Comprehensive Budget Evaluation and Analysis Report

VerifiedAdded on 2020/05/01

|15

|2844

|53

Report

AI Summary

This report provides a comprehensive evaluation of a budget, analyzing various financial aspects. It begins with a sales budget, production budget, direct material purchases budget, direct labor budget, and manufacturing overhead budget, detailing projected figures for January, February, and March. The report then calculates the ending finished goods inventory budget and the cost of goods sold budget. An income statement and a cash budget are presented to assess financial performance. The analysis includes a comparison of production costs with and without a new manufacturing facility. Variance analysis is conducted on sales, material prices, material usage, direct labor rates, and efficiency. Finally, the report discusses the implications of imposed versus participative budgetary approaches and their impact on management and staff, using Paulo as a case study.

Running head: AN EVALUATION OF BUDGET

An evaluation of Budget

Student’s Name:

University Name:

Author Note

An evaluation of Budget

Student’s Name:

University Name:

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AN EVALUATION OF BUDGET

Table of Contents

Part A...............................................................................................................................................2

Answer to Part a...........................................................................................................................2

Answer to Part b..........................................................................................................................2

Answer to Part c...........................................................................................................................2

Answer to Part d..........................................................................................................................3

Answer to Part e...........................................................................................................................4

Answer to Part f...........................................................................................................................4

Answer to Part g..........................................................................................................................5

Answer to Part h..........................................................................................................................6

Answer to Part i...........................................................................................................................6

Workings......................................................................................................................................7

Part B...............................................................................................................................................8

Part C...............................................................................................................................................9

Part D.............................................................................................................................................12

References......................................................................................................................................14

Table of Contents

Part A...............................................................................................................................................2

Answer to Part a...........................................................................................................................2

Answer to Part b..........................................................................................................................2

Answer to Part c...........................................................................................................................2

Answer to Part d..........................................................................................................................3

Answer to Part e...........................................................................................................................4

Answer to Part f...........................................................................................................................4

Answer to Part g..........................................................................................................................5

Answer to Part h..........................................................................................................................6

Answer to Part i...........................................................................................................................6

Workings......................................................................................................................................7

Part B...............................................................................................................................................8

Part C...............................................................................................................................................9

Part D.............................................................................................................................................12

References......................................................................................................................................14

2AN EVALUATION OF BUDGET

Part A

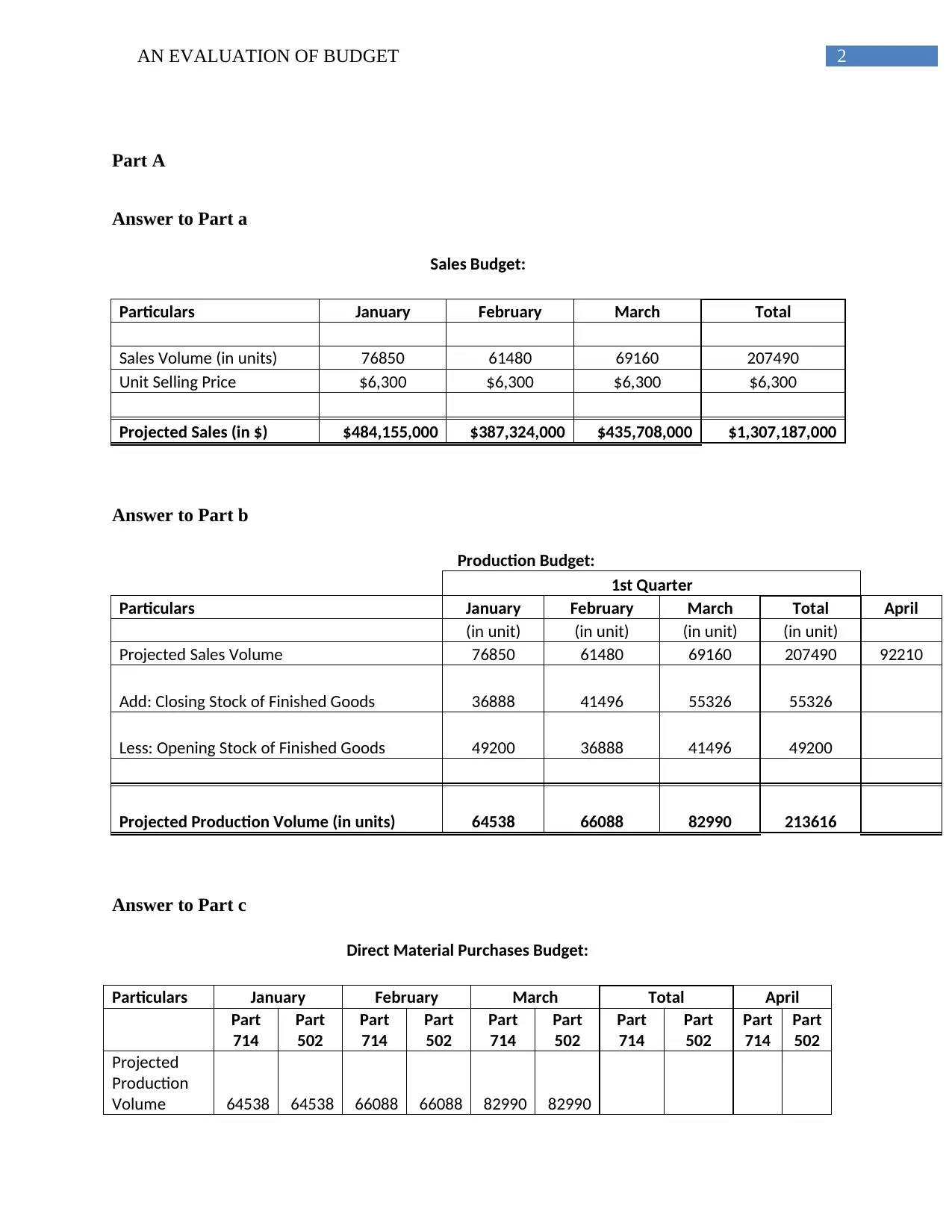

Answer to Part a

Sales Budget:

Particulars January February March Total

Sales Volume (in units) 76850 61480 69160 207490

Unit Selling Price $6,300 $6,300 $6,300 $6,300

Projected Sales (in $) $484,155,000 $387,324,000 $435,708,000 $1,307,187,000

Answer to Part b

Production Budget:

1st Quarter

Particulars January February March Total April

(in unit) (in unit) (in unit) (in unit)

Projected Sales Volume 76850 61480 69160 207490 92210

Add: Closing Stock of Finished Goods 36888 41496 55326 55326

Less: Opening Stock of Finished Goods 49200 36888 41496 49200

Projected Production Volume (in units) 64538 66088 82990 213616

Answer to Part c

Direct Material Purchases Budget:

Particulars January February March Total April

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Projected

Production

Volume 64538 64538 66088 66088 82990 82990

Part A

Answer to Part a

Sales Budget:

Particulars January February March Total

Sales Volume (in units) 76850 61480 69160 207490

Unit Selling Price $6,300 $6,300 $6,300 $6,300

Projected Sales (in $) $484,155,000 $387,324,000 $435,708,000 $1,307,187,000

Answer to Part b

Production Budget:

1st Quarter

Particulars January February March Total April

(in unit) (in unit) (in unit) (in unit)

Projected Sales Volume 76850 61480 69160 207490 92210

Add: Closing Stock of Finished Goods 36888 41496 55326 55326

Less: Opening Stock of Finished Goods 49200 36888 41496 49200

Projected Production Volume (in units) 64538 66088 82990 213616

Answer to Part c

Direct Material Purchases Budget:

Particulars January February March Total April

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Projected

Production

Volume 64538 64538 66088 66088 82990 82990

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AN EVALUATION OF BUDGET

Material

required p.u. 5 6 5 6 5 6

Total

Material

Required

32269

0

38722

8

33044

0

39652

8

41495

0

49794

0

10680

80

128169

6

Add: Closing

Stock of Raw

Materials 61480 73776 69160 82992 92210

11065

2 92210 110652

Less:

Opening

Stock of Raw

Material 76850 92220 61480 73776 69160 82992 76850 92220

Direct

Material

Purchased

(in units)

