Detailed Solution: Consolidation of Financial Statements Homework

VerifiedAdded on 2019/09/24

|8

|873

|144

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial statement consolidation assignment. It begins with the computation of the fair value of identifiable net assets acquired, adhering to AASB 3 standards, and calculates goodwill. The core of the solution lies in the detailed consolidation journal entries, meticulously addressing the elimination of intragroup sales and purchases, unrealized profits in closing inventory, and income tax expenses. It covers the elimination of gains on the sale of plant, excess depreciation, and dividends. The solution includes a consolidated statement of profit and loss, followed by a consolidated financial statement, providing a clear overview of the combined financial position of the entities. The document also provides references for further study.

1

CONSOLIDATION OF FINANCIAL STATEMENTS

CONSOLIDATION OF FINANCIAL STATEMENTS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Table of Contents

1.Solution to Question…………………………………………………………………………. ..3-7

4.References………………………………………………………………………………………..8

Table of Contents

1.Solution to Question…………………………………………………………………………. ..3-7

4.References………………………………………………………………………………………..8

3

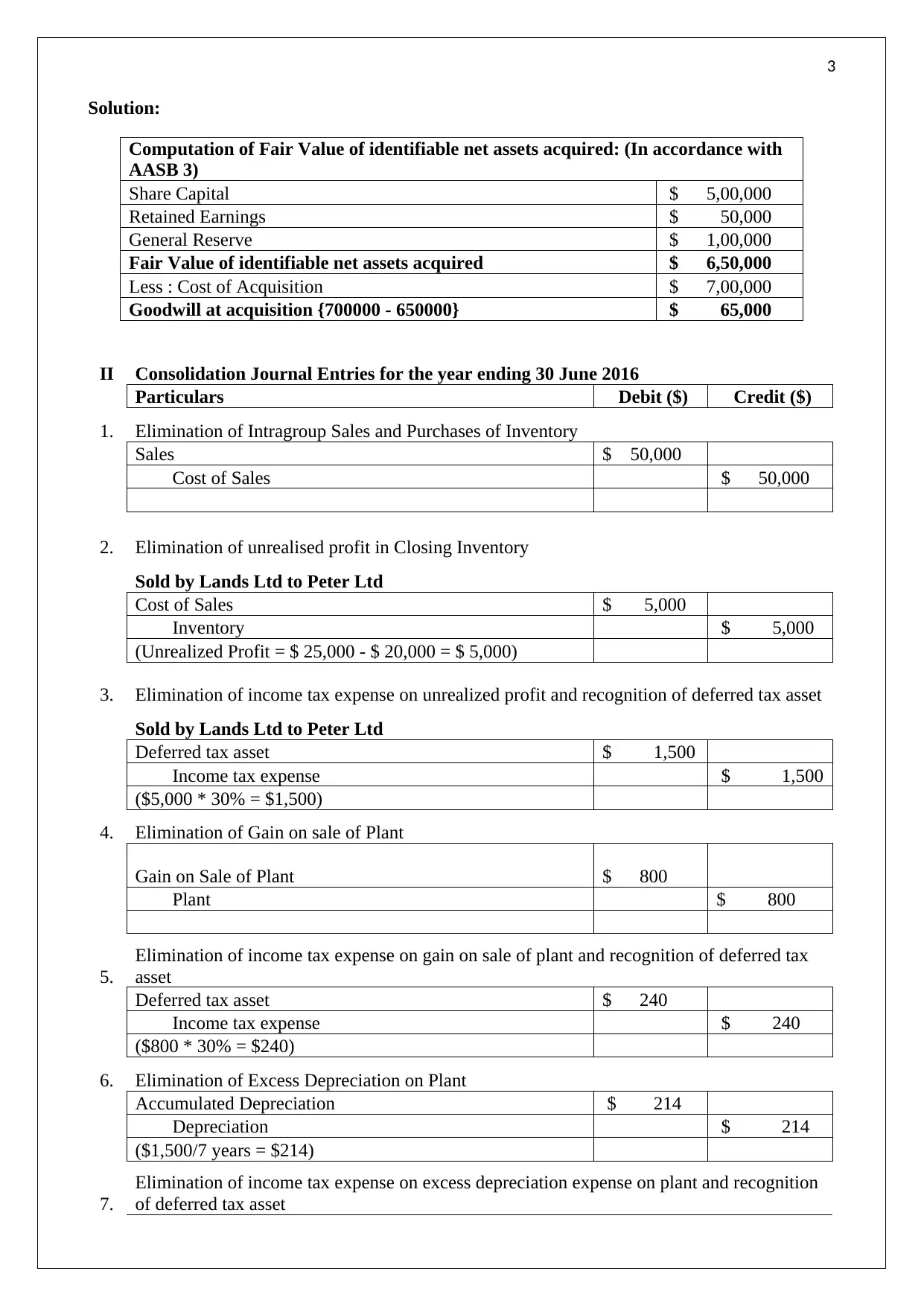

Solution:

Computation of Fair Value of identifiable net assets acquired: (In accordance with

AASB 3)

Share Capital $ 5,00,000

Retained Earnings $ 50,000

General Reserve $ 1,00,000

Fair Value of identifiable net assets acquired $ 6,50,000

Less : Cost of Acquisition $ 7,00,000

Goodwill at acquisition {700000 - 650000} $ 65,000

II Consolidation Journal Entries for the year ending 30 June 2016

Particulars Debit ($) Credit ($)

1. Elimination of Intragroup Sales and Purchases of Inventory

Sales $ 50,000

Cost of Sales $ 50,000

2. Elimination of unrealised profit in Closing Inventory

Sold by Lands Ltd to Peter Ltd

Cost of Sales $ 5,000

Inventory $ 5,000

(Unrealized Profit = $ 25,000 - $ 20,000 = $ 5,000)

