Comprehensive Management Accounting Report: Innocent Drinks

VerifiedAdded on 2023/01/06

|15

|4171

|51

Report

AI Summary

This report delves into the realm of management accounting, focusing on its application within Innocent Drinks. It begins by outlining the essential requirements of different management accounting systems, including cost accounting, job costing, and inventory management. The report then explores various reporting methods such as cost reports, budget reports, and performance reports, highlighting their benefits in terms of efficiency, cash flow control, financial statement simplification, profitability maximization, and reliability. Furthermore, the report examines the application of management accounting techniques like marginal costing, absorption costing, and cost-volume-profit analysis, accompanied by illustrative income statements and break-even point analysis. Finally, the report discusses the advantages and disadvantages of budgetary control tools, providing insights into how Innocent Drinks can adapt to management accounting systems to address financial challenges and achieve sustainable success.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

PART-1............................................................................................................................................3

Management accounting and its essential requirements of different types of management

accounting system........................................................................................................................3

Different method that are used for management accounting reporting.......................................4

Benefits of management accounting system and their application..............................................5

PART 2............................................................................................................................................6

Application of MA techniques.....................................................................................................6

PART-3..........................................................................................................................................10

Advantages and disadvantages of different types of planning tool used for budgetary control10

Advantages and disadvantages of planning budgetary control..................................................11

Use and application of various budgetary planning tool in innocent drink...............................12

Comparison between the way company are adapting to management accounts system to cope

up with financial problem..........................................................................................................12

Analysis of the way management accounting system can lead to sustainable success.............13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

PART-1............................................................................................................................................3

Management accounting and its essential requirements of different types of management

accounting system........................................................................................................................3

Different method that are used for management accounting reporting.......................................4

Benefits of management accounting system and their application..............................................5

PART 2............................................................................................................................................6

Application of MA techniques.....................................................................................................6

PART-3..........................................................................................................................................10

Advantages and disadvantages of different types of planning tool used for budgetary control10

Advantages and disadvantages of planning budgetary control..................................................11

Use and application of various budgetary planning tool in innocent drink...............................12

Comparison between the way company are adapting to management accounts system to cope

up with financial problem..........................................................................................................12

Analysis of the way management accounting system can lead to sustainable success.............13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting is a process that includes preparation of various financial

reports that effective helps manager to take accurate short and long term decision so that

company can sustain its business for longer period of time. Thus, it provides support in business

operation by guiding manager in planning, controlling and monitoring performances so that firm

can earn more profit margins. This report is about Innocent drink that makes smoothies and

juices to be sold in coffee shop, supermarket and various others outlets. Therefore this report

covered information related to method and essential requirements of different types of

management accounting system. It also discussed about different range of management

accounting techniques and planning tool that are used in management accounting. At last it has

discussed about the way different organisations adapt to management accounting systems to

responds to financial problems.

PART-1

Management accounting and its essential requirements of different types of management

accounting system

There are various decision which needs to be taken by manager so that company can

earned sufficient profit margin such as it needs to set prices at products should be sold, amount

of bonus, incentive need to be paid to employees for their hard work and determination.

Therefore, in another term timely preparation of various financial accounts or statistics

information of business operation that assist manager of innocent drink to take correct decision

so that it can gained competitive advantages (Yigitbasioglu, 2017). Financial manager make use

of statistic information to control, monitors, plans and reduce overall cost or set effective pricing

of products so that maximum benefits can be gained by enterprise. There are various essential

requirements of different types of management accounting system that can be illustrated as

follows:

Cost accounting system: It is framework used by finance manager to decide actual value or

cost of products, services profitability analysis. Traditional and activity based are two costing

system that are used in allocation of cost to various products of firm. It calculates actual cost of

products by adding fixed (building, machine) and variable cost (input raw material) thus add

specific amount of profit to it for rendering services to end user. Thus, manager by comparing

3

Management accounting is a process that includes preparation of various financial

reports that effective helps manager to take accurate short and long term decision so that

company can sustain its business for longer period of time. Thus, it provides support in business

operation by guiding manager in planning, controlling and monitoring performances so that firm

can earn more profit margins. This report is about Innocent drink that makes smoothies and

juices to be sold in coffee shop, supermarket and various others outlets. Therefore this report

covered information related to method and essential requirements of different types of

management accounting system. It also discussed about different range of management

accounting techniques and planning tool that are used in management accounting. At last it has

discussed about the way different organisations adapt to management accounting systems to

responds to financial problems.

PART-1

Management accounting and its essential requirements of different types of management

accounting system

There are various decision which needs to be taken by manager so that company can

earned sufficient profit margin such as it needs to set prices at products should be sold, amount

of bonus, incentive need to be paid to employees for their hard work and determination.

Therefore, in another term timely preparation of various financial accounts or statistics

information of business operation that assist manager of innocent drink to take correct decision

so that it can gained competitive advantages (Yigitbasioglu, 2017). Financial manager make use

of statistic information to control, monitors, plans and reduce overall cost or set effective pricing

of products so that maximum benefits can be gained by enterprise. There are various essential

requirements of different types of management accounting system that can be illustrated as

follows:

Cost accounting system: It is framework used by finance manager to decide actual value or

cost of products, services profitability analysis. Traditional and activity based are two costing

system that are used in allocation of cost to various products of firm. It calculates actual cost of

products by adding fixed (building, machine) and variable cost (input raw material) thus add

specific amount of profit to it for rendering services to end user. Thus, manager by comparing

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

actual cost incurred with outcome is able to measure financial performance of business during

particular year.

Job costing system: It is types of system that includes three key elements such as direct

material, overhead and labour that are used in manufacturing or delivering services of Innocent

drink to customers (Wanderley and et.al., 2017). Therefore, the information is about

accumulated cost that have been incurred in delivering of products to end users so manager can

take accurate decision at prices which it have to sell products or services to earn maximum profit

margin and sales volume.

Inventory management: It is other essential requirements for accounting management that

oversee existing inventory, future required, storage capacity of firm etc. The main aim of

inventory management is to minimise under stock and overstock of products for smooth

operation of business. Manager of innocent drink can performed several functions by use of

inventory management system such as creation of purchase orders, disposable of inventory and

reallocation of resources.

Different method that are used for management accounting reporting

Management account is highly dependent upon financial information such as cash flow

statements, balance sheet and profit and loss in order to take correct decision for benefits of firm.

