CGE17105 Personal Financial Plan: Cheung Family - UOW College HK

VerifiedAdded on 2023/05/31

|17

|2240

|199

Report

AI Summary

This report provides a comprehensive financial plan for Stephen and Linda Cheung, a couple with two young children, outlining strategies for managing their income, expenses, and investments over the next 18 years until their children attend college. The plan considers their current income from Stephen's IT contracts and Linda's teaching job, alongside their annual living expenses and expected inflation. It includes a loan repayment schedule for property improvements and emphasizes long-term savings through a recurring deposit account with a 12% annual return. The plan recommends investing 80% of their annual surplus in this account to secure funds for their children's education and their own retirement, while also addressing risk tolerance and liquidity considerations. The report concludes with recommendations for loan management and investment strategies to achieve their financial goals.

Running head: PERSONAL FINANCE

Personal Finance

Name of the Student:

Name of the University:

Authors Note:

Personal Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

PERSONAL FINANCE

Contents

Financial plan:.................................................................................................................................2

Recommendation:..........................................................................................................................14

References:....................................................................................................................................16

PERSONAL FINANCE

Contents

Financial plan:.................................................................................................................................2

Recommendation:..........................................................................................................................14

References:....................................................................................................................................16

2

PERSONAL FINANCE

Financial plan:

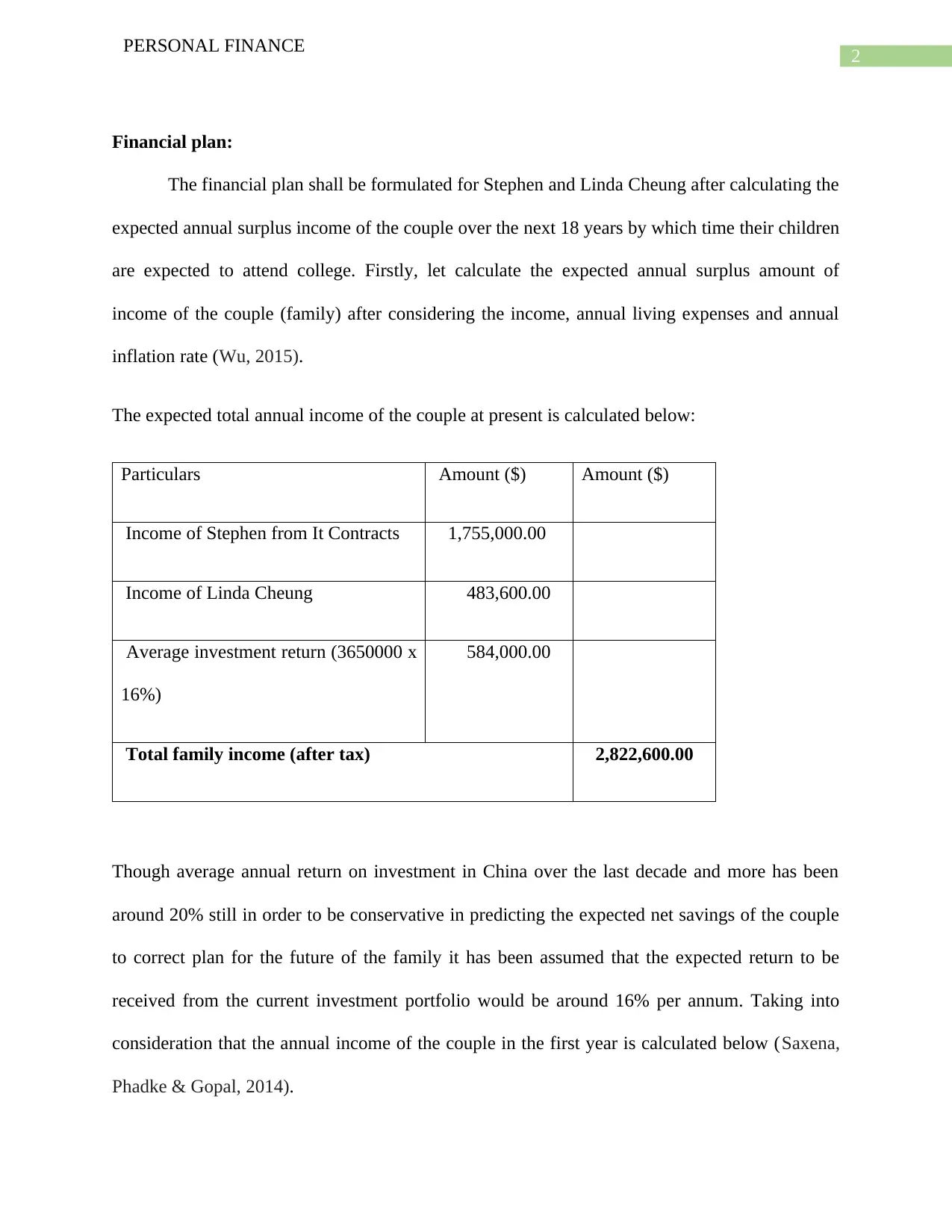

The financial plan shall be formulated for Stephen and Linda Cheung after calculating the

expected annual surplus income of the couple over the next 18 years by which time their children

are expected to attend college. Firstly, let calculate the expected annual surplus amount of

income of the couple (family) after considering the income, annual living expenses and annual

inflation rate (Wu, 2015).

The expected total annual income of the couple at present is calculated below:

Particulars Amount ($) Amount ($)

Income of Stephen from It Contracts 1,755,000.00

Income of Linda Cheung 483,600.00

Average investment return (3650000 x

16%)

584,000.00

Total family income (after tax) 2,822,600.00

Though average annual return on investment in China over the last decade and more has been

around 20% still in order to be conservative in predicting the expected net savings of the couple

to correct plan for the future of the family it has been assumed that the expected return to be

received from the current investment portfolio would be around 16% per annum. Taking into

consideration that the annual income of the couple in the first year is calculated below (Saxena,

Phadke & Gopal, 2014).

PERSONAL FINANCE

Financial plan:

The financial plan shall be formulated for Stephen and Linda Cheung after calculating the

expected annual surplus income of the couple over the next 18 years by which time their children

are expected to attend college. Firstly, let calculate the expected annual surplus amount of

income of the couple (family) after considering the income, annual living expenses and annual

inflation rate (Wu, 2015).

The expected total annual income of the couple at present is calculated below:

Particulars Amount ($) Amount ($)

Income of Stephen from It Contracts 1,755,000.00

Income of Linda Cheung 483,600.00

Average investment return (3650000 x

16%)

584,000.00

Total family income (after tax) 2,822,600.00

Though average annual return on investment in China over the last decade and more has been

around 20% still in order to be conservative in predicting the expected net savings of the couple

to correct plan for the future of the family it has been assumed that the expected return to be

received from the current investment portfolio would be around 16% per annum. Taking into

consideration that the annual income of the couple in the first year is calculated below (Saxena,

Phadke & Gopal, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

PERSONAL FINANCE

Particulars Amount ($) Amount ($)

Income of Stephen from It Contracts 1,755,000.

00

Income of Linda Cheung 483,600.

00

Average investment return (3650000 x

16%)

584,000.

