Group Assignment: Corporate Accounting (ACC2CRE) - Semester 2, 2018

VerifiedAdded on 2023/06/04

|16

|2342

|376

Project

AI Summary

This assignment solution provides a detailed analysis of corporate accounting principles. It includes journal entries for various transactions, an income statement, a statement of financial position, and notes to the accounts. The solution also covers tax calculations, including taxable income and deferred tax liabilities, and demonstrates the application of accounting standards like AASB. Furthermore, the assignment delves into corporate social responsibility (CSR), discussing its benefits and the importance of sustainability reporting, using Pental Ltd as a case study. The document concludes with relevant references to support the analysis and findings. The assignment demonstrates a strong understanding of financial reporting, taxation, and CSR, offering a comprehensive view of corporate accounting practices.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author Note:

Corporate Accounting

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING

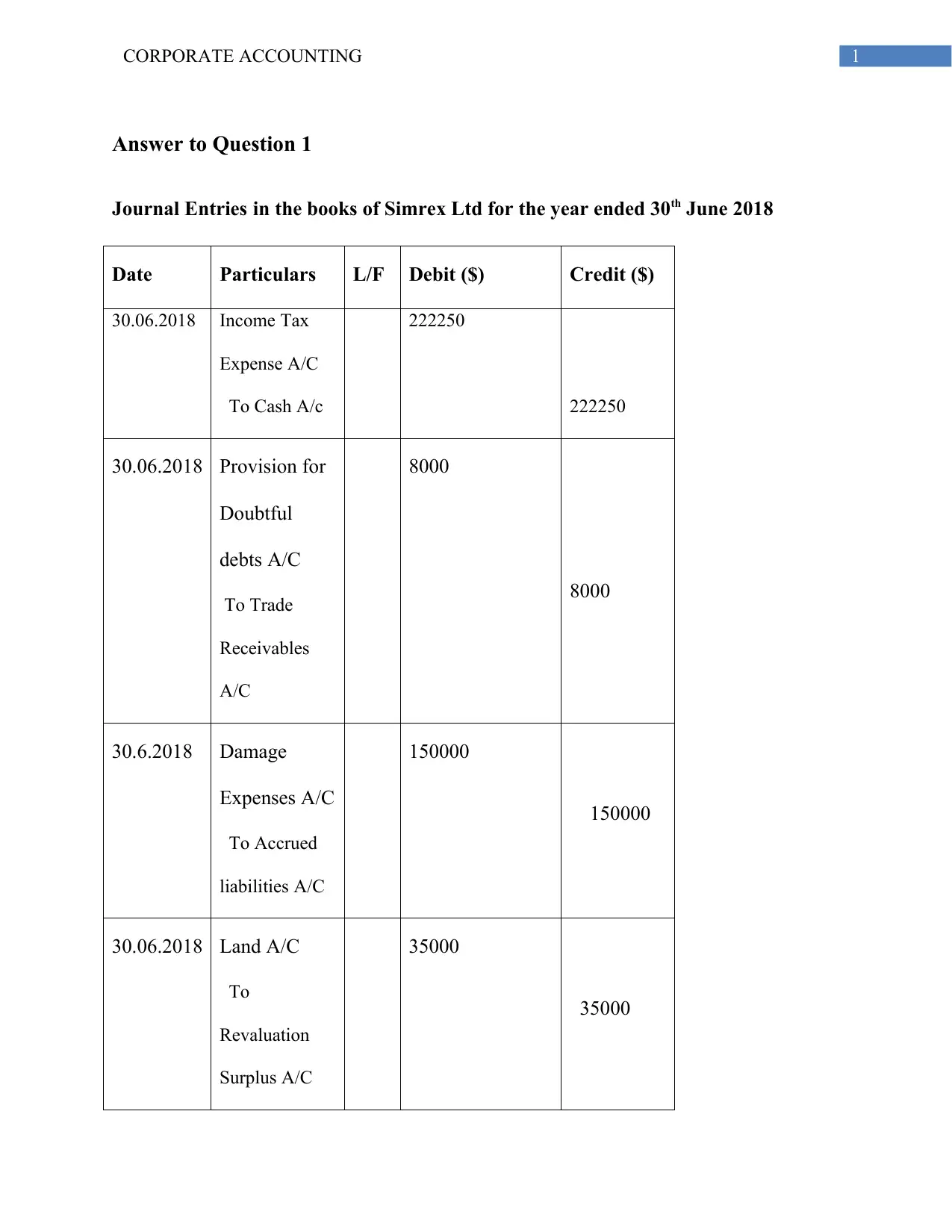

Answer to Question 1

Journal Entries in the books of Simrex Ltd for the year ended 30th June 2018

Date Particulars L/F Debit ($) Credit ($)

30.06.2018 Income Tax

Expense A/C

To Cash A/c

222250

222250

30.06.2018 Provision for

Doubtful

debts A/C

To Trade

Receivables

A/C

8000

8000

30.6.2018 Damage

Expenses A/C

To Accrued

liabilities A/C

150000

150000

30.06.2018 Land A/C

To

Revaluation

Surplus A/C

35000

35000

Answer to Question 1

Journal Entries in the books of Simrex Ltd for the year ended 30th June 2018

Date Particulars L/F Debit ($) Credit ($)