Cost, budget and performance are some other reports that are used by accounting manager of

innocent drink to plan, control and measure performance of enterprise in competitive

environment. Such as:

Cost report: There are various material, efforts that are used in manufacturing or delivering of

products so they needed to be add in cost to find actual prices at which they should be sold to

customers. So, this report content information related to all additional cost that have been

incurred by company such as overhead, labour and other consideration that affect prices of

products (Dierynck and Labro, 2018). Therefore manager of innocent firm can easily compare

between actual price and selling cost thereby take crucial steps to control prices, delivered

maximum value to customers for effective growth and success of firm.

Budget report: Every company prepare a budget regarding specific amount of money need to

be invest in specific area so that overall objectives can be achieved. Budget report of innocent

drink will represent overall sources of income and expense during specific year. Thus, on the

basis of estimated budget financial manager arrange sufficient fund so that it can carry out

4

particular year.

Job costing system: It is types of system that includes three key elements such as direct

material, overhead and labour that are used in manufacturing or delivering services of Innocent

drink to customers (Wanderley and et.al., 2017). Therefore, the information is about

accumulated cost that have been incurred in delivering of products to end users so manager can

take accurate decision at prices which it have to sell products or services to earn maximum profit

margin and sales volume.

Inventory management: It is other essential requirements for accounting management that

oversee existing inventory, future required, storage capacity of firm etc. The main aim of

inventory management is to minimise under stock and overstock of products for smooth

operation of business. Manager of innocent drink can performed several functions by use of

inventory management system such as creation of purchase orders, disposable of inventory and

reallocation of resources.

Different method that are used for management accounting reporting

Management account is highly dependent upon financial information such as cash flow

statements, balance sheet and profit and loss in order to take correct decision for benefits of firm.

Cost, budget and performance are some other reports that are used by accounting manager of

innocent drink to plan, control and measure performance of enterprise in competitive

environment. Such as:

Cost report: There are various material, efforts that are used in manufacturing or delivering of

products so they needed to be add in cost to find actual prices at which they should be sold to

customers. So, this report content information related to all additional cost that have been

incurred by company such as overhead, labour and other consideration that affect prices of

products (Dierynck and Labro, 2018). Therefore manager of innocent firm can easily compare

between actual price and selling cost thereby take crucial steps to control prices, delivered

maximum value to customers for effective growth and success of firm.

Budget report: Every company prepare a budget regarding specific amount of money need to

be invest in specific area so that overall objectives can be achieved. Budget report of innocent

drink will represent overall sources of income and expense during specific year. Thus, on the

basis of estimated budget financial manager arrange sufficient fund so that it can carry out

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

various activities and contribute in growth of firm (Jack, 2017). Company main aim is to

complete various task within specific budget so that organisation can earn more amount of

profitability.

Performance reports: It can be stated that manager by finding difference between budget set

and actual expense, revenue that company have incurred in recent year is able to take decision

about new budget. Thus, it means manager considered the difference amount at time of

preparation of new budget that is known as performance report (Lindholm, Laine and Suomala,

2017). Innocent drink manager by preparing this report at each year is able to plan for future

increase in cost and demand of products.

Benefits of management accounting system and their application

There are various benefits of management accounting and its application to innocent

drink that can be illustrated as follows:

Increase efficiency: It can be stated that scientific system is being used to evaluate performance

of organisation that contributed in increasing efficiency of firm. Manager by use of management

accounting system is able to find deviation within firm thus plan better strategies to influence or

motivate employees to give their best for growth and development of firm (Adler, 2018). It helps

in reducing various types of wastage, defects or errors that happened during production thus

enhancing efficiency of innocent drink.

Control cash flow of business: Another benefit of maintaining and using accounting

management system is that it helps in controlling inflow and outflow of cash. Finance

management is able to find actual cash present in enterprise and needed to be presented to

complete specific task.

Contribute in simplifying financial statement: Management accounting system and

application has helped manager in easily understanding about various financial statements to take

important decision of firm. Thus, manager of innocent drink because of application and system

is able to understand meaning and uses of financial statement in future decision making for

growth and expansion of enterprise (Sugahara, Daidj and Ushio, 2017).

Maximise profitability of firm: Capital budgeting and budget control tool are very useful as it

helps in reducing both capital and operational expenditure of firm. Thus, innocent drink can

easily reduce prices of products and earned more profit margin, sales volume and customers

satisfaction.

5

complete various task within specific budget so that organisation can earn more amount of

profitability.

Performance reports: It can be stated that manager by finding difference between budget set

and actual expense, revenue that company have incurred in recent year is able to take decision

about new budget. Thus, it means manager considered the difference amount at time of

preparation of new budget that is known as performance report (Lindholm, Laine and Suomala,

2017). Innocent drink manager by preparing this report at each year is able to plan for future

increase in cost and demand of products.

Benefits of management accounting system and their application

There are various benefits of management accounting and its application to innocent

drink that can be illustrated as follows:

Increase efficiency: It can be stated that scientific system is being used to evaluate performance

of organisation that contributed in increasing efficiency of firm. Manager by use of management

accounting system is able to find deviation within firm thus plan better strategies to influence or

motivate employees to give their best for growth and development of firm (Adler, 2018). It helps

in reducing various types of wastage, defects or errors that happened during production thus

enhancing efficiency of innocent drink.

Control cash flow of business: Another benefit of maintaining and using accounting

management system is that it helps in controlling inflow and outflow of cash. Finance

management is able to find actual cash present in enterprise and needed to be presented to

complete specific task.

Contribute in simplifying financial statement: Management accounting system and

application has helped manager in easily understanding about various financial statements to take

important decision of firm. Thus, manager of innocent drink because of application and system

is able to understand meaning and uses of financial statement in future decision making for

growth and expansion of enterprise (Sugahara, Daidj and Ushio, 2017).

Maximise profitability of firm: Capital budgeting and budget control tool are very useful as it

helps in reducing both capital and operational expenditure of firm. Thus, innocent drink can

easily reduce prices of products and earned more profit margin, sales volume and customers

satisfaction.

5

Reliability: It can be stated that use of various management accounting tools and application

enhance reliability of business thus more and more people wants to be part of enterprise.

External and internal stakeholders can easily trust data or statistic information present in

financial statements that resulted in building of strong brand image and reputation of

organisation in industry.

