Queen Bee Beauty: Comprehensive Business Plan and Analysis Report

VerifiedAdded on 2023/06/04

|11

|823

|478

Project

AI Summary

The business plan analyzes Queen Bee Beauty, a newly launched company in the organic cosmetics market. It outlines the company's strengths, weaknesses, opportunities, and threats. The plan includes a market analysis using Porter's five forces, projected financial statements (income statement, cash flow, and balance sheet), and a break-even analysis. Ratio analysis is performed to assess the company's financial health. The plan projects financial performance for 2022 and 2023, including sales revenue, cost of sales, and various expenses. The balance sheet provides a snapshot of the company's assets, liabilities, and equity. The analysis also includes a current ratio and a gross profit ratio. The plan aims to provide insights into the company's potential for success in a competitive market, focusing on organic and sustainable products. The plan also includes references to relevant academic literature.

BUSINESS PLAN AND

ANALYSIS

ANALYSIS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

COMPANY OVERVIEW

The business plan is made on company that is named as Queen Bee Beauty.

This is the newly launched company in the market which will sell the variety of organic

cosmetic products in the competitive market.

The purpose of making this business plan having this idea is to know about the things that is

mots required to the customers (Gonzalez, 2021).

The company will be giving new and innovative organic products to the customers in the market.

The business plan is made on company that is named as Queen Bee Beauty.

This is the newly launched company in the market which will sell the variety of organic

cosmetic products in the competitive market.

The purpose of making this business plan having this idea is to know about the things that is

mots required to the customers (Gonzalez, 2021).

The company will be giving new and innovative organic products to the customers in the market.

BUSINESS AND MARKET ANALYSIS

Strengths

Huge demand of natural and organic beauty products

in the market.

Will be having more target customers.

Weaknesses

Raw material is expensive.

Highly labour- intensive process.

Opportunities

Can expand their business in the global market.

Encourage customers to have sustainability in the

market.

This can increase the customer satisfaction as well.

Threats

It will be facing strong competition in the market.

Suppliers for this is low so the raw materials is

somehow expensive that will affect profitability.

Strengths

Huge demand of natural and organic beauty products

in the market.

Will be having more target customers.

Weaknesses

Raw material is expensive.

Highly labour- intensive process.

Opportunities

Can expand their business in the global market.

Encourage customers to have sustainability in the

market.

This can increase the customer satisfaction as well.

Threats

It will be facing strong competition in the market.

Suppliers for this is low so the raw materials is

somehow expensive that will affect profitability.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS, OPERATING PLAN AND

