Corporate Accounting Assignment: AASB 3 Business Combination Analysis

VerifiedAdded on 2021/10/10

|7

|1928

|141

Homework Assignment

AI Summary

This assignment delves into the Australian Accounting Standards Board (AASB) 3, focusing on business combinations and acquisition analysis. It examines the application of AASB 3 to ensure the relevance, reliability, and comparability of financial statements. The assignment outlines key terms like acquirer, non-controlling interest, and subsidiary, along with the acquisition method, including the identification of the acquirer, determination of the acquisition date, and the recognition of assets, liabilities, and non-controlling interests. It emphasizes the importance of recognizing goodwill or gain from bargain purchases and the use of fair value for asset and liability valuation. The analysis includes case studies that apply AASB 3 to various scenarios, such as acquisitions involving share considerations and cash payments, and the computation of goodwill or bargain gains. The solution also provides insights into consolidated financial statements, including necessary adjustments for depreciation, liabilities, and inventory, alongside journal entries for different acquisition scenarios. Additionally, the assignment includes a peer review section highlighting the contributions of team members. The appendix provides detailed acquisition analyses and consolidated financial statements, along with relevant journal entries.

CORPORATE ACCOUNTING

Australian Accounting Standard Board -3 Business combinations

AASB shall be applicable to every entity which satisfies the following conditions:

(a) The company is required to prepare financial report in accordance with Part 2M.3 of the

corporation act and that it is a reporting entity;

(b) General Purpose Financial Statement of each other reporting entity;

(c) Financial statement that are held out as General Purpose Financial Statements.

AASB 3 has been implemented to ensure relevance, reliability and comparability of financial

statements among different entities. Under the said standard, the asset and liabilities are recognised at

fair value for the purpose of determining the goodwill or gain from bargain purchase to be created at

the time of acquisition. The key terms under the said standard has been detailed here-in-below:

(a) Acquirer: The company which acquires the asset;

(b) Non-Controlling Interest: The portion of interest which is left after acquiring and represent

minority stake;

(c) Subsidiary: Holding of stake greater than 50% with voting rights;

The method of acquisition under the said method is acquisition method. Under the said method

acquirer needs to be identified, date of acquisition needs to be determined, recognising asset, liability

and non -controlling interest. Further, the method requires recognising goodwill or gain from bargain

purchase.

In addition to above for asset and liabilities to be recognised at fair value they need to satisfy the

conditions of asset and liabilities. Thus, only those asset that satisfy the terms shall be recognised as

asset in the books of acquirer.

Further, the gain from bargain purchase shall be recognised in Profit and Loss Account. In addition,

any expense incurred shall be expensed.

The relevant Business combination in Australian History has been detailed here-in-below:

(a) Telstra Purchased Sydney based Professional and Managed Service Provider VMtech;

(b) Telstra Purchased Australian based GPS and telematics fleet management company MTData;

(c) Equinox acquired Australian data centre operator Metronade etc.

How Business Combination Acquisition Analysis

AASB 3 has been implemented to ensure relevance, reliability and comparability of financial

statements among different entities. Under the said standard, the asset and liabilities are recognised at

fair value for the purpose of determining the goodwill or gain from bargain purchase to be created at

the time of acquisition. The key terms under the said standard has been detailed here-in-below:

(d) Acquirer: The company which acquires the asset;

(e) Non-Controlling Interest: The portion of interest which is left after acquiring and represent

minority stake;

(f) Subsidiary: Holding of stake greater than 50% with voting rights;

The method of acquisition under the said method is acquisition method. Under the said method

acquirer needs to be identified, date of acquisition needs to be determined, recognising asset, liability

and non -controlling interest. Further, the method requires recognising goodwill or gain from bargain

purchase.

Australian Accounting Standard Board -3 Business combinations

AASB shall be applicable to every entity which satisfies the following conditions:

(a) The company is required to prepare financial report in accordance with Part 2M.3 of the

corporation act and that it is a reporting entity;

(b) General Purpose Financial Statement of each other reporting entity;

(c) Financial statement that are held out as General Purpose Financial Statements.

AASB 3 has been implemented to ensure relevance, reliability and comparability of financial

statements among different entities. Under the said standard, the asset and liabilities are recognised at

fair value for the purpose of determining the goodwill or gain from bargain purchase to be created at

the time of acquisition. The key terms under the said standard has been detailed here-in-below:

(a) Acquirer: The company which acquires the asset;

(b) Non-Controlling Interest: The portion of interest which is left after acquiring and represent

minority stake;

(c) Subsidiary: Holding of stake greater than 50% with voting rights;

The method of acquisition under the said method is acquisition method. Under the said method

acquirer needs to be identified, date of acquisition needs to be determined, recognising asset, liability

and non -controlling interest. Further, the method requires recognising goodwill or gain from bargain

purchase.

In addition to above for asset and liabilities to be recognised at fair value they need to satisfy the

conditions of asset and liabilities. Thus, only those asset that satisfy the terms shall be recognised as

asset in the books of acquirer.

Further, the gain from bargain purchase shall be recognised in Profit and Loss Account. In addition,

any expense incurred shall be expensed.