PART 2

Application of MA techniques

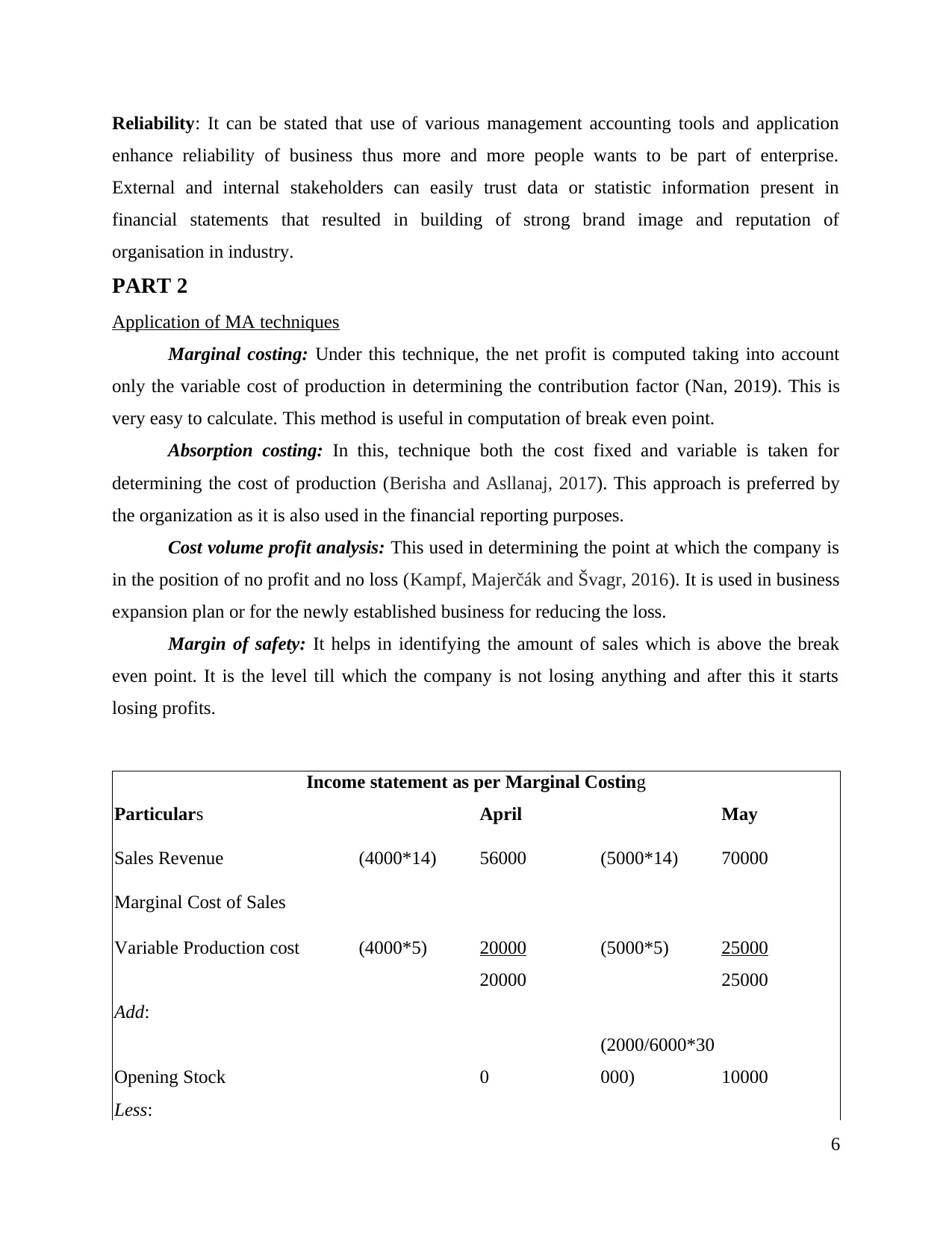

Marginal costing: Under this technique, the net profit is computed taking into account

only the variable cost of production in determining the contribution factor (Nan, 2019). This is

very easy to calculate. This method is useful in computation of break even point.

