Analysis of Accounting Theory and Issues for Caltex Australia Limited

VerifiedAdded on 2023/04/19

|19

|3234

|114

Report

AI Summary

This report critically analyzes Caltex Australia's financial reporting practices through the lens of accounting theory and the conceptual framework. It begins with an overview of the conceptual framework's objectives and components, followed by an introduction to Caltex's business operations. The core of the report examines the suitability of stakeholder theory for Caltex and evaluates the company's compliance with measurement requirements for assets, liabilities, income, and expenses. Furthermore, it assesses Caltex's adherence to both fundamental and enhancing qualitative characteristics in financial reporting, determining the usefulness of financial reports for various user groups. The analysis incorporates screen prints from Caltex's 2017 annual report to support arguments and recommendations for improving accounting practices, disclosures, and reporting. Overall, the report provides a detailed assessment of Caltex's financial reporting in relation to accounting theory and the conceptual framework.

Running head: ACCOUNTING THEORY AND ISSUES

Accounting Theory and Issues

Name of the Student

Name of the University

Authors Note

Course ID

Accounting Theory and Issues

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING THEORY AND ISSUES

Executive Summary:

The current report is based on analysing the requirements of conceptual framework and to

ascertain whether Caltex is in compliance with the requirements of the general purpose

financial reporting.

The term conceptual framework explains that the objectives and concepts of general purpose

financial reporting is viewed as the practical tool that helps in developing the standards that is

based on the constant concepts.

The report evidently lay down that the preparers of financial statement consistently develops

the policies when there is no applicable transaction or events or when the standards enables

the choice of accounting policy.

The chosen company for the assignment is Caltex that has an iconic presence in Australia as

the fuel transport company. Caltex imports, refines and markets the lubricants and fuels that

satisfies the one third of the Australian conveyance fuel requirements.

Executive Summary:

The current report is based on analysing the requirements of conceptual framework and to

ascertain whether Caltex is in compliance with the requirements of the general purpose

financial reporting.

The term conceptual framework explains that the objectives and concepts of general purpose

financial reporting is viewed as the practical tool that helps in developing the standards that is

based on the constant concepts.

The report evidently lay down that the preparers of financial statement consistently develops

the policies when there is no applicable transaction or events or when the standards enables

the choice of accounting policy.

The chosen company for the assignment is Caltex that has an iconic presence in Australia as

the fuel transport company. Caltex imports, refines and markets the lubricants and fuels that

satisfies the one third of the Australian conveyance fuel requirements.

2ACCOUNTING THEORY AND ISSUES

Table of Contents

Introduction:...............................................................................................................................3

Conceptual Framework:.............................................................................................................3

Critical analysis and discussion:................................................................................................4

Theory appropriate for the company:.....................................................................................4

Measurement requirement:.....................................................................................................5

Measurement of asset:............................................................................................................5

Measurement of Liabilities:...................................................................................................6

Measurements of Incomes:....................................................................................................7

Measurement of Expenses:....................................................................................................8

Compliance with the fundamental qualitative characteristics:...................................................9

Compliance with enhancing qualitative characteristics:..........................................................12

Users of financial reports:........................................................................................................13

Requirements relating to basic knowledge:.............................................................................14

Requirements of GPFR (General Purpose Financial Reporting):............................................14

Caltex accounting Issues:.........................................................................................................15

Recommendations:...................................................................................................................15

Conclusion:..............................................................................................................................15

References:...............................................................................................................................17

Table of Contents

Introduction:...............................................................................................................................3

Conceptual Framework:.............................................................................................................3

Critical analysis and discussion:................................................................................................4

Theory appropriate for the company:.....................................................................................4

Measurement requirement:.....................................................................................................5

Measurement of asset:............................................................................................................5

Measurement of Liabilities:...................................................................................................6

Measurements of Incomes:....................................................................................................7

Measurement of Expenses:....................................................................................................8

Compliance with the fundamental qualitative characteristics:...................................................9

Compliance with enhancing qualitative characteristics:..........................................................12

Users of financial reports:........................................................................................................13

Requirements relating to basic knowledge:.............................................................................14

Requirements of GPFR (General Purpose Financial Reporting):............................................14

Caltex accounting Issues:.........................................................................................................15

Recommendations:...................................................................................................................15

Conclusion:..............................................................................................................................15

References:...............................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING THEORY AND ISSUES

Introduction:

Caltex Australia is a honoured and iconic Australian company. Caltex over the years

has become country’s foremost supplier of fuel transport having a network of around 1900

company owned or affiliated sites. The multifaceted supply chains safely and consistently

deliver the fuel with the growing choice of suitability goods and services to greater than three

million consumers every week (Caltex 2018). Caltex imports, refines and markets the

lubricants and fuels that satisfies the one third of the Australian conveyance fuel

requirements. The company has the history that dates back to early 1900 and has come a long

distance to more than 4700 employees with a largely convenient retail network covering

Australia.

