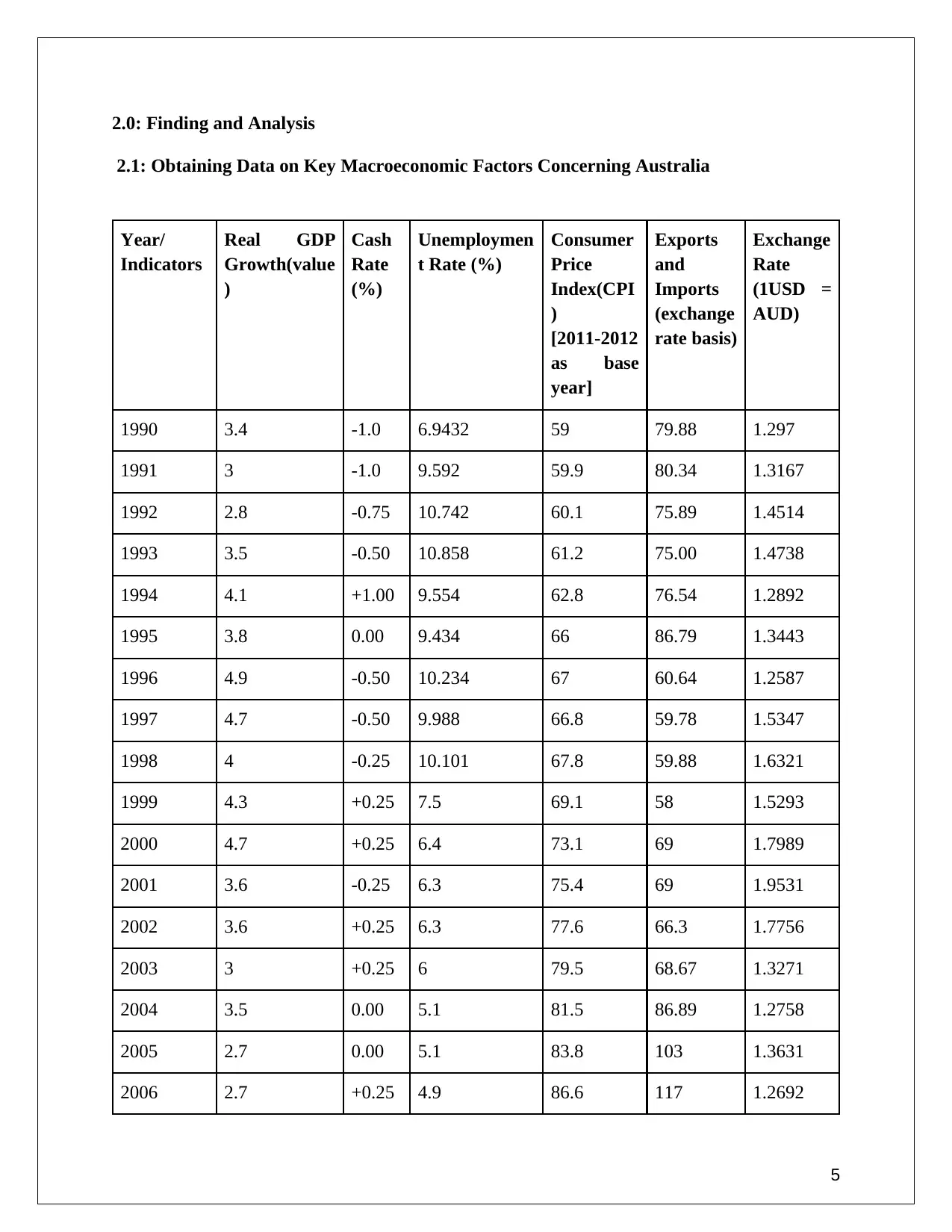

2.0: Finding and Analysis

2.1: Obtaining Data on Key Macroeconomic Factors Concerning Australia

Year/

Indicators

Real GDP

Growth(value

)

Cash

Rate

(%)

Unemploymen

t Rate (%)

Consumer

Price

Index(CPI

)

[2011-2012

as base

year]

Exports

and

Imports

(exchange

rate basis)

Exchange

Rate

(1USD =

AUD)

1990 3.4 -1.0 6.9432 59 79.88 1.297

1991 3 -1.0 9.592 59.9 80.34 1.3167

1992 2.8 -0.75 10.742 60.1 75.89 1.4514

1993 3.5 -0.50 10.858 61.2 75.00 1.4738

1994 4.1 +1.00 9.554 62.8 76.54 1.2892

1995 3.8 0.00 9.434 66 86.79 1.3443

1996 4.9 -0.50 10.234 67 60.64 1.2587

1997 4.7 -0.50 9.988 66.8 59.78 1.5347

1998 4 -0.25 10.101 67.8 59.88 1.6321

1999 4.3 +0.25 7.5 69.1 58 1.5293

2000 4.7 +0.25 6.4 73.1 69 1.7989

2001 3.6 -0.25 6.3 75.4 69 1.9531

2002 3.6 +0.25 6.3 77.6 66.3 1.7756

2003 3 +0.25 6 79.5 68.67 1.3271

2004 3.5 0.00 5.1 81.5 86.89 1.2758

2005 2.7 0.00 5.1 83.8 103 1.3631

2006 2.7 +0.25 4.9 86.6 117 1.2692

5

2.1: Obtaining Data on Key Macroeconomic Factors Concerning Australia

Year/

Indicators

Real GDP

Growth(value

)

Cash

Rate

(%)

Unemploymen

t Rate (%)

Consumer

Price

Index(CPI

)

[2011-2012

as base

year]

Exports

and

Imports

(exchange

rate basis)

Exchange

Rate

(1USD =

AUD)

