Financial Accounting: Recording and Analyzing Business Transactions

VerifiedAdded on 2023/01/03

|16

|2119

|462

Homework Assignment

AI Summary

This assignment presents a comprehensive solution to an accounting problem, focusing on the recording of business transactions and subsequent financial analysis. It begins with detailed journal entries, followed by the creation of T-accounts to balance the accounts and determine opening balances. A trial balance is then prepared, leading to the construction of an income statement and a statement of financial position for Linda's business. Furthermore, the assignment includes a letter to Linda, offering insights into financial matters. Part B involves a thorough ratio calculation for Linda's business, comparing its performance against a competitor. The report analyzes key financial ratios, providing a conclusion based on the findings and referencing relevant academic sources.

Recording Business

Transactions

Transactions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

ASSESSMENT 2.............................................................................................................................1

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

Journal transactions of T- accounts:............................................................................................1

Balance the accounts and an opening balances:..........................................................................2

Trial balance:...............................................................................................................................6

Income statement for the period 31st Oct. 2020:.........................................................................6

Preparation of financial position 31st Oct. 2020:........................................................................7

Letter to Linda..............................................................................................................................7

PART B............................................................................................................................................7

Ratio calculation for Linda's business:........................................................................................7

Analysis of the ratio in comparison to its competitor..................................................................9

CONCLUSION '..............................................................................................................................9

REFERENCES..............................................................................................................................10

ASSESSMENT 2.............................................................................................................................1

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

Journal transactions of T- accounts:............................................................................................1

Balance the accounts and an opening balances:..........................................................................2

Trial balance:...............................................................................................................................6

Income statement for the period 31st Oct. 2020:.........................................................................6

Preparation of financial position 31st Oct. 2020:........................................................................7

Letter to Linda..............................................................................................................................7

PART B............................................................................................................................................7

Ratio calculation for Linda's business:........................................................................................7

Analysis of the ratio in comparison to its competitor..................................................................9

CONCLUSION '..............................................................................................................................9

REFERENCES..............................................................................................................................10

ASSESSMENT 2

INTRODUCTION

Financial statements means records of the financial data which is written in the books of

accounts for measure the performance of the company. Financial information is used by the

investors and analyst to make predictions for the future direction and also used in evaluating of

the financial health and wealth of the company. It is the main source for the decision maker for

making decisions regarding the investing. In the financial statement there is the prepare of the

balance sheet, income statements and statement of cash flow in the given time period. In tis

assessment there is the record of the double entry transactions and evaluation of the statement of

financial position (Ghezzi and Cavallo, 2020). Apart from this there is the interpretation of ratio

analyses with their competitor and examine their performance.

PART A

Journal transactions of T- accounts:

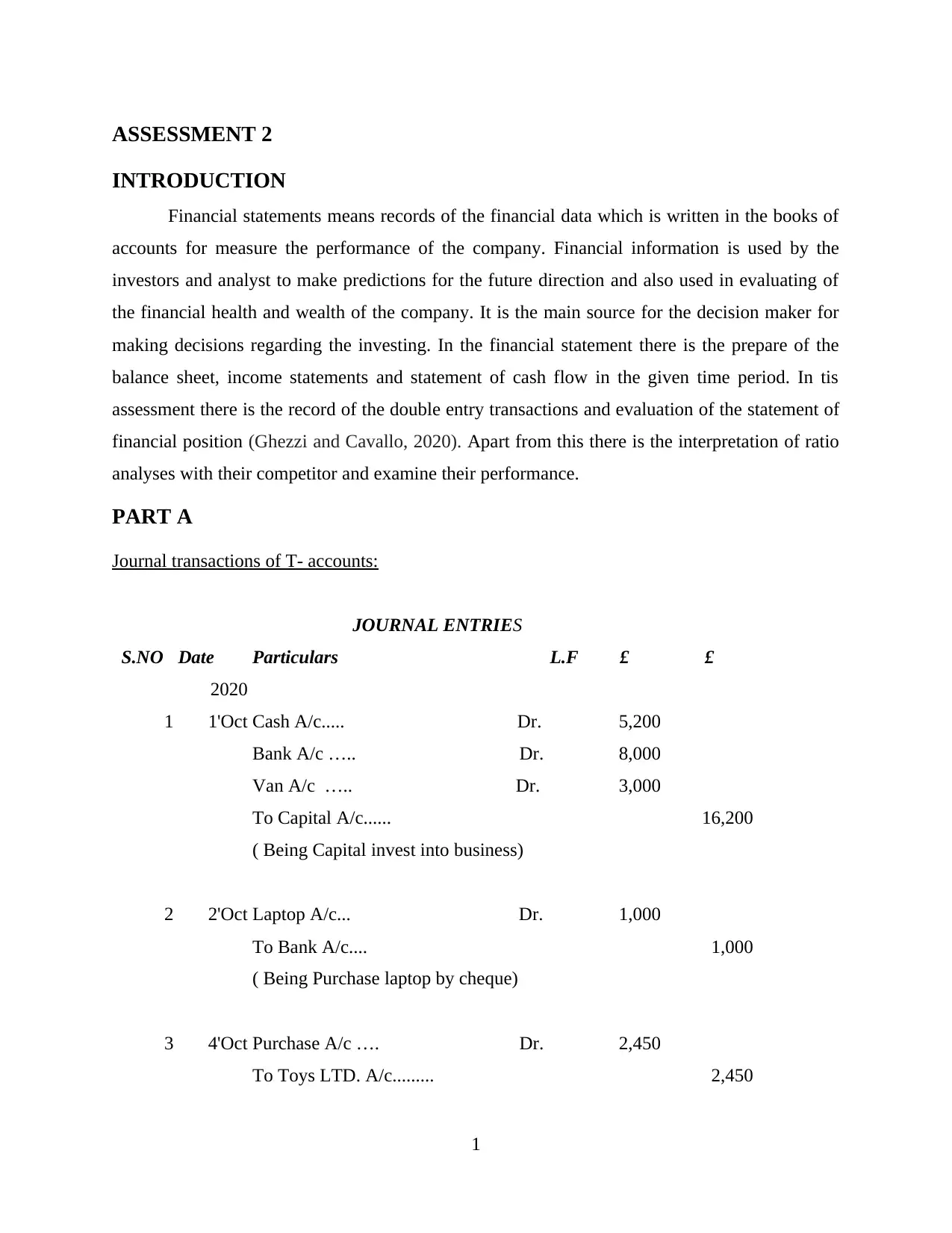

JOURNAL ENTRIES

S.NO Date Particulars L.F £ £

2020

1 1'Oct Cash A/c..... Dr. 5,200

Bank A/c ….. Dr. 8,000

Van A/c ….. Dr. 3,000

To Capital A/c...... 16,200

( Being Capital invest into business)

2 2'Oct Laptop A/c... Dr. 1,000

To Bank A/c.... 1,000

( Being Purchase laptop by cheque)

3 4'Oct Purchase A/c …. Dr. 2,450

To Toys LTD. A/c......... 2,450

1

INTRODUCTION

Financial statements means records of the financial data which is written in the books of

accounts for measure the performance of the company. Financial information is used by the

investors and analyst to make predictions for the future direction and also used in evaluating of

the financial health and wealth of the company. It is the main source for the decision maker for

making decisions regarding the investing. In the financial statement there is the prepare of the

balance sheet, income statements and statement of cash flow in the given time period. In tis

assessment there is the record of the double entry transactions and evaluation of the statement of

financial position (Ghezzi and Cavallo, 2020). Apart from this there is the interpretation of ratio

analyses with their competitor and examine their performance.

