Business Strategy Report: Planning for Growth at Deloitte (UK)

VerifiedAdded on 2023/01/13

|17

|5430

|24

Report

AI Summary

This report provides a comprehensive analysis of Deloitte's growth strategies, focusing on the UK market and small and medium-sized enterprises (SMEs). It begins with an introduction to planning and its importance for business growth, followed by a PESTEL analysis of the external environment, considering political, economic, social, technological, environmental, and legal factors impacting SMEs. The report then uses the Ansoff matrix to evaluate growth opportunities, including market penetration, product development, market development, and diversification. Furthermore, it assesses potential sources of funding and designs a business plan incorporating financial information and strategic objectives. Finally, the report discusses exit and succession alternatives for businesses, providing a critical evaluation of these plans. The report aims to provide insights into the growth strategies of Deloitte and provide guidance for SMEs.

Planning for growth

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................2

TASK 1 ...........................................................................................................................................3

P1 Analyse the key consideration for evaluating growth opportunities and justify in

organisational context.................................................................................................................3

TASK 2............................................................................................................................................7

P3 Assess the potential source of funding present for the business............................................7

M2 Identify the potential source of funding and provide justification.......................................9

D2 Critically identify sources and argue for the particular source.............................................9

TASK 3 ...........................................................................................................................................9

P4 Design a business plan that include financial information and strategies objectives............9

TASK 4 .........................................................................................................................................11

P5 Discuss assessment of the different exist or succession alternative for business................11

M4 Evaluate exit and succession plan......................................................................................12

D4 Provide critical evaluation of exit and succession plan ......................................................13

CONCLUSION..............................................................................................................................13

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................2

TASK 1 ...........................................................................................................................................3

P1 Analyse the key consideration for evaluating growth opportunities and justify in

organisational context.................................................................................................................3

TASK 2............................................................................................................................................7

P3 Assess the potential source of funding present for the business............................................7

M2 Identify the potential source of funding and provide justification.......................................9

D2 Critically identify sources and argue for the particular source.............................................9

TASK 3 ...........................................................................................................................................9

P4 Design a business plan that include financial information and strategies objectives............9

TASK 4 .........................................................................................................................................11

P5 Discuss assessment of the different exist or succession alternative for business................11

M4 Evaluate exit and succession plan......................................................................................12

D4 Provide critical evaluation of exit and succession plan ......................................................13

CONCLUSION..............................................................................................................................13

REFERENCES................................................................................................................................1

INTRODUCTION

Planning is the fundamental function which include suitable decision regarding what to

be done, how it should be done, when it should be done and who is going to do it. It plays an

important role for the success and growth of business as it is a strategic business action which

enables the businesses to plan and track the growth of their revenues. It is a business activity in

which management of company develop suitable plans for the growth(Biddle and Taylor, 2018) .

With the changing conditions in UK regarding Brexit, small businesses are influenced in positive

and negative manner. It defines the suitable use of available resources for the small

organisations. In this report, Deloitte is considered which is a multinational professional services

network and it has big four accounting organisations and headquarters in London, UK. In

addition to this, it describe the key considerations for the growth opportunities of company and

also describe various sources of funds which are useful for company. Moreover, a business plan

is prepared for the growth of company and lastly exit plan is described for small businesses.

TASK 1

P1 Analyse the key consideration for evaluating growth opportunities and justify in

organisational context

PESTEL ANALYSIS

It is that framework which is used by the business to analyse external environment(macro

environment) of firm in which organization works. This analysis provide information about

political, economical, social, technical, environmental and legal factors(Lombard, and et. al.,

2019). This tool is used in formation of business strategies for growth and long run of

organisation. It analyse the negative and positive impact of above mentioned factors on firm

policy and procedures and how firm can overcome on those impacts. It is a crucial model of

analysis external environment which is suggested by Deloitte for SMEs of UK .

Political

Planning is the fundamental function which include suitable decision regarding what to

be done, how it should be done, when it should be done and who is going to do it. It plays an

important role for the success and growth of business as it is a strategic business action which

enables the businesses to plan and track the growth of their revenues. It is a business activity in

which management of company develop suitable plans for the growth(Biddle and Taylor, 2018) .

With the changing conditions in UK regarding Brexit, small businesses are influenced in positive

and negative manner. It defines the suitable use of available resources for the small

organisations. In this report, Deloitte is considered which is a multinational professional services

network and it has big four accounting organisations and headquarters in London, UK. In

addition to this, it describe the key considerations for the growth opportunities of company and

also describe various sources of funds which are useful for company. Moreover, a business plan

is prepared for the growth of company and lastly exit plan is described for small businesses.