1990 3.4 -1.0 6.9432 59 79.88 1.297

1991 3 -1.0 9.592 59.9 80.34 1.3167

1992 2.8 -0.75 10.742 60.1 75.89 1.4514

1993 3.5 -0.50 10.858 61.2 75.00 1.4738

1994 4.1 +1.00 9.554 62.8 76.54 1.2892

1995 3.8 0.00 9.434 66 86.79 1.3443

1996 4.9 -0.50 10.234 67 60.64 1.2587

1997 4.7 -0.50 9.988 66.8 59.78 1.5347

1998 4 -0.25 10.101 67.8 59.88 1.6321

1999 4.3 +0.25 7.5 69.1 58 1.5293

2000 4.7 +0.25 6.4 73.1 69 1.7989

2001 3.6 -0.25 6.3 75.4 69 1.9531

2002 3.6 +0.25 6.3 77.6 66.3 1.7756

2003 3 +0.25 6 79.5 68.67 1.3271

2004 3.5 0.00 5.1 81.5 86.89 1.2758

2005 2.7 0.00 5.1 83.8 103 1.3631

2006 2.7 +0.25 4.9 86.6 117 1.2692

5

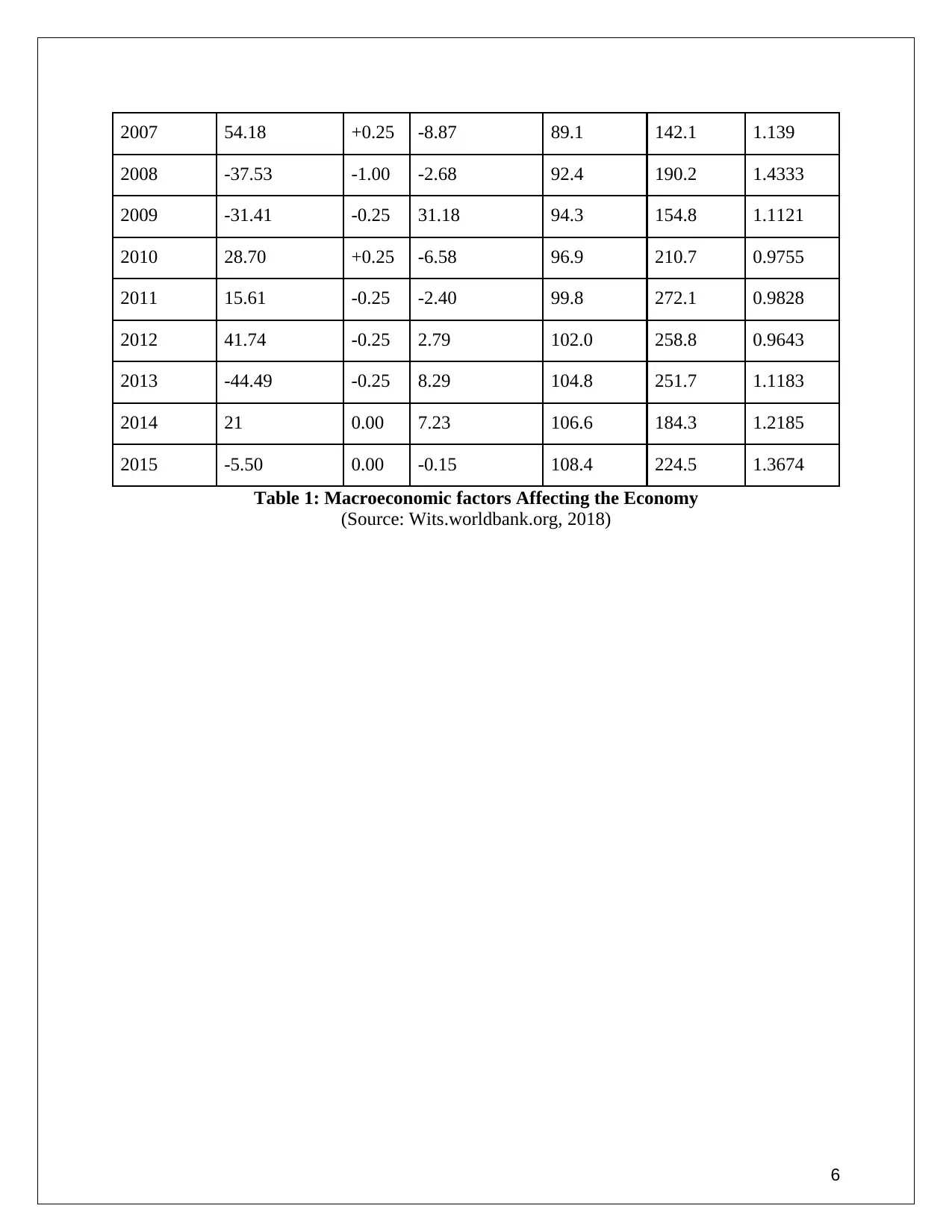

2007 54.18 +0.25 -8.87 89.1 142.1 1.139

2008 -37.53 -1.00 -2.68 92.4 190.2 1.4333

2009 -31.41 -0.25 31.18 94.3 154.8 1.1121

2010 28.70 +0.25 -6.58 96.9 210.7 0.9755

2011 15.61 -0.25 -2.40 99.8 272.1 0.9828

2012 41.74 -0.25 2.79 102.0 258.8 0.9643

2013 -44.49 -0.25 8.29 104.8 251.7 1.1183

2014 21 0.00 7.23 106.6 184.3 1.2185

2015 -5.50 0.00 -0.15 108.4 224.5 1.3674

Table 1: Macroeconomic factors Affecting the Economy

(Source: Wits.worldbank.org, 2018)

6

2008 -37.53 -1.00 -2.68 92.4 190.2 1.4333

2009 -31.41 -0.25 31.18 94.3 154.8 1.1121

2010 28.70 +0.25 -6.58 96.9 210.7 0.9755

2011 15.61 -0.25 -2.40 99.8 272.1 0.9828

2012 41.74 -0.25 2.79 102.0 258.8 0.9643

2013 -44.49 -0.25 8.29 104.8 251.7 1.1183

2014 21 0.00 7.23 106.6 184.3 1.2185

2015 -5.50 0.00 -0.15 108.4 224.5 1.3674

Table 1: Macroeconomic factors Affecting the Economy

(Source: Wits.worldbank.org, 2018)

