Planning for Growth: Strategies for Guildford Tyre Company's Growth

VerifiedAdded on 2022/12/26

|17

|5043

|99

Report

AI Summary

This report analyzes the growth strategies for Guildford Tyre Company, a UK-based SME in the automotive industry. It explores growth options, the Ansoff matrix, and investment appraisal techniques like payback period and NPV, along with internal and external funding sources. The report details a business plan, including an executive summary, company overview, mission and vision, and strategic objectives. It covers financial summaries, industry and market analysis, marketing and sales strategies, operational plans, and management teams. The report also addresses scaling plans and exit and succession strategies, concluding with a comprehensive overview of the company's potential for expansion and development. The report emphasizes the importance of financial planning, strategic decision-making, and market analysis for achieving sustainable growth.

Planning for growth

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

Before expansion, growth option that need to be considered.................................................3

Growth’s model- Ansoff’s matrix..........................................................................................4

Investment appraisal and sources of funding.........................................................................5

Business plan along with Scaling plans..................................................................................7

Exit strategies and succession plan.......................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCE.................................................................................................................................17

INTRODUCTION...........................................................................................................................3

Before expansion, growth option that need to be considered.................................................3

Growth’s model- Ansoff’s matrix..........................................................................................4

Investment appraisal and sources of funding.........................................................................5

Business plan along with Scaling plans..................................................................................7

Exit strategies and succession plan.......................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCE.................................................................................................................................17

INTRODUCTION

Small and medium business are this unit which operates their business solely, independent

which employer fewer than a given number of employees. Financial assets of such type of

business unit are also limited. To use all limited resources in optimized manner it is important to

formulate business plan and to gain growth, such unit have opportunity to enlarge their business.

The primary objective of this assignment is to understand about significance of planning for

growth (Sell and et.al., 2018). For this, an organisation is selected, namely, Guildford Tyre

company, founded in 1976 headquartered in UK. They serve different type of product such as

Vehicle Diagnostics, Fixation of brakes, batteries repairing engine failures. Further, it covers

growth option for expansion, Ansoff matrix, and investment appraisal with funding sources.

Lastly a business plan is formulated with exit and succession plan.

Before expansion, growth option that need to be considered.

To determine the growth opportunities is vital as it assist business to formulate effective

decision and strategies. Competitive advantage refers to benefits that is gain by business unit

from the rivalries of market. There are number of competitive advantage like resources,

capabilities and core competencies that can be gain by respective company to use strategies

effectively:

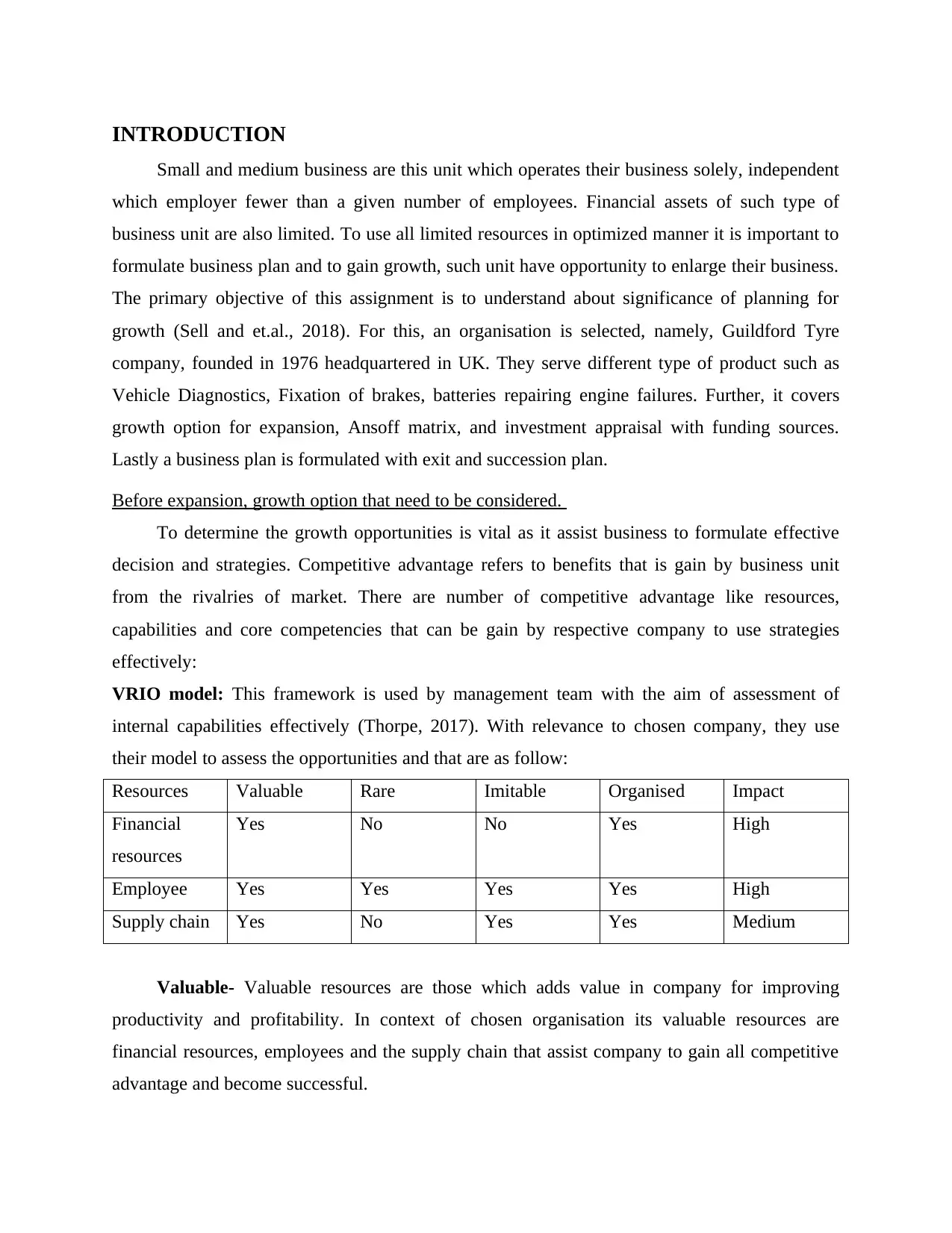

VRIO model: This framework is used by management team with the aim of assessment of

internal capabilities effectively (Thorpe, 2017). With relevance to chosen company, they use

their model to assess the opportunities and that are as follow:

Resources Valuable Rare Imitable Organised Impact

Financial

resources

Yes No No Yes High

Employee Yes Yes Yes Yes High

Supply chain Yes No Yes Yes Medium

Valuable- Valuable resources are those which adds value in company for improving

productivity and profitability. In context of chosen organisation its valuable resources are

financial resources, employees and the supply chain that assist company to gain all competitive

advantage and become successful.