TASK 1

P1 Analyse the key consideration for evaluating growth opportunities and justify in

organisational context

PESTEL ANALYSIS

It is that framework which is used by the business to analyse external environment(macro

environment) of firm in which organization works. This analysis provide information about

political, economical, social, technical, environmental and legal factors(Lombard, and et. al.,

2019). This tool is used in formation of business strategies for growth and long run of

organisation. It analyse the negative and positive impact of above mentioned factors on firm

policy and procedures and how firm can overcome on those impacts. It is a crucial model of

analysis external environment which is suggested by Deloitte for SMEs of UK .

Political

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

political factors are those factors which are related to government polices of the nation

where organisation doing its business . According to Deloitte observation BREXIT is main

political factor for SMEs of UK . It have both positive as well as negative impact on SMEs.

Positive impact : Positive impact of this political blunder is there will be an open market

for SMEs in Britain with some relief in taxation polices because Boris Johnson's government

will focus on strengthening economy.

Negative impact : Negative impact of BREXIT is open market will attract more MNCs

which can cause damage to SMEs . According to Deloitte advise the SMEs should focus on

increasing quality, better branding of their product, and attracting new customer with managing

old ones which will ultimately help them is surviving in open market.

Economic

economic factors incudes the those which is related to economic condition of nation

where the business is situated. This includes the inflation & interest rates in nation, business

cycle in economy, stock market performance, etc. after analysis of economic factors of SMEs of

UK, Deloitte found

positive impact: economic factor like inflation rate made positive impact on SMEs as

inflation in UK high in recent years which helps SMEs in to not spent their profit on making

contingency reserves for inflation. This also increase there net profit.

Negative impact: These factors have also impacted negatively on SMEs as factor like

reassertion in economy leads in huge loss of market which impacted adversely on SMEs as they

are not getting customers because of decline in demand (Agyemang and Silva, 2019). It is

advised by Deloitte that reassertion is a part of business cycle and business have no control over

it but firm can defend itself from it by making uncertainty reserves .

Social

Impact of society on business is known as social factor. This includes the culture, age

distribution, population density, buying habit and eduction level of society which is around

business. According to Deloitte this environment have both positive & negative impact on

business

positive impact : the leaving standers of UK people is vary high because of this they prefer

advanced quality products that provides the opportunity to SMEs for introducing new product

with best quality with better profit margin.

where organisation doing its business . According to Deloitte observation BREXIT is main

political factor for SMEs of UK . It have both positive as well as negative impact on SMEs.

Positive impact : Positive impact of this political blunder is there will be an open market

for SMEs in Britain with some relief in taxation polices because Boris Johnson's government

will focus on strengthening economy.

Negative impact : Negative impact of BREXIT is open market will attract more MNCs

which can cause damage to SMEs . According to Deloitte advise the SMEs should focus on

increasing quality, better branding of their product, and attracting new customer with managing

old ones which will ultimately help them is surviving in open market.

Economic

economic factors incudes the those which is related to economic condition of nation

where the business is situated. This includes the inflation & interest rates in nation, business

cycle in economy, stock market performance, etc. after analysis of economic factors of SMEs of

UK, Deloitte found

positive impact: economic factor like inflation rate made positive impact on SMEs as

inflation in UK high in recent years which helps SMEs in to not spent their profit on making

contingency reserves for inflation. This also increase there net profit.

Negative impact: These factors have also impacted negatively on SMEs as factor like

reassertion in economy leads in huge loss of market which impacted adversely on SMEs as they

are not getting customers because of decline in demand (Agyemang and Silva, 2019). It is

advised by Deloitte that reassertion is a part of business cycle and business have no control over

it but firm can defend itself from it by making uncertainty reserves .

Social

Impact of society on business is known as social factor. This includes the culture, age

distribution, population density, buying habit and eduction level of society which is around

business. According to Deloitte this environment have both positive & negative impact on

business

positive impact : the leaving standers of UK people is vary high because of this they prefer

advanced quality products that provides the opportunity to SMEs for introducing new product

with best quality with better profit margin.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Negative impact : population density if UK is low which have negative impact on SMEs as they

have to pay more for transportation of there product to other destination which leads in decline of

net profit and increase in cost of product. Deloitte suggested that SMEs should adopt the policy

of secondary distribution where they use other's transportation tool then there own.

