YourCloud Pty Ltd: Business Intelligence and Software Launch Project

VerifiedAdded on 2021/06/16

|17

|3202

|104

Project

AI Summary

This project presents a comprehensive business intelligence analysis for YourCloud Pty Ltd, a cloud-based software organization. The project evaluates the viability of launching a new software, considering market dynamics and investment decisions. It utilizes Monte-Carlo simulation with visual DSS software to calculate Net Present Value (NPV) under various scenarios, including different market shares, costs, and initial investments. The analysis includes code snippets for NPV calculations, risk assessment, and sensitivity analysis. The project also demonstrates the use of Microsoft Power BI for data visualization and analysis, showcasing dashboards with sales data, labor costs, and funding information. Furthermore, it discusses the impact of smart, connected products on business competition, detailing the transformation of value chains and the role of business intelligence in this context. The project covers the application of business analytics, the integration of smart components, and the use of data for strategic decision-making.

Running head: BUSINESS INTELLIGENCE

Business Intelligence

Name of Student:

Name of University:

Author’s Note:

Business Intelligence

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS INTELLIGENCE

Table of Contents

Part A...............................................................................................................................................2

Answer 1......................................................................................................................................2

Answer 2......................................................................................................................................3

Answer 3......................................................................................................................................6

Part B...............................................................................................................................................7

Demonstration 1...........................................................................................................................7

Demonstration 2.........................................................................................................................10

Part C.............................................................................................................................................12

How Smart, Connected Products Are Transforming Competition................................................12

Introduction....................................................................................................................................12

Discussion......................................................................................................................................12

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

Table of Contents

Part A...............................................................................................................................................2

Answer 1......................................................................................................................................2

Answer 2......................................................................................................................................3

Answer 3......................................................................................................................................6

Part B...............................................................................................................................................7

Demonstration 1...........................................................................................................................7

Demonstration 2.........................................................................................................................10

Part C.............................................................................................................................................12

How Smart, Connected Products Are Transforming Competition................................................12

Introduction....................................................................................................................................12

Discussion......................................................................................................................................12

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

2BUSINESS INTELLIGENCE

*Columns

*Years 2018,2021

*Rows

Initial investment(0) = 1750000.00 '.2

Market at Introduction (0)= 420000

Market Growth = 0.15'.2

Market Share = 0.10'.2

Total market = Market at Introduction;Total market(-1)*1.15

Sales Volume = Total Market*Market Share

Estimated selling price = 55.00 '.2

COP = nor(25.00,5.00) '.2

Total Revenue = Sales Volume*Estimated selling Price '.2

COGS = Sales Volume*COP

Annual overhead cost = 210000

Cash Flow = Total Revenue-COGS-Annual Overhead cost

Rate = 0.12'.2

NPV(0) = *NPV cash flow;rate

Part A

YourCloud Pty Ltd is a cloud based software organization operating out of Brisbane,

Australia. The organization plans to launch a new software. The cloud based software market is a

highly dynamic market. In recent times due to some bad decisions, there have been some wrong

investments. Hence, the senior management want to analyze the market before investing in any

new software. Towards this end, they have collected some data on the basis of which decision

has to be taken. Monte-Carlo simulation using visual DSS software is used to take the decision.