30732

0

36878

4

33812

0

40574

4

43800

0

52560

0

10834

40

130012

8

Material

Cost p.u. $92 $123 $92 $123 $92 $123 $92 $123

Projected

Direct

Material

Purchased

$28,2

73,44

0

$45,3

60,43

2

$31,1

07,04

0

$49,9

06,51

2

$40,2

96,00

0

$64,6

48,80

0

$99,6

76,48

0

$159,9

15,744

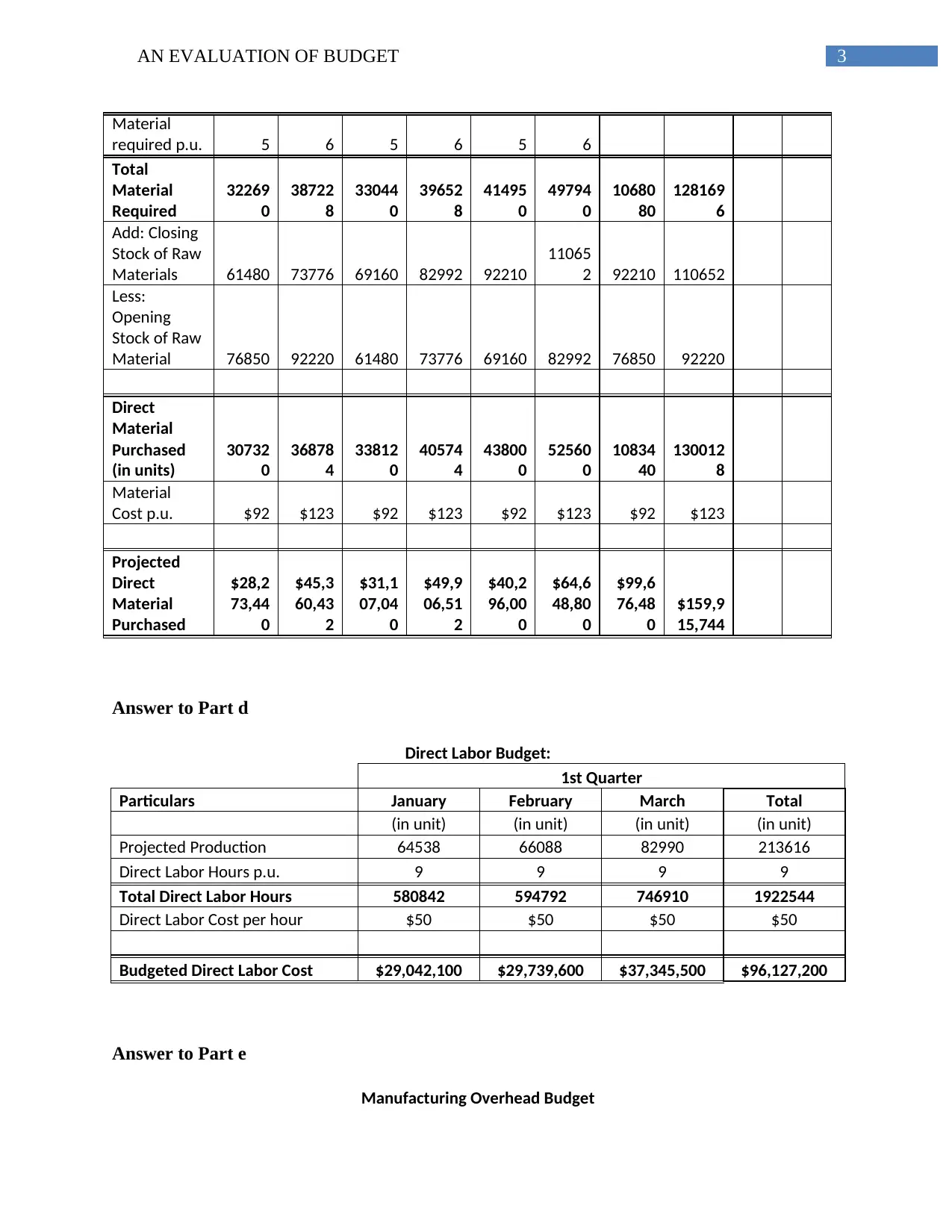

Answer to Part d

Direct Labor Budget:

1st Quarter

Particulars January February March Total

(in unit) (in unit) (in unit) (in unit)

Projected Production 64538 66088 82990 213616

Direct Labor Hours p.u. 9 9 9 9

Total Direct Labor Hours 580842 594792 746910 1922544

Direct Labor Cost per hour $50 $50 $50 $50

Budgeted Direct Labor Cost $29,042,100 $29,739,600 $37,345,500 $96,127,200

Answer to Part e

Manufacturing Overhead Budget

Material

required p.u. 5 6 5 6 5 6

Total

Material

Required

32269

0

38722

8

33044

0

39652

8

41495

0

49794

0

10680

80

128169

6

Add: Closing

Stock of Raw

Materials 61480 73776 69160 82992 92210

11065

2 92210 110652

Less:

Opening

Stock of Raw

Material 76850 92220 61480 73776 69160 82992 76850 92220

Direct

Material

Purchased

(in units)

30732

0

36878

4

33812

0

40574

4

43800

0

52560

0

10834

40

130012

8

Material

Cost p.u. $92 $123 $92 $123 $92 $123 $92 $123

Projected

Direct

Material

Purchased

$28,2

73,44

0

$45,3

60,43

2

$31,1

07,04

0

$49,9

06,51

2

$40,2

96,00

0

$64,6

48,80

0

$99,6

76,48

0

$159,9

15,744

Answer to Part d

Direct Labor Budget:

1st Quarter

Particulars January February March Total

(in unit) (in unit) (in unit) (in unit)

