Financial Analysis Project: Coca-Cola Amatil Capital Structure Report

VerifiedAdded on 2021/06/16

|10

|1261

|82

Project

AI Summary

This project report analyzes the capital structure of Coca-Cola Amatil, focusing on its financial management and performance. The report evaluates the company's overall cost of capital and risk position using WACC (Weighted Average Cost of Capital) and gearing ratio calculations. It provides an overview of Coca-Cola Amatil, a major non-alcoholic beverage company operating in Australia and other regions. The analysis includes detailed calculations of the cost of debt, cost of equity (using CAPM), and the resulting WACC. Furthermore, the report examines the gearing ratio to assess the company's long-term liabilities relative to its capital employed. The findings suggest a competitive capital structure, with detailed explanations, judgments, and recommendations to enhance the company's financial strategy. The report uses financial data from the company's annual reports and external sources to support its analysis.

Running Head: Financial Management

1

Project Report: Financial Management

1

Project Report: Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

2

Executive summary

This study has been prepared to evaluate the capital structure position. In the report,

capital structure position has been studied of Coca cola Amatil, the report takes the concern

of overall cost of capital of the organization as well as the company’s risk position. In the

report WACC and gearing ratio has been calculated to identify the performance of the

company. The position of the capital structure of the company is quite competitive and briefs

that the capital structure of the company is quite competitive.

2

Executive summary

This study has been prepared to evaluate the capital structure position. In the report,

capital structure position has been studied of Coca cola Amatil, the report takes the concern

of overall cost of capital of the organization as well as the company’s risk position. In the

report WACC and gearing ratio has been calculated to identify the performance of the

company. The position of the capital structure of the company is quite competitive and briefs

that the capital structure of the company is quite competitive.

Financial Management

3

Contents

Introduction.......................................................................................................................4

Company overview...........................................................................................................4

WACC..............................................................................................................................4

Explanation and Judgment................................................................................................5

Gearing ratio and issues....................................................................................................6

Findings............................................................................................................................6

Recommendation:.............................................................................................................7

Reflection..........................................................................................................................7

References.........................................................................................................................8

Appendix...........................................................................................................................9

3

Contents

Introduction.......................................................................................................................4

Company overview...........................................................................................................4

WACC..............................................................................................................................4

Explanation and Judgment................................................................................................5

Gearing ratio and issues....................................................................................................6

Findings............................................................................................................................6

Recommendation:.............................................................................................................7

Reflection..........................................................................................................................7

References.........................................................................................................................8

Appendix...........................................................................................................................9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

4

Introduction:

Financial management is a key process of every organization. Financial management

is done by the top level manager of the organization to estimate the company’s performance.

Financial management procedure evaluates all the financial related factors of an organization

to measure the presentation of the company. Capital structure analysis is also a part of

financial management which assists the organization to identify the risk level and total cost

position of the organization. The better the capital structure position of an organization would

be, the better the performance and risk position of the company would be.

In the report, capital structure position has been studied of Coca cola Amatil, the

report takes the concern of overall cost of capital of the corporation as well as the risk place

of the company.

Company overview:

Coca cola Amatil is a beverage corporation which is operating its business in

Australia. The business is registered in the Australian stock exchange. It is one of the largest

non alcoholic beverage companies in Australia. Coca Cola Amatil is the subsidiary company

of coca cola. The company also operates its business in Fiji, Samoa, New Zealand, Papua

New Guinea and Indonesia. The organization offers a huge variety of non alcoholic drinks in

the market (Home, 2017). Annual report (2017) of the company explains about the total

capital (debt and equity) amount of the company and explains that the financial performance

of the company has been better in 2017.

WACC:

For evaluating the capital structure position of an organization, WACC study is one

of the important tool. It explains about the total cost of the company related to the capital.

WACC stands for weighted average cost of capital. This techniques explains that what is the

total cost of the company in terms of various sources which has been used by the company to

finance its resources.

