Detailed Analysis of Cathay Pacific: A Business Research Paper

VerifiedAdded on 2020/04/21

|15

|4152

|700

Report

AI Summary

This research paper provides a comprehensive analysis of Cathay Pacific, a major airline based in Hong Kong. The paper begins with an introduction to Cathay Pacific, detailing its services, history, and market position. A PESTLE analysis is conducted to assess the political, economic, social, technological, legal, and environmental factors influencing the airline's strategic decisions. The report then examines the company's performance from 2013 to 2015 using financial ratios and trend analysis, including profitability, liquidity, and efficiency. Market strategies implemented during these years are also discussed, including cabin upgrades, lounge renovations, and technological advancements. The paper highlights the airline's responses to environmental concerns and its efforts to improve customer experience. The report concludes with an overview of the challenges and opportunities facing Cathay Pacific in the competitive airline industry.

Cathay Pacific 1

A RESEARCH PAPER ON THE CATHAY PACIFIC

A Research Paper on Cathay Pacific By

Student’s Name

Name of the Professor

Institutional Affiliation

City/State

Year/Month/Day

A RESEARCH PAPER ON THE CATHAY PACIFIC

A Research Paper on Cathay Pacific By

Student’s Name

Name of the Professor

Institutional Affiliation

City/State

Year/Month/Day

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cathay Pacific 2

INTRODUCTION

Cathay Pacific is the airline which is enumerated and centered in Hong Kong, giving

scheduled services of cargo and passengers to one hundred and eighty destinations, forty-four

countries and territories. Some of the services of the company are: services of cargo, air

passenger, airline catering, ground handling, passenger handling and services of aircraft

maintenance. The company was founded in 1946 in Hong Kong and has been committed to its

home base investments to improve the economy of the Hong Kong. The airline company has

more than one hundred and forty-six aircrafts and some of its investments are ground handling

companies, catering, and its corporate HQ and the terminal cargo in Hong Kong (Airways,

2017).

Hong Kong dragon airline is a subsidiary owned wholly by the Cathay Pacific operating

forty-two aircrafts and services to fifty-three destinations. The Cathay and the subsidiaries have

more than 34,000 employees worldwide. It is the world's tenth largest airline measured in terms

of sales. In terms of customization, Cathay Pacific airline believes that its size allows it to give

more high quality and personal products (Airways, 2016).

Highlighting its focuses on the services of the customers, airline installed personal videos

in every seat in all the three classes of the aircraft. It also provides three methods of making the

arrangements of travelling to the customers or passengers: local travel agents, a call centre and

the online. The airline gives services of care for different groups of passengers: those with the

special need, young passengers and minors not accompanied. As the regard to its people

advantage, the members of the crew are well qualified and represented in more than sixty

nationalities. Good accessibility is evident in the provision of the aforementioned of three

INTRODUCTION

Cathay Pacific is the airline which is enumerated and centered in Hong Kong, giving

scheduled services of cargo and passengers to one hundred and eighty destinations, forty-four

countries and territories. Some of the services of the company are: services of cargo, air

passenger, airline catering, ground handling, passenger handling and services of aircraft

maintenance. The company was founded in 1946 in Hong Kong and has been committed to its

home base investments to improve the economy of the Hong Kong. The airline company has

more than one hundred and forty-six aircrafts and some of its investments are ground handling

companies, catering, and its corporate HQ and the terminal cargo in Hong Kong (Airways,

2017).

Hong Kong dragon airline is a subsidiary owned wholly by the Cathay Pacific operating

forty-two aircrafts and services to fifty-three destinations. The Cathay and the subsidiaries have

more than 34,000 employees worldwide. It is the world's tenth largest airline measured in terms

of sales. In terms of customization, Cathay Pacific airline believes that its size allows it to give

more high quality and personal products (Airways, 2016).

Highlighting its focuses on the services of the customers, airline installed personal videos

in every seat in all the three classes of the aircraft. It also provides three methods of making the

arrangements of travelling to the customers or passengers: local travel agents, a call centre and

the online. The airline gives services of care for different groups of passengers: those with the

special need, young passengers and minors not accompanied. As the regard to its people

advantage, the members of the crew are well qualified and represented in more than sixty

nationalities. Good accessibility is evident in the provision of the aforementioned of three

Cathay Pacific 3

options to book the services. The Cathay Pacific won the prestigious best marketing campaign

(Dissertation, 2014).

As the industry of airline is increasing it is also affected by an environment like political,

economic, and technologies etc.

Pestle analysis of Cathay Pacific

The pestle analysis comprises six factors from the exterior environment that influence the

decisions of the strategic businesses directly Pacific the legal unfavorable, environmental,

technological, social, economic and political (Dissertation, 2015).

Political

Being the active player in the aviation and airline sector, the companies' decision is

affected largely by the factors of politics. The company cannot bypass the rules of the state and

regulations of any country like security controls and bans on an airline without approval by the

government. The policies of the state are affecting the companies' decisions and the favourable

structure of politics of any countries gives the opportunity for the Cathay Pacific, and

nevertheless, the company have the pre-developed strategy and team to deal with matters of

politics in all the countries (Jim, 2013)

Economical

The decision of the Cathay Pacific are affected largely by economic factors and can even

take the company towards the bankruptcy. The variation of the charges for fuel is the

manipulating issue affecting the performance of the company. Regarding the crisis of 2013-

2014, the main airline was bankrupt because of the increasing prices of fuel and the operating

costs and the recession in the cycle of the economy (Doole, 2015). When the Cathay Pacific

options to book the services. The Cathay Pacific won the prestigious best marketing campaign

(Dissertation, 2014).

As the industry of airline is increasing it is also affected by an environment like political,

economic, and technologies etc.

Pestle analysis of Cathay Pacific

The pestle analysis comprises six factors from the exterior environment that influence the

decisions of the strategic businesses directly Pacific the legal unfavorable, environmental,

technological, social, economic and political (Dissertation, 2015).

