Strategic Management Analysis and Recommendations for Cheval Group

VerifiedAdded on 2023/06/10

|20

|3917

|101

Report

AI Summary

This report provides a comprehensive strategic analysis of the Cheval Group of Companies, a UK-based real estate firm, focusing on its potential for international expansion, specifically into Belgium. The analysis begins with a strategic audit, employing PEST and Porter's Five Forces to assess the external environment and the McKinsey 7S framework to evaluate internal resources and capabilities. Competitive strategies are examined through Porter's generic framework and the Ansoff matrix. A SWOT analysis synthesizes the findings, followed by strategic recommendations for the company's expansion into Belgium, considering its favorable political, economic, social, and technological factors. The report also considers the competitive landscape within the real estate industry and the company's internal strengths and weaknesses to provide a well-rounded strategic roadmap for future growth. The report aims to understand the company's current standing in the market and provide recommendations to expand its operations globally.

Running Head: STRATEGIC RECOMMENDATION

Strategic Recommendation: Cheval group of companies

Name of the Student:

Name of the University:

Author note

Strategic Recommendation: Cheval group of companies

Name of the Student:

Name of the University:

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STRATEGIC RECOMMENDATION

Executive Summary

The purpose of the assignment is to understand and conduct a strategic management audit on

Cheval Group of Companies. The assignment is divided in three sections, the first section is

the strategic audit where PEST, Porter’s five forces are used to understand the external

business environment. 7s framework is used to understand the internal resource and

capabilities, while porter’s five forces and Ansoff matrix is used to determine the competitive

strategies used by the company. The second section is an analysis of the first in terms of a

SWOT analysis, section three is recommendation.

Executive Summary

The purpose of the assignment is to understand and conduct a strategic management audit on

Cheval Group of Companies. The assignment is divided in three sections, the first section is

the strategic audit where PEST, Porter’s five forces are used to understand the external

business environment. 7s framework is used to understand the internal resource and

capabilities, while porter’s five forces and Ansoff matrix is used to determine the competitive

strategies used by the company. The second section is an analysis of the first in terms of a

SWOT analysis, section three is recommendation.

2STRATEGIC RECOMMENDATION

Table of Contents

Introduction................................................................................................................................4

Section 1: Strategic Audit..........................................................................................................4

External Analysis...................................................................................................................4

PEST Analysis...................................................................................................................5

Porter’s Five forces............................................................................................................7

Internal Analysis....................................................................................................................8

McKinsey 7S Framework..................................................................................................8

Competitive Strategy............................................................................................................11

Porter’s Generic framework.............................................................................................11

Ansoff Matrix...................................................................................................................13

Selection 2: SWOT Analysis...................................................................................................14

Section 3: Recommendation....................................................................................................15

Conclusion................................................................................................................................16

Reference List:.........................................................................................................................17

Table of Contents

Introduction................................................................................................................................4

Section 1: Strategic Audit..........................................................................................................4

External Analysis...................................................................................................................4

PEST Analysis...................................................................................................................5

Porter’s Five forces............................................................................................................7

Internal Analysis....................................................................................................................8

McKinsey 7S Framework..................................................................................................8

Competitive Strategy............................................................................................................11

Porter’s Generic framework.............................................................................................11

Ansoff Matrix...................................................................................................................13

Selection 2: SWOT Analysis...................................................................................................14

Section 3: Recommendation....................................................................................................15

Conclusion................................................................................................................................16

Reference List:.........................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STRATEGIC RECOMMENDATION

CHEVAL GROUP OF COMPANIES

The organisation has been operating in the real estate industry in the UK for more than 30

years. The area of expertise for the company has been around Knightsbridge and South

Kensington but the management is constantly developing the company for growth and thus

extending all through the south east of England. The range of services that the company

offers the client ranges from a list of portfolios such as offices, retail and leisure, industrial

and residential properties. The company has been focused upon understanding and catering to

the need and requirement of the clients. Cheval Residences is the part of the group that has its

services across three other countries Belgium, France and Italy.