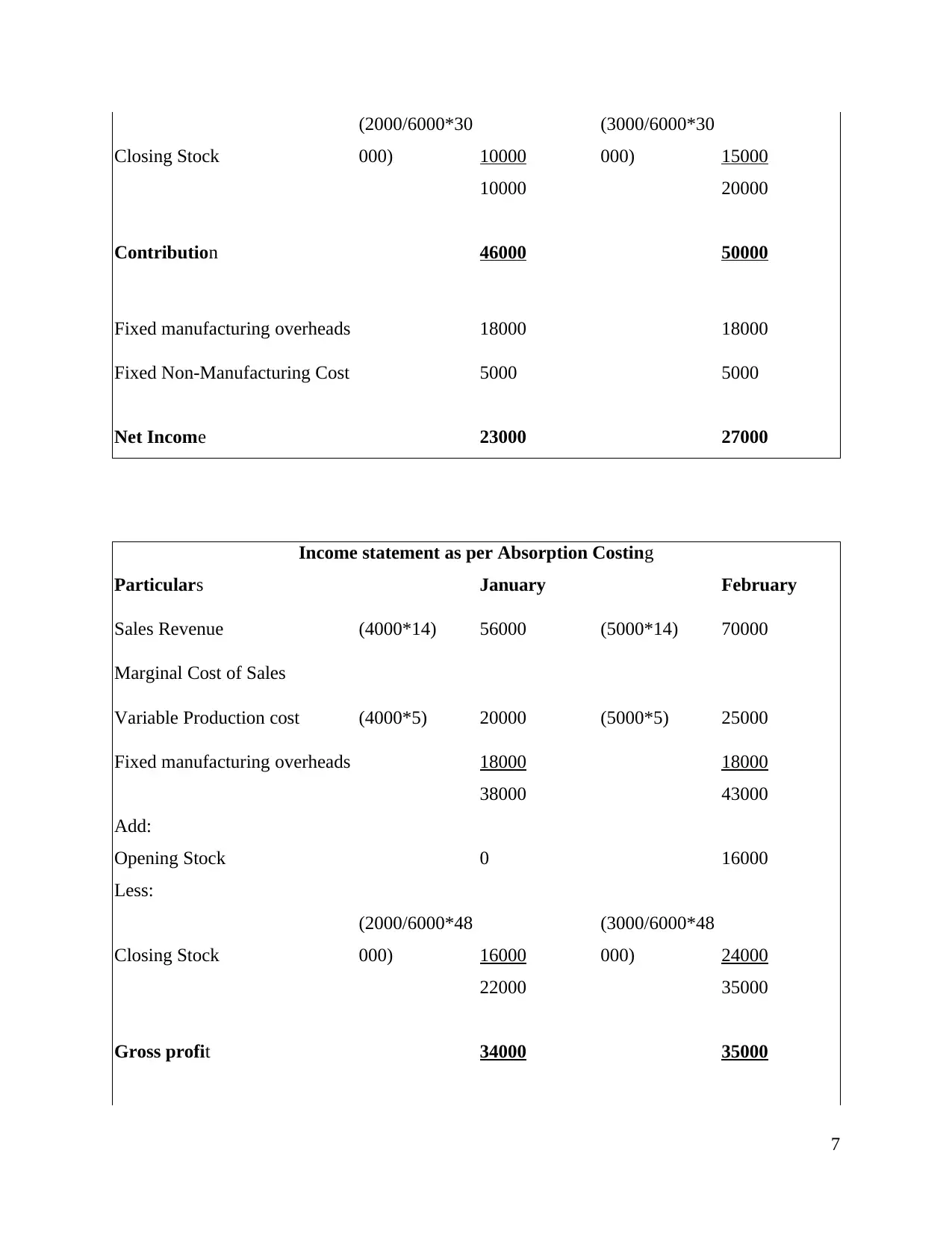

Absorption costing: In this, technique both the cost fixed and variable is taken for

determining the cost of production (Berisha and Asllanaj, 2017). This approach is preferred by

the organization as it is also used in the financial reporting purposes.

Cost volume profit analysis: This used in determining the point at which the company is

in the position of no profit and no loss (Kampf, Majerčák and Švagr, 2016). It is used in business

expansion plan or for the newly established business for reducing the loss.

Margin of safety: It helps in identifying the amount of sales which is above the break

even point. It is the level till which the company is not losing anything and after this it starts

losing profits.

Income statement as per Marginal Costing

Particulars April May

Sales Revenue (4000*14) 56000 (5000*14) 70000

Marginal Cost of Sales

Variable Production cost (4000*5) 20000 (5000*5) 25000

20000 25000

Add:

Opening Stock 0

(2000/6000*30

000) 10000

Less:

6

enhance reliability of business thus more and more people wants to be part of enterprise.

External and internal stakeholders can easily trust data or statistic information present in

financial statements that resulted in building of strong brand image and reputation of

organisation in industry.

PART 2

Application of MA techniques

Marginal costing: Under this technique, the net profit is computed taking into account

only the variable cost of production in determining the contribution factor (Nan, 2019). This is

very easy to calculate. This method is useful in computation of break even point.

Absorption costing: In this, technique both the cost fixed and variable is taken for

determining the cost of production (Berisha and Asllanaj, 2017). This approach is preferred by

the organization as it is also used in the financial reporting purposes.

Cost volume profit analysis: This used in determining the point at which the company is

in the position of no profit and no loss (Kampf, Majerčák and Švagr, 2016). It is used in business

expansion plan or for the newly established business for reducing the loss.

Margin of safety: It helps in identifying the amount of sales which is above the break

even point. It is the level till which the company is not losing anything and after this it starts

losing profits.

Income statement as per Marginal Costing

Particulars April May

Sales Revenue (4000*14) 56000 (5000*14) 70000

Marginal Cost of Sales

Variable Production cost (4000*5) 20000 (5000*5) 25000

20000 25000

Add:

Opening Stock 0

(2000/6000*30

000) 10000

Less:

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Closing Stock

(2000/6000*30

000) 10000

(3000/6000*30

000) 15000

10000 20000

Contribution 46000 50000

Fixed manufacturing overheads 18000 18000

Fixed Non-Manufacturing Cost 5000 5000

Net Income 23000 27000

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (4000*14) 56000 (5000*14) 70000

Marginal Cost of Sales

Variable Production cost (4000*5) 20000 (5000*5) 25000

Fixed manufacturing overheads 18000 18000

38000 43000

Add:

Opening Stock 0 16000

Less:

Closing Stock

(2000/6000*48

000) 16000

(3000/6000*48

000) 24000

22000 35000

Gross profit 34000 35000

7

(2000/6000*30

000) 10000

(3000/6000*30

000) 15000

10000 20000

Contribution 46000 50000

Fixed manufacturing overheads 18000 18000

Fixed Non-Manufacturing Cost 5000 5000

Net Income 23000 27000

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (4000*14) 56000 (5000*14) 70000

Marginal Cost of Sales

Variable Production cost (4000*5) 20000 (5000*5) 25000

Fixed manufacturing overheads 18000 18000

38000 43000

Add:

Opening Stock 0 16000

Less:

Closing Stock

(2000/6000*48

000) 16000

(3000/6000*48

000) 24000

22000 35000

Gross profit 34000 35000

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fixed Non-Manufacturing Cost 5000 5000

Net Income 29000 30000

Analysis: It can be inferred from the above that the result from the absorption costing is

higher than that of marginal costing because it considers fixed cost in cost of production on the

other hand, marginal costing considers only the variable cost in computing the same and also

provides profits lower than the absorption costing.

