University Finance: Consolidation of Subsidiaries Assignment

VerifiedAdded on 2023/06/07

|8

|1236

|141

Homework Assignment

AI Summary

This document presents a comprehensive solution to a finance assignment focusing on the consolidation of financial statements, specifically addressing the topic of non-controlling interests. The solution encompasses three distinct parts. Solution-1 involves an acquisition analysis, detailing the calculation of goodwill arising from the acquisition of Soda Ltd by Pepsi Ltd, considering fair value adjustments for assets like inventory, plant, and land, and the impact of unrecorded customer lists. It includes the calculation of the non-controlling interest and the allocation of goodwill. Solution-2 presents consolidation worksheet entries for the year ended June 30, 2018, including business combination valuation entries, pre-acquisition entries, and entries related to the non-controlling interest's share of equity. This section also includes other journal entries for inter-company transactions, such as intercompany sales, debentures, and dividends. Finally, Solution-3 provides journal entries for Behappy Ltd, addressing transactions involving sales, foreign exchange gains and losses, and the purchase of plant and equipment, illustrating the accounting treatment for these items within the context of the assignment.

Index

Solution-1....................................................................................................................................................1

Solution-2....................................................................................................................................................6

Solution-3....................................................................................................................................................7

Solution-1....................................................................................................................................................1

Solution-2....................................................................................................................................................6

Solution-3....................................................................................................................................................7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

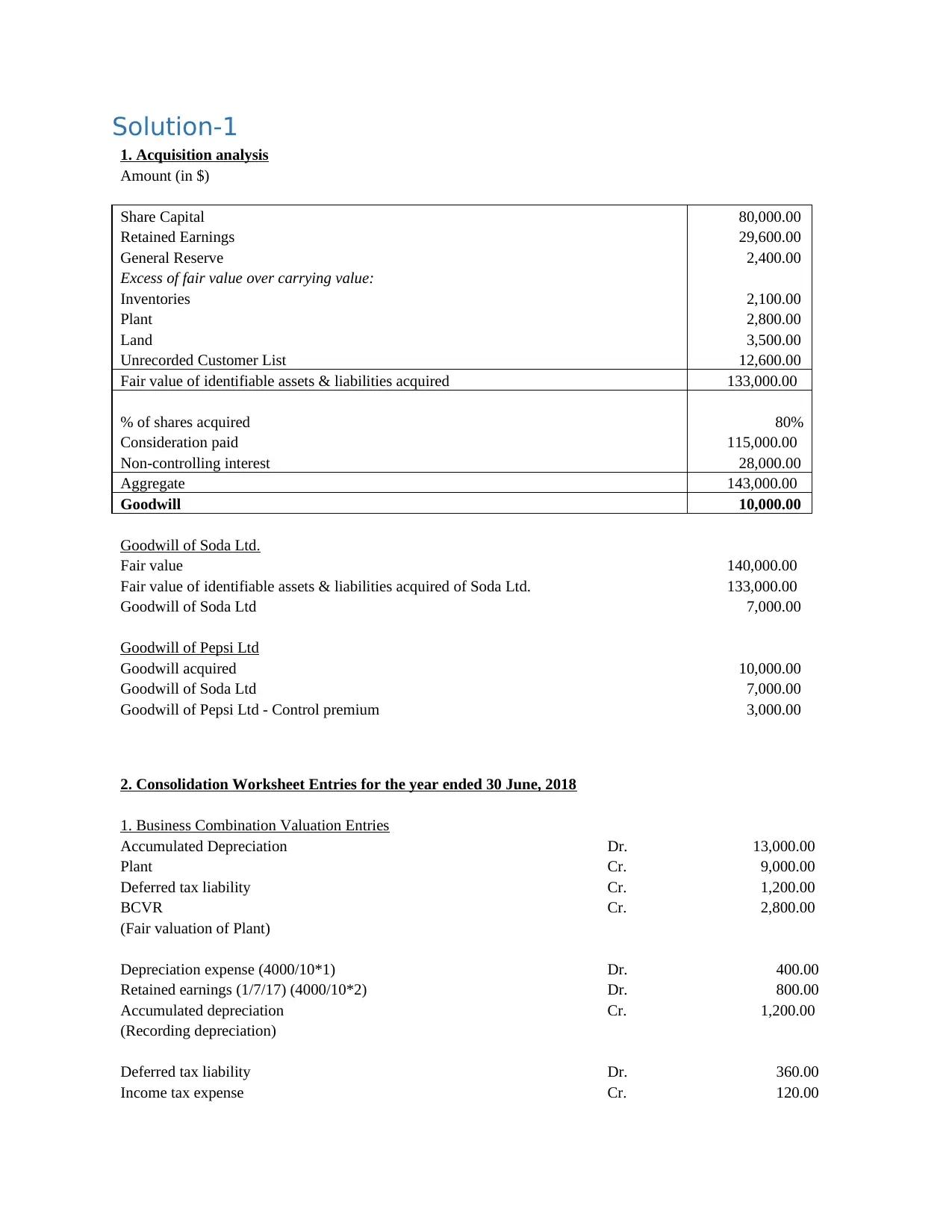

Solution-1

1. Acquisition analysis

Amount (in $)

Share Capital 80,000.00

Retained Earnings 29,600.00

General Reserve 2,400.00

Excess of fair value over carrying value:

Inventories 2,100.00

Plant 2,800.00

Land 3,500.00

Unrecorded Customer List 12,600.00

Fair value of identifiable assets & liabilities acquired 133,000.00

% of shares acquired 80%

Consideration paid 115,000.00

Non-controlling interest 28,000.00

Aggregate 143,000.00

Goodwill 10,000.00

Goodwill of Soda Ltd.

