CoffeeVille: Risk Management Report: NSW Expansion Project Analysis

VerifiedAdded on 2020/07/23

|16

|3669

|36

Report

AI Summary

This report presents a comprehensive risk management analysis for CoffeeVille's business expansion project, focusing on the Lakes Entrance expansion. The report begins with an introduction to risk management and its importance in business practices, followed by a detailed risk review report which includes an assessment of potential risks, stakeholder roles, and PEST and SWOT analyses. The core of the report analyzes and treats identified risks, categorizing them into operational, financial, governance, and project management risks. A risk matrix is developed to evaluate the likelihood and impact of each risk, and a risk mitigation plan is proposed to address high-priority risks such as by-law compliance and financial risks. The report concludes with an overview of how to monitor risks and evaluate processes, emphasizing the need for sound internal controls, written policies, and adherence to legal and regulatory requirements. Email communication and meeting summaries with the CEO are included to illustrate stakeholder involvement in the risk management process. The overall aim is to provide a proactive approach to manage the identified risks.

MANAGE RISK

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

ASSESSMENT: TASK 1................................................................................................................1

Risk review report........................................................................................................................1

E-mail communication to stakeholders........................................................................................4

Summary notes from meeting with CEO.....................................................................................5

TASK 2 - ANALYZE AND TREAT RISK....................................................................................5

PART 1............................................................................................................................................5

Risk matrix...................................................................................................................................6

Risk mitigation plan.....................................................................................................................7

Risk Management Action Plan....................................................................................................9

PART 2..........................................................................................................................................10

1. Implementation of risk management treatment.....................................................................10

TASK 3 – MONITOR RISK AND EVALUATE PROCESSES..................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................12

1

INTRODUCTION...........................................................................................................................1

ASSESSMENT: TASK 1................................................................................................................1

Risk review report........................................................................................................................1

E-mail communication to stakeholders........................................................................................4

Summary notes from meeting with CEO.....................................................................................5

TASK 2 - ANALYZE AND TREAT RISK....................................................................................5

PART 1............................................................................................................................................5

Risk matrix...................................................................................................................................6

Risk mitigation plan.....................................................................................................................7

Risk Management Action Plan....................................................................................................9

PART 2..........................................................................................................................................10

1. Implementation of risk management treatment.....................................................................10

TASK 3 – MONITOR RISK AND EVALUATE PROCESSES..................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................12

1

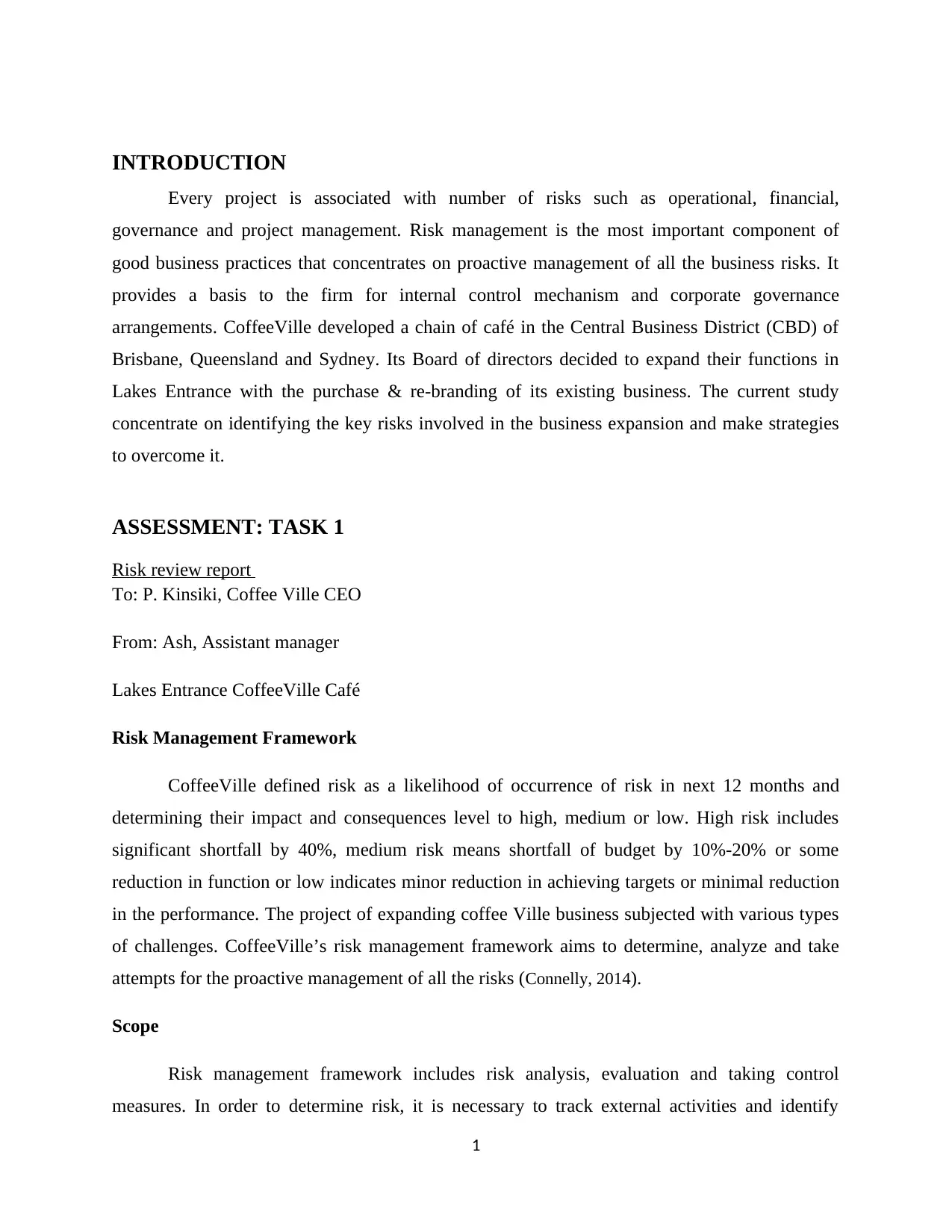

INTRODUCTION

Every project is associated with number of risks such as operational, financial,

governance and project management. Risk management is the most important component of

good business practices that concentrates on proactive management of all the business risks. It

provides a basis to the firm for internal control mechanism and corporate governance

arrangements. CoffeeVille developed a chain of café in the Central Business District (CBD) of

Brisbane, Queensland and Sydney. Its Board of directors decided to expand their functions in

Lakes Entrance with the purchase & re-branding of its existing business. The current study

concentrate on identifying the key risks involved in the business expansion and make strategies

to overcome it.

ASSESSMENT: TASK 1

Risk review report

To: P. Kinsiki, Coffee Ville CEO

From: Ash, Assistant manager

Lakes Entrance CoffeeVille Café

Risk Management Framework

CoffeeVille defined risk as a likelihood of occurrence of risk in next 12 months and

determining their impact and consequences level to high, medium or low. High risk includes

significant shortfall by 40%, medium risk means shortfall of budget by 10%-20% or some

reduction in function or low indicates minor reduction in achieving targets or minimal reduction

in the performance. The project of expanding coffee Ville business subjected with various types

of challenges. CoffeeVille’s risk management framework aims to determine, analyze and take

attempts for the proactive management of all the risks (Connelly, 2014).