Reconciliation statement

April May

Profit as under marginal costing 23000 27000

Add: Under absorption of closing or

opening stock 6000 3000

Profit as under absorption costing 29000 30000

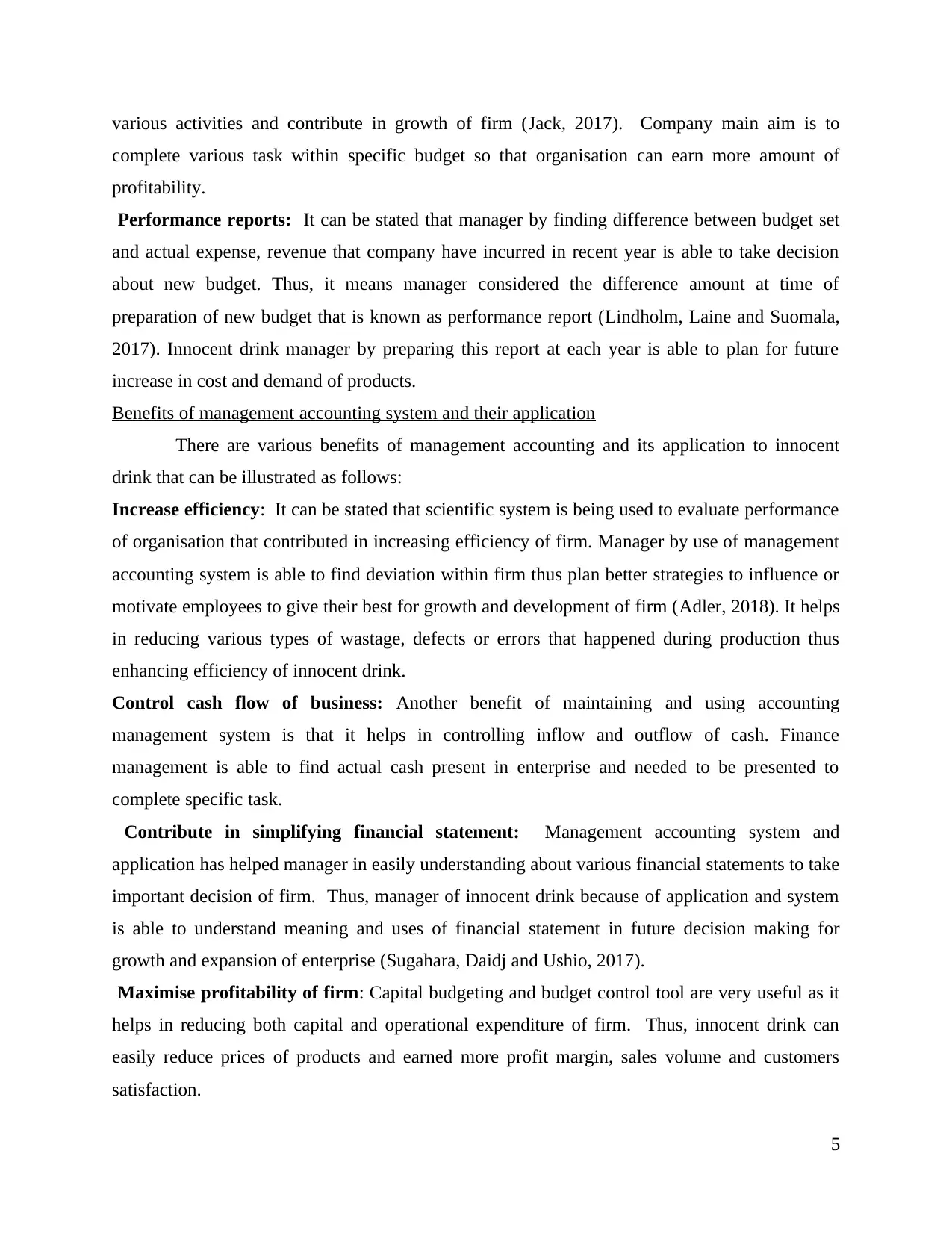

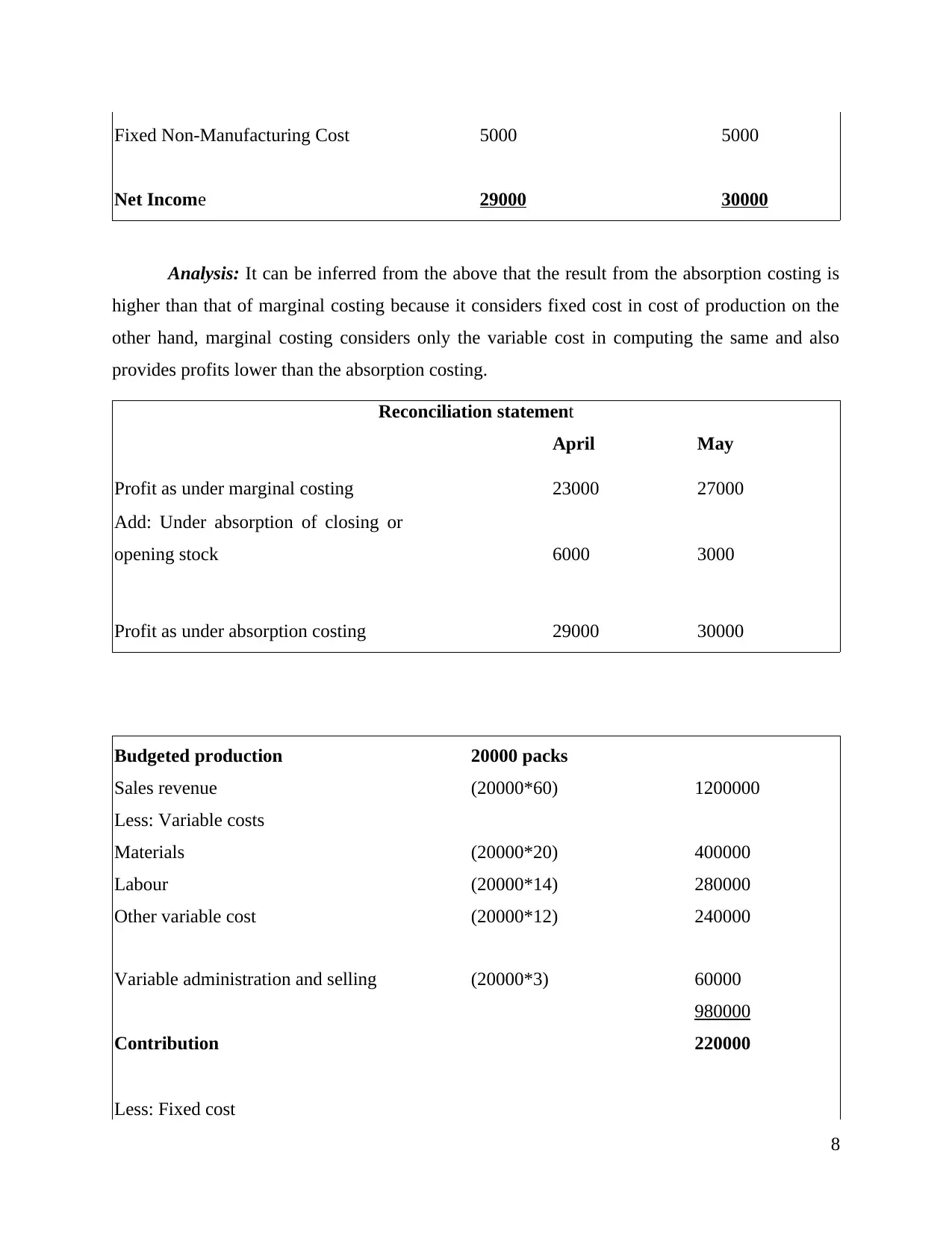

Budgeted production 20000 packs

Sales revenue (20000*60) 1200000

Less: Variable costs

Materials (20000*20) 400000

Labour (20000*14) 280000

Other variable cost (20000*12) 240000

Variable administration and selling (20000*3) 60000

980000

Contribution 220000

Less: Fixed cost

8

Net Income 29000 30000

Analysis: It can be inferred from the above that the result from the absorption costing is

higher than that of marginal costing because it considers fixed cost in cost of production on the

other hand, marginal costing considers only the variable cost in computing the same and also

provides profits lower than the absorption costing.

