Impact of Sustainability Disclosure on Coca-Cola's Market Performance

VerifiedAdded on 2023/06/07

|25

|5926

|325

Report

AI Summary

This report investigates the effect of sustainability disclosure on Coca-Cola's market performance, focusing on Return on Assets (ROA) and Return on Equity (ROE). It uses data from Coca-Cola's sustainability reports, annual reports, and CSR Hub for the period 2003-2017. The analysis includes descriptive statistics, bivariate correlation, and regression analysis to determine the impact of Corporate Social Responsibility (CSR), Community Performance, Employee Performance, Environmental Performance, and Governance Performance ratings on Coca-Cola's ROA and ROE. The research aims to determine if sustainability disclosure significantly influences the company's financial performance, addressing research questions related to the impact on both ROA and ROE, and tests associated null and alternative hypotheses.

Running head: EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET

PERFORMANCE OF COCA COLA

Effect of Sustainability Disclosure onf Market Performance of Coca Cola

Name of the Student

Name of the University

Course ID

PERFORMANCE OF COCA COLA

Effect of Sustainability Disclosure onf Market Performance of Coca Cola

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

Table of Contents

1.0Introduction.................................................................................................................................2

1.1 Definition...............................................................................................................................2

1.2 Background of the research...................................................................................................2

1.3 Aim of the research................................................................................................................3

1.4. Research Questions...............................................................................................................3

2.0 Literature Review......................................................................................................................3

2.1 Importance of sustainability reporting...................................................................................3

2.2 Sustainability reporting and market performance..................................................................4

2.3 Hypothesis.............................................................................................................................5

3.0 Methodology..............................................................................................................................6

3.1 Data collection.......................................................................................................................6

3.2 Data analysis..........................................................................................................................6

4.0 Findings and Analysis................................................................................................................8

4.1 Descriptive statistics..............................................................................................................8

4.2. Bivariate correlation...........................................................................................................10

4.3 Regression............................................................................................................................11

5.0 Discussion................................................................................................................................13

5.1 H1: Sustainability reporting significantly influences Return on Assets of Coca – Cola.....14

5.2 H1: Sustainability reporting significantly influences Return on Equity of Coca – Cola.....15

6.0 Conclusion...............................................................................................................................15

6.1 Research aim and research question....................................................................................16

6.2 Limitation............................................................................................................................16

6.3 Recommendation.................................................................................................................17

7.0 Reference list.......................................................................................................................18

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

Table of Contents

1.0Introduction.................................................................................................................................2

1.1 Definition...............................................................................................................................2

1.2 Background of the research...................................................................................................2

1.3 Aim of the research................................................................................................................3

1.4. Research Questions...............................................................................................................3

2.0 Literature Review......................................................................................................................3

2.1 Importance of sustainability reporting...................................................................................3

2.2 Sustainability reporting and market performance..................................................................4

2.3 Hypothesis.............................................................................................................................5

3.0 Methodology..............................................................................................................................6

3.1 Data collection.......................................................................................................................6

3.2 Data analysis..........................................................................................................................6

4.0 Findings and Analysis................................................................................................................8

4.1 Descriptive statistics..............................................................................................................8

4.2. Bivariate correlation...........................................................................................................10

4.3 Regression............................................................................................................................11

5.0 Discussion................................................................................................................................13

5.1 H1: Sustainability reporting significantly influences Return on Assets of Coca – Cola.....14

5.2 H1: Sustainability reporting significantly influences Return on Equity of Coca – Cola.....15

6.0 Conclusion...............................................................................................................................15

6.1 Research aim and research question....................................................................................16

6.2 Limitation............................................................................................................................16

6.3 Recommendation.................................................................................................................17

7.0 Reference list.......................................................................................................................18

2

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

1.0Introduction

1.1 Definition

Sustainability report of a company implies a composite report consisting economic, social

and environmental impact resulted from daily operation of the organization (Ogundare, 2013) In

other word, the sustainability report is a representative model of governance and value of an

organization (Nor et al., 2016). It also represents interlinkage between strategy of a company and

its commitments towards achieving a sustainable economy (Loh, Thomas & Wang, 2017)

Market performance of a company covers the ultimate results of different policies

including relationship between selling price and cost, output size, relative progressiveness of the

company, production efficiency compared to its rivals and others (Eccles, Ioannou & Serafeim,

2014). Different indicators of market performance include markets share, profitability, revenue,

return on equity, return on assets and the like.

1.2 Background of the research

The sustainability reporting has now a days become one major issue concerning across

the world. The main objective of sustainable practice is to meet the needs to present generation

without sacrificing the potential ability of future generation (Golicic & Smith, 2013) In regard to

this, investor now place a considerable importance on non-financial performance of a company.

The issue of corporate sustainability attracts significant attention in the phase of increased

regulation and awareness among the stakeholder (Hsu et al., 2016).

The research study analyzes impact of sustainability disclosure on market performance of

Coca-Cola. It is an American Corporation engaged in manufacturing and retailing of non-

alcoholic beverages and syrups (coca-colacompany.com, 2018). The company accounts its

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

1.0Introduction

1.1 Definition

Sustainability report of a company implies a composite report consisting economic, social

and environmental impact resulted from daily operation of the organization (Ogundare, 2013) In

other word, the sustainability report is a representative model of governance and value of an

organization (Nor et al., 2016). It also represents interlinkage between strategy of a company and

its commitments towards achieving a sustainable economy (Loh, Thomas & Wang, 2017)

Market performance of a company covers the ultimate results of different policies

including relationship between selling price and cost, output size, relative progressiveness of the

company, production efficiency compared to its rivals and others (Eccles, Ioannou & Serafeim,

2014). Different indicators of market performance include markets share, profitability, revenue,

return on equity, return on assets and the like.

