Business Finance: Stock Portfolio Selection & Return Calculation

VerifiedAdded on 2023/06/14

|24

|8037

|252

Report

AI Summary

This business finance report details the selection of seven stocks (Amcor, Blackmores, Boral, Hutchison Telecommunication, Origin Energy, Qantas Airways, and Telstra) and analyzes their performance from 2000 to 2010. It calculates the risk-free rate using Australian government bond yields and determines monthly and expected returns for each stock and the market index (AORD). The report computes average returns, beta values, and fair returns using the CAPM model, visualizing the relationship through the Security Market Line. Based on the analysis, it recommends stocks for portfolio inclusion and calculates the portfolio's overall return and beta. The study provides a comprehensive overview of stock performance, risk assessment, and portfolio construction strategies within the specified timeframe, concluding with a detailed analysis of stock selection and portfolio optimization.

BUSINESS FINANCE

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS FINANCE

Table of Contents

Selection of Stocks:.........................................................................................................................2

Requirement 1: Risk Free Rate........................................................................................................2

Requirement 2: Monthly & Expected Returns of Shares and Market Index...................................3

Requirement 3: Average Return of Stocks and Market Index.......................................................11

Requirement 4: Beta......................................................................................................................11

Requirement 5: Fair return under CAPM Model...........................................................................15

Requirement 6 & 7: Security Market Line....................................................................................16

Requirement 8: Selection of Stocks for Portfolio..........................................................................16

Requirement 9: Portfolio Return & Beta.......................................................................................18

Requirement 10:.............................................................................................................................19

Bibliography..................................................................................................................................21

Table of Contents

Selection of Stocks:.........................................................................................................................2

Requirement 1: Risk Free Rate........................................................................................................2

Requirement 2: Monthly & Expected Returns of Shares and Market Index...................................3

Requirement 3: Average Return of Stocks and Market Index.......................................................11

Requirement 4: Beta......................................................................................................................11

Requirement 5: Fair return under CAPM Model...........................................................................15

Requirement 6 & 7: Security Market Line....................................................................................16

Requirement 8: Selection of Stocks for Portfolio..........................................................................16

Requirement 9: Portfolio Return & Beta.......................................................................................18

Requirement 10:.............................................................................................................................19

Bibliography..................................................................................................................................21

2BUSINESS FINANCE

Selection of Stocks:

The seven stocks, which have been selected for this task, are as follows:

- Amcor Ltd. (ASX Code – AMC)

- Blackmores (ASX Code – BKL)

- Boral Ltd. (ASX Code – BLD)

- Hutchison Telecommunication (ASX Code – HTA)

- Origin energy (ASX Code – ORG)

- Qantas Airways (ASX Code – QAS)

- Telstra (ASX Code – TLS)

Requirement 1: Risk Free Rate

The shortest maturity date of any Australian government bond is 2 years, which has a

yield to maturity of 2.07%.

Selection of Stocks:

The seven stocks, which have been selected for this task, are as follows:

- Amcor Ltd. (ASX Code – AMC)

- Blackmores (ASX Code – BKL)

- Boral Ltd. (ASX Code – BLD)

- Hutchison Telecommunication (ASX Code – HTA)

- Origin energy (ASX Code – ORG)

- Qantas Airways (ASX Code – QAS)

- Telstra (ASX Code – TLS)

Requirement 1: Risk Free Rate

The shortest maturity date of any Australian government bond is 2 years, which has a

yield to maturity of 2.07%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS FINANCE

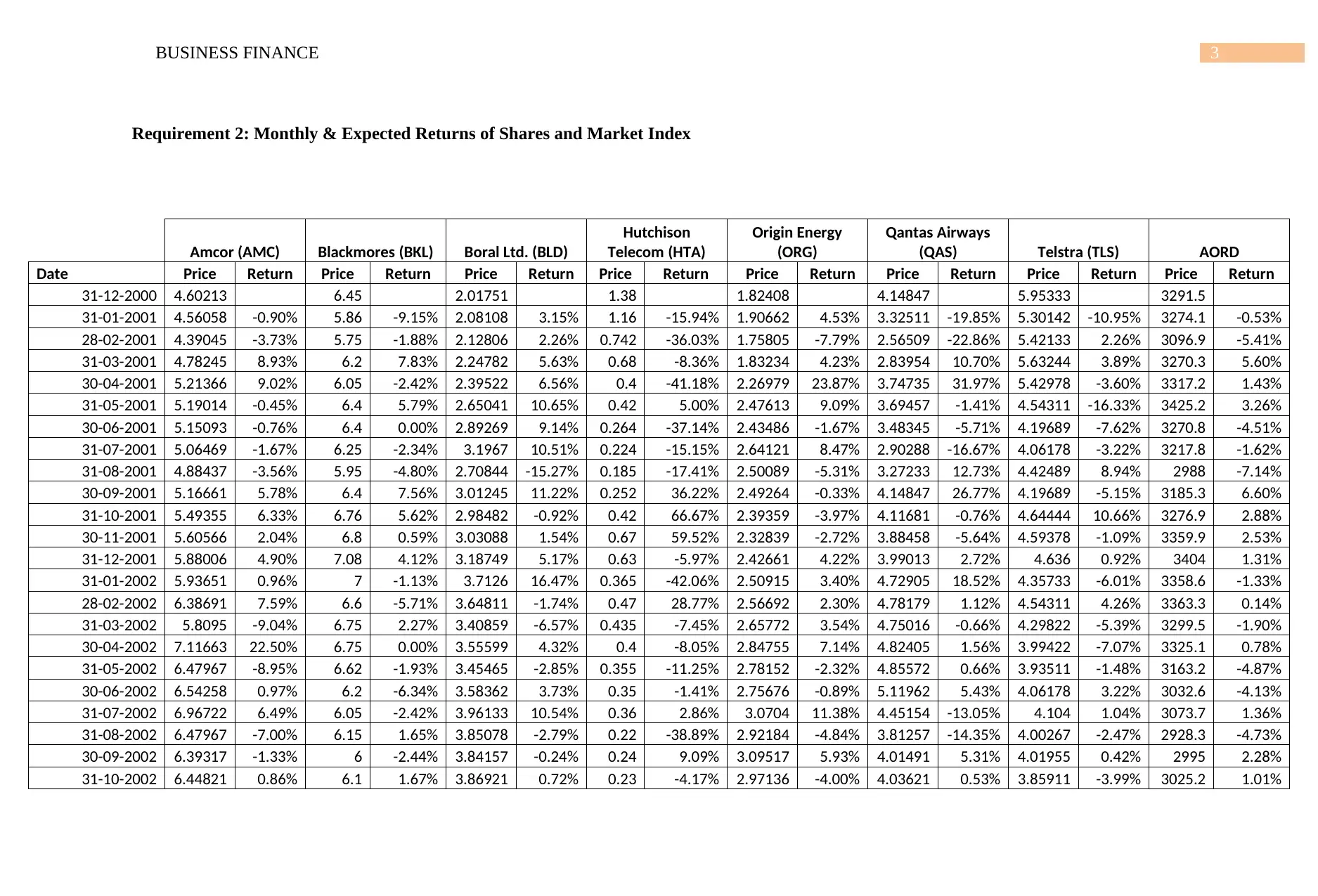

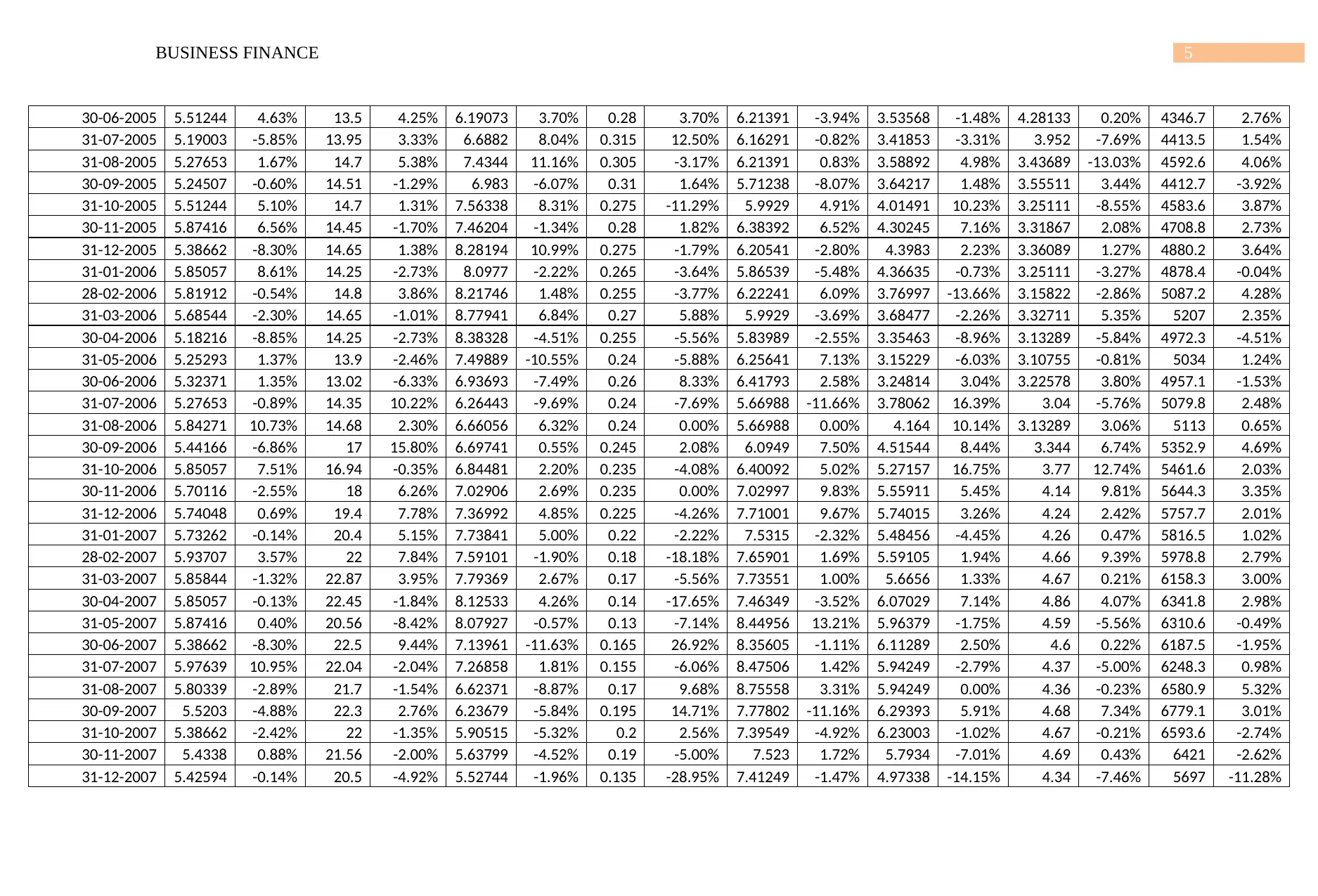

Requirement 2: Monthly & Expected Returns of Shares and Market Index

Amcor (AMC) Blackmores (BKL) Boral Ltd. (BLD)

Hutchison

Telecom (HTA)

Origin Energy

(ORG)

Qantas Airways

(QAS) Telstra (TLS) AORD

Date Price Return Price Return Price Return Price Return Price Return Price Return Price Return Price Return

31-12-2000 4.60213 6.45 2.01751 1.38 1.82408 4.14847 5.95333 3291.5

31-01-2001 4.56058 -0.90% 5.86 -9.15% 2.08108 3.15% 1.16 -15.94% 1.90662 4.53% 3.32511 -19.85% 5.30142 -10.95% 3274.1 -0.53%

28-02-2001 4.39045 -3.73% 5.75 -1.88% 2.12806 2.26% 0.742 -36.03% 1.75805 -7.79% 2.56509 -22.86% 5.42133 2.26% 3096.9 -5.41%

31-03-2001 4.78245 8.93% 6.2 7.83% 2.24782 5.63% 0.68 -8.36% 1.83234 4.23% 2.83954 10.70% 5.63244 3.89% 3270.3 5.60%

30-04-2001 5.21366 9.02% 6.05 -2.42% 2.39522 6.56% 0.4 -41.18% 2.26979 23.87% 3.74735 31.97% 5.42978 -3.60% 3317.2 1.43%

31-05-2001 5.19014 -0.45% 6.4 5.79% 2.65041 10.65% 0.42 5.00% 2.47613 9.09% 3.69457 -1.41% 4.54311 -16.33% 3425.2 3.26%

30-06-2001 5.15093 -0.76% 6.4 0.00% 2.89269 9.14% 0.264 -37.14% 2.43486 -1.67% 3.48345 -5.71% 4.19689 -7.62% 3270.8 -4.51%

31-07-2001 5.06469 -1.67% 6.25 -2.34% 3.1967 10.51% 0.224 -15.15% 2.64121 8.47% 2.90288 -16.67% 4.06178 -3.22% 3217.8 -1.62%

31-08-2001 4.88437 -3.56% 5.95 -4.80% 2.70844 -15.27% 0.185 -17.41% 2.50089 -5.31% 3.27233 12.73% 4.42489 8.94% 2988 -7.14%

30-09-2001 5.16661 5.78% 6.4 7.56% 3.01245 11.22% 0.252 36.22% 2.49264 -0.33% 4.14847 26.77% 4.19689 -5.15% 3185.3 6.60%

31-10-2001 5.49355 6.33% 6.76 5.62% 2.98482 -0.92% 0.42 66.67% 2.39359 -3.97% 4.11681 -0.76% 4.64444 10.66% 3276.9 2.88%

30-11-2001 5.60566 2.04% 6.8 0.59% 3.03088 1.54% 0.67 59.52% 2.32839 -2.72% 3.88458 -5.64% 4.59378 -1.09% 3359.9 2.53%

31-12-2001 5.88006 4.90% 7.08 4.12% 3.18749 5.17% 0.63 -5.97% 2.42661 4.22% 3.99013 2.72% 4.636 0.92% 3404 1.31%

31-01-2002 5.93651 0.96% 7 -1.13% 3.7126 16.47% 0.365 -42.06% 2.50915 3.40% 4.72905 18.52% 4.35733 -6.01% 3358.6 -1.33%

28-02-2002 6.38691 7.59% 6.6 -5.71% 3.64811 -1.74% 0.47 28.77% 2.56692 2.30% 4.78179 1.12% 4.54311 4.26% 3363.3 0.14%

31-03-2002 5.8095 -9.04% 6.75 2.27% 3.40859 -6.57% 0.435 -7.45% 2.65772 3.54% 4.75016 -0.66% 4.29822 -5.39% 3299.5 -1.90%

30-04-2002 7.11663 22.50% 6.75 0.00% 3.55599 4.32% 0.4 -8.05% 2.84755 7.14% 4.82405 1.56% 3.99422 -7.07% 3325.1 0.78%

31-05-2002 6.47967 -8.95% 6.62 -1.93% 3.45465 -2.85% 0.355 -11.25% 2.78152 -2.32% 4.85572 0.66% 3.93511 -1.48% 3163.2 -4.87%

30-06-2002 6.54258 0.97% 6.2 -6.34% 3.58362 3.73% 0.35 -1.41% 2.75676 -0.89% 5.11962 5.43% 4.06178 3.22% 3032.6 -4.13%

