Premier Investments: Comprehensive Report on Business Sustainability

VerifiedAdded on 2020/03/23

|17

|2734

|62

Report

AI Summary

This report provides a comprehensive analysis of business sustainability for Premier Investments, focusing on financial, environmental, and social aspects. It explores key recommendations for improving revenue, reducing operational costs, and enhancing energy efficiency. The report also emphasizes the importance of ethical sourcing, including organic materials and eco-friendly packaging. Furthermore, it includes a transfer pricing analysis and capital investment analysis, detailing revenue projections, cost breakdowns, and financial metrics like Net Present Value (NPV) and Internal Rate of Return (IRR). The findings highlight the significance of measurable objectives and targeted goals in achieving business sustainability, ultimately contributing to investor and consumer preference and improved profitability. The report is divided into three parts: business sustainability, transfer pricing and capital investment analysis.

Premier Investments

A Report on Business Sustainability For Premier Investments

[Type the document subtitle]

ABC

01/01/2017

A Report on Business Sustainability For Premier Investments

[Type the document subtitle]

ABC

01/01/2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

1. Introduction.........................................................................................................................................2

2. Recommendation for Business Sustainability of Premier Investments................................................2

3. Conclusion...........................................................................................................................................5

Table 1: Business Sustainability : Key Recommendations............................................................................3

1. Introduction.........................................................................................................................................2

2. Recommendation for Business Sustainability of Premier Investments................................................2

3. Conclusion...........................................................................................................................................5

Table 1: Business Sustainability : Key Recommendations............................................................................3

Executive Summary

Business Sustainability rests of three important pillars : financial soundness, environmental sustainability

and an organization’s responsibility towards people, in side the organization and outside. This report

seeks to highlight the importance of business sustainability for better business management of Premier

Investments. The report makes some key recommendations towards achieving business sustainability of

Premier Investments. Some of these measures include efforts to reduce energy consumption, efforts

towards ethical sourcing and financial sustainability by seeking better financial bottom lines and cost

cutting.

Business Sustainability rests of three important pillars : financial soundness, environmental sustainability

and an organization’s responsibility towards people, in side the organization and outside. This report

seeks to highlight the importance of business sustainability for better business management of Premier

Investments. The report makes some key recommendations towards achieving business sustainability of

Premier Investments. Some of these measures include efforts to reduce energy consumption, efforts

towards ethical sourcing and financial sustainability by seeking better financial bottom lines and cost

cutting.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Part 1: Report on Business Sustainability

for Premier Investments

1. Introduction

Premier Investments is not only looking at managing its operations in such a way that they are

financially sustainable but must also seeks to reduce its negative impact on the society and improve its

positive impact. Premier Investments aims at strengthening its bond with its customers by way of

impacting the society. (Bonini & Gorner, 2011)

Business sustainability largely encompasses three key aspects or “Triple Bottom Line” a term coined by

John Elkington in 1994. (Hindle, 2009)

Financial: The economics of the firm should fall in line in such a way that investors continue to

see the as a good investment and re-invest. (Friedman, 2012) Reduction of Costs is one the key

goals of remaining financially sustainable while taking advantage of every opportunity in the

market. (Friedman, 2012)

Environmental: This aspect includes creating an environmentally sustainable value chain. The

environmental aspect may relate to reducing the carbon footprint of all processes in the value

chain, making efforts to source environmentally sustainable products etc.

Social: The social aspect relates to the impact that the Company has on the society. Social

sustainability starts with creating a better environment for the employees and can be extended

to having a positive impact on the different members of the society that come in touch with the

business.

