Analyzing Capital Allocation in UK and India Financial Markets

VerifiedAdded on 2023/06/15

|15

|4427

|161

Essay

AI Summary

This essay provides a comprehensive analysis of capital allocation in the UK and India. It begins by outlining the background of financial markets and their role in allocating capital, both domestically and internationally. The essay then delves into the specifics of capital allocation within the UK economy, focusing on capital markets, money markets, and bond markets. It further explores international capital allocation through foreign direct investment (FDI), foreign bonds, and swap or hedge funds. The analysis extends to India as an emerging economy, highlighting the significant role of its financial market in capital allocation, segmented into capital and money markets. Finally, the essay critically evaluates the challenges faced by India due to trade policies and industrialization, concluding with recommendations for enhancing capital allocation to foster economic growth and development. This resource is available on Desklib, where students can find past papers and solved assignments.

INTERNATIONAL TRADE,

FINANCE AND

INVESTMENT

FINANCE AND

INVESTMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

In this essay, the UK economy has been evaluated with reference to how capital

allocation takes place in the country to ensure that funds can transfer from those having surplus

to those who are in need of funds. It has been found that there are different platforms through

capital allocation took place within UK economy that is, capital market, money market and bond

markets. Also, it has been found that capital allocation within an international markets took place

through FDI, foreign bonds and swap or hedge funds. Further, India as an emerging economy has

been evaluated where it has been found Indian financial market plays a significant role in capital

allocation within the economy which segmented into capital and money market where the former

is meant for long term while the latter is meant for short term capital allocation. At last, critical

evaluation has been done of how due to trade policies and industrialization, India is facing

numerous challenges.

In this essay, the UK economy has been evaluated with reference to how capital

allocation takes place in the country to ensure that funds can transfer from those having surplus

to those who are in need of funds. It has been found that there are different platforms through

capital allocation took place within UK economy that is, capital market, money market and bond

markets. Also, it has been found that capital allocation within an international markets took place

through FDI, foreign bonds and swap or hedge funds. Further, India as an emerging economy has

been evaluated where it has been found Indian financial market plays a significant role in capital

allocation within the economy which segmented into capital and money market where the former

is meant for long term while the latter is meant for short term capital allocation. At last, critical

evaluation has been done of how due to trade policies and industrialization, India is facing

numerous challenges.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................2

MAIN BODY..................................................................................................................................4

Background of financial markets.................................................................................................4

Capital allocation within the domestic economy of UK..............................................................5

Capital allocation within international market............................................................................7

Evaluation of emerging economy that is, India.........................................................................10

Critical evaluation of challenges faced by India due to trade policies and industrialization.....11

CONCLUSION..............................................................................................................................12

RECOMMENDATIONS...............................................................................................................12

REFERENCES..............................................................................................................................13

Books and Journals....................................................................................................................13

Online........................................................................................................................................15

EXECUTIVE SUMMARY.............................................................................................................2

MAIN BODY..................................................................................................................................4

Background of financial markets.................................................................................................4

Capital allocation within the domestic economy of UK..............................................................5

Capital allocation within international market............................................................................7

Evaluation of emerging economy that is, India.........................................................................10

Critical evaluation of challenges faced by India due to trade policies and industrialization.....11

CONCLUSION..............................................................................................................................12

RECOMMENDATIONS...............................................................................................................12

REFERENCES..............................................................................................................................13

Books and Journals....................................................................................................................13

Online........................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MAIN BODY

Background of financial markets

Financial market is a term generally used for the markets that are meant for raising

finance where there are again two markets exists that is, capital market and money market. The

former is meant for funding long term proposals while the latter is used for short term financing

needs (Sulong and Bakar, 2018). Capital markets have two different segments that is, stock and

bond markets where shares and bonds are issued for raising finance respectively. Financial

market can also be defined is a combination of sellers & buyers of financial securities.

On the top of the functions performed by financial market within an economy, on of such

functions is allocation of capital which is meant for mediating between demand and supply of

capital or in other words, bridging the gap between those who have capital and those who are in

need of capital. This is done by facilitating capital raising and transferring liquidity through the

platforms known as capital and money markets respectively (Nasir, Huynh and Tram, 2019).

The financial markets allocate capital by attracting funds from those who have surpluses

like investors, and channelize them towards those who are in need of funds such as business

enterprises. These businesses by getting their required capital then utilizes it towards financing

their operational needs in order to achieve growth right from startup till expanding and

diversifying its activities.