Small and medium business are this unit which operates their business solely, independent

which employer fewer than a given number of employees. Financial assets of such type of

business unit are also limited. To use all limited resources in optimized manner it is important to

formulate business plan and to gain growth, such unit have opportunity to enlarge their business.

The primary objective of this assignment is to understand about significance of planning for

growth (Sell and et.al., 2018). For this, an organisation is selected, namely, Guildford Tyre

company, founded in 1976 headquartered in UK. They serve different type of product such as

Vehicle Diagnostics, Fixation of brakes, batteries repairing engine failures. Further, it covers

growth option for expansion, Ansoff matrix, and investment appraisal with funding sources.

Lastly a business plan is formulated with exit and succession plan.

Before expansion, growth option that need to be considered.

To determine the growth opportunities is vital as it assist business to formulate effective

decision and strategies. Competitive advantage refers to benefits that is gain by business unit

from the rivalries of market. There are number of competitive advantage like resources,

capabilities and core competencies that can be gain by respective company to use strategies

effectively:

VRIO model: This framework is used by management team with the aim of assessment of

internal capabilities effectively (Thorpe, 2017). With relevance to chosen company, they use

their model to assess the opportunities and that are as follow:

Resources Valuable Rare Imitable Organised Impact

Financial

resources

Yes No No Yes High

Employee Yes Yes Yes Yes High

Supply chain Yes No Yes Yes Medium

Valuable- Valuable resources are those which adds value in company for improving

productivity and profitability. In context of chosen organisation its valuable resources are

financial resources, employees and the supply chain that assist company to gain all competitive

advantage and become successful.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Rare- These are those resources and competencies which are rare for organisation and

these add high values in market. Employees of selected company are considered as the rare as

they are skilled with advanced knowledge.

Imitable- This tends to intensity that is hold up by resources of company, also not being

imitate by others. For example financial resources of respective organisation are inimitable

whereas the employees and supply chain are imitable.

Organised- In business it is vital to organised all resources effectively and well manner for

gaining positive outcome. With relevance to selected company they organised their all resources

appropriately as they are able to work effectively (Fahed-Sreih and El-Kassar, 2019).

New product/ services- Guildford tyre delivers/ supply services or product that are related

with the automotive industry such as tyres of bus, car, with some other services like vehicle

diagnostic, fixation, batteries repairing engines failure, modifies exhaust and so on. With the help

of all these they are gaining huge growth and success at marketplace.

Growth’s model- Ansoff’s matrix.

To identify the growth opportunities is vital as it help business unit to grow their business

successfully while expansion. Explanation of growth model in context of chosen company are as

follow:

Ansoff’s Matrix- Number of organisation use this model with the aim of determination of

growth opportunities for expansion of business operation. As it is a time consuming process but

give relevant information that are needed for taking advantages of opportunities. It includes

basically four strategies and that are as follow:

Market penetration: This is the growth strategies that relies on existing product within

current market. This is considered as most appropriate strategies due to low risk association. In

context of Guildford Tyre they can use this strategies for their business.

Product development: This is associate with existing market but with a new product.

With the help of this growth strategies, respective company can assess new opportunity for

enlarging their business by enhancing product portfolio. This could help them to grasp more new

consumer and gain success in growth (Wang, 2019).

Market development: This growth strategy is related with the introduction of new

market with existing product. With the help of such type of business growth strategies,

these add high values in market. Employees of selected company are considered as the rare as

they are skilled with advanced knowledge.

Imitable- This tends to intensity that is hold up by resources of company, also not being

imitate by others. For example financial resources of respective organisation are inimitable

whereas the employees and supply chain are imitable.

Organised- In business it is vital to organised all resources effectively and well manner for

gaining positive outcome. With relevance to selected company they organised their all resources

appropriately as they are able to work effectively (Fahed-Sreih and El-Kassar, 2019).

New product/ services- Guildford tyre delivers/ supply services or product that are related

with the automotive industry such as tyres of bus, car, with some other services like vehicle

diagnostic, fixation, batteries repairing engines failure, modifies exhaust and so on. With the help

of all these they are gaining huge growth and success at marketplace.

Growth’s model- Ansoff’s matrix.

To identify the growth opportunities is vital as it help business unit to grow their business

successfully while expansion. Explanation of growth model in context of chosen company are as

follow:

Ansoff’s Matrix- Number of organisation use this model with the aim of determination of

growth opportunities for expansion of business operation. As it is a time consuming process but

give relevant information that are needed for taking advantages of opportunities. It includes

basically four strategies and that are as follow:

Market penetration: This is the growth strategies that relies on existing product within

current market. This is considered as most appropriate strategies due to low risk association. In

context of Guildford Tyre they can use this strategies for their business.

Product development: This is associate with existing market but with a new product.

With the help of this growth strategies, respective company can assess new opportunity for

enlarging their business by enhancing product portfolio. This could help them to grasp more new

consumer and gain success in growth (Wang, 2019).

Market development: This growth strategy is related with the introduction of new

market with existing product. With the help of such type of business growth strategies,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

organisation can enter into new market but the chose company is small and that would not be the

viable for them

Diversification- This emphasise on new product with new market and considered as one

of the most risky strategy. This is helpful for the large business organisation and the selected

firm is small and that is not feasible for them.

For Guildford Tyre, the best and appropriate strategies for enlarging their business would

be the product development for the development and growth of business as with the help of this,

they can serve services as per consumer requirements.

Investment appraisal and sources of funding

Investment appraisal

Payback period- It can be defined as amount of time that are required to recover the cost

of an investment. Shorter payback is considered as the most acceptable.

Merits- It is simple to use and gives quick solution as well as useful in case of

uncertainty.

Demerits- It is not considered the time value of money and not include all cash outflow

also ignore the return on investment of project (Bradley, Burnett and Sparling, 2017).

