Analyzing HSBC Bank's Business Strategy: A Comprehensive Assessment

VerifiedAdded on 2023/01/19

|16

|5178

|89

Report

AI Summary

This report provides a comprehensive analysis of HSBC Bank's business strategy, focusing on its internal and external environments. The report begins with an introduction to business strategy and its importance, followed by an analysis of HSBC's macro environment using PESTLE factors, including political, economic, social, technological, legal, and environmental influences. It then delves into the internal environment, utilizing stakeholder and SWOT analyses to identify the bank's strengths, weaknesses, opportunities, and threats. Furthermore, the report applies Porter's Five Forces to assess the competitive landscape. Finally, it culminates in a strategic management plan, offering recommendations for HSBC's future success, based on the findings from the analyses. The report highlights key challenges such as political instability, economic fluctuations, and the need for improved customer relationship management, while also emphasizing opportunities for growth in emerging markets and through technological advancements.

Business Strategy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

LO1..................................................................................................................................................3

P1 Analysing the impact of macro environment on the organization and its strategies..............3

LO2..................................................................................................................................................6

P2 Analysing the internal environment of organization using appropriate frameworks.............6

LO3..................................................................................................................................................8

P3 Porter's five forces..................................................................................................................8

LO4................................................................................................................................................10

P4 Strategic management plan for the organization..................................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

LO1..................................................................................................................................................3

P1 Analysing the impact of macro environment on the organization and its strategies..............3

LO2..................................................................................................................................................6

P2 Analysing the internal environment of organization using appropriate frameworks.............6

LO3..................................................................................................................................................8

P3 Porter's five forces..................................................................................................................8

LO4................................................................................................................................................10

P4 Strategic management plan for the organization..................................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Business strategy is concerned with combination of several decisions taken in order to

achieve the organizational goals and objectives effectively and efficiently. Business strategy acts

as a road map for every organization and also helps the company in achieving competitive

advantage. It is imperative for every organization to have a planned business strategy or else it

will lag behind. As an analyst hired by HSBC bank I have to do extensive research on bank and

do SWOT as well as PESTEL on it. HSBC is leading bank in the world but now a day it is facing

varied problems in its business. On basis of PESTEL and SWOT I identify areas where bank is

weak and prepare strategic management plan.

The Hong Kong and Shanghai Business Corporation (HSBC) is a British multinational

investment bank that deals in financial services, investment banking, loans, wealth management

and other such activities. HSBC bank was ranked as the 7th largest bank in the world by its size

and operations and has 3900 offices located in more than 67 countries. As of 2018, HSBC bank

employs more than 235,000 individuals worldwide. The current study will highlight the

importance of business strategy in making HSBC a successful organization and also the use of

various tools like PESTLE analysis, SWOT analysis, Porter's five forces and VRIO model that

help a business in making strategic decisions.

MAIN BODY.

LO1

P1 Analysing the impact of macro environment on the organization and its strategies.

Business environment is and addition of both external and internal factors that affect the

working of an organization. The micro factors include customers, competitors, suppliers and

employees whereas the macro factors include political, economic, social, technological, legal and

environmental factors. The macro factors cannot be controlled by the organization and can affect

its working in both positive and negative manner thus its is imperative for multinational

companies like HSBC bank to analyse the impact of macro factors and take precautionary

measures in order to avoid any uncertainty in the near future (Albrecht, Holland and Peters,

2016).

PESTLE analysis of HSBC bank and its business strategies

Political factors: Political factors are basically concerned with the tax rates, subsidy and

government policy that affect the working of a company. HSBC group operates in more

Business strategy is concerned with combination of several decisions taken in order to

achieve the organizational goals and objectives effectively and efficiently. Business strategy acts

as a road map for every organization and also helps the company in achieving competitive

advantage. It is imperative for every organization to have a planned business strategy or else it

will lag behind. As an analyst hired by HSBC bank I have to do extensive research on bank and

do SWOT as well as PESTEL on it. HSBC is leading bank in the world but now a day it is facing

varied problems in its business. On basis of PESTEL and SWOT I identify areas where bank is

weak and prepare strategic management plan.

The Hong Kong and Shanghai Business Corporation (HSBC) is a British multinational

investment bank that deals in financial services, investment banking, loans, wealth management

and other such activities. HSBC bank was ranked as the 7th largest bank in the world by its size

and operations and has 3900 offices located in more than 67 countries. As of 2018, HSBC bank

employs more than 235,000 individuals worldwide. The current study will highlight the

importance of business strategy in making HSBC a successful organization and also the use of

various tools like PESTLE analysis, SWOT analysis, Porter's five forces and VRIO model that

help a business in making strategic decisions.

MAIN BODY.

LO1

P1 Analysing the impact of macro environment on the organization and its strategies.