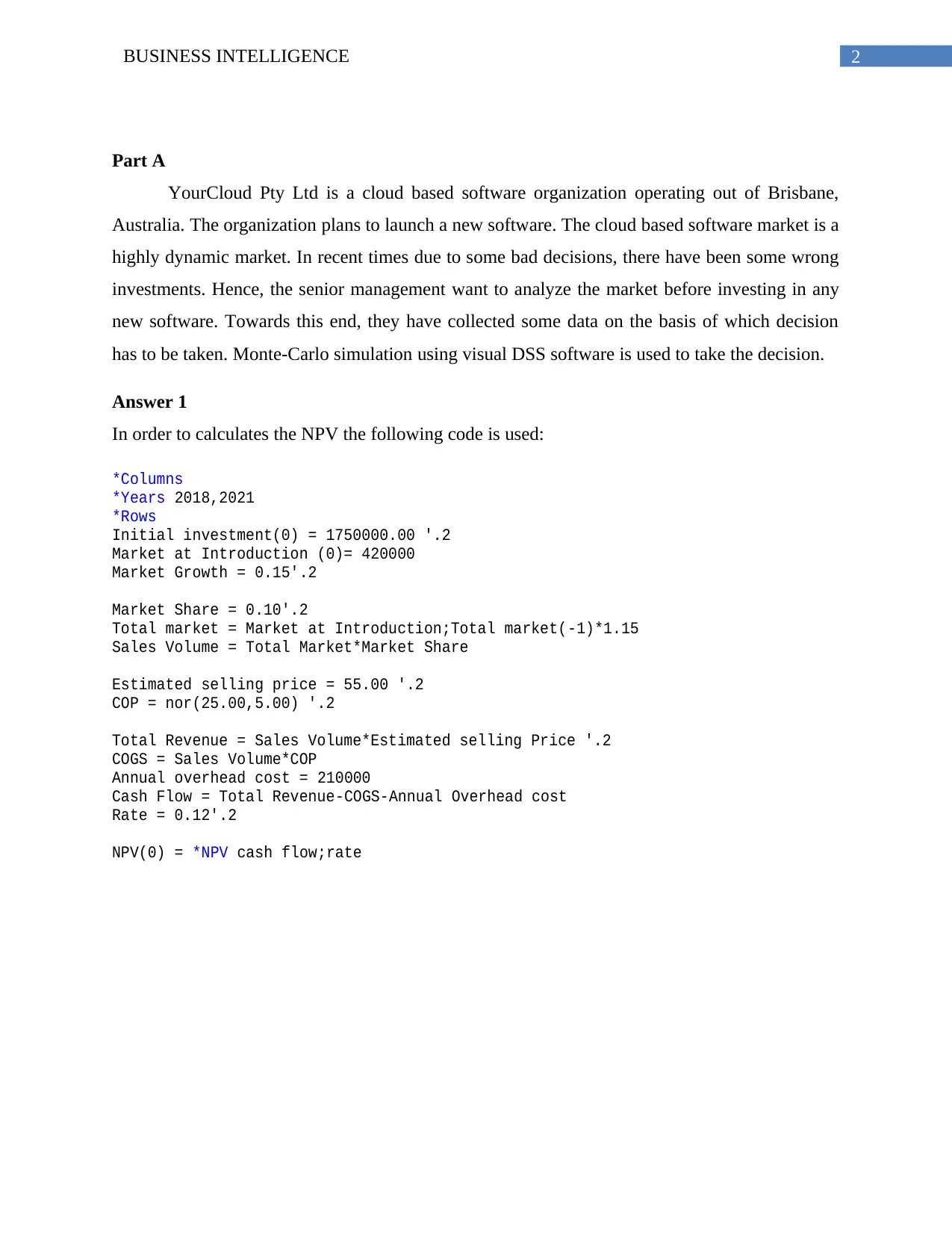

Answer 1

In order to calculates the NPV the following code is used:

*Columns

*Years 2018,2021

*Rows

Initial investment(0) = 1750000.00 '.2

Market at Introduction (0)= 420000

Market Growth = 0.15'.2

Market Share = 0.10'.2

Total market = Market at Introduction;Total market(-1)*1.15

Sales Volume = Total Market*Market Share

Estimated selling price = 55.00 '.2

COP = nor(25.00,5.00) '.2

Total Revenue = Sales Volume*Estimated selling Price '.2

COGS = Sales Volume*COP

Annual overhead cost = 210000

Cash Flow = Total Revenue-COGS-Annual Overhead cost

Rate = 0.12'.2

NPV(0) = *NPV cash flow;rate

Part A

YourCloud Pty Ltd is a cloud based software organization operating out of Brisbane,

Australia. The organization plans to launch a new software. The cloud based software market is a

highly dynamic market. In recent times due to some bad decisions, there have been some wrong

investments. Hence, the senior management want to analyze the market before investing in any

new software. Towards this end, they have collected some data on the basis of which decision

has to be taken. Monte-Carlo simulation using visual DSS software is used to take the decision.

Answer 1

In order to calculates the NPV the following code is used:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS INTELLIGENCE

The analysis from the available data shows that the net present value (NPV) of the new

software would be $5440551. This is much higher than the anticipated NPV of $2million. Thus,

the senior managers can take a decision in favour of launching the new software.

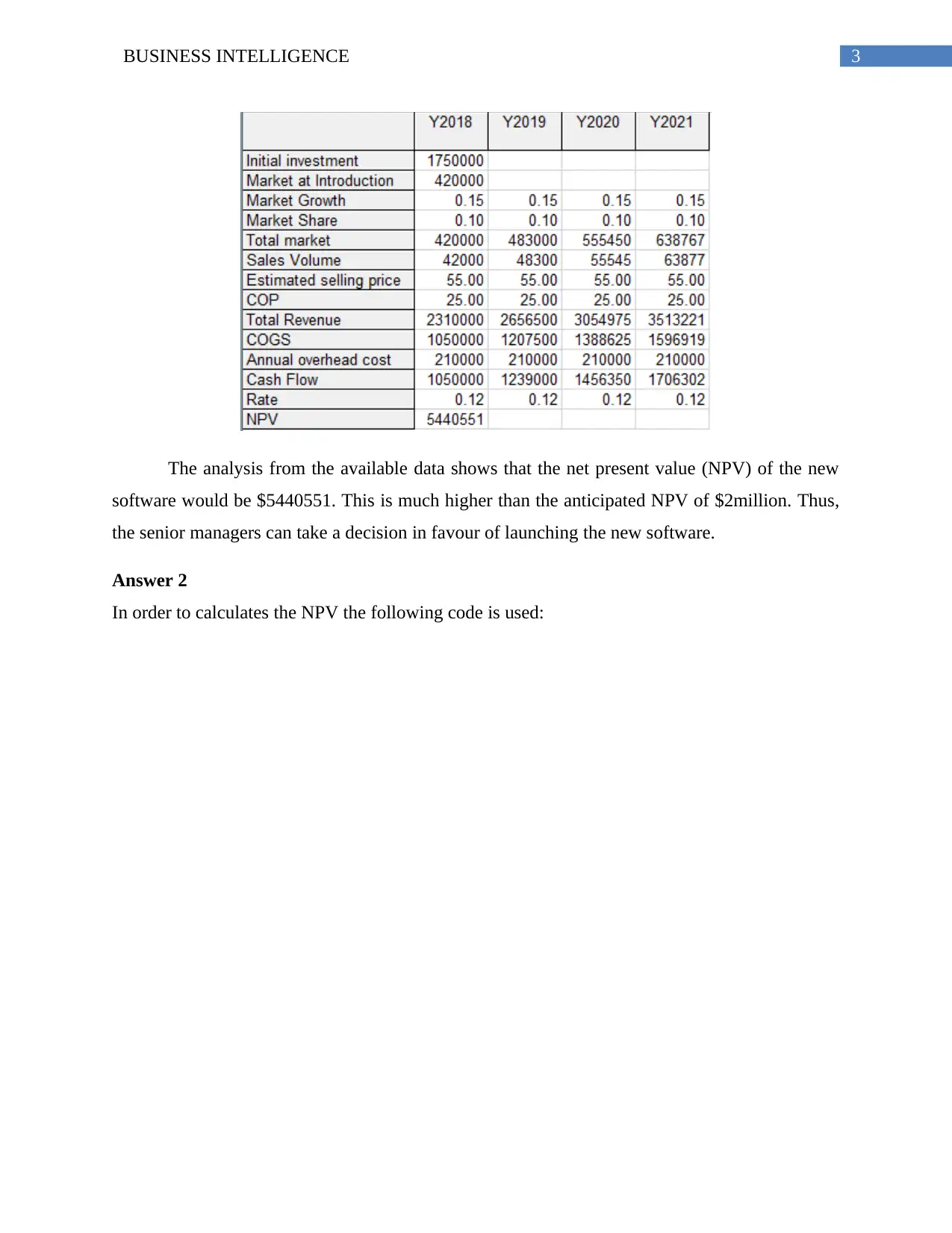

Answer 2

In order to calculates the NPV the following code is used:

The analysis from the available data shows that the net present value (NPV) of the new

software would be $5440551. This is much higher than the anticipated NPV of $2million. Thus,

the senior managers can take a decision in favour of launching the new software.

