HI5020 Corporate Accounting: Cash Flow, OCI & Income Tax Analysis

VerifiedAdded on 2024/05/31

|10

|2609

|242

Report

AI Summary

This report provides a detailed analysis of corporate accounting practices, focusing on cash flow statements, other comprehensive income (OCI), and income tax. It examines various items within the cash flow statement, offering a comparative analysis of operating, investing, and financing activities across multiple years. The report also identifies and explains items included in the other comprehensive income statement, discussing why these are not included in the main income statement. Furthermore, it delves into the accounting for corporate income tax, analyzing tax expenses, deferred tax assets/liabilities, and the differences between income tax expense and income tax paid. The analysis reconciles accounting income with taxable income, addressing timing differences and their impact on financial statements. This document is available on Desklib, a platform offering a wide range of study resources for students.

HI5020 Corporate Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

CASH FLOWS STATEMENT.......................................................................................................4

(i) Various items of cash flow statement.....................................................................................4

(ii) Comparative analysis of various categories in cash flow......................................................4

OTHER COMPREHENSIVE INCOME STATEMENT................................................................5

(iii) Items in another comprehensive income statement..............................................................5

(iv) Understanding of items identified.........................................................................................6

(v) Reasons for not including them in income statements...........................................................6

ACCOUNTING FOR CORPORATE INCOME TAX...................................................................6

(vi) Tax expense in latest financial statements............................................................................6

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm...................................................................7

(viii) Comment on deferred tax assets/liabilities that are reported on the balance sheet

articulating the possible reasons why they have been recorded..................................................7

(ix)Is there any current tax assets or income tax payable recorded by your company? Why is

the income tax payable not the same as income tax expense?.....................................................7

(x) Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?................................................8

(xi)What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s tax

expense in its accounts?...............................................................................................................8

2

CASH FLOWS STATEMENT.......................................................................................................4

(i) Various items of cash flow statement.....................................................................................4

(ii) Comparative analysis of various categories in cash flow......................................................4

OTHER COMPREHENSIVE INCOME STATEMENT................................................................5

(iii) Items in another comprehensive income statement..............................................................5

(iv) Understanding of items identified.........................................................................................6

(v) Reasons for not including them in income statements...........................................................6

ACCOUNTING FOR CORPORATE INCOME TAX...................................................................6

(vi) Tax expense in latest financial statements............................................................................6

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm...................................................................7

(viii) Comment on deferred tax assets/liabilities that are reported on the balance sheet

articulating the possible reasons why they have been recorded..................................................7

(ix)Is there any current tax assets or income tax payable recorded by your company? Why is

the income tax payable not the same as income tax expense?.....................................................7

(x) Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?................................................8

(xi)What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s tax

expense in its accounts?...............................................................................................................8

2

References........................................................................................................................................9

3

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CASH FLOWS STATEMENT

(i) Various items of cash flow statements

The company prepares the cash flow in which all the transactions which are carried out in the

cash are to be included. The items which are included in cash flow of AMA are as follows:

The operating cash flows of the company includes the receipt of the income from the

customers and the also the interest is received by the company. The amount which is

received from customers amounts to 101901 in 2015 and then it rose to 262973 in 2016

and finally to 362877 in 2017. The amount of the interest is 4 then 361 and 98 in the three

years from 2015 to 2017 respectively (AMA Group Limited, 2016).

The payments were made in relation to suppliers, interest and income tax. The payments

which are made to the suppliers are increasing continuously from 89634 in 2015 to

340094 in 2017. The payment of the income tax is also increasing and this has risen from

4198 to 7247 and then 9724 in 2017.

The investing activities in the business are also carried out and in the sale of the plant is

made and with that purchase is also made. The business has been acquired and payment

for the same is also made by the company. Loans and investment in the company are also

included in this (AMA Group Limited, 2017).

In the financing activities, there is the equity which has been raised by the company in

2016 which amounts to 43526. Then borrowings are made for which amount has been

received by the company. The repayment of the loan is also made and dividends have

been paid by the company to the shareholders of the company which are continuously

rising showing the positive aspects of the business.

