Analysis of Business Transactions: Financial Statements and Ratios

VerifiedAdded on 2022/12/27

|17

|2472

|97

Report

AI Summary

This report provides a comprehensive analysis of business transactions, starting with the preparation of journal entries and T-accounts. It covers the balancing of accounts, creation of a trial balance, and the preparation of an income statement and balance sheet. The report then delves into ratio analysis, including liquidity and profitability ratios, and compares the organization's performance to competitors. The analysis includes calculations for current ratio, quick ratio, net profit margin, and gross profit margin. The report concludes by summarizing the findings and emphasizing the importance of financial statements in evaluating an organization's performance and efficiency in the market. The report also includes journal entries, ledger accounts, and financial statements.

Recording

Business

Transactions

Business

Transactions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Preparation of Journal entries of T-accounts .............................................................................3

Balancing of accounts and opening balances..............................................................................5

Preparation of Trial Balance.......................................................................................................8

Income statement of month ending 31st October 2020..............................................................8

Financial Statements of the organisation....................................................................................9

PART B............................................................................................................................................9

Ratio analysis of the given organisation.....................................................................................9

Analysing above ratios in comparison with competitors..........................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

Books and journals....................................................................................................................14

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Preparation of Journal entries of T-accounts .............................................................................3

Balancing of accounts and opening balances..............................................................................5

Preparation of Trial Balance.......................................................................................................8

Income statement of month ending 31st October 2020..............................................................8

Financial Statements of the organisation....................................................................................9

PART B............................................................................................................................................9

Ratio analysis of the given organisation.....................................................................................9

Analysing above ratios in comparison with competitors..........................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

Books and journals....................................................................................................................14

INTRODUCTION

Business transactions consists of various business activities including sales, purchases,

rent paid, etc. It is conducted generally between two parties where one is purchaser and other is

seller. Such exchange is transacted in exchange of money. In short business transactions are

those events which are used to ascertain the factors which are responsible for organisation's

current financial position (Amro, 2019). These transactions are retained in books of accounts

and summary is provided through annual financial reports. Business transactions also includes

various non-exchange transactions like fire loss, depreciation, etc. such transactions must result

in monetary value. It is therefore termed as economic activity which is recorded in company's

financial statements. Every business events is initially recorded by preparation of journal entries

in such regard.

In this respective report, formulation of various financial statements and business

accounts will be discussed. This will include Journal entries, Ledger accounts, ratio analysis,

balance sheet, income statement as well as trial balance. These statements will be prepared in

order to analyse company's financial position as well as its level of profitability and productivity

throughout its operations.

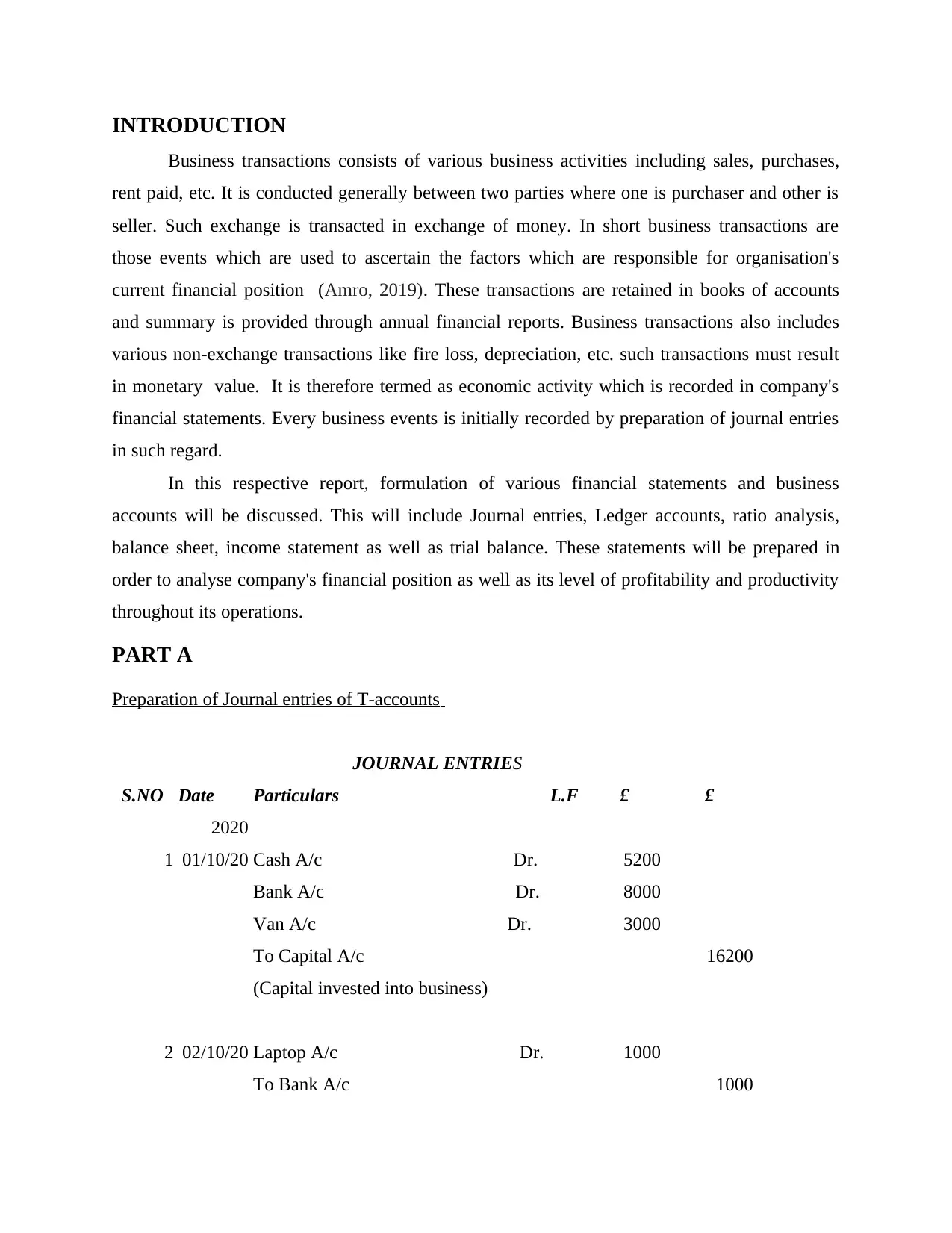

PART A

Preparation of Journal entries of T-accounts

JOURNAL ENTRIES

S.NO Date Particulars L.F £ £

2020

1 01/10/20 Cash A/c Dr. 5200

Bank A/c Dr. 8000

Van A/c Dr. 3000

To Capital A/c 16200

(Capital invested into business)

2 02/10/20 Laptop A/c Dr. 1000

To Bank A/c 1000

Business transactions consists of various business activities including sales, purchases,

rent paid, etc. It is conducted generally between two parties where one is purchaser and other is

seller. Such exchange is transacted in exchange of money. In short business transactions are

those events which are used to ascertain the factors which are responsible for organisation's

current financial position (Amro, 2019). These transactions are retained in books of accounts

and summary is provided through annual financial reports. Business transactions also includes

various non-exchange transactions like fire loss, depreciation, etc. such transactions must result

in monetary value. It is therefore termed as economic activity which is recorded in company's

financial statements. Every business events is initially recorded by preparation of journal entries

in such regard.

