Managerial Finance Report: Coca-Cola Amatil Business Finance Overview

VerifiedAdded on 2022/11/13

|17

|2803

|84

Report

AI Summary

This report provides a comprehensive analysis of the financial activities of Coca-Cola Amatil, an ASX-listed company. It begins with an executive summary and introduction, followed by an examination of the company's risk profile, encompassing both systematic and unsystematic risks. The report then delves into the overall financial performance, including income statements, balance sheets, cash flow, and key financial ratios. A significant portion is dedicated to the time value of money, its importance, and its application to Coca-Cola Amatil's investments. Furthermore, the report explores the company's sources of finance, including debts and equity capital, and its payout policy, including dividend reinvestment plans. The analysis incorporates relevant financial theories and provides insights into the company's strategic decisions and financial health, supported by references to academic sources and company reports.

Running Head: Managerial Finance

Managerial Finance

[Type the document subtitle]

Laptop04011

[Pick the date]

Managerial Finance

[Type the document subtitle]

Laptop04011

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance 1

Executive Summary

The below mentioned paper elaborates the theories about understanding business finance in

external environment. The paper relates to the business finance activities of the ASX listed

company Coca Cola along with the elaboration of various theories in the environment. The risk

profile, time value of money, sources of finance and payout policies are identified in the paper in

relation to various activities of the company Coca Cola Amatil. The financial analysis of the

company has been conducted to give proof to the theories stated in the environment. Further, it

should be noted that the time value of money is crucial in increasing the profitability of the

company in the business environment. The company has invested in various segments which are

expected to provide growth of the business in international environment. More information about

the business finance activities of the company Coca Cola Amatil are discussed below:

Executive Summary

The below mentioned paper elaborates the theories about understanding business finance in

external environment. The paper relates to the business finance activities of the ASX listed

company Coca Cola along with the elaboration of various theories in the environment. The risk

profile, time value of money, sources of finance and payout policies are identified in the paper in

relation to various activities of the company Coca Cola Amatil. The financial analysis of the

company has been conducted to give proof to the theories stated in the environment. Further, it

should be noted that the time value of money is crucial in increasing the profitability of the

company in the business environment. The company has invested in various segments which are

expected to provide growth of the business in international environment. More information about

the business finance activities of the company Coca Cola Amatil are discussed below:

Managerial Finance 2

Contents

Introduction......................................................................................................................................3

Risk Profile......................................................................................................................................3

Overall Financial Performance........................................................................................................5

Income Statement........................................................................................................................5

Balance Sheet...............................................................................................................................6

Cash Flow....................................................................................................................................8

Financial Ratios...........................................................................................................................9

Time Value for Money..................................................................................................................12

Sources of Finance.........................................................................................................................13

Payout Policy.................................................................................................................................13

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

Contents

Introduction......................................................................................................................................3

Risk Profile......................................................................................................................................3

Overall Financial Performance........................................................................................................5

Income Statement........................................................................................................................5

Balance Sheet...............................................................................................................................6

Cash Flow....................................................................................................................................8

Financial Ratios...........................................................................................................................9

Time Value for Money..................................................................................................................12

Sources of Finance.........................................................................................................................13

Payout Policy.................................................................................................................................13

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managerial Finance 3

Introduction

The below mentioned paper discuss information about the ASX listed company Coca Cola

Amatil. The organization is the largest bottlers of non-alcoholic beverages present in the Asia

Pacific region. The company comes under the list of top five major Coca-Cola bottlers present in

the worldwide market. The organization Coca Cola Amatil operates its business in six countries

that are Australia, Indonesia, New Zealand, Samoa, Papua New Guinea and Fiji. The company

was founded in the year 1904 and is currently working in the beverages industry. The main

competitor of Coca Cola Amatil is PepsiCo which is also present in the beverages in industry,

while other competitors of Coca Cola involve Schweppes, Saxby and Heinz etc. The company

Coca Cola Amatil holds 43% of the total share of the beverages industry. Further, the business

objective of Coca Cola is to maximize the level of profits by maintaining long term sustainable

growth activities in the business environment (Coca Cola Amatil, 2019).

Further, the mission statement of the company states that they want to refresh the world and

inspire moments of optimism in the environment. The below mentioned report elaborates details

about the concepts of time value of money, risk of return, sources of finance and payout policy in

the business environment in context to the financial activities of the company Coca Cola Amatil.

More details about the paper are discussed below:

Risk Profile

Being a public company, Coca Cola Amatil faces different types of risks in the environment. The

company faces both systematic and unsystematic risks in the business environment that affects

volatility of its share prices and returns. Initially looking at unsystematic risks, an unsystematic

risk occurs in the industry or organization that affects the activities of respective business only.

So, it should be noted that unsystematic risks fluctuates the position of one single organization in

the target market. This type of risk decreases with the creation of portfolios that diversify the

amount of risks in the business environment (Waemustafa, & Sukri, 2016). Considering the case

in Coca Cola Amatil, it should be noted that in the year 2017, the company Woolworths decided

to set quota for the Coca Cola Amatil’s Mount Franklin Water and favour the company Pepsi in

the target market. This type of activity alarmed the interest of investors in the environment and

Introduction

The below mentioned paper discuss information about the ASX listed company Coca Cola

Amatil. The organization is the largest bottlers of non-alcoholic beverages present in the Asia

Pacific region. The company comes under the list of top five major Coca-Cola bottlers present in

the worldwide market. The organization Coca Cola Amatil operates its business in six countries

that are Australia, Indonesia, New Zealand, Samoa, Papua New Guinea and Fiji. The company

was founded in the year 1904 and is currently working in the beverages industry. The main

competitor of Coca Cola Amatil is PepsiCo which is also present in the beverages in industry,

while other competitors of Coca Cola involve Schweppes, Saxby and Heinz etc. The company

Coca Cola Amatil holds 43% of the total share of the beverages industry. Further, the business

objective of Coca Cola is to maximize the level of profits by maintaining long term sustainable

growth activities in the business environment (Coca Cola Amatil, 2019).

Further, the mission statement of the company states that they want to refresh the world and

inspire moments of optimism in the environment. The below mentioned report elaborates details

about the concepts of time value of money, risk of return, sources of finance and payout policy in

the business environment in context to the financial activities of the company Coca Cola Amatil.