CHEVAL GROUP OF COMPANIES

The organisation has been operating in the real estate industry in the UK for more than 30

years. The area of expertise for the company has been around Knightsbridge and South

Kensington but the management is constantly developing the company for growth and thus

extending all through the south east of England. The range of services that the company

offers the client ranges from a list of portfolios such as offices, retail and leisure, industrial

and residential properties. The company has been focused upon understanding and catering to

the need and requirement of the clients. Cheval Residences is the part of the group that has its

services across three other countries Belgium, France and Italy.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STRATEGIC RECOMMENDATION

Introduction

Strategic management is the process by which any company organise plan and

formulate policies to achieve the objectives of the organisation. Management of organisations

over the years use a number of theories and models which has been developed by scholars to

incorporate them in the decision making process of the company (Bah and Fang 2015).

Setting objectives for the business is also a part of the strategic management and achieving

these objectives connotes the success or failure of the company organisation (Senge 2014).

Based on these set of objectives a business organisation take decisions and with help of

management concepts and models. In this assignment strategic audit will be conducted upon

Cheval group of companies. The assignment will focus on providing strategic

recommendations based on the analysis in order to understand the opportunities it has

towards the global expansion. The area of expansion that the company will try to expand is

Belgium. Following are some of the reason why this country is chosen for international

expansion: first of all the strategic geographic position, there are facilities of high quality in

terms of the availability of logistics and telecommunications infrastructure, there is a very

highly skilled labour force (Santandertrade.com 2018). On the other hand the company has

some of its distribution of services in the country.

Section 1: Strategic Audit

External Analysis

Analysing the external business environment of the company will provide an insight

of the opportunities the company have in terms of aspects such as government support,

economic condition, requirement of the society etc (Bah and Fang 2015). The PEST analysis

will help in understanding these opportunities that the company have in terms of expanding

Introduction

Strategic management is the process by which any company organise plan and

formulate policies to achieve the objectives of the organisation. Management of organisations

over the years use a number of theories and models which has been developed by scholars to

incorporate them in the decision making process of the company (Bah and Fang 2015).

Setting objectives for the business is also a part of the strategic management and achieving

these objectives connotes the success or failure of the company organisation (Senge 2014).

Based on these set of objectives a business organisation take decisions and with help of

management concepts and models. In this assignment strategic audit will be conducted upon

Cheval group of companies. The assignment will focus on providing strategic

recommendations based on the analysis in order to understand the opportunities it has

towards the global expansion. The area of expansion that the company will try to expand is

Belgium. Following are some of the reason why this country is chosen for international

expansion: first of all the strategic geographic position, there are facilities of high quality in

terms of the availability of logistics and telecommunications infrastructure, there is a very

highly skilled labour force (Santandertrade.com 2018). On the other hand the company has

some of its distribution of services in the country.

Section 1: Strategic Audit

External Analysis

Analysing the external business environment of the company will provide an insight

of the opportunities the company have in terms of aspects such as government support,

economic condition, requirement of the society etc (Bah and Fang 2015). The PEST analysis

will help in understanding these opportunities that the company have in terms of expanding

5STRATEGIC RECOMMENDATION

the business in Belgium (Gupta 2013). The external environment of any organisation has to

be analysed and monitored as the dynamics of these elements are not under the control of the

management. The analysis will help in understanding the opportunities as well as the threats

(Ho 2014).

PEST Analysis

Political: Belgium has a constitutional monarch, the King is the head of the state and the

prime Minister leads the government. The government of Belgium encourages trade and

commerce in the country as well as have good trade relations with the UK government

allowing investors opportunity in the country (Santandertrade.com 2018). There is a bilateral

relation in between the country in terms of import and export of goods and services. Due to

Brexit there has been uncertainty in the trade relations but, the scope of business expansion

still remains. Not only that the government of the country has set up infrastructure for more

investment in the country. The introduction of the notional interest by the Government is an

initiative to encourage trade (State.gov 2018). With the help of this measure companies

subject to Belgian corporate tax in the case of long-term debt financing, will have the

provision to subtract their taxable income an amount equal to the interest they would have

paid on their capital (Santandertrade.com 2018). The current center-right government of

Belgium ensures one key economic policies, which is to make the country more attractive for

foreign investment (State.gov 2018).

the business in Belgium (Gupta 2013). The external environment of any organisation has to

be analysed and monitored as the dynamics of these elements are not under the control of the

management. The analysis will help in understanding the opportunities as well as the threats

(Ho 2014).