Political

Being the active player in the aviation and airline sector, the companies' decision is

affected largely by the factors of politics. The company cannot bypass the rules of the state and

regulations of any country like security controls and bans on an airline without approval by the

government. The policies of the state are affecting the companies' decisions and the favourable

structure of politics of any countries gives the opportunity for the Cathay Pacific, and

nevertheless, the company have the pre-developed strategy and team to deal with matters of

politics in all the countries (Jim, 2013)

Economical

The decision of the Cathay Pacific are affected largely by economic factors and can even

take the company towards the bankruptcy. The variation of the charges for fuel is the

manipulating issue affecting the performance of the company. Regarding the crisis of 2013-

2014, the main airline was bankrupt because of the increasing prices of fuel and the operating

costs and the recession in the cycle of the economy (Doole, 2015). When the Cathay Pacific

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cathay Pacific 4

operates in many countries, the indicators of the economy like the rate of joblessness, interest

rate, the rate of exchange and financial growth rate influence the planned decision of the

company directly. In the study of the airline company, the report of the efficiency of operation is

because of the economic factors resulted in a reduction in restructuring and profitability (Neil,

2012).

Social

Strategic choice of the Cathay Pacific is influenced by social factors. The company run

its operation into many beliefs and having its base in many countries, the policies of the

company, services and correspondences are affected by social factors. It uses the combined

approaches of the global and local company which focused on the giving the customers best the

and also listening to the customers. The initiatives of technology like IT outsourcing and smart

sourcing improves the level of service. The airline also respects the norms of local societies and

peoples values in every country and celebrates the events like public events, Easter, and

Christmas. The company should consider the values, norms and social before working in a given

culture (EMEA, 2013).

Technological

The strategic decision of the airline company is affected by the technological factors. The

company trusts the methodologies of progression for promoting its level of technologies such as

buying equipment technology, upgrading the systems of computers, smart sourcing, and IT

development of infrastructure. Other issues related to technology are contingency plans, the

location of infrastructure IT, technology cost, and availability of the skilled staff and equipment

(Eva, 2015).

operates in many countries, the indicators of the economy like the rate of joblessness, interest

rate, the rate of exchange and financial growth rate influence the planned decision of the

company directly. In the study of the airline company, the report of the efficiency of operation is

because of the economic factors resulted in a reduction in restructuring and profitability (Neil,

2012).

Social

Strategic choice of the Cathay Pacific is influenced by social factors. The company run

its operation into many beliefs and having its base in many countries, the policies of the

company, services and correspondences are affected by social factors. It uses the combined

approaches of the global and local company which focused on the giving the customers best the

and also listening to the customers. The initiatives of technology like IT outsourcing and smart

sourcing improves the level of service. The airline also respects the norms of local societies and

peoples values in every country and celebrates the events like public events, Easter, and

Christmas. The company should consider the values, norms and social before working in a given

culture (EMEA, 2013).

Technological

The strategic decision of the airline company is affected by the technological factors. The

company trusts the methodologies of progression for promoting its level of technologies such as

buying equipment technology, upgrading the systems of computers, smart sourcing, and IT

development of infrastructure. Other issues related to technology are contingency plans, the

location of infrastructure IT, technology cost, and availability of the skilled staff and equipment

(Eva, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cathay Pacific 5

Environmental

The airline industry is affected by environmental factors because of the strict

environmental rules of protection. The Cathay Pacific ensure that operations are not

environmentally affected so its implication is to use the engines of efficient fuel, management of

wastes, recycling, management of noise and engagement in the activities of protecting the

environment. The Cathay Pacific doesn't use the aeroplanes that cause pollution and produces

high emissions of carbon (Wendy, 2013). A market that is more profitable boosts competition

levels. In this effort, firms will enter the market to take the shares of some markets away. The

region of Asia Pacific is the example of the market of dynamic where the tourisms of the

outbound enjoys rising growth of around 7.9% outbound with 25% in 2014. All the airlines in

the regions before the current crisis of finance were getting more profits

Legal

The Cathay Pacific follows the legal regulations and rules based in Hong Kong and other

countries. Being the player globally, most of the laws of flight, business laws of international,

airport laws, laws of protection of the customer, safety laws, exchange and security commissions

laws, laws of the environment and many laws of regulation. It reflects the lawful outline of

domestic and international before making the plans of strategic (General Books LLC, 2016).

Sustainability

It is stated that high prices of fuel and rising shortages of natural resources are facing

manufacturers to make vehicle for more eco-friendly and smaller. The environment has been

destroyed by the climate change and global warming and industry of airline has been the issue of

the source of fast growing of emission of greenhouse gases. Airlines have countered the

Environmental

The airline industry is affected by environmental factors because of the strict

environmental rules of protection. The Cathay Pacific ensure that operations are not

environmentally affected so its implication is to use the engines of efficient fuel, management of

wastes, recycling, management of noise and engagement in the activities of protecting the

environment. The Cathay Pacific doesn't use the aeroplanes that cause pollution and produces

high emissions of carbon (Wendy, 2013). A market that is more profitable boosts competition

levels. In this effort, firms will enter the market to take the shares of some markets away. The

region of Asia Pacific is the example of the market of dynamic where the tourisms of the

outbound enjoys rising growth of around 7.9% outbound with 25% in 2014. All the airlines in

the regions before the current crisis of finance were getting more profits

Legal

The Cathay Pacific follows the legal regulations and rules based in Hong Kong and other

countries. Being the player globally, most of the laws of flight, business laws of international,

airport laws, laws of protection of the customer, safety laws, exchange and security commissions

laws, laws of the environment and many laws of regulation. It reflects the lawful outline of

domestic and international before making the plans of strategic (General Books LLC, 2016).

Sustainability

It is stated that high prices of fuel and rising shortages of natural resources are facing

manufacturers to make vehicle for more eco-friendly and smaller. The environment has been

destroyed by the climate change and global warming and industry of airline has been the issue of

the source of fast growing of emission of greenhouse gases. Airlines have countered the

Cathay Pacific 6

environmentalist pressure with denials and relation of public about their green credentials.

Airlines are working smarts to develop jets of biofuel. Airlines should enter the partnership of

environment with the builders of aircraft for eco-friendly aircrafts, quieter takeoffs and landings,

substantially decrease the impacts of the environment (Hong, 2014).