PART A

Journal transactions of T- accounts:

JOURNAL ENTRIES

S.NO Date Particulars L.F £ £

2020

1 1'Oct Cash A/c..... Dr. 5,200

Bank A/c ….. Dr. 8,000

Van A/c ….. Dr. 3,000

To Capital A/c...... 16,200

( Being Capital invest into business)

2 2'Oct Laptop A/c... Dr. 1,000

To Bank A/c.... 1,000

( Being Purchase laptop by cheque)

3 4'Oct Purchase A/c …. Dr. 2,450

To Toys LTD. A/c......... 2,450

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

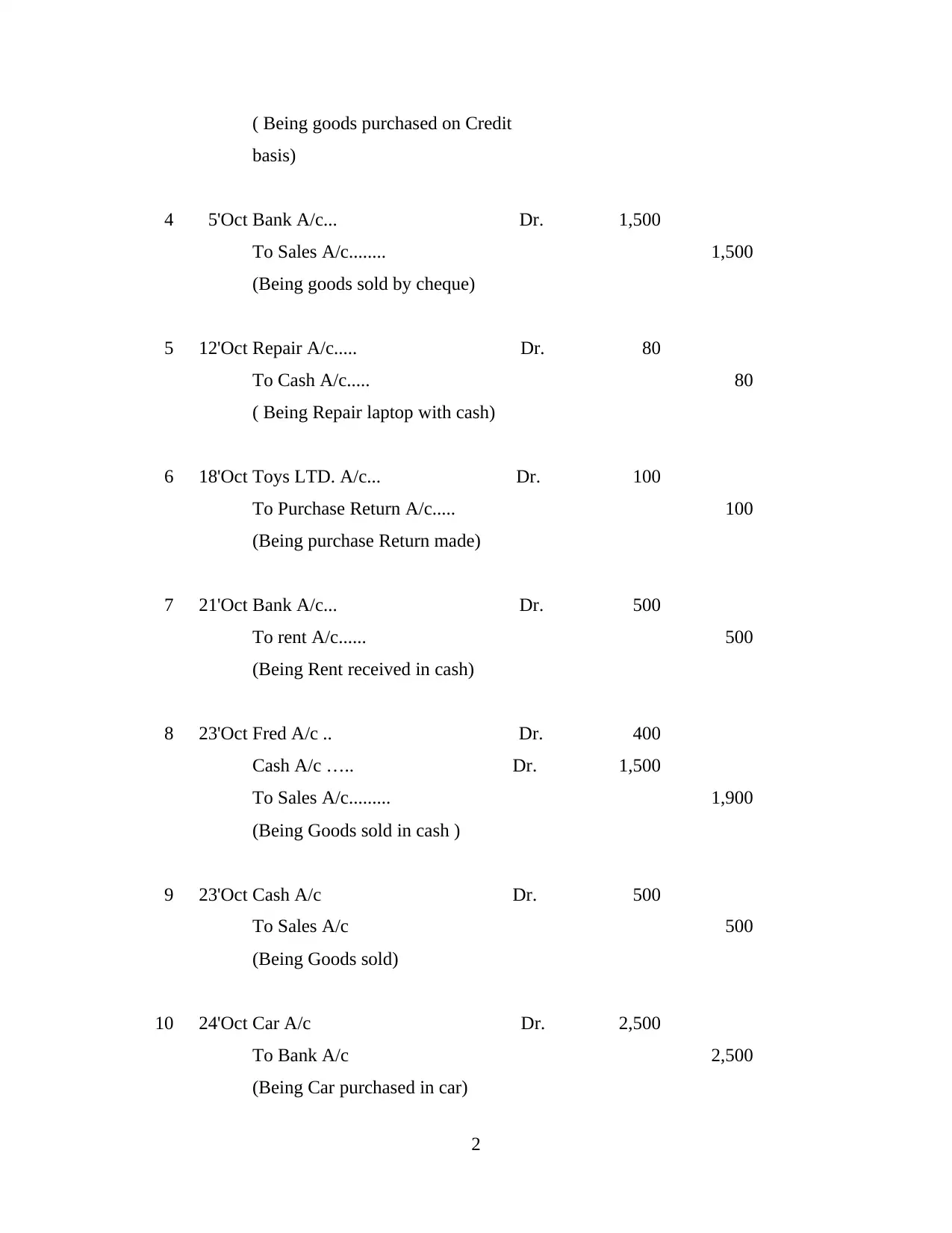

( Being goods purchased on Credit

basis)

4 5'Oct Bank A/c... Dr. 1,500

To Sales A/c........ 1,500

(Being goods sold by cheque)

5 12'Oct Repair A/c..... Dr. 80

To Cash A/c..... 80

( Being Repair laptop with cash)

6 18'Oct Toys LTD. A/c... Dr. 100

To Purchase Return A/c..... 100

(Being purchase Return made)

7 21'Oct Bank A/c... Dr. 500

To rent A/c...... 500

(Being Rent received in cash)

8 23'Oct Fred A/c .. Dr. 400

Cash A/c ….. Dr. 1,500

To Sales A/c......... 1,900

(Being Goods sold in cash )

9 23'Oct Cash A/c Dr. 500

To Sales A/c 500

(Being Goods sold)

10 24'Oct Car A/c Dr. 2,500

To Bank A/c 2,500

(Being Car purchased in car)

2

basis)

4 5'Oct Bank A/c... Dr. 1,500

To Sales A/c........ 1,500

(Being goods sold by cheque)

5 12'Oct Repair A/c..... Dr. 80

To Cash A/c..... 80

( Being Repair laptop with cash)

6 18'Oct Toys LTD. A/c... Dr. 100

To Purchase Return A/c..... 100

(Being purchase Return made)

7 21'Oct Bank A/c... Dr. 500

To rent A/c...... 500

(Being Rent received in cash)

8 23'Oct Fred A/c .. Dr. 400

Cash A/c ….. Dr. 1,500

To Sales A/c......... 1,900

(Being Goods sold in cash )

9 23'Oct Cash A/c Dr. 500

To Sales A/c 500

(Being Goods sold)

10 24'Oct Car A/c Dr. 2,500

To Bank A/c 2,500

(Being Car purchased in car)