PEST Analysis

Political: Belgium has a constitutional monarch, the King is the head of the state and the

prime Minister leads the government. The government of Belgium encourages trade and

commerce in the country as well as have good trade relations with the UK government

allowing investors opportunity in the country (Santandertrade.com 2018). There is a bilateral

relation in between the country in terms of import and export of goods and services. Due to

Brexit there has been uncertainty in the trade relations but, the scope of business expansion

still remains. Not only that the government of the country has set up infrastructure for more

investment in the country. The introduction of the notional interest by the Government is an

initiative to encourage trade (State.gov 2018). With the help of this measure companies

subject to Belgian corporate tax in the case of long-term debt financing, will have the

provision to subtract their taxable income an amount equal to the interest they would have

paid on their capital (Santandertrade.com 2018). The current center-right government of

Belgium ensures one key economic policies, which is to make the country more attractive for

foreign investment (State.gov 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STRATEGIC RECOMMENDATION

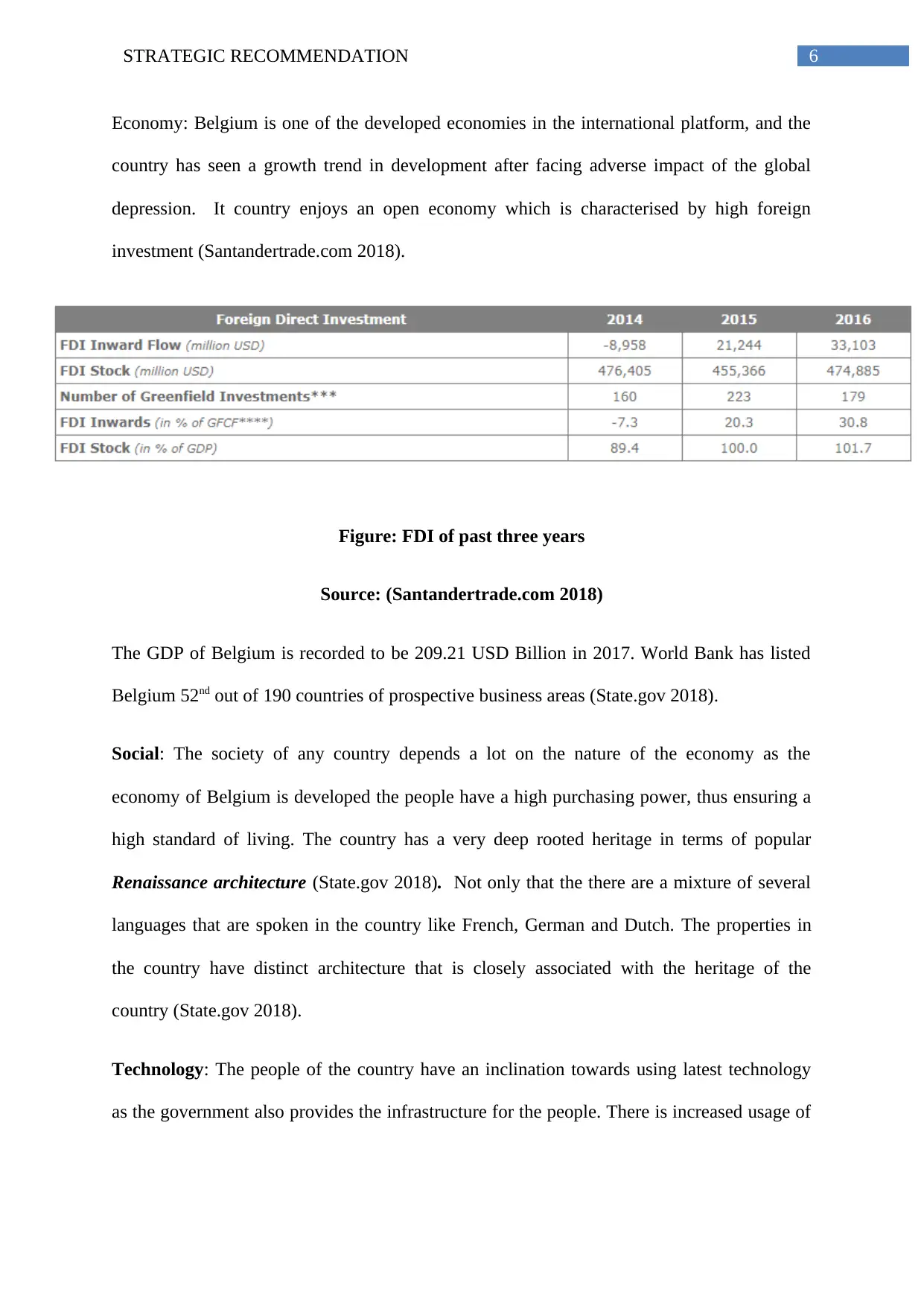

Economy: Belgium is one of the developed economies in the international platform, and the

country has seen a growth trend in development after facing adverse impact of the global

depression. It country enjoys an open economy which is characterised by high foreign

investment (Santandertrade.com 2018).

Figure: FDI of past three years

Source: (Santandertrade.com 2018)

The GDP of Belgium is recorded to be 209.21 USD Billion in 2017. World Bank has listed

Belgium 52nd out of 190 countries of prospective business areas (State.gov 2018).

Social: The society of any country depends a lot on the nature of the economy as the

economy of Belgium is developed the people have a high purchasing power, thus ensuring a

high standard of living. The country has a very deep rooted heritage in terms of popular

Renaissance architecture (State.gov 2018). Not only that the there are a mixture of several

languages that are spoken in the country like French, German and Dutch. The properties in

the country have distinct architecture that is closely associated with the heritage of the

country (State.gov 2018).

Technology: The people of the country have an inclination towards using latest technology

as the government also provides the infrastructure for the people. There is increased usage of

Economy: Belgium is one of the developed economies in the international platform, and the