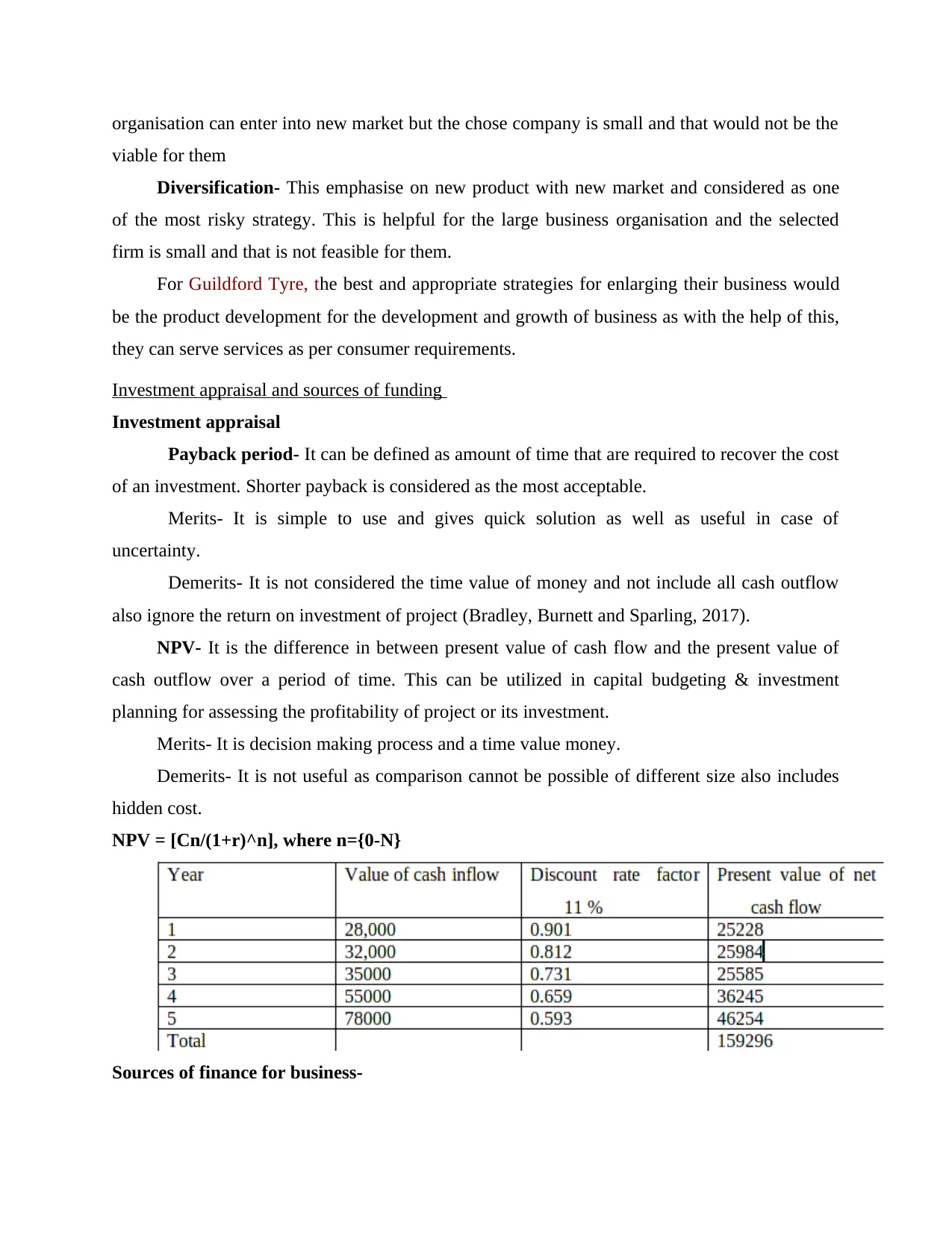

NPV- It is the difference in between present value of cash flow and the present value of

cash outflow over a period of time. This can be utilized in capital budgeting & investment

planning for assessing the profitability of project or its investment.

Merits- It is decision making process and a time value money.

Demerits- It is not useful as comparison cannot be possible of different size also includes

hidden cost.

NPV = [Cn/(1+r)^n], where n={0-N}

Sources of finance for business-

viable for them

Diversification- This emphasise on new product with new market and considered as one

of the most risky strategy. This is helpful for the large business organisation and the selected

firm is small and that is not feasible for them.

For Guildford Tyre, the best and appropriate strategies for enlarging their business would

be the product development for the development and growth of business as with the help of this,

they can serve services as per consumer requirements.

Investment appraisal and sources of funding

Investment appraisal

Payback period- It can be defined as amount of time that are required to recover the cost

of an investment. Shorter payback is considered as the most acceptable.

Merits- It is simple to use and gives quick solution as well as useful in case of

uncertainty.

Demerits- It is not considered the time value of money and not include all cash outflow

also ignore the return on investment of project (Bradley, Burnett and Sparling, 2017).

NPV- It is the difference in between present value of cash flow and the present value of

cash outflow over a period of time. This can be utilized in capital budgeting & investment

planning for assessing the profitability of project or its investment.

Merits- It is decision making process and a time value money.

Demerits- It is not useful as comparison cannot be possible of different size also includes

hidden cost.

NPV = [Cn/(1+r)^n], where n={0-N}

Sources of finance for business-

Within business organisation, it is crucial to have awareness about finance to execute all

plan and strategies effectively. There are various finance sources available for business unit to

collect money for operating business. Some are as follow:

Internal sources of funds

These are such type of fund sources which are collected by business owner internally

from their firms such as owner’s capital, retained profit and selling assets.

Owner’s capital: In this the amount that is investment by owners comes from personal

saving or debit card. Personal saving refers to that amount that is being saved by an entrepreneur.

This is one of the most common mode of fund generation (Mai and Smith, 2018).

Merit- In such type of souse of funding there is no requirements of repayments as there is

no interest charges applied. Also it hold low risk as a business unit which uses more equity than

debt has low risk of bankruptcy.

Demerit- It requires lots of time to do saving, also to use that continuously, again saving

is required which is not easy for owner. Therefore, such type of funding is not easy to do only for

the purpose of investing it in business.

Retained Profit- When business unit makes profit then some amount can be utilized by

them in business again for expansion. It doesn’t incur any interest charge or requires payment of

dividends due to which it can be desirable source of funding.

Merit- In this sources of funding there is no requirement of lenders of shareholders in

case of urgency of funds. Also it reduces the cost of issuing the external equity and remove the

loss incurred on under-pricing (Hu, 2020).

Demerit- the amount raise by retain earning could be limited as tends to highly variable

because of stable policy divided. Also some companies are not giving much importance to

opportunity cost of these earning and invest into sub- marginal projects and that may have

negative NPV.

External sources of funds:

These are those funds that are generated by external sources such as by Bank, loans,

money lenders and so on. Some are described below:

Bank loan- Bank are viewed as a financial institution which help individual to grant

money for so many reasons and it is reflected as most common external sources of funding that

plan and strategies effectively. There are various finance sources available for business unit to

collect money for operating business. Some are as follow:

Internal sources of funds

These are such type of fund sources which are collected by business owner internally

from their firms such as owner’s capital, retained profit and selling assets.

Owner’s capital: In this the amount that is investment by owners comes from personal

saving or debit card. Personal saving refers to that amount that is being saved by an entrepreneur.

This is one of the most common mode of fund generation (Mai and Smith, 2018).

