Comprehensive Tax Return Preparation Case Study for Finance Students

VerifiedAdded on 2022/11/23

|2

|459

|65

Homework Assignment

AI Summary

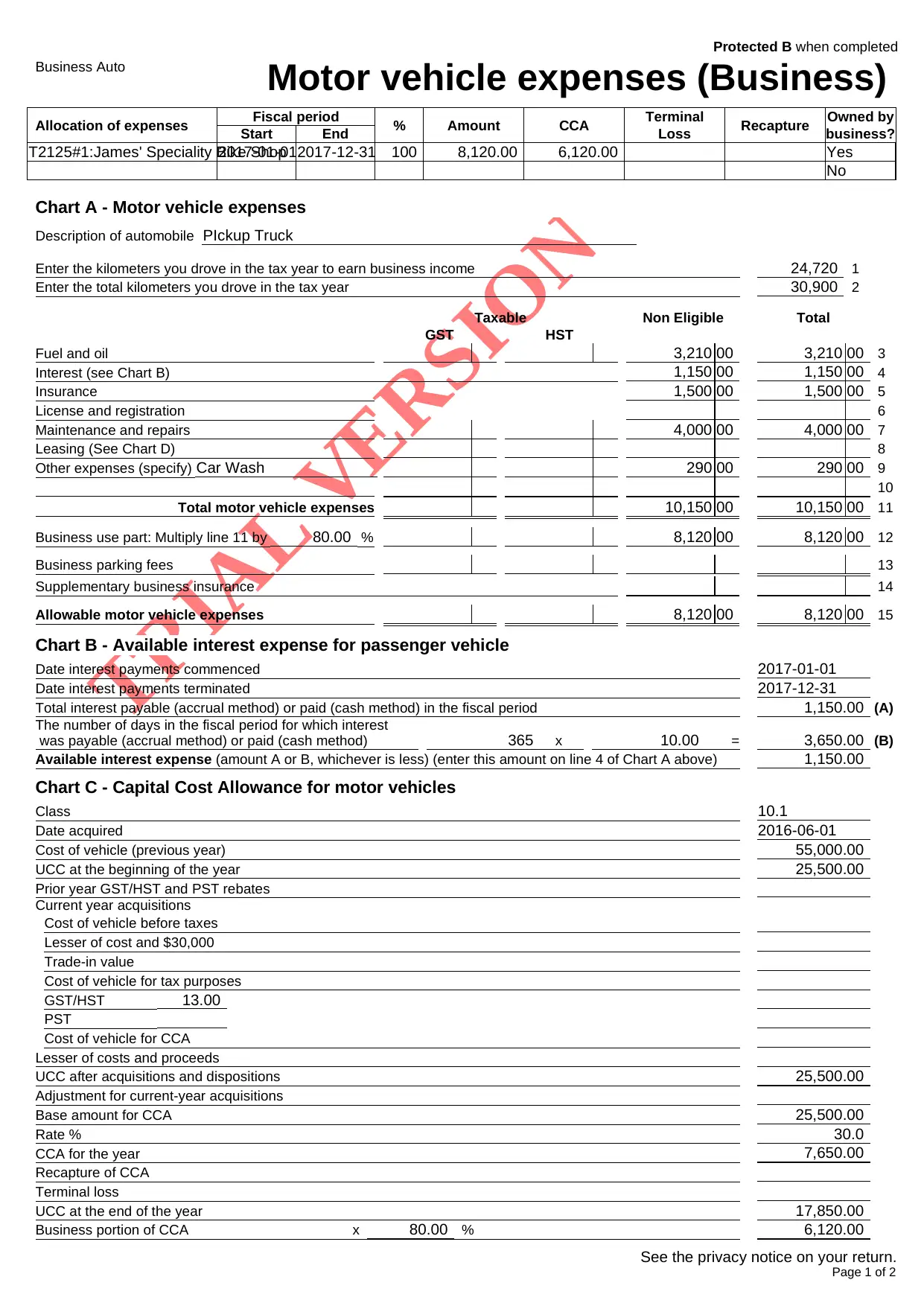

This homework assignment focuses on the practical application of tax return preparation. Students are tasked with completing a personal income tax return based on provided documents, including T4, T4A, and T5 forms. The case study requires analyzing various financial data, such as employment income, pension income, investment income, tuition fees, and motor vehicle expenses, to accurately calculate and report taxable income, deductions, and credits. The assignment includes detailed calculations of motor vehicle expenses, Capital Cost Allowance (CCA), and the proper handling of tuition fees. The goal is to familiarize students with the process of tax filing, ensuring they can apply the rules learned in the course to real-world financial scenarios. The assignment also includes an analysis of tax implications for various income sources and the correct application of tax credits and deductions. The case study requires the use of tax software and the submission of a comprehensive tax return.

1 out of 2

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)