Evaluating Financial Health: Cash Cycle, Risks, and Project Viability

VerifiedAdded on 2023/04/04

|6

|1140

|437

Report

AI Summary

This report provides a financial analysis, beginning with an examination of the cash conversion cycle, revealing a negative cycle indicating efficient working capital management. It identifies systematic market risk, technological risk, supply chain risk, foreign exchange fluctuation risk, and interest rate risk. The analysis includes an assessment of a share's performance against market indices, noting an increase in company debt. Bond valuation calculations are performed with and without interest payments. Furthermore, the report evaluates a project using Net Present Value (NPV) analysis, concluding that the project should be undertaken based on its positive NPV and an Internal Rate of Return (IRR) of 8%, which exceeds the cost of capital. The free cash flow calculations supporting the NPV analysis are appended to the report. Desklib offers similar solved assignments and study tools for students.

Contents

ANSWER A.........................................................................................................................................2

ANSWER B.........................................................................................................................................2

ANSWER C.........................................................................................................................................3

PART 1.................................................................................................................................................3

PART (I)...........................................................................................................................................3

PART (II)..........................................................................................................................................3

PART (III).........................................................................................................................................3

PART2..................................................................................................................................................3

PART (I)...........................................................................................................................................3

PART (II)..........................................................................................................................................3

PART (III).........................................................................................................................................4

PART (IV)........................................................................................................................................4

PART(V)...........................................................................................................................................4

ANSWER A.........................................................................................................................................2

ANSWER B.........................................................................................................................................2

ANSWER C.........................................................................................................................................3

PART 1.................................................................................................................................................3

PART (I)...........................................................................................................................................3

PART (II)..........................................................................................................................................3

PART (III).........................................................................................................................................3

PART2..................................................................................................................................................3

PART (I)...........................................................................................................................................3

PART (II)..........................................................................................................................................3

PART (III).........................................................................................................................................4

PART (IV)........................................................................................................................................4

PART(V)...........................................................................................................................................4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