Fair value 140,000.00

Fair value of identifiable assets & liabilities acquired of Soda Ltd. 133,000.00

Goodwill of Soda Ltd 7,000.00

Goodwill of Pepsi Ltd

Goodwill acquired 10,000.00

Goodwill of Soda Ltd 7,000.00

Goodwill of Pepsi Ltd - Control premium 3,000.00

2. Consolidation Worksheet Entries for the year ended 30 June, 2018

1. Business Combination Valuation Entries

Accumulated Depreciation Dr. 13,000.00

Plant Cr. 9,000.00

Deferred tax liability Cr. 1,200.00

BCVR Cr. 2,800.00

(Fair valuation of Plant)

Depreciation expense (4000/10*1) Dr. 400.00

Retained earnings (1/7/17) (4000/10*2) Dr. 800.00

Accumulated depreciation Cr. 1,200.00

(Recording depreciation)

Deferred tax liability Dr. 360.00

Income tax expense Cr. 120.00

1. Acquisition analysis

Amount (in $)

Share Capital 80,000.00

Retained Earnings 29,600.00

General Reserve 2,400.00

Excess of fair value over carrying value:

Inventories 2,100.00

Plant 2,800.00

Land 3,500.00

Unrecorded Customer List 12,600.00

Fair value of identifiable assets & liabilities acquired 133,000.00

% of shares acquired 80%

Consideration paid 115,000.00

Non-controlling interest 28,000.00

Aggregate 143,000.00

Goodwill 10,000.00

Goodwill of Soda Ltd.

Fair value 140,000.00

Fair value of identifiable assets & liabilities acquired of Soda Ltd. 133,000.00

Goodwill of Soda Ltd 7,000.00

Goodwill of Pepsi Ltd

Goodwill acquired 10,000.00

Goodwill of Soda Ltd 7,000.00

Goodwill of Pepsi Ltd - Control premium 3,000.00

2. Consolidation Worksheet Entries for the year ended 30 June, 2018

1. Business Combination Valuation Entries

Accumulated Depreciation Dr. 13,000.00

Plant Cr. 9,000.00

Deferred tax liability Cr. 1,200.00

BCVR Cr. 2,800.00

(Fair valuation of Plant)

Depreciation expense (4000/10*1) Dr. 400.00

Retained earnings (1/7/17) (4000/10*2) Dr. 800.00

Accumulated depreciation Cr. 1,200.00

(Recording depreciation)