Scope

Risk management framework includes risk analysis, evaluation and taking control

measures. In order to determine risk, it is necessary to track external activities and identify

1

Every project is associated with number of risks such as operational, financial,

governance and project management. Risk management is the most important component of

good business practices that concentrates on proactive management of all the business risks. It

provides a basis to the firm for internal control mechanism and corporate governance

arrangements. CoffeeVille developed a chain of café in the Central Business District (CBD) of

Brisbane, Queensland and Sydney. Its Board of directors decided to expand their functions in

Lakes Entrance with the purchase & re-branding of its existing business. The current study

concentrate on identifying the key risks involved in the business expansion and make strategies

to overcome it.

ASSESSMENT: TASK 1

Risk review report

To: P. Kinsiki, Coffee Ville CEO

From: Ash, Assistant manager

Lakes Entrance CoffeeVille Café

Risk Management Framework

CoffeeVille defined risk as a likelihood of occurrence of risk in next 12 months and

determining their impact and consequences level to high, medium or low. High risk includes

significant shortfall by 40%, medium risk means shortfall of budget by 10%-20% or some

reduction in function or low indicates minor reduction in achieving targets or minimal reduction

in the performance. The project of expanding coffee Ville business subjected with various types

of challenges. CoffeeVille’s risk management framework aims to determine, analyze and take

attempts for the proactive management of all the risks (Connelly, 2014).

Scope

Risk management framework includes risk analysis, evaluation and taking control

measures. In order to determine risk, it is necessary to track external activities and identify

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

potential threats and opportunities. Its scope encompasses policy formation, reporting structure,

business planning & budgeting, risk management review and external audit so as to adequately

respond operational, commercial, financial and strategic risks (Duckert, 2010).

Critical success factors, goals or objectives

To develop a sound risk management framework

To conduct external market analysis to find out opportunity and threats

To take necessary preventive measures to control the risk occurrence

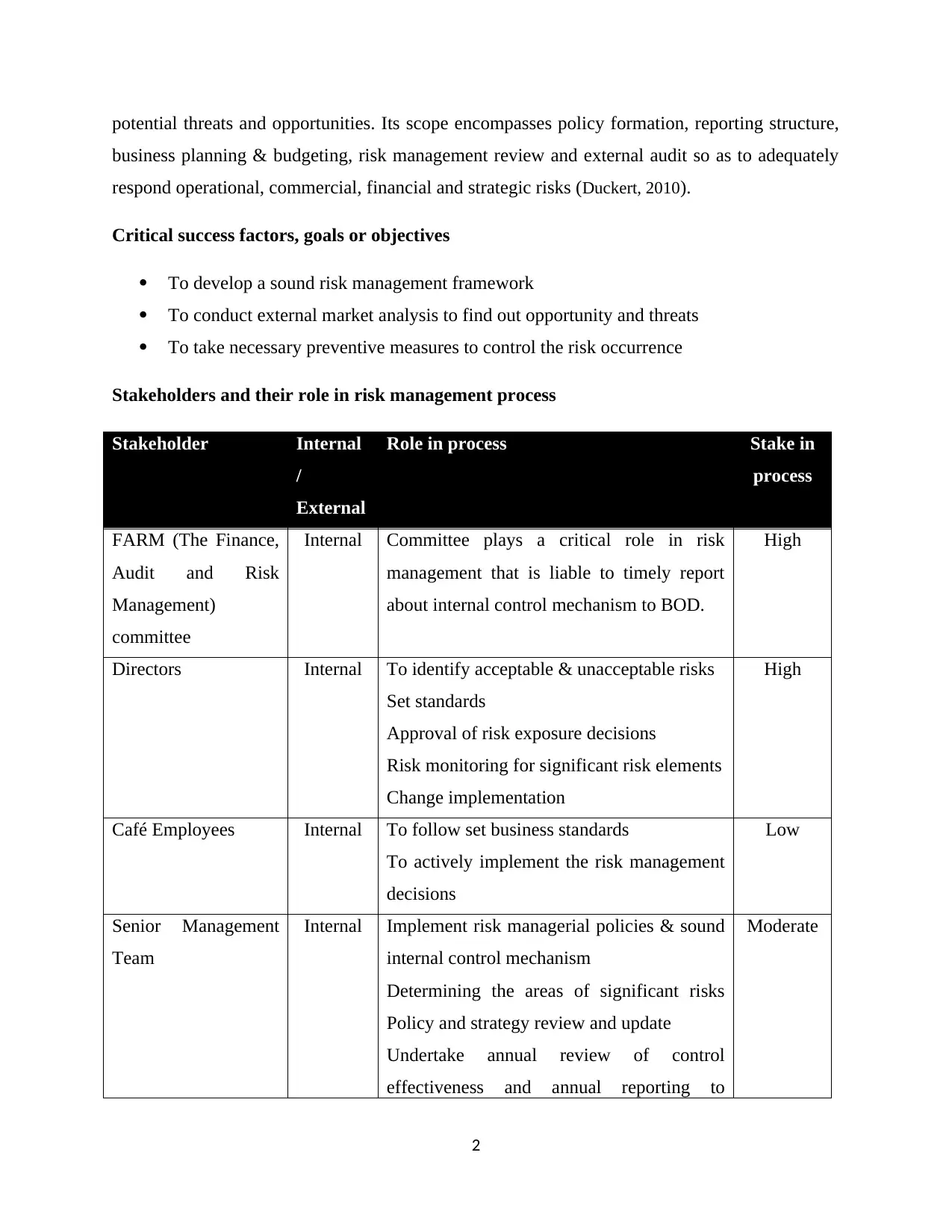

Stakeholders and their role in risk management process

Stakeholder Internal

/

External

Role in process Stake in

process

FARM (The Finance,

Audit and Risk

Management)

committee

Internal Committee plays a critical role in risk

management that is liable to timely report

about internal control mechanism to BOD.

High

Directors Internal To identify acceptable & unacceptable risks

Set standards

Approval of risk exposure decisions

Risk monitoring for significant risk elements

Change implementation

High

Café Employees Internal To follow set business standards

To actively implement the risk management

decisions

Low

Senior Management

Team

Internal Implement risk managerial policies & sound

internal control mechanism

Determining the areas of significant risks

Policy and strategy review and update

Undertake annual review of control

effectiveness and annual reporting to

Moderate

2

business planning & budgeting, risk management review and external audit so as to adequately

respond operational, commercial, financial and strategic risks (Duckert, 2010).

Critical success factors, goals or objectives

To develop a sound risk management framework

To conduct external market analysis to find out opportunity and threats

To take necessary preventive measures to control the risk occurrence

Stakeholders and their role in risk management process

Stakeholder Internal

/

External

Role in process Stake in

process

FARM (The Finance,

Audit and Risk

Management)

committee

Internal Committee plays a critical role in risk

management that is liable to timely report

about internal control mechanism to BOD.