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

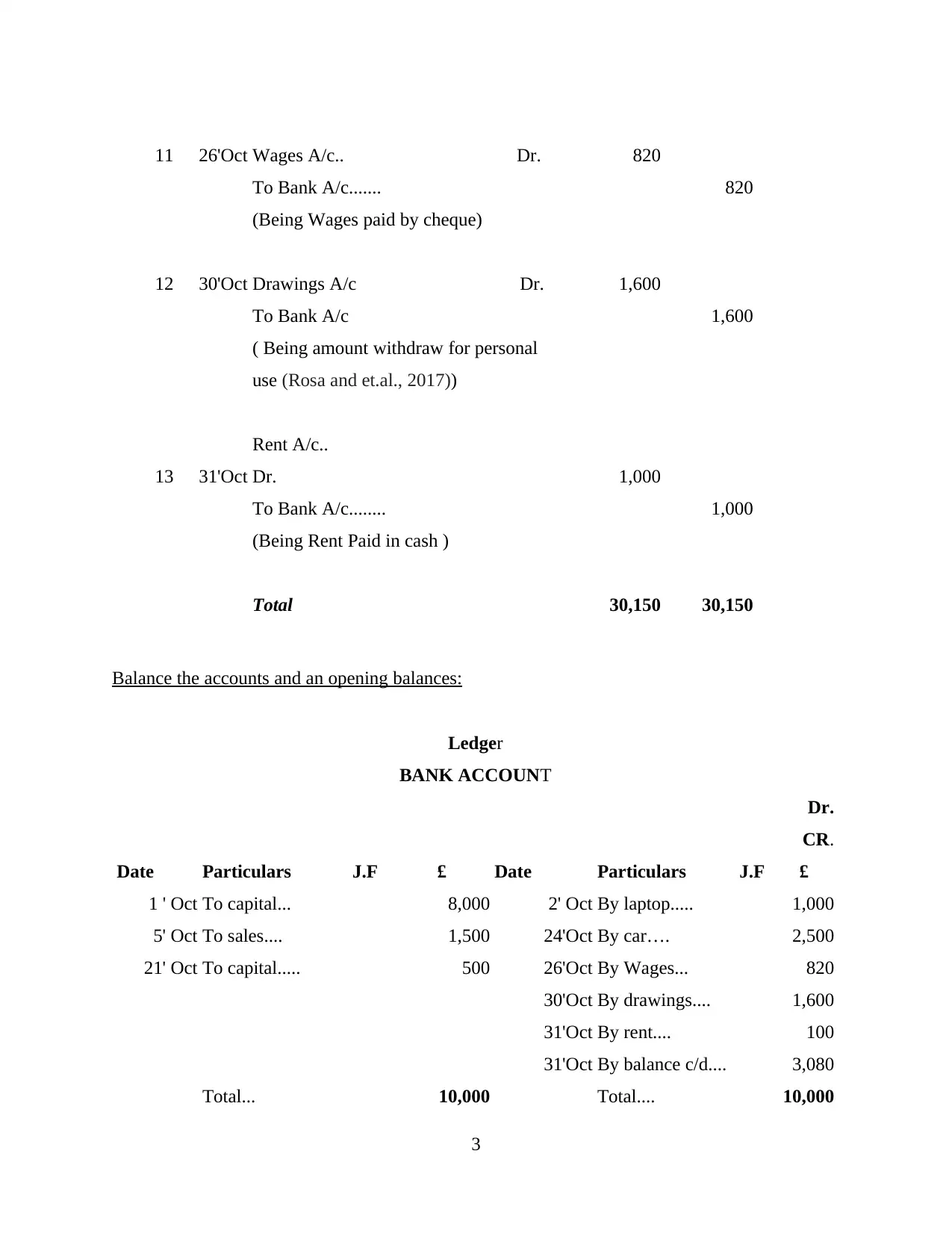

11 26'Oct Wages A/c.. Dr. 820

To Bank A/c....... 820

(Being Wages paid by cheque)

12 30'Oct Drawings A/c Dr. 1,600

To Bank A/c 1,600

( Being amount withdraw for personal

use (Rosa and et.al., 2017))

13 31'Oct

Rent A/c..

Dr. 1,000

To Bank A/c........ 1,000

(Being Rent Paid in cash )

Total 30,150 30,150

Balance the accounts and an opening balances:

Ledger

BANK ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

1 ' Oct To capital... 8,000 2' Oct By laptop..... 1,000

5' Oct To sales.... 1,500 24'Oct By car…. 2,500

21' Oct To capital..... 500 26'Oct By Wages... 820

30'Oct By drawings.... 1,600

31'Oct By rent.... 100

31'Oct By balance c/d.... 3,080

Total... 10,000 Total.... 10,000

3

To Bank A/c....... 820

(Being Wages paid by cheque)

12 30'Oct Drawings A/c Dr. 1,600

To Bank A/c 1,600

( Being amount withdraw for personal

use (Rosa and et.al., 2017))

13 31'Oct

Rent A/c..

Dr. 1,000

To Bank A/c........ 1,000

(Being Rent Paid in cash )

Total 30,150 30,150

Balance the accounts and an opening balances:

Ledger

BANK ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

1 ' Oct To capital... 8,000 2' Oct By laptop..... 1,000

5' Oct To sales.... 1,500 24'Oct By car…. 2,500

21' Oct To capital..... 500 26'Oct By Wages... 820

30'Oct By drawings.... 1,600

31'Oct By rent.... 100

31'Oct By balance c/d.... 3,080

Total... 10,000 Total.... 10,000

3

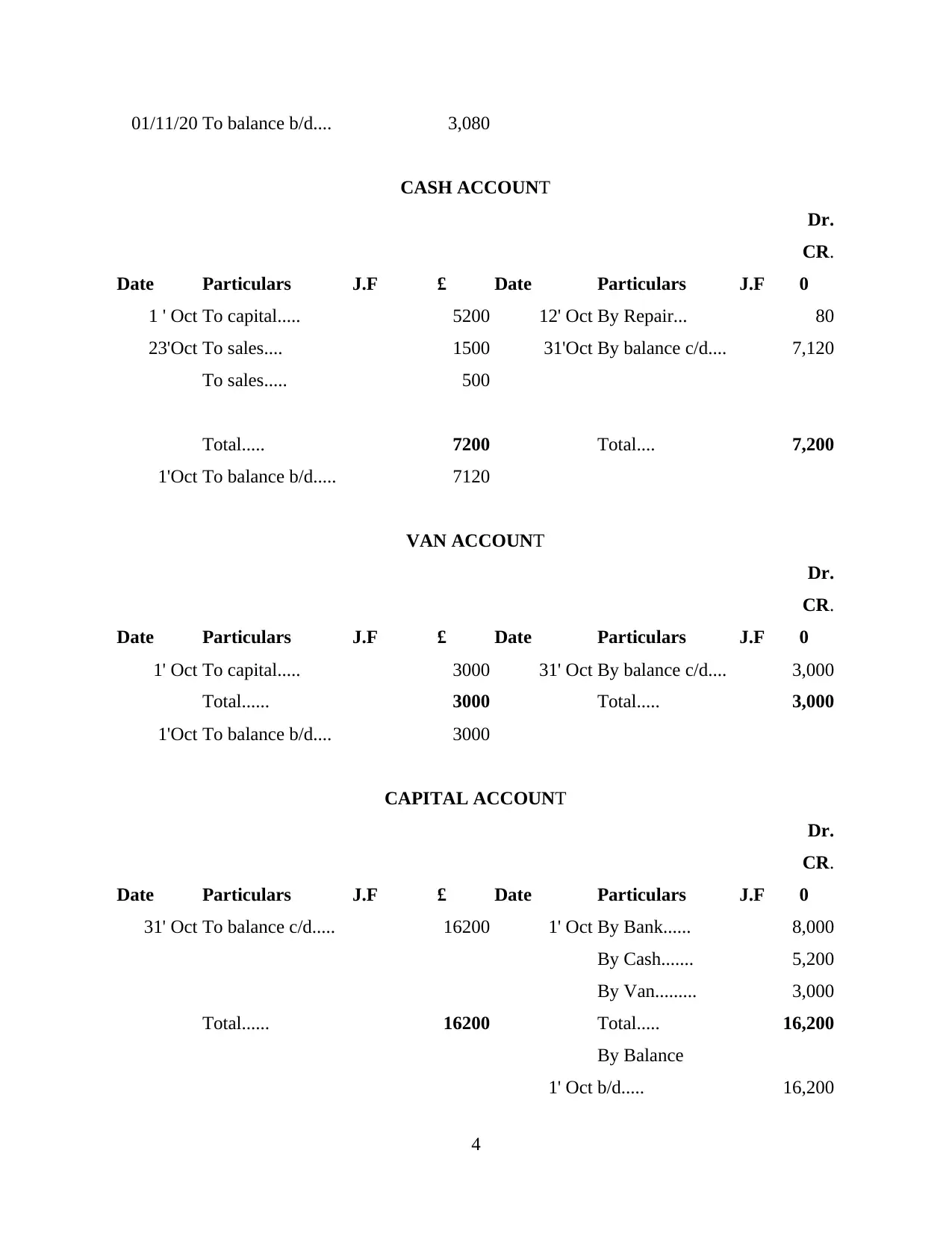

01/11/20 To balance b/d.... 3,080

CASH ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

1 ' Oct To capital..... 5200 12' Oct By Repair... 80

23'Oct To sales.... 1500 31'Oct By balance c/d.... 7,120

To sales..... 500

Total..... 7200 Total.... 7,200

1'Oct To balance b/d..... 7120

VAN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

1' Oct To capital..... 3000 31' Oct By balance c/d.... 3,000

Total...... 3000 Total..... 3,000

1'Oct To balance b/d.... 3000

CAPITAL ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To balance c/d..... 16200 1' Oct By Bank...... 8,000

By Cash....... 5,200

By Van......... 3,000

Total...... 16200 Total..... 16,200

1' Oct

By Balance

b/d..... 16,200

4

CASH ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

1 ' Oct To capital..... 5200 12' Oct By Repair... 80

23'Oct To sales.... 1500 31'Oct By balance c/d.... 7,120

To sales..... 500

Total..... 7200 Total.... 7,200

1'Oct To balance b/d..... 7120

VAN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

1' Oct To capital..... 3000 31' Oct By balance c/d.... 3,000

Total...... 3000 Total..... 3,000

1'Oct To balance b/d.... 3000

CAPITAL ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To balance c/d..... 16200 1' Oct By Bank...... 8,000

By Cash....... 5,200

By Van......... 3,000

Total...... 16200 Total..... 16,200

1' Oct

By Balance

b/d..... 16,200

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

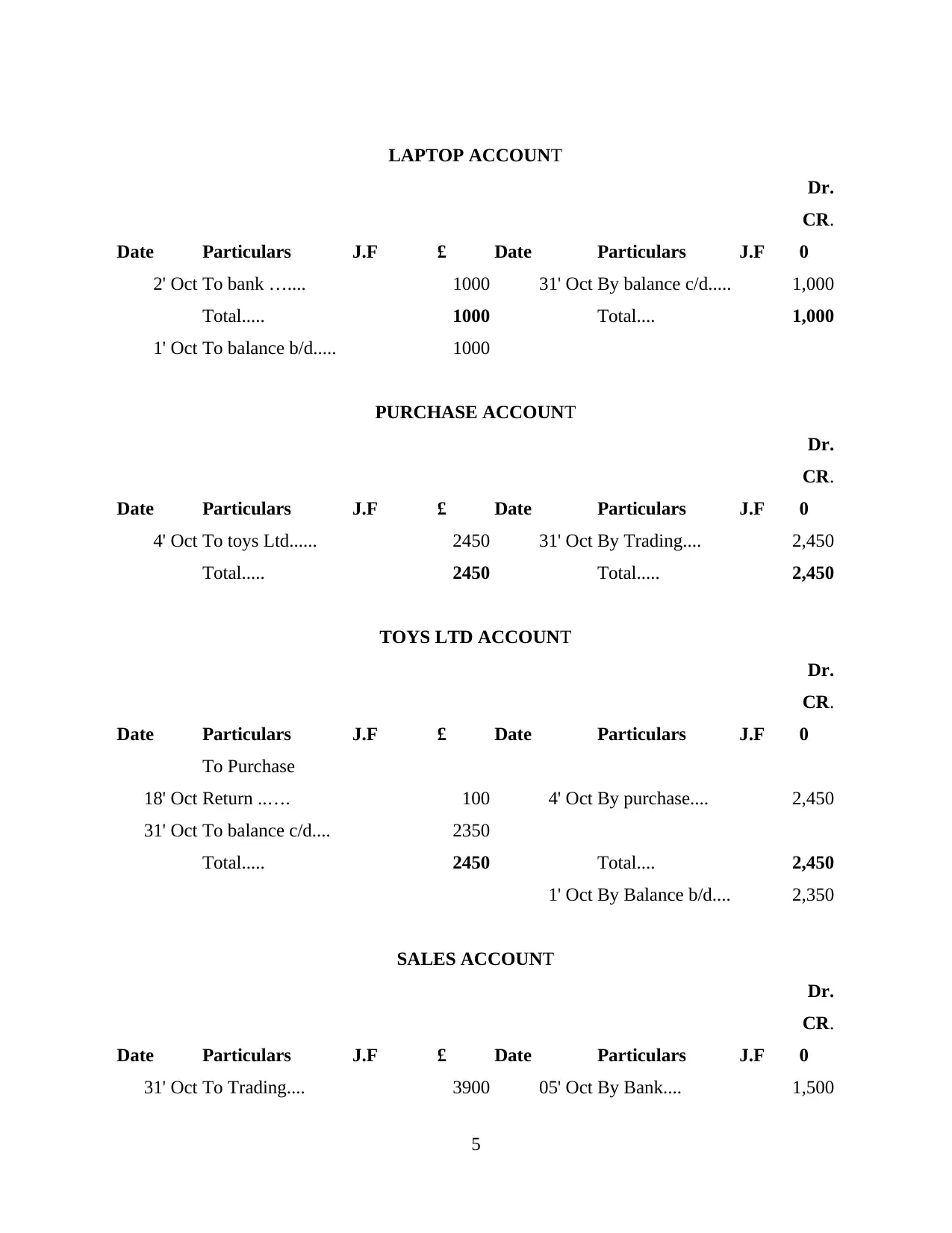

LAPTOP ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

2' Oct To bank ….... 1000 31' Oct By balance c/d..... 1,000

Total..... 1000 Total.... 1,000

1' Oct To balance b/d..... 1000

PURCHASE ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

4' Oct To toys Ltd...... 2450 31' Oct By Trading.... 2,450

Total..... 2450 Total..... 2,450

TOYS LTD ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

18' Oct

To Purchase

Return ..…. 100 4' Oct By purchase.... 2,450

31' Oct To balance c/d.... 2350

Total..... 2450 Total.... 2,450

1' Oct By Balance b/d.... 2,350

SALES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To Trading.... 3900 05' Oct By Bank.... 1,500