Answer 2

In order to calculates the NPV the following code is used:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS INTELLIGENCE

*Columns

*Years 2018,2021

*Rows

Initial investment(0) = UNI(100000.00,200000.00) '.2

Market at introduction (0)= 420000

Market Growth = 0.15'.2

Market Share = TRI(0.05,0.10,0.15)'.2

Total market = Market at introduction;Total market(-1)*1.15

Sales Volume = Total Market*Market Share

Estimated selling price = 55.00 '.2

COP = NOR(30.00,12.00) '.2

Total Revenue = Sales Volume*Estimated selling Price '.2

COGS = Sales Volume*COP

Overhead cost Annual = TRI(150000,215000,350000)

Cash Flow = Total Revenue-COGS-Overhead cost Annual

Rate = 0.12'.2

NPV(0) = *NPV cash flow;rate

In order to evaluate the impact of variations in market share, COP, overheads and initial

investment a risk assessment study needs to be done. The risk assessment needs to be evaluated

based on

*Columns

*Years 2018,2021

*Rows

Initial investment(0) = UNI(100000.00,200000.00) '.2

Market at introduction (0)= 420000

Market Growth = 0.15'.2

Market Share = TRI(0.05,0.10,0.15)'.2

Total market = Market at introduction;Total market(-1)*1.15

Sales Volume = Total Market*Market Share

Estimated selling price = 55.00 '.2

COP = NOR(30.00,12.00) '.2

Total Revenue = Sales Volume*Estimated selling Price '.2

COGS = Sales Volume*COP

Overhead cost Annual = TRI(150000,215000,350000)

Cash Flow = Total Revenue-COGS-Overhead cost Annual

Rate = 0.12'.2

NPV(0) = *NPV cash flow;rate

In order to evaluate the impact of variations in market share, COP, overheads and initial

investment a risk assessment study needs to be done. The risk assessment needs to be evaluated

