Business Study Report: ABILENE OIL AND GAS LIMITED, ASX Listed Company

VerifiedAdded on 2020/04/07

|22

|4475

|74

Report

AI Summary

This business study report provides a comprehensive analysis of ABILENE OIL AND GAS LIMITED, an ASX-listed oil and gas exploration and production company. The report begins with an introduction to the company's business, its location, and its corporate strategy, followed by a comparison with key competitors such as EOG Resources Inc. and Occidental Petroleum Corp. It examines the ownership structure, corporate governance practices, and financial performance, highlighting the company's restructuring initiatives. The report then delves into the production costs, including fixed and variable expenses, and details the company's plans for large-scale operations. A significant portion of the report focuses on the macro business environment, including political stability in the USA, economic indicators such as inflation, unemployment, and interest rates. The report concludes with a discussion on sustainability aspects, including carbon emissions and health and safety measures, providing a holistic view of ABILENE OIL AND GAS LIMITED's operations and its position within the industry.

ABILENE OIL AND GAS LIMITED

Business Study Report

Business Study Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction:...............................................................................................................................3

1.Introduction of the Business, General Business environment:...............................................3

2.Production costs and scale:.....................................................................................................5

3. Macro business environment..................................................................................................6

Political stability.....................................................................................................................7

Economic environment..........................................................................................................8

Inflation trend.....................................................................................................................8

Unemployment trend..........................................................................................................9

Interest rate.......................................................................................................................10

GDP growth trend............................................................................................................11

Consumer sentiment.........................................................................................................12

Currency rate....................................................................................................................13

Key factor of production......................................................................................................14

3. Sustainability........................................................................................................................17

Carbon emission...............................................................................................................17

Bio diversity.....................................................................................................................18

Health and safety..............................................................................................................18

Govt move........................................................................................................................18

Conclusion:..............................................................................................................................18

Reference..................................................................................................................................20

Introduction:...............................................................................................................................3

1.Introduction of the Business, General Business environment:...............................................3

2.Production costs and scale:.....................................................................................................5

3. Macro business environment..................................................................................................6

Political stability.....................................................................................................................7

Economic environment..........................................................................................................8

Inflation trend.....................................................................................................................8

Unemployment trend..........................................................................................................9

Interest rate.......................................................................................................................10

GDP growth trend............................................................................................................11

Consumer sentiment.........................................................................................................12

Currency rate....................................................................................................................13

Key factor of production......................................................................................................14

3. Sustainability........................................................................................................................17

Carbon emission...............................................................................................................17

Bio diversity.....................................................................................................................18

Health and safety..............................................................................................................18

Govt move........................................................................................................................18

Conclusion:..............................................................................................................................18

Reference..................................................................................................................................20

Introduction:

In this assignment we are developing a business study report to understand and analyse the

various aspects of the business. First of all a discussion has been held regarding the location

and nature of business of the chosen company (That is listed in ASX) and the relevant

corporate strategy that is to be followed by the company to run their day to day business

operations .Then analysis has been done regarding the financial performance of the company

with respect to the rivals of the industry (Shah, 2012). The ownership structure and the

corporate governance strategies of the business have also been studied to understand the

overall environment of the chosen company. Besides discussion has also been made

regarding the scale of operation and the type of costs that are mainly present in the business

and how they are affecting the activities of the company. A study of the macro business

factors has been done to analyze the impact of the external factors over the operations of the

company.

1.Introduction of the Business, General Business environment:

Name of the business: ABILENE OIL AND GAS LIMITED

Location Of the business: The Company is an Australia based company that is mainly

engaged in resource exploration with a focus on Oil & GAS sector in Australia and several

Overseas country. The Company has a large business operation in West USA and the assets

of their company are in KANSAS USA.

Type of business: ABILENE OIL AND GAS LIMITED is a oil production development and

exploration company. The company mainly operates in the oil& Gas exploration sector in

USA and holds a special interest in the Klick east oil fields (in.reuters.com, 2017).

The corporate strategy of the company is to handle high return projects along with

innovative funding while maintaining low overhead and low corporate cost.

The main buyers of the exported oil and gas of the company are the Refineries, National

Oil Companies, Oil & Gas distribution companies, Traders of Oil & Gas products of the

nation in which they are operating and also the International Oil and Gas companies. Most

obf these buyers of the company are either located in USA or Australia.

In this assignment we are developing a business study report to understand and analyse the

various aspects of the business. First of all a discussion has been held regarding the location

and nature of business of the chosen company (That is listed in ASX) and the relevant

corporate strategy that is to be followed by the company to run their day to day business

operations .Then analysis has been done regarding the financial performance of the company

with respect to the rivals of the industry (Shah, 2012). The ownership structure and the

corporate governance strategies of the business have also been studied to understand the

overall environment of the chosen company. Besides discussion has also been made

regarding the scale of operation and the type of costs that are mainly present in the business

and how they are affecting the activities of the company. A study of the macro business

factors has been done to analyze the impact of the external factors over the operations of the

company.

1.Introduction of the Business, General Business environment:

Name of the business: ABILENE OIL AND GAS LIMITED

Location Of the business: The Company is an Australia based company that is mainly

engaged in resource exploration with a focus on Oil & GAS sector in Australia and several

Overseas country. The Company has a large business operation in West USA and the assets

of their company are in KANSAS USA.

Type of business: ABILENE OIL AND GAS LIMITED is a oil production development and

exploration company. The company mainly operates in the oil& Gas exploration sector in

USA and holds a special interest in the Klick east oil fields (in.reuters.com, 2017).

The corporate strategy of the company is to handle high return projects along with

innovative funding while maintaining low overhead and low corporate cost.

The main buyers of the exported oil and gas of the company are the Refineries, National

Oil Companies, Oil & Gas distribution companies, Traders of Oil & Gas products of the

nation in which they are operating and also the International Oil and Gas companies. Most

obf these buyers of the company are either located in USA or Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Competitors:

Some of the major competitors of the business are as follows:

EOG Resources Inc (USD): This Company is one of the largest independent crude oil and

natural gas exploration company of USA with a market capitalization value of $ 52605

million. The main objective of the company is to maximize the exploration of oil and natural

gas in the country by offering best rates and returns through the control of capital and

operational costs.

Occidental Petroleum Corp :

The oil and gas production and exploration activities of the company are present in the

geographical locations of United States, Middle East & Latin America and the current market

capitalization value of the company is around $47059 million(Abilene.com.au, 2015).

Canadian Natural Resources Ltd: This Company is another strong competitor that operates

mainly i the field of oil exploration and their operations are mainly present in the oil fields of

Canada & USA and the current market capitalization value of the company is around $ 40142

million (Financials.morningstar.com, 2017).