(ii) Comparative analysis of various categories in cash flow

In the cash flow, there are various items which are included and they all will be classified into

the three segments of the activities which are presented in this. The understanding of the same

can be obtained from the discussion below:

4

(i) Various items of cash flow statements

The company prepares the cash flow in which all the transactions which are carried out in the

cash are to be included. The items which are included in cash flow of AMA are as follows:

The operating cash flows of the company includes the receipt of the income from the

customers and the also the interest is received by the company. The amount which is

received from customers amounts to 101901 in 2015 and then it rose to 262973 in 2016

and finally to 362877 in 2017. The amount of the interest is 4 then 361 and 98 in the three

years from 2015 to 2017 respectively (AMA Group Limited, 2016).

The payments were made in relation to suppliers, interest and income tax. The payments

which are made to the suppliers are increasing continuously from 89634 in 2015 to

340094 in 2017. The payment of the income tax is also increasing and this has risen from

4198 to 7247 and then 9724 in 2017.

The investing activities in the business are also carried out and in the sale of the plant is

made and with that purchase is also made. The business has been acquired and payment

for the same is also made by the company. Loans and investment in the company are also

included in this (AMA Group Limited, 2017).

In the financing activities, there is the equity which has been raised by the company in

2016 which amounts to 43526. Then borrowings are made for which amount has been

received by the company. The repayment of the loan is also made and dividends have

been paid by the company to the shareholders of the company which are continuously

rising showing the positive aspects of the business.

(ii) Comparative analysis of various categories in cash flow

In the cash flow, there are various items which are included and they all will be classified into

the three segments of the activities which are presented in this. The understanding of the same

can be obtained from the discussion below:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