based on

5BUSINESS INTELLIGENCE

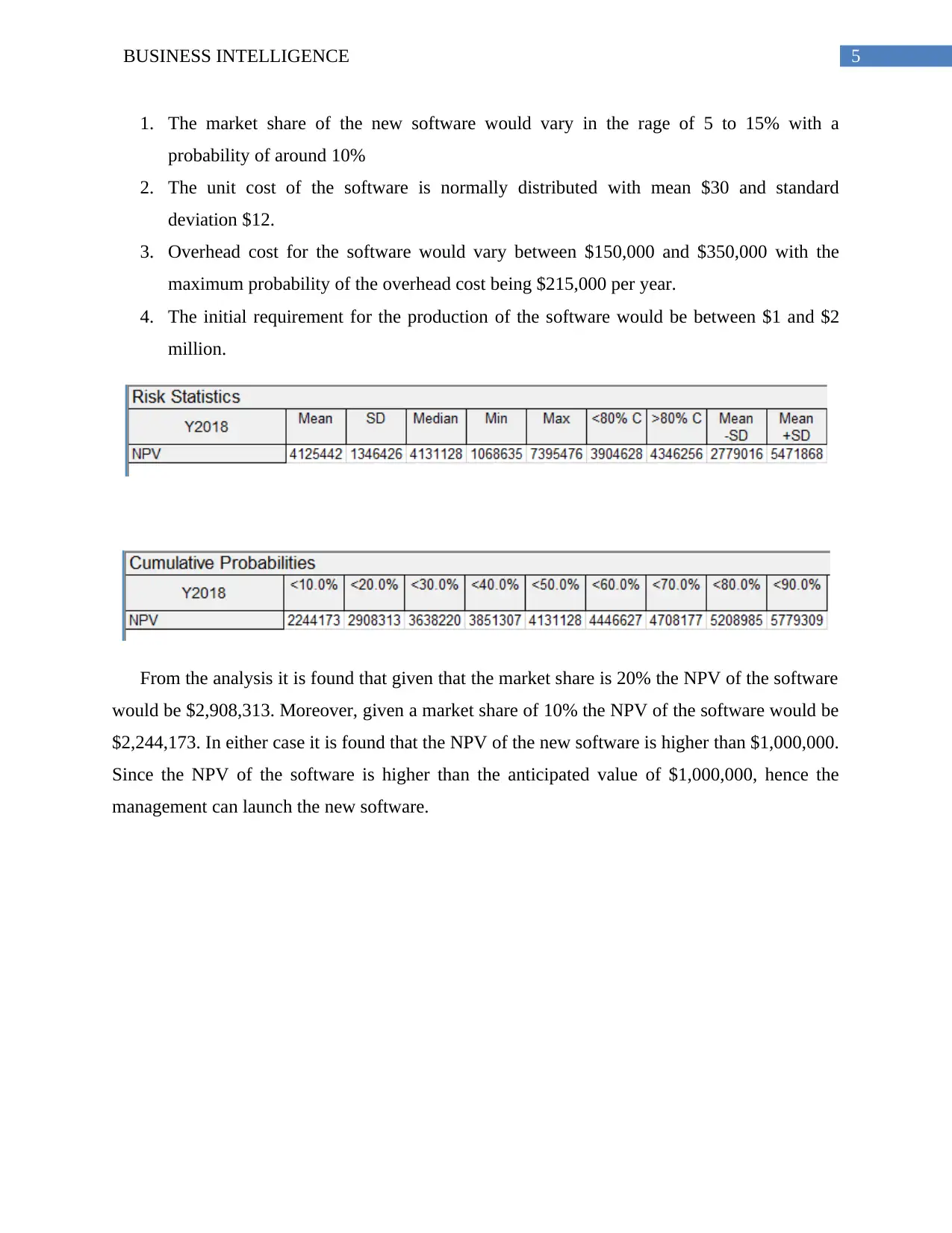

1. The market share of the new software would vary in the rage of 5 to 15% with a

probability of around 10%

2. The unit cost of the software is normally distributed with mean $30 and standard

deviation $12.

3. Overhead cost for the software would vary between $150,000 and $350,000 with the

maximum probability of the overhead cost being $215,000 per year.

4. The initial requirement for the production of the software would be between $1 and $2

million.

From the analysis it is found that given that the market share is 20% the NPV of the software

would be $2,908,313. Moreover, given a market share of 10% the NPV of the software would be

$2,244,173. In either case it is found that the NPV of the new software is higher than $1,000,000.

Since the NPV of the software is higher than the anticipated value of $1,000,000, hence the

management can launch the new software.

1. The market share of the new software would vary in the rage of 5 to 15% with a

probability of around 10%

2. The unit cost of the software is normally distributed with mean $30 and standard

deviation $12.

3. Overhead cost for the software would vary between $150,000 and $350,000 with the

maximum probability of the overhead cost being $215,000 per year.

4. The initial requirement for the production of the software would be between $1 and $2

million.

From the analysis it is found that given that the market share is 20% the NPV of the software

would be $2,908,313. Moreover, given a market share of 10% the NPV of the software would be

$2,244,173. In either case it is found that the NPV of the new software is higher than $1,000,000.

Since the NPV of the software is higher than the anticipated value of $1,000,000, hence the

management can launch the new software.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS INTELLIGENCE