Business environment is and addition of both external and internal factors that affect the

working of an organization. The micro factors include customers, competitors, suppliers and

employees whereas the macro factors include political, economic, social, technological, legal and

environmental factors. The macro factors cannot be controlled by the organization and can affect

its working in both positive and negative manner thus its is imperative for multinational

companies like HSBC bank to analyse the impact of macro factors and take precautionary

measures in order to avoid any uncertainty in the near future (Albrecht, Holland and Peters,

2016).

PESTLE analysis of HSBC bank and its business strategies

Political factors: Political factors are basically concerned with the tax rates, subsidy and

government policy that affect the working of a company. HSBC group operates in more

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

than 67 countries therefore it has been exposed to various political risks and instability. In

order to minimize the adverse effect of various political factors the company keeps a

close check on certain political aspects like growth rate of banking sector in a country,

pricing regulations and the rate of stability in the financial service sector. Although,

according to ElMassah, (2015) the BREXIT had a negative impact on the smooth

working of the bank as the company announced that relocating 1000 employees from

London to Paris would require legal charges which can cost the bank around $300

million. United Kingdom's exit from European Union will also hamper the smooth

working of the company as they need to modify their business strategies and change it

according to the future scenario.

Economic factors: The economic factors include inflation rate, investment level, foreign

exchange rate and also the economic cycle that determine the aggregate demand and

aggregate investment in an economy. With the stability in the inflation in the United

Kingdom, the HSBC bank have opportunity to distribute more and more loan to the

business firms and individuals. Economy of UK is now on track but acceleration in the

economy is still required as its growth rate is low. With passage of time it is expected that

global conditions will improve which will lead to sharp growth of the UK economy

(Prajogo, 2016). Thus, in upcoming time period economic environment will be

favourable for HSBC. In 2008 HSBC observe increase in NPA which badly affect it at

that time. Still UK economy is coming on growth track and on basis of past experience

firm is cautiously distributing loan to the candidates so that NPA remain in control.

Social factors: The socio-cultural factors include the beliefs, culture, values and attitude

of the public in the country. The major social factors that affect the HSBC group are the

demographic of the population as it helps in customer segmentation and also help the

bank in identifying their target customers. Also, it is imperative for HSBC to know about

the income level of the people because if the majority of the people in society belong to

the lower middle-class family then the bank would not be able to sell its premium

services to them and would have to mould its financial services and strategies. Social

factor to great extent affect banks. In order to understand thing just compare society of

two nations like India and USA. In India people believe in saving more and more money

specially in year 2008 and before that. On other hand, in USA people earn high and

order to minimize the adverse effect of various political factors the company keeps a

close check on certain political aspects like growth rate of banking sector in a country,

pricing regulations and the rate of stability in the financial service sector. Although,

according to ElMassah, (2015) the BREXIT had a negative impact on the smooth

working of the bank as the company announced that relocating 1000 employees from

London to Paris would require legal charges which can cost the bank around $300

million. United Kingdom's exit from European Union will also hamper the smooth

working of the company as they need to modify their business strategies and change it

according to the future scenario.

Economic factors: The economic factors include inflation rate, investment level, foreign

exchange rate and also the economic cycle that determine the aggregate demand and

aggregate investment in an economy. With the stability in the inflation in the United

Kingdom, the HSBC bank have opportunity to distribute more and more loan to the

business firms and individuals. Economy of UK is now on track but acceleration in the

economy is still required as its growth rate is low. With passage of time it is expected that

global conditions will improve which will lead to sharp growth of the UK economy

(Prajogo, 2016). Thus, in upcoming time period economic environment will be

favourable for HSBC. In 2008 HSBC observe increase in NPA which badly affect it at

that time. Still UK economy is coming on growth track and on basis of past experience

firm is cautiously distributing loan to the candidates so that NPA remain in control.

Social factors: The socio-cultural factors include the beliefs, culture, values and attitude

of the public in the country. The major social factors that affect the HSBC group are the

demographic of the population as it helps in customer segmentation and also help the

bank in identifying their target customers. Also, it is imperative for HSBC to know about

the income level of the people because if the majority of the people in society belong to

the lower middle-class family then the bank would not be able to sell its premium

services to them and would have to mould its financial services and strategies. Social

factor to great extent affect banks. In order to understand thing just compare society of

two nations like India and USA. In India people believe in saving more and more money

specially in year 2008 and before that. On other hand, in USA people earn high and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

highly materialistic in nature. USA people take more and more loan regardless of their

income and through sale of asset at higher value in the market they gain money and pay

bank loan and keep proceed with them. On and after 2008 crisis NPA of banks was too

high in USA relative to India. Even many banks become bankrupt in USA then India.

