MBA600: Strategic Analysis of Organizational Culture at CBA - Report

VerifiedAdded on 2023/01/17

|16

|1130

|26

Report

AI Summary

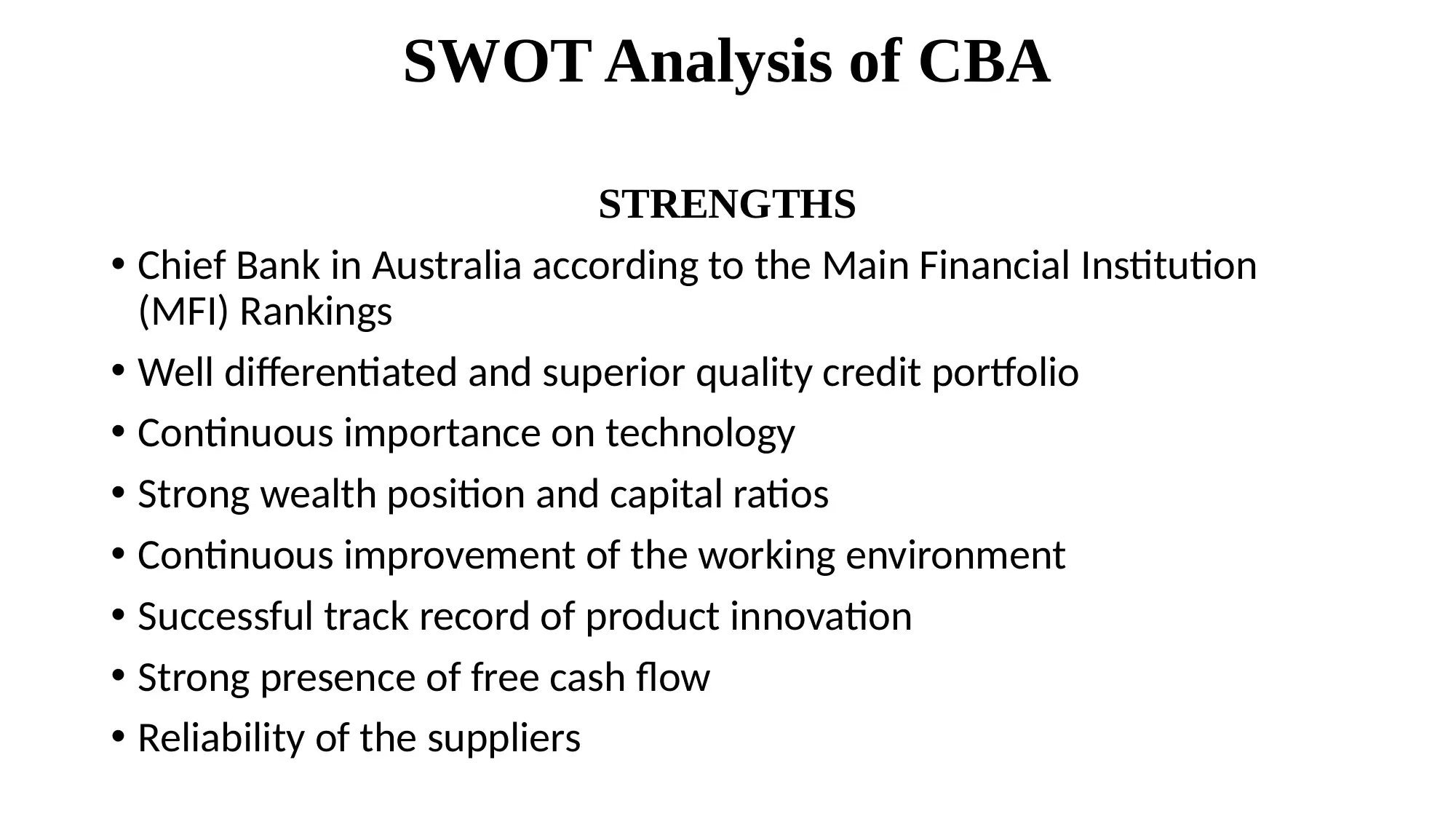

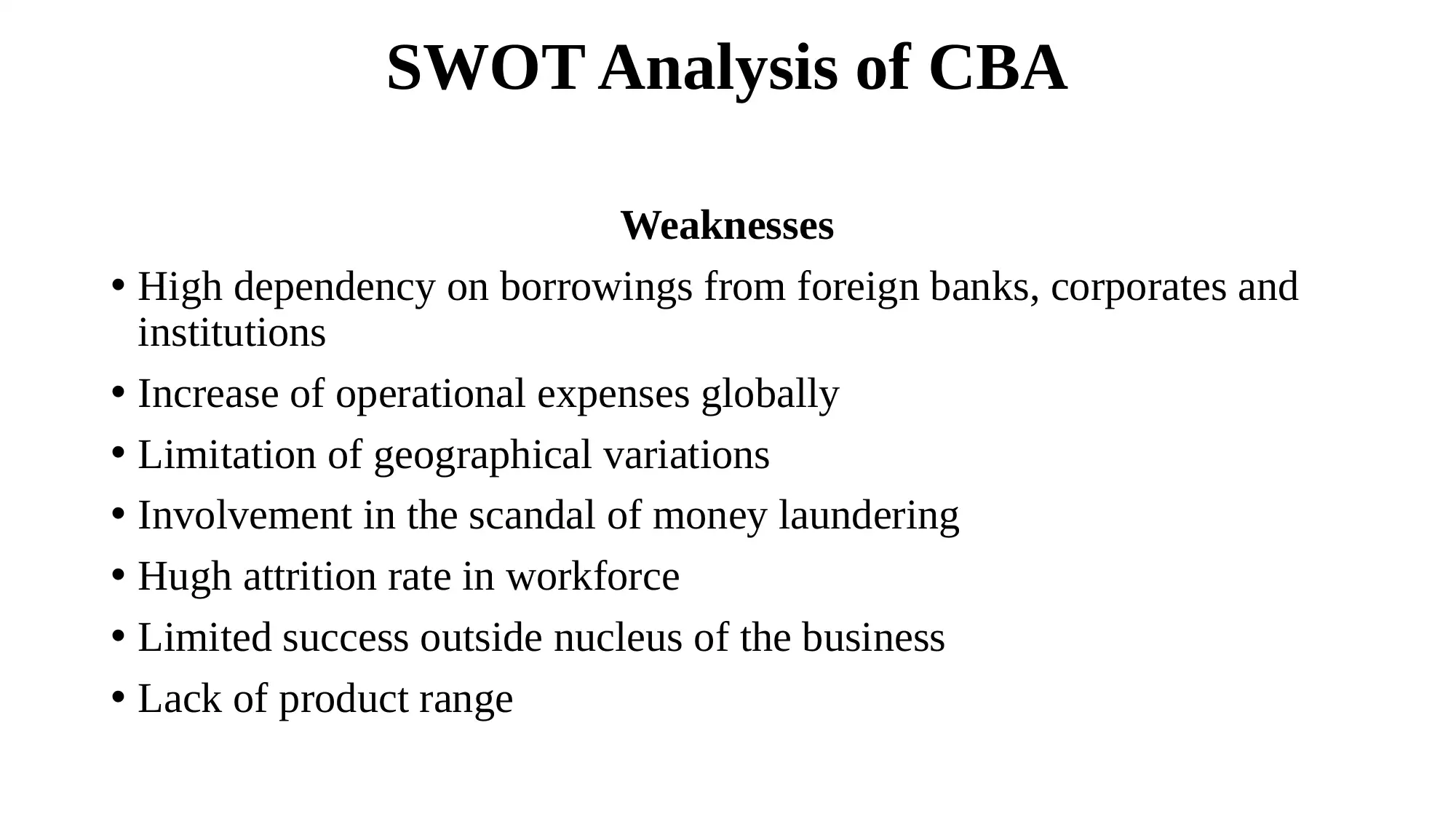

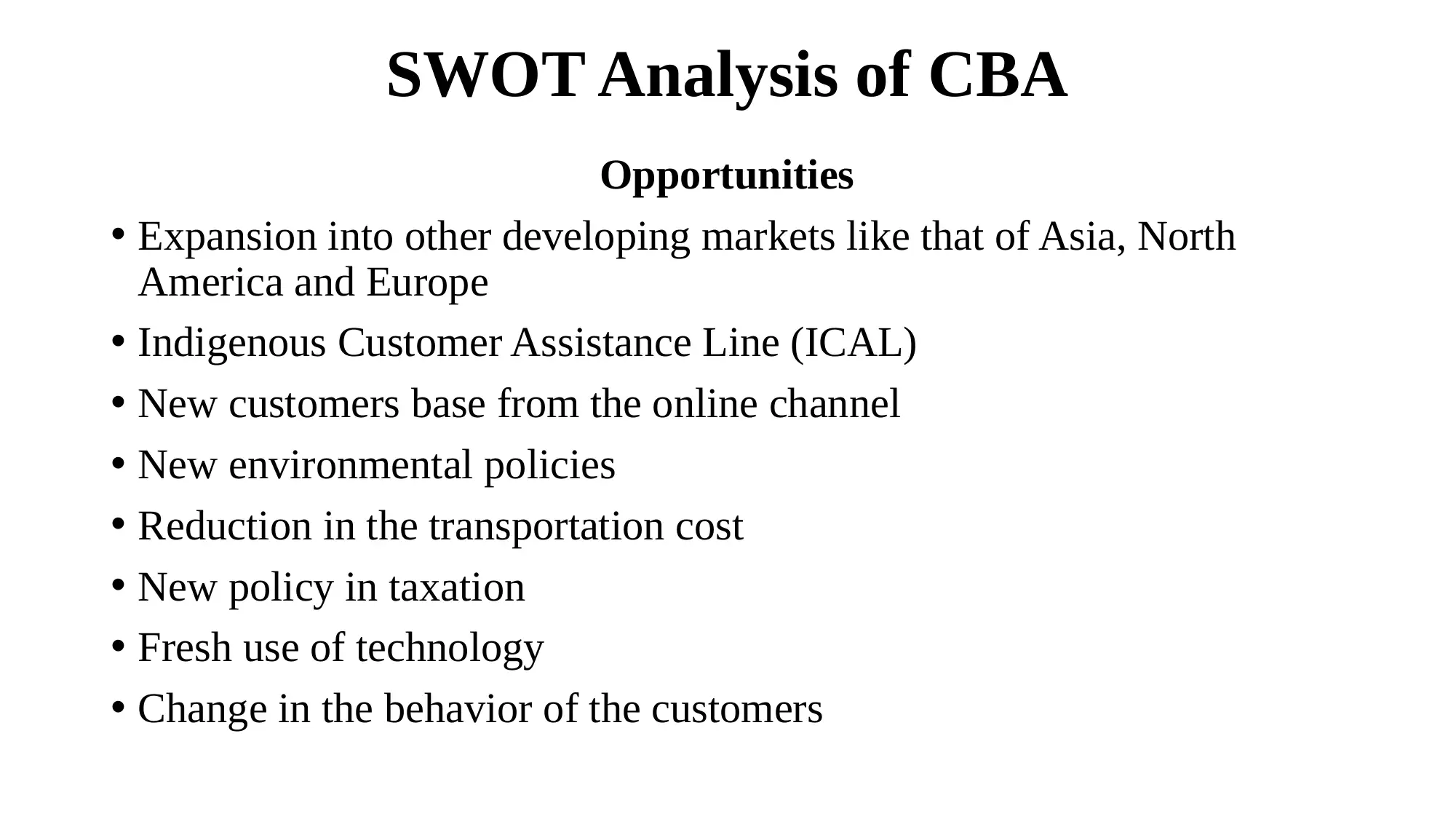

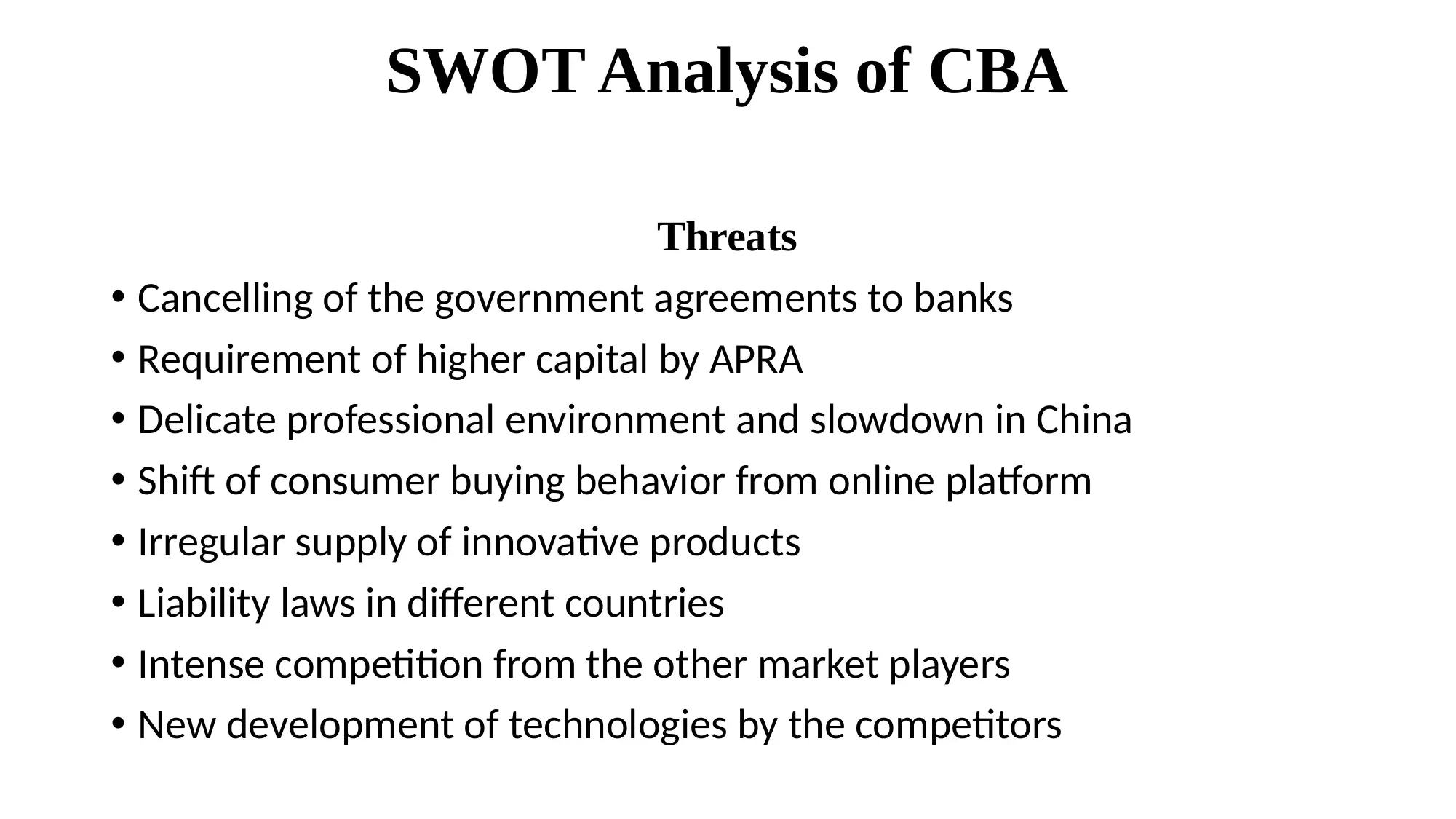