00

Total family income (after tax) 2,822,600.

00

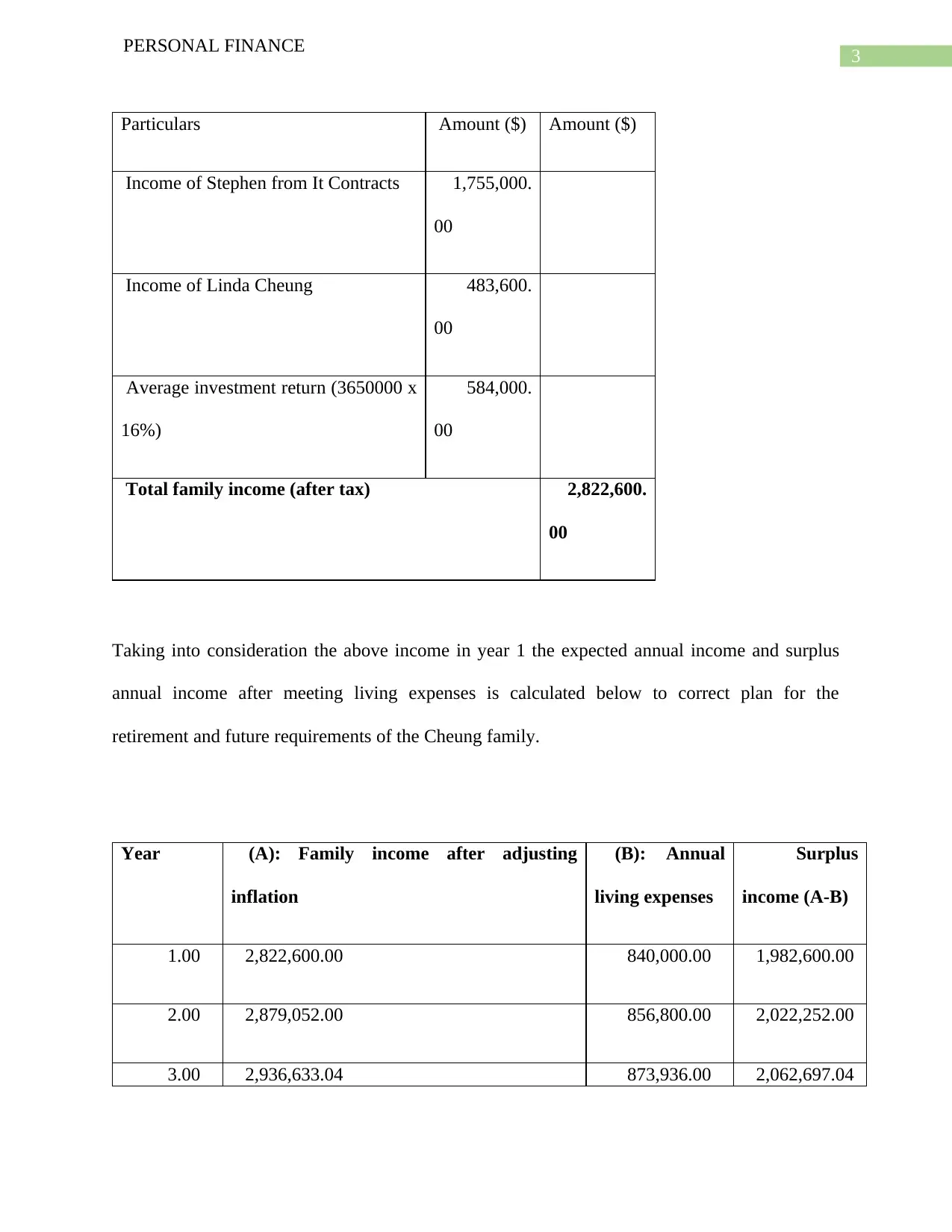

Taking into consideration the above income in year 1 the expected annual income and surplus

annual income after meeting living expenses is calculated below to correct plan for the

retirement and future requirements of the Cheung family.

Year (A): Family income after adjusting

inflation

(B): Annual

living expenses

Surplus

income (A-B)

1.00 2,822,600.00 840,000.00 1,982,600.00

2.00 2,879,052.00 856,800.00 2,022,252.00

3.00 2,936,633.04 873,936.00 2,062,697.04

PERSONAL FINANCE

Particulars Amount ($) Amount ($)

Income of Stephen from It Contracts 1,755,000.

00

Income of Linda Cheung 483,600.

00

Average investment return (3650000 x

16%)

584,000.

00

Total family income (after tax) 2,822,600.

00

Taking into consideration the above income in year 1 the expected annual income and surplus

annual income after meeting living expenses is calculated below to correct plan for the

retirement and future requirements of the Cheung family.

Year (A): Family income after adjusting

inflation

(B): Annual

living expenses

Surplus

income (A-B)