Technological

These are those factors with directly deals with the change in technology, automation,

introduction of AI and innovation in industry context, according to he research of Deloitte this

factor have also major impact on the working of SMEs in there business.

Positive impact: technological factors have a large number of positive impact on

business of SMEs like innovation helps the company to identify the opportunities in market for

there long run . Technological innovation also enable a firm to reduce the chances of error in

there working with its positive implementation on business.

Negative impact : Technology requires regular updates which can impact adversely on

the business of enterprise as update in technological requires huge investment which is a difficult

task for SMEs. Hear Deloitte advise for SMEs is that they should use that technology which

requires less amount of investment and have long life cycle.

Environment

It includes factors like pollution, whether, location , climate, waste management etc.

these factors are related with environment around business. According to Deloitte environment

factor also have both positive and negative impact. In these factor SMEs have to cooperate with

environment without damaging it .

positive impact : According to Deloitte observation on SMEs it analyse that environment factor

like location have positive impact on organisation as waste management helps the organization

in recycling which leads in building image in front of customers of organisation .

Negative impact : this has also negative outcome on cost of production of company as

recycling needs huge cost . Here Deloitte advices that SMEs can use raw material which can be

easily recycle and not require huge cost.

Legal

have to pay more for transportation of there product to other destination which leads in decline of

net profit and increase in cost of product. Deloitte suggested that SMEs should adopt the policy

of secondary distribution where they use other's transportation tool then there own.

Technological

These are those factors with directly deals with the change in technology, automation,

introduction of AI and innovation in industry context, according to he research of Deloitte this

factor have also major impact on the working of SMEs in there business.

Positive impact: technological factors have a large number of positive impact on

business of SMEs like innovation helps the company to identify the opportunities in market for

there long run . Technological innovation also enable a firm to reduce the chances of error in

there working with its positive implementation on business.

Negative impact : Technology requires regular updates which can impact adversely on

the business of enterprise as update in technological requires huge investment which is a difficult

task for SMEs. Hear Deloitte advise for SMEs is that they should use that technology which

requires less amount of investment and have long life cycle.

Environment

It includes factors like pollution, whether, location , climate, waste management etc.

these factors are related with environment around business. According to Deloitte environment

factor also have both positive and negative impact. In these factor SMEs have to cooperate with

environment without damaging it .

positive impact : According to Deloitte observation on SMEs it analyse that environment factor

like location have positive impact on organisation as waste management helps the organization

in recycling which leads in building image in front of customers of organisation .

Negative impact : this has also negative outcome on cost of production of company as

recycling needs huge cost . Here Deloitte advices that SMEs can use raw material which can be

easily recycle and not require huge cost.

Legal

legal factor are those factors which deals with law and legal requirement of nation. This

includes law related to health and safety, tax regulations, employment, product labelling

regulation advertising standards, health care and retirement.

Positive impact : positive impact of this factor is that it can help in increasing brand value of

firm. SMEs have low brand value because of low capital investment so it is advise by Deloitte to

SMEs that they should comply with laws like labour law and others which will help firm in

building brand value.

Negative impact : alteration in laws can also impact adversely on company as it have to change

its police and procedures which can cause confusion in work. For this Deloitte advice that SMEs

should make flexible polices which can be change accordingly.

P2 Describe the opportunities for growth by using Ansoff matrix

Ansoff matrix can be used by the company to analyse marketing strategies or objectives

of the business. The growth depend upon the sales of product and services provided by the

company. This matrix tend to provide a proper structure which aids the top level management for

the future growth and the success of the company. The management of Deloitte must consider

such method for improvising such plan for expansion and growth.

Market penetration: Market penetration allocates the successful selling of goods and as

well services to the particular market(Sarin, 2019) . This often used by a the company for there

existing product within the known market and needs and a growth strategies within the market. It

provide proper path to company as to increase the sales to attract the customer. For the

organisation like Deloitte the management is suggested to their clients to look forward as to

expand the business and take effective measure to reduce risk and theft present in the market.

SME should consider such kind of matrix which is essential for the company to increase the

services as per the needs and wants of customer.

Product Development: This refers to modification of development of new product in

the market as to capture larger number of audience. In this case company tend to change there

design, packaging as well as product quality as per the requirement of consumer. The suggestion

given by Deloitte to SME is that to focus more on the product rather than focusing on the

services of the product. This kind of strategies will focus on achieving success and create a

better image in the minds of customer. Apart from this company can improve the market share

and sales for longer time duration.

includes law related to health and safety, tax regulations, employment, product labelling

regulation advertising standards, health care and retirement.