Projected Production 64538 66088 82990 213616

Direct Labor Hours p.u. 9 9 9 9

Total Direct Labor Hours 580842 594792 746910 1922544

Direct Labor Cost per hour $50 $50 $50 $50

Budgeted Direct Labor Cost $29,042,100 $29,739,600 $37,345,500 $96,127,200

Answer to Part e

Manufacturing Overhead Budget

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AN EVALUATION OF BUDGET

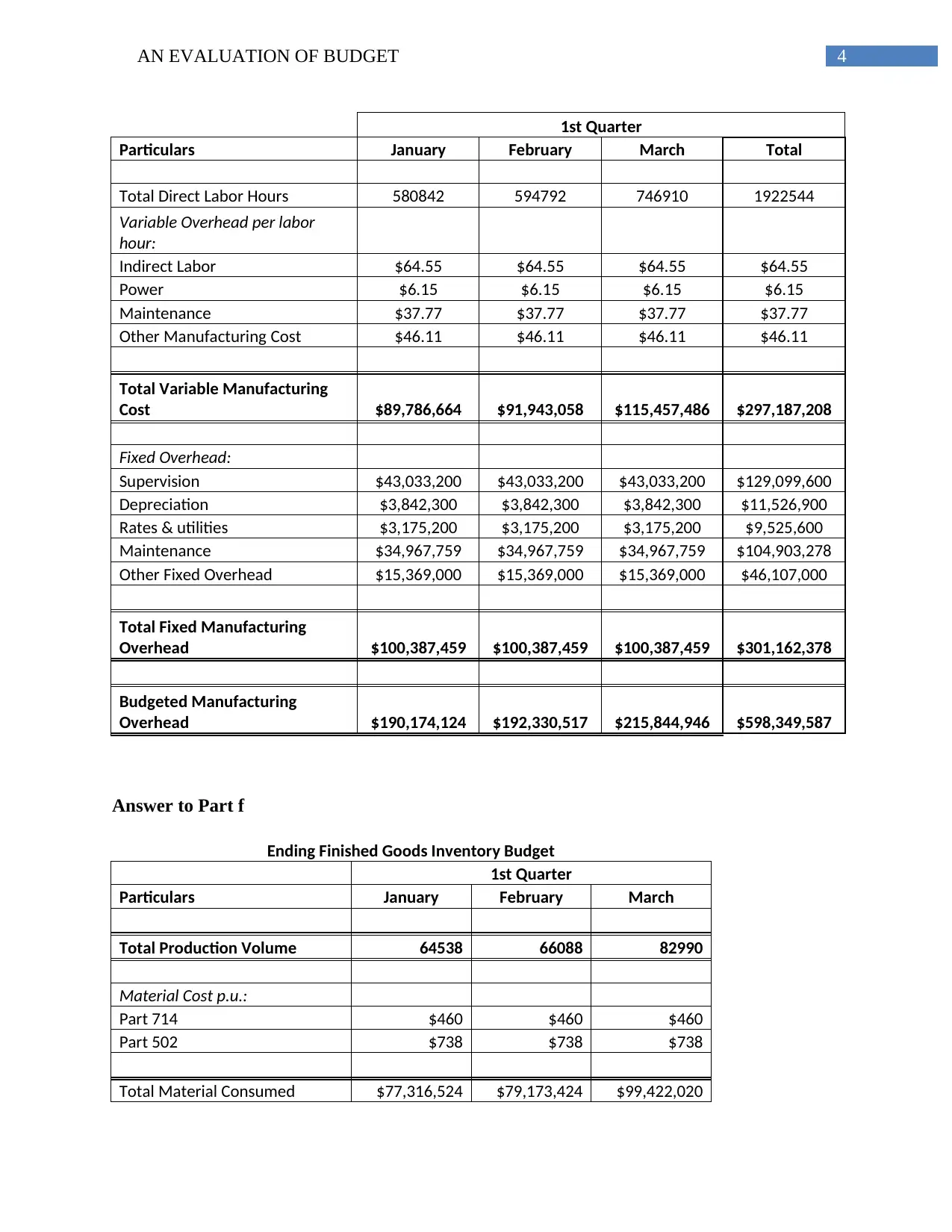

1st Quarter

Particulars January February March Total

Total Direct Labor Hours 580842 594792 746910 1922544

Variable Overhead per labor

hour:

Indirect Labor $64.55 $64.55 $64.55 $64.55

Power $6.15 $6.15 $6.15 $6.15

Maintenance $37.77 $37.77 $37.77 $37.77

Other Manufacturing Cost $46.11 $46.11 $46.11 $46.11

Total Variable Manufacturing

Cost $89,786,664 $91,943,058 $115,457,486 $297,187,208

Fixed Overhead:

Supervision $43,033,200 $43,033,200 $43,033,200 $129,099,600

Depreciation $3,842,300 $3,842,300 $3,842,300 $11,526,900

Rates & utilities $3,175,200 $3,175,200 $3,175,200 $9,525,600

Maintenance $34,967,759 $34,967,759 $34,967,759 $104,903,278

Other Fixed Overhead $15,369,000 $15,369,000 $15,369,000 $46,107,000

Total Fixed Manufacturing

Overhead $100,387,459 $100,387,459 $100,387,459 $301,162,378

Budgeted Manufacturing

Overhead $190,174,124 $192,330,517 $215,844,946 $598,349,587

Answer to Part f

Ending Finished Goods Inventory Budget

1st Quarter

Particulars January February March

Total Production Volume 64538 66088 82990

Material Cost p.u.:

Part 714 $460 $460 $460

Part 502 $738 $738 $738

Total Material Consumed $77,316,524 $79,173,424 $99,422,020

1st Quarter

Particulars January February March Total

Total Direct Labor Hours 580842 594792 746910 1922544

Variable Overhead per labor

hour:

Indirect Labor $64.55 $64.55 $64.55 $64.55

Power $6.15 $6.15 $6.15 $6.15

Maintenance $37.77 $37.77 $37.77 $37.77

Other Manufacturing Cost $46.11 $46.11 $46.11 $46.11

Total Variable Manufacturing

Cost $89,786,664 $91,943,058 $115,457,486 $297,187,208

Fixed Overhead:

Supervision $43,033,200 $43,033,200 $43,033,200 $129,099,600

Depreciation $3,842,300 $3,842,300 $3,842,300 $11,526,900

Rates & utilities $3,175,200 $3,175,200 $3,175,200 $9,525,600

Maintenance $34,967,759 $34,967,759 $34,967,759 $104,903,278

Other Fixed Overhead $15,369,000 $15,369,000 $15,369,000 $46,107,000

Total Fixed Manufacturing

Overhead $100,387,459 $100,387,459 $100,387,459 $301,162,378

Budgeted Manufacturing

Overhead $190,174,124 $192,330,517 $215,844,946 $598,349,587

Answer to Part f

Ending Finished Goods Inventory Budget

1st Quarter

Particulars January February March

Total Production Volume 64538 66088 82990

Material Cost p.u.:

Part 714 $460 $460 $460

Part 502 $738 $738 $738

Total Material Consumed $77,316,524 $79,173,424 $99,422,020

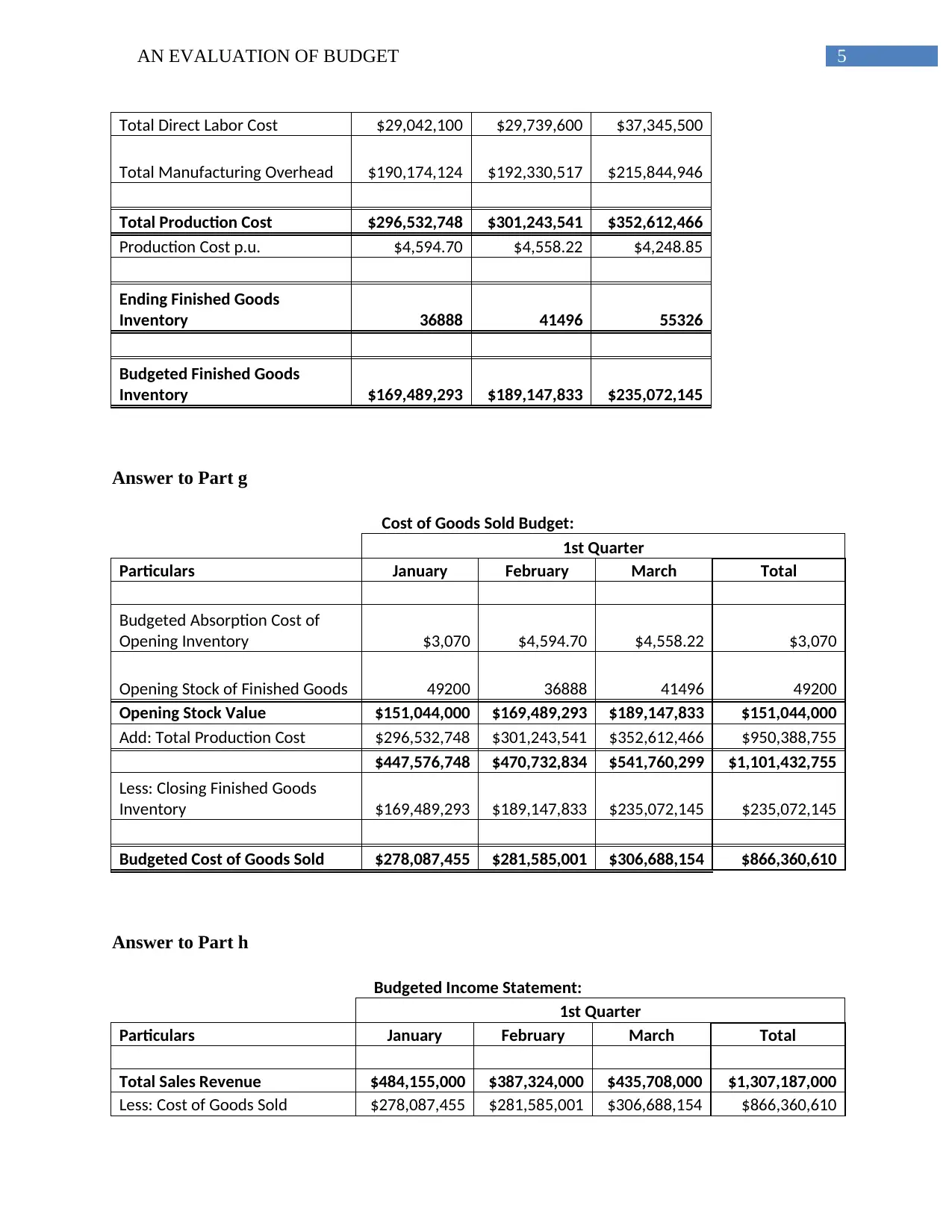

5AN EVALUATION OF BUDGET

Total Direct Labor Cost $29,042,100 $29,739,600 $37,345,500

Total Manufacturing Overhead $190,174,124 $192,330,517 $215,844,946

Total Production Cost $296,532,748 $301,243,541 $352,612,466

Production Cost p.u. $4,594.70 $4,558.22 $4,248.85

Ending Finished Goods

Inventory 36888 41496 55326

Budgeted Finished Goods

Inventory $169,489,293 $189,147,833 $235,072,145

Answer to Part g

Cost of Goods Sold Budget:

1st Quarter

Particulars January February March Total

Budgeted Absorption Cost of

Opening Inventory $3,070 $4,594.70 $4,558.22 $3,070

Opening Stock of Finished Goods 49200 36888 41496 49200

Opening Stock Value $151,044,000 $169,489,293 $189,147,833 $151,044,000

Add: Total Production Cost $296,532,748 $301,243,541 $352,612,466 $950,388,755

$447,576,748 $470,732,834 $541,760,299 $1,101,432,755

Less: Closing Finished Goods

Inventory $169,489,293 $189,147,833 $235,072,145 $235,072,145

Budgeted Cost of Goods Sold $278,087,455 $281,585,001 $306,688,154 $866,360,610

Answer to Part h

Budgeted Income Statement:

1st Quarter

Particulars January February March Total

Total Sales Revenue $484,155,000 $387,324,000 $435,708,000 $1,307,187,000

Less: Cost of Goods Sold $278,087,455 $281,585,001 $306,688,154 $866,360,610

Total Direct Labor Cost $29,042,100 $29,739,600 $37,345,500

Total Manufacturing Overhead $190,174,124 $192,330,517 $215,844,946

Total Production Cost $296,532,748 $301,243,541 $352,612,466

Production Cost p.u. $4,594.70 $4,558.22 $4,248.85

Ending Finished Goods

Inventory 36888 41496 55326

Budgeted Finished Goods

Inventory $169,489,293 $189,147,833 $235,072,145

Answer to Part g

Cost of Goods Sold Budget:

1st Quarter

Particulars January February March Total

Budgeted Absorption Cost of

Opening Inventory $3,070 $4,594.70 $4,558.22 $3,070

Opening Stock of Finished Goods 49200 36888 41496 49200

Opening Stock Value $151,044,000 $169,489,293 $189,147,833 $151,044,000

Add: Total Production Cost $296,532,748 $301,243,541 $352,612,466 $950,388,755

$447,576,748 $470,732,834 $541,760,299 $1,101,432,755

Less: Closing Finished Goods

Inventory $169,489,293 $189,147,833 $235,072,145 $235,072,145

Budgeted Cost of Goods Sold $278,087,455 $281,585,001 $306,688,154 $866,360,610

Answer to Part h

Budgeted Income Statement:

1st Quarter

Particulars January February March Total

Total Sales Revenue $484,155,000 $387,324,000 $435,708,000 $1,307,187,000

Less: Cost of Goods Sold $278,087,455 $281,585,001 $306,688,154 $866,360,610

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AN EVALUATION OF BUDGET

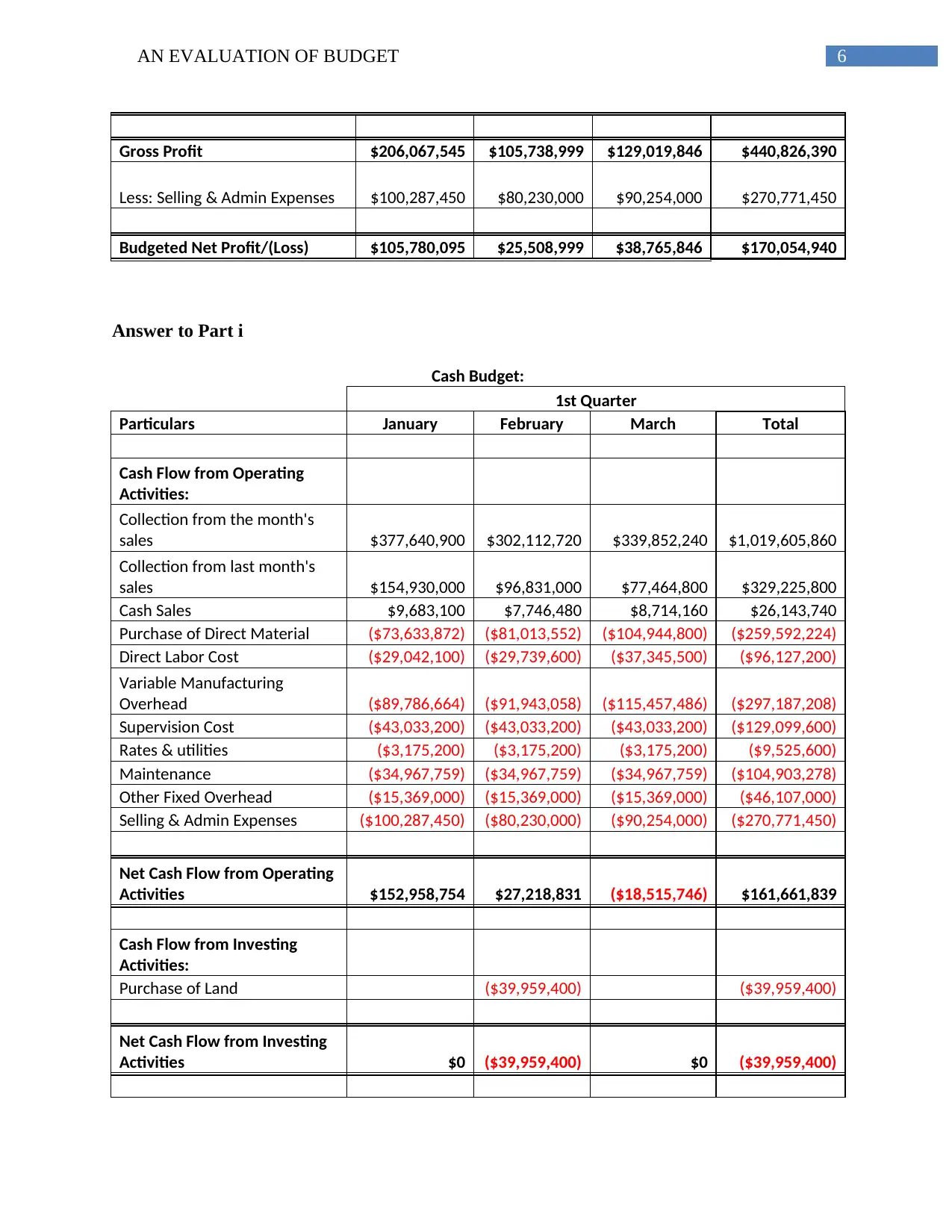

Gross Profit $206,067,545 $105,738,999 $129,019,846 $440,826,390

Less: Selling & Admin Expenses $100,287,450 $80,230,000 $90,254,000 $270,771,450

Budgeted Net Profit/(Loss) $105,780,095 $25,508,999 $38,765,846 $170,054,940

Answer to Part i

Cash Budget:

1st Quarter

Particulars January February March Total

Cash Flow from Operating

Activities:

Collection from the month's

sales $377,640,900 $302,112,720 $339,852,240 $1,019,605,860

Collection from last month's

sales $154,930,000 $96,831,000 $77,464,800 $329,225,800

Cash Sales $9,683,100 $7,746,480 $8,714,160 $26,143,740

Purchase of Direct Material ($73,633,872) ($81,013,552) ($104,944,800) ($259,592,224)

Direct Labor Cost ($29,042,100) ($29,739,600) ($37,345,500) ($96,127,200)

Variable Manufacturing

Overhead ($89,786,664) ($91,943,058) ($115,457,486) ($297,187,208)

Supervision Cost ($43,033,200) ($43,033,200) ($43,033,200) ($129,099,600)

Rates & utilities ($3,175,200) ($3,175,200) ($3,175,200) ($9,525,600)

Maintenance ($34,967,759) ($34,967,759) ($34,967,759) ($104,903,278)