There are many players associated with the financial market who aids in capital

allocation such as bank which helps through obtaining deposits from pool of savers and diverting

it towards businesses and entrepreneurs who deploy for growth and development of the economy

(Popov, 2018). Another player of financial market is stock markets within an economy who

provide platforms for businesses to issue shares and debentures in the open market whereby

buying and selling of these securities allows for transferring funds from savers or investors to

businesses and thus facilitates capital allocation.

Therefore, it can be said that in the absence of financial markets there must be a difficulty

that is faced by borrowers in searching lenders by themselves. Accordingly, in this essay the

discussion will be done pertaining to how capital allocation takes place within the domestic

economy of UK and how they undertake allocation of capital within international markets

Background of financial markets

Financial market is a term generally used for the markets that are meant for raising

finance where there are again two markets exists that is, capital market and money market. The

former is meant for funding long term proposals while the latter is used for short term financing

needs (Sulong and Bakar, 2018). Capital markets have two different segments that is, stock and

bond markets where shares and bonds are issued for raising finance respectively. Financial

market can also be defined is a combination of sellers & buyers of financial securities.

On the top of the functions performed by financial market within an economy, on of such

functions is allocation of capital which is meant for mediating between demand and supply of

capital or in other words, bridging the gap between those who have capital and those who are in

need of capital. This is done by facilitating capital raising and transferring liquidity through the

platforms known as capital and money markets respectively (Nasir, Huynh and Tram, 2019).

The financial markets allocate capital by attracting funds from those who have surpluses

like investors, and channelize them towards those who are in need of funds such as business

enterprises. These businesses by getting their required capital then utilizes it towards financing

their operational needs in order to achieve growth right from startup till expanding and

diversifying its activities.

There are many players associated with the financial market who aids in capital

allocation such as bank which helps through obtaining deposits from pool of savers and diverting

it towards businesses and entrepreneurs who deploy for growth and development of the economy

(Popov, 2018). Another player of financial market is stock markets within an economy who

provide platforms for businesses to issue shares and debentures in the open market whereby

buying and selling of these securities allows for transferring funds from savers or investors to

businesses and thus facilitates capital allocation.

Therefore, it can be said that in the absence of financial markets there must be a difficulty

that is faced by borrowers in searching lenders by themselves. Accordingly, in this essay the

discussion will be done pertaining to how capital allocation takes place within the domestic

economy of UK and how they undertake allocation of capital within international markets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Pradhan and et.al., 2019). Also, the evaluation of an economy will be done with reference to

Indian economy along with stating the critical evaluation of challenges that the country faces due

to the implementation of trade policies and industrialization. At last, the essay will be ended by

concluding the role of financial market in capital allocation within the economy and international

markets followed by recommendations on such capital allocation, so that better growth and

development of an economy could be ensured.

Capital allocation within the domestic economy of UK

For the success of every economy, there is a need of efficient credit allocation within an

economy. The capital allocation in UK is primarily concerned with the local & federal

government and corporations like, government undertakes to fund the national debt and capital

projects like construction and education through issuing bonds and long term notes (Nkukpornu,

Gyimah and Sakyiwaa, 2020). On the other hand, corporations undertake to allocate capital in an

attempt to fund its growth through equity and debt by issuing bonds and stocks in bond market

and stock market respectively.

There is a presence of financial intermediation within the economy of UK which acts a

mean where the intermediary like financial institutions and banks gather funds from savers and

then divert it to borrowers by making investments and loans with them. The two basic platforms

through which capital allocation takes place within UK are capital market, money market and

bond market.

In capital market, those securities are bought and sold that provides long term finance to

UK corporations. Under this system, capital floating takes place through the allocation of bonds,

shares and other securities meant for long term investments (Yakubu and et.al., 2018). There is a

credit market instrument provided by banks in UK in the form of loan which allows for extension

of credit by the lender to the borrower that is required to be repaid on maturity accompanied by

payment of interest agreed among the lender and borrower. Therefore, capital market of UK

plays a great role in providing finance for capital assets. the current value of UK equities is

approximately £950bn indicating its major role in facilitating capital allocation within the

economy.

Another platform in UK through which capital allocation takes place within an economy

is money market which accept short term deposits to provide for short term loans (Robinson,

Indian economy along with stating the critical evaluation of challenges that the country faces due

to the implementation of trade policies and industrialization. At last, the essay will be ended by

concluding the role of financial market in capital allocation within the economy and international

markets followed by recommendations on such capital allocation, so that better growth and

development of an economy could be ensured.