High

Directors Internal To identify acceptable & unacceptable risks

Set standards

Approval of risk exposure decisions

Risk monitoring for significant risk elements

Change implementation

High

Café Employees Internal To follow set business standards

To actively implement the risk management

decisions

Low

Senior Management

Team

Internal Implement risk managerial policies & sound

internal control mechanism

Determining the areas of significant risks

Policy and strategy review and update

Undertake annual review of control

effectiveness and annual reporting to

Moderate

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

directors

PEST Analysis

After reviewing the meeting notes with Ron Langford, it found that in the economic brief,

it discovered that Federal Government is going to introduce local by-law for the usage of

resources by industries. The existing by-laws charged a fine penalty up to $50,000 on Coffee

Ville for the breaches due to excessive usage. At the same time, installing a water tank in

Courtyard will enable café to use water efficiently. Current by-law also bring out an opportunity

for the firm to expand their footpath dining by which, business will be authorized to arrange

more chairs and tables outside premises and thereby serve more people (Fraser and Simkins, 2010).

It has an opportunity to expand their business by opening more cafes at surrounding

places. Currently, its dishwater has a Water Efficiency Labeling and Standards Scheme (WELS)

rating of 3; and in order to increase it to 5-6, it would incur a cost of $6,000 or above. In the

social factor, as the store is located at the corner of two main streets therefore, due to closeness,

it will be able to attract large number of local customers and tourists (Hampton, 2009). Moreover,

it will attract a large percentage of retirees due to easy access to buses. Technological

advancement through WiFi in the café provide free of cost internet accessibility to people. In

addition to this, federal Government’s National Broadband Network will allow café so to

efficiently and effectively use video streaming and teleconferencing system that will help in

technological advancement.

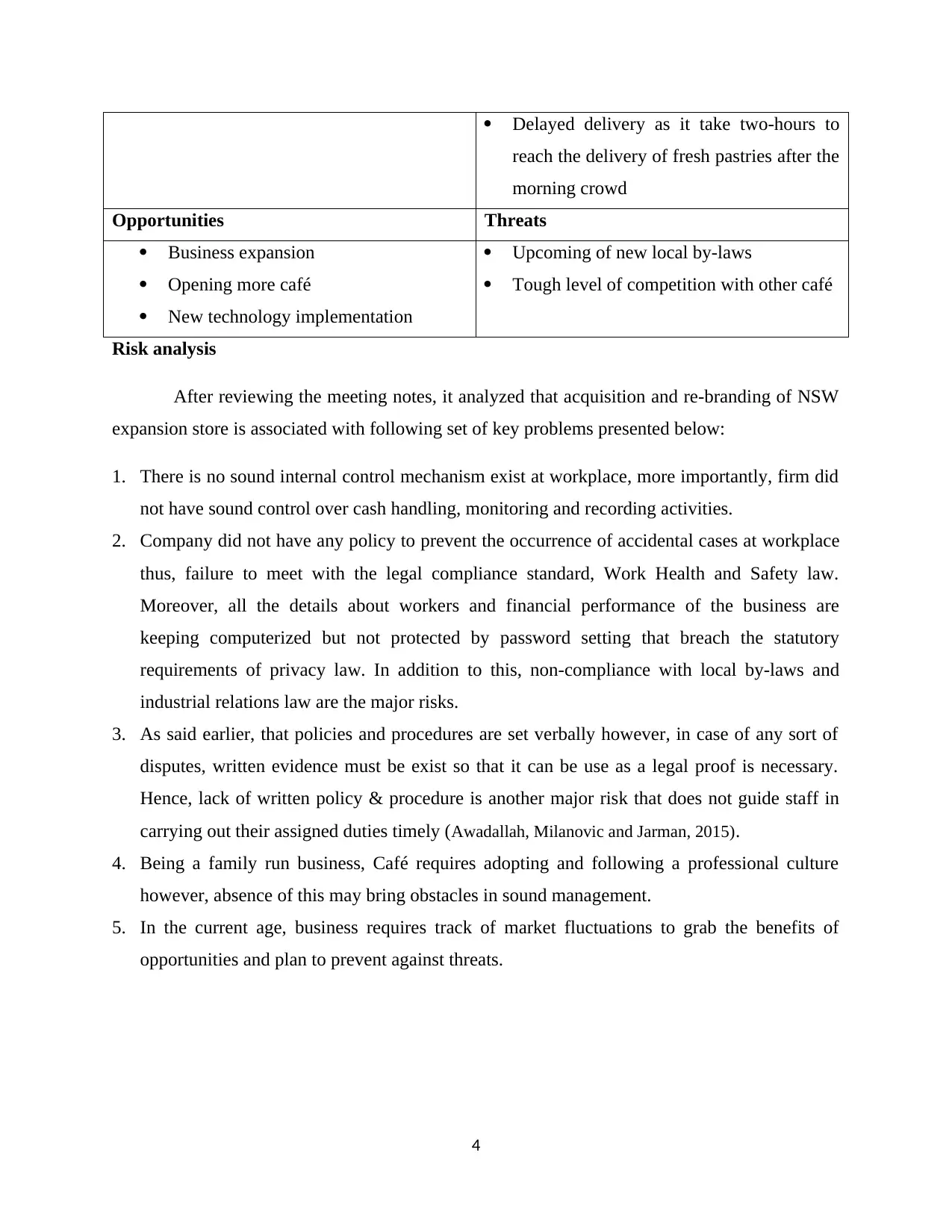

SWOT analysis

Strengths Weaknesses

Qualified chef who provides innovative

and popular range of tasty, healthy and

gourmet rice wraps

Innovative frozen par-bake cooking system

to cook fresh bakery items just in 30

minutes

Lack of sales promotion techniques

Lack of proper record-keeping system and

documentation in place

No system in place to deal with work place

incidents and injuries

Unattractive fit-out

Inefficient use of utilities like water

Verbal setting of policies and procedures

3

PEST Analysis

After reviewing the meeting notes with Ron Langford, it found that in the economic brief,

it discovered that Federal Government is going to introduce local by-law for the usage of

resources by industries. The existing by-laws charged a fine penalty up to $50,000 on Coffee

Ville for the breaches due to excessive usage. At the same time, installing a water tank in

Courtyard will enable café to use water efficiently. Current by-law also bring out an opportunity

for the firm to expand their footpath dining by which, business will be authorized to arrange

more chairs and tables outside premises and thereby serve more people (Fraser and Simkins, 2010).

It has an opportunity to expand their business by opening more cafes at surrounding

places. Currently, its dishwater has a Water Efficiency Labeling and Standards Scheme (WELS)

rating of 3; and in order to increase it to 5-6, it would incur a cost of $6,000 or above. In the

social factor, as the store is located at the corner of two main streets therefore, due to closeness,

it will be able to attract large number of local customers and tourists (Hampton, 2009). Moreover,

it will attract a large percentage of retirees due to easy access to buses. Technological

advancement through WiFi in the café provide free of cost internet accessibility to people. In

addition to this, federal Government’s National Broadband Network will allow café so to

efficiently and effectively use video streaming and teleconferencing system that will help in

technological advancement.

SWOT analysis

Strengths Weaknesses

Qualified chef who provides innovative

and popular range of tasty, healthy and

gourmet rice wraps

Innovative frozen par-bake cooking system

to cook fresh bakery items just in 30

minutes

Lack of sales promotion techniques

Lack of proper record-keeping system and

documentation in place

No system in place to deal with work place

incidents and injuries

Unattractive fit-out

Inefficient use of utilities like water

Verbal setting of policies and procedures

3

Delayed delivery as it take two-hours to

reach the delivery of fresh pastries after the

morning crowd

Opportunities Threats

Business expansion

Opening more café

New technology implementation

Upcoming of new local by-laws

Tough level of competition with other café

Risk analysis

After reviewing the meeting notes, it analyzed that acquisition and re-branding of NSW

expansion store is associated with following set of key problems presented below:

1. There is no sound internal control mechanism exist at workplace, more importantly, firm did

not have sound control over cash handling, monitoring and recording activities.