2. Recommendation for Business Sustainability of Premier

Investments

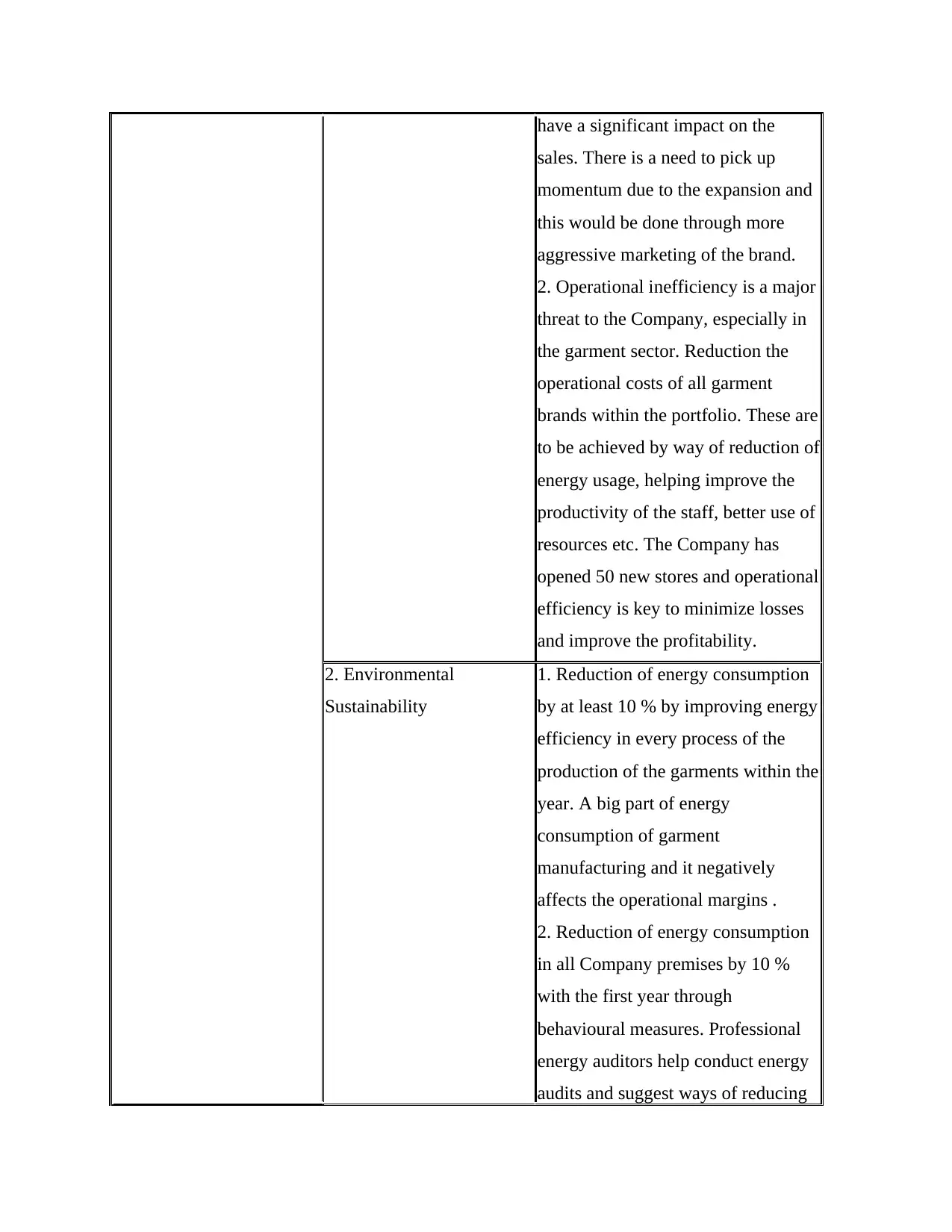

Table 1: Business Sustainability: Key Recommendations

Dimension Objective Possible Performance Measures

Business Sustainability 1. Financial Sustainability 1. Improving the revenues of the

Peter Alexander, at least 5%. The

expansion of the brand is likely to

for Premier Investments

1. Introduction

Premier Investments is not only looking at managing its operations in such a way that they are

financially sustainable but must also seeks to reduce its negative impact on the society and improve its

positive impact. Premier Investments aims at strengthening its bond with its customers by way of

impacting the society. (Bonini & Gorner, 2011)

Business sustainability largely encompasses three key aspects or “Triple Bottom Line” a term coined by

John Elkington in 1994. (Hindle, 2009)

Financial: The economics of the firm should fall in line in such a way that investors continue to

see the as a good investment and re-invest. (Friedman, 2012) Reduction of Costs is one the key

goals of remaining financially sustainable while taking advantage of every opportunity in the

market. (Friedman, 2012)

Environmental: This aspect includes creating an environmentally sustainable value chain. The

environmental aspect may relate to reducing the carbon footprint of all processes in the value

chain, making efforts to source environmentally sustainable products etc.

Social: The social aspect relates to the impact that the Company has on the society. Social

sustainability starts with creating a better environment for the employees and can be extended

to having a positive impact on the different members of the society that come in touch with the

business.

2. Recommendation for Business Sustainability of Premier

Investments

Table 1: Business Sustainability: Key Recommendations

Dimension Objective Possible Performance Measures

Business Sustainability 1. Financial Sustainability 1. Improving the revenues of the

Peter Alexander, at least 5%. The

expansion of the brand is likely to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

have a significant impact on the

sales. There is a need to pick up

momentum due to the expansion and

this would be done through more

aggressive marketing of the brand.