Deferred tax liability Dr. 360.00

Income tax expense Cr. 120.00

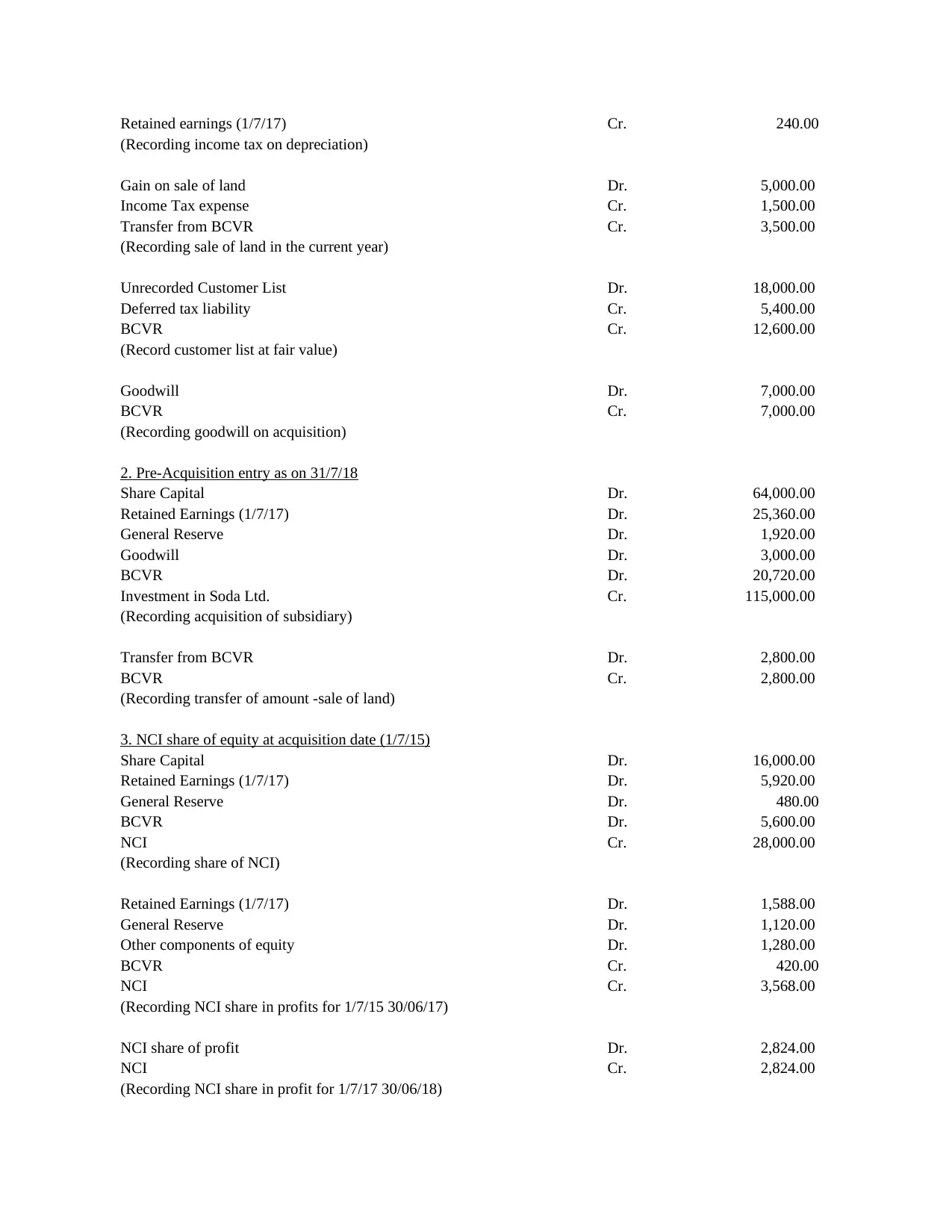

Retained earnings (1/7/17) Cr. 240.00

(Recording income tax on depreciation)

Gain on sale of land Dr. 5,000.00

Income Tax expense Cr. 1,500.00

Transfer from BCVR Cr. 3,500.00

(Recording sale of land in the current year)

Unrecorded Customer List Dr. 18,000.00

Deferred tax liability Cr. 5,400.00

BCVR Cr. 12,600.00

(Record customer list at fair value)

Goodwill Dr. 7,000.00

BCVR Cr. 7,000.00

(Recording goodwill on acquisition)

2. Pre-Acquisition entry as on 31/7/18

Share Capital Dr. 64,000.00

Retained Earnings (1/7/17) Dr. 25,360.00

General Reserve Dr. 1,920.00

Goodwill Dr. 3,000.00

BCVR Dr. 20,720.00

Investment in Soda Ltd. Cr. 115,000.00

(Recording acquisition of subsidiary)

Transfer from BCVR Dr. 2,800.00

BCVR Cr. 2,800.00

(Recording transfer of amount -sale of land)

3. NCI share of equity at acquisition date (1/7/15)

Share Capital Dr. 16,000.00

Retained Earnings (1/7/17) Dr. 5,920.00

General Reserve Dr. 480.00

BCVR Dr. 5,600.00

NCI Cr. 28,000.00

(Recording share of NCI)

Retained Earnings (1/7/17) Dr. 1,588.00

General Reserve Dr. 1,120.00

Other components of equity Dr. 1,280.00

BCVR Cr. 420.00

NCI Cr. 3,568.00

(Recording NCI share in profits for 1/7/15 30/06/17)

NCI share of profit Dr. 2,824.00

NCI Cr. 2,824.00

(Recording NCI share in profit for 1/7/17 30/06/18)

(Recording income tax on depreciation)

Gain on sale of land Dr. 5,000.00

Income Tax expense Cr. 1,500.00

Transfer from BCVR Cr. 3,500.00

(Recording sale of land in the current year)

Unrecorded Customer List Dr. 18,000.00

Deferred tax liability Cr. 5,400.00

BCVR Cr. 12,600.00

(Record customer list at fair value)

Goodwill Dr. 7,000.00

BCVR Cr. 7,000.00

(Recording goodwill on acquisition)

2. Pre-Acquisition entry as on 31/7/18

Share Capital Dr. 64,000.00

Retained Earnings (1/7/17) Dr. 25,360.00

General Reserve Dr. 1,920.00

Goodwill Dr. 3,000.00

BCVR Dr. 20,720.00

Investment in Soda Ltd. Cr. 115,000.00

(Recording acquisition of subsidiary)

Transfer from BCVR Dr. 2,800.00

BCVR Cr. 2,800.00

(Recording transfer of amount -sale of land)

3. NCI share of equity at acquisition date (1/7/15)

Share Capital Dr. 16,000.00

Retained Earnings (1/7/17) Dr. 5,920.00

General Reserve Dr. 480.00

BCVR Dr. 5,600.00

NCI Cr. 28,000.00

(Recording share of NCI)

Retained Earnings (1/7/17) Dr. 1,588.00

General Reserve Dr. 1,120.00

Other components of equity Dr. 1,280.00

BCVR Cr. 420.00

NCI Cr. 3,568.00

(Recording NCI share in profits for 1/7/15 30/06/17)

NCI share of profit Dr. 2,824.00

NCI Cr. 2,824.00

(Recording NCI share in profit for 1/7/17 30/06/18)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