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.2: Discussion on the Relationship of Australia’s Real GDP growth Rate and Inflation

Rate along with the relationship of unemployment rate and real GDP growth rate

All the economic factors are inter-dependable on each other and a change in any one of them

changes the economy as a whole. Though some of the factors are more important than the other

such as the GDP, Inflation Rate, Unemployment Rate, Cash Rate, etc, the minor factors would be

automatically be affected by any change in the major ones. These are the major elements of

economics which the government needs to take care of and these elements in return control the

other minor factors of the economy. GDP that is the Gross Domestic Product as the name

indicates refers to the total amount of goods and services produced within the geographical area

of the country and in a specified time (Anz.com, 2018). To calculate the Real GDP growth rate,

the GDP value is measured on the basis of the base year price and this gives us the Real GDP

growth rate of the country.

Australia’s Real GDP growth rate in 2017 changed up to 2.7%. When a country plans to gear

up its GDP, for this the demand for labor increases which results in the increase of wages. Thus

the unemployment rate reduces and the economy boosts up the purchasing power of its citizens.

The purchasing power of the people increases due to the decreasing unemployment rate and

increased wages. The increased purchasing power results in the increased demand for the goods

and thus the price level increases, which is nothing but inflation. Inflation is nothing but the rate

at which the prices of the goods and services are increasing. Australia’s last inflation rate has

risen by 1.9 %, in the March quarter of 2018.

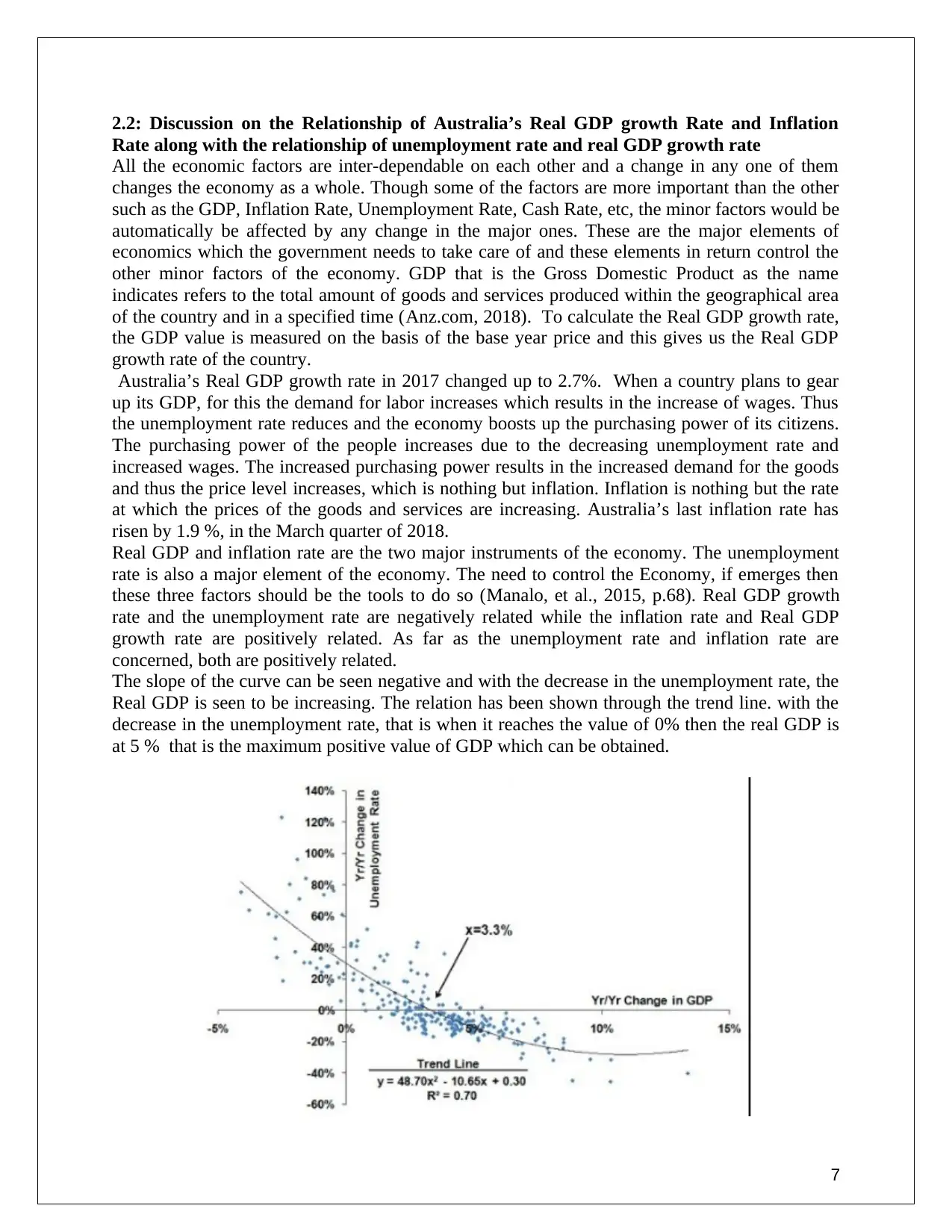

Real GDP and inflation rate are the two major instruments of the economy. The unemployment

rate is also a major element of the economy. The need to control the Economy, if emerges then

these three factors should be the tools to do so (Manalo, et al., 2015, p.68). Real GDP growth

rate and the unemployment rate are negatively related while the inflation rate and Real GDP

growth rate are positively related. As far as the unemployment rate and inflation rate are

concerned, both are positively related.