31-07-2002 6.96722 6.49% 6.05 -2.42% 3.96133 10.54% 0.36 2.86% 3.0704 11.38% 4.45154 -13.05% 4.104 1.04% 3073.7 1.36%

31-08-2002 6.47967 -7.00% 6.15 1.65% 3.85078 -2.79% 0.22 -38.89% 2.92184 -4.84% 3.81257 -14.35% 4.00267 -2.47% 2928.3 -4.73%

30-09-2002 6.39317 -1.33% 6 -2.44% 3.84157 -0.24% 0.24 9.09% 3.09517 5.93% 4.01491 5.31% 4.01955 0.42% 2995 2.28%

31-10-2002 6.44821 0.86% 6.1 1.67% 3.86921 0.72% 0.23 -4.17% 2.97136 -4.00% 4.03621 0.53% 3.85911 -3.99% 3025.2 1.01%

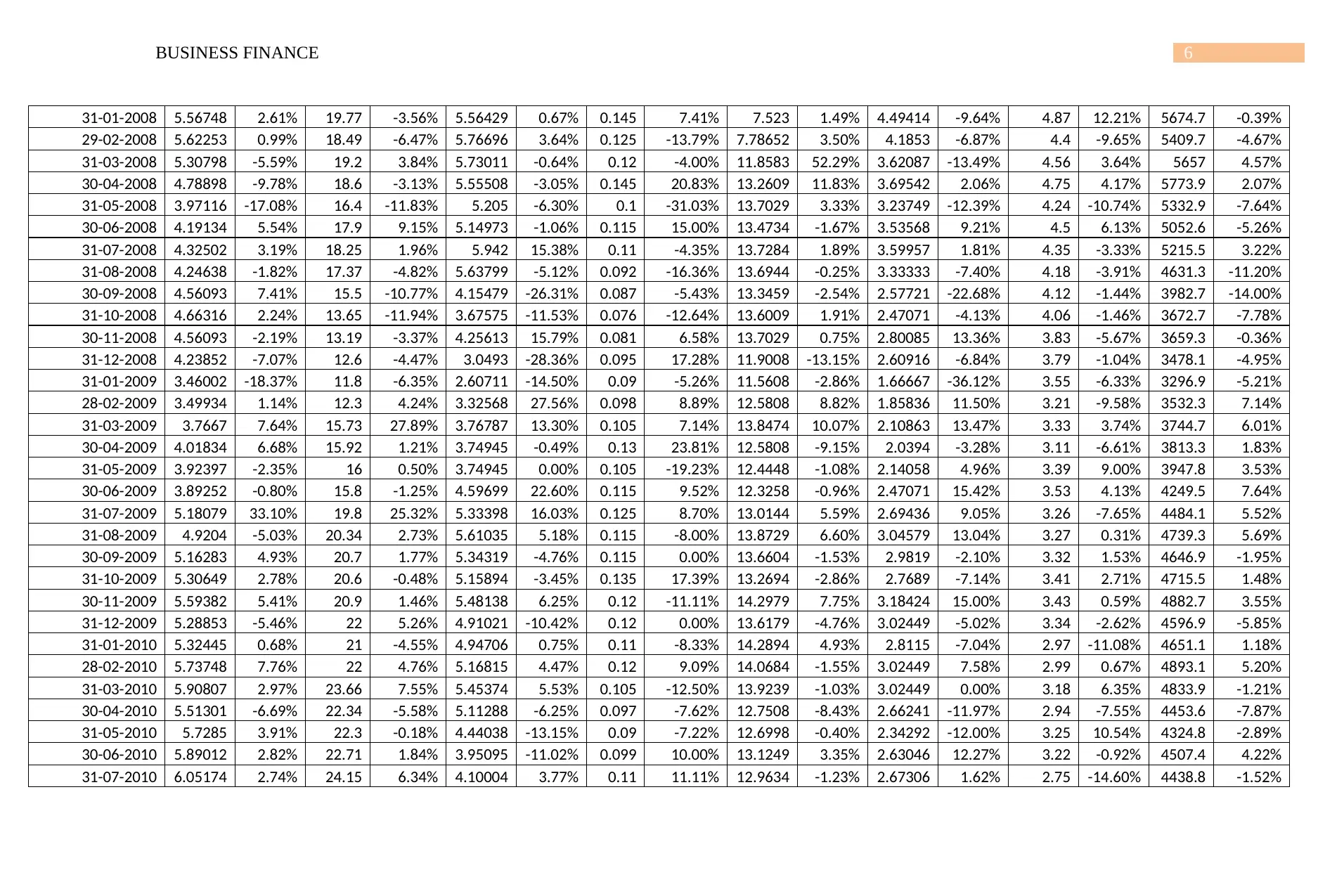

Requirement 2: Monthly & Expected Returns of Shares and Market Index

Amcor (AMC) Blackmores (BKL) Boral Ltd. (BLD)

Hutchison

Telecom (HTA)

Origin Energy

(ORG)

Qantas Airways

(QAS) Telstra (TLS) AORD

Date Price Return Price Return Price Return Price Return Price Return Price Return Price Return Price Return

31-12-2000 4.60213 6.45 2.01751 1.38 1.82408 4.14847 5.95333 3291.5

31-01-2001 4.56058 -0.90% 5.86 -9.15% 2.08108 3.15% 1.16 -15.94% 1.90662 4.53% 3.32511 -19.85% 5.30142 -10.95% 3274.1 -0.53%

28-02-2001 4.39045 -3.73% 5.75 -1.88% 2.12806 2.26% 0.742 -36.03% 1.75805 -7.79% 2.56509 -22.86% 5.42133 2.26% 3096.9 -5.41%

31-03-2001 4.78245 8.93% 6.2 7.83% 2.24782 5.63% 0.68 -8.36% 1.83234 4.23% 2.83954 10.70% 5.63244 3.89% 3270.3 5.60%

30-04-2001 5.21366 9.02% 6.05 -2.42% 2.39522 6.56% 0.4 -41.18% 2.26979 23.87% 3.74735 31.97% 5.42978 -3.60% 3317.2 1.43%

31-05-2001 5.19014 -0.45% 6.4 5.79% 2.65041 10.65% 0.42 5.00% 2.47613 9.09% 3.69457 -1.41% 4.54311 -16.33% 3425.2 3.26%

30-06-2001 5.15093 -0.76% 6.4 0.00% 2.89269 9.14% 0.264 -37.14% 2.43486 -1.67% 3.48345 -5.71% 4.19689 -7.62% 3270.8 -4.51%

31-07-2001 5.06469 -1.67% 6.25 -2.34% 3.1967 10.51% 0.224 -15.15% 2.64121 8.47% 2.90288 -16.67% 4.06178 -3.22% 3217.8 -1.62%

31-08-2001 4.88437 -3.56% 5.95 -4.80% 2.70844 -15.27% 0.185 -17.41% 2.50089 -5.31% 3.27233 12.73% 4.42489 8.94% 2988 -7.14%

30-09-2001 5.16661 5.78% 6.4 7.56% 3.01245 11.22% 0.252 36.22% 2.49264 -0.33% 4.14847 26.77% 4.19689 -5.15% 3185.3 6.60%

31-10-2001 5.49355 6.33% 6.76 5.62% 2.98482 -0.92% 0.42 66.67% 2.39359 -3.97% 4.11681 -0.76% 4.64444 10.66% 3276.9 2.88%

30-11-2001 5.60566 2.04% 6.8 0.59% 3.03088 1.54% 0.67 59.52% 2.32839 -2.72% 3.88458 -5.64% 4.59378 -1.09% 3359.9 2.53%

31-12-2001 5.88006 4.90% 7.08 4.12% 3.18749 5.17% 0.63 -5.97% 2.42661 4.22% 3.99013 2.72% 4.636 0.92% 3404 1.31%

31-01-2002 5.93651 0.96% 7 -1.13% 3.7126 16.47% 0.365 -42.06% 2.50915 3.40% 4.72905 18.52% 4.35733 -6.01% 3358.6 -1.33%

28-02-2002 6.38691 7.59% 6.6 -5.71% 3.64811 -1.74% 0.47 28.77% 2.56692 2.30% 4.78179 1.12% 4.54311 4.26% 3363.3 0.14%

31-03-2002 5.8095 -9.04% 6.75 2.27% 3.40859 -6.57% 0.435 -7.45% 2.65772 3.54% 4.75016 -0.66% 4.29822 -5.39% 3299.5 -1.90%

30-04-2002 7.11663 22.50% 6.75 0.00% 3.55599 4.32% 0.4 -8.05% 2.84755 7.14% 4.82405 1.56% 3.99422 -7.07% 3325.1 0.78%

31-05-2002 6.47967 -8.95% 6.62 -1.93% 3.45465 -2.85% 0.355 -11.25% 2.78152 -2.32% 4.85572 0.66% 3.93511 -1.48% 3163.2 -4.87%

30-06-2002 6.54258 0.97% 6.2 -6.34% 3.58362 3.73% 0.35 -1.41% 2.75676 -0.89% 5.11962 5.43% 4.06178 3.22% 3032.6 -4.13%

31-07-2002 6.96722 6.49% 6.05 -2.42% 3.96133 10.54% 0.36 2.86% 3.0704 11.38% 4.45154 -13.05% 4.104 1.04% 3073.7 1.36%

31-08-2002 6.47967 -7.00% 6.15 1.65% 3.85078 -2.79% 0.22 -38.89% 2.92184 -4.84% 3.81257 -14.35% 4.00267 -2.47% 2928.3 -4.73%

30-09-2002 6.39317 -1.33% 6 -2.44% 3.84157 -0.24% 0.24 9.09% 3.09517 5.93% 4.01491 5.31% 4.01955 0.42% 2995 2.28%

31-10-2002 6.44821 0.86% 6.1 1.67% 3.86921 0.72% 0.23 -4.17% 2.97136 -4.00% 4.03621 0.53% 3.85911 -3.99% 3025.2 1.01%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS FINANCE

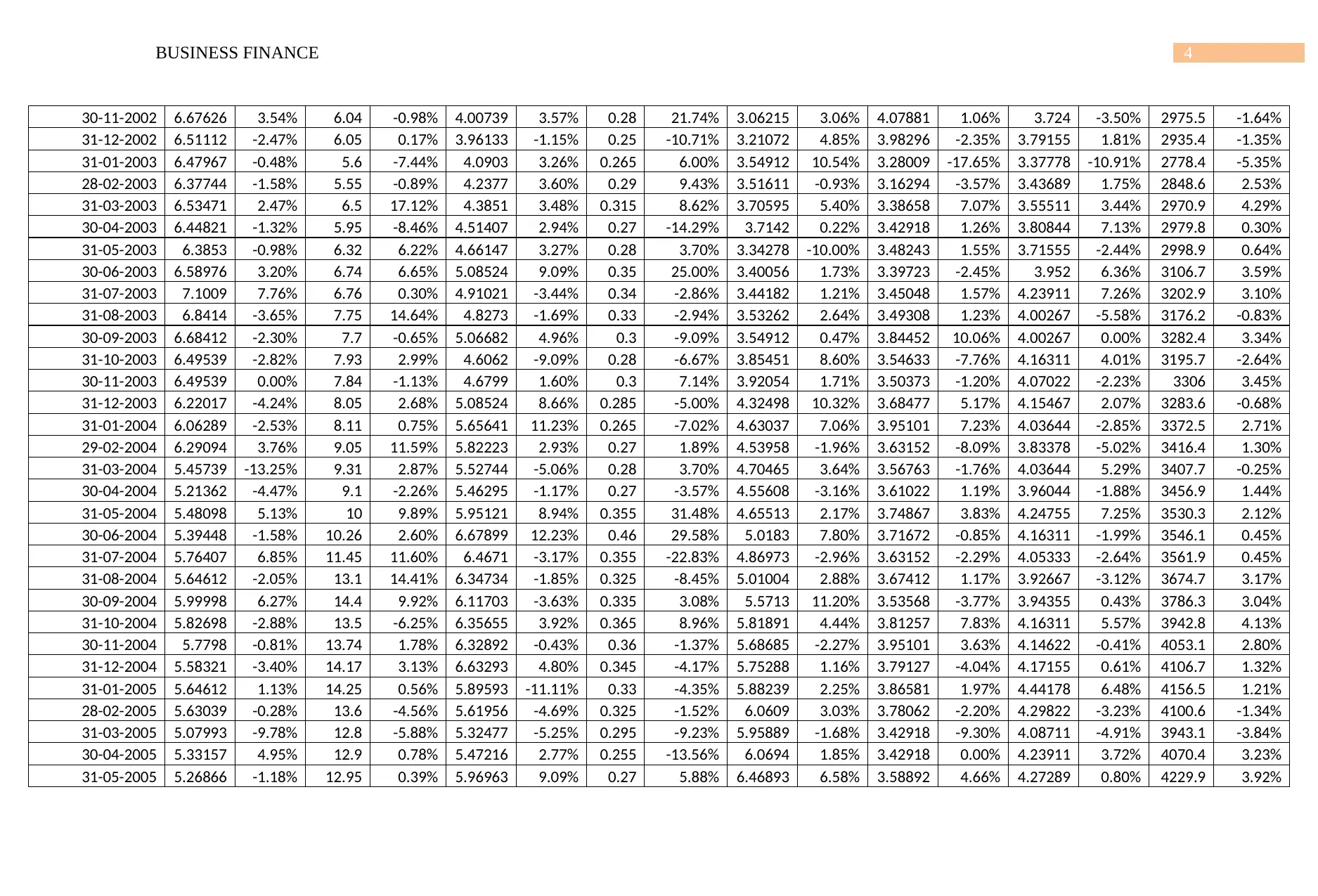

30-11-2002 6.67626 3.54% 6.04 -0.98% 4.00739 3.57% 0.28 21.74% 3.06215 3.06% 4.07881 1.06% 3.724 -3.50% 2975.5 -1.64%

31-12-2002 6.51112 -2.47% 6.05 0.17% 3.96133 -1.15% 0.25 -10.71% 3.21072 4.85% 3.98296 -2.35% 3.79155 1.81% 2935.4 -1.35%

31-01-2003 6.47967 -0.48% 5.6 -7.44% 4.0903 3.26% 0.265 6.00% 3.54912 10.54% 3.28009 -17.65% 3.37778 -10.91% 2778.4 -5.35%

28-02-2003 6.37744 -1.58% 5.55 -0.89% 4.2377 3.60% 0.29 9.43% 3.51611 -0.93% 3.16294 -3.57% 3.43689 1.75% 2848.6 2.53%

31-03-2003 6.53471 2.47% 6.5 17.12% 4.3851 3.48% 0.315 8.62% 3.70595 5.40% 3.38658 7.07% 3.55511 3.44% 2970.9 4.29%

30-04-2003 6.44821 -1.32% 5.95 -8.46% 4.51407 2.94% 0.27 -14.29% 3.7142 0.22% 3.42918 1.26% 3.80844 7.13% 2979.8 0.30%

31-05-2003 6.3853 -0.98% 6.32 6.22% 4.66147 3.27% 0.28 3.70% 3.34278 -10.00% 3.48243 1.55% 3.71555 -2.44% 2998.9 0.64%

30-06-2003 6.58976 3.20% 6.74 6.65% 5.08524 9.09% 0.35 25.00% 3.40056 1.73% 3.39723 -2.45% 3.952 6.36% 3106.7 3.59%

31-07-2003 7.1009 7.76% 6.76 0.30% 4.91021 -3.44% 0.34 -2.86% 3.44182 1.21% 3.45048 1.57% 4.23911 7.26% 3202.9 3.10%