1.00 2,822,600.00 840,000.00 1,982,600.00

2.00 2,879,052.00 856,800.00 2,022,252.00

3.00 2,936,633.04 873,936.00 2,062,697.04

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

PERSONAL FINANCE

4.00 2,995,365.70 891,414.72 2,103,950.98

5.00 3,055,273.01 909,243.01 2,146,030.00

6.00 3,116,378.48 927,427.87 2,188,950.60

7.00 3,178,706.04 945,976.43 2,232,729.61

8.00 3,242,280.17 964,895.96 2,277,384.20

9.00 3,307,125.77 984,193.88 2,322,931.89

10.00 3,373,268.28 1,003,877.76 2,369,390.53

11.00 3,440,733.65 1,023,955.31 2,416,778.34

12.00 3,509,548.32 1,044,434.42 2,465,113.90

13.00 3,579,739.29 1,065,323.11 2,514,416.18

14.00 3,651,334.08 1,086,629.57 2,564,704.51

15.00 3,724,360.76 1,108,362.16 2,615,998.60

16.00 3,798,847.97 1,130,529.40 2,668,318.57

17.00 3,874,824.93 1,153,139.99 2,721,684.94

18.00 3,952,321.43 1,176,202.79 2,776,118.64

PERSONAL FINANCE

4.00 2,995,365.70 891,414.72 2,103,950.98

5.00 3,055,273.01 909,243.01 2,146,030.00

6.00 3,116,378.48 927,427.87 2,188,950.60

7.00 3,178,706.04 945,976.43 2,232,729.61

8.00 3,242,280.17 964,895.96 2,277,384.20

9.00 3,307,125.77 984,193.88 2,322,931.89