COMPETITIVE ANALYSIS

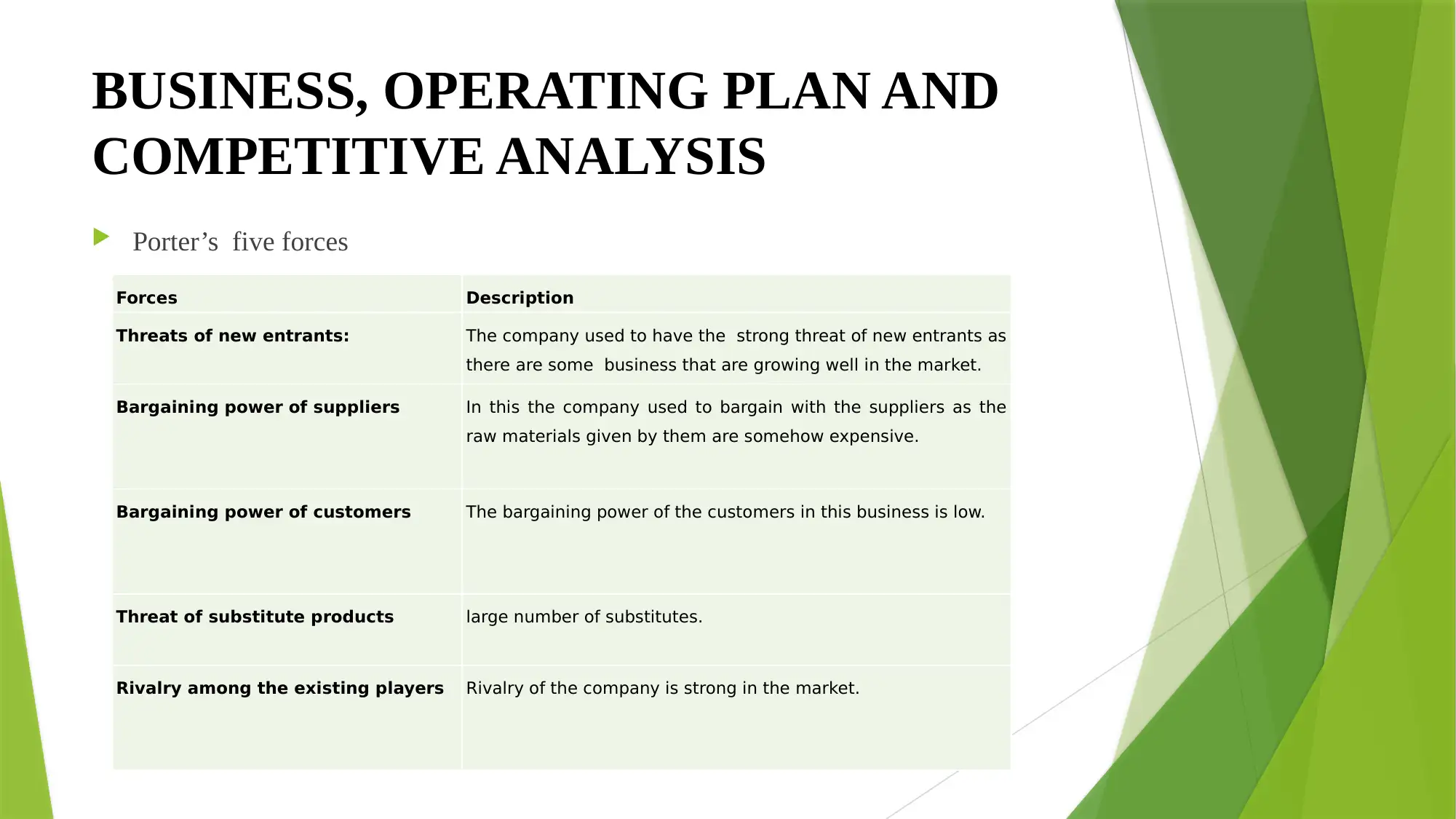

Porter’s five forces

Forces Description

Threats of new entrants: The company used to have the strong threat of new entrants as

there are some business that are growing well in the market.

Bargaining power of suppliers In this the company used to bargain with the suppliers as the

raw materials given by them are somehow expensive.

Bargaining power of customers The bargaining power of the customers in this business is low.

Threat of substitute products large number of substitutes.

Rivalry among the existing players Rivalry of the company is strong in the market.

COMPETITIVE ANALYSIS

Porter’s five forces

Forces Description

Threats of new entrants: The company used to have the strong threat of new entrants as

there are some business that are growing well in the market.

Bargaining power of suppliers In this the company used to bargain with the suppliers as the

raw materials given by them are somehow expensive.

Bargaining power of customers The bargaining power of the customers in this business is low.

Threat of substitute products large number of substitutes.

Rivalry among the existing players Rivalry of the company is strong in the market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