In case of Coca Cola Amatil, it has been found that the company has used the debt

fund and equity fund to raise the total capital of the organization. Total debt amount and

equity amount of the company is $ 1930 million and $ 1549 million, on the basis of book

4

Introduction:

Financial management is a key process of every organization. Financial management

is done by the top level manager of the organization to estimate the company’s performance.

Financial management procedure evaluates all the financial related factors of an organization

to measure the presentation of the company. Capital structure analysis is also a part of

financial management which assists the organization to identify the risk level and total cost

position of the organization. The better the capital structure position of an organization would

be, the better the performance and risk position of the company would be.

In the report, capital structure position has been studied of Coca cola Amatil, the

report takes the concern of overall cost of capital of the corporation as well as the risk place

of the company.

Company overview:

Coca cola Amatil is a beverage corporation which is operating its business in

Australia. The business is registered in the Australian stock exchange. It is one of the largest

non alcoholic beverage companies in Australia. Coca Cola Amatil is the subsidiary company

of coca cola. The company also operates its business in Fiji, Samoa, New Zealand, Papua

New Guinea and Indonesia. The organization offers a huge variety of non alcoholic drinks in

the market (Home, 2017). Annual report (2017) of the company explains about the total

capital (debt and equity) amount of the company and explains that the financial performance

of the company has been better in 2017.

WACC:

For evaluating the capital structure position of an organization, WACC study is one

of the important tool. It explains about the total cost of the company related to the capital.

WACC stands for weighted average cost of capital. This techniques explains that what is the

total cost of the company in terms of various sources which has been used by the company to

finance its resources.

In case of Coca Cola Amatil, it has been found that the company has used the debt

fund and equity fund to raise the total capital of the organization. Total debt amount and

equity amount of the company is $ 1930 million and $ 1549 million, on the basis of book

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

5

value amount of the company and the debt amount and equity amount of the company on the

basis of market value is $ 1930 million and $ 7111 million. The WACC of the company is

WACC calculations of Coca Cola Amatil (Market

Value)

(Amount in million)

Price Cost Weight WACC

Debt 1,930 5.25% 0.21 1.12%

Equity 7,111 5.72% 0.79 4.50%

9,041 Kd 5.62%

(Reuters, 2018)

Explanation and Judgment:

For calculating the WACC amount of the company, cost of debt and cost of equity

(ke) of the company has been measured firstly and it has been multiplied with the sum

portion of debt and equity amount in total capital amount with the cost of debt (kd) and cost

of equity (Ke).

For calculating the cost of debt of the company, tax amount and interest rate has

been required which has been found in the annual report (2017) of the company and it has

been found that the total cost of debt of the company is 5.25%.