1.2 Background of the research

The sustainability reporting has now a days become one major issue concerning across

the world. The main objective of sustainable practice is to meet the needs to present generation

without sacrificing the potential ability of future generation (Golicic & Smith, 2013) In regard to

this, investor now place a considerable importance on non-financial performance of a company.

The issue of corporate sustainability attracts significant attention in the phase of increased

regulation and awareness among the stakeholder (Hsu et al., 2016).

The research study analyzes impact of sustainability disclosure on market performance of

Coca-Cola. It is an American Corporation engaged in manufacturing and retailing of non-

alcoholic beverages and syrups (coca-colacompany.com, 2018). The company accounts its

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

sustainability reporting covering two major objectives of documentation and assessment of

environmental and social impact of the company (Cheng, Green & Ko, 2014) Additionally, the

company incorporates its sustainability disclosure in order to access the scope to communicate

regarding its progress of sustainability and efforts to stakeholders of the organization.

1.3 Aim of the research

The present paper aims at evaluating how sustainability disclosure of Coca-Cola affects

market performance of the company.

1.4. Research Questions

In order to accomplish the research aim following research questions are prepared.

Does sustainability disclosure of Coca – Cola have any effect on return of assets (ROA) of the

company?

Does sustainability disclosure of Coca – Cola affects return of equity (ROE) of the company?

2.0 Literature Review

2.1 Importance of sustainability reporting

Several scholarly researches successfully proved implication of sustainability reporting of

an organization in modern business world (Khan, Serafeim & Yoon, 2016). In studies related to

ranking of sustainability, bankers, analysts and other were asked to report rank on different

accounting data to understand the perceived importance of sustainability (Nekhili et al., 2017).

These studies concluded that sustainability reporting is mostly ranked as moderately important

for financial community (Lu et al., 2014). Study also founded that sustainability reporting

accounted a higher importance in financial world compared to many of the components that were

crucial in past and attracted considerable attention of the researchers (Ekwueme, Egbunike &

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

sustainability reporting covering two major objectives of documentation and assessment of

environmental and social impact of the company (Cheng, Green & Ko, 2014) Additionally, the

company incorporates its sustainability disclosure in order to access the scope to communicate

regarding its progress of sustainability and efforts to stakeholders of the organization.

1.3 Aim of the research

The present paper aims at evaluating how sustainability disclosure of Coca-Cola affects

market performance of the company.

1.4. Research Questions

In order to accomplish the research aim following research questions are prepared.

Does sustainability disclosure of Coca – Cola have any effect on return of assets (ROA) of the

company?

Does sustainability disclosure of Coca – Cola affects return of equity (ROE) of the company?

2.0 Literature Review

2.1 Importance of sustainability reporting

Several scholarly researches successfully proved implication of sustainability reporting of

an organization in modern business world (Khan, Serafeim & Yoon, 2016). In studies related to

ranking of sustainability, bankers, analysts and other were asked to report rank on different

accounting data to understand the perceived importance of sustainability (Nekhili et al., 2017).

These studies concluded that sustainability reporting is mostly ranked as moderately important

for financial community (Lu et al., 2014). Study also founded that sustainability reporting

accounted a higher importance in financial world compared to many of the components that were

crucial in past and attracted considerable attention of the researchers (Ekwueme, Egbunike &

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

Onyali, 2013) Sustainability reporting is considered as typically important as to represent

engagement and communication between an organization and its stakeholders. Stakeholders of a

company include shareholders, employees, investors, suppliers, community and government

(Andrikopoulos & Kriklani, 2013) It is of increasingly interesting for a company to know

sustainability practice of a company and performance of the company in managing impact of

sustainability on creating potential value of the company and mitigating future risks (Nobanee &

Ellili, 2016) This adds to the importance of sustainability reporting. The recent study confirmed

that senior directors and executives of a company now place great importance in handling issues

related to sustainability (Busch, Bauer & Orlitzky, 2016).

2.2 Sustainability reporting and market performance

Studies examining impact of sustainability reporting on market performance of an

organization used different aspects of market performance (Ng & Rezaee, 2015). One such study

examined the impact of social, environmental and ethical aspects on corporate performance for a

company named Alpha (Reimsbach & Hahn, 2015). The paper used measures like GRI,

guidelines for accountability and other reporting principles and concluded that for the selected

company social, environmental and ethical issues do not record much accountability to different

stakeholders (Kim & Lyon, 2014). Rather the evidences suggested a low accountability towards

sustainability reporting. Various external sources raised several questions regarding

stakeholders’ participation in reporting sustainability (Yusuf et al., 2013).