In this respective report, formulation of various financial statements and business

accounts will be discussed. This will include Journal entries, Ledger accounts, ratio analysis,

balance sheet, income statement as well as trial balance. These statements will be prepared in

order to analyse company's financial position as well as its level of profitability and productivity

throughout its operations.

PART A

Preparation of Journal entries of T-accounts

JOURNAL ENTRIES

S.NO Date Particulars L.F £ £

2020

1 01/10/20 Cash A/c Dr. 5200

Bank A/c Dr. 8000

Van A/c Dr. 3000

To Capital A/c 16200

(Capital invested into business)

2 02/10/20 Laptop A/c Dr. 1000

To Bank A/c 1000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

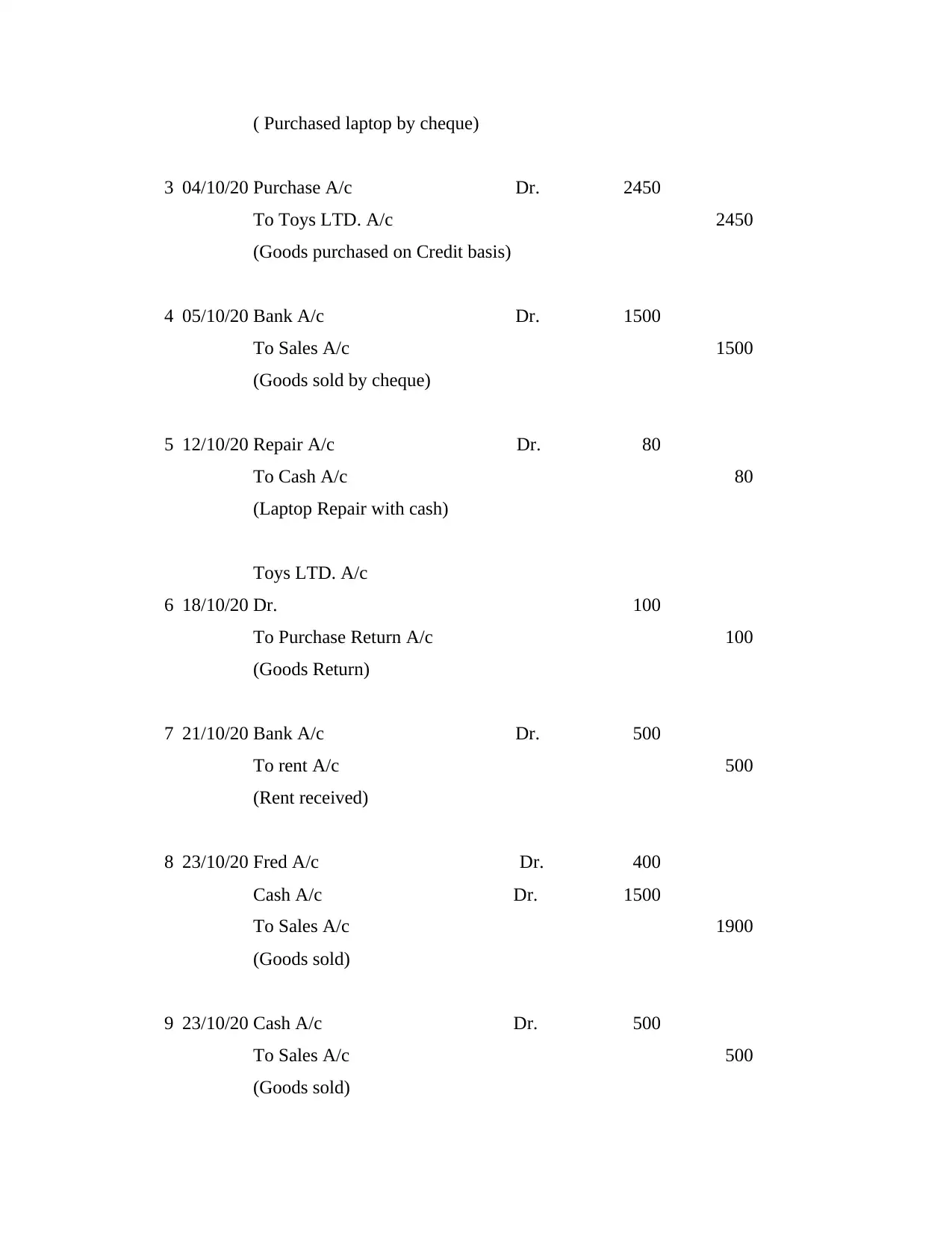

( Purchased laptop by cheque)

3 04/10/20 Purchase A/c Dr. 2450

To Toys LTD. A/c 2450

(Goods purchased on Credit basis)

4 05/10/20 Bank A/c Dr. 1500

To Sales A/c 1500

(Goods sold by cheque)

5 12/10/20 Repair A/c Dr. 80

To Cash A/c 80

(Laptop Repair with cash)

6 18/10/20

Toys LTD. A/c

Dr. 100

To Purchase Return A/c 100

(Goods Return)

7 21/10/20 Bank A/c Dr. 500

To rent A/c 500

(Rent received)

8 23/10/20 Fred A/c Dr. 400

Cash A/c Dr. 1500

To Sales A/c 1900

(Goods sold)

9 23/10/20 Cash A/c Dr. 500

To Sales A/c 500

(Goods sold)

3 04/10/20 Purchase A/c Dr. 2450

To Toys LTD. A/c 2450

(Goods purchased on Credit basis)

4 05/10/20 Bank A/c Dr. 1500

To Sales A/c 1500

(Goods sold by cheque)

5 12/10/20 Repair A/c Dr. 80

To Cash A/c 80

(Laptop Repair with cash)

6 18/10/20

Toys LTD. A/c

Dr. 100

To Purchase Return A/c 100

(Goods Return)

7 21/10/20 Bank A/c Dr. 500

To rent A/c 500

(Rent received)

8 23/10/20 Fred A/c Dr. 400

Cash A/c Dr. 1500

To Sales A/c 1900

(Goods sold)