Conceptual Framework:

The conceptual framework lay down the concepts which facilitates the preparation

and presentation of financial statements for the external users. The conceptual framework

helps the AASB in developing the future Australian Accounting Standards and evaluating the

current Australian Accounting Standards (Aasb.gov.au 2018). The framework helps the

preparers of financial statements in implementing the Australian Accounting Standards by

dealing with the topics which is yet to be a part of subject of Australian Accounting

Standards. The framework helps the auditors in creating an opinion as to whether the

financial statement complies with the Australian Accounting Standards.

The conceptual framework is helpful in forming an accounting policies when IFRS

standards are not pertinent to a specific transaction and particularly it provides assistance to

the shareholder’s in understanding and interpreting the standards (Deegan 2013). The central

purpose of conceptual framework is to deliver the financial information that are useful for the

users in making decision. This includes purchasing, selling and holding the debt or equity

Introduction:

Caltex Australia is a honoured and iconic Australian company. Caltex over the years

has become country’s foremost supplier of fuel transport having a network of around 1900

company owned or affiliated sites. The multifaceted supply chains safely and consistently

deliver the fuel with the growing choice of suitability goods and services to greater than three

million consumers every week (Caltex 2018). Caltex imports, refines and markets the

lubricants and fuels that satisfies the one third of the Australian conveyance fuel

requirements. The company has the history that dates back to early 1900 and has come a long

distance to more than 4700 employees with a largely convenient retail network covering

Australia.

Conceptual Framework:

The conceptual framework lay down the concepts which facilitates the preparation

and presentation of financial statements for the external users. The conceptual framework

helps the AASB in developing the future Australian Accounting Standards and evaluating the

current Australian Accounting Standards (Aasb.gov.au 2018). The framework helps the

preparers of financial statements in implementing the Australian Accounting Standards by

dealing with the topics which is yet to be a part of subject of Australian Accounting

Standards. The framework helps the auditors in creating an opinion as to whether the

financial statement complies with the Australian Accounting Standards.

The conceptual framework is helpful in forming an accounting policies when IFRS

standards are not pertinent to a specific transaction and particularly it provides assistance to

the shareholder’s in understanding and interpreting the standards (Deegan 2013). The central

purpose of conceptual framework is to deliver the financial information that are useful for the

users in making decision. This includes purchasing, selling and holding the debt or equity

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING THEORY AND ISSUES

instruments, settlement or offering of loans or credits in any form to influence the day to day

management decision.

The main components of conceptual framework include the elements of financial

reports, identification and measurement of items that forms the part of income statement and

balance sheet and includes the qualitative characteristics that is required to be followed by a

business while financial reporting (Robson, Young and Power 2017). The main purpose of

GPFR is to deliver financial information by the reporting organization to the potential users

and current set of shareholders, creditors and borrowers at the time of making decision

relating to credit extension of an organization.

Critical analysis and discussion:

Theory appropriate for the company:

On evaluating the financial report of the Caltex Australia it can be stated that the

stakeholder theory is suitable for the company. The primary reason for selecting the

stakeholder theory is to emphasis on the interconnected relationships amid the business and

its customers, employees, communities, investors and people that has their stake in that

entity. The stakeholder theory provides that a business should create a value not only for its

shareholders but should also create value for its stakeholders (Khan 2015). In addition to this,

the stakeholder theory has turned out to be a key factor in meeting business ethics by serving

as the stage for further growth of business. There are certain accounting issues associated

with the stakeholder theory which are as follows;

a. Determining stakeholders: Under this, the interest of the external stakeholders must

be determined exogenously which is irrespective of the management or company’s

view. Determining the variety of external stakeholder is unclear under this theory.

instruments, settlement or offering of loans or credits in any form to influence the day to day

management decision.

The main components of conceptual framework include the elements of financial

reports, identification and measurement of items that forms the part of income statement and

balance sheet and includes the qualitative characteristics that is required to be followed by a

business while financial reporting (Robson, Young and Power 2017). The main purpose of

GPFR is to deliver financial information by the reporting organization to the potential users

and current set of shareholders, creditors and borrowers at the time of making decision

relating to credit extension of an organization.

Critical analysis and discussion:

Theory appropriate for the company:

On evaluating the financial report of the Caltex Australia it can be stated that the

stakeholder theory is suitable for the company. The primary reason for selecting the

stakeholder theory is to emphasis on the interconnected relationships amid the business and

its customers, employees, communities, investors and people that has their stake in that

entity. The stakeholder theory provides that a business should create a value not only for its

shareholders but should also create value for its stakeholders (Khan 2015). In addition to this,

the stakeholder theory has turned out to be a key factor in meeting business ethics by serving

as the stage for further growth of business. There are certain accounting issues associated

with the stakeholder theory which are as follows;

a. Determining stakeholders: Under this, the interest of the external stakeholders must

be determined exogenously which is irrespective of the management or company’s

view. Determining the variety of external stakeholder is unclear under this theory.

