Finance Project: Cost Analysis and Cash Flow for Dysonica Plc

VerifiedAdded on 2023/06/10

|15

|4942

|397

Project

AI Summary

This project delves into the financial aspects of Dysonica Plc, encompassing cost analysis, cash flow forecasting, and performance evaluation. The project begins by defining the purpose of cost and identifying various cost types, including variable, fixed, and semi-variable expenses, as well as unit and absorption costing. It then explores marginal and activity-based costing methods. The second task provides recommendations for expense reduction strategies, suggesting the adoption of activity-based costing to allocate costs effectively and identify areas for improvement. The third task involves arranging a 12-month cash flow forecast for Dysonica Plc, projecting income and expenses. Finally, the project assesses and analyzes Dysonica Plc's performance based on financial data, offering a comprehensive overview of the company's financial health and operational efficiency. The project uses the provided raw numbers in the gauges and financial plans to assess and break down the exhibition of Dysonica Plc.

Time constrained

project Business

Finance

project Business

Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION......................................................................................................................3

MAIN BODY.............................................................................................................................3

Define the purpose of cost and identify them........................................................................3

TASK 2......................................................................................................................................6

Give the suggestions to the business for the expense decrease system..................................6

TASK 3......................................................................................................................................8

Arrangement a 12 - month Cash flow forecast for the business up to 30 April 2023............8

TASK 4....................................................................................................................................11

Based on the raw numbers in the gauges and financial plans, assess and break down the

exhibition of Dysonica Plc...................................................................................................11

CONCLUSION........................................................................................................................13

REFERENCES.........................................................................................................................14

INTRODUCTION......................................................................................................................3

MAIN BODY.............................................................................................................................3

Define the purpose of cost and identify them........................................................................3

TASK 2......................................................................................................................................6

Give the suggestions to the business for the expense decrease system..................................6

TASK 3......................................................................................................................................8

Arrangement a 12 - month Cash flow forecast for the business up to 30 April 2023............8

TASK 4....................................................................................................................................11

Based on the raw numbers in the gauges and financial plans, assess and break down the

exhibition of Dysonica Plc...................................................................................................11

CONCLUSION........................................................................................................................13

REFERENCES.........................................................................................................................14

INTRODUCTION

Business finance alludes to the sum that is raised, organized and oversaw by the

business associations with the end goal of meet the association's prerequisites. It can likewise

be characterized as the assets profited by the organizations to begin a business. These assets

incorporate the capital assets and credit subsidizes that are put resources into a business. The

firm purposes this cash to gain resources, buy raw materials, to create the products for the

operational activities. At the point when the organization start its business, then the capital

presented by it is not sufficient to address every single issue of an undertaking. Accordingly,

to satisfy these necessities business associations, care for such countless components to

produce this income. The assessment of the monetary requirements and conceivable

outcomes can be cross - checked in a standard way so the great monetary administration plan

can be made for the smooth working of a venture (Gundogdu, 2019). This report investigates

the contextual analysis of Dysonica Plc. It includes four exercises, where the absolute first

undertaking contains the expense portions of a business and how it separates them. The

subsequent undertaking features the ideas for the administration that will assist the chiefs

with decreasing its expense and costs. The third errand incorporates the projections of income

of Dysonica Plc till April 30, 2023. What is more, the last undertaking discusses the

examination on the accomplishments and achievements of the organization and how it is

acting in that specific industry. This judgment will happen by taking in view the gauge values

in the income of Dysonica Plc.

MAIN BODY

Define the purpose of cost and identify them.

Cost is the term which is utilized in assembling and providing of services and

products. In the production and manufacturing cycle, cost is vital at each level from obtaining

unrefined substance to completed products of an association. Essentially cost is how much

cash that assists with covering the costs connected with creation. There are a few kinds of

costs which impact the organization yet for the most part two sorts of costs that make

hardships underway of products are variable expense and fixed cost (Kgoroeadira, Burke, and

van Stel, 2019).

Variable expense: It alludes to the expense which is straightforwardly subject to organization

sells and creation or the expense that action the amount of products are selling and

assembling in an undertaking is known as variable cost. Assuming the inventory and creation

Business finance alludes to the sum that is raised, organized and oversaw by the

business associations with the end goal of meet the association's prerequisites. It can likewise

be characterized as the assets profited by the organizations to begin a business. These assets

incorporate the capital assets and credit subsidizes that are put resources into a business. The

firm purposes this cash to gain resources, buy raw materials, to create the products for the

operational activities. At the point when the organization start its business, then the capital

presented by it is not sufficient to address every single issue of an undertaking. Accordingly,

to satisfy these necessities business associations, care for such countless components to

produce this income. The assessment of the monetary requirements and conceivable

outcomes can be cross - checked in a standard way so the great monetary administration plan

can be made for the smooth working of a venture (Gundogdu, 2019). This report investigates

the contextual analysis of Dysonica Plc. It includes four exercises, where the absolute first

undertaking contains the expense portions of a business and how it separates them. The

subsequent undertaking features the ideas for the administration that will assist the chiefs

with decreasing its expense and costs. The third errand incorporates the projections of income

of Dysonica Plc till April 30, 2023. What is more, the last undertaking discusses the

examination on the accomplishments and achievements of the organization and how it is

acting in that specific industry. This judgment will happen by taking in view the gauge values

in the income of Dysonica Plc.

MAIN BODY

Define the purpose of cost and identify them.

Cost is the term which is utilized in assembling and providing of services and

products. In the production and manufacturing cycle, cost is vital at each level from obtaining

unrefined substance to completed products of an association. Essentially cost is how much

cash that assists with covering the costs connected with creation. There are a few kinds of

costs which impact the organization yet for the most part two sorts of costs that make

hardships underway of products are variable expense and fixed cost (Kgoroeadira, Burke, and

van Stel, 2019).

Variable expense: It alludes to the expense which is straightforwardly subject to organization

sells and creation or the expense that action the amount of products are selling and

assembling in an undertaking is known as variable cost. Assuming the inventory and creation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of products of an association increments or reduction then the variable expense is likewise

increments or diminishes individually which implies the two of them are corresponding to

one another. It is a measure of conveyance, natural substance, Visa and may more.

Fixed Cost: It is an expense which is generally same in any event, when change in selling and

creation of services and products. It is a independent expense which amount do not impact

from any of the increment and lessening in the expense of item and administrations. It

incorporates payment of salary, rent, electricity bill, insurance and many others (Zhengxin,

and Qian, 2019).