5

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

2' Oct To bank ….... 1000 31' Oct By balance c/d..... 1,000

Total..... 1000 Total.... 1,000

1' Oct To balance b/d..... 1000

PURCHASE ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

4' Oct To toys Ltd...... 2450 31' Oct By Trading.... 2,450

Total..... 2450 Total..... 2,450

TOYS LTD ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

18' Oct

To Purchase

Return ..…. 100 4' Oct By purchase.... 2,450

31' Oct To balance c/d.... 2350

Total..... 2450 Total.... 2,450

1' Oct By Balance b/d.... 2,350

SALES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To Trading.... 3900 05' Oct By Bank.... 1,500

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

23' Oct By fred.... 400

By Cash..... 1,500

By Cash..... 500

Total.... 3900 Total..... 3,900

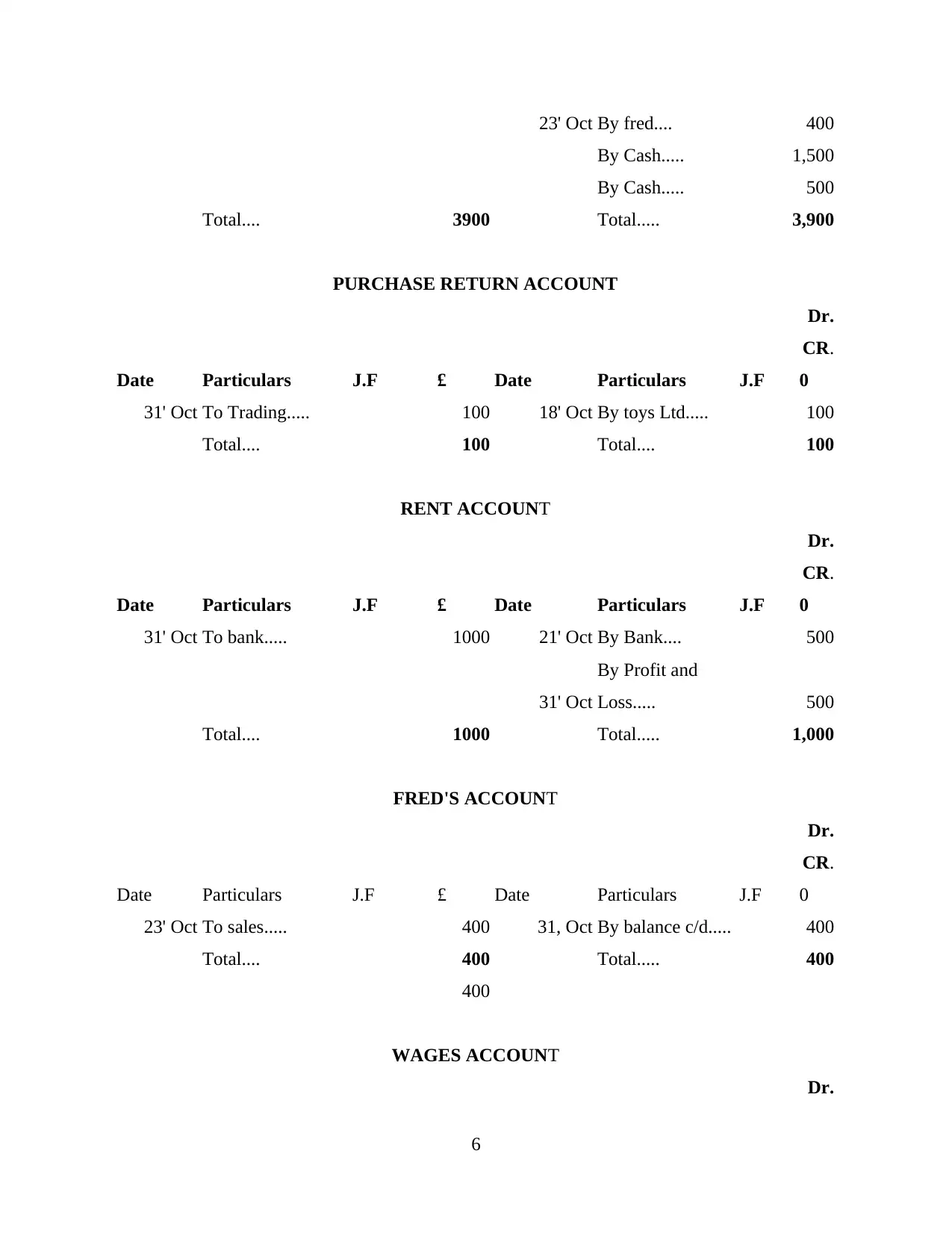

PURCHASE RETURN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To Trading..... 100 18' Oct By toys Ltd..... 100

Total.... 100 Total.... 100

RENT ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To bank..... 1000 21' Oct By Bank.... 500

31' Oct

By Profit and

Loss..... 500

Total.... 1000 Total..... 1,000

FRED'S ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

23' Oct To sales..... 400 31, Oct By balance c/d..... 400

Total.... 400 Total..... 400

400

WAGES ACCOUNT

Dr.

6

By Cash..... 1,500

By Cash..... 500

Total.... 3900 Total..... 3,900

PURCHASE RETURN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To Trading..... 100 18' Oct By toys Ltd..... 100

Total.... 100 Total.... 100

RENT ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

31' Oct To bank..... 1000 21' Oct By Bank.... 500

31' Oct

By Profit and

Loss..... 500

Total.... 1000 Total..... 1,000

FRED'S ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

23' Oct To sales..... 400 31, Oct By balance c/d..... 400

Total.... 400 Total..... 400

400

WAGES ACCOUNT

Dr.