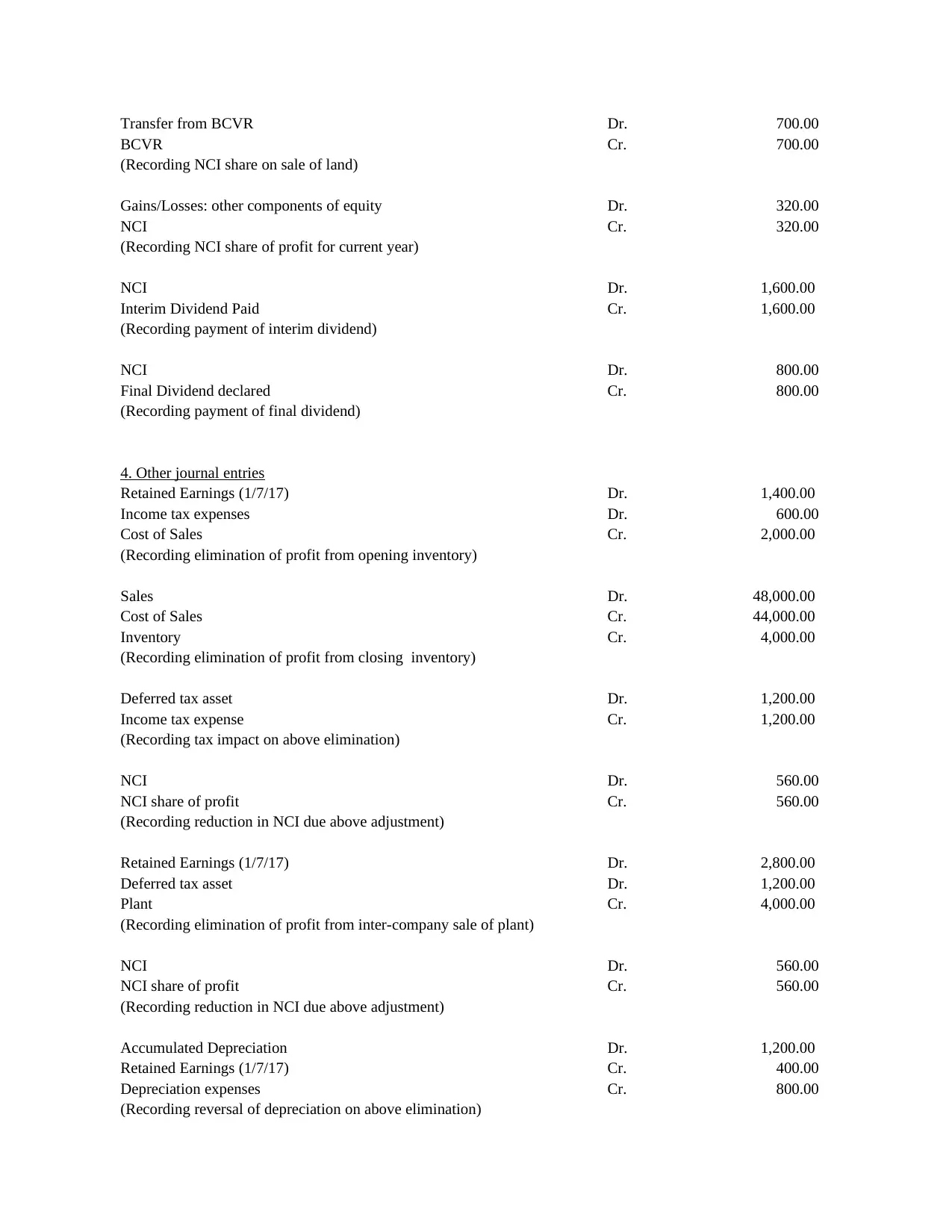

Transfer from BCVR Dr. 700.00

BCVR Cr. 700.00

(Recording NCI share on sale of land)

Gains/Losses: other components of equity Dr. 320.00

NCI Cr. 320.00

(Recording NCI share of profit for current year)

NCI Dr. 1,600.00

Interim Dividend Paid Cr. 1,600.00

(Recording payment of interim dividend)

NCI Dr. 800.00

Final Dividend declared Cr. 800.00

(Recording payment of final dividend)

4. Other journal entries

Retained Earnings (1/7/17) Dr. 1,400.00

Income tax expenses Dr. 600.00

Cost of Sales Cr. 2,000.00

(Recording elimination of profit from opening inventory)

Sales Dr. 48,000.00

Cost of Sales Cr. 44,000.00

Inventory Cr. 4,000.00

(Recording elimination of profit from closing inventory)

Deferred tax asset Dr. 1,200.00

Income tax expense Cr. 1,200.00

(Recording tax impact on above elimination)

NCI Dr. 560.00

NCI share of profit Cr. 560.00

(Recording reduction in NCI due above adjustment)

Retained Earnings (1/7/17) Dr. 2,800.00

Deferred tax asset Dr. 1,200.00

Plant Cr. 4,000.00

(Recording elimination of profit from inter-company sale of plant)

NCI Dr. 560.00

NCI share of profit Cr. 560.00

(Recording reduction in NCI due above adjustment)

Accumulated Depreciation Dr. 1,200.00

Retained Earnings (1/7/17) Cr. 400.00

Depreciation expenses Cr. 800.00

(Recording reversal of depreciation on above elimination)