Capital allocation within the domestic economy of UK

For the success of every economy, there is a need of efficient credit allocation within an

economy. The capital allocation in UK is primarily concerned with the local & federal

government and corporations like, government undertakes to fund the national debt and capital

projects like construction and education through issuing bonds and long term notes (Nkukpornu,

Gyimah and Sakyiwaa, 2020). On the other hand, corporations undertake to allocate capital in an

attempt to fund its growth through equity and debt by issuing bonds and stocks in bond market

and stock market respectively.

There is a presence of financial intermediation within the economy of UK which acts a

mean where the intermediary like financial institutions and banks gather funds from savers and

then divert it to borrowers by making investments and loans with them. The two basic platforms

through which capital allocation takes place within UK are capital market, money market and

bond market.

In capital market, those securities are bought and sold that provides long term finance to

UK corporations. Under this system, capital floating takes place through the allocation of bonds,

shares and other securities meant for long term investments (Yakubu and et.al., 2018). There is a

credit market instrument provided by banks in UK in the form of loan which allows for extension

of credit by the lender to the borrower that is required to be repaid on maturity accompanied by

payment of interest agreed among the lender and borrower. Therefore, capital market of UK

plays a great role in providing finance for capital assets. the current value of UK equities is

approximately £950bn indicating its major role in facilitating capital allocation within the

economy.

Another platform in UK through which capital allocation takes place within an economy

is money market which accept short term deposits to provide for short term loans (Robinson,

2018). This process of acceptance and lending in money market takes place through its

intermediaries such as brokers and banks. Whatever capital are allocated through money market

is being administered by Bank of England and relies on interest rates fixed by it. The players

within the money market of UK are specialist securities dealers, banks and building societies

who undertakes selling and buying of money.

As per the data published by ONS, it has been determined that with the growth in

production, manufacturing and service sector by 0.7%, 0.2% and 0.3% respectively, whatever

fall in construction sector realized has been offset in terms of demand for capital or funds

(Accominotti and Ugolini, 2019).

The third platform of UK through which capital allocation takes place is bond market

where the nature of its securities is such which indicates the amount owed by its issuer to those

who have bought it (investors). Under this market, capital allocation has been followed by

repayment of principle plus interest due thereon. In UK, Bank of England generally issues

securities such as government bonds primarily regarded as debt – based investments which

allows people to loan money to government who in turn agreed to pay interest at a fixed rate and

accordingly, this form of capital allocation is regarded as one of the safest asset class by

investors. Investors are entitled to receive fixed interest payments at a defined interval till the

bond matures (Ahn, 2020). On maturity, actual amount of investment is returned to the investors

and the length of maturity falls between one year to 30 years.

For instance, if an investor has invested 1000 GBP in a 5 - year government bond at a

coupon rate of 7%, then the investor will be paid 50 pounds every year till 5 years and at the end

of 5th year, the principal of 1000 GBP will be repaid to the investor.

The capital allocation within UK is highly affected by the change in interest rate by Bank

of England. Currently, the bank rate set by UK’s central bank is 0.25% which encourage

purchase of UK corporate sterling bonds totaling up to £12bn which is financed through the

issuance of reserves created by its central bank. Also, there were purchases related to UK

government bond giving the value of 35 billion which results in total stock of bond purchases to

£400bn approximately that has been financed through central bank reserves issue. Further, total

capital investment takes place through equities, bonds, infrastructure and property comes to

around 1.7 trillion in 2020 (Total Resource Allocation. 2021).

intermediaries such as brokers and banks. Whatever capital are allocated through money market

is being administered by Bank of England and relies on interest rates fixed by it. The players

within the money market of UK are specialist securities dealers, banks and building societies

who undertakes selling and buying of money.

As per the data published by ONS, it has been determined that with the growth in

production, manufacturing and service sector by 0.7%, 0.2% and 0.3% respectively, whatever

fall in construction sector realized has been offset in terms of demand for capital or funds

(Accominotti and Ugolini, 2019).

The third platform of UK through which capital allocation takes place is bond market

where the nature of its securities is such which indicates the amount owed by its issuer to those

who have bought it (investors). Under this market, capital allocation has been followed by

repayment of principle plus interest due thereon. In UK, Bank of England generally issues

securities such as government bonds primarily regarded as debt – based investments which

allows people to loan money to government who in turn agreed to pay interest at a fixed rate and

accordingly, this form of capital allocation is regarded as one of the safest asset class by

investors. Investors are entitled to receive fixed interest payments at a defined interval till the

bond matures (Ahn, 2020). On maturity, actual amount of investment is returned to the investors

and the length of maturity falls between one year to 30 years.