Positive impact : positive impact of this factor is that it can help in increasing brand value of

firm. SMEs have low brand value because of low capital investment so it is advise by Deloitte to

SMEs that they should comply with laws like labour law and others which will help firm in

building brand value.

Negative impact : alteration in laws can also impact adversely on company as it have to change

its police and procedures which can cause confusion in work. For this Deloitte advice that SMEs

should make flexible polices which can be change accordingly.

P2 Describe the opportunities for growth by using Ansoff matrix

Ansoff matrix can be used by the company to analyse marketing strategies or objectives

of the business. The growth depend upon the sales of product and services provided by the

company. This matrix tend to provide a proper structure which aids the top level management for

the future growth and the success of the company. The management of Deloitte must consider

such method for improvising such plan for expansion and growth.

Market penetration: Market penetration allocates the successful selling of goods and as

well services to the particular market(Sarin, 2019) . This often used by a the company for there

existing product within the known market and needs and a growth strategies within the market. It

provide proper path to company as to increase the sales to attract the customer. For the

organisation like Deloitte the management is suggested to their clients to look forward as to

expand the business and take effective measure to reduce risk and theft present in the market.

SME should consider such kind of matrix which is essential for the company to increase the

services as per the needs and wants of customer.

Product Development: This refers to modification of development of new product in

the market as to capture larger number of audience. In this case company tend to change there

design, packaging as well as product quality as per the requirement of consumer. The suggestion

given by Deloitte to SME is that to focus more on the product rather than focusing on the

services of the product. This kind of strategies will focus on achieving success and create a

better image in the minds of customer. Apart from this company can improve the market share

and sales for longer time duration.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Market development: As the name suggest the main focus of organisation to expand

and explore the business for the company. In other words, this describe the process through

which the company improve the market presence in the market. Here Deloitte suggested that the

SME can to focus on this market as they do not have proper capital investment. Apart from this

small companies should make use proper use of resources for conducting promotional activities

as to provide better market share and profitability.

Diversification: In this stage company usually try to explore new customer base by

improvising the product as per the needs and wants of customer. Here organisation tend to

diversify the product and service as to attract new users. This require huge amount of funds and

sources as to implement such method successfully. As per the Deloitte suggestion to SME as not

to focus on the diversification as this may cover huge risk and may cause failure to company.

Along with this, another suggestion by the company is to focus on existing product and service

as this will help small and medium company to earn more profit for the longer time period.

M1 Discuss the option for growth using wide range of analytical frameworks in organisation

context

After implementing the PESTEL analysis on SMEs it is suggested by Deloitte that there

are various growth opportunities in UK market for SMEs as social , technical and environment

factors are in favour of SMEs but they have to be careful about the uncertainty of future and the

political unrest which is suffered by whole Britain(Rahman and et. Al, 2018). There is no major

negative impact of any environment on business but they have to follow the suggestion of

Deloitte. Furthermore with the assistance of this method small enterprise can improvise there

policies and make changes as per the need of marketplace.

D1 Critical evaluate different option and pathway for growth

There are different method and techniques through which SME can grow and expand the

business effectively. The company is recommended to use Ansoff growth matrix which help to

identify the factors in which firm have to improve and focus on increasing the sales of the

company (Deng, Fu and Sun, 2018). At the market penetration stage the risk is associated with

sales of the company which may decline if company do not take any effective decision. Apart

from this at product development stage the risk of loosing of market share is there as entity focus

and explore the business for the company. In other words, this describe the process through

which the company improve the market presence in the market. Here Deloitte suggested that the

SME can to focus on this market as they do not have proper capital investment. Apart from this

small companies should make use proper use of resources for conducting promotional activities

as to provide better market share and profitability.

Diversification: In this stage company usually try to explore new customer base by

improvising the product as per the needs and wants of customer. Here organisation tend to

diversify the product and service as to attract new users. This require huge amount of funds and

sources as to implement such method successfully. As per the Deloitte suggestion to SME as not

to focus on the diversification as this may cover huge risk and may cause failure to company.

Along with this, another suggestion by the company is to focus on existing product and service

as this will help small and medium company to earn more profit for the longer time period.

M1 Discuss the option for growth using wide range of analytical frameworks in organisation

context

After implementing the PESTEL analysis on SMEs it is suggested by Deloitte that there

are various growth opportunities in UK market for SMEs as social , technical and environment

factors are in favour of SMEs but they have to be careful about the uncertainty of future and the

political unrest which is suffered by whole Britain(Rahman and et. Al, 2018). There is no major

negative impact of any environment on business but they have to follow the suggestion of

Deloitte. Furthermore with the assistance of this method small enterprise can improvise there

policies and make changes as per the need of marketplace.