9 23/10/20 Cash A/c Dr. 500

To Sales A/c 500

(Goods sold)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

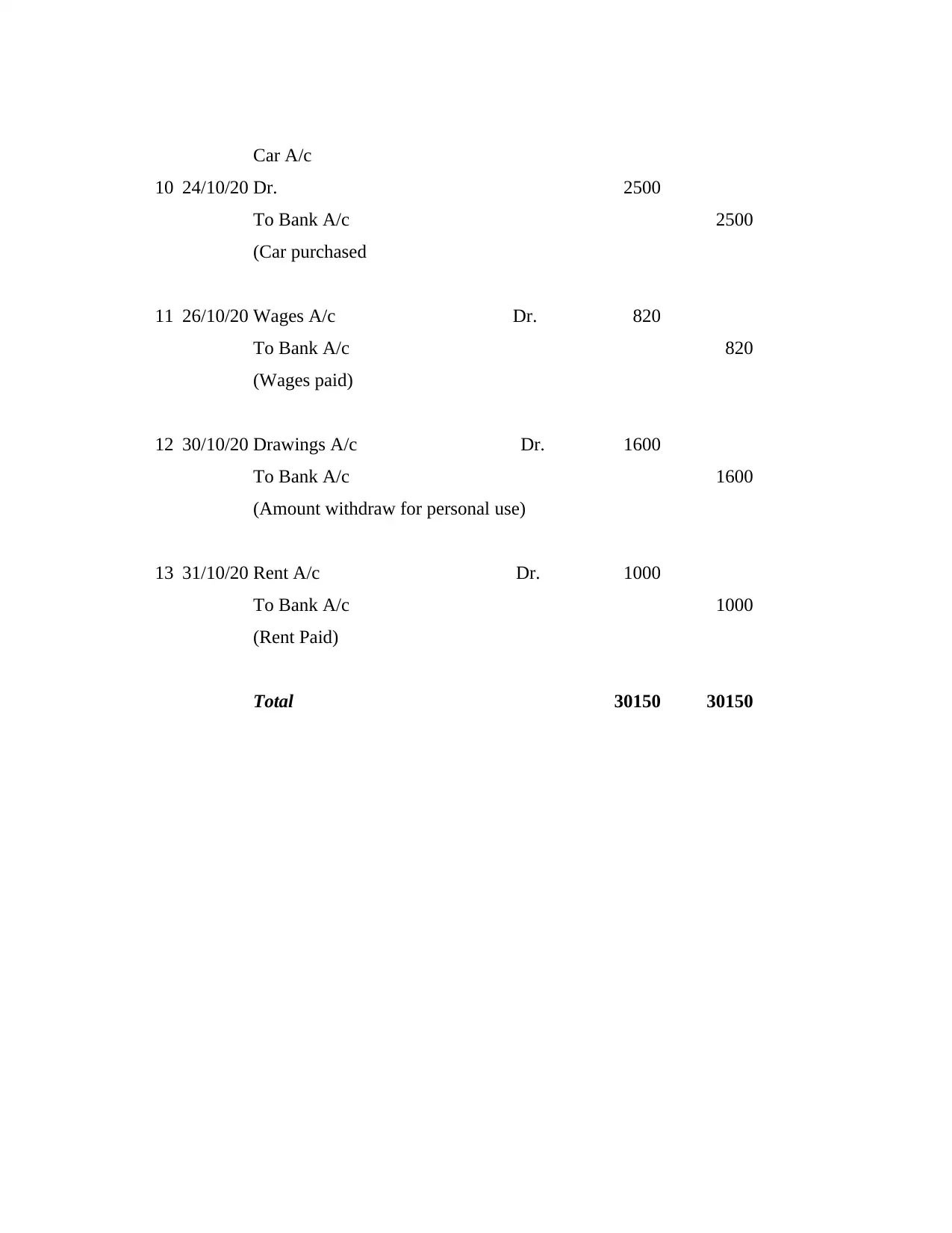

10 24/10/20

Car A/c

Dr. 2500

To Bank A/c 2500

(Car purchased

11 26/10/20 Wages A/c Dr. 820

To Bank A/c 820

(Wages paid)

12 30/10/20 Drawings A/c Dr. 1600

To Bank A/c 1600

(Amount withdraw for personal use)

13 31/10/20 Rent A/c Dr. 1000

To Bank A/c 1000

(Rent Paid)

Total 30150 30150

Car A/c

Dr. 2500

To Bank A/c 2500

(Car purchased

11 26/10/20 Wages A/c Dr. 820

To Bank A/c 820

(Wages paid)

12 30/10/20 Drawings A/c Dr. 1600

To Bank A/c 1600

(Amount withdraw for personal use)

13 31/10/20 Rent A/c Dr. 1000

To Bank A/c 1000

(Rent Paid)

