Business Finance Assignment - Financial Analysis Report

VerifiedAdded on 2019/10/30

|15

|2233

|166

Homework Assignment

AI Summary

This business finance assignment provides solutions to a variety of financial problems, including calculations related to loan amortization, zero-coupon bonds, and stock valuation. The assignment analyzes risk classification, capital budgeting decisions, and the evaluation of investment projects using metrics like NPV, IRR, and payback period. It also covers the interpretation of financial ratios, portfolio management, and risk assessment, along with the depiction of an investor's risk attitude. The assignment utilizes real-world examples and financial models to illustrate key concepts and principles in business finance, offering a comprehensive overview of financial analysis and decision-making.

Running head: BUSINESS FINANCE

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

1

Table of Contents

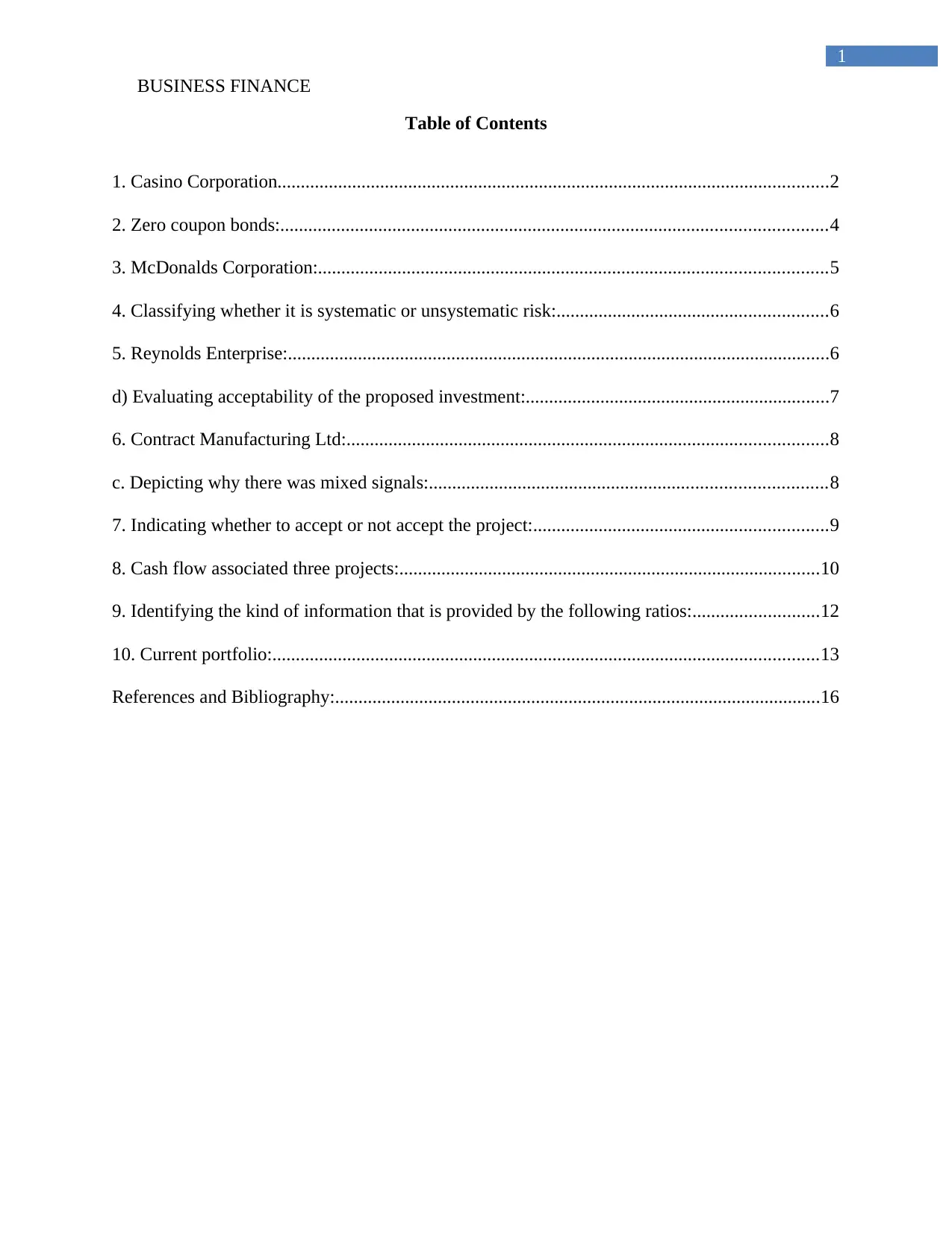

1. Casino Corporation......................................................................................................................2

2. Zero coupon bonds:.....................................................................................................................4

3. McDonalds Corporation:.............................................................................................................5

4. Classifying whether it is systematic or unsystematic risk:..........................................................6

5. Reynolds Enterprise:....................................................................................................................6

d) Evaluating acceptability of the proposed investment:.................................................................7

6. Contract Manufacturing Ltd:.......................................................................................................8

c. Depicting why there was mixed signals:.....................................................................................8