The relevant Business combination in Australian History has been detailed here-in-below:

(a) Telstra Purchased Sydney based Professional and Managed Service Provider VMtech;

(b) Telstra Purchased Australian based GPS and telematics fleet management company MTData;

(c) Equinox acquired Australian data centre operator Metronade etc.

How Business Combination Acquisition Analysis

AASB 3 has been implemented to ensure relevance, reliability and comparability of financial

statements among different entities. Under the said standard, the asset and liabilities are recognised at

fair value for the purpose of determining the goodwill or gain from bargain purchase to be created at

the time of acquisition. The key terms under the said standard has been detailed here-in-below:

(d) Acquirer: The company which acquires the asset;

(e) Non-Controlling Interest: The portion of interest which is left after acquiring and represent

minority stake;

(f) Subsidiary: Holding of stake greater than 50% with voting rights;

The method of acquisition under the said method is acquisition method. Under the said method

acquirer needs to be identified, date of acquisition needs to be determined, recognising asset, liability

and non -controlling interest. Further, the method requires recognising goodwill or gain from bargain

purchase.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Further for the purpose of carrying out the acquisition analysis, one needs to consider the asset and

liabilities which satisfy the definition of asset and liability. Also the asset and liability are to be

recognised at fair value to ascertain net asset and recognise goodwill or bargain gain.

In addition to above, there are two method of goodwill recognition in International Financial

Reporting Standards

(a) Complete or Full Goodwill;

(b) Partial Goodwill.

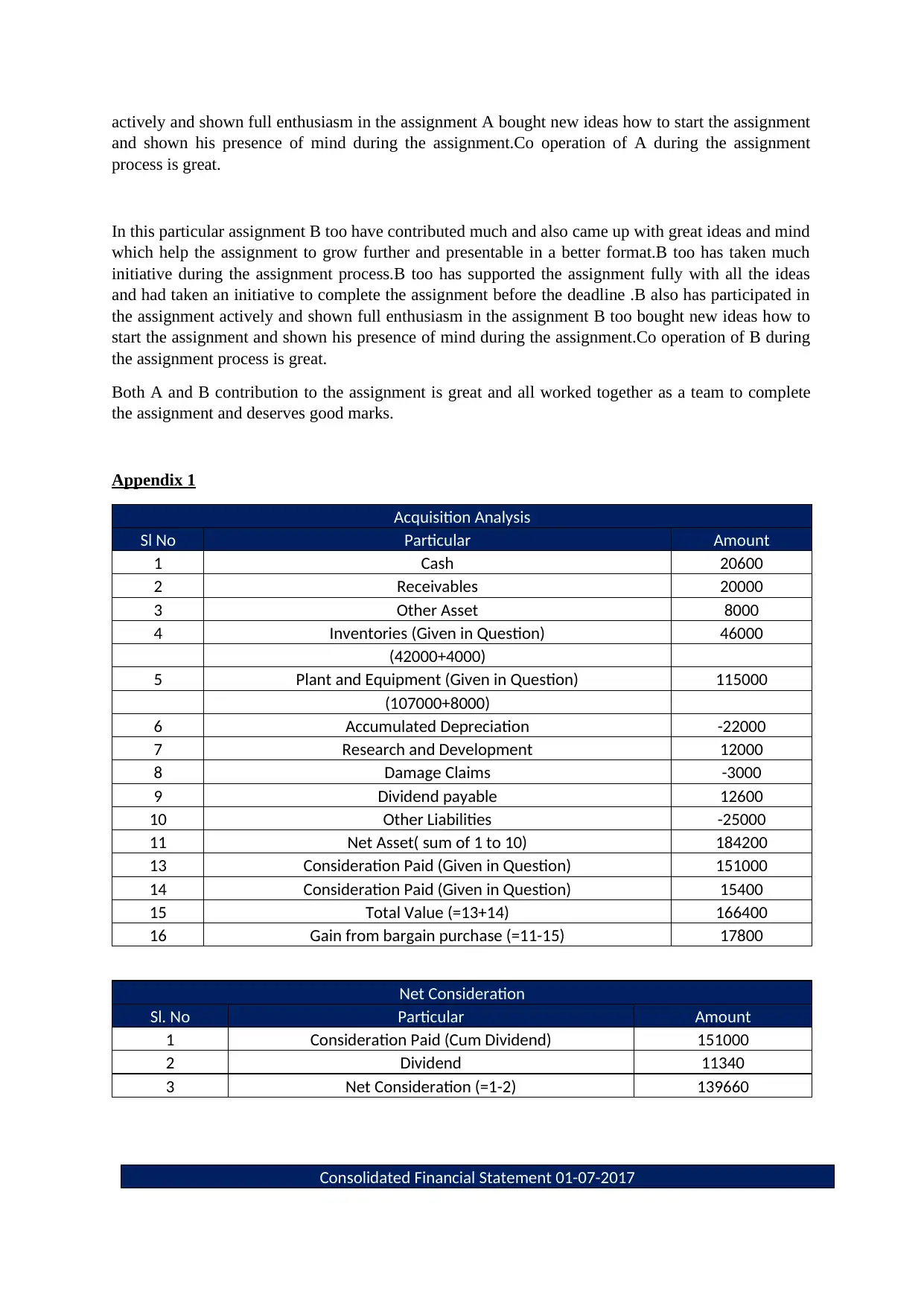

Case 1

Under question 1 Asset has been recognised at fair value along with liabilities in terms of AASB 3.