Total 30150 30150

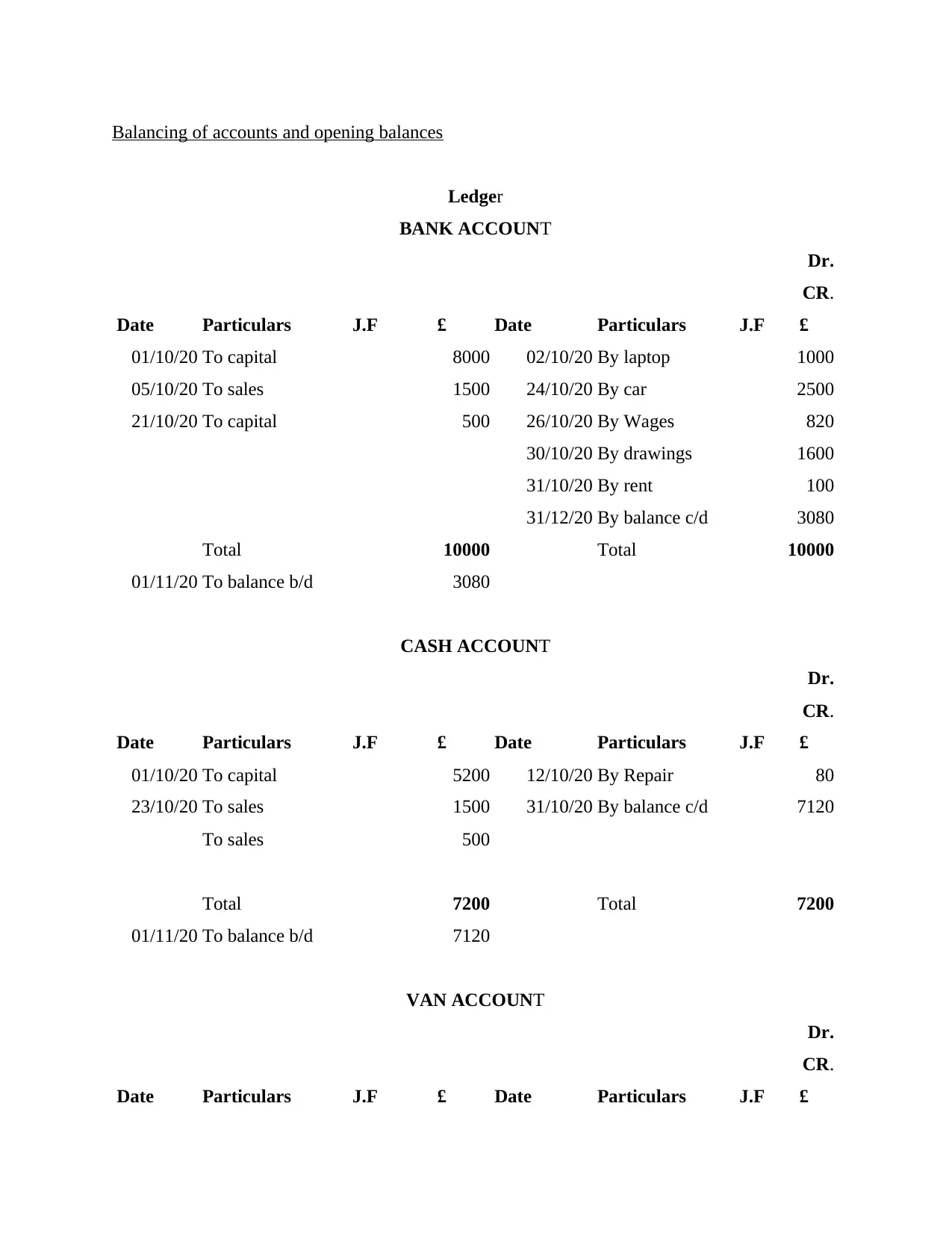

Balancing of accounts and opening balances

Ledger

BANK ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 8000 02/10/20 By laptop 1000

05/10/20 To sales 1500 24/10/20 By car 2500

21/10/20 To capital 500 26/10/20 By Wages 820

30/10/20 By drawings 1600

31/10/20 By rent 100

31/12/20 By balance c/d 3080

Total 10000 Total 10000

01/11/20 To balance b/d 3080

CASH ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 5200 12/10/20 By Repair 80

23/10/20 To sales 1500 31/10/20 By balance c/d 7120

To sales 500

Total 7200 Total 7200

01/11/20 To balance b/d 7120

VAN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

Ledger

BANK ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 8000 02/10/20 By laptop 1000

05/10/20 To sales 1500 24/10/20 By car 2500

21/10/20 To capital 500 26/10/20 By Wages 820

30/10/20 By drawings 1600

31/10/20 By rent 100

31/12/20 By balance c/d 3080

Total 10000 Total 10000

01/11/20 To balance b/d 3080

CASH ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 5200 12/10/20 By Repair 80

23/10/20 To sales 1500 31/10/20 By balance c/d 7120

To sales 500

Total 7200 Total 7200

01/11/20 To balance b/d 7120

VAN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

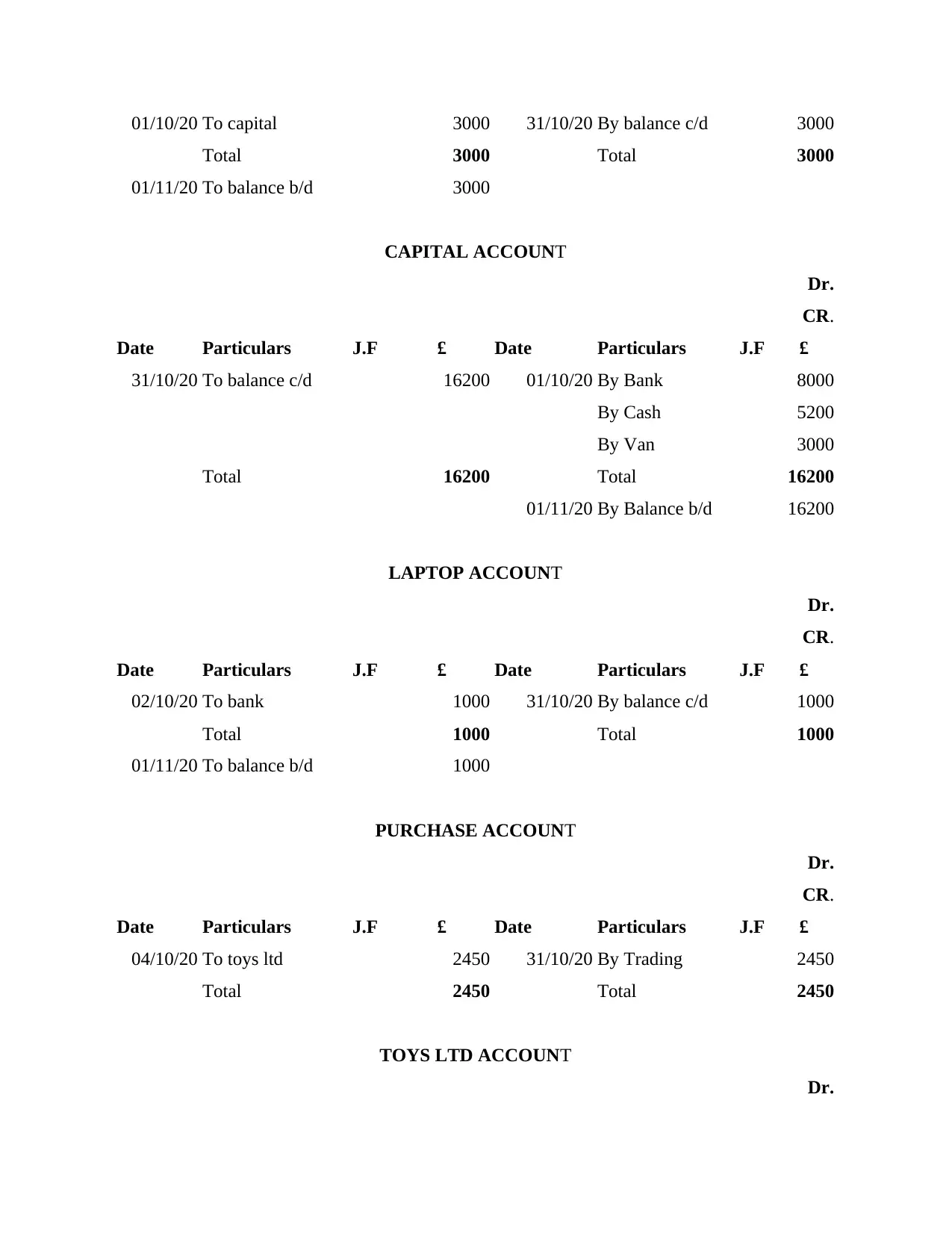

01/10/20 To capital 3000 31/10/20 By balance c/d 3000

Total 3000 Total 3000

01/11/20 To balance b/d 3000

CAPITAL ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To balance c/d 16200 01/10/20 By Bank 8000