6

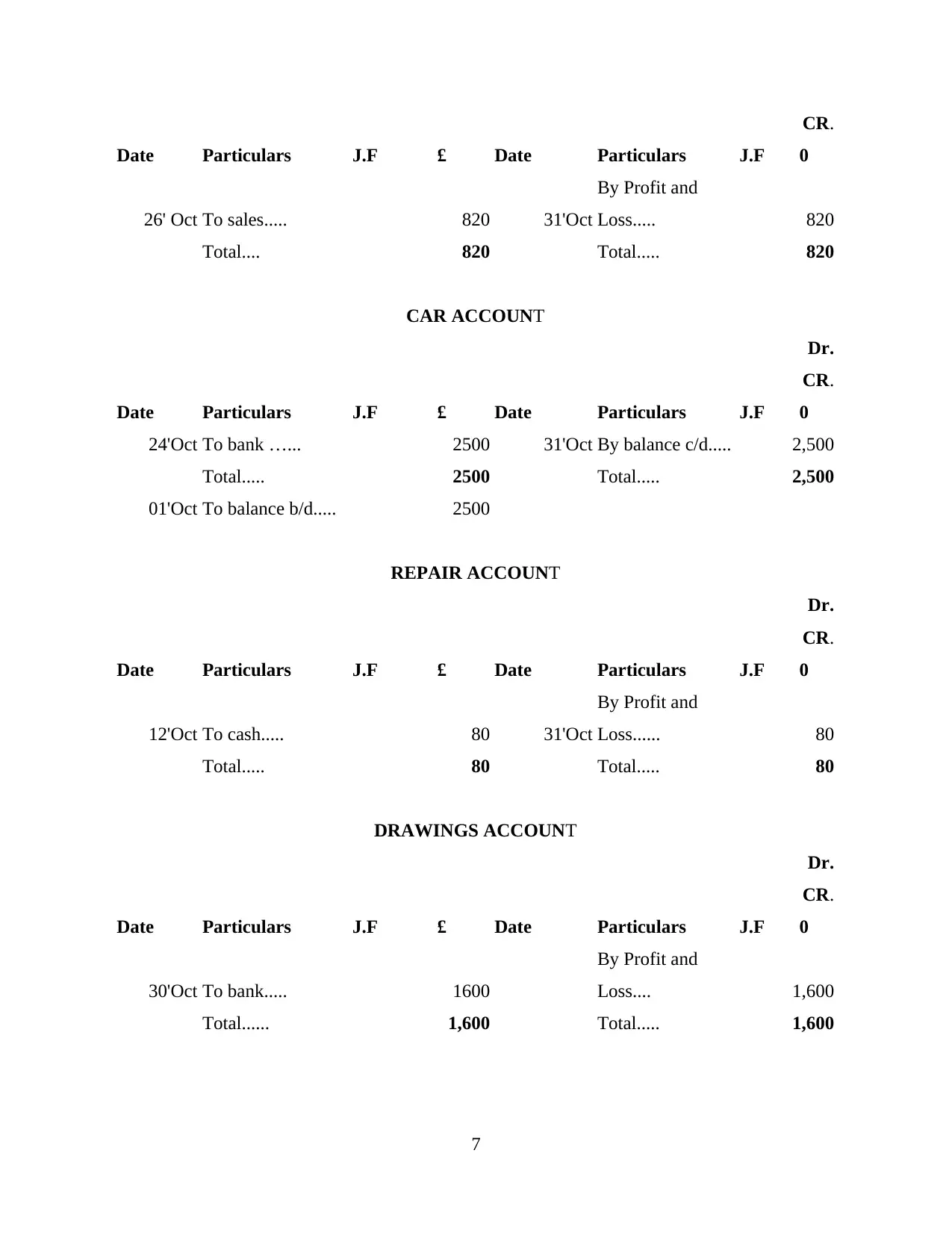

CR.