Banks operate consistently and even today new banks started by local people in India

(Kljucnikov and et.al., 2016). In 2008 and after that India maintain its GDP growth,

whereas in USA it declines sharply. So, it is society value system psychographic factor

which lead to higher NPA and winding up of bank in USA and vice versa in India. Thus,

it can be said that social factor heavily affects banking sector

Technological factors: Technological factors have a very strong impact on the working

of every organization therefore the HSBC bank uses latest and upgraded technology in

order to reduce the overall cost and maximize the profitability of the business. Also, with

the use of modernized technology, the company keeps a close check on its global

operations and ensures that there are no problems faced in regard to working of the

company. Although, according to author Islam, (2018) HSBC has faced various legal

problems with regard to data breaching and disclosure of account details of customers to

third party without prior permission which has hampered the image of the company as a

result, the company started using artificial intelligence and smart software to prevent

cyber-attacks like hacking and phishing.

Legal factors: Legal factors are concerned with the legal rules and regulations that an

organization has to adhere in order to avoid government intervention. The HSBC bank

follows all the legal policies in order to ensure smooth functioning of their organization

and to establish a brand image in the market. However, there have been certain legal

issues faced by the company like as per the US Senate investigation in the year 2012 it

was found that HSBC bank had been an active participant in money laundering and also

performed other illegal activities that led to various legal problems and further affected

the overall performance, brand image and profitability of the company (Vishwatma and

Wolf., 2012). Therefore, it is imperative to follow the legal rules and regulations and the

business strategy must also be updated frequently in respect to changing legal and

regulatory policies.

income and through sale of asset at higher value in the market they gain money and pay

bank loan and keep proceed with them. On and after 2008 crisis NPA of banks was too

high in USA relative to India. Even many banks become bankrupt in USA then India.

Banks operate consistently and even today new banks started by local people in India

(Kljucnikov and et.al., 2016). In 2008 and after that India maintain its GDP growth,

whereas in USA it declines sharply. So, it is society value system psychographic factor

which lead to higher NPA and winding up of bank in USA and vice versa in India. Thus,

it can be said that social factor heavily affects banking sector

Technological factors: Technological factors have a very strong impact on the working

of every organization therefore the HSBC bank uses latest and upgraded technology in

order to reduce the overall cost and maximize the profitability of the business. Also, with

the use of modernized technology, the company keeps a close check on its global

operations and ensures that there are no problems faced in regard to working of the

company. Although, according to author Islam, (2018) HSBC has faced various legal

problems with regard to data breaching and disclosure of account details of customers to

third party without prior permission which has hampered the image of the company as a

result, the company started using artificial intelligence and smart software to prevent

cyber-attacks like hacking and phishing.

Legal factors: Legal factors are concerned with the legal rules and regulations that an

organization has to adhere in order to avoid government intervention. The HSBC bank

follows all the legal policies in order to ensure smooth functioning of their organization

and to establish a brand image in the market. However, there have been certain legal

issues faced by the company like as per the US Senate investigation in the year 2012 it

was found that HSBC bank had been an active participant in money laundering and also

performed other illegal activities that led to various legal problems and further affected

the overall performance, brand image and profitability of the company (Vishwatma and

Wolf., 2012). Therefore, it is imperative to follow the legal rules and regulations and the

business strategy must also be updated frequently in respect to changing legal and

regulatory policies.

Environmental factors: The HSBC bank fulfils its corporate social responsibilities and

also try to protect the environment by practising many initiatives like paperless finance,

extensive use of digital technology and other sustainable operations and initiatives to

keep the atmosphere clean and green (Environmental, social and governance (ESG)

Update supporting sustainable growth., 2018). The use of digital medium has also

proved to beneficial for the company as it has increased their annual profits and also

improved the brand image of the banking group.

LO2

P2 Analysing the internal environment of organization using appropriate frameworks.

Internal environment is concerned with various factors that contribute towards the

success of an organization. Unlike external environment, the company has a complete control on

the internal factors and the internal factors affecting the business operations include employees,

shareholders, customers, suppliers and competitors. Stakeholder analysis of HSBC is given

below. Shareholders: These are those entities that approve or not accept proposals presented in

the annual general meeting. Thus, they can be considered as real owner of the company

(Bah and Fang, L., 2015). They have high interest and power and due to this reason

HSBC must keep them satisfied. Customers: HSBC must address customer queries in systematic way. Even HSBC is

leading bank but customers feedback on its service currently is not good. Customers have

high interest and less power so they must be keep informed time to time. Employees: They are also one of the most important stakeholders because they need

company information and on basis of that they make decisions. Employees make

decisions in interest of firm and accelerate its growth.

It is imperative for HSBC bank to incessantly monitor and evaluate the strength and weakness of

the micro environment so that it can be used towards the growth of the company and also to

identify the weakness and work towards in order to make it their strength. Therefore, for this

purpose SWOT analysis is required as it helps in identifying the strengths and weaknesses of the

organization and also helps in forecasting the opportunities and the potential threats that a

business can face in the near future.

also try to protect the environment by practising many initiatives like paperless finance,

extensive use of digital technology and other sustainable operations and initiatives to

keep the atmosphere clean and green (Environmental, social and governance (ESG)

Update supporting sustainable growth., 2018). The use of digital medium has also

proved to beneficial for the company as it has increased their annual profits and also

improved the brand image of the banking group.