More details about the paper are discussed below:

Risk Profile

Being a public company, Coca Cola Amatil faces different types of risks in the environment. The

company faces both systematic and unsystematic risks in the business environment that affects

volatility of its share prices and returns. Initially looking at unsystematic risks, an unsystematic

risk occurs in the industry or organization that affects the activities of respective business only.

So, it should be noted that unsystematic risks fluctuates the position of one single organization in

the target market. This type of risk decreases with the creation of portfolios that diversify the

amount of risks in the business environment (Waemustafa, & Sukri, 2016). Considering the case

in Coca Cola Amatil, it should be noted that in the year 2017, the company Woolworths decided

to set quota for the Coca Cola Amatil’s Mount Franklin Water and favour the company Pepsi in

the target market. This type of activity alarmed the interest of investors in the environment and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance 4

they started selling their shares in the market due to which the share price of the company’s

product was reduced by almost 3.75% in the business environment (Bhuyan, Reza, & El-Houbi,

2016).

Further, talking about systematic risks, it should be noted that systematic risks includes the

factors that affect the position of the market on a whole. This type of risk can be local or global

in nature but it affects to all the companies present in the industry. This type of fluctuation

creates impact on the whole society in the business environment. Also, this type of risk cannot be

diversified using portfolio diversification in the business environment (Chatzilakos, 2018).

Considering the case of Coca Cola Amatil Company it should be noted that increased use of

online shopping techniques has decreased the sales of the companies present the target market.

Through online sales many organization get to target the customers through multi-level

marketing and provide them products at discounts (Ayoob, 2018).

Resulting in which, customers reduces Coca Cola faces difficulty in supplying the products

online to small retailers due to which the sales revenue of the company is reduced. It should be

noted that systematic risks are much more risky than the unsystematic risk because in case of

unsystematic risk, the organization has the opportunity to pitch in for their risk and negotiate it in

the environment by diversifying the portfolio while in the case of systematic risks, the

organization do not have any way to go where they can manage their growth in market as all

other organizations present in the same industry are struggling to manage their position (Stewart,

2019).

they started selling their shares in the market due to which the share price of the company’s

product was reduced by almost 3.75% in the business environment (Bhuyan, Reza, & El-Houbi,

2016).

Further, talking about systematic risks, it should be noted that systematic risks includes the

factors that affect the position of the market on a whole. This type of risk can be local or global

in nature but it affects to all the companies present in the industry. This type of fluctuation

creates impact on the whole society in the business environment. Also, this type of risk cannot be

diversified using portfolio diversification in the business environment (Chatzilakos, 2018).

Considering the case of Coca Cola Amatil Company it should be noted that increased use of

online shopping techniques has decreased the sales of the companies present the target market.

Through online sales many organization get to target the customers through multi-level

marketing and provide them products at discounts (Ayoob, 2018).

Resulting in which, customers reduces Coca Cola faces difficulty in supplying the products

online to small retailers due to which the sales revenue of the company is reduced. It should be

noted that systematic risks are much more risky than the unsystematic risk because in case of

unsystematic risk, the organization has the opportunity to pitch in for their risk and negotiate it in

the environment by diversifying the portfolio while in the case of systematic risks, the

organization do not have any way to go where they can manage their growth in market as all

other organizations present in the same industry are struggling to manage their position (Stewart,

2019).

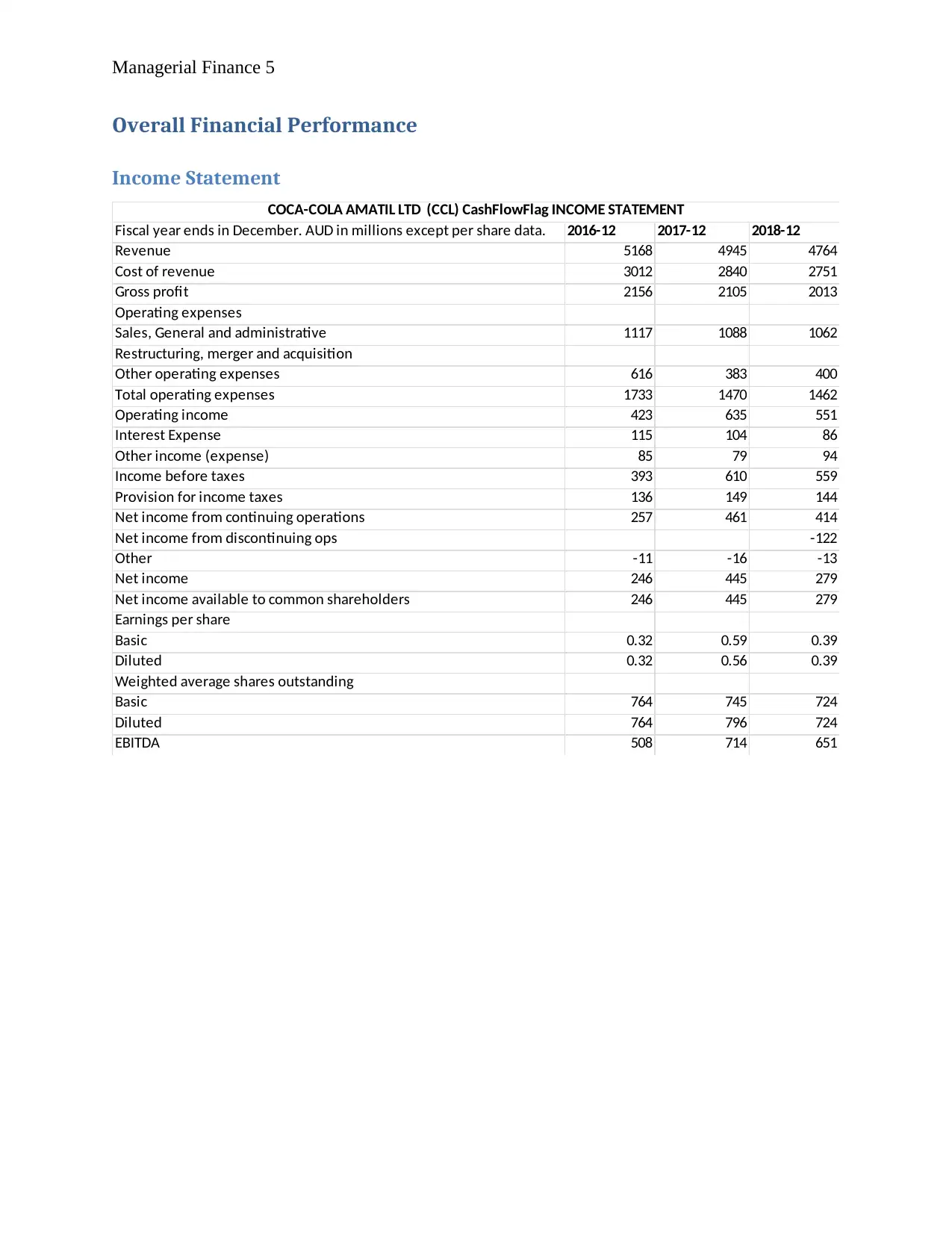

Managerial Finance 5

Overall Financial Performance

Income Statement

Fiscal year ends in December. AUD in millions except per share data. 2016-12 2017-12 2018-12