BCVR Cr. 700.00

(Recording NCI share on sale of land)

Gains/Losses: other components of equity Dr. 320.00

NCI Cr. 320.00

(Recording NCI share of profit for current year)

NCI Dr. 1,600.00

Interim Dividend Paid Cr. 1,600.00

(Recording payment of interim dividend)

NCI Dr. 800.00

Final Dividend declared Cr. 800.00

(Recording payment of final dividend)

4. Other journal entries

Retained Earnings (1/7/17) Dr. 1,400.00

Income tax expenses Dr. 600.00

Cost of Sales Cr. 2,000.00

(Recording elimination of profit from opening inventory)

Sales Dr. 48,000.00

Cost of Sales Cr. 44,000.00

Inventory Cr. 4,000.00

(Recording elimination of profit from closing inventory)

Deferred tax asset Dr. 1,200.00

Income tax expense Cr. 1,200.00

(Recording tax impact on above elimination)

NCI Dr. 560.00

NCI share of profit Cr. 560.00

(Recording reduction in NCI due above adjustment)

Retained Earnings (1/7/17) Dr. 2,800.00

Deferred tax asset Dr. 1,200.00

Plant Cr. 4,000.00

(Recording elimination of profit from inter-company sale of plant)

NCI Dr. 560.00

NCI share of profit Cr. 560.00

(Recording reduction in NCI due above adjustment)

Accumulated Depreciation Dr. 1,200.00

Retained Earnings (1/7/17) Cr. 400.00

Depreciation expenses Cr. 800.00

(Recording reversal of depreciation on above elimination)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

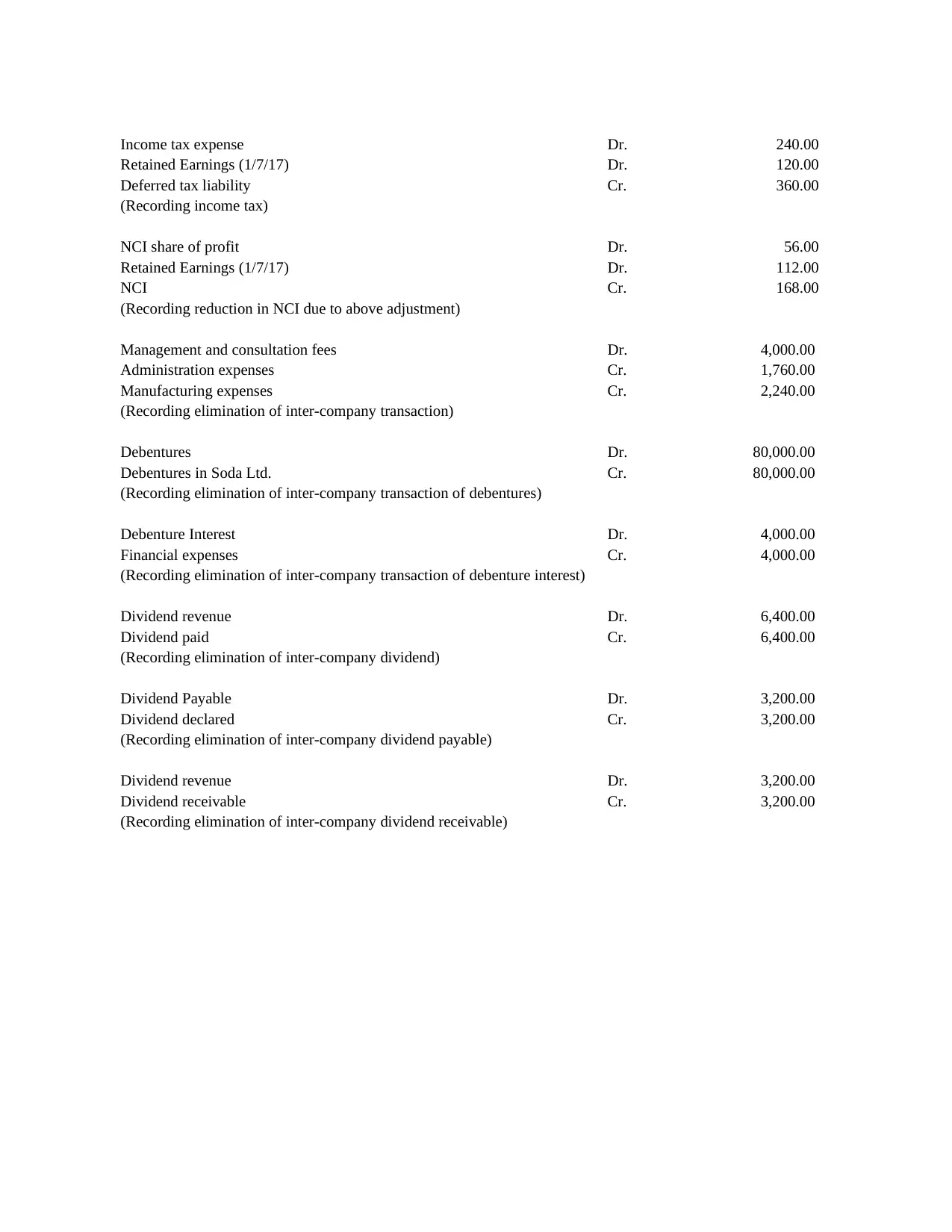

Income tax expense Dr. 240.00

Retained Earnings (1/7/17) Dr. 120.00

Deferred tax liability Cr. 360.00

(Recording income tax)