By Cash 5200

By Van 3000

Total 16200 Total 16200

01/11/20 By Balance b/d 16200

LAPTOP ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

02/10/20 To bank 1000 31/10/20 By balance c/d 1000

Total 1000 Total 1000

01/11/20 To balance b/d 1000

PURCHASE ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

04/10/20 To toys ltd 2450 31/10/20 By Trading 2450

Total 2450 Total 2450

TOYS LTD ACCOUNT

Dr.

Total 3000 Total 3000

01/11/20 To balance b/d 3000

CAPITAL ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To balance c/d 16200 01/10/20 By Bank 8000

By Cash 5200

By Van 3000

Total 16200 Total 16200

01/11/20 By Balance b/d 16200

LAPTOP ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

02/10/20 To bank 1000 31/10/20 By balance c/d 1000

Total 1000 Total 1000

01/11/20 To balance b/d 1000

PURCHASE ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

04/10/20 To toys ltd 2450 31/10/20 By Trading 2450

Total 2450 Total 2450

TOYS LTD ACCOUNT

Dr.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

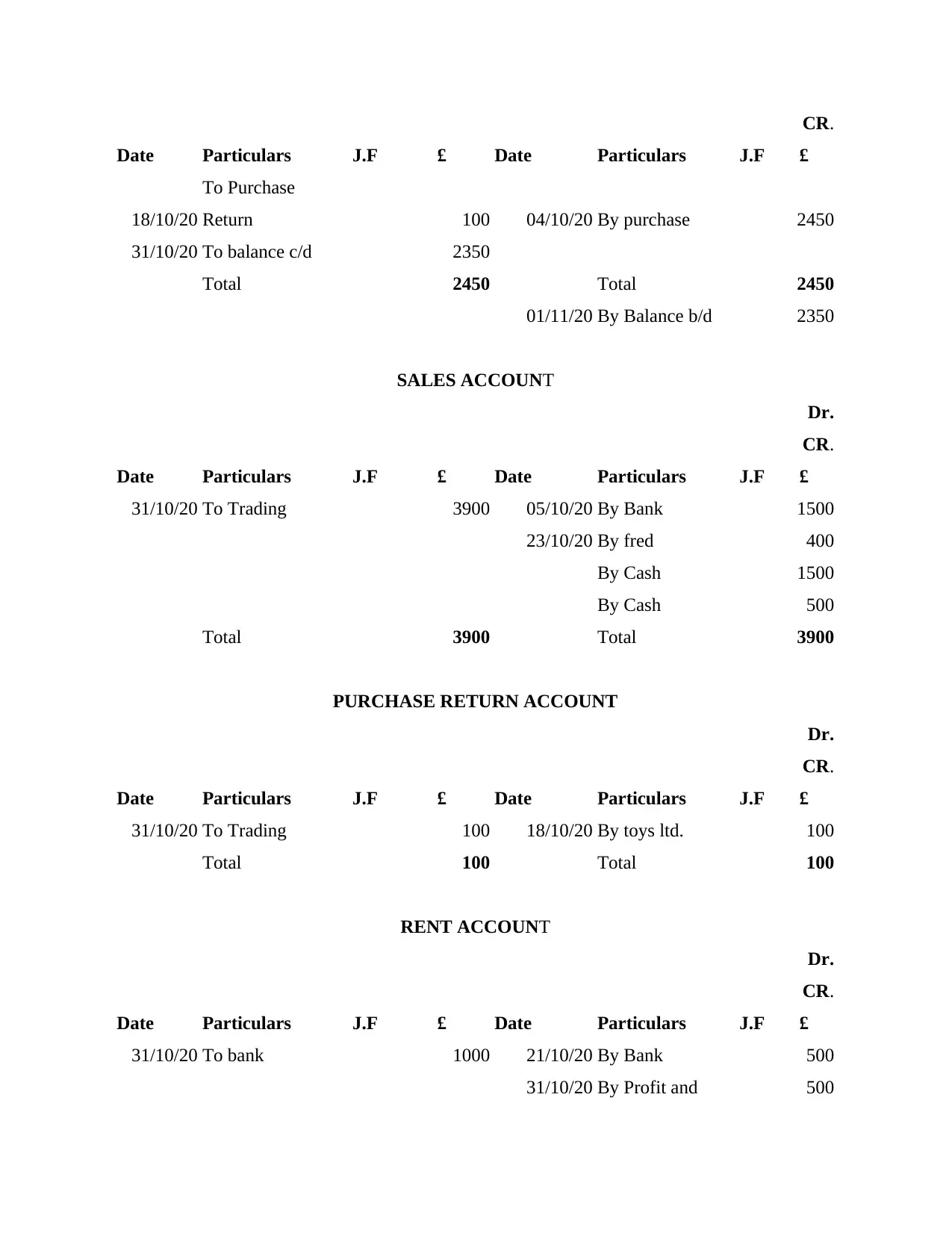

CR.

Date Particulars J.F £ Date Particulars J.F £

18/10/20

To Purchase

Return 100 04/10/20 By purchase 2450

31/10/20 To balance c/d 2350

Total 2450 Total 2450

01/11/20 By Balance b/d 2350

SALES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 3900 05/10/20 By Bank 1500

23/10/20 By fred 400

By Cash 1500

By Cash 500

Total 3900 Total 3900

PURCHASE RETURN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 100 18/10/20 By toys ltd. 100

Total 100 Total 100

RENT ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To bank 1000 21/10/20 By Bank 500

31/10/20 By Profit and 500

Date Particulars J.F £ Date Particulars J.F £

18/10/20

To Purchase

Return 100 04/10/20 By purchase 2450

31/10/20 To balance c/d 2350

Total 2450 Total 2450

01/11/20 By Balance b/d 2350

SALES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 3900 05/10/20 By Bank 1500

23/10/20 By fred 400

By Cash 1500

By Cash 500

Total 3900 Total 3900

PURCHASE RETURN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 100 18/10/20 By toys ltd. 100

Total 100 Total 100

RENT ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To bank 1000 21/10/20 By Bank 500