3. Elimination of income tax expense on unrealized profit and recognition of deferred tax asset

Sold by Lands Ltd to Peter Ltd

Deferred tax asset $ 1,500

Income tax expense $ 1,500

($5,000 * 30% = $1,500)

4. Elimination of Gain on sale of Plant

Gain on Sale of Plant $ 800

Plant $ 800

5.

Elimination of income tax expense on gain on sale of plant and recognition of deferred tax

asset

Deferred tax asset $ 240

Income tax expense $ 240

($800 * 30% = $240)

6. Elimination of Excess Depreciation on Plant

Accumulated Depreciation $ 214

Depreciation $ 214

($1,500/7 years = $214)

7.

Elimination of income tax expense on excess depreciation expense on plant and recognition

of deferred tax asset

Solution:

Computation of Fair Value of identifiable net assets acquired: (In accordance with

AASB 3)

Share Capital $ 5,00,000

Retained Earnings $ 50,000

General Reserve $ 1,00,000

Fair Value of identifiable net assets acquired $ 6,50,000

Less : Cost of Acquisition $ 7,00,000

Goodwill at acquisition {700000 - 650000} $ 65,000

II Consolidation Journal Entries for the year ending 30 June 2016

Particulars Debit ($) Credit ($)

1. Elimination of Intragroup Sales and Purchases of Inventory

Sales $ 50,000

Cost of Sales $ 50,000

2. Elimination of unrealised profit in Closing Inventory

Sold by Lands Ltd to Peter Ltd

Cost of Sales $ 5,000

Inventory $ 5,000

(Unrealized Profit = $ 25,000 - $ 20,000 = $ 5,000)

3. Elimination of income tax expense on unrealized profit and recognition of deferred tax asset

Sold by Lands Ltd to Peter Ltd

Deferred tax asset $ 1,500

Income tax expense $ 1,500

($5,000 * 30% = $1,500)

4. Elimination of Gain on sale of Plant

Gain on Sale of Plant $ 800

Plant $ 800

5.

Elimination of income tax expense on gain on sale of plant and recognition of deferred tax

asset

Deferred tax asset $ 240

Income tax expense $ 240

($800 * 30% = $240)

6. Elimination of Excess Depreciation on Plant

Accumulated Depreciation $ 214

Depreciation $ 214

($1,500/7 years = $214)

7.