Comparisons of the performance of Cathay Pacific in the year 2013, 2014 and 2015

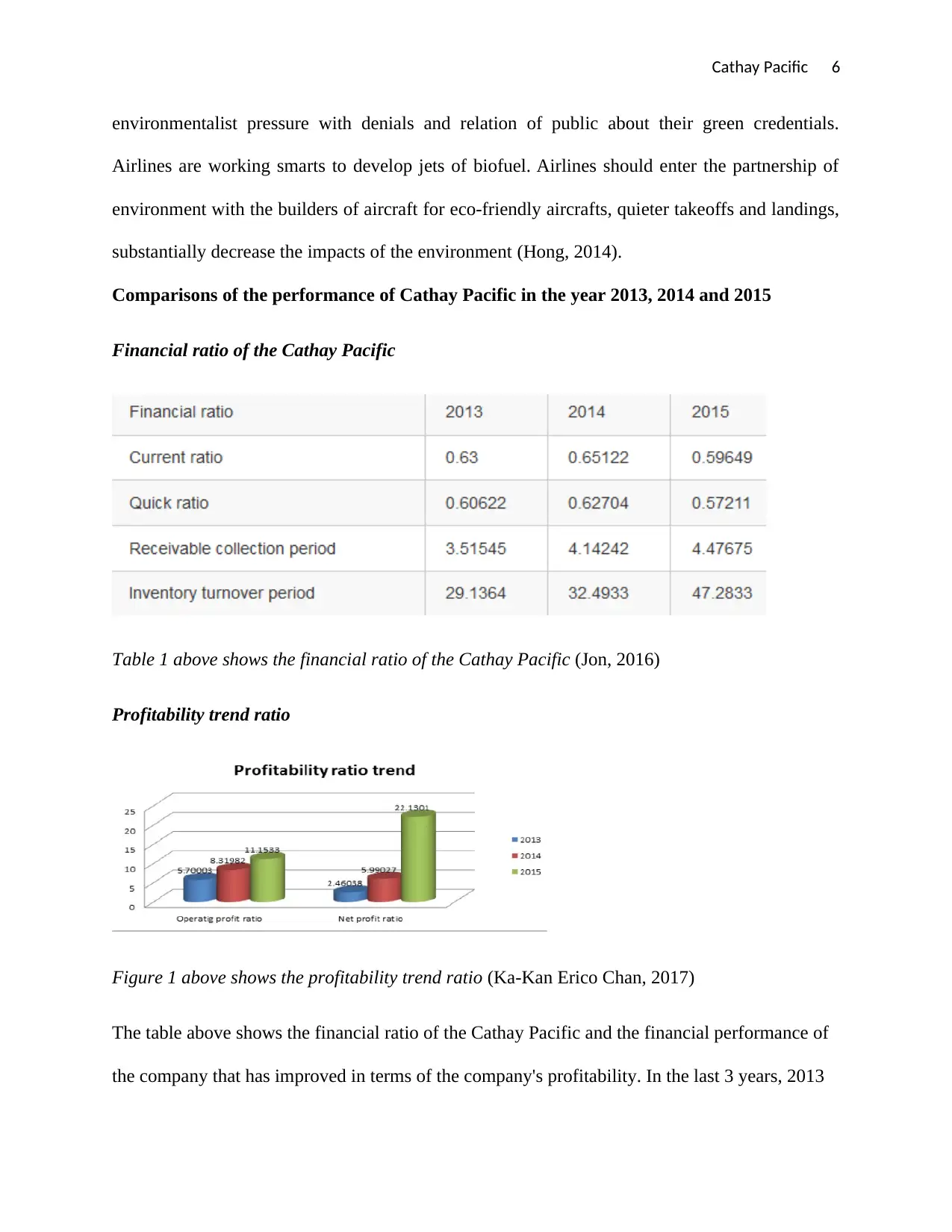

Financial ratio of the Cathay Pacific

Table 1 above shows the financial ratio of the Cathay Pacific (Jon, 2016)

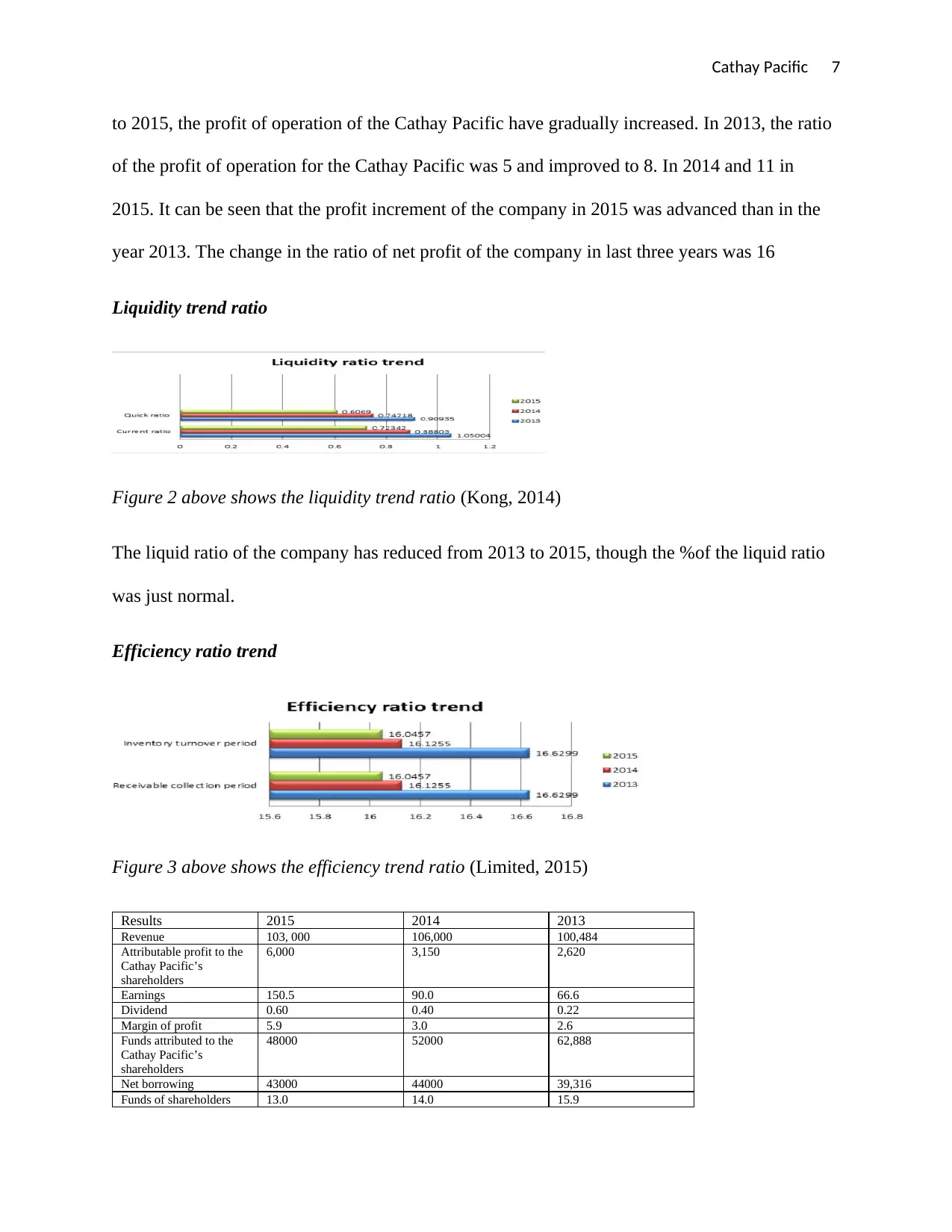

Profitability trend ratio

Figure 1 above shows the profitability trend ratio (Ka-Kan Erico Chan, 2017)