The market capitalization value of Abilene Oil And Gas Limited is only around AUD $ 3

million as per the reports of the “investing .com”. The other local competitors of the company

are Beach Energy (BPT, Australia, market capitalization value: AUD$ 1312 million), Oil

Search (OSH, market capitalization value: AUD$ 10345 million), Santos (STO, market

capitalization value: AUD$ 80165 million), Woodside Petroleum (WPL, market

capitalization value: AUD$ 24094 million).Thus it can be seen that in terms of the market

capitalization the chosen company is much behind of their competitors (investsmart.com.au,

2017).

The ownership structure of the company includes the institutional ownership, Insider

ownership, General public ownership and the Private Company Ownership. The institutional

ownership accounts for 15.92% of the total ownership structure of the company. Insider

ownership, General public ownership and the Private Company Ownership accounts for

57.89%,9.37% and 16.82% respectively out of the total ownership or share holders of the

company. Thus it can be seen the major category of the share holders of the company are in

the category of Insider ownership. The insider ownership is mainly focused towards how the

Some of the major competitors of the business are as follows:

EOG Resources Inc (USD): This Company is one of the largest independent crude oil and

natural gas exploration company of USA with a market capitalization value of $ 52605

million. The main objective of the company is to maximize the exploration of oil and natural

gas in the country by offering best rates and returns through the control of capital and

operational costs.

Occidental Petroleum Corp :

The oil and gas production and exploration activities of the company are present in the

geographical locations of United States, Middle East & Latin America and the current market

capitalization value of the company is around $47059 million(Abilene.com.au, 2015).

Canadian Natural Resources Ltd: This Company is another strong competitor that operates

mainly i the field of oil exploration and their operations are mainly present in the oil fields of

Canada & USA and the current market capitalization value of the company is around $ 40142

million (Financials.morningstar.com, 2017).

The market capitalization value of Abilene Oil And Gas Limited is only around AUD $ 3

million as per the reports of the “investing .com”. The other local competitors of the company

are Beach Energy (BPT, Australia, market capitalization value: AUD$ 1312 million), Oil

Search (OSH, market capitalization value: AUD$ 10345 million), Santos (STO, market

capitalization value: AUD$ 80165 million), Woodside Petroleum (WPL, market

capitalization value: AUD$ 24094 million).Thus it can be seen that in terms of the market

capitalization the chosen company is much behind of their competitors (investsmart.com.au,

2017).

The ownership structure of the company includes the institutional ownership, Insider

ownership, General public ownership and the Private Company Ownership. The institutional

ownership accounts for 15.92% of the total ownership structure of the company. Insider

ownership, General public ownership and the Private Company Ownership accounts for

57.89%,9.37% and 16.82% respectively out of the total ownership or share holders of the

company. Thus it can be seen the major category of the share holders of the company are in

the category of Insider ownership. The insider ownership is mainly focused towards how the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company will be managed and is less focused towards the impact of trading on the

outstanding shares of the company. As the major owners of the company are the Individual

insiders, this indicates that these individual insiders are badly affecting the stock performance

of the company. The company is continuously running with low or underperforming P/E

ratio(Carr and Carr, 2017).

The corporate governance practice of the company ensures that the board of directors of

the company will ensure the highest standard of ethical behaviour and accountability with

respect to every other incidence that are taking place in the company. In order to develop and

maintain a good corporate culture the company often adopt the Corporate Governance

principles and recommendations of the ASX Corporate Governance Council

(Kulander,2012).

Due to continuous week financial performance up to 2012-2013 the company has taken rapid

restructuring initiatives in 2014. The restructuring initiative proposes that the company will

be renamed as “Abilene Oil & GAS” and will be listed in ASX with the new ticker of

“ABL”and mainly focus on exploration of high risk –high return crude oil projects that can

add value to their reserves.

2.Production costs and scale:

The fixed cost of production that ABILENE OIL AND GAS LIMITED has to bear as a

drilling company of natural gas and oil are as follows:

The cost of finding and oil well

The cost of oil drilling

The cost of generating the initial outputs

The cost of maintaining or renting the drilling equipments

The cost of regulatory compliance

Long term workers contract

The decision of incurring the fixed cost is taken by the company once the decision for drilling

and exploration has been taken by the company with respect to a particular oil well. Thus

these are the costs that do not vary with the units of production as the business has to incur

theses expenses at the initial level of production. The expected fixed cost of the company is

around US$480K per annum

outstanding shares of the company. As the major owners of the company are the Individual

insiders, this indicates that these individual insiders are badly affecting the stock performance

of the company. The company is continuously running with low or underperforming P/E

ratio(Carr and Carr, 2017).

The corporate governance practice of the company ensures that the board of directors of

the company will ensure the highest standard of ethical behaviour and accountability with

respect to every other incidence that are taking place in the company. In order to develop and

maintain a good corporate culture the company often adopt the Corporate Governance

principles and recommendations of the ASX Corporate Governance Council

(Kulander,2012).

Due to continuous week financial performance up to 2012-2013 the company has taken rapid

restructuring initiatives in 2014. The restructuring initiative proposes that the company will

be renamed as “Abilene Oil & GAS” and will be listed in ASX with the new ticker of

“ABL”and mainly focus on exploration of high risk –high return crude oil projects that can

add value to their reserves.

2.Production costs and scale:

The fixed cost of production that ABILENE OIL AND GAS LIMITED has to bear as a

drilling company of natural gas and oil are as follows:

The cost of finding and oil well

The cost of oil drilling

The cost of generating the initial outputs

The cost of maintaining or renting the drilling equipments

The cost of regulatory compliance

Long term workers contract

The decision of incurring the fixed cost is taken by the company once the decision for drilling

and exploration has been taken by the company with respect to a particular oil well. Thus

these are the costs that do not vary with the units of production as the business has to incur

theses expenses at the initial level of production. The expected fixed cost of the company is

around US$480K per annum

The variable cost of production of the company is as follows:

The cost of maintaining the well

Short term equipment contracts (Tsui, 2011)

These are the basic & major variable costs that the business has to incur while running the

drilling operations. These costs directly vary with the units of production. In other words if

the business is looking for more production or say drilling of oil then it will extend the cost

contact for maintaining the well and the contract of hiring the equipments(Preserve the

Beartooth Front, 2015).

So far as scale of operation is concerned the business is trying to initiate a large scale

operation as described by the following fact and figures:

The company is all set to adopt a gross production base of 250-1000 BOPD

The adoption of this production base is expected to fetch cash revenue of US$ 155000

per month

The cost of this production rate is expected to be around US$ 738000 per month

Thus there will be enough residual cash flow to fund the operat6ional actitivies of the

company (Tu and Sui, 2011)

The production operation of the company is expected to be financed from the cash

flow of the company

Capturing the large acreage position

The Company is engaged in the projects of Lodestone [15630 acres] & Welch

Bornholdt[13000 acres] with shares of 49% and 50% respectively. All, these projects

are ready to drill projects

As more funding will be available the company will look more acquisition of risky

drilling sites with larger acreage (Clark and Veil,2009)

The company is expected to drill around 15-17 wells in 2015.Out of these wells 10

wells are expected to be under the Lodestone project and 4-6 wells are expected to be

under the Welch Bornholdt project(asx.com.au, 2014)

All the above findings describe that the company is planning a large scale operation in near

future.