Other Fixed Overhead ($15,369,000) ($15,369,000) ($15,369,000) ($46,107,000)

Selling & Admin Expenses ($100,287,450) ($80,230,000) ($90,254,000) ($270,771,450)

Net Cash Flow from Operating

Activities $152,958,754 $27,218,831 ($18,515,746) $161,661,839

Cash Flow from Investing

Activities:

Purchase of Land ($39,959,400) ($39,959,400)

Net Cash Flow from Investing

Activities $0 ($39,959,400) $0 ($39,959,400)

Gross Profit $206,067,545 $105,738,999 $129,019,846 $440,826,390

Less: Selling & Admin Expenses $100,287,450 $80,230,000 $90,254,000 $270,771,450

Budgeted Net Profit/(Loss) $105,780,095 $25,508,999 $38,765,846 $170,054,940

Answer to Part i

Cash Budget:

1st Quarter

Particulars January February March Total

Cash Flow from Operating

Activities:

Collection from the month's

sales $377,640,900 $302,112,720 $339,852,240 $1,019,605,860

Collection from last month's

sales $154,930,000 $96,831,000 $77,464,800 $329,225,800

Cash Sales $9,683,100 $7,746,480 $8,714,160 $26,143,740

Purchase of Direct Material ($73,633,872) ($81,013,552) ($104,944,800) ($259,592,224)

Direct Labor Cost ($29,042,100) ($29,739,600) ($37,345,500) ($96,127,200)

Variable Manufacturing

Overhead ($89,786,664) ($91,943,058) ($115,457,486) ($297,187,208)

Supervision Cost ($43,033,200) ($43,033,200) ($43,033,200) ($129,099,600)

Rates & utilities ($3,175,200) ($3,175,200) ($3,175,200) ($9,525,600)

Maintenance ($34,967,759) ($34,967,759) ($34,967,759) ($104,903,278)

Other Fixed Overhead ($15,369,000) ($15,369,000) ($15,369,000) ($46,107,000)

Selling & Admin Expenses ($100,287,450) ($80,230,000) ($90,254,000) ($270,771,450)

Net Cash Flow from Operating

Activities $152,958,754 $27,218,831 ($18,515,746) $161,661,839

Cash Flow from Investing

Activities:

Purchase of Land ($39,959,400) ($39,959,400)

Net Cash Flow from Investing

Activities $0 ($39,959,400) $0 ($39,959,400)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AN EVALUATION OF BUDGET

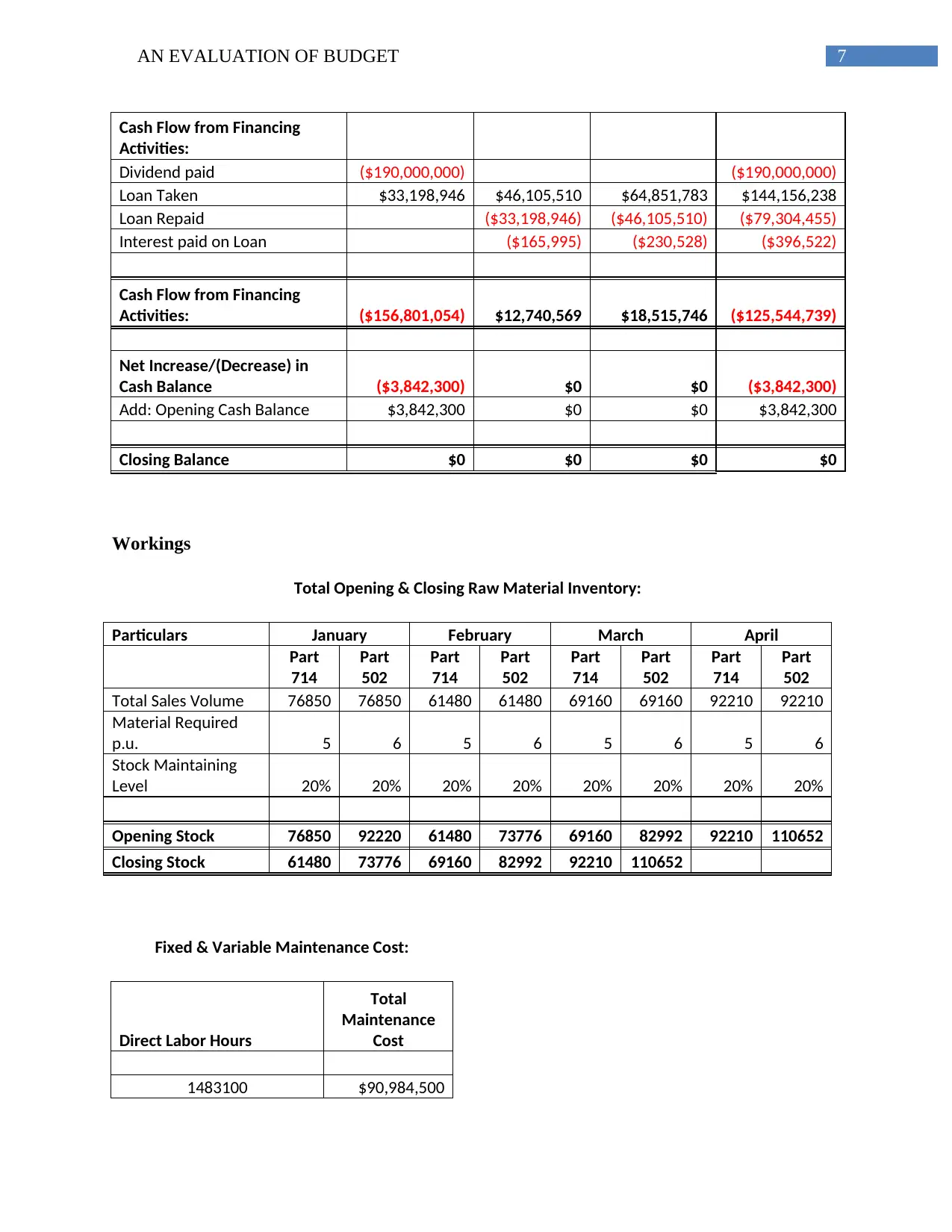

Cash Flow from Financing

Activities:

Dividend paid ($190,000,000) ($190,000,000)

Loan Taken $33,198,946 $46,105,510 $64,851,783 $144,156,238

Loan Repaid ($33,198,946) ($46,105,510) ($79,304,455)

Interest paid on Loan ($165,995) ($230,528) ($396,522)

Cash Flow from Financing

Activities: ($156,801,054) $12,740,569 $18,515,746 ($125,544,739)

Net Increase/(Decrease) in

Cash Balance ($3,842,300) $0 $0 ($3,842,300)

Add: Opening Cash Balance $3,842,300 $0 $0 $3,842,300

Closing Balance $0 $0 $0 $0

Workings

Total Opening & Closing Raw Material Inventory:

Particulars January February March April

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Total Sales Volume 76850 76850 61480 61480 69160 69160 92210 92210

Material Required

p.u. 5 6 5 6 5 6 5 6

Stock Maintaining

Level 20% 20% 20% 20% 20% 20% 20% 20%

Opening Stock 76850 92220 61480 73776 69160 82992 92210 110652

Closing Stock 61480 73776 69160 82992 92210 110652

Fixed & Variable Maintenance Cost:

Direct Labor Hours

Total

Maintenance

Cost

1483100 $90,984,500

Cash Flow from Financing

Activities:

Dividend paid ($190,000,000) ($190,000,000)

Loan Taken $33,198,946 $46,105,510 $64,851,783 $144,156,238

Loan Repaid ($33,198,946) ($46,105,510) ($79,304,455)

Interest paid on Loan ($165,995) ($230,528) ($396,522)

Cash Flow from Financing

Activities: ($156,801,054) $12,740,569 $18,515,746 ($125,544,739)

Net Increase/(Decrease) in

Cash Balance ($3,842,300) $0 $0 ($3,842,300)

Add: Opening Cash Balance $3,842,300 $0 $0 $3,842,300

Closing Balance $0 $0 $0 $0

Workings

Total Opening & Closing Raw Material Inventory:

Particulars January February March April

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Part

714

Part

502

Total Sales Volume 76850 76850 61480 61480 69160 69160 92210 92210

Material Required

p.u. 5 6 5 6 5 6 5 6

Stock Maintaining

Level 20% 20% 20% 20% 20% 20% 20% 20%

Opening Stock 76850 92220 61480 73776 69160 82992 92210 110652

Closing Stock 61480 73776 69160 82992 92210 110652

Fixed & Variable Maintenance Cost:

Direct Labor Hours

Total

Maintenance

Cost

1483100 $90,984,500

8AN EVALUATION OF BUDGET

1690600 $98,822,700

1552300 $93,597,200

1413900 $88,371,800

Variable Maintenance Cost

per hour $37.77

Fixed Maintenance Cost $34,967,759

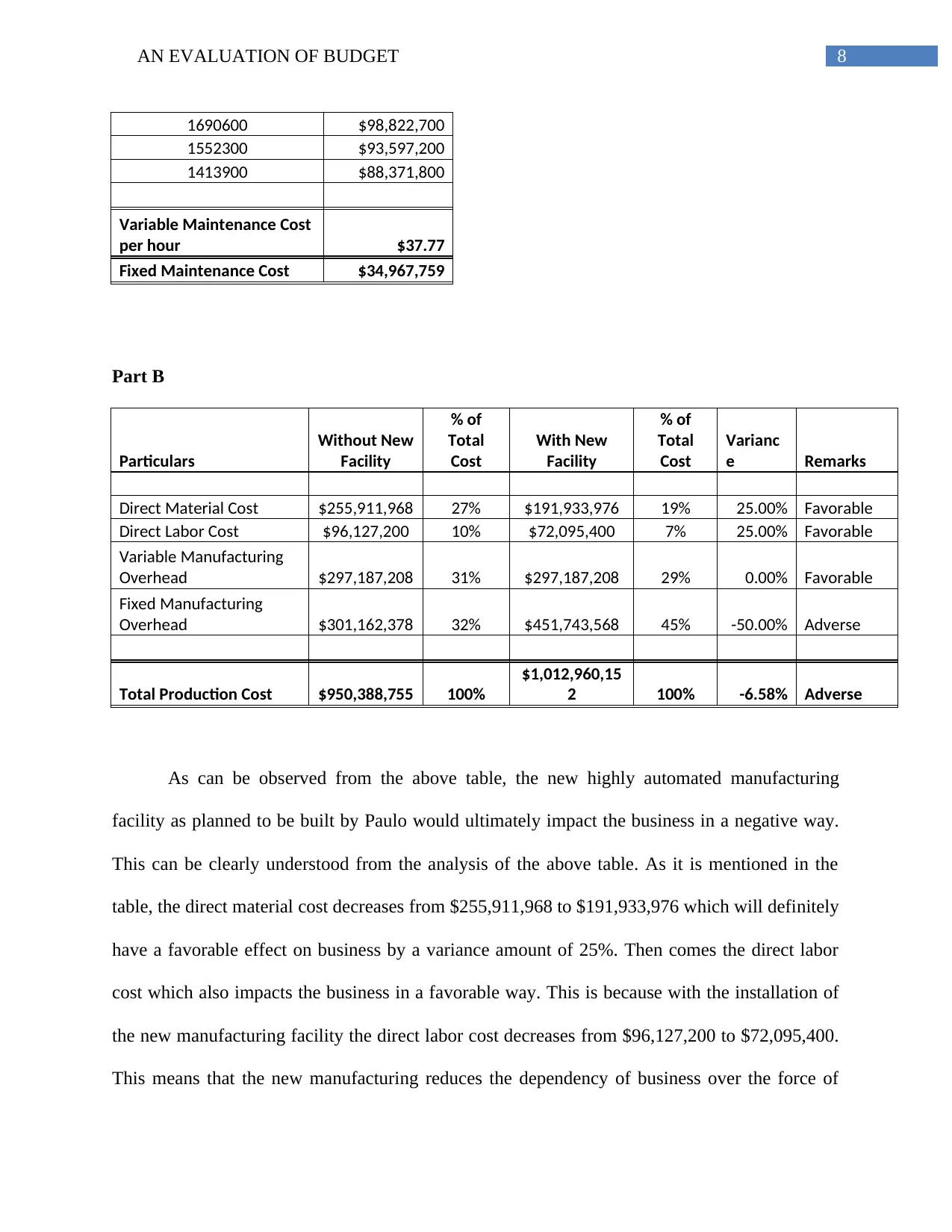

Part B

Particulars

Without New

Facility

% of

Total

Cost

With New

Facility

% of

Total

Cost

Varianc

e Remarks

Direct Material Cost $255,911,968 27% $191,933,976 19% 25.00% Favorable

Direct Labor Cost $96,127,200 10% $72,095,400 7% 25.00% Favorable

Variable Manufacturing

Overhead $297,187,208 31% $297,187,208 29% 0.00% Favorable

Fixed Manufacturing

Overhead $301,162,378 32% $451,743,568 45% -50.00% Adverse

Total Production Cost $950,388,755 100%

$1,012,960,15

2 100% -6.58% Adverse

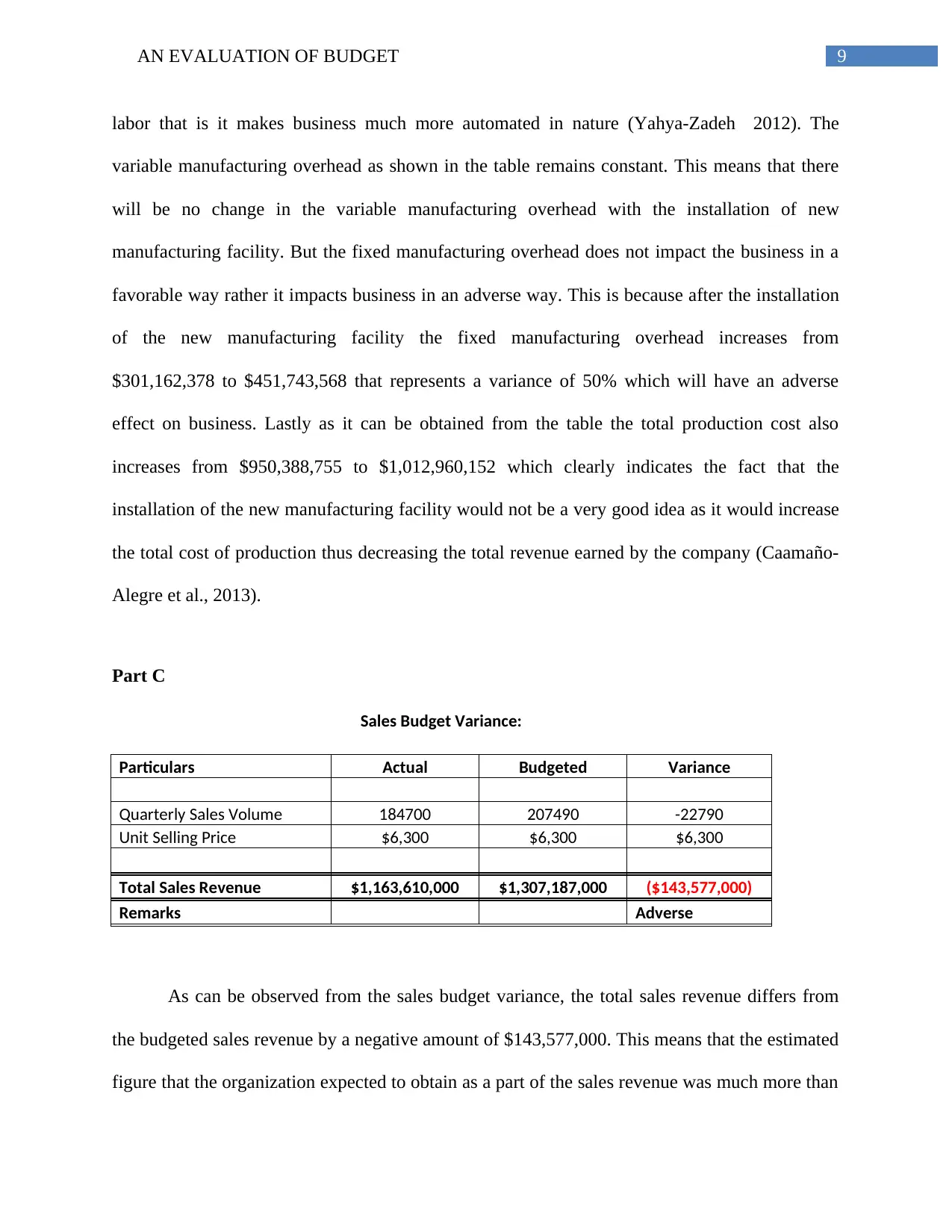

As can be observed from the above table, the new highly automated manufacturing

facility as planned to be built by Paulo would ultimately impact the business in a negative way.