The table above shows the financial ratio of the Cathay Pacific and the financial performance of

the company that has improved in terms of the company's profitability. In the last 3 years, 2013

environmentalist pressure with denials and relation of public about their green credentials.

Airlines are working smarts to develop jets of biofuel. Airlines should enter the partnership of

environment with the builders of aircraft for eco-friendly aircrafts, quieter takeoffs and landings,

substantially decrease the impacts of the environment (Hong, 2014).

Comparisons of the performance of Cathay Pacific in the year 2013, 2014 and 2015

Financial ratio of the Cathay Pacific

Table 1 above shows the financial ratio of the Cathay Pacific (Jon, 2016)

Profitability trend ratio

Figure 1 above shows the profitability trend ratio (Ka-Kan Erico Chan, 2017)

The table above shows the financial ratio of the Cathay Pacific and the financial performance of

the company that has improved in terms of the company's profitability. In the last 3 years, 2013

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cathay Pacific 7

to 2015, the profit of operation of the Cathay Pacific have gradually increased. In 2013, the ratio

of the profit of operation for the Cathay Pacific was 5 and improved to 8. In 2014 and 11 in

2015. It can be seen that the profit increment of the company in 2015 was advanced than in the

year 2013. The change in the ratio of net profit of the company in last three years was 16

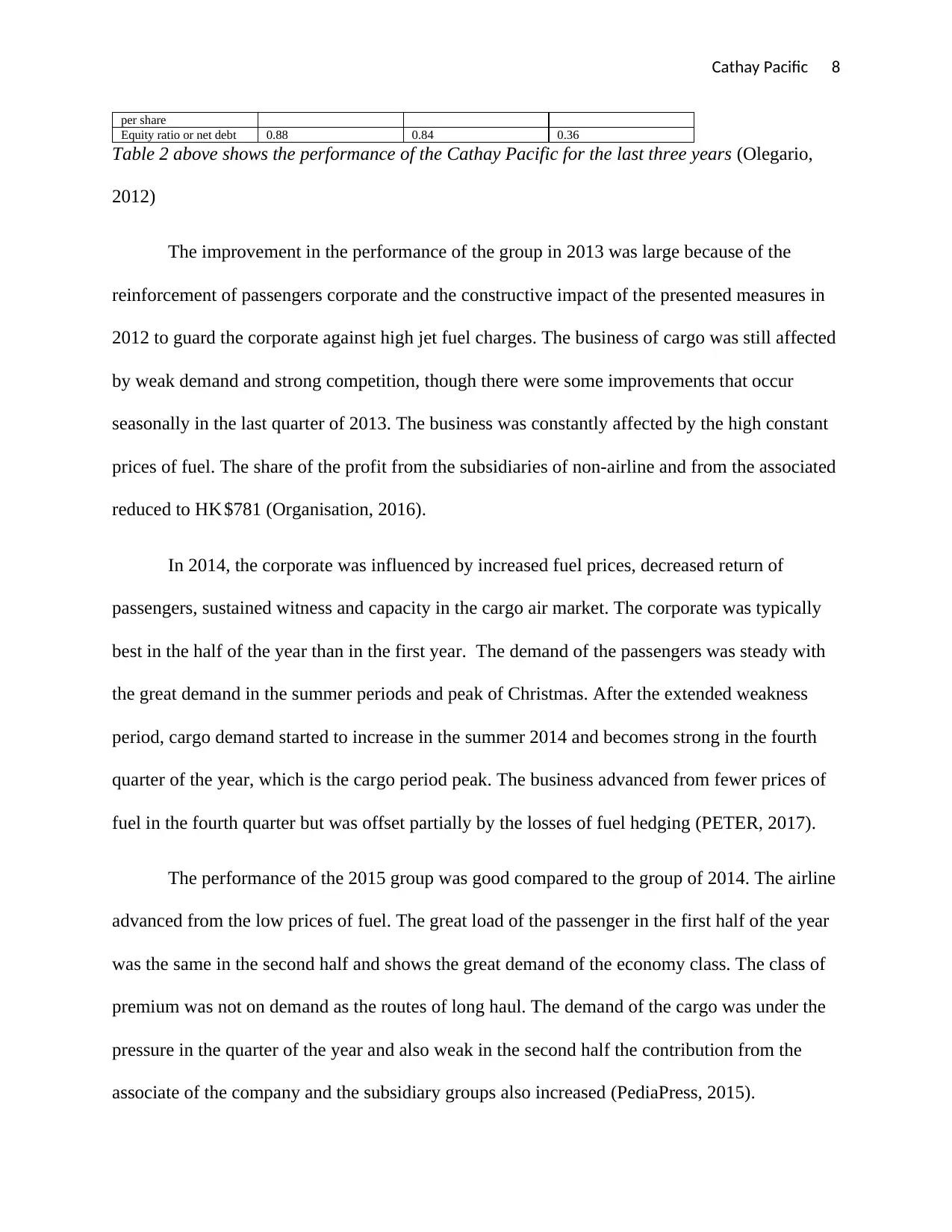

Liquidity trend ratio

Figure 2 above shows the liquidity trend ratio (Kong, 2014)

The liquid ratio of the company has reduced from 2013 to 2015, though the %of the liquid ratio

was just normal.