The cost of maintaining the well

Short term equipment contracts (Tsui, 2011)

These are the basic & major variable costs that the business has to incur while running the

drilling operations. These costs directly vary with the units of production. In other words if

the business is looking for more production or say drilling of oil then it will extend the cost

contact for maintaining the well and the contract of hiring the equipments(Preserve the

Beartooth Front, 2015).

So far as scale of operation is concerned the business is trying to initiate a large scale

operation as described by the following fact and figures:

The company is all set to adopt a gross production base of 250-1000 BOPD

The adoption of this production base is expected to fetch cash revenue of US$ 155000

per month

The cost of this production rate is expected to be around US$ 738000 per month

Thus there will be enough residual cash flow to fund the operat6ional actitivies of the

company (Tu and Sui, 2011)

The production operation of the company is expected to be financed from the cash

flow of the company

Capturing the large acreage position

The Company is engaged in the projects of Lodestone [15630 acres] & Welch

Bornholdt[13000 acres] with shares of 49% and 50% respectively. All, these projects

are ready to drill projects

As more funding will be available the company will look more acquisition of risky

drilling sites with larger acreage (Clark and Veil,2009)

The company is expected to drill around 15-17 wells in 2015.Out of these wells 10

wells are expected to be under the Lodestone project and 4-6 wells are expected to be

under the Welch Bornholdt project(asx.com.au, 2014)

All the above findings describe that the company is planning a large scale operation in near

future.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3. Macro business environment

Abilene Oil and Gas Limited is an ASX listed company which is focused in its business in

the USA’s mid west part. The organisation is engaged in the exploration activity,

development activity and production activity in the oil and gas sector. Most of the assets

company are in the state of Kansas. The organisation wants to increase the number of drilling

locations in its operation with increasing the asset for the production and exploration purpose.

The goals and objective of the company would have an influence from the macro

environmental factors. The macro environmental is analysed through following factor.

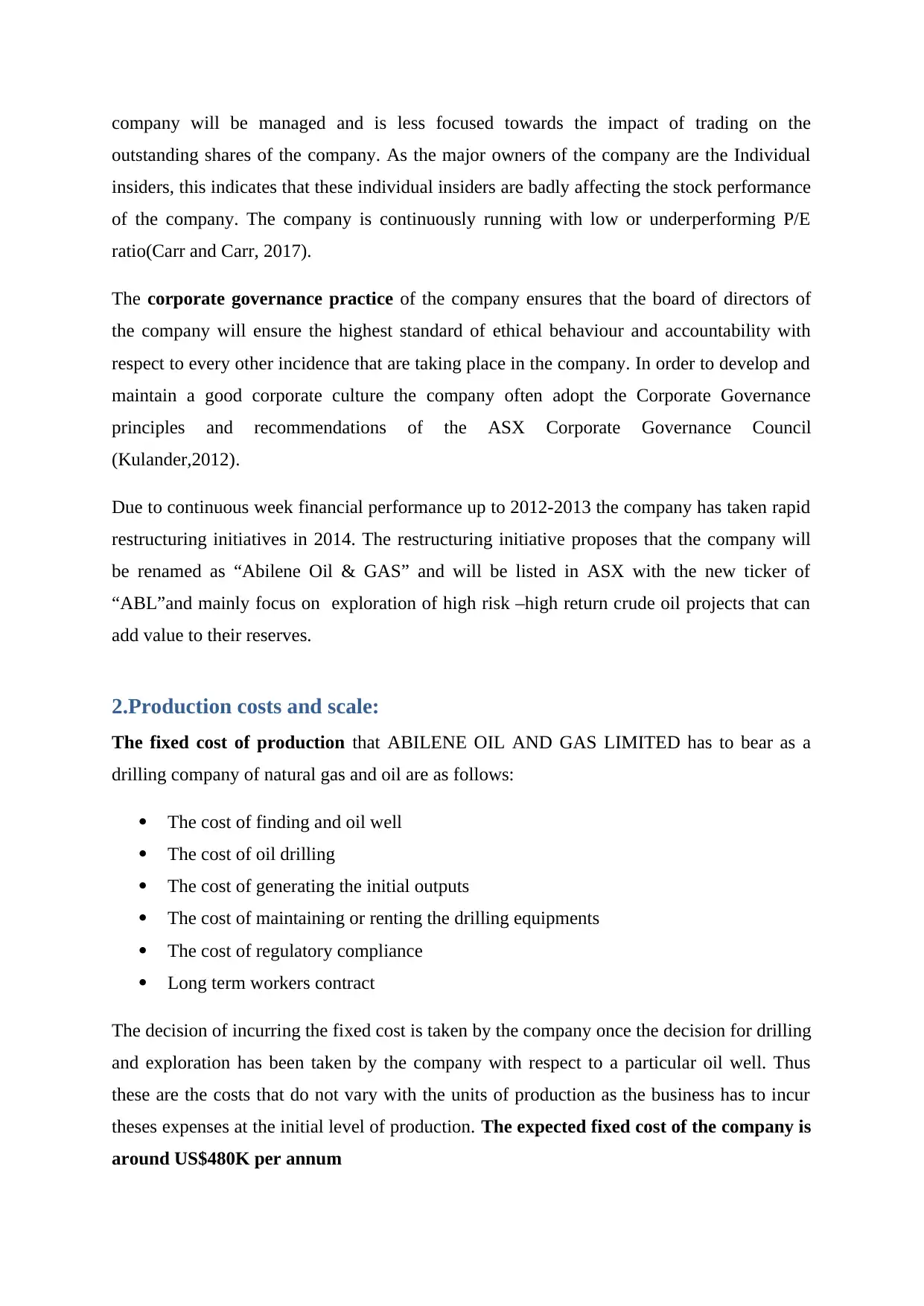

Political stability

USA is one of the oldest democracies in the modern time. The country is politically stable.

The figure below shows the political stability value of the country. The index below ranges

from -2.5 to +2.5 and that is the week and strong value respectively. Around this 20 year

period the country scored on average 0.47. Out of 194 countries USA stands at 56 places in

the global ranking in 2015 (TheGlobalEconomy, 2017). But the recent presidential election of

2016 must have changed the situation. The general population as well as the political parties

of the country are worried about the future political situation and the general future of the

country (USA Today, 2017).