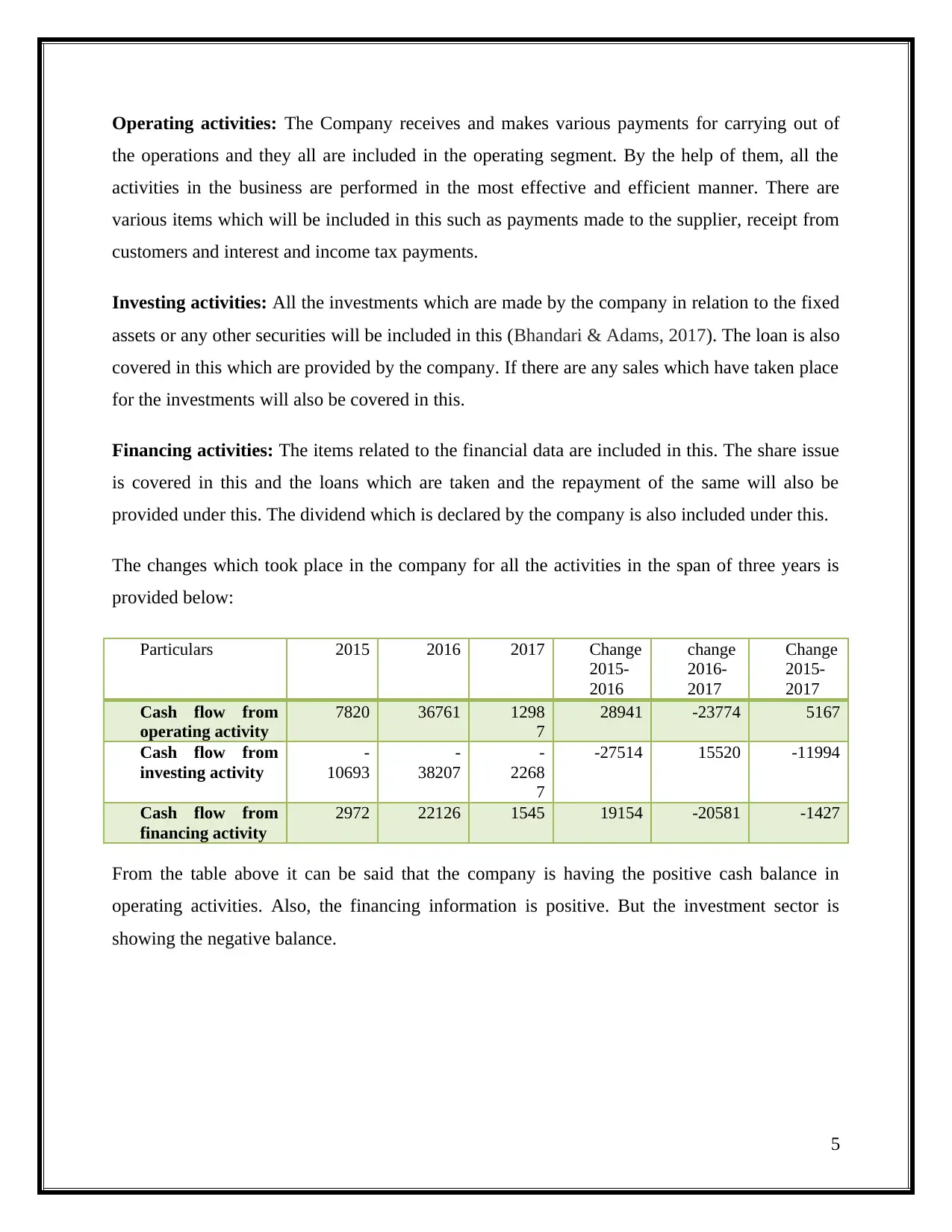

Operating activities: The Company receives and makes various payments for carrying out of

the operations and they all are included in the operating segment. By the help of them, all the

activities in the business are performed in the most effective and efficient manner. There are

various items which will be included in this such as payments made to the supplier, receipt from

customers and interest and income tax payments.

Investing activities: All the investments which are made by the company in relation to the fixed

assets or any other securities will be included in this (Bhandari & Adams, 2017). The loan is also

covered in this which are provided by the company. If there are any sales which have taken place

for the investments will also be covered in this.

Financing activities: The items related to the financial data are included in this. The share issue

is covered in this and the loans which are taken and the repayment of the same will also be

provided under this. The dividend which is declared by the company is also included under this.

The changes which took place in the company for all the activities in the span of three years is

provided below:

Particulars 2015 2016 2017 Change

2015-

2016

change

2016-

2017

Change

2015-

2017

Cash flow from

operating activity

7820 36761 1298

7

28941 -23774 5167

Cash flow from

investing activity

-

10693

-

38207

-

2268

7

-27514 15520 -11994

Cash flow from

financing activity

2972 22126 1545 19154 -20581 -1427

From the table above it can be said that the company is having the positive cash balance in

operating activities. Also, the financing information is positive. But the investment sector is

showing the negative balance.

5

the operations and they all are included in the operating segment. By the help of them, all the

activities in the business are performed in the most effective and efficient manner. There are

various items which will be included in this such as payments made to the supplier, receipt from

customers and interest and income tax payments.

Investing activities: All the investments which are made by the company in relation to the fixed

assets or any other securities will be included in this (Bhandari & Adams, 2017). The loan is also

covered in this which are provided by the company. If there are any sales which have taken place

for the investments will also be covered in this.

Financing activities: The items related to the financial data are included in this. The share issue

is covered in this and the loans which are taken and the repayment of the same will also be

provided under this. The dividend which is declared by the company is also included under this.

The changes which took place in the company for all the activities in the span of three years is

provided below:

Particulars 2015 2016 2017 Change

2015-

2016

change

2016-

2017

Change

2015-

2017

Cash flow from

operating activity

7820 36761 1298

7

28941 -23774 5167

Cash flow from

investing activity

-

10693

-

38207

-

2268

7

-27514 15520 -11994

Cash flow from

financing activity

2972 22126 1545 19154 -20581 -1427

From the table above it can be said that the company is having the positive cash balance in

operating activities. Also, the financing information is positive. But the investment sector is

showing the negative balance.