30.06.2018 Income Tax

Expense A/C

To Cash A/c

222250

222250

30.06.2018 Provision for

Doubtful

debts A/C

To Trade

Receivables

A/C

8000

8000

30.6.2018 Damage

Expenses A/C

To Accrued

liabilities A/C

150000

150000

30.06.2018 Land A/C

To

Revaluation

Surplus A/C

35000

35000

2CORPORATE ACCOUNTING

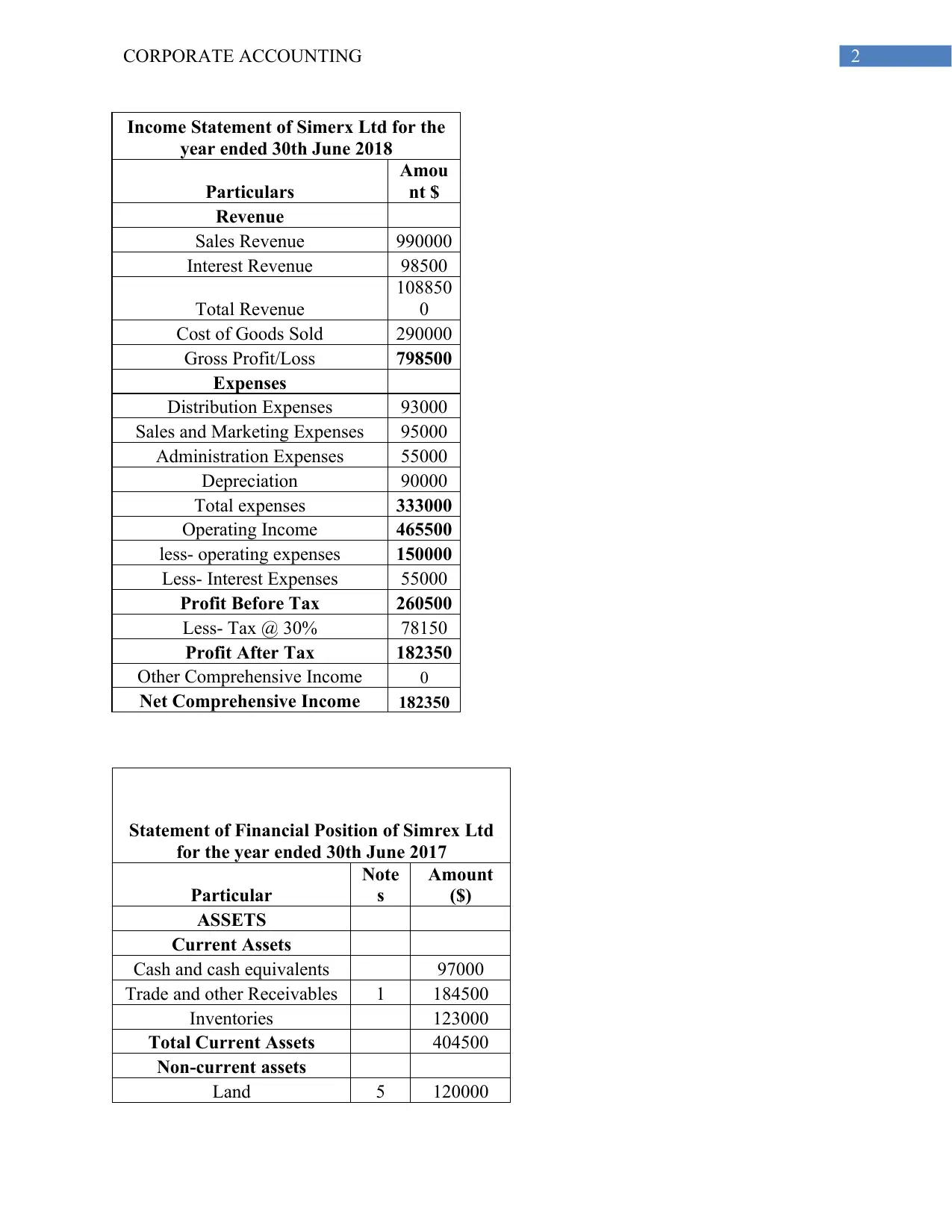

Income Statement of Simerx Ltd for the

year ended 30th June 2018

Particulars

Amou

nt $

Revenue

Sales Revenue 990000

Interest Revenue 98500

Total Revenue

108850

0

Cost of Goods Sold 290000

Gross Profit/Loss 798500

Expenses

Distribution Expenses 93000

Sales and Marketing Expenses 95000

Administration Expenses 55000

Depreciation 90000

Total expenses 333000

Operating Income 465500

less- operating expenses 150000

Less- Interest Expenses 55000

Profit Before Tax 260500

Less- Tax @ 30% 78150

Profit After Tax 182350

Other Comprehensive Income 0

Net Comprehensive Income 182350

Statement of Financial Position of Simrex Ltd

for the year ended 30th June 2017

Particular

Note

s

Amount

($)

ASSETS

Current Assets

Cash and cash equivalents 97000

Trade and other Receivables 1 184500

Inventories 123000

Total Current Assets 404500

Non-current assets

Land 5 120000

Income Statement of Simerx Ltd for the

year ended 30th June 2018

Particulars

Amou

nt $

Revenue

Sales Revenue 990000

Interest Revenue 98500

Total Revenue

108850

0

Cost of Goods Sold 290000

Gross Profit/Loss 798500

Expenses

Distribution Expenses 93000

Sales and Marketing Expenses 95000

Administration Expenses 55000

Depreciation 90000

Total expenses 333000

Operating Income 465500

less- operating expenses 150000

Less- Interest Expenses 55000

Profit Before Tax 260500

Less- Tax @ 30% 78150

Profit After Tax 182350

Other Comprehensive Income 0

Net Comprehensive Income 182350

Statement of Financial Position of Simrex Ltd

for the year ended 30th June 2017

Particular

Note

s

Amount

($)