country has seen a growth trend in development after facing adverse impact of the global

depression. It country enjoys an open economy which is characterised by high foreign

investment (Santandertrade.com 2018).

Figure: FDI of past three years

Source: (Santandertrade.com 2018)

The GDP of Belgium is recorded to be 209.21 USD Billion in 2017. World Bank has listed

Belgium 52nd out of 190 countries of prospective business areas (State.gov 2018).

Social: The society of any country depends a lot on the nature of the economy as the

economy of Belgium is developed the people have a high purchasing power, thus ensuring a

high standard of living. The country has a very deep rooted heritage in terms of popular

Renaissance architecture (State.gov 2018). Not only that the there are a mixture of several

languages that are spoken in the country like French, German and Dutch. The properties in

the country have distinct architecture that is closely associated with the heritage of the

country (State.gov 2018).

Technology: The people of the country have an inclination towards using latest technology

as the government also provides the infrastructure for the people. There is increased usage of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC RECOMMENDATION

telecommunication and social media has provided several opportunities for investors (Kew

and Stredwick 2017).

Porter’s Five forces

With the help of this model the company can understand the competition in the

market and take decisions accordingly to gain an edge over the other players in the market.

Michel porter introduced this concept in 1979 (Porter 2011). The industry in which Cheval

group of companies operate is real estate and thus the analysis is going to revolve around the

same.

Threat of new entry: Real estate is an industry that comes with comparatively large

liabilities, the investment is also large, until the new entrants are backed with a large capital

investment it is difficult to enter the Industry, another major aspect of the industry is building

and working with contacts thus for a newcomer it would be difficult to operate. Thus it can be

inferred that the threat of new entrants is low for the Cheval group as the company has been

operating for a number of years and has created a reputation among the shareholders (Porter

2011).

Intensity of competitors: The real estate industry has intense competition some of the direct

competitors are Mainstay Group, Savills UK, Blue Property Management etc. On the other

hand there are also significant direct competitors in Belgium, therefore it can be concluded

that the intensity is high.