Calculation of cost of debt

Outstanding debt 1,930

interest rate 7.50%

Tax rate 30.0%

Kd 5.25%

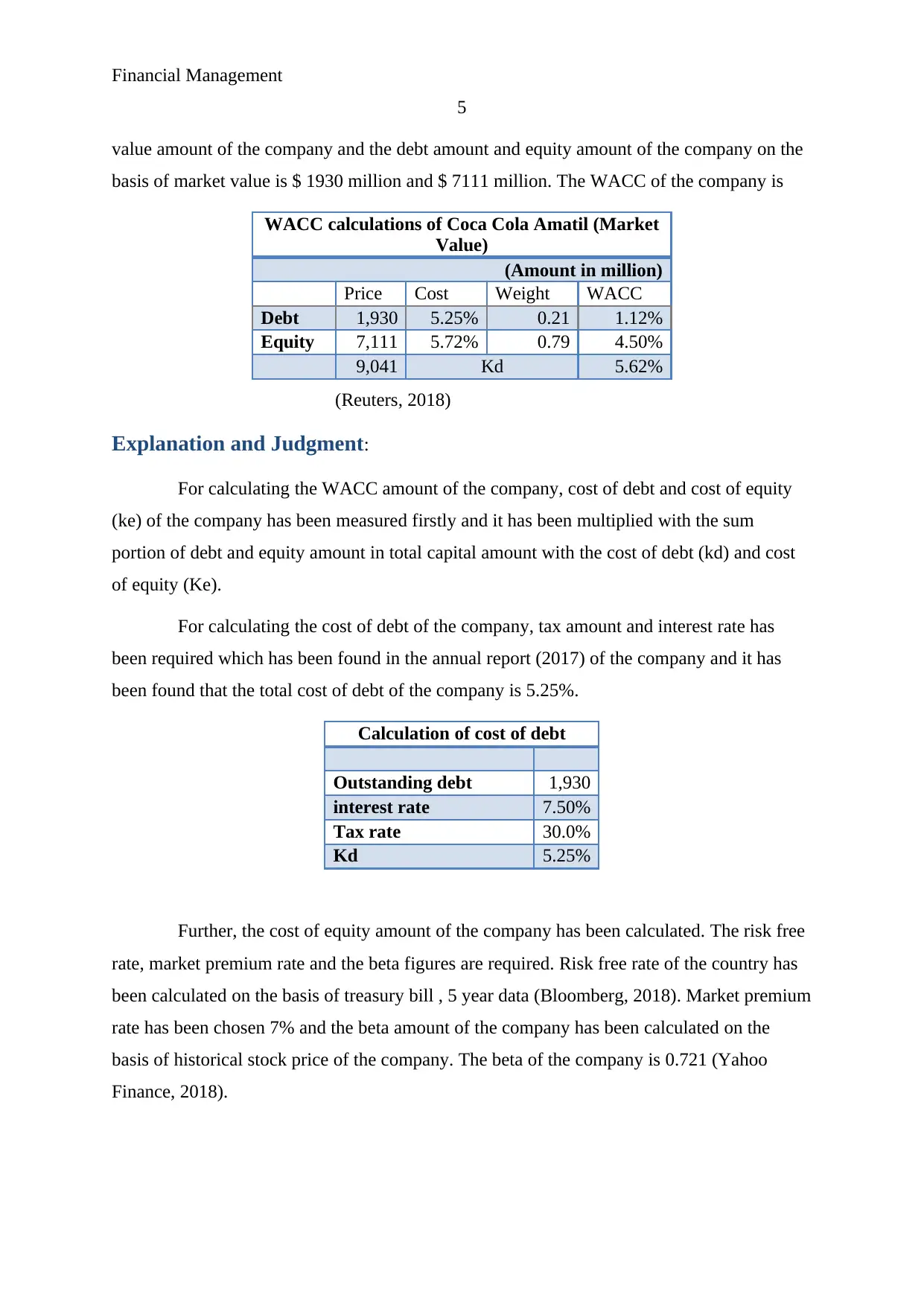

Further, the cost of equity amount of the company has been calculated. The risk free

rate, market premium rate and the beta figures are required. Risk free rate of the country has

been calculated on the basis of treasury bill , 5 year data (Bloomberg, 2018). Market premium

rate has been chosen 7% and the beta amount of the company has been calculated on the

basis of historical stock price of the company. The beta of the company is 0.721 (Yahoo

Finance, 2018).

5

value amount of the company and the debt amount and equity amount of the company on the

basis of market value is $ 1930 million and $ 7111 million. The WACC of the company is

WACC calculations of Coca Cola Amatil (Market

Value)

(Amount in million)

Price Cost Weight WACC

Debt 1,930 5.25% 0.21 1.12%

Equity 7,111 5.72% 0.79 4.50%

9,041 Kd 5.62%

(Reuters, 2018)

Explanation and Judgment:

For calculating the WACC amount of the company, cost of debt and cost of equity

(ke) of the company has been measured firstly and it has been multiplied with the sum

portion of debt and equity amount in total capital amount with the cost of debt (kd) and cost

of equity (Ke).

For calculating the cost of debt of the company, tax amount and interest rate has

been required which has been found in the annual report (2017) of the company and it has

been found that the total cost of debt of the company is 5.25%.