Reconciliation statement

April May

Profit as under marginal costing 23000 27000

Add: Under absorption of closing or

opening stock 6000 3000

Profit as under absorption costing 29000 30000

Budgeted production 20000 packs

Sales revenue (20000*60) 1200000

Less: Variable costs

Materials (20000*20) 400000

Labour (20000*14) 280000

Other variable cost (20000*12) 240000

Variable administration and selling (20000*3) 60000

980000

Contribution 220000

Less: Fixed cost

8

Fixed cost 80000

Fixed administration and selling 60000

140000

Net profit 80000

Contribution margin per unit 60-(20+14+12+3) 11

Contribution margin (11/60) 18.00%

Total fixed cost 140000

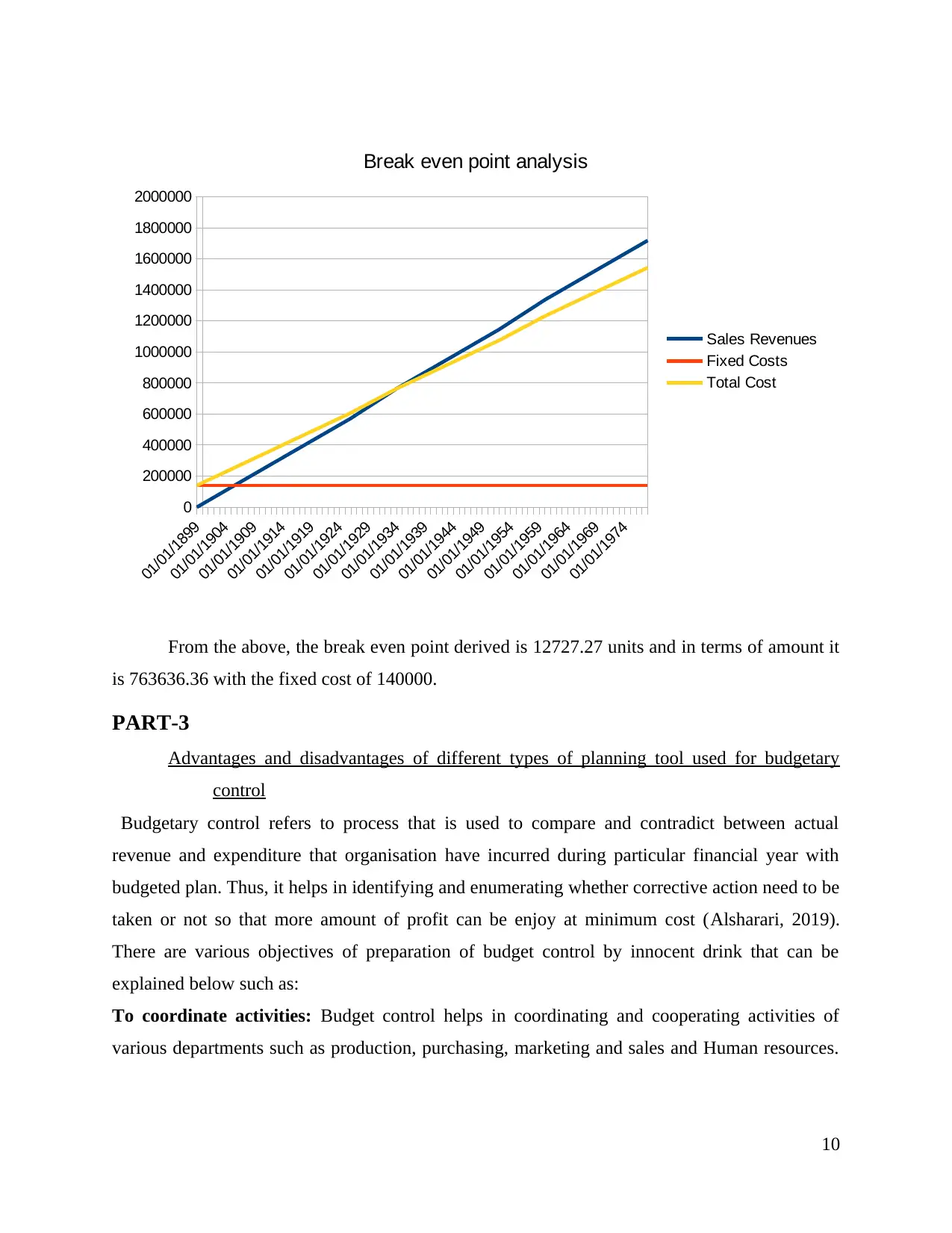

Break even point (in units) 12727.27

Break even point (in amount) 763636.36

Current sales in units 20000

Break even sales in units 12727

Margin of safety (in units) (20000-12727) 7273

Current sales 1200000

Break even sales 763636

Margin of safety (in amount) (1200000-763636) 436364

9

Fixed administration and selling 60000

140000

Net profit 80000

Contribution margin per unit 60-(20+14+12+3) 11

Contribution margin (11/60) 18.00%

Total fixed cost 140000

Break even point (in units) 12727.27

Break even point (in amount) 763636.36

Current sales in units 20000

Break even sales in units 12727

Margin of safety (in units) (20000-12727) 7273

Current sales 1200000

Break even sales 763636

Margin of safety (in amount) (1200000-763636) 436364

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

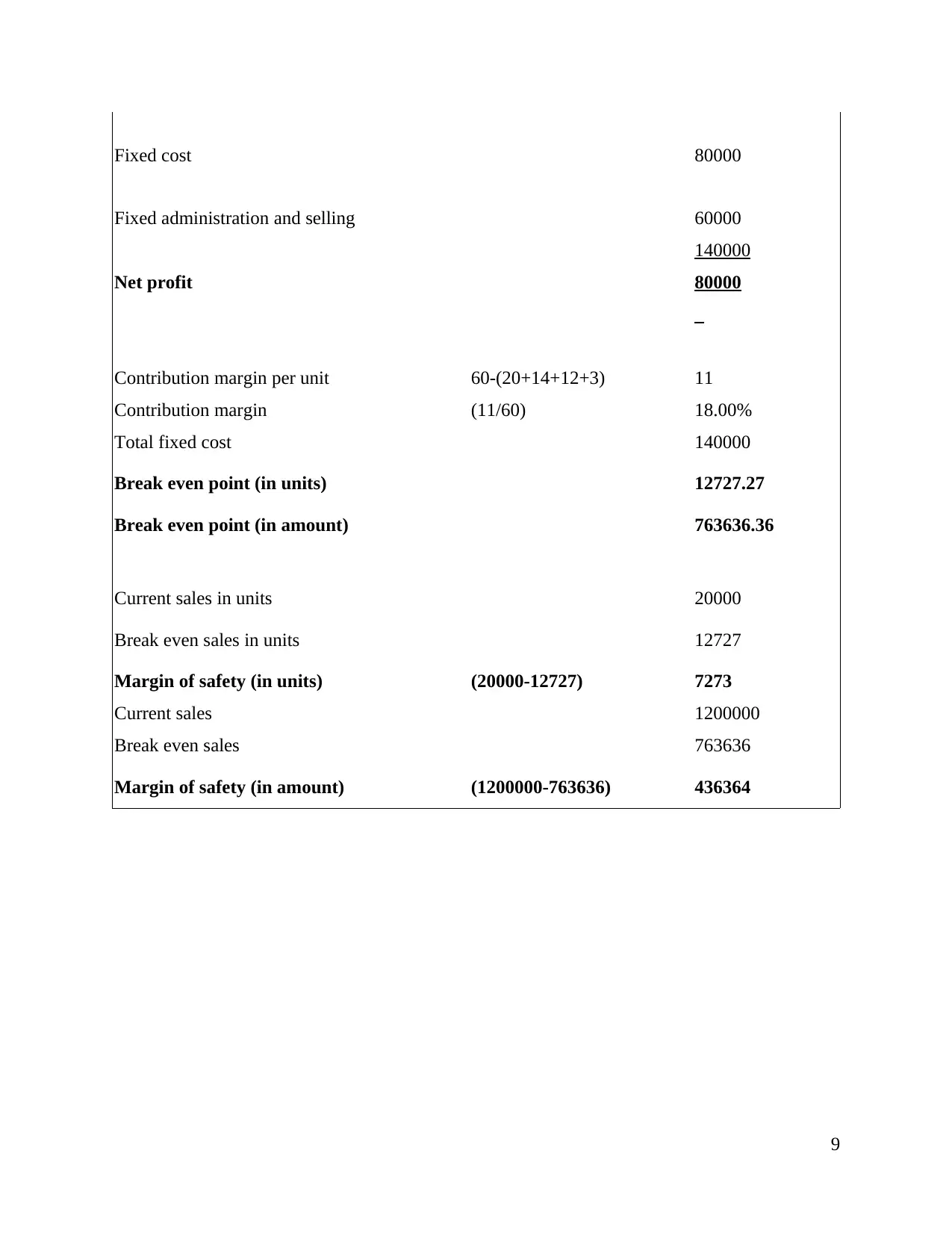

From the above, the break even point derived is 12727.27 units and in terms of amount it

is 763636.36 with the fixed cost of 140000.

PART-3

Advantages and disadvantages of different types of planning tool used for budgetary

control

Budgetary control refers to process that is used to compare and contradict between actual

revenue and expenditure that organisation have incurred during particular financial year with

budgeted plan. Thus, it helps in identifying and enumerating whether corrective action need to be

taken or not so that more amount of profit can be enjoy at minimum cost (Alsharari, 2019).

There are various objectives of preparation of budget control by innocent drink that can be

explained below such as:

To coordinate activities: Budget control helps in coordinating and cooperating activities of

various departments such as production, purchasing, marketing and sales and Human resources.