2. Company did not have any policy to prevent the occurrence of accidental cases at workplace

thus, failure to meet with the legal compliance standard, Work Health and Safety law.

Moreover, all the details about workers and financial performance of the business are

keeping computerized but not protected by password setting that breach the statutory

requirements of privacy law. In addition to this, non-compliance with local by-laws and

industrial relations law are the major risks.

3. As said earlier, that policies and procedures are set verbally however, in case of any sort of

disputes, written evidence must be exist so that it can be use as a legal proof is necessary.

Hence, lack of written policy & procedure is another major risk that does not guide staff in

carrying out their assigned duties timely (Awadallah, Milanovic and Jarman, 2015).

4. Being a family run business, Café requires adopting and following a professional culture

however, absence of this may bring obstacles in sound management.

5. In the current age, business requires track of market fluctuations to grab the benefits of

opportunities and plan to prevent against threats.

4

reach the delivery of fresh pastries after the

morning crowd

Opportunities Threats

Business expansion

Opening more café

New technology implementation

Upcoming of new local by-laws

Tough level of competition with other café

Risk analysis

After reviewing the meeting notes, it analyzed that acquisition and re-branding of NSW

expansion store is associated with following set of key problems presented below:

1. There is no sound internal control mechanism exist at workplace, more importantly, firm did

not have sound control over cash handling, monitoring and recording activities.

2. Company did not have any policy to prevent the occurrence of accidental cases at workplace

thus, failure to meet with the legal compliance standard, Work Health and Safety law.

Moreover, all the details about workers and financial performance of the business are

keeping computerized but not protected by password setting that breach the statutory

requirements of privacy law. In addition to this, non-compliance with local by-laws and

industrial relations law are the major risks.

3. As said earlier, that policies and procedures are set verbally however, in case of any sort of

disputes, written evidence must be exist so that it can be use as a legal proof is necessary.

Hence, lack of written policy & procedure is another major risk that does not guide staff in

carrying out their assigned duties timely (Awadallah, Milanovic and Jarman, 2015).

4. Being a family run business, Café requires adopting and following a professional culture

however, absence of this may bring obstacles in sound management.

5. In the current age, business requires track of market fluctuations to grab the benefits of

opportunities and plan to prevent against threats.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

E-mail communication to stakeholders

To: Stakeholders

From: Ash, Assistant manager

This mail is just to inform all the stakeholders about the major risks elements that are

accompany under the NSW Expansion plan and seeks advices and opinion how to manage it.

Although, CoffeeVille had its own risk management framework, in which, FARM, board of

director and senior managerial team is involved with the process of risk identifying,

measurement, analysis and control measure. Still business need to work upon putting a superb

internal control mechanism, especially with reference to cash transactions in the register. Besides

this, the plan of expansion encompasses compliance and regulatory risk, poor internal control

mechanism, lack of written policy & procedures, lack of sound business culture and failure to

cope up with the external market environment. All these risks require to be manage properly to

enhance the project success rate.

Summary notes from meeting with CEO

In the meeting, CEO replied that first of all, all the policies and procedures must be set in

written and convey to all the employees to guide them for statutory compliance.

Areas where currently, no policy is in place needs policy formulation, especially, cash

management, internal control and monitoring framework to keep control over staff activities

(Bainbridge, 2009).

All the activities and operations must be document well such as wages and superannuation,

taking from cash register by family staff members and others. Moreover, sound operational

strategy must develop to properly utilize utilities, ensure timely delivery and other areas for

sound growth.

Business information is required to be computerized manage with password protection to

restrict unauthorized access and compliance with the mandatory laws and principles of

privacy law.

TASK 2 - ANALYZE AND TREAT RISK

PART 1

Type of risks Key reasons Impact Likelihood

5

To: Stakeholders

From: Ash, Assistant manager

This mail is just to inform all the stakeholders about the major risks elements that are

accompany under the NSW Expansion plan and seeks advices and opinion how to manage it.

Although, CoffeeVille had its own risk management framework, in which, FARM, board of

director and senior managerial team is involved with the process of risk identifying,

measurement, analysis and control measure. Still business need to work upon putting a superb

internal control mechanism, especially with reference to cash transactions in the register. Besides

this, the plan of expansion encompasses compliance and regulatory risk, poor internal control

mechanism, lack of written policy & procedures, lack of sound business culture and failure to

cope up with the external market environment. All these risks require to be manage properly to

enhance the project success rate.

Summary notes from meeting with CEO

In the meeting, CEO replied that first of all, all the policies and procedures must be set in

written and convey to all the employees to guide them for statutory compliance.

Areas where currently, no policy is in place needs policy formulation, especially, cash

management, internal control and monitoring framework to keep control over staff activities

(Bainbridge, 2009).

All the activities and operations must be document well such as wages and superannuation,

taking from cash register by family staff members and others. Moreover, sound operational

strategy must develop to properly utilize utilities, ensure timely delivery and other areas for

sound growth.

Business information is required to be computerized manage with password protection to

restrict unauthorized access and compliance with the mandatory laws and principles of

privacy law.