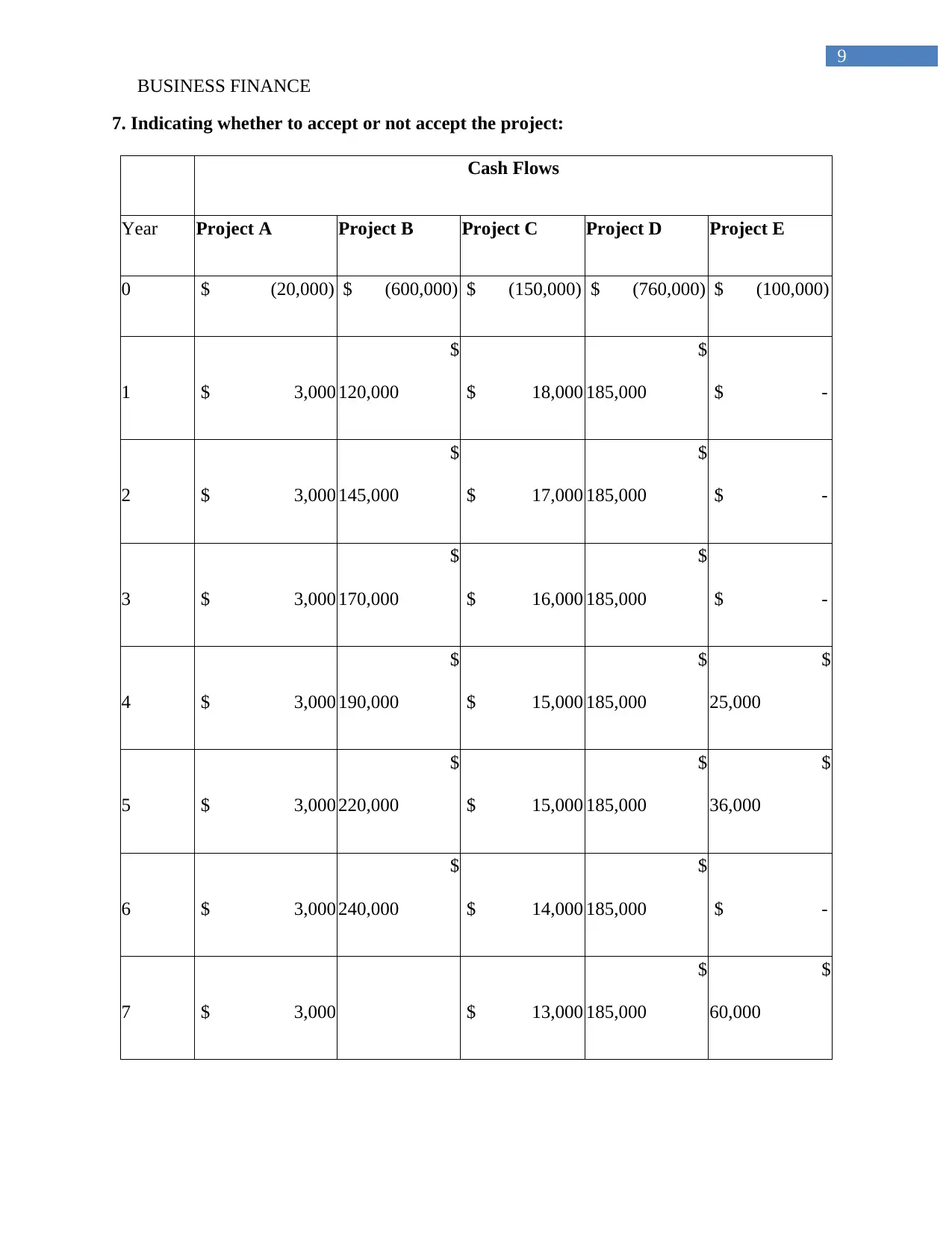

7. Indicating whether to accept or not accept the project:...............................................................9

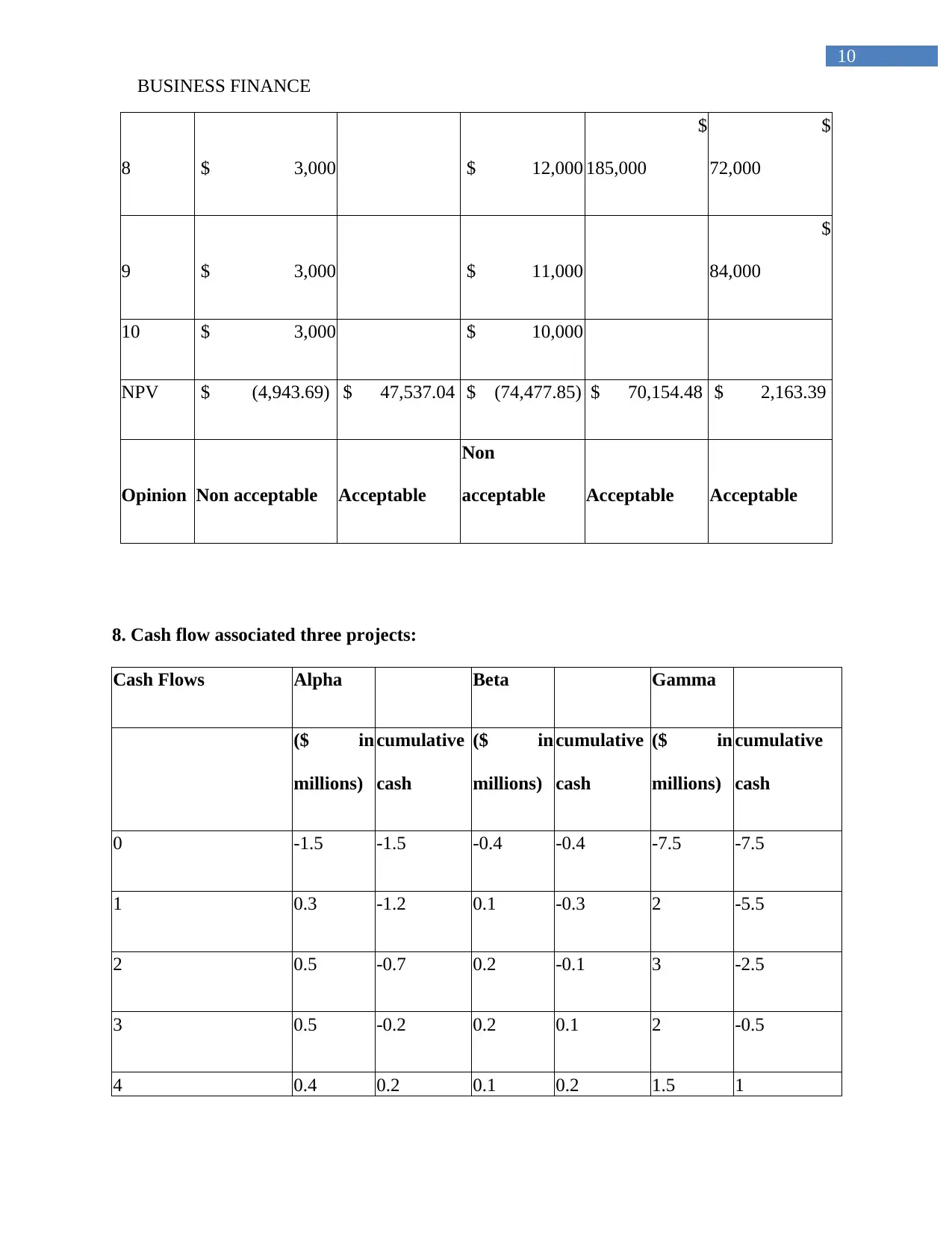

8. Cash flow associated three projects:..........................................................................................10

9. Identifying the kind of information that is provided by the following ratios:...........................12

10. Current portfolio:.....................................................................................................................13

References and Bibliography:........................................................................................................16

1

Table of Contents

1. Casino Corporation......................................................................................................................2

2. Zero coupon bonds:.....................................................................................................................4

3. McDonalds Corporation:.............................................................................................................5

4. Classifying whether it is systematic or unsystematic risk:..........................................................6

5. Reynolds Enterprise:....................................................................................................................6

d) Evaluating acceptability of the proposed investment:.................................................................7

6. Contract Manufacturing Ltd:.......................................................................................................8

c. Depicting why there was mixed signals:.....................................................................................8

7. Indicating whether to accept or not accept the project:...............................................................9

8. Cash flow associated three projects:..........................................................................................10

9. Identifying the kind of information that is provided by the following ratios:...........................12

10. Current portfolio:.....................................................................................................................13

References and Bibliography:........................................................................................................16