For instance, if an investor has invested 1000 GBP in a 5 - year government bond at a

coupon rate of 7%, then the investor will be paid 50 pounds every year till 5 years and at the end

of 5th year, the principal of 1000 GBP will be repaid to the investor.

The capital allocation within UK is highly affected by the change in interest rate by Bank

of England. Currently, the bank rate set by UK’s central bank is 0.25% which encourage

purchase of UK corporate sterling bonds totaling up to £12bn which is financed through the

issuance of reserves created by its central bank. Also, there were purchases related to UK

government bond giving the value of 35 billion which results in total stock of bond purchases to

£400bn approximately that has been financed through central bank reserves issue. Further, total

capital investment takes place through equities, bonds, infrastructure and property comes to

around 1.7 trillion in 2020 (Total Resource Allocation. 2021).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

As per the statistics published by ONS, it has been identified that there is a fall in the

interest rates offered on financial products meant for cash savings. The reason behind such a fall

in interest rates was the low base rate fixed by Bank of England which has been fell currently

from 0.5% to 0.25% in December 2021. Accordingly, as per the reports published in Mintel’s

Consumers, Saving, and Investing - UK, January 2020, it has been revealed that 32% of UK

citizens having savings for investment purposes do not want to save in the event of low interest

rates whereas 40% of UK citizens wants to save more and more while the interest rates are

increasing (Cloyne and et.al., 2018). This attitude cannot be seen as a greater interest in making

investment among UK citizens in order to get better or higher returns. The rest of the 23% of UK

citizens having savings or investments generally get more interested in investing in the event of

low interest rates which indicates their attempt to pass interest rather than encouraging them to

begin with making investment. Thus, it is the scenario of cash savings market of UK resulting

from higher or lower interest rates (Total Resource Allocation. 2021).

The industry playing a great role in capital allocation within the UK economy is

investment management industry who channelize savings to the capital market of the country

where financing takes place through a number of asset classes (Avdjiev and et.al., 2019). Before

the emergence of pandemic in the year 2019, the investment in UK economy took place through

traditional asset classes only such as bonds and listed equities only. However, the changing

economic and political scenario due to financial crisis across the globe has increase the reliance

on alternative asset classes forming part of private markets which encourage investment in

infrastructural projects as well. This leads to fall in the proportion of bond and equities of UK of

its total assets investment in 2020.

Capital allocation within international market

The purpose of international capital market is of allowing residents of different

countries to diversify their investment portfolios by including risky assets offered by businesses

or government of other countries (Latif and et.al., 2018). Capital allocation within international

markets takes place through selling of swap or hedge fund, foreign bond, exchange rate, etc.

There are many ways through which capital allocation takes place at international level.

The first and foremost way in which capital allocation is done in international markets in

Foreign Direct Investment or commonly known as FDI which includes all investments in the

interest rates offered on financial products meant for cash savings. The reason behind such a fall

in interest rates was the low base rate fixed by Bank of England which has been fell currently

from 0.5% to 0.25% in December 2021. Accordingly, as per the reports published in Mintel’s

Consumers, Saving, and Investing - UK, January 2020, it has been revealed that 32% of UK

citizens having savings for investment purposes do not want to save in the event of low interest

rates whereas 40% of UK citizens wants to save more and more while the interest rates are

increasing (Cloyne and et.al., 2018). This attitude cannot be seen as a greater interest in making

investment among UK citizens in order to get better or higher returns. The rest of the 23% of UK

citizens having savings or investments generally get more interested in investing in the event of

low interest rates which indicates their attempt to pass interest rather than encouraging them to

begin with making investment. Thus, it is the scenario of cash savings market of UK resulting

from higher or lower interest rates (Total Resource Allocation. 2021).

The industry playing a great role in capital allocation within the UK economy is

investment management industry who channelize savings to the capital market of the country

where financing takes place through a number of asset classes (Avdjiev and et.al., 2019). Before

the emergence of pandemic in the year 2019, the investment in UK economy took place through

traditional asset classes only such as bonds and listed equities only. However, the changing

economic and political scenario due to financial crisis across the globe has increase the reliance

on alternative asset classes forming part of private markets which encourage investment in

infrastructural projects as well. This leads to fall in the proportion of bond and equities of UK of

its total assets investment in 2020.

Capital allocation within international market

The purpose of international capital market is of allowing residents of different

countries to diversify their investment portfolios by including risky assets offered by businesses

or government of other countries (Latif and et.al., 2018). Capital allocation within international

markets takes place through selling of swap or hedge fund, foreign bond, exchange rate, etc.