31-08-2003 6.8414 -3.65% 7.75 14.64% 4.8273 -1.69% 0.33 -2.94% 3.53262 2.64% 3.49308 1.23% 4.00267 -5.58% 3176.2 -0.83%

30-09-2003 6.68412 -2.30% 7.7 -0.65% 5.06682 4.96% 0.3 -9.09% 3.54912 0.47% 3.84452 10.06% 4.00267 0.00% 3282.4 3.34%

31-10-2003 6.49539 -2.82% 7.93 2.99% 4.6062 -9.09% 0.28 -6.67% 3.85451 8.60% 3.54633 -7.76% 4.16311 4.01% 3195.7 -2.64%

30-11-2003 6.49539 0.00% 7.84 -1.13% 4.6799 1.60% 0.3 7.14% 3.92054 1.71% 3.50373 -1.20% 4.07022 -2.23% 3306 3.45%

31-12-2003 6.22017 -4.24% 8.05 2.68% 5.08524 8.66% 0.285 -5.00% 4.32498 10.32% 3.68477 5.17% 4.15467 2.07% 3283.6 -0.68%

31-01-2004 6.06289 -2.53% 8.11 0.75% 5.65641 11.23% 0.265 -7.02% 4.63037 7.06% 3.95101 7.23% 4.03644 -2.85% 3372.5 2.71%

29-02-2004 6.29094 3.76% 9.05 11.59% 5.82223 2.93% 0.27 1.89% 4.53958 -1.96% 3.63152 -8.09% 3.83378 -5.02% 3416.4 1.30%

31-03-2004 5.45739 -13.25% 9.31 2.87% 5.52744 -5.06% 0.28 3.70% 4.70465 3.64% 3.56763 -1.76% 4.03644 5.29% 3407.7 -0.25%

30-04-2004 5.21362 -4.47% 9.1 -2.26% 5.46295 -1.17% 0.27 -3.57% 4.55608 -3.16% 3.61022 1.19% 3.96044 -1.88% 3456.9 1.44%

31-05-2004 5.48098 5.13% 10 9.89% 5.95121 8.94% 0.355 31.48% 4.65513 2.17% 3.74867 3.83% 4.24755 7.25% 3530.3 2.12%

30-06-2004 5.39448 -1.58% 10.26 2.60% 6.67899 12.23% 0.46 29.58% 5.0183 7.80% 3.71672 -0.85% 4.16311 -1.99% 3546.1 0.45%

31-07-2004 5.76407 6.85% 11.45 11.60% 6.4671 -3.17% 0.355 -22.83% 4.86973 -2.96% 3.63152 -2.29% 4.05333 -2.64% 3561.9 0.45%

31-08-2004 5.64612 -2.05% 13.1 14.41% 6.34734 -1.85% 0.325 -8.45% 5.01004 2.88% 3.67412 1.17% 3.92667 -3.12% 3674.7 3.17%

30-09-2004 5.99998 6.27% 14.4 9.92% 6.11703 -3.63% 0.335 3.08% 5.5713 11.20% 3.53568 -3.77% 3.94355 0.43% 3786.3 3.04%

31-10-2004 5.82698 -2.88% 13.5 -6.25% 6.35655 3.92% 0.365 8.96% 5.81891 4.44% 3.81257 7.83% 4.16311 5.57% 3942.8 4.13%

30-11-2004 5.7798 -0.81% 13.74 1.78% 6.32892 -0.43% 0.36 -1.37% 5.68685 -2.27% 3.95101 3.63% 4.14622 -0.41% 4053.1 2.80%

31-12-2004 5.58321 -3.40% 14.17 3.13% 6.63293 4.80% 0.345 -4.17% 5.75288 1.16% 3.79127 -4.04% 4.17155 0.61% 4106.7 1.32%

31-01-2005 5.64612 1.13% 14.25 0.56% 5.89593 -11.11% 0.33 -4.35% 5.88239 2.25% 3.86581 1.97% 4.44178 6.48% 4156.5 1.21%

28-02-2005 5.63039 -0.28% 13.6 -4.56% 5.61956 -4.69% 0.325 -1.52% 6.0609 3.03% 3.78062 -2.20% 4.29822 -3.23% 4100.6 -1.34%

31-03-2005 5.07993 -9.78% 12.8 -5.88% 5.32477 -5.25% 0.295 -9.23% 5.95889 -1.68% 3.42918 -9.30% 4.08711 -4.91% 3943.1 -3.84%

30-04-2005 5.33157 4.95% 12.9 0.78% 5.47216 2.77% 0.255 -13.56% 6.0694 1.85% 3.42918 0.00% 4.23911 3.72% 4070.4 3.23%

31-05-2005 5.26866 -1.18% 12.95 0.39% 5.96963 9.09% 0.27 5.88% 6.46893 6.58% 3.58892 4.66% 4.27289 0.80% 4229.9 3.92%

30-11-2002 6.67626 3.54% 6.04 -0.98% 4.00739 3.57% 0.28 21.74% 3.06215 3.06% 4.07881 1.06% 3.724 -3.50% 2975.5 -1.64%

31-12-2002 6.51112 -2.47% 6.05 0.17% 3.96133 -1.15% 0.25 -10.71% 3.21072 4.85% 3.98296 -2.35% 3.79155 1.81% 2935.4 -1.35%

31-01-2003 6.47967 -0.48% 5.6 -7.44% 4.0903 3.26% 0.265 6.00% 3.54912 10.54% 3.28009 -17.65% 3.37778 -10.91% 2778.4 -5.35%

28-02-2003 6.37744 -1.58% 5.55 -0.89% 4.2377 3.60% 0.29 9.43% 3.51611 -0.93% 3.16294 -3.57% 3.43689 1.75% 2848.6 2.53%

31-03-2003 6.53471 2.47% 6.5 17.12% 4.3851 3.48% 0.315 8.62% 3.70595 5.40% 3.38658 7.07% 3.55511 3.44% 2970.9 4.29%

30-04-2003 6.44821 -1.32% 5.95 -8.46% 4.51407 2.94% 0.27 -14.29% 3.7142 0.22% 3.42918 1.26% 3.80844 7.13% 2979.8 0.30%

31-05-2003 6.3853 -0.98% 6.32 6.22% 4.66147 3.27% 0.28 3.70% 3.34278 -10.00% 3.48243 1.55% 3.71555 -2.44% 2998.9 0.64%

30-06-2003 6.58976 3.20% 6.74 6.65% 5.08524 9.09% 0.35 25.00% 3.40056 1.73% 3.39723 -2.45% 3.952 6.36% 3106.7 3.59%

31-07-2003 7.1009 7.76% 6.76 0.30% 4.91021 -3.44% 0.34 -2.86% 3.44182 1.21% 3.45048 1.57% 4.23911 7.26% 3202.9 3.10%

31-08-2003 6.8414 -3.65% 7.75 14.64% 4.8273 -1.69% 0.33 -2.94% 3.53262 2.64% 3.49308 1.23% 4.00267 -5.58% 3176.2 -0.83%

30-09-2003 6.68412 -2.30% 7.7 -0.65% 5.06682 4.96% 0.3 -9.09% 3.54912 0.47% 3.84452 10.06% 4.00267 0.00% 3282.4 3.34%

31-10-2003 6.49539 -2.82% 7.93 2.99% 4.6062 -9.09% 0.28 -6.67% 3.85451 8.60% 3.54633 -7.76% 4.16311 4.01% 3195.7 -2.64%

30-11-2003 6.49539 0.00% 7.84 -1.13% 4.6799 1.60% 0.3 7.14% 3.92054 1.71% 3.50373 -1.20% 4.07022 -2.23% 3306 3.45%

31-12-2003 6.22017 -4.24% 8.05 2.68% 5.08524 8.66% 0.285 -5.00% 4.32498 10.32% 3.68477 5.17% 4.15467 2.07% 3283.6 -0.68%

31-01-2004 6.06289 -2.53% 8.11 0.75% 5.65641 11.23% 0.265 -7.02% 4.63037 7.06% 3.95101 7.23% 4.03644 -2.85% 3372.5 2.71%

29-02-2004 6.29094 3.76% 9.05 11.59% 5.82223 2.93% 0.27 1.89% 4.53958 -1.96% 3.63152 -8.09% 3.83378 -5.02% 3416.4 1.30%

31-03-2004 5.45739 -13.25% 9.31 2.87% 5.52744 -5.06% 0.28 3.70% 4.70465 3.64% 3.56763 -1.76% 4.03644 5.29% 3407.7 -0.25%

30-04-2004 5.21362 -4.47% 9.1 -2.26% 5.46295 -1.17% 0.27 -3.57% 4.55608 -3.16% 3.61022 1.19% 3.96044 -1.88% 3456.9 1.44%

31-05-2004 5.48098 5.13% 10 9.89% 5.95121 8.94% 0.355 31.48% 4.65513 2.17% 3.74867 3.83% 4.24755 7.25% 3530.3 2.12%

30-06-2004 5.39448 -1.58% 10.26 2.60% 6.67899 12.23% 0.46 29.58% 5.0183 7.80% 3.71672 -0.85% 4.16311 -1.99% 3546.1 0.45%

31-07-2004 5.76407 6.85% 11.45 11.60% 6.4671 -3.17% 0.355 -22.83% 4.86973 -2.96% 3.63152 -2.29% 4.05333 -2.64% 3561.9 0.45%

31-08-2004 5.64612 -2.05% 13.1 14.41% 6.34734 -1.85% 0.325 -8.45% 5.01004 2.88% 3.67412 1.17% 3.92667 -3.12% 3674.7 3.17%

30-09-2004 5.99998 6.27% 14.4 9.92% 6.11703 -3.63% 0.335 3.08% 5.5713 11.20% 3.53568 -3.77% 3.94355 0.43% 3786.3 3.04%

31-10-2004 5.82698 -2.88% 13.5 -6.25% 6.35655 3.92% 0.365 8.96% 5.81891 4.44% 3.81257 7.83% 4.16311 5.57% 3942.8 4.13%

30-11-2004 5.7798 -0.81% 13.74 1.78% 6.32892 -0.43% 0.36 -1.37% 5.68685 -2.27% 3.95101 3.63% 4.14622 -0.41% 4053.1 2.80%

31-12-2004 5.58321 -3.40% 14.17 3.13% 6.63293 4.80% 0.345 -4.17% 5.75288 1.16% 3.79127 -4.04% 4.17155 0.61% 4106.7 1.32%

31-01-2005 5.64612 1.13% 14.25 0.56% 5.89593 -11.11% 0.33 -4.35% 5.88239 2.25% 3.86581 1.97% 4.44178 6.48% 4156.5 1.21%

28-02-2005 5.63039 -0.28% 13.6 -4.56% 5.61956 -4.69% 0.325 -1.52% 6.0609 3.03% 3.78062 -2.20% 4.29822 -3.23% 4100.6 -1.34%

31-03-2005 5.07993 -9.78% 12.8 -5.88% 5.32477 -5.25% 0.295 -9.23% 5.95889 -1.68% 3.42918 -9.30% 4.08711 -4.91% 3943.1 -3.84%

30-04-2005 5.33157 4.95% 12.9 0.78% 5.47216 2.77% 0.255 -13.56% 6.0694 1.85% 3.42918 0.00% 4.23911 3.72% 4070.4 3.23%

31-05-2005 5.26866 -1.18% 12.95 0.39% 5.96963 9.09% 0.27 5.88% 6.46893 6.58% 3.58892 4.66% 4.27289 0.80% 4229.9 3.92%

5BUSINESS FINANCE

30-06-2005 5.51244 4.63% 13.5 4.25% 6.19073 3.70% 0.28 3.70% 6.21391 -3.94% 3.53568 -1.48% 4.28133 0.20% 4346.7 2.76%

31-07-2005 5.19003 -5.85% 13.95 3.33% 6.6882 8.04% 0.315 12.50% 6.16291 -0.82% 3.41853 -3.31% 3.952 -7.69% 4413.5 1.54%

31-08-2005 5.27653 1.67% 14.7 5.38% 7.4344 11.16% 0.305 -3.17% 6.21391 0.83% 3.58892 4.98% 3.43689 -13.03% 4592.6 4.06%

30-09-2005 5.24507 -0.60% 14.51 -1.29% 6.983 -6.07% 0.31 1.64% 5.71238 -8.07% 3.64217 1.48% 3.55511 3.44% 4412.7 -3.92%

31-10-2005 5.51244 5.10% 14.7 1.31% 7.56338 8.31% 0.275 -11.29% 5.9929 4.91% 4.01491 10.23% 3.25111 -8.55% 4583.6 3.87%

30-11-2005 5.87416 6.56% 14.45 -1.70% 7.46204 -1.34% 0.28 1.82% 6.38392 6.52% 4.30245 7.16% 3.31867 2.08% 4708.8 2.73%

31-12-2005 5.38662 -8.30% 14.65 1.38% 8.28194 10.99% 0.275 -1.79% 6.20541 -2.80% 4.3983 2.23% 3.36089 1.27% 4880.2 3.64%

31-01-2006 5.85057 8.61% 14.25 -2.73% 8.0977 -2.22% 0.265 -3.64% 5.86539 -5.48% 4.36635 -0.73% 3.25111 -3.27% 4878.4 -0.04%

28-02-2006 5.81912 -0.54% 14.8 3.86% 8.21746 1.48% 0.255 -3.77% 6.22241 6.09% 3.76997 -13.66% 3.15822 -2.86% 5087.2 4.28%

31-03-2006 5.68544 -2.30% 14.65 -1.01% 8.77941 6.84% 0.27 5.88% 5.9929 -3.69% 3.68477 -2.26% 3.32711 5.35% 5207 2.35%

30-04-2006 5.18216 -8.85% 14.25 -2.73% 8.38328 -4.51% 0.255 -5.56% 5.83989 -2.55% 3.35463 -8.96% 3.13289 -5.84% 4972.3 -4.51%

31-05-2006 5.25293 1.37% 13.9 -2.46% 7.49889 -10.55% 0.24 -5.88% 6.25641 7.13% 3.15229 -6.03% 3.10755 -0.81% 5034 1.24%

30-06-2006 5.32371 1.35% 13.02 -6.33% 6.93693 -7.49% 0.26 8.33% 6.41793 2.58% 3.24814 3.04% 3.22578 3.80% 4957.1 -1.53%

31-07-2006 5.27653 -0.89% 14.35 10.22% 6.26443 -9.69% 0.24 -7.69% 5.66988 -11.66% 3.78062 16.39% 3.04 -5.76% 5079.8 2.48%

31-08-2006 5.84271 10.73% 14.68 2.30% 6.66056 6.32% 0.24 0.00% 5.66988 0.00% 4.164 10.14% 3.13289 3.06% 5113 0.65%

30-09-2006 5.44166 -6.86% 17 15.80% 6.69741 0.55% 0.245 2.08% 6.0949 7.50% 4.51544 8.44% 3.344 6.74% 5352.9 4.69%

31-10-2006 5.85057 7.51% 16.94 -0.35% 6.84481 2.20% 0.235 -4.08% 6.40092 5.02% 5.27157 16.75% 3.77 12.74% 5461.6 2.03%

30-11-2006 5.70116 -2.55% 18 6.26% 7.02906 2.69% 0.235 0.00% 7.02997 9.83% 5.55911 5.45% 4.14 9.81% 5644.3 3.35%