Merit- In such type of souse of funding there is no requirements of repayments as there is

no interest charges applied. Also it hold low risk as a business unit which uses more equity than

debt has low risk of bankruptcy.

Demerit- It requires lots of time to do saving, also to use that continuously, again saving

is required which is not easy for owner. Therefore, such type of funding is not easy to do only for

the purpose of investing it in business.

Retained Profit- When business unit makes profit then some amount can be utilized by

them in business again for expansion. It doesn’t incur any interest charge or requires payment of

dividends due to which it can be desirable source of funding.

Merit- In this sources of funding there is no requirement of lenders of shareholders in

case of urgency of funds. Also it reduces the cost of issuing the external equity and remove the

loss incurred on under-pricing (Hu, 2020).

Demerit- the amount raise by retain earning could be limited as tends to highly variable

because of stable policy divided. Also some companies are not giving much importance to

opportunity cost of these earning and invest into sub- marginal projects and that may have

negative NPV.

External sources of funds:

These are those funds that are generated by external sources such as by Bank, loans,

money lenders and so on. Some are described below:

Bank loan- Bank are viewed as a financial institution which help individual to grant

money for so many reasons and it is reflected as most common external sources of funding that

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

are used by business unit. Bank grants money with some interest rate along with some specific

time limit.

Merit- In an emergency case, business unit can take loan from bank easily and bank loan

are the major drivers of growth for both public and private companies.

Demerit- It require various paper work/ formalities while taking loan and if the amount is

high then interest charge will also bigger and that is not be feasible for small business unit in

case of huge amount requirements.

Venture capital- This is another type of sources funding that are used by business unit. In

this number of individual or group of parties are involve for investing money into new business

or in growing organisation (Schatz, 2017).

Merit- Such type of funding sources are easily accessible and it provides an advantage to

business unit related to procurement of money in emergency situation, when organisation faces

scarcity of money.

Demerit- Security level is not that much string in this type funding sources as compare to

other. In relevance to chosen organisation, they need to stay away from such type of problems

and risk.

Therefore, from above discussed methods of sources it has been seen that the best and

suitable sources of funding for respective organisation would be the bank loan as it safe and

secure for both the parties due to some documentation. Also they only requires small amount not

a large. There should use the bank funds that can help to get better fund for limited period

without getting any issues which is related with different source of fund that can be there for

small business.

Business plan along with Scaling plans.

Business plan refers to a documentary comprehension that provides guidance to

management for accomplishing all organisational goal effectively as it limits the boundaries. It

basically shows path to followers and it is important as it helps in formulating effective strategies

for starting the new business and provides insights on steps to be taken, determine the needs of

resources for attaining business objective significantly (Dierwechter, 2017) (Marais and de

Lange, 2021). SME companies have to updates their business plane annually as they are way to

gaining growth and development in new markets.

time limit.

Merit- In an emergency case, business unit can take loan from bank easily and bank loan

are the major drivers of growth for both public and private companies.

Demerit- It require various paper work/ formalities while taking loan and if the amount is

high then interest charge will also bigger and that is not be feasible for small business unit in

case of huge amount requirements.

Venture capital- This is another type of sources funding that are used by business unit. In

this number of individual or group of parties are involve for investing money into new business

or in growing organisation (Schatz, 2017).

Merit- Such type of funding sources are easily accessible and it provides an advantage to

business unit related to procurement of money in emergency situation, when organisation faces

scarcity of money.

Demerit- Security level is not that much string in this type funding sources as compare to

other. In relevance to chosen organisation, they need to stay away from such type of problems

and risk.

Therefore, from above discussed methods of sources it has been seen that the best and

suitable sources of funding for respective organisation would be the bank loan as it safe and

secure for both the parties due to some documentation. Also they only requires small amount not

a large. There should use the bank funds that can help to get better fund for limited period

without getting any issues which is related with different source of fund that can be there for

small business.

Business plan along with Scaling plans.

Business plan refers to a documentary comprehension that provides guidance to

management for accomplishing all organisational goal effectively as it limits the boundaries. It

basically shows path to followers and it is important as it helps in formulating effective strategies

for starting the new business and provides insights on steps to be taken, determine the needs of

resources for attaining business objective significantly (Dierwechter, 2017) (Marais and de

Lange, 2021). SME companies have to updates their business plane annually as they are way to

gaining growth and development in new markets.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