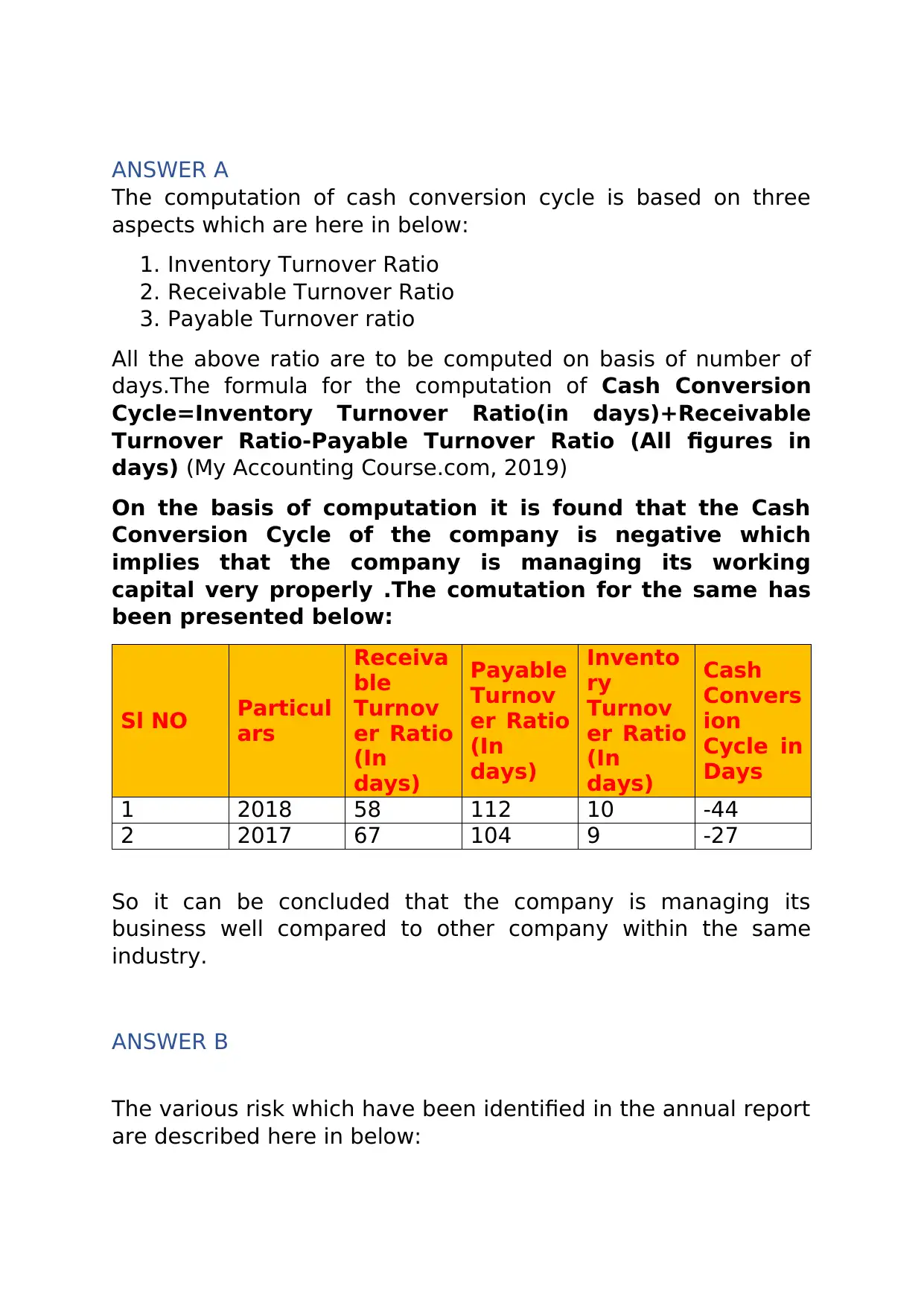

ANSWER A

The computation of cash conversion cycle is based on three

aspects which are here in below:

1. Inventory Turnover Ratio

2. Receivable Turnover Ratio

3. Payable Turnover ratio

All the above ratio are to be computed on basis of number of

days.The formula for the computation of Cash Conversion

Cycle=Inventory Turnover Ratio(in days)+Receivable

Turnover Ratio-Payable Turnover Ratio (All figures in

days) (My Accounting Course.com, 2019)

On the basis of computation it is found that the Cash

Conversion Cycle of the company is negative which

implies that the company is managing its working

capital very properly .The comutation for the same has

been presented below:

Sl NO Particul

ars

Receiva

ble

Turnov

er Ratio

(In

days)

Payable

Turnov

er Ratio

(In

days)

Invento

ry

Turnov

er Ratio

(In

days)

Cash

Convers

ion

Cycle in

Days

1 2018 58 112 10 -44

2 2017 67 104 9 -27

So it can be concluded that the company is managing its

business well compared to other company within the same

industry.

ANSWER B

The various risk which have been identified in the annual report

are described here in below:

The computation of cash conversion cycle is based on three

aspects which are here in below:

1. Inventory Turnover Ratio

2. Receivable Turnover Ratio

3. Payable Turnover ratio

All the above ratio are to be computed on basis of number of

days.The formula for the computation of Cash Conversion

Cycle=Inventory Turnover Ratio(in days)+Receivable

Turnover Ratio-Payable Turnover Ratio (All figures in

days) (My Accounting Course.com, 2019)

On the basis of computation it is found that the Cash

Conversion Cycle of the company is negative which

implies that the company is managing its working

capital very properly .The comutation for the same has

been presented below:

Sl NO Particul

ars

Receiva

ble

Turnov

er Ratio

(In

days)

Payable

Turnov

er Ratio

(In

days)

Invento

ry

Turnov

er Ratio

(In

days)

Cash

Convers

ion

Cycle in

Days

1 2018 58 112 10 -44

2 2017 67 104 9 -27

So it can be concluded that the company is managing its

business well compared to other company within the same

industry.

ANSWER B

The various risk which have been identified in the annual report

are described here in below:

1) Systematic Market Risk:This is a type of risk which arises

due to uncertainty which pertains in market

example:demand for goods,customer needs.

2) Systematic Technological Risk: The change in technology

3) Unsystematic Supply chain Risk: This is a type of risk in

which dependency on middlemen is more involved

4) Systematic Foreign Exchange Fluctuation Risk: Risk

related to fluctuation in currency.

5) Systematic Interest Rate Risk: Change in the yield of

bonds.

ANSWER C

PART 1

PART (I)

The share has outperform the market as it is showing an

upward return compared to other market indices like standard

and poor 500 Index,standard and poor Information Technology

Index and Dow Jones U.S Technology Super Sector Index.

PART (II)

The company debt has considerably been increased from the

past year as can been from the financials of the company.The

percentage increase in debt is considerably more as compared

to the percentage increase in total assets of the company.