10

01/01/1899

01/01/1904

01/01/1909

01/01/1914

01/01/1919

01/01/1924

01/01/1929

01/01/1934

01/01/1939

01/01/1944

01/01/1949

01/01/1954

01/01/1959

01/01/1964

01/01/1969

01/01/1974

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

2000000

Break even point analysis

Sales Revenues

Fixed Costs

Total Cost

is 763636.36 with the fixed cost of 140000.

PART-3

Advantages and disadvantages of different types of planning tool used for budgetary

control

Budgetary control refers to process that is used to compare and contradict between actual

revenue and expenditure that organisation have incurred during particular financial year with

budgeted plan. Thus, it helps in identifying and enumerating whether corrective action need to be

taken or not so that more amount of profit can be enjoy at minimum cost (Alsharari, 2019).

There are various objectives of preparation of budget control by innocent drink that can be

explained below such as:

To coordinate activities: Budget control helps in coordinating and cooperating activities of

various departments such as production, purchasing, marketing and sales and Human resources.

10

01/01/1899

01/01/1904

01/01/1909

01/01/1914

01/01/1919

01/01/1924

01/01/1929

01/01/1934

01/01/1939

01/01/1944

01/01/1949

01/01/1954

01/01/1959

01/01/1964

01/01/1969

01/01/1974

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

2000000

Break even point analysis

Sales Revenues

Fixed Costs

Total Cost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As each department have to carry out their respective activities within limited budget so that

innocent drink can enjoy more profit margin.

To have system of control: It can be stated that budget control planning tool contributed in

maintaining control over business operation thus effective achievements of goals (Nielsen and

Pontoppidan, 2019).

Advantages and disadvantages of planning budgetary control

There are numerous advantages and disadvantages of budgetary control tool for innocent

drink which can be stated below like:

Corrective action: It can be stated from above discussion that planning tools of budget control

contributed in take effective corrective measures in case of errors or mistake (Klychova and

et.al., 2019). Manager can easily know about error within limited time frame thus take particular

action earlier as possible for growth of enterprise.