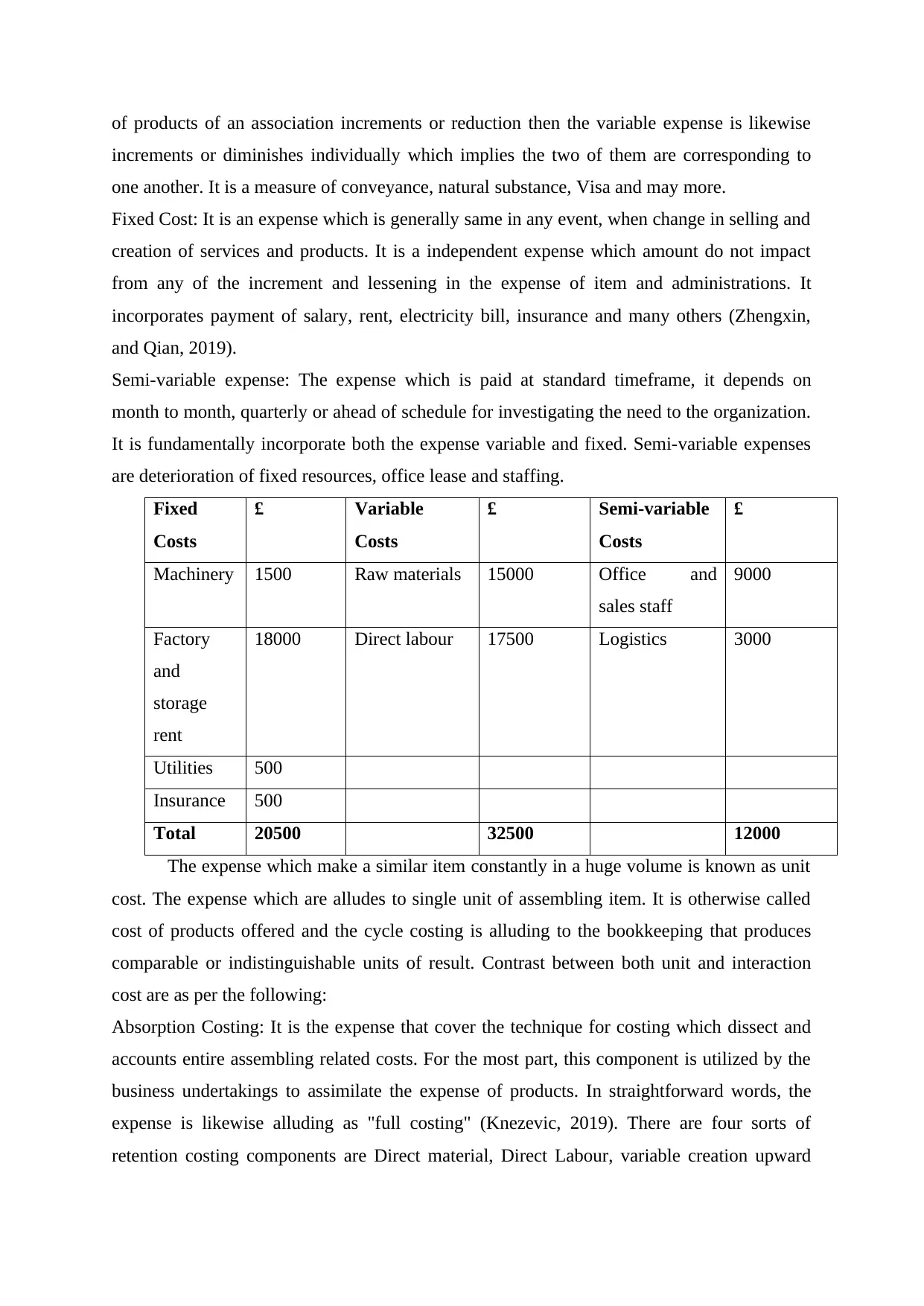

Semi-variable expense: The expense which is paid at standard timeframe, it depends on

month to month, quarterly or ahead of schedule for investigating the need to the organization.

It is fundamentally incorporate both the expense variable and fixed. Semi-variable expenses

are deterioration of fixed resources, office lease and staffing.

Fixed

Costs

£ Variable

Costs

£ Semi-variable

Costs

£

Machinery 1500 Raw materials 15000 Office and

sales staff

9000

Factory

and

storage

rent

18000 Direct labour 17500 Logistics 3000

Utilities 500

Insurance 500

Total 20500 32500 12000

The expense which make a similar item constantly in a huge volume is known as unit

cost. The expense which are alludes to single unit of assembling item. It is otherwise called

cost of products offered and the cycle costing is alluding to the bookkeeping that produces

comparable or indistinguishable units of result. Contrast between both unit and interaction

cost are as per the following:

Absorption Costing: It is the expense that cover the technique for costing which dissect and

accounts entire assembling related costs. For the most part, this component is utilized by the

business undertakings to assimilate the expense of products. In straightforward words, the

expense is likewise alluding as "full costing" (Knezevic, 2019). There are four sorts of

retention costing components are Direct material, Direct Labour, variable creation upward

increments or diminishes individually which implies the two of them are corresponding to

one another. It is a measure of conveyance, natural substance, Visa and may more.

Fixed Cost: It is an expense which is generally same in any event, when change in selling and

creation of services and products. It is a independent expense which amount do not impact

from any of the increment and lessening in the expense of item and administrations. It

incorporates payment of salary, rent, electricity bill, insurance and many others (Zhengxin,

and Qian, 2019).

Semi-variable expense: The expense which is paid at standard timeframe, it depends on

month to month, quarterly or ahead of schedule for investigating the need to the organization.

It is fundamentally incorporate both the expense variable and fixed. Semi-variable expenses

are deterioration of fixed resources, office lease and staffing.

Fixed

Costs

£ Variable

Costs

£ Semi-variable

Costs

£

Machinery 1500 Raw materials 15000 Office and

sales staff

9000

Factory

and

storage

rent

18000 Direct labour 17500 Logistics 3000

Utilities 500

Insurance 500

Total 20500 32500 12000

The expense which make a similar item constantly in a huge volume is known as unit

cost. The expense which are alludes to single unit of assembling item. It is otherwise called

cost of products offered and the cycle costing is alluding to the bookkeeping that produces

comparable or indistinguishable units of result. Contrast between both unit and interaction

cost are as per the following:

Absorption Costing: It is the expense that cover the technique for costing which dissect and

accounts entire assembling related costs. For the most part, this component is utilized by the

business undertakings to assimilate the expense of products. In straightforward words, the

expense is likewise alluding as "full costing" (Knezevic, 2019). There are four sorts of

retention costing components are Direct material, Direct Labour, variable creation upward

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

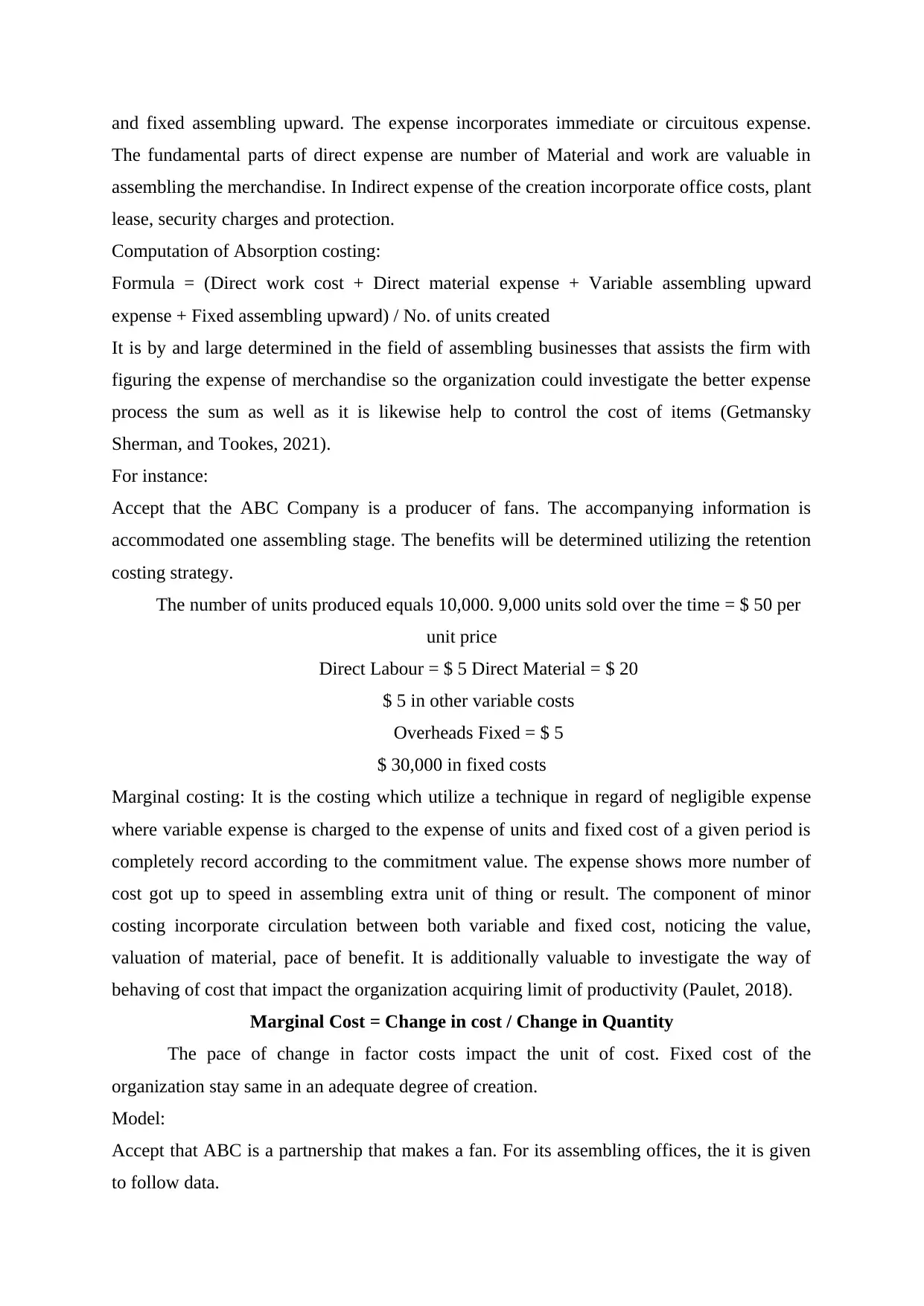

and fixed assembling upward. The expense incorporates immediate or circuitous expense.