PART (III)

If no interest payment to be paid at the end of the year

2020 ,the price of the bond shall be $995.24.If there is a

payment of interest at the end of year than the price of bond

shall be $1040.24.

PART2

Analysis of Net Present Value:

PART (I)

The cost incurred for the purpose of acquisition of land has not

been considered for the purpose of decision making purpose.As

the land cost has already been incurred and if the project is not

due to uncertainty which pertains in market

example:demand for goods,customer needs.

2) Systematic Technological Risk: The change in technology

3) Unsystematic Supply chain Risk: This is a type of risk in

which dependency on middlemen is more involved

4) Systematic Foreign Exchange Fluctuation Risk: Risk

related to fluctuation in currency.

5) Systematic Interest Rate Risk: Change in the yield of

bonds.

ANSWER C

PART 1

PART (I)

The share has outperform the market as it is showing an

upward return compared to other market indices like standard

and poor 500 Index,standard and poor Information Technology

Index and Dow Jones U.S Technology Super Sector Index.

PART (II)

The company debt has considerably been increased from the

past year as can been from the financials of the company.The

percentage increase in debt is considerably more as compared

to the percentage increase in total assets of the company.

PART (III)

If no interest payment to be paid at the end of the year

2020 ,the price of the bond shall be $995.24.If there is a

payment of interest at the end of year than the price of bond

shall be $1040.24.

PART2

Analysis of Net Present Value:

PART (I)

The cost incurred for the purpose of acquisition of land has not

been considered for the purpose of decision making purpose.As

the land cost has already been incurred and if the project is not

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

carried out also the company has to borne such

expenses.Therefore it does not form part of NPV.

PART (II)