There are many ways through which capital allocation takes place at international level.

The first and foremost way in which capital allocation is done in international markets in

Foreign Direct Investment or commonly known as FDI which includes all investments in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

equity capital of non – resident firm. FDI refers to the physical investment such as building a

facility or (factory) done by the company of one nation in another nation (Kannan, 2019). The

investment aims to create buildings, equipment or machinery directly in another nation to initiate

business operations therein. It is not associated with the creation portfolio of investment which is

considered as an indirect investment. However, within the concept of FDI, all the activities

associated with acquisition is being performed outside the home country of investing firm. FDI

can take various forms like direct acquisition of a firm registered in foreign land, construction of

facility on foreign land, forming a joint venture or creating a strategic alliance with the local firm

of different nations through technological input obtaining license of operating under their

intellectual property.

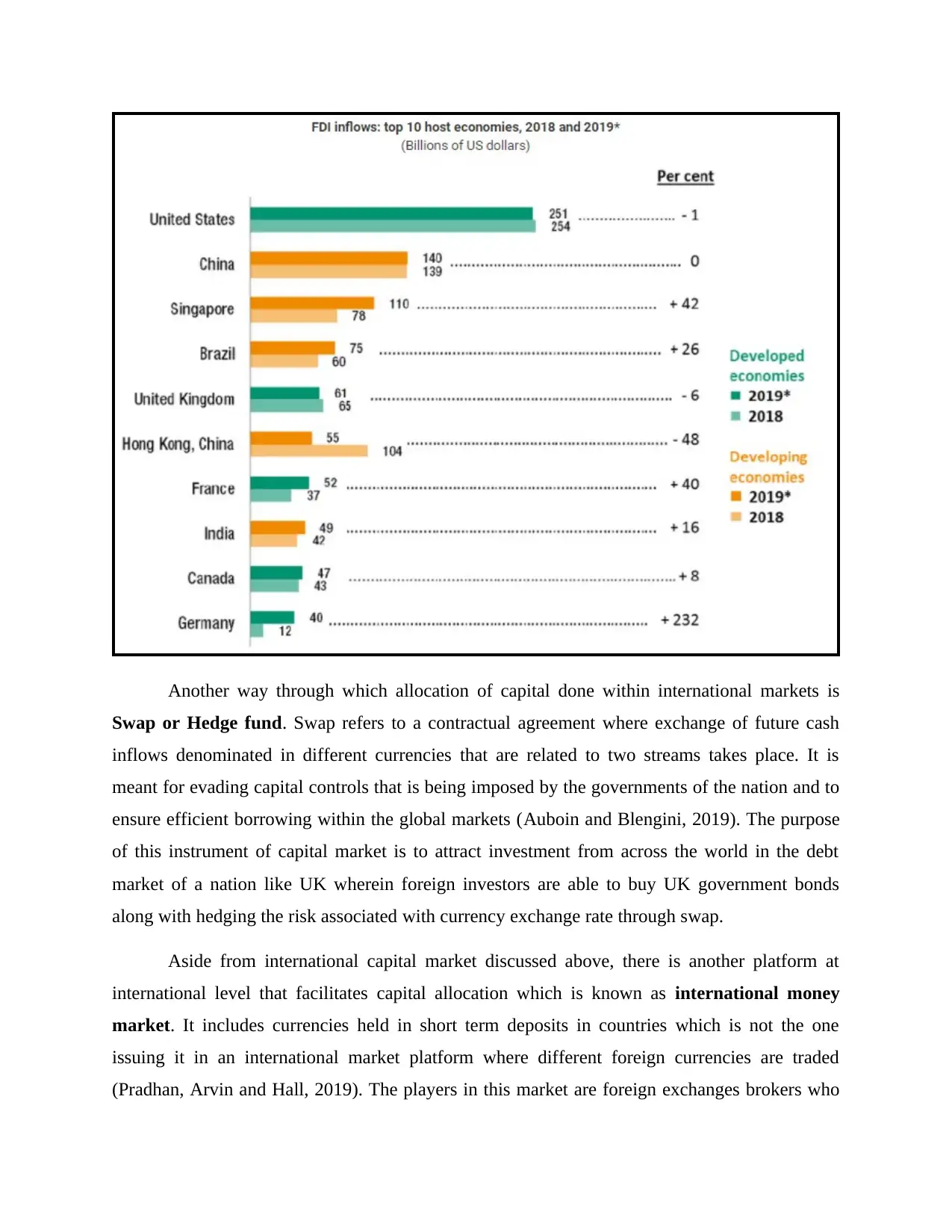

Therefore, by interpreting the purpose of FDI, it has been identified that it facilitates

derivation of finance externally to those countries having limited capital, so that they can arrange

funds beyond their national borders from countries which are wealthier than them

(Abdurakhmanova and Rustamov, 2020). For instance, US is the world’s leader in exporting and