31-12-2006 5.74048 0.69% 19.4 7.78% 7.36992 4.85% 0.225 -4.26% 7.71001 9.67% 5.74015 3.26% 4.24 2.42% 5757.7 2.01%

31-01-2007 5.73262 -0.14% 20.4 5.15% 7.73841 5.00% 0.22 -2.22% 7.5315 -2.32% 5.48456 -4.45% 4.26 0.47% 5816.5 1.02%

28-02-2007 5.93707 3.57% 22 7.84% 7.59101 -1.90% 0.18 -18.18% 7.65901 1.69% 5.59105 1.94% 4.66 9.39% 5978.8 2.79%

31-03-2007 5.85844 -1.32% 22.87 3.95% 7.79369 2.67% 0.17 -5.56% 7.73551 1.00% 5.6656 1.33% 4.67 0.21% 6158.3 3.00%

30-04-2007 5.85057 -0.13% 22.45 -1.84% 8.12533 4.26% 0.14 -17.65% 7.46349 -3.52% 6.07029 7.14% 4.86 4.07% 6341.8 2.98%

31-05-2007 5.87416 0.40% 20.56 -8.42% 8.07927 -0.57% 0.13 -7.14% 8.44956 13.21% 5.96379 -1.75% 4.59 -5.56% 6310.6 -0.49%

30-06-2007 5.38662 -8.30% 22.5 9.44% 7.13961 -11.63% 0.165 26.92% 8.35605 -1.11% 6.11289 2.50% 4.6 0.22% 6187.5 -1.95%

31-07-2007 5.97639 10.95% 22.04 -2.04% 7.26858 1.81% 0.155 -6.06% 8.47506 1.42% 5.94249 -2.79% 4.37 -5.00% 6248.3 0.98%

31-08-2007 5.80339 -2.89% 21.7 -1.54% 6.62371 -8.87% 0.17 9.68% 8.75558 3.31% 5.94249 0.00% 4.36 -0.23% 6580.9 5.32%

30-09-2007 5.5203 -4.88% 22.3 2.76% 6.23679 -5.84% 0.195 14.71% 7.77802 -11.16% 6.29393 5.91% 4.68 7.34% 6779.1 3.01%

31-10-2007 5.38662 -2.42% 22 -1.35% 5.90515 -5.32% 0.2 2.56% 7.39549 -4.92% 6.23003 -1.02% 4.67 -0.21% 6593.6 -2.74%

30-11-2007 5.4338 0.88% 21.56 -2.00% 5.63799 -4.52% 0.19 -5.00% 7.523 1.72% 5.7934 -7.01% 4.69 0.43% 6421 -2.62%

31-12-2007 5.42594 -0.14% 20.5 -4.92% 5.52744 -1.96% 0.135 -28.95% 7.41249 -1.47% 4.97338 -14.15% 4.34 -7.46% 5697 -11.28%

30-06-2005 5.51244 4.63% 13.5 4.25% 6.19073 3.70% 0.28 3.70% 6.21391 -3.94% 3.53568 -1.48% 4.28133 0.20% 4346.7 2.76%

31-07-2005 5.19003 -5.85% 13.95 3.33% 6.6882 8.04% 0.315 12.50% 6.16291 -0.82% 3.41853 -3.31% 3.952 -7.69% 4413.5 1.54%

31-08-2005 5.27653 1.67% 14.7 5.38% 7.4344 11.16% 0.305 -3.17% 6.21391 0.83% 3.58892 4.98% 3.43689 -13.03% 4592.6 4.06%

30-09-2005 5.24507 -0.60% 14.51 -1.29% 6.983 -6.07% 0.31 1.64% 5.71238 -8.07% 3.64217 1.48% 3.55511 3.44% 4412.7 -3.92%

31-10-2005 5.51244 5.10% 14.7 1.31% 7.56338 8.31% 0.275 -11.29% 5.9929 4.91% 4.01491 10.23% 3.25111 -8.55% 4583.6 3.87%

30-11-2005 5.87416 6.56% 14.45 -1.70% 7.46204 -1.34% 0.28 1.82% 6.38392 6.52% 4.30245 7.16% 3.31867 2.08% 4708.8 2.73%

31-12-2005 5.38662 -8.30% 14.65 1.38% 8.28194 10.99% 0.275 -1.79% 6.20541 -2.80% 4.3983 2.23% 3.36089 1.27% 4880.2 3.64%

31-01-2006 5.85057 8.61% 14.25 -2.73% 8.0977 -2.22% 0.265 -3.64% 5.86539 -5.48% 4.36635 -0.73% 3.25111 -3.27% 4878.4 -0.04%

28-02-2006 5.81912 -0.54% 14.8 3.86% 8.21746 1.48% 0.255 -3.77% 6.22241 6.09% 3.76997 -13.66% 3.15822 -2.86% 5087.2 4.28%

31-03-2006 5.68544 -2.30% 14.65 -1.01% 8.77941 6.84% 0.27 5.88% 5.9929 -3.69% 3.68477 -2.26% 3.32711 5.35% 5207 2.35%

30-04-2006 5.18216 -8.85% 14.25 -2.73% 8.38328 -4.51% 0.255 -5.56% 5.83989 -2.55% 3.35463 -8.96% 3.13289 -5.84% 4972.3 -4.51%

31-05-2006 5.25293 1.37% 13.9 -2.46% 7.49889 -10.55% 0.24 -5.88% 6.25641 7.13% 3.15229 -6.03% 3.10755 -0.81% 5034 1.24%

30-06-2006 5.32371 1.35% 13.02 -6.33% 6.93693 -7.49% 0.26 8.33% 6.41793 2.58% 3.24814 3.04% 3.22578 3.80% 4957.1 -1.53%

31-07-2006 5.27653 -0.89% 14.35 10.22% 6.26443 -9.69% 0.24 -7.69% 5.66988 -11.66% 3.78062 16.39% 3.04 -5.76% 5079.8 2.48%

31-08-2006 5.84271 10.73% 14.68 2.30% 6.66056 6.32% 0.24 0.00% 5.66988 0.00% 4.164 10.14% 3.13289 3.06% 5113 0.65%

30-09-2006 5.44166 -6.86% 17 15.80% 6.69741 0.55% 0.245 2.08% 6.0949 7.50% 4.51544 8.44% 3.344 6.74% 5352.9 4.69%

31-10-2006 5.85057 7.51% 16.94 -0.35% 6.84481 2.20% 0.235 -4.08% 6.40092 5.02% 5.27157 16.75% 3.77 12.74% 5461.6 2.03%

30-11-2006 5.70116 -2.55% 18 6.26% 7.02906 2.69% 0.235 0.00% 7.02997 9.83% 5.55911 5.45% 4.14 9.81% 5644.3 3.35%

31-12-2006 5.74048 0.69% 19.4 7.78% 7.36992 4.85% 0.225 -4.26% 7.71001 9.67% 5.74015 3.26% 4.24 2.42% 5757.7 2.01%

31-01-2007 5.73262 -0.14% 20.4 5.15% 7.73841 5.00% 0.22 -2.22% 7.5315 -2.32% 5.48456 -4.45% 4.26 0.47% 5816.5 1.02%

28-02-2007 5.93707 3.57% 22 7.84% 7.59101 -1.90% 0.18 -18.18% 7.65901 1.69% 5.59105 1.94% 4.66 9.39% 5978.8 2.79%

31-03-2007 5.85844 -1.32% 22.87 3.95% 7.79369 2.67% 0.17 -5.56% 7.73551 1.00% 5.6656 1.33% 4.67 0.21% 6158.3 3.00%

30-04-2007 5.85057 -0.13% 22.45 -1.84% 8.12533 4.26% 0.14 -17.65% 7.46349 -3.52% 6.07029 7.14% 4.86 4.07% 6341.8 2.98%

31-05-2007 5.87416 0.40% 20.56 -8.42% 8.07927 -0.57% 0.13 -7.14% 8.44956 13.21% 5.96379 -1.75% 4.59 -5.56% 6310.6 -0.49%

30-06-2007 5.38662 -8.30% 22.5 9.44% 7.13961 -11.63% 0.165 26.92% 8.35605 -1.11% 6.11289 2.50% 4.6 0.22% 6187.5 -1.95%

31-07-2007 5.97639 10.95% 22.04 -2.04% 7.26858 1.81% 0.155 -6.06% 8.47506 1.42% 5.94249 -2.79% 4.37 -5.00% 6248.3 0.98%

31-08-2007 5.80339 -2.89% 21.7 -1.54% 6.62371 -8.87% 0.17 9.68% 8.75558 3.31% 5.94249 0.00% 4.36 -0.23% 6580.9 5.32%

30-09-2007 5.5203 -4.88% 22.3 2.76% 6.23679 -5.84% 0.195 14.71% 7.77802 -11.16% 6.29393 5.91% 4.68 7.34% 6779.1 3.01%

31-10-2007 5.38662 -2.42% 22 -1.35% 5.90515 -5.32% 0.2 2.56% 7.39549 -4.92% 6.23003 -1.02% 4.67 -0.21% 6593.6 -2.74%

30-11-2007 5.4338 0.88% 21.56 -2.00% 5.63799 -4.52% 0.19 -5.00% 7.523 1.72% 5.7934 -7.01% 4.69 0.43% 6421 -2.62%

31-12-2007 5.42594 -0.14% 20.5 -4.92% 5.52744 -1.96% 0.135 -28.95% 7.41249 -1.47% 4.97338 -14.15% 4.34 -7.46% 5697 -11.28%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS FINANCE

31-01-2008 5.56748 2.61% 19.77 -3.56% 5.56429 0.67% 0.145 7.41% 7.523 1.49% 4.49414 -9.64% 4.87 12.21% 5674.7 -0.39%

29-02-2008 5.62253 0.99% 18.49 -6.47% 5.76696 3.64% 0.125 -13.79% 7.78652 3.50% 4.1853 -6.87% 4.4 -9.65% 5409.7 -4.67%

31-03-2008 5.30798 -5.59% 19.2 3.84% 5.73011 -0.64% 0.12 -4.00% 11.8583 52.29% 3.62087 -13.49% 4.56 3.64% 5657 4.57%

30-04-2008 4.78898 -9.78% 18.6 -3.13% 5.55508 -3.05% 0.145 20.83% 13.2609 11.83% 3.69542 2.06% 4.75 4.17% 5773.9 2.07%

31-05-2008 3.97116 -17.08% 16.4 -11.83% 5.205 -6.30% 0.1 -31.03% 13.7029 3.33% 3.23749 -12.39% 4.24 -10.74% 5332.9 -7.64%

30-06-2008 4.19134 5.54% 17.9 9.15% 5.14973 -1.06% 0.115 15.00% 13.4734 -1.67% 3.53568 9.21% 4.5 6.13% 5052.6 -5.26%

31-07-2008 4.32502 3.19% 18.25 1.96% 5.942 15.38% 0.11 -4.35% 13.7284 1.89% 3.59957 1.81% 4.35 -3.33% 5215.5 3.22%

31-08-2008 4.24638 -1.82% 17.37 -4.82% 5.63799 -5.12% 0.092 -16.36% 13.6944 -0.25% 3.33333 -7.40% 4.18 -3.91% 4631.3 -11.20%

30-09-2008 4.56093 7.41% 15.5 -10.77% 4.15479 -26.31% 0.087 -5.43% 13.3459 -2.54% 2.57721 -22.68% 4.12 -1.44% 3982.7 -14.00%

31-10-2008 4.66316 2.24% 13.65 -11.94% 3.67575 -11.53% 0.076 -12.64% 13.6009 1.91% 2.47071 -4.13% 4.06 -1.46% 3672.7 -7.78%

30-11-2008 4.56093 -2.19% 13.19 -3.37% 4.25613 15.79% 0.081 6.58% 13.7029 0.75% 2.80085 13.36% 3.83 -5.67% 3659.3 -0.36%

31-12-2008 4.23852 -7.07% 12.6 -4.47% 3.0493 -28.36% 0.095 17.28% 11.9008 -13.15% 2.60916 -6.84% 3.79 -1.04% 3478.1 -4.95%

31-01-2009 3.46002 -18.37% 11.8 -6.35% 2.60711 -14.50% 0.09 -5.26% 11.5608 -2.86% 1.66667 -36.12% 3.55 -6.33% 3296.9 -5.21%

28-02-2009 3.49934 1.14% 12.3 4.24% 3.32568 27.56% 0.098 8.89% 12.5808 8.82% 1.85836 11.50% 3.21 -9.58% 3532.3 7.14%

31-03-2009 3.7667 7.64% 15.73 27.89% 3.76787 13.30% 0.105 7.14% 13.8474 10.07% 2.10863 13.47% 3.33 3.74% 3744.7 6.01%

30-04-2009 4.01834 6.68% 15.92 1.21% 3.74945 -0.49% 0.13 23.81% 12.5808 -9.15% 2.0394 -3.28% 3.11 -6.61% 3813.3 1.83%

31-05-2009 3.92397 -2.35% 16 0.50% 3.74945 0.00% 0.105 -19.23% 12.4448 -1.08% 2.14058 4.96% 3.39 9.00% 3947.8 3.53%

30-06-2009 3.89252 -0.80% 15.8 -1.25% 4.59699 22.60% 0.115 9.52% 12.3258 -0.96% 2.47071 15.42% 3.53 4.13% 4249.5 7.64%

31-07-2009 5.18079 33.10% 19.8 25.32% 5.33398 16.03% 0.125 8.70% 13.0144 5.59% 2.69436 9.05% 3.26 -7.65% 4484.1 5.52%

31-08-2009 4.9204 -5.03% 20.34 2.73% 5.61035 5.18% 0.115 -8.00% 13.8729 6.60% 3.04579 13.04% 3.27 0.31% 4739.3 5.69%

30-09-2009 5.16283 4.93% 20.7 1.77% 5.34319 -4.76% 0.115 0.00% 13.6604 -1.53% 2.9819 -2.10% 3.32 1.53% 4646.9 -1.95%

31-10-2009 5.30649 2.78% 20.6 -0.48% 5.15894 -3.45% 0.135 17.39% 13.2694 -2.86% 2.7689 -7.14% 3.41 2.71% 4715.5 1.48%

30-11-2009 5.59382 5.41% 20.9 1.46% 5.48138 6.25% 0.12 -11.11% 14.2979 7.75% 3.18424 15.00% 3.43 0.59% 4882.7 3.55%

31-12-2009 5.28853 -5.46% 22 5.26% 4.91021 -10.42% 0.12 0.00% 13.6179 -4.76% 3.02449 -5.02% 3.34 -2.62% 4596.9 -5.85%

31-01-2010 5.32445 0.68% 21 -4.55% 4.94706 0.75% 0.11 -8.33% 14.2894 4.93% 2.8115 -7.04% 2.97 -11.08% 4651.1 1.18%

28-02-2010 5.73748 7.76% 22 4.76% 5.16815 4.47% 0.12 9.09% 14.0684 -1.55% 3.02449 7.58% 2.99 0.67% 4893.1 5.20%

31-03-2010 5.90807 2.97% 23.66 7.55% 5.45374 5.53% 0.105 -12.50% 13.9239 -1.03% 3.02449 0.00% 3.18 6.35% 4833.9 -1.21%

30-04-2010 5.51301 -6.69% 22.34 -5.58% 5.11288 -6.25% 0.097 -7.62% 12.7508 -8.43% 2.66241 -11.97% 2.94 -7.55% 4453.6 -7.87%