5ACCOUNTING THEORY AND ISSUES

b. Measurement of stake: The success should be related with purpose. A business may

be held successful depending upon the performance, revenues and return. The

implications of stakeholder theory are based on the society and not dependent on the

company to ascertain the success.

Measurement requirement:

Measurement refers to the procedure of ascertaining the monetary sum based on

which the elements of financial reports should be identified and carried in the statement of

financial position and comprehensive income statement. This comprises of selecting a

particular base of measurement. The conceptual framework states that the recognition criteria

for an item should carry the value or cost and the value should be reliably measured (Hoskin,

Fizzell and Cherry 2014). Using the suitable estimations forms the essential part of preparing

the financial statements. Given the reasonable estimations are not available then an item

would not be classified in the balance sheet or statement of comprehensive income.

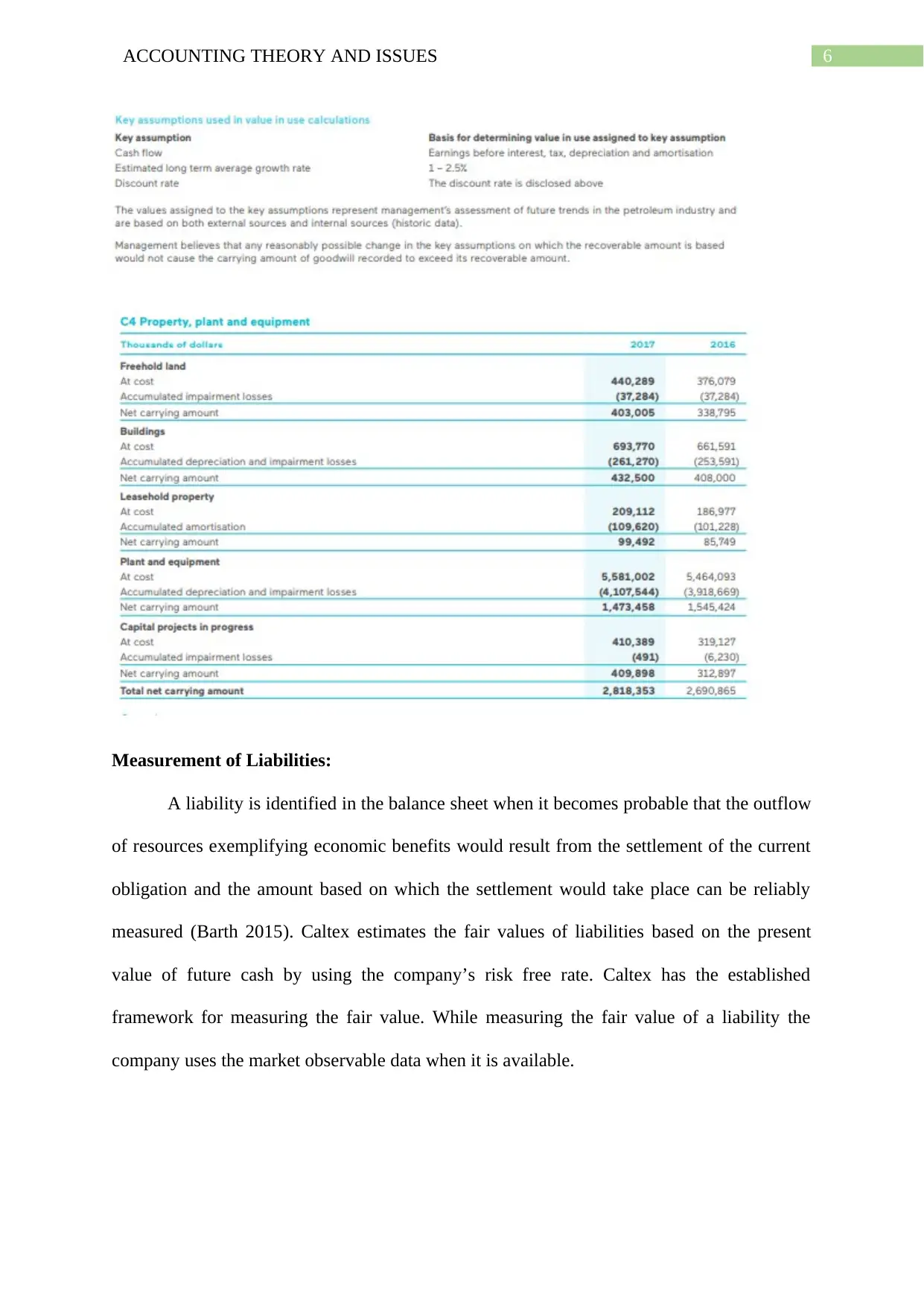

Measurement of asset:

An asset must be reported in the statement of financial position given its value can be

reliably measured and it is anticipated that the economic benefit of an asset for the future is

flown into the organization (Mullinova 2016). As evident from the yearly financial statement

of Caltex for the year 2017, the business records the assets in the balance sheet when the

value of the assets is reliably measured. The property, plant and equipment of the assets is

reviewed by the company to ascertain if there are any signs of impairment. The recoverable

amounts of the assets are estimated and if necessary the impairment is identified in the

income statement. While evaluating the carrying amount of the property, plant and equipment

the management take into account the long term assumptions associated to the key external

factors such as foreign exchange rates and price of crude oil that can create a material impact

on the asset.

b. Measurement of stake: The success should be related with purpose. A business may

be held successful depending upon the performance, revenues and return. The

implications of stakeholder theory are based on the society and not dependent on the

company to ascertain the success.

Measurement requirement:

Measurement refers to the procedure of ascertaining the monetary sum based on

which the elements of financial reports should be identified and carried in the statement of

financial position and comprehensive income statement. This comprises of selecting a

particular base of measurement. The conceptual framework states that the recognition criteria

for an item should carry the value or cost and the value should be reliably measured (Hoskin,

Fizzell and Cherry 2014). Using the suitable estimations forms the essential part of preparing

the financial statements. Given the reasonable estimations are not available then an item

would not be classified in the balance sheet or statement of comprehensive income.

Measurement of asset:

An asset must be reported in the statement of financial position given its value can be

reliably measured and it is anticipated that the economic benefit of an asset for the future is

flown into the organization (Mullinova 2016). As evident from the yearly financial statement

of Caltex for the year 2017, the business records the assets in the balance sheet when the

value of the assets is reliably measured. The property, plant and equipment of the assets is

reviewed by the company to ascertain if there are any signs of impairment. The recoverable

amounts of the assets are estimated and if necessary the impairment is identified in the

income statement. While evaluating the carrying amount of the property, plant and equipment

the management take into account the long term assumptions associated to the key external

factors such as foreign exchange rates and price of crude oil that can create a material impact

on the asset.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING THEORY AND ISSUES