BUSINESS FINANCE

2

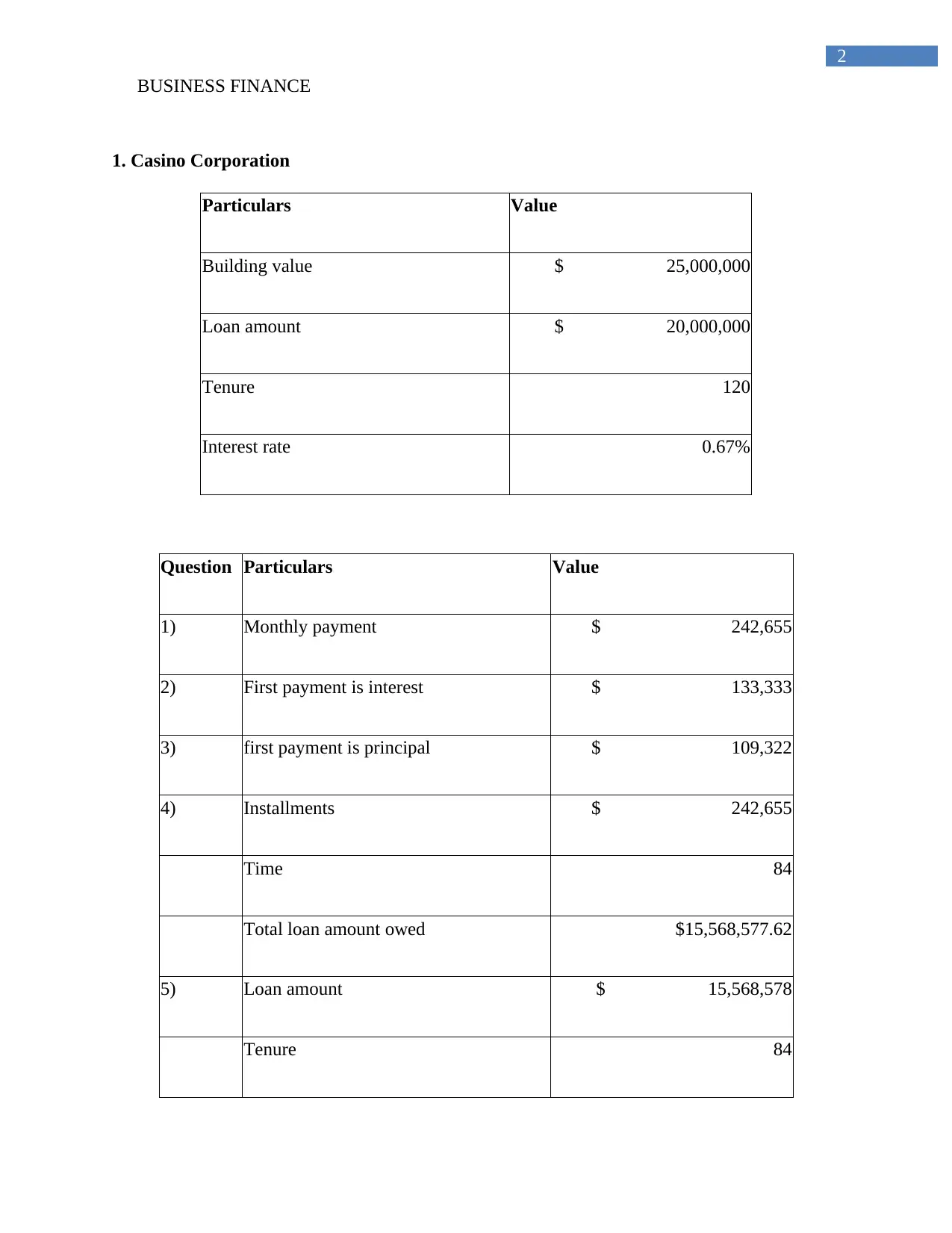

1. Casino Corporation

Particulars Value

Building value $ 25,000,000

Loan amount $ 20,000,000

Tenure 120

Interest rate 0.67%

Question Particulars Value

1) Monthly payment $ 242,655

2) First payment is interest $ 133,333

3) first payment is principal $ 109,322

4) Installments $ 242,655

Time 84

Total loan amount owed $15,568,577.62

5) Loan amount $ 15,568,578

Tenure 84

2

1. Casino Corporation

Particulars Value

Building value $ 25,000,000

Loan amount $ 20,000,000

Tenure 120

Interest rate 0.67%

Question Particulars Value

1) Monthly payment $ 242,655

2) First payment is interest $ 133,333

3) first payment is principal $ 109,322

4) Installments $ 242,655

Time 84

Total loan amount owed $15,568,577.62

5) Loan amount $ 15,568,578

Tenure 84

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

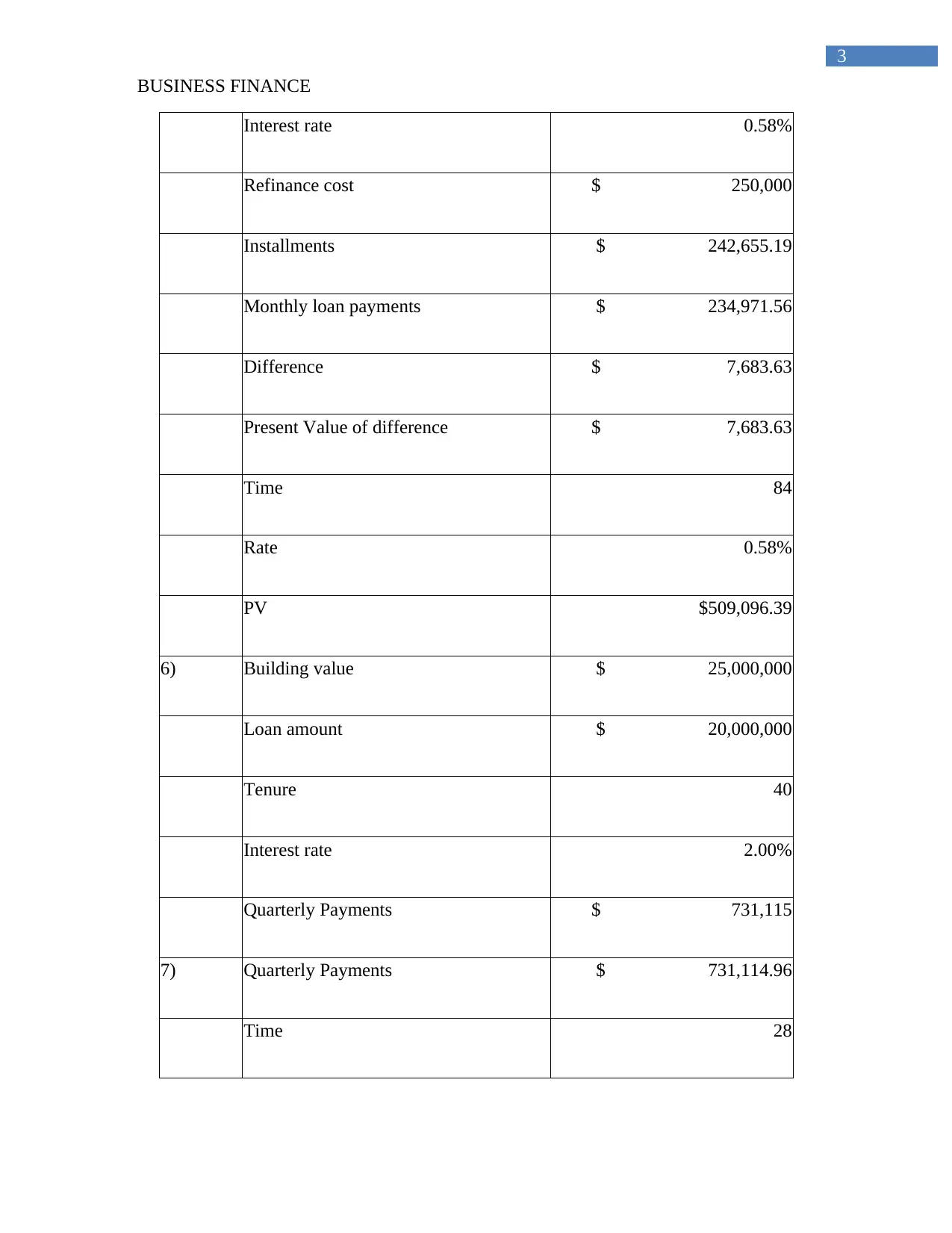

3

Interest rate 0.58%

Refinance cost $ 250,000

Installments $ 242,655.19

Monthly loan payments $ 234,971.56

Difference $ 7,683.63

Present Value of difference $ 7,683.63

Time 84

Rate 0.58%

PV $509,096.39

6) Building value $ 25,000,000

Loan amount $ 20,000,000

Tenure 40

Interest rate 2.00%

Quarterly Payments $ 731,115

7) Quarterly Payments $ 731,114.96

Time 28

3

Interest rate 0.58%

Refinance cost $ 250,000

Installments $ 242,655.19

Monthly loan payments $ 234,971.56

