Taxation Law: Analyzing Capital Gains Tax and Income Assessment

VerifiedAdded on 2023/06/03

|22

|6093

|316

Homework Assignment

AI Summary

This assignment provides a detailed analysis of taxation law, focusing on the calculation of taxable income and tax payable. It examines capital gains tax (CGT) events, including the sale of an investment property, stamp collection, and shares, while also considering carry-forward losses and the quarantining rule for collectables. The assignment further explores the characterization of receipts as ordinary income from business activities, including professional fees, dividends, and rental income, and discusses allowable deductions such as office rent and employee salaries. It references relevant sections of the ITAA 1997 and ITAA 1936, as well as case law, to support its analysis of various income and deduction items, providing a comprehensive overview of the taxation principles involved. This document is available on Desklib, a platform offering a range of study tools and solved assignments for students.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................6

Answer to question 3:...............................................................................................................11

References:...............................................................................................................................18

Table of Contents

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................6

Answer to question 3:...............................................................................................................11

References:...............................................................................................................................18

2TAXATION LAW

Answer to question 1:

According to the Australian taxation office an individual tax payer may make a

capital gains or capital loss when they sell the rental property that is acquired on or after 19th

September 1985. In the circumstances of the sale or disposal or the real estate the time of the

event is treated normally when a person enters into the contract usually when the settlement

is reached (Sadiq et al. 2013). A person may make the capital gains from the sale of the rental

property up to the extent that the capital proceeds that is received by them is greater than the

cost base of the property. A taxpayer might make the capital loss up to the extent that the

property reduce cost base is greater than the capital proceeds.

A gain is treated as the capital gains which is not subjected to income tax under the

ordinary concepts. The income tax liability of the taxpayer includes the net capital gains. In

other words, the net capital gains is included into the assessable income of the taxpayers

(Woellner et al. 2016). The cost base and the reduced cost base of the property comprises of

the amount that is paid for along with the certain incidental costs that are related with

acquiring, holding and selling the property. This includes the legal fees, stamp duty and real

estate agent commission.

A CGT event A1 occurs under “section 104-10 (1) of the ITAA 1997” when the

taxpayer sells any CGT asset. In the current situation it is noticed that Kylie sold an

investment property for $580,000. The selling of investment apartment resulted in “CGT

event A1” under “section 104-10 (1) of the ITAA 1997” (Braithwaite 2017). The apartment

was however bought for $360,000. At the time of acquiring the holiday apartment Kylie

reported an expenses of $5000 and $4000 respectively for stamp duty and valuation costs.

According to the “section 110-25” the cost base of the asset includes the total amount of

money paid to acquire the property. With reference to “section 110-25” expenses on stamp

Answer to question 1:

According to the Australian taxation office an individual tax payer may make a

capital gains or capital loss when they sell the rental property that is acquired on or after 19th

September 1985. In the circumstances of the sale or disposal or the real estate the time of the

event is treated normally when a person enters into the contract usually when the settlement

is reached (Sadiq et al. 2013). A person may make the capital gains from the sale of the rental

property up to the extent that the capital proceeds that is received by them is greater than the

cost base of the property. A taxpayer might make the capital loss up to the extent that the

property reduce cost base is greater than the capital proceeds.

A gain is treated as the capital gains which is not subjected to income tax under the

ordinary concepts. The income tax liability of the taxpayer includes the net capital gains. In

other words, the net capital gains is included into the assessable income of the taxpayers

(Woellner et al. 2016). The cost base and the reduced cost base of the property comprises of

the amount that is paid for along with the certain incidental costs that are related with

acquiring, holding and selling the property. This includes the legal fees, stamp duty and real

estate agent commission.

A CGT event A1 occurs under “section 104-10 (1) of the ITAA 1997” when the

taxpayer sells any CGT asset. In the current situation it is noticed that Kylie sold an

investment property for $580,000. The selling of investment apartment resulted in “CGT

event A1” under “section 104-10 (1) of the ITAA 1997” (Braithwaite 2017). The apartment

was however bought for $360,000. At the time of acquiring the holiday apartment Kylie

reported an expenses of $5000 and $4000 respectively for stamp duty and valuation costs.

According to the “section 110-25” the cost base of the asset includes the total amount of

money paid to acquire the property. With reference to “section 110-25” expenses on stamp

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

duty and valuation costs for acquiring the rental property are added to the cost base of the

apartment under the second element.

The third element of the cost base items includes the cost of ownership. The cost of

ownership comprises of the interest, cost of maintenance, repairs and renovation, insurance,

rates and land tax (Bankman et al. 2017). Kylie later reported on 1st July 2009 relating to

costs incurred on renovating the apartment. Kylie incurred renovation cost of $15,000. The

cost of renovating the apartment falls under the third element of cost base under “section

110-25 of the ITAA 1997”. Therefore, the same is added into the cost base of the apartment.

The fourth element of cost base comprises of the capital enhancement and

preservation costs. This includes any form of capital expenditure such as improvement to the

asset that is incurred by the taxpayer in increasing the value of the asset that forms the part of

the fourth element of the cost base under “section 110-25 (5) of the ITAA 1997” (Schenk

2017). The fourth element of cost base includes the capital expenditure that is related to the

installation or moving the asset. Kylie later reports on 1st February 2009 an expenditure of

$40,000 related to addition of second bathroom in the apartment. The cost can be

characterised as improvement to the asset in the form of capital enhancement and falls under

the part of fourth element of cost base.

While arriving at the final settlement of the investment apartment Kylie reported legal

expenses and real estate commission. The expenses are considered as cost of selling and the

same is subtracted to ascertain the net selling price (Murphy and Higgins 2016). The selling

of investment apartment resulted in capital gains under “CGT event A1” and the net amount

of capital gains is included into the assessable income of Kylie.

Later Kylie granted a three month option of purchasing the rental property to local

property developer which eventually lapsed and resulted in receipt of $10,500. She incurred

duty and valuation costs for acquiring the rental property are added to the cost base of the

apartment under the second element.