ASSETS

Current Assets

Cash and cash equivalents 97000

Trade and other Receivables 1 184500

Inventories 123000

Total Current Assets 404500

Non-current assets

Land 5 120000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

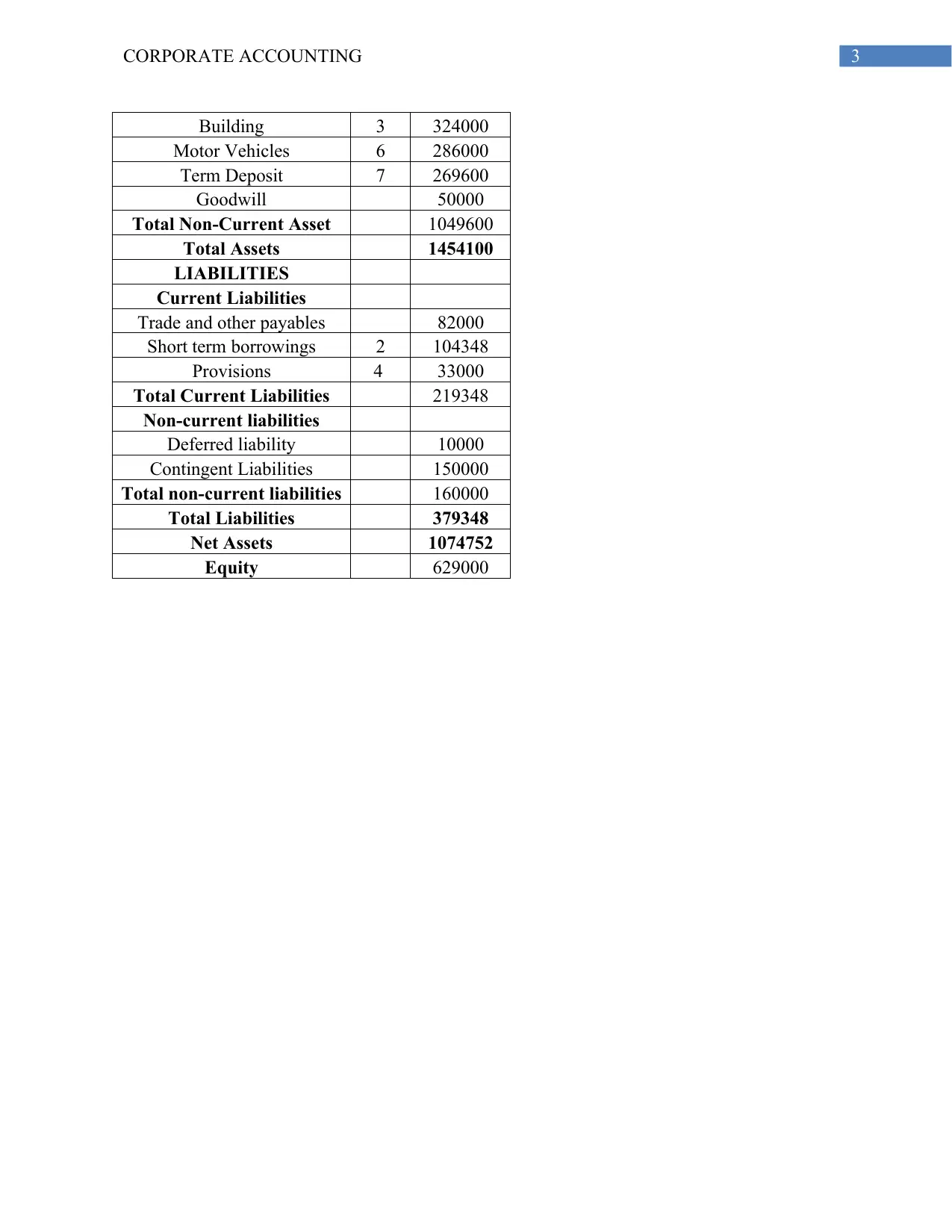

3CORPORATE ACCOUNTING

Building 3 324000

Motor Vehicles 6 286000

Term Deposit 7 269600

Goodwill 50000

Total Non-Current Asset 1049600

Total Assets 1454100

LIABILITIES

Current Liabilities

Trade and other payables 82000

Short term borrowings 2 104348

Provisions 4 33000

Total Current Liabilities 219348

Non-current liabilities

Deferred liability 10000

Contingent Liabilities 150000

Total non-current liabilities 160000

Total Liabilities 379348

Net Assets 1074752

Equity 629000

Building 3 324000

Motor Vehicles 6 286000

Term Deposit 7 269600

Goodwill 50000

Total Non-Current Asset 1049600

Total Assets 1454100

LIABILITIES

Current Liabilities

Trade and other payables 82000

Short term borrowings 2 104348

Provisions 4 33000

Total Current Liabilities 219348

Non-current liabilities

Deferred liability 10000

Contingent Liabilities 150000

Total non-current liabilities 160000

Total Liabilities 379348

Net Assets 1074752

Equity 629000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING

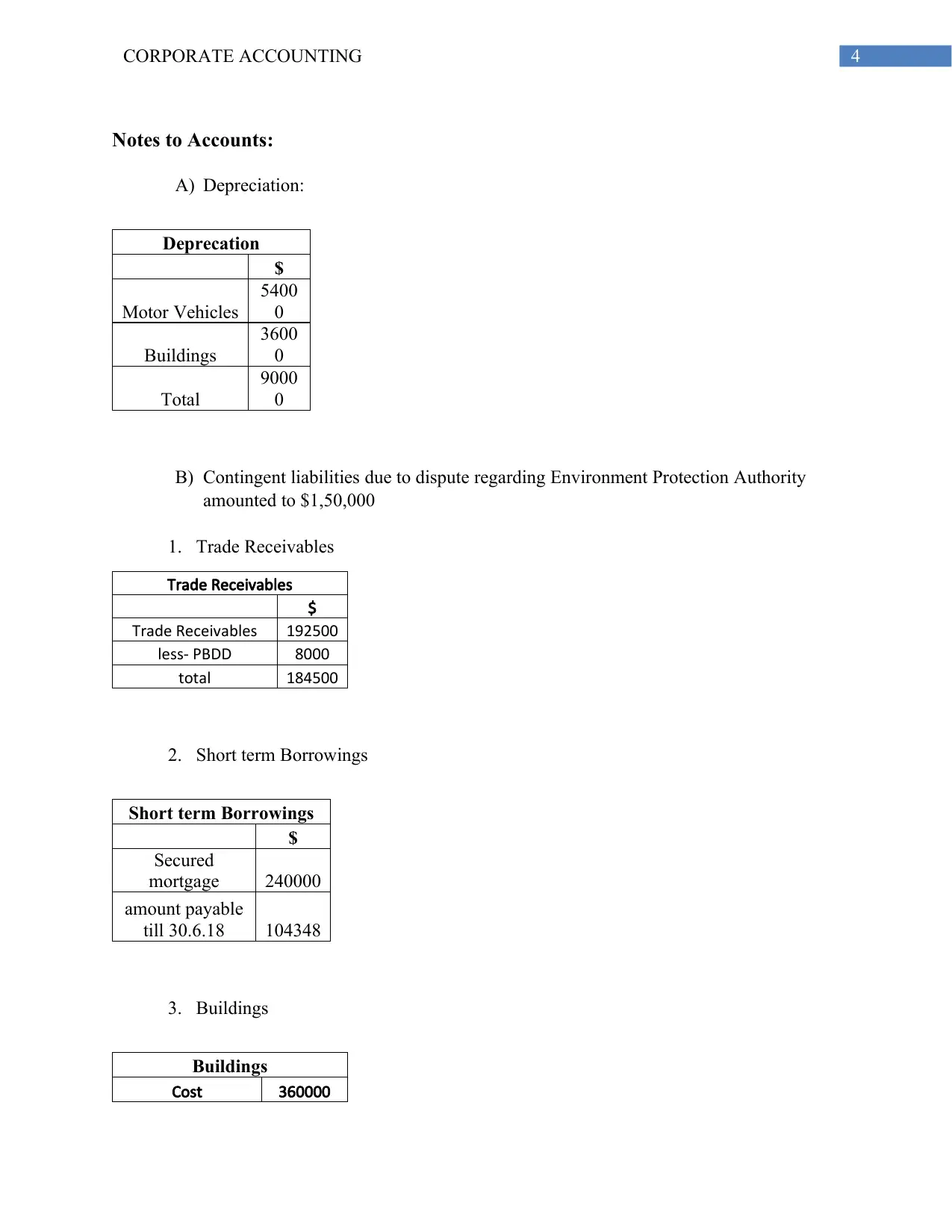

Notes to Accounts:

A) Depreciation:

Deprecation

$

Motor Vehicles

5400

0

Buildings

3600

0

Total

9000

0

B) Contingent liabilities due to dispute regarding Environment Protection Authority

amounted to $1,50,000

1. Trade Receivables

Trade Receivables

$

Trade Receivables 192500

less- PBDD 8000

total 184500

2. Short term Borrowings

Short term Borrowings

$

Secured

mortgage 240000

amount payable

till 30.6.18 104348

3. Buildings

Buildings

Cost 360000

Notes to Accounts:

A) Depreciation:

Deprecation

$

Motor Vehicles

5400

0

Buildings

3600

0

Total

9000

0

B) Contingent liabilities due to dispute regarding Environment Protection Authority