FDI which helps in rapidly growing is economy. Here is a list of other countries using FDI to

allocate capital within international markets.

facility or (factory) done by the company of one nation in another nation (Kannan, 2019). The

investment aims to create buildings, equipment or machinery directly in another nation to initiate

business operations therein. It is not associated with the creation portfolio of investment which is

considered as an indirect investment. However, within the concept of FDI, all the activities

associated with acquisition is being performed outside the home country of investing firm. FDI

can take various forms like direct acquisition of a firm registered in foreign land, construction of

facility on foreign land, forming a joint venture or creating a strategic alliance with the local firm

of different nations through technological input obtaining license of operating under their

intellectual property.

Therefore, by interpreting the purpose of FDI, it has been identified that it facilitates

derivation of finance externally to those countries having limited capital, so that they can arrange

funds beyond their national borders from countries which are wealthier than them

(Abdurakhmanova and Rustamov, 2020). For instance, US is the world’s leader in exporting and

FDI which helps in rapidly growing is economy. Here is a list of other countries using FDI to

allocate capital within international markets.

Another way through which allocation of capital done within international markets is

Swap or Hedge fund. Swap refers to a contractual agreement where exchange of future cash

inflows denominated in different currencies that are related to two streams takes place. It is

meant for evading capital controls that is being imposed by the governments of the nation and to

ensure efficient borrowing within the global markets (Auboin and Blengini, 2019). The purpose

of this instrument of capital market is to attract investment from across the world in the debt

market of a nation like UK wherein foreign investors are able to buy UK government bonds

along with hedging the risk associated with currency exchange rate through swap.

Aside from international capital market discussed above, there is another platform at

international level that facilitates capital allocation which is known as international money

market. It includes currencies held in short term deposits in countries which is not the one

issuing it in an international market platform where different foreign currencies are traded

(Pradhan, Arvin and Hall, 2019). The players in this market are foreign exchanges brokers who

Swap or Hedge fund. Swap refers to a contractual agreement where exchange of future cash

inflows denominated in different currencies that are related to two streams takes place. It is

meant for evading capital controls that is being imposed by the governments of the nation and to

ensure efficient borrowing within the global markets (Auboin and Blengini, 2019). The purpose

of this instrument of capital market is to attract investment from across the world in the debt

market of a nation like UK wherein foreign investors are able to buy UK government bonds

along with hedging the risk associated with currency exchange rate through swap.

Aside from international capital market discussed above, there is another platform at

international level that facilitates capital allocation which is known as international money

market. It includes currencies held in short term deposits in countries which is not the one

issuing it in an international market platform where different foreign currencies are traded

(Pradhan, Arvin and Hall, 2019). The players in this market are foreign exchanges brokers who

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

acts as intermediary and foreign exchange dealers who are employed by banks (acts as

principals). In this market, transaction in international currency are undertaken by central banks

of different countries that are generally denominated in either US dollar or gold. Here borrowing

and lending of money took place by financial institutions, banks and government of different

nations.

Like domestic bond market, there is a similar platform at international platform known as

international bond market where issuance of foreign bonds is done by foreign borrowers which

used local currency (Muhammad and et.al., 2020). Also, its issuance and sale is supervised by

local market authorities and is issued by both private sector and government.

In this way, capital allocation through financial market is operating at global level is done

within international market which is affected by changes taking place in exchange rates. When

the rate fluctuates there are resulting increase or decrease in spending by overseas residents in

UK in terms of making capital investment. With the devaluation of GBP, there will be increase

in capital allocated to UK and vice versa.

Evaluation of emerging economy that is, India

Economy of India in one of the emerging economy of modern time along with being

sixth largest by nominal GDP and third largest by PPP (Purchasing Power Parity). The financial

sector here plays a significant role in efficient allocation of capital and accordingly, investment is

done in those sectors that are expected to generate high returns along with withdrawing from

those sectors that are not generating good returns (Redmond and Nasir, 2020). Therefore,

financial market has a great role to play in capital allocation within the Indian economy to aids in

economic growth of the nation. Indian financial market is bifurcated in two major segments that

is, capital and money market.