Elimination of income tax expense on excess depreciation expense on plant and recognition

of deferred tax asset

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

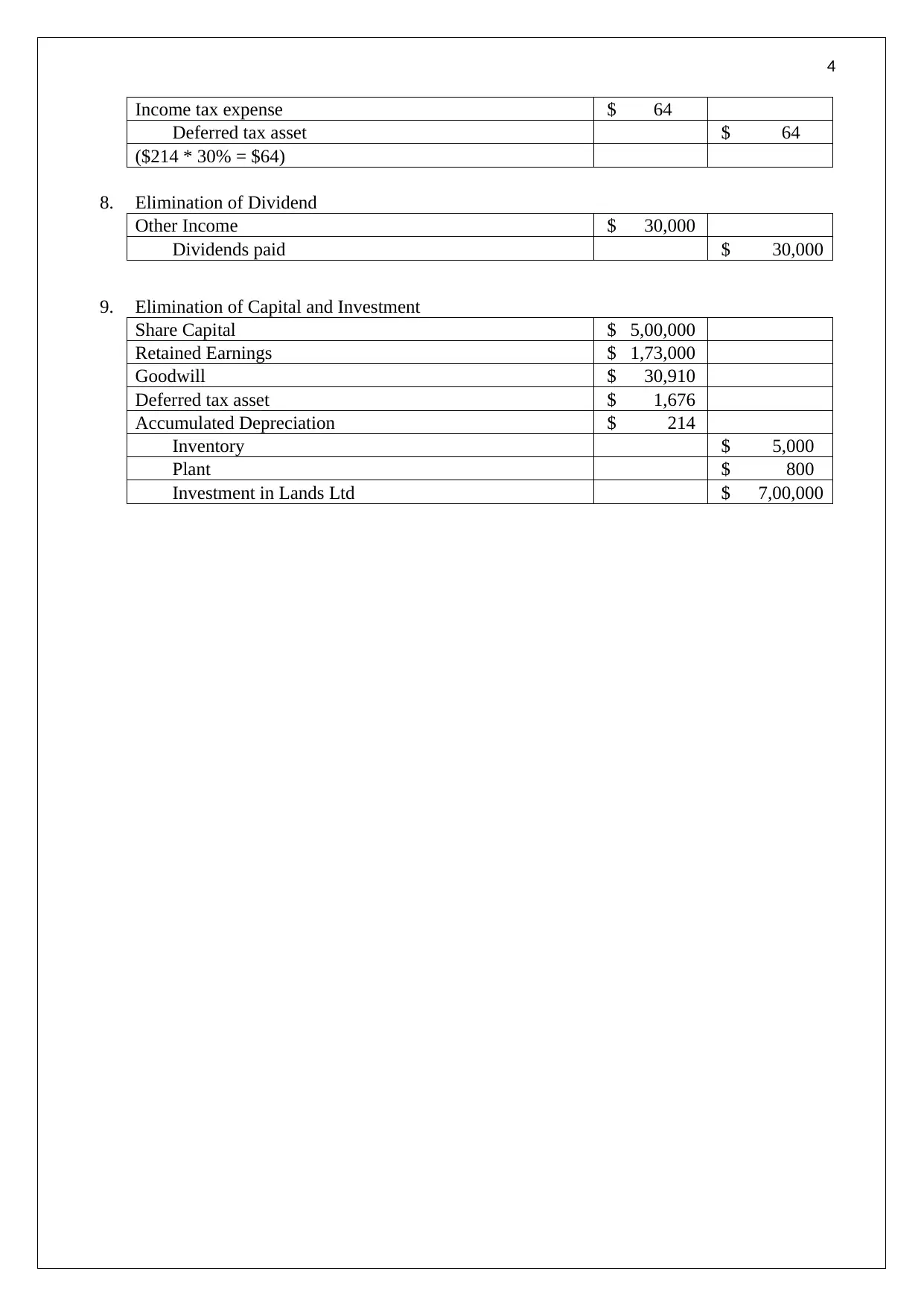

4

Income tax expense $ 64

Deferred tax asset $ 64

($214 * 30% = $64)

8. Elimination of Dividend

Other Income $ 30,000

Dividends paid $ 30,000

9. Elimination of Capital and Investment

Share Capital $ 5,00,000

Retained Earnings $ 1,73,000

Goodwill $ 30,910

Deferred tax asset $ 1,676

Accumulated Depreciation $ 214

Inventory $ 5,000

Plant $ 800

Investment in Lands Ltd $ 7,00,000

Income tax expense $ 64

Deferred tax asset $ 64

($214 * 30% = $64)

8. Elimination of Dividend

Other Income $ 30,000

Dividends paid $ 30,000

9. Elimination of Capital and Investment

Share Capital $ 5,00,000

Retained Earnings $ 1,73,000

Goodwill $ 30,910

Deferred tax asset $ 1,676

Accumulated Depreciation $ 214

Inventory $ 5,000

Plant $ 800

Investment in Lands Ltd $ 7,00,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