amounted to $1,50,000

1. Trade Receivables

Trade Receivables

$

Trade Receivables 192500

less- PBDD 8000

total 184500

2. Short term Borrowings

Short term Borrowings

$

Secured

mortgage 240000

amount payable

till 30.6.18 104348

3. Buildings

Buildings

Cost 360000

5CORPORATE ACCOUNTING

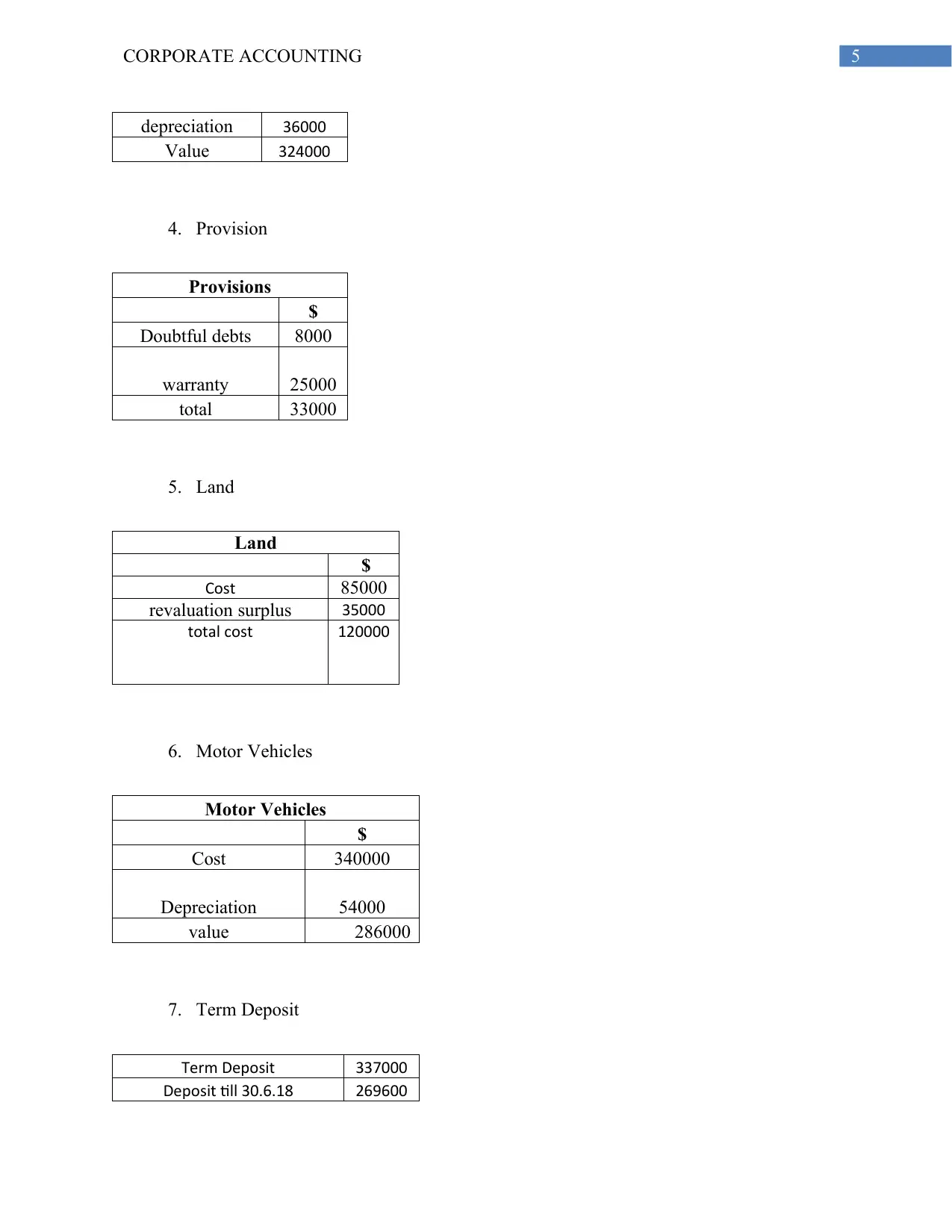

depreciation 36000

Value 324000

4. Provision

Provisions

$

Doubtful debts 8000

warranty 25000

total 33000

5. Land

Land

$

Cost 85000

revaluation surplus 35000

total cost 120000

6. Motor Vehicles

Motor Vehicles

$

Cost 340000

Depreciation 54000

value 286000

7. Term Deposit

Term Deposit 337000

Deposit till 30.6.18 269600

depreciation 36000

Value 324000

4. Provision

Provisions

$

Doubtful debts 8000

warranty 25000

total 33000

5. Land

Land

$

Cost 85000

revaluation surplus 35000

total cost 120000

6. Motor Vehicles

Motor Vehicles

$

Cost 340000

Depreciation 54000

value 286000

7. Term Deposit

Term Deposit 337000

Deposit till 30.6.18 269600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

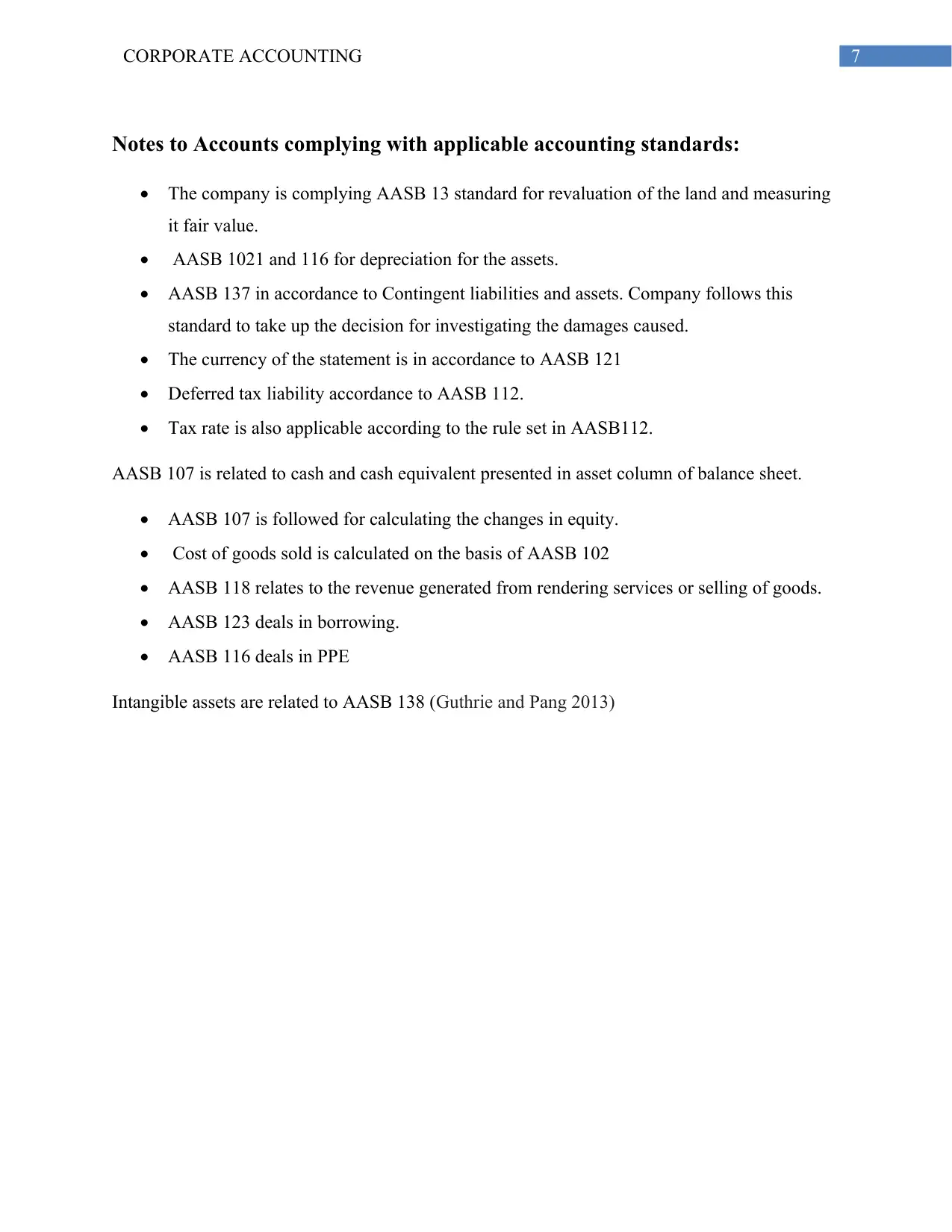

Notes to Accounts complying with applicable accounting standards:

The company is complying AASB 13 standard for revaluation of the land and measuring

it fair value.

AASB 1021 and 116 for depreciation for the assets.

AASB 137 in accordance to Contingent liabilities and assets. Company follows this

standard to take up the decision for investigating the damages caused.