LO2

P2 Analysing the internal environment of organization using appropriate frameworks.

Internal environment is concerned with various factors that contribute towards the

success of an organization. Unlike external environment, the company has a complete control on

the internal factors and the internal factors affecting the business operations include employees,

shareholders, customers, suppliers and competitors. Stakeholder analysis of HSBC is given

below. Shareholders: These are those entities that approve or not accept proposals presented in

the annual general meeting. Thus, they can be considered as real owner of the company

(Bah and Fang, L., 2015). They have high interest and power and due to this reason

HSBC must keep them satisfied. Customers: HSBC must address customer queries in systematic way. Even HSBC is

leading bank but customers feedback on its service currently is not good. Customers have

high interest and less power so they must be keep informed time to time. Employees: They are also one of the most important stakeholders because they need

company information and on basis of that they make decisions. Employees make

decisions in interest of firm and accelerate its growth.

It is imperative for HSBC bank to incessantly monitor and evaluate the strength and weakness of

the micro environment so that it can be used towards the growth of the company and also to

identify the weakness and work towards in order to make it their strength. Therefore, for this

purpose SWOT analysis is required as it helps in identifying the strengths and weaknesses of the

organization and also helps in forecasting the opportunities and the potential threats that a

business can face in the near future.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

SWOT analysis of HSBC Banking Group

Strengths:

In the view point of Anh Tran, (2016) the strength at micro level of HSBC bank are its

employees. The company employs more than 200,000 from all around the world with

different cultural backgrounds, knowledge, skills and this has proven to be extremely

beneficial as it leads to innovative ideas and services which help in the growth of the

company. Also, the employees are given proper training and development that improves

their overall efficiency and effectiveness to perform their duties.

According to Asiedu, (2016) HSBC bank operates in more than 60 countries thus it holds

a strong customer base under its name as a result the banking company has never faced

any shortcomings related to cash flows which has helped the banking group to diversify

their activities by investing into new projects and investments.

The extensive use of latest and modern technology has helped HSBC bank in providing

quick services to the customers without any errors and mistakes which has established

their brand image in the industry, Also, use of automated technology has brought

consistency in company's daily operations and allowed them to focus on other core

activities which has provided competitive advantage to the organization.

Weaknesses:

The OFFER, (2017) argues that despite being the 7th largest banking company in the

world HSBC has a poor feedback mechanism which has led to reduction in their market

share after the entry of new competitors into the finance industry. Therefore, the

company needs to improve its customer relationship management activities in order to

build a trustworthy and loyal relationship with their customers.

Another weakness of HSBC bank involves its high operating cost which has further

reduced their profit share and the overall growth prospects. The banking company owns

various buildings and offices which has blocked their money and also reduced the

company's opportunities to invest into other organizations. The company needs to reduce

its operating cost or else it will not be able to achieve competitive advantage especially

with the increasing entry of new competitors.

Opportunities:

Strengths:

In the view point of Anh Tran, (2016) the strength at micro level of HSBC bank are its

employees. The company employs more than 200,000 from all around the world with

different cultural backgrounds, knowledge, skills and this has proven to be extremely

beneficial as it leads to innovative ideas and services which help in the growth of the

company. Also, the employees are given proper training and development that improves

their overall efficiency and effectiveness to perform their duties.

According to Asiedu, (2016) HSBC bank operates in more than 60 countries thus it holds

a strong customer base under its name as a result the banking company has never faced

any shortcomings related to cash flows which has helped the banking group to diversify

their activities by investing into new projects and investments.

The extensive use of latest and modern technology has helped HSBC bank in providing

quick services to the customers without any errors and mistakes which has established

their brand image in the industry, Also, use of automated technology has brought

consistency in company's daily operations and allowed them to focus on other core

activities which has provided competitive advantage to the organization.

Weaknesses:

The OFFER, (2017) argues that despite being the 7th largest banking company in the

world HSBC has a poor feedback mechanism which has led to reduction in their market

share after the entry of new competitors into the finance industry. Therefore, the

company needs to improve its customer relationship management activities in order to

build a trustworthy and loyal relationship with their customers.

Another weakness of HSBC bank involves its high operating cost which has further

reduced their profit share and the overall growth prospects. The banking company owns

various buildings and offices which has blocked their money and also reduced the

company's opportunities to invest into other organizations. The company needs to reduce

its operating cost or else it will not be able to achieve competitive advantage especially

with the increasing entry of new competitors.

Opportunities:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The HSBC bank has great growth prospects in Asia therefore the banking company must

expand its operations there in order to maximize the customer base and profitability.

Also, the established brand image of HSBC bank will help it in achieving an edge over its

competitors.

Another opportunity for HSBC is that it can make more investment in nations like India

where large population is of youngsters who are more focused on fashion and are also

making investments in business. Thus, HSBC can increase investment in Asia.