Revenue 5168 4945 4764

Cost of revenue 3012 2840 2751

Gross profit 2156 2105 2013

Operating expenses

Sales, General and administrative 1117 1088 1062

Restructuring, merger and acquisition

Other operating expenses 616 383 400

Total operating expenses 1733 1470 1462

Operating income 423 635 551

Interest Expense 115 104 86

Other income (expense) 85 79 94

Income before taxes 393 610 559

Provision for income taxes 136 149 144

Net income from continuing operations 257 461 414

Net income from discontinuing ops -122

Other -11 -16 -13

Net income 246 445 279

Net income available to common shareholders 246 445 279

Earnings per share

Basic 0.32 0.59 0.39

Diluted 0.32 0.56 0.39

Weighted average shares outstanding

Basic 764 745 724

Diluted 764 796 724

EBITDA 508 714 651

COCA-COLA AMATIL LTD (CCL) CashFlowFlag INCOME STATEMENT

Overall Financial Performance

Income Statement

Fiscal year ends in December. AUD in millions except per share data. 2016-12 2017-12 2018-12

Revenue 5168 4945 4764

Cost of revenue 3012 2840 2751

Gross profit 2156 2105 2013

Operating expenses

Sales, General and administrative 1117 1088 1062

Restructuring, merger and acquisition

Other operating expenses 616 383 400

Total operating expenses 1733 1470 1462

Operating income 423 635 551

Interest Expense 115 104 86

Other income (expense) 85 79 94

Income before taxes 393 610 559

Provision for income taxes 136 149 144

Net income from continuing operations 257 461 414

Net income from discontinuing ops -122

Other -11 -16 -13

Net income 246 445 279

Net income available to common shareholders 246 445 279

Earnings per share

Basic 0.32 0.59 0.39

Diluted 0.32 0.56 0.39

Weighted average shares outstanding

Basic 764 745 724

Diluted 764 796 724

EBITDA 508 714 651

COCA-COLA AMATIL LTD (CCL) CashFlowFlag INCOME STATEMENT

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managerial Finance 6

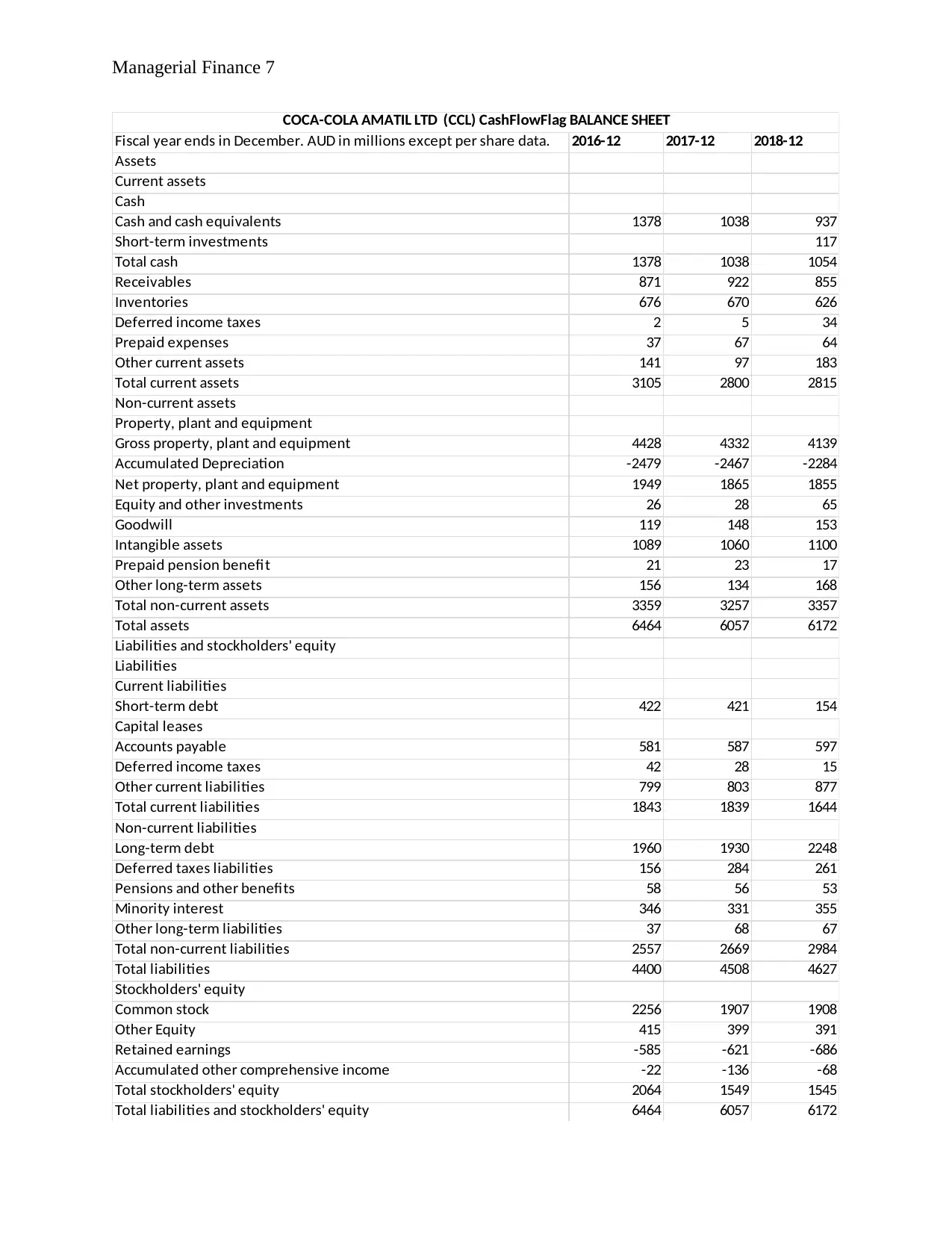

Balance Sheet

Balance Sheet

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance 7

Fiscal year ends in December. AUD in millions except per share data. 2016-12 2017-12 2018-12