TASK 2 - ANALYZE AND TREAT RISK

PART 1

Type of risks Key reasons Impact Likelihood

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

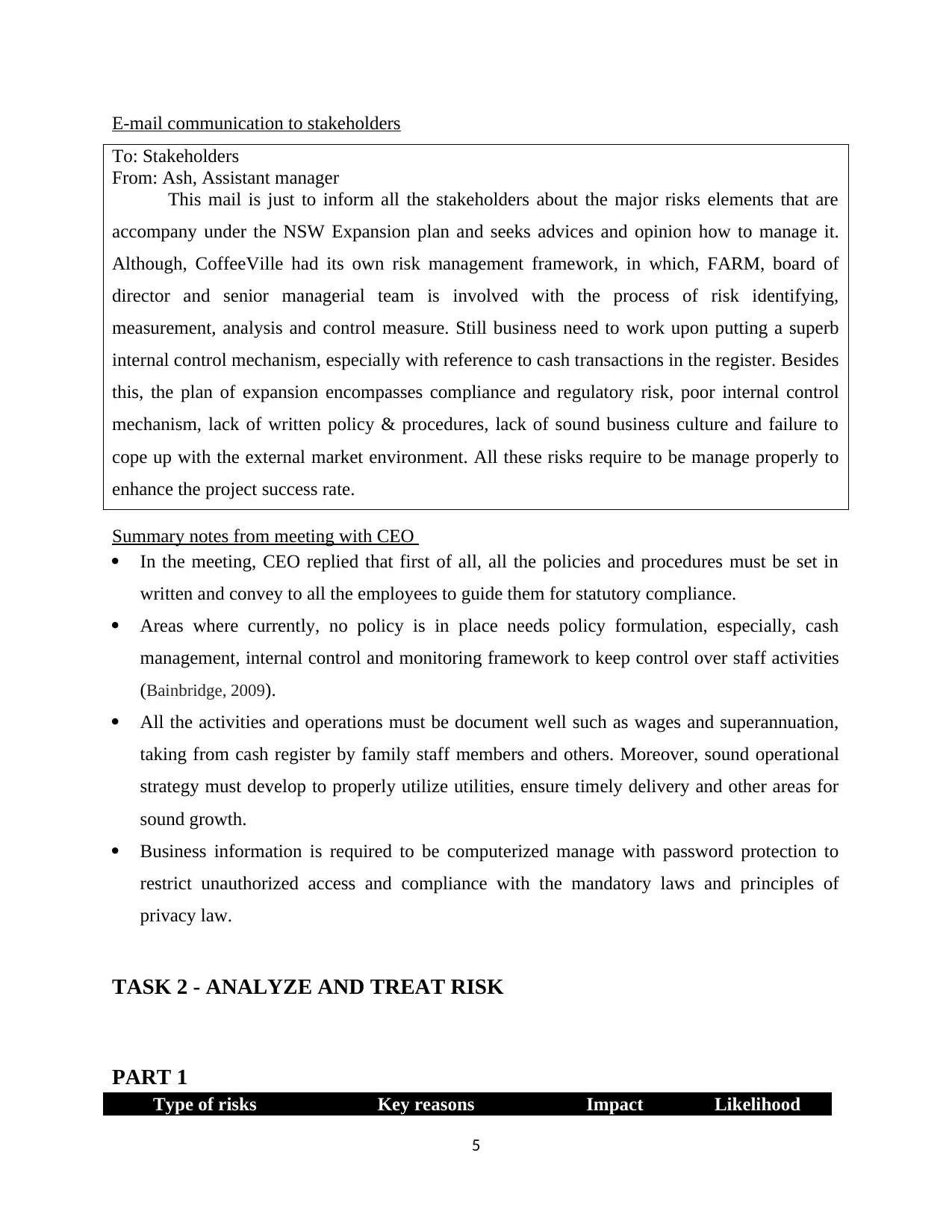

/Consequences

Operational risks Legal and regulatory

compliance risk with WHS,

Privacy and industrial laws

High (3) High (3)

Financial risks Poor cash management and

ineffective monitoring over

its usage, fraudulent activities

or theft by staff

High (3) Moderate (2)

Governance risk Lack of internal control

management and poor

documentation

Moderate (2) Moderate (2)

Project management

risks

Verbal policy setting, poor

monitoring issues, lack of

sound culture post the risk of

conflicts among stakeholders,

delay in conducting training

sessions

Low (1) Moderate (1)

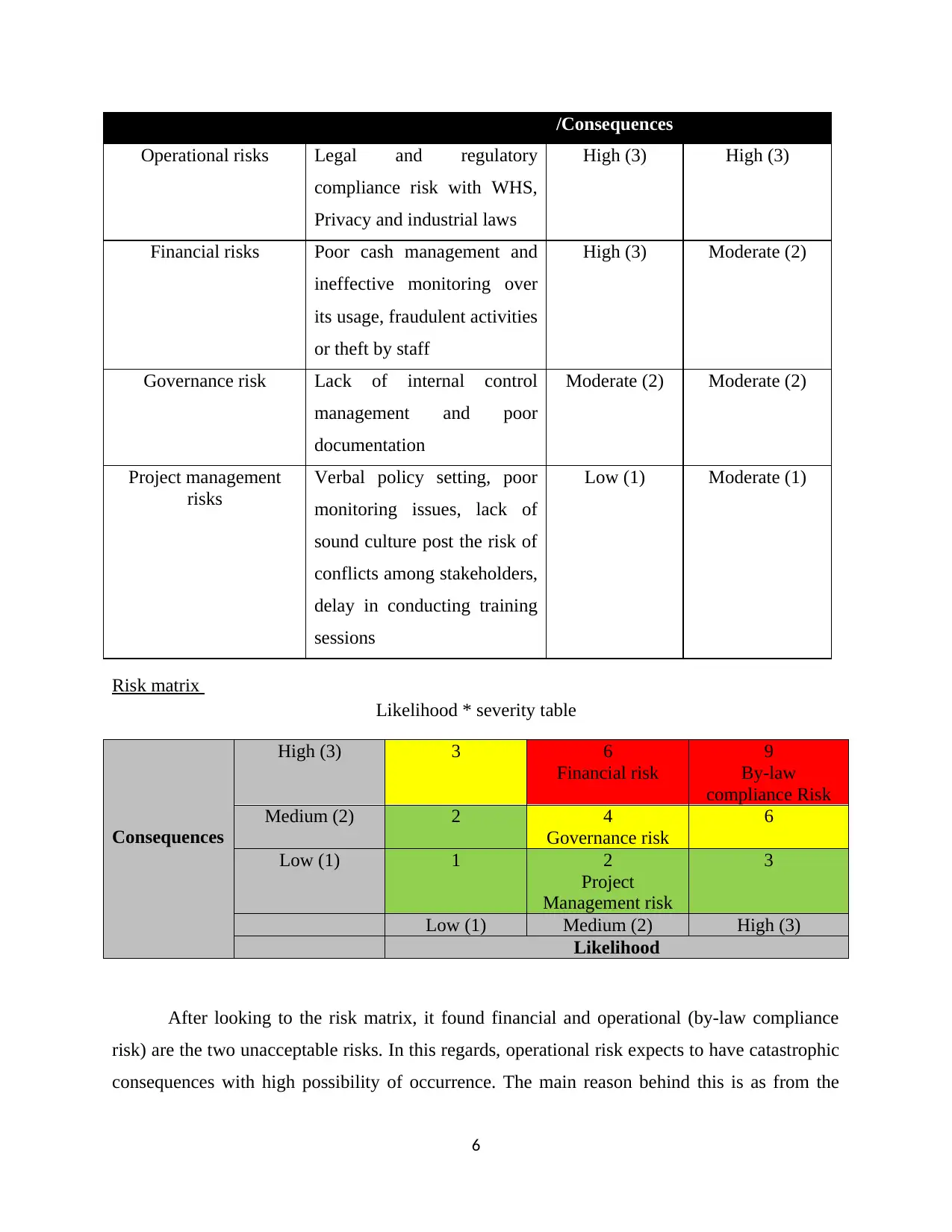

Risk matrix

Likelihood * severity table

Consequences

High (3) 3 6

Financial risk

9

By-law

compliance Risk

Medium (2) 2 4

Governance risk

6

Low (1) 1 2

Project

Management risk

3

Low (1) Medium (2) High (3)

Likelihood

After looking to the risk matrix, it found financial and operational (by-law compliance

risk) are the two unacceptable risks. In this regards, operational risk expects to have catastrophic

consequences with high possibility of occurrence. The main reason behind this is as from the

6

Operational risks Legal and regulatory

compliance risk with WHS,

Privacy and industrial laws

High (3) High (3)

Financial risks Poor cash management and

ineffective monitoring over

its usage, fraudulent activities

or theft by staff

High (3) Moderate (2)

Governance risk Lack of internal control

management and poor

documentation

Moderate (2) Moderate (2)

Project management

risks

Verbal policy setting, poor

monitoring issues, lack of

sound culture post the risk of

conflicts among stakeholders,

delay in conducting training

sessions

Low (1) Moderate (1)

Risk matrix

Likelihood * severity table

Consequences

High (3) 3 6

Financial risk

9

By-law

compliance Risk

Medium (2) 2 4

Governance risk

6

Low (1) 1 2

Project

Management risk

3

Low (1) Medium (2) High (3)

Likelihood

After looking to the risk matrix, it found financial and operational (by-law compliance

risk) are the two unacceptable risks. In this regards, operational risk expects to have catastrophic

consequences with high possibility of occurrence. The main reason behind this is as from the

6

scenario; it is clearly stated that currently, CoffeeVille is not complying with the workplace

health and safety laws and at the workplace, there are not proper arrangements kept in place.