2. Operational inefficiency is a major

threat to the Company, especially in

the garment sector. Reduction the

operational costs of all garment

brands within the portfolio. These are

to be achieved by way of reduction of

energy usage, helping improve the

productivity of the staff, better use of

resources etc. The Company has

opened 50 new stores and operational

efficiency is key to minimize losses

and improve the profitability.

2. Environmental

Sustainability

1. Reduction of energy consumption

by at least 10 % by improving energy

efficiency in every process of the

production of the garments within the

year. A big part of energy

consumption of garment

manufacturing and it negatively

affects the operational margins .

2. Reduction of energy consumption

in all Company premises by 10 %

with the first year through

behavioural measures. Professional

energy auditors help conduct energy

audits and suggest ways of reducing

sales. There is a need to pick up

momentum due to the expansion and

this would be done through more

aggressive marketing of the brand.

2. Operational inefficiency is a major

threat to the Company, especially in

the garment sector. Reduction the

operational costs of all garment

brands within the portfolio. These are

to be achieved by way of reduction of

energy usage, helping improve the

productivity of the staff, better use of

resources etc. The Company has

opened 50 new stores and operational

efficiency is key to minimize losses

and improve the profitability.

2. Environmental

Sustainability

1. Reduction of energy consumption

by at least 10 % by improving energy

efficiency in every process of the

production of the garments within the

year. A big part of energy

consumption of garment

manufacturing and it negatively

affects the operational margins .

2. Reduction of energy consumption

in all Company premises by 10 %

with the first year through

behavioural measures. Professional

energy auditors help conduct energy

audits and suggest ways of reducing

electricity consumption techniques

such as targeted radiation etc. A

company wide seminar of energy

saving behavior could be a part of

this exercise. The goal is to reduce

energy consumption in all operations

(apart from all manufacturing

processes) by at least 3 % through

behavioral changes.