Assets

Current assets

Cash

Cash and cash equivalents 1378 1038 937

Short-term investments 117

Total cash 1378 1038 1054

Receivables 871 922 855

Inventories 676 670 626

Deferred income taxes 2 5 34

Prepaid expenses 37 67 64

Other current assets 141 97 183

Total current assets 3105 2800 2815

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 4428 4332 4139

Accumulated Depreciation -2479 -2467 -2284

Net property, plant and equipment 1949 1865 1855

Equity and other investments 26 28 65

Goodwill 119 148 153

Intangible assets 1089 1060 1100

Prepaid pension benefit 21 23 17

Other long-term assets 156 134 168

Total non-current assets 3359 3257 3357

Total assets 6464 6057 6172

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 422 421 154

Capital leases

Accounts payable 581 587 597

Deferred income taxes 42 28 15

Other current liabilities 799 803 877

Total current liabilities 1843 1839 1644

Non-current liabilities

Long-term debt 1960 1930 2248

Deferred taxes liabilities 156 284 261

Pensions and other benefits 58 56 53

Minority interest 346 331 355

Other long-term liabilities 37 68 67

Total non-current liabilities 2557 2669 2984

Total liabilities 4400 4508 4627

Stockholders' equity

Common stock 2256 1907 1908

Other Equity 415 399 391

Retained earnings -585 -621 -686

Accumulated other comprehensive income -22 -136 -68

Total stockholders' equity 2064 1549 1545

Total liabilities and stockholders' equity 6464 6057 6172

COCA-COLA AMATIL LTD (CCL) CashFlowFlag BALANCE SHEET

Fiscal year ends in December. AUD in millions except per share data. 2016-12 2017-12 2018-12