Difference $ 7,683.63

Present Value of difference $ 7,683.63

Time 84

Rate 0.58%

PV $509,096.39

6) Building value $ 25,000,000

Loan amount $ 20,000,000

Tenure 40

Interest rate 2.00%

Quarterly Payments $ 731,115

7) Quarterly Payments $ 731,114.96

Time 28

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

4

Total payments conducted in 3 years $15,559,056.50

8) Interest rate 8%

9) R 0.01

N 5.00

EAR 4.90

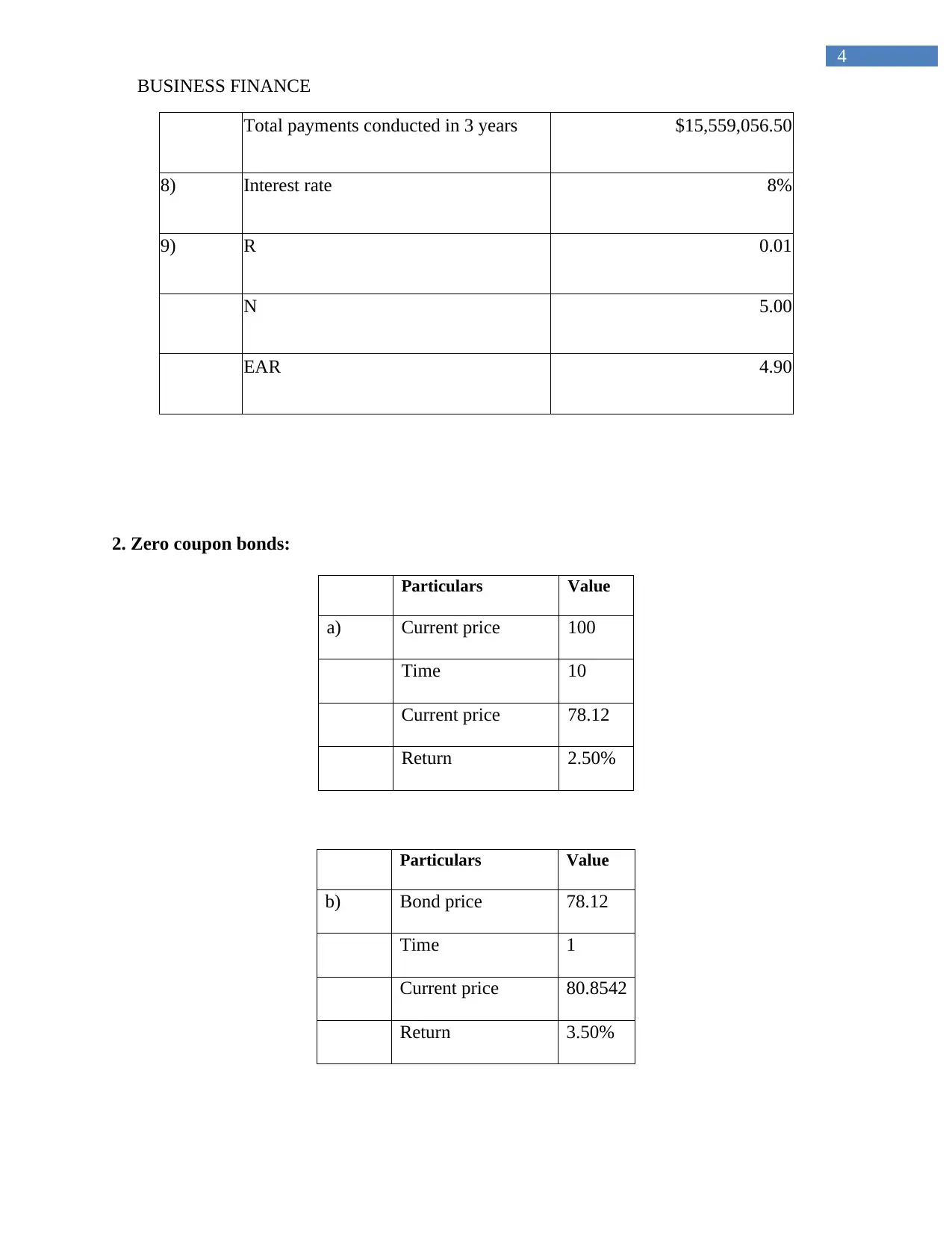

2. Zero coupon bonds:

Particulars Value

a) Current price 100

Time 10

Current price 78.12

Return 2.50%

Particulars Value

b) Bond price 78.12

Time 1

Current price 80.8542

Return 3.50%

4

Total payments conducted in 3 years $15,559,056.50

8) Interest rate 8%

9) R 0.01

N 5.00

EAR 4.90

2. Zero coupon bonds:

Particulars Value

a) Current price 100

Time 10

Current price 78.12

Return 2.50%

Particulars Value

b) Bond price 78.12

Time 1

Current price 80.8542

Return 3.50%

BUSINESS FINANCE

5

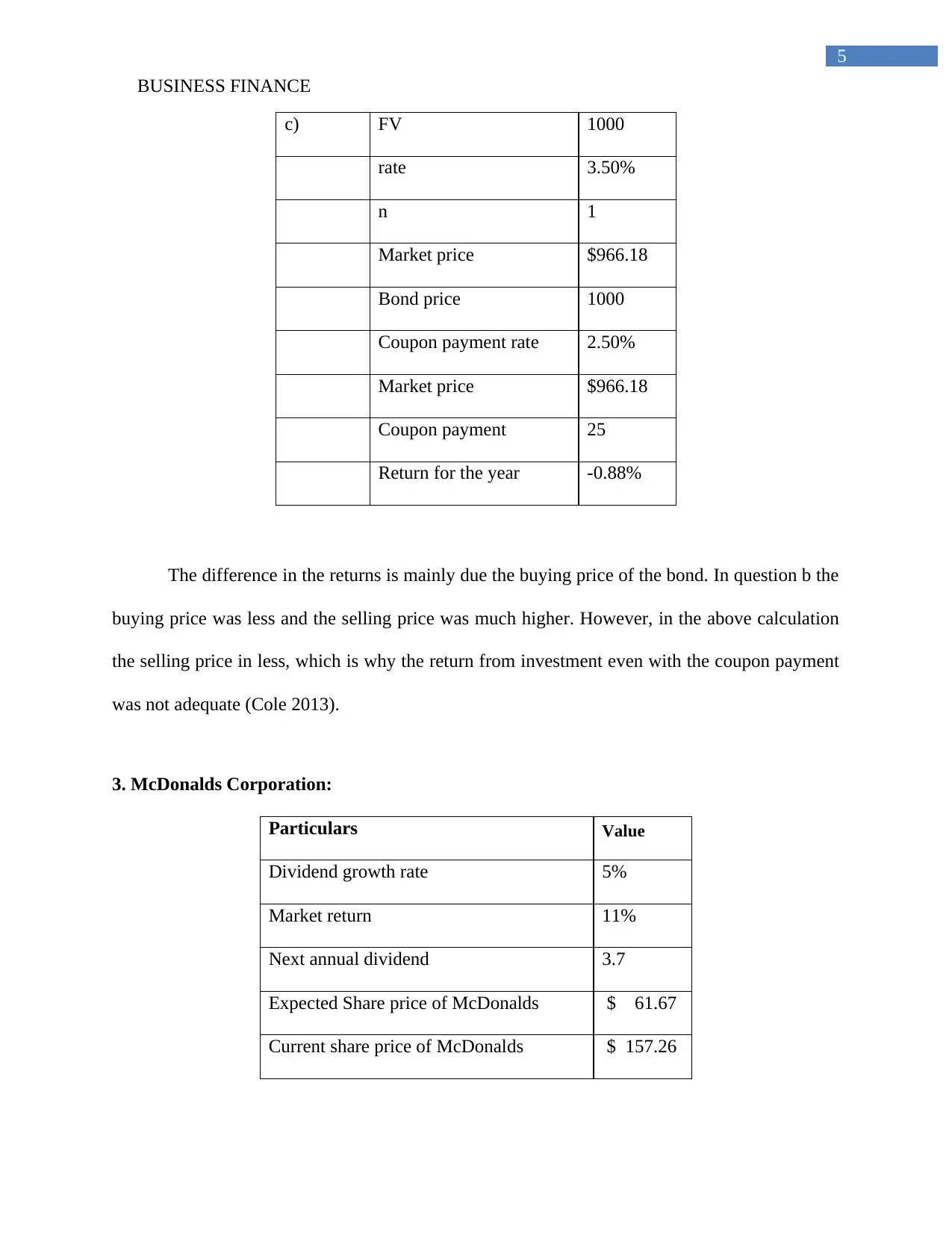

c) FV 1000

rate 3.50%

n 1

Market price $966.18

Bond price 1000

Coupon payment rate 2.50%

Market price $966.18

Coupon payment 25

Return for the year -0.88%

The difference in the returns is mainly due the buying price of the bond. In question b the

buying price was less and the selling price was much higher. However, in the above calculation