The currency of the statement is in accordance to AASB 121

Deferred tax liability accordance to AASB 112.

Tax rate is also applicable according to the rule set in AASB112.

AASB 107 is related to cash and cash equivalent presented in asset column of balance sheet.

AASB 107 is followed for calculating the changes in equity.

Cost of goods sold is calculated on the basis of AASB 102

AASB 118 relates to the revenue generated from rendering services or selling of goods.

AASB 123 deals in borrowing.

AASB 116 deals in PPE

Intangible assets are related to AASB 138 (Guthrie and Pang 2013)

Notes to Accounts complying with applicable accounting standards:

The company is complying AASB 13 standard for revaluation of the land and measuring

it fair value.

AASB 1021 and 116 for depreciation for the assets.

AASB 137 in accordance to Contingent liabilities and assets. Company follows this

standard to take up the decision for investigating the damages caused.

The currency of the statement is in accordance to AASB 121

Deferred tax liability accordance to AASB 112.

Tax rate is also applicable according to the rule set in AASB112.

AASB 107 is related to cash and cash equivalent presented in asset column of balance sheet.

AASB 107 is followed for calculating the changes in equity.

Cost of goods sold is calculated on the basis of AASB 102

AASB 118 relates to the revenue generated from rendering services or selling of goods.

AASB 123 deals in borrowing.