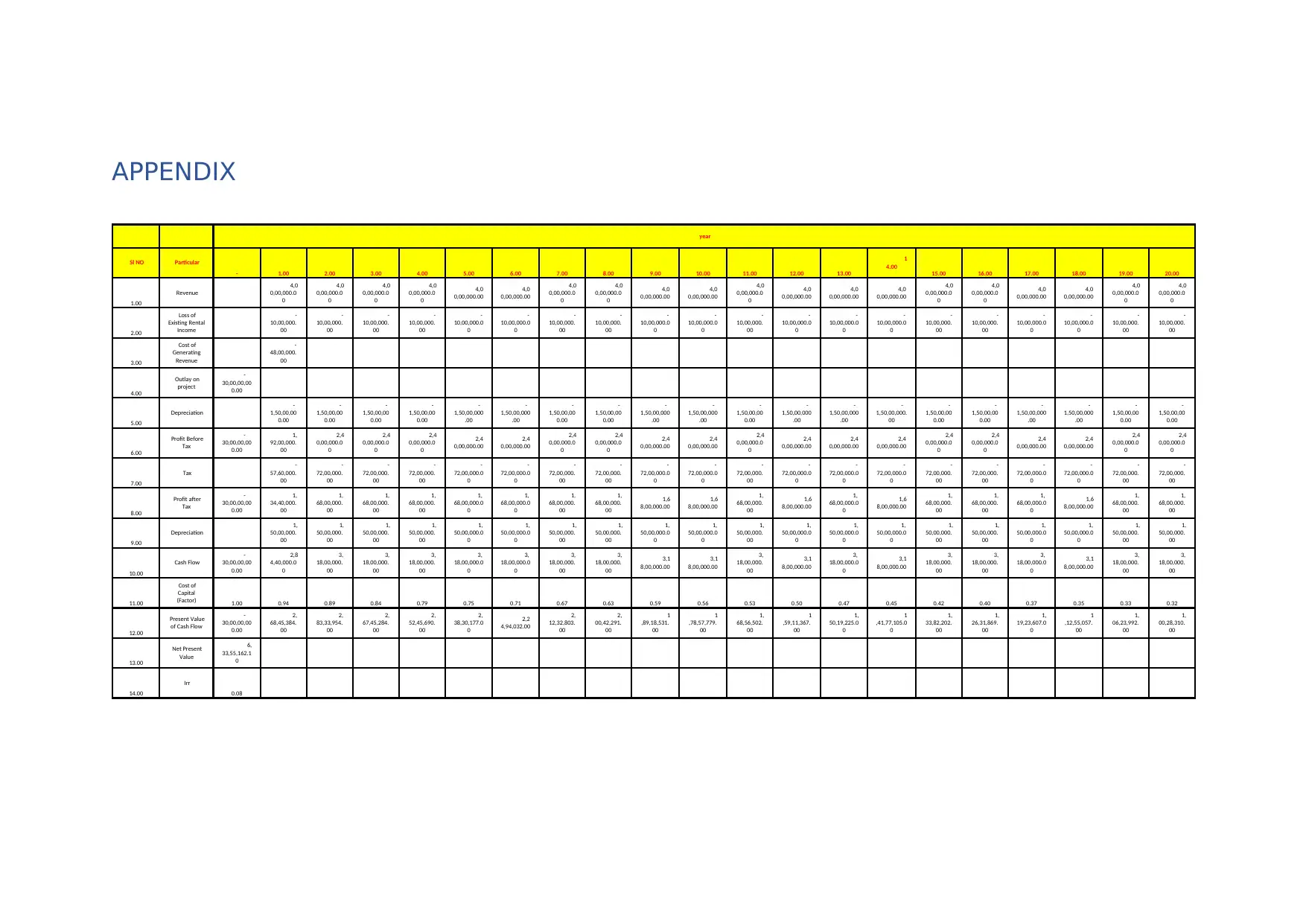

The free cash flow has been shown and attached at the end of

report.

PART (III)

The project should be undertaken by the management of the

company on the basis of research and analysis done.

PART (IV)

The project Internal rate of Return shall be 8 % which is much

higher than the cost of capital of the project.

PART(V)

The management of the company should move ahead with the

decision of building the store based on Net Present Value and

Internal Rate of Return analysis.

References

My Accounting Course.com, 2019. Cash Conversion Cycle. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/cash-conversion-cycle

[Accessed 24 May 2019].

expenses.Therefore it does not form part of NPV.

PART (II)

The free cash flow has been shown and attached at the end of

report.

PART (III)

The project should be undertaken by the management of the

company on the basis of research and analysis done.

PART (IV)

The project Internal rate of Return shall be 8 % which is much

higher than the cost of capital of the project.

PART(V)

The management of the company should move ahead with the

decision of building the store based on Net Present Value and

Internal Rate of Return analysis.

References

My Accounting Course.com, 2019. Cash Conversion Cycle. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/cash-conversion-cycle

[Accessed 24 May 2019].

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

APPENDIX

year

Sl NO Particular

- 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 11.00 12.00 13.00

1

4.00

15.00 16.00 17.00 18.00 19.00 20.00

1.00

Revenue

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.0

0

2.00

Loss of

Existing Rental

Income

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.

00

3.00

Cost of

Generating

Revenue

-

48,00,000.

00

4.00

Outlay on

project

-

30,00,00,00

0.00

5.00

Depreciation

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,000.

00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

6.00

Profit Before

Tax

-

30,00,00,00

0.00

1,

92,00,000.

00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

7.00

Tax

-

57,60,000.

00

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.

00

8.00

Profit after

Tax

-

30,00,00,00

0.00

1,

34,40,000.

00

1,

68,00,000.

00

1,

68,00,000.

00

1,

68,00,000.

00

1,

68,00,000.0

0

1,

68,00,000.0

0

1,

68,00,000.

00

1,

68,00,000.

00

1,6

8,00,000.00

1,6

8,00,000.00

1,

68,00,000.

00

1,6

8,00,000.00

1,

68,00,000.0

0

1,6

8,00,000.00

1,

68,00,000.

00

1,

68,00,000.

00

1,

68,00,000.0

0

1,6

8,00,000.00

1,

68,00,000.

00

1,

68,00,000.

00

9.00

Depreciation

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.

00

10.00

Cash Flow

-

30,00,00,00

0.00

2,8

4,40,000.0

0

3,

18,00,000.

00

3,

18,00,000.

00

3,

18,00,000.

00

3,

18,00,000.0

0

3,

18,00,000.0

0

3,

18,00,000.

00

3,

18,00,000.

00

3,1

8,00,000.00

3,1

8,00,000.00

3,

18,00,000.

00

3,1

8,00,000.00

3,

18,00,000.0

0

3,1

8,00,000.00

3,

18,00,000.

00

3,

18,00,000.

00

3,

18,00,000.0

0

3,1

8,00,000.00

3,

18,00,000.

00

3,

18,00,000.

00

11.00

Cost of

Capital

(Factor) 1.00 0.94 0.89 0.84 0.79 0.75 0.71 0.67 0.63 0.59 0.56 0.53 0.50 0.47 0.45 0.42 0.40 0.37 0.35 0.33 0.32

12.00

Present Value

of Cash Flow

-

30,00,00,00

0.00

2,

68,45,384.