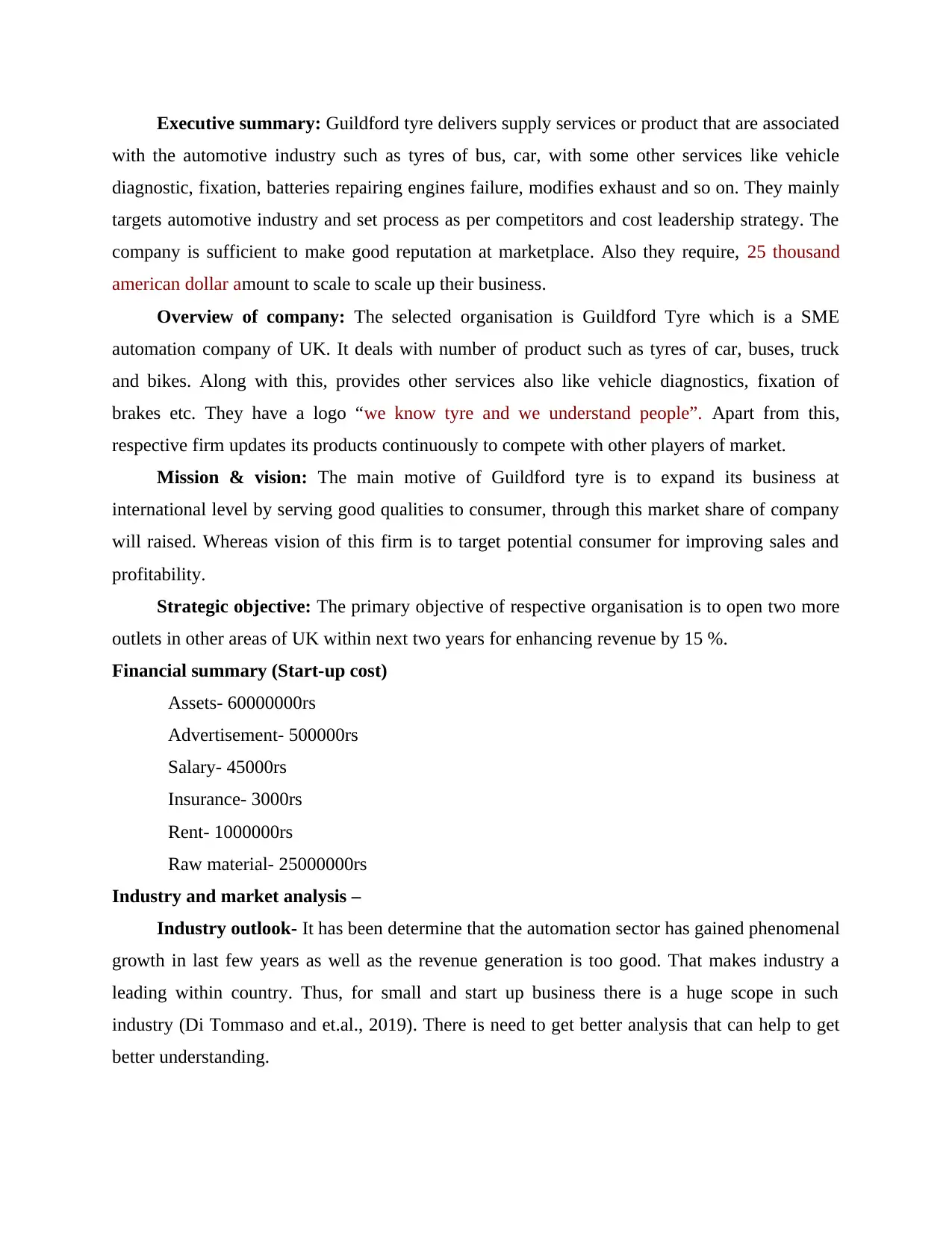

Executive summary: Guildford tyre delivers supply services or product that are associated

with the automotive industry such as tyres of bus, car, with some other services like vehicle

diagnostic, fixation, batteries repairing engines failure, modifies exhaust and so on. They mainly

targets automotive industry and set process as per competitors and cost leadership strategy. The

company is sufficient to make good reputation at marketplace. Also they require, 25 thousand

american dollar amount to scale to scale up their business.

Overview of company: The selected organisation is Guildford Tyre which is a SME

automation company of UK. It deals with number of product such as tyres of car, buses, truck

and bikes. Along with this, provides other services also like vehicle diagnostics, fixation of

brakes etc. They have a logo “we know tyre and we understand people”. Apart from this,

respective firm updates its products continuously to compete with other players of market.

Mission & vision: The main motive of Guildford tyre is to expand its business at

international level by serving good qualities to consumer, through this market share of company

will raised. Whereas vision of this firm is to target potential consumer for improving sales and

profitability.

Strategic objective: The primary objective of respective organisation is to open two more

outlets in other areas of UK within next two years for enhancing revenue by 15 %.

Financial summary (Start-up cost)

Assets- 60000000rs

Advertisement- 500000rs

Salary- 45000rs

Insurance- 3000rs

Rent- 1000000rs

Raw material- 25000000rs

Industry and market analysis –

Industry outlook- It has been determine that the automation sector has gained phenomenal

growth in last few years as well as the revenue generation is too good. That makes industry a

leading within country. Thus, for small and start up business there is a huge scope in such

industry (Di Tommaso and et.al., 2019). There is need to get better analysis that can help to get

better understanding.

with the automotive industry such as tyres of bus, car, with some other services like vehicle

diagnostic, fixation, batteries repairing engines failure, modifies exhaust and so on. They mainly

targets automotive industry and set process as per competitors and cost leadership strategy. The

company is sufficient to make good reputation at marketplace. Also they require, 25 thousand

american dollar amount to scale to scale up their business.

Overview of company: The selected organisation is Guildford Tyre which is a SME

automation company of UK. It deals with number of product such as tyres of car, buses, truck

and bikes. Along with this, provides other services also like vehicle diagnostics, fixation of

brakes etc. They have a logo “we know tyre and we understand people”. Apart from this,

respective firm updates its products continuously to compete with other players of market.

Mission & vision: The main motive of Guildford tyre is to expand its business at

international level by serving good qualities to consumer, through this market share of company

will raised. Whereas vision of this firm is to target potential consumer for improving sales and

profitability.

Strategic objective: The primary objective of respective organisation is to open two more

outlets in other areas of UK within next two years for enhancing revenue by 15 %.

Financial summary (Start-up cost)

Assets- 60000000rs

Advertisement- 500000rs

Salary- 45000rs

Insurance- 3000rs

Rent- 1000000rs

Raw material- 25000000rs

Industry and market analysis –

Industry outlook- It has been determine that the automation sector has gained phenomenal

growth in last few years as well as the revenue generation is too good. That makes industry a

leading within country. Thus, for small and start up business there is a huge scope in such

industry (Di Tommaso and et.al., 2019). There is need to get better analysis that can help to get

better understanding.