Assets

Current assets

Cash

Cash and cash equivalents 1378 1038 937

Short-term investments 117

Total cash 1378 1038 1054

Receivables 871 922 855

Inventories 676 670 626

Deferred income taxes 2 5 34

Prepaid expenses 37 67 64

Other current assets 141 97 183

Total current assets 3105 2800 2815

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 4428 4332 4139

Accumulated Depreciation -2479 -2467 -2284

Net property, plant and equipment 1949 1865 1855

Equity and other investments 26 28 65

Goodwill 119 148 153

Intangible assets 1089 1060 1100

Prepaid pension benefit 21 23 17

Other long-term assets 156 134 168

Total non-current assets 3359 3257 3357

Total assets 6464 6057 6172

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 422 421 154

Capital leases

Accounts payable 581 587 597

Deferred income taxes 42 28 15

Other current liabilities 799 803 877

Total current liabilities 1843 1839 1644

Non-current liabilities

Long-term debt 1960 1930 2248

Deferred taxes liabilities 156 284 261

Pensions and other benefits 58 56 53

Minority interest 346 331 355

Other long-term liabilities 37 68 67

Total non-current liabilities 2557 2669 2984

Total liabilities 4400 4508 4627

Stockholders' equity

Common stock 2256 1907 1908

Other Equity 415 399 391

Retained earnings -585 -621 -686

Accumulated other comprehensive income -22 -136 -68

Total stockholders' equity 2064 1549 1545

Total liabilities and stockholders' equity 6464 6057 6172

COCA-COLA AMATIL LTD (CCL) CashFlowFlag BALANCE SHEET

Managerial Finance 8

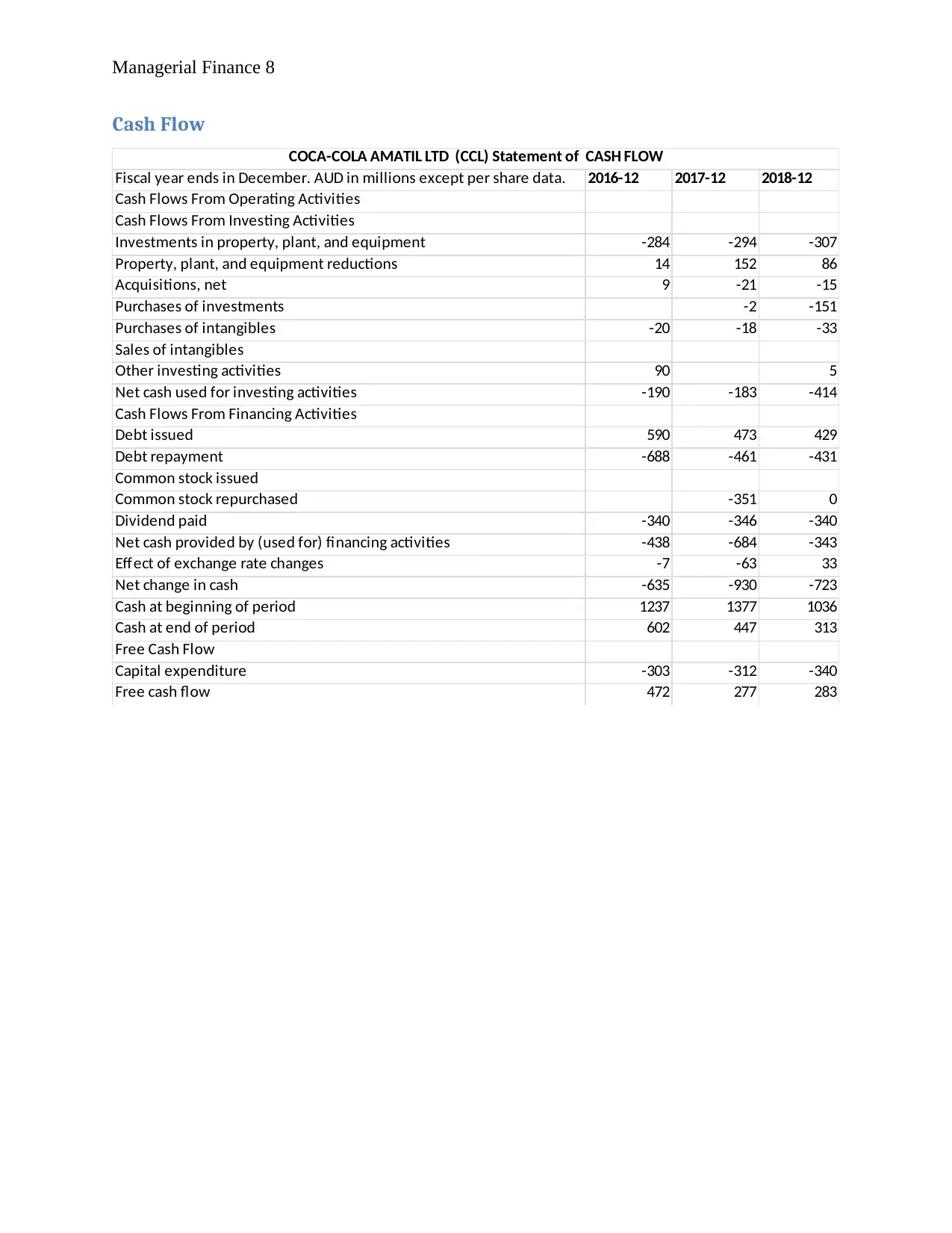

Cash Flow

Fiscal year ends in December. AUD in millions except per share data. 2016-12 2017-12 2018-12

Cash Flows From Operating Activities

Cash Flows From Investing Activities

Investments in property, plant, and equipment -284 -294 -307

Property, plant, and equipment reductions 14 152 86

Acquisitions, net 9 -21 -15

Purchases of investments -2 -151

Purchases of intangibles -20 -18 -33

Sales of intangibles

Other investing activities 90 5

Net cash used for investing activities -190 -183 -414

Cash Flows From Financing Activities

Debt issued 590 473 429

Debt repayment -688 -461 -431

Common stock issued

Common stock repurchased -351 0

Dividend paid -340 -346 -340

Net cash provided by (used for) financing activities -438 -684 -343

Effect of exchange rate changes -7 -63 33

Net change in cash -635 -930 -723

Cash at beginning of period 1237 1377 1036

Cash at end of period 602 447 313

Free Cash Flow

Capital expenditure -303 -312 -340

Free cash flow 472 277 283

COCA-COLA AMATIL LTD (CCL) Statement of CASH FLOW

Cash Flow

Fiscal year ends in December. AUD in millions except per share data. 2016-12 2017-12 2018-12