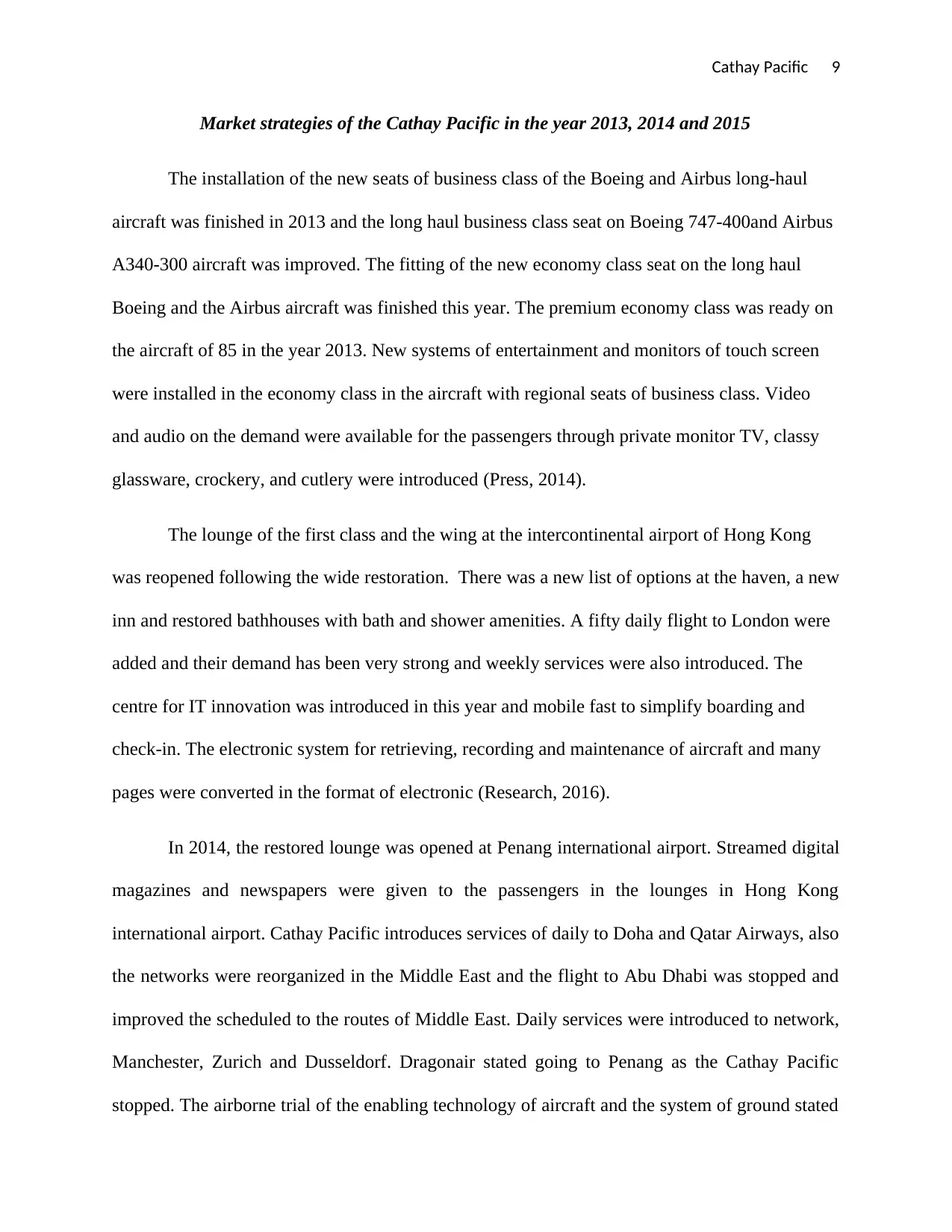

Efficiency ratio trend

Figure 3 above shows the efficiency trend ratio (Limited, 2015)

Results 2015 2014 2013

Revenue 103, 000 106,000 100,484

Attributable profit to the

Cathay Pacific’s

shareholders

6,000 3,150 2,620

Earnings 150.5 90.0 66.6

Dividend 0.60 0.40 0.22

Margin of profit 5.9 3.0 2.6

Funds attributed to the

Cathay Pacific’s

shareholders

48000 52000 62,888

Net borrowing 43000 44000 39,316

Funds of shareholders 13.0 14.0 15.9

to 2015, the profit of operation of the Cathay Pacific have gradually increased. In 2013, the ratio

of the profit of operation for the Cathay Pacific was 5 and improved to 8. In 2014 and 11 in

2015. It can be seen that the profit increment of the company in 2015 was advanced than in the

year 2013. The change in the ratio of net profit of the company in last three years was 16

Liquidity trend ratio

Figure 2 above shows the liquidity trend ratio (Kong, 2014)

The liquid ratio of the company has reduced from 2013 to 2015, though the %of the liquid ratio

was just normal.

Efficiency ratio trend

Figure 3 above shows the efficiency trend ratio (Limited, 2015)

Results 2015 2014 2013

Revenue 103, 000 106,000 100,484

Attributable profit to the

Cathay Pacific’s

shareholders

6,000 3,150 2,620

Earnings 150.5 90.0 66.6

Dividend 0.60 0.40 0.22

Margin of profit 5.9 3.0 2.6

Funds attributed to the

Cathay Pacific’s

shareholders

48000 52000 62,888

Net borrowing 43000 44000 39,316

Funds of shareholders 13.0 14.0 15.9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cathay Pacific 8

per share

Equity ratio or net debt 0.88 0.84 0.36

Table 2 above shows the performance of the Cathay Pacific for the last three years (Olegario,

2012)

The improvement in the performance of the group in 2013 was large because of the

reinforcement of passengers corporate and the constructive impact of the presented measures in

2012 to guard the corporate against high jet fuel charges. The business of cargo was still affected

by weak demand and strong competition, though there were some improvements that occur

seasonally in the last quarter of 2013. The business was constantly affected by the high constant

prices of fuel. The share of the profit from the subsidiaries of non-airline and from the associated

reduced to HK $781 (Organisation, 2016).

In 2014, the corporate was influenced by increased fuel prices, decreased return of

passengers, sustained witness and capacity in the cargo air market. The corporate was typically

best in the half of the year than in the first year. The demand of the passengers was steady with

the great demand in the summer periods and peak of Christmas. After the extended weakness

period, cargo demand started to increase in the summer 2014 and becomes strong in the fourth

quarter of the year, which is the cargo period peak. The business advanced from fewer prices of

fuel in the fourth quarter but was offset partially by the losses of fuel hedging (PETER, 2017).