AASB 116 deals in PPE

Intangible assets are related to AASB 138 (Guthrie and Pang 2013)

8CORPORATE ACCOUNTING

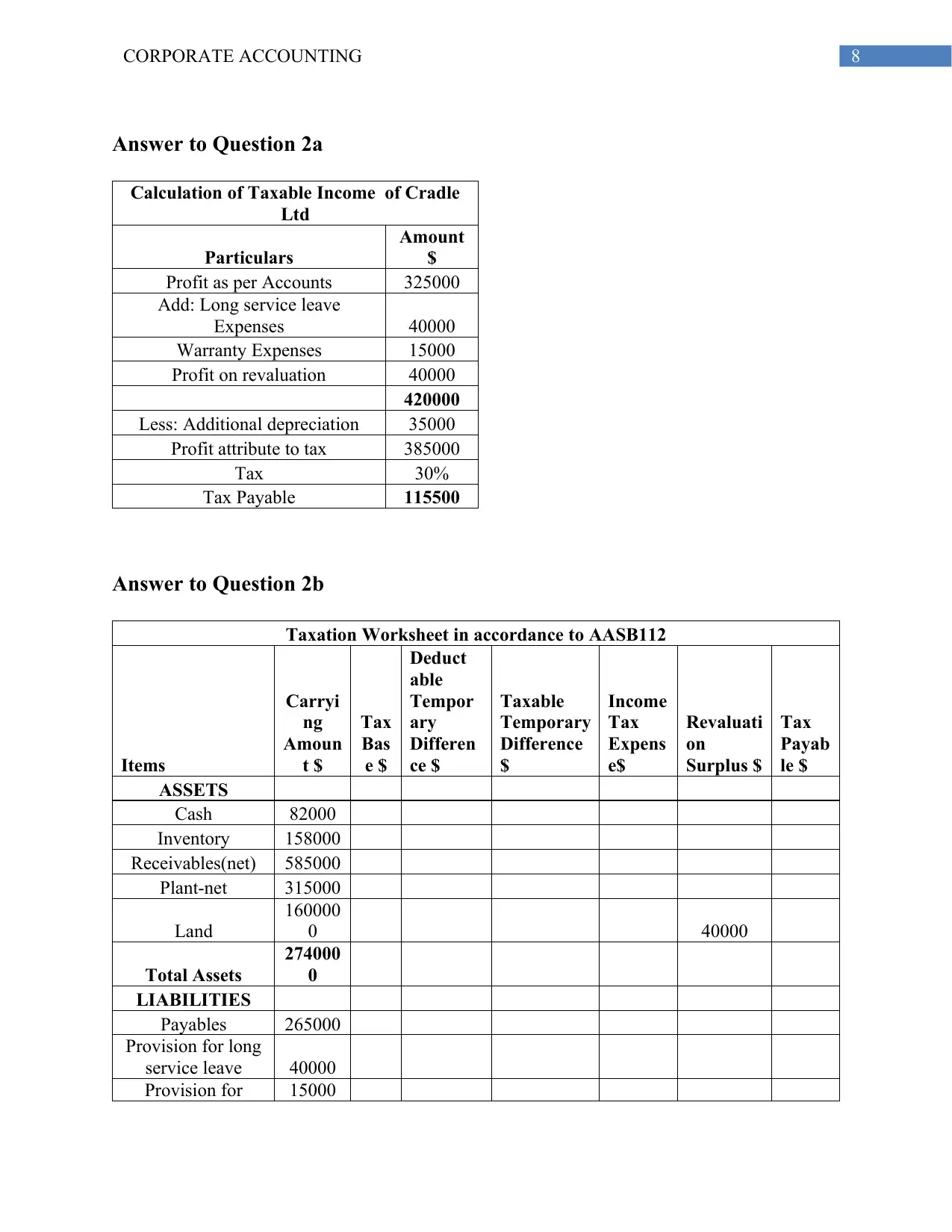

Answer to Question 2a

Calculation of Taxable Income of Cradle

Ltd

Particulars

Amount

$

Profit as per Accounts 325000

Add: Long service leave

Expenses 40000

Warranty Expenses 15000

Profit on revaluation 40000

420000

Less: Additional depreciation 35000

Profit attribute to tax 385000

Tax 30%

Tax Payable 115500

Answer to Question 2b

Taxation Worksheet in accordance to AASB112

Items

Carryi

ng

Amoun

t $

Tax

Bas

e $

Deduct

able

Tempor

ary

Differen

ce $

Taxable

Temporary

Difference

$

Income

Tax

Expens

e$

Revaluati

on

Surplus $

Tax

Payab

le $

ASSETS

Cash 82000

Inventory 158000

Receivables(net) 585000

Plant-net 315000

Land

160000

0 40000

Total Assets

274000

0

LIABILITIES

Payables 265000

Provision for long

service leave 40000

Provision for 15000

Answer to Question 2a

Calculation of Taxable Income of Cradle

Ltd

Particulars

Amount

$

Profit as per Accounts 325000

Add: Long service leave

Expenses 40000

Warranty Expenses 15000

Profit on revaluation 40000

420000

Less: Additional depreciation 35000

Profit attribute to tax 385000

Tax 30%

Tax Payable 115500

Answer to Question 2b

Taxation Worksheet in accordance to AASB112