Threats:

With the increasing use of digital technology by HSBC bank, the company faces a

serious threat of cyber-attacks and hacking. Also, Santos and Laczniak, (2015) states that

the banking company has faced such problems in the past therefore it is recommended for

the organization to use appropriate security measures or else it would hamper the image

of the company even further and reduce their profit shares (Vargas-Hernández and

Garcia, 2019).

The HSBC company has faced a threat in its business because rival banks tie up with

other banks and launch new innovative products. For example, in India ICICI bank and

Bajaj Allianz launch new product where one invests in scheme and receive interest on it

and on happening of any unfortunate event can also claim insurance under same scheme.

Thus, such kind of innovative idea are creating threat for the HSBC.

LO3

P3 Porter's five forces

Porter's five forces is a strategic management tool used to analyse the industry in which

the business operates and other underlying factors that can contribute towards the profitability of

the organization. It was developed by Michael Porter in the year 1979 to understand the key

competitive forces affecting an industry. The Porter's five forces are used by the top-level

management of HSBC group in order to analyse the various factors that can contribute towards

the competitive advantage and long term profitability of the banking company (Ndung’u, Otieno

and Rotich, 2016).

Porter's five forces in regard to HSBC bank.

Threat of new entrants: Threat of new entrant is issue faced by the HSBC bank and it

place huge pressure on it. Therefore, it has become imperative for the company to

expand its operations there in order to maximize the customer base and profitability.

Also, the established brand image of HSBC bank will help it in achieving an edge over its

competitors.

Another opportunity for HSBC is that it can make more investment in nations like India

where large population is of youngsters who are more focused on fashion and are also

making investments in business. Thus, HSBC can increase investment in Asia.

Threats:

With the increasing use of digital technology by HSBC bank, the company faces a

serious threat of cyber-attacks and hacking. Also, Santos and Laczniak, (2015) states that

the banking company has faced such problems in the past therefore it is recommended for

the organization to use appropriate security measures or else it would hamper the image

of the company even further and reduce their profit shares (Vargas-Hernández and

Garcia, 2019).

The HSBC company has faced a threat in its business because rival banks tie up with

other banks and launch new innovative products. For example, in India ICICI bank and

Bajaj Allianz launch new product where one invests in scheme and receive interest on it

and on happening of any unfortunate event can also claim insurance under same scheme.

Thus, such kind of innovative idea are creating threat for the HSBC.

LO3

P3 Porter's five forces

Porter's five forces is a strategic management tool used to analyse the industry in which

the business operates and other underlying factors that can contribute towards the profitability of

the organization. It was developed by Michael Porter in the year 1979 to understand the key

competitive forces affecting an industry. The Porter's five forces are used by the top-level

management of HSBC group in order to analyse the various factors that can contribute towards

the competitive advantage and long term profitability of the banking company (Ndung’u, Otieno

and Rotich, 2016).

Porter's five forces in regard to HSBC bank.

Threat of new entrants: Threat of new entrant is issue faced by the HSBC bank and it

place huge pressure on it. Therefore, it has become imperative for the company to

develop new business strategies like lower pricing strategy, minimizing the costs and

providing new value services to its customers. However, threat is not so high on this front

because HSBC is well established brand and new entrant cannot compete with it (Safari.,

Farhan and Rajabzadehyazdi, 2016). New entrant will need to take long time to create its

specific image in the eyes of the customers. The HSBC group must introduce new

products and services at competitive prices so that it not only attracts new consumers but

also provide an adequate reason for old customers to buy company's products.

Furthermore, the HSBC must reduce its operating costs by achieving economies of scale

and invest more in research and development so that it can counter the new entrants in the

banking industry and achieve a competitive edge over every other player.

Bargaining power of suppliers: There is less bargaining power of the suppliers because

HSBC bank is offering attractive interest rate on deposits to the depositors (Eskandari

and et.al., 2015). Hence, depositors or loan providers do not have higher bargaining

power.

Threat of substitute products: These are those products that can be used in the place of

an organization's products or services which affect the market share and further reduces

the profitability of the company. There is not threat on this front because HSBC is

already updated with the advanced technology and currently there is not any substitute

service that is on market and HSBC do not have that in its business (Safa. and et.al.,

2015). Introduction of online banking has helped HSBC in not only attracting new

customers but also increased the use of these services within the old share of customers

(Schyns, 2016).

Competition in the industry: It refers to the level of competition in the industry under

which an organization operates. Banking and financial services industry is extremely

competitive and there exists neck to neck competition therefore it has become essential

for the HSBC bank to develop unique services and provide new facilities to their

customers in order to achieve an edge over the other players in the market. Moreover, it is

also important to diversify the business operations or to enter into a new market in order

to grow and increase the overall profitability. The intense rivalry in the UK banking

industry has driven down the prices and decreased the revenue of all the banking

companies in the industry. Competition is high in the banking sector across the globe.

providing new value services to its customers. However, threat is not so high on this front

because HSBC is well established brand and new entrant cannot compete with it (Safari.,

Farhan and Rajabzadehyazdi, 2016). New entrant will need to take long time to create its

specific image in the eyes of the customers. The HSBC group must introduce new

products and services at competitive prices so that it not only attracts new consumers but

also provide an adequate reason for old customers to buy company's products.

