Analysis of Innovation & Sustainable Business Development at CommBank

VerifiedAdded on 2023/06/13

|12

|825

|272

Case Study

AI Summary

This case study examines Commonwealth Bank's (CommBank) business model, focusing on innovation and sustainable business development. It explores the bank's services, including financial, retail, investment, and insurance offerings, alongside its adoption of smart-connected products to enhance customer experience. The analysis identifies opportunities such as gaining a competitive edge and moving towards automation, as well as threats like increased training costs and potential misuse of customer information. The business model canvas highlights key partners, activities, resources, value propositions, customer relationships, channels, customer segments, and revenue streams. The study concludes that CommBank's business model is effective for enhancing goodwill and achieving future growth, but also emphasizes the need for adapting strategies and resources to meet evolving customer needs. Desklib provides access to this case study and other resources for students.

Innovation and

Sustainable Business

Development

Sustainable Business

Development

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

“

CommBank Can.

2

CommBank Can.

2

Table of Content

- Business model

- Disruption

- Services of Commonwealth Bank

- Smart-connected products

- Threats and Opportunities of Smart-

connected devices

- Business model canvas of Commonwealth

Bank

- Conclusion

3

- Business model

- Disruption

- Services of Commonwealth Bank

- Smart-connected products

- Threats and Opportunities of Smart-

connected devices

- Business model canvas of Commonwealth

Bank

- Conclusion

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Model

Business model acts as

the structure for a

business that includes

sundry aspects for an

organization. All these

aspects consists key

capabilities and resources

which plays crucial role in

terms of overall

environment of a

business enterprise

(Paetz, 2014). 4

Business model acts as

the structure for a

business that includes

sundry aspects for an

organization. All these

aspects consists key

capabilities and resources

which plays crucial role in

terms of overall

environment of a

business enterprise

(Paetz, 2014). 4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Disruption

Disruptive innovation

is a term which

indicates the field of

business

administration. It

refers to an

innovation which

creates new markets

or modifies existing

products of the

organization to