The fundamental parts of direct expense are number of Material and work are valuable in

assembling the merchandise. In Indirect expense of the creation incorporate office costs, plant

lease, security charges and protection.

Computation of Absorption costing:

Formula = (Direct work cost + Direct material expense + Variable assembling upward

expense + Fixed assembling upward) / No. of units created

It is by and large determined in the field of assembling businesses that assists the firm with

figuring the expense of merchandise so the organization could investigate the better expense

process the sum as well as it is likewise help to control the cost of items (Getmansky

Sherman, and Tookes, 2021).

For instance:

Accept that the ABC Company is a producer of fans. The accompanying information is

accommodated one assembling stage. The benefits will be determined utilizing the retention

costing strategy.

The number of units produced equals 10,000. 9,000 units sold over the time = $ 50 per

unit price

Direct Labour = $ 5 Direct Material = $ 20

$ 5 in other variable costs

Overheads Fixed = $ 5

$ 30,000 in fixed costs

Marginal costing: It is the costing which utilize a technique in regard of negligible expense

where variable expense is charged to the expense of units and fixed cost of a given period is

completely record according to the commitment value. The expense shows more number of

cost got up to speed in assembling extra unit of thing or result. The component of minor

costing incorporate circulation between both variable and fixed cost, noticing the value,

valuation of material, pace of benefit. It is additionally valuable to investigate the way of

behaving of cost that impact the organization acquiring limit of productivity (Paulet, 2018).

Marginal Cost = Change in cost / Change in Quantity

The pace of change in factor costs impact the unit of cost. Fixed cost of the

organization stay same in an adequate degree of creation.

Model:

Accept that ABC is a partnership that makes a fan. For its assembling offices, the it is given

to follow data.

The fundamental parts of direct expense are number of Material and work are valuable in

assembling the merchandise. In Indirect expense of the creation incorporate office costs, plant

lease, security charges and protection.

Computation of Absorption costing:

Formula = (Direct work cost + Direct material expense + Variable assembling upward

expense + Fixed assembling upward) / No. of units created

It is by and large determined in the field of assembling businesses that assists the firm with

figuring the expense of merchandise so the organization could investigate the better expense

process the sum as well as it is likewise help to control the cost of items (Getmansky

Sherman, and Tookes, 2021).

For instance:

Accept that the ABC Company is a producer of fans. The accompanying information is

accommodated one assembling stage. The benefits will be determined utilizing the retention

costing strategy.

The number of units produced equals 10,000. 9,000 units sold over the time = $ 50 per

unit price

Direct Labour = $ 5 Direct Material = $ 20

$ 5 in other variable costs

Overheads Fixed = $ 5

$ 30,000 in fixed costs

Marginal costing: It is the costing which utilize a technique in regard of negligible expense

where variable expense is charged to the expense of units and fixed cost of a given period is

completely record according to the commitment value. The expense shows more number of

cost got up to speed in assembling extra unit of thing or result. The component of minor

costing incorporate circulation between both variable and fixed cost, noticing the value,

valuation of material, pace of benefit. It is additionally valuable to investigate the way of

behaving of cost that impact the organization acquiring limit of productivity (Paulet, 2018).

Marginal Cost = Change in cost / Change in Quantity

The pace of change in factor costs impact the unit of cost. Fixed cost of the

organization stay same in an adequate degree of creation.

Model:

Accept that ABC is a partnership that makes a fan. For its assembling offices, the it is given

to follow data.

Month 1 Units Produced = 10,000 Month 2 Units Produced = 15,000 Variable Costs in

Month 1= $ 50,000 Variable Costs in Month 2 = $ 80,000

Change in cost/change in quantity Equals Marginal Cost

(80,000 – 50,000)/ (15,000 – 10,000) = Marginal Cost

Therefore, the result of marginal cost per unit is $ 6 (30,000/5,000).

Activity based costing: It is cost which is useful to investigate the expense of creation. It is

breakdown down upward expense among assembling in light of techniques. The course of

action based costing are trailed by zeroing in on limiting the worth of upward expense. The

significance of this costing are as per the following:

Valuable to investigate the expense rehearses shows the expense rehearses way with

deference of organization position (Fairchild, and Hahn, 2020).

The ABC business examine the course of dissemination are utilized by the vender to sell the

item or administrations, similar to retailer, distributer, person to person communication site

and house to house administrations.

The valuing of products is likewise a significant piece of action based costing that

straightforwardly impact the organization benefit. Cost of the merchandise are fixed

subsequent to breaking down the market and the worth of similar challenger’s organization

item. In the event that the cost of merchandise in more than least expense than it makes an

issue of misfortune thus, the base valuing is useful to keep up with the situation on the

lookout.

TASK 2

Give the suggestions to the business for the expense decrease system.

There are different techniques that a business can embrace to lessen or chop down its

costs and accomplish wanted or the expressed target in strategies consider the main concern

in a decent way.

Based on the outcomes that has been shown up on execution of the above procedures the end

that has been made that they ought to consolidate Activity based costing strategy as their

technique in computing the expense. The fundamental justification for choice of such

technique is that it thinks about cost of every branch of the business partition and distribute

the expense based on drivers that has been determined (Motta, 2020). The ABC costing

would help them in empowering the expense in every one of their business cycles and they

can without much of a stretch check what office is valuable for them as far as cost

Month 1= $ 50,000 Variable Costs in Month 2 = $ 80,000

Change in cost/change in quantity Equals Marginal Cost

(80,000 – 50,000)/ (15,000 – 10,000) = Marginal Cost

Therefore, the result of marginal cost per unit is $ 6 (30,000/5,000).

Activity based costing: It is cost which is useful to investigate the expense of creation. It is

breakdown down upward expense among assembling in light of techniques. The course of

action based costing are trailed by zeroing in on limiting the worth of upward expense. The

significance of this costing are as per the following:

Valuable to investigate the expense rehearses shows the expense rehearses way with

deference of organization position (Fairchild, and Hahn, 2020).

The ABC business examine the course of dissemination are utilized by the vender to sell the

item or administrations, similar to retailer, distributer, person to person communication site

and house to house administrations.

The valuing of products is likewise a significant piece of action based costing that

straightforwardly impact the organization benefit. Cost of the merchandise are fixed

subsequent to breaking down the market and the worth of similar challenger’s organization

item. In the event that the cost of merchandise in more than least expense than it makes an

issue of misfortune thus, the base valuing is useful to keep up with the situation on the

lookout.

TASK 2

Give the suggestions to the business for the expense decrease system.

There are different techniques that a business can embrace to lessen or chop down its

costs and accomplish wanted or the expressed target in strategies consider the main concern

in a decent way.