[Source: TheGlobalEconomy, 2017]

Abilene Oil and Gas Limited is an ASX listed company which is focused in its business in

the USA’s mid west part. The organisation is engaged in the exploration activity,

development activity and production activity in the oil and gas sector. Most of the assets

company are in the state of Kansas. The organisation wants to increase the number of drilling

locations in its operation with increasing the asset for the production and exploration purpose.

The goals and objective of the company would have an influence from the macro

environmental factors. The macro environmental is analysed through following factor.

Political stability

USA is one of the oldest democracies in the modern time. The country is politically stable.

The figure below shows the political stability value of the country. The index below ranges

from -2.5 to +2.5 and that is the week and strong value respectively. Around this 20 year

period the country scored on average 0.47. Out of 194 countries USA stands at 56 places in

the global ranking in 2015 (TheGlobalEconomy, 2017). But the recent presidential election of

2016 must have changed the situation. The general population as well as the political parties

of the country are worried about the future political situation and the general future of the

country (USA Today, 2017).

[Source: TheGlobalEconomy, 2017]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

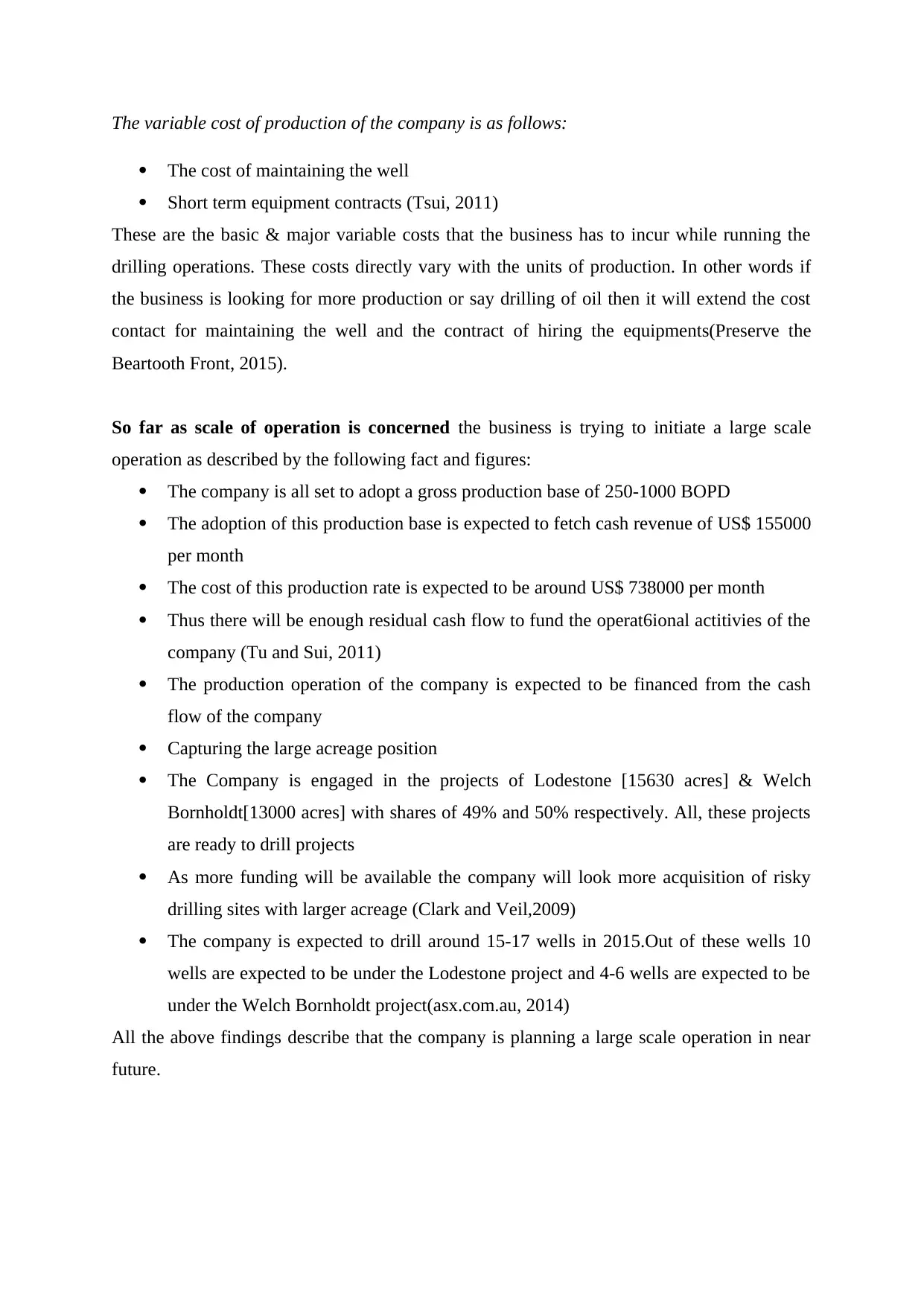

The main threatening factors for the oil and gas industry are the political stability and the

conflict of geo-political nature. In the world around 90% of the oil and gas reserved are

owned by the national company and their share in the production is 75%n (Pitatzis, 2016).

The political instability is a common factor among the energy rich countries. But the stable

political scenario of USA does not provide such threats for the company. On the contrary the

policies of the Trump administration regarding the oil and gas sector are favourable. As soon

as they came to power the administration declared their pro energy policy for this industry

(Sharma, 2017). This is big confidence boost for the industry which was facing problems for

the low oil price for past few years.

[Source: Pitatzis, 2016]