NCI share of profit Dr. 56.00

Retained Earnings (1/7/17) Dr. 112.00

NCI Cr. 168.00

(Recording reduction in NCI due to above adjustment)

Management and consultation fees Dr. 4,000.00

Administration expenses Cr. 1,760.00

Manufacturing expenses Cr. 2,240.00

(Recording elimination of inter-company transaction)

Debentures Dr. 80,000.00

Debentures in Soda Ltd. Cr. 80,000.00

(Recording elimination of inter-company transaction of debentures)

Debenture Interest Dr. 4,000.00

Financial expenses Cr. 4,000.00

(Recording elimination of inter-company transaction of debenture interest)

Dividend revenue Dr. 6,400.00

Dividend paid Cr. 6,400.00

(Recording elimination of inter-company dividend)

Dividend Payable Dr. 3,200.00

Dividend declared Cr. 3,200.00

(Recording elimination of inter-company dividend payable)

Dividend revenue Dr. 3,200.00

Dividend receivable Cr. 3,200.00

(Recording elimination of inter-company dividend receivable)

Retained Earnings (1/7/17) Dr. 120.00

Deferred tax liability Cr. 360.00

(Recording income tax)

NCI share of profit Dr. 56.00

Retained Earnings (1/7/17) Dr. 112.00

NCI Cr. 168.00

(Recording reduction in NCI due to above adjustment)

Management and consultation fees Dr. 4,000.00

Administration expenses Cr. 1,760.00

Manufacturing expenses Cr. 2,240.00

(Recording elimination of inter-company transaction)

Debentures Dr. 80,000.00

Debentures in Soda Ltd. Cr. 80,000.00

(Recording elimination of inter-company transaction of debentures)

Debenture Interest Dr. 4,000.00

Financial expenses Cr. 4,000.00

(Recording elimination of inter-company transaction of debenture interest)

Dividend revenue Dr. 6,400.00

Dividend paid Cr. 6,400.00

(Recording elimination of inter-company dividend)

Dividend Payable Dr. 3,200.00

Dividend declared Cr. 3,200.00

(Recording elimination of inter-company dividend payable)

Dividend revenue Dr. 3,200.00

Dividend receivable Cr. 3,200.00

(Recording elimination of inter-company dividend receivable)