Consolidated Statement of Profit and Loss

Peter Ltd and Lands Ltd

(Amount in

$)

Particulars Peter Ltd

(A)

Lands Ltd

(B)

Total (A+B) =

C

Adjustments

Dr

Adjustments

Cr Consolidation

Sales 20,00,000 9,28,000 29,28,000 50,000 - 28,78,000

Less

: Cost of Sales -7,00,000 -6,70,000 -13,70,000 - 50,00

0 -13,20,000

Wages and Salaries -61,000 -32,000 -93,000 - - -93,000

Depreciation -5,100 -4,800 -9,900 - 21

4 -9,686

Other Expenses -5,500 - -5,500 - - -5,500

Impairment of Goodwill - - - 7,000 - -7,000

Total Expense -7,71,600 -7,06,800 -14,78,400 7,000 50,21

4 -14,35,186

Gross Profit 12,28,400 2,21,200 14,49,600 57,000 50,21

4 14,42,814

Profit from Sale of Plant 800 - 800 800 - -

Other Income 30,000 - 30,000 30,000 - -

Legal Fees -3,500 - -3,500 - - -3,500

Profit before income tax 12,55,700 2,21,200 14,76,900 87,800 50,21

4 14,39,314

Income tax expense -3,67,710 -88,480 -4,56,190 64 1,740 -4,54,514

Operating profit after tax

8,87,99

0 1,32,720

10,20,71

0

87,86

4

51,95

4

9,84,80

0

Consolidated Statement of Profit and Loss

Peter Ltd and Lands Ltd

(Amount in

$)

Particulars Peter Ltd

(A)

Lands Ltd

(B)