Based on the outcomes that has been shown up on execution of the above procedures the end

that has been made that they ought to consolidate Activity based costing strategy as their

technique in computing the expense. The fundamental justification for choice of such

technique is that it thinks about cost of every branch of the business partition and distribute

the expense based on drivers that has been determined (Motta, 2020). The ABC costing

would help them in empowering the expense in every one of their business cycles and they

can without much of a stretch check what office is valuable for them as far as cost

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

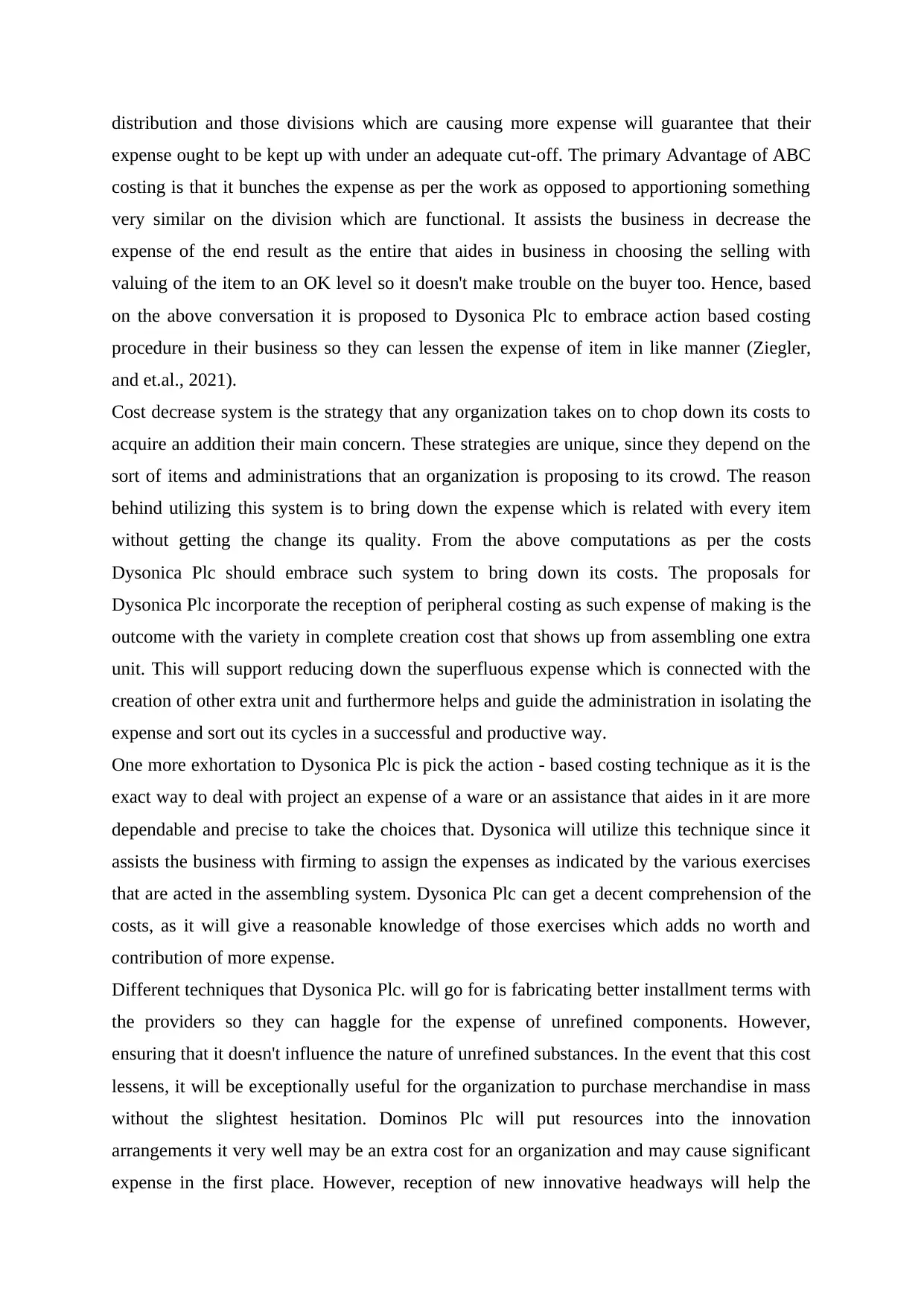

distribution and those divisions which are causing more expense will guarantee that their

expense ought to be kept up with under an adequate cut-off. The primary Advantage of ABC

costing is that it bunches the expense as per the work as opposed to apportioning something

very similar on the division which are functional. It assists the business in decrease the

expense of the end result as the entire that aides in business in choosing the selling with

valuing of the item to an OK level so it doesn't make trouble on the buyer too. Hence, based

on the above conversation it is proposed to Dysonica Plc to embrace action based costing

procedure in their business so they can lessen the expense of item in like manner (Ziegler,

and et.al., 2021).

Cost decrease system is the strategy that any organization takes on to chop down its costs to

acquire an addition their main concern. These strategies are unique, since they depend on the

sort of items and administrations that an organization is proposing to its crowd. The reason

behind utilizing this system is to bring down the expense which is related with every item

without getting the change its quality. From the above computations as per the costs

Dysonica Plc should embrace such system to bring down its costs. The proposals for

Dysonica Plc incorporate the reception of peripheral costing as such expense of making is the

outcome with the variety in complete creation cost that shows up from assembling one extra

unit. This will support reducing down the superfluous expense which is connected with the

creation of other extra unit and furthermore helps and guide the administration in isolating the

expense and sort out its cycles in a successful and productive way.

One more exhortation to Dysonica Plc is pick the action - based costing technique as it is the

exact way to deal with project an expense of a ware or an assistance that aides in it are more

dependable and precise to take the choices that. Dysonica will utilize this technique since it

assists the business with firming to assign the expenses as indicated by the various exercises

that are acted in the assembling system. Dysonica Plc can get a decent comprehension of the

costs, as it will give a reasonable knowledge of those exercises which adds no worth and

contribution of more expense.

Different techniques that Dysonica Plc. will go for is fabricating better installment terms with

the providers so they can haggle for the expense of unrefined components. However,

ensuring that it doesn't influence the nature of unrefined substances. In the event that this cost

lessens, it will be exceptionally useful for the organization to purchase merchandise in mass

without the slightest hesitation. Dominos Plc will put resources into the innovation

arrangements it very well may be an extra cost for an organization and may cause significant

expense in the first place. However, reception of new innovative headways will help the

expense ought to be kept up with under an adequate cut-off. The primary Advantage of ABC

costing is that it bunches the expense as per the work as opposed to apportioning something

very similar on the division which are functional. It assists the business in decrease the

expense of the end result as the entire that aides in business in choosing the selling with

valuing of the item to an OK level so it doesn't make trouble on the buyer too. Hence, based

on the above conversation it is proposed to Dysonica Plc to embrace action based costing

procedure in their business so they can lessen the expense of item in like manner (Ziegler,

and et.al., 2021).

Cost decrease system is the strategy that any organization takes on to chop down its costs to

acquire an addition their main concern. These strategies are unique, since they depend on the

sort of items and administrations that an organization is proposing to its crowd. The reason

behind utilizing this system is to bring down the expense which is related with every item

without getting the change its quality. From the above computations as per the costs

Dysonica Plc should embrace such system to bring down its costs. The proposals for

Dysonica Plc incorporate the reception of peripheral costing as such expense of making is the

outcome with the variety in complete creation cost that shows up from assembling one extra

unit. This will support reducing down the superfluous expense which is connected with the

creation of other extra unit and furthermore helps and guide the administration in isolating the

expense and sort out its cycles in a successful and productive way.

One more exhortation to Dysonica Plc is pick the action - based costing technique as it is the

exact way to deal with project an expense of a ware or an assistance that aides in it are more

dependable and precise to take the choices that. Dysonica will utilize this technique since it

assists the business with firming to assign the expenses as indicated by the various exercises

that are acted in the assembling system. Dysonica Plc can get a decent comprehension of the

costs, as it will give a reasonable knowledge of those exercises which adds no worth and

contribution of more expense.

Different techniques that Dysonica Plc. will go for is fabricating better installment terms with

the providers so they can haggle for the expense of unrefined components. However,

ensuring that it doesn't influence the nature of unrefined substances. In the event that this cost

lessens, it will be exceptionally useful for the organization to purchase merchandise in mass

without the slightest hesitation. Dominos Plc will put resources into the innovation

arrangements it very well may be an extra cost for an organization and may cause significant

expense in the first place. However, reception of new innovative headways will help the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

business firms to diminish to bring down its functional expense for a really long time - term

and the result will likewise be expanded (Xu, and et.al., 2020).

Dysonica Plc. Ltd will monitor expenses that are caused in the presentation of day - to - day

business exercises. It will watch out for the expense of capacity, utility, property and different

expenses. Furthermore, will make spending plans in like manner so it can direct the

organization in regards to the assignment of cost by the exercises in the various divisions.

Through these upward expenses can be chopped down.