the selling price in less, which is why the return from investment even with the coupon payment

was not adequate (Cole 2013).

3. McDonalds Corporation:

Particulars Value

Dividend growth rate 5%

Market return 11%

Next annual dividend 3.7

Expected Share price of McDonalds $ 61.67

Current share price of McDonalds $ 157.26

5

c) FV 1000

rate 3.50%

n 1

Market price $966.18

Bond price 1000

Coupon payment rate 2.50%

Market price $966.18

Coupon payment 25

Return for the year -0.88%

The difference in the returns is mainly due the buying price of the bond. In question b the

buying price was less and the selling price was much higher. However, in the above calculation

the selling price in less, which is why the return from investment even with the coupon payment

was not adequate (Cole 2013).

3. McDonalds Corporation:

Particulars Value

Dividend growth rate 5%

Market return 11%

Next annual dividend 3.7

Expected Share price of McDonalds $ 61.67

Current share price of McDonalds $ 157.26

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

6

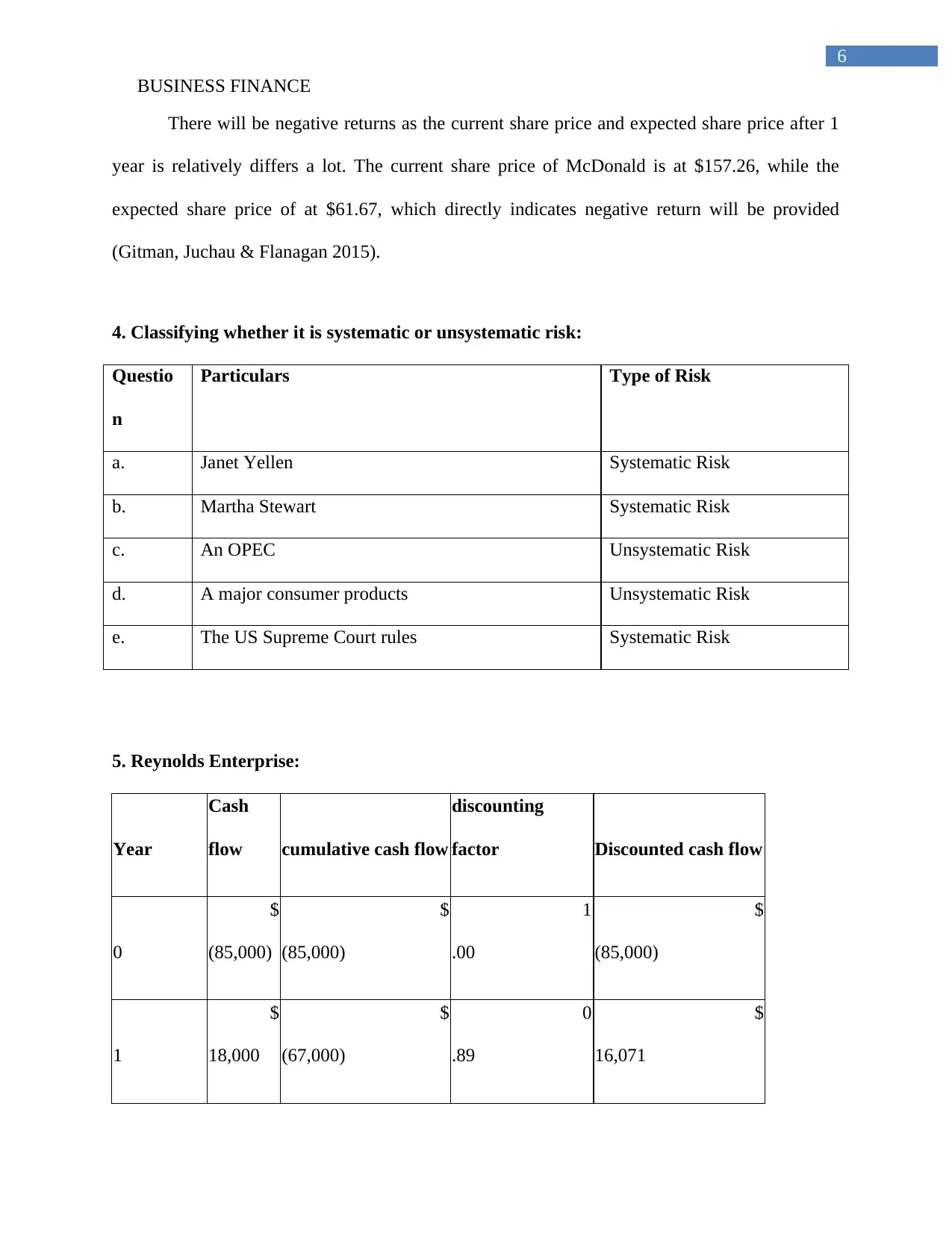

There will be negative returns as the current share price and expected share price after 1

year is relatively differs a lot. The current share price of McDonald is at $157.26, while the

expected share price of at $61.67, which directly indicates negative return will be provided

(Gitman, Juchau & Flanagan 2015).