D1 Critical evaluate different option and pathway for growth

There are different method and techniques through which SME can grow and expand the

business effectively. The company is recommended to use Ansoff growth matrix which help to

identify the factors in which firm have to improve and focus on increasing the sales of the

company (Deng, Fu and Sun, 2018). At the market penetration stage the risk is associated with

sales of the company which may decline if company do not take any effective decision. Apart

from this at product development stage the risk of loosing of market share is there as entity focus

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

on product and put less emphasis on market activities. At diversification stage risk in involved as

the failure of product due to uncertainty present in the market.

TASK 2

P3 Assess the potential source of funding present for the business

For expansion and growth the company require huge amount of funds to expand the

business. In this case top level management decide the amount of money have to be invested in

the organisation as to increase the sales and increase market opportunities for the

company(Gounaridis, Chorianopoulos and Koukoulas, 2018). This is suggest to the company is

to provide different market services which help in to gather large market share as per the needs

and wants. There are different source of funding market present in the market and companies

may choose the option as the per requirement. Here are some of the sources which is explained

down blow:

Bank loan:

This most popular source of funding use by the organisation as to expand the business

effectively. SME can choose bank as the option for funding as they have low interest rate which

is beneficial for the company to explore the business. The Deloitte management suggest to SME

to go for bank loan as they provide flexible repayments option to provide convenience for the

company.

Benefits: The bank loan is provide various option for the payment and have instant loan

facilities for the company. They also require less paper work as to save time of organisation as

well as of bank. As like equity finance the business issues shares and bank do not take any kind

of ownership from the company. Apart from this bank do not indulge in any kind of business

activity of company which is beneficial to expand the business for SME.

Drawback: The major drawback for the bank loan is that, they do not provide loan

unless the company have proper records and paper of financial years. Apart from this, it is a

lengthy process as the bank is careful while providing loan. If the company fails to repay the loan

in this scenario bank have right to seize the assets for recovery of loss.

Crowdfunding:

This is method in which the company raise capital from the market with different people

and provide profit after expansion and growth. This is consider as less risky and Deloitte suggest

the failure of product due to uncertainty present in the market.

TASK 2

P3 Assess the potential source of funding present for the business

For expansion and growth the company require huge amount of funds to expand the

business. In this case top level management decide the amount of money have to be invested in

the organisation as to increase the sales and increase market opportunities for the

company(Gounaridis, Chorianopoulos and Koukoulas, 2018). This is suggest to the company is

to provide different market services which help in to gather large market share as per the needs

and wants. There are different source of funding market present in the market and companies

may choose the option as the per requirement. Here are some of the sources which is explained

down blow:

Bank loan:

This most popular source of funding use by the organisation as to expand the business

effectively. SME can choose bank as the option for funding as they have low interest rate which

is beneficial for the company to explore the business. The Deloitte management suggest to SME

to go for bank loan as they provide flexible repayments option to provide convenience for the

company.

Benefits: The bank loan is provide various option for the payment and have instant loan

facilities for the company. They also require less paper work as to save time of organisation as

well as of bank. As like equity finance the business issues shares and bank do not take any kind

of ownership from the company. Apart from this bank do not indulge in any kind of business

activity of company which is beneficial to expand the business for SME.

Drawback: The major drawback for the bank loan is that, they do not provide loan

unless the company have proper records and paper of financial years. Apart from this, it is a

lengthy process as the bank is careful while providing loan. If the company fails to repay the loan

in this scenario bank have right to seize the assets for recovery of loss.

Crowdfunding:

This is method in which the company raise capital from the market with different people

and provide profit after expansion and growth. This is consider as less risky and Deloitte suggest

to SME is to avail funds from crowdfunding as this tend to expand the business effectively.

Beside this company can reach to larger audience as can create image in market due to funds

raising method.

Benefits: The major advantage of crowdfunding is that company can gather huge amount

of attention while exploring the business effectively (Wu, 2018) . However this easily gain the

attention of the market and company can explore and expand the business effectively. The

Deloitte manager suggest to SME as to use such method for funding as this creates brand image

and make shareholder loyal which help in raising funds effectively.

Drawback: The major drawback of crowdfunding is that company loose control at the

business activities to some extent. In the, Deloitte management provide proposal to SME to make

use such method for raising the funds as if company fails to collect the amount hence this

hamper the image which leads to slow performance of the company.