The slope of the curve can be seen negative and with the decrease in the unemployment rate, the

Real GDP is seen to be increasing. The relation has been shown through the trend line. with the

decrease in the unemployment rate, that is when it reaches the value of 0% then the real GDP is

at 5 % that is the maximum positive value of GDP which can be obtained.

7

Rate along with the relationship of unemployment rate and real GDP growth rate

All the economic factors are inter-dependable on each other and a change in any one of them

changes the economy as a whole. Though some of the factors are more important than the other

such as the GDP, Inflation Rate, Unemployment Rate, Cash Rate, etc, the minor factors would be

automatically be affected by any change in the major ones. These are the major elements of

economics which the government needs to take care of and these elements in return control the

other minor factors of the economy. GDP that is the Gross Domestic Product as the name

indicates refers to the total amount of goods and services produced within the geographical area

of the country and in a specified time (Anz.com, 2018). To calculate the Real GDP growth rate,

the GDP value is measured on the basis of the base year price and this gives us the Real GDP

growth rate of the country.

Australia’s Real GDP growth rate in 2017 changed up to 2.7%. When a country plans to gear

up its GDP, for this the demand for labor increases which results in the increase of wages. Thus

the unemployment rate reduces and the economy boosts up the purchasing power of its citizens.

The purchasing power of the people increases due to the decreasing unemployment rate and

increased wages. The increased purchasing power results in the increased demand for the goods

and thus the price level increases, which is nothing but inflation. Inflation is nothing but the rate

at which the prices of the goods and services are increasing. Australia’s last inflation rate has

risen by 1.9 %, in the March quarter of 2018.

Real GDP and inflation rate are the two major instruments of the economy. The unemployment

rate is also a major element of the economy. The need to control the Economy, if emerges then

these three factors should be the tools to do so (Manalo, et al., 2015, p.68). Real GDP growth

rate and the unemployment rate are negatively related while the inflation rate and Real GDP

growth rate are positively related. As far as the unemployment rate and inflation rate are

concerned, both are positively related.

The slope of the curve can be seen negative and with the decrease in the unemployment rate, the

Real GDP is seen to be increasing. The relation has been shown through the trend line. with the

decrease in the unemployment rate, that is when it reaches the value of 0% then the real GDP is

at 5 % that is the maximum positive value of GDP which can be obtained.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 1: Change in Unemployment Rate as a function of Real GDP

(Source: Ampcapital.com.au, 2018)

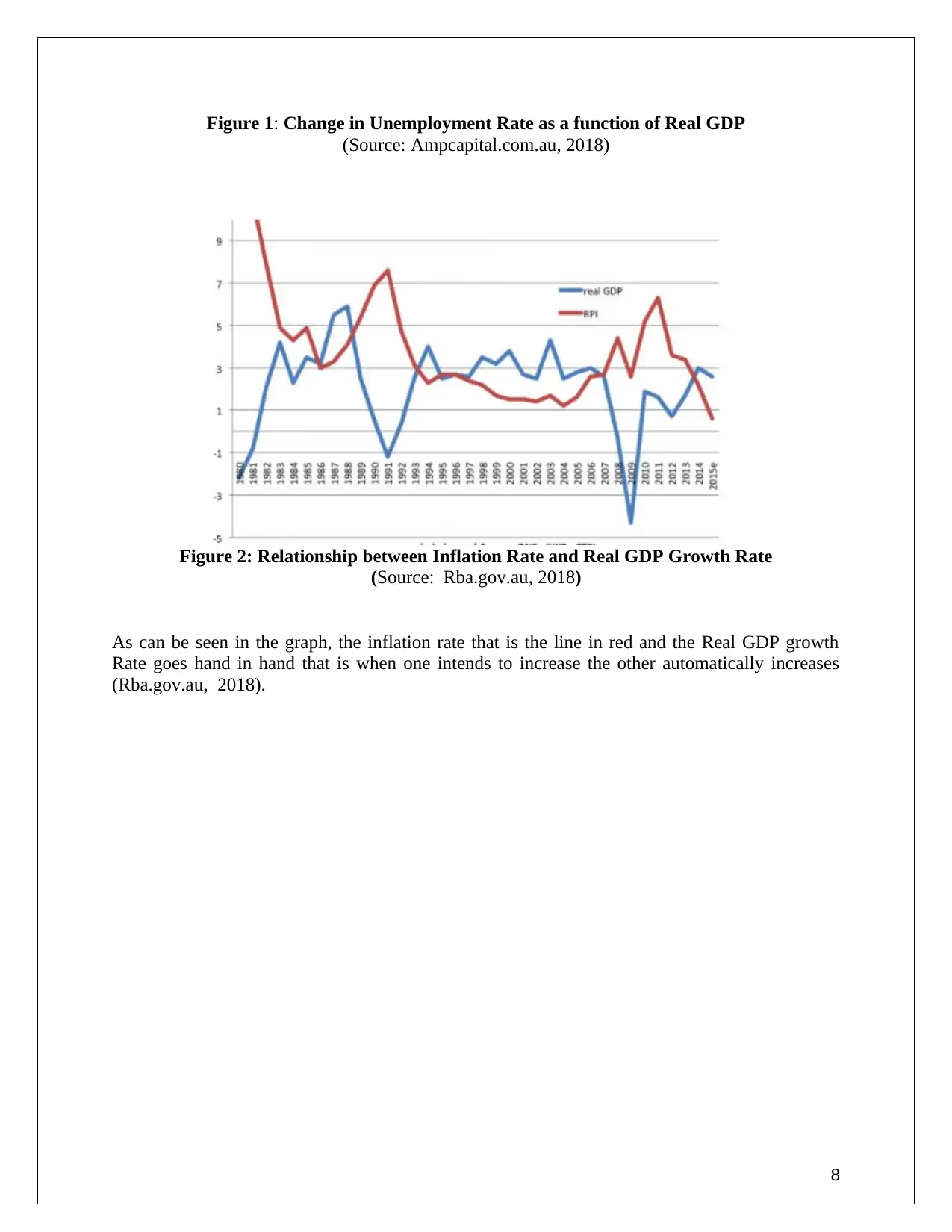

Figure 2: Relationship between Inflation Rate and Real GDP Growth Rate

(Source: Rba.gov.au, 2018)

As can be seen in the graph, the inflation rate that is the line in red and the Real GDP growth

Rate goes hand in hand that is when one intends to increase the other automatically increases

(Rba.gov.au, 2018).