Cash Flows From Operating Activities

Cash Flows From Investing Activities

Investments in property, plant, and equipment -284 -294 -307

Property, plant, and equipment reductions 14 152 86

Acquisitions, net 9 -21 -15

Purchases of investments -2 -151

Purchases of intangibles -20 -18 -33

Sales of intangibles

Other investing activities 90 5

Net cash used for investing activities -190 -183 -414

Cash Flows From Financing Activities

Debt issued 590 473 429

Debt repayment -688 -461 -431

Common stock issued

Common stock repurchased -351 0

Dividend paid -340 -346 -340

Net cash provided by (used for) financing activities -438 -684 -343

Effect of exchange rate changes -7 -63 33

Net change in cash -635 -930 -723

Cash at beginning of period 1237 1377 1036

Cash at end of period 602 447 313

Free Cash Flow

Capital expenditure -303 -312 -340

Free cash flow 472 277 283

COCA-COLA AMATIL LTD (CCL) Statement of CASH FLOW

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managerial Finance 9

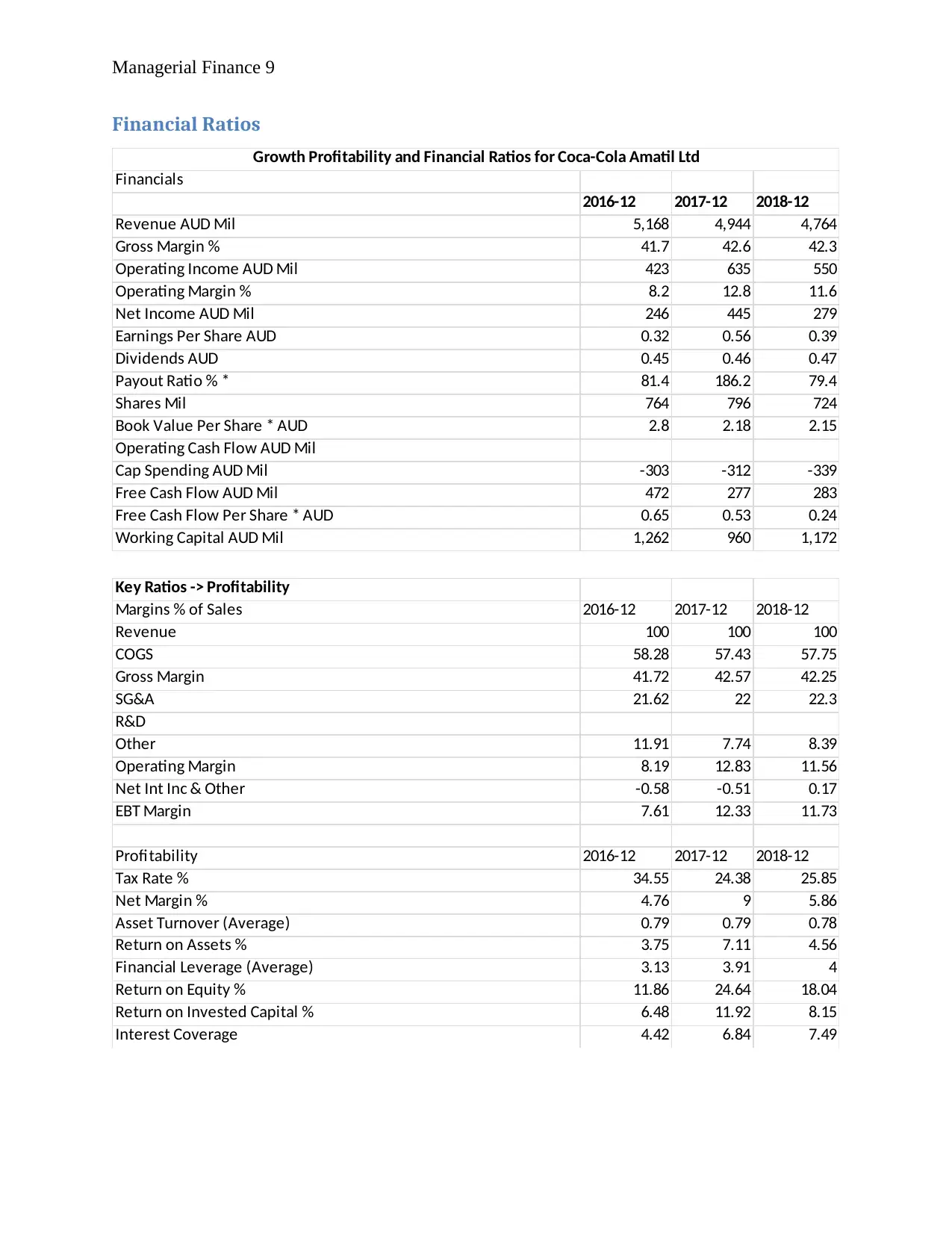

Financial Ratios

Financials

2016-12 2017-12 2018-12

Revenue AUD Mil 5,168 4,944 4,764

Gross Margin % 41.7 42.6 42.3

Operating Income AUD Mil 423 635 550

Operating Margin % 8.2 12.8 11.6

Net Income AUD Mil 246 445 279

Earnings Per Share AUD 0.32 0.56 0.39

Dividends AUD 0.45 0.46 0.47

Payout Ratio % * 81.4 186.2 79.4

Shares Mil 764 796 724

Book Value Per Share * AUD 2.8 2.18 2.15

Operating Cash Flow AUD Mil

Cap Spending AUD Mil -303 -312 -339

Free Cash Flow AUD Mil 472 277 283

Free Cash Flow Per Share * AUD 0.65 0.53 0.24

Working Capital AUD Mil 1,262 960 1,172

Growth Profitability and Financial Ratios for Coca-Cola Amatil Ltd

Key Ratios -> Profitability

Margins % of Sales 2016-12 2017-12 2018-12

Revenue 100 100 100

COGS 58.28 57.43 57.75

Gross Margin 41.72 42.57 42.25

SG&A 21.62 22 22.3

R&D

Other 11.91 7.74 8.39

Operating Margin 8.19 12.83 11.56

Net Int Inc & Other -0.58 -0.51 0.17

EBT Margin 7.61 12.33 11.73

Profitability 2016-12 2017-12 2018-12

Tax Rate % 34.55 24.38 25.85

Net Margin % 4.76 9 5.86

Asset Turnover (Average) 0.79 0.79 0.78

Return on Assets % 3.75 7.11 4.56

Financial Leverage (Average) 3.13 3.91 4

Return on Equity % 11.86 24.64 18.04

Return on Invested Capital % 6.48 11.92 8.15

Interest Coverage 4.42 6.84 7.49

Financial Ratios

Financials

2016-12 2017-12 2018-12

Revenue AUD Mil 5,168 4,944 4,764

Gross Margin % 41.7 42.6 42.3

Operating Income AUD Mil 423 635 550

Operating Margin % 8.2 12.8 11.6

Net Income AUD Mil 246 445 279

Earnings Per Share AUD 0.32 0.56 0.39

Dividends AUD 0.45 0.46 0.47

Payout Ratio % * 81.4 186.2 79.4

Shares Mil 764 796 724

Book Value Per Share * AUD 2.8 2.18 2.15

Operating Cash Flow AUD Mil

Cap Spending AUD Mil -303 -312 -339

Free Cash Flow AUD Mil 472 277 283

Free Cash Flow Per Share * AUD 0.65 0.53 0.24

Working Capital AUD Mil 1,262 960 1,172

Growth Profitability and Financial Ratios for Coca-Cola Amatil Ltd

Key Ratios -> Profitability

Margins % of Sales 2016-12 2017-12 2018-12

Revenue 100 100 100

COGS 58.28 57.43 57.75

Gross Margin 41.72 42.57 42.25

SG&A 21.62 22 22.3

R&D

Other 11.91 7.74 8.39

Operating Margin 8.19 12.83 11.56

Net Int Inc & Other -0.58 -0.51 0.17

EBT Margin 7.61 12.33 11.73

Profitability 2016-12 2017-12 2018-12

Tax Rate % 34.55 24.38 25.85

Net Margin % 4.76 9 5.86

Asset Turnover (Average) 0.79 0.79 0.78

Return on Assets % 3.75 7.11 4.56

Financial Leverage (Average) 3.13 3.91 4

Return on Equity % 11.86 24.64 18.04

Return on Invested Capital % 6.48 11.92 8.15

Interest Coverage 4.42 6.84 7.49

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance 10

Looking at the calculation of profitability ratio of the company, it should be noted that the

organization is attaining optimum amount of interest coverage in the environment through its

investments. The net margin ratio of the company has reduced from the past year but still the

growth is sustainable (Stewart, 2019).