KEY PROJECTED FINANCIALS

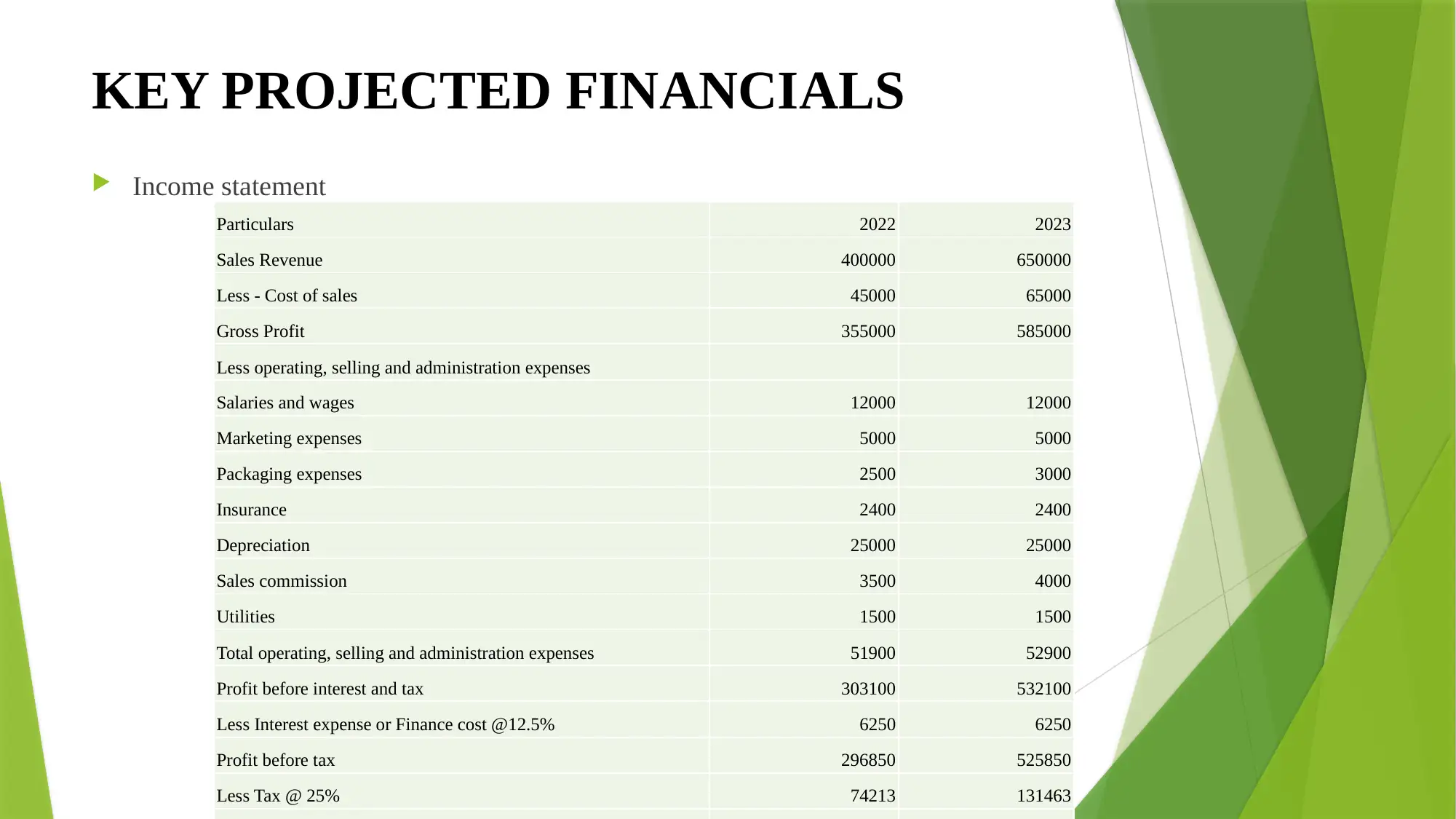

Income statement

Particulars 2022 2023

Sales Revenue 400000 650000

Less - Cost of sales 45000 65000

Gross Profit 355000 585000

Less operating, selling and administration expenses

Salaries and wages 12000 12000

Marketing expenses 5000 5000

Packaging expenses 2500 3000

Insurance 2400 2400

Depreciation 25000 25000

Sales commission 3500 4000

Utilities 1500 1500

Total operating, selling and administration expenses 51900 52900

Profit before interest and tax 303100 532100

Less Interest expense or Finance cost @12.5% 6250 6250

Profit before tax 296850 525850

Less Tax @ 25% 74213 131463

Income statement

Particulars 2022 2023

Sales Revenue 400000 650000

Less - Cost of sales 45000 65000

Gross Profit 355000 585000

Less operating, selling and administration expenses

Salaries and wages 12000 12000

Marketing expenses 5000 5000

Packaging expenses 2500 3000

Insurance 2400 2400

Depreciation 25000 25000

Sales commission 3500 4000

Utilities 1500 1500

Total operating, selling and administration expenses 51900 52900

Profit before interest and tax 303100 532100

Less Interest expense or Finance cost @12.5% 6250 6250

Profit before tax 296850 525850

Less Tax @ 25% 74213 131463

CONTD…

Cash flow statements

Particulars 2022 2023

Receipt

Initial investment (Loan from bank) 50000

Cash from sales 400000 650000

Total receipt 450000 650000

Less- Payments

Purchase of plant and equipment 125000

Cash payment for purchases 50000 70000