acquire an effective

position in the

existing market

(Porter & 5

Disruptive innovation

is a term which

indicates the field of

business

administration. It

refers to an

innovation which

creates new markets

or modifies existing

products of the

organization to

acquire an effective

position in the

existing market

(Porter & 5

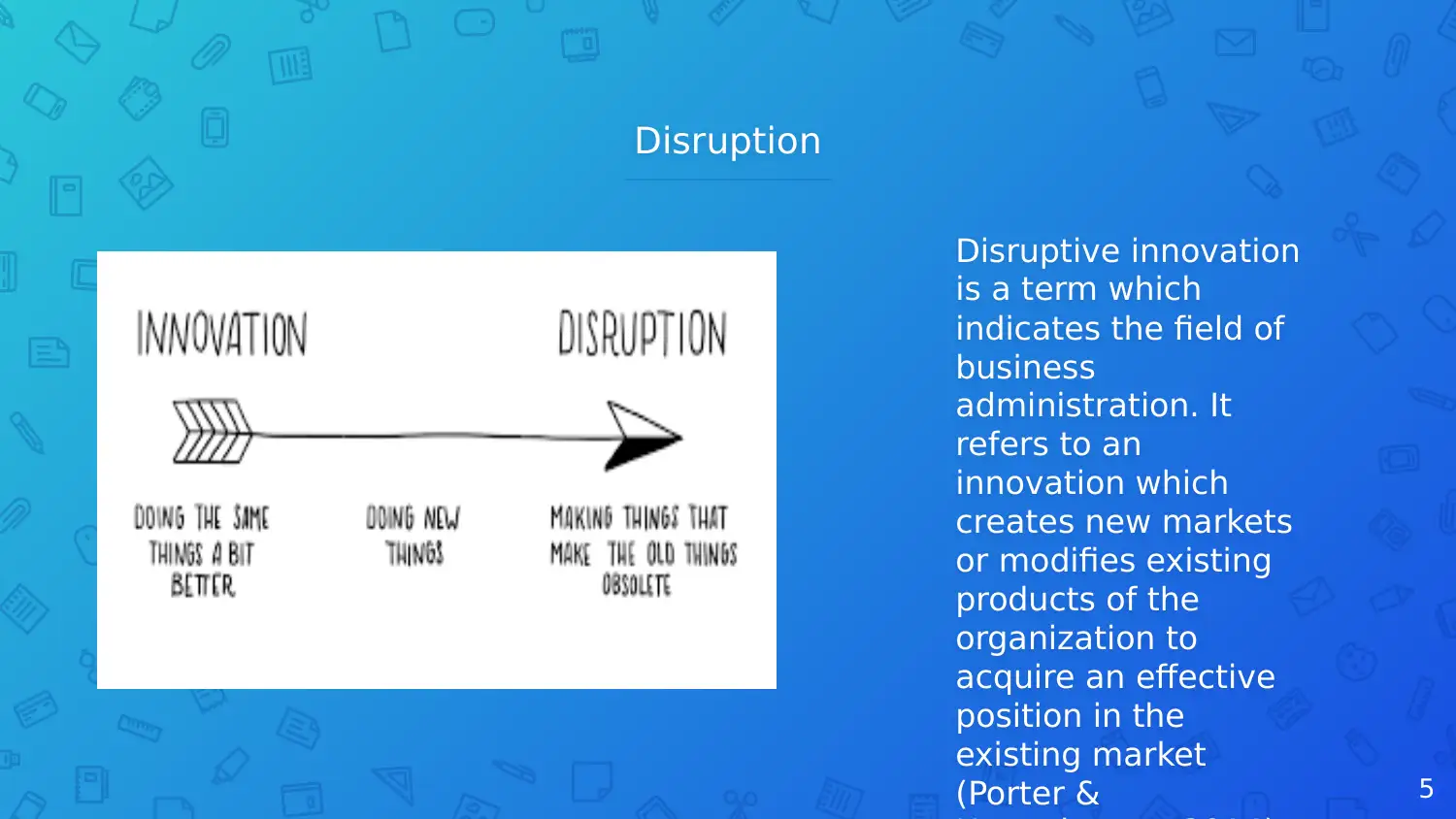

Services of Commonwealth Bank

6

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

to be continued…..

7

Commonwealth bank, Australia which is a

multi-national bank and offers various

services to the customers as well as to the

business enterprises (Commonwealth

Bank, 2018). Financial services, retail

services, investment, insurance, business

banking, etc. are some of the primary

services offered by bank. Along with

Australia, Commonwealth Bank is also

situated in various parts of the globe such

as New Zealand, United Kingdom, and

United States of America (Porter &

Heppelmann, 2015).

7

Commonwealth bank, Australia which is a

multi-national bank and offers various

services to the customers as well as to the

business enterprises (Commonwealth

Bank, 2018). Financial services, retail

services, investment, insurance, business

banking, etc. are some of the primary

services offered by bank. Along with

Australia, Commonwealth Bank is also

situated in various parts of the globe such

as New Zealand, United Kingdom, and

United States of America (Porter &

Heppelmann, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Smart-connected Products

8

Disruptive innovation leads to create

smart connected devices which are

essential to operate in an effective

manner. In terms of banking sector, it has

been reviewed that banking sector plays

crucial role as smart-connected devices

helps the banks to enhance the customer

experience in relation with the

consumption of banking services. In

relation with the continuous increase in

the customer base, management of

Commonwealth Bank has adopted usage

of smart-connected devices in their

procedure (Radziwill, 2015).

8

Disruptive innovation leads to create

smart connected devices which are

essential to operate in an effective

manner. In terms of banking sector, it has

been reviewed that banking sector plays

crucial role as smart-connected devices

helps the banks to enhance the customer

experience in relation with the

consumption of banking services. In

relation with the continuous increase in

the customer base, management of

Commonwealth Bank has adopted usage

of smart-connected devices in their

procedure (Radziwill, 2015).