Bargaining power of the suppliers: The switching powers of the suppliers are low as there

is intensity of competition in the market. The suppliers can easily choose one company over

another if they are not bound by any contract. The bargaining power of the suppliers is

medium (Porter 2011).

telecommunication and social media has provided several opportunities for investors (Kew

and Stredwick 2017).

Porter’s Five forces

With the help of this model the company can understand the competition in the

market and take decisions accordingly to gain an edge over the other players in the market.

Michel porter introduced this concept in 1979 (Porter 2011). The industry in which Cheval

group of companies operate is real estate and thus the analysis is going to revolve around the

same.

Threat of new entry: Real estate is an industry that comes with comparatively large

liabilities, the investment is also large, until the new entrants are backed with a large capital

investment it is difficult to enter the Industry, another major aspect of the industry is building

and working with contacts thus for a newcomer it would be difficult to operate. Thus it can be

inferred that the threat of new entrants is low for the Cheval group as the company has been

operating for a number of years and has created a reputation among the shareholders (Porter

2011).

Intensity of competitors: The real estate industry has intense competition some of the direct

competitors are Mainstay Group, Savills UK, Blue Property Management etc. On the other

hand there are also significant direct competitors in Belgium, therefore it can be concluded

that the intensity is high.

Bargaining power of the suppliers: The switching powers of the suppliers are low as there

is intensity of competition in the market. The suppliers can easily choose one company over

another if they are not bound by any contract. The bargaining power of the suppliers is

medium (Porter 2011).

8STRATEGIC RECOMMENDATION

Bargaining power of the customers: The customers are usually regarded as the most

important stakeholders of the business as they are the reason why the company is formed in

the first place. Due to the high intensity of competition the bargaining power of the customers

rises, in case they do not like what Cheval group has to offer they can easily switch to another

company. Therefore the company has to always be in constant evolution of the policies to

make it more attractive for the customers (Dobbs 2014).

Threat of substitution: The substitutes to such an organisation are individual brokers or

clients independently looking for properties. The threat is low to medium in this case as there

is also a trust factor that is important while operating in the real estate industry (Fiore et al.

2015).

Internal Analysis

McKinsey 7S Framework

This model will help in analysing the way in which Cheval Group of companies

achieve the objectives of the business. Developed in 1980, this framework will help in

understanding the ways in which the performance of the company can be improved (Ravanfar

2015). There are seven elements discussed in the framework which are divided in two

categories hard and soft. Following is the analysis of Cheval group’s internal resource and

capabilities.

Hard elements:

Strategy: To maintain an edge over the other players in the market the company has

specialized in areas by limiting the operations to selected areas. This has given the company

opportunity to explore the portfolio in terms of services (Chevalgroup.com 2018). Operating

in a limited areas provide the company to offer focused high quality services to the clients.

Bargaining power of the customers: The customers are usually regarded as the most

important stakeholders of the business as they are the reason why the company is formed in

the first place. Due to the high intensity of competition the bargaining power of the customers

rises, in case they do not like what Cheval group has to offer they can easily switch to another

company. Therefore the company has to always be in constant evolution of the policies to

make it more attractive for the customers (Dobbs 2014).

Threat of substitution: The substitutes to such an organisation are individual brokers or

clients independently looking for properties. The threat is low to medium in this case as there

is also a trust factor that is important while operating in the real estate industry (Fiore et al.

2015).

Internal Analysis

McKinsey 7S Framework

This model will help in analysing the way in which Cheval Group of companies

achieve the objectives of the business. Developed in 1980, this framework will help in

understanding the ways in which the performance of the company can be improved (Ravanfar

2015). There are seven elements discussed in the framework which are divided in two

categories hard and soft. Following is the analysis of Cheval group’s internal resource and

capabilities.

Hard elements:

Strategy: To maintain an edge over the other players in the market the company has

specialized in areas by limiting the operations to selected areas. This has given the company

opportunity to explore the portfolio in terms of services (Chevalgroup.com 2018). Operating

in a limited areas provide the company to offer focused high quality services to the clients.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STRATEGIC RECOMMENDATION

On the other hand this has also limited the operations to a large extent (Chevalgroup.com

2018).