Further, the purchase paid by the company to acquire the asset is inclusive of dividend as stated in the

case.

Further the net asset computed on the basis of above stands at $184200. Further, the Consideration

paid stands at $151000 which includes dividend and the fair value of 10% acquisition stands at

$15400. The above figures have been reduced to arrive at conclusion that fair value of asset exceeds

the consideration paid. Accordingly bargain gain is recognised in Profit and Loss Account as

disclosed in Consolidated Profit and Loss Account. The bargain gain stood at $17800.

In addition while consolidating books at the end of the end of year following points needs to be

considered:

(a) Additional Depreciation needs to be charged on the difference in fair value and book value of the

asset;

(b) Gain of settling liability at a lower amount of $ 200;

(c) Adjustment for inventor sold during the year at fair value.

Case 2

Under the second case, three situation has been given for analysis

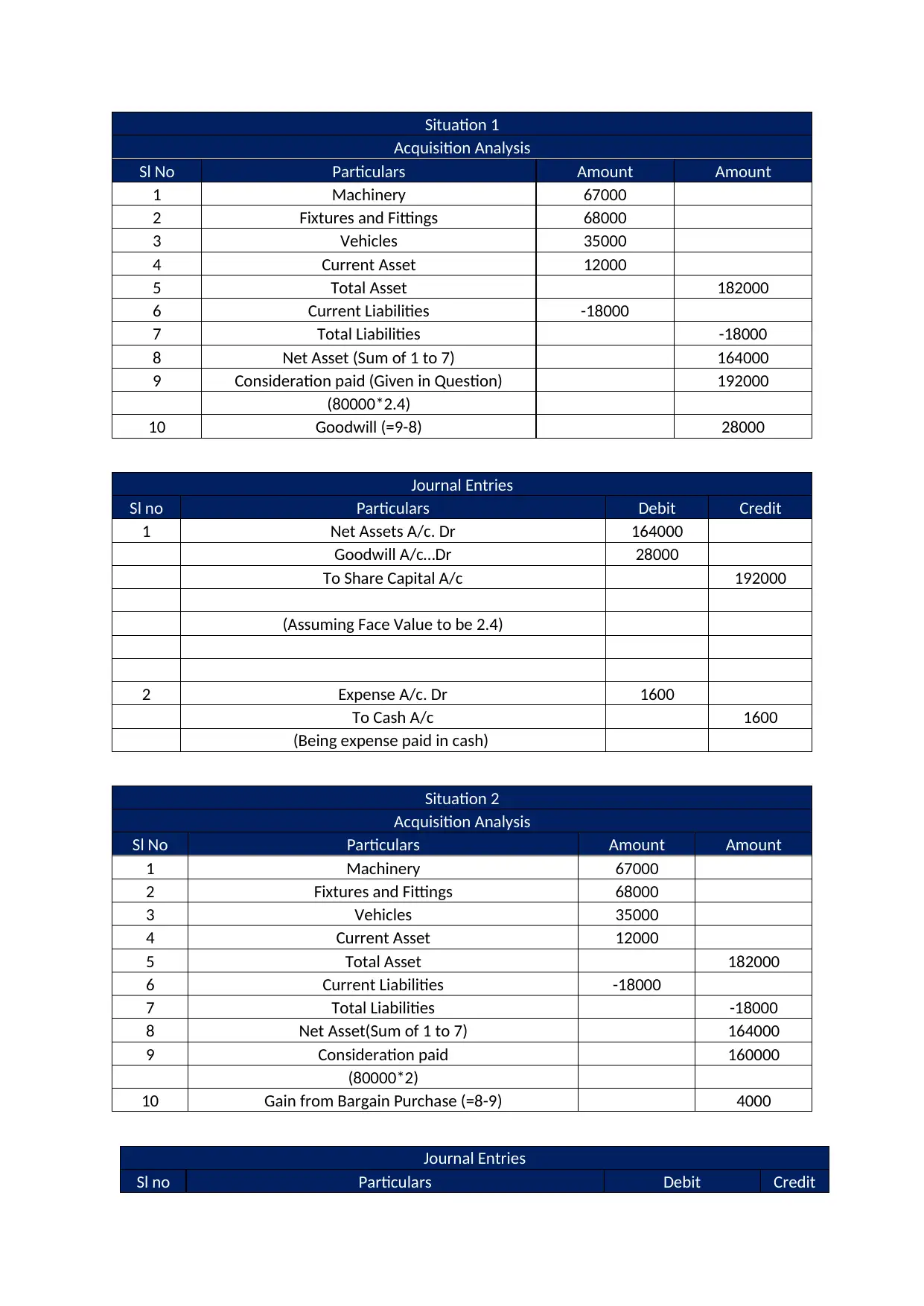

In the first situation consideration is paid in shares of the company. The face value of the shares has

been considered at 2.4. Accordingly, no share premium considered. Further, after recognising the

asset and liabilities at fair value, goodwill has been recognised to the extent of $28000 in the books of

Angelina. For detailed computation refer excel.