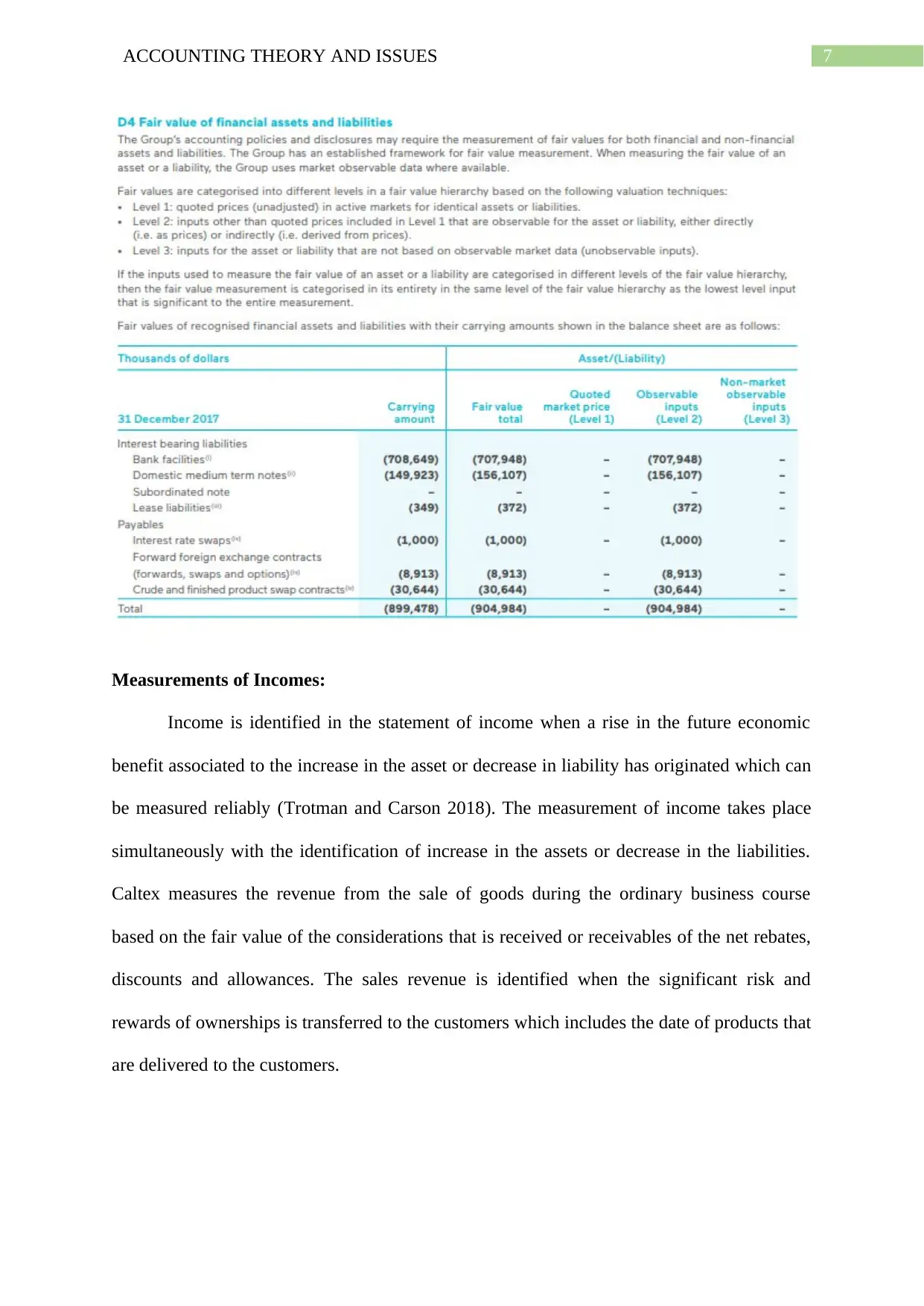

Measurement of Liabilities:

A liability is identified in the balance sheet when it becomes probable that the outflow

of resources exemplifying economic benefits would result from the settlement of the current

obligation and the amount based on which the settlement would take place can be reliably

measured (Barth 2015). Caltex estimates the fair values of liabilities based on the present

value of future cash by using the company’s risk free rate. Caltex has the established

framework for measuring the fair value. While measuring the fair value of a liability the

company uses the market observable data when it is available.

Measurement of Liabilities:

A liability is identified in the balance sheet when it becomes probable that the outflow

of resources exemplifying economic benefits would result from the settlement of the current

obligation and the amount based on which the settlement would take place can be reliably

measured (Barth 2015). Caltex estimates the fair values of liabilities based on the present

value of future cash by using the company’s risk free rate. Caltex has the established

framework for measuring the fair value. While measuring the fair value of a liability the

company uses the market observable data when it is available.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING THEORY AND ISSUES