Salaries and wages 12000 12000

Marketing expenses 5000 5000

Packaging expenses 2500 3000

Insurance 2400 2400

Sales commission 3500 4000

Purchase of inventory 1300 1300

Interest expense or Finance cost 6250 6250

Tax expenses 30363 37613

Total payment 113313 141563

Net cash flow 336687 508437

Add Opening cash balance 100000 436687

Closing cash balance 436687 945124

Cash flow statements

Particulars 2022 2023

Receipt

Initial investment (Loan from bank) 50000

Cash from sales 400000 650000

Total receipt 450000 650000

Less- Payments

Purchase of plant and equipment 125000

Cash payment for purchases 50000 70000

Salaries and wages 12000 12000

Marketing expenses 5000 5000

Packaging expenses 2500 3000

Insurance 2400 2400

Sales commission 3500 4000

Purchase of inventory 1300 1300

Interest expense or Finance cost 6250 6250

Tax expenses 30363 37613

Total payment 113313 141563

Net cash flow 336687 508437

Add Opening cash balance 100000 436687

Closing cash balance 436687 945124

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONTD…

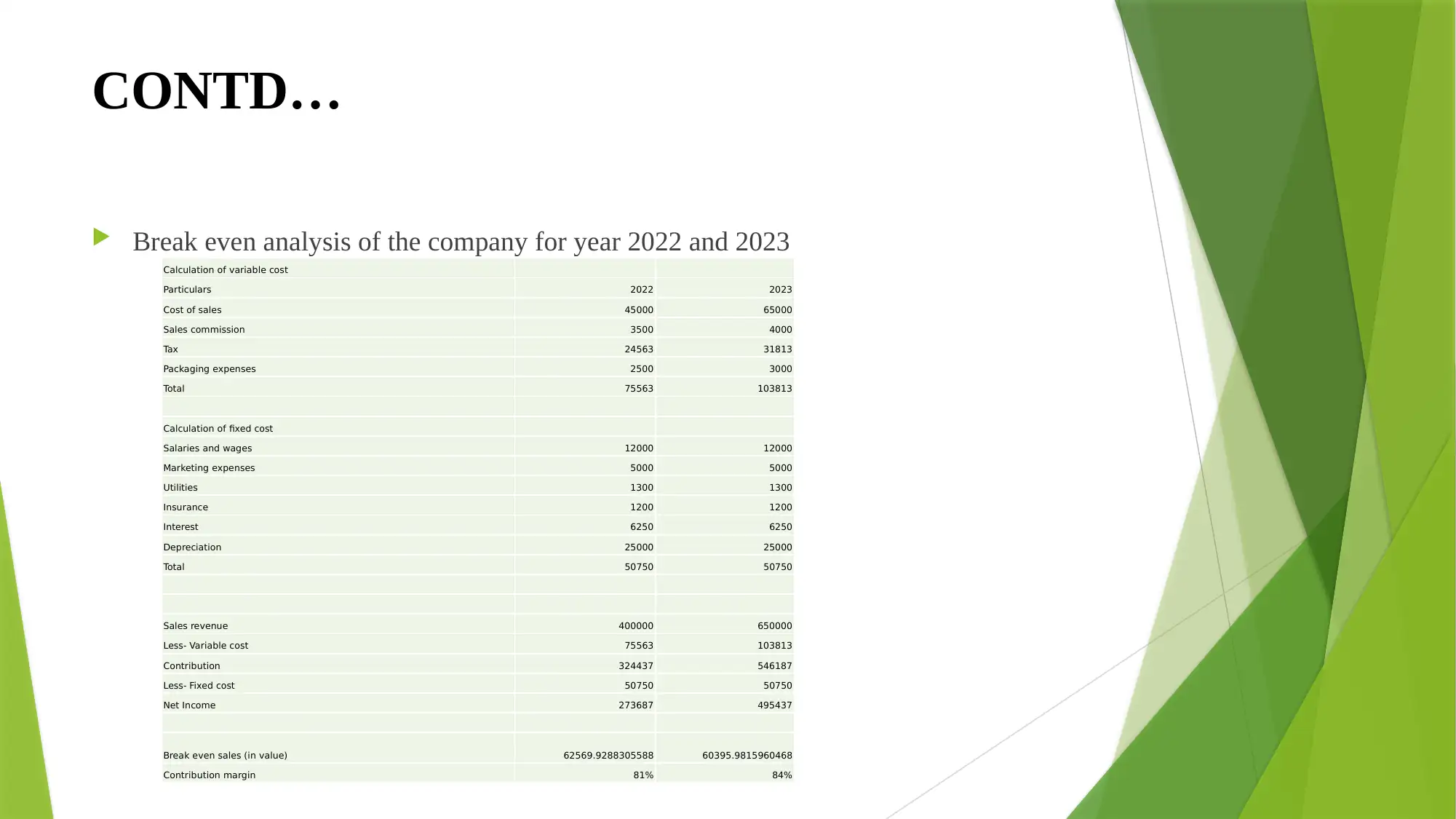

Break even analysis of the company for year 2022 and 2023

Calculation of variable cost

Particulars 2022 2023

Cost of sales 45000 65000

Sales commission 3500 4000

Tax 24563 31813

Packaging expenses 2500 3000

Total 75563 103813

Calculation of fixed cost

Salaries and wages 12000 12000

Marketing expenses 5000 5000

Utilities 1300 1300

Insurance 1200 1200

Interest 6250 6250

Depreciation 25000 25000

Total 50750 50750