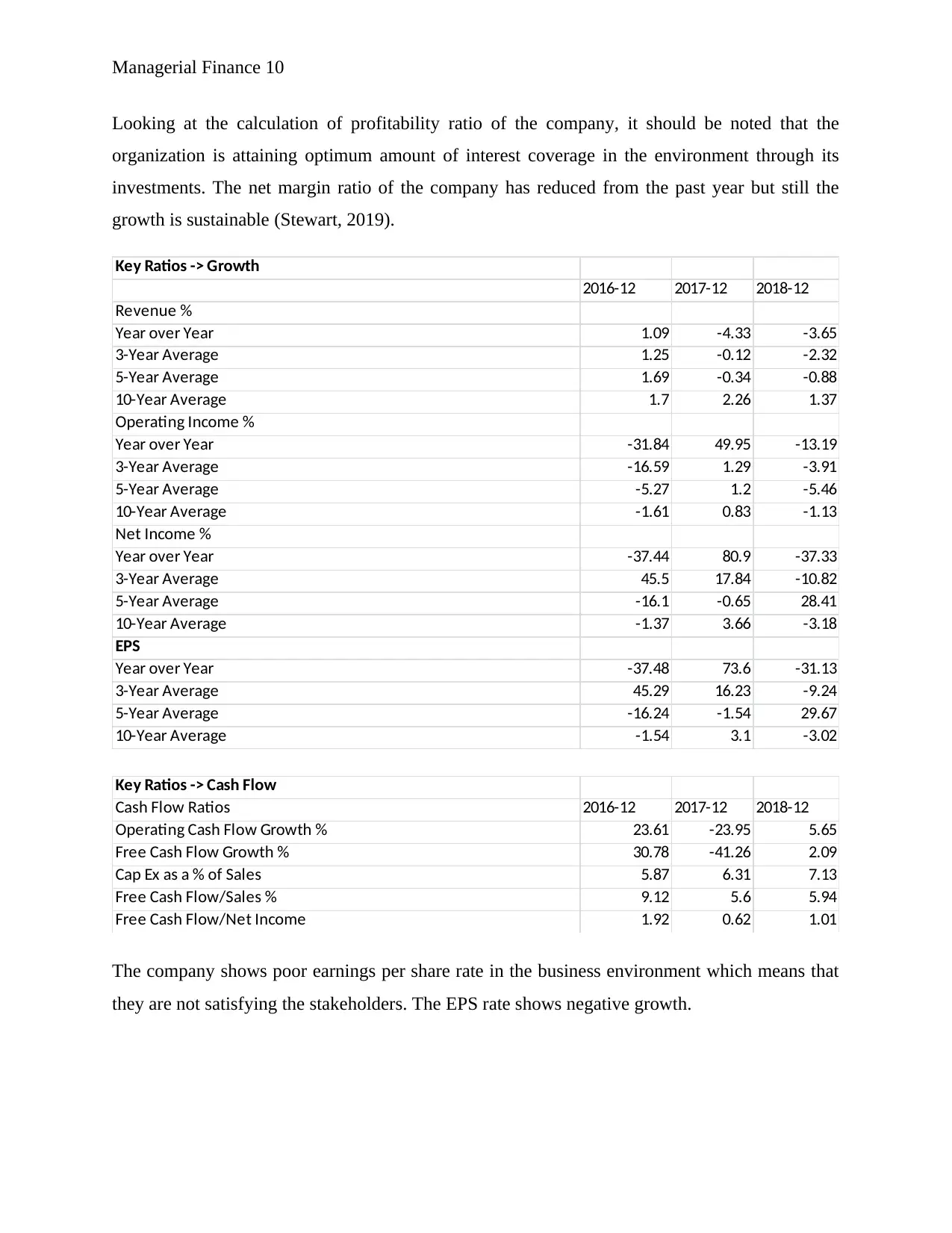

Key Ratios -> Growth

2016-12 2017-12 2018-12

Revenue %

Year over Year 1.09 -4.33 -3.65

3-Year Average 1.25 -0.12 -2.32

5-Year Average 1.69 -0.34 -0.88

10-Year Average 1.7 2.26 1.37

Operating Income %

Year over Year -31.84 49.95 -13.19

3-Year Average -16.59 1.29 -3.91

5-Year Average -5.27 1.2 -5.46

10-Year Average -1.61 0.83 -1.13

Net Income %

Year over Year -37.44 80.9 -37.33

3-Year Average 45.5 17.84 -10.82

5-Year Average -16.1 -0.65 28.41

10-Year Average -1.37 3.66 -3.18

EPS

Year over Year -37.48 73.6 -31.13

3-Year Average 45.29 16.23 -9.24

5-Year Average -16.24 -1.54 29.67

10-Year Average -1.54 3.1 -3.02

Key Ratios -> Cash Flow

Cash Flow Ratios 2016-12 2017-12 2018-12

Operating Cash Flow Growth % 23.61 -23.95 5.65

Free Cash Flow Growth % 30.78 -41.26 2.09

Cap Ex as a % of Sales 5.87 6.31 7.13

Free Cash Flow/Sales % 9.12 5.6 5.94

Free Cash Flow/Net Income 1.92 0.62 1.01

The company shows poor earnings per share rate in the business environment which means that

they are not satisfying the stakeholders. The EPS rate shows negative growth.

Looking at the calculation of profitability ratio of the company, it should be noted that the

organization is attaining optimum amount of interest coverage in the environment through its

investments. The net margin ratio of the company has reduced from the past year but still the

growth is sustainable (Stewart, 2019).

Key Ratios -> Growth

2016-12 2017-12 2018-12

Revenue %

Year over Year 1.09 -4.33 -3.65

3-Year Average 1.25 -0.12 -2.32

5-Year Average 1.69 -0.34 -0.88

10-Year Average 1.7 2.26 1.37

Operating Income %

Year over Year -31.84 49.95 -13.19

3-Year Average -16.59 1.29 -3.91

5-Year Average -5.27 1.2 -5.46

10-Year Average -1.61 0.83 -1.13

Net Income %

Year over Year -37.44 80.9 -37.33

3-Year Average 45.5 17.84 -10.82

5-Year Average -16.1 -0.65 28.41

10-Year Average -1.37 3.66 -3.18

EPS

Year over Year -37.48 73.6 -31.13

3-Year Average 45.29 16.23 -9.24

5-Year Average -16.24 -1.54 29.67

10-Year Average -1.54 3.1 -3.02

Key Ratios -> Cash Flow

Cash Flow Ratios 2016-12 2017-12 2018-12

Operating Cash Flow Growth % 23.61 -23.95 5.65

Free Cash Flow Growth % 30.78 -41.26 2.09

Cap Ex as a % of Sales 5.87 6.31 7.13

Free Cash Flow/Sales % 9.12 5.6 5.94

Free Cash Flow/Net Income 1.92 0.62 1.01

The company shows poor earnings per share rate in the business environment which means that

they are not satisfying the stakeholders. The EPS rate shows negative growth.