*Columns

*Years 2018,2021

*Rows

Initial investment (0) = 1750000.00 '.2

Market at introduction (0)= 420000

Market Growth = 0.15'.2

Market Share = TRI(0.05,0.10,0.15)'.2

Total market = Market at introduction;Total market(-1)*1.15

Sales Volume = Total Market*Market Share

Estimated selling price = UNI(45.00,65.00) '.2

COP = NOR(25.00,5.00) '.2

Total Revenue = Sales Volume*Estimated selling Price '.2

COGS = Sales Volume*COP

Overhead cost Annual = 210000

Cash Flow = Total Revenue-COGS-Overhead cost Annual

Rate = 0.12'.2

NPV(0) = *NPV cash flow;rate

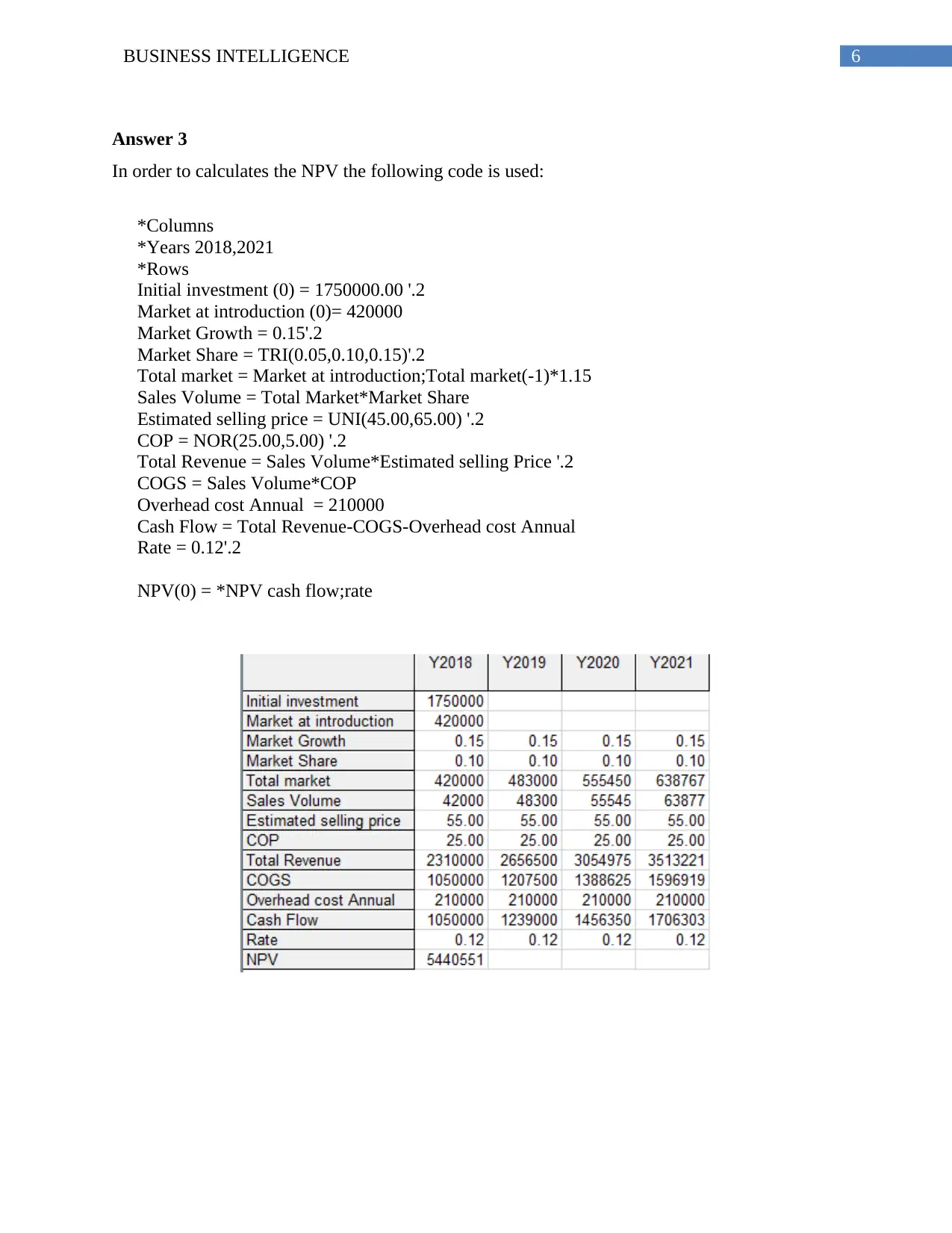

Answer 3

In order to calculates the NPV the following code is used:

*Columns

*Years 2018,2021

*Rows

Initial investment (0) = 1750000.00 '.2

Market at introduction (0)= 420000

Market Growth = 0.15'.2

Market Share = TRI(0.05,0.10,0.15)'.2

Total market = Market at introduction;Total market(-1)*1.15

Sales Volume = Total Market*Market Share

Estimated selling price = UNI(45.00,65.00) '.2

COP = NOR(25.00,5.00) '.2

Total Revenue = Sales Volume*Estimated selling Price '.2

COGS = Sales Volume*COP

Overhead cost Annual = 210000

Cash Flow = Total Revenue-COGS-Overhead cost Annual

Rate = 0.12'.2

NPV(0) = *NPV cash flow;rate

Answer 3

In order to calculates the NPV the following code is used:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS INTELLIGENCE

The CEO of the organization had requested certain extra assumptions to be considered before

he gave the signal to produce the software. The assumptions according to the CEO are:

1. The selling price of the software is in the range of $45 and $65.

2. The unit cost of the software is normally distributed with mean $25 and standard

deviation of $5

3. There should 80% probability that the NPV of the software would be more than

$2,500,000.

On the basis of the above assumption the re-evaluated model shows that there is 80%

probability that the NPV would be at least $6,258,513. Since the estimated NPV is higher than

the CEO’s requirements hence the software may be launched.

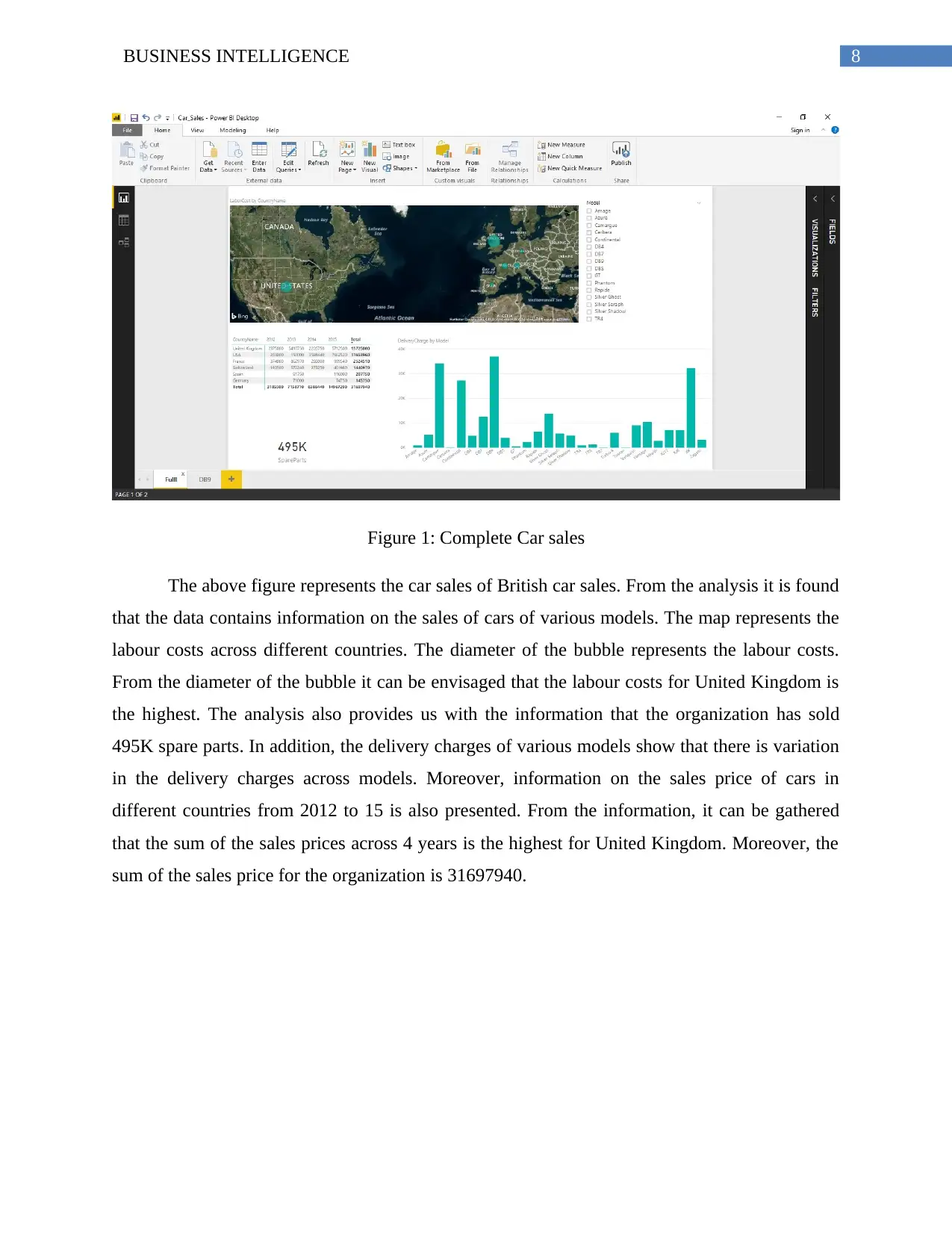

Part B

Demonstration 1

The CEO of the organization had requested certain extra assumptions to be considered before

he gave the signal to produce the software. The assumptions according to the CEO are:

1. The selling price of the software is in the range of $45 and $65.

2. The unit cost of the software is normally distributed with mean $25 and standard

deviation of $5

3. There should 80% probability that the NPV of the software would be more than

$2,500,000.