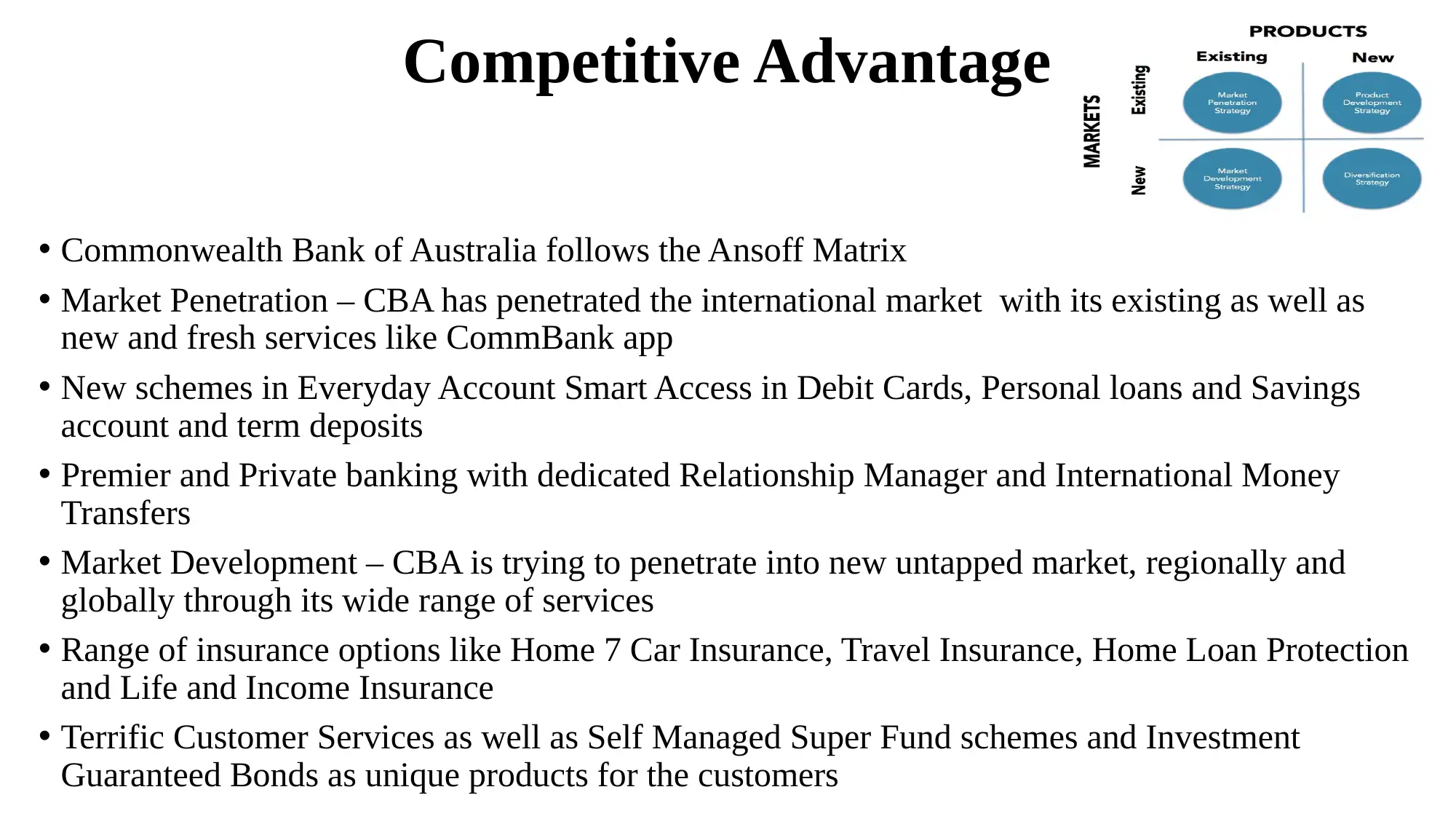

This report presents a comprehensive analysis of the Commonwealth Bank of Australia's (CBA) organizational culture. It begins with an overview of CBA, its history, and market position. The core of the report involves a detailed SWOT analysis, identifying CBA's strengths (e.g., strong financial position, technological advancements), weaknesses (e.g., reliance on foreign borrowings, past scandals), opportunities (e.g., expansion into new markets, technological advancements), and threats (e.g., competition, regulatory changes). A PESTLE analysis evaluates the political, economic, social, technological, legal, and environmental factors impacting CBA. The report then identifies CBA's competitive advantages, including market penetration, product development, and diversification strategies, referencing the Ansoff Matrix. A diagnosis section synthesizes the findings, highlighting the need for continuous innovation and addressing brand image issues. The report concludes with a discussion of CBA's growth potential, importance of customer satisfaction, and the significance of corporate social responsibility, supported by a list of relevant references.

1 out of 16

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)