31/10/20 By Profit and 500

Loss

Total 1000 Total 1000

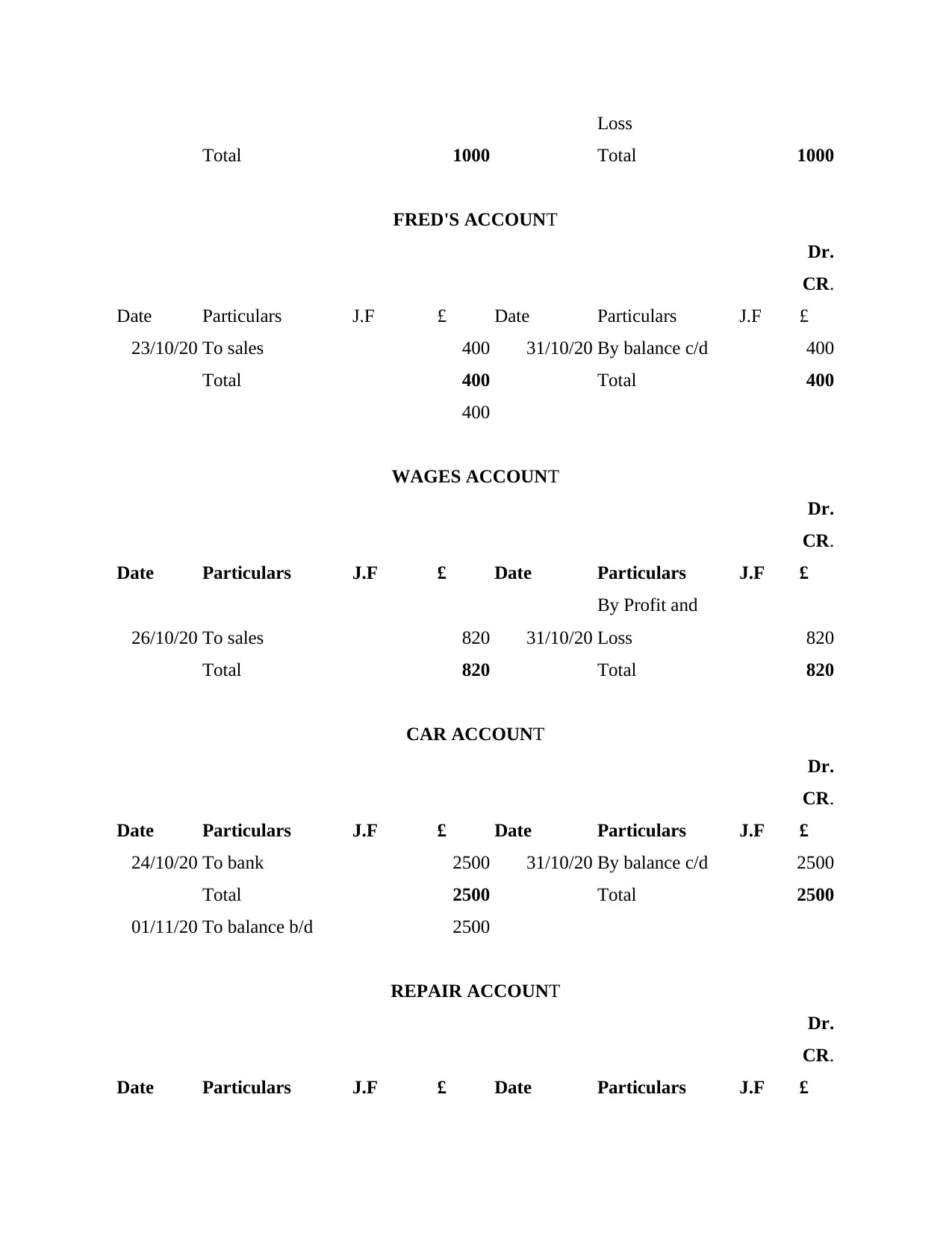

FRED'S ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

23/10/20 To sales 400 31/10/20 By balance c/d 400

Total 400 Total 400

400

WAGES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

26/10/20 To sales 820 31/10/20

By Profit and

Loss 820

Total 820 Total 820

CAR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

24/10/20 To bank 2500 31/10/20 By balance c/d 2500

Total 2500 Total 2500

01/11/20 To balance b/d 2500

REPAIR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

Total 1000 Total 1000

FRED'S ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

23/10/20 To sales 400 31/10/20 By balance c/d 400

Total 400 Total 400

400

WAGES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

26/10/20 To sales 820 31/10/20

By Profit and

Loss 820

Total 820 Total 820

CAR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

24/10/20 To bank 2500 31/10/20 By balance c/d 2500

Total 2500 Total 2500

01/11/20 To balance b/d 2500

REPAIR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

12/10/20 To cash 80 31/10/20

By Profit and

Loss 80

Total 80 Total 80