On the basis of the above assumption the re-evaluated model shows that there is 80%

probability that the NPV would be at least $6,258,513. Since the estimated NPV is higher than

the CEO’s requirements hence the software may be launched.

Part B

Demonstration 1

8BUSINESS INTELLIGENCE

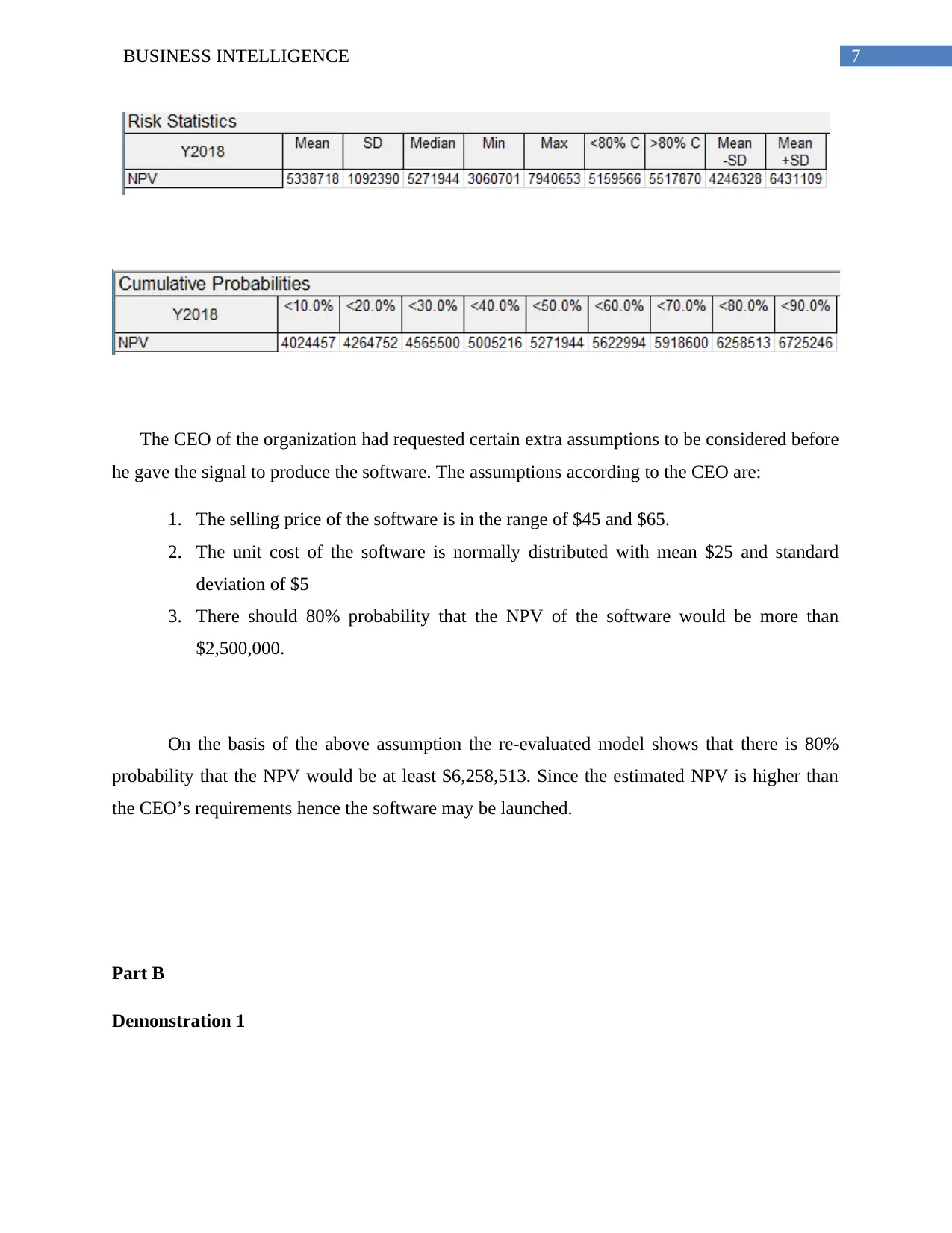

Figure 1: Complete Car sales

The above figure represents the car sales of British car sales. From the analysis it is found

that the data contains information on the sales of cars of various models. The map represents the

labour costs across different countries. The diameter of the bubble represents the labour costs.

From the diameter of the bubble it can be envisaged that the labour costs for United Kingdom is

the highest. The analysis also provides us with the information that the organization has sold

495K spare parts. In addition, the delivery charges of various models show that there is variation

in the delivery charges across models. Moreover, information on the sales price of cars in

different countries from 2012 to 15 is also presented. From the information, it can be gathered

that the sum of the sales prices across 4 years is the highest for United Kingdom. Moreover, the

sum of the sales price for the organization is 31697940.

Figure 1: Complete Car sales

The above figure represents the car sales of British car sales. From the analysis it is found

that the data contains information on the sales of cars of various models. The map represents the

labour costs across different countries. The diameter of the bubble represents the labour costs.