Date Particulars J.F £ Date Particulars J.F 0

26' Oct To sales..... 820 31'Oct

By Profit and

Loss..... 820

Total.... 820 Total..... 820

CAR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

24'Oct To bank …... 2500 31'Oct By balance c/d..... 2,500

Total..... 2500 Total..... 2,500

01'Oct To balance b/d..... 2500

REPAIR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

12'Oct To cash..... 80 31'Oct

By Profit and

Loss...... 80

Total..... 80 Total..... 80

DRAWINGS ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

30'Oct To bank..... 1600

By Profit and

Loss.... 1,600

Total...... 1,600 Total..... 1,600

7

Date Particulars J.F £ Date Particulars J.F 0

26' Oct To sales..... 820 31'Oct

By Profit and

Loss..... 820

Total.... 820 Total..... 820

CAR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

24'Oct To bank …... 2500 31'Oct By balance c/d..... 2,500

Total..... 2500 Total..... 2,500

01'Oct To balance b/d..... 2500

REPAIR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

12'Oct To cash..... 80 31'Oct

By Profit and

Loss...... 80

Total..... 80 Total..... 80

DRAWINGS ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F 0

30'Oct To bank..... 1600

By Profit and

Loss.... 1,600

Total...... 1,600 Total..... 1,600

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

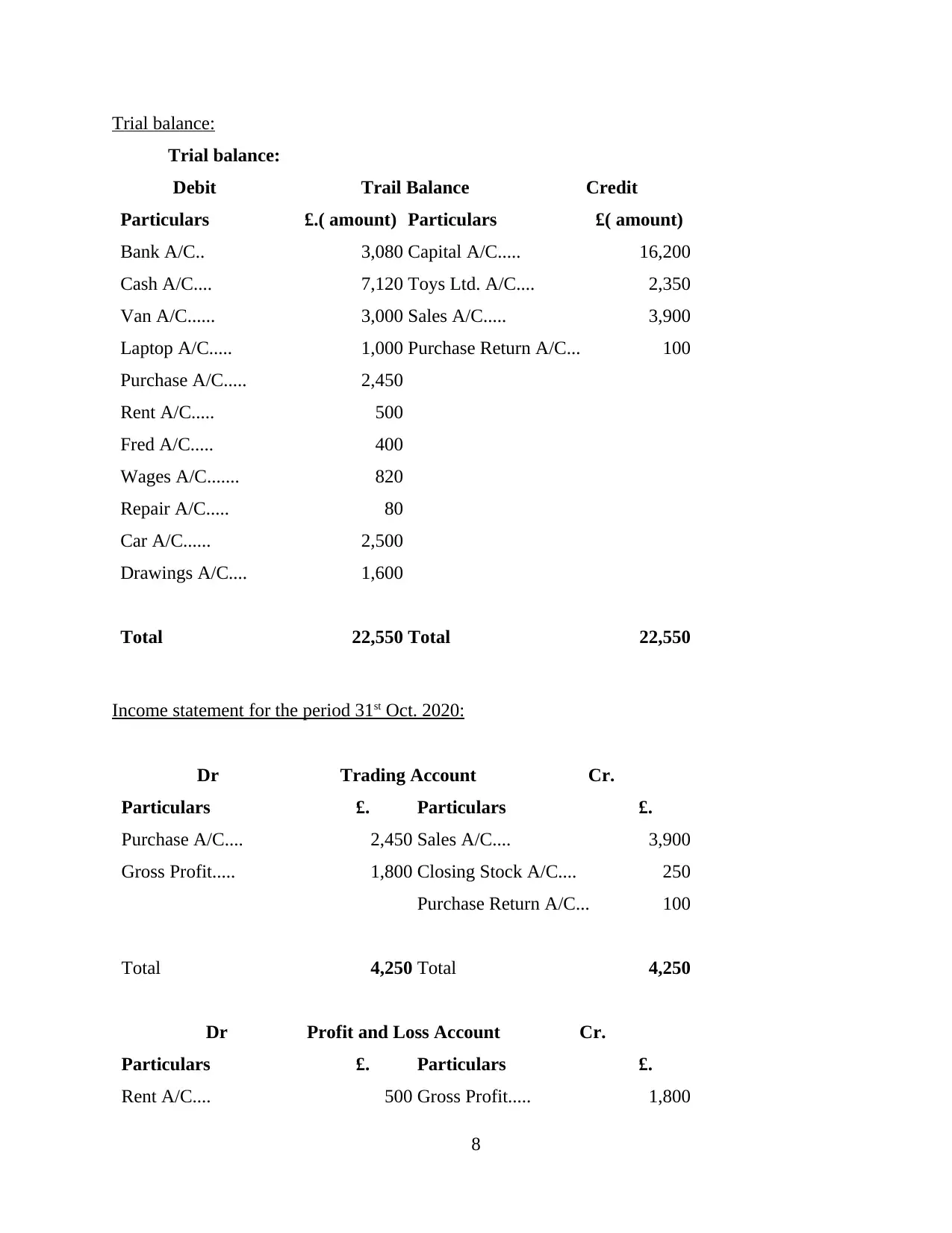

Trial balance:

Trial balance:

Debit Trail Balance Credit

Particulars £.( amount) Particulars £( amount)

Bank A/C.. 3,080 Capital A/C..... 16,200

Cash A/C.... 7,120 Toys Ltd. A/C.... 2,350

Van A/C...... 3,000 Sales A/C..... 3,900

Laptop A/C..... 1,000 Purchase Return A/C... 100

Purchase A/C..... 2,450

Rent A/C..... 500

Fred A/C..... 400

Wages A/C....... 820

Repair A/C..... 80

Car A/C...... 2,500

Drawings A/C.... 1,600

Total 22,550 Total 22,550

Income statement for the period 31st Oct. 2020:

Dr Trading Account Cr.

Particulars £. Particulars £.

Purchase A/C.... 2,450 Sales A/C.... 3,900

Gross Profit..... 1,800 Closing Stock A/C.... 250

Purchase Return A/C... 100

Total 4,250 Total 4,250

Dr Profit and Loss Account Cr.

Particulars £. Particulars £.

Rent A/C.... 500 Gross Profit..... 1,800

8

Trial balance:

Debit Trail Balance Credit

Particulars £.( amount) Particulars £( amount)

Bank A/C.. 3,080 Capital A/C..... 16,200

Cash A/C.... 7,120 Toys Ltd. A/C.... 2,350

Van A/C...... 3,000 Sales A/C..... 3,900

Laptop A/C..... 1,000 Purchase Return A/C... 100

Purchase A/C..... 2,450

Rent A/C..... 500

Fred A/C..... 400

Wages A/C....... 820

Repair A/C..... 80

Car A/C...... 2,500

Drawings A/C.... 1,600

Total 22,550 Total 22,550

Income statement for the period 31st Oct. 2020:

Dr Trading Account Cr.

Particulars £. Particulars £.

Purchase A/C.... 2,450 Sales A/C.... 3,900

Gross Profit..... 1,800 Closing Stock A/C.... 250

Purchase Return A/C... 100

Total 4,250 Total 4,250

Dr Profit and Loss Account Cr.

Particulars £. Particulars £.

Rent A/C.... 500 Gross Profit..... 1,800

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

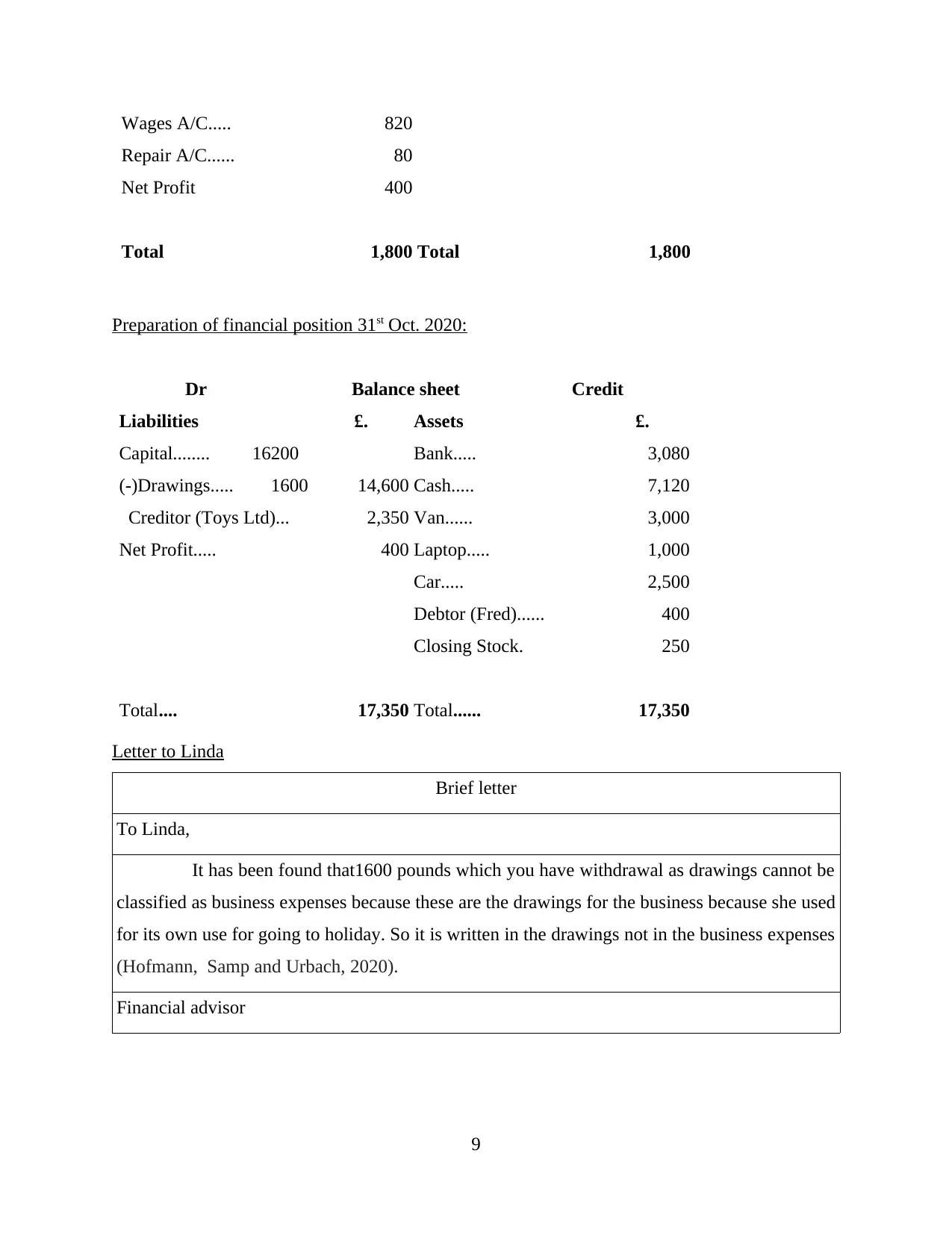

Wages A/C..... 820

Repair A/C...... 80

Net Profit 400

Total 1,800 Total 1,800

Preparation of financial position 31st Oct. 2020:

Dr Balance sheet Credit

Liabilities £. Assets £.