8

(Source: Ampcapital.com.au, 2018)

Figure 2: Relationship between Inflation Rate and Real GDP Growth Rate

(Source: Rba.gov.au, 2018)

As can be seen in the graph, the inflation rate that is the line in red and the Real GDP growth

Rate goes hand in hand that is when one intends to increase the other automatically increases

(Rba.gov.au, 2018).

8

2.3: Discussing the relationship between the Net Exports and Real Exchange Rate of

Australia and U.S.A

Net Export refers to that amount of goods which gets calculated by Export fewer Imports of the

country. If the Net Export is higher or positive that means the country is in a better position and

if the net exports are negative that is the country needs to import more goods than it exports, it is

a matter of economic concern. The Net exports depend on the exchange rate of a country. It is

the rate at which one country sells goods to the other country. It can also be defined as the value

of one currency in terms of the other currency (Bajada, et al., 2017, p.67). As Australia's

economy works on a free market system which includes trade and financial flows, the exchange

rate is very crucial part of Australia's economy.

The exchange rate of Australia in terms of U.S. that is the value of $1 in terms of AUD, last

recorded was 1.3239 ($1= 1.3239AUD). The Net export of Australia in 2017 was -117 which

means that the import exceeded the export of the country. Whereas that of U.S. the net export of

U.S. amounted to -602, which is again import higher than the export. If the comparison is made

between the net exports of Australia and U.S, then the U.S. needs to check its imports as that

would help in increasing its GDP rate (Wilde, et al., 2017, p.35). The home production of the

goods would generate more benefits to the country.

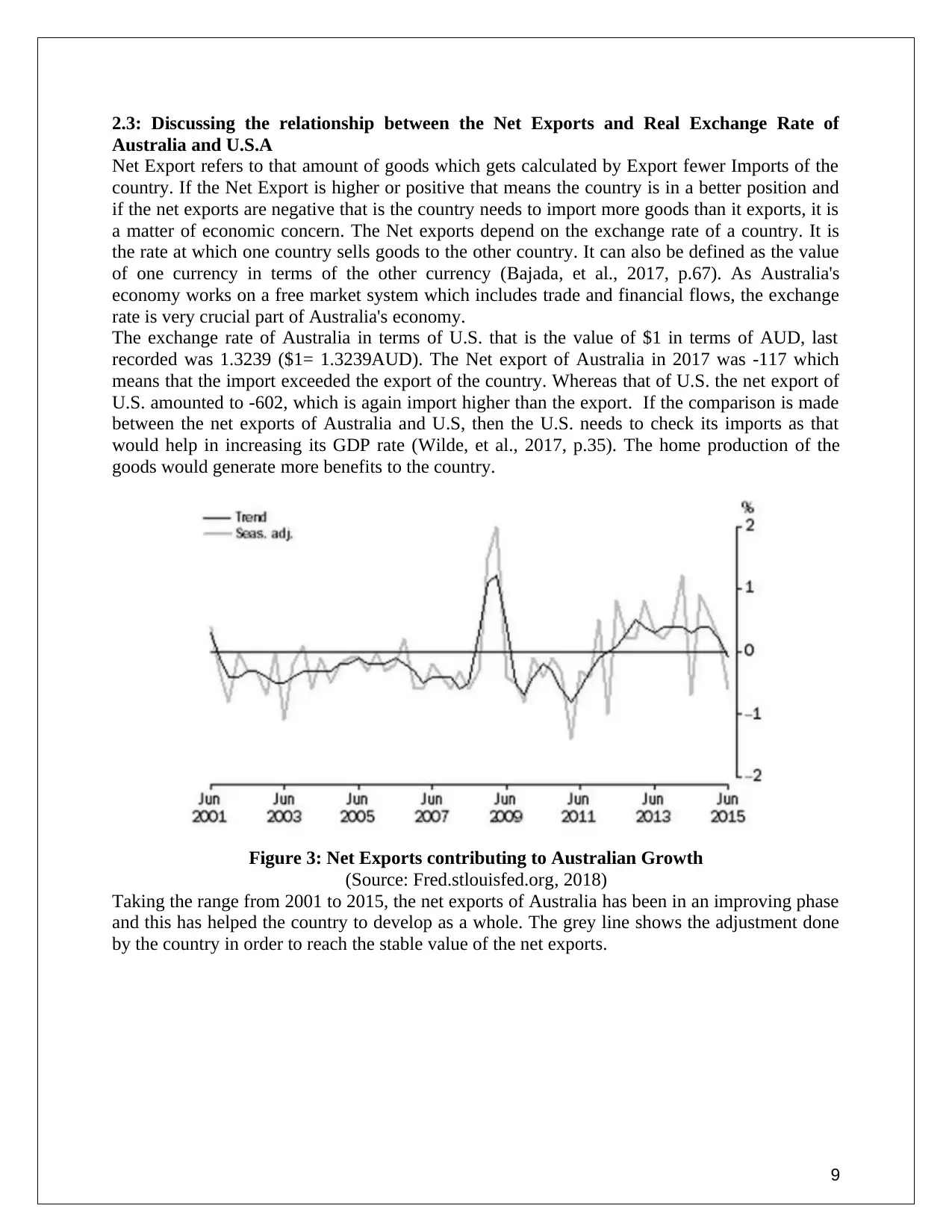

Figure 3: Net Exports contributing to Australian Growth

(Source: Fred.stlouisfed.org, 2018)

Taking the range from 2001 to 2015, the net exports of Australia has been in an improving phase

and this has helped the country to develop as a whole. The grey line shows the adjustment done

by the country in order to reach the stable value of the net exports.