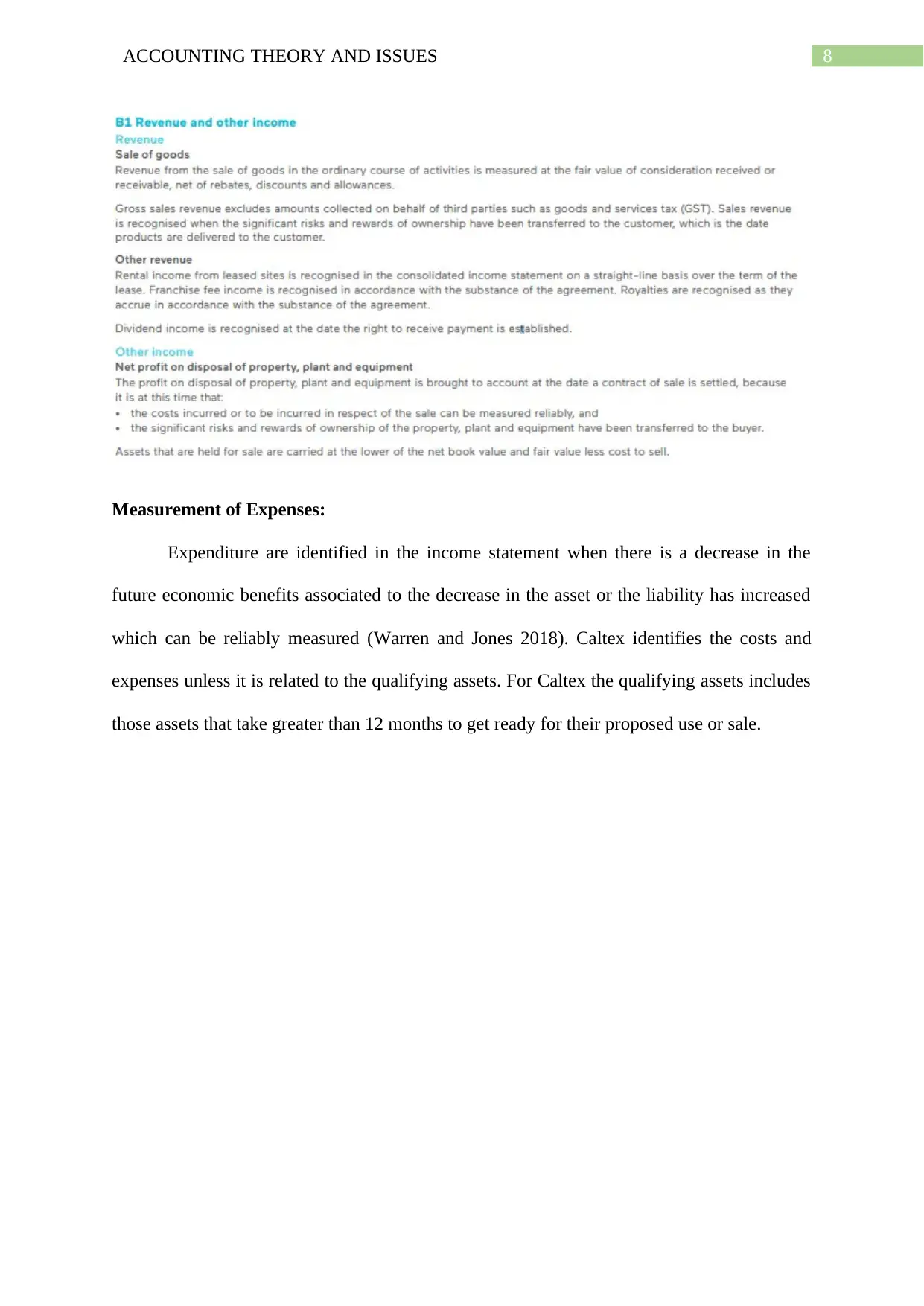

Measurements of Incomes:

Income is identified in the statement of income when a rise in the future economic

benefit associated to the increase in the asset or decrease in liability has originated which can

be measured reliably (Trotman and Carson 2018). The measurement of income takes place

simultaneously with the identification of increase in the assets or decrease in the liabilities.

Caltex measures the revenue from the sale of goods during the ordinary business course

based on the fair value of the considerations that is received or receivables of the net rebates,

discounts and allowances. The sales revenue is identified when the significant risk and

rewards of ownerships is transferred to the customers which includes the date of products that

are delivered to the customers.

Measurements of Incomes:

Income is identified in the statement of income when a rise in the future economic

benefit associated to the increase in the asset or decrease in liability has originated which can

be measured reliably (Trotman and Carson 2018). The measurement of income takes place

simultaneously with the identification of increase in the assets or decrease in the liabilities.

Caltex measures the revenue from the sale of goods during the ordinary business course

based on the fair value of the considerations that is received or receivables of the net rebates,

discounts and allowances. The sales revenue is identified when the significant risk and

rewards of ownerships is transferred to the customers which includes the date of products that

are delivered to the customers.