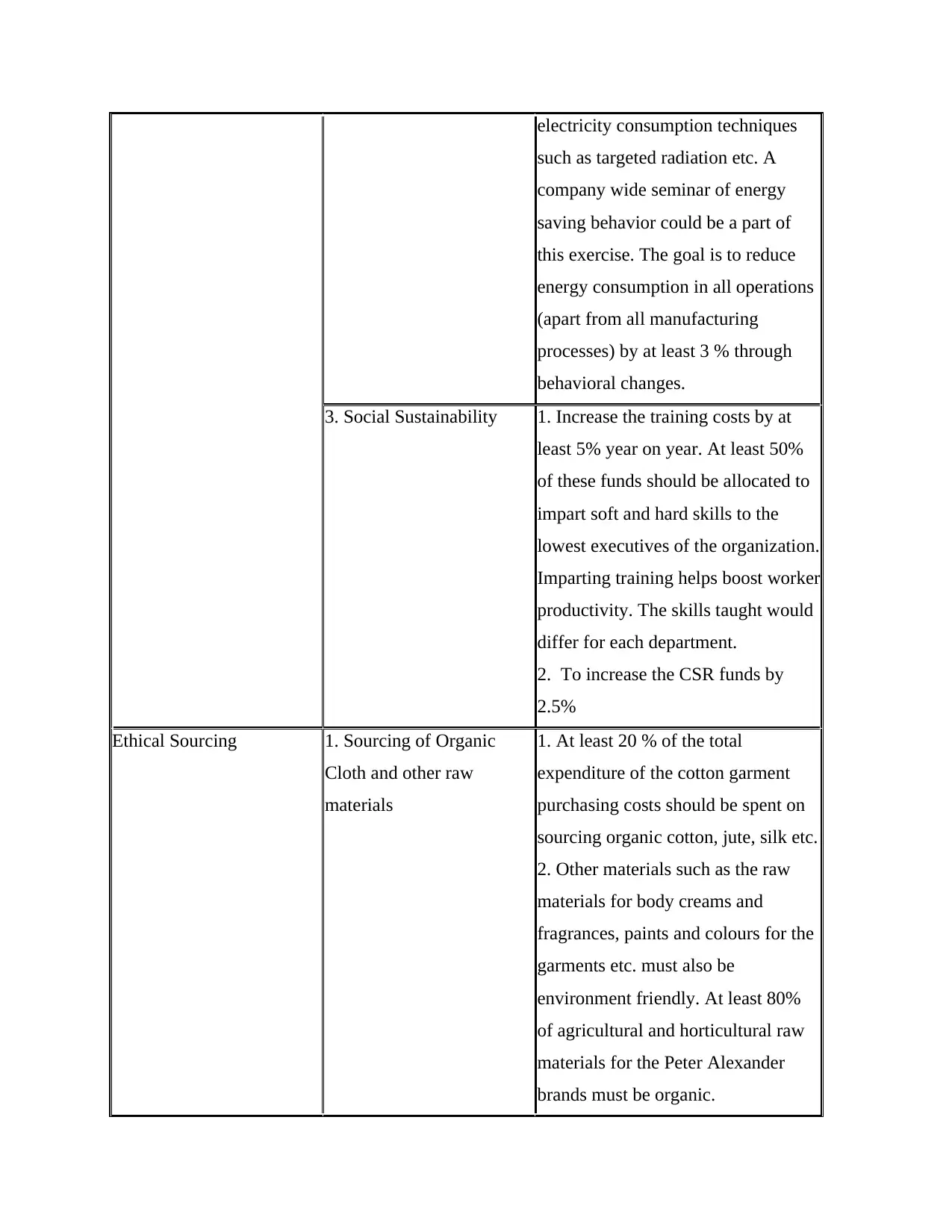

3. Social Sustainability 1. Increase the training costs by at

least 5% year on year. At least 50%

of these funds should be allocated to

impart soft and hard skills to the

lowest executives of the organization.

Imparting training helps boost worker

productivity. The skills taught would

differ for each department.

2. To increase the CSR funds by

2.5%

Ethical Sourcing 1. Sourcing of Organic

Cloth and other raw

materials

1. At least 20 % of the total

expenditure of the cotton garment

purchasing costs should be spent on

sourcing organic cotton, jute, silk etc.

2. Other materials such as the raw

materials for body creams and

fragrances, paints and colours for the

garments etc. must also be

environment friendly. At least 80%

of agricultural and horticultural raw

materials for the Peter Alexander

brands must be organic.

such as targeted radiation etc. A

company wide seminar of energy

saving behavior could be a part of

this exercise. The goal is to reduce

energy consumption in all operations

(apart from all manufacturing

processes) by at least 3 % through

behavioral changes.

3. Social Sustainability 1. Increase the training costs by at

least 5% year on year. At least 50%

of these funds should be allocated to

impart soft and hard skills to the

lowest executives of the organization.

Imparting training helps boost worker

productivity. The skills taught would

differ for each department.

2. To increase the CSR funds by

2.5%

Ethical Sourcing 1. Sourcing of Organic

Cloth and other raw

materials

1. At least 20 % of the total

expenditure of the cotton garment

purchasing costs should be spent on

sourcing organic cotton, jute, silk etc.