31-05-2010 5.7285 3.91% 22.3 -0.18% 4.44038 -13.15% 0.09 -7.22% 12.6998 -0.40% 2.34292 -12.00% 3.25 10.54% 4324.8 -2.89%

30-06-2010 5.89012 2.82% 22.71 1.84% 3.95095 -11.02% 0.099 10.00% 13.1249 3.35% 2.63046 12.27% 3.22 -0.92% 4507.4 4.22%

31-07-2010 6.05174 2.74% 24.15 6.34% 4.10004 3.77% 0.11 11.11% 12.9634 -1.23% 2.67306 1.62% 2.75 -14.60% 4438.8 -1.52%

31-01-2008 5.56748 2.61% 19.77 -3.56% 5.56429 0.67% 0.145 7.41% 7.523 1.49% 4.49414 -9.64% 4.87 12.21% 5674.7 -0.39%

29-02-2008 5.62253 0.99% 18.49 -6.47% 5.76696 3.64% 0.125 -13.79% 7.78652 3.50% 4.1853 -6.87% 4.4 -9.65% 5409.7 -4.67%

31-03-2008 5.30798 -5.59% 19.2 3.84% 5.73011 -0.64% 0.12 -4.00% 11.8583 52.29% 3.62087 -13.49% 4.56 3.64% 5657 4.57%

30-04-2008 4.78898 -9.78% 18.6 -3.13% 5.55508 -3.05% 0.145 20.83% 13.2609 11.83% 3.69542 2.06% 4.75 4.17% 5773.9 2.07%

31-05-2008 3.97116 -17.08% 16.4 -11.83% 5.205 -6.30% 0.1 -31.03% 13.7029 3.33% 3.23749 -12.39% 4.24 -10.74% 5332.9 -7.64%

30-06-2008 4.19134 5.54% 17.9 9.15% 5.14973 -1.06% 0.115 15.00% 13.4734 -1.67% 3.53568 9.21% 4.5 6.13% 5052.6 -5.26%

31-07-2008 4.32502 3.19% 18.25 1.96% 5.942 15.38% 0.11 -4.35% 13.7284 1.89% 3.59957 1.81% 4.35 -3.33% 5215.5 3.22%

31-08-2008 4.24638 -1.82% 17.37 -4.82% 5.63799 -5.12% 0.092 -16.36% 13.6944 -0.25% 3.33333 -7.40% 4.18 -3.91% 4631.3 -11.20%

30-09-2008 4.56093 7.41% 15.5 -10.77% 4.15479 -26.31% 0.087 -5.43% 13.3459 -2.54% 2.57721 -22.68% 4.12 -1.44% 3982.7 -14.00%

31-10-2008 4.66316 2.24% 13.65 -11.94% 3.67575 -11.53% 0.076 -12.64% 13.6009 1.91% 2.47071 -4.13% 4.06 -1.46% 3672.7 -7.78%

30-11-2008 4.56093 -2.19% 13.19 -3.37% 4.25613 15.79% 0.081 6.58% 13.7029 0.75% 2.80085 13.36% 3.83 -5.67% 3659.3 -0.36%

31-12-2008 4.23852 -7.07% 12.6 -4.47% 3.0493 -28.36% 0.095 17.28% 11.9008 -13.15% 2.60916 -6.84% 3.79 -1.04% 3478.1 -4.95%

31-01-2009 3.46002 -18.37% 11.8 -6.35% 2.60711 -14.50% 0.09 -5.26% 11.5608 -2.86% 1.66667 -36.12% 3.55 -6.33% 3296.9 -5.21%

28-02-2009 3.49934 1.14% 12.3 4.24% 3.32568 27.56% 0.098 8.89% 12.5808 8.82% 1.85836 11.50% 3.21 -9.58% 3532.3 7.14%

31-03-2009 3.7667 7.64% 15.73 27.89% 3.76787 13.30% 0.105 7.14% 13.8474 10.07% 2.10863 13.47% 3.33 3.74% 3744.7 6.01%

30-04-2009 4.01834 6.68% 15.92 1.21% 3.74945 -0.49% 0.13 23.81% 12.5808 -9.15% 2.0394 -3.28% 3.11 -6.61% 3813.3 1.83%

31-05-2009 3.92397 -2.35% 16 0.50% 3.74945 0.00% 0.105 -19.23% 12.4448 -1.08% 2.14058 4.96% 3.39 9.00% 3947.8 3.53%

30-06-2009 3.89252 -0.80% 15.8 -1.25% 4.59699 22.60% 0.115 9.52% 12.3258 -0.96% 2.47071 15.42% 3.53 4.13% 4249.5 7.64%

31-07-2009 5.18079 33.10% 19.8 25.32% 5.33398 16.03% 0.125 8.70% 13.0144 5.59% 2.69436 9.05% 3.26 -7.65% 4484.1 5.52%

31-08-2009 4.9204 -5.03% 20.34 2.73% 5.61035 5.18% 0.115 -8.00% 13.8729 6.60% 3.04579 13.04% 3.27 0.31% 4739.3 5.69%

30-09-2009 5.16283 4.93% 20.7 1.77% 5.34319 -4.76% 0.115 0.00% 13.6604 -1.53% 2.9819 -2.10% 3.32 1.53% 4646.9 -1.95%

31-10-2009 5.30649 2.78% 20.6 -0.48% 5.15894 -3.45% 0.135 17.39% 13.2694 -2.86% 2.7689 -7.14% 3.41 2.71% 4715.5 1.48%

30-11-2009 5.59382 5.41% 20.9 1.46% 5.48138 6.25% 0.12 -11.11% 14.2979 7.75% 3.18424 15.00% 3.43 0.59% 4882.7 3.55%

31-12-2009 5.28853 -5.46% 22 5.26% 4.91021 -10.42% 0.12 0.00% 13.6179 -4.76% 3.02449 -5.02% 3.34 -2.62% 4596.9 -5.85%

31-01-2010 5.32445 0.68% 21 -4.55% 4.94706 0.75% 0.11 -8.33% 14.2894 4.93% 2.8115 -7.04% 2.97 -11.08% 4651.1 1.18%

28-02-2010 5.73748 7.76% 22 4.76% 5.16815 4.47% 0.12 9.09% 14.0684 -1.55% 3.02449 7.58% 2.99 0.67% 4893.1 5.20%

31-03-2010 5.90807 2.97% 23.66 7.55% 5.45374 5.53% 0.105 -12.50% 13.9239 -1.03% 3.02449 0.00% 3.18 6.35% 4833.9 -1.21%

30-04-2010 5.51301 -6.69% 22.34 -5.58% 5.11288 -6.25% 0.097 -7.62% 12.7508 -8.43% 2.66241 -11.97% 2.94 -7.55% 4453.6 -7.87%

31-05-2010 5.7285 3.91% 22.3 -0.18% 4.44038 -13.15% 0.09 -7.22% 12.6998 -0.40% 2.34292 -12.00% 3.25 10.54% 4324.8 -2.89%

30-06-2010 5.89012 2.82% 22.71 1.84% 3.95095 -11.02% 0.099 10.00% 13.1249 3.35% 2.63046 12.27% 3.22 -0.92% 4507.4 4.22%

31-07-2010 6.05174 2.74% 24.15 6.34% 4.10004 3.77% 0.11 11.11% 12.9634 -1.23% 2.67306 1.62% 2.75 -14.60% 4438.8 -1.52%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

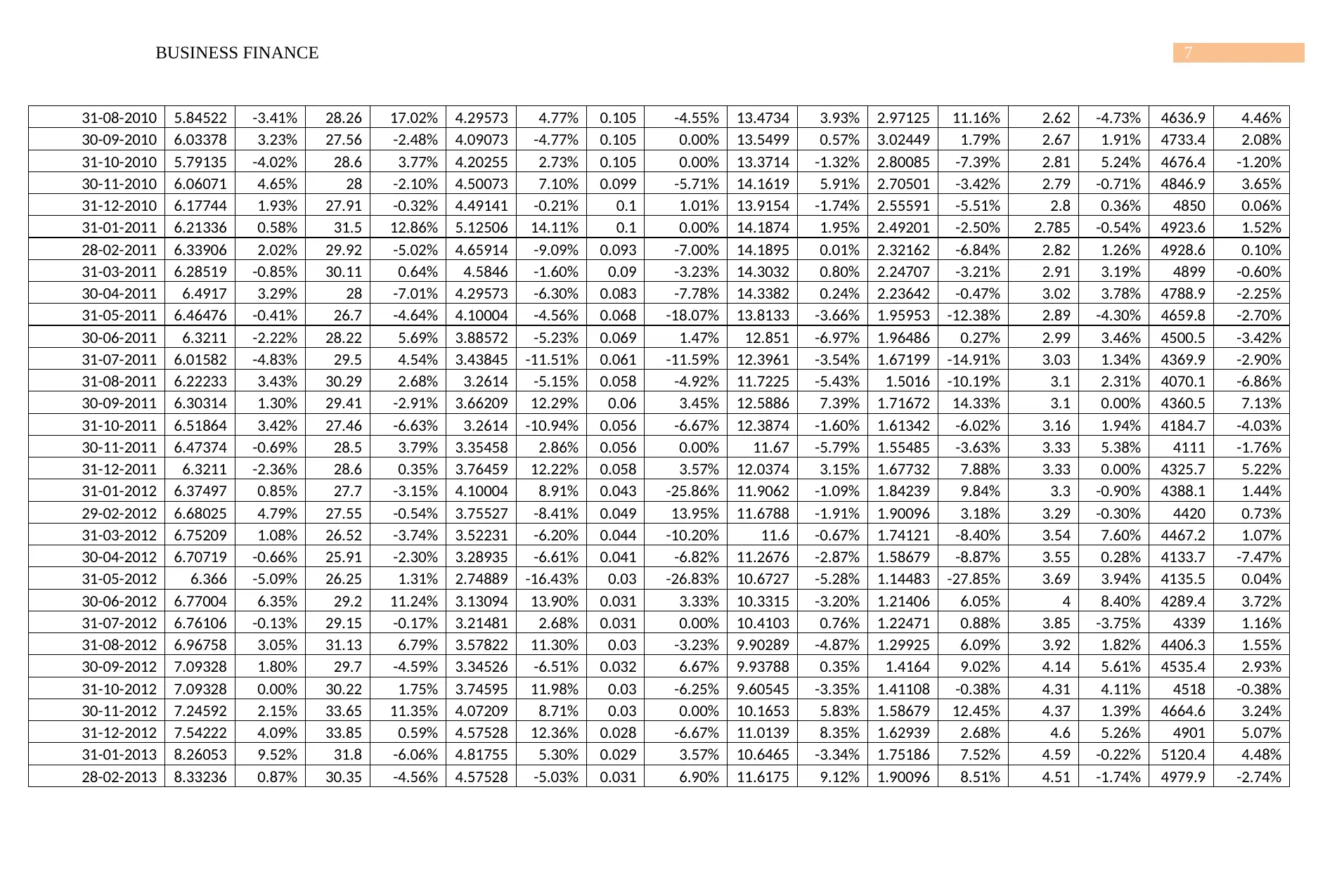

7BUSINESS FINANCE

31-08-2010 5.84522 -3.41% 28.26 17.02% 4.29573 4.77% 0.105 -4.55% 13.4734 3.93% 2.97125 11.16% 2.62 -4.73% 4636.9 4.46%

30-09-2010 6.03378 3.23% 27.56 -2.48% 4.09073 -4.77% 0.105 0.00% 13.5499 0.57% 3.02449 1.79% 2.67 1.91% 4733.4 2.08%

31-10-2010 5.79135 -4.02% 28.6 3.77% 4.20255 2.73% 0.105 0.00% 13.3714 -1.32% 2.80085 -7.39% 2.81 5.24% 4676.4 -1.20%

30-11-2010 6.06071 4.65% 28 -2.10% 4.50073 7.10% 0.099 -5.71% 14.1619 5.91% 2.70501 -3.42% 2.79 -0.71% 4846.9 3.65%

31-12-2010 6.17744 1.93% 27.91 -0.32% 4.49141 -0.21% 0.1 1.01% 13.9154 -1.74% 2.55591 -5.51% 2.8 0.36% 4850 0.06%

31-01-2011 6.21336 0.58% 31.5 12.86% 5.12506 14.11% 0.1 0.00% 14.1874 1.95% 2.49201 -2.50% 2.785 -0.54% 4923.6 1.52%

28-02-2011 6.33906 2.02% 29.92 -5.02% 4.65914 -9.09% 0.093 -7.00% 14.1895 0.01% 2.32162 -6.84% 2.82 1.26% 4928.6 0.10%

31-03-2011 6.28519 -0.85% 30.11 0.64% 4.5846 -1.60% 0.09 -3.23% 14.3032 0.80% 2.24707 -3.21% 2.91 3.19% 4899 -0.60%

30-04-2011 6.4917 3.29% 28 -7.01% 4.29573 -6.30% 0.083 -7.78% 14.3382 0.24% 2.23642 -0.47% 3.02 3.78% 4788.9 -2.25%

31-05-2011 6.46476 -0.41% 26.7 -4.64% 4.10004 -4.56% 0.068 -18.07% 13.8133 -3.66% 1.95953 -12.38% 2.89 -4.30% 4659.8 -2.70%

30-06-2011 6.3211 -2.22% 28.22 5.69% 3.88572 -5.23% 0.069 1.47% 12.851 -6.97% 1.96486 0.27% 2.99 3.46% 4500.5 -3.42%

31-07-2011 6.01582 -4.83% 29.5 4.54% 3.43845 -11.51% 0.061 -11.59% 12.3961 -3.54% 1.67199 -14.91% 3.03 1.34% 4369.9 -2.90%

31-08-2011 6.22233 3.43% 30.29 2.68% 3.2614 -5.15% 0.058 -4.92% 11.7225 -5.43% 1.5016 -10.19% 3.1 2.31% 4070.1 -6.86%

30-09-2011 6.30314 1.30% 29.41 -2.91% 3.66209 12.29% 0.06 3.45% 12.5886 7.39% 1.71672 14.33% 3.1 0.00% 4360.5 7.13%

31-10-2011 6.51864 3.42% 27.46 -6.63% 3.2614 -10.94% 0.056 -6.67% 12.3874 -1.60% 1.61342 -6.02% 3.16 1.94% 4184.7 -4.03%

30-11-2011 6.47374 -0.69% 28.5 3.79% 3.35458 2.86% 0.056 0.00% 11.67 -5.79% 1.55485 -3.63% 3.33 5.38% 4111 -1.76%

31-12-2011 6.3211 -2.36% 28.6 0.35% 3.76459 12.22% 0.058 3.57% 12.0374 3.15% 1.67732 7.88% 3.33 0.00% 4325.7 5.22%

31-01-2012 6.37497 0.85% 27.7 -3.15% 4.10004 8.91% 0.043 -25.86% 11.9062 -1.09% 1.84239 9.84% 3.3 -0.90% 4388.1 1.44%

29-02-2012 6.68025 4.79% 27.55 -0.54% 3.75527 -8.41% 0.049 13.95% 11.6788 -1.91% 1.90096 3.18% 3.29 -0.30% 4420 0.73%

31-03-2012 6.75209 1.08% 26.52 -3.74% 3.52231 -6.20% 0.044 -10.20% 11.6 -0.67% 1.74121 -8.40% 3.54 7.60% 4467.2 1.07%