Total (A+B) =

C

Adjustments

Dr

Adjustments

Cr Consolidation

Sales 20,00,000 9,28,000 29,28,000 50,000 - 28,78,000

Less

: Cost of Sales -7,00,000 -6,70,000 -13,70,000 - 50,00

0 -13,20,000

Wages and Salaries -61,000 -32,000 -93,000 - - -93,000

Depreciation -5,100 -4,800 -9,900 - 21

4 -9,686

Other Expenses -5,500 - -5,500 - - -5,500

Impairment of Goodwill - - - 7,000 - -7,000

Total Expense -7,71,600 -7,06,800 -14,78,400 7,000 50,21

4 -14,35,186

Gross Profit 12,28,400 2,21,200 14,49,600 57,000 50,21

4 14,42,814

Profit from Sale of Plant 800 - 800 800 - -

Other Income 30,000 - 30,000 30,000 - -

Legal Fees -3,500 - -3,500 - - -3,500

Profit before income tax 12,55,700 2,21,200 14,76,900 87,800 50,21

4 14,39,314

Income tax expense -3,67,710 -88,480 -4,56,190 64 1,740 -4,54,514

Operating profit after tax

8,87,99

0 1,32,720

10,20,71

0

87,86

4

51,95

4

9,84,80

0

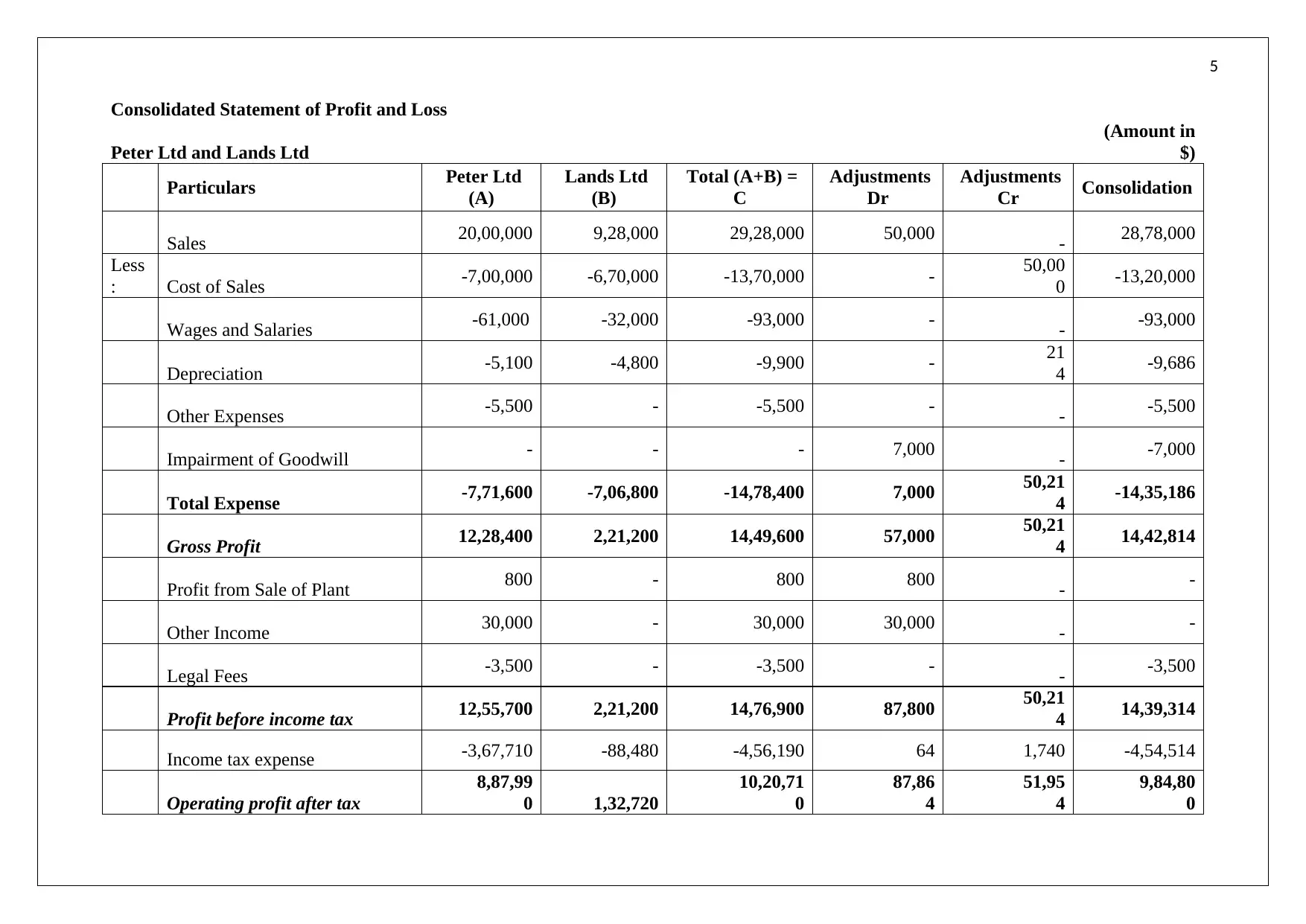

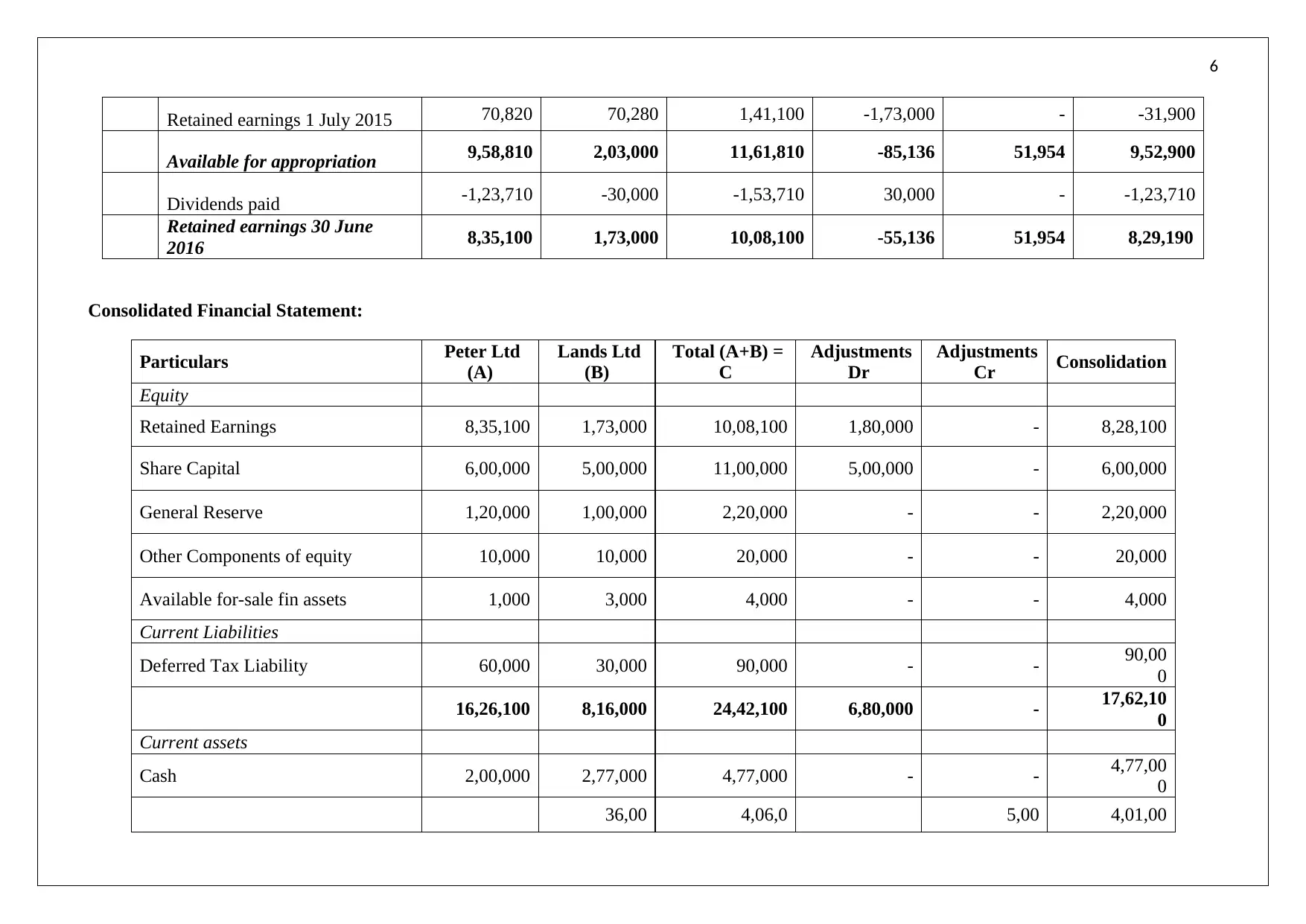

6

Retained earnings 1 July 2015 70,820 70,280 1,41,100 -1,73,000 - -31,900

Available for appropriation 9,58,810 2,03,000 11,61,810 -85,136 51,954 9,52,900

Dividends paid -1,23,710 -30,000 -1,53,710 30,000 - -1,23,710