10.00 3,373,268.28 1,003,877.76 2,369,390.53

11.00 3,440,733.65 1,023,955.31 2,416,778.34

12.00 3,509,548.32 1,044,434.42 2,465,113.90

13.00 3,579,739.29 1,065,323.11 2,514,416.18

14.00 3,651,334.08 1,086,629.57 2,564,704.51

15.00 3,724,360.76 1,108,362.16 2,615,998.60

16.00 3,798,847.97 1,130,529.40 2,668,318.57

17.00 3,874,824.93 1,153,139.99 2,721,684.94

18.00 3,952,321.43 1,176,202.79 2,776,118.64

5

PERSONAL FINANCE

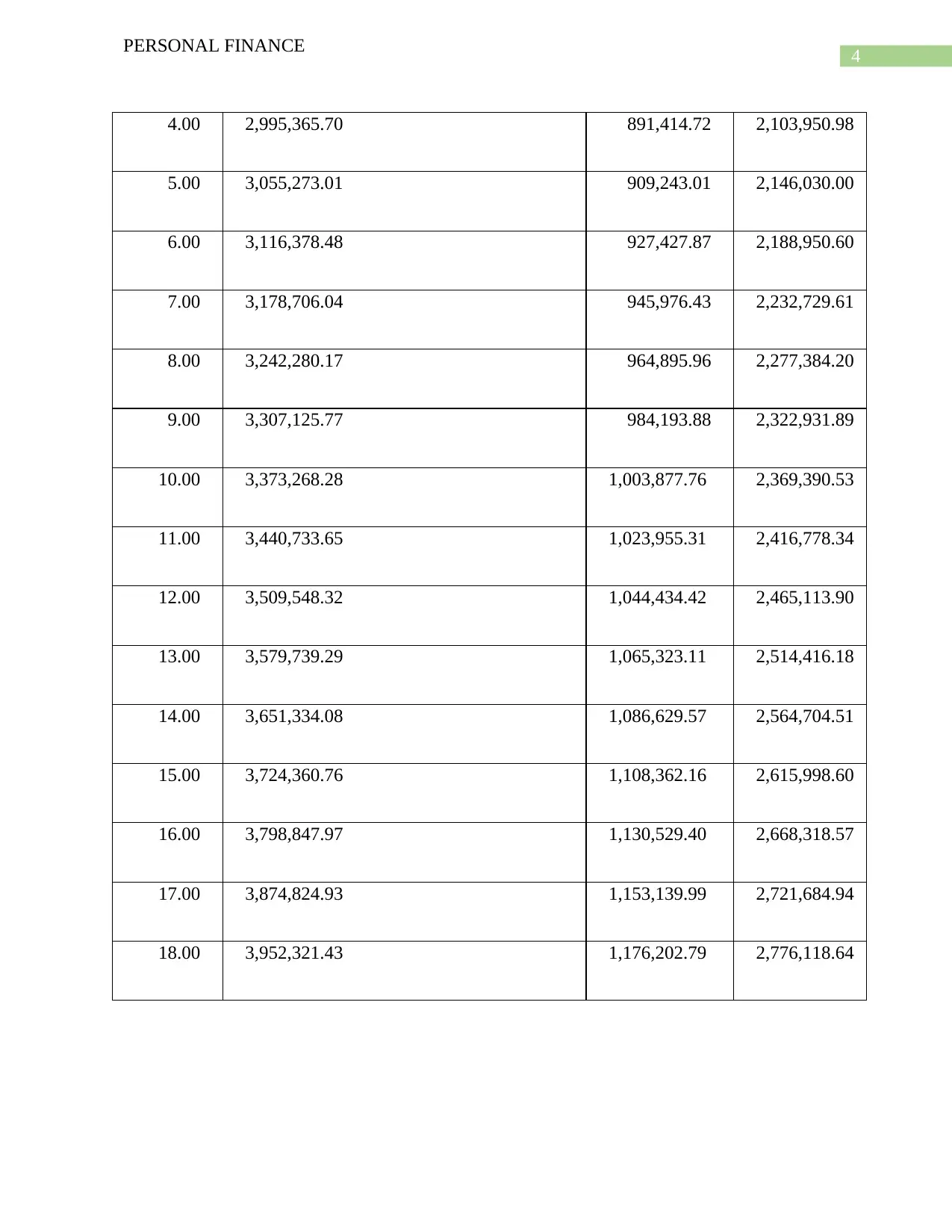

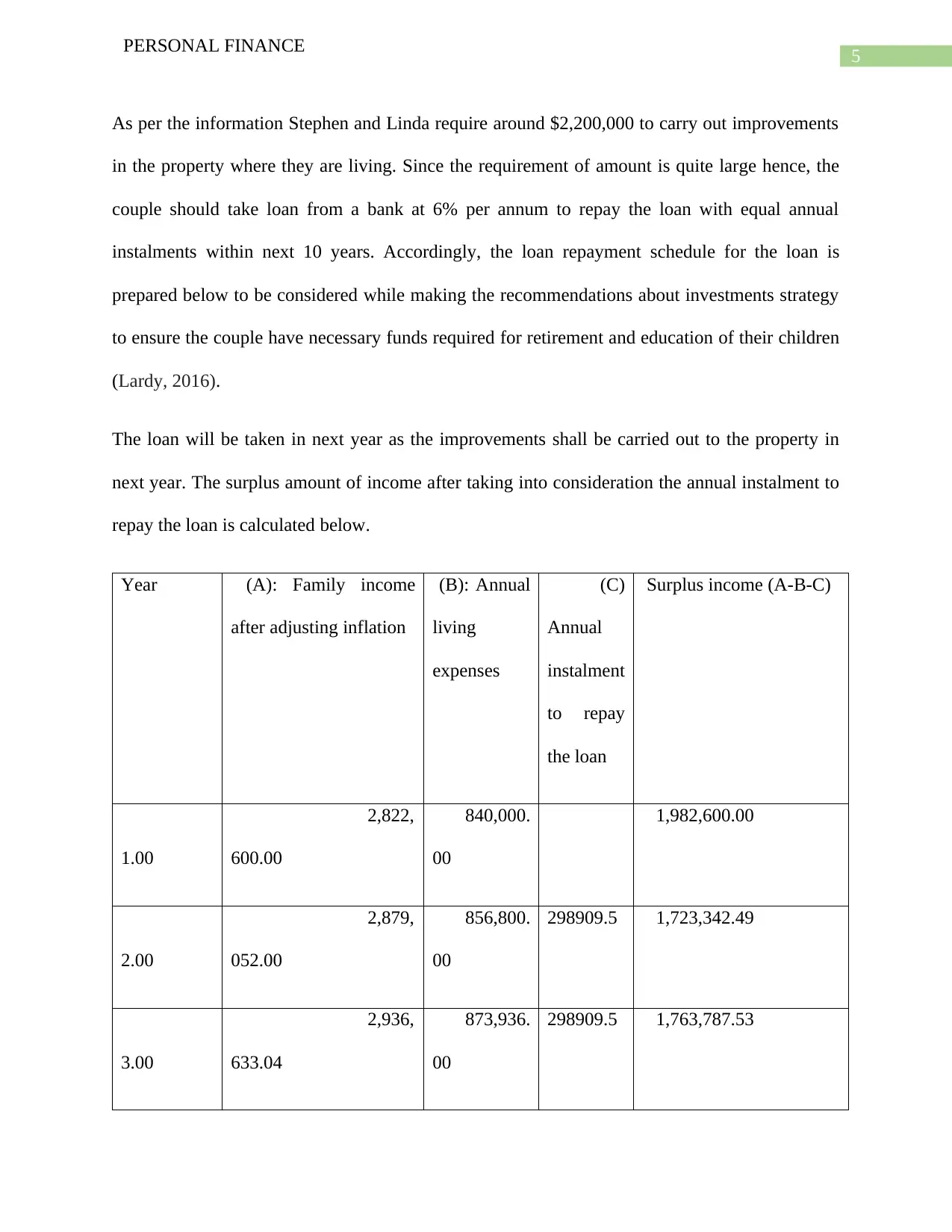

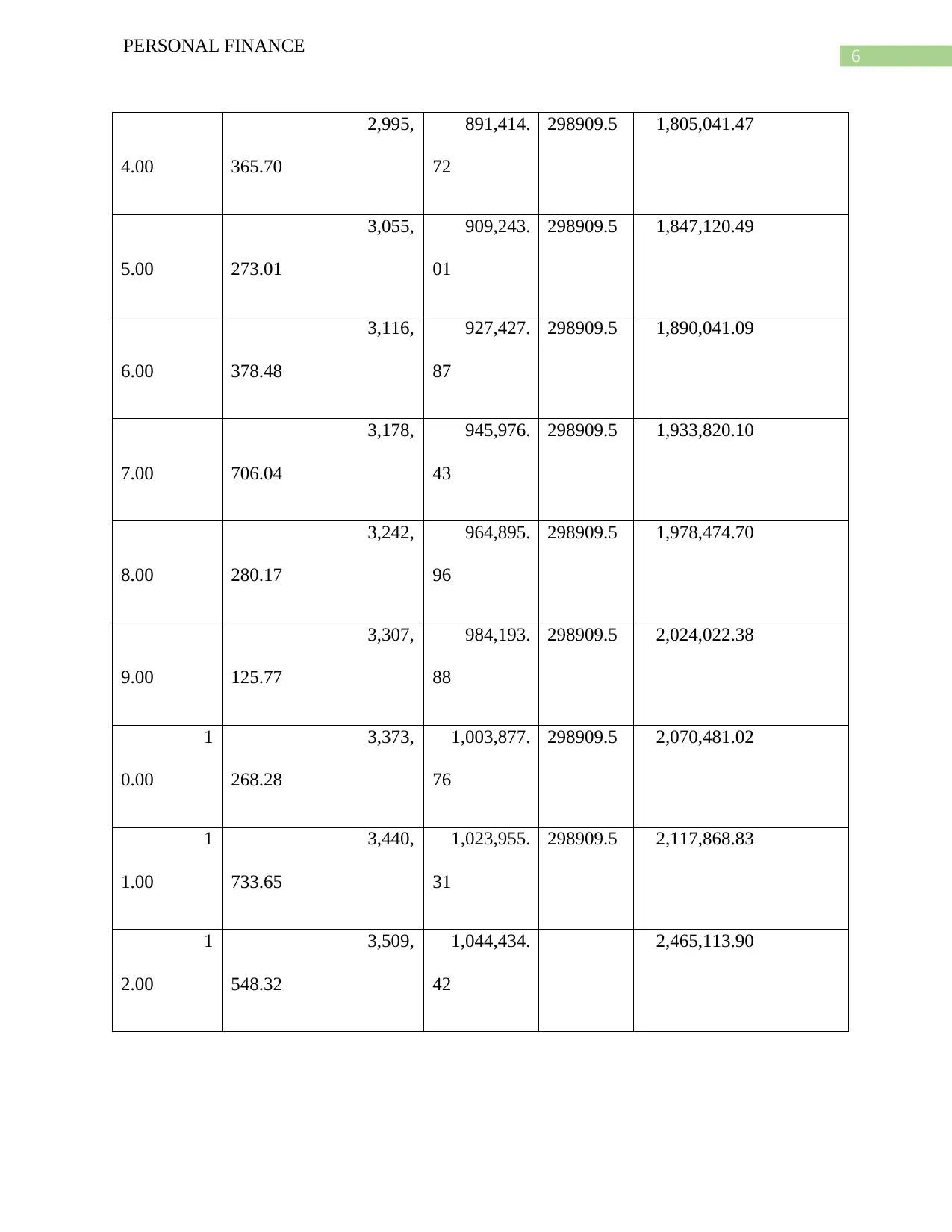

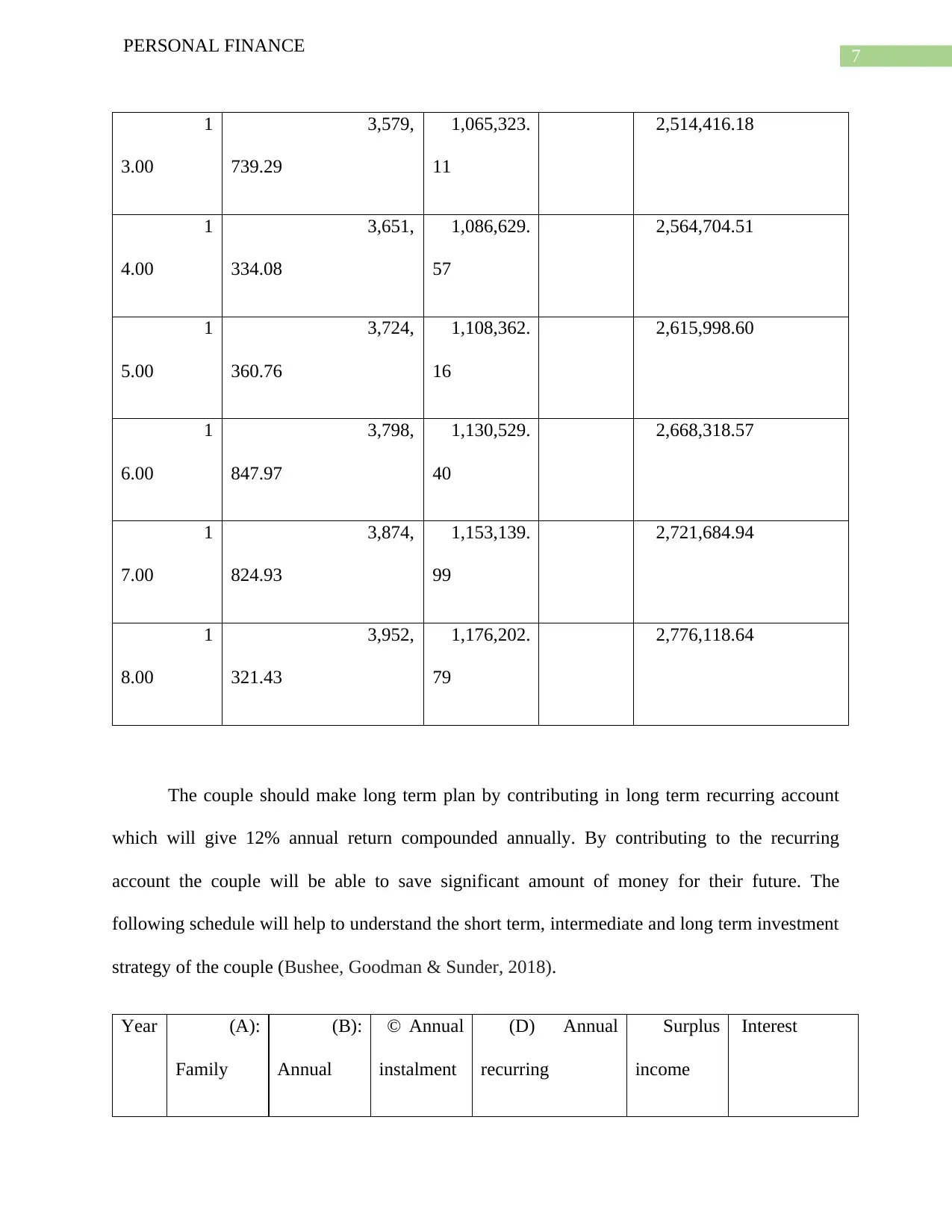

As per the information Stephen and Linda require around $2,200,000 to carry out improvements

in the property where they are living. Since the requirement of amount is quite large hence, the

couple should take loan from a bank at 6% per annum to repay the loan with equal annual

instalments within next 10 years. Accordingly, the loan repayment schedule for the loan is

prepared below to be considered while making the recommendations about investments strategy

to ensure the couple have necessary funds required for retirement and education of their children

(Lardy, 2016).