30-04-2012 6.70719 -0.66% 25.91 -2.30% 3.28935 -6.61% 0.041 -6.82% 11.2676 -2.87% 1.58679 -8.87% 3.55 0.28% 4133.7 -7.47%

31-05-2012 6.366 -5.09% 26.25 1.31% 2.74889 -16.43% 0.03 -26.83% 10.6727 -5.28% 1.14483 -27.85% 3.69 3.94% 4135.5 0.04%

30-06-2012 6.77004 6.35% 29.2 11.24% 3.13094 13.90% 0.031 3.33% 10.3315 -3.20% 1.21406 6.05% 4 8.40% 4289.4 3.72%

31-07-2012 6.76106 -0.13% 29.15 -0.17% 3.21481 2.68% 0.031 0.00% 10.4103 0.76% 1.22471 0.88% 3.85 -3.75% 4339 1.16%

31-08-2012 6.96758 3.05% 31.13 6.79% 3.57822 11.30% 0.03 -3.23% 9.90289 -4.87% 1.29925 6.09% 3.92 1.82% 4406.3 1.55%

30-09-2012 7.09328 1.80% 29.7 -4.59% 3.34526 -6.51% 0.032 6.67% 9.93788 0.35% 1.4164 9.02% 4.14 5.61% 4535.4 2.93%

31-10-2012 7.09328 0.00% 30.22 1.75% 3.74595 11.98% 0.03 -6.25% 9.60545 -3.35% 1.41108 -0.38% 4.31 4.11% 4518 -0.38%

30-11-2012 7.24592 2.15% 33.65 11.35% 4.07209 8.71% 0.03 0.00% 10.1653 5.83% 1.58679 12.45% 4.37 1.39% 4664.6 3.24%

31-12-2012 7.54222 4.09% 33.85 0.59% 4.57528 12.36% 0.028 -6.67% 11.0139 8.35% 1.62939 2.68% 4.6 5.26% 4901 5.07%

31-01-2013 8.26053 9.52% 31.8 -6.06% 4.81755 5.30% 0.029 3.57% 10.6465 -3.34% 1.75186 7.52% 4.59 -0.22% 5120.4 4.48%

28-02-2013 8.33236 0.87% 30.35 -4.56% 4.57528 -5.03% 0.031 6.90% 11.6175 9.12% 1.90096 8.51% 4.51 -1.74% 4979.9 -2.74%

31-08-2010 5.84522 -3.41% 28.26 17.02% 4.29573 4.77% 0.105 -4.55% 13.4734 3.93% 2.97125 11.16% 2.62 -4.73% 4636.9 4.46%

30-09-2010 6.03378 3.23% 27.56 -2.48% 4.09073 -4.77% 0.105 0.00% 13.5499 0.57% 3.02449 1.79% 2.67 1.91% 4733.4 2.08%

31-10-2010 5.79135 -4.02% 28.6 3.77% 4.20255 2.73% 0.105 0.00% 13.3714 -1.32% 2.80085 -7.39% 2.81 5.24% 4676.4 -1.20%

30-11-2010 6.06071 4.65% 28 -2.10% 4.50073 7.10% 0.099 -5.71% 14.1619 5.91% 2.70501 -3.42% 2.79 -0.71% 4846.9 3.65%

31-12-2010 6.17744 1.93% 27.91 -0.32% 4.49141 -0.21% 0.1 1.01% 13.9154 -1.74% 2.55591 -5.51% 2.8 0.36% 4850 0.06%

31-01-2011 6.21336 0.58% 31.5 12.86% 5.12506 14.11% 0.1 0.00% 14.1874 1.95% 2.49201 -2.50% 2.785 -0.54% 4923.6 1.52%

28-02-2011 6.33906 2.02% 29.92 -5.02% 4.65914 -9.09% 0.093 -7.00% 14.1895 0.01% 2.32162 -6.84% 2.82 1.26% 4928.6 0.10%

31-03-2011 6.28519 -0.85% 30.11 0.64% 4.5846 -1.60% 0.09 -3.23% 14.3032 0.80% 2.24707 -3.21% 2.91 3.19% 4899 -0.60%

30-04-2011 6.4917 3.29% 28 -7.01% 4.29573 -6.30% 0.083 -7.78% 14.3382 0.24% 2.23642 -0.47% 3.02 3.78% 4788.9 -2.25%

31-05-2011 6.46476 -0.41% 26.7 -4.64% 4.10004 -4.56% 0.068 -18.07% 13.8133 -3.66% 1.95953 -12.38% 2.89 -4.30% 4659.8 -2.70%

30-06-2011 6.3211 -2.22% 28.22 5.69% 3.88572 -5.23% 0.069 1.47% 12.851 -6.97% 1.96486 0.27% 2.99 3.46% 4500.5 -3.42%

31-07-2011 6.01582 -4.83% 29.5 4.54% 3.43845 -11.51% 0.061 -11.59% 12.3961 -3.54% 1.67199 -14.91% 3.03 1.34% 4369.9 -2.90%

31-08-2011 6.22233 3.43% 30.29 2.68% 3.2614 -5.15% 0.058 -4.92% 11.7225 -5.43% 1.5016 -10.19% 3.1 2.31% 4070.1 -6.86%

30-09-2011 6.30314 1.30% 29.41 -2.91% 3.66209 12.29% 0.06 3.45% 12.5886 7.39% 1.71672 14.33% 3.1 0.00% 4360.5 7.13%

31-10-2011 6.51864 3.42% 27.46 -6.63% 3.2614 -10.94% 0.056 -6.67% 12.3874 -1.60% 1.61342 -6.02% 3.16 1.94% 4184.7 -4.03%

30-11-2011 6.47374 -0.69% 28.5 3.79% 3.35458 2.86% 0.056 0.00% 11.67 -5.79% 1.55485 -3.63% 3.33 5.38% 4111 -1.76%

31-12-2011 6.3211 -2.36% 28.6 0.35% 3.76459 12.22% 0.058 3.57% 12.0374 3.15% 1.67732 7.88% 3.33 0.00% 4325.7 5.22%

31-01-2012 6.37497 0.85% 27.7 -3.15% 4.10004 8.91% 0.043 -25.86% 11.9062 -1.09% 1.84239 9.84% 3.3 -0.90% 4388.1 1.44%

29-02-2012 6.68025 4.79% 27.55 -0.54% 3.75527 -8.41% 0.049 13.95% 11.6788 -1.91% 1.90096 3.18% 3.29 -0.30% 4420 0.73%

31-03-2012 6.75209 1.08% 26.52 -3.74% 3.52231 -6.20% 0.044 -10.20% 11.6 -0.67% 1.74121 -8.40% 3.54 7.60% 4467.2 1.07%

30-04-2012 6.70719 -0.66% 25.91 -2.30% 3.28935 -6.61% 0.041 -6.82% 11.2676 -2.87% 1.58679 -8.87% 3.55 0.28% 4133.7 -7.47%

31-05-2012 6.366 -5.09% 26.25 1.31% 2.74889 -16.43% 0.03 -26.83% 10.6727 -5.28% 1.14483 -27.85% 3.69 3.94% 4135.5 0.04%

30-06-2012 6.77004 6.35% 29.2 11.24% 3.13094 13.90% 0.031 3.33% 10.3315 -3.20% 1.21406 6.05% 4 8.40% 4289.4 3.72%

31-07-2012 6.76106 -0.13% 29.15 -0.17% 3.21481 2.68% 0.031 0.00% 10.4103 0.76% 1.22471 0.88% 3.85 -3.75% 4339 1.16%

31-08-2012 6.96758 3.05% 31.13 6.79% 3.57822 11.30% 0.03 -3.23% 9.90289 -4.87% 1.29925 6.09% 3.92 1.82% 4406.3 1.55%

30-09-2012 7.09328 1.80% 29.7 -4.59% 3.34526 -6.51% 0.032 6.67% 9.93788 0.35% 1.4164 9.02% 4.14 5.61% 4535.4 2.93%

31-10-2012 7.09328 0.00% 30.22 1.75% 3.74595 11.98% 0.03 -6.25% 9.60545 -3.35% 1.41108 -0.38% 4.31 4.11% 4518 -0.38%

30-11-2012 7.24592 2.15% 33.65 11.35% 4.07209 8.71% 0.03 0.00% 10.1653 5.83% 1.58679 12.45% 4.37 1.39% 4664.6 3.24%

31-12-2012 7.54222 4.09% 33.85 0.59% 4.57528 12.36% 0.028 -6.67% 11.0139 8.35% 1.62939 2.68% 4.6 5.26% 4901 5.07%

31-01-2013 8.26053 9.52% 31.8 -6.06% 4.81755 5.30% 0.029 3.57% 10.6465 -3.34% 1.75186 7.52% 4.59 -0.22% 5120.4 4.48%

28-02-2013 8.33236 0.87% 30.35 -4.56% 4.57528 -5.03% 0.031 6.90% 11.6175 9.12% 1.90096 8.51% 4.51 -1.74% 4979.9 -2.74%

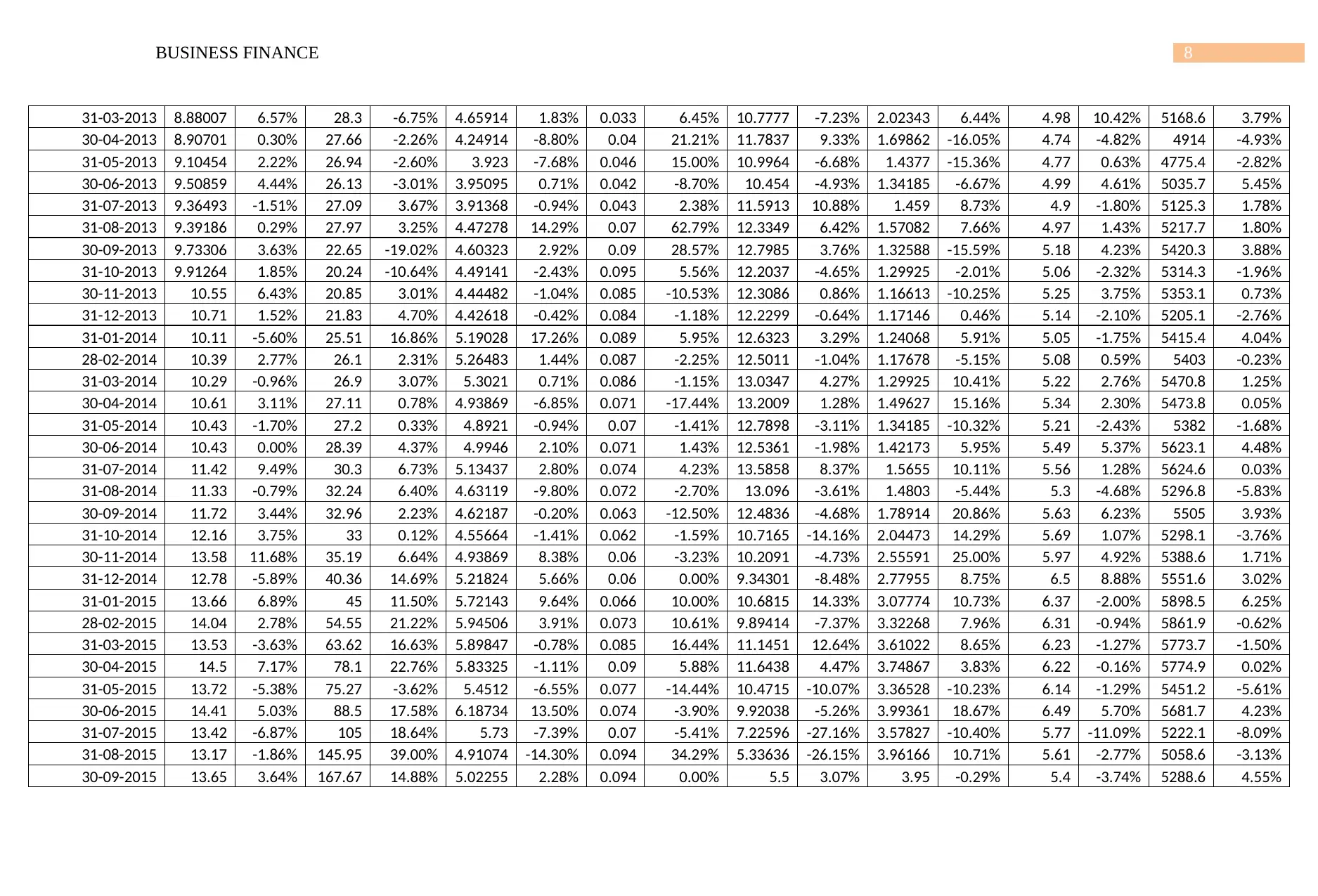

8BUSINESS FINANCE

31-03-2013 8.88007 6.57% 28.3 -6.75% 4.65914 1.83% 0.033 6.45% 10.7777 -7.23% 2.02343 6.44% 4.98 10.42% 5168.6 3.79%

30-04-2013 8.90701 0.30% 27.66 -2.26% 4.24914 -8.80% 0.04 21.21% 11.7837 9.33% 1.69862 -16.05% 4.74 -4.82% 4914 -4.93%

31-05-2013 9.10454 2.22% 26.94 -2.60% 3.923 -7.68% 0.046 15.00% 10.9964 -6.68% 1.4377 -15.36% 4.77 0.63% 4775.4 -2.82%

30-06-2013 9.50859 4.44% 26.13 -3.01% 3.95095 0.71% 0.042 -8.70% 10.454 -4.93% 1.34185 -6.67% 4.99 4.61% 5035.7 5.45%

31-07-2013 9.36493 -1.51% 27.09 3.67% 3.91368 -0.94% 0.043 2.38% 11.5913 10.88% 1.459 8.73% 4.9 -1.80% 5125.3 1.78%

31-08-2013 9.39186 0.29% 27.97 3.25% 4.47278 14.29% 0.07 62.79% 12.3349 6.42% 1.57082 7.66% 4.97 1.43% 5217.7 1.80%

30-09-2013 9.73306 3.63% 22.65 -19.02% 4.60323 2.92% 0.09 28.57% 12.7985 3.76% 1.32588 -15.59% 5.18 4.23% 5420.3 3.88%

31-10-2013 9.91264 1.85% 20.24 -10.64% 4.49141 -2.43% 0.095 5.56% 12.2037 -4.65% 1.29925 -2.01% 5.06 -2.32% 5314.3 -1.96%

30-11-2013 10.55 6.43% 20.85 3.01% 4.44482 -1.04% 0.085 -10.53% 12.3086 0.86% 1.16613 -10.25% 5.25 3.75% 5353.1 0.73%

31-12-2013 10.71 1.52% 21.83 4.70% 4.42618 -0.42% 0.084 -1.18% 12.2299 -0.64% 1.17146 0.46% 5.14 -2.10% 5205.1 -2.76%

31-01-2014 10.11 -5.60% 25.51 16.86% 5.19028 17.26% 0.089 5.95% 12.6323 3.29% 1.24068 5.91% 5.05 -1.75% 5415.4 4.04%

28-02-2014 10.39 2.77% 26.1 2.31% 5.26483 1.44% 0.087 -2.25% 12.5011 -1.04% 1.17678 -5.15% 5.08 0.59% 5403 -0.23%