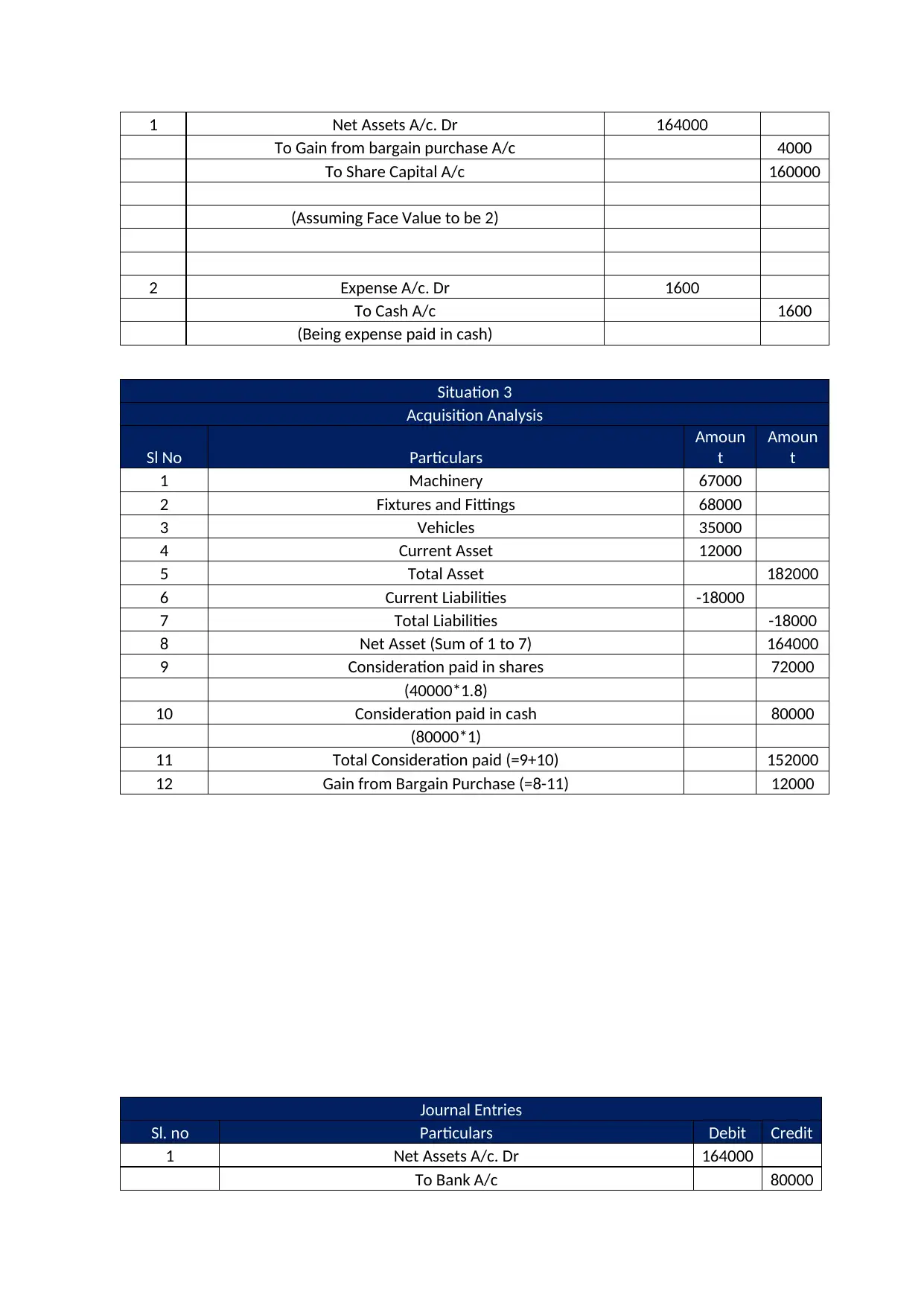

In the second situation consideration is paid in shares of the company. The face value of the shares

has been considered at 2. Accordingly, no share premium considered. Further, after recognising the

asset and liabilities at fair value, gain on bargain purchase has been recognised to the extent of $ 4000

in the books of Angelina. For detailed computation refer excel.