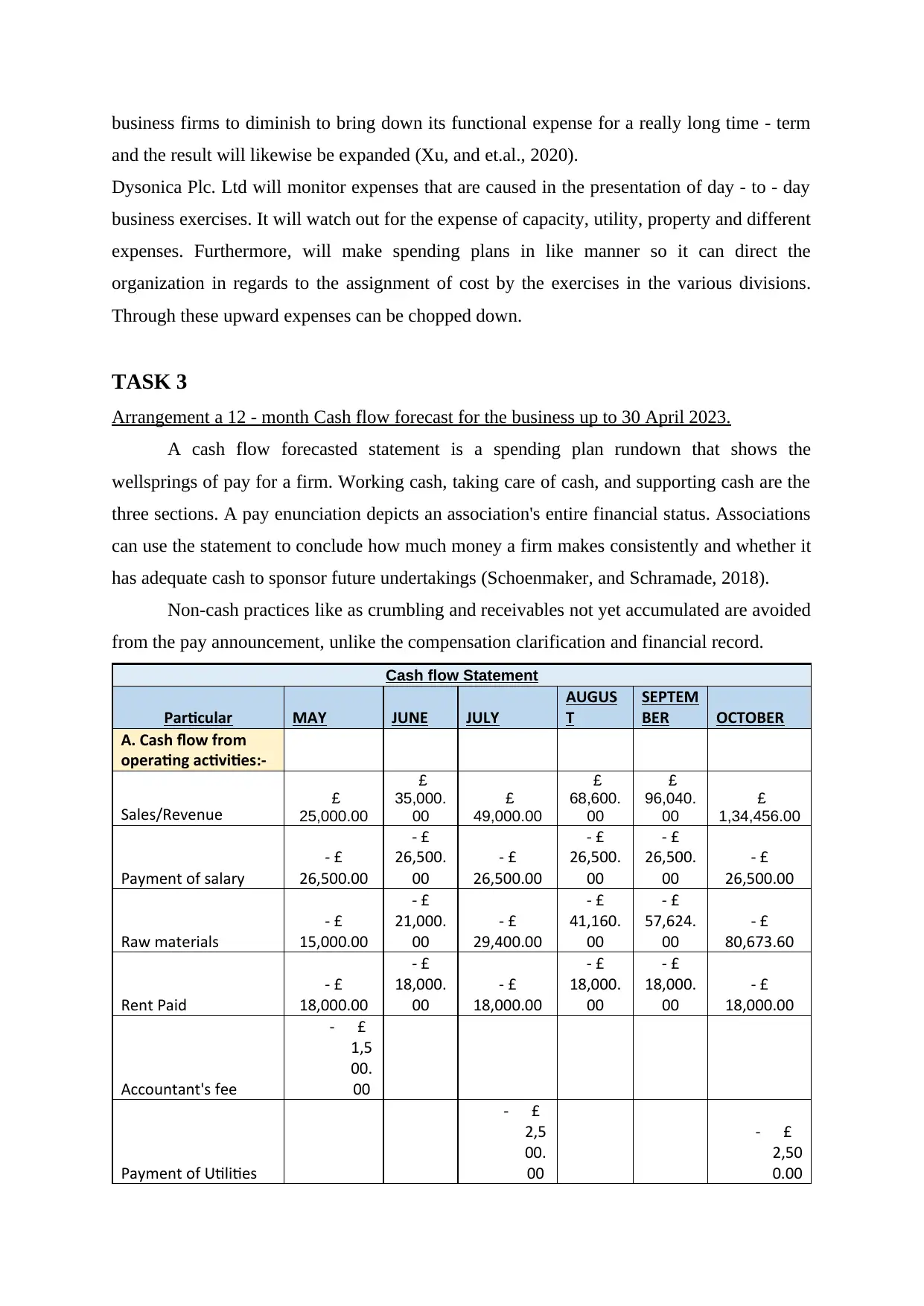

TASK 3

Arrangement a 12 - month Cash flow forecast for the business up to 30 April 2023.

A cash flow forecasted statement is a spending plan rundown that shows the

wellsprings of pay for a firm. Working cash, taking care of cash, and supporting cash are the

three sections. A pay enunciation depicts an association's entire financial status. Associations

can use the statement to conclude how much money a firm makes consistently and whether it

has adequate cash to sponsor future undertakings (Schoenmaker, and Schramade, 2018).

Non-cash practices like as crumbling and receivables not yet accumulated are avoided

from the pay announcement, unlike the compensation clarification and financial record.

Cash flow Statement

Particular MAY JUNE JULY

AUGUS

T

SEPTEM

BER OCTOBER

A. Cash flow from

operating activities:-

Sales/Revenue £

25,000.00

£

35,000.

00

£

49,000.00

£

68,600.

00

£

96,040.

00

£

1,34,456.00

Payment of salary

- £

26,500.00

- £

26,500.

00

- £

26,500.00

- £

26,500.

00

- £

26,500.

00

- £

26,500.00

Raw materials

- £

15,000.00

- £

21,000.

00

- £

29,400.00

- £

41,160.

00

- £

57,624.

00

- £

80,673.60

Rent Paid

- £

18,000.00

- £

18,000.

00

- £

18,000.00

- £

18,000.

00

- £

18,000.

00

- £

18,000.00

Accountant's fee

- £

1,5

00.

00

Payment of Utilities

- £

2,5

00.

00

- £

2,50

0.00

and the result will likewise be expanded (Xu, and et.al., 2020).

Dysonica Plc. Ltd will monitor expenses that are caused in the presentation of day - to - day

business exercises. It will watch out for the expense of capacity, utility, property and different

expenses. Furthermore, will make spending plans in like manner so it can direct the

organization in regards to the assignment of cost by the exercises in the various divisions.

Through these upward expenses can be chopped down.

TASK 3

Arrangement a 12 - month Cash flow forecast for the business up to 30 April 2023.

A cash flow forecasted statement is a spending plan rundown that shows the

wellsprings of pay for a firm. Working cash, taking care of cash, and supporting cash are the

three sections. A pay enunciation depicts an association's entire financial status. Associations

can use the statement to conclude how much money a firm makes consistently and whether it

has adequate cash to sponsor future undertakings (Schoenmaker, and Schramade, 2018).

Non-cash practices like as crumbling and receivables not yet accumulated are avoided

from the pay announcement, unlike the compensation clarification and financial record.

Cash flow Statement

Particular MAY JUNE JULY

AUGUS

T

SEPTEM

BER OCTOBER

A. Cash flow from

operating activities:-

Sales/Revenue £

25,000.00

£

35,000.

00

£

49,000.00

£

68,600.

00

£

96,040.

00

£

1,34,456.00

Payment of salary

- £

26,500.00

- £

26,500.

00

- £

26,500.00

- £

26,500.

00

- £

26,500.

00

- £

26,500.00

Raw materials

- £

15,000.00

- £

21,000.

00

- £

29,400.00

- £

41,160.

00

- £

57,624.

00

- £

80,673.60

Rent Paid

- £

18,000.00

- £

18,000.

00

- £

18,000.00

- £

18,000.

00

- £

18,000.

00

- £

18,000.00

Accountant's fee

- £

1,5

00.

00

Payment of Utilities

- £

2,5

00.

00

- £

2,50

0.00

Telephones

-£

1,000.00

- £

1,00

0.00

Vehicles

- £

20,000.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

marketing costs

- £

1,250.00

- £

1,750.0

0

- £

2,450.00

- £

3,430.0

0

- £

4,802.0

0

- £

6,722.80

water

- £

100

.00

- £

100.

00

logistics

- £

3,000.00

- £

3,000.0

0

- £

3,000.00

- £

4,500.0

0

- £

3,000.0

0

- £

3,000.00

Machinery

- £

1,500.00

- £

1,500.0

0

- £

1,500.00

- £

1,500.0

0

- £

1,500.0

0

- £

1,500.00

Insurance

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

Misc. Expense

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

Net cash flow from

operating activities:-

- £

62,300.00

- £

37,500.

00

- £

36,200.00

- £

27,240.

00

- £

16,136.

00

- £

6,290.40

B. Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

Net Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

C. Cash flow from

Investing activities:-

Initial investment

made

£

20,000.00

£

-

£

-

£

-

£

-

£

-

Net cash flow from

investing activities:-

£

20,000.00

£

-

£

-

£

-

£

-

£

-

Total cash

inflow/outflows(A+B

+C)

- £

42,300.00

- £

37,500.

00

- £

36,200.00

- £

27,240.

00

- £

16,136.