Items

Carryi

ng

Amoun

t $

Tax

Bas

e $

Deduct

able

Tempor

ary

Differen

ce $

Taxable

Temporary

Difference

$

Income

Tax

Expens

e$

Revaluati

on

Surplus $

Tax

Payab

le $

ASSETS

Cash 82000

Inventory 158000

Receivables(net) 585000

Plant-net 315000

Land

160000

0 40000

Total Assets

274000

0

LIABILITIES

Payables 265000

Provision for long

service leave 40000

Provision for 15000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

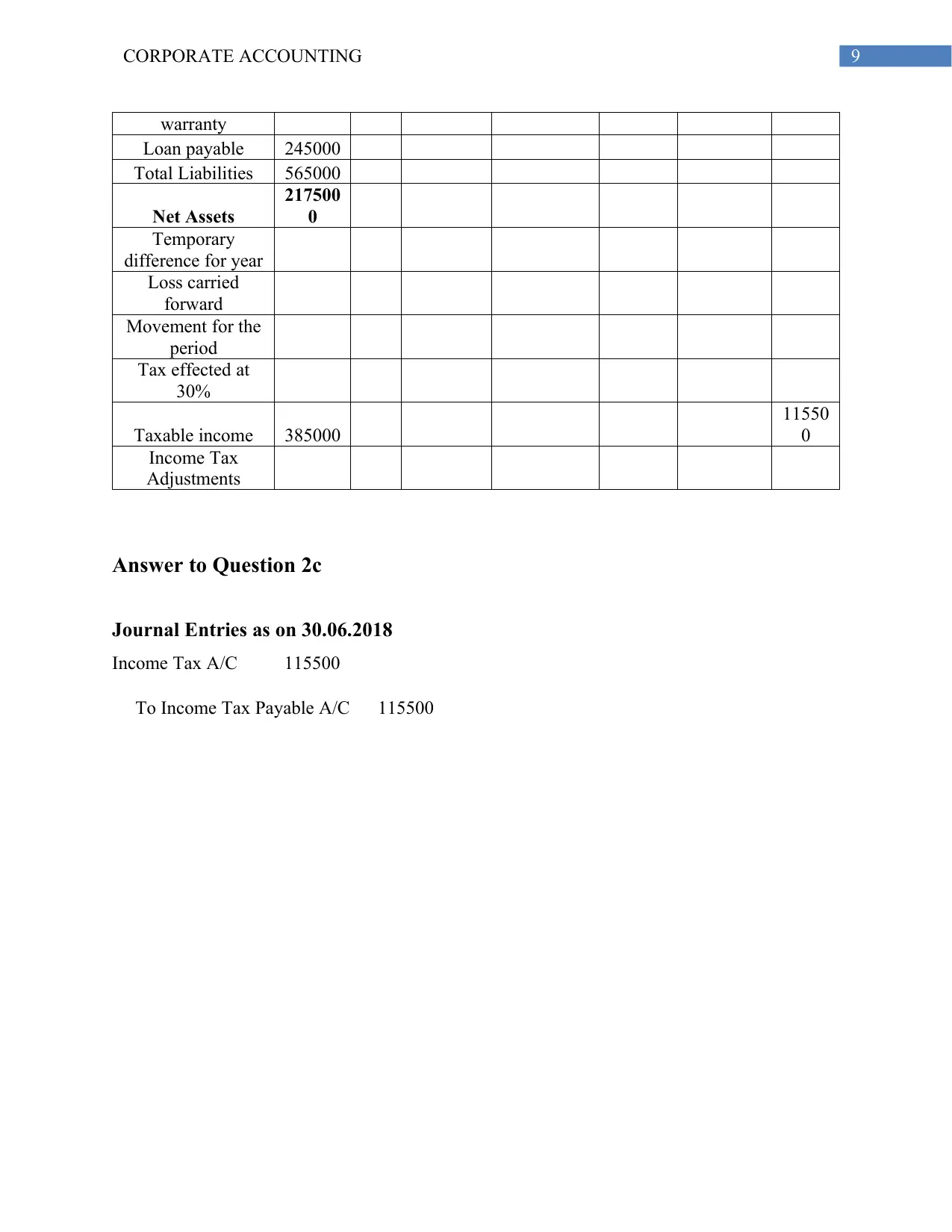

9CORPORATE ACCOUNTING

warranty

Loan payable 245000

Total Liabilities 565000

Net Assets

217500

0

Temporary

difference for year

Loss carried

forward

Movement for the

period

Tax effected at

30%

Taxable income 385000

11550

0

Income Tax

Adjustments

Answer to Question 2c

Journal Entries as on 30.06.2018

Income Tax A/C 115500

To Income Tax Payable A/C 115500

warranty

Loan payable 245000

Total Liabilities 565000

Net Assets

217500

0

Temporary

difference for year

Loss carried

forward

Movement for the

period

Tax effected at

30%

Taxable income 385000

11550

0

Income Tax

Adjustments

Answer to Question 2c

Journal Entries as on 30.06.2018

Income Tax A/C 115500

To Income Tax Payable A/C 115500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CORPORATE ACCOUNTING