This can be clearly understood from the analysis of the above table. As it is mentioned in the

table, the direct material cost decreases from $255,911,968 to $191,933,976 which will definitely

have a favorable effect on business by a variance amount of 25%. Then comes the direct labor

cost which also impacts the business in a favorable way. This is because with the installation of

the new manufacturing facility the direct labor cost decreases from $96,127,200 to $72,095,400.

This means that the new manufacturing reduces the dependency of business over the force of

1690600 $98,822,700

1552300 $93,597,200

1413900 $88,371,800

Variable Maintenance Cost

per hour $37.77

Fixed Maintenance Cost $34,967,759

Part B

Particulars

Without New

Facility

% of

Total

Cost

With New

Facility

% of

Total

Cost

Varianc

e Remarks

Direct Material Cost $255,911,968 27% $191,933,976 19% 25.00% Favorable

Direct Labor Cost $96,127,200 10% $72,095,400 7% 25.00% Favorable

Variable Manufacturing

Overhead $297,187,208 31% $297,187,208 29% 0.00% Favorable

Fixed Manufacturing

Overhead $301,162,378 32% $451,743,568 45% -50.00% Adverse

Total Production Cost $950,388,755 100%

$1,012,960,15

2 100% -6.58% Adverse

As can be observed from the above table, the new highly automated manufacturing

facility as planned to be built by Paulo would ultimately impact the business in a negative way.

This can be clearly understood from the analysis of the above table. As it is mentioned in the

table, the direct material cost decreases from $255,911,968 to $191,933,976 which will definitely

have a favorable effect on business by a variance amount of 25%. Then comes the direct labor

cost which also impacts the business in a favorable way. This is because with the installation of

the new manufacturing facility the direct labor cost decreases from $96,127,200 to $72,095,400.

This means that the new manufacturing reduces the dependency of business over the force of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AN EVALUATION OF BUDGET

labor that is it makes business much more automated in nature (Yahya-Zadeh 2012). The

variable manufacturing overhead as shown in the table remains constant. This means that there

will be no change in the variable manufacturing overhead with the installation of new

manufacturing facility. But the fixed manufacturing overhead does not impact the business in a

favorable way rather it impacts business in an adverse way. This is because after the installation

of the new manufacturing facility the fixed manufacturing overhead increases from

$301,162,378 to $451,743,568 that represents a variance of 50% which will have an adverse

effect on business. Lastly as it can be obtained from the table the total production cost also

increases from $950,388,755 to $1,012,960,152 which clearly indicates the fact that the

installation of the new manufacturing facility would not be a very good idea as it would increase

the total cost of production thus decreasing the total revenue earned by the company (Caamaño-

Alegre et al., 2013).

Part C

Sales Budget Variance:

Particulars Actual Budgeted Variance

Quarterly Sales Volume 184700 207490 -22790

Unit Selling Price $6,300 $6,300 $6,300

Total Sales Revenue $1,163,610,000 $1,307,187,000 ($143,577,000)

Remarks Adverse

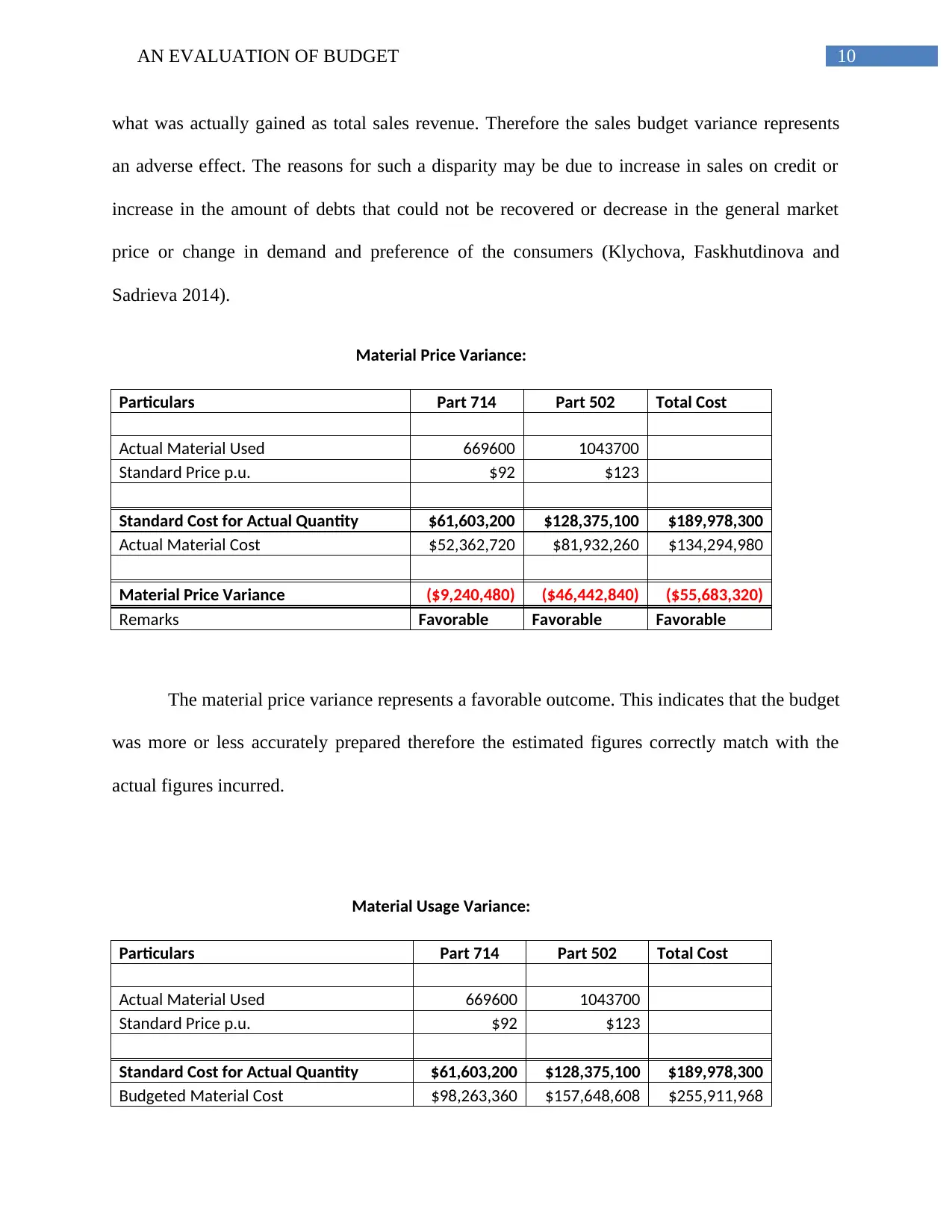

As can be observed from the sales budget variance, the total sales revenue differs from

the budgeted sales revenue by a negative amount of $143,577,000. This means that the estimated

figure that the organization expected to obtain as a part of the sales revenue was much more than

labor that is it makes business much more automated in nature (Yahya-Zadeh 2012). The

variable manufacturing overhead as shown in the table remains constant. This means that there

will be no change in the variable manufacturing overhead with the installation of new

manufacturing facility. But the fixed manufacturing overhead does not impact the business in a

favorable way rather it impacts business in an adverse way. This is because after the installation

of the new manufacturing facility the fixed manufacturing overhead increases from

$301,162,378 to $451,743,568 that represents a variance of 50% which will have an adverse

effect on business. Lastly as it can be obtained from the table the total production cost also

increases from $950,388,755 to $1,012,960,152 which clearly indicates the fact that the

installation of the new manufacturing facility would not be a very good idea as it would increase

the total cost of production thus decreasing the total revenue earned by the company (Caamaño-

Alegre et al., 2013).