The loan will be taken in next year as the improvements shall be carried out to the property in

next year. The surplus amount of income after taking into consideration the annual instalment to

repay the loan is calculated below.

Year (A): Family income

after adjusting inflation

(B): Annual

living

expenses

(C)

Annual

instalment

to repay

the loan

Surplus income (A-B-C)

1.00

2,822,

600.00

840,000.

00

1,982,600.00

2.00

2,879,

052.00

856,800.

00

298909.5 1,723,342.49

3.00

2,936,

633.04

873,936.

00

298909.5 1,763,787.53

PERSONAL FINANCE

As per the information Stephen and Linda require around $2,200,000 to carry out improvements

in the property where they are living. Since the requirement of amount is quite large hence, the

couple should take loan from a bank at 6% per annum to repay the loan with equal annual

instalments within next 10 years. Accordingly, the loan repayment schedule for the loan is

prepared below to be considered while making the recommendations about investments strategy

to ensure the couple have necessary funds required for retirement and education of their children

(Lardy, 2016).

The loan will be taken in next year as the improvements shall be carried out to the property in

next year. The surplus amount of income after taking into consideration the annual instalment to

repay the loan is calculated below.

Year (A): Family income

after adjusting inflation

(B): Annual

living

expenses

(C)

Annual

instalment

to repay

the loan

Surplus income (A-B-C)

1.00

2,822,

600.00

840,000.

00

1,982,600.00

2.00

2,879,

052.00

856,800.

00

298909.5 1,723,342.49

3.00

2,936,

633.04

873,936.

00

298909.5 1,763,787.53

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

PERSONAL FINANCE

4.00

2,995,

365.70

891,414.

72

298909.5 1,805,041.47

5.00

3,055,

273.01

909,243.

01

298909.5 1,847,120.49

6.00

3,116,

378.48

927,427.

87

298909.5 1,890,041.09

7.00

3,178,

706.04

945,976.

43

298909.5 1,933,820.10

8.00

3,242,

280.17

964,895.

96

298909.5 1,978,474.70

9.00

3,307,

125.77

984,193.

88

298909.5 2,024,022.38

1

0.00

3,373,

268.28

1,003,877.

76

298909.5 2,070,481.02

1

1.00

3,440,

733.65

1,023,955.

31

298909.5 2,117,868.83

1

2.00

3,509,

548.32

1,044,434.

42

2,465,113.90

PERSONAL FINANCE

4.00

2,995,

365.70

891,414.

72

298909.5 1,805,041.47

5.00

3,055,

273.01

909,243.

01

298909.5 1,847,120.49

6.00

3,116,

378.48

927,427.

87

298909.5 1,890,041.09

7.00

3,178,

706.04

945,976.

43

298909.5 1,933,820.10

8.00

3,242,

280.17

964,895.

96

298909.5 1,978,474.70

9.00

3,307,

125.77

984,193.

88

298909.5 2,024,022.38

1

0.00

3,373,

268.28

1,003,877.

76

298909.5 2,070,481.02

1

1.00

3,440,

733.65

1,023,955.

31

298909.5 2,117,868.83

1

2.00

3,509,

548.32

1,044,434.

42

2,465,113.90

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

PERSONAL FINANCE

1

3.00

3,579,

739.29

1,065,323.

11

2,514,416.18

1

4.00

3,651,

334.08

1,086,629.

57

2,564,704.51

1

5.00

3,724,

360.76

1,108,362.

16

2,615,998.60

1

6.00

3,798,

847.97

1,130,529.

40

2,668,318.57

1

7.00

3,874,

824.93

1,153,139.

99

2,721,684.94

1

8.00

3,952,

321.43

1,176,202.