Retained earnings 30 June

2016 8,35,100 1,73,000 10,08,100 -55,136 51,954 8,29,190

Consolidated Financial Statement:

Particulars Peter Ltd

(A)

Lands Ltd

(B)

Total (A+B) =

C

Adjustments

Dr

Adjustments

Cr Consolidation

Equity

Retained Earnings 8,35,100 1,73,000 10,08,100 1,80,000 - 8,28,100

Share Capital 6,00,000 5,00,000 11,00,000 5,00,000 - 6,00,000

General Reserve 1,20,000 1,00,000 2,20,000 - - 2,20,000

Other Components of equity 10,000 10,000 20,000 - - 20,000

Available for-sale fin assets 1,000 3,000 4,000 - - 4,000

Current Liabilities

Deferred Tax Liability 60,000 30,000 90,000 - - 90,00

0

16,26,100 8,16,000 24,42,100 6,80,000 - 17,62,10

0

Current assets

Cash 2,00,000 2,77,000 4,77,000 - - 4,77,00

0

36,00 4,06,0 5,00 4,01,00

Retained earnings 1 July 2015 70,820 70,280 1,41,100 -1,73,000 - -31,900

Available for appropriation 9,58,810 2,03,000 11,61,810 -85,136 51,954 9,52,900

Dividends paid -1,23,710 -30,000 -1,53,710 30,000 - -1,23,710

Retained earnings 30 June

2016 8,35,100 1,73,000 10,08,100 -55,136 51,954 8,29,190

Consolidated Financial Statement:

Particulars Peter Ltd

(A)

Lands Ltd

(B)