00

- £

6,290.40

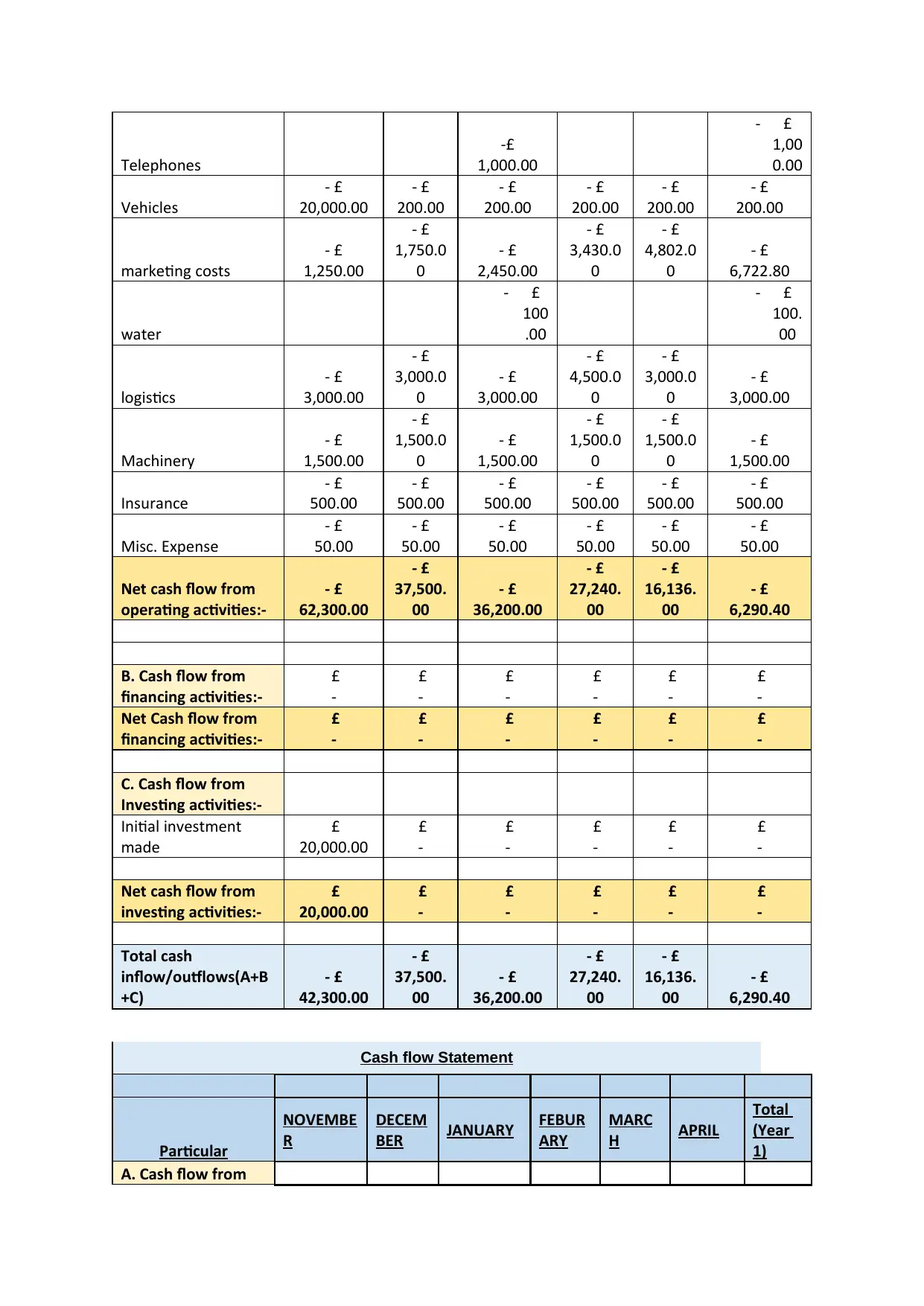

Cash flow Statement

Particular

NOVEMBE

R

DECEM

BER JANUARY FEBUR

ARY

MARC

H APRIL

Total

(Year

1)

A. Cash flow from

-£

1,000.00

- £

1,00

0.00

Vehicles

- £

20,000.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

marketing costs

- £

1,250.00

- £

1,750.0

0

- £

2,450.00

- £

3,430.0

0

- £

4,802.0

0

- £

6,722.80

water

- £

100

.00

- £

100.

00

logistics

- £

3,000.00

- £

3,000.0

0

- £

3,000.00

- £

4,500.0

0

- £

3,000.0

0

- £

3,000.00

Machinery

- £

1,500.00

- £

1,500.0

0

- £

1,500.00

- £

1,500.0

0

- £

1,500.0

0

- £

1,500.00

Insurance

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

Misc. Expense

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

Net cash flow from

operating activities:-

- £

62,300.00

- £

37,500.

00

- £

36,200.00

- £

27,240.

00

- £

16,136.

00

- £

6,290.40

B. Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

Net Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

C. Cash flow from

Investing activities:-

Initial investment

made

£

20,000.00

£

-

£

-

£

-

£

-

£

-

Net cash flow from

investing activities:-

£

20,000.00

£

-

£

-

£

-

£

-

£

-

Total cash

inflow/outflows(A+B

+C)

- £

42,300.00

- £

37,500.

00

- £

36,200.00

- £

27,240.

00

- £

16,136.

00

- £

6,290.40

Cash flow Statement

Particular

NOVEMBE

R

DECEM

BER JANUARY FEBUR

ARY

MARC

H APRIL

Total

(Year

1)