Calculation of cost of debt

Outstanding debt 1,930

interest rate 7.50%

Tax rate 30.0%

Kd 5.25%

Further, the cost of equity amount of the company has been calculated. The risk free

rate, market premium rate and the beta figures are required. Risk free rate of the country has

been calculated on the basis of treasury bill , 5 year data (Bloomberg, 2018). Market premium

rate has been chosen 7% and the beta amount of the company has been calculated on the

basis of historical stock price of the company. The beta of the company is 0.721 (Yahoo

Finance, 2018).

Financial Management

6

Figure 1: Return

Calculation of cost of equity

(CAPM)

RF 2.41%

RM 7.00%

Beta 0.721

Cost of equity 5.72%

It leads to a conclusion that the cost of debt and cost of equity of the company is

5.25% and 5.72%. And the weight of debt and equity is 0.21 and 0.79. It leads to the total

WACC of 5.62%. It explains that the current cost of capita of the company is 5.72%. It

explains that the company is required to pay 5.72% in total for the current resources of the

company.

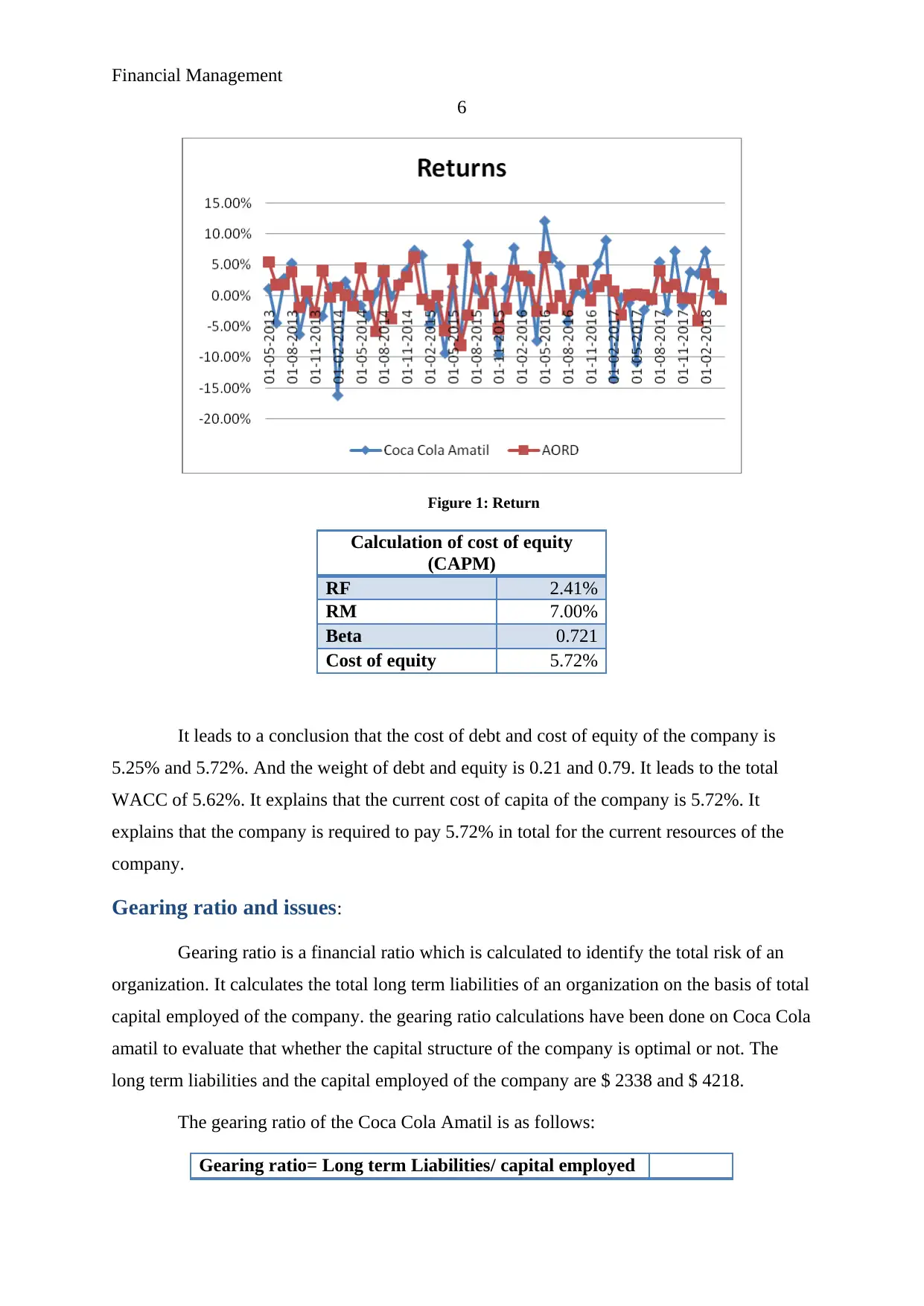

Gearing ratio and issues:

Gearing ratio is a financial ratio which is calculated to identify the total risk of an

organization. It calculates the total long term liabilities of an organization on the basis of total

capital employed of the company. the gearing ratio calculations have been done on Coca Cola

amatil to evaluate that whether the capital structure of the company is optimal or not. The

long term liabilities and the capital employed of the company are $ 2338 and $ 4218.

The gearing ratio of the Coca Cola Amatil is as follows:

Gearing ratio= Long term Liabilities/ capital employed

6

Figure 1: Return

Calculation of cost of equity

(CAPM)

RF 2.41%

RM 7.00%

Beta 0.721

Cost of equity 5.72%

It leads to a conclusion that the cost of debt and cost of equity of the company is

5.25% and 5.72%. And the weight of debt and equity is 0.21 and 0.79. It leads to the total

WACC of 5.62%. It explains that the current cost of capita of the company is 5.72%. It

explains that the company is required to pay 5.72% in total for the current resources of the

company.

Gearing ratio and issues:

Gearing ratio is a financial ratio which is calculated to identify the total risk of an

organization. It calculates the total long term liabilities of an organization on the basis of total

capital employed of the company. the gearing ratio calculations have been done on Coca Cola

amatil to evaluate that whether the capital structure of the company is optimal or not. The

long term liabilities and the capital employed of the company are $ 2338 and $ 4218.

The gearing ratio of the Coca Cola Amatil is as follows:

Gearing ratio= Long term Liabilities/ capital employed

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

7

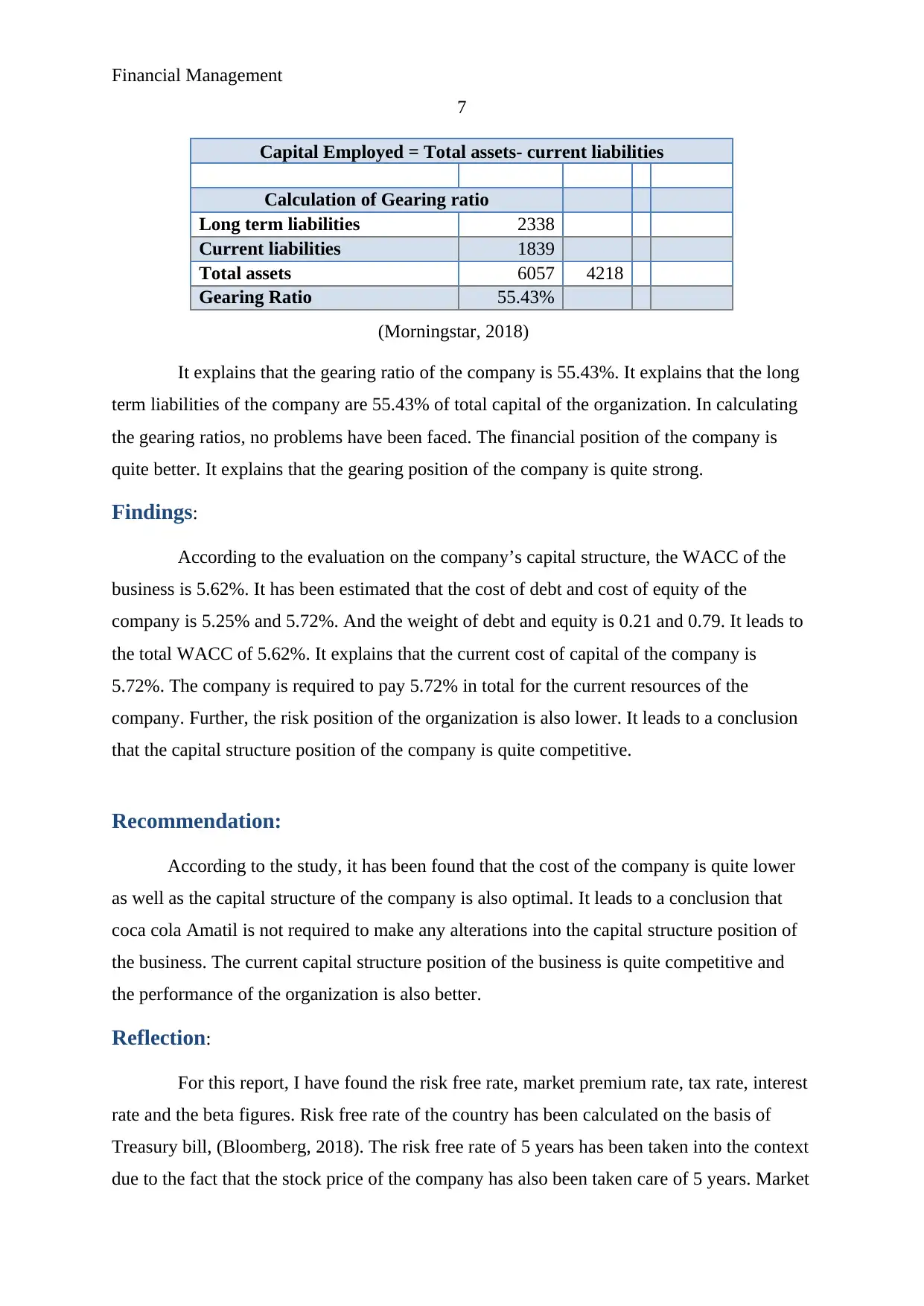

Capital Employed = Total assets- current liabilities

Calculation of Gearing ratio

Long term liabilities 2338

Current liabilities 1839

Total assets 6057 4218

Gearing Ratio 55.43%

(Morningstar, 2018)

It explains that the gearing ratio of the company is 55.43%. It explains that the long

term liabilities of the company are 55.43% of total capital of the organization. In calculating

the gearing ratios, no problems have been faced. The financial position of the company is

quite better. It explains that the gearing position of the company is quite strong.

Findings:

According to the evaluation on the company’s capital structure, the WACC of the

business is 5.62%. It has been estimated that the cost of debt and cost of equity of the

company is 5.25% and 5.72%. And the weight of debt and equity is 0.21 and 0.79. It leads to

the total WACC of 5.62%. It explains that the current cost of capital of the company is

5.72%. The company is required to pay 5.72% in total for the current resources of the

company. Further, the risk position of the organization is also lower. It leads to a conclusion

that the capital structure position of the company is quite competitive.

Recommendation:

According to the study, it has been found that the cost of the company is quite lower

as well as the capital structure of the company is also optimal. It leads to a conclusion that

coca cola Amatil is not required to make any alterations into the capital structure position of

the business. The current capital structure position of the business is quite competitive and

the performance of the organization is also better.

Reflection:

For this report, I have found the risk free rate, market premium rate, tax rate, interest

rate and the beta figures. Risk free rate of the country has been calculated on the basis of

Treasury bill, (Bloomberg, 2018). The risk free rate of 5 years has been taken into the context

due to the fact that the stock price of the company has also been taken care of 5 years. Market

7

Capital Employed = Total assets- current liabilities

Calculation of Gearing ratio

Long term liabilities 2338

Current liabilities 1839

Total assets 6057 4218

Gearing Ratio 55.43%

(Morningstar, 2018)

It explains that the gearing ratio of the company is 55.43%. It explains that the long

term liabilities of the company are 55.43% of total capital of the organization. In calculating

the gearing ratios, no problems have been faced. The financial position of the company is

quite better. It explains that the gearing position of the company is quite strong.