2. Other materials such as the raw

materials for body creams and

fragrances, paints and colours for the

garments etc. must also be

environment friendly. At least 80%

of agricultural and horticultural raw

materials for the Peter Alexander

brands must be organic.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

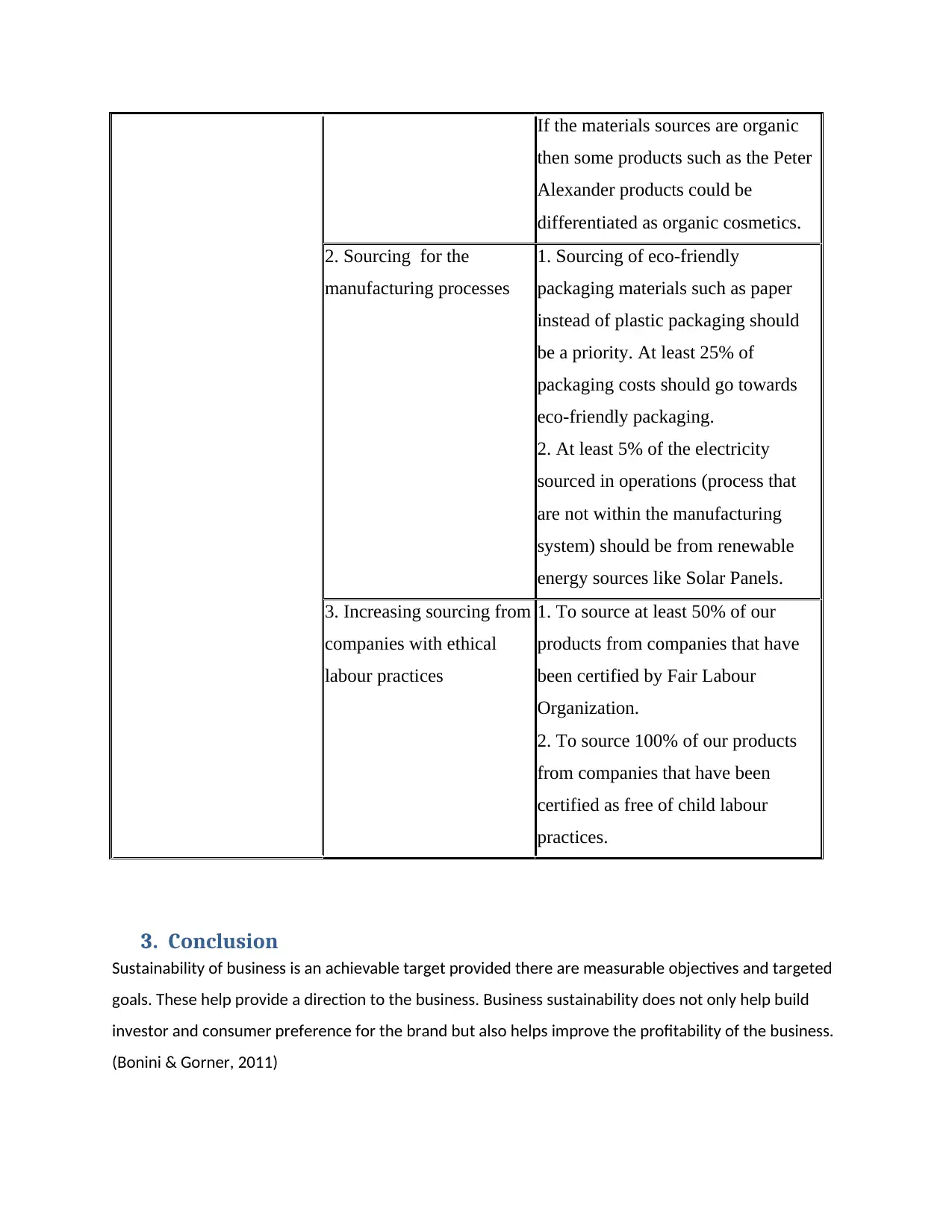

If the materials sources are organic

then some products such as the Peter

Alexander products could be

differentiated as organic cosmetics.

2. Sourcing for the

manufacturing processes

1. Sourcing of eco-friendly

packaging materials such as paper

instead of plastic packaging should

be a priority. At least 25% of

packaging costs should go towards

eco-friendly packaging.

2. At least 5% of the electricity

sourced in operations (process that

are not within the manufacturing

system) should be from renewable

energy sources like Solar Panels.

3. Increasing sourcing from

companies with ethical

labour practices

1. To source at least 50% of our

products from companies that have

been certified by Fair Labour

Organization.

2. To source 100% of our products

from companies that have been

certified as free of child labour

practices.

3. Conclusion

Sustainability of business is an achievable target provided there are measurable objectives and targeted

goals. These help provide a direction to the business. Business sustainability does not only help build

investor and consumer preference for the brand but also helps improve the profitability of the business.

(Bonini & Gorner, 2011)

then some products such as the Peter

Alexander products could be

differentiated as organic cosmetics.

2. Sourcing for the

manufacturing processes

1. Sourcing of eco-friendly

packaging materials such as paper

instead of plastic packaging should

be a priority. At least 25% of

packaging costs should go towards

eco-friendly packaging.

2. At least 5% of the electricity

sourced in operations (process that

are not within the manufacturing

system) should be from renewable

energy sources like Solar Panels.

3. Increasing sourcing from

companies with ethical

labour practices

1. To source at least 50% of our

products from companies that have

been certified by Fair Labour

Organization.

2. To source 100% of our products

from companies that have been

certified as free of child labour

practices.

3. Conclusion

Sustainability of business is an achievable target provided there are measurable objectives and targeted

goals. These help provide a direction to the business. Business sustainability does not only help build

investor and consumer preference for the brand but also helps improve the profitability of the business.

(Bonini & Gorner, 2011)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Bibliography

Bonini, S., & Gorner, S. (2011). The Business of Sustainability: Putting It into Practice. San Francisco:

McKinsey & company.

Friedman, J. (2012, 06 11). 6 Business Benefits of Sustainability. Retrieved Spetember 16, 2017, from

HuffPost: https://huffpost.com/us/entry/1576400

Hindle, T. (2009, November 17). Triple Bottom Line. Retrieved Spetember 16, 2017, from The Economist.

Bonini, S., & Gorner, S. (2011). The Business of Sustainability: Putting It into Practice. San Francisco:

McKinsey & company.