31-03-2014 10.29 -0.96% 26.9 3.07% 5.3021 0.71% 0.086 -1.15% 13.0347 4.27% 1.29925 10.41% 5.22 2.76% 5470.8 1.25%

30-04-2014 10.61 3.11% 27.11 0.78% 4.93869 -6.85% 0.071 -17.44% 13.2009 1.28% 1.49627 15.16% 5.34 2.30% 5473.8 0.05%

31-05-2014 10.43 -1.70% 27.2 0.33% 4.8921 -0.94% 0.07 -1.41% 12.7898 -3.11% 1.34185 -10.32% 5.21 -2.43% 5382 -1.68%

30-06-2014 10.43 0.00% 28.39 4.37% 4.9946 2.10% 0.071 1.43% 12.5361 -1.98% 1.42173 5.95% 5.49 5.37% 5623.1 4.48%

31-07-2014 11.42 9.49% 30.3 6.73% 5.13437 2.80% 0.074 4.23% 13.5858 8.37% 1.5655 10.11% 5.56 1.28% 5624.6 0.03%

31-08-2014 11.33 -0.79% 32.24 6.40% 4.63119 -9.80% 0.072 -2.70% 13.096 -3.61% 1.4803 -5.44% 5.3 -4.68% 5296.8 -5.83%

30-09-2014 11.72 3.44% 32.96 2.23% 4.62187 -0.20% 0.063 -12.50% 12.4836 -4.68% 1.78914 20.86% 5.63 6.23% 5505 3.93%

31-10-2014 12.16 3.75% 33 0.12% 4.55664 -1.41% 0.062 -1.59% 10.7165 -14.16% 2.04473 14.29% 5.69 1.07% 5298.1 -3.76%

30-11-2014 13.58 11.68% 35.19 6.64% 4.93869 8.38% 0.06 -3.23% 10.2091 -4.73% 2.55591 25.00% 5.97 4.92% 5388.6 1.71%

31-12-2014 12.78 -5.89% 40.36 14.69% 5.21824 5.66% 0.06 0.00% 9.34301 -8.48% 2.77955 8.75% 6.5 8.88% 5551.6 3.02%

31-01-2015 13.66 6.89% 45 11.50% 5.72143 9.64% 0.066 10.00% 10.6815 14.33% 3.07774 10.73% 6.37 -2.00% 5898.5 6.25%

28-02-2015 14.04 2.78% 54.55 21.22% 5.94506 3.91% 0.073 10.61% 9.89414 -7.37% 3.32268 7.96% 6.31 -0.94% 5861.9 -0.62%

31-03-2015 13.53 -3.63% 63.62 16.63% 5.89847 -0.78% 0.085 16.44% 11.1451 12.64% 3.61022 8.65% 6.23 -1.27% 5773.7 -1.50%

30-04-2015 14.5 7.17% 78.1 22.76% 5.83325 -1.11% 0.09 5.88% 11.6438 4.47% 3.74867 3.83% 6.22 -0.16% 5774.9 0.02%

31-05-2015 13.72 -5.38% 75.27 -3.62% 5.4512 -6.55% 0.077 -14.44% 10.4715 -10.07% 3.36528 -10.23% 6.14 -1.29% 5451.2 -5.61%

30-06-2015 14.41 5.03% 88.5 17.58% 6.18734 13.50% 0.074 -3.90% 9.92038 -5.26% 3.99361 18.67% 6.49 5.70% 5681.7 4.23%

31-07-2015 13.42 -6.87% 105 18.64% 5.73 -7.39% 0.07 -5.41% 7.22596 -27.16% 3.57827 -10.40% 5.77 -11.09% 5222.1 -8.09%

31-08-2015 13.17 -1.86% 145.95 39.00% 4.91074 -14.30% 0.094 34.29% 5.33636 -26.15% 3.96166 10.71% 5.61 -2.77% 5058.6 -3.13%

30-09-2015 13.65 3.64% 167.67 14.88% 5.02255 2.28% 0.094 0.00% 5.5 3.07% 3.95 -0.29% 5.4 -3.74% 5288.6 4.55%

31-03-2013 8.88007 6.57% 28.3 -6.75% 4.65914 1.83% 0.033 6.45% 10.7777 -7.23% 2.02343 6.44% 4.98 10.42% 5168.6 3.79%

30-04-2013 8.90701 0.30% 27.66 -2.26% 4.24914 -8.80% 0.04 21.21% 11.7837 9.33% 1.69862 -16.05% 4.74 -4.82% 4914 -4.93%

31-05-2013 9.10454 2.22% 26.94 -2.60% 3.923 -7.68% 0.046 15.00% 10.9964 -6.68% 1.4377 -15.36% 4.77 0.63% 4775.4 -2.82%

30-06-2013 9.50859 4.44% 26.13 -3.01% 3.95095 0.71% 0.042 -8.70% 10.454 -4.93% 1.34185 -6.67% 4.99 4.61% 5035.7 5.45%

31-07-2013 9.36493 -1.51% 27.09 3.67% 3.91368 -0.94% 0.043 2.38% 11.5913 10.88% 1.459 8.73% 4.9 -1.80% 5125.3 1.78%

31-08-2013 9.39186 0.29% 27.97 3.25% 4.47278 14.29% 0.07 62.79% 12.3349 6.42% 1.57082 7.66% 4.97 1.43% 5217.7 1.80%

30-09-2013 9.73306 3.63% 22.65 -19.02% 4.60323 2.92% 0.09 28.57% 12.7985 3.76% 1.32588 -15.59% 5.18 4.23% 5420.3 3.88%

31-10-2013 9.91264 1.85% 20.24 -10.64% 4.49141 -2.43% 0.095 5.56% 12.2037 -4.65% 1.29925 -2.01% 5.06 -2.32% 5314.3 -1.96%

30-11-2013 10.55 6.43% 20.85 3.01% 4.44482 -1.04% 0.085 -10.53% 12.3086 0.86% 1.16613 -10.25% 5.25 3.75% 5353.1 0.73%

31-12-2013 10.71 1.52% 21.83 4.70% 4.42618 -0.42% 0.084 -1.18% 12.2299 -0.64% 1.17146 0.46% 5.14 -2.10% 5205.1 -2.76%

31-01-2014 10.11 -5.60% 25.51 16.86% 5.19028 17.26% 0.089 5.95% 12.6323 3.29% 1.24068 5.91% 5.05 -1.75% 5415.4 4.04%

28-02-2014 10.39 2.77% 26.1 2.31% 5.26483 1.44% 0.087 -2.25% 12.5011 -1.04% 1.17678 -5.15% 5.08 0.59% 5403 -0.23%

31-03-2014 10.29 -0.96% 26.9 3.07% 5.3021 0.71% 0.086 -1.15% 13.0347 4.27% 1.29925 10.41% 5.22 2.76% 5470.8 1.25%

30-04-2014 10.61 3.11% 27.11 0.78% 4.93869 -6.85% 0.071 -17.44% 13.2009 1.28% 1.49627 15.16% 5.34 2.30% 5473.8 0.05%

31-05-2014 10.43 -1.70% 27.2 0.33% 4.8921 -0.94% 0.07 -1.41% 12.7898 -3.11% 1.34185 -10.32% 5.21 -2.43% 5382 -1.68%

30-06-2014 10.43 0.00% 28.39 4.37% 4.9946 2.10% 0.071 1.43% 12.5361 -1.98% 1.42173 5.95% 5.49 5.37% 5623.1 4.48%

31-07-2014 11.42 9.49% 30.3 6.73% 5.13437 2.80% 0.074 4.23% 13.5858 8.37% 1.5655 10.11% 5.56 1.28% 5624.6 0.03%

31-08-2014 11.33 -0.79% 32.24 6.40% 4.63119 -9.80% 0.072 -2.70% 13.096 -3.61% 1.4803 -5.44% 5.3 -4.68% 5296.8 -5.83%

30-09-2014 11.72 3.44% 32.96 2.23% 4.62187 -0.20% 0.063 -12.50% 12.4836 -4.68% 1.78914 20.86% 5.63 6.23% 5505 3.93%

31-10-2014 12.16 3.75% 33 0.12% 4.55664 -1.41% 0.062 -1.59% 10.7165 -14.16% 2.04473 14.29% 5.69 1.07% 5298.1 -3.76%

30-11-2014 13.58 11.68% 35.19 6.64% 4.93869 8.38% 0.06 -3.23% 10.2091 -4.73% 2.55591 25.00% 5.97 4.92% 5388.6 1.71%

31-12-2014 12.78 -5.89% 40.36 14.69% 5.21824 5.66% 0.06 0.00% 9.34301 -8.48% 2.77955 8.75% 6.5 8.88% 5551.6 3.02%

31-01-2015 13.66 6.89% 45 11.50% 5.72143 9.64% 0.066 10.00% 10.6815 14.33% 3.07774 10.73% 6.37 -2.00% 5898.5 6.25%

28-02-2015 14.04 2.78% 54.55 21.22% 5.94506 3.91% 0.073 10.61% 9.89414 -7.37% 3.32268 7.96% 6.31 -0.94% 5861.9 -0.62%

31-03-2015 13.53 -3.63% 63.62 16.63% 5.89847 -0.78% 0.085 16.44% 11.1451 12.64% 3.61022 8.65% 6.23 -1.27% 5773.7 -1.50%

30-04-2015 14.5 7.17% 78.1 22.76% 5.83325 -1.11% 0.09 5.88% 11.6438 4.47% 3.74867 3.83% 6.22 -0.16% 5774.9 0.02%

31-05-2015 13.72 -5.38% 75.27 -3.62% 5.4512 -6.55% 0.077 -14.44% 10.4715 -10.07% 3.36528 -10.23% 6.14 -1.29% 5451.2 -5.61%

30-06-2015 14.41 5.03% 88.5 17.58% 6.18734 13.50% 0.074 -3.90% 9.92038 -5.26% 3.99361 18.67% 6.49 5.70% 5681.7 4.23%

31-07-2015 13.42 -6.87% 105 18.64% 5.73 -7.39% 0.07 -5.41% 7.22596 -27.16% 3.57827 -10.40% 5.77 -11.09% 5222.1 -8.09%

31-08-2015 13.17 -1.86% 145.95 39.00% 4.91074 -14.30% 0.094 34.29% 5.33636 -26.15% 3.96166 10.71% 5.61 -2.77% 5058.6 -3.13%

30-09-2015 13.65 3.64% 167.67 14.88% 5.02255 2.28% 0.094 0.00% 5.5 3.07% 3.95 -0.29% 5.4 -3.74% 5288.6 4.55%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

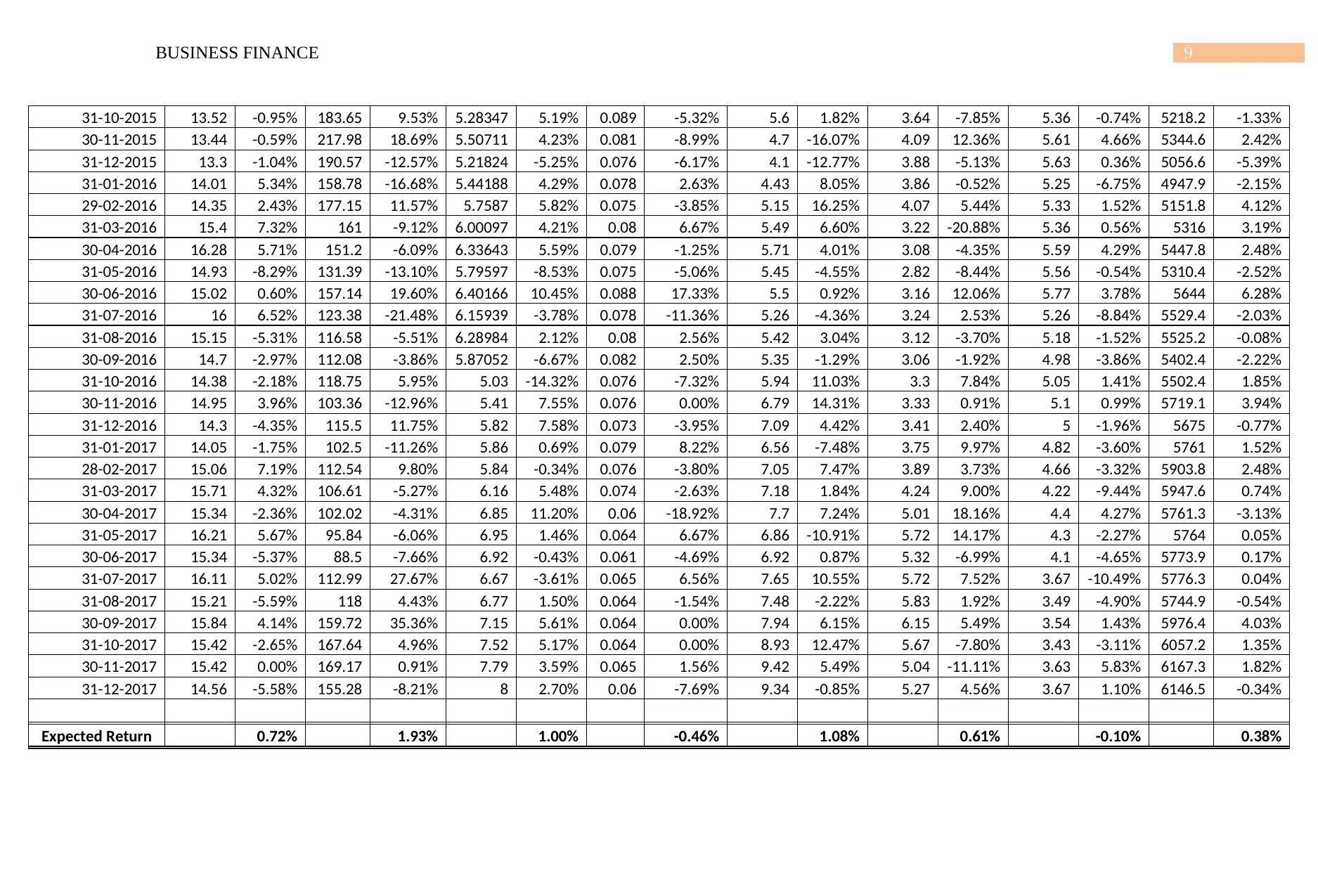

9BUSINESS FINANCE

31-10-2015 13.52 -0.95% 183.65 9.53% 5.28347 5.19% 0.089 -5.32% 5.6 1.82% 3.64 -7.85% 5.36 -0.74% 5218.2 -1.33%

30-11-2015 13.44 -0.59% 217.98 18.69% 5.50711 4.23% 0.081 -8.99% 4.7 -16.07% 4.09 12.36% 5.61 4.66% 5344.6 2.42%

31-12-2015 13.3 -1.04% 190.57 -12.57% 5.21824 -5.25% 0.076 -6.17% 4.1 -12.77% 3.88 -5.13% 5.63 0.36% 5056.6 -5.39%

31-01-2016 14.01 5.34% 158.78 -16.68% 5.44188 4.29% 0.078 2.63% 4.43 8.05% 3.86 -0.52% 5.25 -6.75% 4947.9 -2.15%

29-02-2016 14.35 2.43% 177.15 11.57% 5.7587 5.82% 0.075 -3.85% 5.15 16.25% 4.07 5.44% 5.33 1.52% 5151.8 4.12%