5

OTHER COMPREHENSIVE INCOME STATEMENT

(iii) Items in other comprehensive income statements

The comprehensive income statement is prepared so that all the items which cannot be taking

into the income statement can be included in this. They are those amounts which have not been

realised in the company (Gobetti & Orair, 2017). It depends on their position and whenever they

will be realised they are transferred to the income statement of the company. Under this there are

various items which will be reported and for that a separate statement is prepared in every

company at the end of the period.

(iv) Understanding of items identified

In the company there are various amounts which are not taken into account while making of the

income statement and they are incorporated in this. In the given case there are not much of the

items which are to be incorporated. There is only one item which is the exchange difference that

has been faced by the company on the foreign operations. This is of the amount 11 in the year

2016 and then in the 2017 there is loss of 6 (AMA Group Limited, 2017). The adjustment for the

same is made and then the income which is derived is attributed among the members of the

group.

(v) Reasons for not including them in income statements

In the financial statements it is required that fair disclosure shall be made by which true picture

of the business is depicted. Due to this it is required that only those items which have been

realised and are in relation to the present period will be included in the income statements. All of

the other items which will be realised by the company in the coming period will have to be

recorded in the comprehensive income statement. They will be moved to the main income

statement when the same will be realised.

6

(iii) Items in other comprehensive income statements

The comprehensive income statement is prepared so that all the items which cannot be taking

into the income statement can be included in this. They are those amounts which have not been

realised in the company (Gobetti & Orair, 2017). It depends on their position and whenever they

will be realised they are transferred to the income statement of the company. Under this there are

various items which will be reported and for that a separate statement is prepared in every

company at the end of the period.

(iv) Understanding of items identified

In the company there are various amounts which are not taken into account while making of the

income statement and they are incorporated in this. In the given case there are not much of the

items which are to be incorporated. There is only one item which is the exchange difference that

has been faced by the company on the foreign operations. This is of the amount 11 in the year

2016 and then in the 2017 there is loss of 6 (AMA Group Limited, 2017). The adjustment for the

same is made and then the income which is derived is attributed among the members of the

group.

(v) Reasons for not including them in income statements

In the financial statements it is required that fair disclosure shall be made by which true picture

of the business is depicted. Due to this it is required that only those items which have been

realised and are in relation to the present period will be included in the income statements. All of

the other items which will be realised by the company in the coming period will have to be

recorded in the comprehensive income statement. They will be moved to the main income

statement when the same will be realised.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR CORPORATE INCOME TAX

(vi) Tax expense in latest financial statements.

The company is required to comply with the laws and regulation which are specified by the laws.

For that, it is required that all of the income in the company shall be identified and then on that

the income tax will have to be paid (Graham, et. al., 2012). The rate at which it will be paid is

specified under the act. It is mandatory to comply with them so that appropriate tax treatment is

made by the company. In the present case, AMA is following all of them and it is charging the

tax accordingly. The tax expense which has been charged in the current year of 2017 amounts to

7994 and this has increased in comparison to the last year’s tax which was 6242.

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

The accounting tax and the tax by the act are not same in the company. There are various such

items in which adjustment is required as the items which are deductible in the accounting income

are not allowed for the tax purpose and for that they are required to be considered. The tax as per

the act is charged at 30% and then in that various adjustments are made which are related to the

impairment, employee equity plan, and various other non-deductible items. They all are

considered by the company and with the help of that, the tax which is determined as per the

accounts is reconciled.

(viii) Comment on deferred tax assets/liabilities that are reported on the balance sheet

articulating the possible reasons why they have been recorded.

In the business, there are various items which are considered at the different time in both the

accounts and as per the tax laws. For that, there is the timing difference which arises and in order

to deal with that, it is required that deferred tax assets and liabilities are to be recognized (Jaya,

2016). In the given AMA group bit the assets and liabilities in this respect are recognized

separately and they have not been adjusted. The deferred tax assets are identified which amounts

to 1682 in 2016\5 and then 5227 in 2016 and finally 7205 in the current year. The liabilities

which are determined are 862, 2720 and 3509 in all the three years which are 2015, 2016 and

2017 respectively.