Evidencing from the case study, currently, chairs and tables become obsolete, unstable and

broken, which pose the risk of workplace incidents. Besides this, some parts of the worn carpet

simply taped over with gaffer tape. Besides this, non-compliance with the Water Efficiency

Labeling and Standards Scheme (WELS) due to excessive usage of water had brought

compliance risk and created adverse image about the business (Marchetti, 2011). All these have

catastrophic impact over the business because non-compliance will result in loss of brand

recognition by building a poor reputational image among all people. It seems unacceptable risks

and requires immediate action of the management to control its occurrence.

Besides this, finance is the most important business requirement because in the volatile

and competitive world, none of the business can successfully survive in the market without

having proper financial management. However, considering the current case of CoffeeVille, it is

identified that café did not manage cash effectively as all the takings out from cash registers are

not managed properly. Moreover, administrators do not have effective control over the cash-

related transactions hence, the risk of theft or misuse of monetary resource seems an obvious risk

(Poolsappasit, Dewri and Ray, 2012). It will also bring considerable impact on the business

henceforth, considered as an acceptable risk. These two risks must be prioritize over others

because of strong severity impact over CoffeeVille.

Effective operational management requires sound internal control and proper

documentation of all the events is necessary. However, as noticed in CoffeeVille, lack of

managerial control over the daily functions is a main risk; still, such risks expects to have

moderate likelihood with moderate severity over the enterprise, hence, it is founded as

undesirable and require to be controlled promptly by corrective measures (Rampini, Sufi and

Viswanathan, 2014). Lastly, as every policy must be clearly set out on the documents in written,

which were not currently, follow by CoffeeVille. In spite of this, professional culture, ethical

business practices and others are necessary to comply with, absence of such cultural practices at

family-running business bring out the possibility that risk may take place medium likelihood and

low severity.

7

health and safety laws and at the workplace, there are not proper arrangements kept in place.

Evidencing from the case study, currently, chairs and tables become obsolete, unstable and

broken, which pose the risk of workplace incidents. Besides this, some parts of the worn carpet

simply taped over with gaffer tape. Besides this, non-compliance with the Water Efficiency

Labeling and Standards Scheme (WELS) due to excessive usage of water had brought

compliance risk and created adverse image about the business (Marchetti, 2011). All these have

catastrophic impact over the business because non-compliance will result in loss of brand

recognition by building a poor reputational image among all people. It seems unacceptable risks

and requires immediate action of the management to control its occurrence.

Besides this, finance is the most important business requirement because in the volatile

and competitive world, none of the business can successfully survive in the market without

having proper financial management. However, considering the current case of CoffeeVille, it is

identified that café did not manage cash effectively as all the takings out from cash registers are

not managed properly. Moreover, administrators do not have effective control over the cash-

related transactions hence, the risk of theft or misuse of monetary resource seems an obvious risk

(Poolsappasit, Dewri and Ray, 2012). It will also bring considerable impact on the business

henceforth, considered as an acceptable risk. These two risks must be prioritize over others

because of strong severity impact over CoffeeVille.

Effective operational management requires sound internal control and proper

documentation of all the events is necessary. However, as noticed in CoffeeVille, lack of

managerial control over the daily functions is a main risk; still, such risks expects to have

moderate likelihood with moderate severity over the enterprise, hence, it is founded as

undesirable and require to be controlled promptly by corrective measures (Rampini, Sufi and

Viswanathan, 2014). Lastly, as every policy must be clearly set out on the documents in written,

which were not currently, follow by CoffeeVille. In spite of this, professional culture, ethical

business practices and others are necessary to comply with, absence of such cultural practices at

family-running business bring out the possibility that risk may take place medium likelihood and