Furthermore, the HSBC must reduce its operating costs by achieving economies of scale

and invest more in research and development so that it can counter the new entrants in the

banking industry and achieve a competitive edge over every other player.

Bargaining power of suppliers: There is less bargaining power of the suppliers because

HSBC bank is offering attractive interest rate on deposits to the depositors (Eskandari

and et.al., 2015). Hence, depositors or loan providers do not have higher bargaining

power.

Threat of substitute products: These are those products that can be used in the place of

an organization's products or services which affect the market share and further reduces

the profitability of the company. There is not threat on this front because HSBC is

already updated with the advanced technology and currently there is not any substitute

service that is on market and HSBC do not have that in its business (Safa. and et.al.,

2015). Introduction of online banking has helped HSBC in not only attracting new

customers but also increased the use of these services within the old share of customers

(Schyns, 2016).

Competition in the industry: It refers to the level of competition in the industry under

which an organization operates. Banking and financial services industry is extremely

competitive and there exists neck to neck competition therefore it has become essential

for the HSBC bank to develop unique services and provide new facilities to their

customers in order to achieve an edge over the other players in the market. Moreover, it is

also important to diversify the business operations or to enter into a new market in order

to grow and increase the overall profitability. The intense rivalry in the UK banking

industry has driven down the prices and decreased the revenue of all the banking

companies in the industry. Competition is high in the banking sector across the globe.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Power of customers: It is concerned with capability of customers to bring down the

prices of banks. The power of customers can be determined by the number of customers a

banking company has, how significant are they and how much would it cost to let go a

consumer. There is high power of the customers because there are number of alternative

banks that are available to the people as option (O'Hara. and et.al., 2017). If people are

not satisfied from the services of HSBC then will move to another bank. Hence,

bargaining power of customers is high.

LO4

P4 Strategic management plan for the organization.

Strategic management plan is a set of objectives established to achieve organizational

goals effectively and efficiently. The plan involves a series of road steps that must be followed

by the organization in order to achieve the SMART goals. It also involves setting up of priorities,

allocating of resources and ensuring that all the employees and shareholders are working towards

achievement of single goal (Mahmood, 2018).

The strategic management plan of HSBC bank involves

Mission: The mission statement of HSBC bank is to provide exceptional financial

services to their customers and to promote incessant growth through long term economic

development, environmental stewardship and fulfilment of social responsibilities

(Soviyanti, 2018).

Vision: Vision is concerned with the long term goals of the organization and the plans to

achieve it. The vision of HSBC bank includes diversifying its business operations

globally and also developing new services for its customers in order to enhance their

overall banking experience.

Goals and objectives: The goals and objectives of HSBC bank includes maintaining

price stability in the market and to provide smooth banking experience to the customers.

The goals and objectives also include achieving competitive edge over other players in

the industry and to expand its branches in different parts of the world.

Action plan: The action plan consists of the resources required to achieve the goals and

objectives, assigning tasks to its employees and also deciding the time limit within which

the goals and objectives can be accomplished. It basically acts as a road map to achieve

these goals and objectives effectively and efficiently.

prices of banks. The power of customers can be determined by the number of customers a

banking company has, how significant are they and how much would it cost to let go a

consumer. There is high power of the customers because there are number of alternative

banks that are available to the people as option (O'Hara. and et.al., 2017). If people are

not satisfied from the services of HSBC then will move to another bank. Hence,

bargaining power of customers is high.

LO4

P4 Strategic management plan for the organization.

Strategic management plan is a set of objectives established to achieve organizational

goals effectively and efficiently. The plan involves a series of road steps that must be followed

by the organization in order to achieve the SMART goals. It also involves setting up of priorities,

allocating of resources and ensuring that all the employees and shareholders are working towards

achievement of single goal (Mahmood, 2018).

The strategic management plan of HSBC bank involves

Mission: The mission statement of HSBC bank is to provide exceptional financial

services to their customers and to promote incessant growth through long term economic

development, environmental stewardship and fulfilment of social responsibilities

(Soviyanti, 2018).

Vision: Vision is concerned with the long term goals of the organization and the plans to

achieve it. The vision of HSBC bank includes diversifying its business operations

globally and also developing new services for its customers in order to enhance their

overall banking experience.

Goals and objectives: The goals and objectives of HSBC bank includes maintaining

price stability in the market and to provide smooth banking experience to the customers.

The goals and objectives also include achieving competitive edge over other players in

the industry and to expand its branches in different parts of the world.