The performance of the 2015 group was good compared to the group of 2014. The airline

advanced from the low prices of fuel. The great load of the passenger in the first half of the year

was the same in the second half and shows the great demand of the economy class. The class of

premium was not on demand as the routes of long haul. The demand of the cargo was under the

pressure in the quarter of the year and also weak in the second half the contribution from the

associate of the company and the subsidiary groups also increased (PediaPress, 2015).

per share

Equity ratio or net debt 0.88 0.84 0.36

Table 2 above shows the performance of the Cathay Pacific for the last three years (Olegario,

2012)

The improvement in the performance of the group in 2013 was large because of the

reinforcement of passengers corporate and the constructive impact of the presented measures in

2012 to guard the corporate against high jet fuel charges. The business of cargo was still affected

by weak demand and strong competition, though there were some improvements that occur

seasonally in the last quarter of 2013. The business was constantly affected by the high constant

prices of fuel. The share of the profit from the subsidiaries of non-airline and from the associated

reduced to HK $781 (Organisation, 2016).

In 2014, the corporate was influenced by increased fuel prices, decreased return of

passengers, sustained witness and capacity in the cargo air market. The corporate was typically

best in the half of the year than in the first year. The demand of the passengers was steady with

the great demand in the summer periods and peak of Christmas. After the extended weakness

period, cargo demand started to increase in the summer 2014 and becomes strong in the fourth

quarter of the year, which is the cargo period peak. The business advanced from fewer prices of

fuel in the fourth quarter but was offset partially by the losses of fuel hedging (PETER, 2017).

The performance of the 2015 group was good compared to the group of 2014. The airline

advanced from the low prices of fuel. The great load of the passenger in the first half of the year

was the same in the second half and shows the great demand of the economy class. The class of

premium was not on demand as the routes of long haul. The demand of the cargo was under the

pressure in the quarter of the year and also weak in the second half the contribution from the

associate of the company and the subsidiary groups also increased (PediaPress, 2015).

Cathay Pacific 9

Market strategies of the Cathay Pacific in the year 2013, 2014 and 2015

The installation of the new seats of business class of the Boeing and Airbus long-haul

aircraft was finished in 2013 and the long haul business class seat on Boeing 747-400and Airbus

A340-300 aircraft was improved. The fitting of the new economy class seat on the long haul

Boeing and the Airbus aircraft was finished this year. The premium economy class was ready on

the aircraft of 85 in the year 2013. New systems of entertainment and monitors of touch screen

were installed in the economy class in the aircraft with regional seats of business class. Video

and audio on the demand were available for the passengers through private monitor TV, classy

glassware, crockery, and cutlery were introduced (Press, 2014).

The lounge of the first class and the wing at the intercontinental airport of Hong Kong

was reopened following the wide restoration. There was a new list of options at the haven, a new

inn and restored bathhouses with bath and shower amenities. A fifty daily flight to London were

added and their demand has been very strong and weekly services were also introduced. The

centre for IT innovation was introduced in this year and mobile fast to simplify boarding and

check-in. The electronic system for retrieving, recording and maintenance of aircraft and many

pages were converted in the format of electronic (Research, 2016).

In 2014, the restored lounge was opened at Penang international airport. Streamed digital

magazines and newspapers were given to the passengers in the lounges in Hong Kong

international airport. Cathay Pacific introduces services of daily to Doha and Qatar Airways, also

the networks were reorganized in the Middle East and the flight to Abu Dhabi was stopped and

improved the scheduled to the routes of Middle East. Daily services were introduced to network,

Manchester, Zurich and Dusseldorf. Dragonair stated going to Penang as the Cathay Pacific

stopped. The airborne trial of the enabling technology of aircraft and the system of ground stated

Market strategies of the Cathay Pacific in the year 2013, 2014 and 2015

The installation of the new seats of business class of the Boeing and Airbus long-haul

aircraft was finished in 2013 and the long haul business class seat on Boeing 747-400and Airbus

A340-300 aircraft was improved. The fitting of the new economy class seat on the long haul

Boeing and the Airbus aircraft was finished this year. The premium economy class was ready on

the aircraft of 85 in the year 2013. New systems of entertainment and monitors of touch screen

were installed in the economy class in the aircraft with regional seats of business class. Video

and audio on the demand were available for the passengers through private monitor TV, classy

glassware, crockery, and cutlery were introduced (Press, 2014).

The lounge of the first class and the wing at the intercontinental airport of Hong Kong

was reopened following the wide restoration. There was a new list of options at the haven, a new

inn and restored bathhouses with bath and shower amenities. A fifty daily flight to London were

added and their demand has been very strong and weekly services were also introduced. The

centre for IT innovation was introduced in this year and mobile fast to simplify boarding and

check-in. The electronic system for retrieving, recording and maintenance of aircraft and many

pages were converted in the format of electronic (Research, 2016).

In 2014, the restored lounge was opened at Penang international airport. Streamed digital

magazines and newspapers were given to the passengers in the lounges in Hong Kong

international airport. Cathay Pacific introduces services of daily to Doha and Qatar Airways, also

the networks were reorganized in the Middle East and the flight to Abu Dhabi was stopped and

improved the scheduled to the routes of Middle East. Daily services were introduced to network,

Manchester, Zurich and Dusseldorf. Dragonair stated going to Penang as the Cathay Pacific

stopped. The airborne trial of the enabling technology of aircraft and the system of ground stated

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cathay Pacific 10

in 2014, the technology facilitates the working practices improvement and reduces the operation

costs (Research, 2016).

“Live” television channels, was launched for the passengers to stay well-informed of the

worldwide newscast, sporting from the skies and extended access to the cheap connectivity of

great speediness for passengers in each cabin. The passengers were able to surf the internet and

stay in touch with individuals on their private diplomacies (Press, 2014). The services of

chauffeur-drive were expanded across all network, carrying out about one million trips in 2014,

and carrying 23% more first-class customers from and to the airport compared to 2013. At the

airport, practice planned holes-in-the-wall were coupled with software to restore the check-in

procedure

In 2015, the mobile application was introduced that enabled the blocking of the flight on

the mobile phone and also the content of the website of the airline was improved this year.

Catering system of cloud-based was introduced to improve the efficiency and productivity and

facilitate the catering improvements in the future. Tablets were given to the cabin crew of the

airline to provide the information that gives more personalized and consistent experience of

travel to the passengers. Bag drop of self-service and facility of kiosk tagging bag were

introduced and new systems were established to replace the system of booking, also the system

that deals with the passengers’ complaints were introduced.