Structure: The company is led by the managing director Mohammed S Almarzooqi who is

the managing director and the structure of the company is hierarchal when it comes to

operations however there are individual leaders who leads there teams (Chevalgroup.com

2018). Director Mike Sadler leads the team of Property & Facilities Management, Asset

management, Maintenance team. Finance director Louise Uys-Jones, leads the finance team

under her visionary leadership, while Development manager Bill Reddrop heads the

development team. This structure is effective as there is a clear point of contact for the people

and this ensures effective communication (Chevalgroup.com 2018).

System: Each of the team mentioned above have their job roles and operations resulting on

achieving the day to day operations of the business (Ravanfar 2015).

Soft elements

Shared values: the core value of the company is to provide the customers with a high quality

service in terms of managing the property and reach out the right kind of place that the clients

require. The company also believes in educating the customers regarding the trends and the

requirements in the real estate market as well as providing them with information they are

looking for (Singh 2013).

Style: The leadership style that will be adopted by the by the leaders of the company is

transformational in nature as the company has evolved and has changed over the years to

cater to the dynamic needs and requirements of the customers (Chevalgroup.com 2018).

Staff: The human resources of the company are not only skilled in their domain but are also

experienced in their field and have knowledge about the job role and responsibilities that they

On the other hand this has also limited the operations to a large extent (Chevalgroup.com

2018).

Structure: The company is led by the managing director Mohammed S Almarzooqi who is

the managing director and the structure of the company is hierarchal when it comes to

operations however there are individual leaders who leads there teams (Chevalgroup.com

2018). Director Mike Sadler leads the team of Property & Facilities Management, Asset

management, Maintenance team. Finance director Louise Uys-Jones, leads the finance team

under her visionary leadership, while Development manager Bill Reddrop heads the

development team. This structure is effective as there is a clear point of contact for the people

and this ensures effective communication (Chevalgroup.com 2018).

System: Each of the team mentioned above have their job roles and operations resulting on

achieving the day to day operations of the business (Ravanfar 2015).

Soft elements

Shared values: the core value of the company is to provide the customers with a high quality

service in terms of managing the property and reach out the right kind of place that the clients

require. The company also believes in educating the customers regarding the trends and the

requirements in the real estate market as well as providing them with information they are

looking for (Singh 2013).

Style: The leadership style that will be adopted by the by the leaders of the company is

transformational in nature as the company has evolved and has changed over the years to

cater to the dynamic needs and requirements of the customers (Chevalgroup.com 2018).

Staff: The human resources of the company are not only skilled in their domain but are also

experienced in their field and have knowledge about the job role and responsibilities that they

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STRATEGIC RECOMMENDATION

have to perform. The company has posted experienced leaders in management posts to lead

the company towards achieving success (Gyepi-Garbrah and Binfor 2013).

Skill: As the company operates in the service industry some of the most important skill

among the people are efficient and effective communication, academic accreditation as well

as understanding of the industry (Cross 2015).

have to perform. The company has posted experienced leaders in management posts to lead

the company towards achieving success (Gyepi-Garbrah and Binfor 2013).

Skill: As the company operates in the service industry some of the most important skill

among the people are efficient and effective communication, academic accreditation as well

as understanding of the industry (Cross 2015).