Brining economic of scale: Manager of Innocent drink by planning in advance about actual

amount of money needs to be spend in particular areas is able to make optimum, systematic

utilisation of fund within organisation. Therefore, ultimately all such tool contributed in reducing

cost, maximum utilisation of resources and effective achievements of company goals.

Determination of weakness: Innocent drink can easily find key areas in which it lacks that can

act as a threat in future operation of business in competitive market condition. Thus, manager of

firm put its best efforts to remove weakness so that it can easily expand its business operation

and earn sufficient profit margin (Fleischman, Johnson and Walker, 2017).

Contribute in development of plan and policies: It can be stated that manager of innocent

drink by use of several budgetary control tools can develop effective plan, strategies and policies

that are used to achieve specific objectives of firm. Thus helps employees to complete their task

in best possible manners or minimum wastage of resources so that maximum return on invested

capital can be gained by company.

Despite of all such advantages of different tool of planning budget controlling there are certain

limitation which can be discussed as:

Uncertain future: There are several changes in external business environment that affects

adversely on business operation and strategy. All these tools of planning are used to prepared

budget for future circumstance that is ever changing or uncertain (Lay and Jusoh, 2017).

11

innocent drink can enjoy more profit margin.

To have system of control: It can be stated that budget control planning tool contributed in

maintaining control over business operation thus effective achievements of goals (Nielsen and

Pontoppidan, 2019).

Advantages and disadvantages of planning budgetary control

There are numerous advantages and disadvantages of budgetary control tool for innocent

drink which can be stated below like:

Corrective action: It can be stated from above discussion that planning tools of budget control

contributed in take effective corrective measures in case of errors or mistake (Klychova and

et.al., 2019). Manager can easily know about error within limited time frame thus take particular

action earlier as possible for growth of enterprise.

Brining economic of scale: Manager of Innocent drink by planning in advance about actual

amount of money needs to be spend in particular areas is able to make optimum, systematic

utilisation of fund within organisation. Therefore, ultimately all such tool contributed in reducing

cost, maximum utilisation of resources and effective achievements of company goals.

Determination of weakness: Innocent drink can easily find key areas in which it lacks that can

act as a threat in future operation of business in competitive market condition. Thus, manager of

firm put its best efforts to remove weakness so that it can easily expand its business operation

and earn sufficient profit margin (Fleischman, Johnson and Walker, 2017).

Contribute in development of plan and policies: It can be stated that manager of innocent

drink by use of several budgetary control tools can develop effective plan, strategies and policies

that are used to achieve specific objectives of firm. Thus helps employees to complete their task

in best possible manners or minimum wastage of resources so that maximum return on invested

capital can be gained by company.

Despite of all such advantages of different tool of planning budget controlling there are certain

limitation which can be discussed as:

Uncertain future: There are several changes in external business environment that affects

adversely on business operation and strategy. All these tools of planning are used to prepared

budget for future circumstance that is ever changing or uncertain (Lay and Jusoh, 2017).

11

Therefore, future changes reduce utility of budgetary control system, indirectly impact on

smooth operation of firm.

Conflict among different department: Another disadvantage of budgetary control is that it

leads to conflict or confusion between various departments of innocent drink such as every

department wants maximum fund so that they can effectively carry out several activities. Thus, it

creates conflict and inappropriate coordination between departments to work together for

achievements of common goals.

Use and application of various budgetary planning tool in innocent drink

There are various planning tool for budget control which is used by manager of innocent

drink that are explained below such as:

Competitive pricing: It type of budgetary control tool in which manager oversee pricing of

other competitors in market in order to set effective price for its products so that customers are

motivated to make purchase form it as compared to others.

Marginal cost pricing: Innocent drink manager is able to adapt to marginal cost pricing method

in case actual cost price- volume are accomplished (Lindholm, Laine and Suomala, 2017).

Standard costing: Historical data are used to prepared budget by assuming standard cost that

innocent drink needs to incur in order to manufacture products and services. Accounting

manager considered standard and actual cost while preparation of new budget in order to have

sufficient amount of capital to operate business.

Cost plus pricing: It is another method of planning of budget control which stated that manager

in order to set prices add cost plus pricing to complete excess amount that have contributed in

company reserves.

Activity based costing: It can be stated that there are two types of expense or cost that is direct

and indirect such as company by spending in technology which is fixed asset is able to enhance

volume of products thus reduce price (Nielsen and Pontoppidan, 2019). Therefore, it can be said

that it have contributed in reducing direct cost of company but indirect cost is still similar or

higher.

Comparison between the way company are adapting to management accounts system to cope up

with financial problem

Company that effectively adapted to external change is able to retain its customer’s

satisfaction level, build strong brand image or reputation in mind and heart of various

12

smooth operation of firm.

Conflict among different department: Another disadvantage of budgetary control is that it

leads to conflict or confusion between various departments of innocent drink such as every

department wants maximum fund so that they can effectively carry out several activities. Thus, it

creates conflict and inappropriate coordination between departments to work together for

achievements of common goals.

Use and application of various budgetary planning tool in innocent drink

There are various planning tool for budget control which is used by manager of innocent

drink that are explained below such as:

Competitive pricing: It type of budgetary control tool in which manager oversee pricing of

other competitors in market in order to set effective price for its products so that customers are

motivated to make purchase form it as compared to others.

Marginal cost pricing: Innocent drink manager is able to adapt to marginal cost pricing method

in case actual cost price- volume are accomplished (Lindholm, Laine and Suomala, 2017).

Standard costing: Historical data are used to prepared budget by assuming standard cost that

innocent drink needs to incur in order to manufacture products and services. Accounting

manager considered standard and actual cost while preparation of new budget in order to have

sufficient amount of capital to operate business.

Cost plus pricing: It is another method of planning of budget control which stated that manager

in order to set prices add cost plus pricing to complete excess amount that have contributed in

company reserves.

Activity based costing: It can be stated that there are two types of expense or cost that is direct

and indirect such as company by spending in technology which is fixed asset is able to enhance

volume of products thus reduce price (Nielsen and Pontoppidan, 2019). Therefore, it can be said

that it have contributed in reducing direct cost of company but indirect cost is still similar or

higher.

Comparison between the way company are adapting to management accounts system to cope up

with financial problem

Company that effectively adapted to external change is able to retain its customer’s

satisfaction level, build strong brand image or reputation in mind and heart of various

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.