Total (A+B) =

C

Adjustments

Dr

Adjustments

Cr Consolidation

Equity

Retained Earnings 8,35,100 1,73,000 10,08,100 1,80,000 - 8,28,100

Share Capital 6,00,000 5,00,000 11,00,000 5,00,000 - 6,00,000

General Reserve 1,20,000 1,00,000 2,20,000 - - 2,20,000

Other Components of equity 10,000 10,000 20,000 - - 20,000

Available for-sale fin assets 1,000 3,000 4,000 - - 4,000

Current Liabilities

Deferred Tax Liability 60,000 30,000 90,000 - - 90,00

0

16,26,100 8,16,000 24,42,100 6,80,000 - 17,62,10

0

Current assets

Cash 2,00,000 2,77,000 4,77,000 - - 4,77,00

0

36,00 4,06,0 5,00 4,01,00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

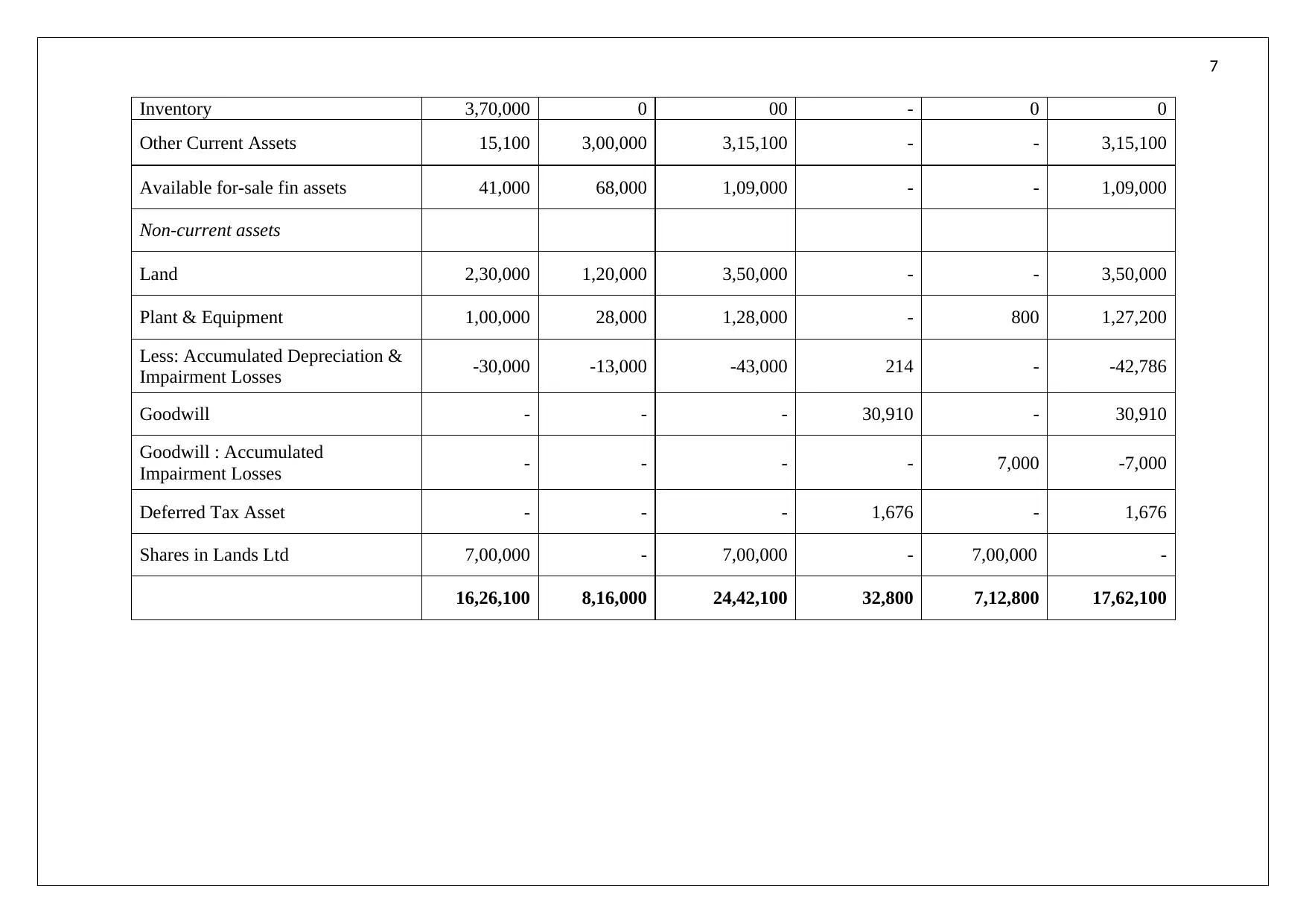

7

Inventory 3,70,000 0 00 - 0 0

Other Current Assets 15,100 3,00,000 3,15,100 - - 3,15,100

Available for-sale fin assets 41,000 68,000 1,09,000 - - 1,09,000

Non-current assets

Land 2,30,000 1,20,000 3,50,000 - - 3,50,000

Plant & Equipment 1,00,000 28,000 1,28,000 - 800 1,27,200

Less: Accumulated Depreciation &

Impairment Losses -30,000 -13,000 -43,000 214 - -42,786

Goodwill - - - 30,910 - 30,910

Goodwill : Accumulated

Impairment Losses - - - - 7,000 -7,000

Deferred Tax Asset - - - 1,676 - 1,676

Shares in Lands Ltd 7,00,000 - 7,00,000 - 7,00,000 -

16,26,100 8,16,000 24,42,100 32,800 7,12,800 17,62,100

Inventory 3,70,000 0 00 - 0 0

Other Current Assets 15,100 3,00,000 3,15,100 - - 3,15,100

Available for-sale fin assets 41,000 68,000 1,09,000 - - 1,09,000

Non-current assets

Land 2,30,000 1,20,000 3,50,000 - - 3,50,000

Plant & Equipment 1,00,000 28,000 1,28,000 - 800 1,27,200

Less: Accumulated Depreciation &

Impairment Losses -30,000 -13,000 -43,000 214 - -42,786

Goodwill - - - 30,910 - 30,910

Goodwill : Accumulated

Impairment Losses - - - - 7,000 -7,000

Deferred Tax Asset - - - 1,676 - 1,676