M2 Identify the potential source of funding and provide justification

There are different sources of funding present in the business environment and company

has to chose the best possible source as per the need and requirement. There are different kinds

of loans institution present in the market such as bank loan and crowdfunding (Angotti, 2018) .

This is been recommended to SME company to take bank loan as this is one of the easiest way to

avail loan and they also provide different repayments option to borrowers. Apart from this, bank

to do not interfere in the activities of company as they also charge low interest rate from the

organisation. They also provide instant loan facilities with less paper work for the company.

D2 Critically identify sources and argue for the particular source

There are different kind of method through which company can raise funds. The

company must choose the best possible outcome for funding which help organisation to expand

the business at the larger scale . The best funding source for SME is bank as they provide various

option for repayment and help to provide flexible payment as per the convenience of the

company. Although crowdfunding is the option for the company but it has lot of risk for small

organisation as people fear to invest money in such companies due to lack of trust and market

size of the company.

Beside this company can reach to larger audience as can create image in market due to funds

raising method.

Benefits: The major advantage of crowdfunding is that company can gather huge amount

of attention while exploring the business effectively (Wu, 2018) . However this easily gain the

attention of the market and company can explore and expand the business effectively. The

Deloitte manager suggest to SME as to use such method for funding as this creates brand image

and make shareholder loyal which help in raising funds effectively.

Drawback: The major drawback of crowdfunding is that company loose control at the

business activities to some extent. In the, Deloitte management provide proposal to SME to make

use such method for raising the funds as if company fails to collect the amount hence this

hamper the image which leads to slow performance of the company.

M2 Identify the potential source of funding and provide justification

There are different sources of funding present in the business environment and company

has to chose the best possible source as per the need and requirement. There are different kinds

of loans institution present in the market such as bank loan and crowdfunding (Angotti, 2018) .

This is been recommended to SME company to take bank loan as this is one of the easiest way to

avail loan and they also provide different repayments option to borrowers. Apart from this, bank

to do not interfere in the activities of company as they also charge low interest rate from the

organisation. They also provide instant loan facilities with less paper work for the company.

D2 Critically identify sources and argue for the particular source

There are different kind of method through which company can raise funds. The

company must choose the best possible outcome for funding which help organisation to expand

the business at the larger scale . The best funding source for SME is bank as they provide various

option for repayment and help to provide flexible payment as per the convenience of the

company. Although crowdfunding is the option for the company but it has lot of risk for small

organisation as people fear to invest money in such companies due to lack of trust and market

size of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 3

P4 Design a business plan that include financial information and strategies objectives

Business plan is the document which is used to attain the business as well as objectives

effectively(Stein, 2018). This provide layout which is consist of marketing, financial and

operational viewpoint. These are important for the company which allow firm to reach the

organisational goals and objectives in a well define manner. Below discussed is a business plan

which is adopted by the plan in SME in UK in a detail way.

Company overview: SME can view the plan for the business which help in expansion of

business effectively. In orders to achieve desire aims and objectives company has to focus on

product and service as improvise changes to provide better services to consumer. The present

organisation is Deloitte which is an multinational professional service networks which provide

audit and management consulting to SME companies. The headquarters of entity is located in

UK and there around 321000 employees working in the company.

Vision: The vision of the company is related to the long term objectives which have to be

achieved by the company.

Mission: The mission statement of the company is provide high quality service to

consumer and capture large market share.

Objectives: Main objective of the company is to increase the profit share by 10% in

coming 5 years.

STP analysis:

This is the method which is used by the marketing department in the organisation to

figure out the different target consumer effectively. Hence this provide proper guidance for the

company to move in proper direction and make product as per the needs and requirement of user.

Small and medium enterprise must use such kind of strategies after being analyse target

audience.

Segmentation: In this method the company divide whole market into different groups

and the segment is based upon the different needs and wants of consumer. The SME companies

must focus on dividing customer on the basis of demographic, geographical behaviour of the

consumer. Along with this company have to segment there target audience on the basis of age

group to provide better services.

P4 Design a business plan that include financial information and strategies objectives

Business plan is the document which is used to attain the business as well as objectives

effectively(Stein, 2018). This provide layout which is consist of marketing, financial and

operational viewpoint. These are important for the company which allow firm to reach the

organisational goals and objectives in a well define manner. Below discussed is a business plan

which is adopted by the plan in SME in UK in a detail way.