31-03-2016 15.4 7.32% 161 -9.12% 6.00097 4.21% 0.08 6.67% 5.49 6.60% 3.22 -20.88% 5.36 0.56% 5316 3.19%

30-04-2016 16.28 5.71% 151.2 -6.09% 6.33643 5.59% 0.079 -1.25% 5.71 4.01% 3.08 -4.35% 5.59 4.29% 5447.8 2.48%

31-05-2016 14.93 -8.29% 131.39 -13.10% 5.79597 -8.53% 0.075 -5.06% 5.45 -4.55% 2.82 -8.44% 5.56 -0.54% 5310.4 -2.52%

30-06-2016 15.02 0.60% 157.14 19.60% 6.40166 10.45% 0.088 17.33% 5.5 0.92% 3.16 12.06% 5.77 3.78% 5644 6.28%

31-07-2016 16 6.52% 123.38 -21.48% 6.15939 -3.78% 0.078 -11.36% 5.26 -4.36% 3.24 2.53% 5.26 -8.84% 5529.4 -2.03%

31-08-2016 15.15 -5.31% 116.58 -5.51% 6.28984 2.12% 0.08 2.56% 5.42 3.04% 3.12 -3.70% 5.18 -1.52% 5525.2 -0.08%

30-09-2016 14.7 -2.97% 112.08 -3.86% 5.87052 -6.67% 0.082 2.50% 5.35 -1.29% 3.06 -1.92% 4.98 -3.86% 5402.4 -2.22%

31-10-2016 14.38 -2.18% 118.75 5.95% 5.03 -14.32% 0.076 -7.32% 5.94 11.03% 3.3 7.84% 5.05 1.41% 5502.4 1.85%

30-11-2016 14.95 3.96% 103.36 -12.96% 5.41 7.55% 0.076 0.00% 6.79 14.31% 3.33 0.91% 5.1 0.99% 5719.1 3.94%

31-12-2016 14.3 -4.35% 115.5 11.75% 5.82 7.58% 0.073 -3.95% 7.09 4.42% 3.41 2.40% 5 -1.96% 5675 -0.77%

31-01-2017 14.05 -1.75% 102.5 -11.26% 5.86 0.69% 0.079 8.22% 6.56 -7.48% 3.75 9.97% 4.82 -3.60% 5761 1.52%

28-02-2017 15.06 7.19% 112.54 9.80% 5.84 -0.34% 0.076 -3.80% 7.05 7.47% 3.89 3.73% 4.66 -3.32% 5903.8 2.48%

31-03-2017 15.71 4.32% 106.61 -5.27% 6.16 5.48% 0.074 -2.63% 7.18 1.84% 4.24 9.00% 4.22 -9.44% 5947.6 0.74%

30-04-2017 15.34 -2.36% 102.02 -4.31% 6.85 11.20% 0.06 -18.92% 7.7 7.24% 5.01 18.16% 4.4 4.27% 5761.3 -3.13%

31-05-2017 16.21 5.67% 95.84 -6.06% 6.95 1.46% 0.064 6.67% 6.86 -10.91% 5.72 14.17% 4.3 -2.27% 5764 0.05%

30-06-2017 15.34 -5.37% 88.5 -7.66% 6.92 -0.43% 0.061 -4.69% 6.92 0.87% 5.32 -6.99% 4.1 -4.65% 5773.9 0.17%

31-07-2017 16.11 5.02% 112.99 27.67% 6.67 -3.61% 0.065 6.56% 7.65 10.55% 5.72 7.52% 3.67 -10.49% 5776.3 0.04%

31-08-2017 15.21 -5.59% 118 4.43% 6.77 1.50% 0.064 -1.54% 7.48 -2.22% 5.83 1.92% 3.49 -4.90% 5744.9 -0.54%

30-09-2017 15.84 4.14% 159.72 35.36% 7.15 5.61% 0.064 0.00% 7.94 6.15% 6.15 5.49% 3.54 1.43% 5976.4 4.03%

31-10-2017 15.42 -2.65% 167.64 4.96% 7.52 5.17% 0.064 0.00% 8.93 12.47% 5.67 -7.80% 3.43 -3.11% 6057.2 1.35%

30-11-2017 15.42 0.00% 169.17 0.91% 7.79 3.59% 0.065 1.56% 9.42 5.49% 5.04 -11.11% 3.63 5.83% 6167.3 1.82%

31-12-2017 14.56 -5.58% 155.28 -8.21% 8 2.70% 0.06 -7.69% 9.34 -0.85% 5.27 4.56% 3.67 1.10% 6146.5 -0.34%

Expected Return 0.72% 1.93% 1.00% -0.46% 1.08% 0.61% -0.10% 0.38%

31-10-2015 13.52 -0.95% 183.65 9.53% 5.28347 5.19% 0.089 -5.32% 5.6 1.82% 3.64 -7.85% 5.36 -0.74% 5218.2 -1.33%

30-11-2015 13.44 -0.59% 217.98 18.69% 5.50711 4.23% 0.081 -8.99% 4.7 -16.07% 4.09 12.36% 5.61 4.66% 5344.6 2.42%

31-12-2015 13.3 -1.04% 190.57 -12.57% 5.21824 -5.25% 0.076 -6.17% 4.1 -12.77% 3.88 -5.13% 5.63 0.36% 5056.6 -5.39%

31-01-2016 14.01 5.34% 158.78 -16.68% 5.44188 4.29% 0.078 2.63% 4.43 8.05% 3.86 -0.52% 5.25 -6.75% 4947.9 -2.15%

29-02-2016 14.35 2.43% 177.15 11.57% 5.7587 5.82% 0.075 -3.85% 5.15 16.25% 4.07 5.44% 5.33 1.52% 5151.8 4.12%

31-03-2016 15.4 7.32% 161 -9.12% 6.00097 4.21% 0.08 6.67% 5.49 6.60% 3.22 -20.88% 5.36 0.56% 5316 3.19%

30-04-2016 16.28 5.71% 151.2 -6.09% 6.33643 5.59% 0.079 -1.25% 5.71 4.01% 3.08 -4.35% 5.59 4.29% 5447.8 2.48%

31-05-2016 14.93 -8.29% 131.39 -13.10% 5.79597 -8.53% 0.075 -5.06% 5.45 -4.55% 2.82 -8.44% 5.56 -0.54% 5310.4 -2.52%

30-06-2016 15.02 0.60% 157.14 19.60% 6.40166 10.45% 0.088 17.33% 5.5 0.92% 3.16 12.06% 5.77 3.78% 5644 6.28%

31-07-2016 16 6.52% 123.38 -21.48% 6.15939 -3.78% 0.078 -11.36% 5.26 -4.36% 3.24 2.53% 5.26 -8.84% 5529.4 -2.03%

31-08-2016 15.15 -5.31% 116.58 -5.51% 6.28984 2.12% 0.08 2.56% 5.42 3.04% 3.12 -3.70% 5.18 -1.52% 5525.2 -0.08%

30-09-2016 14.7 -2.97% 112.08 -3.86% 5.87052 -6.67% 0.082 2.50% 5.35 -1.29% 3.06 -1.92% 4.98 -3.86% 5402.4 -2.22%

31-10-2016 14.38 -2.18% 118.75 5.95% 5.03 -14.32% 0.076 -7.32% 5.94 11.03% 3.3 7.84% 5.05 1.41% 5502.4 1.85%

30-11-2016 14.95 3.96% 103.36 -12.96% 5.41 7.55% 0.076 0.00% 6.79 14.31% 3.33 0.91% 5.1 0.99% 5719.1 3.94%

31-12-2016 14.3 -4.35% 115.5 11.75% 5.82 7.58% 0.073 -3.95% 7.09 4.42% 3.41 2.40% 5 -1.96% 5675 -0.77%

31-01-2017 14.05 -1.75% 102.5 -11.26% 5.86 0.69% 0.079 8.22% 6.56 -7.48% 3.75 9.97% 4.82 -3.60% 5761 1.52%

28-02-2017 15.06 7.19% 112.54 9.80% 5.84 -0.34% 0.076 -3.80% 7.05 7.47% 3.89 3.73% 4.66 -3.32% 5903.8 2.48%

31-03-2017 15.71 4.32% 106.61 -5.27% 6.16 5.48% 0.074 -2.63% 7.18 1.84% 4.24 9.00% 4.22 -9.44% 5947.6 0.74%

30-04-2017 15.34 -2.36% 102.02 -4.31% 6.85 11.20% 0.06 -18.92% 7.7 7.24% 5.01 18.16% 4.4 4.27% 5761.3 -3.13%

31-05-2017 16.21 5.67% 95.84 -6.06% 6.95 1.46% 0.064 6.67% 6.86 -10.91% 5.72 14.17% 4.3 -2.27% 5764 0.05%

30-06-2017 15.34 -5.37% 88.5 -7.66% 6.92 -0.43% 0.061 -4.69% 6.92 0.87% 5.32 -6.99% 4.1 -4.65% 5773.9 0.17%

31-07-2017 16.11 5.02% 112.99 27.67% 6.67 -3.61% 0.065 6.56% 7.65 10.55% 5.72 7.52% 3.67 -10.49% 5776.3 0.04%

31-08-2017 15.21 -5.59% 118 4.43% 6.77 1.50% 0.064 -1.54% 7.48 -2.22% 5.83 1.92% 3.49 -4.90% 5744.9 -0.54%

30-09-2017 15.84 4.14% 159.72 35.36% 7.15 5.61% 0.064 0.00% 7.94 6.15% 6.15 5.49% 3.54 1.43% 5976.4 4.03%

31-10-2017 15.42 -2.65% 167.64 4.96% 7.52 5.17% 0.064 0.00% 8.93 12.47% 5.67 -7.80% 3.43 -3.11% 6057.2 1.35%

30-11-2017 15.42 0.00% 169.17 0.91% 7.79 3.59% 0.065 1.56% 9.42 5.49% 5.04 -11.11% 3.63 5.83% 6167.3 1.82%

31-12-2017 14.56 -5.58% 155.28 -8.21% 8 2.70% 0.06 -7.69% 9.34 -0.85% 5.27 4.56% 3.67 1.10% 6146.5 -0.34%

Expected Return 0.72% 1.93% 1.00% -0.46% 1.08% 0.61% -0.10% 0.38%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10BUSINESS FINANCE

11BUSINESS FINANCE

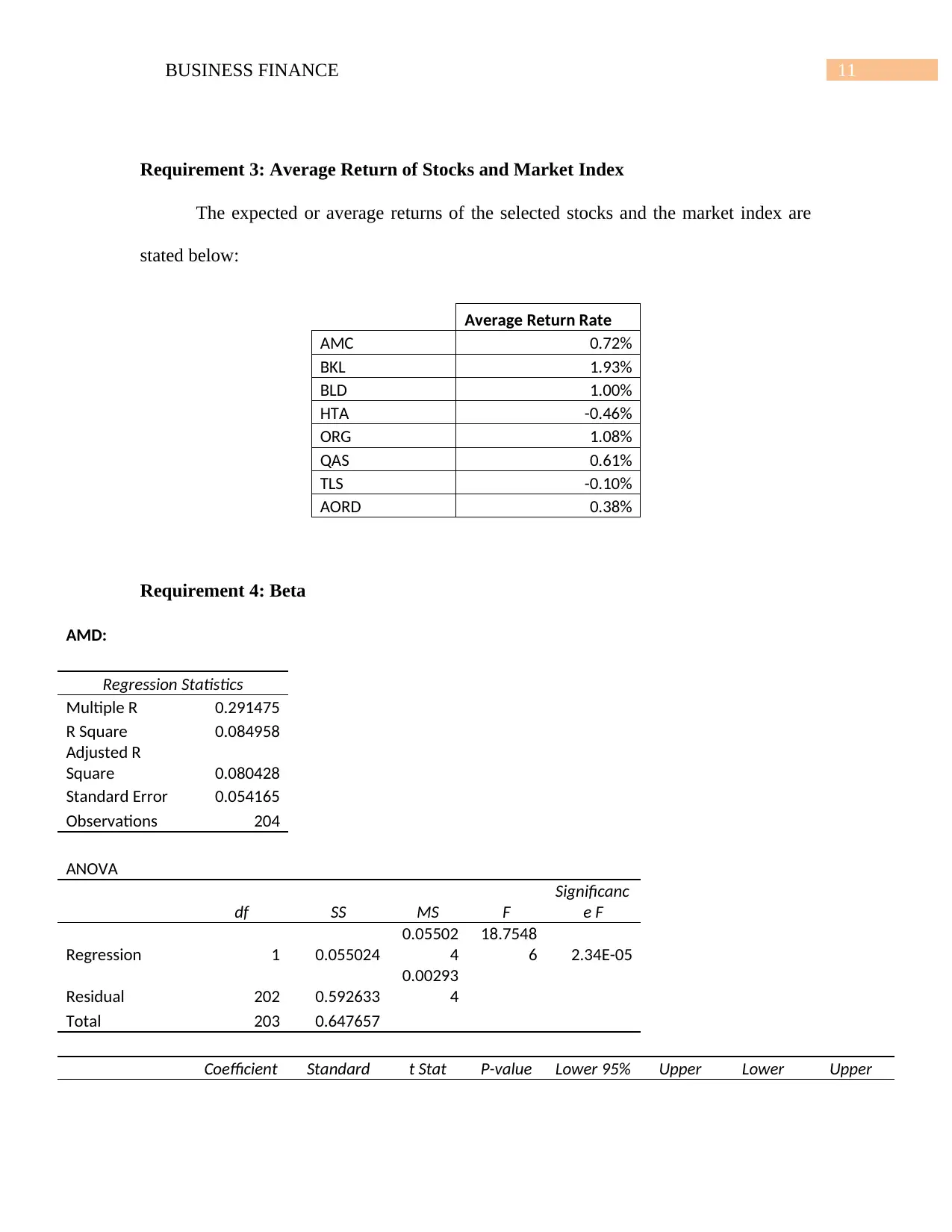

Requirement 3: Average Return of Stocks and Market Index

The expected or average returns of the selected stocks and the market index are

stated below:

Average Return Rate

AMC 0.72%

BKL 1.93%

BLD 1.00%

HTA -0.46%

ORG 1.08%

QAS 0.61%

TLS -0.10%

AORD 0.38%

Requirement 4: Beta

AMD:

Regression Statistics

Multiple R 0.291475

R Square 0.084958

Adjusted R

Square 0.080428

Standard Error 0.054165

Observations 204

ANOVA

df SS MS F

Significanc

e F

Regression 1 0.055024

0.05502

4

18.7548

6 2.34E-05

Residual 202 0.592633

0.00293

4

Total 203 0.647657

Coefficient Standard t Stat P-value Lower 95% Upper Lower Upper

Requirement 3: Average Return of Stocks and Market Index

The expected or average returns of the selected stocks and the market index are

stated below:

Average Return Rate

AMC 0.72%

BKL 1.93%

BLD 1.00%

HTA -0.46%

ORG 1.08%

QAS 0.61%

TLS -0.10%

AORD 0.38%

Requirement 4: Beta

AMD:

Regression Statistics

Multiple R 0.291475

R Square 0.084958

Adjusted R

Square 0.080428

Standard Error 0.054165

Observations 204

ANOVA

df SS MS F

Significanc

e F

Regression 1 0.055024

0.05502

4

18.7548

6 2.34E-05

Residual 202 0.592633

0.00293

4

Total 203 0.647657

Coefficient Standard t Stat P-value Lower 95% Upper Lower Upper

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.