An empirical study analyzing importance of environmental disclosure revealed a positive

association between discretionary disclosure of a company and its environmental performance

(Chen, Feldmann & Tang, 2015). The paper made an extensive research design to study

importance of sustainability reporting. Results from past study questioned robustness of socio

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

Onyali, 2013) Sustainability reporting is considered as typically important as to represent

engagement and communication between an organization and its stakeholders. Stakeholders of a

company include shareholders, employees, investors, suppliers, community and government

(Andrikopoulos & Kriklani, 2013) It is of increasingly interesting for a company to know

sustainability practice of a company and performance of the company in managing impact of

sustainability on creating potential value of the company and mitigating future risks (Nobanee &

Ellili, 2016) This adds to the importance of sustainability reporting. The recent study confirmed

that senior directors and executives of a company now place great importance in handling issues

related to sustainability (Busch, Bauer & Orlitzky, 2016).

2.2 Sustainability reporting and market performance

Studies examining impact of sustainability reporting on market performance of an

organization used different aspects of market performance (Ng & Rezaee, 2015). One such study

examined the impact of social, environmental and ethical aspects on corporate performance for a

company named Alpha (Reimsbach & Hahn, 2015). The paper used measures like GRI,

guidelines for accountability and other reporting principles and concluded that for the selected

company social, environmental and ethical issues do not record much accountability to different

stakeholders (Kim & Lyon, 2014). Rather the evidences suggested a low accountability towards

sustainability reporting. Various external sources raised several questions regarding

stakeholders’ participation in reporting sustainability (Yusuf et al., 2013).

An empirical study analyzing importance of environmental disclosure revealed a positive

association between discretionary disclosure of a company and its environmental performance

(Chen, Feldmann & Tang, 2015). The paper made an extensive research design to study

importance of sustainability reporting. Results from past study questioned robustness of socio

5

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

political theories regarding prediction of environmental disclosure of a company. Analysis of this

study was based on the guidelines of Global Sustainability reporting. This study attempted to

assess the impact of environmental and social disclosure (Hahn & Kühnen, 2013). In this study,

191 firms were randomly chosen from five industries namely Pulp and Paper, Oil and Gas,

Metals and Mining, Chemicals and Utilities (Hahn & Lulfs, 2014). The chosen five industries

tend to have higher population propensity and subject to strict environment regulation in United

State in the last 30 years or more (Michelon, Boesso & Kumar, 2013). Literature based on public

listed companies in Malaysia suggested that there exists a significant and positive relation

between corporate social responsibility of these companies and institutional ownership.

2.3 Hypothesis

In order to analyze the two research questions following two hypotheses are developed.

Hypothesis 1

Null Hypothesis (HI0): Sustainability reporting of Coca- Cola has no statistically significant

impact on Return on Assets (ROA) of the company.

Alternative Hypothesis (H1A): Sustainability reporting of Coca-Cola has a statistically significant

impact on Return on Assets (ROA) of Coca-Cola.

Hypothesis 1

Null Hypothesis (H20): Sustainability reporting of Coca- Cola has no statistically significant

impact on Return on Equity (ROE) of the company.

Alternative Hypothesis (H2A): Sustainability reporting of Coca-Cola has a statistically significant

impact on Return on Equity (ROE) of Coca-Cola.

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

political theories regarding prediction of environmental disclosure of a company. Analysis of this

study was based on the guidelines of Global Sustainability reporting. This study attempted to

assess the impact of environmental and social disclosure (Hahn & Kühnen, 2013). In this study,

191 firms were randomly chosen from five industries namely Pulp and Paper, Oil and Gas,

Metals and Mining, Chemicals and Utilities (Hahn & Lulfs, 2014). The chosen five industries

tend to have higher population propensity and subject to strict environment regulation in United

State in the last 30 years or more (Michelon, Boesso & Kumar, 2013). Literature based on public

listed companies in Malaysia suggested that there exists a significant and positive relation

between corporate social responsibility of these companies and institutional ownership.

2.3 Hypothesis

In order to analyze the two research questions following two hypotheses are developed.

Hypothesis 1

Null Hypothesis (HI0): Sustainability reporting of Coca- Cola has no statistically significant

impact on Return on Assets (ROA) of the company.

Alternative Hypothesis (H1A): Sustainability reporting of Coca-Cola has a statistically significant

impact on Return on Assets (ROA) of Coca-Cola.

Hypothesis 1

Null Hypothesis (H20): Sustainability reporting of Coca- Cola has no statistically significant

impact on Return on Equity (ROE) of the company.

Alternative Hypothesis (H2A): Sustainability reporting of Coca-Cola has a statistically significant

impact on Return on Equity (ROE) of Coca-Cola.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

3.0 Methodology

3.1 Data collection

Objective of the research study is to find out how sustainability reporting affects market

performance of Coca-Cola Company. The papers conducts an explorative research depending

upon raw data collected from sources (McCusker & Gunaydin, 2015). The data are available

publicly on official websites of the company ad website reporting sustainability practice and

sustainability ranking. The paper thus reviews data from published document of the selected

company, sustainability report and annual reports

In order to model sustainability reporting, rating in five different aspects are considered.

These are rating relating to Corporate Social Responsibility, Community performance rating,

Employees performance rating, Environment performance rating and finally Government

performance rating. All the ratings are measured on a scale ranging from 0 to 100. Data relate to

sustainability reporting of Coca- Cola are collected from CSR hub. Market performance of the

company is measured in terms of Return on Assets and Return on Equity. These data are

collected from annual reports available in the official website of the company. All the data are

collected for the last fifteen years ranging from 2003 to 2017.