The third element of the cost base items includes the cost of ownership. The cost of

ownership comprises of the interest, cost of maintenance, repairs and renovation, insurance,

rates and land tax (Bankman et al. 2017). Kylie later reported on 1st July 2009 relating to

costs incurred on renovating the apartment. Kylie incurred renovation cost of $15,000. The

cost of renovating the apartment falls under the third element of cost base under “section

110-25 of the ITAA 1997”. Therefore, the same is added into the cost base of the apartment.

The fourth element of cost base comprises of the capital enhancement and

preservation costs. This includes any form of capital expenditure such as improvement to the

asset that is incurred by the taxpayer in increasing the value of the asset that forms the part of

the fourth element of the cost base under “section 110-25 (5) of the ITAA 1997” (Schenk

2017). The fourth element of cost base includes the capital expenditure that is related to the

installation or moving the asset. Kylie later reports on 1st February 2009 an expenditure of

$40,000 related to addition of second bathroom in the apartment. The cost can be

characterised as improvement to the asset in the form of capital enhancement and falls under

the part of fourth element of cost base.

While arriving at the final settlement of the investment apartment Kylie reported legal

expenses and real estate commission. The expenses are considered as cost of selling and the

same is subtracted to ascertain the net selling price (Murphy and Higgins 2016). The selling

of investment apartment resulted in capital gains under “CGT event A1” and the net amount

of capital gains is included into the assessable income of Kylie.

Later Kylie granted a three month option of purchasing the rental property to local

property developer which eventually lapsed and resulted in receipt of $10,500. She incurred

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

the expense of $500 as the fees paid to solicitor for repairing the contract. Fees paid to the

solicitor for preparing the option contract can be treated as eligible deduction under the

“section 8-1 of the ITAA 1997” because it was incurred in the gaining the assessable income.

According to the “section 108-10 (2) of the ITAA 1997” collectables refers to the

artwork, an antique coin or medallion or a postage stamp that is mainly kept by the taxpayer

for their private usage and enjoyment purpose (Schmalbeck, Zelenak and Lawsky, 2015).

There are certain special rules that are applicable on collectables. The capital gains and

capital losses should be disregarded under “section 118-10 (1) of the ITAA 1997” when the

cost base of the collectable is less than $500. The quarantining rule under “section 108-10

(1)” states that capital loss from the collectables can be only used to offset the capital gains

from the collectables (Seto 2015). Kylie later reports capital gains from the sale of stamp

collection however she has the carry-forward loss of $5000 from the sale of coin. As a result

of this, Kylie under the quarantining rule of “section 108-10 (1)” can only offset the capital

loss that is made from the sale of antique coin.

Shares in company or units in the trust are considered in the similar manner as the

other assets for the purpose of capital gains tax. For an individual investors capital gains tax

is applied on the shares and units when they sell them originating from the CGT event

(Finkelstein 2014). In the current situation it is noticed that Kylie made a capital gains from

the shares of BHP however she had the carry forward loss of $20,000 from the shares during

the income year of 2008-. The gains made from the shares of BHP are offset against the carry

forward loss.

Kylie carried on the business of gymnasium that only made profit once in every ten

year however the gymnasium did not reported profit during the year 2017-18. The loss made

the expense of $500 as the fees paid to solicitor for repairing the contract. Fees paid to the

solicitor for preparing the option contract can be treated as eligible deduction under the

“section 8-1 of the ITAA 1997” because it was incurred in the gaining the assessable income.

According to the “section 108-10 (2) of the ITAA 1997” collectables refers to the

artwork, an antique coin or medallion or a postage stamp that is mainly kept by the taxpayer

for their private usage and enjoyment purpose (Schmalbeck, Zelenak and Lawsky, 2015).

There are certain special rules that are applicable on collectables. The capital gains and

capital losses should be disregarded under “section 118-10 (1) of the ITAA 1997” when the

cost base of the collectable is less than $500. The quarantining rule under “section 108-10

(1)” states that capital loss from the collectables can be only used to offset the capital gains

from the collectables (Seto 2015). Kylie later reports capital gains from the sale of stamp

collection however she has the carry-forward loss of $5000 from the sale of coin. As a result

of this, Kylie under the quarantining rule of “section 108-10 (1)” can only offset the capital

loss that is made from the sale of antique coin.

Shares in company or units in the trust are considered in the similar manner as the

other assets for the purpose of capital gains tax. For an individual investors capital gains tax

is applied on the shares and units when they sell them originating from the CGT event

(Finkelstein 2014). In the current situation it is noticed that Kylie made a capital gains from

the shares of BHP however she had the carry forward loss of $20,000 from the shares during

the income year of 2008-. The gains made from the shares of BHP are offset against the carry

forward loss.

Kylie carried on the business of gymnasium that only made profit once in every ten

year however the gymnasium did not reported profit during the year 2017-18. The loss made

5TAXATION LAW

from the gymnasium should be carry forward to the later years and the same can be offset by

Kylie when the business makes profits from such operations carried on by her.