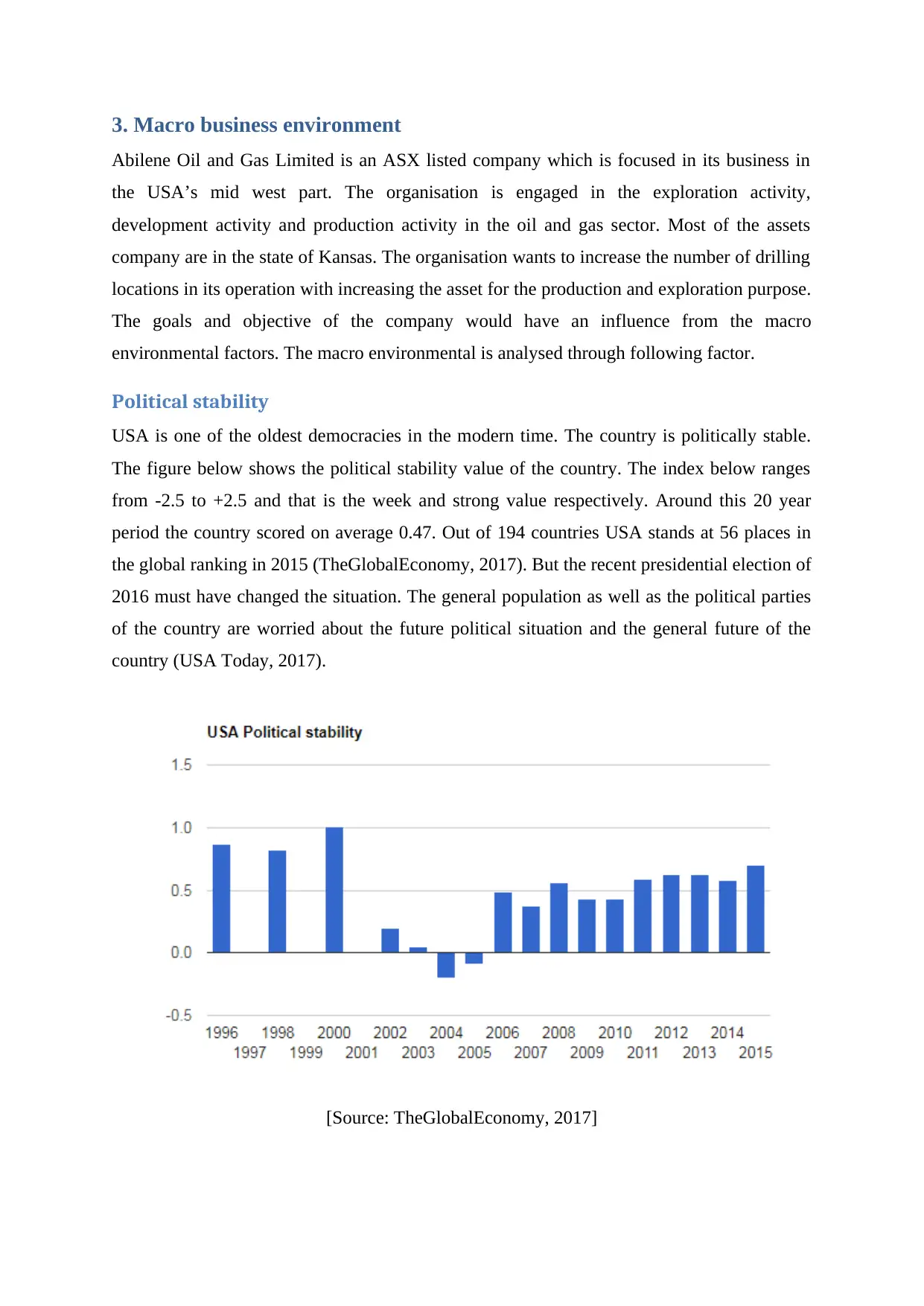

Economic environment

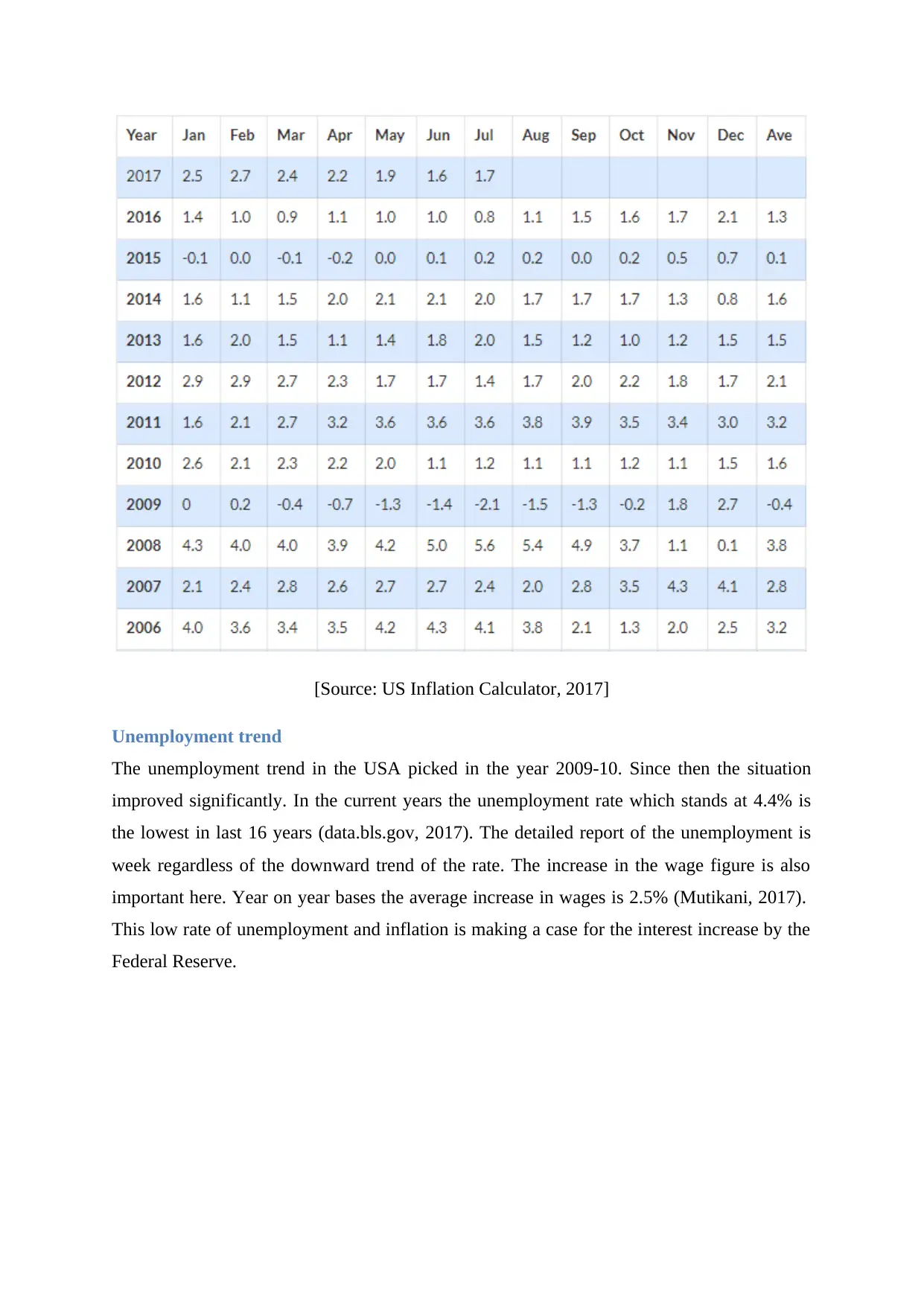

Inflation trend

The economic scenario of the USA is also important for the industry. The good economic

scenario and positive consumer spending scenario would impact the sector. The rate of

inflation of the USA economy for the last 12 month is 1.7% (US Inflation Calculator, 2017).

The inflationary trend is higher compare to the previous year’s position but it is expected to

stay below the figure of 2011.

conflict of geo-political nature. In the world around 90% of the oil and gas reserved are

owned by the national company and their share in the production is 75%n (Pitatzis, 2016).