3.2 Data analysis

As the paper explore relation between sustainability, reporting and market performance

quantitative data analysis method is appropriate here. Data on last fifteen years have been

analyzed using different statistical measures namely descriptive, correlation and regression

analysis. Summary or descriptive statistics helps to understand the overall trend of data series

including average, maximum, minimum, standard deviation and other. Bivariate correlation is

analyzed to find association of ROA and ROE with each of the sustainability indicator (Mertens,

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

3.0 Methodology

3.1 Data collection

Objective of the research study is to find out how sustainability reporting affects market

performance of Coca-Cola Company. The papers conducts an explorative research depending

upon raw data collected from sources (McCusker & Gunaydin, 2015). The data are available

publicly on official websites of the company ad website reporting sustainability practice and

sustainability ranking. The paper thus reviews data from published document of the selected

company, sustainability report and annual reports

In order to model sustainability reporting, rating in five different aspects are considered.

These are rating relating to Corporate Social Responsibility, Community performance rating,

Employees performance rating, Environment performance rating and finally Government

performance rating. All the ratings are measured on a scale ranging from 0 to 100. Data relate to

sustainability reporting of Coca- Cola are collected from CSR hub. Market performance of the

company is measured in terms of Return on Assets and Return on Equity. These data are

collected from annual reports available in the official website of the company. All the data are

collected for the last fifteen years ranging from 2003 to 2017.

3.2 Data analysis

As the paper explore relation between sustainability, reporting and market performance

quantitative data analysis method is appropriate here. Data on last fifteen years have been

analyzed using different statistical measures namely descriptive, correlation and regression

analysis. Summary or descriptive statistics helps to understand the overall trend of data series

including average, maximum, minimum, standard deviation and other. Bivariate correlation is

analyzed to find association of ROA and ROE with each of the sustainability indicator (Mertens,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

2014). The obtained association from bivariate correlation is finally verified using regression

analysis.

Two separate regression analysis has been conducted to find out the impact of

sustainability disclosure on market performance. In one model Return on Asset is taken as

dependent variable and independent variables are overall CSR rating, Community Performance

Rating, Employees Performance Rating, Environmental Performance Rating and Governance

Performance Rating. In the second model, Return on Equity is taken as dependent variable and

overall CSR rating, Community Performance Rating, Employees Performance Rating,

Environmental Performance Rating and Governance Performance Rating are the independent

variables.

3.2.1 Reporting of Sustainability

First part of the analysis requires information regarding sustainability disclosure of Coca-

Cola. The ratings are reported about Corporate Social Responsibility, Community Performance,

Employees Performance, Environmental Performance and government performance. The

sustainability reporting. Data on sustainability reporting of Coca-Cola is available at CSR Hub.

3.2.1 Return on assets and Return on equity

The dependent variables are ROA and ROE. Data on ROA and ROE are available at

official website of the company. From the published annual report data on net income, total

assets and total equity are collected for the last fifteen years. Return on asset is then computed

using data on net income and total assets. Using the data on net income and total equity return on

equity is computed for each of year.

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

2014). The obtained association from bivariate correlation is finally verified using regression

analysis.

Two separate regression analysis has been conducted to find out the impact of

sustainability disclosure on market performance. In one model Return on Asset is taken as

dependent variable and independent variables are overall CSR rating, Community Performance

Rating, Employees Performance Rating, Environmental Performance Rating and Governance

Performance Rating. In the second model, Return on Equity is taken as dependent variable and

overall CSR rating, Community Performance Rating, Employees Performance Rating,

Environmental Performance Rating and Governance Performance Rating are the independent

variables.

3.2.1 Reporting of Sustainability

First part of the analysis requires information regarding sustainability disclosure of Coca-

Cola. The ratings are reported about Corporate Social Responsibility, Community Performance,

Employees Performance, Environmental Performance and government performance. The

sustainability reporting. Data on sustainability reporting of Coca-Cola is available at CSR Hub.

3.2.1 Return on assets and Return on equity

The dependent variables are ROA and ROE. Data on ROA and ROE are available at

official website of the company. From the published annual report data on net income, total

assets and total equity are collected for the last fifteen years. Return on asset is then computed

using data on net income and total assets. Using the data on net income and total equity return on

equity is computed for each of year.