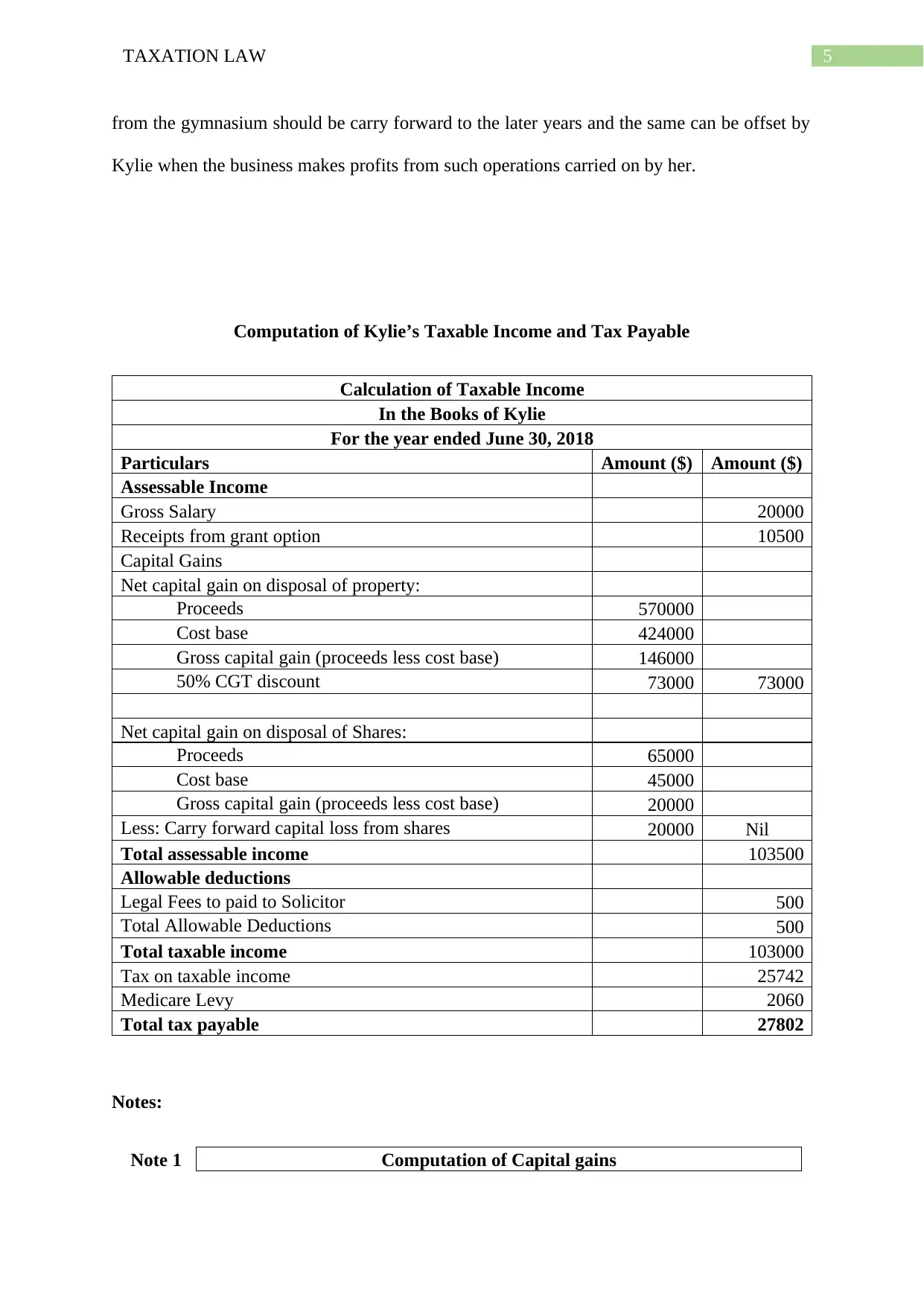

Computation of Kylie’s Taxable Income and Tax Payable

Calculation of Taxable Income

In the Books of Kylie

For the year ended June 30, 2018

Particulars Amount ($) Amount ($)

Assessable Income

Gross Salary 20000

Receipts from grant option 10500

Capital Gains

Net capital gain on disposal of property:

Proceeds 570000

Cost base 424000

Gross capital gain (proceeds less cost base) 146000

50% CGT discount 73000 73000

Net capital gain on disposal of Shares:

Proceeds 65000

Cost base 45000

Gross capital gain (proceeds less cost base) 20000

Less: Carry forward capital loss from shares 20000 Nil

Total assessable income 103500

Allowable deductions

Legal Fees to paid to Solicitor 500

Total Allowable Deductions 500

Total taxable income 103000

Tax on taxable income 25742

Medicare Levy 2060

Total tax payable 27802

Notes:

Note 1 Computation of Capital gains

from the gymnasium should be carry forward to the later years and the same can be offset by

Kylie when the business makes profits from such operations carried on by her.

Computation of Kylie’s Taxable Income and Tax Payable

Calculation of Taxable Income

In the Books of Kylie

For the year ended June 30, 2018

Particulars Amount ($) Amount ($)

Assessable Income

Gross Salary 20000

Receipts from grant option 10500

Capital Gains

Net capital gain on disposal of property:

Proceeds 570000

Cost base 424000

Gross capital gain (proceeds less cost base) 146000

50% CGT discount 73000 73000

Net capital gain on disposal of Shares:

Proceeds 65000

Cost base 45000

Gross capital gain (proceeds less cost base) 20000

Less: Carry forward capital loss from shares 20000 Nil

Total assessable income 103500

Allowable deductions

Legal Fees to paid to Solicitor 500

Total Allowable Deductions 500

Total taxable income 103000

Tax on taxable income 25742

Medicare Levy 2060

Total tax payable 27802

Notes:

Note 1 Computation of Capital gains

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

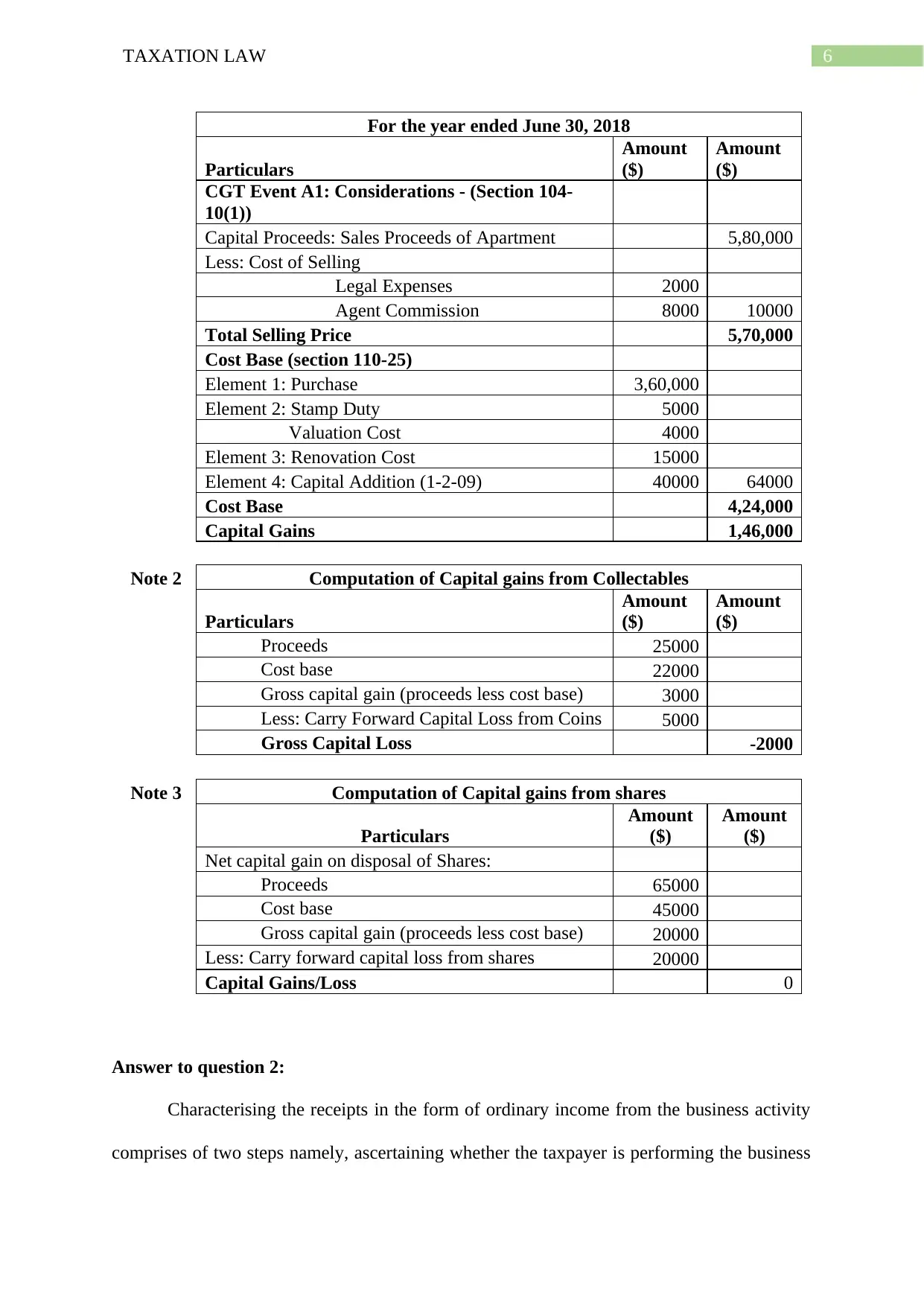

For the year ended June 30, 2018

Particulars

Amount

($)

Amount

($)

CGT Event A1: Considerations - (Section 104-

10(1))

Capital Proceeds: Sales Proceeds of Apartment 5,80,000

Less: Cost of Selling

Legal Expenses 2000

Agent Commission 8000 10000

Total Selling Price 5,70,000

Cost Base (section 110-25)

Element 1: Purchase 3,60,000

Element 2: Stamp Duty 5000

Valuation Cost 4000

Element 3: Renovation Cost 15000

Element 4: Capital Addition (1-2-09) 40000 64000

Cost Base 4,24,000

Capital Gains 1,46,000

Note 2 Computation of Capital gains from Collectables

Particulars

Amount

($)

Amount

($)

Proceeds 25000

Cost base 22000

Gross capital gain (proceeds less cost base) 3000

Less: Carry Forward Capital Loss from Coins 5000

Gross Capital Loss -2000

Note 3 Computation of Capital gains from shares

Particulars

Amount

($)

Amount

($)

Net capital gain on disposal of Shares:

Proceeds 65000

Cost base 45000

Gross capital gain (proceeds less cost base) 20000

Less: Carry forward capital loss from shares 20000

Capital Gains/Loss 0

Answer to question 2:

Characterising the receipts in the form of ordinary income from the business activity

comprises of two steps namely, ascertaining whether the taxpayer is performing the business

For the year ended June 30, 2018

Particulars

Amount

($)

Amount

($)

CGT Event A1: Considerations - (Section 104-

10(1))

Capital Proceeds: Sales Proceeds of Apartment 5,80,000

Less: Cost of Selling

Legal Expenses 2000

Agent Commission 8000 10000

Total Selling Price 5,70,000

Cost Base (section 110-25)

Element 1: Purchase 3,60,000

Element 2: Stamp Duty 5000

Valuation Cost 4000

Element 3: Renovation Cost 15000

Element 4: Capital Addition (1-2-09) 40000 64000

Cost Base 4,24,000

Capital Gains 1,46,000

Note 2 Computation of Capital gains from Collectables

Particulars

Amount

($)

Amount

($)

Proceeds 25000

Cost base 22000

Gross capital gain (proceeds less cost base) 3000

Less: Carry Forward Capital Loss from Coins 5000

Gross Capital Loss -2000

Note 3 Computation of Capital gains from shares

Particulars

Amount

($)

Amount

($)

Net capital gain on disposal of Shares:

Proceeds 65000

Cost base 45000

Gross capital gain (proceeds less cost base) 20000

Less: Carry forward capital loss from shares 20000

Capital Gains/Loss 0

Answer to question 2:

Characterising the receipts in the form of ordinary income from the business activity

comprises of two steps namely, ascertaining whether the taxpayer is performing the business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

or whether the receipts are treated as the normal proceeds of the business (Hoffman et al.

2014). Gains obtained by the taxpayer from carrying on of the business is treated as the

ordinary income under “section 6-5 of the ITAA 1997”. As understood in the current

situation, Salvador Ryan was the accountant and Director of accounting practice firm.