A. Cash flow from

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

operating

activities:-

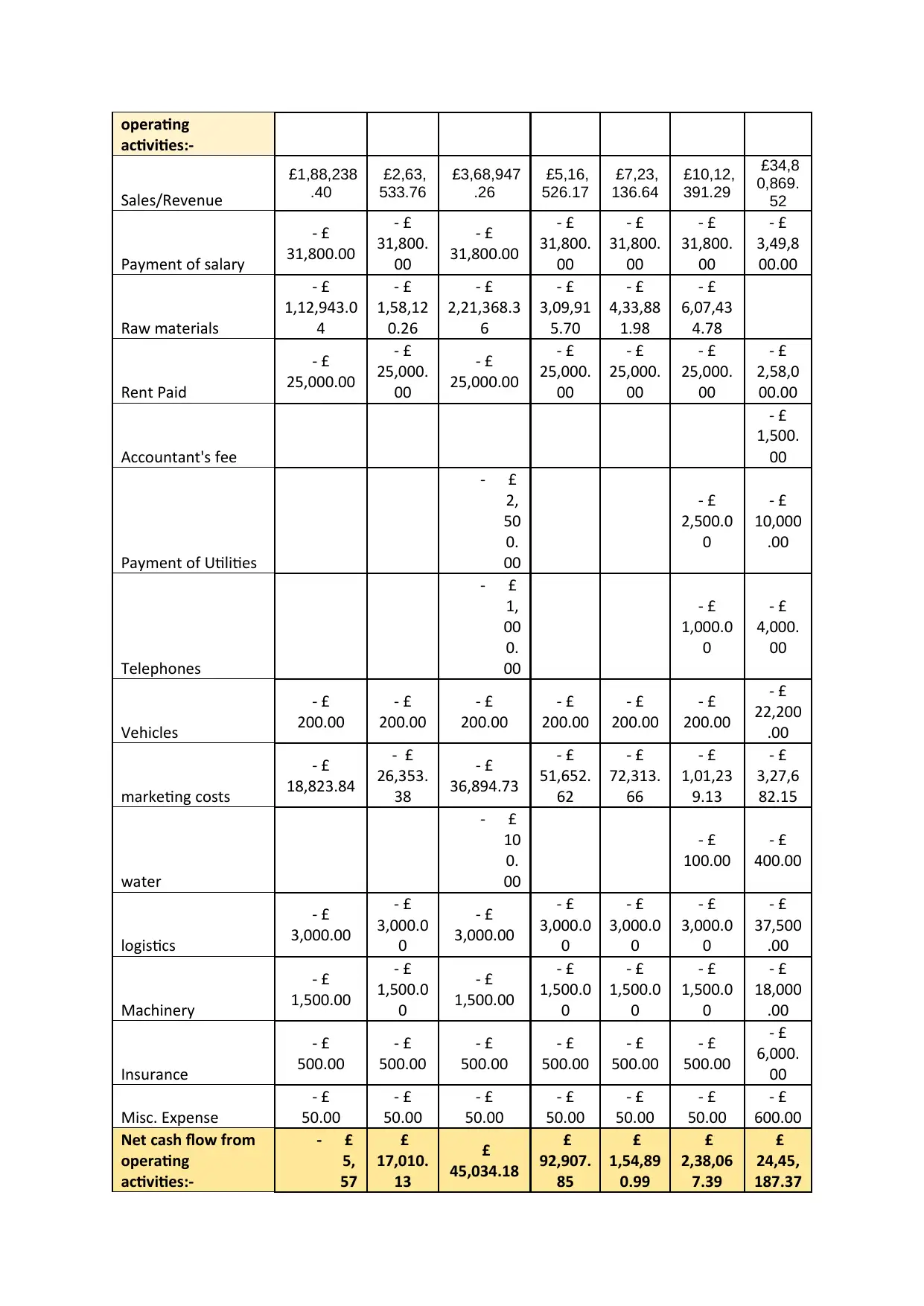

Sales/Revenue

£1,88,238

.40

£2,63,

533.76

£3,68,947

.26

£5,16,

526.17

£7,23,

136.64

£10,12,

391.29

£34,8

0,869.

52

Payment of salary

- £

31,800.00

- £

31,800.

00

- £

31,800.00

- £

31,800.

00

- £

31,800.

00

- £

31,800.

00

- £

3,49,8

00.00

Raw materials

- £

1,12,943.0

4

- £

1,58,12

0.26

- £

2,21,368.3

6

- £

3,09,91

5.70

- £

4,33,88

1.98

- £

6,07,43

4.78

Rent Paid

- £

25,000.00

- £

25,000.

00

- £

25,000.00

- £

25,000.

00

- £

25,000.

00

- £

25,000.

00

- £

2,58,0

00.00

Accountant's fee

- £

1,500.

00

Payment of Utilities

- £

2,

50

0.

00

- £

2,500.0

0

- £

10,000

.00

Telephones

- £

1,

00

0.

00

- £

1,000.0

0

- £

4,000.

00

Vehicles

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

22,200

.00

marketing costs

- £

18,823.84

- £

26,353.

38

- £

36,894.73

- £

51,652.

62

- £

72,313.

66

- £

1,01,23

9.13

- £

3,27,6

82.15

water

- £

10

0.

00

- £

100.00

- £

400.00

logistics

- £

3,000.00

- £

3,000.0

0

- £

3,000.00

- £

3,000.0

0

- £

3,000.0

0

- £

3,000.0

0

- £

37,500

.00

Machinery

- £

1,500.00

- £

1,500.0

0

- £

1,500.00

- £

1,500.0

0

- £

1,500.0

0

- £

1,500.0

0

- £

18,000

.00

Insurance

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

6,000.

00

Misc. Expense

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

600.00

Net cash flow from

operating

activities:-

- £

5,

57

£

17,010.

13

£

45,034.18

£

92,907.

85

£

1,54,89

0.99

£

2,38,06

7.39

£

24,45,

187.37

activities:-

Sales/Revenue

£1,88,238

.40

£2,63,

533.76

£3,68,947

.26

£5,16,

526.17

£7,23,

136.64

£10,12,

391.29

£34,8

0,869.

52

Payment of salary

- £

31,800.00

- £

31,800.

00

- £

31,800.00

- £

31,800.

00

- £

31,800.

00

- £

31,800.

00

- £

3,49,8

00.00

Raw materials

- £

1,12,943.0

4

- £

1,58,12

0.26

- £

2,21,368.3

6

- £

3,09,91

5.70

- £

4,33,88

1.98

- £

6,07,43

4.78

Rent Paid

- £

25,000.00

- £

25,000.

00

- £

25,000.00

- £

25,000.

00

- £

25,000.

00

- £

25,000.

00

- £

2,58,0

00.00

Accountant's fee

- £

1,500.

00

Payment of Utilities

- £

2,

50

0.

00

- £

2,500.0

0

- £

10,000

.00

Telephones

- £

1,

00

0.

00

- £

1,000.0

0

- £

4,000.

00

Vehicles

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

200.00

- £

22,200

.00

marketing costs

- £

18,823.84

- £

26,353.

38

- £

36,894.73

- £

51,652.

62

- £

72,313.

66

- £

1,01,23

9.13

- £

3,27,6

82.15

water

- £

10

0.

00

- £

100.00

- £

400.00

logistics

- £

3,000.00

- £

3,000.0

0

- £

3,000.00

- £

3,000.0

0

- £

3,000.0

0

- £

3,000.0

0

- £

37,500

.00

Machinery

- £

1,500.00

- £

1,500.0

0

- £

1,500.00

- £

1,500.0

0

- £

1,500.0

0

- £

1,500.0

0

- £

18,000

.00

Insurance

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

500.00

- £

6,000.

00

Misc. Expense

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

50.00

- £

600.00

Net cash flow from

operating

activities:-

- £

5,

57

£

17,010.

13

£

45,034.18

£

92,907.

85

£

1,54,89

0.99

£

2,38,06

7.39

£

24,45,

187.37

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8.

48

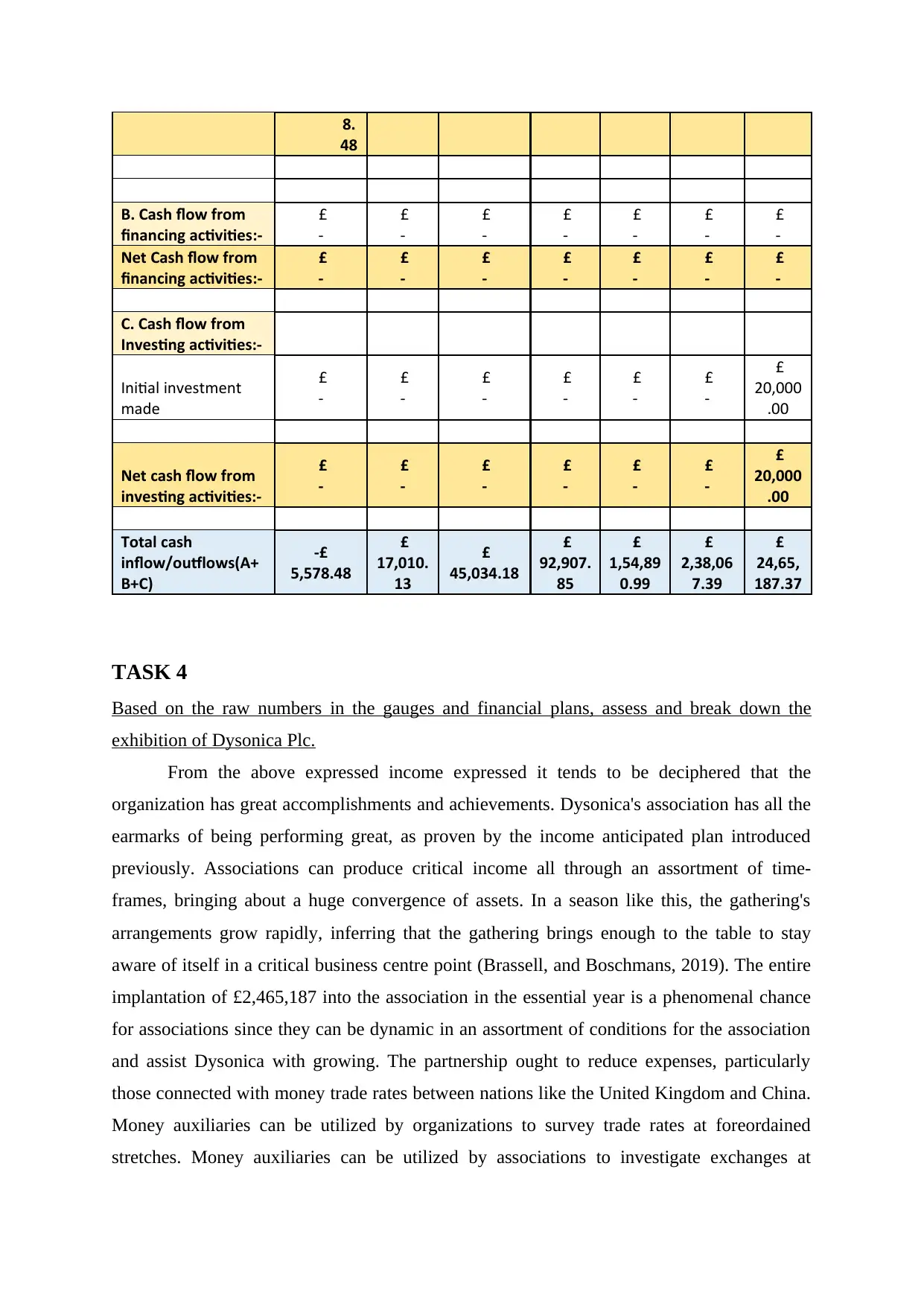

B. Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

£

-

Net Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

£

-

C. Cash flow from

Investing activities:-

Initial investment

made

£

-

£

-

£

-

£

-

£

-

£

-

£

20,000

.00

Net cash flow from

investing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

£

20,000

.00

Total cash

inflow/outflows(A+

B+C)

-£

5,578.48

£

17,010.