Friedman, J. (2012, 06 11). 6 Business Benefits of Sustainability. Retrieved Spetember 16, 2017, from

HuffPost: https://huffpost.com/us/entry/1576400

Hindle, T. (2009, November 17). Triple Bottom Line. Retrieved Spetember 16, 2017, from The Economist.

Part 2 Transfer Pricing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

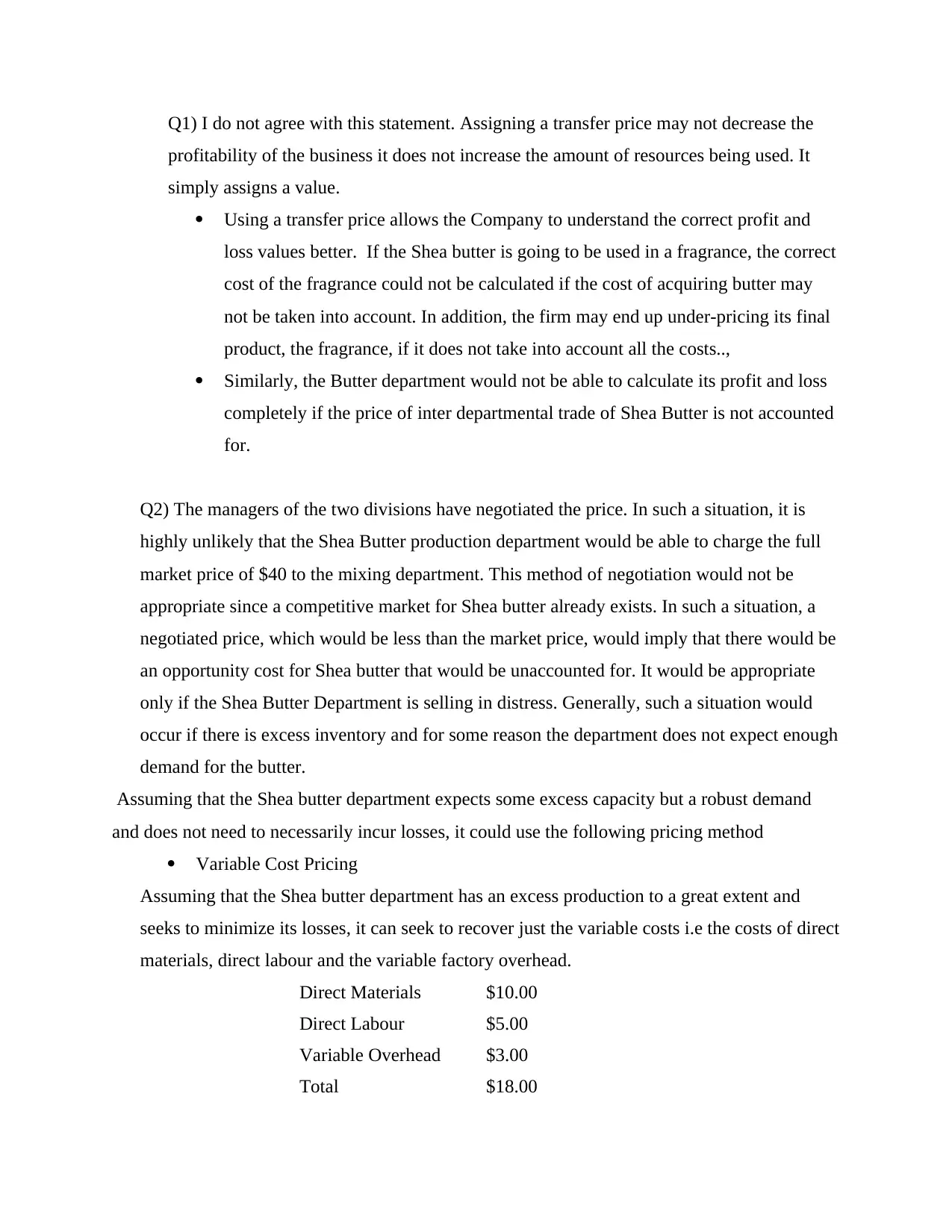

Q1) I do not agree with this statement. Assigning a transfer price may not decrease the

profitability of the business it does not increase the amount of resources being used. It

simply assigns a value.

Using a transfer price allows the Company to understand the correct profit and

loss values better. If the Shea butter is going to be used in a fragrance, the correct

cost of the fragrance could not be calculated if the cost of acquiring butter may

not be taken into account. In addition, the firm may end up under-pricing its final

product, the fragrance, if it does not take into account all the costs..,

Similarly, the Butter department would not be able to calculate its profit and loss

completely if the price of inter departmental trade of Shea Butter is not accounted

for.