Salvador reported the receipt of $600,000 from the professional fees and $25,000 from the

sales of superannuation guide.

As per “section 6-5” most of the income that comes into the taxpayer must be treated

as ordinary income. The court in “Scott v CT (1935)” held that appropriate principles must be

applied in determining the receipts within the ordinary concepts (Burns and Ziliak 2017).

Therefore, the receipts from professional fees and sales of superannuation guide should be

held assessable under the ordinary concept of “section 6-5”.

As per “section 44 (1) of the ITAA 1936” dividends and gains obtained from shares

are held as statutory income (Buenker 2018). A resident company may pay franking

dividends to a person. The dividends may be entirely franked or may be partially franked

which means that the dividend has franked and unfranked amount. As understood Salvador

reported a receipt of partially franked $17,000 dividend. The dividend is included for

assessment under “section 44 (1) of the ITAA 1936” as the statutory income.

The interest from bank deposits are treated as the ordinary income under “section 6-5

of the ITAA 1997”. Therefore, the interest received from the bank deposits are ordinary

income and it is included for assessment. The court in “Adelaide Fruit and Produce

Exchange Co Ltd v FC of T (1932)” stated that the rent refers to the price paid as the right of

using another person’s property (Robin 2017). The receipt of rental income from the

investment property is held as assessable income as the income from ordinary concepts.

or whether the receipts are treated as the normal proceeds of the business (Hoffman et al.

2014). Gains obtained by the taxpayer from carrying on of the business is treated as the

ordinary income under “section 6-5 of the ITAA 1997”. As understood in the current

situation, Salvador Ryan was the accountant and Director of accounting practice firm.

Salvador reported the receipt of $600,000 from the professional fees and $25,000 from the

sales of superannuation guide.

As per “section 6-5” most of the income that comes into the taxpayer must be treated

as ordinary income. The court in “Scott v CT (1935)” held that appropriate principles must be

applied in determining the receipts within the ordinary concepts (Burns and Ziliak 2017).

Therefore, the receipts from professional fees and sales of superannuation guide should be

held assessable under the ordinary concept of “section 6-5”.

As per “section 44 (1) of the ITAA 1936” dividends and gains obtained from shares

are held as statutory income (Buenker 2018). A resident company may pay franking

dividends to a person. The dividends may be entirely franked or may be partially franked

which means that the dividend has franked and unfranked amount. As understood Salvador

reported a receipt of partially franked $17,000 dividend. The dividend is included for

assessment under “section 44 (1) of the ITAA 1936” as the statutory income.

The interest from bank deposits are treated as the ordinary income under “section 6-5

of the ITAA 1997”. Therefore, the interest received from the bank deposits are ordinary

income and it is included for assessment. The court in “Adelaide Fruit and Produce

Exchange Co Ltd v FC of T (1932)” stated that the rent refers to the price paid as the right of

using another person’s property (Robin 2017). The receipt of rental income from the

investment property is held as assessable income as the income from ordinary concepts.

8TAXATION LAW

Salvador reported profits from the sale of the office equipment. The profit has been

included for assessment as the receipts under the ordinary concepts. As per the Australian

taxation office, the assessable income from the overseas nation should be declared by the

taxpayer in their Australian income tax return. An individual that has paid foreign tax in other

nation, may be entitled to the Australian foreign income tax offset that provides the taxpayer

from the double taxation relief (Blakelock and King 2017). The gross dividend of $850 from

the shares of IBM (USA) has been included for assessment as receipts under ordinary concept

however the withholding tax of $150 is claimed as foreign income tax offset.

The general deduction rule states that the taxpayer can obtain from their taxable

income a loss or the outgoings till the extent that are assessable under “section 8-1 (1) of the

ITAA 1997” (Martin and Connor 2017). The expenses should be incurred in gaining or

generating the assessable income. The expenses must be necessarily incurred for the business

purpose of generating assessable income.

Salvador reported expenses towards office rent, superannuation guides and salary paid

to employee secretary. The court in “Amalgamated Zinc Ltd v FC of T (1935)” explained

that to claim a deduction for loss or outgoing the expenditure must hold the sufficient nexus

or connection in deriving the assessable income (Burton 2017). With reference to the

“section 8-1 of the ITAA 1997” the expenses were incurred in gaining the assessable income

and the business course of the taxpayer. The expenses are eligible for deduction because it

was incurred in course of generating assessable income.

The court in “Lunney v FC of T (1958)” held that the travel between home and a

taxpayer usual work place is usually not allowed as deductions (Maley 2018). Salvador

reported an expense related to train fare for travel between home and workplace. As held in

“Payne v FC of T 2001” the court denied deduction for the cost of travelling between the

Salvador reported profits from the sale of the office equipment. The profit has been

included for assessment as the receipts under the ordinary concepts. As per the Australian

taxation office, the assessable income from the overseas nation should be declared by the

taxpayer in their Australian income tax return. An individual that has paid foreign tax in other

nation, may be entitled to the Australian foreign income tax offset that provides the taxpayer

from the double taxation relief (Blakelock and King 2017). The gross dividend of $850 from

the shares of IBM (USA) has been included for assessment as receipts under ordinary concept

however the withholding tax of $150 is claimed as foreign income tax offset.

The general deduction rule states that the taxpayer can obtain from their taxable

income a loss or the outgoings till the extent that are assessable under “section 8-1 (1) of the

ITAA 1997” (Martin and Connor 2017). The expenses should be incurred in gaining or

generating the assessable income. The expenses must be necessarily incurred for the business

purpose of generating assessable income.

Salvador reported expenses towards office rent, superannuation guides and salary paid

to employee secretary. The court in “Amalgamated Zinc Ltd v FC of T (1935)” explained

that to claim a deduction for loss or outgoing the expenditure must hold the sufficient nexus

or connection in deriving the assessable income (Burton 2017). With reference to the

“section 8-1 of the ITAA 1997” the expenses were incurred in gaining the assessable income

and the business course of the taxpayer. The expenses are eligible for deduction because it

was incurred in course of generating assessable income.