Findings:

According to the evaluation on the company’s capital structure, the WACC of the

business is 5.62%. It has been estimated that the cost of debt and cost of equity of the

company is 5.25% and 5.72%. And the weight of debt and equity is 0.21 and 0.79. It leads to

the total WACC of 5.62%. It explains that the current cost of capital of the company is

5.72%. The company is required to pay 5.72% in total for the current resources of the

company. Further, the risk position of the organization is also lower. It leads to a conclusion

that the capital structure position of the company is quite competitive.

Recommendation:

According to the study, it has been found that the cost of the company is quite lower

as well as the capital structure of the company is also optimal. It leads to a conclusion that

coca cola Amatil is not required to make any alterations into the capital structure position of

the business. The current capital structure position of the business is quite competitive and

the performance of the organization is also better.

Reflection:

For this report, I have found the risk free rate, market premium rate, tax rate, interest

rate and the beta figures. Risk free rate of the country has been calculated on the basis of

Treasury bill, (Bloomberg, 2018). The risk free rate of 5 years has been taken into the context

due to the fact that the stock price of the company has also been taken care of 5 years. Market

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

8

premium rate has been chosen 7% and the beta amount of the company has been calculated

on the basis of historical stock price of the company. The beta of the company is 0.721.

Further, the tax rate and the interest rate have been found in the annual report of the

company.

8

premium rate has been chosen 7% and the beta amount of the company has been calculated

on the basis of historical stock price of the company. The beta of the company is 0.721.

Further, the tax rate and the interest rate have been found in the annual report of the

company.

Financial Management

9

References:

Annual report. (2017). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/-/media/Cca/Corporate/Files/Annual-Reports/2018/Annual-

Report-2017.ashx.

Bloomberg. (2018). Australian bonds and rates. (Online). Retrieved on 14 May 2018 from:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/australia.

Home. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/.

Morningstar. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

http://financials.morningstar.com/income-statement/is.html?t=CCL®ion=aus.

Reuters. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.reuters.com/finance/stocks/overview/CCL.AX.

Yahoo Finance. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://finance.yahoo.com/quote/CCL.AX?ltr=1.

9

References:

Annual report. (2017). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/-/media/Cca/Corporate/Files/Annual-Reports/2018/Annual-

Report-2017.ashx.

Bloomberg. (2018). Australian bonds and rates. (Online). Retrieved on 14 May 2018 from:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/australia.

Home. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/.

Morningstar. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

http://financials.morningstar.com/income-statement/is.html?t=CCL®ion=aus.

Reuters. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.reuters.com/finance/stocks/overview/CCL.AX.

Yahoo Finance. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://finance.yahoo.com/quote/CCL.AX?ltr=1.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