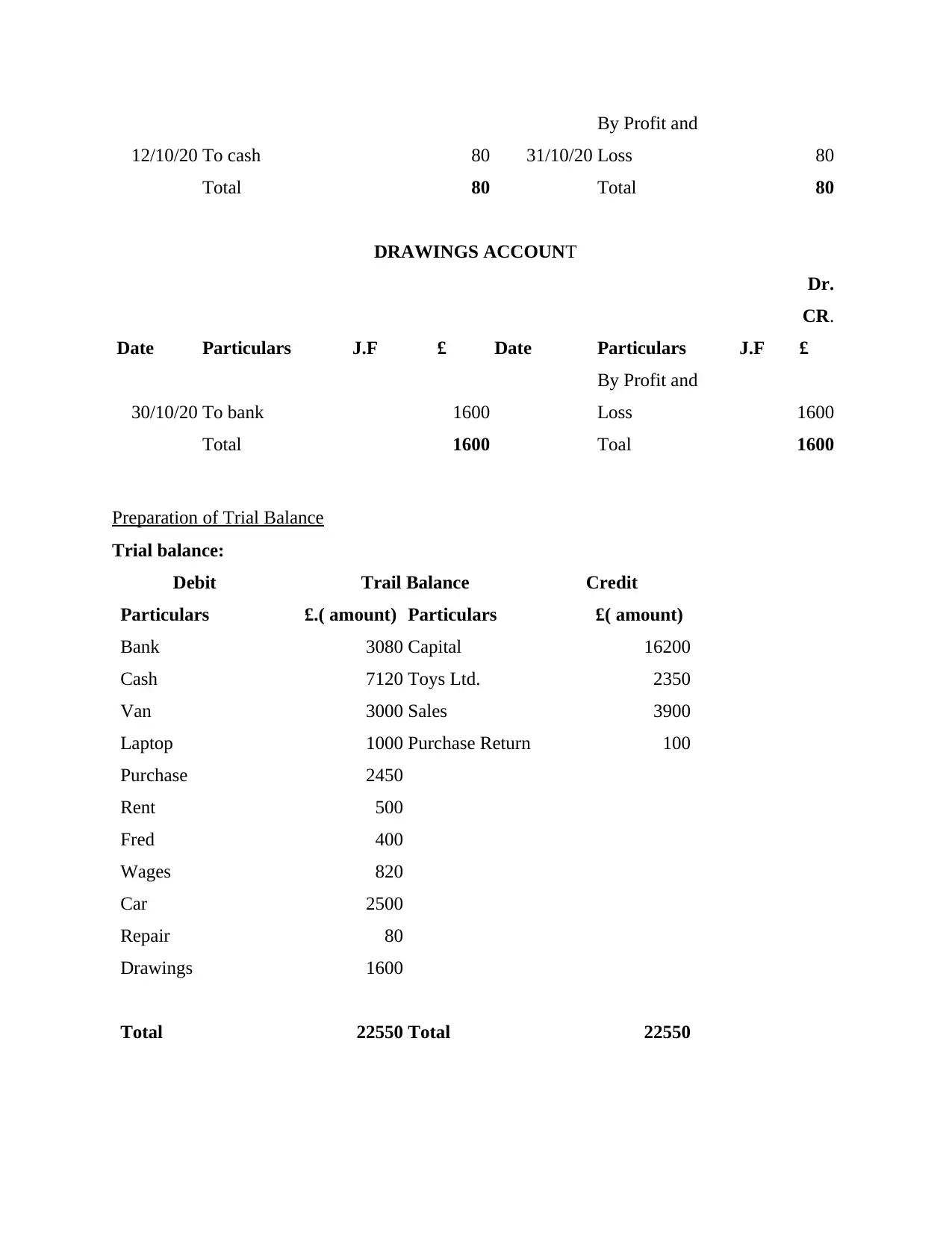

DRAWINGS ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

30/10/20 To bank 1600

By Profit and

Loss 1600

Total 1600 Toal 1600

Preparation of Trial Balance

Trial balance:

Debit Trail Balance Credit

Particulars £.( amount) Particulars £( amount)

Bank 3080 Capital 16200

Cash 7120 Toys Ltd. 2350

Van 3000 Sales 3900

Laptop 1000 Purchase Return 100

Purchase 2450

Rent 500

Fred 400

Wages 820

Car 2500

Repair 80

Drawings 1600

Total 22550 Total 22550

By Profit and

Loss 80

Total 80 Total 80

DRAWINGS ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

30/10/20 To bank 1600

By Profit and

Loss 1600

Total 1600 Toal 1600

Preparation of Trial Balance

Trial balance:

Debit Trail Balance Credit

Particulars £.( amount) Particulars £( amount)

Bank 3080 Capital 16200

Cash 7120 Toys Ltd. 2350

Van 3000 Sales 3900

Laptop 1000 Purchase Return 100

Purchase 2450

Rent 500

Fred 400

Wages 820

Car 2500

Repair 80

Drawings 1600

Total 22550 Total 22550

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

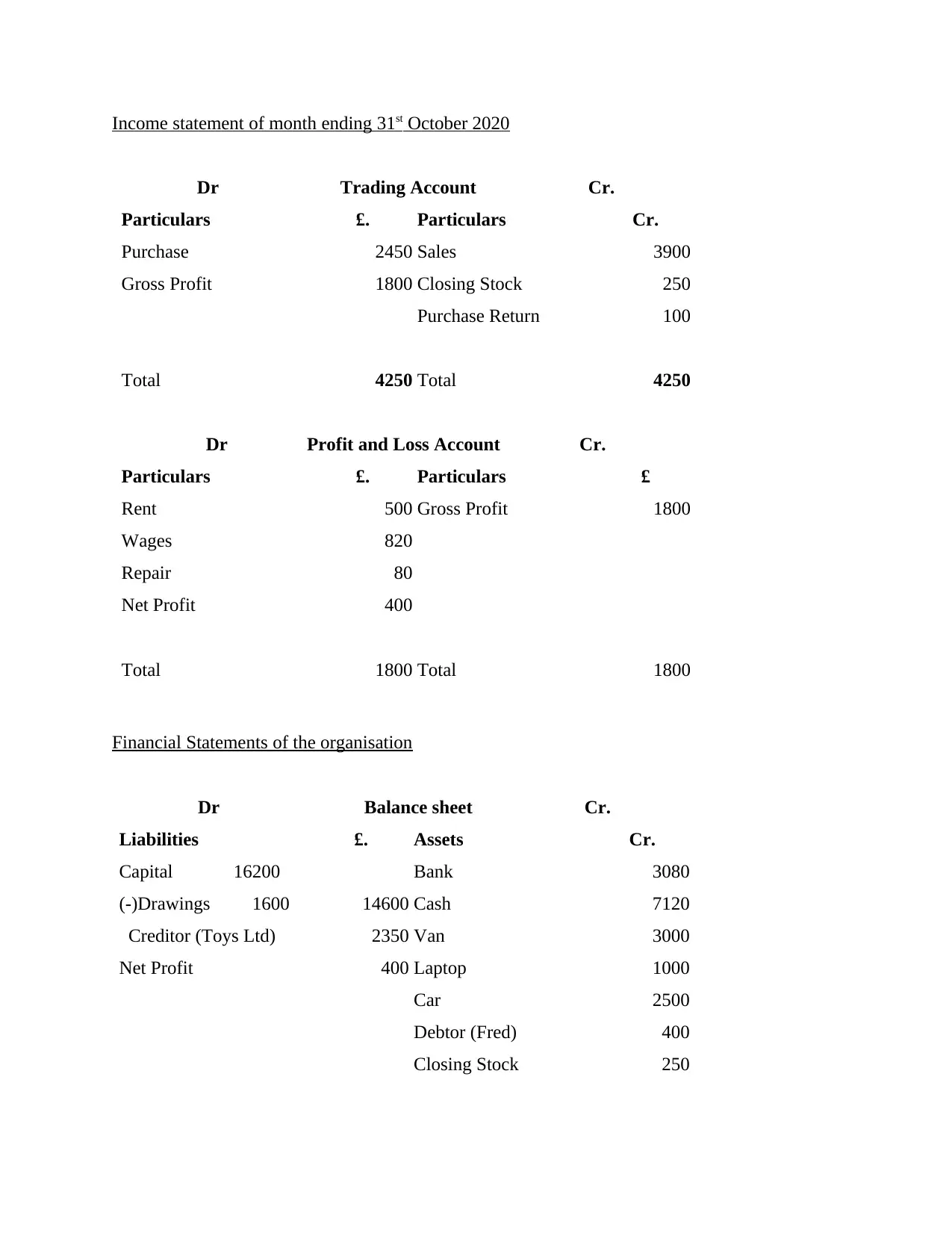

Income statement of month ending 31st October 2020

Dr Trading Account Cr.