The court in “Lunney v FC of T (1958)” held that the travel between home and a

taxpayer usual work place is usually not allowed as deductions (Maley 2018). Salvador

reported an expense related to train fare for travel between home and workplace. As held in

“Payne v FC of T 2001” the court denied deduction for the cost of travelling between the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

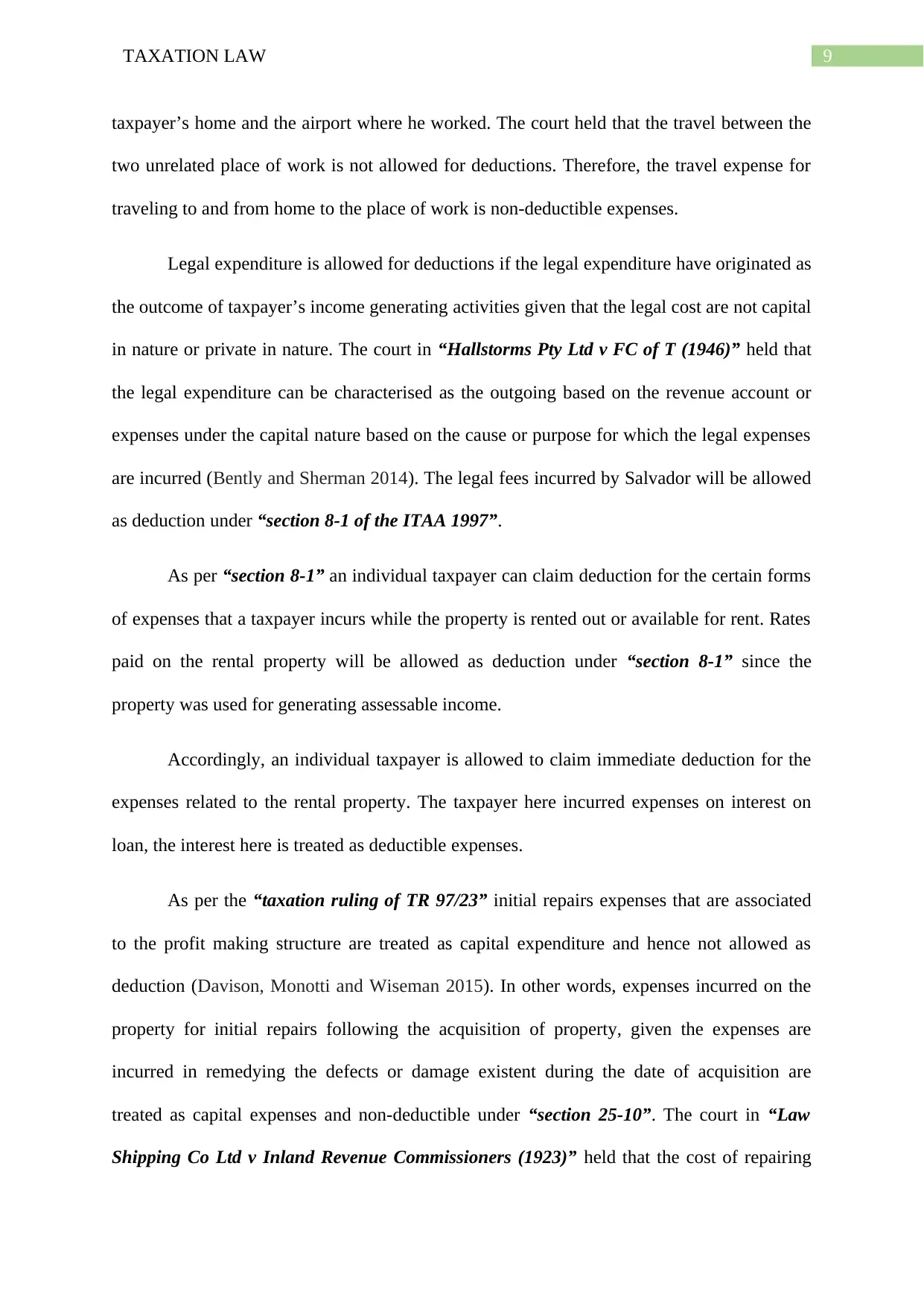

9TAXATION LAW

taxpayer’s home and the airport where he worked. The court held that the travel between the

two unrelated place of work is not allowed for deductions. Therefore, the travel expense for

traveling to and from home to the place of work is non-deductible expenses.

Legal expenditure is allowed for deductions if the legal expenditure have originated as

the outcome of taxpayer’s income generating activities given that the legal cost are not capital

in nature or private in nature. The court in “Hallstorms Pty Ltd v FC of T (1946)” held that

the legal expenditure can be characterised as the outgoing based on the revenue account or

expenses under the capital nature based on the cause or purpose for which the legal expenses

are incurred (Bently and Sherman 2014). The legal fees incurred by Salvador will be allowed

as deduction under “section 8-1 of the ITAA 1997”.

As per “section 8-1” an individual taxpayer can claim deduction for the certain forms

of expenses that a taxpayer incurs while the property is rented out or available for rent. Rates

paid on the rental property will be allowed as deduction under “section 8-1” since the

property was used for generating assessable income.

Accordingly, an individual taxpayer is allowed to claim immediate deduction for the

expenses related to the rental property. The taxpayer here incurred expenses on interest on

loan, the interest here is treated as deductible expenses.

As per the “taxation ruling of TR 97/23” initial repairs expenses that are associated

to the profit making structure are treated as capital expenditure and hence not allowed as

deduction (Davison, Monotti and Wiseman 2015). In other words, expenses incurred on the

property for initial repairs following the acquisition of property, given the expenses are

incurred in remedying the defects or damage existent during the date of acquisition are

treated as capital expenses and non-deductible under “section 25-10”. The court in “Law

Shipping Co Ltd v Inland Revenue Commissioners (1923)” held that the cost of repairing

taxpayer’s home and the airport where he worked. The court held that the travel between the

two unrelated place of work is not allowed for deductions. Therefore, the travel expense for

traveling to and from home to the place of work is non-deductible expenses.