low severity.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

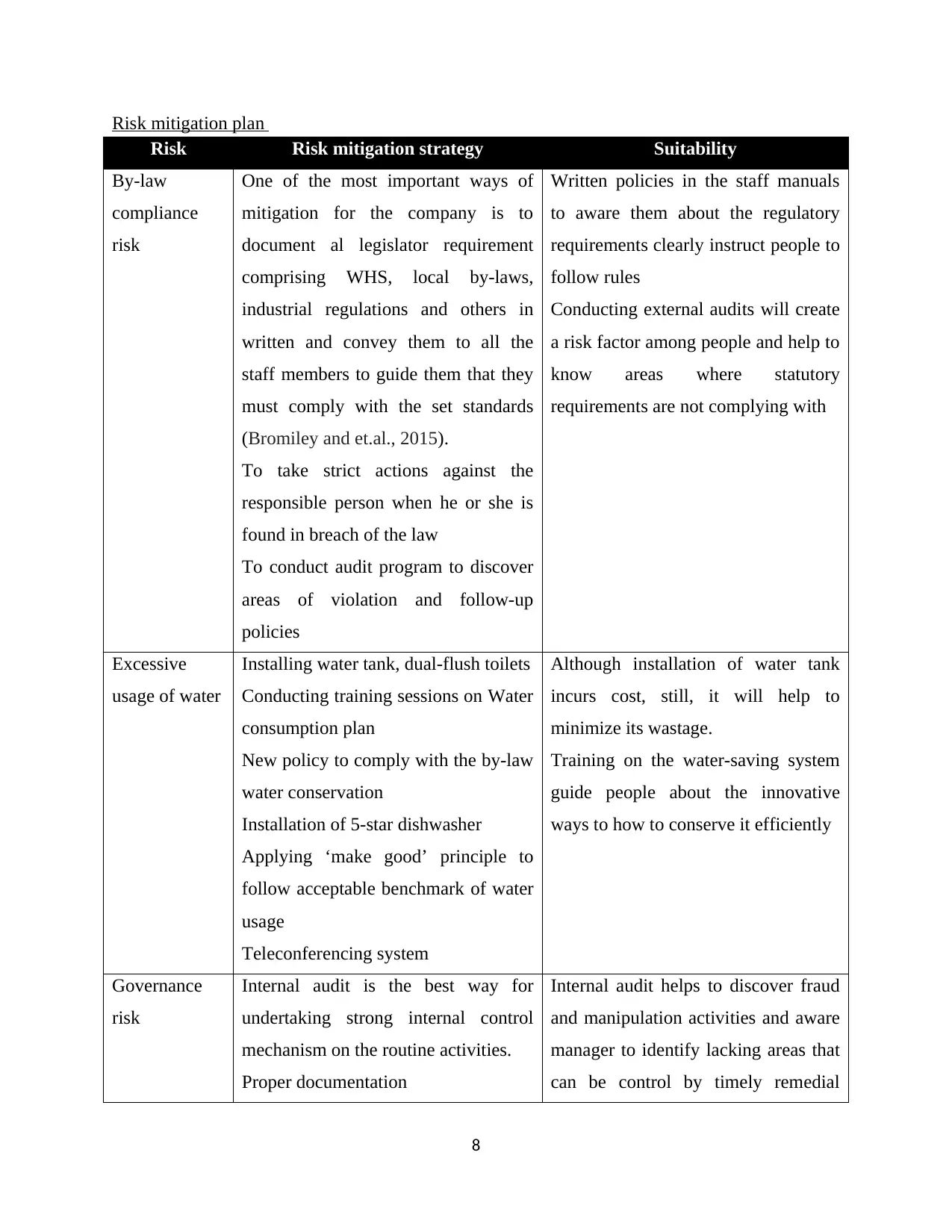

Risk mitigation plan

Risk Risk mitigation strategy Suitability

By-law

compliance

risk

One of the most important ways of

mitigation for the company is to

document al legislator requirement

comprising WHS, local by-laws,

industrial regulations and others in

written and convey them to all the

staff members to guide them that they

must comply with the set standards

(Bromiley and et.al., 2015).

To take strict actions against the

responsible person when he or she is

found in breach of the law

To conduct audit program to discover

areas of violation and follow-up

policies

Written policies in the staff manuals

to aware them about the regulatory

requirements clearly instruct people to

follow rules

Conducting external audits will create

a risk factor among people and help to

know areas where statutory

requirements are not complying with

Excessive

usage of water

Installing water tank, dual-flush toilets

Conducting training sessions on Water

consumption plan

New policy to comply with the by-law

water conservation

Installation of 5-star dishwasher

Applying ‘make good’ principle to

follow acceptable benchmark of water

usage

Teleconferencing system

Although installation of water tank

incurs cost, still, it will help to

minimize its wastage.

Training on the water-saving system

guide people about the innovative

ways to how to conserve it efficiently

Governance

risk

Internal audit is the best way for

undertaking strong internal control

mechanism on the routine activities.

Proper documentation

Internal audit helps to discover fraud

and manipulation activities and aware

manager to identify lacking areas that

can be control by timely remedial

8

Risk Risk mitigation strategy Suitability

By-law

compliance

risk

One of the most important ways of

mitigation for the company is to

document al legislator requirement

comprising WHS, local by-laws,

industrial regulations and others in

written and convey them to all the

staff members to guide them that they

must comply with the set standards

(Bromiley and et.al., 2015).

To take strict actions against the

responsible person when he or she is

found in breach of the law

To conduct audit program to discover

areas of violation and follow-up

policies

Written policies in the staff manuals

to aware them about the regulatory

requirements clearly instruct people to

follow rules

Conducting external audits will create

a risk factor among people and help to

know areas where statutory

requirements are not complying with

Excessive

usage of water

Installing water tank, dual-flush toilets

Conducting training sessions on Water

consumption plan

New policy to comply with the by-law

water conservation

Installation of 5-star dishwasher

Applying ‘make good’ principle to

follow acceptable benchmark of water

usage

Teleconferencing system

Although installation of water tank

incurs cost, still, it will help to

minimize its wastage.

Training on the water-saving system

guide people about the innovative

ways to how to conserve it efficiently

Governance

risk

Internal audit is the best way for

undertaking strong internal control

mechanism on the routine activities.

Proper documentation

Internal audit helps to discover fraud

and manipulation activities and aware

manager to identify lacking areas that

can be control by timely remedial

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

actions.

Financial risk Training on daily banking deposits

Financial control, management and

regulatory framework

By providing training to the

workforce, they will be able to

efficiently use their funds

(Christoffersen, 2012). Moreover, strict

monitoring and controlling framework

will enable the entity to reduce its

usage.

Project

management

risk

It is require setting written policy

including travel policy, harassment

policy, no discrimination,

organizational culture policy and

others.

Corporate governance mechanism

needs to be design by which all the

staff members must be adhere.