8ACCOUNTING THEORY AND ISSUES

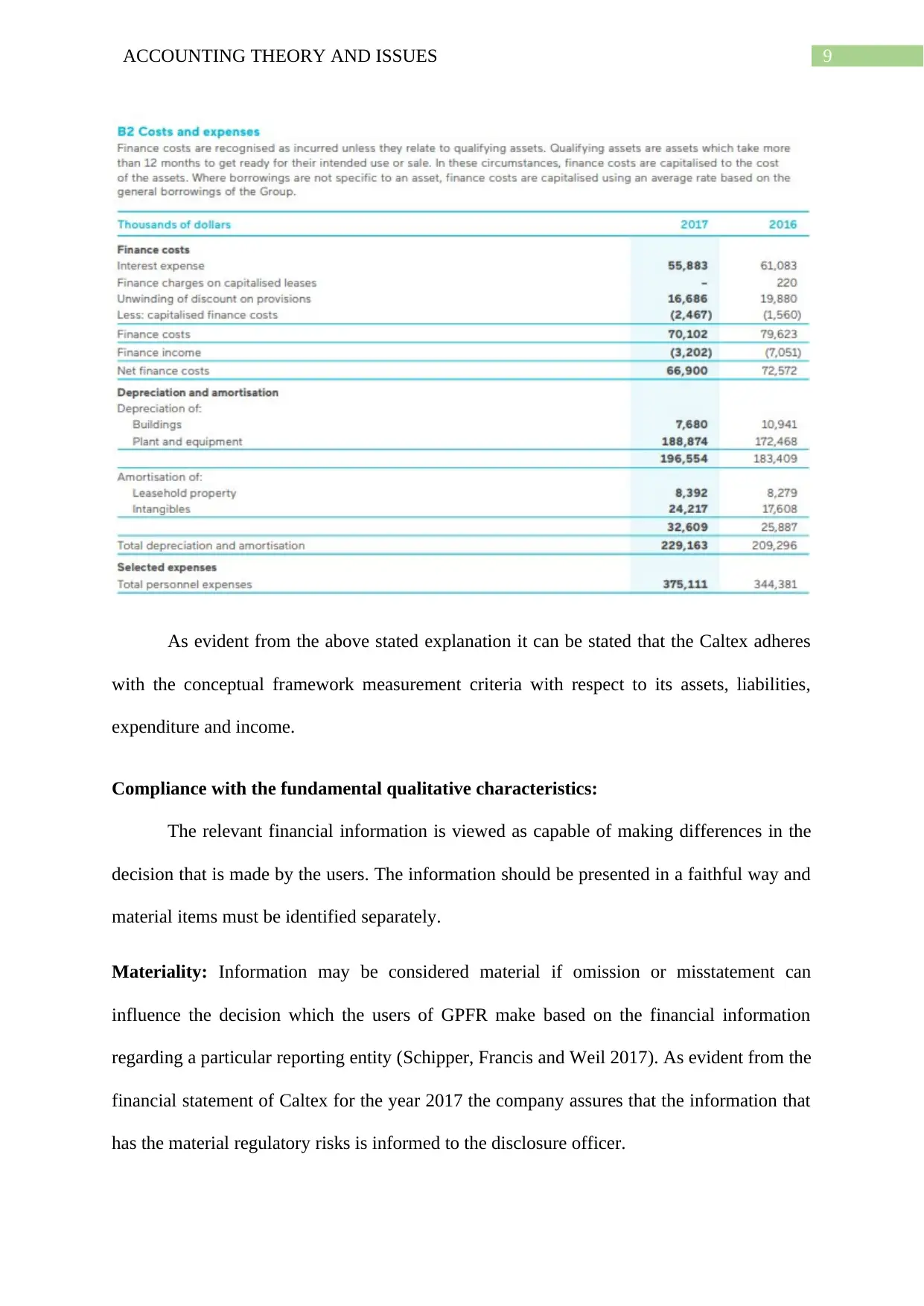

Measurement of Expenses:

Expenditure are identified in the income statement when there is a decrease in the

future economic benefits associated to the decrease in the asset or the liability has increased

which can be reliably measured (Warren and Jones 2018). Caltex identifies the costs and

expenses unless it is related to the qualifying assets. For Caltex the qualifying assets includes

those assets that take greater than 12 months to get ready for their proposed use or sale.

Measurement of Expenses:

Expenditure are identified in the income statement when there is a decrease in the

future economic benefits associated to the decrease in the asset or the liability has increased

which can be reliably measured (Warren and Jones 2018). Caltex identifies the costs and

expenses unless it is related to the qualifying assets. For Caltex the qualifying assets includes

those assets that take greater than 12 months to get ready for their proposed use or sale.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING THEORY AND ISSUES

As evident from the above stated explanation it can be stated that the Caltex adheres

with the conceptual framework measurement criteria with respect to its assets, liabilities,

expenditure and income.

Compliance with the fundamental qualitative characteristics:

The relevant financial information is viewed as capable of making differences in the

decision that is made by the users. The information should be presented in a faithful way and

material items must be identified separately.

Materiality: Information may be considered material if omission or misstatement can

influence the decision which the users of GPFR make based on the financial information

regarding a particular reporting entity (Schipper, Francis and Weil 2017). As evident from the

financial statement of Caltex for the year 2017 the company assures that the information that

has the material regulatory risks is informed to the disclosure officer.

As evident from the above stated explanation it can be stated that the Caltex adheres

with the conceptual framework measurement criteria with respect to its assets, liabilities,

expenditure and income.

Compliance with the fundamental qualitative characteristics:

The relevant financial information is viewed as capable of making differences in the

decision that is made by the users. The information should be presented in a faithful way and

material items must be identified separately.

Materiality: Information may be considered material if omission or misstatement can

influence the decision which the users of GPFR make based on the financial information

regarding a particular reporting entity (Schipper, Francis and Weil 2017). As evident from the

financial statement of Caltex for the year 2017 the company assures that the information that

has the material regulatory risks is informed to the disclosure officer.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING THEORY AND ISSUES

Relevance: The relevant information in the financial report can create a difference among the

user’s decisions making. Information might create differences in the process of decision

making even though the users undertakes the decision of not taking the advantage or are well

known fact (Narasimhan 2017). The financial statements of Caltex are prepared based on the

general purpose financial report and it is in accordance with the requirements of the

corporation Act and Australian Accounting Standards. The financial report of Caltex is in

accordance with the IFRS that is adopted by the IASB.

Relevance: The relevant information in the financial report can create a difference among the

user’s decisions making. Information might create differences in the process of decision

making even though the users undertakes the decision of not taking the advantage or are well

known fact (Narasimhan 2017). The financial statements of Caltex are prepared based on the

general purpose financial report and it is in accordance with the requirements of the

corporation Act and Australian Accounting Standards. The financial report of Caltex is in

accordance with the IFRS that is adopted by the IASB.