The app was launched for iPad and iPhone, to enable consumers to accomplish each

feature of their tourism with the Cathay Pacific whether the reservation, meals and seat selection

(Vicky, 2017).

in 2014, the technology facilitates the working practices improvement and reduces the operation

costs (Research, 2016).

“Live” television channels, was launched for the passengers to stay well-informed of the

worldwide newscast, sporting from the skies and extended access to the cheap connectivity of

great speediness for passengers in each cabin. The passengers were able to surf the internet and

stay in touch with individuals on their private diplomacies (Press, 2014). The services of

chauffeur-drive were expanded across all network, carrying out about one million trips in 2014,

and carrying 23% more first-class customers from and to the airport compared to 2013. At the

airport, practice planned holes-in-the-wall were coupled with software to restore the check-in

procedure

In 2015, the mobile application was introduced that enabled the blocking of the flight on

the mobile phone and also the content of the website of the airline was improved this year.

Catering system of cloud-based was introduced to improve the efficiency and productivity and

facilitate the catering improvements in the future. Tablets were given to the cabin crew of the

airline to provide the information that gives more personalized and consistent experience of

travel to the passengers. Bag drop of self-service and facility of kiosk tagging bag were

introduced and new systems were established to replace the system of booking, also the system

that deals with the passengers’ complaints were introduced.

The app was launched for iPad and iPhone, to enable consumers to accomplish each

feature of their tourism with the Cathay Pacific whether the reservation, meals and seat selection

(Vicky, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cathay Pacific 11

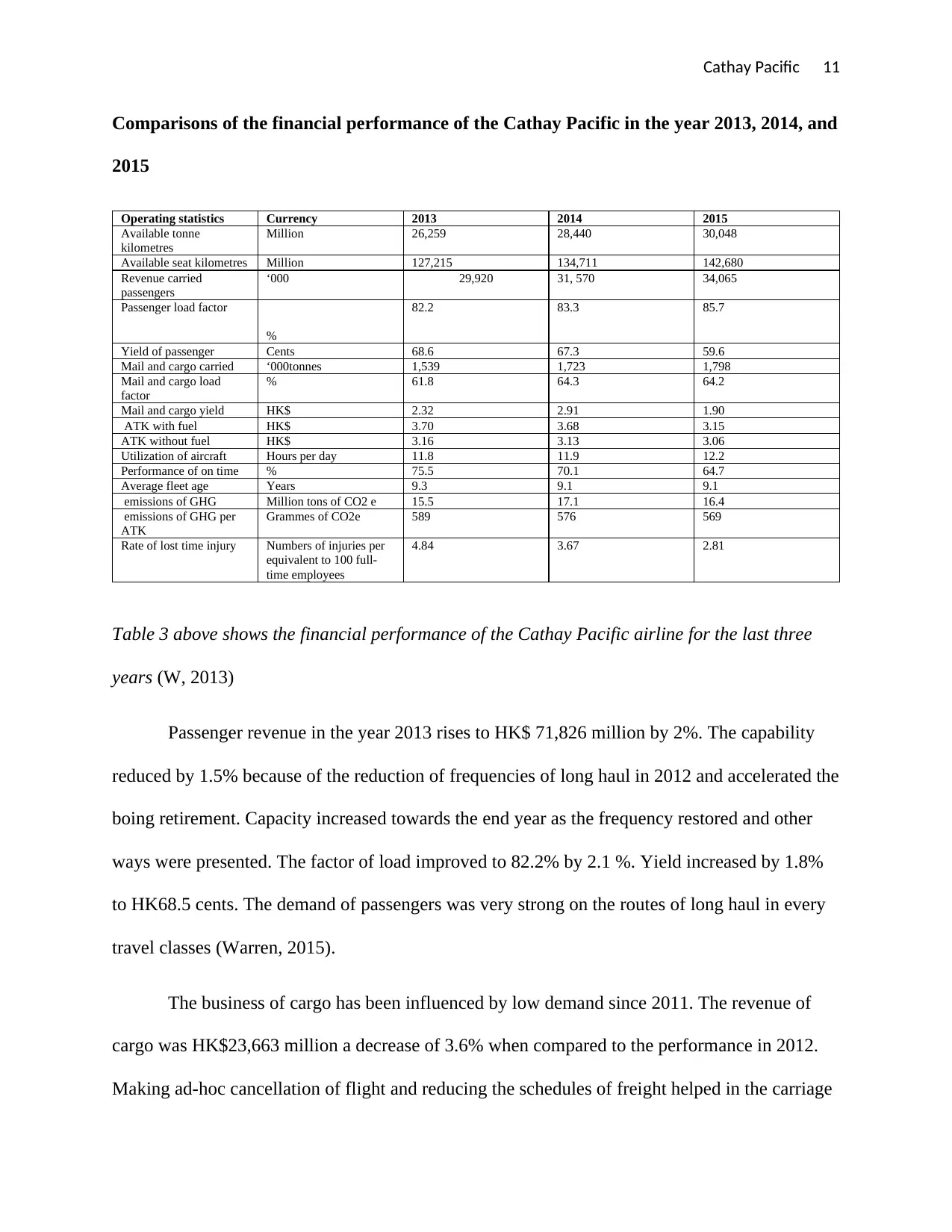

Comparisons of the financial performance of the Cathay Pacific in the year 2013, 2014, and

2015

Operating statistics Currency 2013 2014 2015

Available tonne

kilometres

Million 26,259 28,440 30,048

Available seat kilometres Million 127,215 134,711 142,680

Revenue carried

passengers

‘000 29,920 31, 570 34,065

Passenger load factor

%

82.2 83.3 85.7

Yield of passenger Cents 68.6 67.3 59.6

Mail and cargo carried ‘000tonnes 1,539 1,723 1,798

Mail and cargo load

factor

% 61.8 64.3 64.2

Mail and cargo yield HK$ 2.32 2.91 1.90

ATK with fuel HK$ 3.70 3.68 3.15

ATK without fuel HK$ 3.16 3.13 3.06

Utilization of aircraft Hours per day 11.8 11.9 12.2

Performance of on time % 75.5 70.1 64.7

Average fleet age Years 9.3 9.1 9.1

emissions of GHG Million tons of CO2 e 15.5 17.1 16.4

emissions of GHG per

ATK

Grammes of CO2e 589 576 569

Rate of lost time injury Numbers of injuries per

equivalent to 100 full-

time employees

4.84 3.67 2.81

Table 3 above shows the financial performance of the Cathay Pacific airline for the last three

years (W, 2013)

Passenger revenue in the year 2013 rises to HK$ 71,826 million by 2%. The capability

reduced by 1.5% because of the reduction of frequencies of long haul in 2012 and accelerated the

boing retirement. Capacity increased towards the end year as the frequency restored and other

ways were presented. The factor of load improved to 82.2% by 2.1 %. Yield increased by 1.8%

to HK68.5 cents. The demand of passengers was very strong on the routes of long haul in every

travel classes (Warren, 2015).