00

2,

83,33,954.

00

2,

67,45,284.

00

2,

52,45,690.

00

2,

38,30,177.0

0

2,2

4,94,032.00

2,

12,32,803.

00

2,

00,42,291.

00

1

,89,18,531.

00

1

,78,57,779.

00

1,

68,56,502.

00

1

,59,11,367.

00

1,

50,19,225.0

0

1

,41,77,105.0

0

1,

33,82,202.

00

1,

26,31,869.

00

1,

19,23,607.0

0

1

,12,55,057.

00

1,

06,23,992.

00

1,

00,28,310.

00

13.00

Net Present

Value

6,

33,55,162.1

0

14.00

Irr

0.08

year

Sl NO Particular

- 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 11.00 12.00 13.00

1

4.00

15.00 16.00 17.00 18.00 19.00 20.00

1.00

Revenue

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.0

0

4,0

0,00,000.00

4,0

0,00,000.00

4,0

0,00,000.0

0

4,0

0,00,000.0

0

2.00

Loss of

Existing Rental

Income

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.

00

-

10,00,000.0

0

-

10,00,000.0

0

-

10,00,000.

00

-

10,00,000.

00

3.00

Cost of

Generating

Revenue

-

48,00,000.

00

4.00

Outlay on

project

-

30,00,00,00

0.00

5.00

Depreciation

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,000.

00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

-

1,50,00,000

.00

-

1,50,00,000

.00

-

1,50,00,00

0.00

-

1,50,00,00

0.00

6.00

Profit Before

Tax

-

30,00,00,00

0.00

1,

92,00,000.

00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

2,4

0,00,000.00

2,4

0,00,000.00

2,4

0,00,000.0

0

2,4

0,00,000.0

0

7.00

Tax

-

57,60,000.

00

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.

00

-

72,00,000.0

0

-

72,00,000.0

0

-

72,00,000.

00

-

72,00,000.

00

8.00

Profit after

Tax

-

30,00,00,00

0.00

1,

34,40,000.

00

1,

68,00,000.

00

1,

68,00,000.

00

1,

68,00,000.

00

1,

68,00,000.0

0

1,

68,00,000.0

0

1,

68,00,000.

00

1,

68,00,000.

00

1,6

8,00,000.00

1,6

8,00,000.00

1,

68,00,000.

00

1,6

8,00,000.00

1,

68,00,000.0

0

1,6

8,00,000.00

1,

68,00,000.

00

1,

68,00,000.

00

1,

68,00,000.0

0

1,6

8,00,000.00

1,

68,00,000.

00

1,

68,00,000.

00

9.00

Depreciation

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.

00

1,

50,00,000.0

0

1,

50,00,000.0

0

1,

50,00,000.

00

1,

50,00,000.

00

10.00

Cash Flow

-

30,00,00,00

0.00

2,8

4,40,000.0

0

3,

18,00,000.

00

3,

18,00,000.

00

3,

18,00,000.

00

3,

18,00,000.0

0

3,

18,00,000.0

0

3,

18,00,000.

00

3,

18,00,000.

00

3,1

8,00,000.00

3,1

8,00,000.00

3,

18,00,000.

00

3,1

8,00,000.00

3,

18,00,000.0

0

3,1

8,00,000.00

3,

18,00,000.

00

3,

18,00,000.

00

3,

18,00,000.0

0

3,1

8,00,000.00

3,

18,00,000.

00

3,

18,00,000.

00

11.00

Cost of

Capital

(Factor) 1.00 0.94 0.89 0.84 0.79 0.75 0.71 0.67 0.63 0.59 0.56 0.53 0.50 0.47 0.45 0.42 0.40 0.37 0.35 0.33 0.32

12.00

Present Value

of Cash Flow

-

30,00,00,00

0.00

2,

68,45,384.

00

2,

83,33,954.

00

2,

67,45,284.

00

2,

52,45,690.

00

2,

38,30,177.0

0

2,2

4,94,032.00

2,

12,32,803.

00

2,

00,42,291.

00

1

,89,18,531.

00

1

,78,57,779.

00

1,

68,56,502.

00

1

,59,11,367.

00

1,

50,19,225.0

0

1

,41,77,105.0

0

1,

33,82,202.

00

1,

26,31,869.

00

1,

19,23,607.0

0

1

,12,55,057.

00

1,

06,23,992.

00

1,

00,28,310.

00

13.00

Net Present

Value

6,

33,55,162.1

0

14.00

Irr

0.08

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.