Action plan: The action plan consists of the resources required to achieve the goals and

objectives, assigning tasks to its employees and also deciding the time limit within which

the goals and objectives can be accomplished. It basically acts as a road map to achieve

these goals and objectives effectively and efficiently.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

VRIO Model: The VRIO framework is a strategic analysis tool concerned with protection of

long term resources and capabilities that give the organization a long term competitive

advantage. The main objective of VRIO model is to provide sustainable competitive advantage

to the concerned organization. VRIO model stands for valuable, rare, inimitable and

organization.

The VRIO model for HSBC bank is as follows:

Value: The value aspect in VRIO model is concerned with the fact that whether the

company offers resources that add value to the lives of the customers. If the answer is yes

it means that the organization has achieved competitive advantage but if the answer is no

then it needs to re-evaluate its resources and capabilities in order to become competitive

again. The HSBC bank adds value by providing personalized attention to its millions of

customers whether it is for the purpose of investment banking, mortgage loans or even

addressing query. It clearly means that the bank adds value to the lives of the clients

(Indartono and Wibowo, 2017)

Rarity: Rarity is concerned with that whether the company owns certain resources that

are rare and unique or not. If the company has any rare resource or quality then it can

increase their brand value and also gives the organization an opportunity to maximize

their overall profitability. If the organization lacks rare resources then it must reassess

and identify its rare resources or capabilities. HSBC bank has more than 3900 branches

located all around the world which is rare and unique quality as it helps the bank to

attract new customers on daily basis and thus increases the growth prospects of the

organization.

Imitability: Imitability means whether it is easy to duplicate the rare resources of an

organization or is it very difficult to do so. If the resources are easy to copy and imitate

then the organization has competitive advantage for temporary basis but if the company

has some valuable, rare and inimitable resources or services then it can achieve

completive edge and has the potential to achieve huge market share.

Organization: The organization involves the efficient and effective structure, process

and management system that has the potential to capitalize on the resources and

capabilities. If the company has adequate organizational policy, employees and structure

then it can easily achieve the competitive advantage and can become a market leader

long term resources and capabilities that give the organization a long term competitive

advantage. The main objective of VRIO model is to provide sustainable competitive advantage

to the concerned organization. VRIO model stands for valuable, rare, inimitable and

organization.

The VRIO model for HSBC bank is as follows:

Value: The value aspect in VRIO model is concerned with the fact that whether the

company offers resources that add value to the lives of the customers. If the answer is yes

it means that the organization has achieved competitive advantage but if the answer is no

then it needs to re-evaluate its resources and capabilities in order to become competitive

again. The HSBC bank adds value by providing personalized attention to its millions of

customers whether it is for the purpose of investment banking, mortgage loans or even

addressing query. It clearly means that the bank adds value to the lives of the clients

(Indartono and Wibowo, 2017)

Rarity: Rarity is concerned with that whether the company owns certain resources that

are rare and unique or not. If the company has any rare resource or quality then it can

increase their brand value and also gives the organization an opportunity to maximize

their overall profitability. If the organization lacks rare resources then it must reassess

and identify its rare resources or capabilities. HSBC bank has more than 3900 branches

located all around the world which is rare and unique quality as it helps the bank to

attract new customers on daily basis and thus increases the growth prospects of the

organization.

Imitability: Imitability means whether it is easy to duplicate the rare resources of an

organization or is it very difficult to do so. If the resources are easy to copy and imitate

then the organization has competitive advantage for temporary basis but if the company

has some valuable, rare and inimitable resources or services then it can achieve

completive edge and has the potential to achieve huge market share.

Organization: The organization involves the efficient and effective structure, process

and management system that has the potential to capitalize on the resources and

capabilities. If the company has adequate organizational policy, employees and structure

then it can easily achieve the competitive advantage and can become a market leader

otherwise not. The HSBC banks employs individuals from different cultural backgrounds

with adequate skills and knowledge and also has a flexible organizational structure which

means that the HSBC bank can become a market leader by achieving an edge over other

competitors in the banking industry(Knott, 2015).

Step 2

Figure 1ANSOFF matrix

(Source: Ansoff matrix., 2019)