Legal expenditure is allowed for deductions if the legal expenditure have originated as

the outcome of taxpayer’s income generating activities given that the legal cost are not capital

in nature or private in nature. The court in “Hallstorms Pty Ltd v FC of T (1946)” held that

the legal expenditure can be characterised as the outgoing based on the revenue account or

expenses under the capital nature based on the cause or purpose for which the legal expenses

are incurred (Bently and Sherman 2014). The legal fees incurred by Salvador will be allowed

as deduction under “section 8-1 of the ITAA 1997”.

As per “section 8-1” an individual taxpayer can claim deduction for the certain forms

of expenses that a taxpayer incurs while the property is rented out or available for rent. Rates

paid on the rental property will be allowed as deduction under “section 8-1” since the

property was used for generating assessable income.

Accordingly, an individual taxpayer is allowed to claim immediate deduction for the

expenses related to the rental property. The taxpayer here incurred expenses on interest on

loan, the interest here is treated as deductible expenses.

As per the “taxation ruling of TR 97/23” initial repairs expenses that are associated

to the profit making structure are treated as capital expenditure and hence not allowed as

deduction (Davison, Monotti and Wiseman 2015). In other words, expenses incurred on the

property for initial repairs following the acquisition of property, given the expenses are

incurred in remedying the defects or damage existent during the date of acquisition are

treated as capital expenses and non-deductible under “section 25-10”. The court in “Law

Shipping Co Ltd v Inland Revenue Commissioners (1923)” held that the cost of repairing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

the roof, guttering, painting, wall and wooden floor during the year of income when it was

acquired was expenses of capital in nature and non-deductible under “section 25-10”. The

cost of $5,000 for painting the rental property immediately following the purchase will be

treated as capital expenditure and non-deductible under “section 25-10 of the ITAA 1997”.

The court in “W Thomas & Co Pty Ltd v FC of T (1965)” explained that repairs and

improvements relating to restoration of thing to a certain condition without changing the

character (Miller and Oats 2016). Repairs done on the premises to remedy the defects caused

by wear and tear or damage by storm are allowed as deduction under “section 25-10 of the

ITAA 1997”. Similarly, the cost of replacing the roof tiles on the investment property will be

treated as deductible under “section 25-10” since it involves restoration of the condition on

the premises that is damaged by storm.

As per the “taxation ruling of TR 97/23” repairs done on the investment property

does not changes necessarily since it was executed at the same time as the improvement

(James and Nobes 2016). If the work accounts to substantial improvement, addition or

alteration is not treated as repair and it is not deductible under “section 25-10 of the ITAA

1997”. The cost of extending the bathroom in rental property is treated as capital expenses

and non-deductible under “section 25-10”.

As per the ATO assets purchase entirely for the business use are treated as allowable

deductions. The purchase of BMW for 100% business use is included for deduction since the

asset is used entirely for the business purpose.

According to the ATO if the business makes any losses in the earlier year they can

carry forward these losses and claim the same as the deduction for those losses in the later

year. The carry forward of $42,000 as the loss from the previous year will be allowed as tax

offset.

the roof, guttering, painting, wall and wooden floor during the year of income when it was

acquired was expenses of capital in nature and non-deductible under “section 25-10”. The

cost of $5,000 for painting the rental property immediately following the purchase will be

treated as capital expenditure and non-deductible under “section 25-10 of the ITAA 1997”.

The court in “W Thomas & Co Pty Ltd v FC of T (1965)” explained that repairs and

improvements relating to restoration of thing to a certain condition without changing the

character (Miller and Oats 2016). Repairs done on the premises to remedy the defects caused

by wear and tear or damage by storm are allowed as deduction under “section 25-10 of the

ITAA 1997”. Similarly, the cost of replacing the roof tiles on the investment property will be

treated as deductible under “section 25-10” since it involves restoration of the condition on

the premises that is damaged by storm.

As per the “taxation ruling of TR 97/23” repairs done on the investment property

does not changes necessarily since it was executed at the same time as the improvement

(James and Nobes 2016). If the work accounts to substantial improvement, addition or

alteration is not treated as repair and it is not deductible under “section 25-10 of the ITAA

1997”. The cost of extending the bathroom in rental property is treated as capital expenses

and non-deductible under “section 25-10”.

As per the ATO assets purchase entirely for the business use are treated as allowable

deductions. The purchase of BMW for 100% business use is included for deduction since the

asset is used entirely for the business purpose.

According to the ATO if the business makes any losses in the earlier year they can

carry forward these losses and claim the same as the deduction for those losses in the later

year. The carry forward of $42,000 as the loss from the previous year will be allowed as tax

offset.