Part C

Sales Budget Variance:

Particulars Actual Budgeted Variance

Quarterly Sales Volume 184700 207490 -22790

Unit Selling Price $6,300 $6,300 $6,300

Total Sales Revenue $1,163,610,000 $1,307,187,000 ($143,577,000)

Remarks Adverse

As can be observed from the sales budget variance, the total sales revenue differs from

the budgeted sales revenue by a negative amount of $143,577,000. This means that the estimated

figure that the organization expected to obtain as a part of the sales revenue was much more than

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AN EVALUATION OF BUDGET

what was actually gained as total sales revenue. Therefore the sales budget variance represents

an adverse effect. The reasons for such a disparity may be due to increase in sales on credit or

increase in the amount of debts that could not be recovered or decrease in the general market

price or change in demand and preference of the consumers (Klychova, Faskhutdinova and

Sadrieva 2014).

Material Price Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 669600 1043700

Standard Price p.u. $92 $123

Standard Cost for Actual Quantity $61,603,200 $128,375,100 $189,978,300

Actual Material Cost $52,362,720 $81,932,260 $134,294,980

Material Price Variance ($9,240,480) ($46,442,840) ($55,683,320)

Remarks Favorable Favorable Favorable

The material price variance represents a favorable outcome. This indicates that the budget

was more or less accurately prepared therefore the estimated figures correctly match with the

actual figures incurred.

Material Usage Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 669600 1043700

Standard Price p.u. $92 $123

Standard Cost for Actual Quantity $61,603,200 $128,375,100 $189,978,300

Budgeted Material Cost $98,263,360 $157,648,608 $255,911,968

what was actually gained as total sales revenue. Therefore the sales budget variance represents

an adverse effect. The reasons for such a disparity may be due to increase in sales on credit or

increase in the amount of debts that could not be recovered or decrease in the general market

price or change in demand and preference of the consumers (Klychova, Faskhutdinova and

Sadrieva 2014).

Material Price Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 669600 1043700

Standard Price p.u. $92 $123

Standard Cost for Actual Quantity $61,603,200 $128,375,100 $189,978,300

Actual Material Cost $52,362,720 $81,932,260 $134,294,980

Material Price Variance ($9,240,480) ($46,442,840) ($55,683,320)

Remarks Favorable Favorable Favorable

The material price variance represents a favorable outcome. This indicates that the budget

was more or less accurately prepared therefore the estimated figures correctly match with the

actual figures incurred.

Material Usage Variance:

Particulars Part 714 Part 502 Total Cost

Actual Material Used 669600 1043700

Standard Price p.u. $92 $123

Standard Cost for Actual Quantity $61,603,200 $128,375,100 $189,978,300

Budgeted Material Cost $98,263,360 $157,648,608 $255,911,968

11AN EVALUATION OF BUDGET

Material Usage Variance $36,660,160 $29,273,508 $65,933,668

Remarks Adverse Adverse Adverse

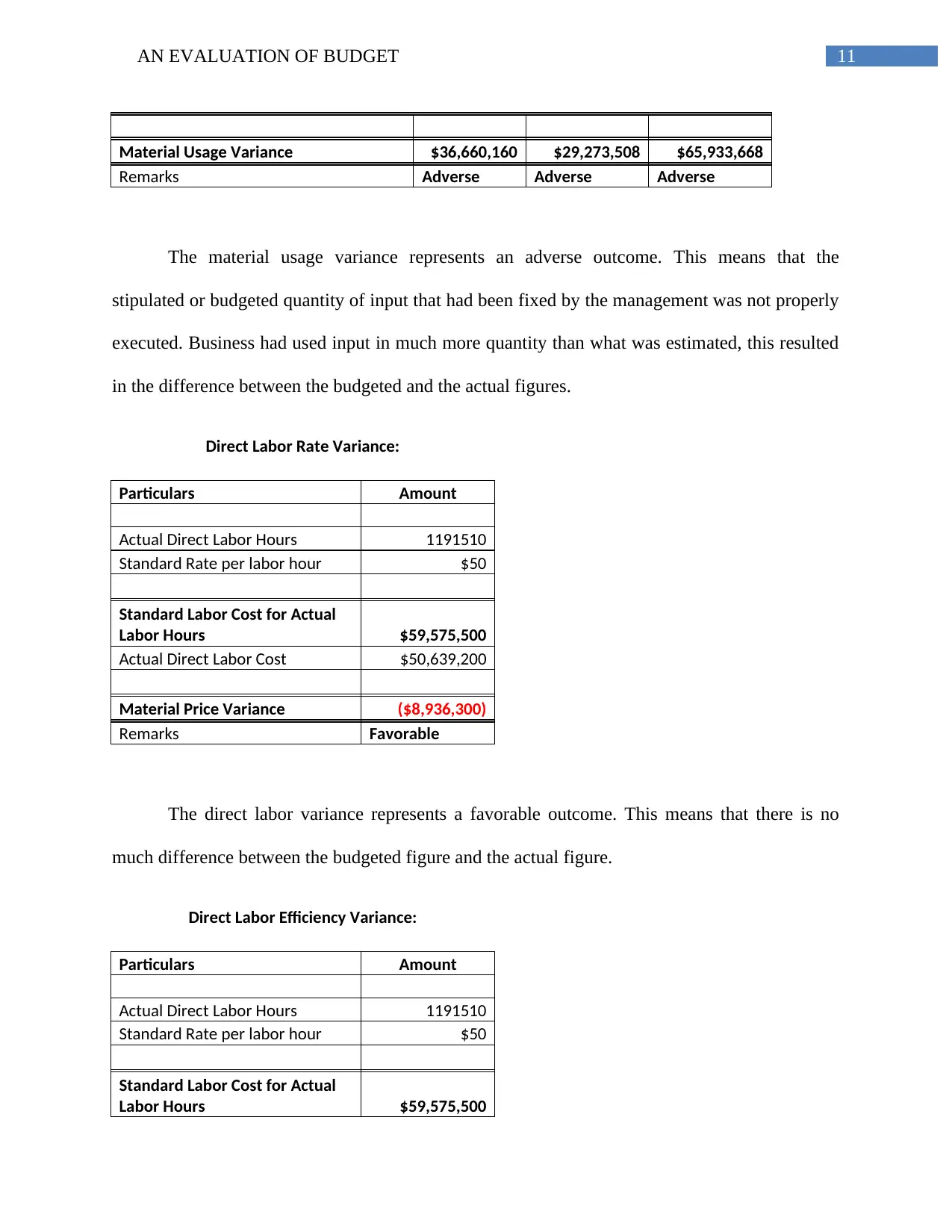

The material usage variance represents an adverse outcome. This means that the

stipulated or budgeted quantity of input that had been fixed by the management was not properly

executed. Business had used input in much more quantity than what was estimated, this resulted

in the difference between the budgeted and the actual figures.

Direct Labor Rate Variance:

Particulars Amount

Actual Direct Labor Hours 1191510

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $59,575,500

Actual Direct Labor Cost $50,639,200

Material Price Variance ($8,936,300)

Remarks Favorable

The direct labor variance represents a favorable outcome. This means that there is no

much difference between the budgeted figure and the actual figure.

Direct Labor Efficiency Variance:

Particulars Amount

Actual Direct Labor Hours 1191510

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $59,575,500

Material Usage Variance $36,660,160 $29,273,508 $65,933,668

Remarks Adverse Adverse Adverse

The material usage variance represents an adverse outcome. This means that the

stipulated or budgeted quantity of input that had been fixed by the management was not properly

executed. Business had used input in much more quantity than what was estimated, this resulted

in the difference between the budgeted and the actual figures.

Direct Labor Rate Variance:

Particulars Amount

Actual Direct Labor Hours 1191510

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $59,575,500

Actual Direct Labor Cost $50,639,200

Material Price Variance ($8,936,300)

Remarks Favorable

The direct labor variance represents a favorable outcome. This means that there is no

much difference between the budgeted figure and the actual figure.

Direct Labor Efficiency Variance:

Particulars Amount

Actual Direct Labor Hours 1191510

Standard Rate per labor hour $50

Standard Labor Cost for Actual

Labor Hours $59,575,500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.