8

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

4.0 Findings and Analysis

4.1 Descriptive statistics

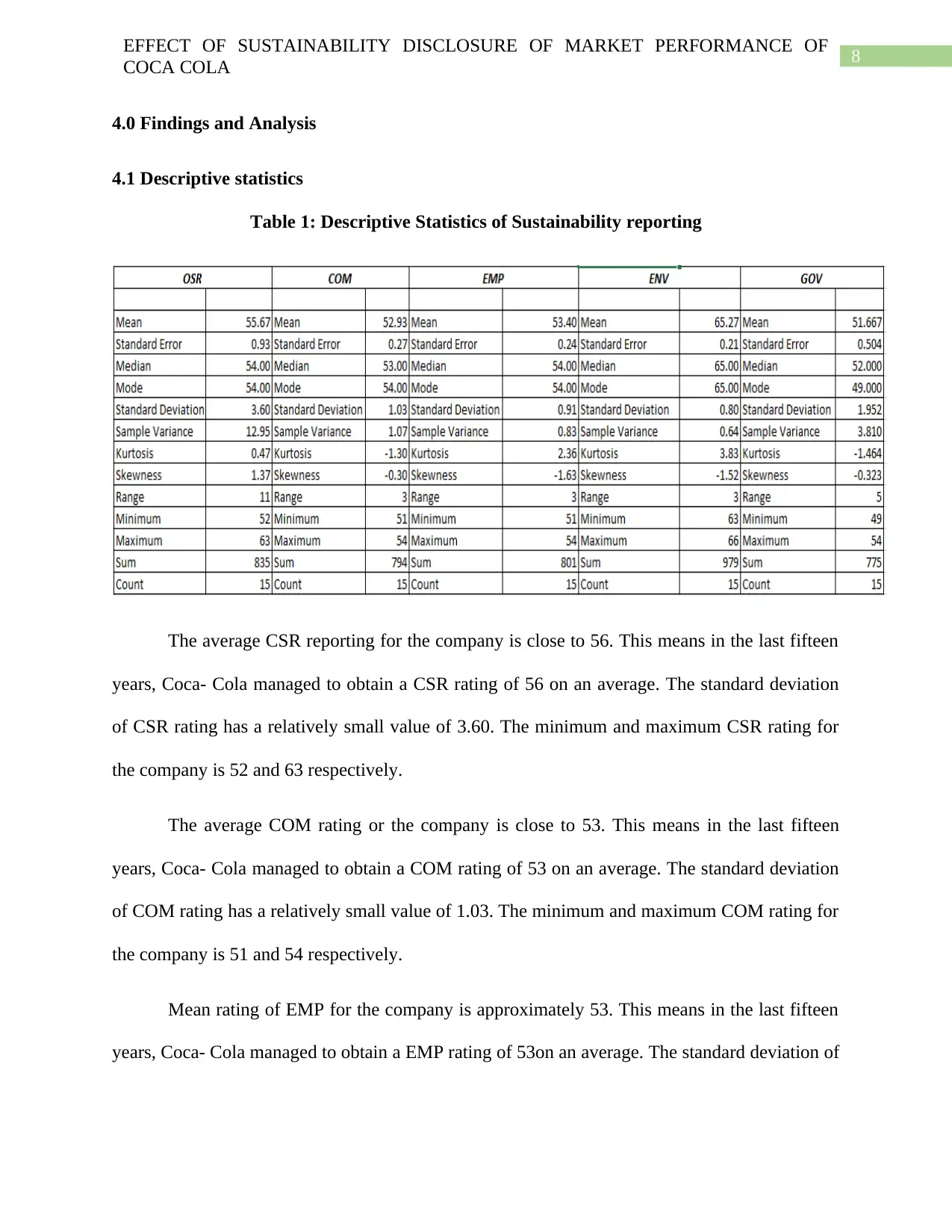

Table 1: Descriptive Statistics of Sustainability reporting

The average CSR reporting for the company is close to 56. This means in the last fifteen

years, Coca- Cola managed to obtain a CSR rating of 56 on an average. The standard deviation

of CSR rating has a relatively small value of 3.60. The minimum and maximum CSR rating for

the company is 52 and 63 respectively.

The average COM rating or the company is close to 53. This means in the last fifteen

years, Coca- Cola managed to obtain a COM rating of 53 on an average. The standard deviation

of COM rating has a relatively small value of 1.03. The minimum and maximum COM rating for

the company is 51 and 54 respectively.

Mean rating of EMP for the company is approximately 53. This means in the last fifteen

years, Coca- Cola managed to obtain a EMP rating of 53on an average. The standard deviation of

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

4.0 Findings and Analysis

4.1 Descriptive statistics

Table 1: Descriptive Statistics of Sustainability reporting

The average CSR reporting for the company is close to 56. This means in the last fifteen

years, Coca- Cola managed to obtain a CSR rating of 56 on an average. The standard deviation

of CSR rating has a relatively small value of 3.60. The minimum and maximum CSR rating for

the company is 52 and 63 respectively.

The average COM rating or the company is close to 53. This means in the last fifteen

years, Coca- Cola managed to obtain a COM rating of 53 on an average. The standard deviation

of COM rating has a relatively small value of 1.03. The minimum and maximum COM rating for

the company is 51 and 54 respectively.

Mean rating of EMP for the company is approximately 53. This means in the last fifteen

years, Coca- Cola managed to obtain a EMP rating of 53on an average. The standard deviation of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

EMP rating has a relatively small value of 0.91. The highest and lowest EMP rating for the

company is 54 and 51respectively.

The average ENV reporting for the company is close to 65. The standard deviation of

ENV rating has a relatively small value of 0.80. The minimum and maximum ENV rating for the

company is 63 and 66 respectively.

The mean GOV reporting for the company is close to 52. This means in the last fifteen

years, Coca- Cola managed to obtain a GOV rating of 52 on an average. The standard deviation

of GOV rating has a relatively small value of 1.95. The lowest and highest GOV rating for Coca-

Cola is 49 and 54 respectively.