The business of cargo has been influenced by low demand since 2011. The revenue of

cargo was HK$23,663 million a decrease of 3.6% when compared to the performance in 2012.

Making ad-hoc cancellation of flight and reducing the schedules of freight helped in the carriage

Comparisons of the financial performance of the Cathay Pacific in the year 2013, 2014, and

2015

Operating statistics Currency 2013 2014 2015

Available tonne

kilometres

Million 26,259 28,440 30,048

Available seat kilometres Million 127,215 134,711 142,680

Revenue carried

passengers

‘000 29,920 31, 570 34,065

Passenger load factor

%

82.2 83.3 85.7

Yield of passenger Cents 68.6 67.3 59.6

Mail and cargo carried ‘000tonnes 1,539 1,723 1,798

Mail and cargo load

factor

% 61.8 64.3 64.2

Mail and cargo yield HK$ 2.32 2.91 1.90

ATK with fuel HK$ 3.70 3.68 3.15

ATK without fuel HK$ 3.16 3.13 3.06

Utilization of aircraft Hours per day 11.8 11.9 12.2

Performance of on time % 75.5 70.1 64.7

Average fleet age Years 9.3 9.1 9.1

emissions of GHG Million tons of CO2 e 15.5 17.1 16.4

emissions of GHG per

ATK

Grammes of CO2e 589 576 569

Rate of lost time injury Numbers of injuries per

equivalent to 100 full-

time employees

4.84 3.67 2.81

Table 3 above shows the financial performance of the Cathay Pacific airline for the last three

years (W, 2013)

Passenger revenue in the year 2013 rises to HK$ 71,826 million by 2%. The capability

reduced by 1.5% because of the reduction of frequencies of long haul in 2012 and accelerated the

boing retirement. Capacity increased towards the end year as the frequency restored and other

ways were presented. The factor of load improved to 82.2% by 2.1 %. Yield increased by 1.8%

to HK68.5 cents. The demand of passengers was very strong on the routes of long haul in every

travel classes (Warren, 2015).

The business of cargo has been influenced by low demand since 2011. The revenue of

cargo was HK$23,663 million a decrease of 3.6% when compared to the performance in 2012.

Making ad-hoc cancellation of flight and reducing the schedules of freight helped in the carriage

Cathay Pacific 12

of more cargo in the passenger aircraft. The price of fuel of jet accounts for 39% of the total cost

of operation in 2013. The groups’ fuel in 2013 reduced by 4.6% as compared to 2012 as an

outcome of outline measures of 2012 like changing the schedule, capacity reduction, older

withdrawal and less efficient aircraft (Young, 2014).

The revenue of the passenger group for 2014 improved to HK$ 75,734 million by 5%.

Capacity rises by 5.9% because of the establishment of other routes and raised regularities of

available routes. The factor of the load improved by points of 1.1 % to 31.6 million. Yield

reduced to HK 67.3 cents by 1.8 percent. After the longtime of weakness, the demand for cargo

improves in the summer of the year 2014 and become so strong in the fourth quarter of the year.

The revenue of the group cargo rises to HK$25,000 million by 7.3% compared to 2013. In 2014,

the cost of fuel rises by 0.7 percent compared to the previous year, importantly below the cargo

and passenger capacity increase of 5.9 and 10.4 percent. The consumption of fuel was high

because many flights were being operated but this problem ended by the introduction of aircraft

of less fuel efficient (Airways, 2017).

Overcapacity in the market cargo put the compression on the first year’s rates. The rates

improved in the second half due to the demand improve or the shipment from the mainland

China and Hong Kong. The carried tonnage rises by around 12percent compared to the previous

year. The revenue of the passenger group in 2015 was HK$ 73,000 million, a reduction of 3.5

when compared to 2014. There was the increase in capacity because of the introduction of the

new route and the frequency increase in the routes. The load factor increased by 2.4% to 85%.

Stiff competition, a reduction in the surcharges fuel, unfavorable currencies and the fact that the

Hong Kong was used by the passengers to connect put the downward pressure on the yield that

reduced by 11 percent (Airways, 2016).

of more cargo in the passenger aircraft. The price of fuel of jet accounts for 39% of the total cost

of operation in 2013. The groups’ fuel in 2013 reduced by 4.6% as compared to 2012 as an

outcome of outline measures of 2012 like changing the schedule, capacity reduction, older

withdrawal and less efficient aircraft (Young, 2014).

The revenue of the passenger group for 2014 improved to HK$ 75,734 million by 5%.

Capacity rises by 5.9% because of the establishment of other routes and raised regularities of

available routes. The factor of the load improved by points of 1.1 % to 31.6 million. Yield

reduced to HK 67.3 cents by 1.8 percent. After the longtime of weakness, the demand for cargo

improves in the summer of the year 2014 and become so strong in the fourth quarter of the year.

The revenue of the group cargo rises to HK$25,000 million by 7.3% compared to 2013. In 2014,

the cost of fuel rises by 0.7 percent compared to the previous year, importantly below the cargo

and passenger capacity increase of 5.9 and 10.4 percent. The consumption of fuel was high

because many flights were being operated but this problem ended by the introduction of aircraft

of less fuel efficient (Airways, 2017).

Overcapacity in the market cargo put the compression on the first year’s rates. The rates

improved in the second half due to the demand improve or the shipment from the mainland

China and Hong Kong. The carried tonnage rises by around 12percent compared to the previous

year. The revenue of the passenger group in 2015 was HK$ 73,000 million, a reduction of 3.5

when compared to 2014. There was the increase in capacity because of the introduction of the

new route and the frequency increase in the routes. The load factor increased by 2.4% to 85%.

Stiff competition, a reduction in the surcharges fuel, unfavorable currencies and the fact that the

Hong Kong was used by the passengers to connect put the downward pressure on the yield that

reduced by 11 percent (Airways, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.