Sales revenue 400000 650000

Less- Variable cost 75563 103813

Contribution 324437 546187

Less- Fixed cost 50750 50750

Net Income 273687 495437

Break even sales (in value) 62569.9288305588 60395.9815960468

Contribution margin 81% 84%

Break even analysis of the company for year 2022 and 2023

Calculation of variable cost

Particulars 2022 2023

Cost of sales 45000 65000

Sales commission 3500 4000

Tax 24563 31813

Packaging expenses 2500 3000

Total 75563 103813

Calculation of fixed cost

Salaries and wages 12000 12000

Marketing expenses 5000 5000

Utilities 1300 1300

Insurance 1200 1200

Interest 6250 6250

Depreciation 25000 25000

Total 50750 50750

Sales revenue 400000 650000

Less- Variable cost 75563 103813

Contribution 324437 546187

Less- Fixed cost 50750 50750

Net Income 273687 495437

Break even sales (in value) 62569.9288305588 60395.9815960468

Contribution margin 81% 84%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTD…

Balance sheet for the year ended 2022.

Particulars Amount (£)

Assets

Non- current assets

Plant and equipment 100000

Total non- current assets 100000

Current assets

Cash and bank 436687

Inventory 1300

Debtors 20000

Total current assets 457987

Total assets 557987

Equity and liabilities

Equities

Capital

+ Net profit for the year

222638

Total equity 222638

Liabilities

Non current liabilities

Bank loan 50000

Current liabilities

Creditors 285349

Total liabilities 335349

Total equity and liabilities 557987

Balance sheet for the year ended 2022.

Particulars Amount (£)