Particulars £. Particulars Cr.

Purchase 2450 Sales 3900

Gross Profit 1800 Closing Stock 250

Purchase Return 100

Total 4250 Total 4250

Dr Profit and Loss Account Cr.

Particulars £. Particulars £

Rent 500 Gross Profit 1800

Wages 820

Repair 80

Net Profit 400

Total 1800 Total 1800

Financial Statements of the organisation

Dr Balance sheet Cr.

Liabilities £. Assets Cr.

Capital 16200 Bank 3080

(-)Drawings 1600 14600 Cash 7120

Creditor (Toys Ltd) 2350 Van 3000

Net Profit 400 Laptop 1000

Car 2500

Debtor (Fred) 400

Closing Stock 250

Dr Trading Account Cr.

Particulars £. Particulars Cr.

Purchase 2450 Sales 3900

Gross Profit 1800 Closing Stock 250

Purchase Return 100

Total 4250 Total 4250

Dr Profit and Loss Account Cr.

Particulars £. Particulars £

Rent 500 Gross Profit 1800

Wages 820

Repair 80

Net Profit 400

Total 1800 Total 1800

Financial Statements of the organisation

Dr Balance sheet Cr.

Liabilities £. Assets Cr.

Capital 16200 Bank 3080

(-)Drawings 1600 14600 Cash 7120

Creditor (Toys Ltd) 2350 Van 3000

Net Profit 400 Laptop 1000

Car 2500

Debtor (Fred) 400

Closing Stock 250

Total 17350 Total 17350

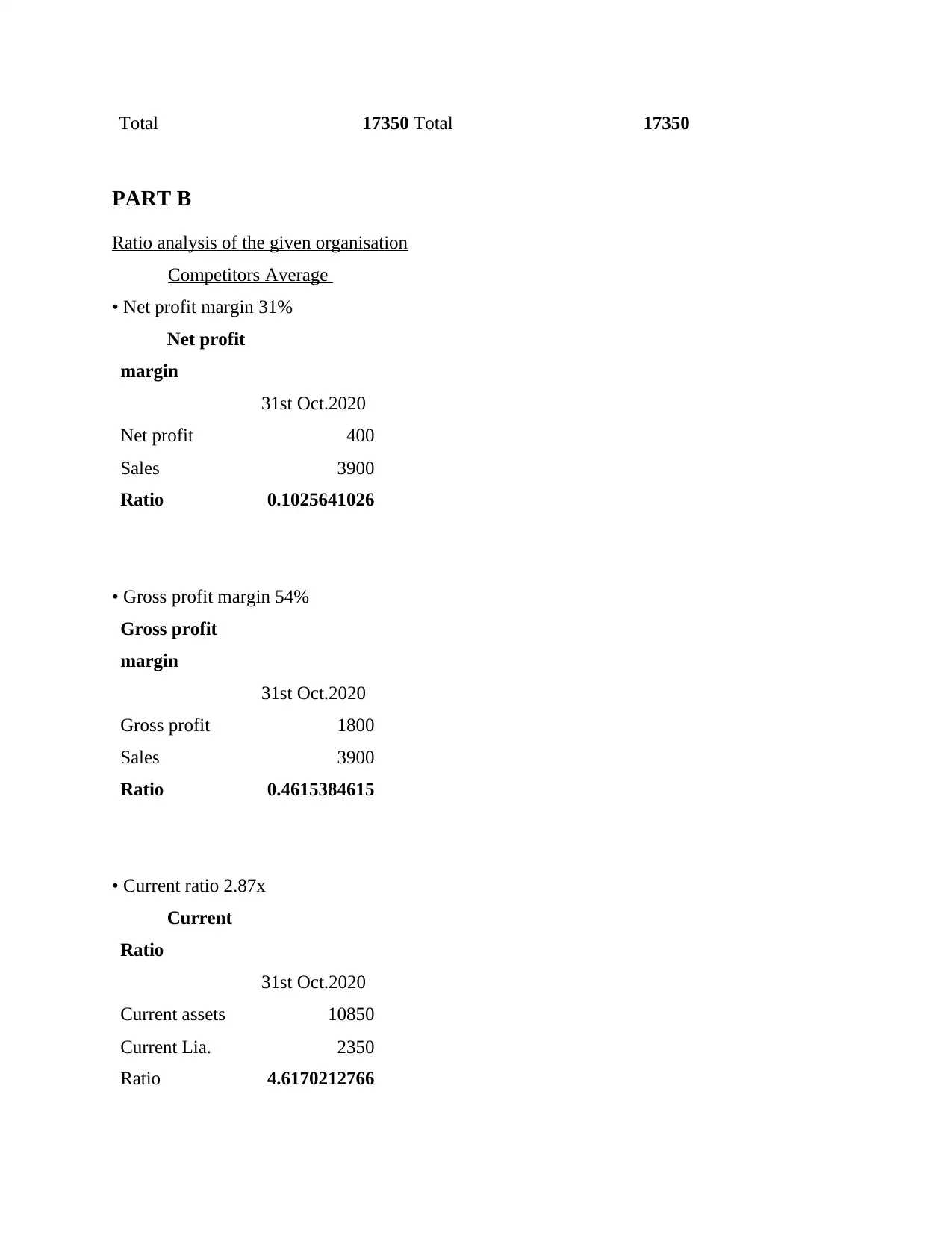

PART B

Ratio analysis of the given organisation

Competitors Average

• Net profit margin 31%

Net profit

margin

31st Oct.2020

Net profit 400

Sales 3900

Ratio 0.1025641026

• Gross profit margin 54%

Gross profit

margin

31st Oct.2020

Gross profit 1800

Sales 3900

Ratio 0.4615384615

• Current ratio 2.87x

Current

Ratio

31st Oct.2020

Current assets 10850

Current Lia. 2350

Ratio 4.6170212766

PART B

Ratio analysis of the given organisation

Competitors Average

• Net profit margin 31%

Net profit

margin

31st Oct.2020

Net profit 400

Sales 3900

Ratio 0.1025641026

• Gross profit margin 54%

Gross profit

margin

31st Oct.2020

Gross profit 1800

Sales 3900

Ratio 0.4615384615

• Current ratio 2.87x

Current

Ratio

31st Oct.2020

Current assets 10850

Current Lia. 2350

Ratio 4.6170212766

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.