Capital........ 16200 Bank..... 3,080

(-)Drawings..... 1600 14,600 Cash..... 7,120

Creditor (Toys Ltd)... 2,350 Van...... 3,000

Net Profit..... 400 Laptop..... 1,000

Car..... 2,500

Debtor (Fred)...... 400

Closing Stock. 250

Total.... 17,350 Total...... 17,350

Letter to Linda

Brief letter

To Linda,

It has been found that1600 pounds which you have withdrawal as drawings cannot be

classified as business expenses because these are the drawings for the business because she used

for its own use for going to holiday. So it is written in the drawings not in the business expenses

(Hofmann, Samp and Urbach, 2020).

Financial advisor

9

Repair A/C...... 80

Net Profit 400

Total 1,800 Total 1,800

Preparation of financial position 31st Oct. 2020:

Dr Balance sheet Credit

Liabilities £. Assets £.

Capital........ 16200 Bank..... 3,080

(-)Drawings..... 1600 14,600 Cash..... 7,120

Creditor (Toys Ltd)... 2,350 Van...... 3,000

Net Profit..... 400 Laptop..... 1,000

Car..... 2,500

Debtor (Fred)...... 400

Closing Stock. 250

Total.... 17,350 Total...... 17,350

Letter to Linda

Brief letter

To Linda,

It has been found that1600 pounds which you have withdrawal as drawings cannot be

classified as business expenses because these are the drawings for the business because she used

for its own use for going to holiday. So it is written in the drawings not in the business expenses

(Hofmann, Samp and Urbach, 2020).

Financial advisor

9

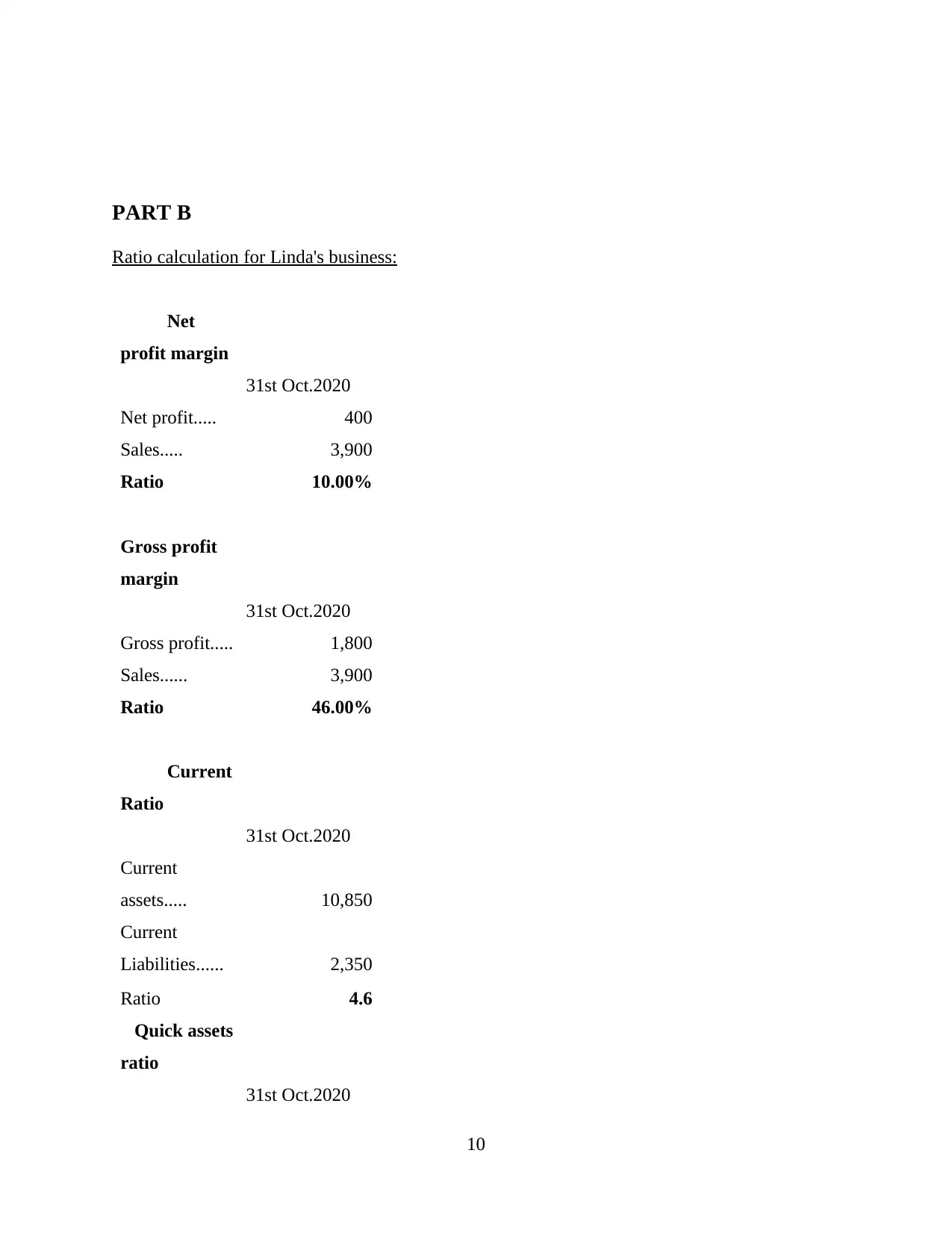

PART B

Ratio calculation for Linda's business:

Net

profit margin

31st Oct.2020

Net profit..... 400

Sales..... 3,900

Ratio 10.00%

Gross profit

margin

31st Oct.2020

Gross profit..... 1,800

Sales...... 3,900

Ratio 46.00%

Current

Ratio

31st Oct.2020

Current

assets..... 10,850

Current

Liabilities...... 2,350

Ratio 4.6

Quick assets

ratio

31st Oct.2020

10

Ratio calculation for Linda's business:

Net

profit margin

31st Oct.2020

Net profit..... 400

Sales..... 3,900

Ratio 10.00%

Gross profit

margin

31st Oct.2020

Gross profit..... 1,800

Sales...... 3,900

Ratio 46.00%

Current

Ratio

31st Oct.2020

Current

assets..... 10,850

Current

Liabilities...... 2,350

Ratio 4.6

Quick assets

ratio

31st Oct.2020

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.