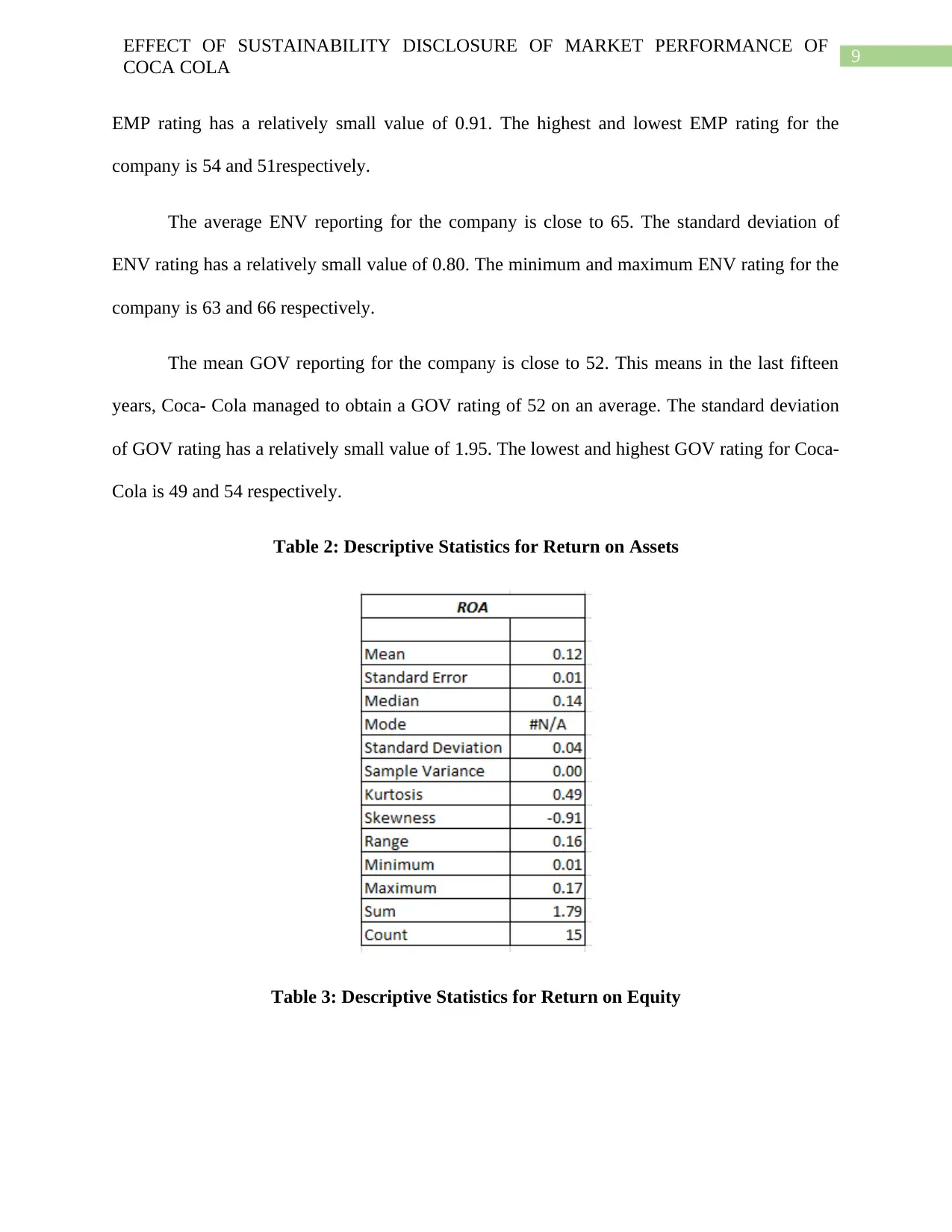

Table 2: Descriptive Statistics for Return on Assets

Table 3: Descriptive Statistics for Return on Equity

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

EMP rating has a relatively small value of 0.91. The highest and lowest EMP rating for the

company is 54 and 51respectively.

The average ENV reporting for the company is close to 65. The standard deviation of

ENV rating has a relatively small value of 0.80. The minimum and maximum ENV rating for the

company is 63 and 66 respectively.

The mean GOV reporting for the company is close to 52. This means in the last fifteen

years, Coca- Cola managed to obtain a GOV rating of 52 on an average. The standard deviation

of GOV rating has a relatively small value of 1.95. The lowest and highest GOV rating for Coca-

Cola is 49 and 54 respectively.