Managerial Finance 11

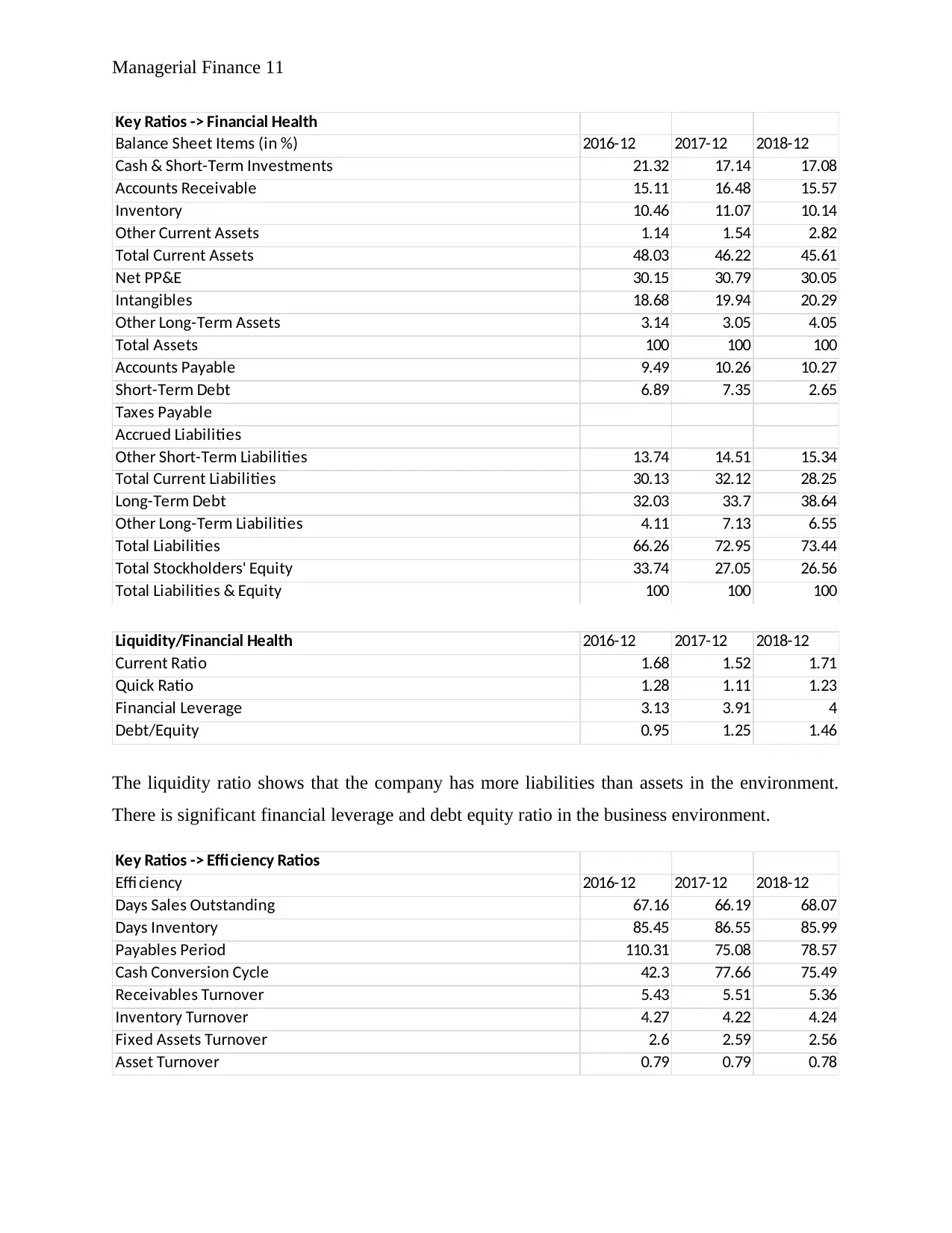

Key Ratios -> Financial Health

Balance Sheet Items (in %) 2016-12 2017-12 2018-12

Cash & Short-Term Investments 21.32 17.14 17.08

Accounts Receivable 15.11 16.48 15.57

Inventory 10.46 11.07 10.14

Other Current Assets 1.14 1.54 2.82

Total Current Assets 48.03 46.22 45.61

Net PP&E 30.15 30.79 30.05

Intangibles 18.68 19.94 20.29

Other Long-Term Assets 3.14 3.05 4.05

Total Assets 100 100 100

Accounts Payable 9.49 10.26 10.27

Short-Term Debt 6.89 7.35 2.65

Taxes Payable

Accrued Liabilities

Other Short-Term Liabilities 13.74 14.51 15.34

Total Current Liabilities 30.13 32.12 28.25

Long-Term Debt 32.03 33.7 38.64

Other Long-Term Liabilities 4.11 7.13 6.55

Total Liabilities 66.26 72.95 73.44

Total Stockholders' Equity 33.74 27.05 26.56

Total Liabilities & Equity 100 100 100

Liquidity/Financial Health 2016-12 2017-12 2018-12

Current Ratio 1.68 1.52 1.71

Quick Ratio 1.28 1.11 1.23

Financial Leverage 3.13 3.91 4

Debt/Equity 0.95 1.25 1.46

The liquidity ratio shows that the company has more liabilities than assets in the environment.

There is significant financial leverage and debt equity ratio in the business environment.

Key Ratios -> Efficiency Ratios

Effi ciency 2016-12 2017-12 2018-12

Days Sales Outstanding 67.16 66.19 68.07

Days Inventory 85.45 86.55 85.99

Payables Period 110.31 75.08 78.57

Cash Conversion Cycle 42.3 77.66 75.49

Receivables Turnover 5.43 5.51 5.36

Inventory Turnover 4.27 4.22 4.24

Fixed Assets Turnover 2.6 2.59 2.56

Asset Turnover 0.79 0.79 0.78

Key Ratios -> Financial Health

Balance Sheet Items (in %) 2016-12 2017-12 2018-12

Cash & Short-Term Investments 21.32 17.14 17.08

Accounts Receivable 15.11 16.48 15.57

Inventory 10.46 11.07 10.14

Other Current Assets 1.14 1.54 2.82

Total Current Assets 48.03 46.22 45.61

Net PP&E 30.15 30.79 30.05

Intangibles 18.68 19.94 20.29

Other Long-Term Assets 3.14 3.05 4.05

Total Assets 100 100 100

Accounts Payable 9.49 10.26 10.27

Short-Term Debt 6.89 7.35 2.65

Taxes Payable

Accrued Liabilities

Other Short-Term Liabilities 13.74 14.51 15.34

Total Current Liabilities 30.13 32.12 28.25

Long-Term Debt 32.03 33.7 38.64

Other Long-Term Liabilities 4.11 7.13 6.55

Total Liabilities 66.26 72.95 73.44

Total Stockholders' Equity 33.74 27.05 26.56

Total Liabilities & Equity 100 100 100

Liquidity/Financial Health 2016-12 2017-12 2018-12

Current Ratio 1.68 1.52 1.71

Quick Ratio 1.28 1.11 1.23

Financial Leverage 3.13 3.91 4

Debt/Equity 0.95 1.25 1.46

The liquidity ratio shows that the company has more liabilities than assets in the environment.

There is significant financial leverage and debt equity ratio in the business environment.

Key Ratios -> Efficiency Ratios

Effi ciency 2016-12 2017-12 2018-12

Days Sales Outstanding 67.16 66.19 68.07

Days Inventory 85.45 86.55 85.99

Payables Period 110.31 75.08 78.57

Cash Conversion Cycle 42.3 77.66 75.49

Receivables Turnover 5.43 5.51 5.36

Inventory Turnover 4.27 4.22 4.24

Fixed Assets Turnover 2.6 2.59 2.56

Asset Turnover 0.79 0.79 0.78

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.