11TAXATION LAW

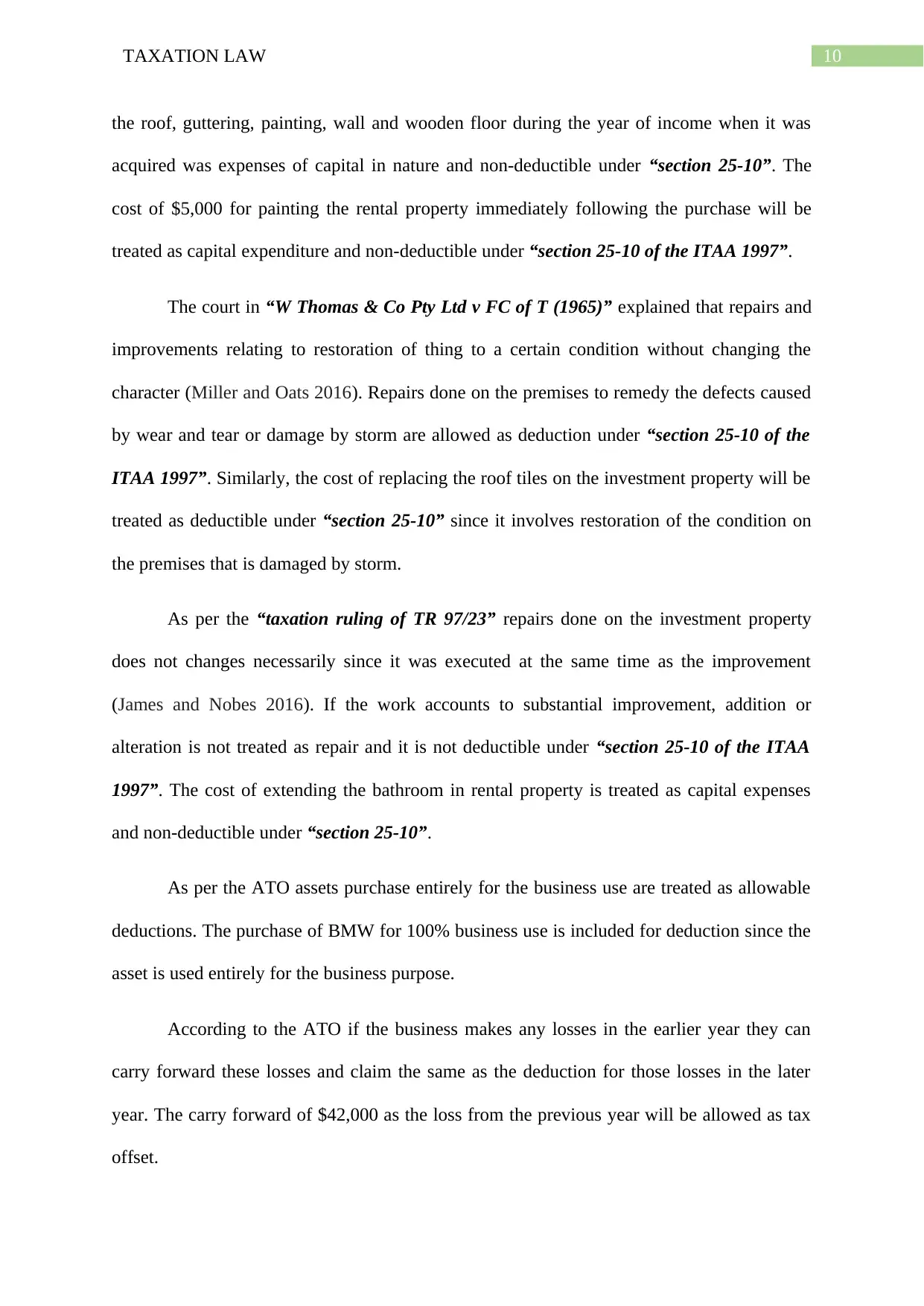

Calculation of Tax Payable

In the Books of Darwin Taxation Services Pty Ltd

For the year ended 30 June 2018

Particulars

Amount

($)

Amount

($)

Receipts Eligible for Assessment

Professional Accounting Fees 600000

Sales of Superannuation guides 25000

Australian sourced dividend income:

Fully franked (net) 8500

Gross up for franking credits (17000 x 50/50) 8500 17000

Australian sourced interest income 5000

Australian sourced rental income 10000

Foreign sourced dividend income (gross of WHT of AUD

150) 1000

Profit on Sale of Office Equipment 2000

Total Assessable Income 660000

Expenses Eligible as Deductions

Office Rent 14000

Cost of Sales (Superannuation Guide) 10000

Salary Paid to Employee 38000

Legal Fees 1000

Rates on Rental Property 2000

Interest on Loan 15000

Cost of replacing the roof tiles 1000

Cost of new BMW 136000

PAYG Instalments 150000

Total Allowable Deductions 367000

Total taxable Income 293000

Tax on Taxable Income @27.5% 80575

Less: Foreign Income tax offset 150

Less: Franking Credit 8500

Less: Carry-forward of Previous year loss 42000

Total tax payable 29925

Answer to question 3:

Partnership cannot be referred as separate legal entity under the general law and does

not pay tax rather it is the partners that pay tax on the profits distributed to them from

partnerships (Zeff 2016). Partnerships should lodge the income tax return to reflect how the

profits that are distributed to the partners are taxed. As per the “section 92 of the ITAA

Calculation of Tax Payable

In the Books of Darwin Taxation Services Pty Ltd

For the year ended 30 June 2018

Particulars

Amount

($)

Amount

($)

Receipts Eligible for Assessment

Professional Accounting Fees 600000

Sales of Superannuation guides 25000

Australian sourced dividend income:

Fully franked (net) 8500

Gross up for franking credits (17000 x 50/50) 8500 17000

Australian sourced interest income 5000

Australian sourced rental income 10000

Foreign sourced dividend income (gross of WHT of AUD

150) 1000

Profit on Sale of Office Equipment 2000

Total Assessable Income 660000

Expenses Eligible as Deductions

Office Rent 14000

Cost of Sales (Superannuation Guide) 10000

Salary Paid to Employee 38000

Legal Fees 1000

Rates on Rental Property 2000

Interest on Loan 15000

Cost of replacing the roof tiles 1000

Cost of new BMW 136000

PAYG Instalments 150000

Total Allowable Deductions 367000

Total taxable Income 293000

Tax on Taxable Income @27.5% 80575

Less: Foreign Income tax offset 150

Less: Franking Credit 8500

Less: Carry-forward of Previous year loss 42000

Total tax payable 29925

Answer to question 3:

Partnership cannot be referred as separate legal entity under the general law and does

not pay tax rather it is the partners that pay tax on the profits distributed to them from

partnerships (Zeff 2016). Partnerships should lodge the income tax return to reflect how the

profits that are distributed to the partners are taxed. As per the “section 92 of the ITAA

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.