9

Australia and U.S.A

Net Export refers to that amount of goods which gets calculated by Export fewer Imports of the

country. If the Net Export is higher or positive that means the country is in a better position and

if the net exports are negative that is the country needs to import more goods than it exports, it is

a matter of economic concern. The Net exports depend on the exchange rate of a country. It is

the rate at which one country sells goods to the other country. It can also be defined as the value

of one currency in terms of the other currency (Bajada, et al., 2017, p.67). As Australia's

economy works on a free market system which includes trade and financial flows, the exchange

rate is very crucial part of Australia's economy.

The exchange rate of Australia in terms of U.S. that is the value of $1 in terms of AUD, last

recorded was 1.3239 ($1= 1.3239AUD). The Net export of Australia in 2017 was -117 which

means that the import exceeded the export of the country. Whereas that of U.S. the net export of

U.S. amounted to -602, which is again import higher than the export. If the comparison is made

between the net exports of Australia and U.S, then the U.S. needs to check its imports as that

would help in increasing its GDP rate (Wilde, et al., 2017, p.35). The home production of the

goods would generate more benefits to the country.

Figure 3: Net Exports contributing to Australian Growth

(Source: Fred.stlouisfed.org, 2018)

Taking the range from 2001 to 2015, the net exports of Australia has been in an improving phase

and this has helped the country to develop as a whole. The grey line shows the adjustment done

by the country in order to reach the stable value of the net exports.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

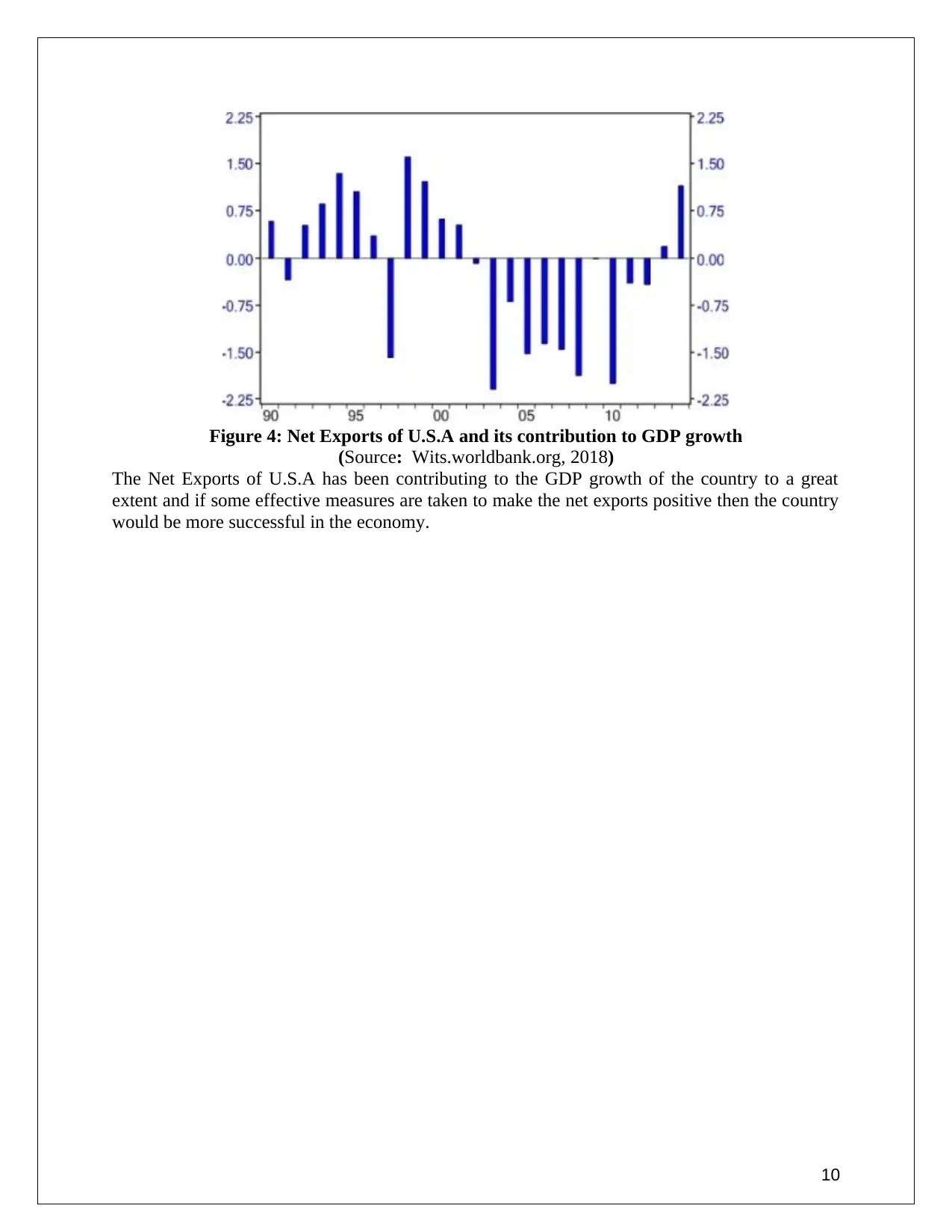

Figure 4: Net Exports of U.S.A and its contribution to GDP growth

(Source: Wits.worldbank.org, 2018)

The Net Exports of U.S.A has been contributing to the GDP growth of the country to a great

extent and if some effective measures are taken to make the net exports positive then the country

would be more successful in the economy.