10

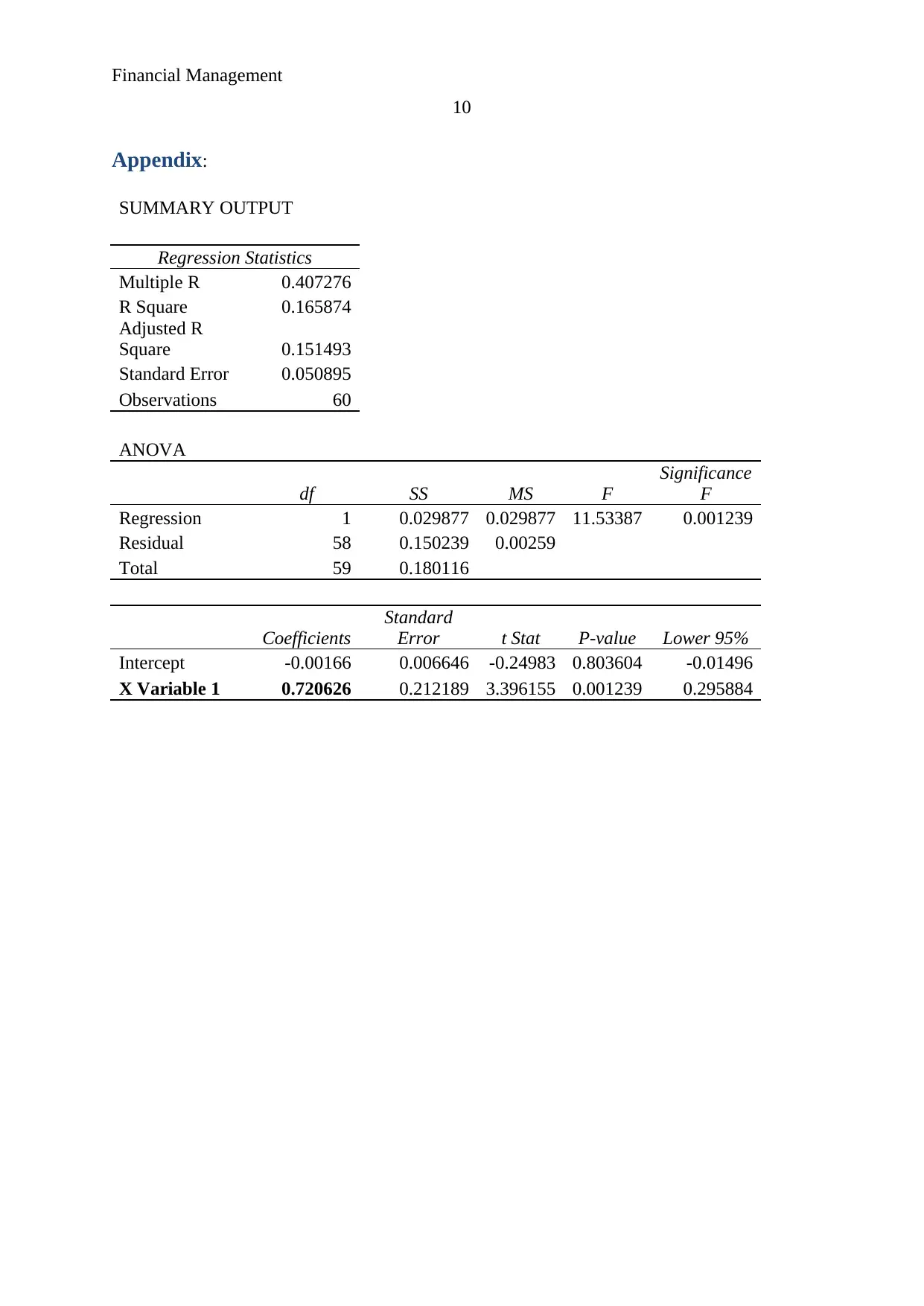

Appendix:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.407276

R Square 0.165874

Adjusted R

Square 0.151493

Standard Error 0.050895

Observations 60

ANOVA

df SS MS F

Significance

F

Regression 1 0.029877 0.029877 11.53387 0.001239

Residual 58 0.150239 0.00259

Total 59 0.180116

Coefficients

Standard

Error t Stat P-value Lower 95%

Intercept -0.00166 0.006646 -0.24983 0.803604 -0.01496

X Variable 1 0.720626 0.212189 3.396155 0.001239 0.295884

10

Appendix:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.407276

R Square 0.165874

Adjusted R

Square 0.151493

Standard Error 0.050895

Observations 60

ANOVA

df SS MS F

Significance

F

Regression 1 0.029877 0.029877 11.53387 0.001239

Residual 58 0.150239 0.00259

Total 59 0.180116

Coefficients

Standard

Error t Stat P-value Lower 95%

Intercept -0.00166 0.006646 -0.24983 0.803604 -0.01496

X Variable 1 0.720626 0.212189 3.396155 0.001239 0.295884

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.