By communicating all information to

staff members about business policy

via manual helps to establish sound

management

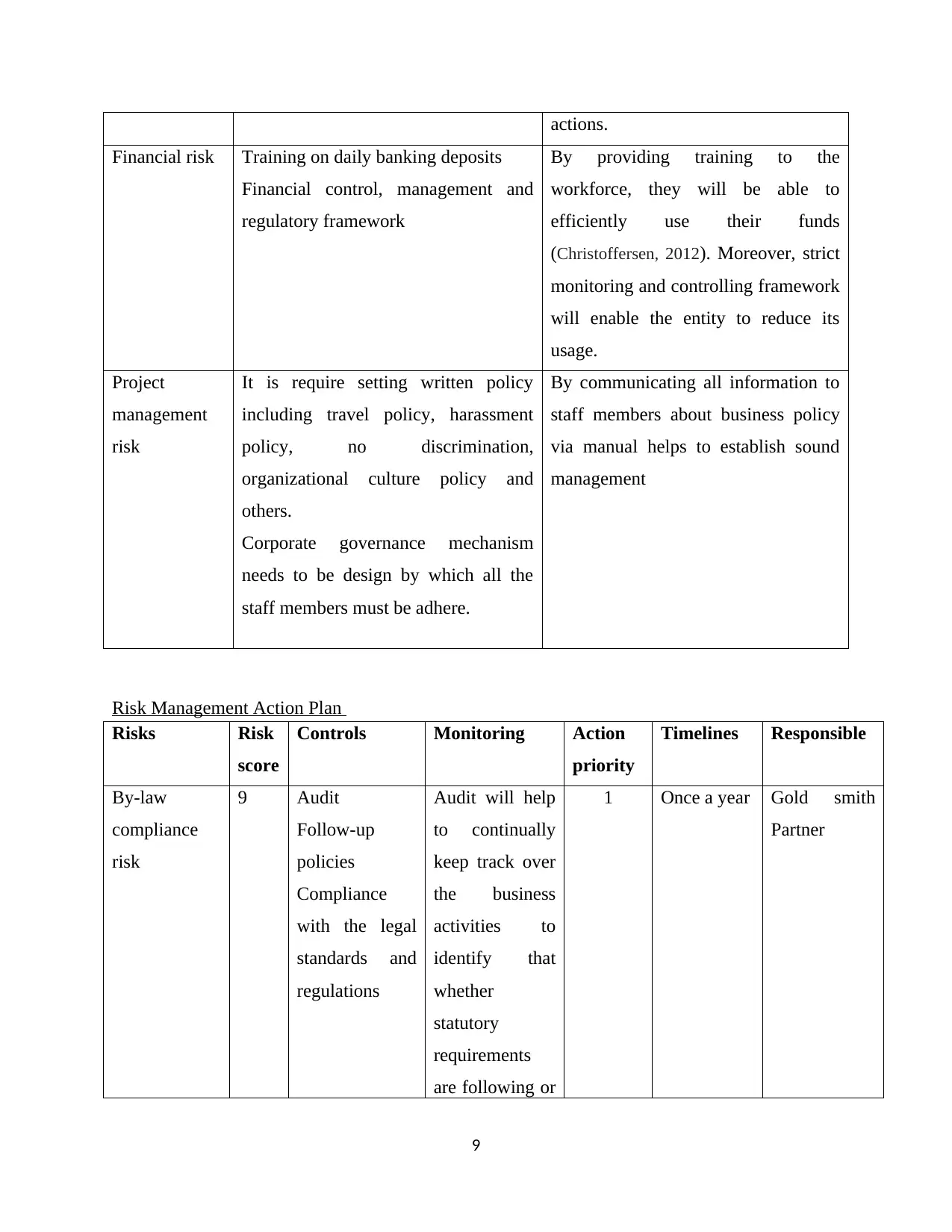

Risk Management Action Plan

Risks Risk

score

Controls Monitoring Action

priority

Timelines Responsible

By-law

compliance

risk

9 Audit

Follow-up

policies

Compliance

with the legal

standards and

regulations

Audit will help

to continually

keep track over

the business

activities to

identify that

whether

statutory

requirements

are following or

1 Once a year Gold smith

Partner

9

Financial risk Training on daily banking deposits

Financial control, management and

regulatory framework

By providing training to the

workforce, they will be able to

efficiently use their funds

(Christoffersen, 2012). Moreover, strict

monitoring and controlling framework

will enable the entity to reduce its

usage.

Project

management

risk

It is require setting written policy

including travel policy, harassment

policy, no discrimination,

organizational culture policy and

others.

Corporate governance mechanism

needs to be design by which all the

staff members must be adhere.

By communicating all information to

staff members about business policy

via manual helps to establish sound

management

Risk Management Action Plan

Risks Risk

score

Controls Monitoring Action

priority

Timelines Responsible

By-law

compliance

risk

9 Audit

Follow-up

policies

Compliance

with the legal

standards and

regulations

Audit will help

to continually

keep track over

the business

activities to

identify that

whether

statutory

requirements

are following or

1 Once a year Gold smith

Partner

9

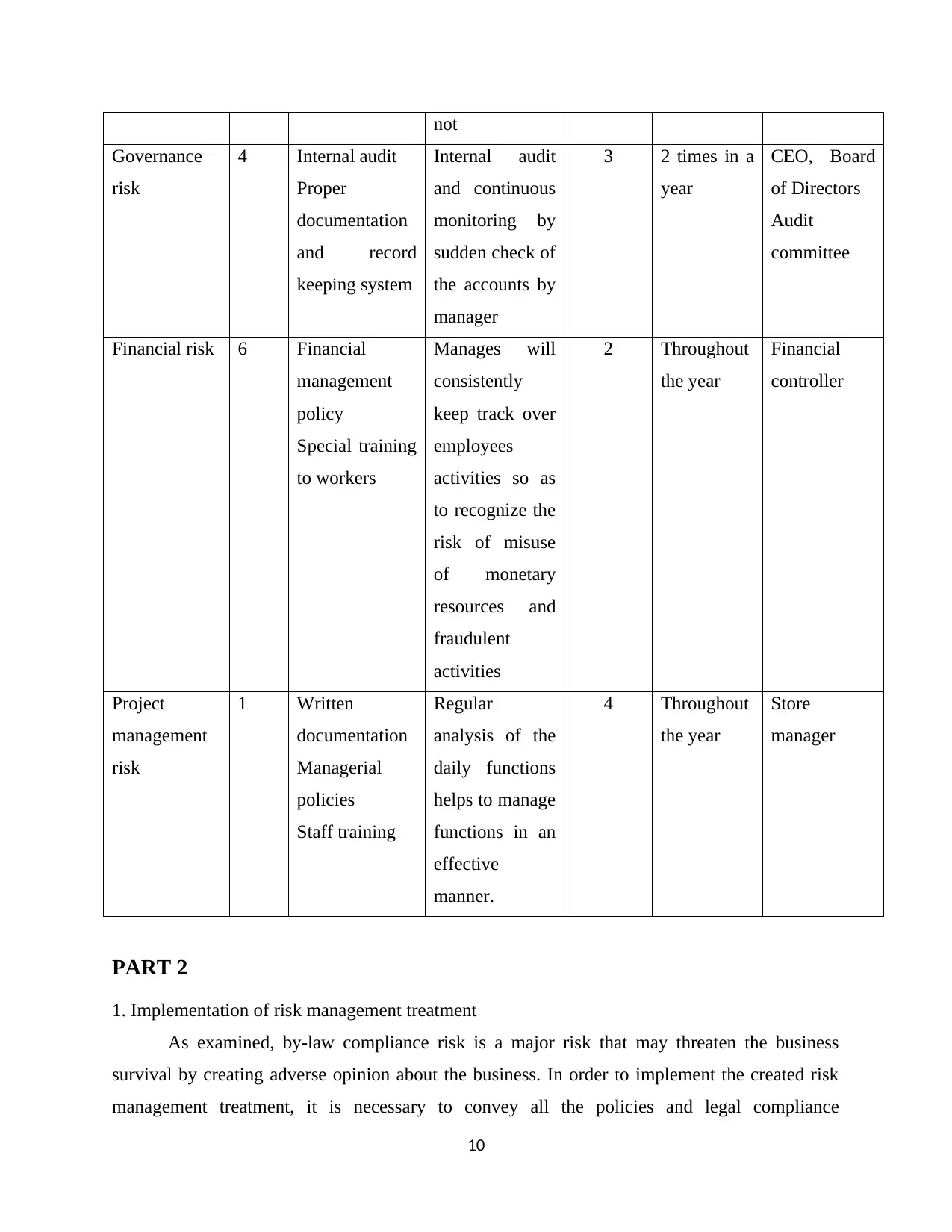

not

Governance

risk

4 Internal audit

Proper

documentation

and record

keeping system

Internal audit

and continuous

monitoring by

sudden check of

the accounts by

manager

3 2 times in a

year

CEO, Board

of Directors

Audit

committee

Financial risk 6 Financial

management

policy

Special training

to workers

Manages will

consistently

keep track over

employees

activities so as

to recognize the

risk of misuse

of monetary

resources and

fraudulent

activities

2 Throughout

the year

Financial

controller

Project

management

risk

1 Written

documentation

Managerial

policies

Staff training

Regular

analysis of the

daily functions

helps to manage

functions in an

effective

manner.

4 Throughout

the year

Store

manager

PART 2

1. Implementation of risk management treatment

As examined, by-law compliance risk is a major risk that may threaten the business

survival by creating adverse opinion about the business. In order to implement the created risk

management treatment, it is necessary to convey all the policies and legal compliance

10

Governance

risk

4 Internal audit

Proper

documentation

and record

keeping system

Internal audit

and continuous

monitoring by

sudden check of

the accounts by

manager

3 2 times in a

year

CEO, Board

of Directors

Audit

committee

Financial risk 6 Financial

management

policy

Special training

to workers

Manages will

consistently

keep track over

employees

activities so as

to recognize the

risk of misuse

of monetary

resources and

fraudulent

activities

2 Throughout

the year

Financial

controller

Project

management

risk

1 Written

documentation

Managerial

policies

Staff training

Regular

analysis of the

daily functions

helps to manage

functions in an

effective

manner.

4 Throughout

the year

Store

manager

PART 2

1. Implementation of risk management treatment

As examined, by-law compliance risk is a major risk that may threaten the business

survival by creating adverse opinion about the business. In order to implement the created risk

management treatment, it is necessary to convey all the policies and legal compliance

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.