University Company Accounting Assignment: ACCT20073 Solution

VerifiedAdded on 2023/01/03

|7

|557

|99

Homework Assignment

AI Summary

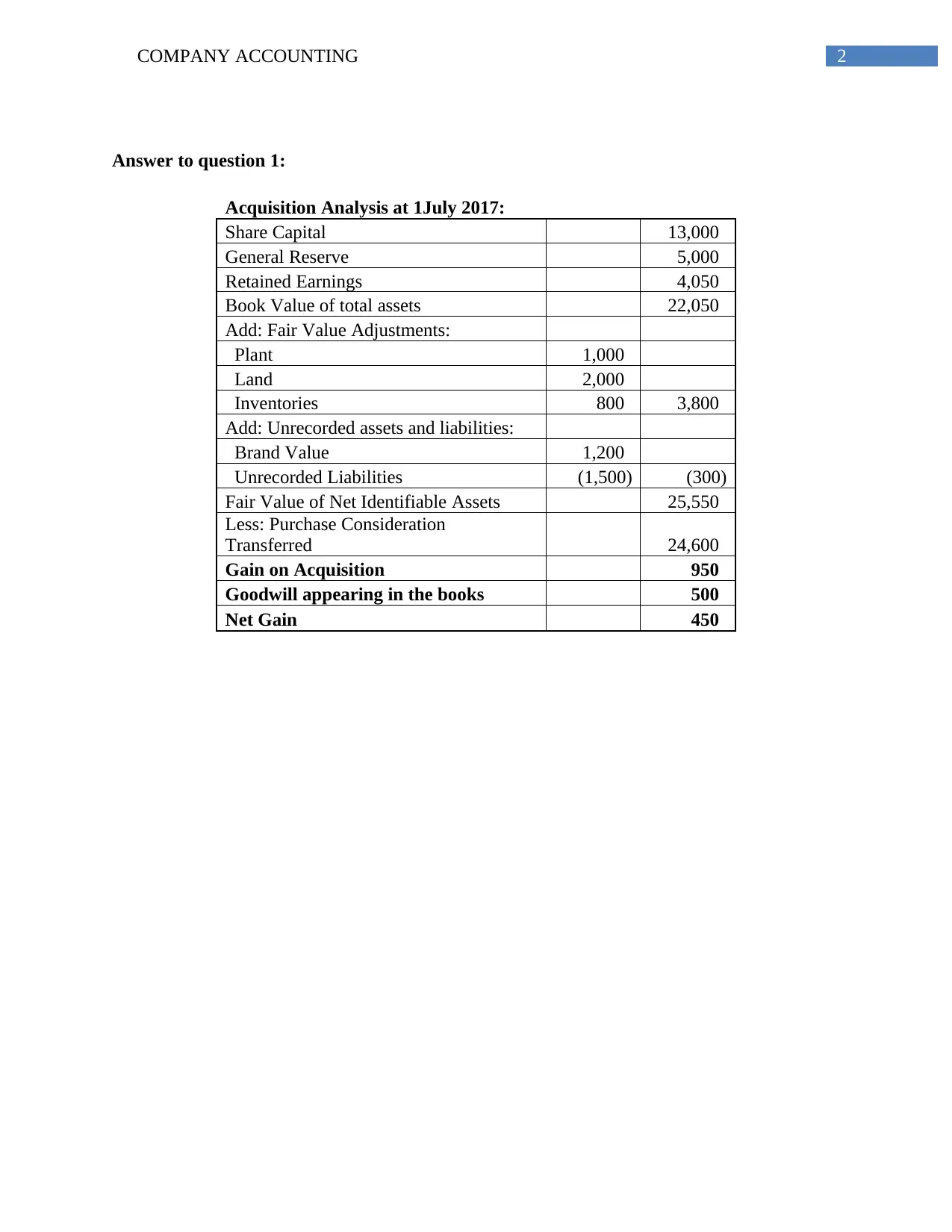

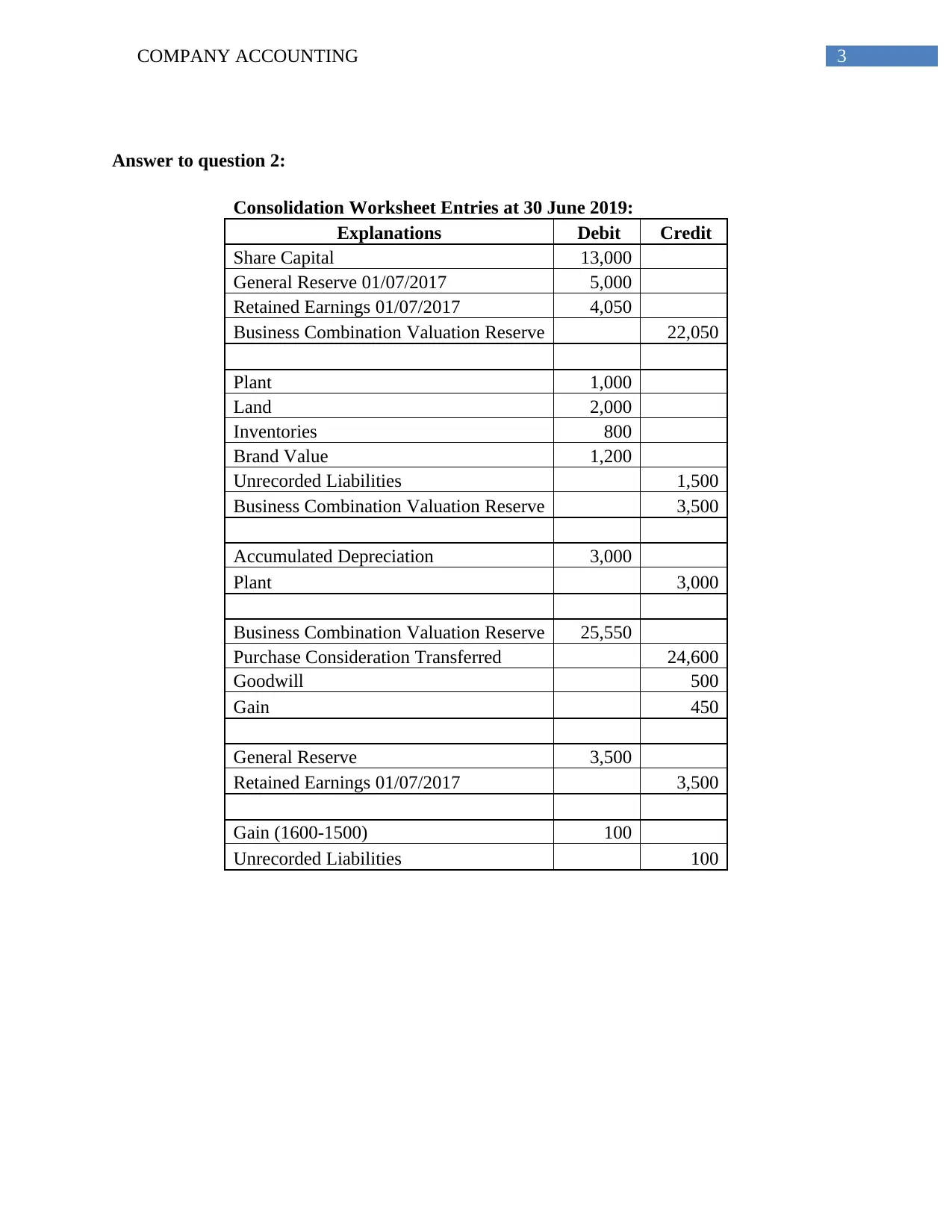

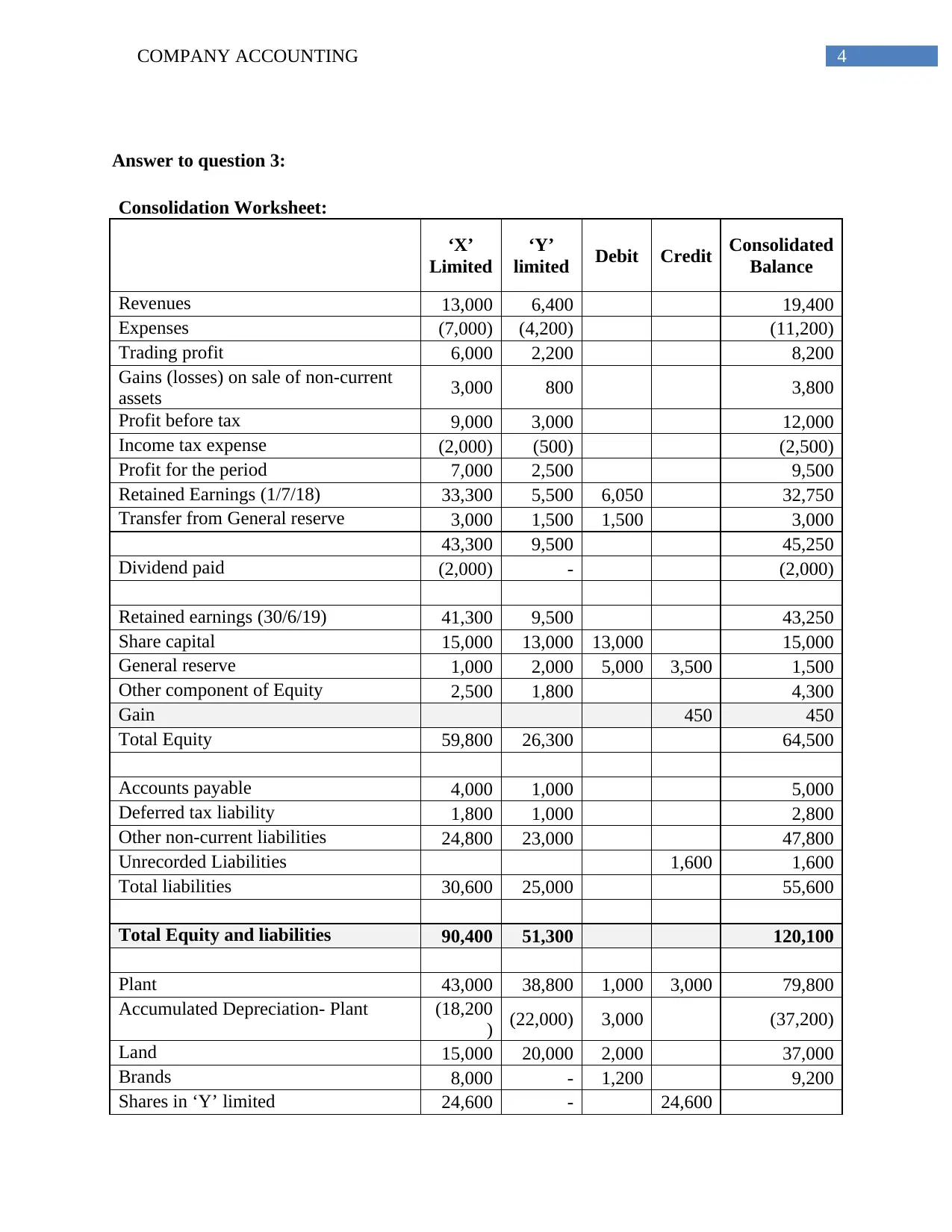

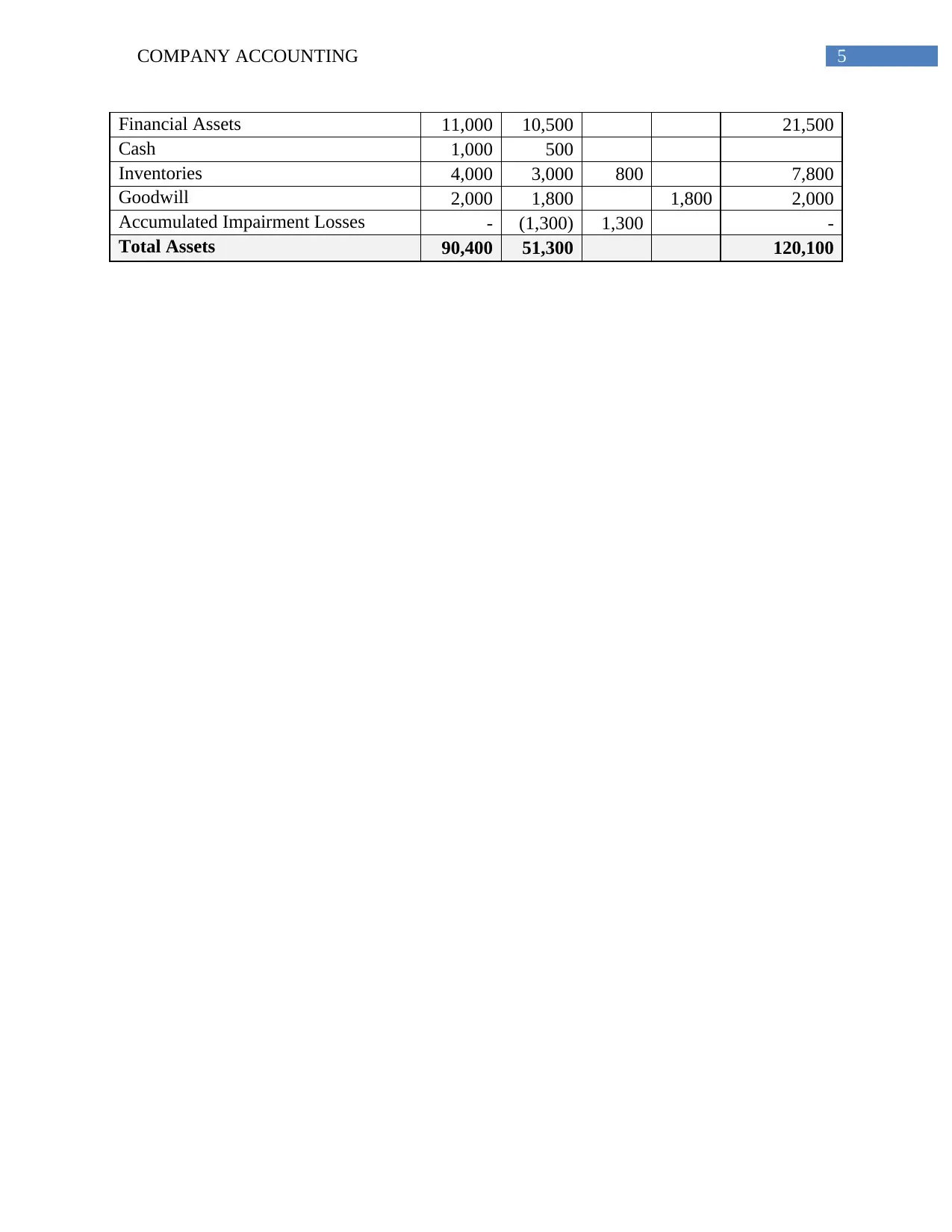

This document presents a comprehensive solution to a company accounting assignment, likely for an undergraduate accounting course. It addresses key concepts such as acquisition analysis, detailing the fair value adjustments and calculation of goodwill. The solution includes a consolidation worksheet with journal entries, explaining the debit and credit adjustments needed for consolidation. Furthermore, it provides a consolidated balance sheet, income statement, and other financial statements, demonstrating the financial position and performance of the combined entities. The assignment likely requires the student to apply accounting standards to prepare consolidated financial statements, interpret financial data, and understand the implications of business combinations. The solution incorporates various financial figures and calculations to arrive at the final consolidated financial statements.

1 out of 7

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)