79

2,776,118.64

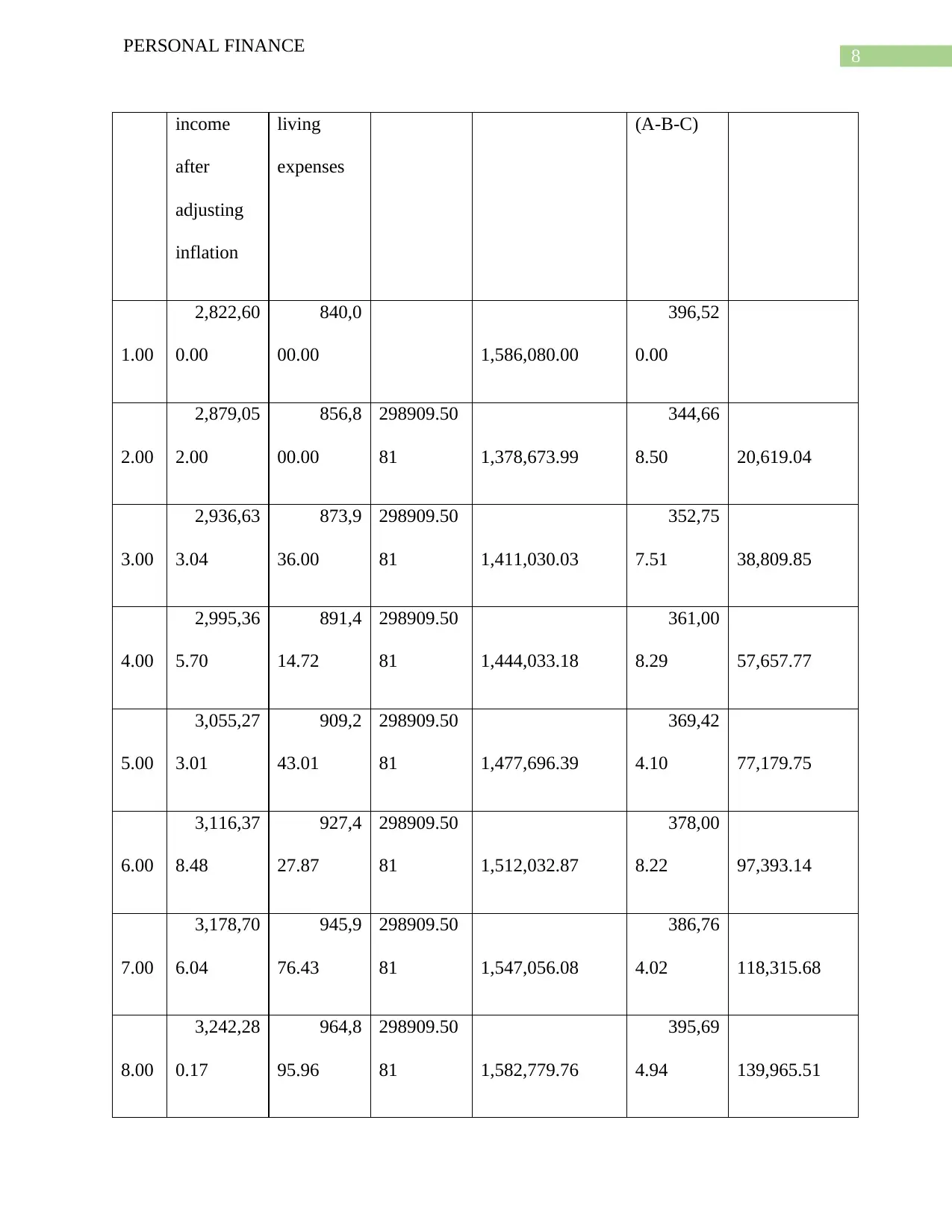

The couple should make long term plan by contributing in long term recurring account

which will give 12% annual return compounded annually. By contributing to the recurring

account the couple will be able to save significant amount of money for their future. The

following schedule will help to understand the short term, intermediate and long term investment

strategy of the couple (Bushee, Goodman & Sunder, 2018).

Year (A):

Family

(B):

Annual

© Annual

instalment

(D) Annual

recurring

Surplus

income

Interest

PERSONAL FINANCE

1

3.00

3,579,

739.29

1,065,323.

11

2,514,416.18

1

4.00

3,651,

334.08

1,086,629.

57

2,564,704.51

1

5.00

3,724,

360.76

1,108,362.

16

2,615,998.60

1

6.00

3,798,

847.97

1,130,529.

40

2,668,318.57

1

7.00

3,874,

824.93

1,153,139.

99

2,721,684.94

1

8.00

3,952,

321.43

1,176,202.

79

2,776,118.64

The couple should make long term plan by contributing in long term recurring account

which will give 12% annual return compounded annually. By contributing to the recurring

account the couple will be able to save significant amount of money for their future. The

following schedule will help to understand the short term, intermediate and long term investment

strategy of the couple (Bushee, Goodman & Sunder, 2018).

Year (A):

Family

(B):

Annual

© Annual

instalment

(D) Annual

recurring

Surplus

income

Interest

8

PERSONAL FINANCE

income

after

adjusting

inflation

living

expenses

(A-B-C)

1.00

2,822,60

0.00

840,0

00.00 1,586,080.00

396,52

0.00

2.00

2,879,05

2.00

856,8

00.00

298909.50

81 1,378,673.99

344,66

8.50 20,619.04

3.00

2,936,63

3.04

873,9

36.00

298909.50

81 1,411,030.03

352,75

7.51 38,809.85

4.00

2,995,36

5.70

891,4

14.72

298909.50

81 1,444,033.18

361,00

8.29 57,657.77

5.00

3,055,27

3.01

909,2

43.01

298909.50

81 1,477,696.39

369,42

4.10 77,179.75

6.00

3,116,37

8.48

927,4

27.87

298909.50

81 1,512,032.87

378,00

8.22 97,393.14

7.00

3,178,70

6.04

945,9

76.43

298909.50

81 1,547,056.08

386,76

4.02 118,315.68

8.00

3,242,28

0.17

964,8

95.96

298909.50

81 1,582,779.76

395,69

4.94 139,965.51

PERSONAL FINANCE

income

after

adjusting

inflation

living

expenses

(A-B-C)