From the diameter of the bubble it can be envisaged that the labour costs for United Kingdom is

the highest. The analysis also provides us with the information that the organization has sold

495K spare parts. In addition, the delivery charges of various models show that there is variation

in the delivery charges across models. Moreover, information on the sales price of cars in

different countries from 2012 to 15 is also presented. From the information, it can be gathered

that the sum of the sales prices across 4 years is the highest for United Kingdom. Moreover, the

sum of the sales price for the organization is 31697940.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9BUSINESS INTELLIGENCE

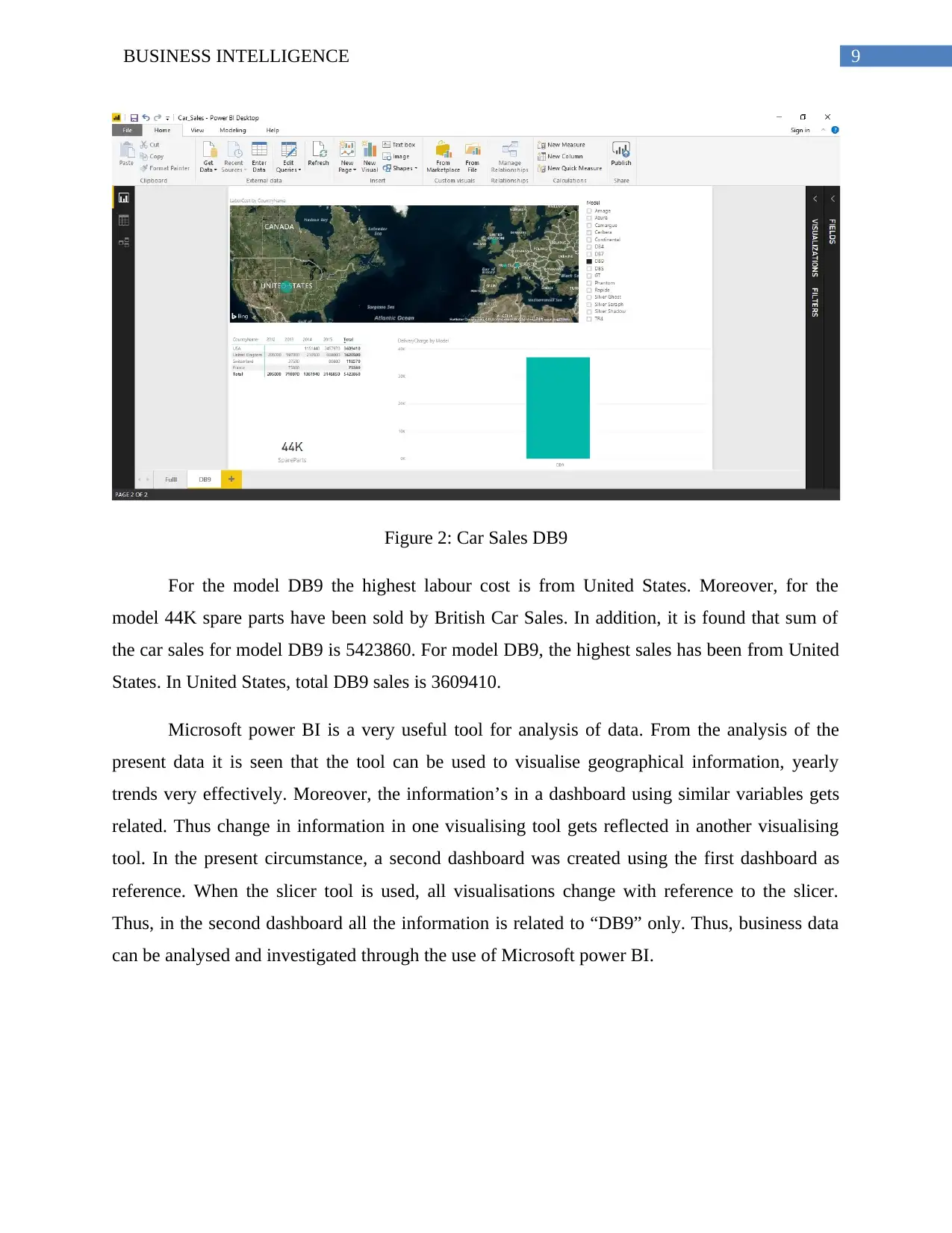

Figure 2: Car Sales DB9

For the model DB9 the highest labour cost is from United States. Moreover, for the

model 44K spare parts have been sold by British Car Sales. In addition, it is found that sum of

the car sales for model DB9 is 5423860. For model DB9, the highest sales has been from United

States. In United States, total DB9 sales is 3609410.

Microsoft power BI is a very useful tool for analysis of data. From the analysis of the

present data it is seen that the tool can be used to visualise geographical information, yearly

trends very effectively. Moreover, the information’s in a dashboard using similar variables gets

related. Thus change in information in one visualising tool gets reflected in another visualising

tool. In the present circumstance, a second dashboard was created using the first dashboard as

reference. When the slicer tool is used, all visualisations change with reference to the slicer.

Thus, in the second dashboard all the information is related to “DB9” only. Thus, business data

can be analysed and investigated through the use of Microsoft power BI.

Figure 2: Car Sales DB9

For the model DB9 the highest labour cost is from United States. Moreover, for the

model 44K spare parts have been sold by British Car Sales. In addition, it is found that sum of

the car sales for model DB9 is 5423860. For model DB9, the highest sales has been from United

States. In United States, total DB9 sales is 3609410.

Microsoft power BI is a very useful tool for analysis of data. From the analysis of the

present data it is seen that the tool can be used to visualise geographical information, yearly

trends very effectively. Moreover, the information’s in a dashboard using similar variables gets

related. Thus change in information in one visualising tool gets reflected in another visualising

tool. In the present circumstance, a second dashboard was created using the first dashboard as

reference. When the slicer tool is used, all visualisations change with reference to the slicer.