Q2) The managers of the two divisions have negotiated the price. In such a situation, it is

highly unlikely that the Shea Butter production department would be able to charge the full

market price of $40 to the mixing department. This method of negotiation would not be

appropriate since a competitive market for Shea butter already exists. In such a situation, a

negotiated price, which would be less than the market price, would imply that there would be

an opportunity cost for Shea butter that would be unaccounted for. It would be appropriate

only if the Shea Butter Department is selling in distress. Generally, such a situation would

occur if there is excess inventory and for some reason the department does not expect enough

demand for the butter.

Assuming that the Shea butter department expects some excess capacity but a robust demand

and does not need to necessarily incur losses, it could use the following pricing method

Variable Cost Pricing

Assuming that the Shea butter department has an excess production to a great extent and

seeks to minimize its losses, it can seek to recover just the variable costs i.e the costs of direct

materials, direct labour and the variable factory overhead.

Direct Materials $10.00

Direct Labour $5.00

Variable Overhead $3.00

Total $18.00

profitability of the business it does not increase the amount of resources being used. It

simply assigns a value.

Using a transfer price allows the Company to understand the correct profit and

loss values better. If the Shea butter is going to be used in a fragrance, the correct

cost of the fragrance could not be calculated if the cost of acquiring butter may

not be taken into account. In addition, the firm may end up under-pricing its final

product, the fragrance, if it does not take into account all the costs..,

Similarly, the Butter department would not be able to calculate its profit and loss

completely if the price of inter departmental trade of Shea Butter is not accounted

for.

Q2) The managers of the two divisions have negotiated the price. In such a situation, it is

highly unlikely that the Shea Butter production department would be able to charge the full

market price of $40 to the mixing department. This method of negotiation would not be

appropriate since a competitive market for Shea butter already exists. In such a situation, a

negotiated price, which would be less than the market price, would imply that there would be

an opportunity cost for Shea butter that would be unaccounted for. It would be appropriate

only if the Shea Butter Department is selling in distress. Generally, such a situation would

occur if there is excess inventory and for some reason the department does not expect enough

demand for the butter.

Assuming that the Shea butter department expects some excess capacity but a robust demand

and does not need to necessarily incur losses, it could use the following pricing method

Variable Cost Pricing

Assuming that the Shea butter department has an excess production to a great extent and

seeks to minimize its losses, it can seek to recover just the variable costs i.e the costs of direct

materials, direct labour and the variable factory overhead.