10

(Source: Wits.worldbank.org, 2018)

The Net Exports of U.S.A has been contributing to the GDP growth of the country to a great

extent and if some effective measures are taken to make the net exports positive then the country

would be more successful in the economy.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

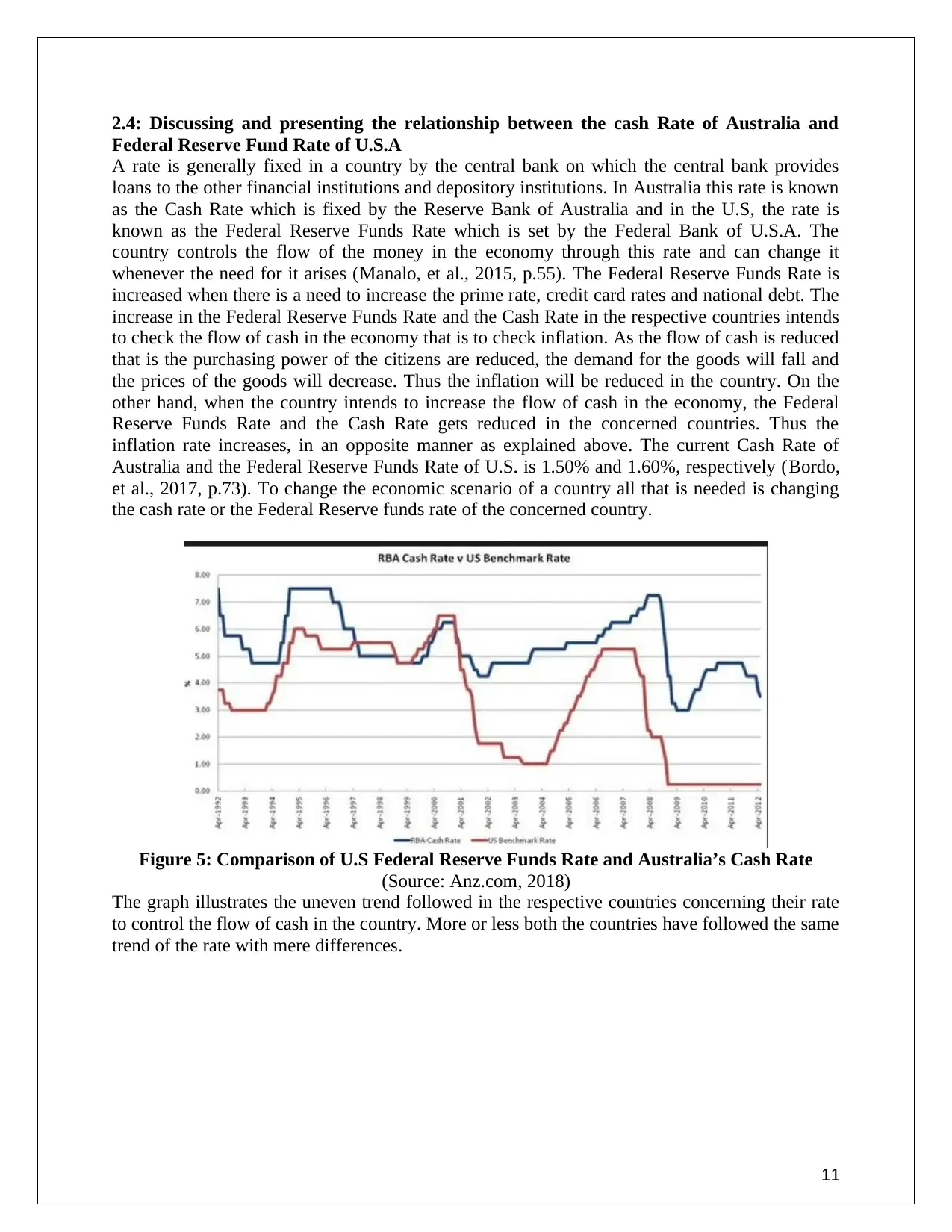

2.4: Discussing and presenting the relationship between the cash Rate of Australia and

Federal Reserve Fund Rate of U.S.A

A rate is generally fixed in a country by the central bank on which the central bank provides

loans to the other financial institutions and depository institutions. In Australia this rate is known

as the Cash Rate which is fixed by the Reserve Bank of Australia and in the U.S, the rate is

known as the Federal Reserve Funds Rate which is set by the Federal Bank of U.S.A. The

country controls the flow of the money in the economy through this rate and can change it

whenever the need for it arises (Manalo, et al., 2015, p.55). The Federal Reserve Funds Rate is

increased when there is a need to increase the prime rate, credit card rates and national debt. The

increase in the Federal Reserve Funds Rate and the Cash Rate in the respective countries intends

to check the flow of cash in the economy that is to check inflation. As the flow of cash is reduced

that is the purchasing power of the citizens are reduced, the demand for the goods will fall and

the prices of the goods will decrease. Thus the inflation will be reduced in the country. On the

other hand, when the country intends to increase the flow of cash in the economy, the Federal

Reserve Funds Rate and the Cash Rate gets reduced in the concerned countries. Thus the

inflation rate increases, in an opposite manner as explained above. The current Cash Rate of

Australia and the Federal Reserve Funds Rate of U.S. is 1.50% and 1.60%, respectively (Bordo,

et al., 2017, p.73). To change the economic scenario of a country all that is needed is changing

the cash rate or the Federal Reserve funds rate of the concerned country.

Figure 5: Comparison of U.S Federal Reserve Funds Rate and Australia’s Cash Rate

(Source: Anz.com, 2018)

The graph illustrates the uneven trend followed in the respective countries concerning their rate

to control the flow of cash in the country. More or less both the countries have followed the same

trend of the rate with mere differences.