The political instability is a common factor among the energy rich countries. But the stable

political scenario of USA does not provide such threats for the company. On the contrary the

policies of the Trump administration regarding the oil and gas sector are favourable. As soon

as they came to power the administration declared their pro energy policy for this industry

(Sharma, 2017). This is big confidence boost for the industry which was facing problems for

the low oil price for past few years.

[Source: Pitatzis, 2016]

Economic environment

Inflation trend

The economic scenario of the USA is also important for the industry. The good economic

scenario and positive consumer spending scenario would impact the sector. The rate of

inflation of the USA economy for the last 12 month is 1.7% (US Inflation Calculator, 2017).

The inflationary trend is higher compare to the previous year’s position but it is expected to

stay below the figure of 2011.

[Source: US Inflation Calculator, 2017]

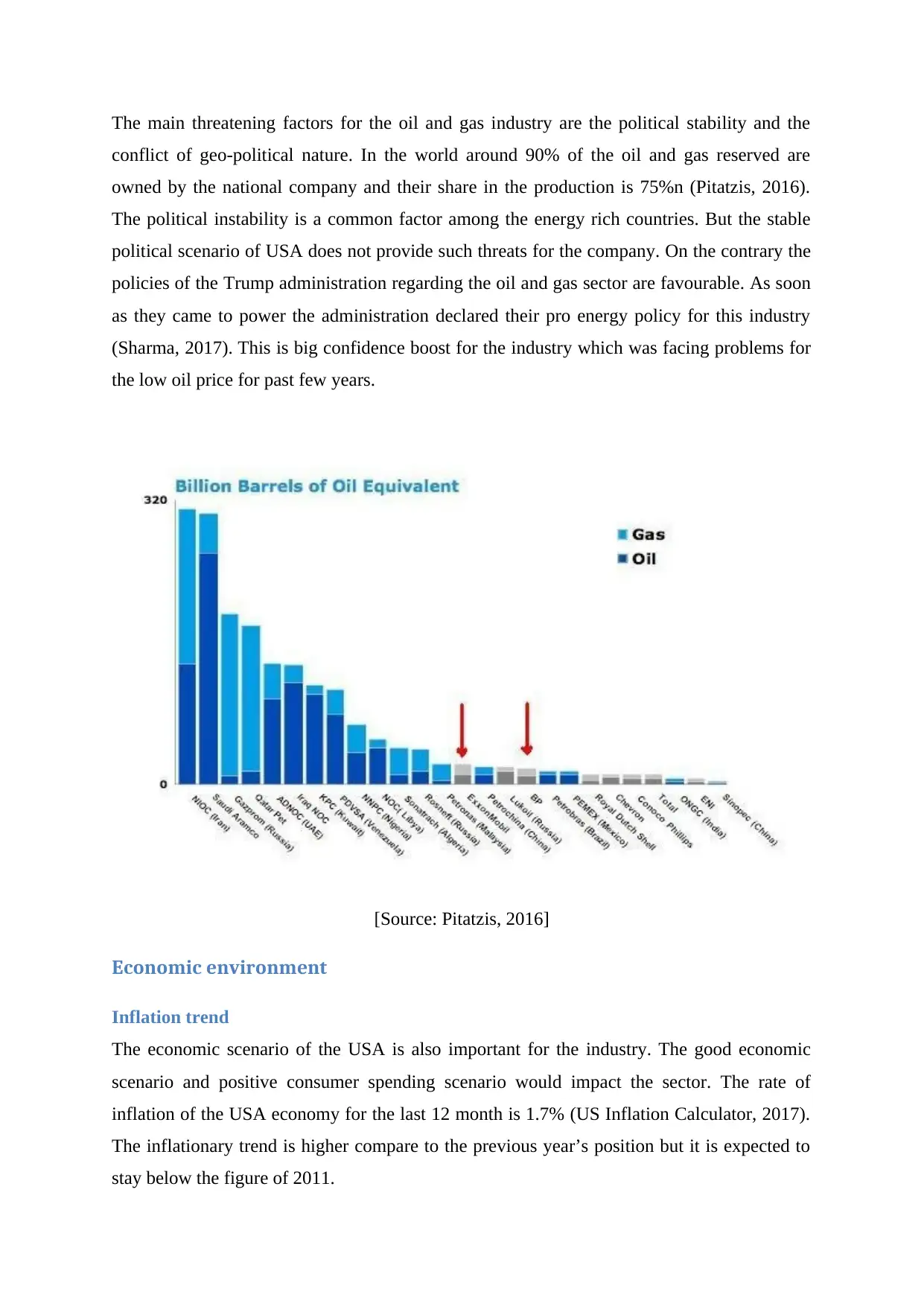

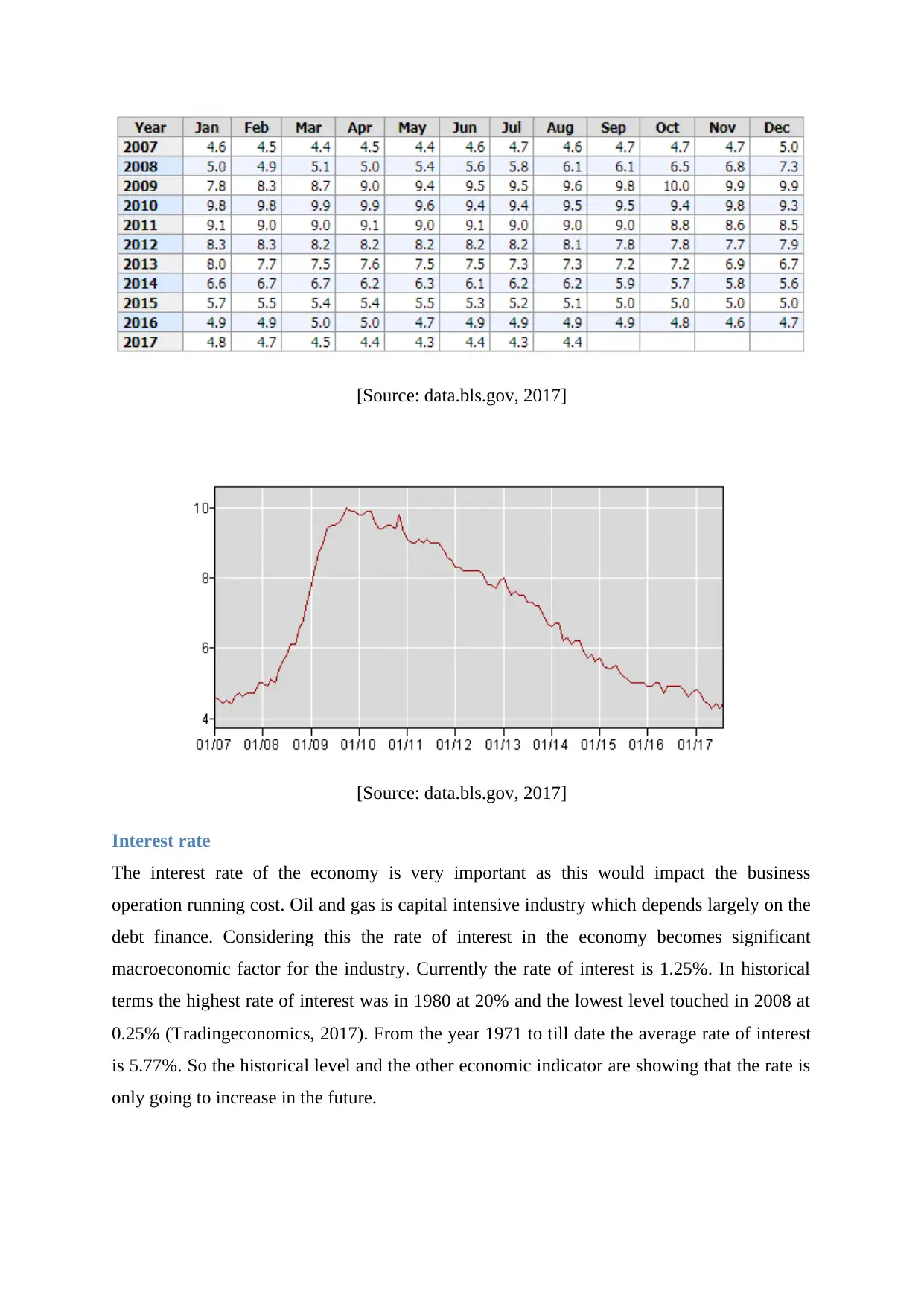

Unemployment trend

The unemployment trend in the USA picked in the year 2009-10. Since then the situation

improved significantly. In the current years the unemployment rate which stands at 4.4% is

the lowest in last 16 years (data.bls.gov, 2017). The detailed report of the unemployment is

week regardless of the downward trend of the rate. The increase in the wage figure is also

important here. Year on year bases the average increase in wages is 2.5% (Mutikani, 2017).