Opportunities and Threats of Smaart-connected products

Opportunities

Acquiring competitive advantage

in the internal banking industry.

Enhancing customer base

Moving towards automation

(Schlagwein, Thorogood &

Willcocks, 2014).

Threats

Training and development

costs increases

Adaptation of change in

technology for staff is bit

diffiuclt process

Miss-utilisation of customer’s

infromation.

9

Opportunities

Acquiring competitive advantage

in the internal banking industry.

Enhancing customer base

Moving towards automation

(Schlagwein, Thorogood &

Willcocks, 2014).

Threats

Training and development

costs increases

Adaptation of change in

technology for staff is bit

diffiuclt process

Miss-utilisation of customer’s

infromation.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

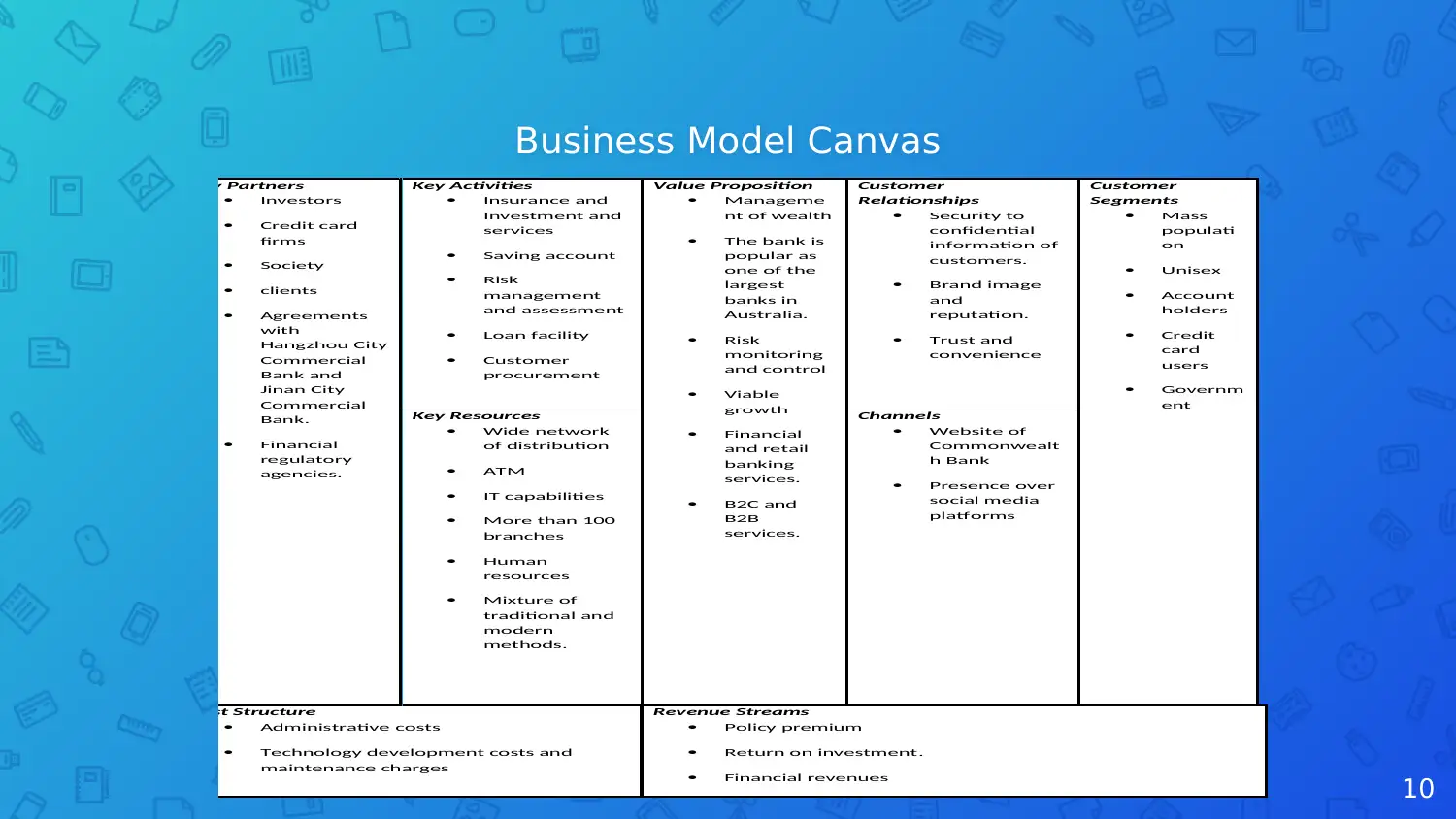

Business Model Canvas

10

Key Partners

Investors

Credit card

firms

Society

clients

Agreements

with

Hangzhou City

Commercial

Bank and

Jinan City

Commercial

Bank.

Financial

regulatory

agencies.

Key Activities

Insurance and

Investment and

services

Saving account

Risk

management

and assessment

Loan facility

Customer

procurement

Value Proposition

Manageme

nt of wealth

The bank is

popular as

one of the

largest

banks in

Australia.

Risk

monitoring

and control

Viable

growth

Financial

and retail

banking

services.

B2C and

B2B

services.

Customer

Relationships

Security to

confidential

information of

customers.

Brand image

and

reputation.

Trust and

convenience

Customer

Segments

Mass

populati

on

Unisex

Account

holders

Credit

card

users

Governm

ent

Key Resources

Wide network

of distribution

ATM

IT capabilities

More than 100

branches

Human

resources

Mixture of

traditional and

modern

methods.

Channels

Website of

Commonwealt

h Bank

Presence over

social media

platforms

Cost Structure

Administrative costs

Technology development costs and

maintenance charges

Revenue Streams

Policy premium

Return on investment.

Financial revenues

Key Partners

Investors

Credit card