4. Classifying whether it is systematic or unsystematic risk:

Questio

n

Particulars Type of Risk

a. Janet Yellen Systematic Risk

b. Martha Stewart Systematic Risk

c. An OPEC Unsystematic Risk

d. A major consumer products Unsystematic Risk

e. The US Supreme Court rules Systematic Risk

5. Reynolds Enterprise:

Year

Cash

flow cumulative cash flow

discounting

factor Discounted cash flow

0

$

(85,000)

$

(85,000)

1

.00

$

(85,000)

1

$

18,000

$

(67,000)

0

.89

$

16,071

6

There will be negative returns as the current share price and expected share price after 1

year is relatively differs a lot. The current share price of McDonald is at $157.26, while the

expected share price of at $61.67, which directly indicates negative return will be provided

(Gitman, Juchau & Flanagan 2015).

4. Classifying whether it is systematic or unsystematic risk:

Questio

n

Particulars Type of Risk

a. Janet Yellen Systematic Risk

b. Martha Stewart Systematic Risk

c. An OPEC Unsystematic Risk

d. A major consumer products Unsystematic Risk

e. The US Supreme Court rules Systematic Risk

5. Reynolds Enterprise:

Year

Cash

flow cumulative cash flow

discounting

factor Discounted cash flow

0

$

(85,000)

$

(85,000)

1

.00

$

(85,000)

1

$

18,000

$

(67,000)

0

.89

$

16,071

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

7

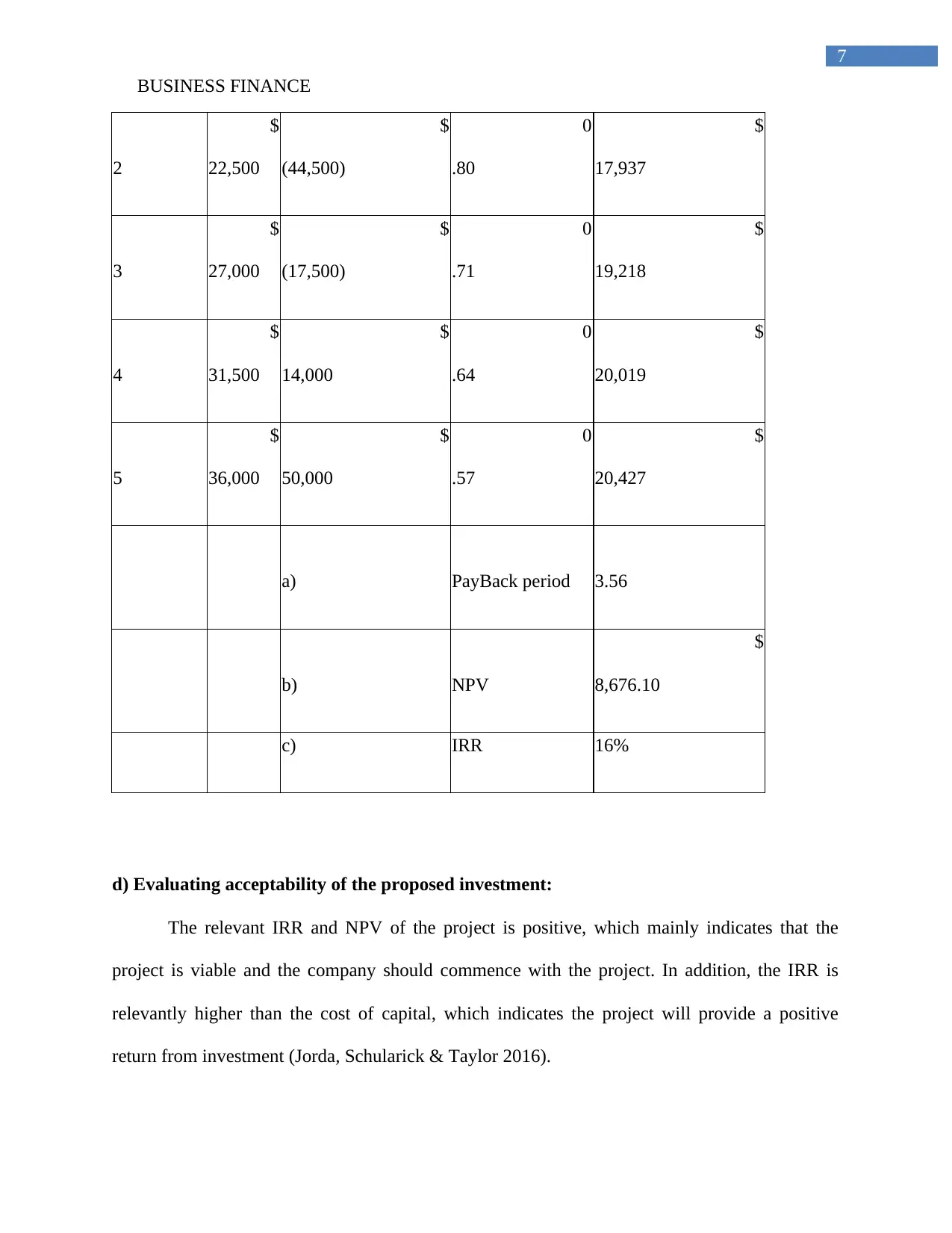

2

$

22,500

$

(44,500)

0

.80

$

17,937

3

$

27,000

$

(17,500)

0

.71

$

19,218

4

$

31,500

$

14,000

0

.64

$

20,019

5

$

36,000

$

50,000

0

.57

$

20,427

a) PayBack period 3.56

b) NPV

$

8,676.10

c) IRR 16%

d) Evaluating acceptability of the proposed investment:

The relevant IRR and NPV of the project is positive, which mainly indicates that the

project is viable and the company should commence with the project. In addition, the IRR is

relevantly higher than the cost of capital, which indicates the project will provide a positive

return from investment (Jorda, Schularick & Taylor 2016).

7

2

$

22,500

$

(44,500)

0

.80

$

17,937

3

$

27,000

$

(17,500)

0

.71

$

19,218

4

$

31,500

$

14,000

0

.64

$

20,019

5

$

36,000

$

50,000

0

.57

$

20,427

a) PayBack period 3.56

b) NPV

$

8,676.10

c) IRR 16%

d) Evaluating acceptability of the proposed investment:

The relevant IRR and NPV of the project is positive, which mainly indicates that the

project is viable and the company should commence with the project. In addition, the IRR is

relevantly higher than the cost of capital, which indicates the project will provide a positive

return from investment (Jorda, Schularick & Taylor 2016).