This low rate of unemployment and inflation is making a case for the interest increase by the

Federal Reserve.

Unemployment trend

The unemployment trend in the USA picked in the year 2009-10. Since then the situation

improved significantly. In the current years the unemployment rate which stands at 4.4% is

the lowest in last 16 years (data.bls.gov, 2017). The detailed report of the unemployment is

week regardless of the downward trend of the rate. The increase in the wage figure is also

important here. Year on year bases the average increase in wages is 2.5% (Mutikani, 2017).

This low rate of unemployment and inflation is making a case for the interest increase by the

Federal Reserve.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

[Source: data.bls.gov, 2017]

[Source: data.bls.gov, 2017]

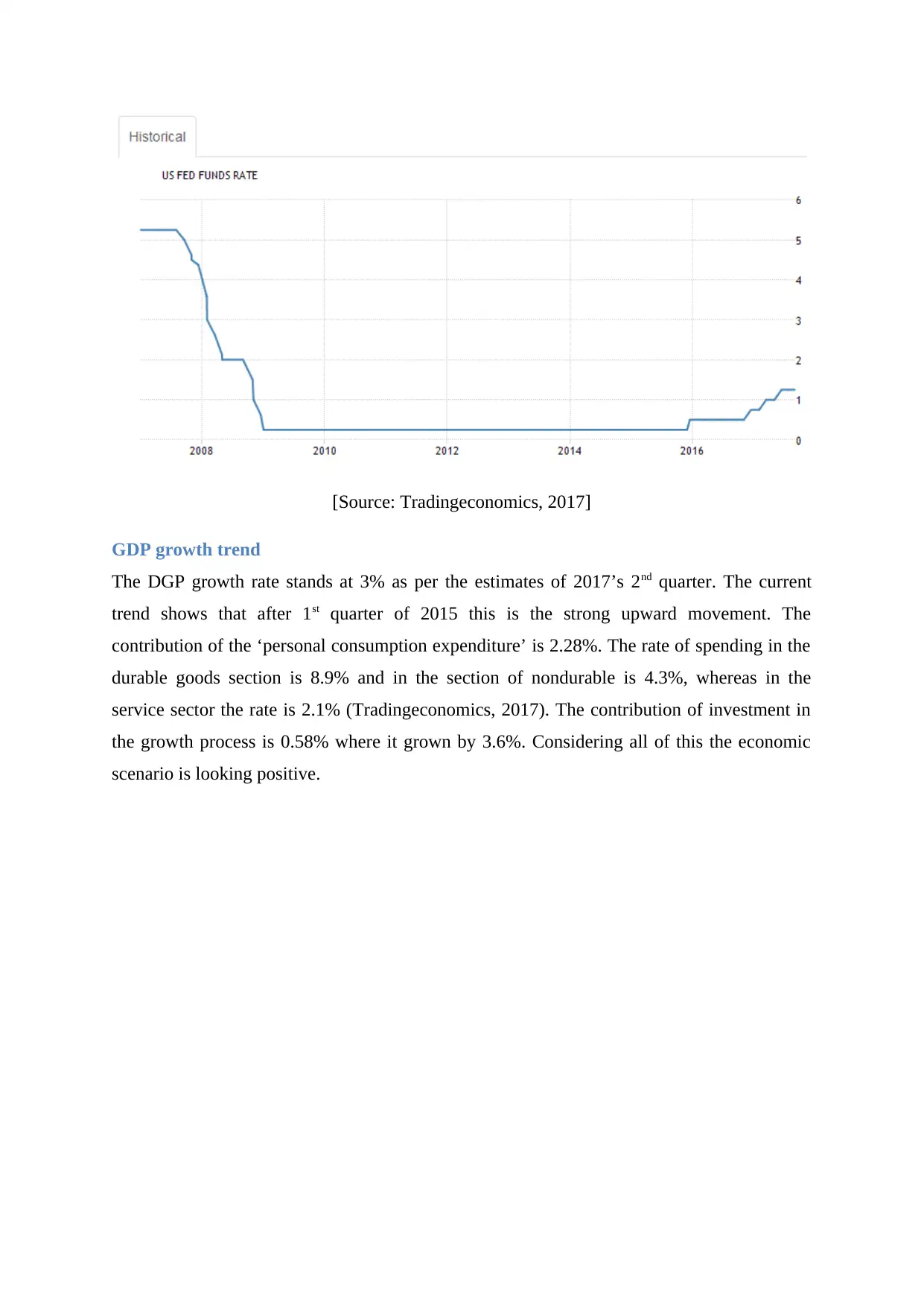

Interest rate

The interest rate of the economy is very important as this would impact the business

operation running cost. Oil and gas is capital intensive industry which depends largely on the

debt finance. Considering this the rate of interest in the economy becomes significant

macroeconomic factor for the industry. Currently the rate of interest is 1.25%. In historical

terms the highest rate of interest was in 1980 at 20% and the lowest level touched in 2008 at

0.25% (Tradingeconomics, 2017). From the year 1971 to till date the average rate of interest

is 5.77%. So the historical level and the other economic indicator are showing that the rate is

only going to increase in the future.