Direct Materials $10.00

Direct Labour $5.00

Variable Overhead $3.00

Total $18.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

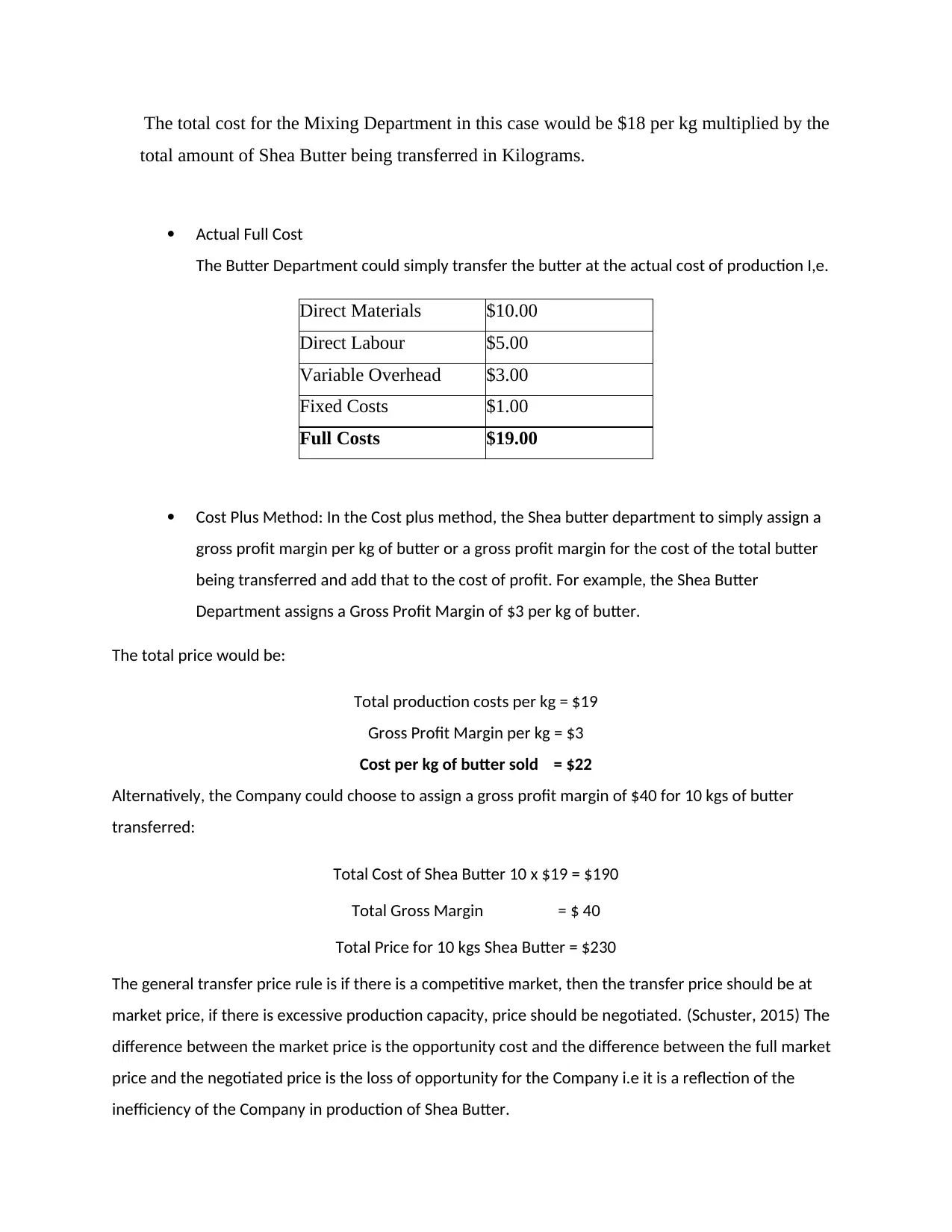

The total cost for the Mixing Department in this case would be $18 per kg multiplied by the

total amount of Shea Butter being transferred in Kilograms.

Actual Full Cost

The Butter Department could simply transfer the butter at the actual cost of production I,e.

Direct Materials $10.00

Direct Labour $5.00

Variable Overhead $3.00

Fixed Costs $1.00

Full Costs $19.00

Cost Plus Method: In the Cost plus method, the Shea butter department to simply assign a

gross profit margin per kg of butter or a gross profit margin for the cost of the total butter

being transferred and add that to the cost of profit. For example, the Shea Butter

Department assigns a Gross Profit Margin of $3 per kg of butter.

The total price would be:

Total production costs per kg = $19

Gross Profit Margin per kg = $3

Cost per kg of butter sold = $22

Alternatively, the Company could choose to assign a gross profit margin of $40 for 10 kgs of butter

transferred:

Total Cost of Shea Butter 10 x $19 = $190

Total Gross Margin = $ 40

Total Price for 10 kgs Shea Butter = $230

The general transfer price rule is if there is a competitive market, then the transfer price should be at

market price, if there is excessive production capacity, price should be negotiated. (Schuster, 2015) The

difference between the market price is the opportunity cost and the difference between the full market

price and the negotiated price is the loss of opportunity for the Company i.e it is a reflection of the

inefficiency of the Company in production of Shea Butter.

total amount of Shea Butter being transferred in Kilograms.

Actual Full Cost

The Butter Department could simply transfer the butter at the actual cost of production I,e.

Direct Materials $10.00

Direct Labour $5.00

Variable Overhead $3.00

Fixed Costs $1.00

Full Costs $19.00

Cost Plus Method: In the Cost plus method, the Shea butter department to simply assign a

gross profit margin per kg of butter or a gross profit margin for the cost of the total butter

being transferred and add that to the cost of profit. For example, the Shea Butter

Department assigns a Gross Profit Margin of $3 per kg of butter.

The total price would be:

Total production costs per kg = $19

Gross Profit Margin per kg = $3

Cost per kg of butter sold = $22

Alternatively, the Company could choose to assign a gross profit margin of $40 for 10 kgs of butter

transferred:

Total Cost of Shea Butter 10 x $19 = $190

Total Gross Margin = $ 40

Total Price for 10 kgs Shea Butter = $230

The general transfer price rule is if there is a competitive market, then the transfer price should be at

market price, if there is excessive production capacity, price should be negotiated. (Schuster, 2015) The

difference between the market price is the opportunity cost and the difference between the full market

price and the negotiated price is the loss of opportunity for the Company i.e it is a reflection of the

inefficiency of the Company in production of Shea Butter.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.