Company overview: SME can view the plan for the business which help in expansion of

business effectively. In orders to achieve desire aims and objectives company has to focus on

product and service as improvise changes to provide better services to consumer. The present

organisation is Deloitte which is an multinational professional service networks which provide

audit and management consulting to SME companies. The headquarters of entity is located in

UK and there around 321000 employees working in the company.

Vision: The vision of the company is related to the long term objectives which have to be

achieved by the company.

Mission: The mission statement of the company is provide high quality service to

consumer and capture large market share.

Objectives: Main objective of the company is to increase the profit share by 10% in

coming 5 years.

STP analysis:

This is the method which is used by the marketing department in the organisation to

figure out the different target consumer effectively. Hence this provide proper guidance for the

company to move in proper direction and make product as per the needs and requirement of user.

Small and medium enterprise must use such kind of strategies after being analyse target

audience.

Segmentation: In this method the company divide whole market into different groups

and the segment is based upon the different needs and wants of consumer. The SME companies

must focus on dividing customer on the basis of demographic, geographical behaviour of the

consumer. Along with this company have to segment there target audience on the basis of age

group to provide better services.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Targeting: SME company has to focus on the particular consumer group rather than

focusing on different target user. This usually help entity to focus on the needs and wants of

consumer and make changes to provide better quality of services.

Positioning: In this process company usually try to position there presence in the

marketplace. SME company should focus on differentiate the product from the rivals with the

assistance of new product and innovation. This allow organisation to create a better image

among the competitive market.