11ACCOUNTING THEORY AND ISSUES

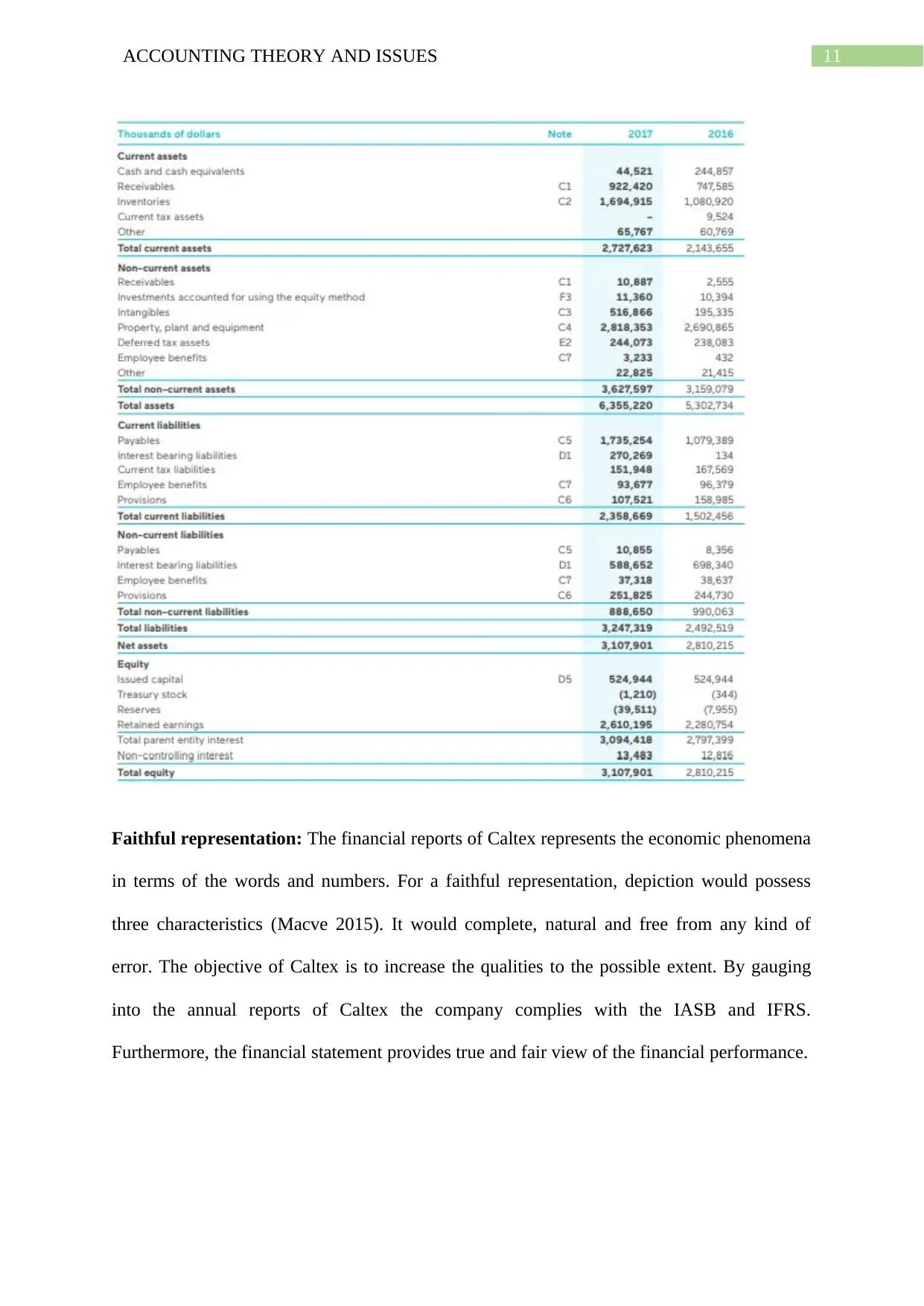

Faithful representation: The financial reports of Caltex represents the economic phenomena

in terms of the words and numbers. For a faithful representation, depiction would possess

three characteristics (Macve 2015). It would complete, natural and free from any kind of

error. The objective of Caltex is to increase the qualities to the possible extent. By gauging

into the annual reports of Caltex the company complies with the IASB and IFRS.

Furthermore, the financial statement provides true and fair view of the financial performance.

Faithful representation: The financial reports of Caltex represents the economic phenomena

in terms of the words and numbers. For a faithful representation, depiction would possess

three characteristics (Macve 2015). It would complete, natural and free from any kind of

error. The objective of Caltex is to increase the qualities to the possible extent. By gauging

into the annual reports of Caltex the company complies with the IASB and IFRS.

Furthermore, the financial statement provides true and fair view of the financial performance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.