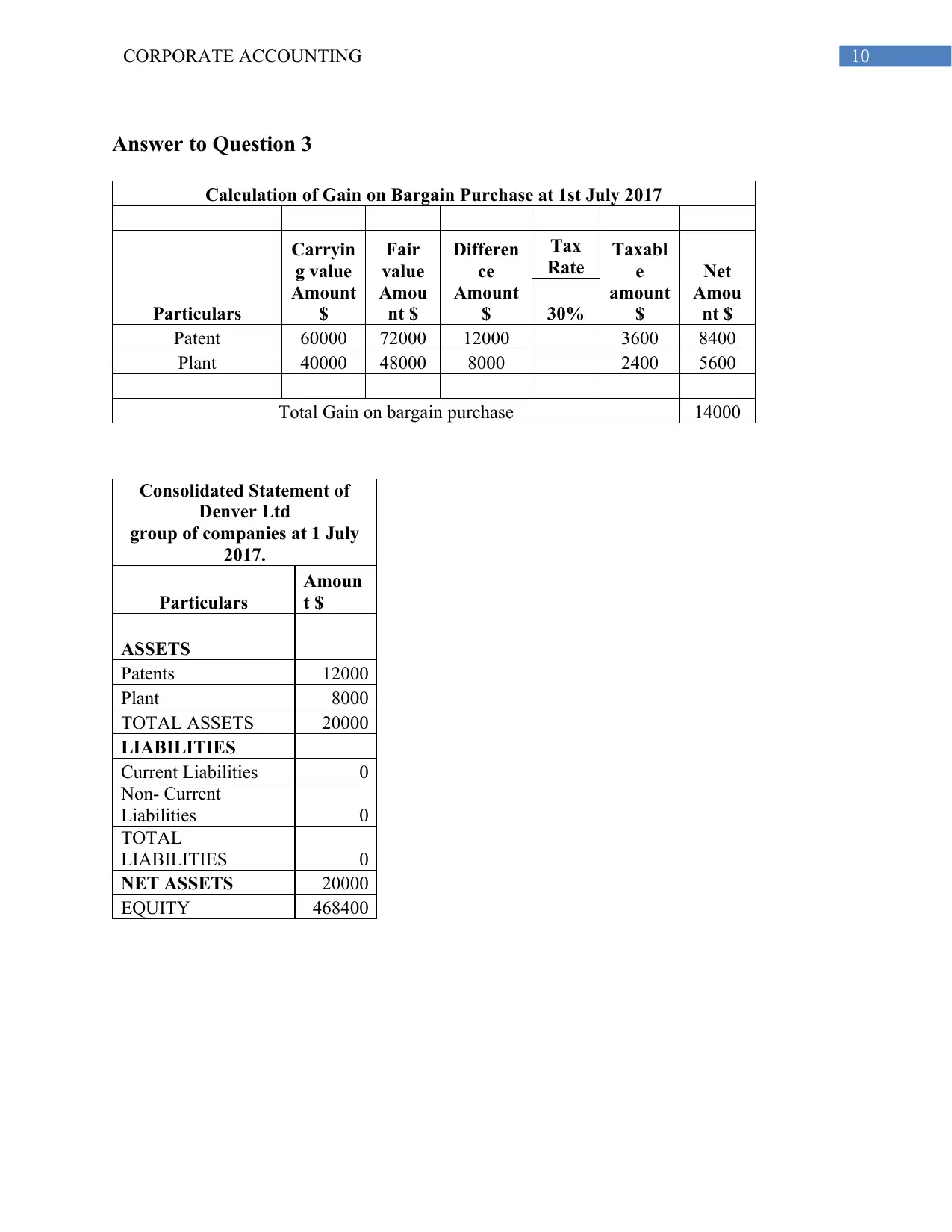

Answer to Question 3

Calculation of Gain on Bargain Purchase at 1st July 2017

Particulars

Carryin

g value

Amount

$

Fair

value

Amou

nt $

Differen

ce

Amount

$

Tax

Rate Taxabl

e

amount

$

Net

Amou

nt $30%

Patent 60000 72000 12000 3600 8400

Plant 40000 48000 8000 2400 5600

Total Gain on bargain purchase 14000

Consolidated Statement of

Denver Ltd

group of companies at 1 July

2017.

Particulars

Amoun

t $

ASSETS

Patents 12000

Plant 8000

TOTAL ASSETS 20000

LIABILITIES

Current Liabilities 0

Non- Current

Liabilities 0

TOTAL

LIABILITIES 0

NET ASSETS 20000

EQUITY 468400

Answer to Question 3

Calculation of Gain on Bargain Purchase at 1st July 2017

Particulars

Carryin

g value

Amount

$

Fair

value

Amou

nt $

Differen

ce

Amount

$

Tax

Rate Taxabl

e

amount

$

Net

Amou

nt $30%

Patent 60000 72000 12000 3600 8400

Plant 40000 48000 8000 2400 5600

Total Gain on bargain purchase 14000

Consolidated Statement of

Denver Ltd

group of companies at 1 July

2017.

Particulars

Amoun

t $

ASSETS

Patents 12000

Plant 8000

TOTAL ASSETS 20000

LIABILITIES

Current Liabilities 0

Non- Current

Liabilities 0

TOTAL

LIABILITIES 0

NET ASSETS 20000

EQUITY 468400

11CORPORATE ACCOUNTING

Answer to Question 3b

The control exists in the hands of banks. In AASB10, paragraph B40 it is stated under rights

from other contractual arrangements that it gives the investor a right for directing the activities

that are relevant as it has rights specified in the contract, which is enough to direct the activities

related to fiancé and operations of the company. Therefore, if there is no other right is the present

pecuniary dependence of an investee on the investor concerning the relationship of a supplier and

major consumers do not principal to the investor having control over the investee.

Answer to Question 4

Introduction

Pental Ltd from its modest start had an aim to grow and include itself in a portfolio of prominent

brands these have become familiar in the houses of New Zealand and Australia. It had achieved

the name of pioneering merchandise leader with prime indigenous manufacturing of cube

firelighters, bar soaps and liquid bleach. Since sixty years, it is working hard for providing true

services to the citizen and culture of Australia. Maximum manufacturing is done at Shepparton

Victoria that is supplemented among third party agreement for the local merchandise in New

Zealand. Shepparton site has four different plants for production that are Firelighters, Soap plant,

Liquid plant and Bleach plant. The company has grown up over and done with an unremitting

commitment for quality, efficiency and innovation. This commitment has made the company

among the trusted makers of products of household and commercial. Pental has successfully

expanded it business from Australia, New Zealand to new Asian merchandise. The company has

decide to expand its business in commercial and industrial channels. Its products are available in

more than 300 petrol, 4000 supermarkets, and 700 pharmacies. The distribution of the product is

done through the warehouses of Christchurch and Auckland (New Zealand), the Shanghai and

Ningbo Free Trade Zones (China) and Shepparton (Victoria). (Pental.com 2018)

The report is constructed to recommend on the nature, extent of social, and environment

reporting and putting stress on company`s social responsibility and the benefit of reporting the

Corporate social responsibility.

Answer to Question 3b

The control exists in the hands of banks. In AASB10, paragraph B40 it is stated under rights

from other contractual arrangements that it gives the investor a right for directing the activities

that are relevant as it has rights specified in the contract, which is enough to direct the activities

related to fiancé and operations of the company. Therefore, if there is no other right is the present

pecuniary dependence of an investee on the investor concerning the relationship of a supplier and

major consumers do not principal to the investor having control over the investee.

Answer to Question 4

Introduction

Pental Ltd from its modest start had an aim to grow and include itself in a portfolio of prominent

brands these have become familiar in the houses of New Zealand and Australia. It had achieved

the name of pioneering merchandise leader with prime indigenous manufacturing of cube

firelighters, bar soaps and liquid bleach. Since sixty years, it is working hard for providing true

services to the citizen and culture of Australia. Maximum manufacturing is done at Shepparton

Victoria that is supplemented among third party agreement for the local merchandise in New

Zealand. Shepparton site has four different plants for production that are Firelighters, Soap plant,

Liquid plant and Bleach plant. The company has grown up over and done with an unremitting

commitment for quality, efficiency and innovation. This commitment has made the company

among the trusted makers of products of household and commercial. Pental has successfully

expanded it business from Australia, New Zealand to new Asian merchandise. The company has

decide to expand its business in commercial and industrial channels. Its products are available in

more than 300 petrol, 4000 supermarkets, and 700 pharmacies. The distribution of the product is

done through the warehouses of Christchurch and Auckland (New Zealand), the Shanghai and

Ningbo Free Trade Zones (China) and Shepparton (Victoria). (Pental.com 2018)

The report is constructed to recommend on the nature, extent of social, and environment

reporting and putting stress on company`s social responsibility and the benefit of reporting the

Corporate social responsibility.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.