firms

Society

clients

Agreements

with

Hangzhou City

Commercial

Bank and

Jinan City

Commercial

Bank.

Financial

regulatory

agencies.

Key Activities

Insurance and

Investment and

services

Saving account

Risk

management

and assessment

Loan facility

Customer

procurement

Value Proposition

Manageme

nt of wealth

The bank is

popular as

one of the

largest

banks in

Australia.

Risk

monitoring

and control

Viable

growth

Financial

and retail

banking

services.

B2C and

B2B

services.

Customer

Relationships

Security to

confidential

information of

customers.

Brand image

and

reputation.

Trust and

convenience

Customer

Segments

Mass

populati

on

Unisex

Account

holders

Credit

card

users

Governm

ent

Key Resources

Wide network

of distribution

ATM

IT capabilities

More than 100

branches

Human

resources

Mixture of

traditional and

modern

methods.

Channels

Website of

Commonwealt

h Bank

Presence over

social media

platforms

Cost Structure

Administrative costs

Technology development costs and

maintenance charges

Revenue Streams

Policy premium

Return on investment.

Financial revenues

10

Key Partners

Investors

Credit card

firms

Society

clients

Agreements

with

Hangzhou City

Commercial

Bank and

Jinan City

Commercial

Bank.

Financial

regulatory

agencies.

Key Activities

Insurance and

Investment and

services

Saving account

Risk

management

and assessment

Loan facility

Customer

procurement

Value Proposition

Manageme

nt of wealth

The bank is

popular as

one of the

largest

banks in

Australia.

Risk

monitoring

and control

Viable

growth

Financial

and retail

banking

services.

B2C and

B2B

services.

Customer

Relationships

Security to

confidential

information of

customers.

Brand image

and

reputation.

Trust and

convenience

Customer

Segments

Mass

populati

on

Unisex

Account

holders

Credit

card

users

Governm

ent

Key Resources

Wide network

of distribution

ATM

IT capabilities

More than 100

branches

Human

resources

Mixture of

traditional and

modern

methods.