11STRATEGIC RECOMMENDATION

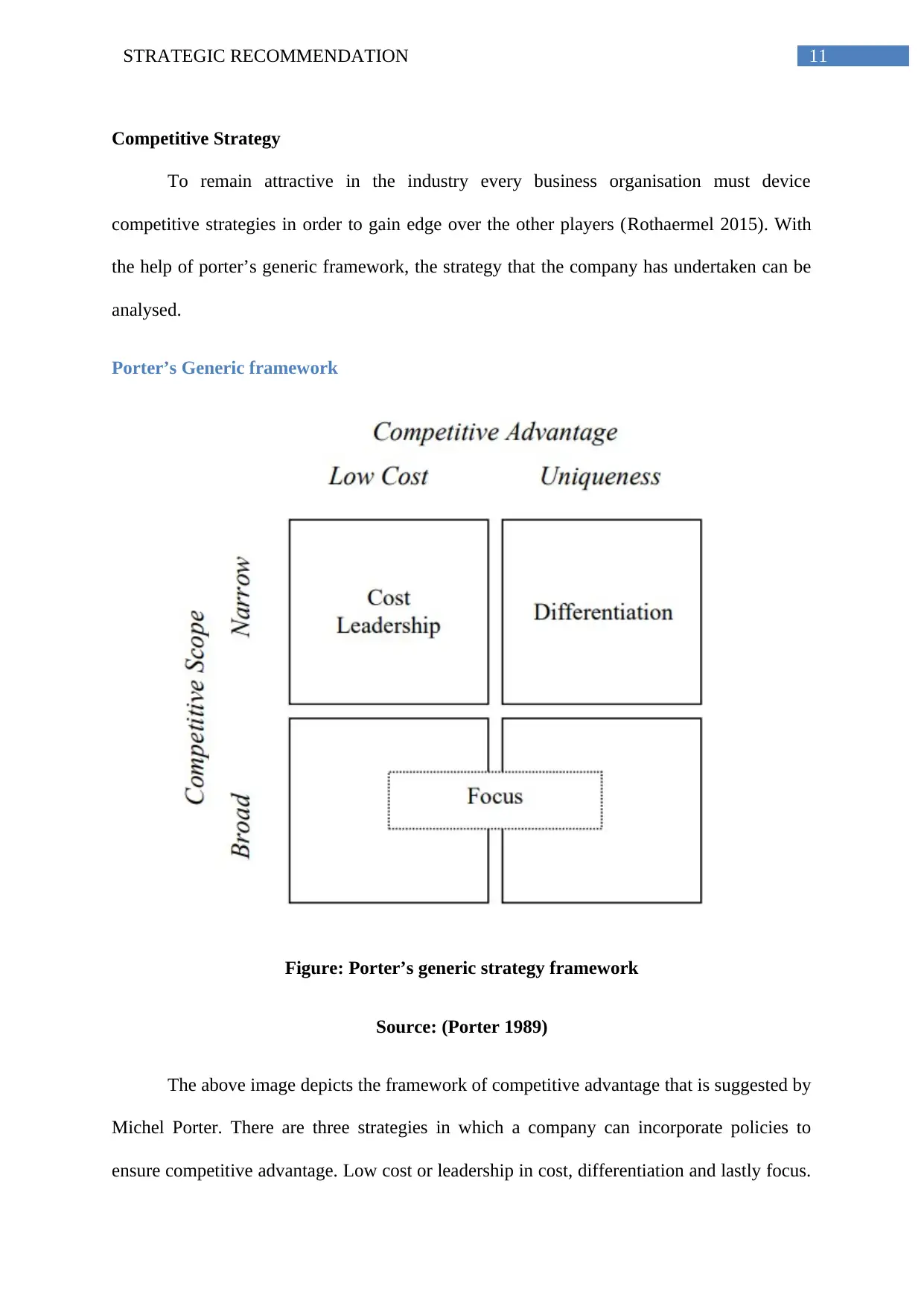

Competitive Strategy

To remain attractive in the industry every business organisation must device

competitive strategies in order to gain edge over the other players (Rothaermel 2015). With

the help of porter’s generic framework, the strategy that the company has undertaken can be

analysed.

Porter’s Generic framework

Figure: Porter’s generic strategy framework

Source: (Porter 1989)

The above image depicts the framework of competitive advantage that is suggested by

Michel Porter. There are three strategies in which a company can incorporate policies to

ensure competitive advantage. Low cost or leadership in cost, differentiation and lastly focus.

Competitive Strategy

To remain attractive in the industry every business organisation must device

competitive strategies in order to gain edge over the other players (Rothaermel 2015). With

the help of porter’s generic framework, the strategy that the company has undertaken can be

analysed.

Porter’s Generic framework

Figure: Porter’s generic strategy framework

Source: (Porter 1989)

The above image depicts the framework of competitive advantage that is suggested by

Michel Porter. There are three strategies in which a company can incorporate policies to

ensure competitive advantage. Low cost or leadership in cost, differentiation and lastly focus.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.