11

Federal Reserve Fund Rate of U.S.A

A rate is generally fixed in a country by the central bank on which the central bank provides

loans to the other financial institutions and depository institutions. In Australia this rate is known

as the Cash Rate which is fixed by the Reserve Bank of Australia and in the U.S, the rate is

known as the Federal Reserve Funds Rate which is set by the Federal Bank of U.S.A. The

country controls the flow of the money in the economy through this rate and can change it

whenever the need for it arises (Manalo, et al., 2015, p.55). The Federal Reserve Funds Rate is

increased when there is a need to increase the prime rate, credit card rates and national debt. The

increase in the Federal Reserve Funds Rate and the Cash Rate in the respective countries intends

to check the flow of cash in the economy that is to check inflation. As the flow of cash is reduced

that is the purchasing power of the citizens are reduced, the demand for the goods will fall and

the prices of the goods will decrease. Thus the inflation will be reduced in the country. On the

other hand, when the country intends to increase the flow of cash in the economy, the Federal

Reserve Funds Rate and the Cash Rate gets reduced in the concerned countries. Thus the

inflation rate increases, in an opposite manner as explained above. The current Cash Rate of

Australia and the Federal Reserve Funds Rate of U.S. is 1.50% and 1.60%, respectively (Bordo,

et al., 2017, p.73). To change the economic scenario of a country all that is needed is changing

the cash rate or the Federal Reserve funds rate of the concerned country.

Figure 5: Comparison of U.S Federal Reserve Funds Rate and Australia’s Cash Rate

(Source: Anz.com, 2018)

The graph illustrates the uneven trend followed in the respective countries concerning their rate

to control the flow of cash in the country. More or less both the countries have followed the same

trend of the rate with mere differences.

11

2.5: Presentation of the detailed discussing on the prediction for Future of Australia’s

Economy

Taking into consideration the data of 2018 of the essential indicator of macroeconomic of

Australia, it could be analysed that Australia economy has minimum chances of depression of

any kind for the following next ten years. According to Lu and Qu, (2015, p.151), the rate of

unemployment in Australia is analysed to be 5.25%. The rate of growth of GDP of Australia has

increased by 2.27%. This accounted for a great rise and shows an improvement in the economy

of the country. The rate of cash of Australia is determined to be 1.5%. This rate of cash makes it

clear that the country wants the citizens of Australia to live a life which is luxurious and lavish.

The rate of cash and the funds of Federal Reserve of the country have been analysed to show no

distinction. This could be used by the country to gear the economy. The rate of cash of the

country which has been determined shows that the issues related to money are maintained in a

proper and balanced way. The rate of unemployment helps in describing the economy's

efficiency for generating or producing work for the country's people. The total export of the

country has been analysed to be 34,352 AUD. The increase in the export of the country has

helped in making the country more active economically. This in turn also helped the country

growing financially. The rate of exchange of the country has also been determined in this project,

which shows an increase in the rate of exchange. The Index of Consumer Price has been

accounted to 1.8 and this shows the maintained balance of the country. The Index of Consumer

Price also shows how the country has managed to deflect the impact of the rate of growth of

GDP and also of the reducing unemployment on prices. Thus, the Index of Consumer Price helps

in recording this. The rate of exchange and total export of Australia helps to achieve the goal of

the country. The rising imports and decreasing exports due to the rate of exchange being high

help in maintaining the balance of economy for the country. By data analysing, it can be

analysed that the government of Australia has focused to maintain the country's economy in a

format that is stable in nature. It has been observed that in the recent past years, Australia has

followed a growth trend of about 2-3 %. By December 2017 it was seen that the growth rate

revolved around a change of about just 0.4% and in that annual year it enjoyed a growth rate of

2.4%. If the country continues to control its inflation and maintains a balance in the other

economic factors, then by next year it may achieve a GDP growth of 4%. The unemployment

rate which is already quite low as compared to other countries would reach its minimum level

and that would help the country to be among on the top of the developed countries list. The

control on the Cash Rate would enhance the country's economy in the mere future and that would

control the exchange rate too. Hence the net exports will be checked in turn.

12

Economy

Taking into consideration the data of 2018 of the essential indicator of macroeconomic of

Australia, it could be analysed that Australia economy has minimum chances of depression of

any kind for the following next ten years. According to Lu and Qu, (2015, p.151), the rate of

unemployment in Australia is analysed to be 5.25%. The rate of growth of GDP of Australia has

increased by 2.27%. This accounted for a great rise and shows an improvement in the economy

of the country. The rate of cash of Australia is determined to be 1.5%. This rate of cash makes it

clear that the country wants the citizens of Australia to live a life which is luxurious and lavish.

The rate of cash and the funds of Federal Reserve of the country have been analysed to show no

distinction. This could be used by the country to gear the economy. The rate of cash of the

country which has been determined shows that the issues related to money are maintained in a

proper and balanced way. The rate of unemployment helps in describing the economy's

efficiency for generating or producing work for the country's people. The total export of the

country has been analysed to be 34,352 AUD. The increase in the export of the country has

helped in making the country more active economically. This in turn also helped the country

growing financially. The rate of exchange of the country has also been determined in this project,

which shows an increase in the rate of exchange. The Index of Consumer Price has been

accounted to 1.8 and this shows the maintained balance of the country. The Index of Consumer

Price also shows how the country has managed to deflect the impact of the rate of growth of

GDP and also of the reducing unemployment on prices. Thus, the Index of Consumer Price helps

in recording this. The rate of exchange and total export of Australia helps to achieve the goal of

the country. The rising imports and decreasing exports due to the rate of exchange being high

help in maintaining the balance of economy for the country. By data analysing, it can be

analysed that the government of Australia has focused to maintain the country's economy in a

format that is stable in nature. It has been observed that in the recent past years, Australia has

followed a growth trend of about 2-3 %. By December 2017 it was seen that the growth rate

revolved around a change of about just 0.4% and in that annual year it enjoyed a growth rate of

2.4%. If the country continues to control its inflation and maintains a balance in the other

economic factors, then by next year it may achieve a GDP growth of 4%. The unemployment

rate which is already quite low as compared to other countries would reach its minimum level

and that would help the country to be among on the top of the developed countries list. The

control on the Cash Rate would enhance the country's economy in the mere future and that would

control the exchange rate too. Hence the net exports will be checked in turn.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.