Shares in Lands Ltd 7,00,000 - 7,00,000 - 7,00,000 -

16,26,100 8,16,000 24,42,100 32,800 7,12,800 17,62,100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

References:

Consolidated Financial Statements. (2011). http://www.aasb.gov.au. Retrieved 4 September 2016, from

http://www.aasb.gov.au/admin/file/content105/c9/AASB10_08-11.pdf

Ron Dagwell, R., Wines, G., & Lambert, C. (2011). Corporate Accounting in Australia. Google Books.

Retrieved 4 September 2016, from https://books.google.co.in/books?

id=qCziBAAAQBAJ&pg=PA357&lpg=PA357&dq=consolidation+journal+entries+for+goodwill+in+australia&s

ource=bl&ots=0_9R0p0Ahy&sig=qbRxOKpc45cVGIkdHPa8ewoAi8&hl=en&sa=X&ved=0ahUKEwjR3PylwvP

OAhWHRI8KHS6XB5wQ6AEIHDAA#v=onepage&q=consolidation%20journal%20entries%20for%20goodwill

%20in%20australia&f=false

Income Taxes. (2012). http://www.aasb.gov.au. Retrieved 4 September 2016, from

http://www.aasb.gov.au/admin/file/content105/c9/AASB112_07-04_COMPsep11_07-12.pdf

References:

Consolidated Financial Statements. (2011). http://www.aasb.gov.au. Retrieved 4 September 2016, from

http://www.aasb.gov.au/admin/file/content105/c9/AASB10_08-11.pdf

Ron Dagwell, R., Wines, G., & Lambert, C. (2011). Corporate Accounting in Australia. Google Books.

Retrieved 4 September 2016, from https://books.google.co.in/books?

id=qCziBAAAQBAJ&pg=PA357&lpg=PA357&dq=consolidation+journal+entries+for+goodwill+in+australia&s

ource=bl&ots=0_9R0p0Ahy&sig=qbRxOKpc45cVGIkdHPa8ewoAi8&hl=en&sa=X&ved=0ahUKEwjR3PylwvP

OAhWHRI8KHS6XB5wQ6AEIHDAA#v=onepage&q=consolidation%20journal%20entries%20for%20goodwill

%20in%20australia&f=false

Income Taxes. (2012). http://www.aasb.gov.au. Retrieved 4 September 2016, from

http://www.aasb.gov.au/admin/file/content105/c9/AASB112_07-04_COMPsep11_07-12.pdf

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.