1.00

2,822,60

0.00

840,0

00.00 1,586,080.00

396,52

0.00

2.00

2,879,05

2.00

856,8

00.00

298909.50

81 1,378,673.99

344,66

8.50 20,619.04

3.00

2,936,63

3.04

873,9

36.00

298909.50

81 1,411,030.03

352,75

7.51 38,809.85

4.00

2,995,36

5.70

891,4

14.72

298909.50

81 1,444,033.18

361,00

8.29 57,657.77

5.00

3,055,27

3.01

909,2

43.01

298909.50

81 1,477,696.39

369,42

4.10 77,179.75

6.00

3,116,37

8.48

927,4

27.87

298909.50

81 1,512,032.87

378,00

8.22 97,393.14

7.00

3,178,70

6.04

945,9

76.43

298909.50

81 1,547,056.08

386,76

4.02 118,315.68

8.00

3,242,28

0.17

964,8

95.96

298909.50

81 1,582,779.76

395,69

4.94 139,965.51

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

PERSONAL FINANCE

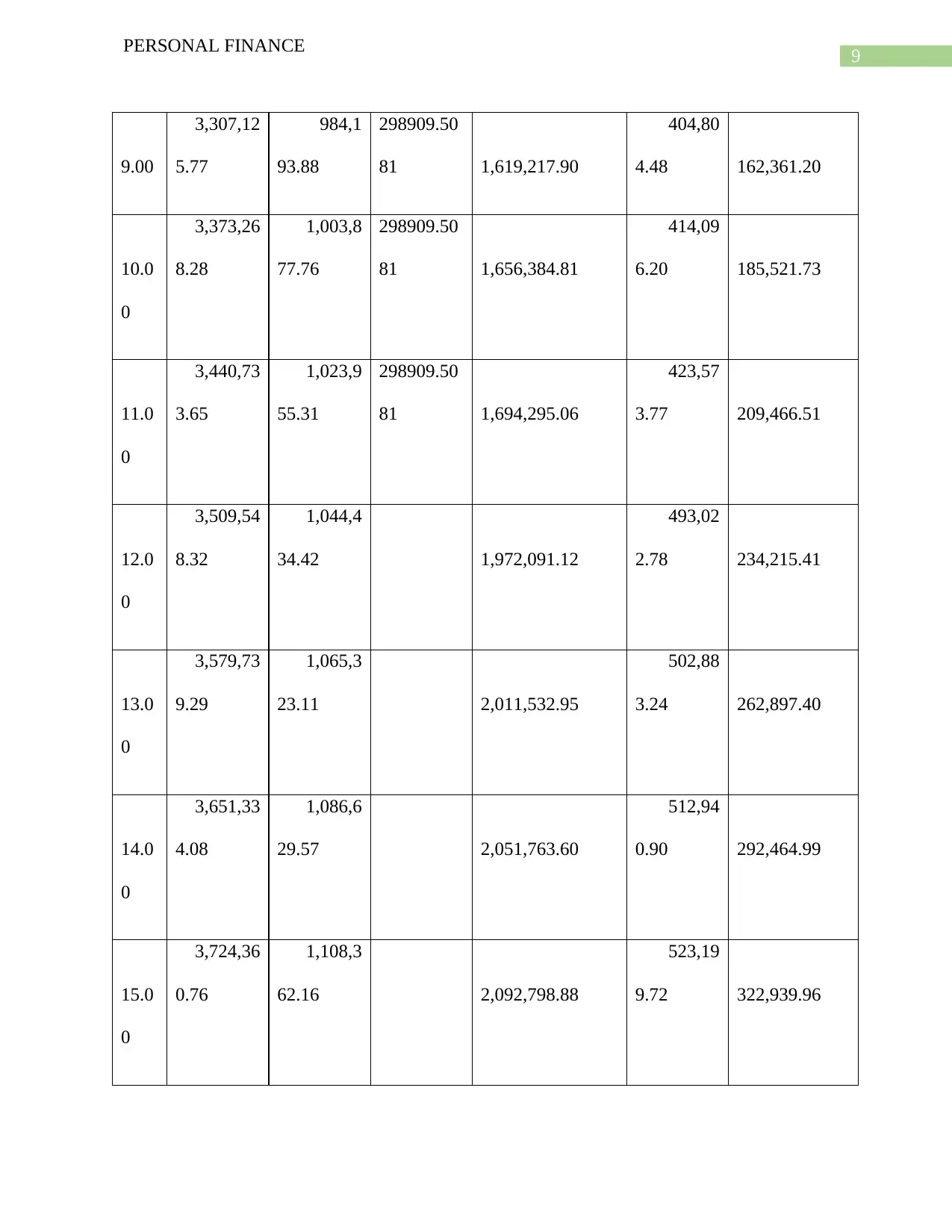

9.00

3,307,12

5.77

984,1

93.88

298909.50

81 1,619,217.90

404,80

4.48 162,361.20

10.0

0

3,373,26

8.28

1,003,8

77.76

298909.50

81 1,656,384.81

414,09

6.20 185,521.73

11.0

0

3,440,73

3.65

1,023,9

55.31

298909.50

81 1,694,295.06

423,57

3.77 209,466.51

12.0

0

3,509,54

8.32

1,044,4

34.42 1,972,091.12

493,02

2.78 234,215.41

13.0

0

3,579,73

9.29

1,065,3

23.11 2,011,532.95

502,88

3.24 262,897.40

14.0

0

3,651,33

4.08

1,086,6

29.57 2,051,763.60

512,94

0.90 292,464.99

15.0

0

3,724,36

0.76

1,108,3

62.16 2,092,798.88

523,19

9.72 322,939.96

PERSONAL FINANCE

9.00

3,307,12

5.77

984,1

93.88

298909.50

81 1,619,217.90

404,80

4.48 162,361.20

10.0

0

3,373,26

8.28

1,003,8

77.76

298909.50

81 1,656,384.81

414,09

6.20 185,521.73

11.0

0

3,440,73

3.65

1,023,9

55.31

298909.50

81 1,694,295.06

423,57

3.77 209,466.51

12.0

0

3,509,54

8.32

1,044,4

34.42 1,972,091.12

493,02

2.78 234,215.41

13.0

0

3,579,73

9.29

1,065,3

23.11 2,011,532.95

502,88

3.24 262,897.40

14.0

0

3,651,33

4.08

1,086,6

29.57 2,051,763.60

512,94

0.90 292,464.99

15.0

0

3,724,36

0.76

1,108,3

62.16 2,092,798.88

523,19

9.72 322,939.96

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

PERSONAL FINANCE

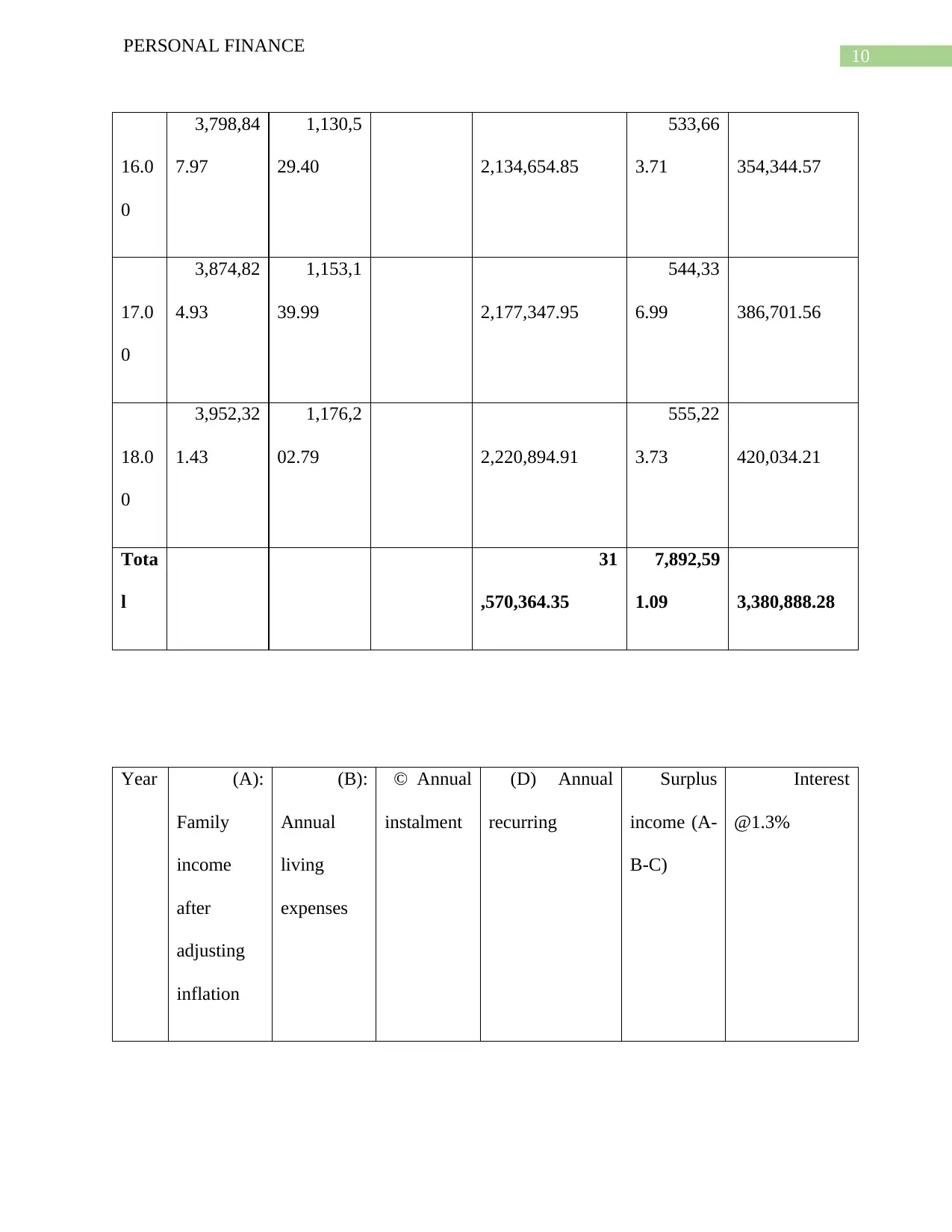

16.0

0

3,798,84

7.97

1,130,5

29.40 2,134,654.85

533,66

3.71 354,344.57

17.0

0

3,874,82

4.93

1,153,1

39.99 2,177,347.95

544,33

6.99 386,701.56

18.0

0

3,952,32

1.43

1,176,2

02.79 2,220,894.91

555,22

3.73 420,034.21

Tota

l

31

,570,364.35

7,892,59

1.09 3,380,888.28

Year (A):