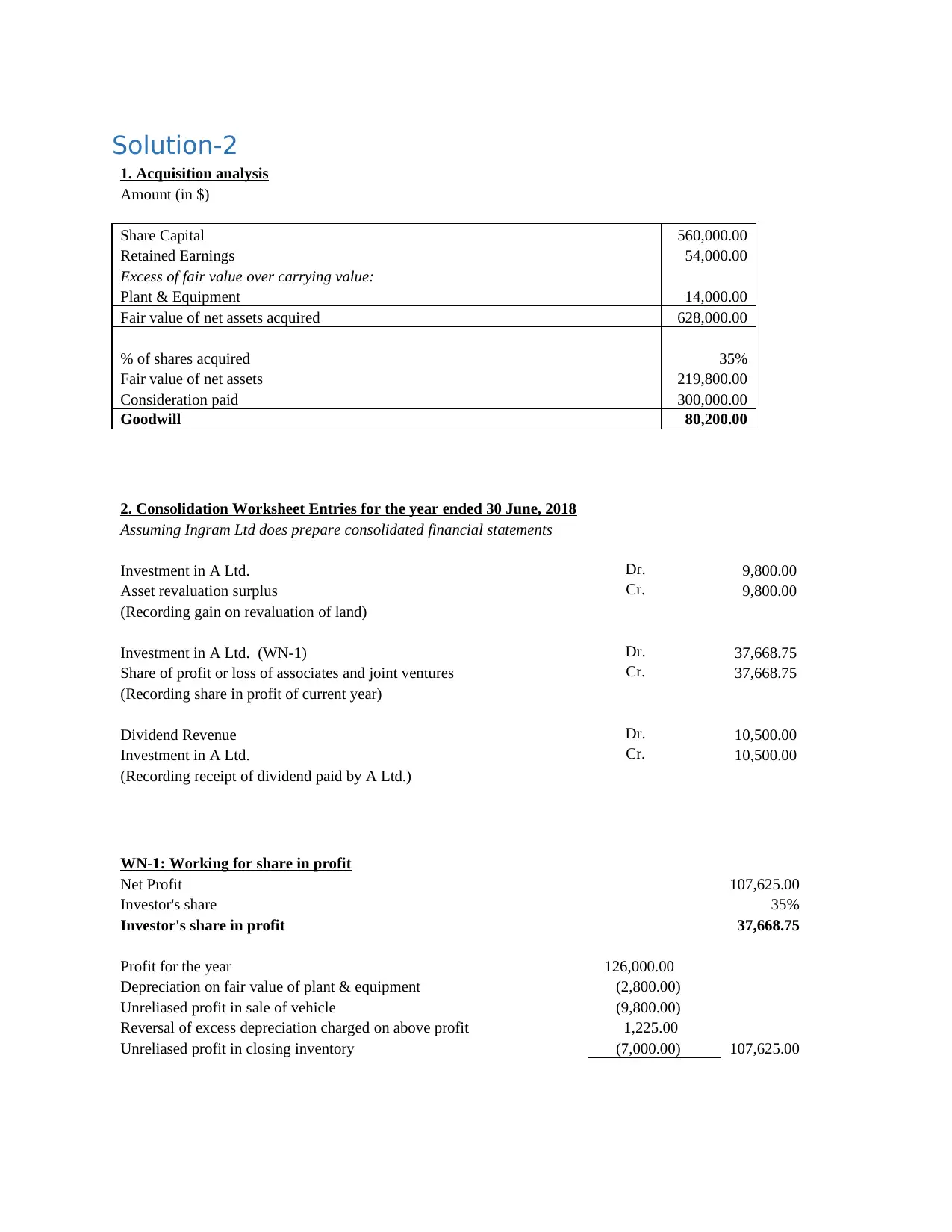

Solution-2

1. Acquisition analysis

Amount (in $)

Share Capital 560,000.00

Retained Earnings 54,000.00

Excess of fair value over carrying value:

Plant & Equipment 14,000.00

Fair value of net assets acquired 628,000.00

% of shares acquired 35%

Fair value of net assets 219,800.00

Consideration paid 300,000.00

Goodwill 80,200.00

2. Consolidation Worksheet Entries for the year ended 30 June, 2018

Assuming Ingram Ltd does prepare consolidated financial statements

Investment in A Ltd. Dr. 9,800.00

Asset revaluation surplus Cr. 9,800.00

(Recording gain on revaluation of land)

Investment in A Ltd. (WN-1) Dr. 37,668.75

Share of profit or loss of associates and joint ventures Cr. 37,668.75

(Recording share in profit of current year)

Dividend Revenue Dr. 10,500.00

Investment in A Ltd. Cr. 10,500.00

(Recording receipt of dividend paid by A Ltd.)

WN-1: Working for share in profit

Net Profit 107,625.00

Investor's share 35%

Investor's share in profit 37,668.75

Profit for the year 126,000.00

Depreciation on fair value of plant & equipment (2,800.00)

Unreliased profit in sale of vehicle (9,800.00)

Reversal of excess depreciation charged on above profit 1,225.00

Unreliased profit in closing inventory (7,000.00) 107,625.00

1. Acquisition analysis

Amount (in $)

Share Capital 560,000.00

Retained Earnings 54,000.00

Excess of fair value over carrying value:

Plant & Equipment 14,000.00

Fair value of net assets acquired 628,000.00

% of shares acquired 35%

Fair value of net assets 219,800.00

Consideration paid 300,000.00

Goodwill 80,200.00

2. Consolidation Worksheet Entries for the year ended 30 June, 2018

Assuming Ingram Ltd does prepare consolidated financial statements

Investment in A Ltd. Dr. 9,800.00

Asset revaluation surplus Cr. 9,800.00

(Recording gain on revaluation of land)

Investment in A Ltd. (WN-1) Dr. 37,668.75

Share of profit or loss of associates and joint ventures Cr. 37,668.75

(Recording share in profit of current year)

Dividend Revenue Dr. 10,500.00

Investment in A Ltd. Cr. 10,500.00

(Recording receipt of dividend paid by A Ltd.)

WN-1: Working for share in profit

Net Profit 107,625.00

Investor's share 35%

Investor's share in profit 37,668.75

Profit for the year 126,000.00

Depreciation on fair value of plant & equipment (2,800.00)

Unreliased profit in sale of vehicle (9,800.00)

Reversal of excess depreciation charged on above profit 1,225.00

Unreliased profit in closing inventory (7,000.00) 107,625.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