13

£

45,034.18

£

92,907.

85

£

1,54,89

0.99

£

2,38,06

7.39

£

24,65,

187.37

TASK 4

Based on the raw numbers in the gauges and financial plans, assess and break down the

exhibition of Dysonica Plc.

From the above expressed income expressed it tends to be deciphered that the

organization has great accomplishments and achievements. Dysonica's association has all the

earmarks of being performing great, as proven by the income anticipated plan introduced

previously. Associations can produce critical income all through an assortment of time-

frames, bringing about a huge convergence of assets. In a season like this, the gathering's

arrangements grow rapidly, inferring that the gathering brings enough to the table to stay

aware of itself in a critical business centre point (Brassell, and Boschmans, 2019). The entire

implantation of £2,465,187 into the association in the essential year is a phenomenal chance

for associations since they can be dynamic in an assortment of conditions for the association

and assist Dysonica with growing. The partnership ought to reduce expenses, particularly

those connected with money trade rates between nations like the United Kingdom and China.

Money auxiliaries can be utilized by organizations to survey trade rates at foreordained

stretches. Money auxiliaries can be utilized by associations to investigate exchanges at

48

B. Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

£

-

Net Cash flow from

financing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

£

-

C. Cash flow from

Investing activities:-

Initial investment

made

£

-

£

-

£

-

£

-

£

-

£

-

£

20,000

.00

Net cash flow from

investing activities:-

£

-

£

-

£

-

£

-

£

-

£

-

£

20,000

.00

Total cash

inflow/outflows(A+

B+C)

-£

5,578.48

£

17,010.

13

£

45,034.18

£

92,907.

85

£

1,54,89

0.99

£

2,38,06

7.39

£

24,65,

187.37

TASK 4

Based on the raw numbers in the gauges and financial plans, assess and break down the

exhibition of Dysonica Plc.

From the above expressed income expressed it tends to be deciphered that the

organization has great accomplishments and achievements. Dysonica's association has all the

earmarks of being performing great, as proven by the income anticipated plan introduced

previously. Associations can produce critical income all through an assortment of time-

frames, bringing about a huge convergence of assets. In a season like this, the gathering's

arrangements grow rapidly, inferring that the gathering brings enough to the table to stay

aware of itself in a critical business centre point (Brassell, and Boschmans, 2019). The entire

implantation of £2,465,187 into the association in the essential year is a phenomenal chance

for associations since they can be dynamic in an assortment of conditions for the association

and assist Dysonica with growing. The partnership ought to reduce expenses, particularly

those connected with money trade rates between nations like the United Kingdom and China.

Money auxiliaries can be utilized by organizations to survey trade rates at foreordained

stretches. Money auxiliaries can be utilized by associations to investigate exchanges at

foreordained trade rates, permitting them to all the more likely control the expenses

associated with this part of the business. Troublesome inflows are normal, showing that the

organization has income in its initial six to eight years of activity, inferring that the

organization needs to extend exchanging or cut utilization The organization's financing

position is impacted by the repeating ascend in speculation, which is an essential for any

association to win in profound business sectors and all over the planet. Costs can be cut by

utilizing elective stock associations and figuring out which drives are at fault and which are

costing the organization cash. They should complete their functional exercises on the steady

speed to that their functional incomes will stay positive for the more drawn out timeframe

(Cusmano, and Thompson, 2019).

The absolute first part of income from working exercises for a bookkeeping period reflects

deals beginning from the long stretch of May and finishing off with April and an increment

can be seen in a year. The anticipated income proclamations mirror that the organization has

great and sound monetary position. The Dysonica Plc. can meet its transient commitments

without confronting any obstacles and it has enough of current resources for manage the

ongoing liabilities. Additionally, the business projections can be noticed, which addresses

that the business is truly playing forthright to sell its items and administrations and producing

great measure of benefit out of the deal incomes. The all out cash inflow for the primary year

is analysed at £ 2,465,187 which is the best things and furthermore gives a beginning and

degree to the Dysonica Plc to create new speculation open doors. Interest in new resources

will really help Dysonica Plc. to develop its business and draw in huge number of investors

gatherings. It very well may be seen from the projected income explanations that the

Dysonica Plc. is associated with the unfamiliar trade rates with the nations like China and

United Kingdom. Along these lines, the expense that is happened is this trade is coming

about to the significant level sum which will be constrained by the business association by

involving the bound innovation as it will aid the assessment of exchange at the pre - chose

rate (Derkachenko, and Khudolii, 2018). This will help the business in that very field to

control and direct the expenses. For an additional a half year a negative inflow in real money

is assessed which implies that the organization will zero in on expanding its deals and

decrease its expenses. Since, in such a case that there will be negative money inflows that it

will turn out to be undeniably challenging for an organization to get by on the lookout and in

that industry, as it will prompt the disappointment in reimbursement of short - term and long -

term obligations and it will be uncommon test for Dysonica Plc. to complete its functional

exercises in a powerful and smooth manner. There is cash surge that should be visible in the

associated with this part of the business. Troublesome inflows are normal, showing that the

organization has income in its initial six to eight years of activity, inferring that the

organization needs to extend exchanging or cut utilization The organization's financing

position is impacted by the repeating ascend in speculation, which is an essential for any

association to win in profound business sectors and all over the planet. Costs can be cut by

utilizing elective stock associations and figuring out which drives are at fault and which are

costing the organization cash. They should complete their functional exercises on the steady

speed to that their functional incomes will stay positive for the more drawn out timeframe

(Cusmano, and Thompson, 2019).

The absolute first part of income from working exercises for a bookkeeping period reflects

deals beginning from the long stretch of May and finishing off with April and an increment

can be seen in a year. The anticipated income proclamations mirror that the organization has

great and sound monetary position. The Dysonica Plc. can meet its transient commitments

without confronting any obstacles and it has enough of current resources for manage the

ongoing liabilities. Additionally, the business projections can be noticed, which addresses

that the business is truly playing forthright to sell its items and administrations and producing

great measure of benefit out of the deal incomes. The all out cash inflow for the primary year

is analysed at £ 2,465,187 which is the best things and furthermore gives a beginning and

degree to the Dysonica Plc to create new speculation open doors. Interest in new resources

will really help Dysonica Plc. to develop its business and draw in huge number of investors

gatherings. It very well may be seen from the projected income explanations that the

Dysonica Plc. is associated with the unfamiliar trade rates with the nations like China and

United Kingdom. Along these lines, the expense that is happened is this trade is coming

about to the significant level sum which will be constrained by the business association by

involving the bound innovation as it will aid the assessment of exchange at the pre - chose

rate (Derkachenko, and Khudolii, 2018). This will help the business in that very field to

control and direct the expenses. For an additional a half year a negative inflow in real money

is assessed which implies that the organization will zero in on expanding its deals and

decrease its expenses. Since, in such a case that there will be negative money inflows that it

will turn out to be undeniably challenging for an organization to get by on the lookout and in

that industry, as it will prompt the disappointment in reimbursement of short - term and long -

term obligations and it will be uncommon test for Dysonica Plc. to complete its functional

exercises in a powerful and smooth manner. There is cash surge that should be visible in the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.