7

(vi) Tax expense in latest financial statements.

The company is required to comply with the laws and regulation which are specified by the laws.

For that, it is required that all of the income in the company shall be identified and then on that

the income tax will have to be paid (Graham, et. al., 2012). The rate at which it will be paid is

specified under the act. It is mandatory to comply with them so that appropriate tax treatment is

made by the company. In the present case, AMA is following all of them and it is charging the

tax accordingly. The tax expense which has been charged in the current year of 2017 amounts to

7994 and this has increased in comparison to the last year’s tax which was 6242.

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

The accounting tax and the tax by the act are not same in the company. There are various such

items in which adjustment is required as the items which are deductible in the accounting income

are not allowed for the tax purpose and for that they are required to be considered. The tax as per

the act is charged at 30% and then in that various adjustments are made which are related to the

impairment, employee equity plan, and various other non-deductible items. They all are

considered by the company and with the help of that, the tax which is determined as per the

accounts is reconciled.

(viii) Comment on deferred tax assets/liabilities that are reported on the balance sheet

articulating the possible reasons why they have been recorded.

In the business, there are various items which are considered at the different time in both the

accounts and as per the tax laws. For that, there is the timing difference which arises and in order

to deal with that, it is required that deferred tax assets and liabilities are to be recognized (Jaya,

2016). In the given AMA group bit the assets and liabilities in this respect are recognized

separately and they have not been adjusted. The deferred tax assets are identified which amounts

to 1682 in 2016\5 and then 5227 in 2016 and finally 7205 in the current year. The liabilities

which are determined are 862, 2720 and 3509 in all the three years which are 2015, 2016 and

2017 respectively.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(ix)Is there any current tax assets or income tax payable recorded by your company? Why

is the income tax payable not the same as income tax expense?

The company has recognized the income tax payable on its balance sheet and this is the

amount which the company will have to pay in the coming period. They will be met by the

company irrespective of any situation in the company. The amount which is identified in this

regard is 949 for 2015 and 1828 in 2016 and for 2017 this is calculated to be 458 (AMA

Group Limited, 2016). They all are different from the tax expense which has been recognised

and this is because the expense is on the amount which has been earned in the current year

but out of that the whole amount will not be paid and there are certain adjustments which are

to made and the tax which is to be paid in the current period is only taken as the payable

amount.

(x) Is the income tax expense shown in the income stat, elements same as the income tax

paid shown in the cash flow statement? If not why is the difference?

In the company the ammo, unit of the tax expense which is identified in the income statement

and that of the paid which is shown in the cash flow is different. The amount which is to be paid

in cash is 7247 for 2016 and 9724 for 2017 (AMA Group Limited, 2017). They are different as

the amount which is determined as the expense is for the income which is identified in the

income statement but the payment is made after the adjustment is made in relation to the past

dues also which are there. After the adjustment not, it is decided that what amount is to be paid

in cash and that is the tax paid in the cash flow.

(xi)What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

In the company, there are tax treatments which are made and they all are made in accordance

with the laws which have been specified. It is complying with the rules and proper disclosures

are also made in this respect. By that, the true picture is represented. There is the tax

consolidation group which has been made by the company and this is as per the tax consolidation

8

is the income tax payable not the same as income tax expense?

The company has recognized the income tax payable on its balance sheet and this is the

amount which the company will have to pay in the coming period. They will be met by the

company irrespective of any situation in the company. The amount which is identified in this

regard is 949 for 2015 and 1828 in 2016 and for 2017 this is calculated to be 458 (AMA

Group Limited, 2016). They all are different from the tax expense which has been recognised

and this is because the expense is on the amount which has been earned in the current year

but out of that the whole amount will not be paid and there are certain adjustments which are

to made and the tax which is to be paid in the current period is only taken as the payable

amount.

(x) Is the income tax expense shown in the income stat, elements same as the income tax

paid shown in the cash flow statement? If not why is the difference?

