Finance Report: Describing Business Assets, Liabilities, Expenses

VerifiedAdded on 2021/01/01

|6

|670

|95

Report

AI Summary

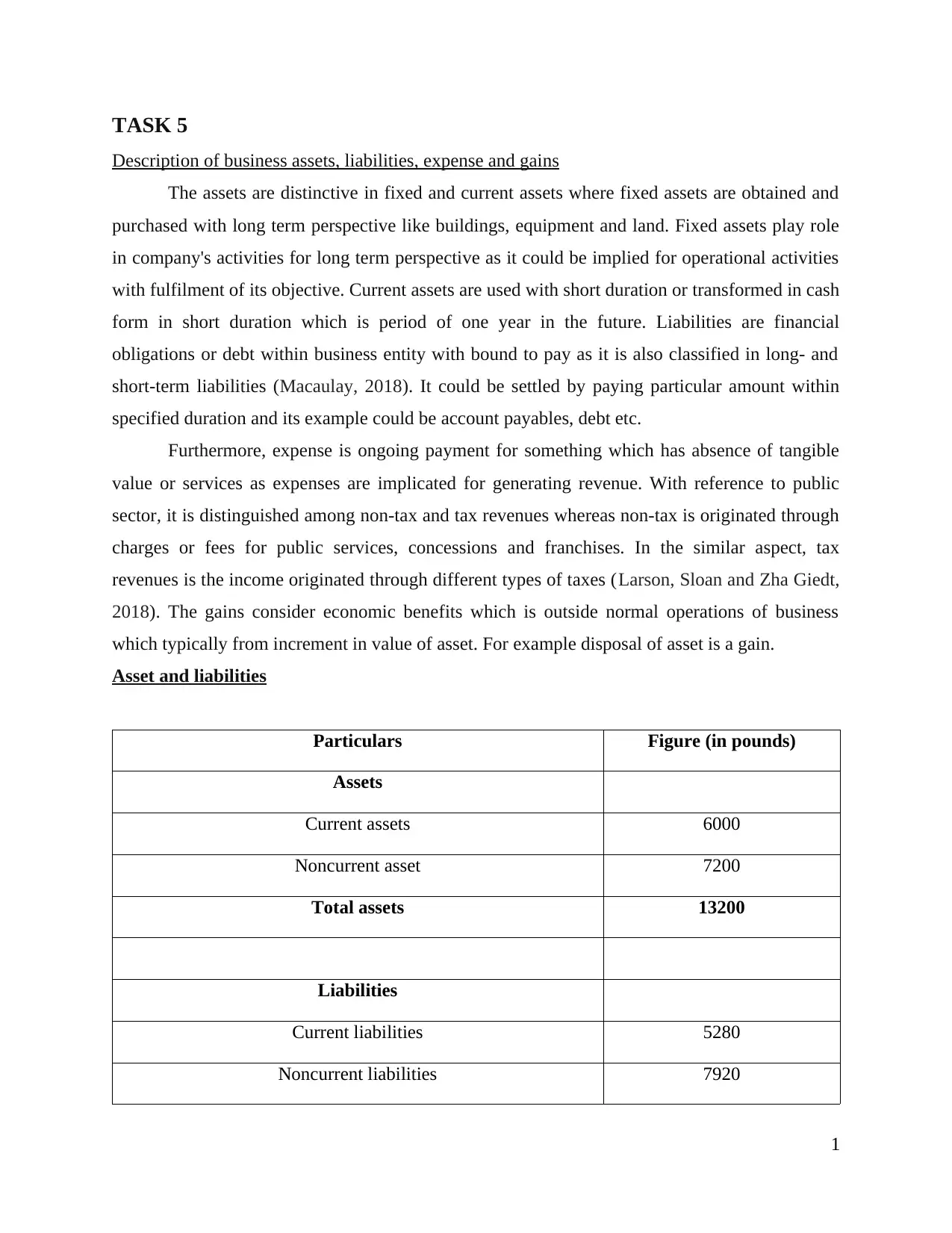

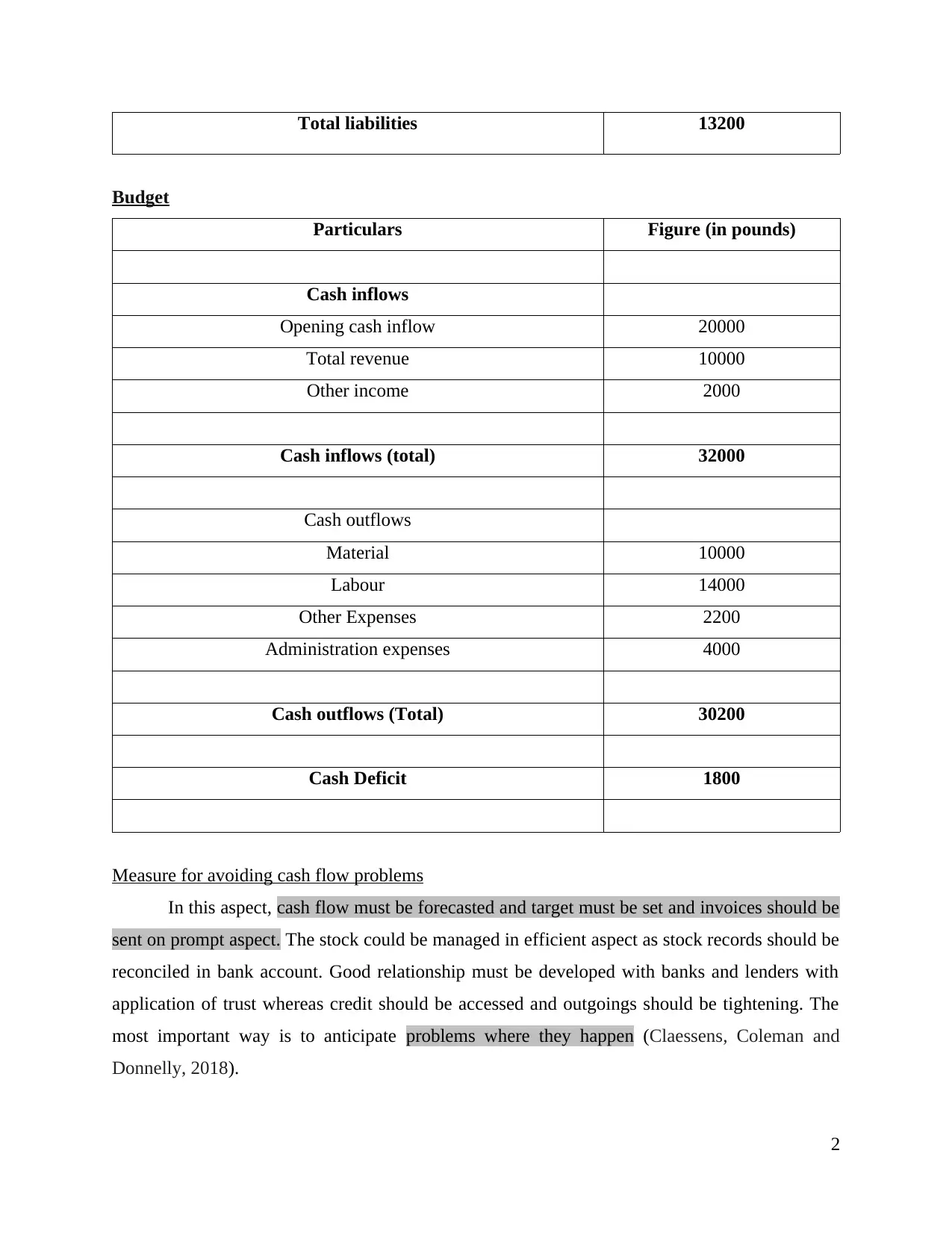

This report provides a detailed analysis of a business's assets, liabilities, expenses, and gains. It distinguishes between fixed and current assets, and long- and short-term liabilities, offering a clear understanding of financial obligations. The report further explores different types of expenses and gains, including tax and non-tax revenues. Furthermore, the report presents example tables illustrating assets, liabilities, and a budget with cash inflows and outflows. It also provides practical measures to avoid cash flow problems, such as forecasting, efficient stock management, and developing strong relationships with financial institutions, as well as the importance of anticipating potential issues. The report references several academic sources to support its findings.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)