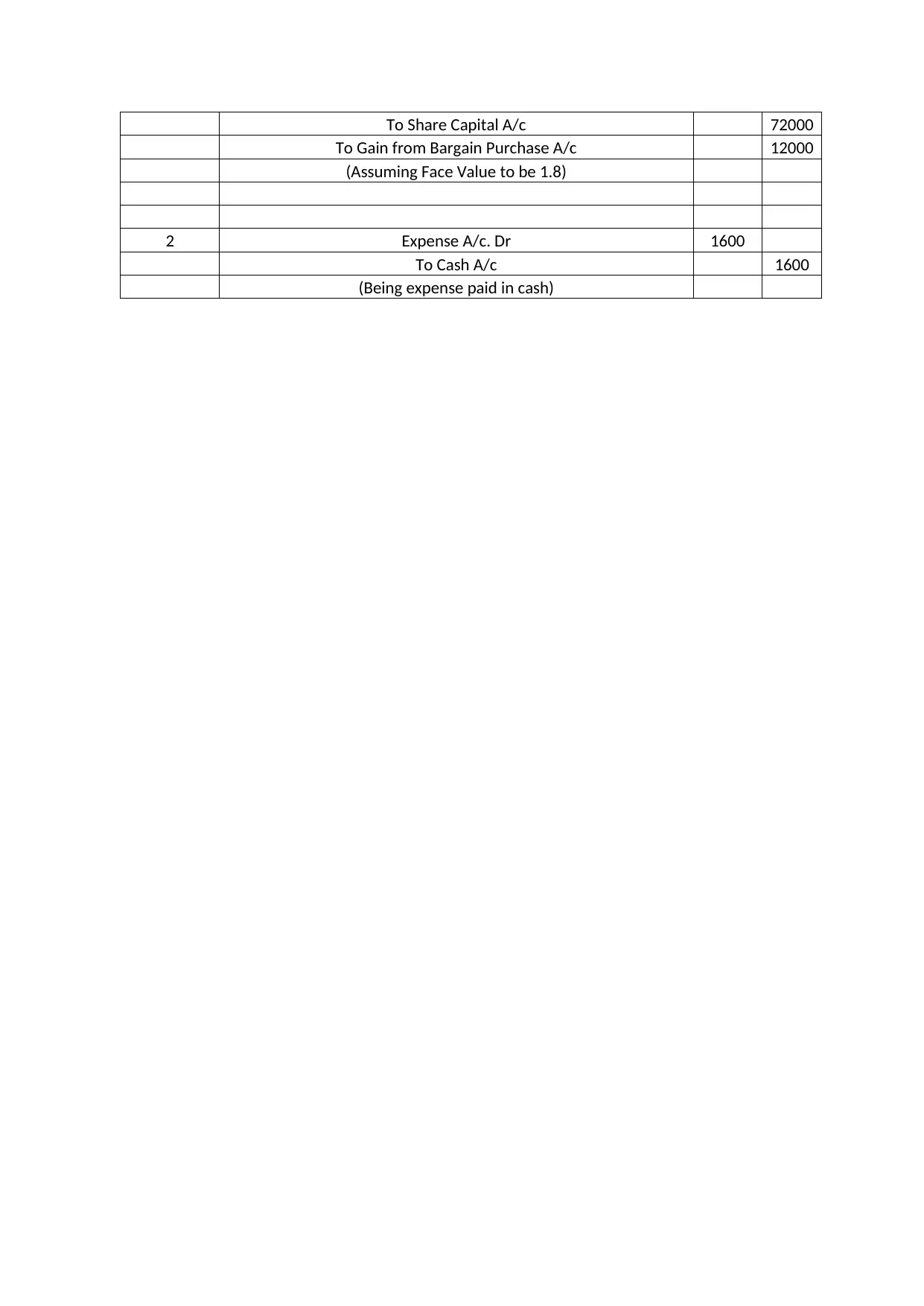

In the third situation consideration is paid in shares of the company and cash. The face value of the

shares has been considered at 1.8. Accordingly, no share premium considered. Further, after

recognising the asset and liabilities at fair value, gain on bargain purchase has been recognised to the

extent of $12000 in the books of Angelina. For detailed computation refer excel.

PEER REVIEW

In this particular assignment A have contributed much and came up with the fresh ideas and mind

which help the assignment to complete and presentable in a better format.A also has taken much

initiative during the assignment process.A supported the assignment fully with all the ideas and had

taken an initiative to complete the assignment before the deadline . A participated in the assignment

liabilities which satisfy the definition of asset and liability. Also the asset and liability are to be

recognised at fair value to ascertain net asset and recognise goodwill or bargain gain.

In addition to above, there are two method of goodwill recognition in International Financial

Reporting Standards

(a) Complete or Full Goodwill;

(b) Partial Goodwill.

Case 1

Under question 1 Asset has been recognised at fair value along with liabilities in terms of AASB 3.

Further, the purchase paid by the company to acquire the asset is inclusive of dividend as stated in the

case.

Further the net asset computed on the basis of above stands at $184200. Further, the Consideration

paid stands at $151000 which includes dividend and the fair value of 10% acquisition stands at

$15400. The above figures have been reduced to arrive at conclusion that fair value of asset exceeds

the consideration paid. Accordingly bargain gain is recognised in Profit and Loss Account as

disclosed in Consolidated Profit and Loss Account. The bargain gain stood at $17800.

In addition while consolidating books at the end of the end of year following points needs to be

considered:

(a) Additional Depreciation needs to be charged on the difference in fair value and book value of the

asset;

(b) Gain of settling liability at a lower amount of $ 200;

(c) Adjustment for inventor sold during the year at fair value.

Case 2

Under the second case, three situation has been given for analysis

In the first situation consideration is paid in shares of the company. The face value of the shares has

been considered at 2.4. Accordingly, no share premium considered. Further, after recognising the

asset and liabilities at fair value, goodwill has been recognised to the extent of $28000 in the books of

Angelina. For detailed computation refer excel.