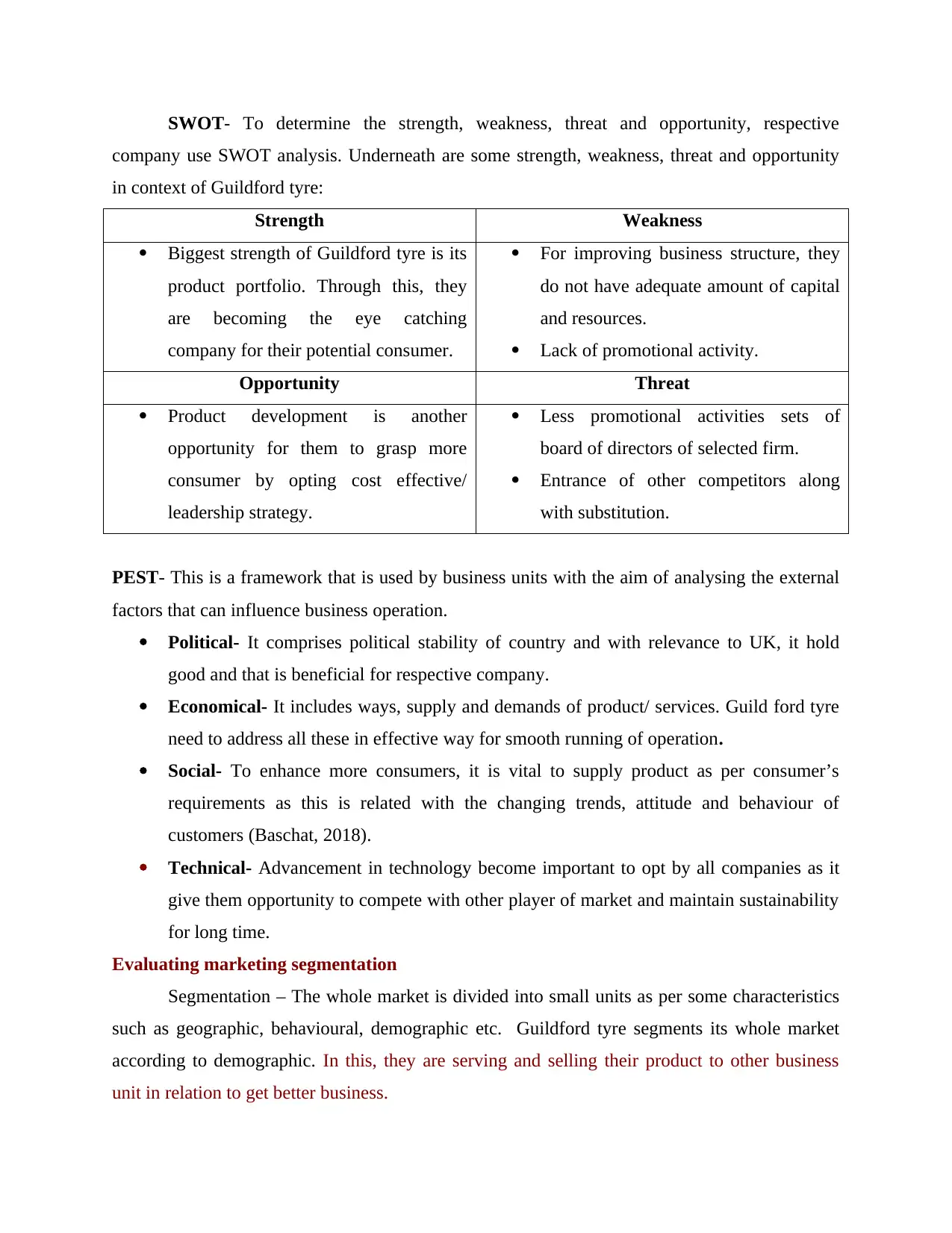

SWOT- To determine the strength, weakness, threat and opportunity, respective

company use SWOT analysis. Underneath are some strength, weakness, threat and opportunity

in context of Guildford tyre:

Strength Weakness

Biggest strength of Guildford tyre is its

product portfolio. Through this, they

are becoming the eye catching

company for their potential consumer.

For improving business structure, they

do not have adequate amount of capital

and resources.

Lack of promotional activity.

Opportunity Threat

Product development is another

opportunity for them to grasp more

consumer by opting cost effective/

leadership strategy.

Less promotional activities sets of

board of directors of selected firm.

Entrance of other competitors along

with substitution.

PEST- This is a framework that is used by business units with the aim of analysing the external

factors that can influence business operation.

Political- It comprises political stability of country and with relevance to UK, it hold

good and that is beneficial for respective company.

Economical- It includes ways, supply and demands of product/ services. Guild ford tyre

need to address all these in effective way for smooth running of operation.

Social- To enhance more consumers, it is vital to supply product as per consumer’s

requirements as this is related with the changing trends, attitude and behaviour of

customers (Baschat, 2018).

Technical- Advancement in technology become important to opt by all companies as it

give them opportunity to compete with other player of market and maintain sustainability

for long time.

Evaluating marketing segmentation

Segmentation – The whole market is divided into small units as per some characteristics

such as geographic, behavioural, demographic etc. Guildford tyre segments its whole market

according to demographic. In this, they are serving and selling their product to other business

unit in relation to get better business.

company use SWOT analysis. Underneath are some strength, weakness, threat and opportunity

in context of Guildford tyre:

Strength Weakness

Biggest strength of Guildford tyre is its

product portfolio. Through this, they

are becoming the eye catching

company for their potential consumer.

For improving business structure, they

do not have adequate amount of capital

and resources.

Lack of promotional activity.

Opportunity Threat

Product development is another

opportunity for them to grasp more

consumer by opting cost effective/

leadership strategy.

Less promotional activities sets of

board of directors of selected firm.

Entrance of other competitors along

with substitution.

PEST- This is a framework that is used by business units with the aim of analysing the external

factors that can influence business operation.

Political- It comprises political stability of country and with relevance to UK, it hold

good and that is beneficial for respective company.

Economical- It includes ways, supply and demands of product/ services. Guild ford tyre

need to address all these in effective way for smooth running of operation.

Social- To enhance more consumers, it is vital to supply product as per consumer’s

requirements as this is related with the changing trends, attitude and behaviour of

customers (Baschat, 2018).

Technical- Advancement in technology become important to opt by all companies as it

give them opportunity to compete with other player of market and maintain sustainability

for long time.

Evaluating marketing segmentation

Segmentation – The whole market is divided into small units as per some characteristics

such as geographic, behavioural, demographic etc. Guildford tyre segments its whole market

according to demographic. In this, they are serving and selling their product to other business

unit in relation to get better business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Targeting- They mainly targets the manufacture of vehicle for improving their sales and

profitability.

Positioning- It reflects towards creation of position at marketplace and in context of

Guildford tyre company they have well known & positive image at marketplace.

Competitors- It is important for all types of companies to analyse their competitors

while enlarging business as with this they will able to analyse risk associated with business due

to competitors. In context of chosen company the market stability is flexible in nature and that

can influence business operation. Therefore, Guildford tyre needs to analyse competition

effectively and with the help of porter’s five forces it can be easily assessed:

Threat of new entry: New entry bring innovation and that put pressure on Guildford tyre

to low their pricing strategy, reduce costs and add values preposition to consumer. They

have to manage all challenges by innovating new services/ product that bring new

consumers to fold but also give old consumer to buy their products.

Threat of substitution: To deal with this factor respective company need to be service

oriented instead of just product oriented, also need to understand the preferences of

consumer.

Competitive rivalry: Competition in automation industry is to high

Supplier’s power: The number of suppliers within automation industry is so many, due

to this, supplier’s power is low and it is possible by creating effective supply chain with

them (Bagheri and et.al., 2018).

Bargaining power: There are number of option available for buyer for switching.

Therefore bargaining power is high. By creating large consumers base with the help of

launching new innovative product they can reduce the bargaining power of consumers.

There is need to get better evaluation in which there are many of competitors need

to focus on business that can provide better business.

Promotion- The promotional strategy that is used by Guildford tyre is social media

platform and advertisement mode as both of these are less costly as compare to other

promotional strategies.

Marketing strategy with pricing strategy- They mainly use digital and social

marketing strategies in order to create awareness about their product and with the help of cost

profitability.

Positioning- It reflects towards creation of position at marketplace and in context of

Guildford tyre company they have well known & positive image at marketplace.