Table 2: Descriptive Statistics for Return on Assets

Table 3: Descriptive Statistics for Return on Equity

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

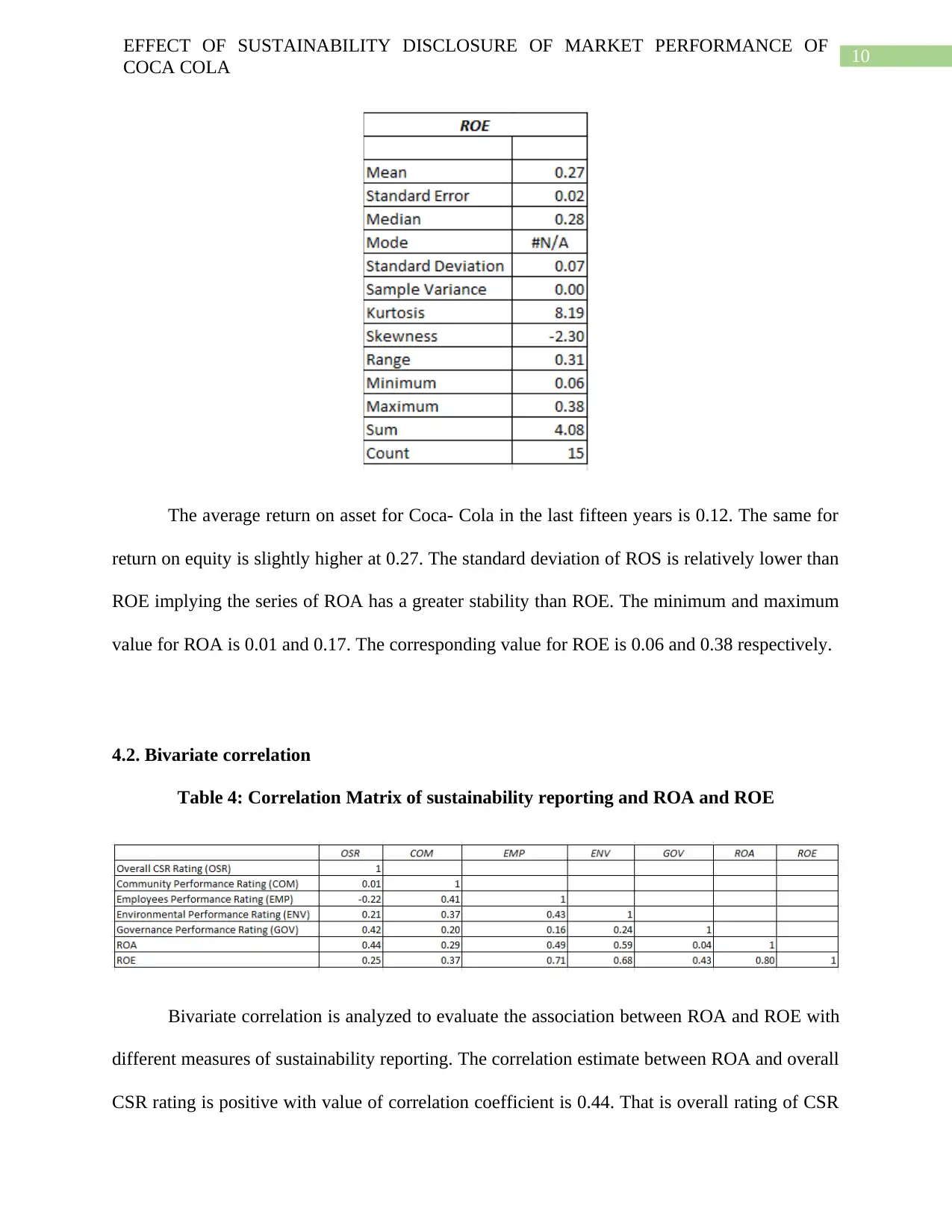

The average return on asset for Coca- Cola in the last fifteen years is 0.12. The same for

return on equity is slightly higher at 0.27. The standard deviation of ROS is relatively lower than

ROE implying the series of ROA has a greater stability than ROE. The minimum and maximum

value for ROA is 0.01 and 0.17. The corresponding value for ROE is 0.06 and 0.38 respectively.