Thus, in the second dashboard all the information is related to “DB9” only. Thus, business data

can be analysed and investigated through the use of Microsoft power BI.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10BUSINESS INTELLIGENCE

Demonstration 2

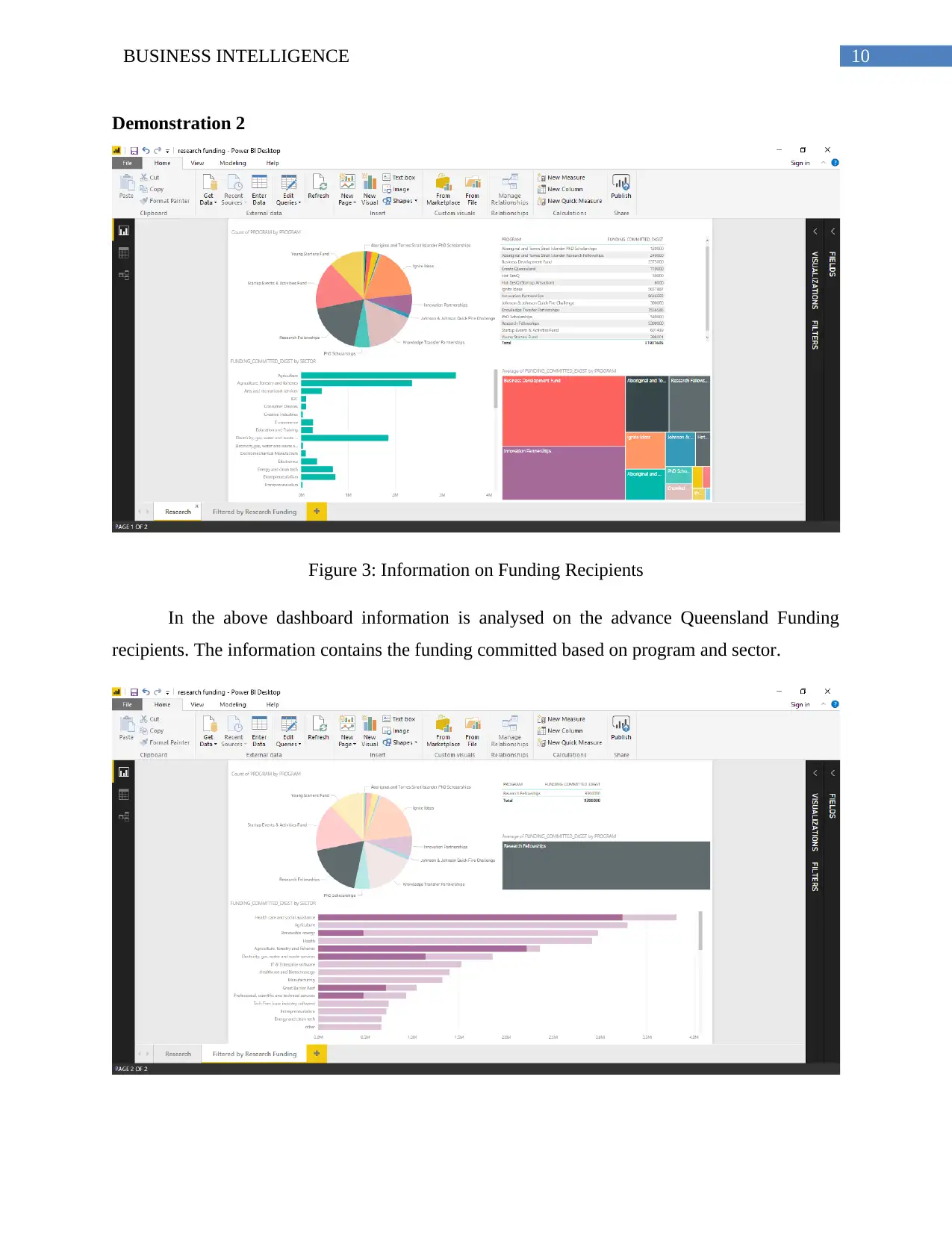

Figure 3: Information on Funding Recipients

In the above dashboard information is analysed on the advance Queensland Funding

recipients. The information contains the funding committed based on program and sector.

Demonstration 2

Figure 3: Information on Funding Recipients

In the above dashboard information is analysed on the advance Queensland Funding

recipients. The information contains the funding committed based on program and sector.

11BUSINESS INTELLIGENCE

Figure 4: Research Funding’s on Research Fellowships

The above dashboard presents information on advance funding for research fellowships.

The total advance for research fellowships is 9300000. The maximum amount advanced for

research fellowships is for health care and social assistance.

The information on advances by Government of Queensland has been analysed by the

use of Microsoft Power BI. In the first dashboard we have created a pie chart, tree map, a table

and stacked bar chart. However, the link between the four charts is very poor. When the second

dashboard is created we select “research fellowships.” In the tree map we select the given

variable. However, the pie chart is not able to reflect the value of “research fellowships,” only

the instruments become lighter. Further, in the stacked bar chart we find that the values of

“research fellowships” are deeper as compared to other instruments. Thus, in such

circumstances, where there is a poor link between the charts, data validation is poor.

Figure 4: Research Funding’s on Research Fellowships

The above dashboard presents information on advance funding for research fellowships.

The total advance for research fellowships is 9300000. The maximum amount advanced for

research fellowships is for health care and social assistance.

The information on advances by Government of Queensland has been analysed by the

use of Microsoft Power BI. In the first dashboard we have created a pie chart, tree map, a table

and stacked bar chart. However, the link between the four charts is very poor. When the second

dashboard is created we select “research fellowships.” In the tree map we select the given

variable. However, the pie chart is not able to reflect the value of “research fellowships,” only

the instruments become lighter. Further, in the stacked bar chart we find that the values of

“research fellowships” are deeper as compared to other instruments. Thus, in such

circumstances, where there is a poor link between the charts, data validation is poor.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.