In the company the ammo, unit of the tax expense which is identified in the income statement

and that of the paid which is shown in the cash flow is different. The amount which is to be paid

in cash is 7247 for 2016 and 9724 for 2017 (AMA Group Limited, 2017). They are different as

the amount which is determined as the expense is for the income which is identified in the

income statement but the payment is made after the adjustment is made in relation to the past

dues also which are there. After the adjustment not, it is decided that what amount is to be paid

in cash and that is the tax paid in the cash flow.

(xi)What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

In the company, there are tax treatments which are made and they all are made in accordance

with the laws which have been specified. It is complying with the rules and proper disclosures

are also made in this respect. By that, the true picture is represented. There is the tax

consolidation group which has been made by the company and this is as per the tax consolidation

8

legislation (AMA Group Limited, 2017). All the current tax and the deferred tax in the group is

recognized by all the entities in a separate manner. For the proper measurement and allocation of

them stand alone taxpayer approach is used by the group. It has been determined that the tax

credits and losses which are unused are to be transferred to head entity at that time only in the

most appropriate manner. By all of this is can be said that company is not making any defaults in

the payment and recognition of the tax amounts.

9

recognized by all the entities in a separate manner. For the proper measurement and allocation of

them stand alone taxpayer approach is used by the group. It has been determined that the tax

credits and losses which are unused are to be transferred to head entity at that time only in the

most appropriate manner. By all of this is can be said that company is not making any defaults in

the payment and recognition of the tax amounts.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Bhandari, S. B., & Adams, M. T. (2017). On the Definition, Measurement, and Use of the

Free Cash Flow Concept in Financial Reporting and Analysis: A Review and

Recommendations. Journal of Accounting and Finance, 17(1), 11-19.

Gobetti, S. W., & Orair, R. O. (2017). Taxation and distribution of income in Brazil: new

evidence from personal income tax data. Revista de Economia Política, 37(2), 267-286.

Graham, J. R., Raedy, J. S., & Shackelford, D. A. (2012). Research in accounting for

income taxes. Journal of Accounting and Economics, 53(1), 412-434.

Jaya, T. E. (2016). Earnings, Leverage, and Deferred Tax on Tax Penalties and Fines

(Case study in Indonesia).

AMA Group Limited. (2016). Annual report. [Online]. AMA Group Limited. Available

at: http://amagroupltd.com/wp-content/uploads/2016/11/appendix-4e-and-annual-report-

2016.pdf. [Accessed: 25 May 2018]

AMA Group Limited. (2017). Annual report. [Online]. AMA Group Limited. Available

at: http://amagroupltd.com/wp-content/uploads/2017/09/Annual-Report-to-shareholders-

1.pdf. [Accessed: 25 May 2018]

10

Bhandari, S. B., & Adams, M. T. (2017). On the Definition, Measurement, and Use of the

Free Cash Flow Concept in Financial Reporting and Analysis: A Review and

Recommendations. Journal of Accounting and Finance, 17(1), 11-19.

Gobetti, S. W., & Orair, R. O. (2017). Taxation and distribution of income in Brazil: new

evidence from personal income tax data. Revista de Economia Política, 37(2), 267-286.

Graham, J. R., Raedy, J. S., & Shackelford, D. A. (2012). Research in accounting for

income taxes. Journal of Accounting and Economics, 53(1), 412-434.

Jaya, T. E. (2016). Earnings, Leverage, and Deferred Tax on Tax Penalties and Fines

(Case study in Indonesia).

AMA Group Limited. (2016). Annual report. [Online]. AMA Group Limited. Available

at: http://amagroupltd.com/wp-content/uploads/2016/11/appendix-4e-and-annual-report-

2016.pdf. [Accessed: 25 May 2018]

AMA Group Limited. (2017). Annual report. [Online]. AMA Group Limited. Available

at: http://amagroupltd.com/wp-content/uploads/2017/09/Annual-Report-to-shareholders-

1.pdf. [Accessed: 25 May 2018]

10

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.