Competitors- It is important for all types of companies to analyse their competitors

while enlarging business as with this they will able to analyse risk associated with business due

to competitors. In context of chosen company the market stability is flexible in nature and that

can influence business operation. Therefore, Guildford tyre needs to analyse competition

effectively and with the help of porter’s five forces it can be easily assessed:

Threat of new entry: New entry bring innovation and that put pressure on Guildford tyre

to low their pricing strategy, reduce costs and add values preposition to consumer. They

have to manage all challenges by innovating new services/ product that bring new

consumers to fold but also give old consumer to buy their products.

Threat of substitution: To deal with this factor respective company need to be service

oriented instead of just product oriented, also need to understand the preferences of

consumer.

Competitive rivalry: Competition in automation industry is to high

Supplier’s power: The number of suppliers within automation industry is so many, due

to this, supplier’s power is low and it is possible by creating effective supply chain with

them (Bagheri and et.al., 2018).

Bargaining power: There are number of option available for buyer for switching.

Therefore bargaining power is high. By creating large consumers base with the help of

launching new innovative product they can reduce the bargaining power of consumers.

There is need to get better evaluation in which there are many of competitors need

to focus on business that can provide better business.

Promotion- The promotional strategy that is used by Guildford tyre is social media

platform and advertisement mode as both of these are less costly as compare to other

promotional strategies.

Marketing strategy with pricing strategy- They mainly use digital and social

marketing strategies in order to create awareness about their product and with the help of cost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

leadership pricing strategies they can gain success in expansion. Also they have to set the price

of product according to their competitors for beating them.

Strategy and implementation way- All marketing and other strategies that are devised

with the aim of gaining success is implemented as one time investment as it is a SME business,

and they will not able to tolerate any kind of large loss. Also they will make effective policies

and norms in order to implement that effectively. There is need to use the Ansoff matrix in which

there is focus on the market development in which there is introduction of new product in

existing market. Diversification in which there is new product in the new market. Market

penetration where existing product is there in the existing market. Product development is the

one which is there is existing market get introduced by new product.

Personnel and management –

- Ownership (sole trader/partnership/limited liability etc.) – The managerial structure that

is followed by Guildford Tyre Company is hierarchy and operated by sole proprietor and have

CEO, COO, head of management with 10 team leaders and 200 employees. In order to open new

two more outlet they require 50 more employee and that cost within 3 years become 3 times

more than existing.

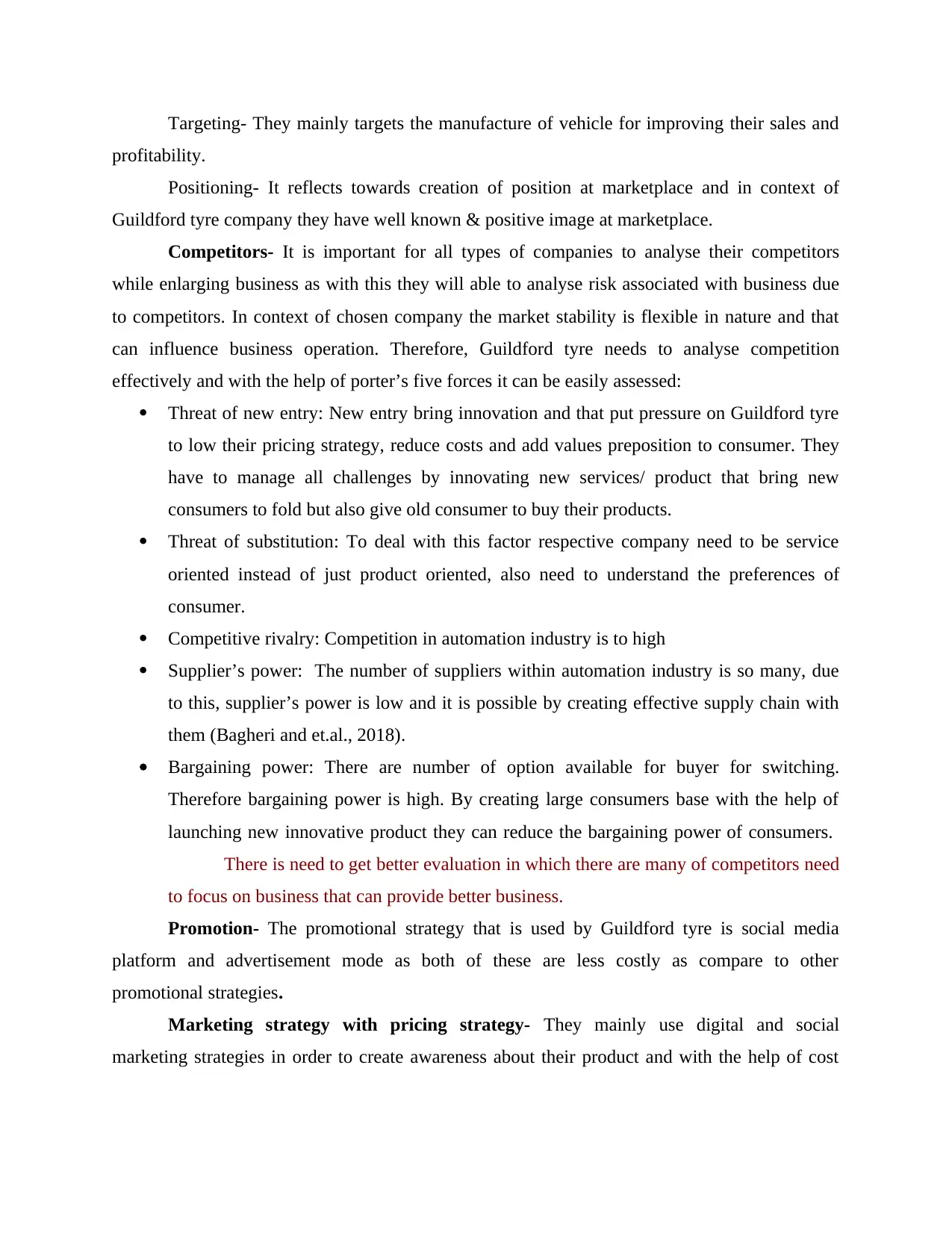

Financial plan-

Assumption- The total budget that is required to scale up the business is about $2 million

also the whole plan that are devised below will be executed under this budget effectively.

Cash Budget

Particulars January February March April May June

Receipts:

Cash fees 18000 27000 45000 54000 50000 70000

Credit fees 36000 36000 54000 90000 65000 55000

Sale of asset 20000

Total receipt 54000 63000 99000 164000 115000 125000

Payment:

Salary 26250 26250 26250 26250 26250 26250

of product according to their competitors for beating them.

Strategy and implementation way- All marketing and other strategies that are devised

with the aim of gaining success is implemented as one time investment as it is a SME business,

and they will not able to tolerate any kind of large loss. Also they will make effective policies

and norms in order to implement that effectively. There is need to use the Ansoff matrix in which

there is focus on the market development in which there is introduction of new product in

existing market. Diversification in which there is new product in the new market. Market

penetration where existing product is there in the existing market. Product development is the

one which is there is existing market get introduced by new product.