In the second situation consideration is paid in shares of the company. The face value of the shares

has been considered at 2. Accordingly, no share premium considered. Further, after recognising the

asset and liabilities at fair value, gain on bargain purchase has been recognised to the extent of $ 4000

in the books of Angelina. For detailed computation refer excel.

In the third situation consideration is paid in shares of the company and cash. The face value of the

shares has been considered at 1.8. Accordingly, no share premium considered. Further, after

recognising the asset and liabilities at fair value, gain on bargain purchase has been recognised to the

extent of $12000 in the books of Angelina. For detailed computation refer excel.

PEER REVIEW

In this particular assignment A have contributed much and came up with the fresh ideas and mind

which help the assignment to complete and presentable in a better format.A also has taken much

initiative during the assignment process.A supported the assignment fully with all the ideas and had

taken an initiative to complete the assignment before the deadline . A participated in the assignment

actively and shown full enthusiasm in the assignment A bought new ideas how to start the assignment

and shown his presence of mind during the assignment.Co operation of A during the assignment

process is great.

In this particular assignment B too have contributed much and also came up with great ideas and mind

which help the assignment to grow further and presentable in a better format.B too has taken much

initiative during the assignment process.B too has supported the assignment fully with all the ideas

and had taken an initiative to complete the assignment before the deadline .B also has participated in

the assignment actively and shown full enthusiasm in the assignment B too bought new ideas how to

start the assignment and shown his presence of mind during the assignment.Co operation of B during

the assignment process is great.

Both A and B contribution to the assignment is great and all worked together as a team to complete

the assignment and deserves good marks.

Appendix 1

Acquisition Analysis

Sl No Particular Amount

1 Cash 20600

2 Receivables 20000

3 Other Asset 8000

4 Inventories (Given in Question) 46000

(42000+4000)

5 Plant and Equipment (Given in Question) 115000

(107000+8000)

6 Accumulated Depreciation -22000

7 Research and Development 12000

8 Damage Claims -3000

9 Dividend payable 12600

10 Other Liabilities -25000

11 Net Asset( sum of 1 to 10) 184200

13 Consideration Paid (Given in Question) 151000

14 Consideration Paid (Given in Question) 15400

15 Total Value (=13+14) 166400

16 Gain from bargain purchase (=11-15) 17800

Net Consideration

Sl. No Particular Amount

1 Consideration Paid (Cum Dividend) 151000

2 Dividend 11340

3 Net Consideration (=1-2) 139660

Consolidated Financial Statement 01-07-2017

and shown his presence of mind during the assignment.Co operation of A during the assignment

process is great.

In this particular assignment B too have contributed much and also came up with great ideas and mind

which help the assignment to grow further and presentable in a better format.B too has taken much

initiative during the assignment process.B too has supported the assignment fully with all the ideas

and had taken an initiative to complete the assignment before the deadline .B also has participated in

the assignment actively and shown full enthusiasm in the assignment B too bought new ideas how to

start the assignment and shown his presence of mind during the assignment.Co operation of B during

the assignment process is great.

Both A and B contribution to the assignment is great and all worked together as a team to complete

the assignment and deserves good marks.

Appendix 1

Acquisition Analysis

Sl No Particular Amount

1 Cash 20600

2 Receivables 20000

3 Other Asset 8000

4 Inventories (Given in Question) 46000

(42000+4000)

5 Plant and Equipment (Given in Question) 115000

(107000+8000)

6 Accumulated Depreciation -22000

7 Research and Development 12000

8 Damage Claims -3000

9 Dividend payable 12600

10 Other Liabilities -25000

11 Net Asset( sum of 1 to 10) 184200

13 Consideration Paid (Given in Question) 151000

14 Consideration Paid (Given in Question) 15400

15 Total Value (=13+14) 166400

16 Gain from bargain purchase (=11-15) 17800

Net Consideration

Sl. No Particular Amount

1 Consideration Paid (Cum Dividend) 151000

2 Dividend 11340

3 Net Consideration (=1-2) 139660

Consolidated Financial Statement 01-07-2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