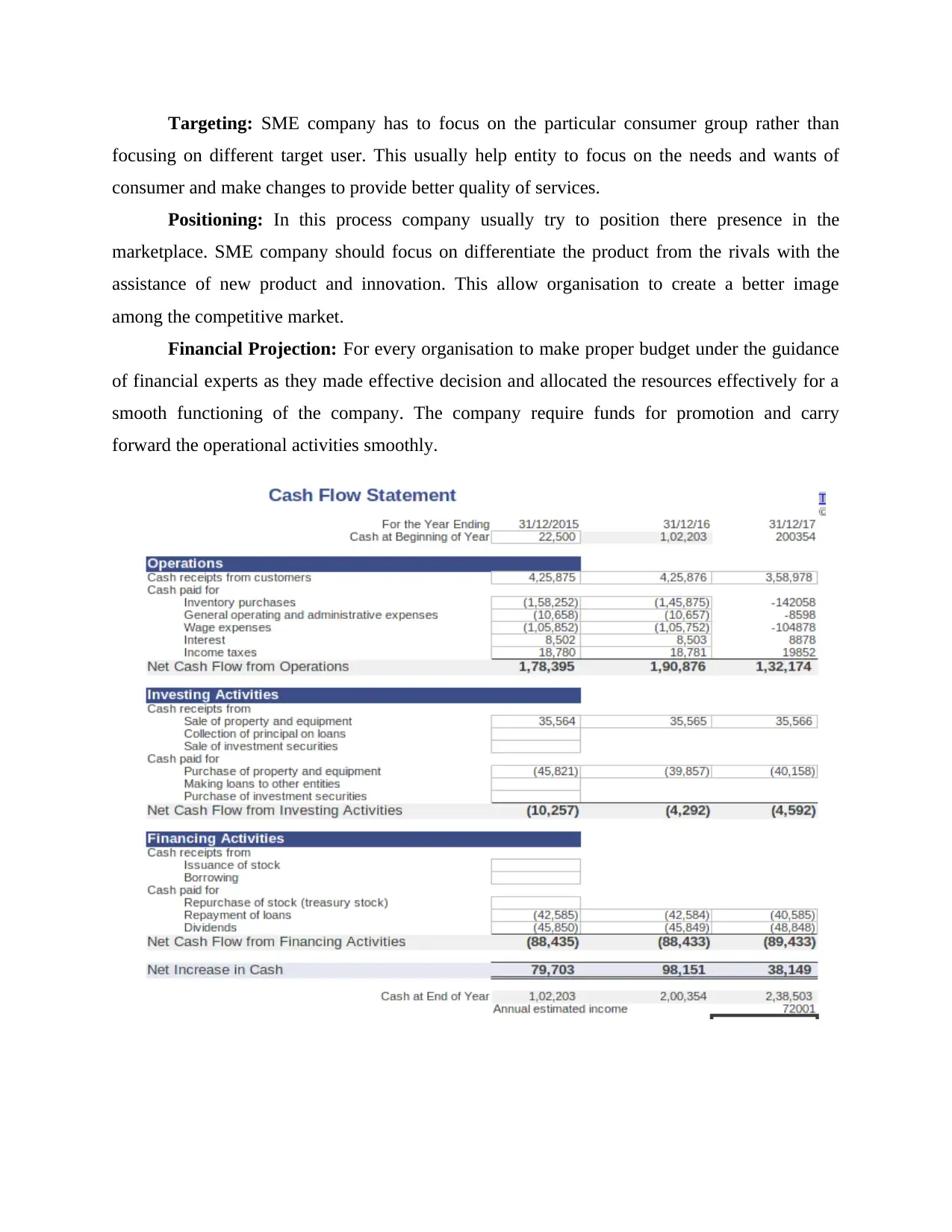

Financial Projection: For every organisation to make proper budget under the guidance

of financial experts as they made effective decision and allocated the resources effectively for a

smooth functioning of the company. The company require funds for promotion and carry

forward the operational activities smoothly.

focusing on different target user. This usually help entity to focus on the needs and wants of

consumer and make changes to provide better quality of services.

Positioning: In this process company usually try to position there presence in the

marketplace. SME company should focus on differentiate the product from the rivals with the

assistance of new product and innovation. This allow organisation to create a better image

among the competitive market.

Financial Projection: For every organisation to make proper budget under the guidance

of financial experts as they made effective decision and allocated the resources effectively for a

smooth functioning of the company. The company require funds for promotion and carry

forward the operational activities smoothly.

From the cash flow presented above, it has been observed that the organization has the enough

liquidation for paying out its debt and liability. The organization fixed asset value are also very

much high which can help them in paying out the loans if they want to pay back their liability

through selling out its fixed asset like land, buildings, machineries and so on.

M3 Develop an appropriate and detailed plan for growth and securing investment

This has been suggested to SME company as to develop effective plan because it help in

achieving desire aims and objectives effectively (Bates, 2018). As planning is the key to success

and company must review the plan to ensure about to meet the continuous need and demand of

users. The company must focus on meeting the objectives and work towards achieving desire

aims effectively. Along with this company management has to focus on current performance

constantly on regular basis of identify the best possible outcomes for strategies of growth.

D3 Present a coherent and in depth business plan that demonstrates knowledge and

understanding

Once the company makes plan this essential to make proper road map to target consumer

effectively. SME have work upon the vision and mission of the company and make sure that

employees must work upon to achieve common effectively. In addition to this, business plan

consist proper financial budget to make sure that the resources are used properly and minimize

the waste effectively. Segmentation, targeting and positioning plays and vital role in business

planing which describer about the different kind of customers.

TASK 4

P5 Discuss assessment of the different exist or succession alternative for business

There are different kind of schemes and method through which the company use exit or

succession plan. Here the SME company is suggested to adopt the succession strategies as it is

beneficial for the company to expand the business effectively (Bagheri and et. al., 2018) . Apart

from this, it tend to increase the market share along with the brand image. Here are some

secession strategies which SME companies must grow through are explained below:

Exit

liquidation for paying out its debt and liability. The organization fixed asset value are also very

much high which can help them in paying out the loans if they want to pay back their liability

through selling out its fixed asset like land, buildings, machineries and so on.

M3 Develop an appropriate and detailed plan for growth and securing investment

This has been suggested to SME company as to develop effective plan because it help in

achieving desire aims and objectives effectively (Bates, 2018). As planning is the key to success

and company must review the plan to ensure about to meet the continuous need and demand of

users. The company must focus on meeting the objectives and work towards achieving desire

aims effectively. Along with this company management has to focus on current performance

constantly on regular basis of identify the best possible outcomes for strategies of growth.

D3 Present a coherent and in depth business plan that demonstrates knowledge and

understanding

Once the company makes plan this essential to make proper road map to target consumer

effectively. SME have work upon the vision and mission of the company and make sure that

employees must work upon to achieve common effectively. In addition to this, business plan

consist proper financial budget to make sure that the resources are used properly and minimize

the waste effectively. Segmentation, targeting and positioning plays and vital role in business

planing which describer about the different kind of customers.

TASK 4

P5 Discuss assessment of the different exist or succession alternative for business

There are different kind of schemes and method through which the company use exit or

succession plan. Here the SME company is suggested to adopt the succession strategies as it is

beneficial for the company to expand the business effectively (Bagheri and et. al., 2018) . Apart

from this, it tend to increase the market share along with the brand image. Here are some

secession strategies which SME companies must grow through are explained below:

Exit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.