BUSINESS FINANCE

8

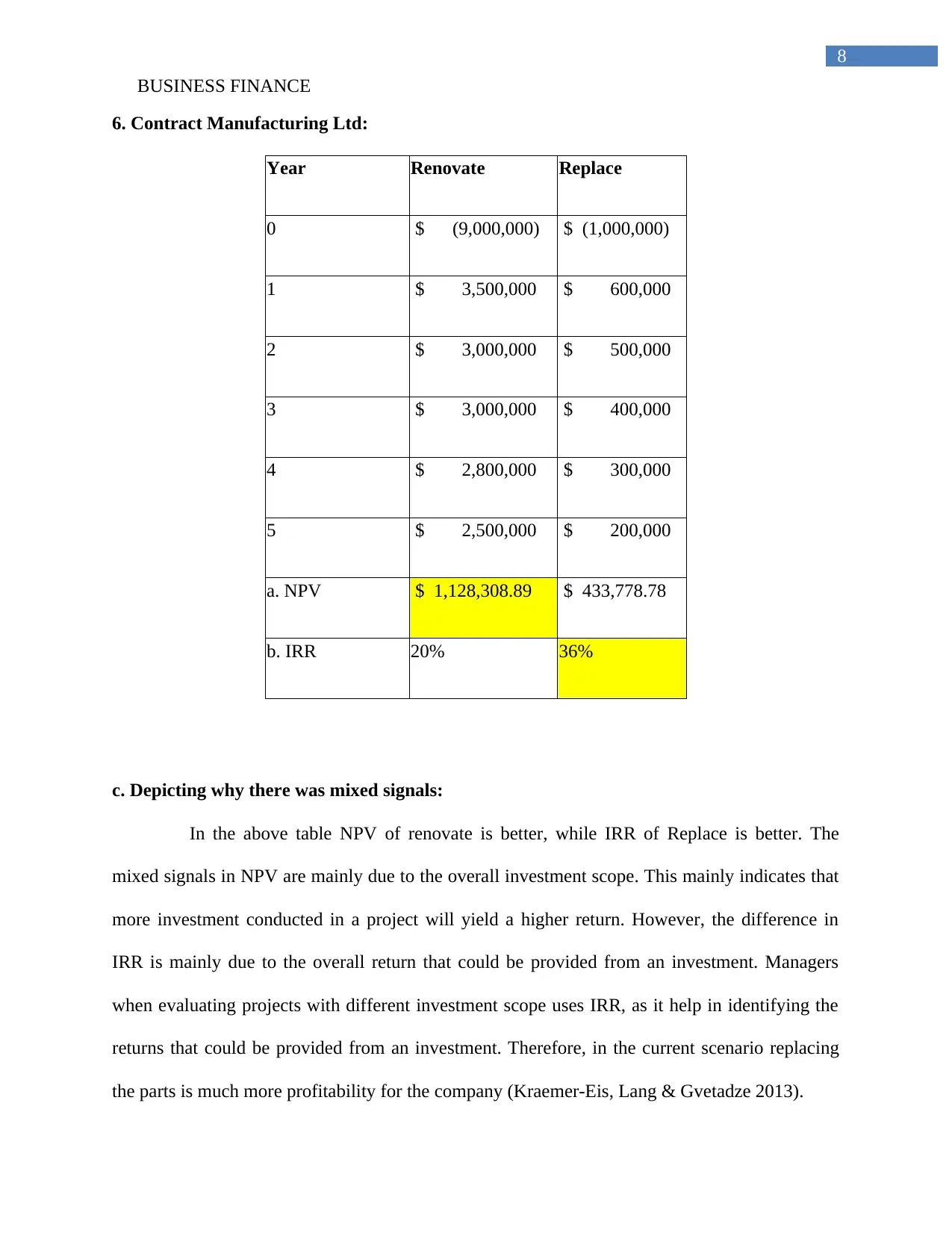

6. Contract Manufacturing Ltd:

Year Renovate Replace

0 $ (9,000,000) $ (1,000,000)

1 $ 3,500,000 $ 600,000

2 $ 3,000,000 $ 500,000

3 $ 3,000,000 $ 400,000

4 $ 2,800,000 $ 300,000

5 $ 2,500,000 $ 200,000

a. NPV $ 1,128,308.89 $ 433,778.78

b. IRR 20% 36%

c. Depicting why there was mixed signals:

In the above table NPV of renovate is better, while IRR of Replace is better. The

mixed signals in NPV are mainly due to the overall investment scope. This mainly indicates that

more investment conducted in a project will yield a higher return. However, the difference in

IRR is mainly due to the overall return that could be provided from an investment. Managers

when evaluating projects with different investment scope uses IRR, as it help in identifying the

returns that could be provided from an investment. Therefore, in the current scenario replacing

the parts is much more profitability for the company (Kraemer-Eis, Lang & Gvetadze 2013).

8

6. Contract Manufacturing Ltd:

Year Renovate Replace

0 $ (9,000,000) $ (1,000,000)

1 $ 3,500,000 $ 600,000

2 $ 3,000,000 $ 500,000

3 $ 3,000,000 $ 400,000

4 $ 2,800,000 $ 300,000

5 $ 2,500,000 $ 200,000

a. NPV $ 1,128,308.89 $ 433,778.78

b. IRR 20% 36%

c. Depicting why there was mixed signals:

In the above table NPV of renovate is better, while IRR of Replace is better. The

mixed signals in NPV are mainly due to the overall investment scope. This mainly indicates that

more investment conducted in a project will yield a higher return. However, the difference in

IRR is mainly due to the overall return that could be provided from an investment. Managers

when evaluating projects with different investment scope uses IRR, as it help in identifying the

returns that could be provided from an investment. Therefore, in the current scenario replacing

the parts is much more profitability for the company (Kraemer-Eis, Lang & Gvetadze 2013).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

9

7. Indicating whether to accept or not accept the project:

Cash Flows

Year Project A Project B Project C Project D Project E

0 $ (20,000) $ (600,000) $ (150,000) $ (760,000) $ (100,000)

1 $ 3,000

$

120,000 $ 18,000

$

185,000 $ -

2 $ 3,000

$

145,000 $ 17,000

$

185,000 $ -

3 $ 3,000

$

170,000 $ 16,000

$

185,000 $ -

4 $ 3,000

$

190,000 $ 15,000

$

185,000

$

25,000

5 $ 3,000

$

220,000 $ 15,000

$

185,000

$

36,000

6 $ 3,000

$

240,000 $ 14,000

$

185,000 $ -

7 $ 3,000 $ 13,000

$

185,000

$

60,000

9

7. Indicating whether to accept or not accept the project:

Cash Flows

Year Project A Project B Project C Project D Project E

0 $ (20,000) $ (600,000) $ (150,000) $ (760,000) $ (100,000)