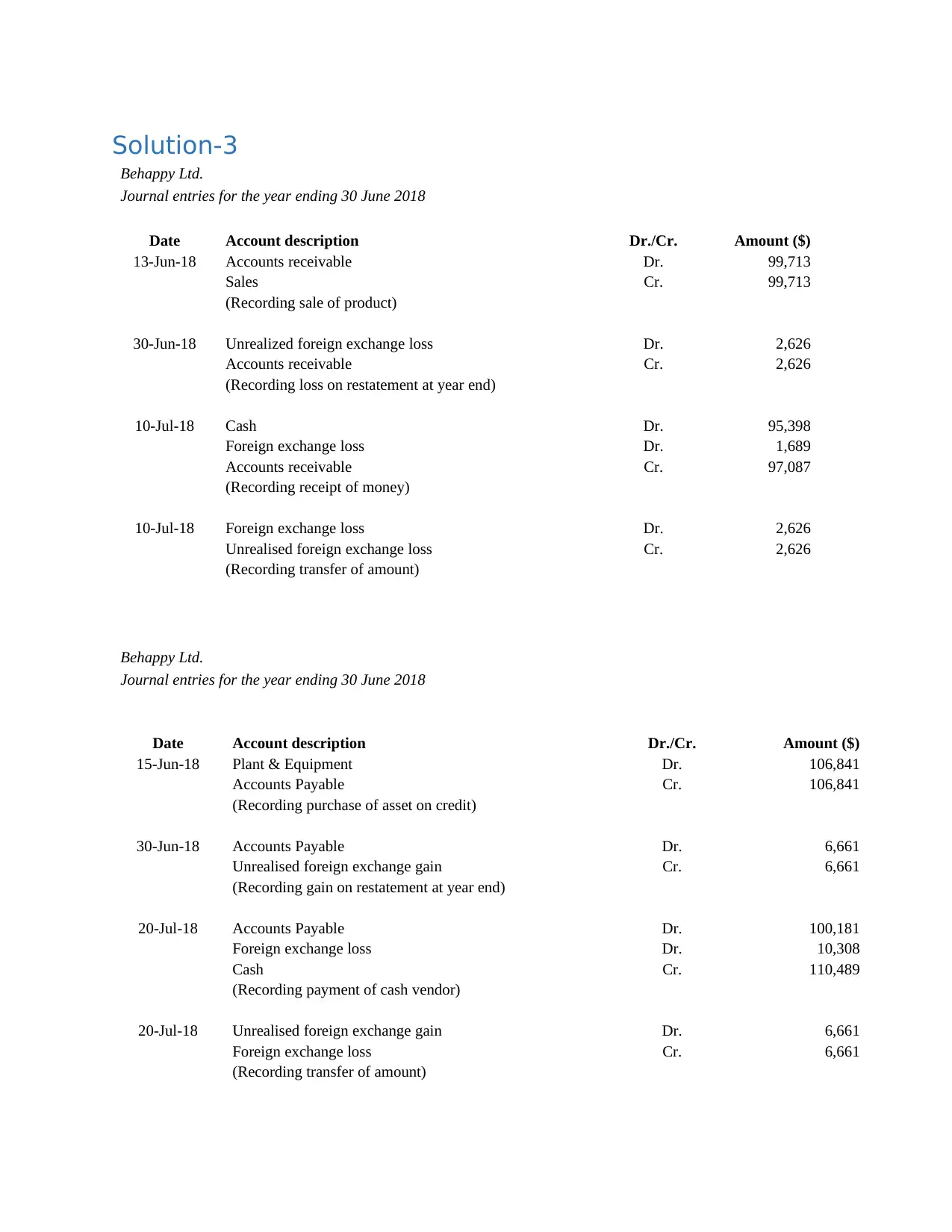

Solution-3

Behappy Ltd.

Journal entries for the year ending 30 June 2018

Date Account description Dr./Cr. Amount ($)

13-Jun-18 Accounts receivable Dr. 99,713

Sales Cr. 99,713

(Recording sale of product)

30-Jun-18 Unrealized foreign exchange loss Dr. 2,626

Accounts receivable Cr. 2,626

(Recording loss on restatement at year end)

10-Jul-18 Cash Dr. 95,398

Foreign exchange loss Dr. 1,689

Accounts receivable Cr. 97,087

(Recording receipt of money)

10-Jul-18 Foreign exchange loss Dr. 2,626

Unrealised foreign exchange loss Cr. 2,626

(Recording transfer of amount)

Behappy Ltd.

Journal entries for the year ending 30 June 2018

Date Account description Dr./Cr. Amount ($)

15-Jun-18 Plant & Equipment Dr. 106,841

Accounts Payable Cr. 106,841

(Recording purchase of asset on credit)

30-Jun-18 Accounts Payable Dr. 6,661

Unrealised foreign exchange gain Cr. 6,661

(Recording gain on restatement at year end)

20-Jul-18 Accounts Payable Dr. 100,181

Foreign exchange loss Dr. 10,308

Cash Cr. 110,489

(Recording payment of cash vendor)

20-Jul-18 Unrealised foreign exchange gain Dr. 6,661

Foreign exchange loss Cr. 6,661

(Recording transfer of amount)

Behappy Ltd.

Journal entries for the year ending 30 June 2018

Date Account description Dr./Cr. Amount ($)

13-Jun-18 Accounts receivable Dr. 99,713

Sales Cr. 99,713

(Recording sale of product)

30-Jun-18 Unrealized foreign exchange loss Dr. 2,626

Accounts receivable Cr. 2,626

(Recording loss on restatement at year end)

10-Jul-18 Cash Dr. 95,398

Foreign exchange loss Dr. 1,689

Accounts receivable Cr. 97,087

(Recording receipt of money)

10-Jul-18 Foreign exchange loss Dr. 2,626

Unrealised foreign exchange loss Cr. 2,626

(Recording transfer of amount)

Behappy Ltd.

Journal entries for the year ending 30 June 2018

Date Account description Dr./Cr. Amount ($)

15-Jun-18 Plant & Equipment Dr. 106,841

Accounts Payable Cr. 106,841

(Recording purchase of asset on credit)

30-Jun-18 Accounts Payable Dr. 6,661

Unrealised foreign exchange gain Cr. 6,661

(Recording gain on restatement at year end)

20-Jul-18 Accounts Payable Dr. 100,181

Foreign exchange loss Dr. 10,308

Cash Cr. 110,489

(Recording payment of cash vendor)

20-Jul-18 Unrealised foreign exchange gain Dr. 6,661

Foreign exchange loss Cr. 6,661

(Recording transfer of amount)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.