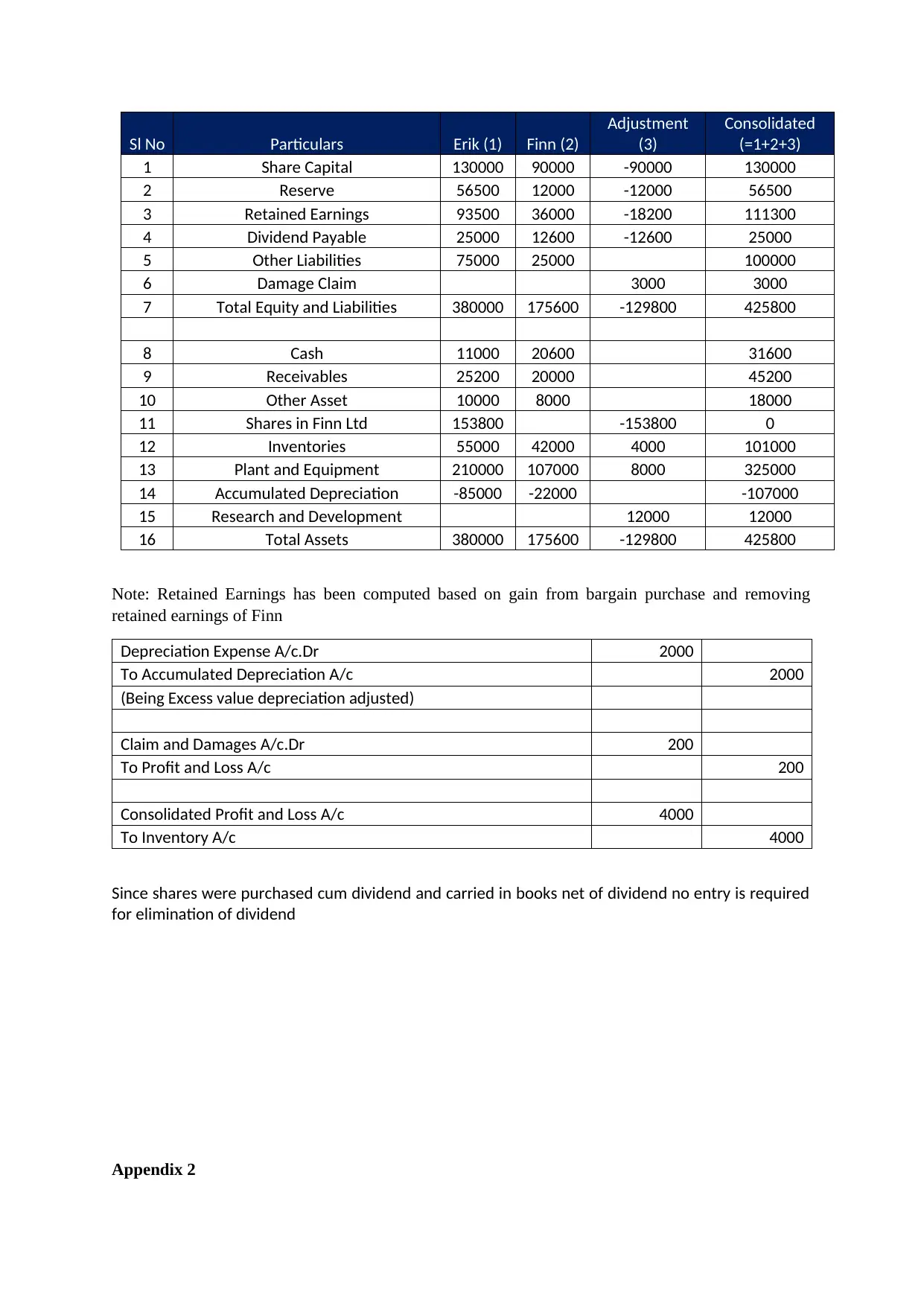

Sl No Particulars Erik (1) Finn (2)

Adjustment

(3)

Consolidated

(=1+2+3)

1 Share Capital 130000 90000 -90000 130000

2 Reserve 56500 12000 -12000 56500

3 Retained Earnings 93500 36000 -18200 111300

4 Dividend Payable 25000 12600 -12600 25000

5 Other Liabilities 75000 25000 100000

6 Damage Claim 3000 3000

7 Total Equity and Liabilities 380000 175600 -129800 425800

8 Cash 11000 20600 31600

9 Receivables 25200 20000 45200

10 Other Asset 10000 8000 18000

11 Shares in Finn Ltd 153800 -153800 0

12 Inventories 55000 42000 4000 101000

13 Plant and Equipment 210000 107000 8000 325000

14 Accumulated Depreciation -85000 -22000 -107000

15 Research and Development 12000 12000

16 Total Assets 380000 175600 -129800 425800

Note: Retained Earnings has been computed based on gain from bargain purchase and removing

retained earnings of Finn

Depreciation Expense A/c.Dr 2000

To Accumulated Depreciation A/c 2000

(Being Excess value depreciation adjusted)

Claim and Damages A/c.Dr 200

To Profit and Loss A/c 200

Consolidated Profit and Loss A/c 4000

To Inventory A/c 4000

Since shares were purchased cum dividend and carried in books net of dividend no entry is required

for elimination of dividend

Appendix 2

Adjustment

(3)

Consolidated

(=1+2+3)

1 Share Capital 130000 90000 -90000 130000

2 Reserve 56500 12000 -12000 56500

3 Retained Earnings 93500 36000 -18200 111300

4 Dividend Payable 25000 12600 -12600 25000

5 Other Liabilities 75000 25000 100000

6 Damage Claim 3000 3000

7 Total Equity and Liabilities 380000 175600 -129800 425800

8 Cash 11000 20600 31600

9 Receivables 25200 20000 45200

10 Other Asset 10000 8000 18000

11 Shares in Finn Ltd 153800 -153800 0

12 Inventories 55000 42000 4000 101000

13 Plant and Equipment 210000 107000 8000 325000

14 Accumulated Depreciation -85000 -22000 -107000

15 Research and Development 12000 12000

16 Total Assets 380000 175600 -129800 425800

Note: Retained Earnings has been computed based on gain from bargain purchase and removing

retained earnings of Finn

Depreciation Expense A/c.Dr 2000

To Accumulated Depreciation A/c 2000

(Being Excess value depreciation adjusted)