Assets

Non- current assets

Plant and equipment 100000

Total non- current assets 100000

Current assets

Cash and bank 436687

Inventory 1300

Debtors 20000

Total current assets 457987

Total assets 557987

Equity and liabilities

Equities

Capital

+ Net profit for the year

222638

Total equity 222638

Liabilities

Non current liabilities

Bank loan 50000

Current liabilities

Creditors 285349

Total liabilities 335349

Total equity and liabilities 557987

CONTD…

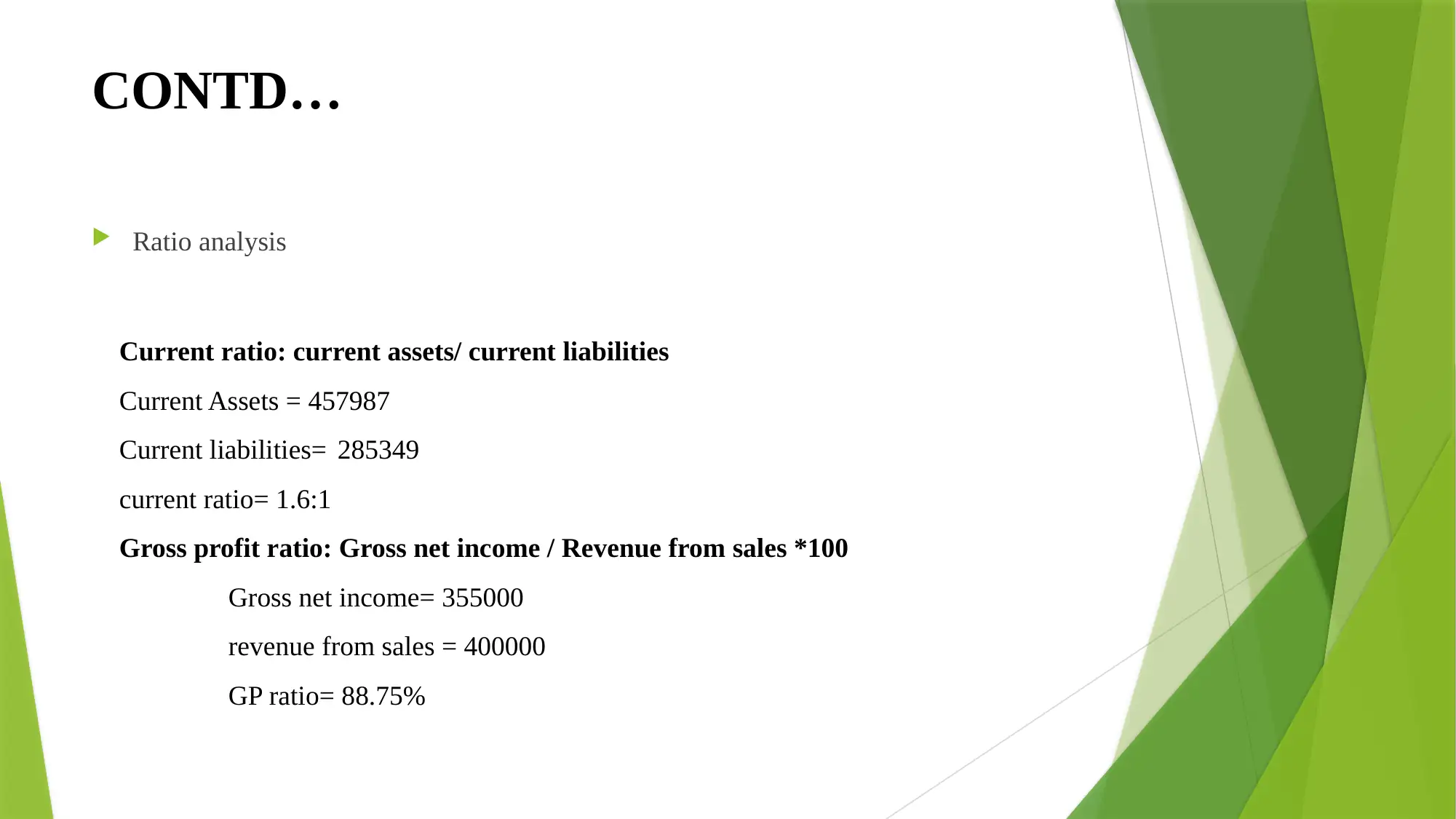

Ratio analysis

Current ratio: current assets/ current liabilities

Current Assets = 457987

Current liabilities= 285349

current ratio= 1.6:1

Gross profit ratio: Gross net income / Revenue from sales *100

Gross net income= 355000

revenue from sales = 400000

GP ratio= 88.75%

Ratio analysis

Current ratio: current assets/ current liabilities

Current Assets = 457987

Current liabilities= 285349

current ratio= 1.6:1

Gross profit ratio: Gross net income / Revenue from sales *100

Gross net income= 355000

revenue from sales = 400000

GP ratio= 88.75%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Tong, S., Luo, X. and Xu, B., 2020. Personalized mobile marketing strategies. Journal of the

Academy of Marketing Science. 48(1). pp.64-78.

Alonso-Vazquez, M., del Pilar Pastor-Pérez, M. and Alonso-Castañón, M. A., 2018.

Management and business plan. In The Emerald Handbook of Entrepreneurship in Tourism,

Travel and Hospitality. Emerald Publishing Limited.

Gonzalez, L., 2021. Spurring inclusive entrepreneurship and student development post-C19:

synergies between research and business plan competitions. Journal of Research in Innovative

Teaching & Learning.

Tong, S., Luo, X. and Xu, B., 2020. Personalized mobile marketing strategies. Journal of the

Academy of Marketing Science. 48(1). pp.64-78.

Alonso-Vazquez, M., del Pilar Pastor-Pérez, M. and Alonso-Castañón, M. A., 2018.

Management and business plan. In The Emerald Handbook of Entrepreneurship in Tourism,

Travel and Hospitality. Emerald Publishing Limited.

Gonzalez, L., 2021. Spurring inclusive entrepreneurship and student development post-C19:

synergies between research and business plan competitions. Journal of Research in Innovative

Teaching & Learning.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.