[Source: data.bls.gov, 2017]

Interest rate

The interest rate of the economy is very important as this would impact the business

operation running cost. Oil and gas is capital intensive industry which depends largely on the

debt finance. Considering this the rate of interest in the economy becomes significant

macroeconomic factor for the industry. Currently the rate of interest is 1.25%. In historical

terms the highest rate of interest was in 1980 at 20% and the lowest level touched in 2008 at

0.25% (Tradingeconomics, 2017). From the year 1971 to till date the average rate of interest

is 5.77%. So the historical level and the other economic indicator are showing that the rate is

only going to increase in the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

[Source: Tradingeconomics, 2017]

GDP growth trend

The DGP growth rate stands at 3% as per the estimates of 2017’s 2nd quarter. The current

trend shows that after 1st quarter of 2015 this is the strong upward movement. The

contribution of the ‘personal consumption expenditure’ is 2.28%. The rate of spending in the

durable goods section is 8.9% and in the section of nondurable is 4.3%, whereas in the

service sector the rate is 2.1% (Tradingeconomics, 2017). The contribution of investment in

the growth process is 0.58% where it grown by 3.6%. Considering all of this the economic

scenario is looking positive.

GDP growth trend

The DGP growth rate stands at 3% as per the estimates of 2017’s 2nd quarter. The current

trend shows that after 1st quarter of 2015 this is the strong upward movement. The

contribution of the ‘personal consumption expenditure’ is 2.28%. The rate of spending in the

durable goods section is 8.9% and in the section of nondurable is 4.3%, whereas in the

service sector the rate is 2.1% (Tradingeconomics, 2017). The contribution of investment in

the growth process is 0.58% where it grown by 3.6%. Considering all of this the economic

scenario is looking positive.

[Source: Tradingeconomics, 2017]

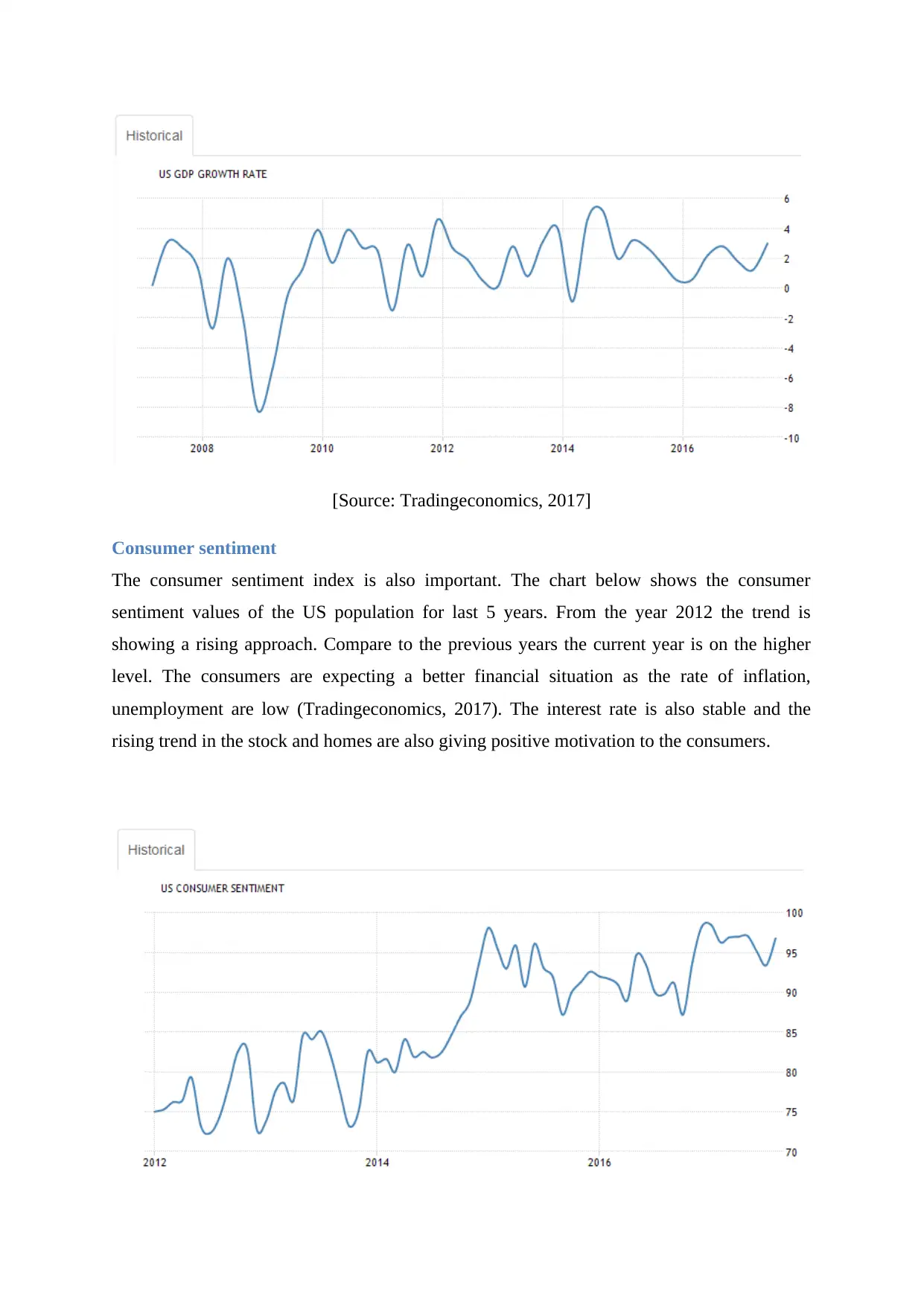

Consumer sentiment

The consumer sentiment index is also important. The chart below shows the consumer

sentiment values of the US population for last 5 years. From the year 2012 the trend is

showing a rising approach. Compare to the previous years the current year is on the higher

level. The consumers are expecting a better financial situation as the rate of inflation,

unemployment are low (Tradingeconomics, 2017). The interest rate is also stable and the

rising trend in the stock and homes are also giving positive motivation to the consumers.

Consumer sentiment

The consumer sentiment index is also important. The chart below shows the consumer

sentiment values of the US population for last 5 years. From the year 2012 the trend is

showing a rising approach. Compare to the previous years the current year is on the higher

level. The consumers are expecting a better financial situation as the rate of inflation,

unemployment are low (Tradingeconomics, 2017). The interest rate is also stable and the

rising trend in the stock and homes are also giving positive motivation to the consumers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.