Indian capital market consists of primary and secondary market where debt, equity and

hybrid securities are issued through brokers, underwriters, investment bankers and stock

exchanges acting as an intermediary in this market. It is regulated by SEBI (Securities and

Exchange Board of India) (Sysoeva and et.al., 2018). The various players of this market are

corporates, CRA, individuals, banks or FIs and FDI or FIIs who plays the role of channelizing

savings to those are in needs of funds. Major suppliers of fund in Indian capital market are

banks, financial institutions, business corporations and retirement funds while major borrowers

principals). In this market, transaction in international currency are undertaken by central banks

of different countries that are generally denominated in either US dollar or gold. Here borrowing

and lending of money took place by financial institutions, banks and government of different

nations.

Like domestic bond market, there is a similar platform at international platform known as

international bond market where issuance of foreign bonds is done by foreign borrowers which

used local currency (Muhammad and et.al., 2020). Also, its issuance and sale is supervised by

local market authorities and is issued by both private sector and government.

In this way, capital allocation through financial market is operating at global level is done

within international market which is affected by changes taking place in exchange rates. When

the rate fluctuates there are resulting increase or decrease in spending by overseas residents in

UK in terms of making capital investment. With the devaluation of GBP, there will be increase

in capital allocated to UK and vice versa.

Evaluation of emerging economy that is, India

Economy of India in one of the emerging economy of modern time along with being

sixth largest by nominal GDP and third largest by PPP (Purchasing Power Parity). The financial

sector here plays a significant role in efficient allocation of capital and accordingly, investment is

done in those sectors that are expected to generate high returns along with withdrawing from

those sectors that are not generating good returns (Redmond and Nasir, 2020). Therefore,

financial market has a great role to play in capital allocation within the Indian economy to aids in

economic growth of the nation. Indian financial market is bifurcated in two major segments that

is, capital and money market.

Indian capital market consists of primary and secondary market where debt, equity and

hybrid securities are issued through brokers, underwriters, investment bankers and stock

exchanges acting as an intermediary in this market. It is regulated by SEBI (Securities and

Exchange Board of India) (Sysoeva and et.al., 2018). The various players of this market are

corporates, CRA, individuals, banks or FIs and FDI or FIIs who plays the role of channelizing

savings to those are in needs of funds. Major suppliers of fund in Indian capital market are

banks, financial institutions, business corporations and retirement funds while major borrowers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

are corporations, securities dealers and treasury departments. Equities are traded on Bombay

stock exchange, NSE and OTCE which is also known as stock or secondary market.

Indian money market comprises of both organized and unorganized sector where the

former consists of RBI, public and private sector banks and developmental banks and FIs is

fairly integrated but the latter consists of money lenders, Nidhi’s, Chit funds and indigenous

bankers is not homogenous and integrated one (Nkukpornu, Gyimah and Sakyiwaa, 2020). The

instruments of organized sector are call money, treasury bill, commercial bill, commercial papers

and certificates of deposits that are meant for arranging finance for short term needs. Reserve

Bank of India is the regulator of this platform of capital allocation.

FDI in India is largely encouraged for the economic growth and development of the

nation. The biggest investor allocating their capital in India through FDIs are UK, Japan, US,

France and Germany. In case of private companies, 100% is permitted through automatic route.

There were 22.5% increase in FDI inflows in the financial year 2021 where capital allocation

amounts to $67000 million.

Critical evaluation of challenges faced by India due to trade policies and industrialization

The trade policies of a nation indicate rules, standards and regulations that are applicable

to the nations involved in trade with India (Yakubu and et.al., 2018). The Indian trade policy

aims to increase share of country in the global trade and doubling exports by the end of 2021.

Industrialization aims to establish industries which produces both capital and consumer goods in

an attempt to provide goods and services to businesses and individuals residing both in India and

foreign countries through exports (Robinson, 2018). However, there are many challenges faced

by India due to its trade policies and industrialization.

The biggest challenge that the country faces is the disappearance of natural resources and

pollution of air, water and land across the nation. In an attempt to get cheaper labor, industries

are encouraging child labor which is not good for economic development of the country. The

advancement of technology within these industries are resulting in displacement of manpower

and thus unemployment is increasing in India.

Despite above challenges, there are many benefits that the country is enjoying due to its

trade policies and industrialization such as growth of industries leads to implementing country’s

stock exchange, NSE and OTCE which is also known as stock or secondary market.