1 $ 3,000

$

120,000 $ 18,000

$

185,000 $ -

2 $ 3,000

$

145,000 $ 17,000

$

185,000 $ -

3 $ 3,000

$

170,000 $ 16,000

$

185,000 $ -

4 $ 3,000

$

190,000 $ 15,000

$

185,000

$

25,000

5 $ 3,000

$

220,000 $ 15,000

$

185,000

$

36,000

6 $ 3,000

$

240,000 $ 14,000

$

185,000 $ -

7 $ 3,000 $ 13,000

$

185,000

$

60,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

10

8 $ 3,000 $ 12,000

$

185,000

$

72,000

9 $ 3,000 $ 11,000

$

84,000

10 $ 3,000 $ 10,000

NPV $ (4,943.69) $ 47,537.04 $ (74,477.85) $ 70,154.48 $ 2,163.39

Opinion Non acceptable Acceptable

Non

acceptable Acceptable Acceptable

8. Cash flow associated three projects:

Cash Flows Alpha Beta Gamma

($ in

millions)

cumulative

cash

($ in

millions)

cumulative

cash

($ in

millions)

cumulative

cash

0 -1.5 -1.5 -0.4 -0.4 -7.5 -7.5

1 0.3 -1.2 0.1 -0.3 2 -5.5

2 0.5 -0.7 0.2 -0.1 3 -2.5

3 0.5 -0.2 0.2 0.1 2 -0.5

4 0.4 0.2 0.1 0.2 1.5 1

10

8 $ 3,000 $ 12,000

$

185,000

$

72,000

9 $ 3,000 $ 11,000

$

84,000

10 $ 3,000 $ 10,000

NPV $ (4,943.69) $ 47,537.04 $ (74,477.85) $ 70,154.48 $ 2,163.39

Opinion Non acceptable Acceptable

Non

acceptable Acceptable Acceptable

8. Cash flow associated three projects:

Cash Flows Alpha Beta Gamma

($ in

millions)

cumulative

cash

($ in

millions)

cumulative

cash

($ in

millions)

cumulative

cash

0 -1.5 -1.5 -0.4 -0.4 -7.5 -7.5

1 0.3 -1.2 0.1 -0.3 2 -5.5

2 0.5 -0.7 0.2 -0.1 3 -2.5

3 0.5 -0.2 0.2 0.1 2 -0.5

4 0.4 0.2 0.1 0.2 1.5 1

BUSINESS FINANCE

11

5 0.3 0.5 -0.2 0 5.5 6.5

a. Payback period 3.5 2.5 3.33

b.1 if the cutoff period

is 3 years Unaccepted Accepted Unaccepted

b.2 if the cutoff period

is 4 years Accepted Accepted Accepted

c. investment in

shortest period Unaccepted Accepted Unaccepted

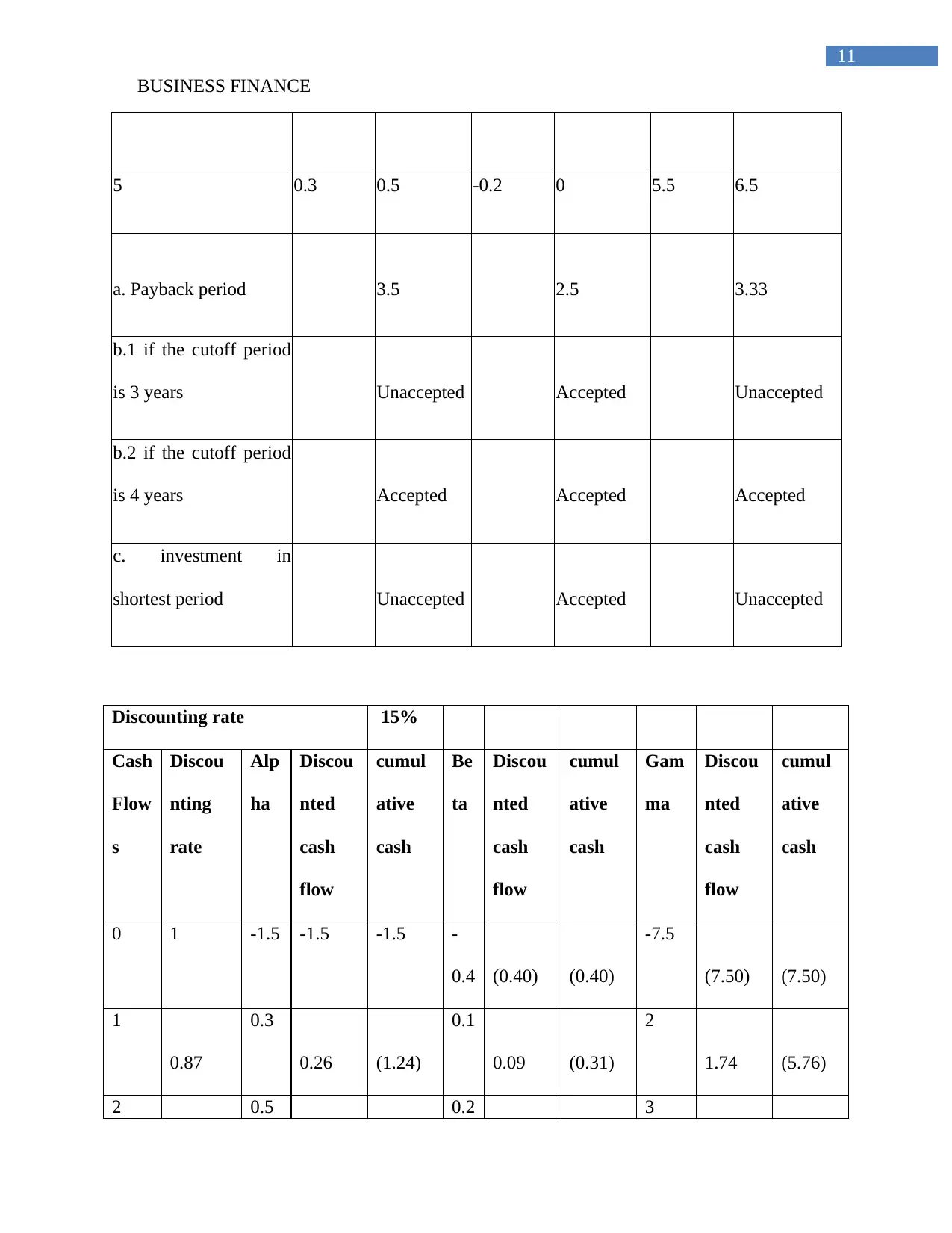

Discounting rate 15%

Cash

Flow

s

Discou

nting

rate

Alp

ha

Discou

nted

cash

flow

cumul

ative

cash

Be

ta

Discou

nted

cash

flow

cumul

ative

cash

Gam

ma

Discou

nted

cash

flow

cumul

ative

cash

0 1 -1.5 -1.5 -1.5 -

0.4 (0.40) (0.40)

-7.5

(7.50) (7.50)

1

0.87

0.3

0.26 (1.24)

0.1

0.09 (0.31)

2

1.74 (5.76)

2 0.5 0.2 3

11

5 0.3 0.5 -0.2 0 5.5 6.5

a. Payback period 3.5 2.5 3.33

b.1 if the cutoff period

is 3 years Unaccepted Accepted Unaccepted

b.2 if the cutoff period

is 4 years Accepted Accepted Accepted

c. investment in

shortest period Unaccepted Accepted Unaccepted

Discounting rate 15%

Cash

Flow

s

Discou

nting

rate

Alp

ha

Discou

nted

cash

flow

cumul

ative

cash

Be

ta

Discou

nted

cash

flow

cumul

ative

cash

Gam

ma

Discou

nted

cash

flow

cumul

ative

cash

0 1 -1.5 -1.5 -1.5 -

0.4 (0.40) (0.40)

-7.5

(7.50) (7.50)

1

0.87

0.3

0.26 (1.24)

0.1

0.09 (0.31)

2

1.74 (5.76)

2 0.5 0.2 3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Financial Problems Analysis: Finance Assignment for [University Name]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fsr%2F60e406c63e90418b8e9357fd9a9a4d51.jpg&w=256&q=75)