Channels

Website of

Commonwealt

h Bank

Presence over

social media

platforms

Cost Structure

Administrative costs

Technology development costs and

maintenance charges

Revenue Streams

Policy premium

Return on investment.

Financial revenues

Key Partners

Investors

Credit card

firms

Society

clients

Agreements

with

Hangzhou City

Commercial

Bank and

Jinan City

Commercial

Bank.

Financial

regulatory

agencies.

Key Activities

Insurance and

Investment and

services

Saving account

Risk

management

and assessment

Loan facility

Customer

procurement

Value Proposition

Manageme

nt of wealth

The bank is

popular as

one of the

largest

banks in

Australia.

Risk

monitoring

and control

Viable

growth

Financial

and retail

banking

services.

B2C and

B2B

services.

Customer

Relationships

Security to

confidential

information of

customers.

Brand image

and

reputation.

Trust and

convenience

Customer

Segments

Mass

populati

on

Unisex

Account

holders

Credit

card

users

Governm

ent

Key Resources

Wide network

of distribution

ATM

IT capabilities

More than 100

branches

Human

resources

Mixture of

traditional and

modern

methods.

Channels

Website of

Commonwealt

h Bank

Presence over

social media

platforms

Cost Structure

Administrative costs

Technology development costs and

maintenance charges

Revenue Streams

Policy premium

Return on investment.

Financial revenues

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

11

It could be concluded that the business

canvas model adopted by Commonwealth

Bank is effective enough to enhance the

goodwill along with attainment of future

growth objectives. With the above

analysis, it has been recognised that

Commonwealth Bank is required to adopt

certain other strategies and resources with

the objective of meeting with future

customers’ needs.

11

It could be concluded that the business

canvas model adopted by Commonwealth

Bank is effective enough to enhance the

goodwill along with attainment of future

growth objectives. With the above

analysis, it has been recognised that

Commonwealth Bank is required to adopt

certain other strategies and resources with

the objective of meeting with future

customers’ needs.

References

12

• Paetz, P. (2014). Disruption by Design: How to Create Products that Disrupt and

then Dominate Markets. NY: Apress.

• Porter, M. E., & Heppelmann, J. E. (2014). How smart, connected products are

transforming competition. Harvard Business Review, 92(11), 64-88.

• Porter, M. E., & Heppelmann, J. E. (2015). How smart, connected products are

transforming companies. Harvard Business Review, 93(10), 96-114.

• Radziwill, N. (2015). Value Proposition Design. The Quality Management

Journal, 22(1), 61.

• Schlagwein, D., Thorogood, A., & Willcocks, L. P. (2014). How Commonwealth

Bank of Australia Gained Benefits Using a Standards-Based, Multi-Provider Cloud

Model. MIS Quarterly Executive, 13(4).

• Commonwealth Bank. (2018). CommBank: Personal banking including accounts,

credit cards. Retrieved from https://www.commbank.com.au/.

12

• Paetz, P. (2014). Disruption by Design: How to Create Products that Disrupt and

then Dominate Markets. NY: Apress.

• Porter, M. E., & Heppelmann, J. E. (2014). How smart, connected products are

transforming competition. Harvard Business Review, 92(11), 64-88.

• Porter, M. E., & Heppelmann, J. E. (2015). How smart, connected products are

transforming companies. Harvard Business Review, 93(10), 96-114.

• Radziwill, N. (2015). Value Proposition Design. The Quality Management

Journal, 22(1), 61.

• Schlagwein, D., Thorogood, A., & Willcocks, L. P. (2014). How Commonwealth

Bank of Australia Gained Benefits Using a Standards-Based, Multi-Provider Cloud

Model. MIS Quarterly Executive, 13(4).

• Commonwealth Bank. (2018). CommBank: Personal banking including accounts,

credit cards. Retrieved from https://www.commbank.com.au/.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.