Family

income

after

adjusting

inflation

(B):

Annual

living

expenses

© Annual

instalment

(D) Annual

recurring

Surplus

income (A-

B-C)

Interest

@1.3%

PERSONAL FINANCE

16.0

0

3,798,84

7.97

1,130,5

29.40 2,134,654.85

533,66

3.71 354,344.57

17.0

0

3,874,82

4.93

1,153,1

39.99 2,177,347.95

544,33

6.99 386,701.56

18.0

0

3,952,32

1.43

1,176,2

02.79 2,220,894.91

555,22

3.73 420,034.21

Tota

l

31

,570,364.35

7,892,59

1.09 3,380,888.28

Year (A):

Family

income

after

adjusting

inflation

(B):

Annual

living

expenses

© Annual

instalment

(D) Annual

recurring

Surplus

income (A-

B-C)

Interest

@1.3%

11

PERSONAL FINANCE

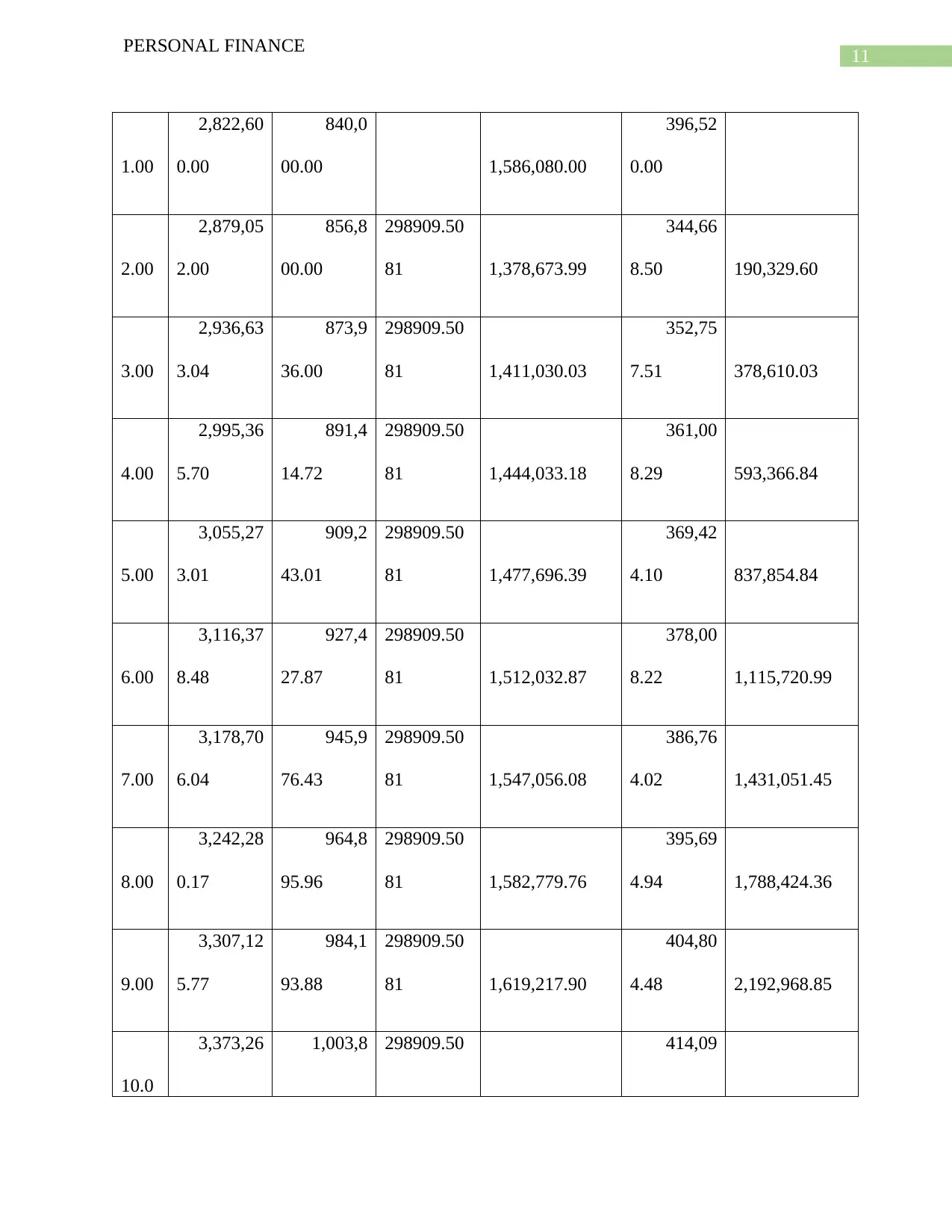

1.00

2,822,60

0.00

840,0

00.00 1,586,080.00

396,52

0.00

2.00

2,879,05

2.00

856,8

00.00

298909.50

81 1,378,673.99

344,66

8.50 190,329.60

3.00

2,936,63

3.04

873,9

36.00

298909.50

81 1,411,030.03

352,75

7.51 378,610.03

4.00

2,995,36

5.70

891,4

14.72

298909.50

81 1,444,033.18

361,00

8.29 593,366.84

5.00

3,055,27

3.01

909,2

43.01

298909.50

81 1,477,696.39

369,42

4.10 837,854.84

6.00

3,116,37

8.48

927,4

27.87

298909.50

81 1,512,032.87

378,00

8.22 1,115,720.99

7.00

3,178,70

6.04

945,9

76.43

298909.50

81 1,547,056.08

386,76

4.02 1,431,051.45

8.00

3,242,28

0.17

964,8

95.96

298909.50

81 1,582,779.76

395,69

4.94 1,788,424.36

9.00

3,307,12

5.77

984,1

93.88

298909.50

81 1,619,217.90

404,80

4.48 2,192,968.85

10.0

3,373,26 1,003,8 298909.50 414,09

PERSONAL FINANCE

1.00

2,822,60

0.00

840,0

00.00 1,586,080.00

396,52

0.00

2.00

2,879,05

2.00

856,8

00.00

298909.50

81 1,378,673.99

344,66

8.50 190,329.60

3.00

2,936,63

3.04

873,9

36.00

298909.50

81 1,411,030.03

352,75

7.51 378,610.03

4.00

2,995,36

5.70

891,4

14.72

298909.50

81 1,444,033.18

361,00

8.29 593,366.84

5.00

3,055,27

3.01

909,2

43.01

298909.50

81 1,477,696.39

369,42

4.10 837,854.84

6.00

3,116,37

8.48

927,4

27.87

298909.50

81 1,512,032.87

378,00

8.22 1,115,720.99

7.00

3,178,70

6.04

945,9

76.43

298909.50

81 1,547,056.08

386,76

4.02 1,431,051.45

8.00

3,242,28

0.17

964,8

95.96

298909.50

81 1,582,779.76

395,69

4.94 1,788,424.36

9.00

3,307,12

5.77

984,1

93.88

298909.50

81 1,619,217.90

404,80

4.48 2,192,968.85

10.0

3,373,26 1,003,8 298909.50 414,09

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.