Claim and Damages A/c.Dr 200

To Profit and Loss A/c 200

Consolidated Profit and Loss A/c 4000

To Inventory A/c 4000

Since shares were purchased cum dividend and carried in books net of dividend no entry is required

for elimination of dividend

Appendix 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Situation 1

Acquisition Analysis

Sl No Particulars Amount Amount

1 Machinery 67000

2 Fixtures and Fittings 68000

3 Vehicles 35000

4 Current Asset 12000

5 Total Asset 182000

6 Current Liabilities -18000

7 Total Liabilities -18000

8 Net Asset (Sum of 1 to 7) 164000

9 Consideration paid (Given in Question) 192000

(80000*2.4)

10 Goodwill (=9-8) 28000

Journal Entries

Sl no Particulars Debit Credit

1 Net Assets A/c. Dr 164000

Goodwill A/c…Dr 28000

To Share Capital A/c 192000

(Assuming Face Value to be 2.4)

2 Expense A/c. Dr 1600

To Cash A/c 1600

(Being expense paid in cash)

Situation 2

Acquisition Analysis

Sl No Particulars Amount Amount

1 Machinery 67000

2 Fixtures and Fittings 68000

3 Vehicles 35000

4 Current Asset 12000

5 Total Asset 182000

6 Current Liabilities -18000

7 Total Liabilities -18000

8 Net Asset(Sum of 1 to 7) 164000

9 Consideration paid 160000

(80000*2)

10 Gain from Bargain Purchase (=8-9) 4000

Journal Entries

Sl no Particulars Debit Credit

Acquisition Analysis

Sl No Particulars Amount Amount

1 Machinery 67000

2 Fixtures and Fittings 68000

3 Vehicles 35000

4 Current Asset 12000

5 Total Asset 182000

6 Current Liabilities -18000

7 Total Liabilities -18000

8 Net Asset (Sum of 1 to 7) 164000

9 Consideration paid (Given in Question) 192000

(80000*2.4)

10 Goodwill (=9-8) 28000

Journal Entries

Sl no Particulars Debit Credit

1 Net Assets A/c. Dr 164000

Goodwill A/c…Dr 28000

To Share Capital A/c 192000

(Assuming Face Value to be 2.4)

2 Expense A/c. Dr 1600

To Cash A/c 1600

(Being expense paid in cash)

Situation 2

Acquisition Analysis

Sl No Particulars Amount Amount

1 Machinery 67000

2 Fixtures and Fittings 68000

3 Vehicles 35000

4 Current Asset 12000

5 Total Asset 182000

6 Current Liabilities -18000

7 Total Liabilities -18000

8 Net Asset(Sum of 1 to 7) 164000

9 Consideration paid 160000

(80000*2)

10 Gain from Bargain Purchase (=8-9) 4000

Journal Entries

Sl no Particulars Debit Credit

1 Net Assets A/c. Dr 164000

To Gain from bargain purchase A/c 4000

To Share Capital A/c 160000

(Assuming Face Value to be 2)

2 Expense A/c. Dr 1600

To Cash A/c 1600

(Being expense paid in cash)

Situation 3

Acquisition Analysis

Sl No Particulars

Amoun

t

Amoun

t

1 Machinery 67000

2 Fixtures and Fittings 68000

3 Vehicles 35000

4 Current Asset 12000

5 Total Asset 182000

6 Current Liabilities -18000

7 Total Liabilities -18000

8 Net Asset (Sum of 1 to 7) 164000

9 Consideration paid in shares 72000

(40000*1.8)

10 Consideration paid in cash 80000

(80000*1)

11 Total Consideration paid (=9+10) 152000

12 Gain from Bargain Purchase (=8-11) 12000

Journal Entries

Sl. no Particulars Debit Credit

1 Net Assets A/c. Dr 164000

To Bank A/c 80000

To Gain from bargain purchase A/c 4000

To Share Capital A/c 160000

(Assuming Face Value to be 2)

2 Expense A/c. Dr 1600

To Cash A/c 1600

(Being expense paid in cash)

Situation 3

Acquisition Analysis

Sl No Particulars

Amoun

t

Amoun

t

1 Machinery 67000

2 Fixtures and Fittings 68000

3 Vehicles 35000

4 Current Asset 12000

5 Total Asset 182000

6 Current Liabilities -18000

7 Total Liabilities -18000

8 Net Asset (Sum of 1 to 7) 164000

9 Consideration paid in shares 72000

(40000*1.8)

10 Consideration paid in cash 80000

(80000*1)

11 Total Consideration paid (=9+10) 152000

12 Gain from Bargain Purchase (=8-11) 12000

Journal Entries

Sl. no Particulars Debit Credit

1 Net Assets A/c. Dr 164000

To Bank A/c 80000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To Share Capital A/c 72000

To Gain from Bargain Purchase A/c 12000

(Assuming Face Value to be 1.8)

2 Expense A/c. Dr 1600

To Cash A/c 1600

(Being expense paid in cash)

To Gain from Bargain Purchase A/c 12000

(Assuming Face Value to be 1.8)

2 Expense A/c. Dr 1600

To Cash A/c 1600

(Being expense paid in cash)

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.