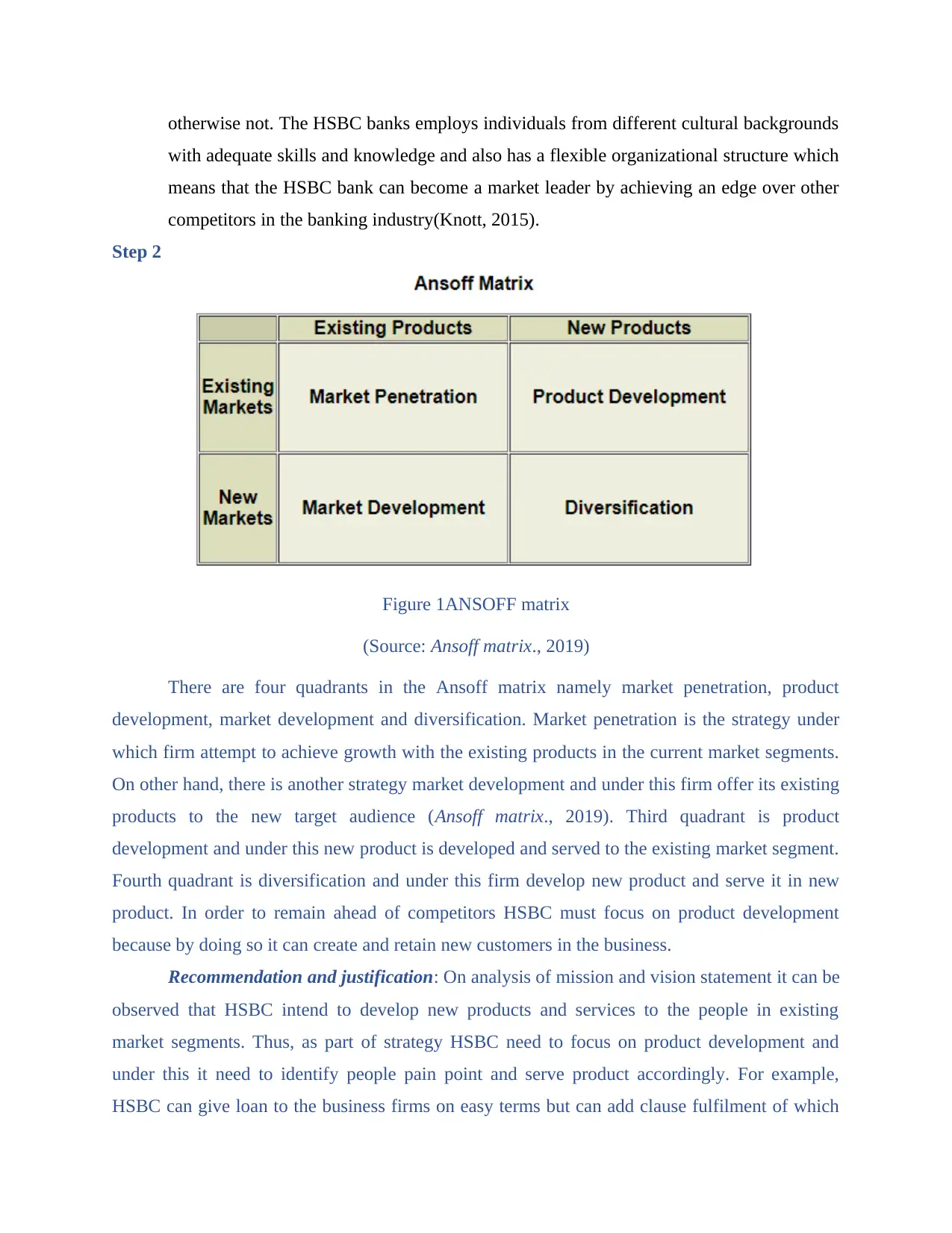

There are four quadrants in the Ansoff matrix namely market penetration, product

development, market development and diversification. Market penetration is the strategy under

which firm attempt to achieve growth with the existing products in the current market segments.

On other hand, there is another strategy market development and under this firm offer its existing

products to the new target audience (Ansoff matrix., 2019). Third quadrant is product

development and under this new product is developed and served to the existing market segment.

Fourth quadrant is diversification and under this firm develop new product and serve it in new

product. In order to remain ahead of competitors HSBC must focus on product development

because by doing so it can create and retain new customers in the business.

Recommendation and justification: On analysis of mission and vision statement it can be

observed that HSBC intend to develop new products and services to the people in existing

market segments. Thus, as part of strategy HSBC need to focus on product development and

under this it need to identify people pain point and serve product accordingly. For example,

HSBC can give loan to the business firms on easy terms but can add clause fulfilment of which

with adequate skills and knowledge and also has a flexible organizational structure which

means that the HSBC bank can become a market leader by achieving an edge over other

competitors in the banking industry(Knott, 2015).

Step 2

Figure 1ANSOFF matrix

(Source: Ansoff matrix., 2019)

There are four quadrants in the Ansoff matrix namely market penetration, product

development, market development and diversification. Market penetration is the strategy under

which firm attempt to achieve growth with the existing products in the current market segments.

On other hand, there is another strategy market development and under this firm offer its existing

products to the new target audience (Ansoff matrix., 2019). Third quadrant is product

development and under this new product is developed and served to the existing market segment.

Fourth quadrant is diversification and under this firm develop new product and serve it in new

product. In order to remain ahead of competitors HSBC must focus on product development

because by doing so it can create and retain new customers in the business.

Recommendation and justification: On analysis of mission and vision statement it can be

observed that HSBC intend to develop new products and services to the people in existing

market segments. Thus, as part of strategy HSBC need to focus on product development and

under this it need to identify people pain point and serve product accordingly. For example,

HSBC can give loan to the business firms on easy terms but can add clause fulfilment of which

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.