4.2. Bivariate correlation

Table 4: Correlation Matrix of sustainability reporting and ROA and ROE

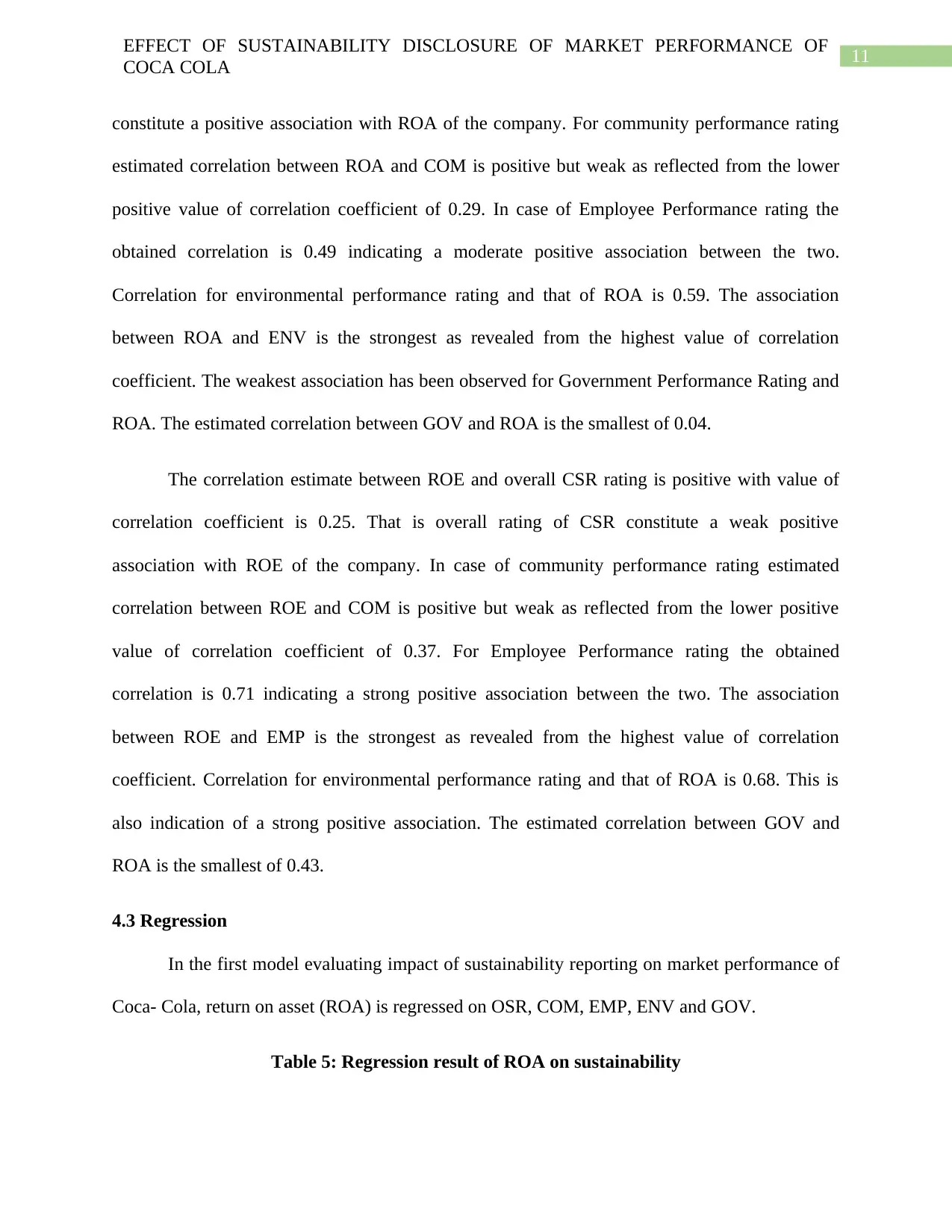

Bivariate correlation is analyzed to evaluate the association between ROA and ROE with

different measures of sustainability reporting. The correlation estimate between ROA and overall

CSR rating is positive with value of correlation coefficient is 0.44. That is overall rating of CSR

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

The average return on asset for Coca- Cola in the last fifteen years is 0.12. The same for

return on equity is slightly higher at 0.27. The standard deviation of ROS is relatively lower than

ROE implying the series of ROA has a greater stability than ROE. The minimum and maximum

value for ROA is 0.01 and 0.17. The corresponding value for ROE is 0.06 and 0.38 respectively.

4.2. Bivariate correlation

Table 4: Correlation Matrix of sustainability reporting and ROA and ROE

Bivariate correlation is analyzed to evaluate the association between ROA and ROE with

different measures of sustainability reporting. The correlation estimate between ROA and overall

CSR rating is positive with value of correlation coefficient is 0.44. That is overall rating of CSR

11

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

constitute a positive association with ROA of the company. For community performance rating

estimated correlation between ROA and COM is positive but weak as reflected from the lower

positive value of correlation coefficient of 0.29. In case of Employee Performance rating the

obtained correlation is 0.49 indicating a moderate positive association between the two.

Correlation for environmental performance rating and that of ROA is 0.59. The association

between ROA and ENV is the strongest as revealed from the highest value of correlation

coefficient. The weakest association has been observed for Government Performance Rating and

ROA. The estimated correlation between GOV and ROA is the smallest of 0.04.

The correlation estimate between ROE and overall CSR rating is positive with value of

correlation coefficient is 0.25. That is overall rating of CSR constitute a weak positive

association with ROE of the company. In case of community performance rating estimated

correlation between ROE and COM is positive but weak as reflected from the lower positive

value of correlation coefficient of 0.37. For Employee Performance rating the obtained

correlation is 0.71 indicating a strong positive association between the two. The association

between ROE and EMP is the strongest as revealed from the highest value of correlation

coefficient. Correlation for environmental performance rating and that of ROA is 0.68. This is

also indication of a strong positive association. The estimated correlation between GOV and

ROA is the smallest of 0.43.

4.3 Regression

In the first model evaluating impact of sustainability reporting on market performance of

Coca- Cola, return on asset (ROA) is regressed on OSR, COM, EMP, ENV and GOV.

Table 5: Regression result of ROA on sustainability

EFFECT OF SUSTAINABILITY DISCLOSURE OF MARKET PERFORMANCE OF

COCA COLA

constitute a positive association with ROA of the company. For community performance rating

estimated correlation between ROA and COM is positive but weak as reflected from the lower

positive value of correlation coefficient of 0.29. In case of Employee Performance rating the

obtained correlation is 0.49 indicating a moderate positive association between the two.

Correlation for environmental performance rating and that of ROA is 0.59. The association

between ROA and ENV is the strongest as revealed from the highest value of correlation

coefficient. The weakest association has been observed for Government Performance Rating and

ROA. The estimated correlation between GOV and ROA is the smallest of 0.04.

The correlation estimate between ROE and overall CSR rating is positive with value of

correlation coefficient is 0.25. That is overall rating of CSR constitute a weak positive

association with ROE of the company. In case of community performance rating estimated

correlation between ROE and COM is positive but weak as reflected from the lower positive

value of correlation coefficient of 0.37. For Employee Performance rating the obtained

correlation is 0.71 indicating a strong positive association between the two. The association

between ROE and EMP is the strongest as revealed from the highest value of correlation

coefficient. Correlation for environmental performance rating and that of ROA is 0.68. This is

also indication of a strong positive association. The estimated correlation between GOV and

ROA is the smallest of 0.43.

4.3 Regression

In the first model evaluating impact of sustainability reporting on market performance of

Coca- Cola, return on asset (ROA) is regressed on OSR, COM, EMP, ENV and GOV.

Table 5: Regression result of ROA on sustainability

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.