Personnel and management –

- Ownership (sole trader/partnership/limited liability etc.) – The managerial structure that

is followed by Guildford Tyre Company is hierarchy and operated by sole proprietor and have

CEO, COO, head of management with 10 team leaders and 200 employees. In order to open new

two more outlet they require 50 more employee and that cost within 3 years become 3 times

more than existing.

Financial plan-

Assumption- The total budget that is required to scale up the business is about $2 million

also the whole plan that are devised below will be executed under this budget effectively.

Cash Budget

Particulars January February March April May June

Receipts:

Cash fees 18000 27000 45000 54000 50000 70000

Credit fees 36000 36000 54000 90000 65000 55000

Sale of asset 20000

Total receipt 54000 63000 99000 164000 115000 125000

Payment:

Salary 26250 26250 26250 26250 26250 26250

Bonus 6300 12600 1900

Expenses 9000 13500 22500 27000 25000 30000

Fixed overhead 4300 4300 4300 4300 4300 4300

Taxation - - - 95800

Interest - 3000 6000

Total payments 39550 44050 62350 165950 61550 62450

Net cash flow 14450 18950 36650 -1950 53450 62550

Opening balance -40000 -25550 -6600 -30050 -35000 22000

Closing balance -25550 -6600 -30050 -28100 -38500 18000

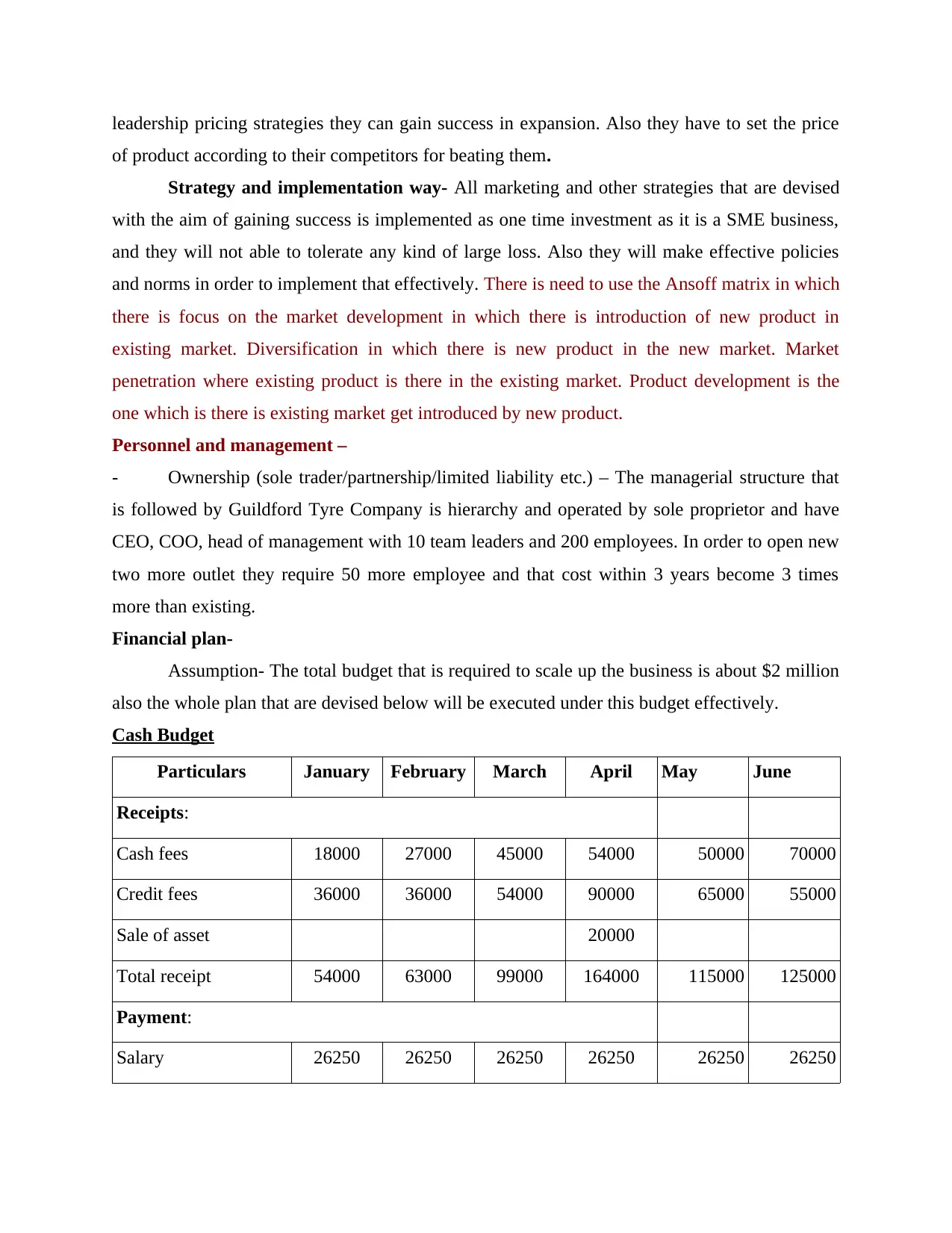

Payback Period

Year Cash inflow in £ (000) Cumulative cash inflow

(000)

1 28 28

2 32 60

3 35 95

4 55 150

5 78 228

Formula of payback period: = Base year + primary outlay - collective cash inflow of base

year / future year cash inflow

3 + 100000 – 95000 / 55000 = 3.09 year

Break even analysis

Breakeven point:-

Fixed costs / Contribution per unit = (80000 + 60000)/ 640 218.75

Project profit and loss account

Expenses 9000 13500 22500 27000 25000 30000

Fixed overhead 4300 4300 4300 4300 4300 4300

Taxation - - - 95800

Interest - 3000 6000

Total payments 39550 44050 62350 165950 61550 62450

Net cash flow 14450 18950 36650 -1950 53450 62550

Opening balance -40000 -25550 -6600 -30050 -35000 22000

Closing balance -25550 -6600 -30050 -28100 -38500 18000

Payback Period

Year Cash inflow in £ (000) Cumulative cash inflow

(000)

1 28 28

2 32 60

3 35 95

4 55 150

5 78 228

Formula of payback period: = Base year + primary outlay - collective cash inflow of base

year / future year cash inflow

3 + 100000 – 95000 / 55000 = 3.09 year

Break even analysis

Breakeven point:-

Fixed costs / Contribution per unit = (80000 + 60000)/ 640 218.75

Project profit and loss account

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.