Indian money market comprises of both organized and unorganized sector where the

former consists of RBI, public and private sector banks and developmental banks and FIs is

fairly integrated but the latter consists of money lenders, Nidhi’s, Chit funds and indigenous

bankers is not homogenous and integrated one (Nkukpornu, Gyimah and Sakyiwaa, 2020). The

instruments of organized sector are call money, treasury bill, commercial bill, commercial papers

and certificates of deposits that are meant for arranging finance for short term needs. Reserve

Bank of India is the regulator of this platform of capital allocation.

FDI in India is largely encouraged for the economic growth and development of the

nation. The biggest investor allocating their capital in India through FDIs are UK, Japan, US,

France and Germany. In case of private companies, 100% is permitted through automatic route.

There were 22.5% increase in FDI inflows in the financial year 2021 where capital allocation

amounts to $67000 million.

Critical evaluation of challenges faced by India due to trade policies and industrialization

The trade policies of a nation indicate rules, standards and regulations that are applicable

to the nations involved in trade with India (Yakubu and et.al., 2018). The Indian trade policy

aims to increase share of country in the global trade and doubling exports by the end of 2021.

Industrialization aims to establish industries which produces both capital and consumer goods in

an attempt to provide goods and services to businesses and individuals residing both in India and

foreign countries through exports (Robinson, 2018). However, there are many challenges faced

by India due to its trade policies and industrialization.

The biggest challenge that the country faces is the disappearance of natural resources and

pollution of air, water and land across the nation. In an attempt to get cheaper labor, industries

are encouraging child labor which is not good for economic development of the country. The

advancement of technology within these industries are resulting in displacement of manpower

and thus unemployment is increasing in India.

Despite above challenges, there are many benefits that the country is enjoying due to its

trade policies and industrialization such as growth of industries leads to implementing country’s

trade policies of increasing exports because industrialization facilitates large scale production of

goods and services (Accominotti and Ugolini, 2019). Accordingly, there seems rise in standard

of living of the country’s citizens. Also, various job opportunities have been created across the

nation which results in removal of poverty.

CONCLUSION

From the above essay it has been concluded that financial markets within each country

plays a great role in allocating capital within the economy and within the international markets as

well. Every country operates its financial market through different platforms having numerous

constituents therein like in this report capital allocation within UK and Indian economy has been

evaluated which indicates how finance is being arranges from savers or investors to meet the

funding needs of those who need it (corporations and government) for economic growth and

development. Also, it has been evaluated in this essay that how capital allocation takes place

within international markets. Furthermore, critical evaluation of challenges faced by India due to

its trade policies and industrialization has been evaluated in this report.

RECOMMENDATIONS

There are certain recommendations that can be made to countries across the world with reference

to their trade, finance and investment, such as the following:

The investors or citizens must be educated to understand their responsibility in engaging

with capital allocation of the nation by offering their savings to risky investments, so that

higher returns for the country could be generated and accordingly, economic growth and

development could be achieved (Ahn, 2020).

Also, issuers of securities, stock exchanges and regulators forming part of financial market

of the country should ensure that there must be presence of robust regulations while making

capital allocation decisions. This can be done by regulators of financial market by increasing

discipline and accountability among the players in the market which is helpful in higher

confidence among investors within the country.

goods and services (Accominotti and Ugolini, 2019). Accordingly, there seems rise in standard

of living of the country’s citizens. Also, various job opportunities have been created across the

nation which results in removal of poverty.

CONCLUSION

From the above essay it has been concluded that financial markets within each country

plays a great role in allocating capital within the economy and within the international markets as

well. Every country operates its financial market through different platforms having numerous

constituents therein like in this report capital allocation within UK and Indian economy has been

evaluated which indicates how finance is being arranges from savers or investors to meet the

funding needs of those who need it (corporations and government) for economic growth and

development. Also, it has been evaluated in this essay that how capital allocation takes place

within international markets. Furthermore, critical evaluation of challenges faced by India due to

its trade policies and industrialization has been evaluated in this report.

RECOMMENDATIONS

There are certain recommendations that can be made to countries across the world with reference

to their trade, finance and investment, such as the following:

The investors or citizens must be educated to understand their responsibility in engaging

with capital allocation of the nation by offering their savings to risky investments, so that

higher returns for the country could be generated and accordingly, economic growth and

development could be achieved (Ahn, 2020).

Also, issuers of securities, stock exchanges and regulators forming part of financial market

of the country should ensure that there must be presence of robust regulations while making

capital allocation decisions. This can be done by regulators of financial market by increasing

discipline and accountability among the players in the market which is helpful in higher

confidence among investors within the country.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.